3. Model description and basic assumptions

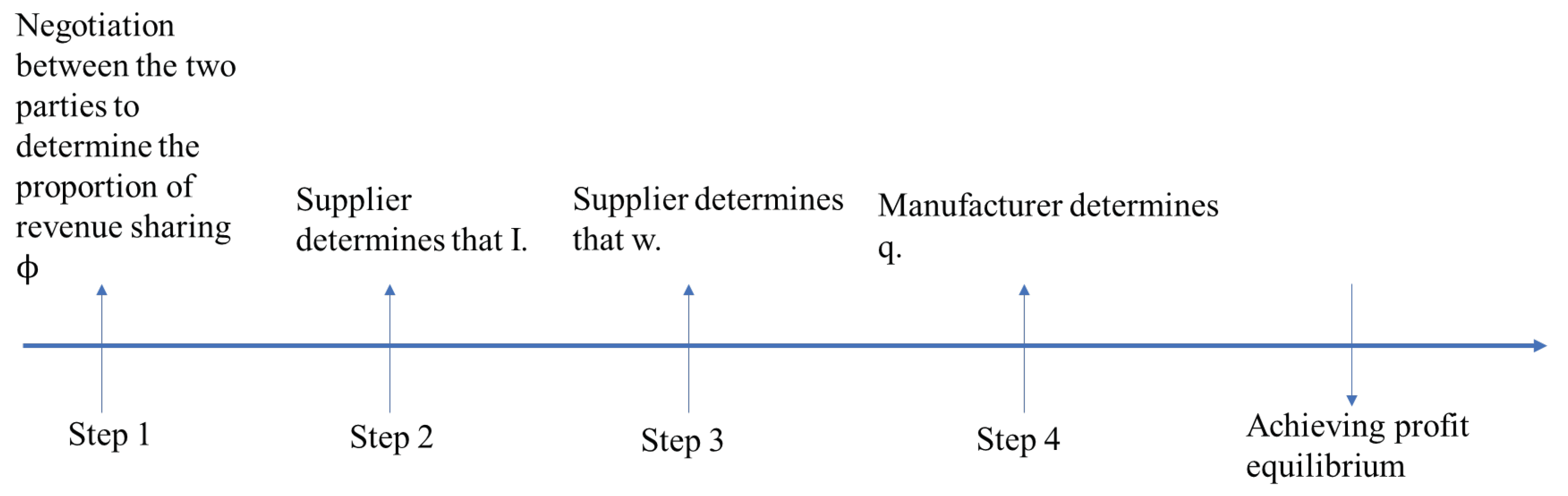

The research setting for this study is a supply chain consisting of a single supplier and single manufacturer. The basic assumptions are stated as: both supply partners tend to be overconfident, the supplier is a Stackelberg leader responsible for the R&D and production of the key components, and the manufacturer is a follower responsible for the manufacturing and sales of products. After the supplier's R&D on key components, in addition to the one-off R&D costs invested upfront, it is assumed that the unit cost of production of key components increases as the level of R&D investment increases. In order to better co-ordinate the R&D inputs of key components from upstream and downstream of the supply chain, the supplier and the manufacturer share the sales revenue through a RS contract. The game sequence includes four steps, which are shown in

Figure 1.

Step 1: Supplier and manufacturer negotiate to determine the percentage of RS to be received by the supplier (). In this paper, bargaining power is defined as the effect of the profits that each of the cooperative firms can make from the co-operation on the parties' bargaining objective function (Feng & Lu, 2013). The greater the bargaining power of a party, the greater the impact of its profits on the bargaining objective function. We denote the supplier's bargaining power by (), the manufacturer's bargaining power by , and the manufacturer's (supplier's) full bargaining power by (). indicates that the parties have equal bargaining power.

Step 2: The supplier determines the level of R&D inputs in key components ; in order to characterize the incremental marginal cost, the R&D investment is in the form of a quadratic; the amount of R&D investment is , where the R&D coefficient is (Chen et al., 2019). Let the production cost per unit of key components be , denoting the production cost per unit of key components when no R&D in-puts are made, and for simplicity of the model, it is set to 0, so that (Chen et al., 2019). denotes the effect of the level of R&D inputs on unit production costs.

Step 3: The supplier determines the wholesale price of key components based on previous inputs. It is worth noting that since Step 2 and Step 3 are consecutive decisions made by the supplier, simultaneous or sequential decisions in Step 2 and Step 3 do not affect the equilibrium outcome of the game.

Step 4: The manufacturer acts as a follower and determines the volume of product to be produced based on the overall decisions of the supplier (Li & Zhao, 2022; Lin et al., 2014; Niu et al., 2019). The manufacturer's unit assembly costs are not taken into account; when unit assembly costs are positive, this portion can be considered in the unit production costs of the supplier's components (Li & Zhao, 2022).

R&D investment in components can improve product performance, and customers are willing to pay a higher price for products with better performance: for example, the high-end industrial mother machine loaded with Huazhong 9, a new generation of intellectual CNC system developed by Huazhong CNC, has been received favorably customers. We let the manufacturer's inverse demand function be (Feng & Lu, 2013; Xie et al., 2021), where is the selling price of the product, is the maximum selling price of the product without R&D investment in key components, is the coefficient of influence of the level of R&D investment in key components on the selling price of the product, and in order to ensure economic feasibility, we have . In addition, market acceptance of technological performance improvements resulting from R&D investments is characteristically uncertain. Assuming a continuous random variable on the interval with mean , variance , cumulative distribution function and probability density function (Du et al., 2021), we have .

In this paper, overconfidence is defined as an overestimation of one's own ability or results (overestimation), which manifests in the form of an overestimation of the impact of the level of R&D investment in key components on the selling price of a product, with the mean value of

(the investment) being higher than its actual mean value

. Both the manufacturer and the supplier tend to be overconfident, and the decision objectives of both sup-ply chain partners are stated as:

In the above equations, () is the overconfidence coefficient of the supplier (manufacturer); in this case, the mean value of the supplier's (manufacturer's) perception is (), and the variance is . There can be four models: SM (both the supplier and manufacturer are overconfident, in this case, ), SN (only the supplier is overconfident, in this case, ), NM (only the manufacturer is overconfident, in this case, ), and NN (there is no overconfidence on both sides, in this case, ). and denote the expectations of the utility functions of the supplier and the manufacturer, respectively.

The profit functions for each side are formulated as:

In the above equations, and represent the expectation of the profit function of supplier and manufacturer, respectively, when or when , and when or when , . We denote the supply chain profit by ().

The supplier and the manufacturer differ in their level of overconfidence in the impact of the level of R&D investment in key components on the selling price of the product; they can be aware of the level of overconfidence of the other party, but they do not update their own level of overconfidence based on the level of overconfidence of the other party that they have learnt in the game. The descriptions of the notations appearing in this paper are shown in

Table 1.

4. Model analysis

This section models the tendency of both the manufacturer and the supplier to be overconfident about the impact of the level of R&D inputs in key components on the selling price of the product. We focus on analyzing the impact of the model's main inputs (the revenue-sharing proportion and the coefficient of overconfidence) on the outcomes: the level of R&D inputs, the volume of production, the wholesale price, and the profit. The optimal solution is denoted by *.

Under the conditions , , , and when , , when , [see the proof following Lemma 4 for the above conditions] and when the income sharing ratio is exogenous, there are Lemmas 1-4.

Lemma 1: In model SM, the optimal wholesale price is , the optimal level of R&D is , the optimal production volume is , the optimal profits of the two firms are and , and the total profit of the supply chain is .

Lemma 2: In model SN, the optimal wholesale price is , the optimal level of R&D is , the optimal production volume is , the optimal profits of the two firms are ,, and the total profit of the supply chain is .

Lemma 3: In model NM, the optimal wholesale price is , the optimal level of R&D is , the optimal production volume is , the optimal profits of the two firms are ,, and the total profit of the supply chain is .

Lemma 4: In model NN, the optimal wholesale price is , the optimal level of R&D is , the optimal production volume is , the optimal profits of the two firms are , , and the total profit of the supply chain is .

In the above equation , , , there are , in model SM’ , there are ,,in model SN’ , there are , in model NM’ , and there are , in model NN’ .

Proof of Lemmas 1-4: The solution by inverse induction is obtained by taking the derivative of Eq. (2) with respect to and making it equal to zero:

The solution by inverse induction is obtained by taking the derivative of Eq. (2) with respect to zero and setting it equal to zero: , , therefore, is an extreme value solution. Substituting into Eq. (1) and taking the derivatives of Eq. (1) with respect to and to make them equal to 0, we obtain and . Hessian matrices , first-order leading minor is significantly less than 0; second-order leading minor is . To ensure that Eq. (1) is strictly concave with respect to and , it is necessary to ensure that is positive in all four models SM, SN, NM and NN. Therefore, , , and must be satisfied at the same time. Substituting and into , we obtain , and substituting , , and into equations (3) and (4), we obtain and . is constant. It is also necessary to ensure that , , , . After the constraints take the intersection, it is sufficient to ensure that , [ to ensure], [ to ensure], and when , [ to ensure], and when , [ to ensure].

Where , , , , and .

4.1. Comparative analysis

A comparison of Lemmas 1-4 leads to Corollary 1-4.

Corollary 1 , , ; when , , , when , , ; if and only if and , otherwise .

Proof , ,,,,,,

,,, when , , or (discard). When , or (discard). When , we have , . When , we have , , where , only if and 时,.

In order to observe the relationship

with

,

with

, and

with

more clearly, we have conducted a numerical analysis, and set

. The boundary line between

and

,

and

is the same as

. The relationship between

and

when

we have

, and

under this condition, see

Table 2. Under this numerical assumption, in order to ensure that the Lemmas 1-4 are established, there are

,

,

,

,

.

From Corollary 1, among the four models, the optimal wholesale price , optimal level of R&D inputs , and optimal production volume are the highest when both the supplier and the manufacturer are overconfident (model SM); the optimal wholesale price , optimal level of R&D inputs , and optimal production volume are the lowest when neither the supplier nor the manufacturer is overconfident (model NN); and the optimal wholesale price , optimal level of R&D inputs , and optimal production volume are between models SM and NN for the supplier-only or manufacturer-only overconfidence (model SN or model NM). The optimal wholesale price , optimal level of R&D inputs , and optimal production volume for the case where only the supplier or only the manufacturer is overconfident (Model SN or Model NM) are set between Model SM and Model NN. This suggests that overestimation of the impact of the level of R&D inputs in key components on the selling price of the product by either the supplier or the manufacturer leads to an increase in the optimal wholesale price , optimal level of R&D inputs , and optimal production volume . When both overestimate the impact of the level of R&D inputs on the selling price of key components, the impacts are superimposed so that the optimal wholesale price , the optimal level of R&D inputs , and the optimal production volume are the highest.

From

Corollary 1 and

Table 2, it can be seen that when the overconfidence coefficient

in Model SN satisfies the relationship

with the one

in Model NM, the level of R&D inputs and production volume of the formulation in Model SN will be higher than that in Model NM, and in the reverse case, it will be low. The overconfidence coefficient

in Model SN satisfies the relationship

(i.e.

is smaller) with the one

in Model NM, and when

, the wholesale price of key components formulated in Model SN will be higher than that formulated in Model NM, and vice versa.

Corollary 2 , ; when , , when , .

Proof ,,,.Let , after multiplication cross, shifting to the left side of the equation gives , let be equal to the above equation. Since , when , so , and when , , so there must exist a point with respect to which makes .

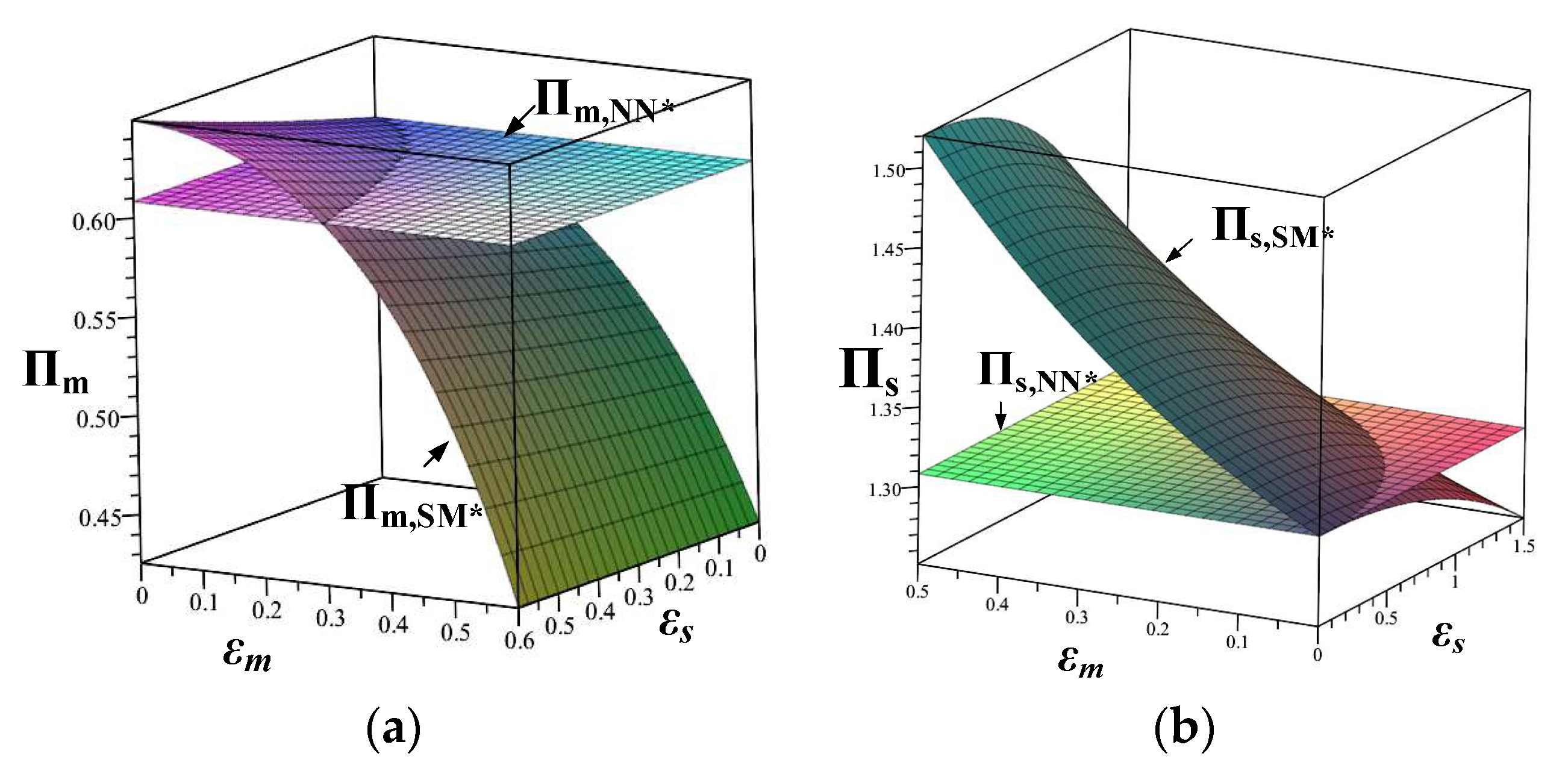

In order to observe the relationship between

with

more clearly, we make a graph, see

Figure 2(a), with the same parameter values as above

.

Corollary 2 compares the profitability of the manufacturer in the four models, where supplier overconfidence alone must increase the manufacturer's profitability and manufacturer overconfidence alone must reduce the manufacturer's profitability compared to neither model (overestimating the impact of the level of R&D inputs in key components on the selling price of the product). The manufacturer's profits are higher when the supplier is overconfident than when only the manufacturer is overconfident. The manufacturer's profits will be higher when only the supplier is overconfident compared to when both are overconfident. Corollary 2 illustrates that manufacturer overconfidence decreases the manufacturer's profits because the manufacturer overestimates the impact of the level of R&D inputs in key components on the selling price of the product and makes decisions accordingly, but does not actually achieve this utility, thus harming its own profits. The supplier's overconfidence leads the supplier to set higher levels of R&D inputs for key components, which increases customer acceptance, which in turn leads the manufacturer to produce more products, and therefore increases the manufacturer's profits.

When manufacturer's and supplier's overconfidence act at the same time, the effects of both will be superimposed, see

Corollary 2 and

Figure 2(a). The relationship between manufacturer's and supplier's overconfidence satisfies the condition

,

and vice versa

. This is because when the manufacturer's overconfidence is greater than the supplier's overconfidence, the manufacturer's overconfidence dominates the manufacturer's own profit reduction, resulting in a lower

compared to

. When the manufacturer's overconfidence is small compared to the supplier's overconfidence, the supplier's overconfidence plays a dominant role in increasing the manufacturer's profits, resulting in

being higher compared to

.

Corollary 3 , .When , ; when , .

Proof ,,,

. Let

, after multiplication cross, shifting to the left side of the equation yields

. Let

be equal to the above equation, since

, when

,

; when

,

, so there must exist a point

with respect to

such that

. In order to observe the relationship between

and

more clearly, we make a graph, see

Figure 2(b), with the same parameter values as above

.

Corollary 3 compares the profitability of the supplier in the four models, where overconfidence on the part of the manufacturer alone must increase the profitability of the supplier, and overconfidence on the part of the supplier alone must harm the profitability of the supplier, compared to neither model (overestimating the impact of the level of R&D investment in key components on the selling price of the product). Supplier profits are higher when the manufacturer is overconfident than when only the supplier is overconfident. Supplier profits will be higher when only the manufacturer is overconfident compared to when both are overconfident. Corollary 3 shows that supplier overconfidence damages supplier profits because the supplier overestimates the impact of the level of R&D inputs in key components on the selling price of the product and makes a decision accordingly; however, the manufacturer does not order as much as the supplier expects, thus damaging the supplier's profits. The manufacturer's overconfidence may cause the manufacturer to order more critical components, thus increasing the supplier's profitability.

When manufacturer's overconfidence and supplier's overconfidence act simultaneously, the effects of both will be superimposed, see

Corollary 3 and

Figure 2(b). The relationship between manufacturer's and supplier's overconfidence satisfies the condition

,

and vice versa

. This is because when the manufacturer's overconfidence is larger than the supplier's overconfidence, the manufacturer's overconfidence plays a dominant role in increasing the supplier's profit, resulting in higher

compared to

. When the manufacturer's overconfidence is smaller than the supplier's overconfidence, the supplier's overconfidence plays a dominant role in the supplier's own damage, resulting in higher

compared to

.

Corollary 4 .

Proof , obviously increases with increasing , because , substituting in gives .

Corollary 4 demonstrates that the maximum level of overconfidence of the supplier in Model SN is higher than the maximum level of overconfidence of the manufacturer in Model NM. Corollary 4 shows that an upstream supplier who is in the supply chain leader position and develops and produces key components may choose aggressive managers to make decisions for the firm. A downstream manufacturer that is a follower in the supply chain and assembles the end product with key components should choose a conservative decision maker for the decision-making process.

4.2. Sensitivity analysis

To reveal more managerial insights, we analyze the effects of exogenous RS proportions and overconfidence on the optimal outcome and obtain the following proposition.

Proposition 1: When , , , ; when , , ; . .

Proof , , , under the constraints given in the text, is monotonically decreasing in and , so is constant.

, where , , ,, ; for the value of see the proof after Lemma 4. Thus, we only need to determine the positivity or negativity of . Under the restriction, , , , , there is one and only one root between , where . In the above equation, when , ; when , , ; when , , ; when , , ., , , , holds under the conditions that the values of , and are constant.

We graphically analyze the impact of

changes in the proportion of revenue-sharing received by suppliers on

and

, as shown in

Figure 3. From Proposition 1, supplier profit , optimal level of R&D investment , and optimal production volume increase as the supplier's share of RS ; in all four models, the manufacturer's profit increases and then decreases as the supplier's share of RS .

Figure 3 verifies that

increases and then decreases as

. From

Proposition 1 and

Figure 3(a)(b)(c), it can be observed that in comparison to the absence of overconfidence in both, the manufacturer will be willing to share a larger proportion of profits with the supplier for its own profit considerations when the supplier alone is overconfident, and the proportion of profits that the manufacturer is willing to share a larger proportion of with the supplier for its own profit considerations when the manufacturer alone is overconfident will decrease. When both are overconfident [

Figure 3(d)], the two effects will be superimposed, and the proportion of profit that the manufacturer is willing to share with the supplier for the sake of its own profitability will be in the range between models SN and NM.

Proposition 2., , , , , ,, .

Proof , ,, , , , , , .

, ,, , , , .

From Proposition 2, it can be seen that the optimal level of R&D investment, the optimal production volume, and the manufacturer's profit all increase with the supplier's overconfidence coefficient, but the supplier's profit decreases with the supplier's overconfidence coefficient, in both models SN and SM. Proposition 2 suggests that supplier overconfidence increases the supplier's R&D investment in key components, which improves the market acceptance of the product, which in turn motivates the manufacturer to produce more products and increases the manufacturer's profitability, but at the disadvantage of the supplier's profit.

Proposition 3: , , , , , , , .

Proof , ,, , , , ,.

It can be seen from Proposition 3 that the optimal level of R&D investment , the optimal production volume , and the manufacturer's profit increase with the manufacturer's coefficient of overconfidence, but the manufacturer's profit decreases with the manufacturer's coefficient of overconfidence, in both models NM and SM. Propositions 1-3 provide another explanation as to why the optimal level of R&D input and optimal production volume are largest in model SM among the four models, and why the supplier's (manufacturer's) profit is largest when only the manufacturer (supplier) is overconfident, and smallest when only the supplier (manufacturer) is overconfident. This is because the optimal level of R&D investment and the optimal production volume increase with both the manufacturer's overconfidence coefficient and the supplier's overconfidence coefficient. In addition, both manufacturer/supplier profits are smaller than their own overconfidence and larger than the other's overconfidence.

Proposition 4: When , , when , ; when , , when , .

Proof , is a cubic function with respect to and the coefficients of the cubic and quadratic terms of the primary term are negative, expression omitted, when , , when , , when , , when , , thus, there must exist a point such that in the interval .

, is a cubic function with respect to and the coefficients of the cubic and quadratic terms of the primary term are negative, expression omitted, when , , when , , when , , thus, there must exist a point such that in the interval .

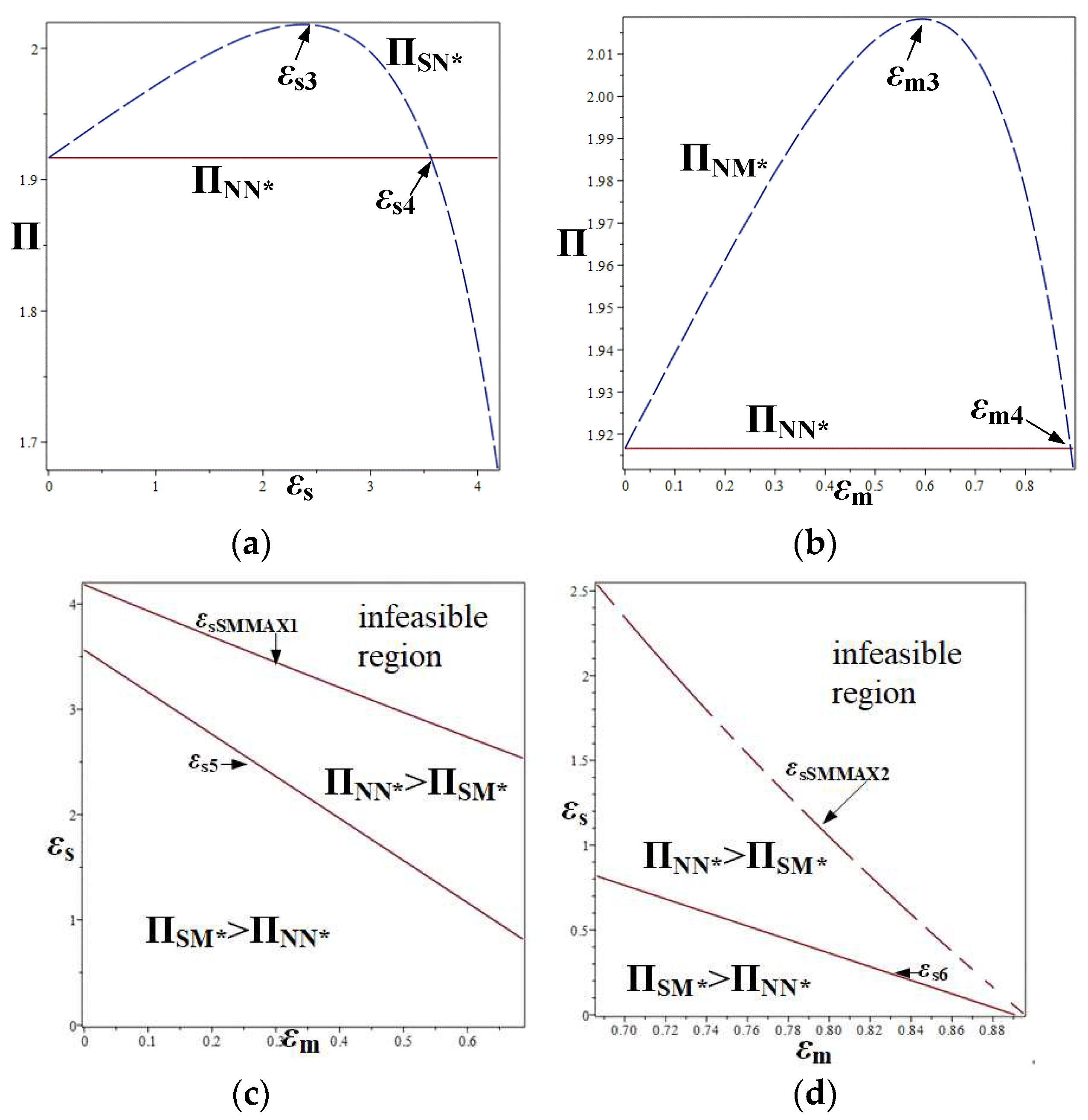

To better observe

Proposition 4 and

Corollary 5, see

Figure 4.

From

Proposition 4 and

Figure 4(a)(b), it is clear that in a supply chain consisting of two parties, the upstream supplier who develops and produces the key components and the downstream manufacturer who assembles the end-products using the key components, when overconfidence exists in only one party (model SN or model NM), as long as the degree of this overconfidence is small (

,

), the supply chain profit will increase with the degree of overconfidence, allowing the supply chain to gain more profit.

Combining Propositions 2 and 3, it can be inferred that when overconfidence exists in only one party (model SN or model NM), the value of the increase in the other party's profit from the overconfidence is greater than the value of the damage to one's own profit. There exists an optimal degree of overconfidence (, ) for both model SN and model NM that maximizes supply chain profit, and once this value is exceeded, supply chain profit decreases with the degree of overconfidence.

Corollary 5

(a) When , , when , . When , , when , .

(b) When , if , ; if , . When , if , ; if , .

Proof

(a) Let , after cross-multiplication, move to the left side of the equation, the left side is , is a cubic function on , the expression is omitted, when , ; when , , there must exist a point so that in the interval .

Let , after cross-multiplication, move to the left side of the equation, the left side is , is a cubic function on , the expression is omitted, when , ; when , ; when , ; there must exist a point so that in the interval .

(b) Let , after cross-multiplication, move to the left side of the equation, the left side is , is a cubic function on , and also a cubic function with respect to . The expression is omitted.

When , if , , if , , , there must exist a point in , such that in the interval .

When , if , , , if , , , there must exist a point in with respect to , such that in the interval .

Corollary 5(a) and

Figure 4(a)(b) demonstrate that when overconfidence exists on only one side (model SN or model NM), as long as the degree of that overconfidence is relatively small (

,

), it can lead to an increase in supply chain profitability compared to model NN. However, once the degree of overconfidence is large, it can harm supply chain profits.

Corollary 5(b) and

Figure 4(c)(d) indicate that when both the supplier and the manufacturer are overconfident (model SM), a relatively small degree of overconfidence in both of them, when

,

or when

,

, can lead to higher supply chain profitability in the SM model as compared to that in the NN model. The opposite would be detrimental to supply chain profitability.

These findings also corroborate the view of some scholars that overconfidence is potentially disastrous (Plous, 1993). Regardless of whether the model is SN, NM or SM, when the level of overconfidence is large it can damage the profitability of the whole supply chain.

4.3. Bargaining Model for Bilateral Negotiations

Next, we analyze the situation where the RS proportion is negotiated between the supplier and the manufacturer.

In the first stage of the game, the two players negotiate to determine the optimal revenue-sharing proportion to be enjoyed by the supplier, where the GNB mechanism is used to solve the optimization problem of the two firms:

i=SM, SN, NM and NN (5)

Lemma 5. , , , . When , , .

Proof

Derivation of equation (5) is sufficient to make it 0. For i=NN, the derivation is easy to obtain and is omitted. Now for i=SN to explain. i=SN when the , , is a quadratic function on . It is sufficient to decide that is positive or negative, when , when , and there must exist a point (where is a function on ) such that . and are proved in the same way as , omitted. When the manufacturer has full bargaining power , then the revenue-sharing proportion is entirely determined by the manufacturer, i.e., the manufacturer will choose in Proposition 1 and the relation is satisfied Since is a continuous function with respect to , when there is .

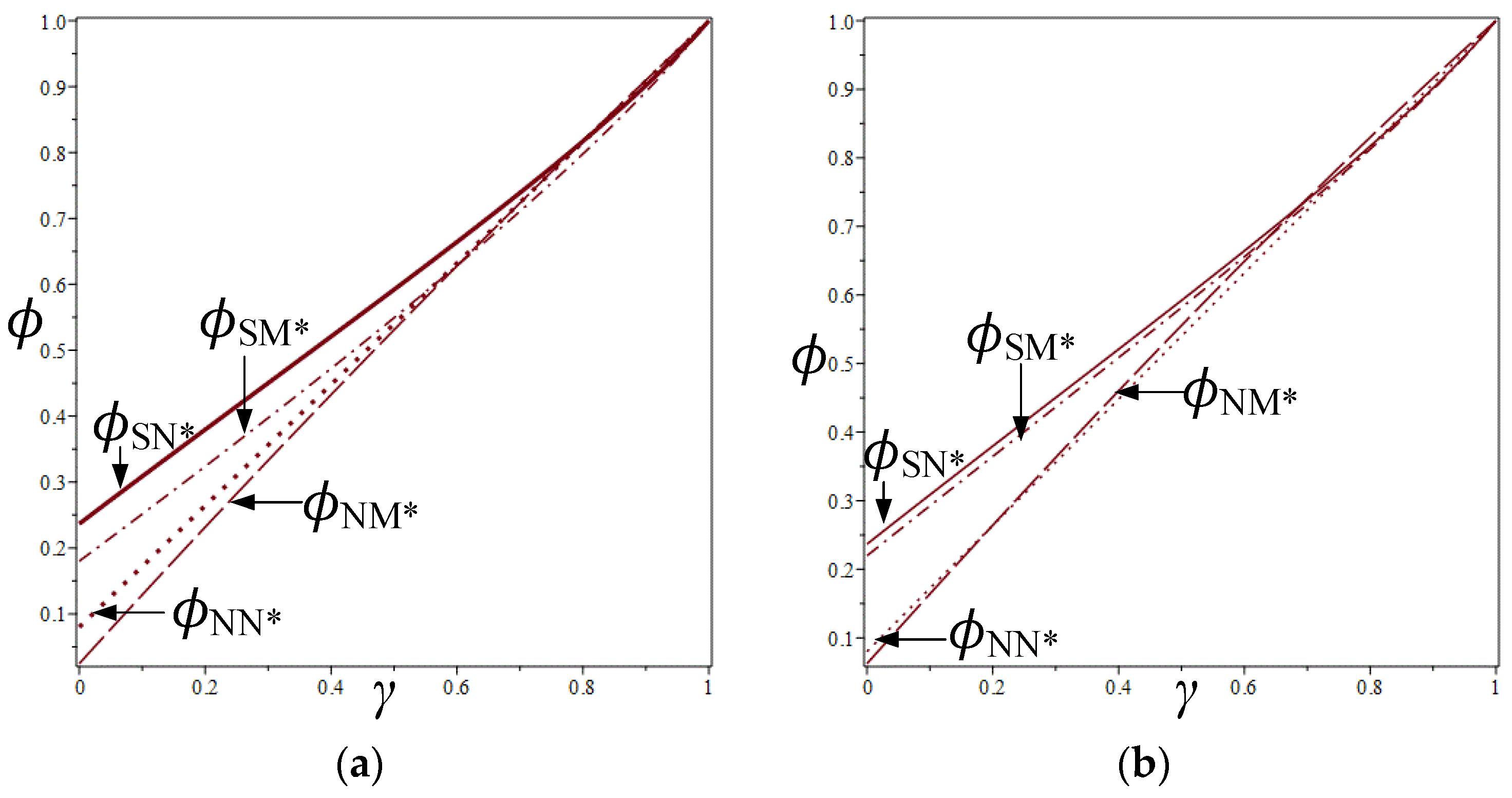

In

Figure 5(a), when

,

; when

,

; when

,

; when

,

; when

,

; it is constant that

is greater than

.

In other words, when , ; when , ; when , ; when , ; when , ; when , .

In

Figure 5(b), when

,

; when

,

; when

,

; when

,

; when

,

; it is constant that

is greater than

.

In other words, when , ; when , ; when , ; when , ; when , ; when , .

When the supplier's bargaining power

, the revenue-sharing proportion is entirely determined by the manufacturer, and the value of

in each model when

is shown in

In

Figure 3(a)(b)(c)(d), when the downstream and upstream firms decide on revenue sharing, the optimal decision of the downstream firm is to share a certain proportion of the revenue with the upstream firm instead of exclusively capturing all of the revenue by itself.

In conjunction with Proposition 1, since supplier profits increase with the RS proportion, it can be inferred that as the supplier's bargaining power gradually increases, the RS proportion obtained by the supplier, as determined by the two parties through negotiations, will gradually increase. Therefore, the greater the bargaining power of the supplier, the higher the level of R&D investment in key components will be when the revenue-sharing proportion is set through negotiation between the two parties. in each model when , so the level of R&D inputs in key components must be higher than in the case where there is no revenue-sharing contract, regardless of the value of the supplier's bargaining power. When the supplier's bargaining power , the upstream firm will have exclusive access to all revenues. This is similar to the findings in the literature (Xiao et al., 2020).

From

Lemma 5 and

Figure 5(a)(b), we can see that when the supplier's bargaining power is low, among the four models, the supplier receives the highest percentage of RS in Model SN. This is because the supplier makes more R&D inputs for its overconfidence compared to the other models but without the concurrent concerted effort from the manufacturer, so that the manufacturer is willing to share a slightly larger percentage of revenue with the supplier in this model; of the four models, model NM has the lowest percentage of revenue-sharing for the supplier, because the manufacturer makes decisions under its own overconfidence utility, yet does not actually achieve this utility, but increases the supplier's profit. When the bargaining power of the supplier is relatively low, the proportion of RS to the supplier will be lower compared to other models. It can be seen that in this case the RS contract has a compensatory effect on the loss of profit due to overconfidence.