1. Introduction and Literature Review

Financial technology (fintech) was first proposed by John Reed, former Chairman of Citibank, in the 1890s (Wang and Zhu 2022, Wang and Luo 2022). Further, the Wharton School of Business first defined fintech as “the financial field transformed by electronic science and technology,” a definition that has been widely used in practice and academic research. In 2016, the International Financial Stability Board also gave a relatively authoritative standard definition at the international level in its Report on the Panoramic Description and Analysis Framework of Fintech: “Fintech is financial innovation driven by technologies that aim to transform or innovate financial products, service processes, business models, etc. with the help of modern scientific and technological achievements, so as to promote both quality and efficiency of financial development.” With the continuous development of Internet technologies, the connotation of fintech is constantly expanding. It usually refers to the innovation of products and services provided by the traditional financial industry through various technological means to improve financial markets’ operating efficiency and significantly reduce operating costs (Sajid et al. 2023).

The Chinese fintech industry is growing in prosperity and scale, having rapidly expanded from 210.4 billion yuan in 2016 to 542.3 billion yuan in 2022. Although the annual growth rate of the Chinese fintech market dropped sharply to 5.65% in 2020 due to the impact of the global epidemic, the market scale of China’s fintech industry will persist in expanding in the future, and market competition will become more intense.

Simultaneously, the financial industry is constantly innovating, and the integration of emerging technologies and the financial sector is accelerating. Owing to the innovative development of the Internet, big data, mobile payments, and other technologies, fintech experienced exponential growth, constantly injecting new vitality into commercial banks. To enhance the support of technologies on core business, commercial banks have begun to focus on the entire process of customer transactions and actively develop the practical application of big data, machine learning, biometrics, and other cutting-edge technologies to improve business efficiency, optimize the experience of users, reduce costs, and help commercial banks enter the “Smart Transformation Era” (Cheng and Qu 2020, Kadyan et al. 2022).

Currently, interest income is the main profit source for commercial banks in China’s banking system. With the trend of interest rate liberalization, the interest rate spread between deposits and loans is constantly tightening, and commercial banks’ market share is gradually eroded. On the asset side, banks win high-quality loan customers through price competition and service improvement, which greatly reduces the incomes of the asset side; on the liability side, deposits are becoming increasingly market-oriented, and the emergence of new products such as “Yu’e Bao” and “Lingqiantong” diverts the wealth management business of traditional commercial banks, resulting in an irreversible rigid rise on the liability side for banks. This dual problem greatly reduced commercial banks’ profitability. Coupled with the economic downturn and the pandemic’s recent impact, the real economy’s operating capacity has declined rapidly, and banks’ financing costs are much higher, which has led to a surge of non-performing loans and caused a considerable negative influence on Chinese commercial banks’ profitability. In addition, the emergence and rise of fintech enterprises have seriously affected commercial banks’ interest income business development in recent years, resulting in a sharp drop in their profitability.

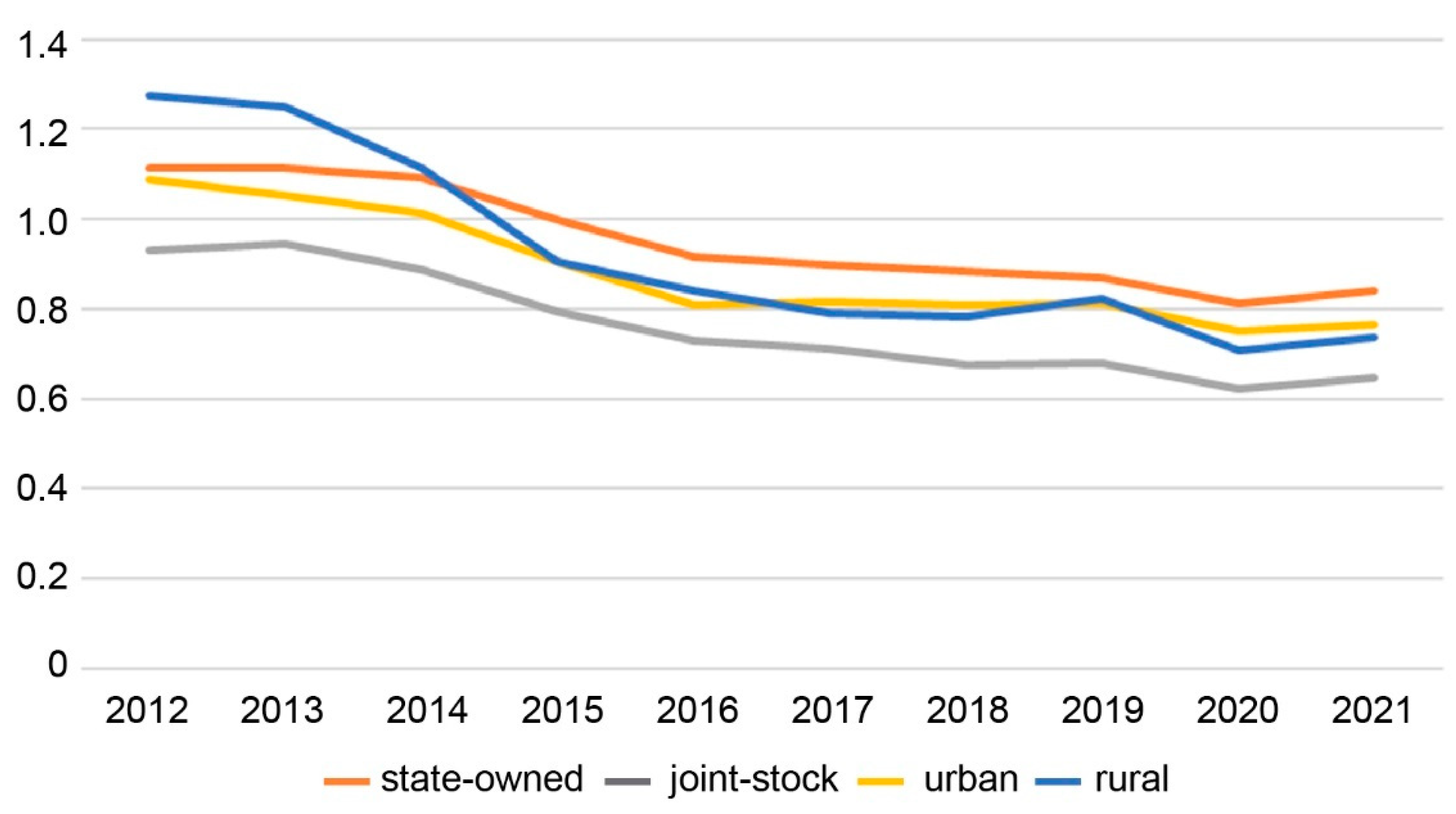

Figure 1 shows the changing trend in Chinese commercial banks’ return on assets (ROA) from 2012 to 2021. The figure shows that the return on total assets for Chinese commercial banks has exhibited a downward trend of varying degrees over the past ten years. Overall, the rate of return on total assets of large state-owned commercial banks declined the least, indicating that they are least affected by fintech because of their advantageous large asset scale and rich policy resources. The rate of return on the total assets of rural commercial banks declined the most; thus, we can conclude that fintech had the most significant impact on their profitability.

The use of fintech has greatly improved the timeliness and convenience of services and created various opportunities and challenges for the banking industry (Tanda and Schena 2019). Thus, the digital transformation of China’s traditional commercial banks has become a general trend. This approach can help improve operations, fintech development, and industry transformation. Under the wave of digitization, whether the application of fintech can empower commercial banks and enhance their profitability or bring substantial challenges to the Chinese banking industry and whether the impact varies depending on the bank have become serious issues.

Figure 1 shows that although the overall return on total assets of Chinese commercial banks continues to decline, we can see a clear declining trend, with only a slight increase during 2020-2021. Hence, Chinese commercial banks are actively responding to the challenges brought about by fintech development and striving to explore digital transformation.

Currently, investment in fintech is increasing and is an active topic in academic research. Some scholars argue that fintech negatively affects traditional commercial banks. Fintech gained significant market share from the traditional financial system (i.e., banks) because of its advantages, such as low-cost operations, low-threshold loans, and efficient marketing (Koffi 2016). After separations, mergers, and reorganizations, we now find that fintech enterprises specialize in certain fields that may affect the traditional business of commercial banks (Tanda and Schena 2019). Stulz (2019) finds that compared with traditional banks, fintech companies and large tech companies benefit from an uneven competitive environment and less regulation, making them compete with banks regarding product and service innovation. Fintech companies compete directly with commercial banks in many fields, such as deposits and loans, capital financing, payment and settlement, investment, and wealth management (Thakor 2020). Zhao et al.’s (Zhao et al. 2022) study reports that relative to the technology spillover effect, the competition effect brought about by fintech is greater and varies depending on the size of the commercial bank. Wang and Zhu (Wang and Zhu 2022, Wang and Luo 2022) conducted an empirical regression on the data of 51 commercial banks from 2011 to 2020 and found that fintech development reduces commercial banks’ profits to varying degrees.

However, some scholars believe that fintech development can positively influence the profitability of commercial banks. Wonglimpiyarat’s (Wonglimpiyarat 2017) analysis of a system innovation model reveals that fintech can positively promote the development of commercial banks. Bömer and Maxin (Bömer and Maxin 2018) empirically study data from Commerzbank and find that the application of fintech can promote product upgrades and service innovation while also improving the profitability of commercial banks. Lee et al. (2021) use data at the fintech enterprise level to construct a development index for the fintech industry and the stochastic meta-frontier method to measure the relevant efficiency scores of Chinese banks with different equity structures. They conclude that fintech development can promote commercial banks’ efficiency.

Fintech is conducive to repairing the financing gap by reducing the probability of good companies being misclassified as bad companies, that is, by reducing information friction and helping commercial banks effectively allocate credit assets and improve profitability. Zhao et al.’s (Zhao and Bu 2022) in-depth analysis of the panel data of 92 Chinese commercial banks from 2008 to 2019 reveals that fintech can improve the operational performance of commercial banks by reducing the cost-to-income and non-performing loan ratios, and this impact is more obvious for larger commercial banks. Wang and Luo (Wang and Zhu 2022, Wang and Luo 2022) use the unbalanced panel data of 368 commercial banks from 2011 to 2019 to conduct an empirical regression and report that fintech development would have an inverted U-shaped influence that first promotes and then suppresses commercial banks’ operating performance and its role in promoting large commercial banks and commercial banks in areas with a low level of fintech development is more significant.

The development of fintech has a profound influence on the market environment, business operations, asset allocation, risk prevention, and control of commercial banks, bringing opportunities and challenges to the sustainable development of the banking industry (Li et al. 2022, Wang, Xiuping et al. 2021, Wang, Liu et al. 2021). Exploring the impact of fintech on commercial banks can help Chinese commercial banks more quickly and adeptly complete digital transformation. Establishing a complete and efficient modern financial system is of great importance to the reform of the Chinese financial industry, with the banking industry at its core. Therefore, this study investigates the mechanism by which fintech influences Chinese commercial banks’ profitability through theoretical research and uses a two-way fixed-effect model to conduct empirical regression tests. Unlike existing studies that focus more on the influence of fintech applications on commercial banks, this study is innovative in that it introduces the quadratic term of the fintech development level index as a supplementary explanatory variable to analyze the characteristics of the impact that fintech development and innovation may have on commercial banks’ profitability in the future. We further analyze the heterogeneous influence of fintech on the profitability of different categories of commercial banks.

2. Mechanism and Research Hypotheses

Fintech primarily influences commercial banks’ profitability through two mechanisms: competition and technology spillover.

2.1. Competition Effect

According to long-tail theory, the future profitable customer group of business and culture is not in popular products and traditional demand curves but in the infinitely long tail of the demand curve. Traditional commercial banks previously tended to focus on creating high-value, top-core customers and providing them with financial services, thus ignoring a large number of tail groups with diverse needs. However, fintech companies rely on advanced technologies such as big data to attract tail groups and seize market share, which significantly intensifies their competition with commercial banks. Moreover, the main businesses of commercial banks, such as payment and settlement, credit financing, investment, and wealth management, have also been negatively affected to a certain extent. Here, we analyze the competition effect caused by the development and application of fintech in Chinese commercial banks from three perspectives.

The first perspective is reflected in payments and settlements. In traditional commercial banks, individual consumers have the characteristics of frequent transactions, small single transaction volumes, and meager profits; thus, they rarely provide corresponding products and services. However, these services have a large market demand, providing room for third-party trading institutions’ survival and development. Third-party trading platforms, represented by China’s WeChat Pay and Alipay, have gradually shaken the monopoly position of traditional commercial banks in offline transaction settlements and other business fields. Simultaneously, by providing convenient and secure financial services, such as transfers, payments, and settlements, non-bank financial enterprises and fintech companies have diverted many customers from commercial banks, upsetting the payment and settlement market (Guo and Bouwman 2016, Thakor 2020, Vives 2017).

The second perspective is reflected in the credit business for micro-, small-, and medium-sized companies. In the past, due to poor credit status, information imbalance, and other problems, micro-, small-, and medium-sized companies generally faced the dilemma of expensive and difficult financing. With the rapid development of fintech, many internet companies have begun to set foot in the field of financial services by virtue of their technological and platform advantages. They use advanced technology to portray AI to customers and issue loans to micro, small, and medium-sized companies based on information symmetry, effectively overcoming their financing problems. However, they are also seizing the original credit market of commercial banks (Wang and Zhu 2022, Wang and Luo 2022, Zhao et al. 2022, Zhao and Bu 2022). In addition, fintech enterprises can develop many financial products according to demand to meet customers’ personalized needs, which has a considerable competitive effect on commercial banks in this area (Sheng 2021, Temelkov and Gogova Samonikov 2018).

The third aspect is reflected in personal financial services. With recent rapid economic development, people’s awareness of independent financial management has gradually increased. Traditional financial products can no longer meet customers’ personalized needs; therefore, people are gradually turning their attention to long-term and personalized financial products (Huang and Qiu 2021). Using emerging technologies, fintech companies tailor personalized investment plans based on different preferences from user feedback. They also provide intelligent tools to assist customers in independently selecting products according to their own preferences and risk tolerance, truly achieving personalized investment services and automated investment decisions, thus creating fierce market competition.

In summary, considering the development status of domestic fintech and commercial bank profitability, one can reasonably infer that China is still in the initial stage of applying fintech and is significantly affected by competition. Accordingly, the following research hypothesis is proposed:

H1. In the short term, fintech development is negatively correlated with commercial bank profitability.

2.2. Technology Spillover Effect

According to the theory of economies of scale, the unit cost of a product decreases with an increase in the number of products produced within a certain period. That is, the average cost of an enterprise can be reduced by expanding the production scale, thereby improving its work efficiency and profit level. Early in fintech development, traditional commercial banks needed to invest a substantial amount in talent, technology, equipment, and capital costs, so their profits were low. In the future, the innovative development of fintech will gradually expand commercial banks’ scale, drive commercial banks to accelerate digital transformation from the four areas of innovation ability, customer expansion ability, operation and marketing ability, and risk control ability, and build a more efficient business model (Elsaid 2021, Legowo et al. 2021, Lu 2018,). Here, we analyze the technology spillover effect of the application and development of fintech on commercial banks from four aspects.

First, we break the time-space constraints of financial services. Previously, commercial banks relied on offline physical outlets to provide services, and their business objectives were limited to areas near institutions. In addition, traditional commercial banks are constrained by business hours when conducting business. Owing to mobile payments, the Internet, and other scientific technologies, fintech enables commercial banks to achieve online real-time services, effectively expanding business coverage (Wang and Zhu 2022, Wang and Luo 2022).

The second effect is through the enhanced ability of “acquiring customers” and “living customers.” The popularization and application of advanced science and technology significantly enhanced commercial banks’ information collection, processing, and analysis capabilities. Commercial banks can quickly and effectively collect data such as the investment behaviors, hobbies, and financial management habits of individuals and enterprises using the Internet and then apply AI to organize, process, and analyze data to establish customer labels, segment customer needs, and dig deep into potential customers to expand the service product coverage of existing customers (Cheng and Qu 2020).

Subsequently, operating costs declined, such as those related to transactions. In the initial stage of fintech development, investment costs in various aspects were relatively high; however, after investments were completed, the marginal cost of each customer gradually decreased according to economies of scale. The second objective is to reduce operating costs. With the help of big data, cloud computing, and other cutting-edge technologies, commercial banks are expected to make the sharing, allocation, and integration of all resources available within the organization, thereby reducing operating costs. The last method is to reduce channel costs. Commercial banks can use AI to analyze collected information and optimize the design of service venues and methods for different customers based on the advantages of each channel to reduce service and channel costs to the greatest extent (Guo and Zhang 2023, Lee et al. 2021, Stulz 2019).

Finally, fintech enhances risk defense capabilities. Fintech can alleviate the information asymmetry dilemma commercial banks face. Commercial banks use cutting-edge technologies to aggregate relevant information from multiple perspectives, thereby enriching the types and content of risk information. The in-depth integration of emerging technologies such as machine learning, artificial intelligence, and the financial industry revolutionized traditional bank risk management (Anifa et al. 2022, Cheng and Qu 2020, Lagna and Ravishankar 2022).

In summary, one can reasonably speculate that with the deep integration of fintech and the banking industry in the future, commercial banks will gradually complete their digital transformation, and the technology spillover effect will be more significant. Therefore, the following research hypothesis was proposed:

H2. In the long run, fintech development helps improve the profitability of commercial banks.

Currently, Chinese commercial banks can be divided into four categories according to their scale. Different types of banks significantly differ in their business philosophy, operational model, asset allocation, and administrative management. Therefore, the application of fintech also has a certain degree of impact on their profitability. Accordingly, the following research hypothesis is proposed:

H3. Fintech has a heterogeneous influence on the profitability of different types of commercial banks.

3. Research Design

3.1. Model

To clarify and investigate how fintech influences commercial banks’ profitability, we construct the following two-way fixed effects regression model:

In Equation (1), the subscript i denotes the bank, t denotes the year, λ and μ denote the individual and time effects, respectively, and ε is the random error term.

Regarding the heterogeneity test of the influence of fintech on the profitability of different categories of commercial banks, we divide the sample data into two groups: large state-owned and nationwide joint-stock commercial banks as sample group I and urban and rural commercial banks as sample group II. Empirical regressions are conducted successively to investigate whether there is heterogeneity in the influence of fintech on different categories of commercial banks.

3.2. Variables

Explained Variable: Commercial bank profitability. Scholars generally choose two indicators, return on assets (ROA) and return on equity (ROE), to describe commercial banks’ profitability. Lu et al. (2013) used both ROA and ROE indicators to study the factors affecting Chinese commercial banks’ profitability, and Hu et al. (2018) used the ROA indicator to analyze the relationship between financial innovation and commercial banks’ profitability. Taken together, ROA reflects the net profit created from total assets, whereas ROE reflects the value of the profit generated from net assets. Compared to the other two, ROE ignores the importance of credit assets. Therefore, this study uses ROA as an indicator of commercial banks’ profitability.

Explanatory variable 1: Fintech Index. As domestic fintech is still in its developmental stage, there is currently no unified index system for measuring its development level. Most of the more authoritative fintech statistical indices were created later, such as the Fintech Center Index launched by the Sinan Research Institute of Zhejiang University in 2017 and the Xiangmi Lake Fintech Index published by the Shenzhen Stock Exchange in the same year, which do not completely reflect the development history of fintech in China. Therefore, most scholars construct indices through text mining methods or use proxy variables directly. For example, Guo and Shen (2015) synthesized an Internet finance index by searching keyword frequency on Baidu using a text mining method and factor analysis, while Wang and Zhu (Wang and Zhu 2022, Wang and Luo 2022) chose Peking University’s inclusive finance index as a proxy variable. Referring to the existing literature and considering the credibility and practicality of the data, this study selected the Peking University Digital Inclusive Finance Index (2012-2021) compiled by Peking University’s Digital Finance Research Center to measure the development level of China’s fintech. The fintech development level of each bank is evaluated using the digital inclusive finance index of the province in which its head office is located.

Explanatory variable 2: Fintech Future Development Index. In line with our hypotheses, we speculate that the influence of fintech on Chinese commercial banks’ profitability is U-shaped. To verify this conjecture, we refer to Xie et al. (2021) and introduce the squared term of Peking University’s Digital Financial Inclusion Index to represent the future development level of fintech.

Control variables: Macroeconomic and internal banking factors. The macroeconomic factors include levels of macroeconomic development and inflation. First, the macroeconomic development level reflects the current development and future trends of various industries in China. Second, because the profits of Chinese commercial banks come from deposits and loan spreads, deflation or inflation will have a significant impact. In addition, banks’ internal factors are the cost-to-income ratio, non-interest income ratio, and total assets. The cost-to-income ratio assesses the expected cost per unit of income; the lower the ratio is, the stronger the bank’s profitability. Non-interest income refers to earnings from activities, such as intermediation, consulting, and investment, which are safer and more secure than interest income. Therefore, the higher the ratio of this income component is, the better the bank’s profitability. Total assets can measure a commercial bank’s status and strength; the larger the total assets, the more competitive the bank.

Table 1 presents the definitions and descriptions of each variable.

3.3. Data Sources

Taking the completeness and availability of the data into account, we use the panel data of 46 Chinese-listed commercial banks from 2012 to 2021 as the research sample. The sample includes six large state-owned commercial banks, 12 national joint-stock banks, 17 urban commercial banks, and 11 rural commercial banks based on the China Banking and Insurance Regulatory Commission classification of commercial banks. The fintech index data come from the Peking University Digital Inclusive Finance Index (2012-2021) compiled by the research group of Peking University Digital Finance Research Center, the internal data at the bank level come from the Wind database, and the annual reports on the official websites of major banks, and the economic data at the macro level come from the Wind database and the website of the National Bureau of Statistics of China.

4. Empirical Results

4.1. Indicators and Descriptive Statistics

Before conducting the empirical regression analysis, a descriptive statistical analysis of the main variables was conducted. The sample period is from 2012 to 2021.

Table 2 summarizes each variable’s sample size, mean, standard deviation, and minimum and maximum values.

According to the descriptive statistics, the mean value of the explanatory variable ROA is 0.89%, the minimum value is 0.05%, and the maximum value is 1.7%, implying that over the past ten years, all of the sample commercial banks had a positive ROA, though with considerable differences among them. Considering the difference in data volume, the explanatory variable Fintech is, therefore, reduced; that is, by dividing the original value by 100, the mean value of the explanatory variable after treatment is 3.30, the minimum value is 1.07, and the maximum value is 4.62, indicating that domestic fintech has continued to be popularized and has developed rapidly in the past ten years.

We took the logarithm of the banks’ internal factors owing to the continuous innovation of commercial banks in recent years and the large value of total assets. The minimum value obtained after the treatment was 14.86, the maximum value was 21.98, and the standard deviation was 1.68, indicating large differences in asset size among the different commercial banks. In addition, the minimum and maximum values of the cost-to-income ratio and non-interest income ratio are both very different, and the standard deviation is larger than the rest of the values, which indicates that there are also sizable gaps among Chinese commercial banks in terms of their business decisions, operations, management, and profit structure.

Regarding the macroeconomic variables, CPI is relatively stable, fluctuating steadily between 100.2 and 104.5. The GDP growth rate peaked at 8.4% in 2021 and bottomed out at 2.2% in 2020, which may be attributed to the seriousness of the Xin Guan Pneumonia epidemic in the first half of 2020, leading to a drastic drop in GDP growth.

4.2. Basic Regression Results

Model 1 represents the basic two-way fixed effects model. After gradually deleting the least significant variables based on Model 1, new regression analysis Models 2 (deleting

LnTA), 3 (deleting

LnTA and

NIR), and 4 (deleting

LnTA,

NIR, and

CIR) were obtained.

Table 3 reports the results.

Considering all factors, the first model was used as the main reference standard. According to the regression analysis results, the coefficient of the quadratic term of the explanatory variable Fintech is 0.085, which indicates that the image curve faces upward; the coefficient of the primary term is -0.486, which is highly significant at the 1% level. Fintech and commercial bank profitability are indeed U-shaped and non-linearly correlated. Specifically, in the short term, fintech applications would play a negative role in commercial banks’ profitability; however, with the continuous innovation of fintech, it will be conducive to improving commercial banks’ profitability in the future, which is also consistent with Hypotheses 1 and 2.

For the macroeconomic factors, the coefficient of the control variable GDP growth rate is -0.058, indicating that a higher GDP growth rate has negative effects on commercial banks’ profitability. In contrast, the coefficient of the control variable CPI is 0.291, indicating that an increase in the inflation rate promotes commercial banks’ profitability to some extent.

From the viewpoint of internal bank factors, the regression coefficients of the control variables LnTA and CIR are all negative, but the result for CIR is more significant, implying that fintech applications can reduce the cost-income ratio of commercial banks. Under the wave of fintech, commercial banks use Internet technology to build online financial service platforms such as online banking and constantly broaden the scope of business and customer acquisition. Financial technology helps banks gradually transfer their business from offline to online. Acquiring new customers does not cause an increase in fixed costs, which effectively reduces the cost-income ratio. The coefficient of NIR is 0.002 and is highly significant at the 1% level, which means that the higher the proportion of non-interest income, the stronger the profitability of commercial banks. The non-interest income of Chinese commercial banks mainly originates from the settlements and credit card businesses. Along with the improvement in the development level of fintech, commercial banks take full advantage of big data and cloud computing technology for efficient approvals and real-time settlements. As online space is nearly infinite, the user group could expand infinitely, which improves non-interest income and enhances profitability.

4.3. Heterogeneity Analysis

To analyze the differing influence of fintech on the profitability of different categories of commercial banks, we separate the sample into Group I, which contains the large state-owned and national joint-stock commercial banks, and Group II, which contains urban and rural commercial banks. We run the regressions on each group and provide the results in

Table 4.

The coefficient of the explanatory variable Fintech for sample Group I is -0.106, and that for Fintech2 is 0.014, though the results are not significant. Group II has coefficients of -0.620 for Fintech and 0.111 for Fintech2, which are highly significant. We can conclude that, in the short run, fintech has a dampening effect on the profitability of different categories of commercial banks; however, its negative influence on the profitability of small- and medium-sized commercial banks is much larger than that on the profitability of large commercial banks. In the long run, fintech can positively affect the profitability of different categories of commercial banks; however, its effect on the profitability of small- and medium-sized commercial banks is more obvious than that on the profitability of large commercial banks. Thus, the application and development of fintech have significantly different influences on the profitability of different categories of commercial banks, which verifies Hypothesis 3.

4.4. Robustness Tests

To ensure the reliability and accuracy of the results, we conducted a robustness test on the empirical regression model. The tests included replacing variables, adjusting data classification, and changing the standard model to observe the changes in the direction and significance levels of the empirical results. We verify that the robustness of the regression model is robust by shortening the sample period and adding or subtracting control variables. Specifically, we deleted the data for 2020 and 2021 (Model 4), deleted the control variable of total assets (Model 5), and added the deposit-to-loan ratio as a new control variable (Model 6).

Table 5 summarizes the results.

In the robustness test, the regression coefficients of the explanatory variable Fintech are negative for all three new models, and those of Fintech2 are positive. All of the results are highly significant at the 1% level. Only the regression coefficients of the control variable, GDP, changed positively and negatively, which may have been caused by removing the epidemic’s effect in the alternate sample period. The coefficients of the remaining control variables do not show any significant changes, indicating that the model is robust and the empirical results are both accurate and reliable.

5. Discussion

5.1. The Influence of Fintech on Commercial Banks

The application of fintech has a strong influence on all aspects of commercial banks. This study analyzes the influence of fintech on commercial banks’ profitability from both the theoretical and empirical perspectives and draws the following conclusions.

First, fintech has a U-shaped nonlinear influence on commercial banks’ profitability. Specifically, in the early time of fintech application, owing to its large impact and the inability of most commercial banks to change their business philosophy quickly, the competition effect is far greater than the technology spillover effect, and banks’ profitability is reduced along with the application of fintech. However, with the gradual popularization and development of fintech, commercial banks have started rationally utilizing or even developing fintech technologies independently. At this time, the technology spillover effect gradually exceeds the competition effect, and profitability improves.

Second, there are clear differences in the influence of fintech on the profitability of different categories of commercial banks. Compared with large commercial banks, the application of fintech has a more obvious inhibitory effect on the profitability of small- and medium-sized commercial banks in the short run. However, with the in-depth reform of finance and technology, fintech development will also have a stronger promotional effect on the profitability of small- and medium-sized commercial banks in the future. Overall, the widespread application and innovative development of fintech will eventually help improve commercial banks’ profitability.

5.2. Implications for the Development of Commercial Banks

5.2.1. Change Business Philosophy and Revenue Model

From the empirical results, we can conclude that the current competition effect brought about by fintech exceeds the technology spillover effect; that is, Chinese commercial banks have not yet realized the importance of the long-tail effect. Traditional commercial banks tend to ignore small- and medium-sized customer groups and focus on large customer groups. However, the advent of fintech has made the implementation of this model difficult. Therefore, commercial banks should abandon the traditional management philosophy and concentrate on small- and medium-sized customer groups. For example, cooperation with high-quality fintech companies can be considered. On the one hand, commercial banks have long-term and stable customer flow, resources, and reputation; on the other hand, fintech companies can provide advanced and complete technology and equipment. Through cooperation, the two parties can give full play to the long-tail effect, attract tail customer groups, share useful resources, and achieve mutual benefits and win-win results.

In addition, commercial banks should vigorously develop their intermediary businesses. For a long time, the interest rate spread between deposits and loans has been the main source of profit for most banks in China, and the smaller the scales of commercial banks, the more they rely on this profit model. Owing to the increasing popularity of the Internet and innovation in 5G technology in recent years, network service platforms such as Lingqiantong and Yu’e Bao have taken over the original market and customers. Therefore, commercial banks should prioritize intermediary businesses, optimize revenue models, divide the market for different customers simultaneously, and strive to improve service efficiency and quality. Second, based on the status of commercial banks in the financial industry, most customers have high levels of trust and strong stickiness. Therefore, on this basis, commercial banks can further expand their relationship networks, tap potential customers deeply, fully promote products and services, and promote the use of mobile payments. These banks can implement network platforms to obtain commissions and handle fees to promote the prosperity of intermediary businesses.

5.2.2. Vigorously Improve the Innovation Capabilities of Fintech

The regression analysis shows that commercial banks’ profitability is negatively correlated with fintech in the early stages of development but improves thereafter. Therefore, commercial banks should actively follow the fintech wave, rationally use and vigorously develop related technologies, and enhance their innovation capabilities.

First, in terms of investment, commercial banks must allocate funds in a targeted and reasonable manner, focus on the R&D needs of artificial intelligence, and increase investment in AI-related hardware and software infrastructure. In the future, commercial banks’ development will focus on both the proportion and structure of technology investment. Commercial banks with a higher proportion of capital investment in the AI field of artificial intelligence are more competitive.

Second, commercial banks will need to expand both the quantity and quality of talent. Such banks should formulate and implement a clear talent strategy; rationally coordinate the structure of traditional IT and data talents; increase the introduction of product managers, data analysts, and algorithm engineers and expand the salary boundary; pay attention to the introduction of top product managers and artificial intelligence algorithm talents; and bring top talents’ leading role into full play.

Finally, independent research and development are required to achieve independent controllability. In the future, commercial banks will apply artificial intelligence technology to various aspects of service, operation, marketing, risk control, and so on, which will involve a large amount of confidential information about the core business. Therefore, banks need to ensure independence and controllability through independent research and development as soon as possible.

5.2.3. Choose the Appropriate Fintech Development Route

The heterogeneity analysis reveals that the influence of fintech on the profitability of different categories of commercial banks differs significantly. Therefore, each type of commercial bank should be rooted in its own characteristics and advantages and choose a differentiated development route for fintech.

(1) Large commercial banks should take advantage of the resources and build ecological platforms.

Generally, large commercial banks have sufficient customer and product resources, capital, and technical strength. Therefore, in the process of promoting Internet-based process transformation, they can cooperate with fintech companies in some subdivisions, such as the “Fintech Joint Laboratory” jointly established by the Agricultural Bank of China and Baidu. Additionally, they can cooperate with external companies such as operators and online e-commerce platforms to open customer portals in diversified scenarios and platforms and embed services such as transfer, payment, lending, and wealth management. For example, the three Internet financial platform strategies of finance, e-commerce, and social networking implemented by the Agricultural Bank of China are developing in this direction. Compared with technological innovation, large commercial banks should formulate a clear fintech development strategy and clarify their internal management processes and innovation concepts.

(2) Small and medium commercial banks should create unique competitive advantages based on their resource endowments

Relative to large commercial banks, most small- and medium-sized commercial banks are limited in scale and have a large gap in resources such as customers, talents, and technologies. Therefore, a large and comprehensive platform-based development strategy may not be suitable. However, they should develop distinct characteristics and create a “small and beautiful” differentiated road for technological and financial development.

Regarding business models, most small- and medium-sized commercial banks should be rooted in their own resource endowments and innovate their development models through web-based thinking. They should adopt defensive strategies to stabilize customer sources by providing customized products for medium- and high-end customers. Simultaneously, other existing customers should be provided with an organic combination of direct sales, online banking, and mobile payments to make the service more favorable and convenient. Additionally, they should adopt an offensive strategy, take full advantage of the characteristics of grounding and high decision-making efficiency to strive to win tail customers in the market and explore unique paths for small- and medium-sized commercial banks to develop fintech.

Second, in terms of the implementation path, given the rapid development of the Internet tide, small- and medium-sized commercial banks should enhance cooperation with fintech companies to make up for their own shortcomings as soon as possible, reduce trial and error costs, and aim to collect technological dividends. For example, risk control models or cooperative loans can be built with the help of external technologies, and innovation in online financing and lending services can be implemented based on controllable costs and shared risks. Simultaneously, owing to the limited assets of a single small- and medium-sized commercial bank, it is usually impossible to achieve economies of scale. Therefore, they should work together to develop and grow, for example, by relying on common data and shared products to enrich application scenarios and increase product richness.

5.2.4. Develop Personalized Customization in a User-Centered Approach

Currently, the products and services provided by most commercial banks in China lack competitiveness and differentiation, making it difficult for them to meet different customer groups’ demands, thereby reducing their competitiveness and weakening profitability. Therefore, in the process of digital transformation and upgrading, commercial banks should fully consider the uniqueness of each customer and provide them with professional and personalized financial services based on their needs and values to increase the penetration rate of products and services. First, through cloud computing, big data, and other advanced technologies, commercial banks can dig deep into customer information and build customer segments to understand the demand dynamics of existing and potential customers more accurately and efficiently. This can be used as a standard to classify different customers to achieve detailed management. Second, according to the needs of different customers, commercial banks should design differentiated products and services in a targeted manner to improve their service quality and reputation. Third, commercial banks should concentrate on enhancing the attractiveness and innovation of their products. Once the needs of different customers are grouped, evaluated, and analyzed, they should develop the corresponding products and services in the shortest time and continuously optimize the product logic and service process.

5.2.5. Realize Digital Transformation and Upgrading

From the empirical results, the innovative development of fintech in the future can encourage commercial banks to improve their profitability. Thus, commercial banks should actively follow the wave of digitalization, give full play to the technology spillover effect brought about by fintech, and complete digital transformation and upgrades.

(1) Scenario-based front-end

In the era of traditional finance, those who won the network usually won the world; however, in the era of Fintech 3.0, it is now the case that those who win the scenarios win the world. Commercial banks not only need to provide financial products and services but also need to connect WeChat, Taobao, Didi, and other fragmented life scenes to create seamless financial services. In addition, commercial banks should also pay attention to using AI in various scenarios to learn about customer needs and then use modular product development to configure targeted products for them. Finally, they should rely on service scenes integrated into the life and ubiquitous bank entrances to make transfers, loans, wealth management, and other financial services embedded in the daily work and life of customers; integrate into corporate account reconciliation the payment, financing, and lending, and economic management of public enterprises; and embed the tax payment, fiscal expenditure, social security, and other services for government customers.

(2) Intelligent middle end

The continuous development and application of cloud computing, big data, machine learning, and other emerging cutting-edge technologies will promote commercial banks’ intelligent transformation. Through data integration, model optimization, and other advanced technologies, commercial banks will complete their evolution from data-assisted support to intelligent decision-making in areas such as asset-liability management and credit risk management. Specifically, in the credit business, data modeling and automatic judgment can be used to replace the experienced judgment of manual experts. The application of machine learning has also brought about dramatic changes in areas such as asset trading investments, internal controls, and compliance management. For example, COIN, a smart contract analysis app developed by J. P. Morgan, completed work that required 360,000 development hours in just a few seconds, and its accuracy rate has been greatly improved.

(3) Cloud-based back end

Compared with the costly calculation methods of the past, cloud computing, an emerging technology, has the ability to manage huge amounts of data, which makes the calculation process cheaper and more efficient while also eliminating the computing power gap between large and small- and medium-sized commercial banks. According to a survey of 102 financial service companies in 20 countries conducted by the International Cloud Security Alliance in 2015, 82% of financial institutions worldwide have already used or planned to use cloud services. In the future, large commercial banks will focus on private clouds, medium commercial banks will likely use core systems to build their own private clouds, and small commercial banks will gradually turn to financial industry clouds.

Author Contributions

Xiaoling Song: Conceptualization, Funding acquisition, Project administration, Resources, Methodology, Formal analysis, Visualization, Supervision, Writing—original draft, Writing—review & editing. Huizhi Yu: Methodology, Data curation, Software, Formal analysis, Visualization, Writing—original draft. Zehai He: Writing—original draft, Writing—review & editing.

Funding

The National Social Science Foundation Project, “Multi-dimensional research on the comparative evaluation and enhancement mechanism of financial inclusion under digital empowerment” (Project No.: 21BJL087).

Data Availability Statement

The data presented in this study are openly available from FigShare at 10.6084/m9.figshare.23993514.

Acknowledgments

This research project is supported by the National Social Science Foundation Project, “Multi-dimensional research on the comparative evaluation and enhancement mechanism of financial inclusion under digital empowerment” (Project No.: 21BJL087). We would like to thank Editage (

www.editage.cn) for their English language editing. We are grateful to the anonymous reviewers who commented on our manuscript.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

References

- Anifa, M., Ramakrishnan, S., Joghee, S., Kabiraj, S., Bishnoi, M.M. 2022. Fintech innovations in the financial service industry. J Risk Financ Manag. 15:1–19. [CrossRef]

- Bömer, M., Maxin, H. 2018. Why fintechs cooperate with banks—Evidence from Germany. ZVersWiss. 107:359–386. [CrossRef]

- Cheng, M., Qu, Y. 2020. Does bank FinTech reduce credit risk? Evidence from China. Pacific-Basin Fin J. 63:101398. [CrossRef]

- Elsaid, H.M. 2021. A review of literature directions regarding the impact of fintech firms on the banking industry. Qual Res Financ Markets. [CrossRef]

- Guo, J. Bouwman, H. 2016. An ecosystem view on third party mobile payment providers: A case study of Alipay wallet. Info. 18:56–78. [CrossRef]

- Guo, P., Zhang, C. 2023. The impact of bank FinTech on liquidity creation: Evidence from China. Res Int Bus Fin. 64:101858. [CrossRef]

- Guo, P.; Shen, Y. 2015.The impact of Internet Finance on Risk Taking of Commercial Banks: Theoretical Interpretation and Empirical Test. Fin Trade Econ. 10:102–116. [CrossRef]

- Hu, W., Zhang, L., Li, X., Li, X. 2018. Research on the nonlinear relationship between financial innovation and profitability of commercial banks: A threshold model analysis based on panel data of listed commercial banks in China. Financial Regulation Research. 09:16–31.

- Huang, Y., Qiu, H. 2021. Big tech credit: A new credit risk management framework. Manag World. 37:12–21+50+2+16.

- Kadyan, S., Bhasin, N.K., Sharma, M. 2022. Fintech: Review of theoretical perspectives and exploring challenges to trust building and retention in improving online Digital Bank Marketing. Transnat Mark, J. 2022:579–592.

- Koffi, H.W.S. 2016. The fintech revolution: An opportunity for the west African financial sector. OJAppS. 06:771–782. [CrossRef]

- Lagna, A., Ravishankar, M.N. 2022. Making the world a better place with fintech research. Inf Syst J. 32:61–102. [CrossRef]

- Lee, C.C., Li, X., Yu, C.H., Zhao, J. 2021. Does fintech innovation improve bank efficiency? Evidence from China’s banking industry. Int Rev Econ Fin. 74:468–483. [CrossRef]

- Legowo, M.B., Subanidja, S. and Sorongan, F.A., 2021. Fintech and bank: Past, present, and future. Jurnal Teknik Komputer AMIK BSI. 7(1), pp.94-99. [CrossRef]

- Li, G., Elahi, E., Zhao, L. 2022. Fintech, Bank Risk-Taking, and Risk-Warning for Commercial Banks in the Era of Digital Technology. Front Psychol. 13:934053. [CrossRef]

- Lu, J., Allah, T., Yin, Y. 2013. Factors influencing the profitability of Chinese commercial banks: An empirical analysis based on data from 1997 to 2010; Financial Forum. 18:3–14.

- Lu, L. 2018. Decoding Alipay: Mobile payments, a cashless society and regulatory challenges. Butterworths Journal of International Banking and Financial Law. 40–43.

- Sajid, R., Ayub, H., Malik, B.F., Ellahi, A. 2023. The role of fintech on bank risk-taking: Mediating role of Bank’s operating efficiency. Hum Behav Emerg Technol. 2023:1–11. [CrossRef]

- Sheng, T. 2021. The effect of fintech on banks’ credit provision to SMEs: Evidence from China. Fin Res Lett. 39:101558. [CrossRef]

- Stulz, R.M. 2019. FinTech, BigTech, and the Future of Banks. J Appl Corp Finance. 31:86–97. [CrossRef]

- Tanda, A.; Schena, C.M. 2019. Fintech, B. Tech and Banks; Palgrave Pivot: Cham. pp. 7–36.

- Temelkov, Z., Gogova Samonikov, M. 2018. The need for fintech companies as nonbank financing alternatives for SME in developing economies. International Journal of Information. Bus Manag. 10:25–33.

- Thakor, A.V. 2020. Fintech and banking: What do we know? J Financ Intermed. 41:1–46. [CrossRef]

- Vives, X. 2017. The impact of FinTech on banking. Eur Econ. 2:97–105.

- Wang, M., Zhu, J. 2022. How fintech affects the profitability of commercial banks: An empirical analysis based on listed commercial banks. Sci Decis Mak. 06:1–15.

- Wang, R., Liu, J., Luo, H. 2021. Fintech development and bank risk taking in China. Eur J Fin. 27:397–418. [CrossRef]

- Wang, Y., Luo, S. 2022. Fintech and business performance of commercial banks: An analysis of the mediating effect based on risk taking. Financial Forum. 27:19–30.

- Wang, Y., Xiuping, S., Zhang, Q. 2021. Can fintech improve the efficiency of commercial banks?—An analysis based on big data. Res Int Bus Fin. 55:101338. [CrossRef]

- Wonglimpiyarat, J. 2017. FinTech banking industry: A systemic approach. Foresight. 19:590–603. [CrossRef]

- Xie, R., Li, S., Zhang, M. 2021. Research on the impact of inclusive finance on the profitability of commercial banks under the background of fintech. Quantitative Economics and Technical Economics Research. 38:145–163.

- Zhao, J., Li, X., Yu, C.H., Chen, S., Lee, C.C. 2022. Riding the FinTech innovation wave: FinTech, patents and bank performance. J Int Money Fin. 122:102552. [CrossRef]

- Zhao, Q., Bu, L. 2022. Can banks develop fintech to improve business performance? Empirical evidences from 92 banks in China. Theor Pract Fin Econ. 43:19–26.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).