Preprint

Article

AHP-SWOT Analysis of the Development Strategy of China’s Northeast Economy Under the New Economic Situation

Altmetrics

Downloads

134

Views

75

Comments

0

Submitted:

19 September 2023

Posted:

21 September 2023

You are already at the latest version

Alerts

Abstract

In order to accurately identify the external economic situation in China and analyze the situation of economic development in Northeast China, based on the Strengths, Weaknesses, Opportunities and Threats (SWOT) analysis framework, this article analyses the economy in Northeast China from the four factors of SWOT. To solve the lack of quantitative analysis in SWOT analysis, this article applies Analytic Hierarchy Process (AHP) to the analysis, and finally forms a complete system framework with the combination of qualitative and quantitative factors, through the analysis of the important degree of various factors and the consistency test, the key factors influencing the economic development in Northeast China are analyzed, and constructive countermeasures are proposed.

Keywords:

Subject: Business, Economics and Management - Economics

1. Introduction

The original idea of economic development in the Northeast is to follow the Northeast revitalization strategy of the theory of comparative advantage, but different regions are at different stages of development and cannot exactly replicate the same development policies to generate comparative advantage. With the increasing complexity of the international economic situation and the influence of regional instability factors and other backgrounds, the Northeast economy has a more serious tendency to slow down its growth rate compared with other regions.

Therefore, to study the economic development of the Northeast region, it is necessary to analyze the internal and external environment, the industrial structure and economic development characteristics of the Northeast region itself. The “Theory of comparative advantage” should not be the guiding principle for the formulation of strategies in each region. In recent years, scholars in China have conducted studies on foreign trade and regional economic growth in Northeast China [7], East Asian economic cooperation [1], the industrial structure of the three northeastern provinces [6], but most of them have focused on a certain direction or influencing factors, and there are few quantitative research methods that target the whole dimension. There are foreign articles based on AHP-SWOT studies on strategy and urban construction, etc. [2,3,4,5], but no studies on China’s regional economy.

In order to analyze the internal and external environment and the strengths and weaknesses of the Northeast economy, this paper uses a combination of hierarchical analysis (AHP) and SWOT analysis to make quantitative calculations using a hierarchical analysis model, and finally to propose targeted policy recommendations and explore the potential for high-quality economic development in the Northeast in more detail.

2. AHP-SWOT analysis research methodology and data preparation

2.1. Research Methodology

The article uses AHP-SWOT analysis to provide recommendations for the construction of an economic development strategy of scale in the Northeast. The main steps are as follows:

2.1.1 Through the analysis of the macro-environment, international capital flows and regional instability factors, as well as literature research and data review on the current economic development of the Northeast region and supported by authoritative data such as the National Bureau of Statistics, the internal and external influencing factors affecting the development of the scale economy in the Northeast region are collected and a SWOT analysis matrix is formed. And through the relevant data obtained from the survey, the actual strength of each factor in the SWOT analysis matrix is calculated.

2.1.2 Based on the SWOT analysis matrix, the model was divided into four levels according to the hierarchical analysis method: goal level, criteria level 1, criteria level 2 and alternative choices. The goal level is the objective and motivation of the study, and this paper is the development strategy of the economy of scale in the Northeast region, and all the levels under it will have different degrees of influence on the goal level. Criteria level 1 is the strengths (S), weaknesses (W), opportunities (O) and threats (T) contained in the internal and external environment, criteria level 2 is the specific elements of the previous level, and the final solution level is the combination of the criteria levels, i.e. the selection of an appropriate development strategy, which completes the construction of the model of AHP-SWOT for the development of economies of scale in the Northeast region. (Figure 1).

2.1.3 The next step is to create a comparison matrix of AHP-SWOT and make pair-wise comparisons between each criterion. The results of the comparison (for each pair of factors) were described in terms of integer values from 1 (equal) to 9 (extremely different), where a higher number means that the selected factor is considered more important to a greater extent than the other factor being compared with. The example scale for the comparison is shown in Table 1.

2.1.4 This step is to normalize the matrix by summing the numbers in each column. Each entry in the column is then divided by the column sum to give its normalized score, and the sum of each column is 1.

2.1.5 This step is called consistency analysis. The purpose of this is to make sure that the original preference ratings were consistent, so we need 3 steps to get the consistency ratio:

- 1)

- Calculate the consistency measure

- 2)

- Calculate the consistency index (CI)

- 3)

- Calculate the consistency ratio (CI/RI where RI is a random index)

2.1.6 Determine the strategic positioning of development. Based on the above calculation results, construct a strategic quadrilateral for the development of economies of scale in the northeast region, calculate the central coordinates of the strategic quadrilateral, judge the strategic positioning accordingly, and formulate the development strategy.

2.2. Data preparation

The data for this study were obtained from a questionnaire survey, and the respondents included Teachers and students of some universities and colleges in the three northeastern provinces, cadres and employees of some automobile and heavy industry enterprises in Jilin and Liaoning, cadres and employees of Jilin Guarantee Joint Stock Company, employees of institutions such as Jilin Provincial Department of Finance and Planning Museum, and financial institutions such as Industrial and Commercial Bank and Changchun Branch of Pudong Development Bank, and financial institutions such as Industrial and Commercial Bank and Changchun Branch of Pudong Development Bank, the research reflects both the theoretical perspectives of experts and The research reflects both the theoretical perspectives of experts and the views of participants from universities and academics, enterprises and institutions, and financial institutions. In the end, 1,372 questionnaires were returned, with 1,274 valid questionnaires and an effective rate of 92.9%. The information collected through the questionnaires is representative and can be used as a reference basis for the study, and the statistics of the questionnaires are shown in Table 2.

3. Materials and Methods

3.1. Strengths (S) Analysis

3.1.1. Geographical advantages of the Northeast (S1): The Northeast is close to Russia, South Korea, North Korea and Japan, is taking on increasingly important roles in foreign trade and economic cooperation and has great potential for development. Japan and South Korea are important sources of imported capital and advanced technology, as well as important markets for Northeast China’s exports; Russia has become an important export destination, and economic and trade cooperation between the two sides is deepening.

3.1.2. Northeast industrial base (S2): Modern industrial clusters have been formed in the Northeast, including the automotive and locomotive cluster in Changchun, the chemical industry cluster in Jilin, the special machine tool and steel industry cluster in Shenyang, and the three major powerhouses in Harbin. These clusters with strong industrial bases have created a strong pulling effect on the economy.

3.1.3. Northeast Systematic Infrastructure (S3): The cities in the northeast are better laid out and more functional. With the support and investment of China’s revitalization strategy, old industrial bases in Northeast China, metro, light rail and interprovincial intercity rail transport have all been rapidly developed, and energy supply is relatively abundant compared to southern regions.

3.1.4. The northeast is rich in natural resources (S4): The Northeast has two intact forest ecosystems, including the Xing’an Mountain and Changbai Mountain areas, and rich marine resources in the Bohai Bay area. The Northeast is an important grain silo in China, and rich plant and animal resources provide good resource support for the economic development of the Northeast.

3.2. Weaknesses (W) Analysis

3.2.1 Serious talent loss in the northeast (W1): Northeast has a strong foundation of educational resources, the advantage of basic education is obvious, such as Liaoning Province has nearly 70 colleges and universities, the annual training of 120,000 college students and 40,000 software talents. In the past decade, due to the relative backwardness of economic development in Northeast China and the lack of attractiveness of talent policies, Northeast China has experienced a serious talent loss, especially in the past five years, when the talent inflow to Northeast China was the lowest in the country, statistically averaging 3.61%. Table 3 shows the statistics on the source of students and employment destinations of universities across China between 2016-2021.

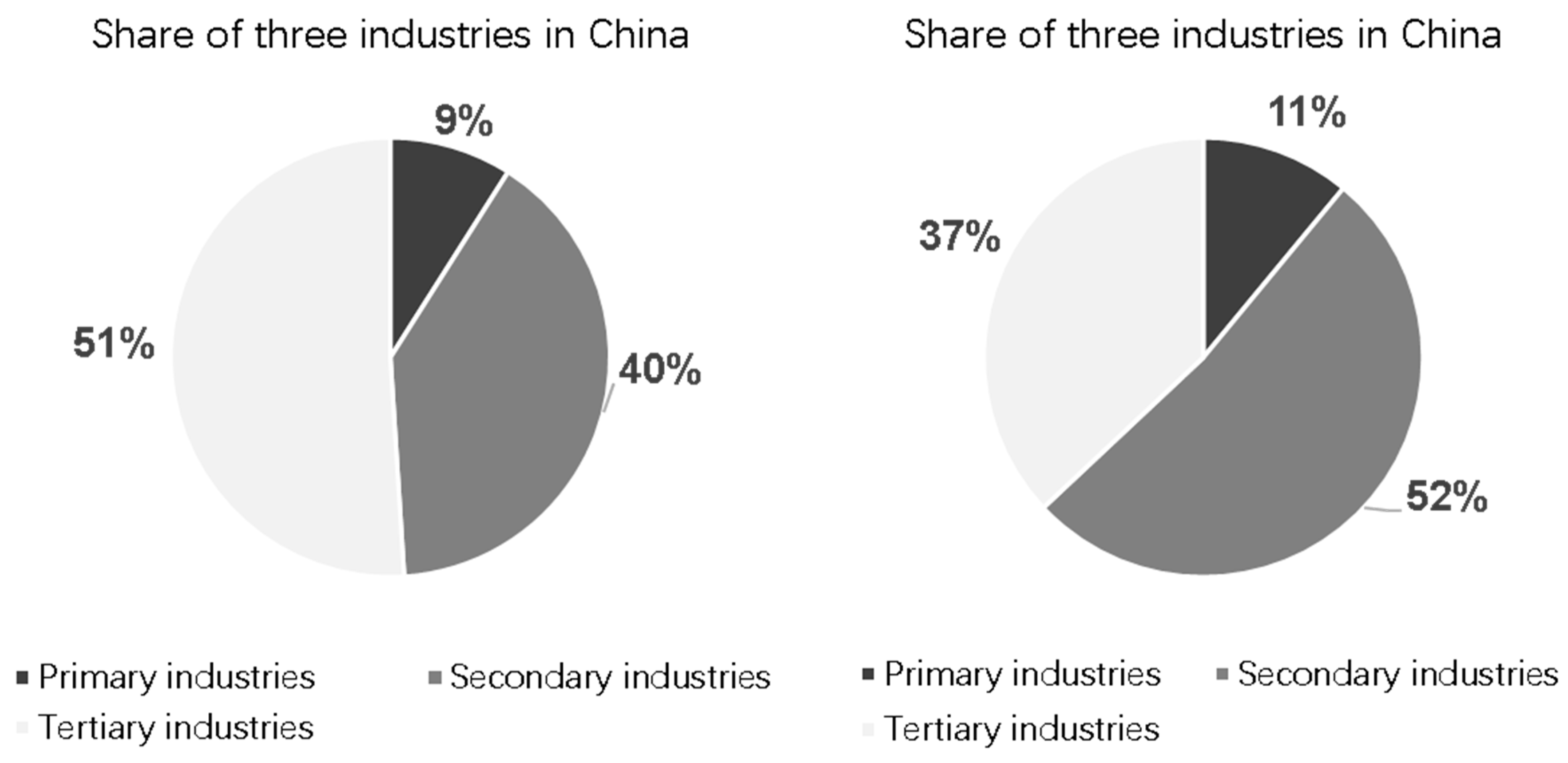

3.2.2 The imbalance in the share of industries in the Northeast (W2): According to the analysis of the industrial structure of the Northeast, there is an imbalance in the proportion of heavy industries (63% of primary and secondary industries) and light industries (37% of tertiary industries).The lack of sufficient new and high-tech industries has led to a small value of industries with more development potential and a weak pull on the economy, which will drag down the existing advantages of the Northeast if this disadvantage continues, see Figure 2.

3.2.3 Irrational energy structure for industrial development in the Northeast (W3): From the perspective of sustainable regional development, some of the important resources needed for industrial development in the Northeast, such as mineral and petroleum resources, are lacking. In addition, coal production has been declining steadily for 10 years and at least 10 mines are facing closure due to lack of economic benefits. It is therefore urgent for the Northeast to rapidly restructure its energy structure, adopt a green and sustainable development approach and increase the share of new energy sources such as wind power.

3.2.4 Insufficient innovation in the Northeast (W4): The lack of healthy competition, low efficiency and conservation exist in the Northeast under the relative backwardness of the system and the ageing population, which affects the efficiency of innovation and reform.

3.3. Opportunity (O) Analysis

3.3.1 Industrial restructuring (O1): Some industries in the Northeast are facing restructuring based on, for example, the automobile industry, especially the new energy automobile-related industrial chain.

3.3.2 China’s financial policy environment (O2): China’s financial market is gradually opening to the outside world. According to the latest media reports on 30 December 2019, China has released up to US$4.5 billion into the financial market, creating huge development opportunities. A good financial market environment will stimulate and drive industrial upgrading and investment, with annual profits of up to US$9 billion predicted for the banking and securities sector by 2030. According to Zhu Min, director of the National Institute of Finance at Tsinghua University, the global economy is entering a post-crisis era characterized by low inflation, low interest rates and low growth. China’s bond market and interest rate levels will become very attractive.

3.3.3 High financial stability in China (O3): In response to the coronavirus, the People’s Bank of China stabilized the financial market through initiatives such as a RMB300 billion special loan, granting loan extensions and other preferential policies for loans to small, medium and micro enterprises and private enterprises to help enterprises maintain stable cash flows and reduce financing costs for the real economy. Through open market operations and targeted downgrading, short-term and medium- to long-term liquidity was provided in a timely manner to maintain reasonable liquidity abundance in the banking system and ensure the continued smooth operation of the financial market after the market opening. From February to March 2020, the peak of the coronavirus, the domestic RMB traded at a depreciation of 0.7 percent, while the emerging market currency index fell by 10 percent in the same period, and the RMB exchange rate performed relatively steadily in the global foreign exchange market.

3.3.4 Big data and cloud computing in China (O4): The development of big data and cloud computing has provided stronger technical support for data collection and analysis, enabling more accurate and timely processing of statistics on economic sectors, promoting the development of internet finance in China, and creating more value.

3.4. Threats (T) Analysis

3.4.1 Regional competition (T1): Industrial structure similarity coefficient can be used to measure the similarity of industrial structure, comparing the industrial structure of two regions, the construction of similarity coefficient can effectively respond to the degree of similarity of industrial structure between regions indicators, the formula:

Where is the structural similarity coefficient of regions i and j, is the proportion of industry k in region i to the whole industry, is the proportion of industry k in region j to the whole industry, takes values in the range [0,1]. The larger the value of indicates that the greater the degree of industrial isomorphism between two regions, the closer the value is to 1 indicates that the industrial structure between regions is extremely similar, with poor regional complementarity, and intense competition between regions, which is not conducive to the integration of resources and synergistic development between regions.

The similarity of the industrial structure of the three provinces has been measured, with a similarity coefficient of 0.995 between Liaoning and Jilin, 0.935 between Heilongjiang and Liaoning, and 0.964 between Jilin and Heilongjiang, the above coefficients are close to 1, which shows that the industrial structure convergence is too high. This has led to the weak ability of the Northeast region to withstand economic fluctuations and financial turbulence in a competitive market.

3.4.2 The threat of energy price increases and energy conservation and emission reduction policies (T2) Heavy industries in the northeast are energy-dependent, and the impact of energy price fluctuations on the economic development of the northeast is highlighted. With high logistics costs, rising energy prices hinder the sustainable development of the northeast. From a sustainable development perspective, China will implement energy conservation and emission reduction policies, which will pose a serious challenge to the current high energy consumption and inefficient industrial development model in the Northeast.

3.4.3 Impact of international exchange rate movements on exports (T3): The spread of the global sovereign debt crisis has increased debt risk in emerging markets. The depreciation of the euro and the US dollar can directly alleviate their sovereign debt crisis, stimulate exports, and reduce imports by devaluing the crisis countries’ currencies. It is unfavorable for the Northeast’s agricultural and light industrial exports, leading to an increase in the Northeast’s foreign trade and economic risks.

3.4.4 Core technology is monopolized (T4): Due to the international monopoly of core technologies in the automobile, machinery and electronics industries, resulting in no breakthrough in core technologies in machinery, automobile manufacturing and components in the Northeast, core components rely on CKD imports and bear up to 10 times higher costs, the impact of technology monopoly on the industrial economy of the Northeast has increased.

4. Results and Discussion

4.1. Results of Normalization and Consistency analysis

Based on the questionnaire statistics, the SWOT strategy assessment matrix A, the strengths assessment matrix S, the weaknesses assessment matrix W, the opportunities assessment matrix O, and the threats assessment matrix T have been determined.

Use the evaluation matrix to calculate the weights of each factor on the target level, using the A matrix as an example, and proceed as follows:

- 1)

- Normalizing each column of the vector of A:

- 2)

- Summation by rows for :

- 3)

- Normalizing : is Approximate characteristic roots.

- 4)

- Calculating , as Maximum characteristic root approximation

- 5)

- Calculating the consistency index (CI),

- 6)

- Calculating the random index (RI), RI=0.90

- 7)

- Calculating the consistency ratio (CR), , if , the CR of the matrix A is within the allowed range, then the feature vectors of matrix A can be used as weight vectors.

After the Consistency analysis, all results of matrix A, S, W, O, T are , see Table 4.

The consistency analysis for the choices level (denoted here by level B) continues in the same way as in 4.1. Use level A to indicate a single level, the ranking of goal from factors is , the ranking of factors from level B to level Aare: , i.e.

The total consistency analysis is , and all results are .

4.2. SWOT quadrilateral strategic choices.

After the calculation the total ranking table at decision level are as Table 5.

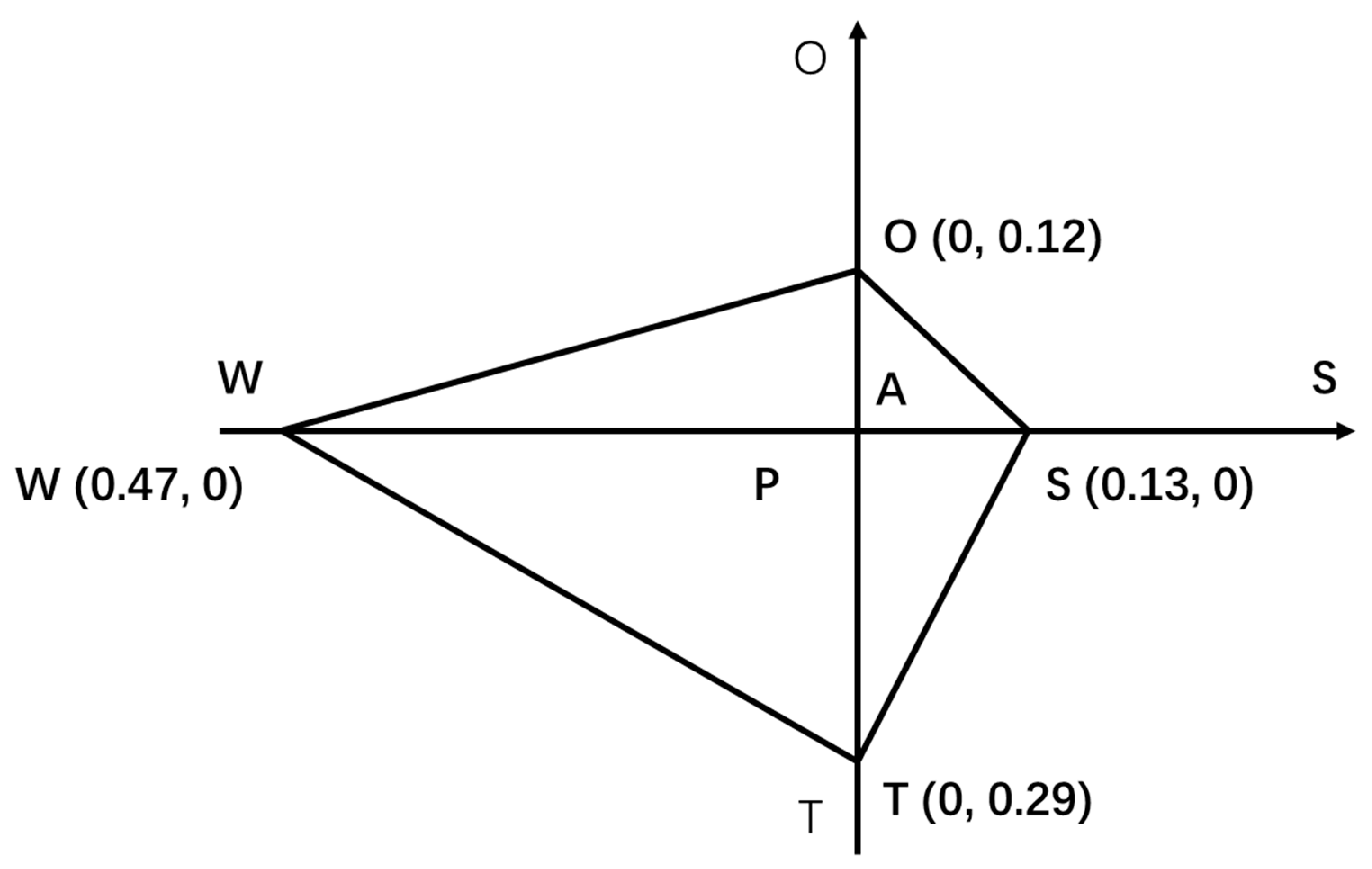

After using AHP to determine the total weight of each group of SWOT influencing elements for strategic choice, the premise of strategic choice is available, by constructing a SWOT quadrilateral, the sovereign weight of each strategic element is marked on the corresponding axes and connected in sequence to form a SWOT quadrilateral, as shown in Figure 3.

Based on Figure 7, calculate the area of the triangle in each quadrant:

The triangular area is ordered as . Therefore, the choice of economic development strategy for the Northeast is: WT (known as Defensive Strategy) > WO (known as Turnaround Strategy) > ST (known as Diversified Strategy) > SO (known as Development Strategy).

5. Conclusion

In summary, the defensive strategy (WT) is recommended as the primary strategy and the turnaround strategy (WO) as a complementary solution. Combined with the single level ranking analyzed by AHP-SWOT, the following constructive countermeasures are highlighted and recommended:

- 1)

- Develop an attractive talent policy to attract scarce talent and leaders to fill the huge talent gap (W1).

- 2)

- Preventing the effects of regional competitive instability and building a healthy chain of economies of scale (T1).

- 3)

- Promote energy conservation and emission reduction policies, develop a long-term energy plan for the Northeast region, and focus on rectifying highly polluting and inefficient industries (T2/W3).

- 4)

- Adjust and formulate industrial structure development strategies in the Northeast to avoid duplication of investment in industries with too high a similarity coefficient (W2).

- 5)

- Strengthen the financial regulatory system to prevent high-risk foreign trade financing and eliminate the effects of volatility in international financial markets (T3).

Acknowledgments

This Study was funded by Jilin Office of Philosophy and Social Science Fund Project in China (2018JD6).

Declaration of interest statement

The author declared no potential conflicts of interest with respect to the research, authorship, and/or publication of this article.

References

- Li, YQ., (2016). The Research of the China’s Role for the Security Cooperation of Northeast Asia. Dissertation for Ph.D. in Jilin University.

- Aikaterini P., (2020). An AHP-SWOT-Fuzzy TOPSIS Approach for Achieving a Cross-Border RES Cooperation. Sustainability. [CrossRef]

- Mohamed A.B., (2018). An Extension of Neutrosophic AHP-SWOT Analysis for Strategic Planning and Decision-Making. Symmetry. [CrossRef]

- Allahyari H., (2017). Evaluation of visual pollution in urban squares, using SWOT, AHP, and QSPM techniques. University of Tehran, Iran. ISSN: 2383-4501. [CrossRef]

- Djordje N., (2015). SWOT-AHP model for prioritization of strategies of the resort stara planina. Serbian Journal of Management. 10 (2) 141-150.

- Ma S., (2015). Research on evaluation system of rural eco-friendly residence in northeast regions based on analytic hierarchy process. Dissertation for master’s degree in Harbin Institute of Technology.

- Qu Y., (2011). The research of foreign trade and regional economic growth in the three provinces in Northeast China. Dissertation for Ph.D. in Northeast Normal University.

Figure 1.

Model of AHP-SWOT.

Figure 2.

Comparison of the industrial structure of the three northeastern provinces and the whole country (data source: China Statistical Yearbook 2018).

Figure 2.

Comparison of the industrial structure of the three northeastern provinces and the whole country (data source: China Statistical Yearbook 2018).

Figure 3.

SWOT Quadrilateral.

Table 1.

Scale for comparison.

| Scale | Degree of preference |

|---|---|

| 1 | Equal importance |

| 3 | Moderate importance of one factor over another |

| 5 | Strong or essential importance |

| 7 | Very strong importance |

| 9 | Extreme importance |

| 2、4、6、8 | Values for inverse comparison |

| 1/2, 1/3… | If the criterion in the column is preferred to the criteria in the row, then the inverse of the rating is given |

Table 2.

Descriptive statistics of questionnaire survey.

| Respondents | questionnaires | valid questionnaires | effective rate % |

|---|---|---|---|

| Teachers and students at universities | 352 | 331 | 94.0 |

| Cadres and employees of automobile industry | 580 | 522 | 90.0 |

| Cadres and employees of finance | 240 | 239 | 99.6 |

| Teachers and academics in economics | 60 | 60 | 100 |

| Employees from Provincial Department of Finance and Planning Museum | 140 | 122 | 87.1 |

| Total | 1,372 | 1,274 | 92.9 |

Table 3.

Statistics on talent inflow in major regions of China from 2016 to 2021 (Data source: China Talent Online).

Table 3.

Statistics on talent inflow in major regions of China from 2016 to 2021 (Data source: China Talent Online).

| employ | Southwest | East China | South China | Central China | North China | Northwest | Northeast | |

|---|---|---|---|---|---|---|---|---|

| source | ||||||||

| Southwest | 76.79% | 6.79% | 8.93% | 4.18% | 2.64% | 0.43% | 0.24% | |

| East China | 22.10% | 54.11% | 14.24% | 4.41% | 4.04% | 0.22% | 0.88% | |

| South China | 15.77% | 6.92% | 71.91% | 3.46% | 1.92% | 0.01% | 0.01% | |

| Central China | 32.62% | 14.08% | 18.78% | 27.07% | 5.86% | 1.29% | 0.30% | |

| North China | 27.59% | 12.59% | 11.03% | 5.52% | 39.66% | 1.90% | 1.71% | |

| Northwest | 38.35% | 15.26% | 8.66% | 4.33% | 3.92% | 28.87% | 0.61% | |

| Northeast | 30.82% | 14.53% | 12.21% | 4.65% | 15.12% | 1.16% | 21.51% | |

| Average | 34.86% | 17.75% | 20.82% | 7.66% | 10.45% | 4.84% | 3.61% | |

Table 4.

Results of Normalization and Consistency analysis.

| Matrix | CI | RI | CR | |||||

|---|---|---|---|---|---|---|---|---|

| A | 4.25 | 0.13 | 0.47 | 0.12 | 0.29 | 0.08 | 0.90 | 0.09 |

| S | 4.07 | 0.52 | 0.21 | 0.21 | 0.05 | 0.02 | 0.90 | 0.03 |

| W | 4.04 | 0.52 | 0.20 | 0.20 | 0.08 | 0.01 | 0.90 | 0.02 |

| O | 4.12 | 0.09 | 0.54 | 0.28 | 0.09 | 0.04 | 0.90 | 0.04 |

| T | 4.19 | 0.44 | 0.34 | 0.14 | 0.08 | 0.06 | 0.90 | 0.07 |

Table 5.

Total ranking table at decision level.

| SWOT | Group weight | SWOT elements | CR | Weight in group | Weighted | Total weight |

|---|---|---|---|---|---|---|

| S | 0.13 | S1 | 0.03 | 0.52 | 0.07 | 0.13 |

| S2 | 0.21 | 0.03 | ||||

| S3 | 0.21 | 0.03 | ||||

| S4 | 0.05 | 0.01 | ||||

| W | 0.47 | W1 | 0.02 | 0.52 | 0.24 | 0.47 |

| W2 | 0.20 | 0.09 | ||||

| W3 | 0.20 | 0.09 | ||||

| W4 | 0.08 | 0.04 | ||||

| O | 0.12 | O1 | 0.04 | 0.09 | 0.01 | 0.12 |

| O2 | 0.54 | 0.06 | ||||

| O3 | 0.28 | 0.03 | ||||

| O4 | 0.09 | 0.01 | ||||

| T | 0.29 | T1 | 0.07 | 0.44 | 0.12 | 0.29 |

| T2 | 0.34 | 0.10 | ||||

| T3 | 0.14 | 0.04 | ||||

| T4 | 0.08 | 0.02 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Copyright: This open access article is published under a Creative Commons CC BY 4.0 license, which permit the free download, distribution, and reuse, provided that the author and preprint are cited in any reuse.

MDPI Initiatives

Important Links

© 2024 MDPI (Basel, Switzerland) unless otherwise stated