Submitted:

22 September 2023

Posted:

26 September 2023

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Related Research

2.1. Influencing Factors of the Price

2.2. Analyzing the Factors Influencing Price from the Perspective of Online Public Opinion

2.3. Opinion Analysis Method of Network Public

2.3.1. Hot Spot Discovery, Topic Extraction and Clustering of Public Opinion

2.3.2. Research on Sentiment Analysis Methods

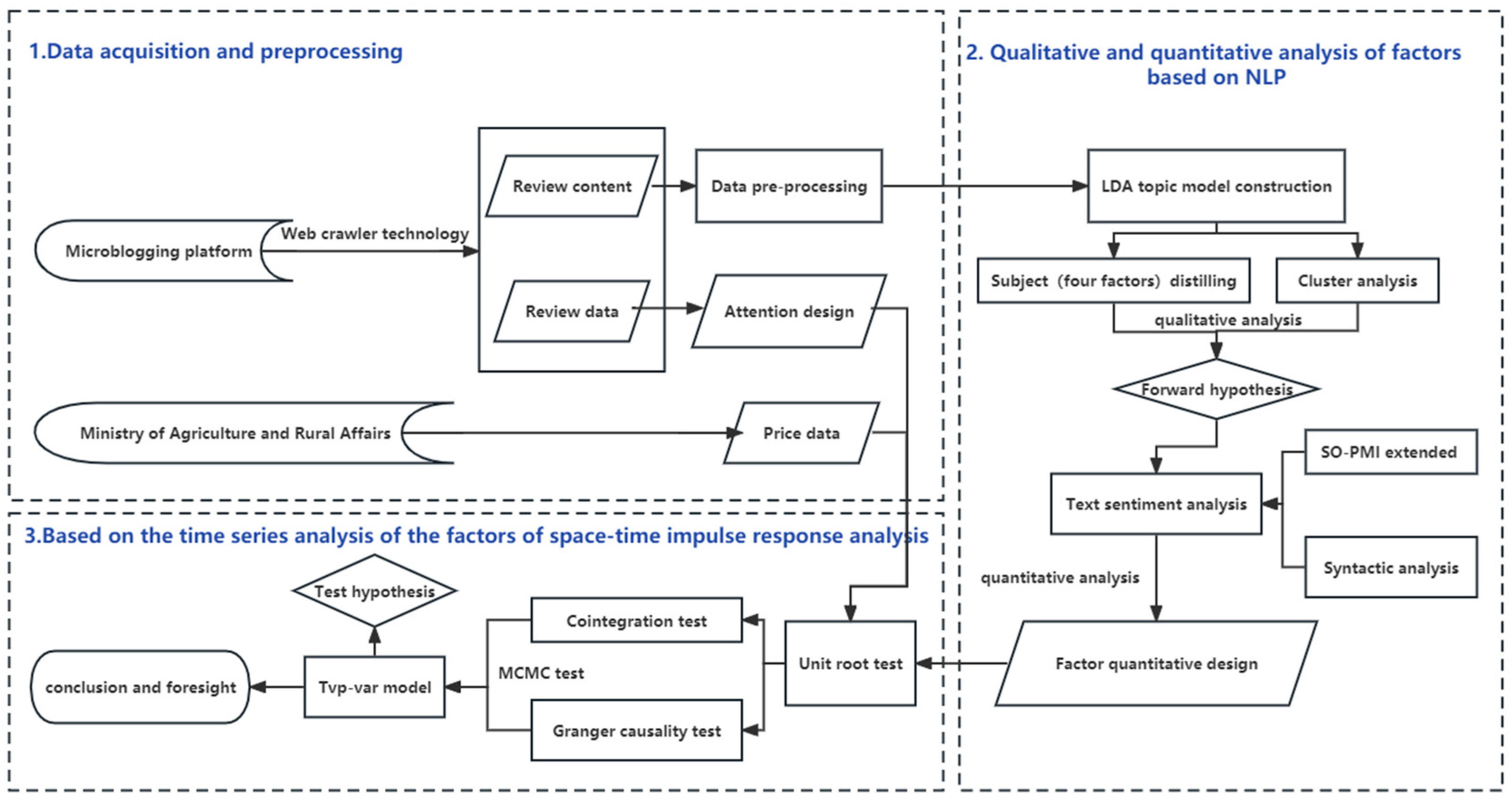

3. Materials and Qualitative Analysis Method

3.1. Overview

3.2. Data Acquisition

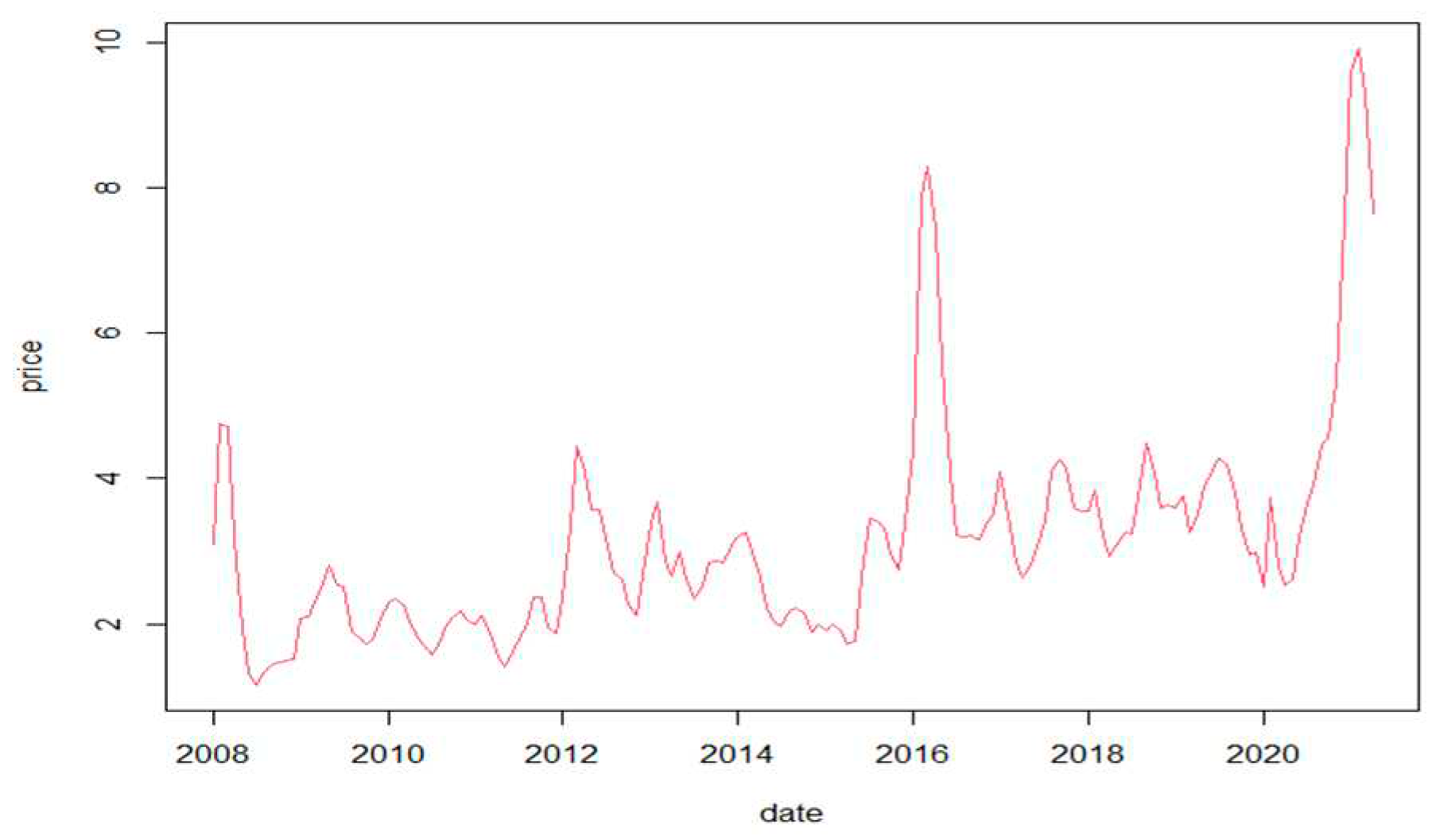

3.2.1. Price Data Acquisition

3.2.2. Public Opinion Data Acquisition

3.3. Public Opinion Data Preprocessing

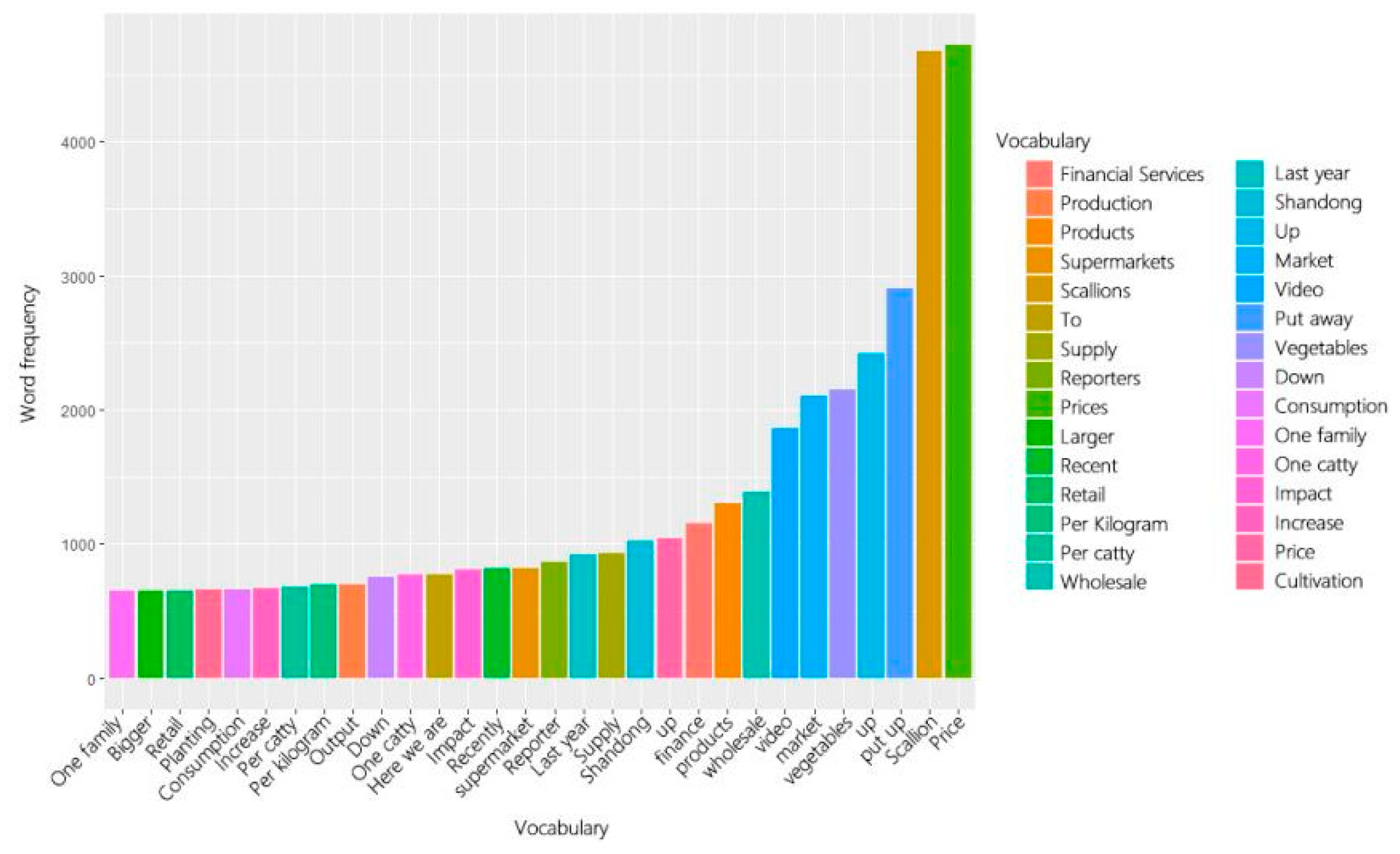

3.3.1. Chinese Word Segmentation Processing

3.3.2. Construction of Deactivated Lexicon and Text Vectorization

3.3. Analysis of Price Influencing Factors Based on Topic Classification

3.3.1. LDA Model Construction

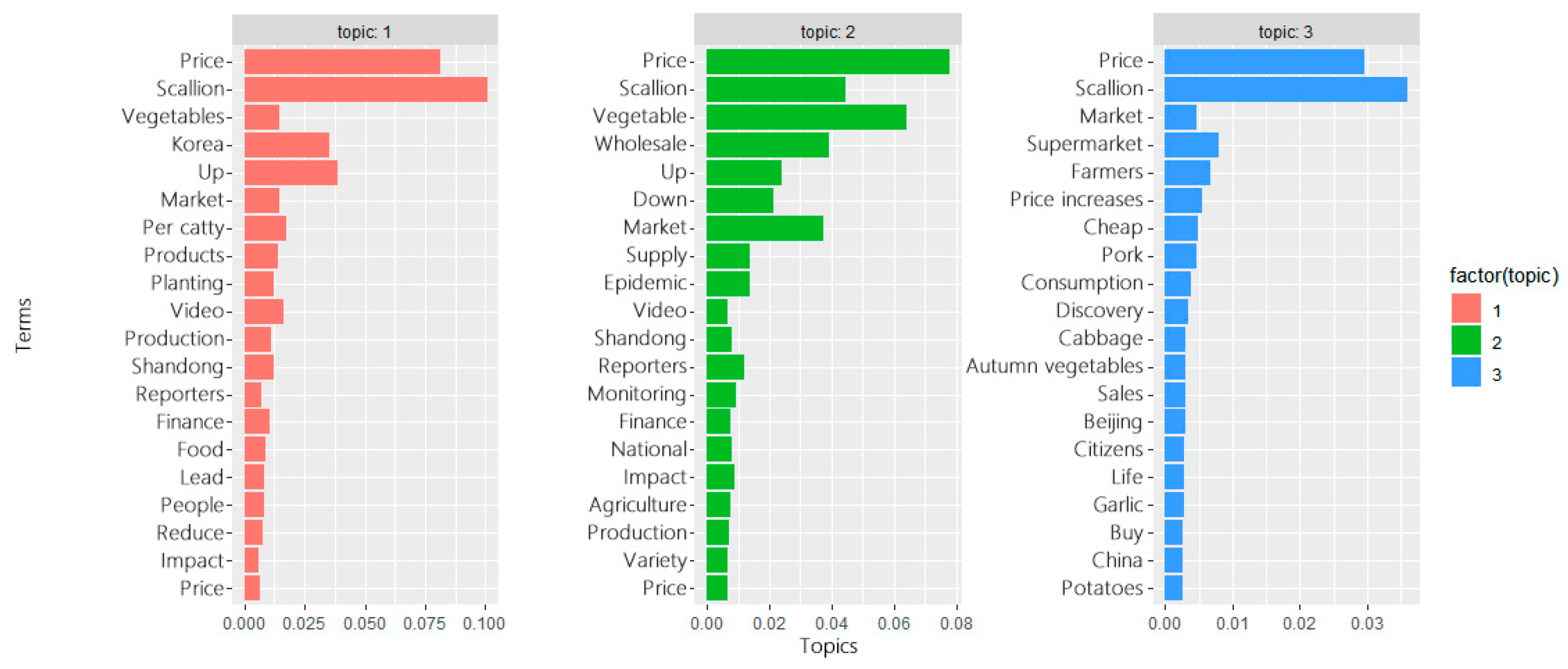

3.3.2. Agricultural Public Opinion Theme Discovery

3.3.3. Topic Division and Index Classification

| Subjects | Special key subject words | Summary of theme content |

|---|---|---|

| No 1 | Korea, planting, yield, Shandong, people, area, security, production, weather, Henan, nature, news, etc. | Market factors: including market supply and demand relationship, weather changes and natural disasters (main producing areas), total output of scallion (planting area of scallion, farming situation of farmers), import and export trade (Japan and South Korea are the main exporters of scallion) and other factors. |

| No 2 | Supply, epidemic situation, Shandong, monitoring, national, agriculture, Spring Festival, trade, personnel, environment, country, delivery, etc. | Macro factors: including the mutual influence between various consumer entities and the market environment under COVID-19, the national macro-policy regulation and control, the overall national economic situation and holiday conditions. |

| No 3 | Supermarkets, farmers, pork, cabbage, autumn vegetables, garlic, potatoes, food, condiments, restaurants, chili, ginger, etc. | Agricultural products themselves and their associated product factors: As the main condiment, the price of scallion is also affected by the prices of pork, cabbage and other related agricultural products and substitutes such as garlic, pepper and ginger. |

3.4. Hypothesis of the Price Fluctuation Factors

3.4.1. Qualitative Analysis of the Influence of Different Factors

3.4.2. The Proposed Hypothesis

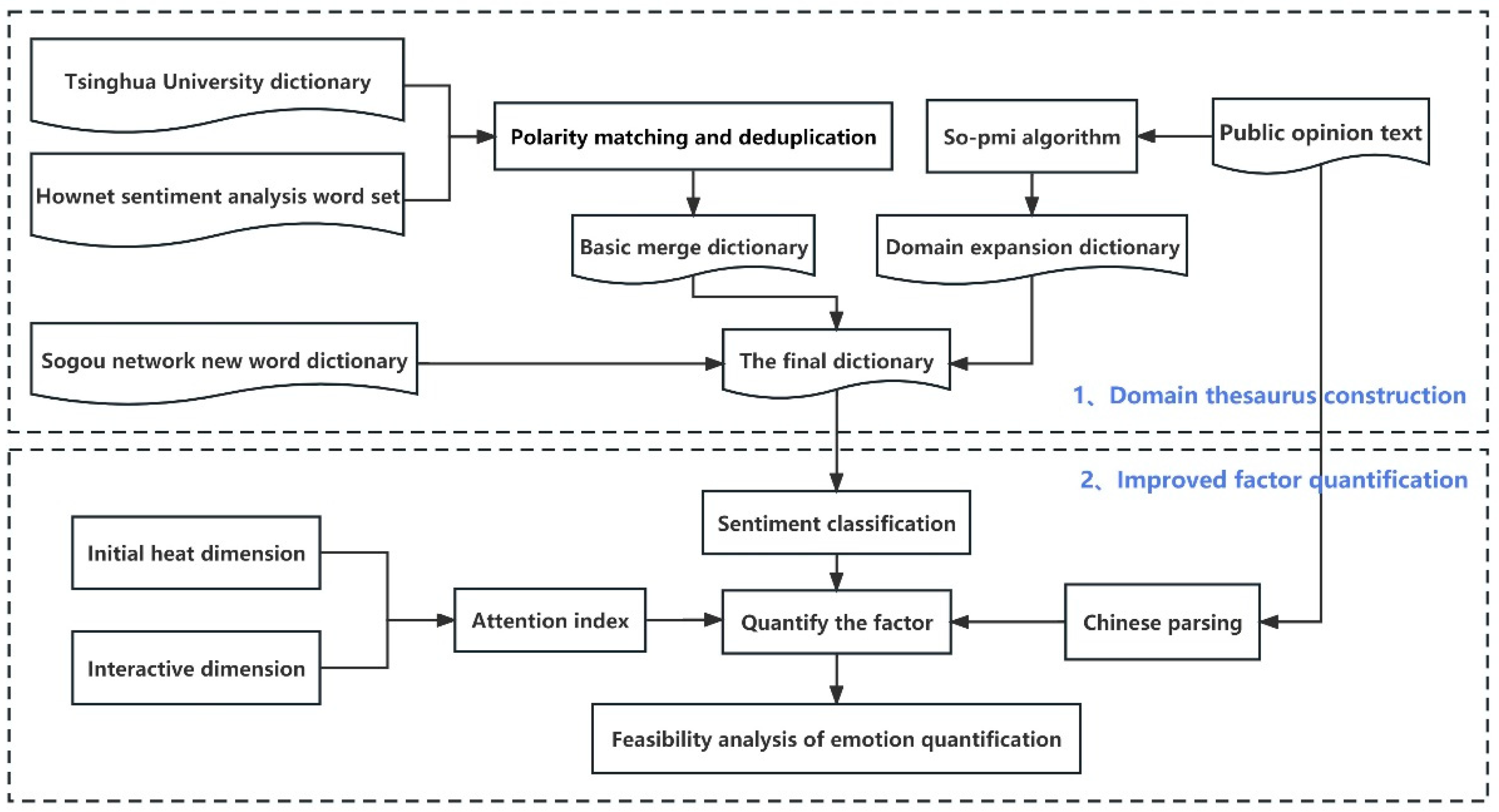

4. Quantitative Process of Influencing Factors Based on Emotional Analysis

4.1. Quantitative Analysis of the Influence of Public Opinion Factors

4.1.1. Basic Emotional Dictionary Construction

4.1.2. Domain Dictionary Expansion Based on SO-PMI Algorithm

- (1)

- Pointwise Mutual Information (PMI) is used to determine the probability of two words appearing at the same time in the corpus. The formula is as follows:

- (2)

- The emotional tendency point mutual information algorithm uses the PMI algorithm to extract emotional words in the corpus, and then performs word-level semantic orientation (SO). The SO algorithm formula is as follows:

4.1.3. Descriptive Statistics of Final Domain Dictionary

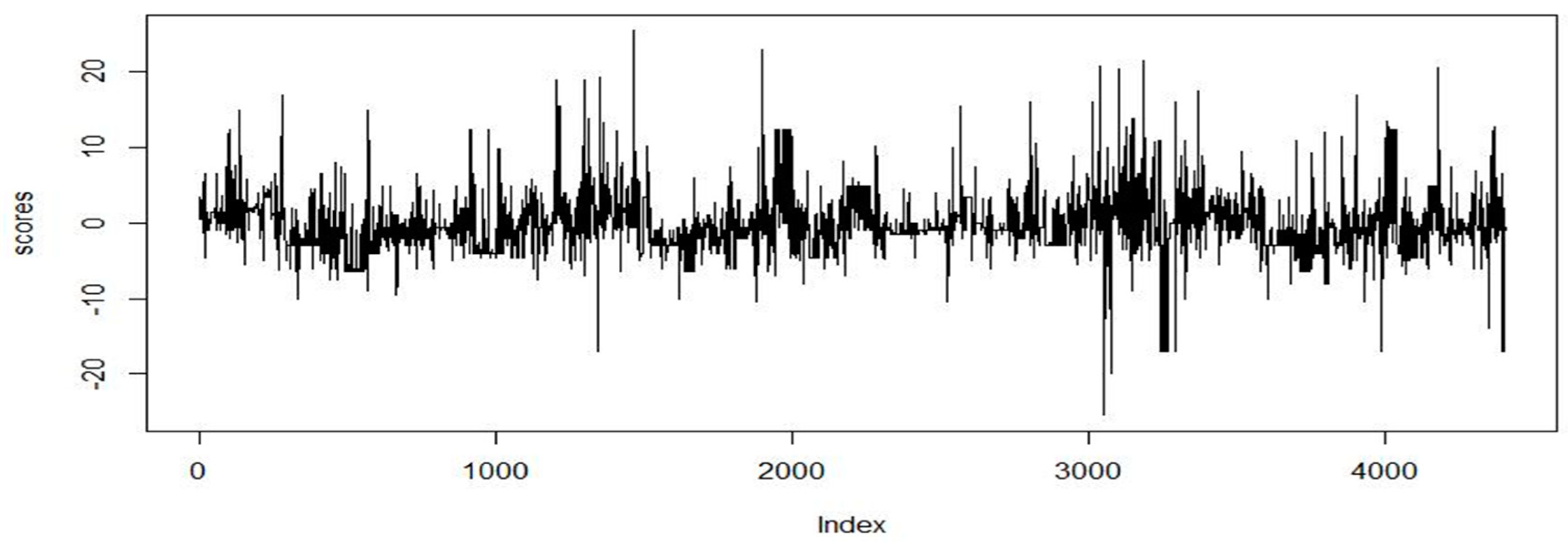

4.2. Quantitative Analysis of Influencing Factors

4.3. Evaluation of Sentiment Analysis

| Real category | Sentiment analysis output category | |

|---|---|---|

| Positive example | Negative example | |

| True example | TP | FN |

| False example | FP | TN |

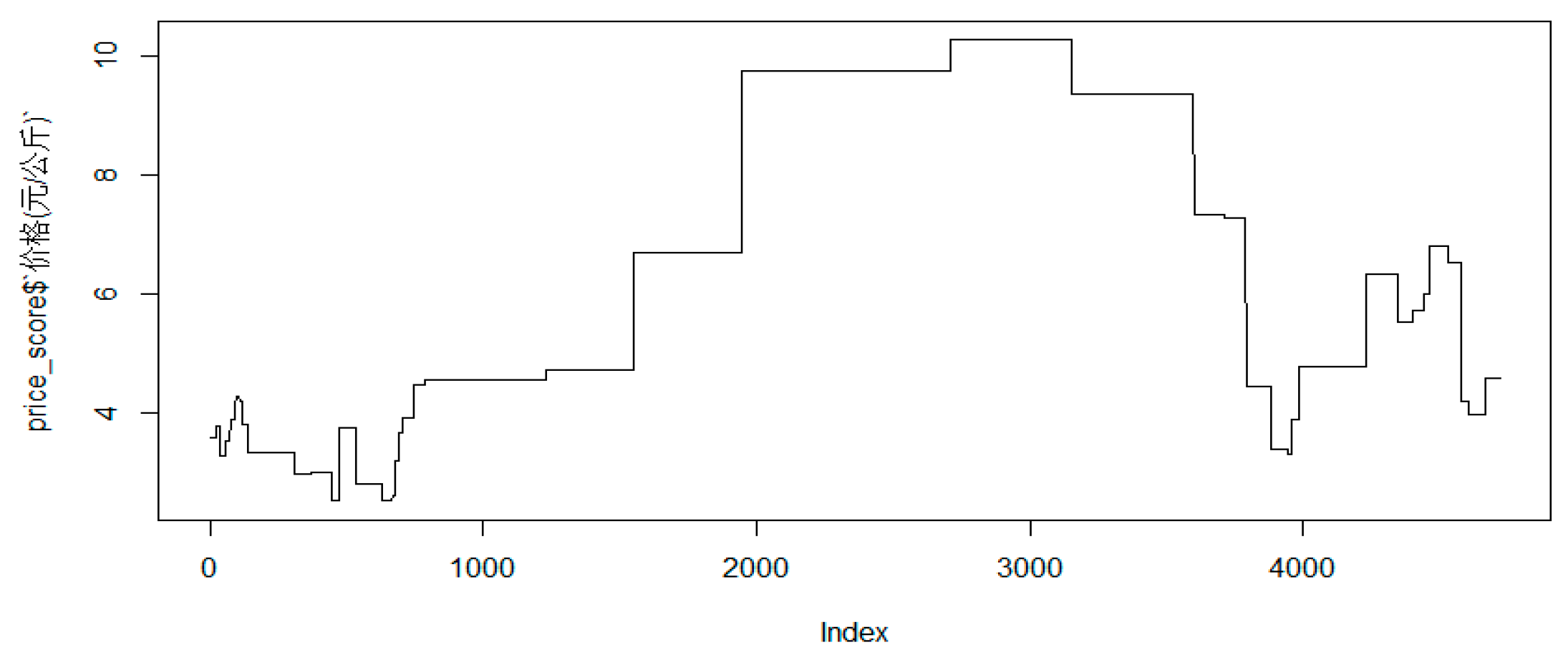

4.4. The fourth influencing factor (attention) index conversion

5. Empirical Analysis and Results

5.1. Time Series Analysis and Testing

5.2. Cointegration Test

| Unrestricted Cointegration Rank Test (Trace) | ||||

|---|---|---|---|---|

| HypothesizedNo.of CE(s) | Eigenvalue | Trace Statistic | 0.05 Critical Value | Prob.** |

| None * | 0.598301 | 83.20350 | 47.85613 | 0.0000 |

| At most 1* | 0.520643 | 45.80937 | 29.79707 | 0.0003 |

| At most 2* | 0.238634 | 15.66168 | 15.49471 | 0.0472 |

| At most 3* | 0.103584 | 4.483380 | 3.841466 | 0.0342 |

| At most 4* | 0.096926 | 4.078019 | 3.531465 | 0.0434 |

5.3. Granger Causality Test

| Null Hypothesis: | F-Statistic | Prob. | Verdict |

|---|---|---|---|

| X1 does not Granger Cause Y | 6.05255 | 0.0007 | Refuse |

| Y does not Granger Cause X1 | 0.13908 | 0.9816 | Accept |

| X2 does not Granger Cause Y | 3.73956 | 0.0106 | Refuse |

| Y does not Granger Cause X2 | 1.26245 | 0.3086 | Accept |

| X3 does not Granger Cause Y | 5.43636 | 0.0014 | Refuse |

| Y does not Granger Cause X3 | 0.42273 | 0.8287 | Accept |

| X4 does not Granger Cause Y | 5.29149 | 0.0016 | Refuse |

| Y does not Granger Cause X4 | 0.49052 | 0.7804 | Accept |

5.4. Empirical Analysis Based on TVP-VAR Model

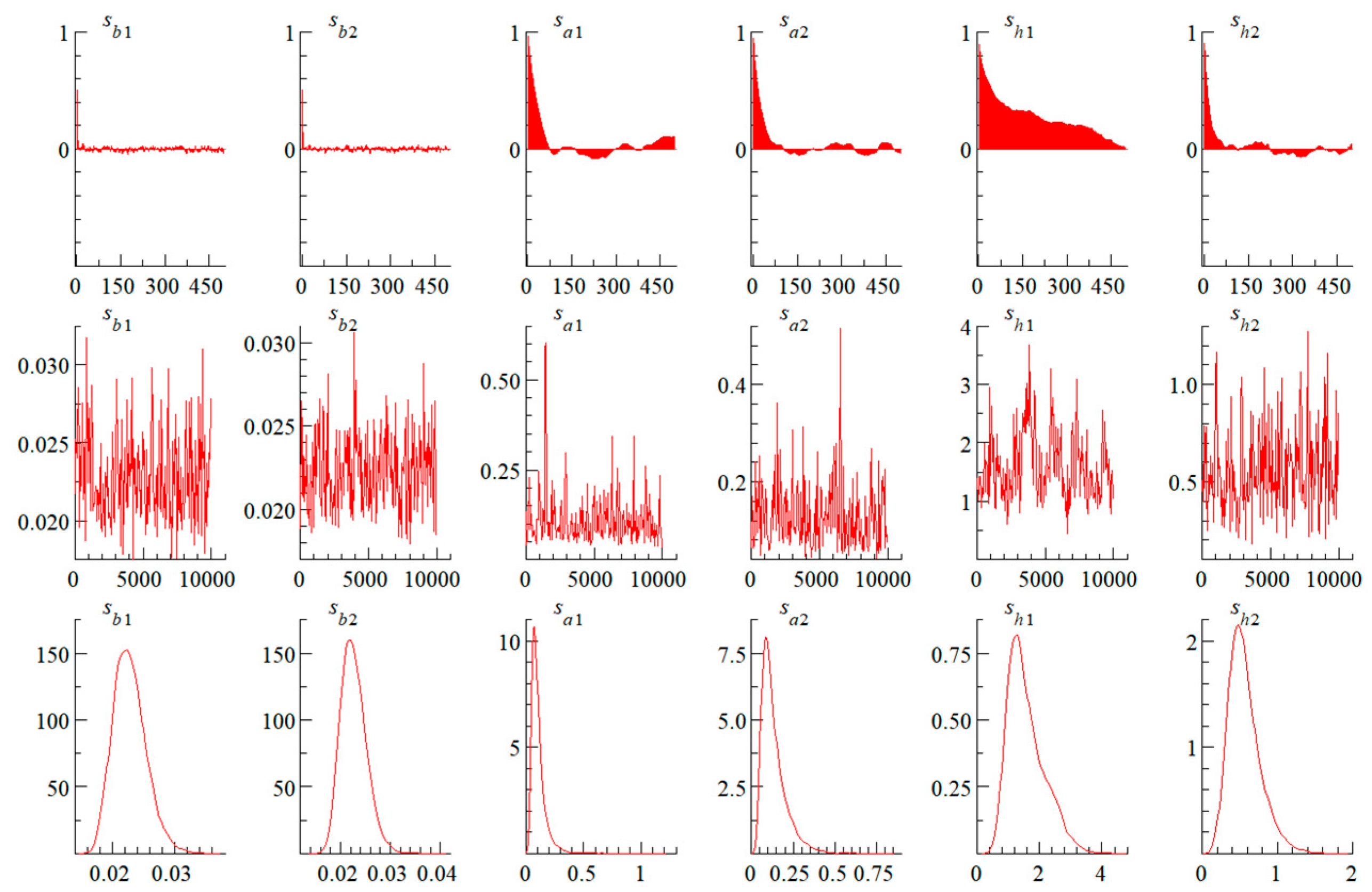

5.4.1. Estimation of time-varying parameters based on MCMC algorithm

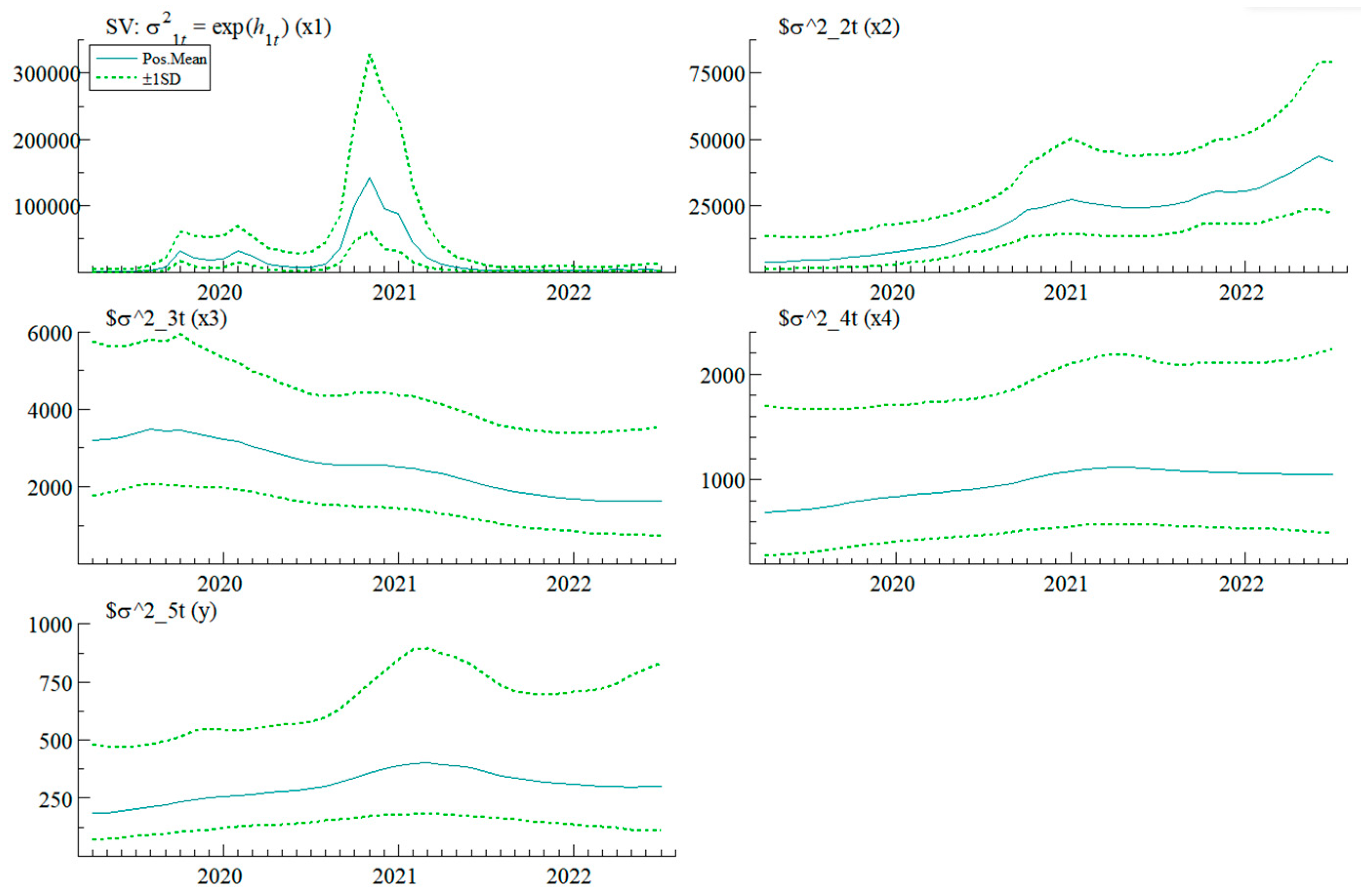

5.4.2. Factor Stochastic Volatility Analysis

5.4.3. Spatio-Temporal Impact Analysis

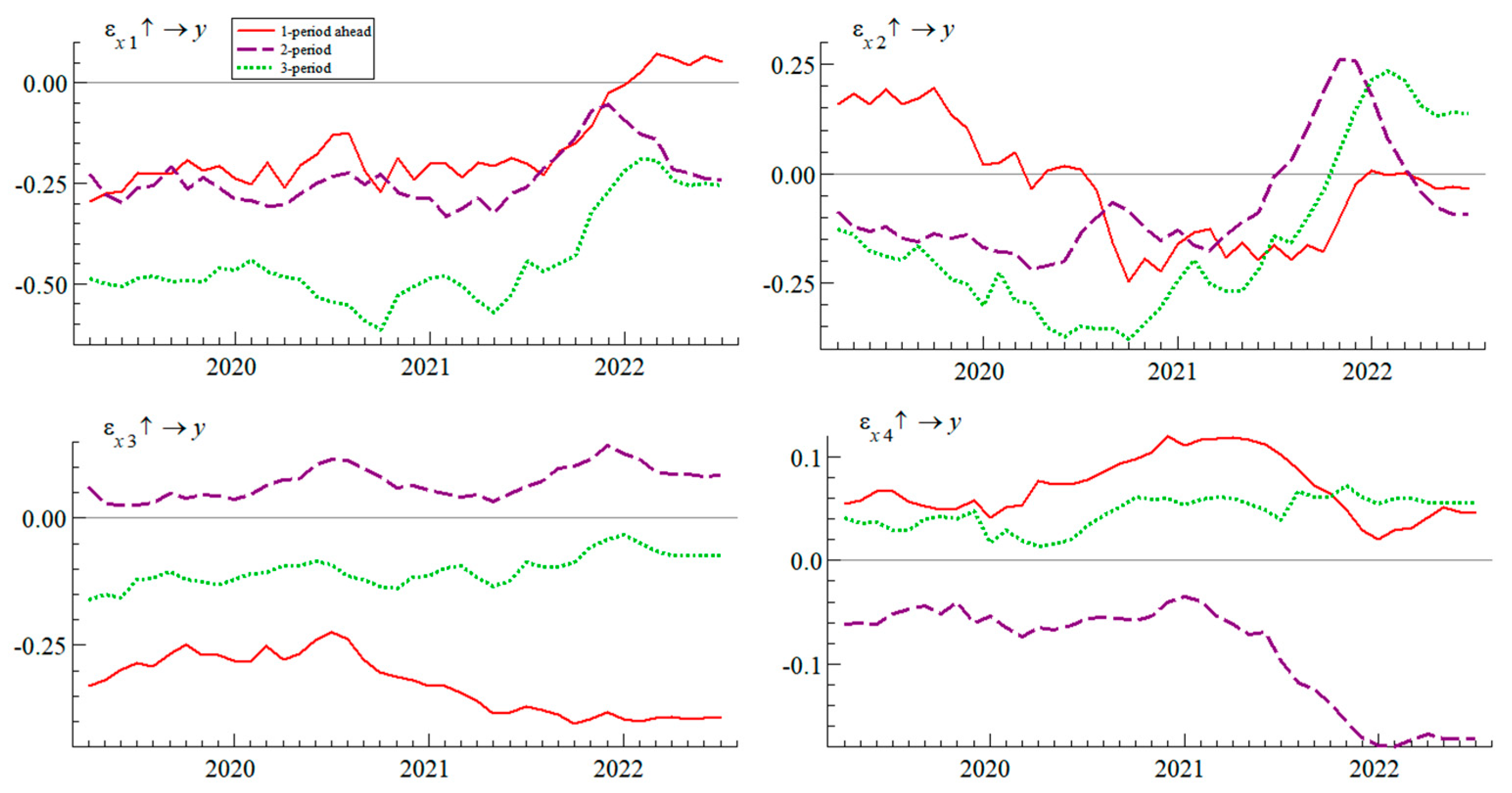

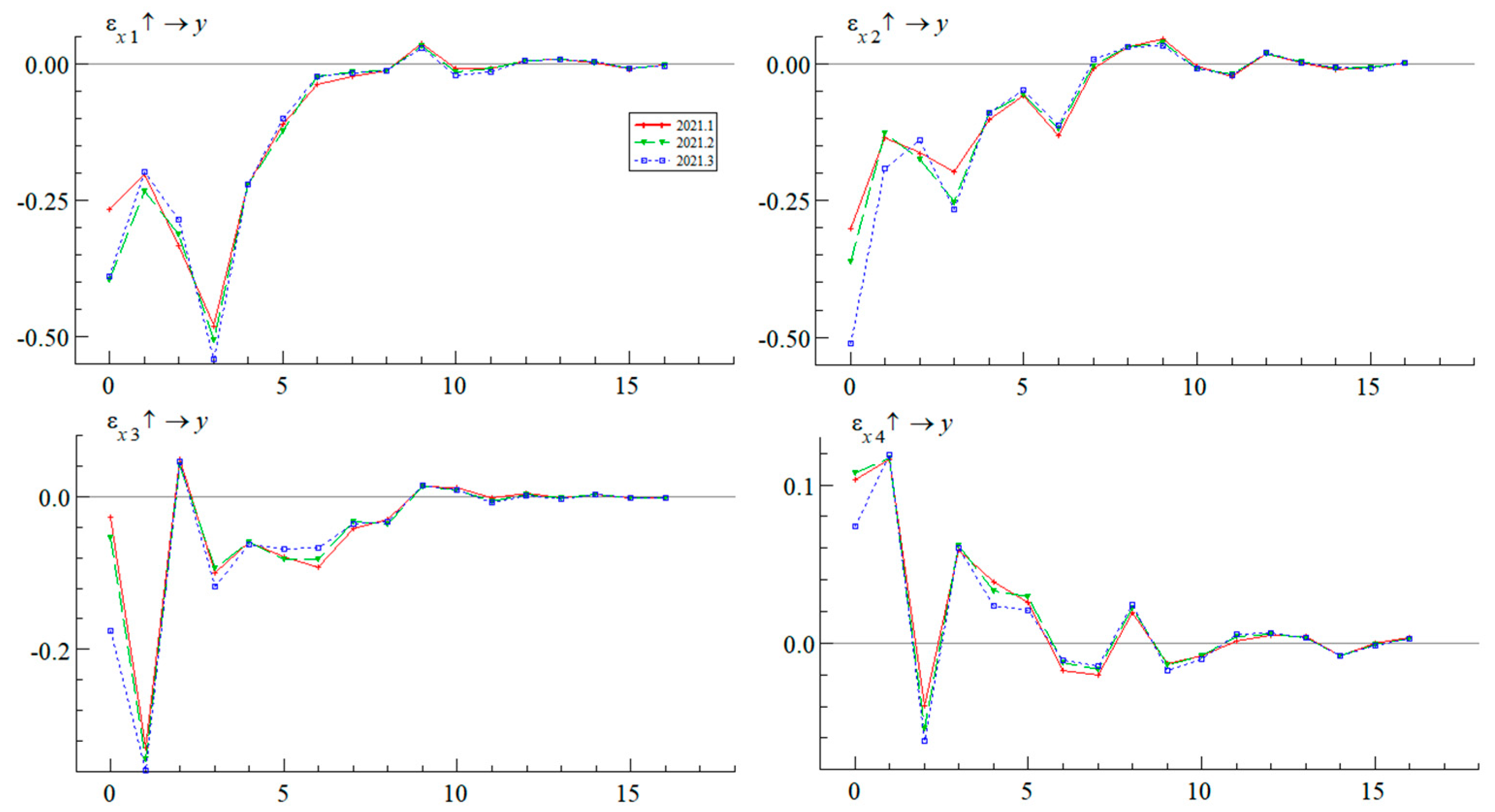

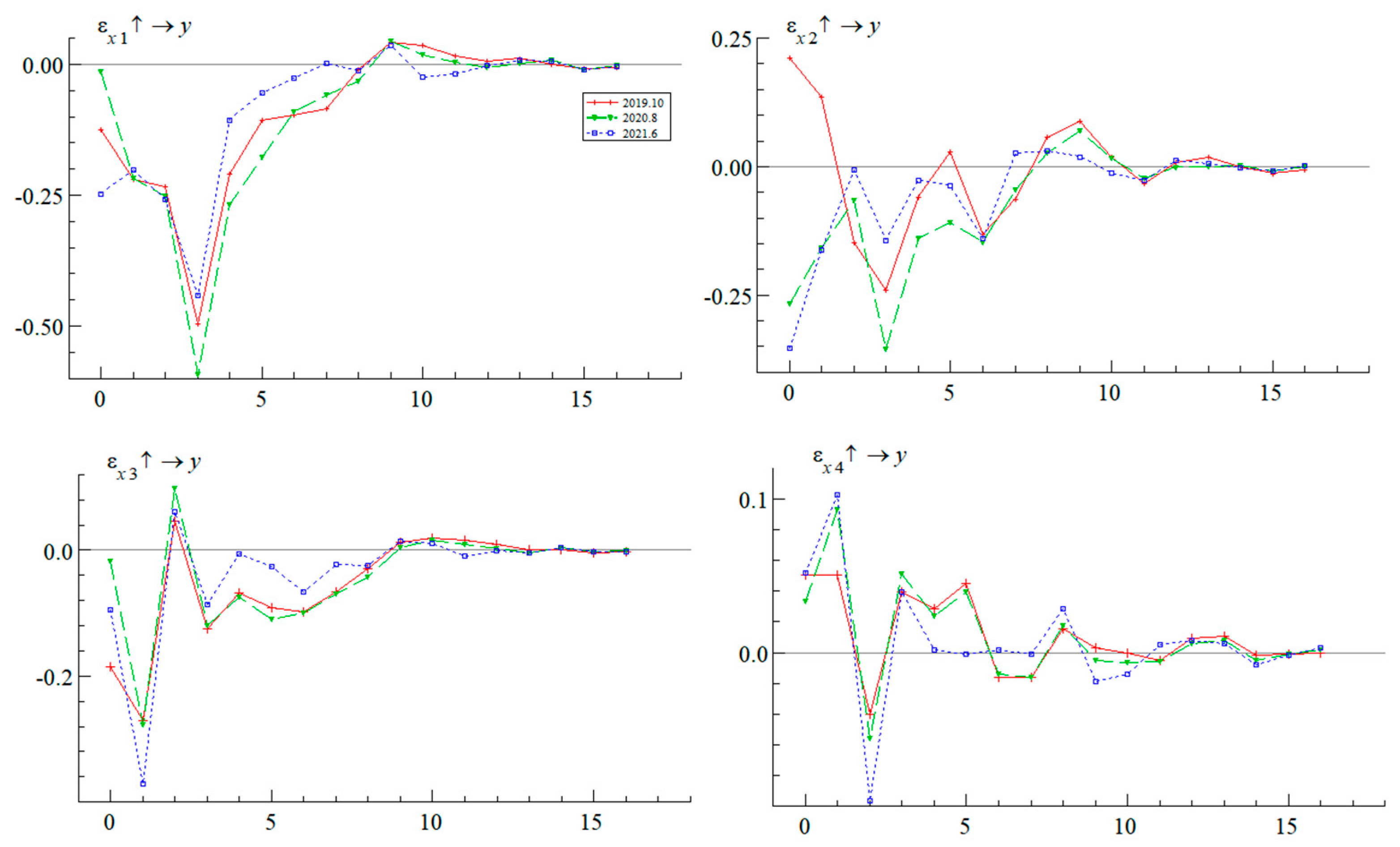

5.4.3.1. Test Results for Four Hypotheses

5.4.3.2. Analysis of Time-Varying Characteristics of Impulse Response

6. Conclusion and Suggestions

- (1)

- Over the past three years, in the context of longer cycles, the four factors exhibit distinct overall changing trends and varying magnitudes of influence on scallion prices. Market factors, which reflect supply-demand relationships and production elements, continue to be the primary drivers of agricultural product prices, reaffirming the fundamental dynamics of agricultural markets. However, the period from 2019 to 2022 is unique due to the global impact of the COVID-19 pandemic on the economy. During this time, the fluctuations in scallion prices were significantly influenced by both social and economic environmental factors. As the pandemic gradually stabilized and was brought under control after 2021, the influence of the socio-economic environment on price fluctuations rapidly diminished.

- (2)

- The effects of market factors, environmental factors, related agricultural product prices, and market attention on scallion prices are characterized by time-varying and lagged features, reflecting certain lifecycle characteristics. On one hand, these four factors exhibit significant variations in their impact on scallion prices during different periods, with notable differences in the lagged effects. Market factors and environmental factors show the most significant lagged effects within a quarterly lag period, suggesting that these factors have longer-lasting delayed impacts on price fluctuations. On the other hand, the factors related to prices of other agricultural products and market attention exhibit the most significant lagged effects within a monthly lag period, indicating that these two factors have more pronounced short-term lagged effects on scallion prices. Additionally, according to the lifecycle theory, it's observed that the dynamic pulse responses are more pronounced at time points when scallion prices exhibit high levels of random volatility.

- (3)

- At different time points and time periods, there are evident characteristics of heterogeneity in the impact of the four factors. During the phase from mid-2019 to early 2020 when the COVID-19 pandemic was spreading and erupting, the influence of environmental factors reflecting the socio-economic conditions and the factor of market attention was relatively significant. As the pandemic transitioned from rapid spread to gradual control, the influence of these two factors experienced corresponding fluctuations, but overall, they exhibited a decreasing trend. On the other hand, the impact of market factors gradually intensified over time. This pattern reflects that short-term fluctuations in scallion prices are more influenced by socio-economic conditions and specific events, while the influence of market factors becomes more pronounced over longer time periods.

- (1)

- Establishing a Comprehensive Small-Scale Agricultural Product Market Information Dissemination Mechanism and Sharing Platform

- (2)

- Enhancing Public Sentiment Monitoring and Regulation, and Guiding Positive Public Discourse

7. Limitations and Prospects

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Key parameter | Implication | Input or output content |

|---|---|---|

| df | Define input public opinion data | 4721 obs.of 13 variables |

| Stop | Define input stop word library data | 1890 obs.of 1 variables |

| Word | Define the number of all word segmentation results | 628238 obs.of 15 variables |

| Word.lda | Import R Machine Learning Component Package | Large LDA-VEM (4.2 MB) |

| Word.dtm | Define the input data format and attributes | Large Document Term Matrix |

| Word.frq | Output text word frequency total statistics | 423867 obs.of 3 variables |

| Word.frq1 | Output word frequency statistics after removing stop words | 308938 obs.of 3 variables |

| Word.frq2 | Output word frequency statistics after further data cleaning | 174990 obs.of 3 variables |

| Word.label | Test gamma distribution, output word belongs to label | 14160 obs.of 3 variables |

| Word.comments | Test the gamma distribution and output the class cluster of the comment topic | 14160 obs.of 3 variables |

| Word.topics | Test the beta distribution and output the probability of each word corresponding to the topic | 32814 obs.of 3 variables |

| Word.terms | Test the beta distribution and output the top keywords of each topic | 40 obs.of 3 variables |

| Topicwords | Output the first n representative words in the topic | Chr [1:150]“价格”“大葱”“蔬菜”“上涨”... |

| pawβ-Judged | nawβ-Judged | ||||||

| Word | PMI | Length | Part-of-speech | Word | PMI | Length | Part-of-speech |

| 投放 储备 稳定 物流 回落 推荐 支持 发展 协调 保障 |

98.4349 92.0971 84.0112 82.4268 76.8883 76.2915 72.5271 72.4991 75.2731 74.2025 |

2 2 2 2 2 2 2 2 2 2 |

v v/n v/ad n v v v/n v v v/n |

翻倍 吃不起 涨到 涨价 涨幅 高达 疯狂 暴涨 翻番 买不起 |

96.0905 87.1588 86.9920 84.2206 83.7222 79.1152 71.2544 70.7319 65.7654 64.1543 |

2 3 2 2 2 2 2 2 2 3 |

v v v n n ad ad v v v |

| Attribute/polarity | Quantity | Instantiation | Weight | ||

| Part-of-speech | Positive emotional words | 10217 | 好转、回落、给力、实惠、平稳、惠民、稳定、缓解、回落、小康等 | 1 | |

| Negative emotional words | 8952 | 坑人、上涨、走高、垃圾、可恶、疫情、暴涨、弊端、向前葱、哄抬物价等 | -1 | ||

| Negation | 45 | 不、未曾、无须、不要、请勿、休想、绝不、绝非、禁止、从未有过等 | -2 | ||

| Degree adverbs | over | 30 | 忒、过度、过猛、过于、太强、何止、超额、何啻、过了头等 | 2 | |

| extreme/most | 69 | 倍加、极度、极端、极其、绝对、最为、百分之百、彻头彻尾等 | 1.8 | ||

| very | 42 | 颇为、实在、不少、分外、格外、何等、特别、尤其、尤为等 | 1.5 | ||

| more | 37 | 较为、更为、更加、愈发、愈加、越加、越是、越来越、越...越等 | 1.2 | ||

| -ish | 29 | 略微、略加、稍稍、稍微、一些、一点、有点、有些、一丢丢、多多少少等 | 0.8 | ||

| insufficiently | 12 | 弱、微、微小、轻微、轻度、不甚、不大、不怎么、不丁点儿等 | 0.5 | ||

Appendix B

| 1% level | 5% level | 10% level | T-Statistic | P-Value | verdict | |

|---|---|---|---|---|---|---|

| Price | -4.018748 | -3.439267 | -3.143999 | -5.687067 | 0.0000 | stable |

| Factor 1 | -2.622585 | -1.949097 | -1.611824 | -2.831748 | 0.0057 | stable |

| Factor 2 | -3.596616 | -2.933158 | -2.604867 | -3.996649 | 0.0034 | stable |

| Factor 3 | -2.621185 | -1.948886 | -1.611932 | -4.045642 | 0.0002 | stable |

| Factor 4 | -3.596616 | -2.933158 | -2.604867 | -3.354618 | 0.0185 | stable |

| Lag | LogL | LR | FPE | AIC | SC | HQ |

|---|---|---|---|---|---|---|

| 0 | -1043.097 | NA | 3.95e+16 | 52.40483 | 52.61594 | 52.48116 |

| 1 | -989.3681 | 91.33837 | 9.50e+15 | 50.96840 | 52.23506* | 51.42639* |

| 2 | -963.2682 | 37.84473 | 9.56e+15 | 50.91341 | 53.23562 | 51.75305 |

| 3 | -930.8227 | 38.93465* | 7.76e+12* | 50.54114* | 53.91889 | 51.76243 |

| 4 | -919.9629 | 42.35847 | 8.48e+12 | 51.86989 | 53.97046 | 51.91059 |

| Parameter | Mean | Stdev | 95%L | 95%U | Geweke | Inef. |

|---|---|---|---|---|---|---|

| sb1 | 0.0228 | 0.0026 | 0.0184 | 0.0286 | 0.753 | 2.14 |

| sb2 | 0.0229 | 0.0027 | 0.0184 | 0.0288 | 0.414 | 2.97 |

| sa1 | 0.1082 | 0.0648 | 0.0442 | 0.2911 | 0.165 | 49.17 |

| sa2 | 0.1116 | 0.0626 | 0.0470 | 0.2833 | 0.440 | 25.03 |

| sh1 | 1.0015 | 0.4084 | 0.1582 | 1.8642 | 0.410 | 83.42 |

| sh2 | 0.2696 | 0.1666 | 0.0668 | 0.6841 | 0.798 | 66.96 |

References

- Fan, S. Agriculture, Food and Nutrition Security Under Covid-19: Lessons from China[J]. Journal, 2020, 10.

- Zhang Youwang, Xu Yuanyan, Liu Jiaojiao. Study on Price Risk Identification and Mitigation Strategies of Small-Scale Agricultural Products: A Case Study of Scallion, Ginger, and Garlic[J]. Price: Theory & Practice, 2022, 10: 5.

- Pan D, Yang J, Zhou G, et al. The influence of COVID-19 on agricultural economy and emergency mitigation measures in China: A text mining analysis[J]. PLoS ONE, 2020, 15(10): e0241167.

- Xu Pan. Study on Prediction of Pork Price Using Sentiment Analysis and Prophet-BP Model[D]. Anhui Agricultural University, 2020. [CrossRef]

- Yang Y, Zhang Y, Zhang X, et al. Spatial evolution patterns of public panic on Chinese social networks amidst the COVID-19 pandemic[J]. International journal of disaster risk reduction: IJDRR, 2022, 70: 102762.

- Cabezas Javier et al. Detecting Emotional Evolution on Twitter during the COVID-19 Pandemic Using Text Analysis[J]. International journal of environmental research and public health, 2021, 18(13): 6981-6981.

- Chen F, Huang J. Herd Instinct of the Transmission of Network Public Opinion Based on Evolutionary Game[J]. Journal of Intelligence, 2013.

- Raviraja, S. Reference Groups and Opinion Leadership Effect on Purchase Decision of Consumer Durables[J]. Bioscience Biotechnology Research Communications, 2020.

- Meng Jun, Lü Xingchen. Study on the Characteristics and Patterns of Price Fluctuations of Small Agricultural Products in China: An Analysis Based on ARCH Models[J]. Price: Theory & Practice, 2021, 11: 87-90.

- Gao Xiaodan. Analysis of the Patterns and Causes of Price Fluctuations in China's Small Agricultural Products[J]. Agricultural Economics, 2017, No.356(01): 133-135.

- Liu H, Li N. Empirical Analysis of the Reasons for Price Fluctuations of Small Variety Agricultural Products: Based on the Investigation of Mung Bean Farmers in Baicheng City, Jilin Province[J]. Agricultural Technology Economy, 2014, (02): 76-84. 2014.02.008.

- Liu, Z. Simulation Study on the Price Fluctuation Mechanism and Influence Factors of Small-scale Agricultural Products: A Case Study of Garlic[J]. Price: Theory & Practice, 2018, (01): 94-97. 2018.01.024.

- Zhe, L. Simulation Analysis on the Price Fluctuation Mechanism and Influence Factors of Small-scale Agricultural Products By the Case Study of Garlic[J]. Price: Theory & Practice, 2018.

- Yao, S. Study on the Characteristics and Influencing Factors of Price Fluctuations of Small Variety Agricultural Products: A Case Study of Garlic-like Storage-resistant Agricultural Products[J]. Price: Theory & Practice, 2021, (08): 100-103+186. 2021.08.25.

- Lian H B. Research on the Price Fluctuation Characteristics and Correlation of Scallion, Ginger and Garlic[J]. Hebei Agricultural University, 2019.

- Zhang S Z, Liu L. Study on Price Fluctuation of Small-scale Agricultural Products and the Impact of Money Supply: Based on the Mathematical and Empirical Research of Cobweb Model and VAR Model[J]. Financial Theory & Practice, 2012, (11): 5.

- Balcilar M, Sertoglu K, Agan B. The COVID-19 effects on agricultural commodity markets[J]. Agrekon, 2022, 61.

- Liu Y, Liu S, Ye D, et al. Dynamic impact of negative public sentiment on agricultural product prices during COVID-19[J]. Journal of Retailing and Consumer Services, 2022, 64.

- Zheng Y, Ma J. Research on the Dynamic Impact of Avian Influenza Epidemic Changes on Livestock and Poultry Product Prices: Based on Time-varying Parameter Vector Autoregressive (TVP-VAR) Model[J]. Agricultural Modernization Research, 2018, 39(5): 10.

- Pasupulety U, Anees A A, Anmol S, et al. Predicting Stock Prices using Ensemble Learning and Sentiment Analysis[C]// 2019 IEEE Second International Conference on Artificial Intelligence and Knowledge Engineering (AIKE). IEEE, 2019.

- Li B, Chan K, Ou C, et al. Discovering public sentiment in social media for predicting stock movement of publicly listed companies[J]. Information Systems, 2017, 69: 81-92.

- Gurdgiev C, O'Loughlin D, Chlebowski B. Behavioral Basis Of Cryptocurrencies Markets: Examining Effects Of Public Sentiment, Fear, And Uncertainty On Price Formation[J]. Journal of Financial Transformation, 2019, 49.

- Jia C, Xia C P, Qin Q X. Impact of COVID-19 Pandemic on China's Pork Prices[J]. Journal of China Agricultural University, 2021, 26(7): 13.

- Yang M B. E-commerce Product Price Prediction Model Based on Network Public Opinion Analysis[J]. Cooperative Economy and Technology, 2018(11): 3.

- Yang S, Yang Y T, Wen Z Y, et al. Extraction-based Single Document Summary Method Based on Semantic Space[J]. Journal of Xiamen University: Natural Science, 2019, 58(2): 6.

- Kumar G K, Rani D M. Paragraph summarization based on word frequency using NLP techniques[C]// PROCEEDINGS OF THE 14TH ASIA-PACIFIC PHYSICS CONFERENCE. 2021.

- Mourisse D, Lefever E, Verbiest N, et al. SBFC: An Efficient Feature Frequency-Based Approach to Tackle Cross-Lingual Word Sense Disambiguation[J]. Springer, 2012.

- Wang L, Xu J M. Application of Distributed K-means Clustering in Weibo Hot Topic Discovery[J]. Computer Simulation, 2020, 37(08): 121-125.

- Zhang J R. Research on Association Rule Mining Based on Multi-topic Classification and Named Entity Recognition[D]. Chongqing University of Technology, 2022.000169.

- Yi J W. News Text Topic Classification Based on BERT Pre-trained Model and VAE Feature Reconstruction[D]. Lanzhou University, 2021.001547.[30] Yi J W. News Text Topic Classification Based on BERT Pre-trained Model and VAE Feature Reconstruction[D]. Lanzhou University, 2021.001547.

- Sun L C, Huang R C. News Text Classification Model with LSTM and Attention Mechanism[J]. Sensors & Microsystems, 2022, 41(09): 38-41.

- Deng L, Lujuan et al. News Text Classification Method Based on the GRU_CNN Model[J]. International Transactions on Electrical Energy Systems, 2022.

- Varsha Mittal, Duraprasad Gangodkar, Bhaskar Pant. Deep Graph-Long Short-Term Memory: A Deep Learning Based Approach for Text Classification[J]. Wireless Personal Communications, 2021: 1-15.

- Dybowski T P, Admmer P. The economic effects of U.S. presidential tax communication: Evidence from a correlated topic model[J]. European Journal of Political Economy, 2018: S0176268017302355.

- Rao Y, Lei J, Liu W, et al. Building emotional dictionary for sentiment analysis of online news[J]. World Wide Web, 2014, 17(4): 723-742.

- Wei G, Pei G J, Zhang Y, Zhang Q. Chinese Sentiment Analysis of Online Public Opinion Texts Based on Information Enhancement[J]. Communications Technology, 2022, 55(07): 859-864.

- Deng H, Ergu D, Liu F, et al. Text sentiment analysis of fusion model based on attention mechanism[J]. Procedia Computer Science, 2022, 199: 741-748.

- Zhou N, Zhong N, Jin G Y, Liu B. Chinese Text Sentiment Analysis based on Dual-channel Attention Network with Mixed Word Embeddings[J/OL]. Data Analysis and Knowledge Discovery: 1-14 [2022-08-29].

- Liu J, Gu F Y. Sentiment Analysis of Unbalanced Texts in Online Public Opinion Based on BERT and BiLSTM Hybrid Method[J]. Journal of Intelligence, 2022, 41(04): 104-110.

- Song G Y. Research on Multi-task Text Analysis Based on BERT[D]. Shandong University, 2021.003951.

- Yucel Ahmet et al. A novel text analytic methodology for classification of product and service reviews[J]. Journal of Business Research, 2022, 151: 287-297.ss).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).