1. Introduction

With the new generation of information technologies represented by big data and artificial intelligence being applied in many fields of social life, the digital economy and e-commerce of countries worldwide have been greatly developed. The China E-commerce Report (2021) revealed that the national e-commerce transaction volume may reach ¥42.3 trillion RMB in 2021, with a year-on-year growth of 19.6%. According to the Digital China Development Report (2022), the scale of China’s digital economy reached ¥50.2 trillion RMB in 2022, ranking second in the world, with a year-on-year nominal growth of 10.3%. With an increasing focus on environmental protection by people and organizations in societies worldwide, an increasing number of customers want to buy green products in e-business [

1]. To fulfill customers’ green preferences, drop shipping e-tailers should purchase green products from suppliers with a drop shipping option who produce green products. In other words, the supplier with a drop shipping option should spend more resources to innovate its production of green products compared to normal ones, which would subsequently increase the cost of manufacturing these green products and the wholesale price. In this scenario, the supplier with a drop shipping option should decide whether to provide green products or sell normal products. When the supplier with a drop shipping option supplies green products at a higher wholesale price than normal products to the drop shipping e-tailer, the latter should also determines whether to provide green products at a high retail price or to supply normal products at a low retail price, because the increase in retail price of physical goods will reduce the number of customer demand. This study proposes two operational scenarios for drop shipping e-tailers based on traditional models [

2]. The first scenario involves a drop shipping e-tailer selling normal products, and the second scenario involves a drop shipping e-tailer providing green products. Furthermore, this study expands green innovation of the e-tailer and supplier from traditional models to drop shipping models, and the optimal decisions of the drop shipping e-tailers and suppliers with a drop shipping option across different operational environments are also evaluated.

The Global Digital Economy White Paper released at the 2023 Global Digital Economy Conference, indicates that the scale of China’s digital economy will increase to

$4.1 trillion dollars in 2022, with a compound annual growth rate of 14.2%. Against the backdrop of a booming digital economy, China’s e-commerce has also exhibited a thriving and prosperous scene. The concept of the digital economy was first proposed by Tapscott in 1995, and he believed that an important feature of the digital economy is networked intelligence [

3]. In 1998, Tapscott, Lowy and Ticoll et al. wrote a blueprint for the digital economy and believed that the era of e-business was coming and would bring more wealth to the society [

4]. Carlsson then evaluated the reasons why the digital economy is called the new economy of the United States’ economy in the latter half of the 1990s, and observed changes in the view that digitization of information, combined with the Internet, etc. [

5]. Peitz and Waldfogel provided a series of theoretical and empirical works on the digital economy, including the digital industry and business practices [

6]. Although green development has been accepted in many countries worldwide, Liu, Liu and Osmani agreed that digital technology had powerful potential in promoting the development of a circular economy and reviewed the research progress and trends of the integration of the circular economy and digital economy [

7]. Rusch, Schoggl and Baumgartner considered digital technologies to act as enablers for a more sustainable and circular economy and offered a comprehensive overview of current and potential examples of digital technology applications in different models through quantitative and qualitative content analysis [

8]. In general, with more than decades of continuous research on the digital economy and green development by many scholars and experts, fruitful results have valuable positive significance for the sustainable development of the world economy and natural environment.

Drop Shipping was initially used by mail order companies as a marketing method in the 1990s, achieving great success after they were introduced into e-commerce, and obtaining a win-win model of sharing customer information and e-fulfillment capabilities between the e-tailers and suppliers [

9]. The world’s largest luggage e-tailer, eBags, uses drop shipping to sell over 12000 kinds of goods with more than 200 brands. Many e-tailers in Taobao, eBay, and Amazon chose drop shipping to complete their customer orders. Lee and Chu examined the variation in the e-tailer’s profit in traditional, VMI, CAM and drop shipping modes based on the Newsvendor Model [

10]. Bailey and Ravinovich believed that e-tailers should mix traditional channel and drop shipping mode in most operational environments, which can improve product sales [

11]. Mukhopadhyay, Zhu and Yue analyzed the optimal decision-making issues of manufacturers using mixed-channel models [

12]. Xiao, Chen and Chen evaluated the optimal inventory and ordering decisions of an e-tailer in hybrid channels, who utilized an Internet store and physical shop to provide seasonal commodities for customer demand from online and offline channels [

13]. Chiang and Feng investigated corporate issues between the manufacturer and the e-tailer with traditional distribution channel and drop shipping channel and analyzed the profit rate and efficiency of these two channels [

14]. Zhao, Duan and Wang et al. focused on the coordination mechanism and pricing issues of a dual-channel supply chain with a drop shipping option [

15]. In recent years, with the gradual increase in emerging information technologies such as big data in e-commerce and other related fields [

16], research on e-tailers has attracted the attention of many experts and scholars worldwide. In 2018, Chen, Chiu and Lin et al. proposed online products arrangement and stock management problems for an e-tailer in a drop shipping environment [

17]. Sodero, Namin and Gauri et al. used analytical models to examine the inventory assortment operation of an e-tailer who provided seasonal products to the market with both drop-shipping and store channels [

18]. Qiu, Hou and Sun, et al. analyzed the decision issues of a dual-channel supply chain that contained a manufacturer, a traditional retailer, and an e-tailer, and obtained analytical solutions for pricing and ordering decisions with uncertain demands through a distribution-free approach [

19]. These findings indicate that e-commerce has become an important growth point in the social economy and a new driving force for promoting economic growth, but there are rarely research of the green innovation of the drop shipping e-tailer and supplier in e-commerce, it is just the motivation of this study. And with the vigorous development of e-commerce activities worldwide, particularly the rise of cross-border e-commerce, various business model innovations will continue to emerge in the real economy.

The remainder of this paper is organized as follows:

Section 2 describes the notations utilized in this research. The operational models of the drop shipping e-tailers and suppliers with a drop shipping option are investigated in section 3, and this section analyzes the margins they gained from selling normal and green products to customers.

Section 4 evaluates the optimal choices and decisions of drop shipping e-tailers and suppliers with a drop shipping option for offering normal and green commodities. The effect of environmental parameters on drop shipping e-tailers and suppliers with a drop shipping option in different operational scenarios are illustrated through simulation analysis in

Section 5.

Section 6 concludes.

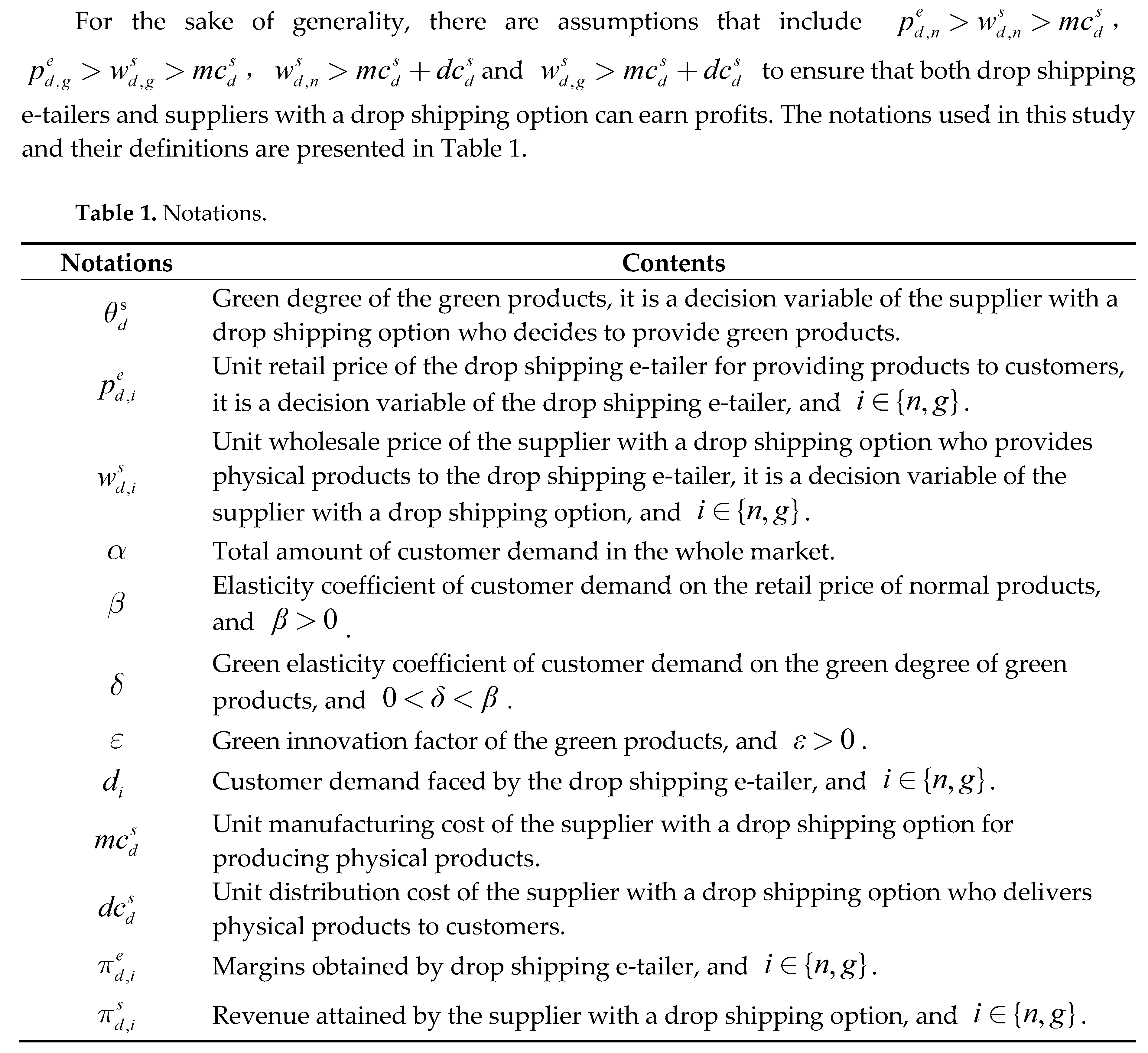

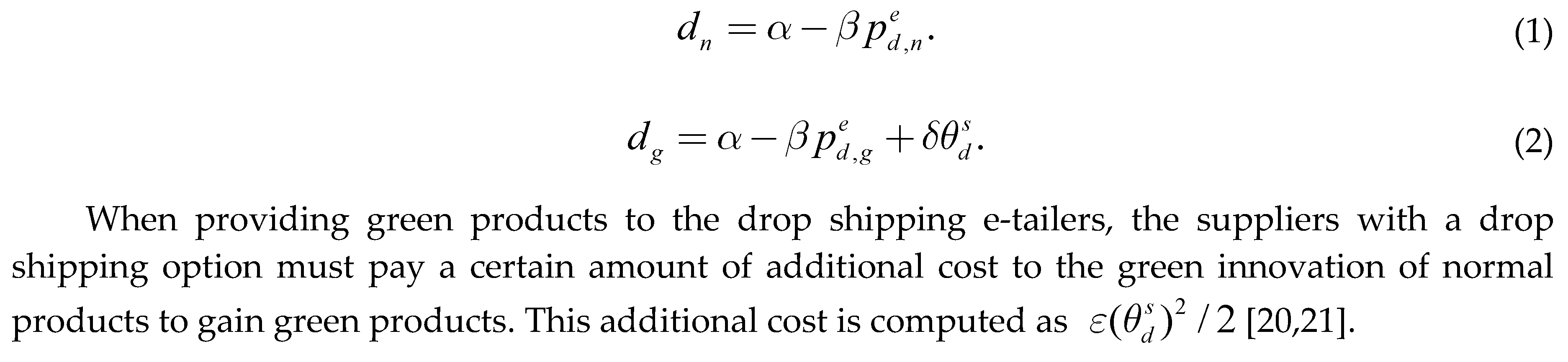

3. Models of the Drop Shipping E-tailers and Suppliers

In drop shipping models, the customer demands in the market where the suppliers with a drop shipping option produce normal and green products are computed using equations (1) and (2) [

2,

20].

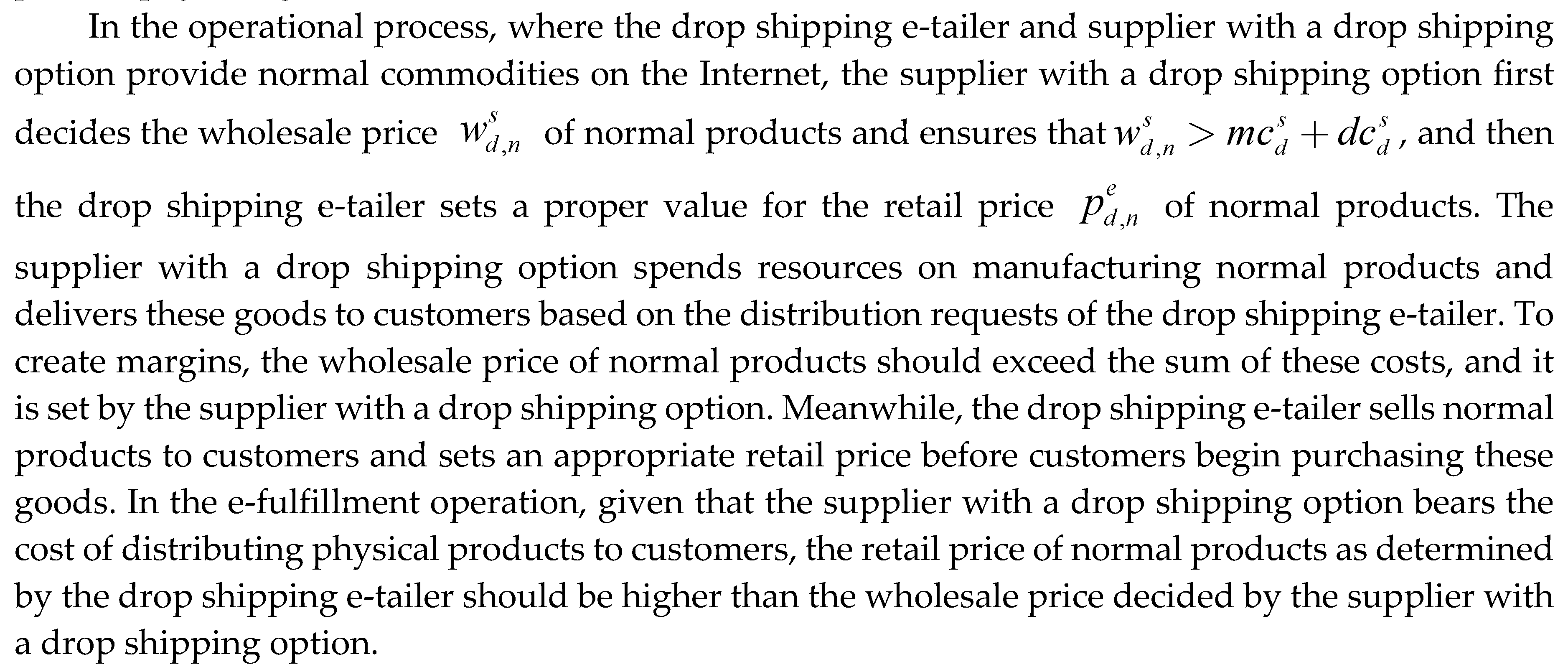

3.1. Drop Shipping Models with Normal Products

E-tailers do not have a private inventory system in the drop shipping models. When customers on the Internet purchase normal goods from the drop shipping e-tailer, the latter receives the order information from the customers, and then transfers this information to the supplier with a drop shipping option; the supplier delivers these physical products to customers directly according to received order information. Drop shipping e-tailers differ from traditional e-tailers in three ways. First, traditional e-tailers operate an inventory system, whereas drop shipping e-tailers have no such system. Second, traditional e-tailers send their physical products to customers and pay the distribution cost, whereas drop shipping e-tailers do not charge any distribution cost and let the suppliers with a drop shipping option finish the distribution process. Third, e-fulfillment is accomplished by the traditional e-tailers themselves with their inventory stocks, whereas the drop shipping e-tailers fully depends on the suppliers with a drop shipping option to complete the e-fulfillment process. For the suppliers, the biggest change is the newly added distribution cost in drop shipping models compared with traditional models, and it will cause an increase in the wholesale price of physical goods.

In general, the wholesale and retail prices of normal products are decided by the supplier with a drop shipping option and drop shipping e-tailer, respectively. The supplier with a drop shipping option spends a certain amount of fees on manufacturing physical products, delivers physical products to end customers according to the order information received from the drop shipping e-tailer, and supplies commodities to the drop shipping e-tailer at the wholesale price. Whereas, the drop shipping e-tailer provides product information to customers, gathers their order information over the Internet and sends order information to the supplier with a drop shipping option for the distribution service.

If the supplier with a drop shipping option and drop shipping e-tailer offer normal products to

the market, the unit margin of the drop shipping e-tailer for providing normal products is obtained

by subtracting the wholesale price from the retail price of normal goods, whereas its total income is

obtained by multiplying the amount of customer demand dn by the unit revenue. Meanwhile, the unit profit of the supplier with a drop shipping option for offering normal commodities is computed

as the wholesale price minus the manufacturing and distribution costs of normal products, and its total income is obtained by multiplying the sum of customer demand dn for normal products on the Internet by unit revenue. Then the profits of the drop shipping e-tailer and supplier with a drop shipping option are computed using equations (3) and (4), respectively.

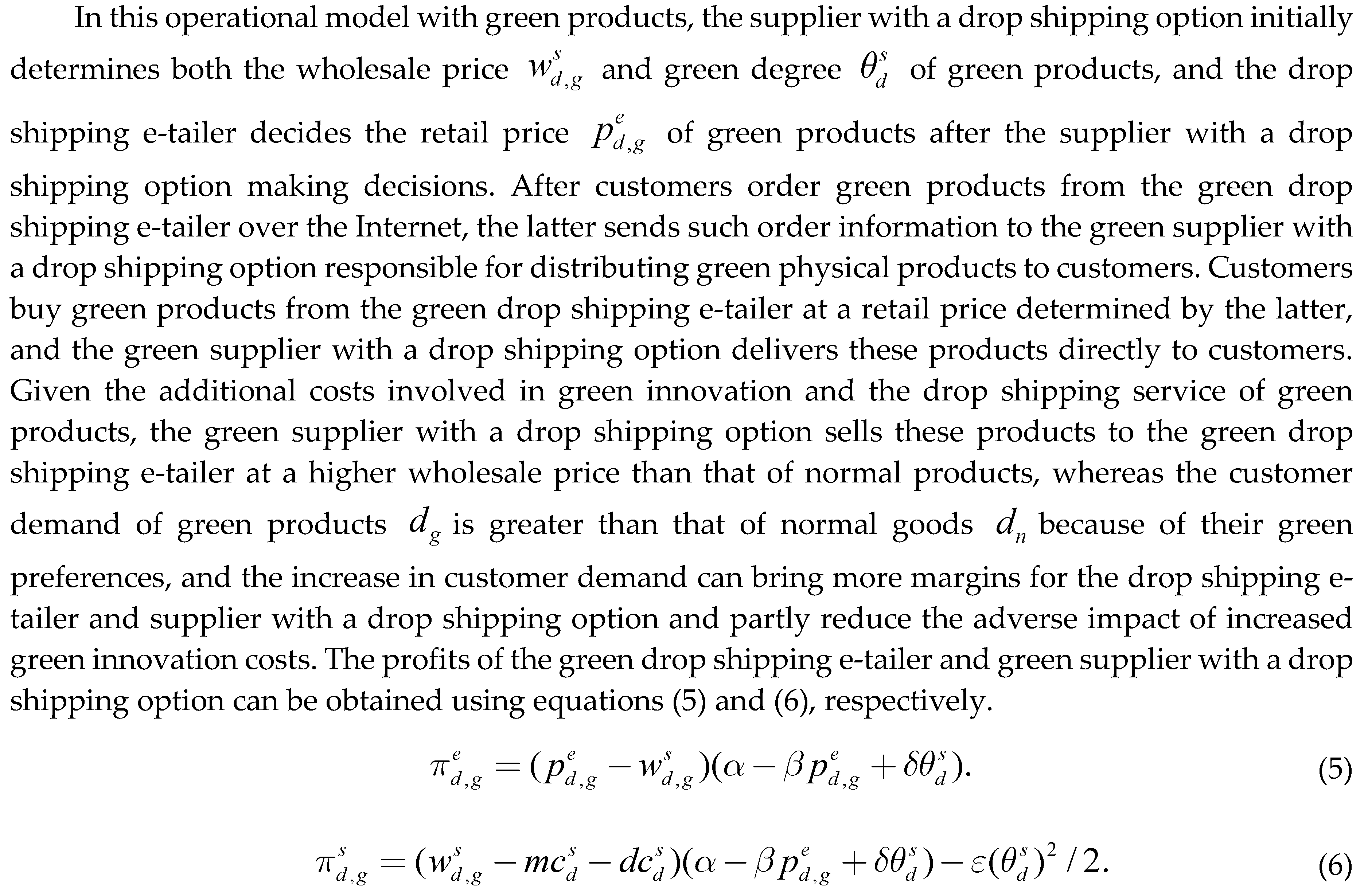

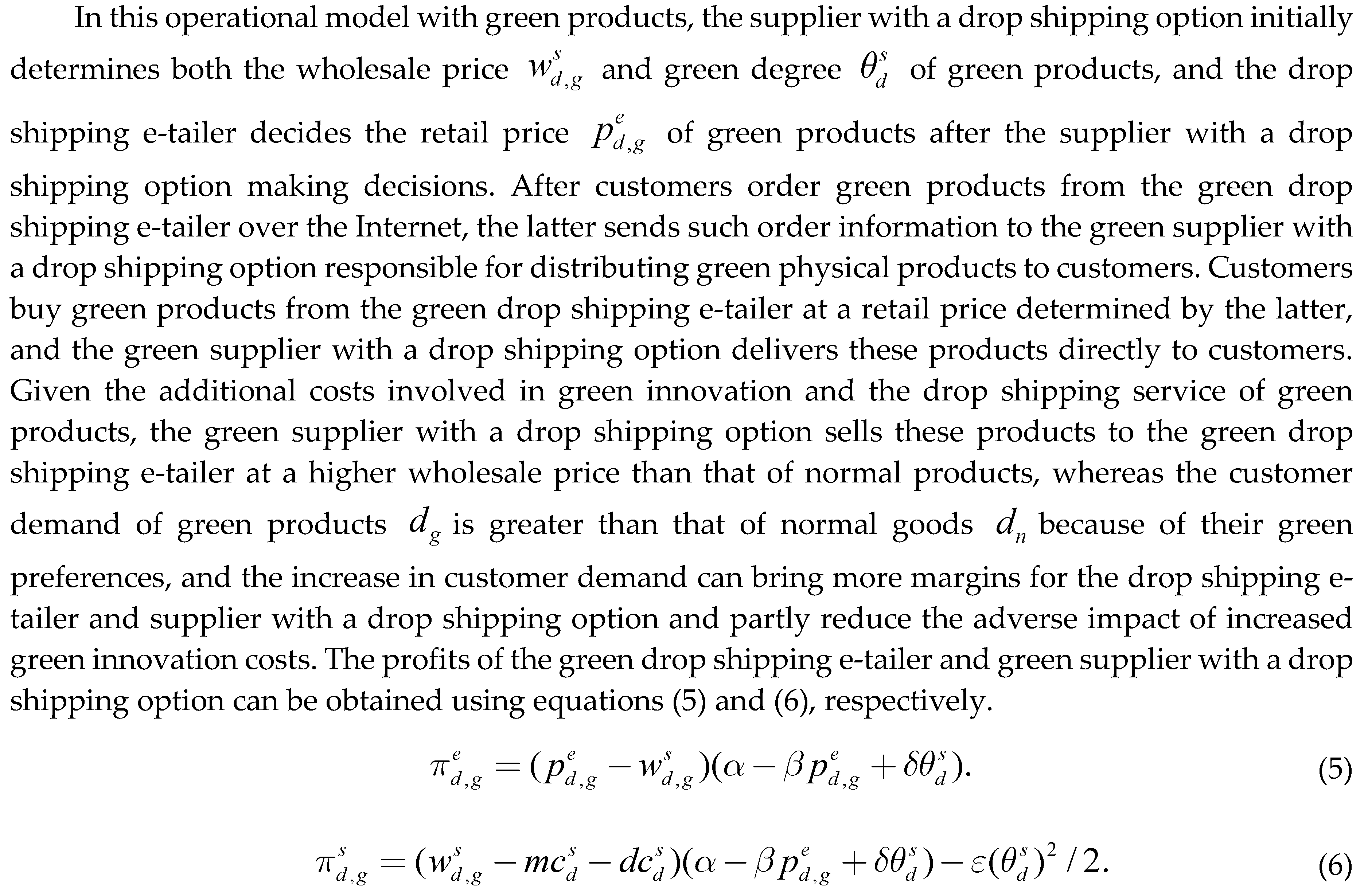

3.2. Drop Shipping Models with Green Products

Based on the operational environment of the green drop shipping e-tailer and green supplier with a drop shipping option, the physical goods stored in the inventory systems of the latter are all green products in drop shipping models, and the operational steps in e-fulfillment are the same as those for the normal products. The green supplier with a drop shipping option is responsible for manufacturing green goods for the drop shipping e-tailer and distributing these green goods to customers. Meanwhile, the green drop shipping e-tailer must transfers information about green products to customers and sends order information to the green supplier with a drop shipping option. In the process of manufacturing green products, the green supplier with a drop shipping option should charge additional fees to perform the green innovation of green products. Therefore, for the green supplier with a drop shipping option, the fees for manufacturing green products are higher than those for producing normal products.

4. Optimal Choices and Decisions of the Drop Shipping E-tailers and Suppliers

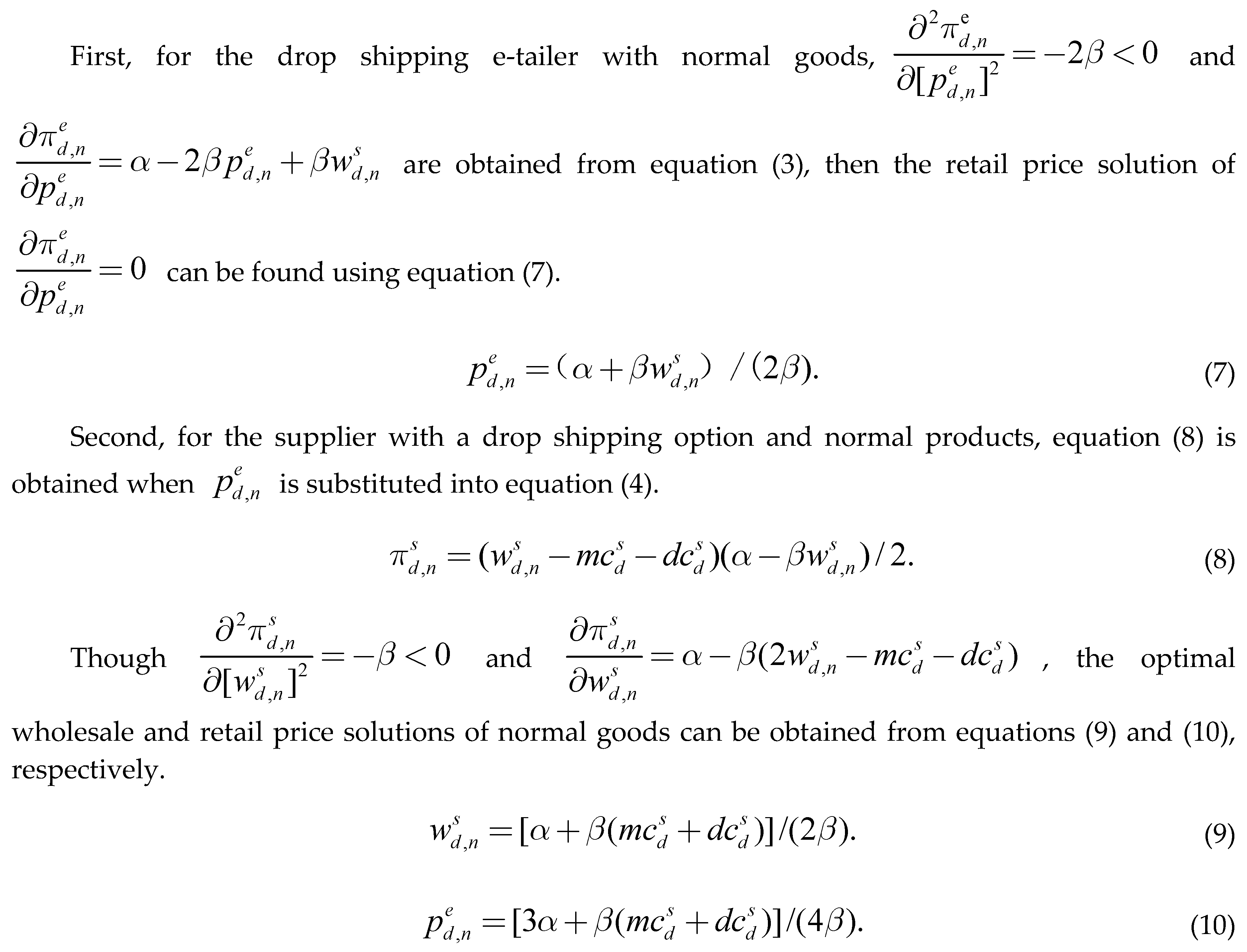

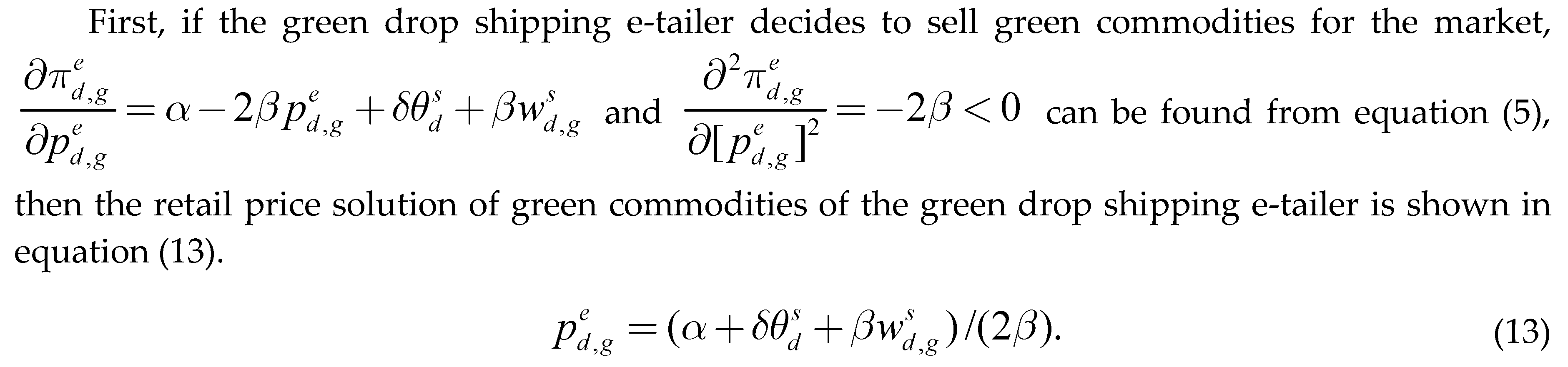

4.1. Optimal Pricings Decisions of the Drop Shipping E-tailer and Supplier with Normal Products

In this section, the optimal retail and wholesale prices of normal commodities for the drop shipping e-tailer and supplier with a drop shipping option are analyzed based on equations (3) and (4).

Third, when providing normal goods to customers in drop shipping models, the margins of the drop shipping e-tailer and supplier with a drop shipping option can be described as follows:

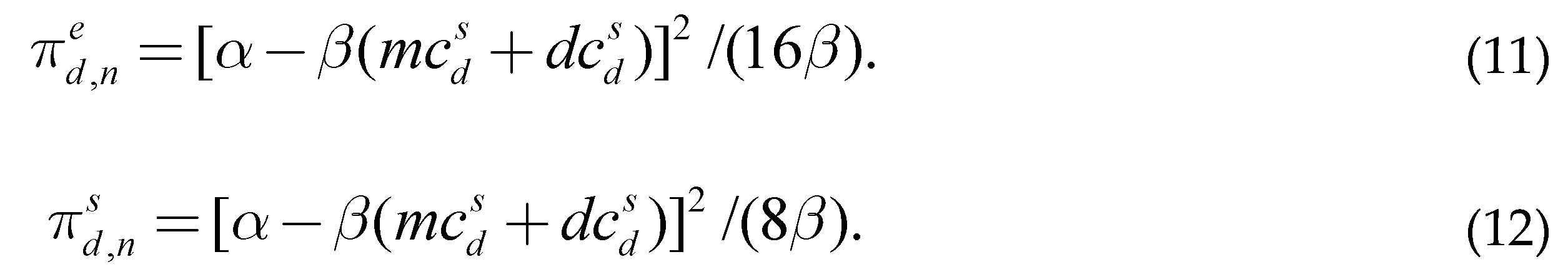

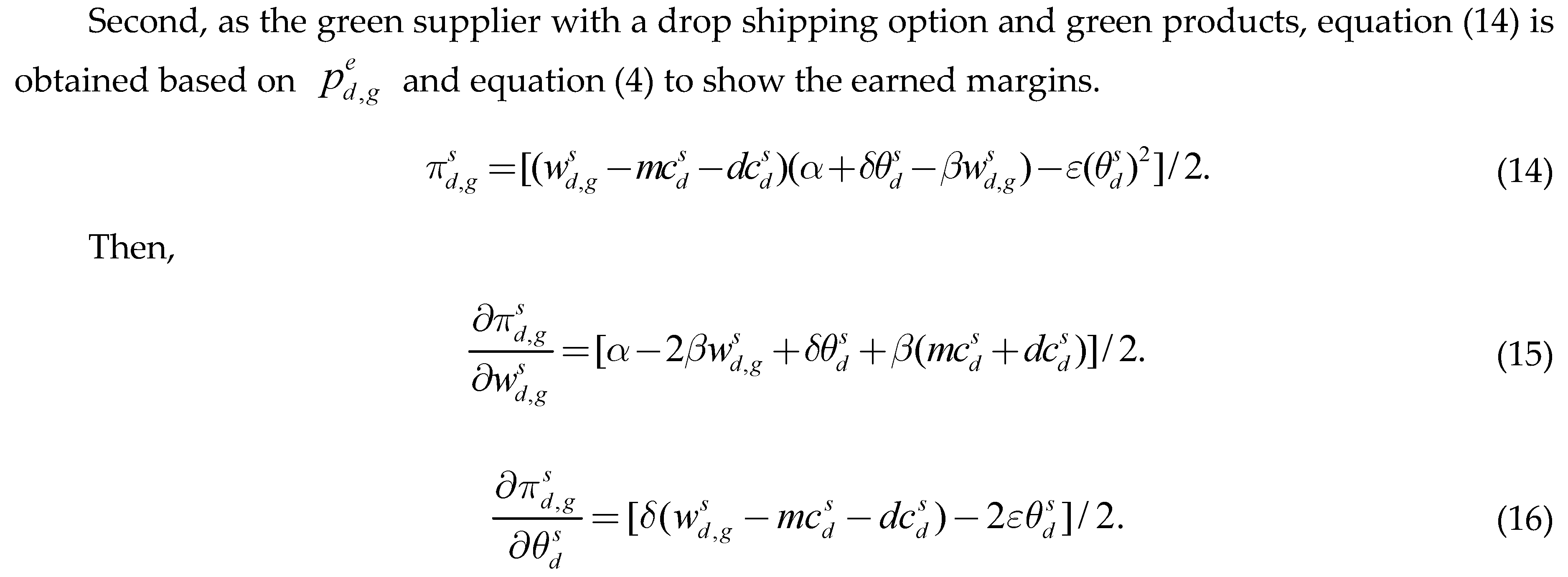

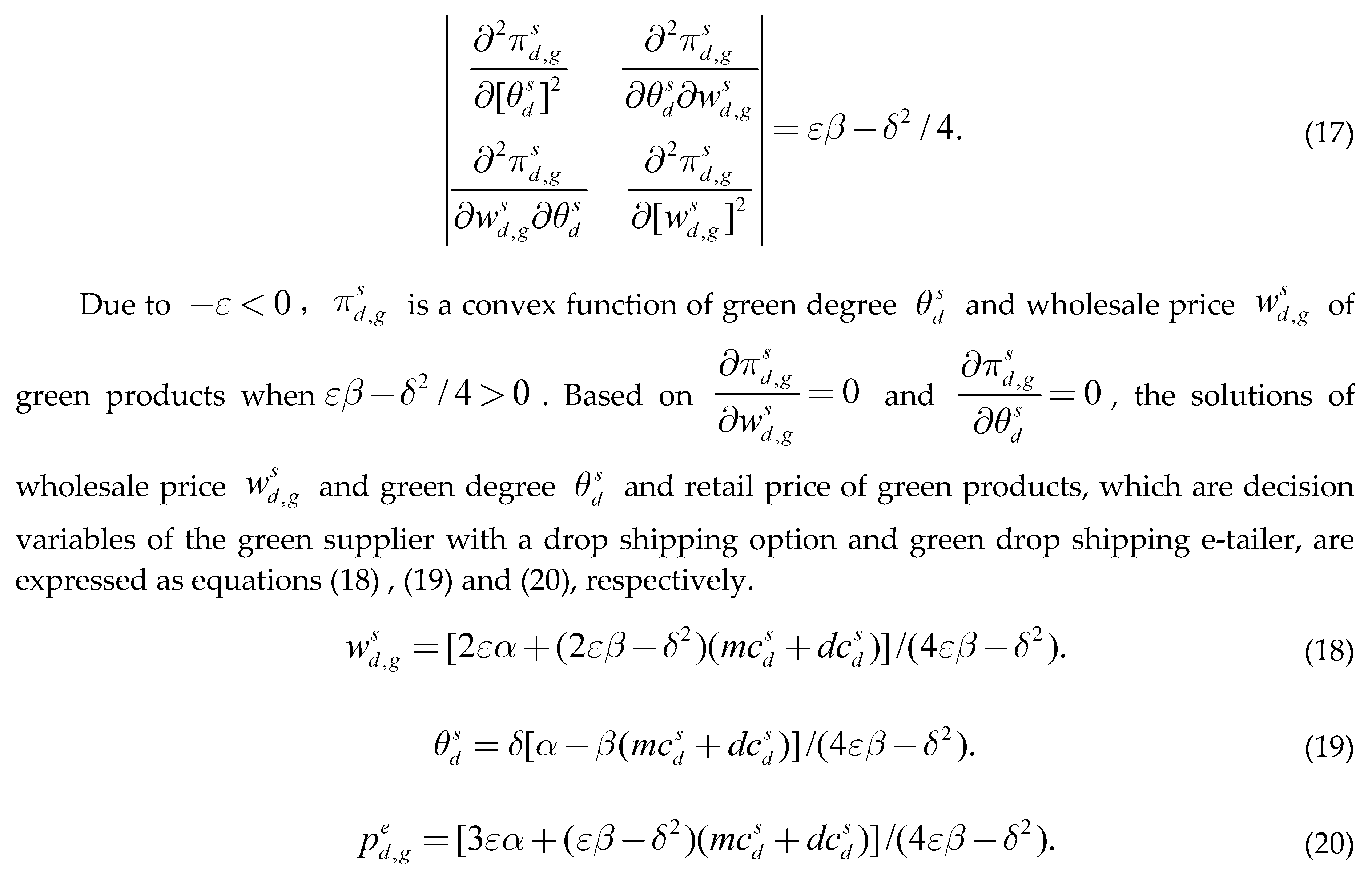

4.2. Optimal Green Degree and Pricings Decisions of the Drop Shipping E-tailer and Supplier with Green Products

Compared to drop shipping models with normal products, the green supplier with a drop shipping option has two decision variables, which are wholesale price and the green degree of green goods when offering green products to customers, while the green drop shipping e-tailer decides the retail price of green products in this scenario. The optimal wholesale price, green degree and retail price of the green supplier with a drop shipping option and green drop shipping e-tailer are examined in this section according to equations (5) and (6) .

Third, after the optimal values of three decision variables were achieved in drop shipping models with green products, the maximum profits of the green drop shipping e-tailer and green supplier with a drop shipping option when providing green products were constructed using equations (21) and (22), respectively.

4.3. Analysis of the Optimal Choices and Decisions of the Drop Shipping E-tailer and Supplier

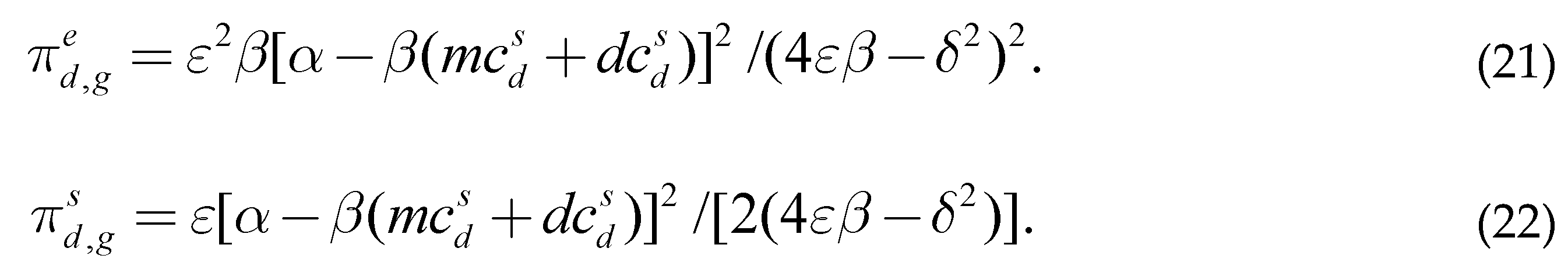

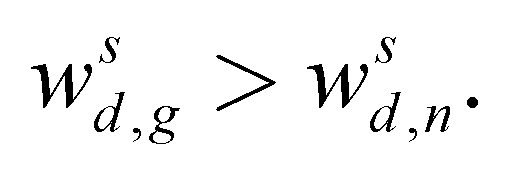

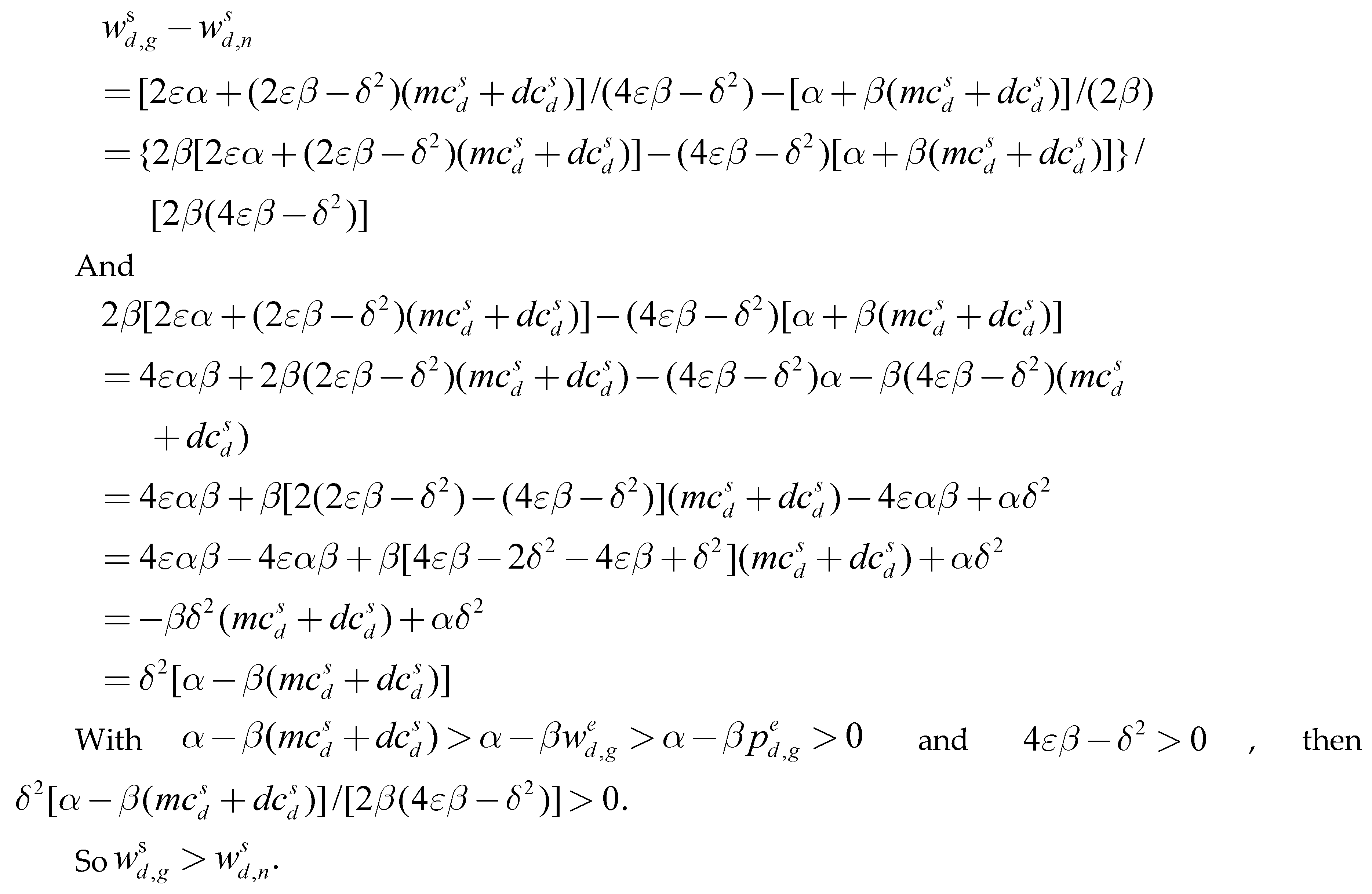

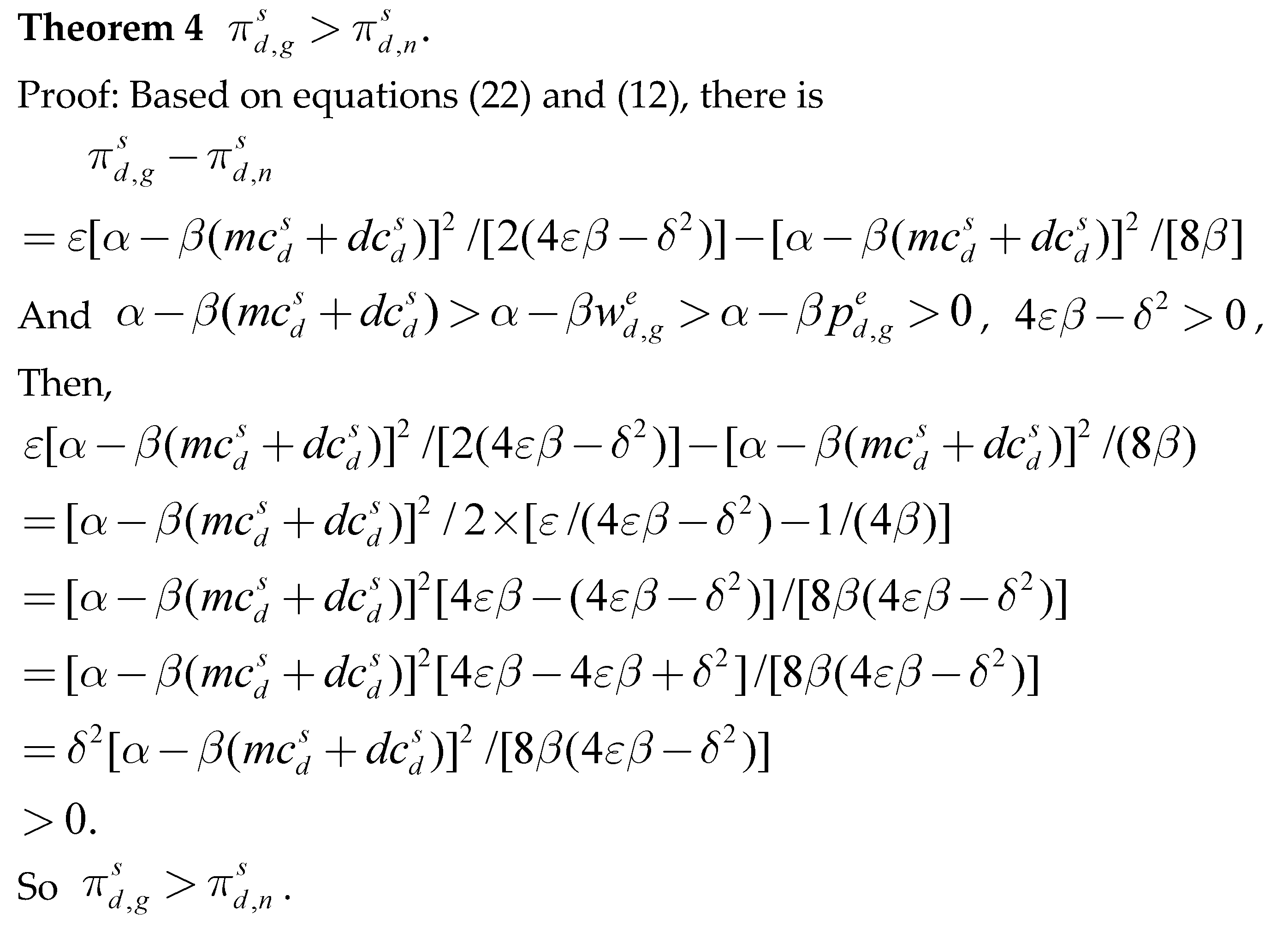

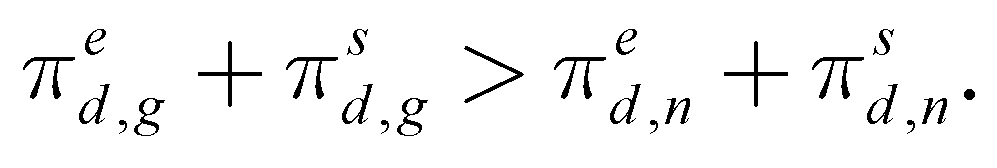

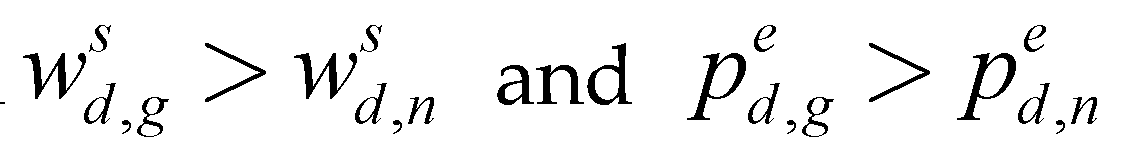

Finally, five theorems were obtained based on the analysis of the optimal decisions on wholesale and retail prices and margins of the drop shipping e-tailer and supplier with a drop shipping option in two different drop shipping models.

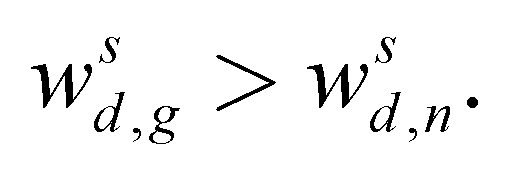

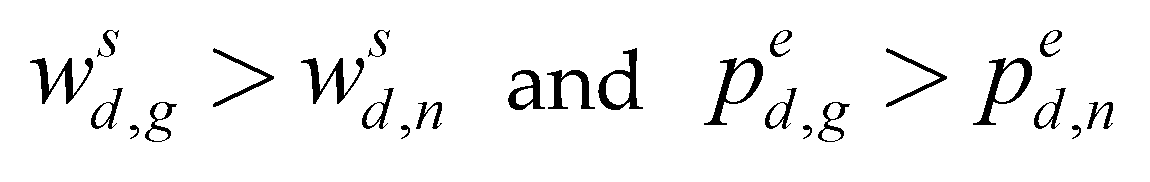

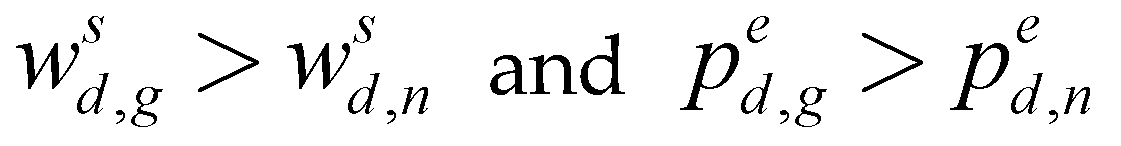

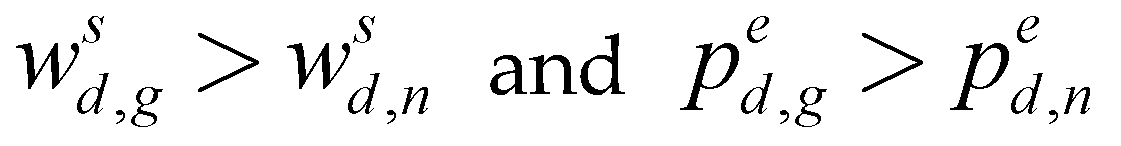

Theorem 1.

Proof: It can be obtained from equation (18) minuses equation (9), as follows:

and

Theorem 1 reveals that the wholesale price of green products decided by the green supplier with a drop shipping option is higher than that of normal products in the drop shipping models.

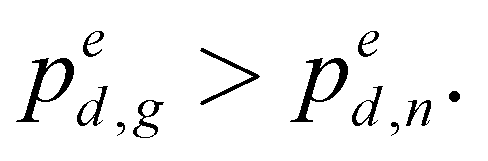

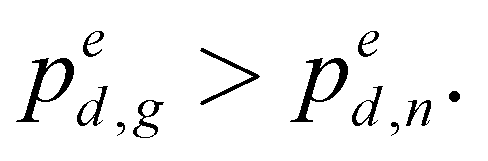

Theorem 2.

Proof: The result of equation(20)minuses equation(10)is,

Theorem 2 shows that the retail price of green products determined by the green drop shipping e-tailer is also higher than that of normal products.

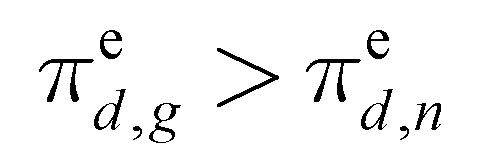

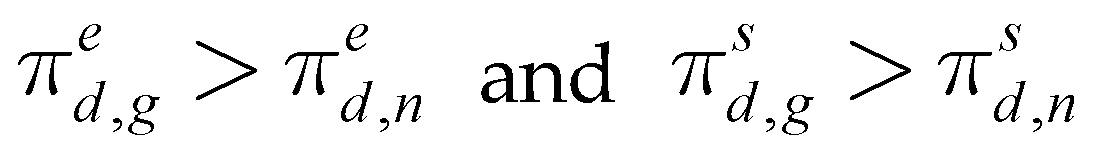

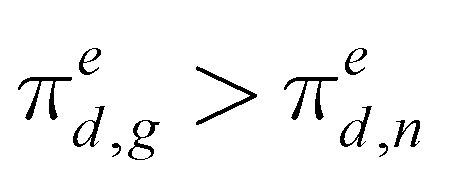

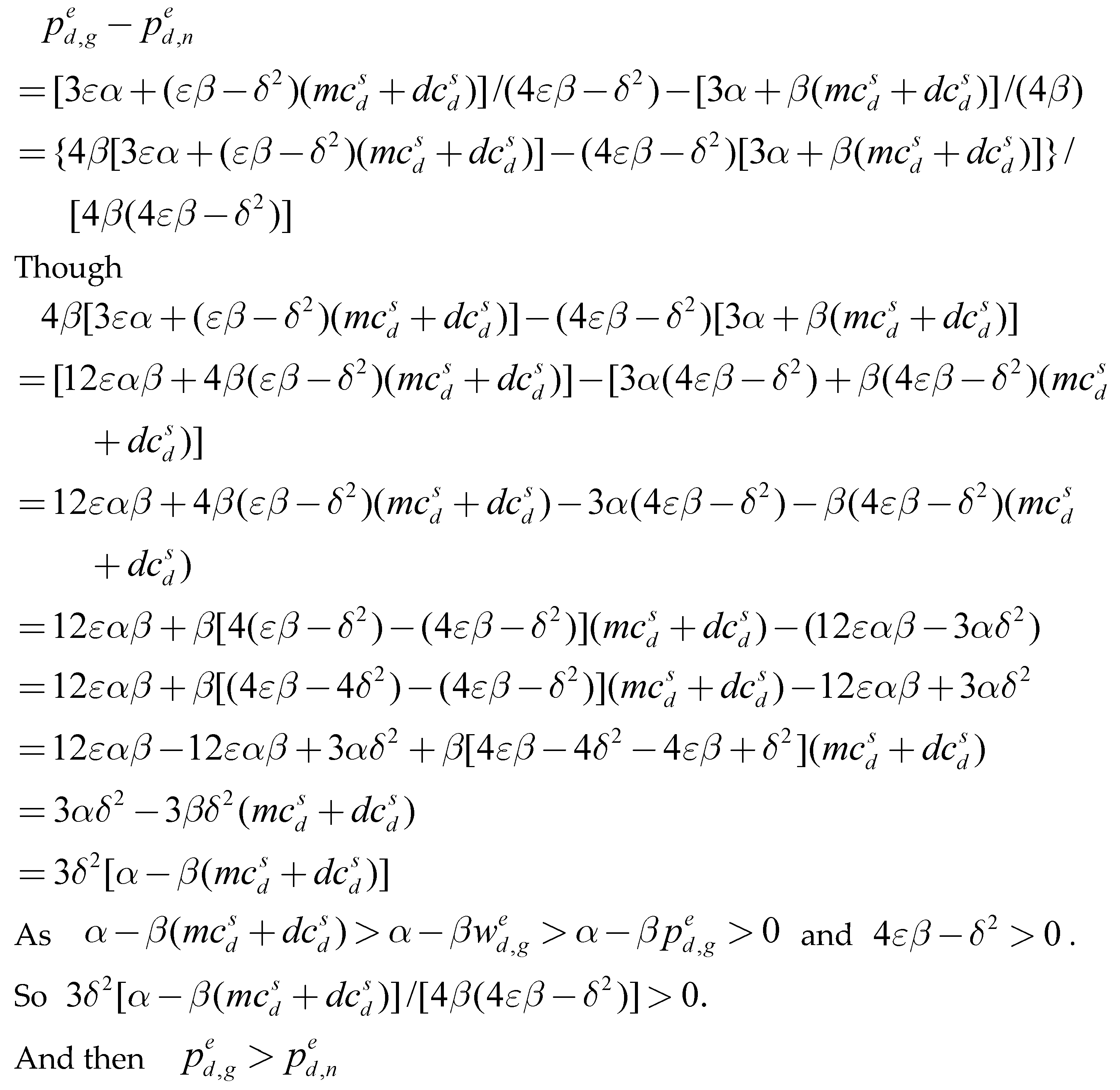

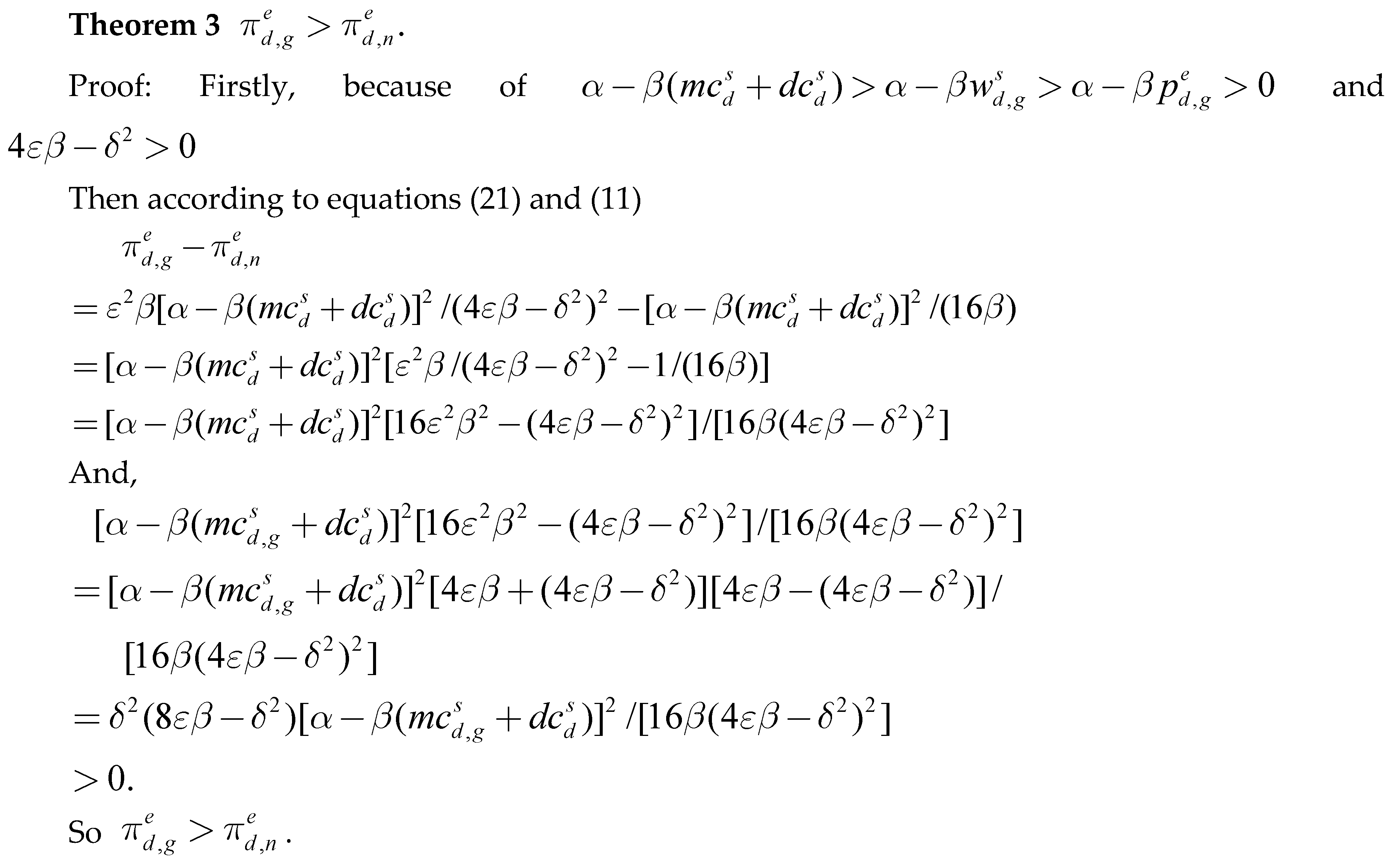

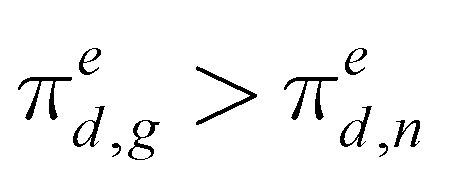

Theorem 3 implies that the green drop shipping e-tailer obtains more margins from providing green products than normal ones in the drop shipping models.

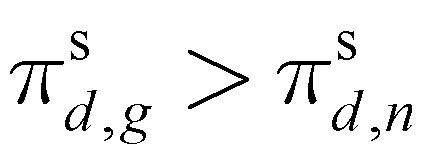

Theorem 4 indicates that the green supplier with a drop shipping option generates more revenues by providing green products to the green drop shipping e-tailer than normal products.

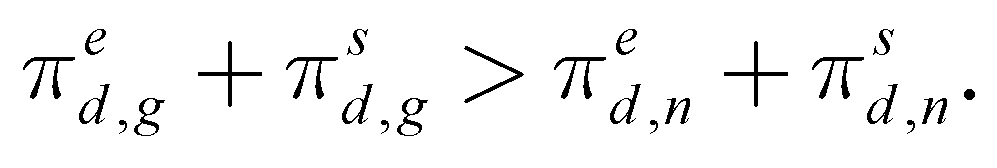

Theorem 5.

Proof: Theorem 5 is obtained based on Theorem 3 and Theorem 4.

Theorem 5 proves that the total income earned from supplying green products is greater than that of normal products in an operational environment with drop shipping.

The results of these theorems show that, the optimal choices of the drop shipping e-tailer and supplier with a drop shipping option are all offering green products to the market, both the green drop shipping e-tailer and green supplier with a drop shipping option earn more margins from selling green products than normal ones in drop shipping models, although the retail and wholesale prices of green products are greater than those of normal products.

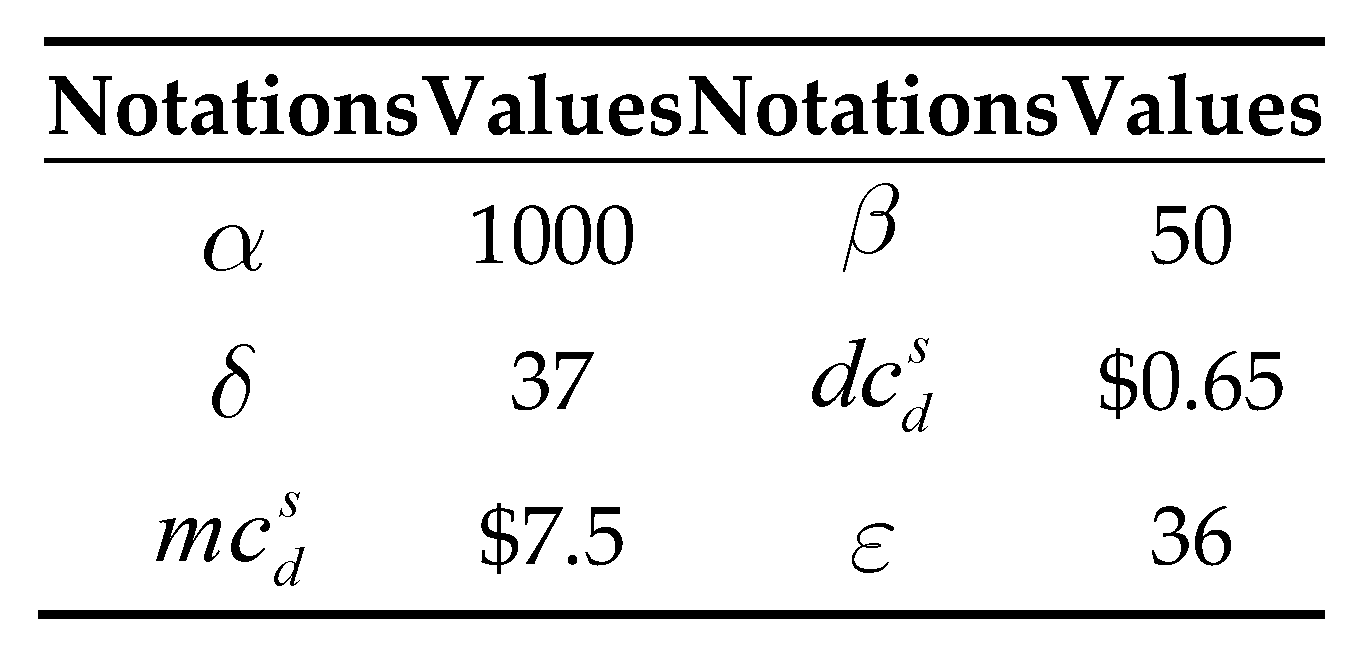

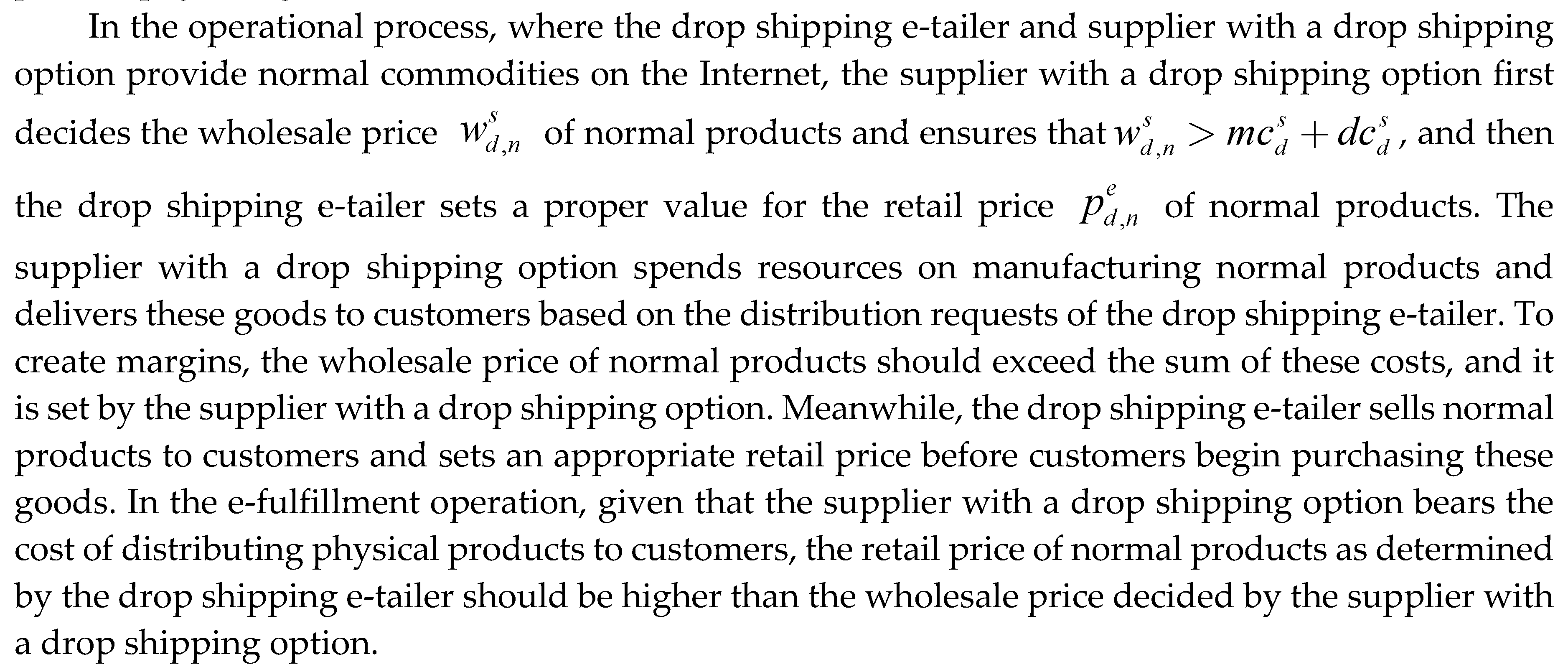

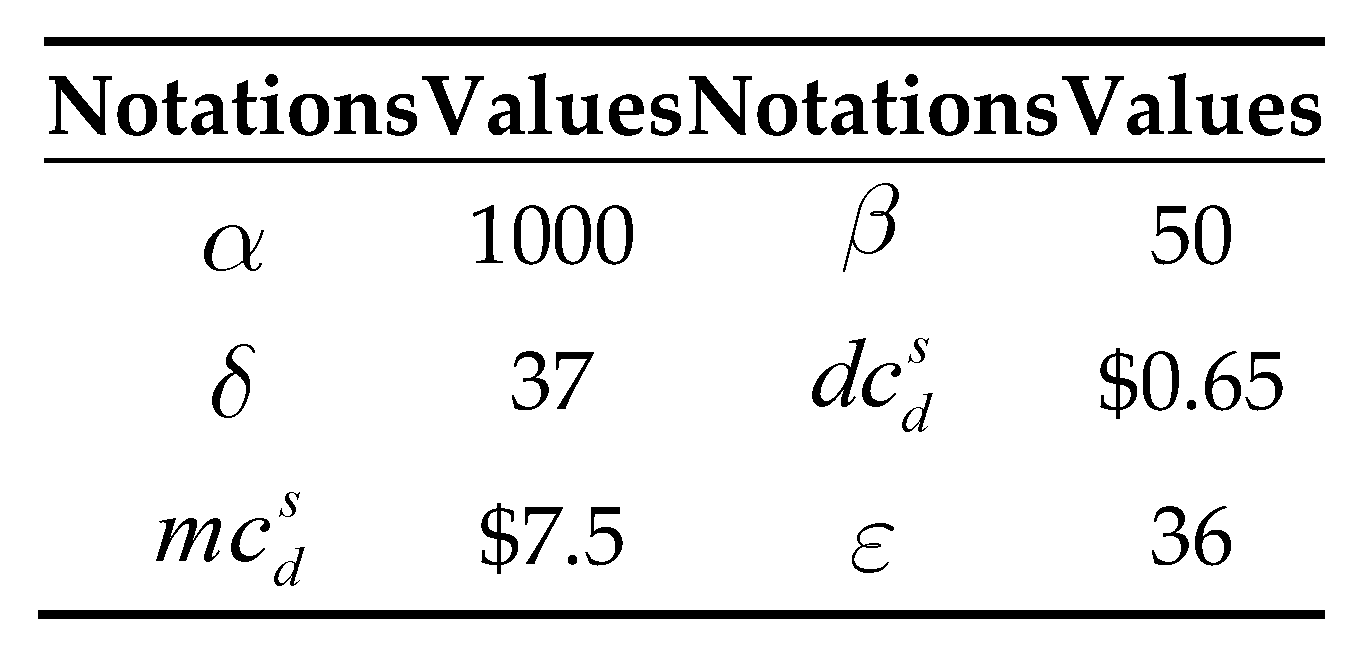

5. Experimental Analysis

The Simulation platform consists of a Lenovo (RAM: 16G, CPU: Intel Core i5-7200U 2.50GHz, HDD: 1T) and MATLAB (v.R2010b).The effects of the green elasticity coefficient, green innovation factor, manufacturing cost, and distribution cost on the drop shipping e-tailer and supplier with a drop shipping option were evaluated in this experimental simulation. The simulation considers the green degree, wholesale and retail prices of green products, and the margins earned by the drop shipping e-tailer and supplier with a drop shipping option from supplying green products to the market. The optimal choices and decisions of the drop shipping e-tailer and supplier with a drop shipping option were ensured through a comparative analysis in different operational scenarios. The values of environmental parameters used in the simulation are listed in Table 2.

Table 2. The values of environmental parameters.

5.1. Analysis of the Impact of Operational Parameters on the Green Degree of Green Products

The green supplier with a drop shipping option consumes additional fees to accomplish the green innovation of green products, because the optimal choices of the drop shipping e-tailer and supplier with a drop shipping option are chosen to provide green commodities for customers. The additional fees can cause an increase in the wholesale and retail price of green products, and a decrease in customer demand, whereas an increasing green degree of green products may bring more customer demand to the green drop shipping e-tailer and green supplier with a drop shipping models. So the green supplier with a drop shipping option regards the green degree as a valuable decision variable for green products to maximize margins. And the operational parameters which include the green innovation factor, green elasticity coefficient, manufacturing cost and distribution cost, impact the green degree of green products are evaluated in this experiment simulation.

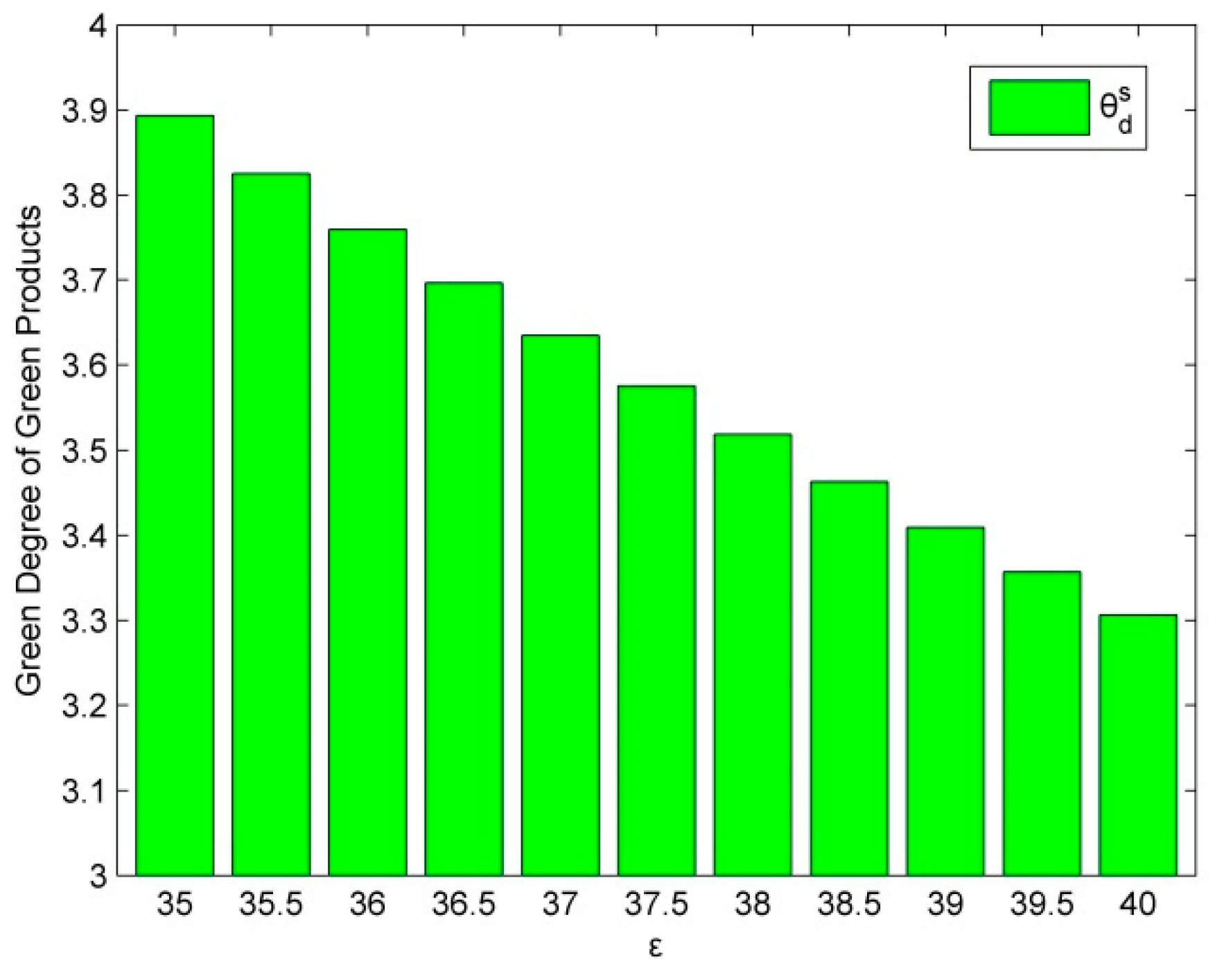

5.1.1. Analysis of the Green Innovation Factor Influents on the Green Degree of Green Products

As

Figure 1 shows, the optimal green degree of green products gradually decreases when the green innovation factor of green commodities increases. An increase in the green innovation factor of green goods suggests that the green supplier with a drop shipping option should invest additional fees to achieve the same green innovation level as before. Thus, when the amount of costs spent on green innovation remains unchanged, an increase in the green innovation factor of green commodities decreases the green degree of green products produced by the green supplier with a drop shipping option. For instance, if the green innovation factor of green goods increases from 35 to 40, the green degree of the green products has an opposite trend, and it decreases from 3.8932 to 3.3061.

For the green supplier with a drop shipping option, the lower the green innovation factor, the lower additional fees spent on the green innovation in producing green products. If the additional costs invested in green innovation of green products decrease, the wholesale and retail prices of green products will become lower than before, then the customer demand for green goods will increase, and the green drop shipping e-tailer and green supplier with a drop shipping option can earn more profits with a low green innovation factor.

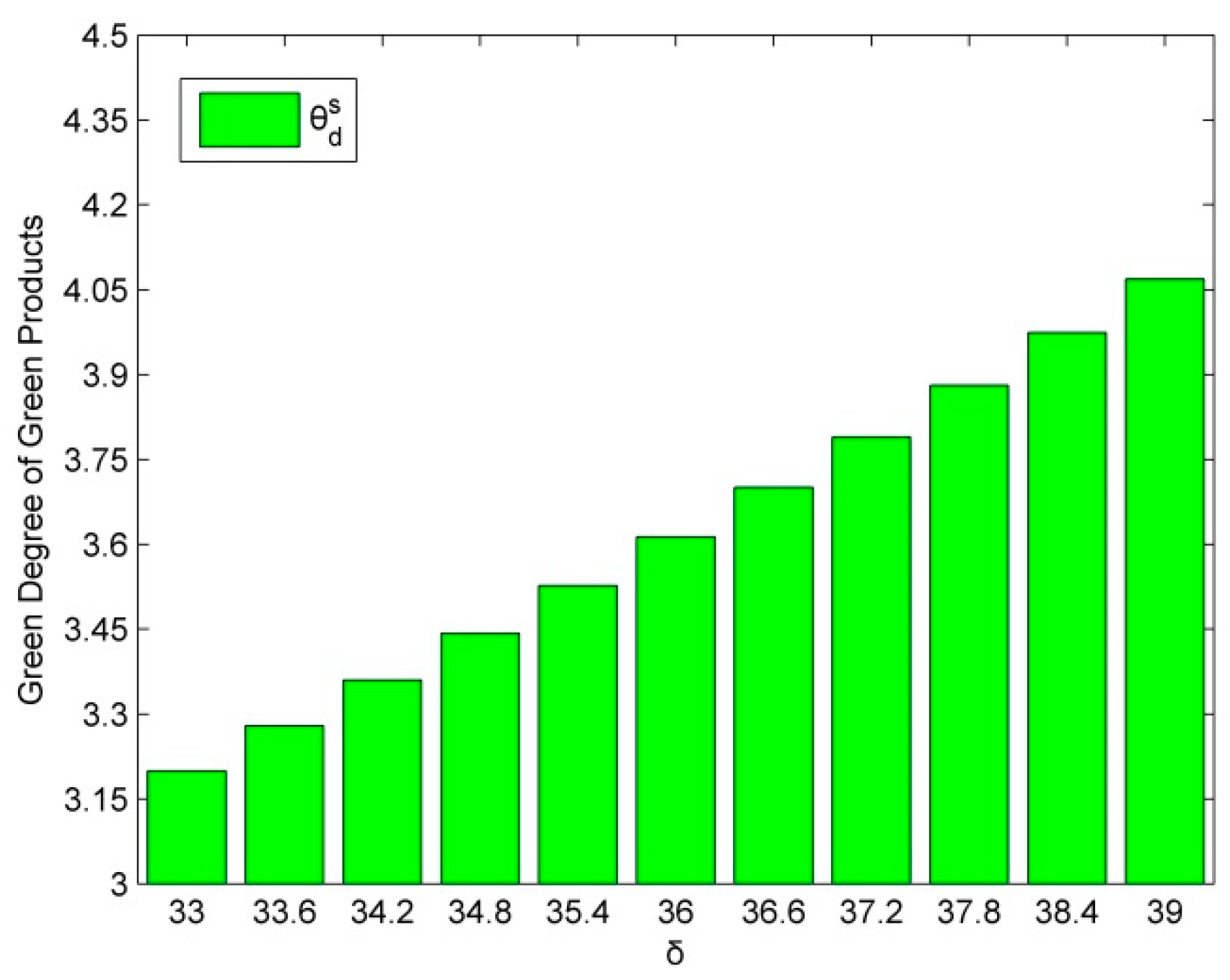

5.1.2. Analysis of the Green Elasticity Coefficient Influents on the Green Degree of Green Products

As the green elasticity coefficient increases, the green degree of green products shows an upward trend, as shown in

Figure 2. An increase in the green elasticity coefficient corresponds to an increase in customer demand for green products on the Internet, which in turn increases the revenues attained by the green drop shipping e-tailer and green supplier with a drop shipping option from selling green products. In this case, the green supplier with a drop shipping option is pushed to pay additional fees for the green innovation of green products to improve the green degree. Specifically, if the green elasticity coefficient increases from 33 to 39, the green degree of green products manufactured by the green supplier with a drop shipping option increases from 3.1996 to 4.0689.

For the green drop shipping e-tailer, the larger the green elasticity coefficient, the greater the customer demand and margins earned. Thus, the green drop shipping e-tailer and green supplier with a drop shipping option can make more profits when they meet a large green elasticity coefficient in drop shipping environment

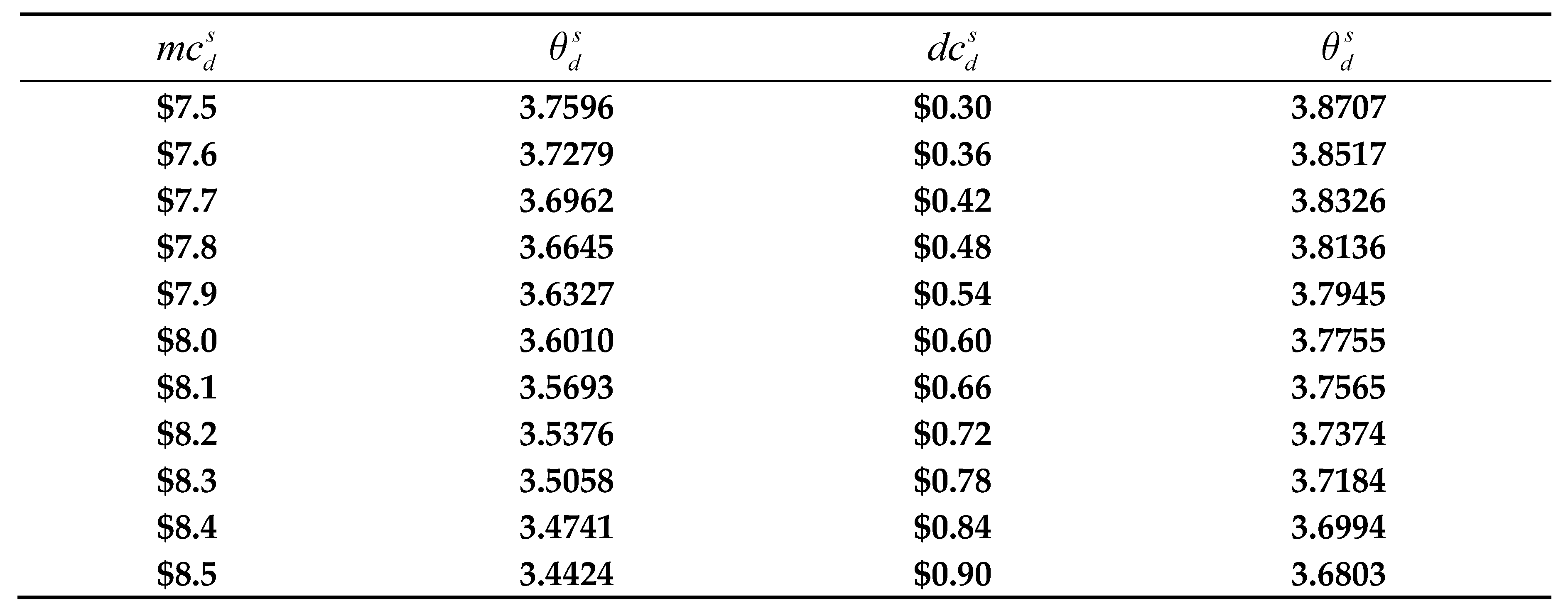

5.1.3. Analysis of the Manufacturing Cost Influents on the Green Degree of Green Products

When the manufacturing cost of green commodities increases, the green degree of green products produced by the green supplier with a drop shipping option decreases, as shown in Table 3. For example, when the manufacturing cost of green products increases from $7.5 to $8.5, the green degree of green products decided by the green supplier with a drop shipping option, decreases from 3.7596 to 3.4424, highlighting a negative correlation between the green degree and the manufacturing cost of green goods. These results mean that the larger the manufacturing cost, the smaller the green degree of green commodities.

Table 3. Influence of manufacturing cost and distribution cost on the green degree of green products.

5.1.4. Analysis of the Distribution Cost Influents on the Green Degree of Green Products

With increasing distribution cost of the green supplier in drop shipping models, the green degree of green commodities manufactured by the green supplier with a drop shipping option, shows a decreasing trend in Table 3. When the distribution cost of the green supplier with a drop shipping option increases, the wholesale and retail prices of green products also increase, and the customer demand for green goods decreases, thereby decreasing the profits of both the green supplier with a drop shipping option and green drop shipping e-tailer. In this case, the green supplier with a drop shipping option would invest fewer resources in the green innovation of green products than before, thus reducing the green degree of these products. For instance, if the distribution cost of the green supplier with a drop shipping option increases from $0.30 to $0.90, the green degree of green commodities decreases from 3.8707 to 3.6803.

Though the distribution cost is borne by the green supplier in drop shipping models, if this cost increases, the green supplier with a drop shipping option will spend fewer fees on the green innovation of green goods when given limited total resources, and the green degree of green commodities becomes smaller, which causes a reduction in customer demand for green goods, and both the green supplier with a drop shipping option and green drop shipping e-tailer obtain fewer margins in this scenario. Therefore, the green drop shipping e-tailer and green supplier with a drop shipping option should try to reduce the distribution cost to maximize their income.

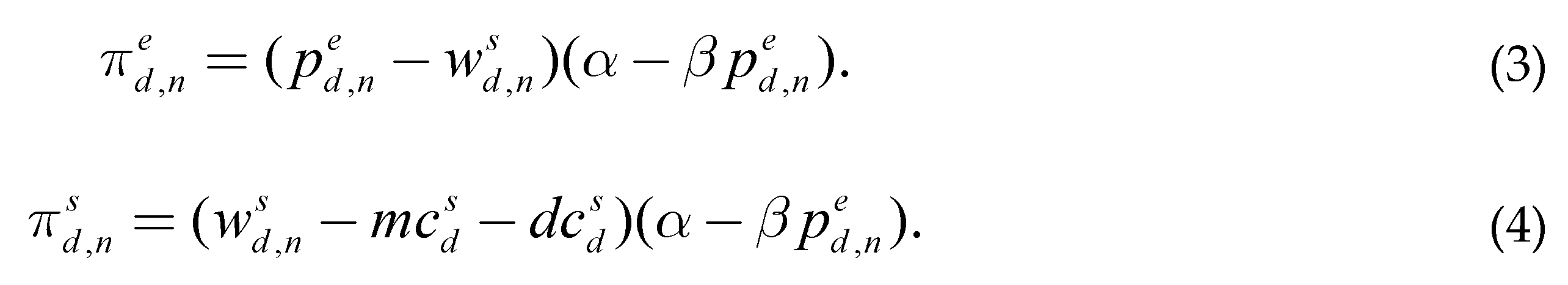

5.2. Impact of the Green Elasticity Coefficient on the Drop Shipping E-tailer and Supplier

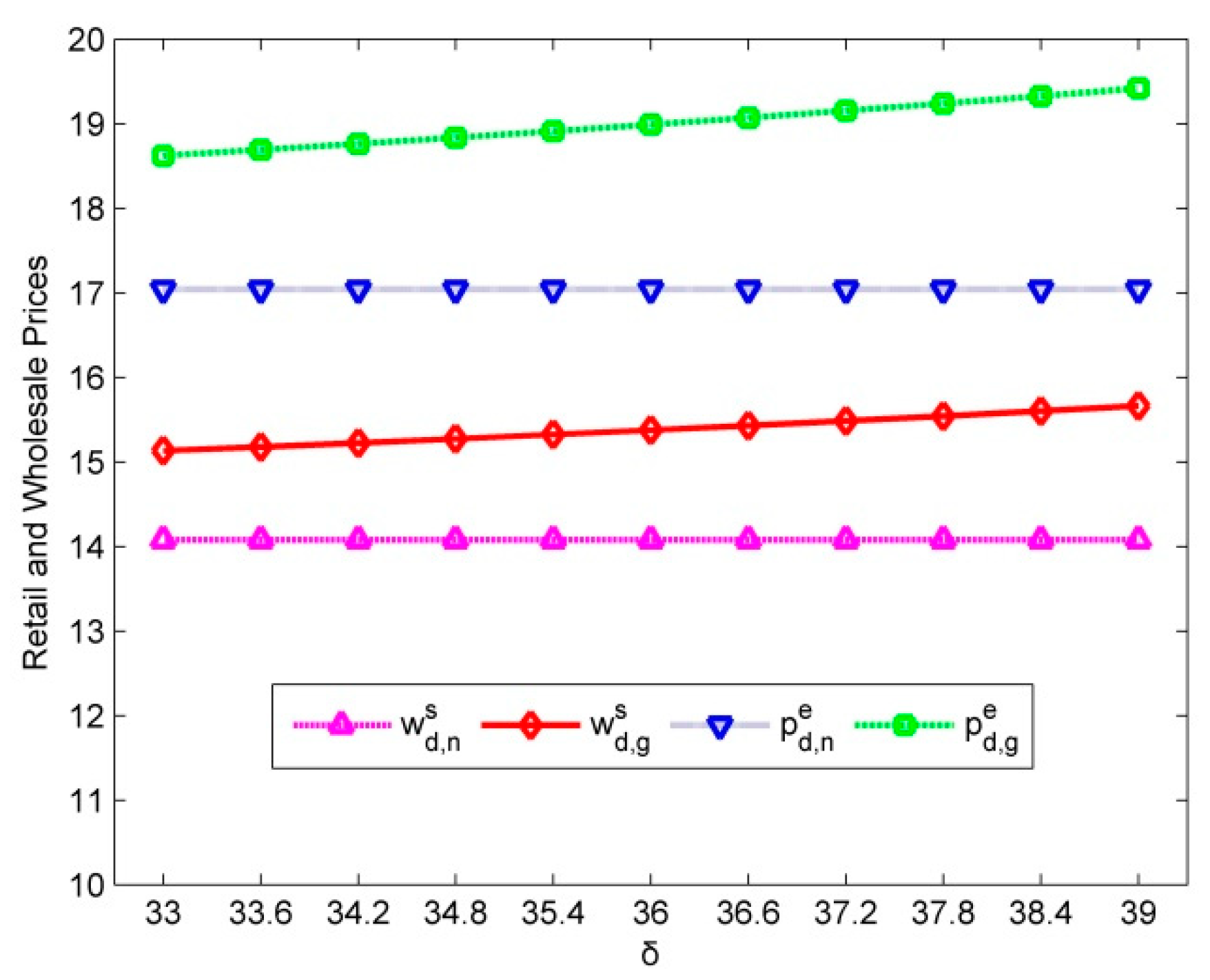

5.2.1. Analysis of the Green Elasticity Coefficient Influents on the Retail and Wholesale Prices

Increasing the green elasticity coefficient also increases the customer demand for green commodities on the Internet. Thus, the green drop shipping e-tailer increases the retail price of green goods, which in turn drives the green supplier with a drop shipping option to increase the wholesale price of green products. Both the green drop shipping e-tailer and green supplier with a drops shipping option gain higher margins by providing green commodities. The effect of the green elasticity coefficient on the wholesale and retail prices of green goods is shown in

Figure 3. When the coefficient gradually rises, the wholesale and retail prices of green products also increase. For instance, if the green elasticity coefficient of green commodities rises from 33.0 to 39.0, the wholesale price of green products decided by the green supplier with a drop shipping option increases from

$15.1309 to

$15.6619, whereas the retail price of green goods determined by the green drop shipping e-tailer increases from

$18.6213 to

$19.4178.

In the drop shipping models,

Figure 3 also indicates that the retail and wholesale prices of green commodities are higher than those of normal ones because of the additional fees spent by the green supplier with a drop shipping option on the green innovation of green products. Under this condition, the wholesale price of green goods is always higher than that of normal products, and an increase in the wholesale price of green goods causes the retail price of these products to increase. In addition, the retail and wholesale prices of normal commodities are not affected by the green elasticity coefficient and remain at

$17.0375 and

$14.0750 throughout the experiment. Finally, these results show that the variable of green elasticity coefficient and that of the retail and wholesale prices of green products have the same trend, the bigger the green elasticity coefficient, the higher the retail and wholesale prices of green products.

5.2.2. Analysis of the Green Elasticity Coefficient Influents on Margins of the Drop Shipping E-tailer and Supplier

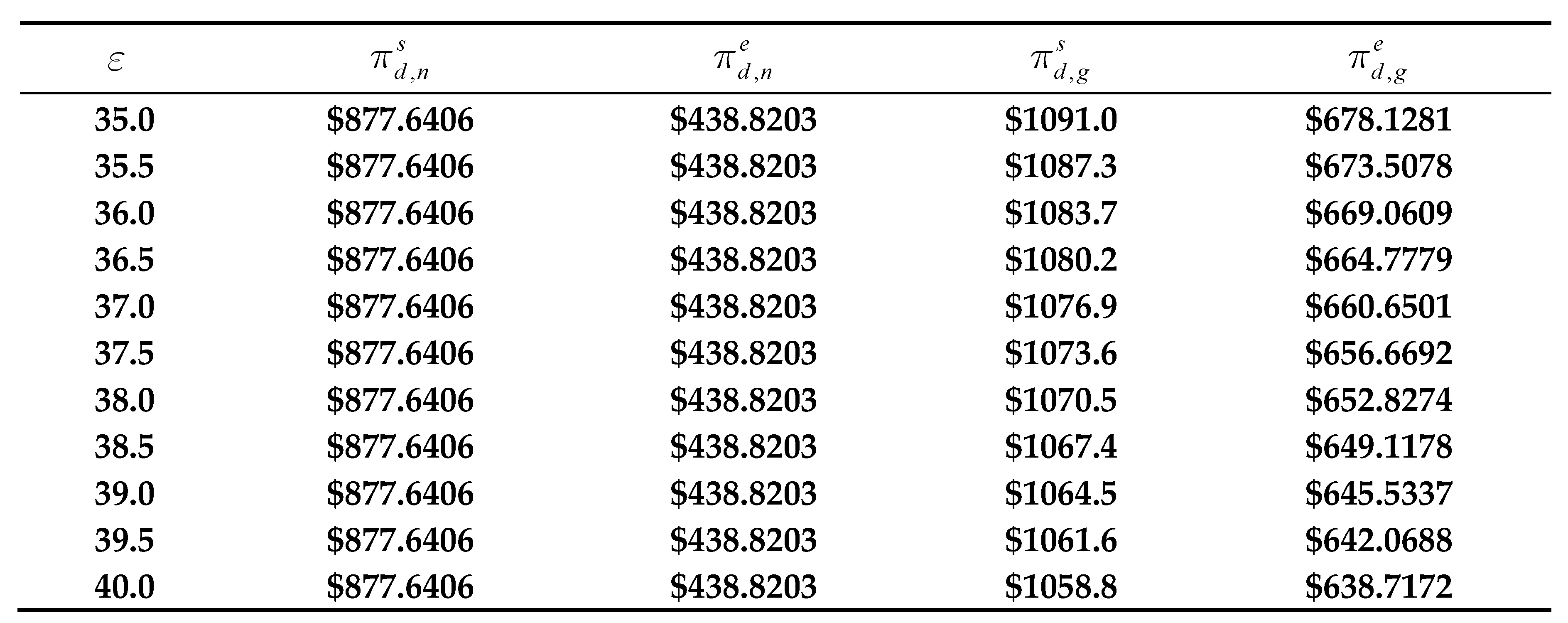

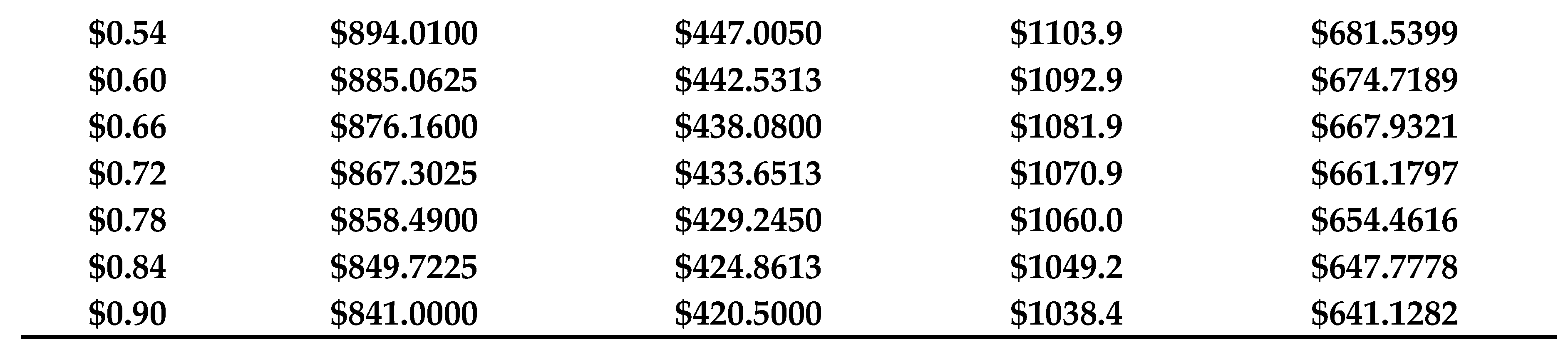

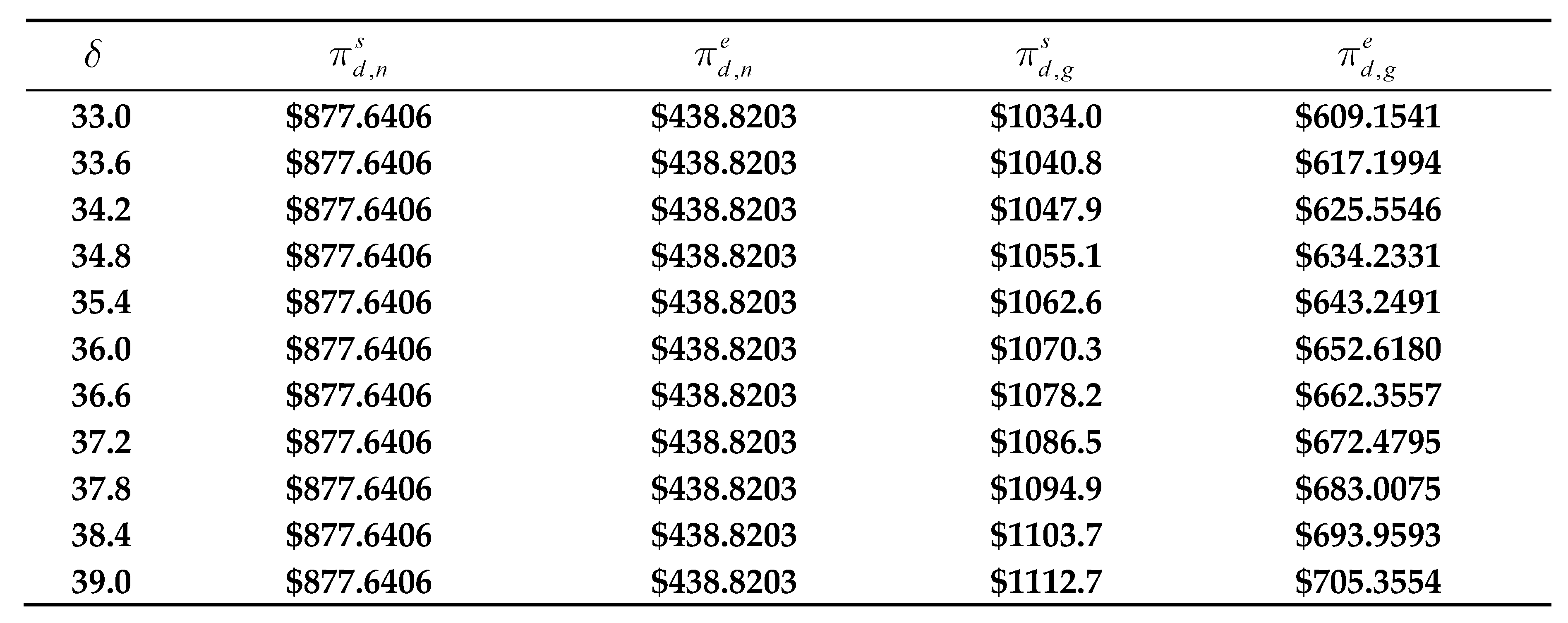

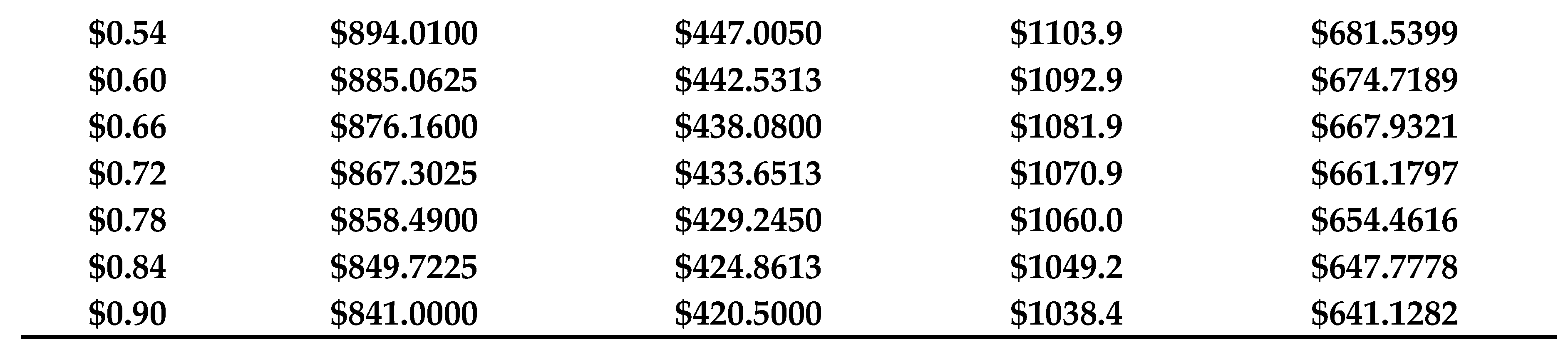

When the green elasticity coefficient of green goods increases, the retail and wholesale prices of green products will increase, and the income obtained by the green drop shipping e-tailer and green supplier with a drop shipping option shows an upward trend. However, this trend has no effect on the margins of the drop shipping e-tailer and supplier with a drop shipping option of supplying normal commodities to customers. Table 4 shows the influence of the green elasticity coefficient on the margins of the drop shipping e-tailer and supplier with a drop shipping option.

Table 4. Influence of the green elasticity coefficient on margins of the drop shipping e-tailer and supplier.

Specifically, if the green elasticity coefficient of green goods rises from 33.0 to 39.0, the margins of the green drop shipping e-tailer from providing green commodities increase from

$609.1541 to

$705.3554, while those of the green supplier with a drop shipping option rise from

$1034.0 to

$1112.7. However, the revenue of the drop shipping e-tailer and supplier with a drop shipping option for providing normal commodities were maintained at

$438.8203 and

$877.6406, respectively. Therefore, the green drop shipping e-tailer and green supplier with a drop shipping option can generate more margins from supplying green goods than normal ones. In this case,

and

hold.

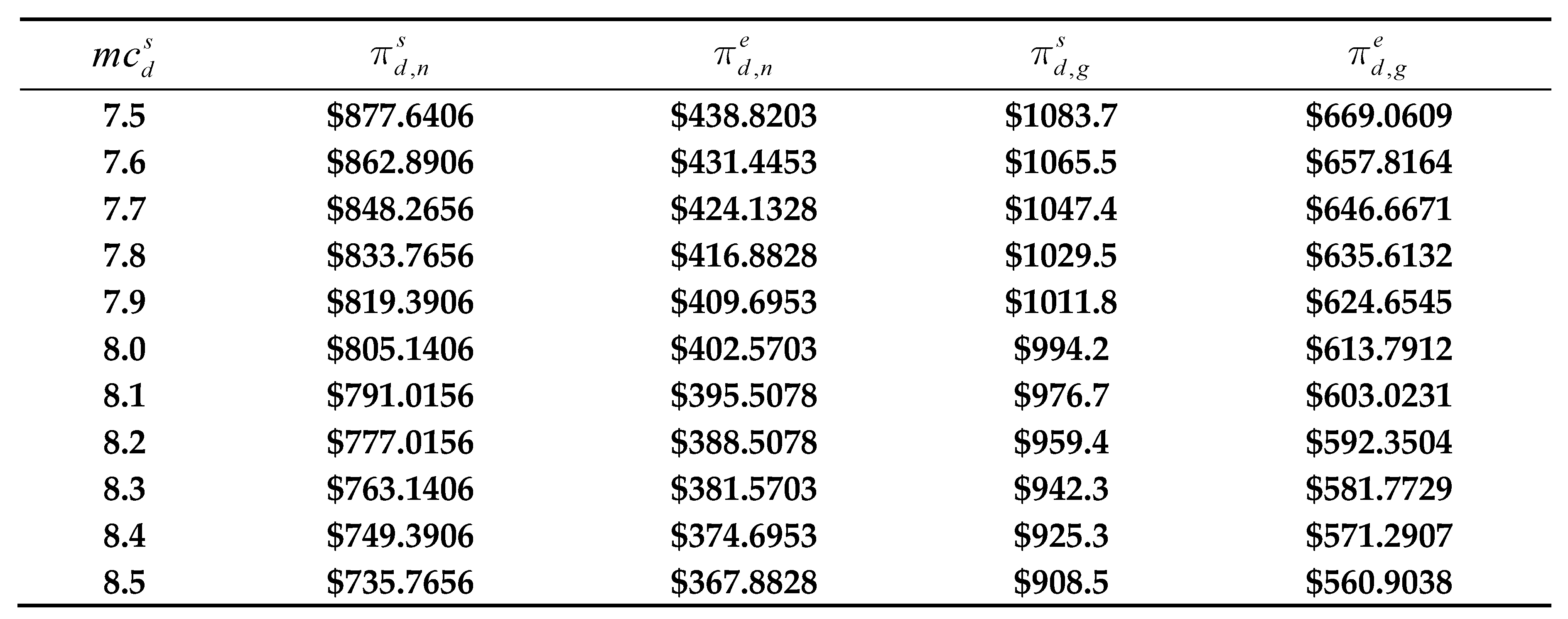

5.3. Impact of Manufacturing Cost on the Drop Shipping E-tailer and Supplier

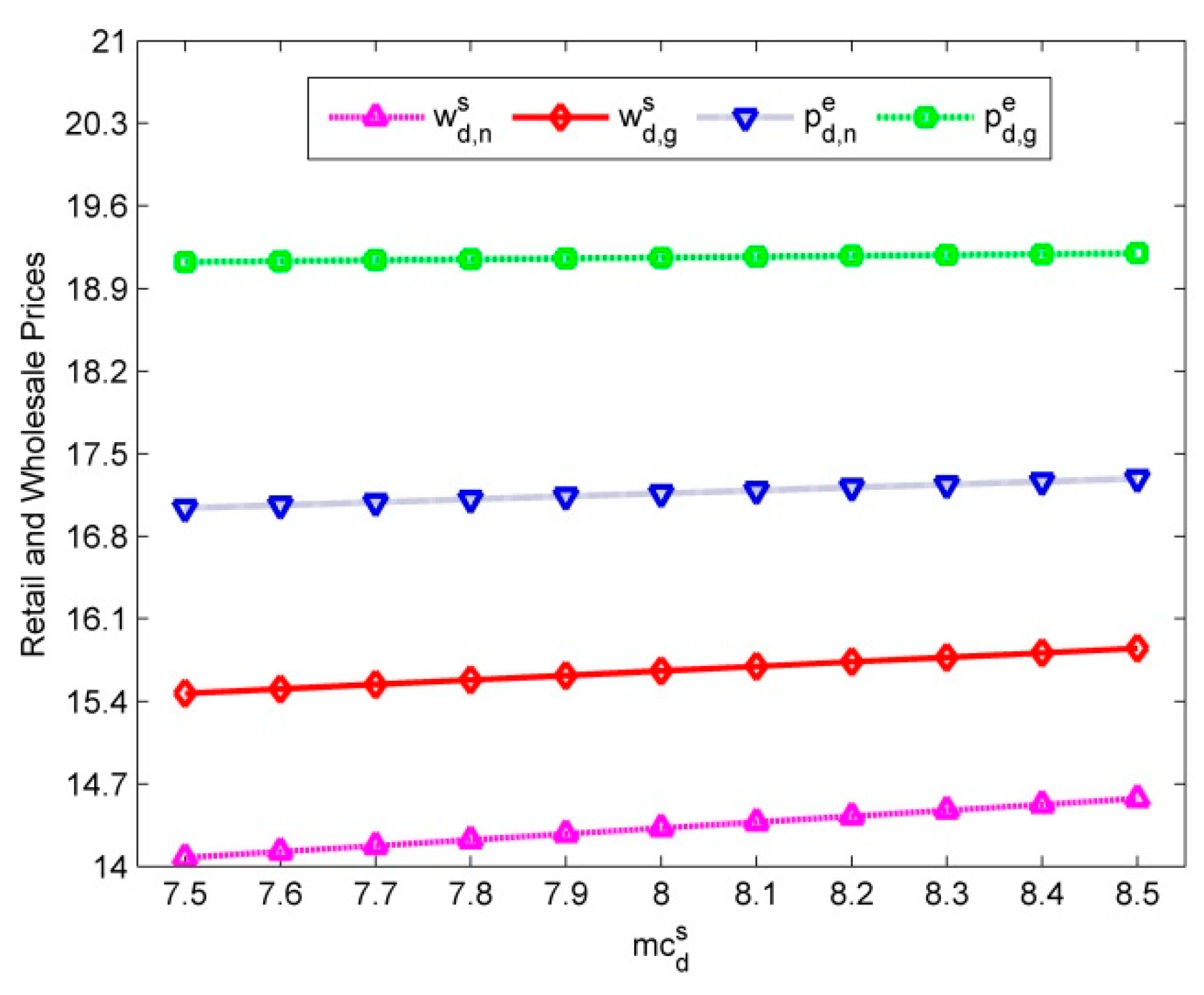

5.3.1. Analysis of Manufacturing Cost Influents on the Retail and Wholesale Prices

In drop shipping models, the variation in

the manufacturing cost of the supplier with a drop shipping option has an

important influence on both the drop shipping e-tailer and supplier with a drop

shipping option. An increase in the manufacturing cost of physical goods, to

which the supplier with a drop shipping option responded by setting a higher

wholesale price to maintain a proper amount of revenue. And these increases

will push the drop shipping e-tailer to rise the retail price of physical

commodities. As Figure 4 shows, when the manufacturing cost of physical products increases,

the wholesale prices of these two goods show an upward trend. For instance, if

the manufacturing cost of physical commodities rises from

$7.5 to and

$8.5,

their wholesale prices increase from

$15.4661 and

$14.0750 to

$15.8487 and

$14.5750, respectively, whereas the retail prices of green and normal goods

rise from

$19.1241 and

$17.0375 to

$19.1980 and

$17.2875, respectively.

hold true under

these conditions.

5.3.2. Analysis of Manufacturing Cost Influents on Margins of the Drop Shipping E-tailer and Supplier

If the manufacturing cost of physical goods increases, the supplier with a drop shipping option and drop shipping e-tailer should raise the wholesale and retail prices of physical products to achieve a certain level of profitability. However, an increase in the retail price of these products further reduces customer demand in the market and eventually causes a decrease in the margins of the drop shipping e-tailer and supplier with a drop shipping option. This scenario is illustrated in Table 5.

Table 5. Influence of manufacturing cost on margins of the drop shipping e-tailer and supplier.

In these models, whether the drop

shipping e-tailer provides green or normal commodities, revenues earned by them

always show a downward trend. For instance, if the manufacturing cost of

physical goods increases from

$7.5 to

$8.5, the benefits of the suppliers with

a drop shipping option for selling two goods decrease from

$1083.7 and

$877.6406 to

$908.5 and

$735.7656, respectively. Meanwhile, the profits of the

drop shipping e-tailer with two commodities decrease from

$669.0609 and

$438.8203 to

$560.9038 and

$367.8828, respectively. Therefore, an increase in

the manufacturing cost of physical products has a harmful effect on both the

drop shipping e-tailer and supplier with a drop shipping option.

also hold under

these conditions.

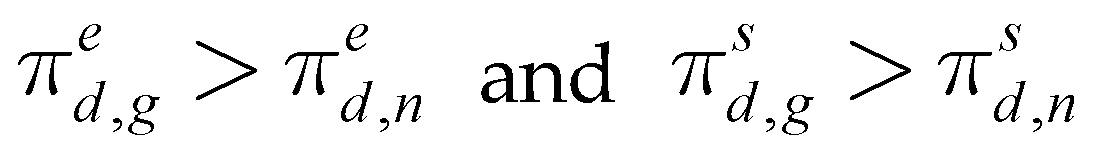

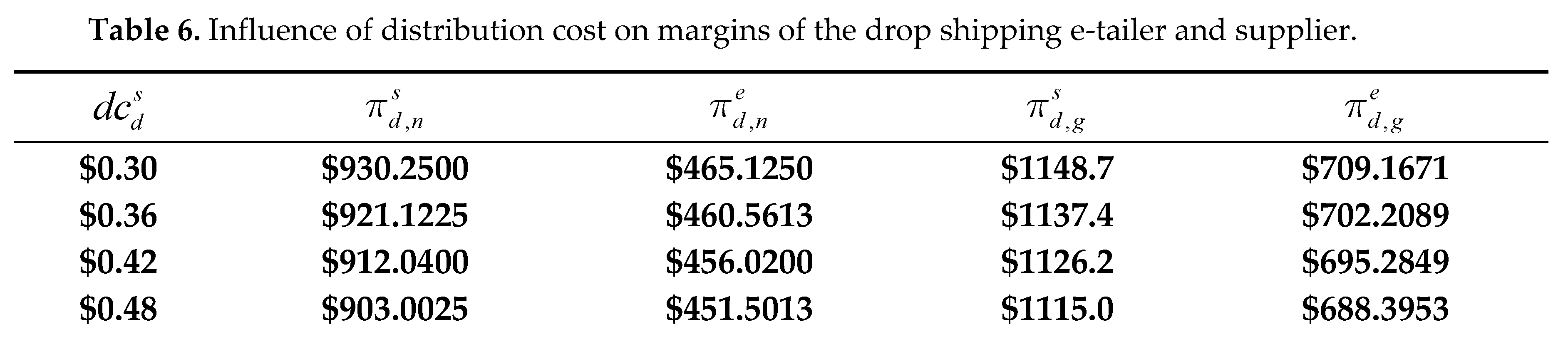

5.4. Impact of Distribution Cost on the Drop Shipping E-tailer and Supplier

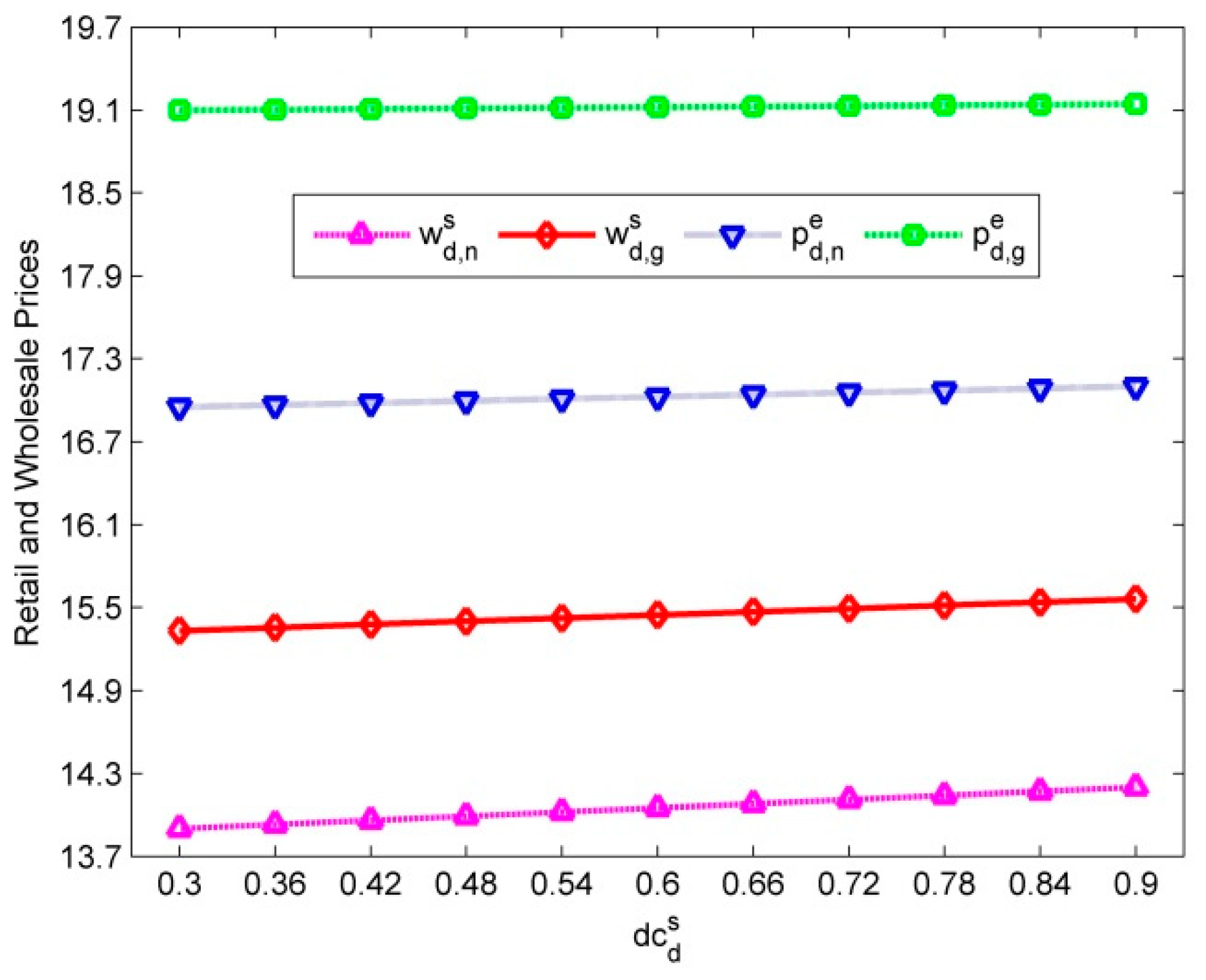

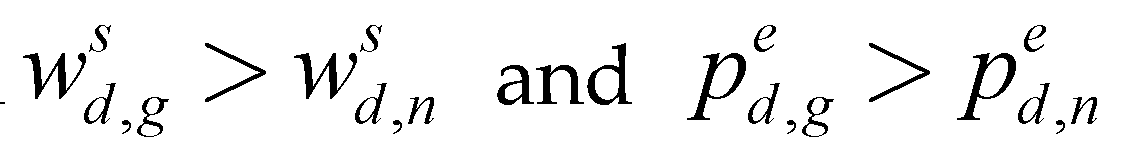

5.4.1. Analysis of Distribution Cost Influents on the Retail and Wholesale Prices

If the distribution cost of the supplier with a drop shipping option increases, both the wholesale and retail prices of normal and green products all increase, which are different from the traditional models. For instance, if the distribution cost of the supplier with a drop shipping option rises from

$0.30 to

$0.90 in

Figure 5, the retail prices of normal and green goods decided by the drop shipping e-tailer increase from

$16.9500 and

$19.0982 to

$17.1000 and

$19.1426, respectively, meanwhile, the wholesale prices of these two products increase from

$13.9000 and

$15.3322 to

$14.2000 and

$15.5617, respectively. These results indicate that if the distribution cost increases, the supplier with a drop shipping option hedges these costs by improving the wholesale price of these two commodities, which leads to the increases in the retail prices of two physical goods.

For the supplier with a drop shipping

option, increasing the wholesale price of two different commodities may reduce

part of the negative influence of the rising distribution cost. While, for the

drop shipping e-tailer, increasing the retail price of two physical products

may result in greater margins. Both

hold true in this

scenario.

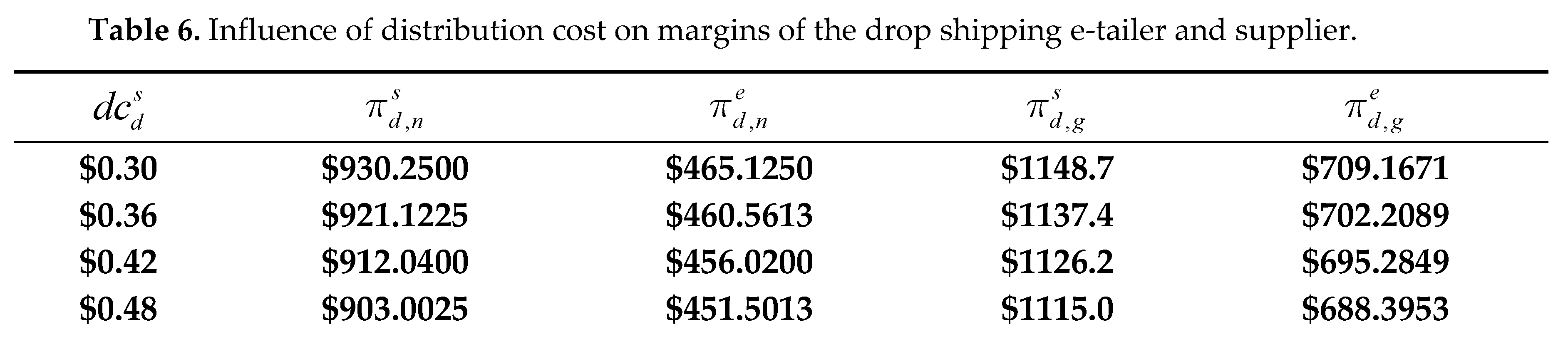

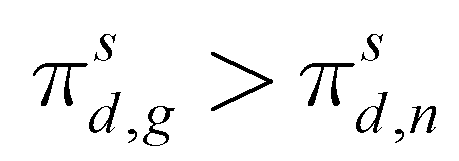

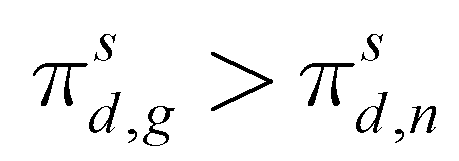

5.4.2. Analysis of Distribution Cost Influents on Margins of the Drop Shipping E-tailer and Supplier

When the distribution cost borne by the

supplier with a drop shipping option increases, the earned margins of the drop

shipping e-tailer and supplier with a drop shipping option decrease, as shown

in Table 6. Specifically, when the

distribution cost of the supplier with a drop shipping option rises from

$0.30

to

$0.90, the income gained by the supplier with a drop shipping option from

green and normal goods reduces from

$1148.7 and

$930.2500 to

$1038.4 and

$841.0000, respectively. Meanwhile, the margins of the drop shipping e-tailer

for these two goods decrease from

$709.1671 and

$465.1250 to

$641.1282 and

$420.5000, respectively.

hold true in this

scenario.

The experimental results indicate that the increase in distribution cost has an adverse impact on the benefits earned by both the drop shipping e-tailer and supplier with a drop shipping option for whether green or normal commodities. In order to gain more margins, the supplier with a drop shipping option should try to reduce the distribution cost in operational environment.

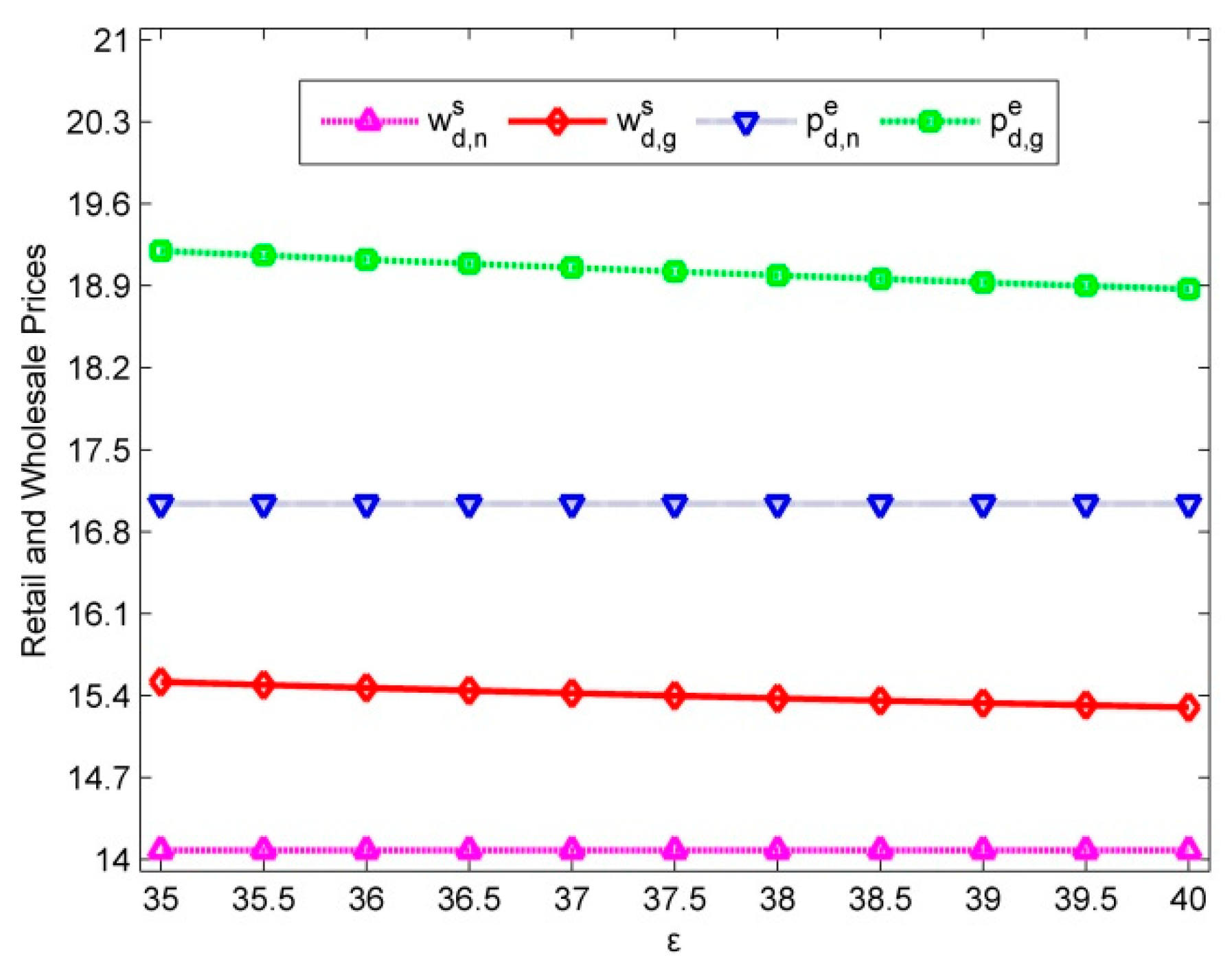

5.5. Impact of Green Innovation Factor on the Drop Shipping E-tailer and Supplier

5.5.1. Analysis of Green Innovation Factor Influents on the Retail and Wholesale Prices

The wholesale prices of green products,

as determined by the green supplier with a drop shipping option, show a

decreasing trend along with an increasing green innovation factor. Thus, an

opposite relationship between the green innovation factor and the wholesale

price of green products can be observed. The results also indicate that an

increasing green innovation factor has a harmful effect on the retail price of

green products, which is decided by the green drop shipping e-tailer. However,

variation in the green innovation factor has no influence on the retail and

wholesale prices of normal goods. Specifically, when the green innovation

factor of green products rises from 35 to 40, the wholesale and retail prices

of green products reduce from

$15.5155 and

$19.1982 to

$15.2982 and

$18.8724,

respectively, whereas those of normal products remain at

$14.0750 and

$17.0375,

respectively.

also

hold for the entire variation process of the green innovation factor, as shown

in

Figure 6.

5.5.2. Analysis of Green Innovation Factor Influents on Margins of the Drop Shipping E-tailer and Supplier

The green innovation factor of green

goods has no impact on the revenues earned by the drop shipping e-tailer and

supplier with a drop shipping option from normal commodities. As shown in Table 7, these margins remain unchanged at

$438.8203 and

$877.6406, respectively. In contrast, the margins of the green

drop shipping e-tailer and green supplier with a drop shipping option decrease

with an increasing green innovation factor of green commodities, and a negative

correlation is observed between the green innovation factor of green products

and the benefits of the drop shipping e-tailer and supplier with a drop

shipping option. For instance, as the green innovation factor of green goods

rises from 35 to 40, the margins of the drop shipping e-tailer and supplier

with a drop shipping option reduces from

$678.1281 and

$1091.0 to

$638.7172 and

$1058.8, respectively. In these scenarios, the benefits of the drop shipping

e-tailer and supplier with a drop shipping option fulfill

and

.

Table 7. Influence of distribution cost on margins of the drop shipping e-tailer and supplier.

and

and  hold.

hold. hold true under

these conditions.

hold true under

these conditions.

also hold under

these conditions.

also hold under

these conditions. hold true in this

scenario.

hold true in this

scenario. hold true in this

scenario.

hold true in this

scenario.

also

hold for the entire variation process of the green innovation factor, as shown

in Figure 6.

also

hold for the entire variation process of the green innovation factor, as shown

in Figure 6. and

and  .

.