2. Literature review in the field of transport and courier market

In Poland, transport plays a very important role, not only for the individual movement of people, but above all for the movement of goods. The Covid-19 pandemic was also important for transport, contributing to the development of online shopping and, therefore, a significant development of road transport. Over recent years, the transport services market has been intensively developed. In 2019, revenues from all road units increased by 17.3% compared to the previous year. The value of the proceeds may depend on the total weight of the vehicle. Per 100 km traveled, a truck with a GVW of 3.5 to 7.5 t generates revenue for the state budget in the amount of PLN 147, and for cars with a GVM of over 40 t - PLN 278. Poland's geographical location is important, as it plays a very important role in the transport and logistics sector, and Polish carriers provide their services throughout the European Union. As it turns out according to the report of the General Directorate for National Roads and Motorways (GDDKiA) - the public road network covers almost 420 thousand kilometers, of which 19.4 thousand kilometers are national. GDDKiA manages a network with a total length of 17.8 thousand km, including 4.2 thousand km of expressways, 1.3 thousand km of motorways and 2.9 thousand km of expressways. The remaining road sections are managed by concessionaires, cities with municipal poviat rights within their administrative borders, as well as border crossing authorities. National road construction program for 2014-2023 (with a perspective until 2025) and the program for the construction of 100 bypasses for 2020-2030 includes the construction of many kilometers of roads, highways, and bypasses, which will ultimately have a positive impact on the development of transport in Poland. The indicated programs are intended to significantly improve the movement of vehicles on Polish roads, but it should be considered that a large part of the roads still require significant improvement. In Poland, various means of transport are used to transport people and goods, but the largest share is road transport, as shown by the data in

Table 1 [

1],[

2].

Road transport includes, among others, transport; private (passenger cars), city, truck, motorcycle, courier. The courier services market has developed intensively due to the increasingly frequent online shopping. A big factor influencing this situation was the Covid-19 pandemic, a time when most purchases were made via stores and online platforms. Referring to the definition of a courier service, it is understood as the process of collecting a parcel from the customer and delivering it to the customer at the indicated address within the specified time. The KEP (courier-express-parcel) industry includes courier, express and postal shipments.

Due to the growing demand for courier services over recent years, there are several fundamental problems. These include traffic congestion during rush hours, a phenomenon that is considered an everyday occurrence in metropolises. This situation results in delivery delays. Another important aspect is deteriorating air condition due to excessive exhaust emissions and transport dependence on crude oil. To regulate the existing situation, reference should be made to transport policy, because it is one of the forms of regulation of transport systems. Its main assumption is to strive for changes and improvement of broadly understood transport. The whole thing is based on decisions of the authorities of a given country or European Union bodies. However, the main document regulating transport policy is the Treaty on the functioning of the European Union (Articles 90-100), the main goal of which is to eliminate existing transport problems. One of the planned solutions to the problems that have arisen is the development of appropriate documents, the content of which will require actions to be taken to implement green transport. At European level, work has been going on for years to improve the negative effects of transport by encouraging the use of alternative fuels. At the national level, subsidies are being introduced for users of vehicles with unconventional drives [

4]. The main EU documents include the Transport White Paper, where the plan was established in 2011, its aim was, among other things, to use alternative fuels in transport [

5]. Another important document in which a lot of attention is devoted to the use of alternative fuels is Directive 2014/94/EU of the European Parliament and of the Council, where conventional fuels are proposed to be replaced by: electricity, biogas, hydrogen, LPG, LNG, CNG. In Poland, a response to the European Parliament Directive and Council 2014/94/EU is the Act of 2018 on electromobility and alternative fuels. Its main goal is to facilitate and accelerate technological development in Poland [

6]. Since the Act came into force, there have been numerous changes and updates to its content, the last one taking place on December 2, 2021.

Renewable energy sources

In accordance with the definition contained in Art. 2 of the Act of February 20, 2015, a renewable energy source is: non-fossil energy sources including wind energy, solar radiation energy, aerothermal energy, geothermal energy, hydrothermal energy, hydroenergy, energy of waves, sea currents and tides, energy obtained from biomass, biogas, agricultural biogas and bioliquids [

7]. In general terms, renewable sources are those whose acquisition does not cause any shortages or deficits in the environment. Conventional energy sources produce by-products which include radioactive waste (nuclear energy), CO2, NO2, SO2 (thermal coal, crude oil) and dust (thermal coal) [

8]. A great advantage of renewable energy sources (RES) is their constant renewal by nature, which solves the problem of resource availability. Renewable energy sources can be divided according to the source they come from (

Figure 1)

The main hydropower resources are based on energy from rivers (flow and level differences) and ocean energy (tides, waves, currents). In hydroelectric power plants, the energy obtained from water is converted into electricity. The types of hydropower include [

9]:

Hydroelectric power plants have their drawbacks, which include disruption of the hydrological structure or silting up of reservoirs, but one should not forget about their significant advantages, such as the production of clean, ecological energy, flood prevention and low operating costs [

10].

Wind energy is much less diverse than hydropower, but just as effective. Currently, one type of generating this energy is used and this is the use of wind turbines, i.e., "windmills". Wind power plants are divided into:

by power (micro, small, medium, large, and very large),

due to location (sea and land),

due to the rotor rotation setting (vertical and horizontal).

A characteristic feature of this type of energy is the selection of locations, preferably places with a lot of windy days (e.g., the coast). This sector is witnessing rapid and dynamic development due to the increasingly new technologies being used. A significant disadvantage of wind turbines is the noise they generate, which clearly prevents them from being built near inhabited areas.

Another type of energy is from biomass. As defined herein in the Directive of the European Parliament and of the Council of 23 April 2009, biomass is defined as; the biodegradable part of products, waste, or residues of biological origin from agriculture (including plant and animal substances), forestry and related industries, including fishing and aquaculture, as well as the biodegradable part of industrial and urban waste [

11]. It can be noted that the definition of biomass is very broad, so there are many ways to process it. The most frequently used methods include burning e.g., wood waste or straw. Biomass can also be used to obtain liquid fuels resulting from the fermentation of cereals, sugar beets, rapeseed, and many others. In such fermentation, e.g., E85 gasoline, biodiesel, oxydiesel are obtained. One of the next methods of obtaining energy is the aerobic and anaerobic fermentation of biomass, which produces methanol, ethanol, and biogas - fuels used in combustion engines or boiler rooms [

10].

Geothermal energy, according to the Polish Geological Institute, is defined as energy stored in the form of heat under the earth's surface [

2]. This concept is very broad and includes the energy contained in geothermal waters. The use of this energy is very wide, and the most important aspect is the size of the deposits, they are huge and constantly powered by heat coming from the Earth's interior. For everyday use, it can be used in central heating systems or for heating buildings, supplying swimming pools with hot water, snow removal or fish farming, as is the case in Iceland [

12].

The last energy discussed will be solar, considered the most important source of renewable energy. Energy is obtained from solar radiation, so an important factor determining the energy potential of a given area is its geographical location. It is estimated that in Poland 80% of total solar radiation occurs for 6 months, i.e., from April to September [

9]. After obtaining solar energy, it is processed using collectors (used to heat water for central heating and domestic hot water) and photovoltaic cells (most often installed by households to power devices with electricity or in the form of photovoltaic farms) [

13] 14].

Renewable energy sources are becoming more and more important not only

in small processes, but also on the scale of entire systems. Many opponents of renewable energy consider it a fad or a prevailing trend that has no future in wider application. It is difficult to express a clear opinion about the future of renewable energy sources at this point because the dynamics of life are too great. What is visible and known is that they are currently gaining in importance and are being used more and more widely. Poland is trying to follow the global trend by increasing the use of renewable energy in the energy economy.

Table 2 presents data showing the change in the installed capacity of individual renewable energy carriers in Poland over 15 years.

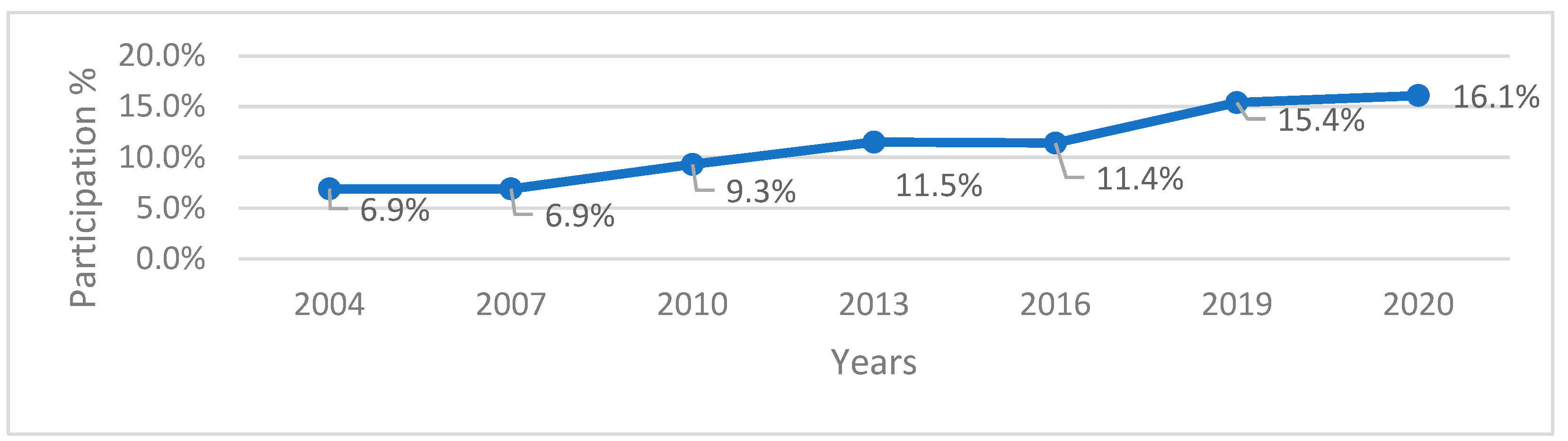

Analyzing the data in table 2, a significant increase in renewable energy sources is noted in Poland. This means that not only are they gaining in popularity, but above all there is a market need for this type of energy. In 2020, compared to 2005, there is an 8-fold increase in the total power of registered installations using wind, biomass, and solar energy. The development of renewable energy sources should be synonymous with an increasing share of "green" energy in Poland (

Figure 2).

Analyzing the data in figure 2, it is noted that over the last 16 years, the share of renewable energy in Poland has been increasing, and this trend is still growing.

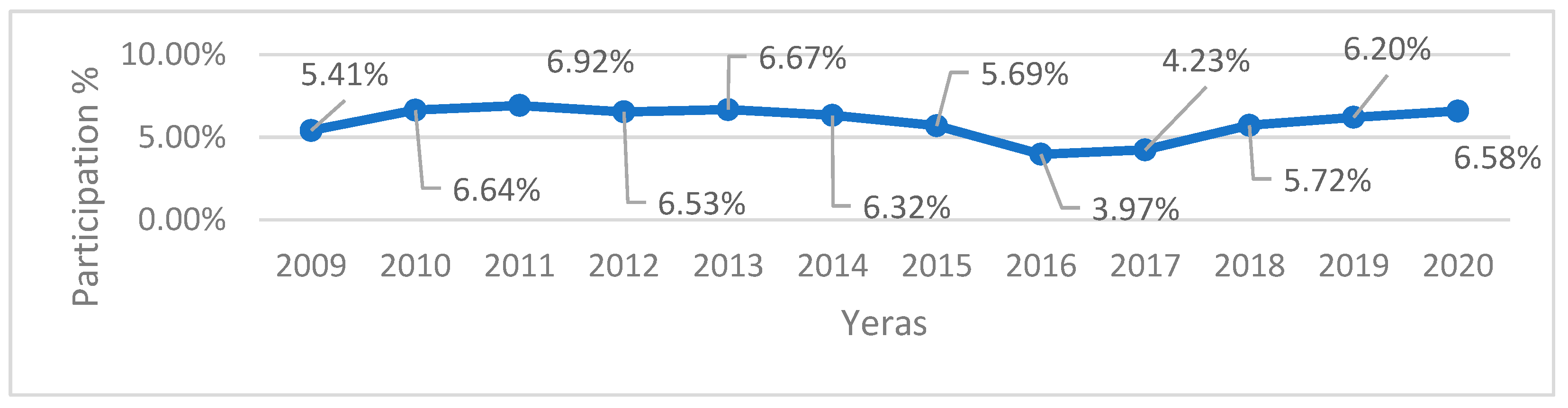

Logistics also follows the development of renewable energy sources, introducing innovative solutions into its activities. Transport deserves special attention here. According to data published by the Central Statistical Office, over the years 2009-2020 there has been a growing interest in the use of energy from renewable sources in transport, with slight fluctuations over the years (

Figure 3).

The main advantage of using renewable energy for transport is reducing the demand for crude oil. Biofuels effectively replace diesel and gasoline, which contributes to the increase in the number of cars powered by alternative fuels. To further encourage the replacement of conventionally powered vehicles with unconventional ones, the European Union has provided subsidies for the purchase of vehicles using renewable energy sources. Currently, the most popular are cars powered by solar energy, i.e., so-called electric cars. Due to the possibility of installing a micro photovoltaic installation at home, these vehicles are gaining popularity. In addition to vehicles for private use, many logistics companies are trying to expand their awareness of the need to replace vehicles with ones that use renewable energy. It seems that in logistics in particular courier companies have one of the largest shares in transport. An example is the GLS company, which has been implementing the Think Green initiative since 2008, which involves the company carrying out a wide range of pro-ecological activities. The e-commerce industry seems to be a leader in the use of renewable energy, e.g., InPost. They created the "Green City" program, under which it expands the parcel locker network with machines powered only by solar energy.

Alternative drive vehicles for the courier market

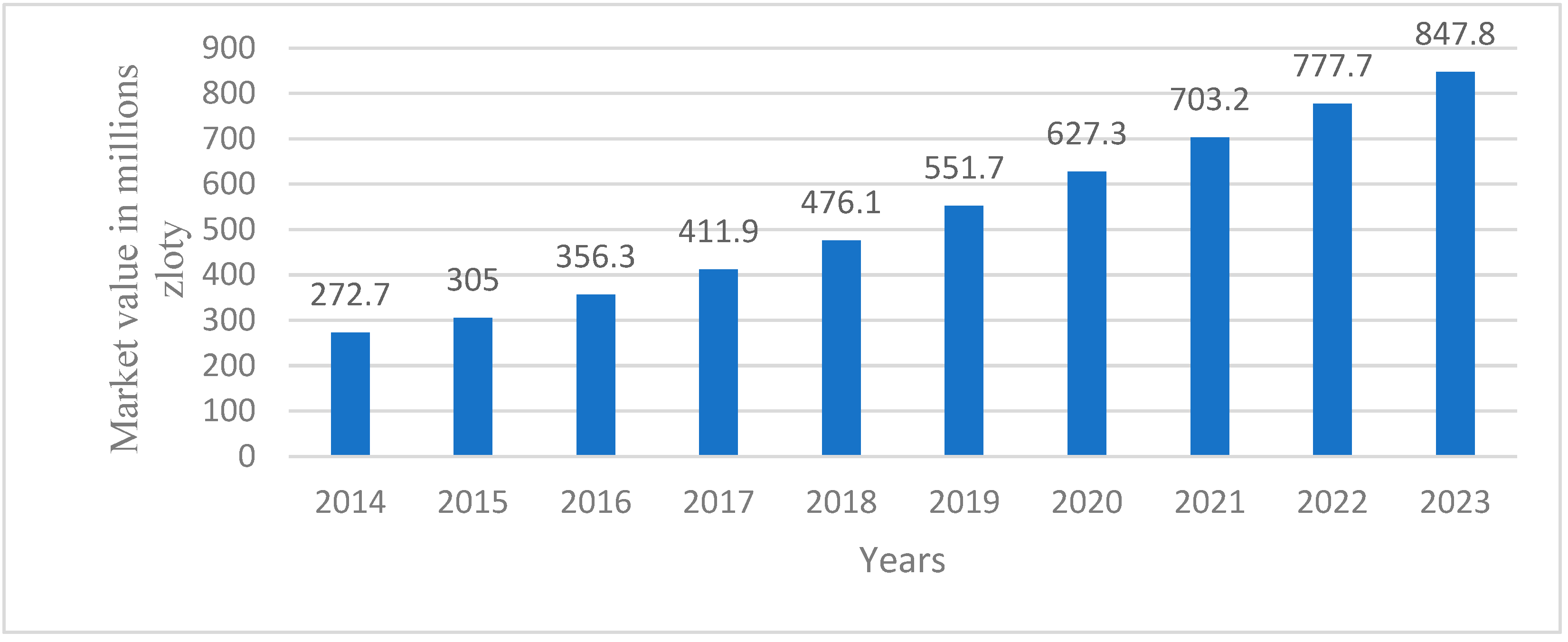

Courier service is a process of collecting a parcel from point A (sender)and transporting it to point B (recipient). The elements that create such a service are; price (the amount for which the courier company will deliver the parcel), deadline (specified when purchasing the service - includes the date of collection from the sender and delivery to the recipient), quality (delivery of an undamaged parcel, and in the event of damage during transport, the cost of damage is borne by the courier company). The courier industry is abbreviated as KEP (courier-express-paczka). Its services include courier, express and postal shipments, mainly for parcels up to 31.5 kg. The courier and postal services are very similarin application. In the first case, the difference lies in the selection of additional options, such as: tracking the shipment route, selecting the date (day and time) of shipment delivery. Additionally, many courier companies, despite selecting the date before the recipient, allow making further changes (redirecting the parcel to another address or day/time) 24 hours before the parcel is delivered, notifying the recipient via e-mail. The range of additional services provided by courier companies (KEP) is expanding day by day, trying to be unrivaled in the home parcel delivery market. This is extremely important because the dynamic development of the Internet and the Covid-19 pandemic contributed to the expansion of e-commerce. At the same time, it resulted in the development of the courier industry - illustrated in

Figure 4.

Analyzing the data contained in

Figure 4, an increase in the value of the KEP market is noted over the years 2014-2023. We can therefore conclude that the number of delivered parcels is increasing every year. Therefore, KEP enterprises must follow technological progress while introducing new technical solutions aimed at improving their services. The creation of modern terminals and sorting facilities shortens the shipment supply chain process, which allows for the provision of services with shorter lead times, which is very important for the final recipient. There has also been development in the methods of collecting parcels, cashless payments are becoming more and more popular, and the network of parcel lockers and parcel collection points is developing dynamically. Activities that stimulate the development of KEP include pressure to reduce outstanding inventories, dynamic development of online shopping, changing concept of retail sales [

19]. Additionally, courier companies introduce Intelligent Transport Systems (ITS) and low-emission cars in transport and organization. Through ITS systems, it is possible to plan routes and service areas for a given courier, optimizing the number of possible parcels to be delivered and the number of kilometers traveled by the courier. Car manufacturers believe that the number of electric cars intended for courier companies will increase due to the demand for courier services. They are preparing not only to implement the guidelines related to the Electromobility Act (from January 1, 2022, companies implementing social/municipal/government contracts should have a 10% share of electric cars in their fleets), but also to meet the growing demand for e-services from customers for whom electric vehicle delivery is consistent with their environmental views. A good example illustrating the development of electromobility on the courier market is the Voltii company in London, where it turned out that a kilometer traveled around the British capital by Voltia cost 1.8 pence, while a diesel cost 2.8 pence. Therefore, the expenses for operating the Volitia fleet were about 20% lower than the diesel ones. And the tested e-vans delivered on average 34% more parcels (over the course of a week) than smaller vehicles powered by conventional fuels. The company calculated that 112,000 electric cars could replace 218,000 diesel vehicles [

24]. Another example of the development of electromobility is Elocity, the Polish leader in EMP (electromobility provider), which continues to develop services related to electromobility for the logistics and KEP sectors. Elocity's first and largest client in this area was DPD (courier services), very well known on the Polish market. Elocity boasts that in mid-December 2021, she managed the DPD infrastructure, electric vehicle charging stations (over 100 stations), optimization of the charging process, and provided the necessary reports to increase the efficiency of couriers' work. Elocity's clients also include GLS, a company very well known on the Polish courier services market. For GLS Elocity in 2021, he built an entire system related to electromobility, which included construction and development of the infrastructure of own charging stations, management of these stations, management of the car charging process, cost optimization and work on increasing the efficiency of the electrified fleet. Additionally, GLS can boast that it has expanded its fleet by 100 new electric vehicles by the end of 2022. The first series of 21 Ford E-Transit 350 series vehicles was delivered to the company in October 2022. These cars charge in about 30 minutes and have a range of 260 km. The plans of the GLS management board are that by 2030 at least 50% of the vehicles in the fleet will have low- or zero-emission drive, and in 2035 every new transport vehicle will meet such conditions. In addition to meeting exhaust emission standards, such cars are also equipped with many safety and driving systems. These include parking sensors, cameras, collision avoidance systems with automatic braking and a lane departure warning system. These are, of course, just some of the systems that are currently installed in such cars. DHL Express is also decarbonizing its fleet in Poland. By 2025, 60 percent courier vehicles will be electric. By the end of 2021, they appeared in Szczecin, Gdańsk, Olsztyn, Poznań, Warsaw, Wrocław, Lublin and Rzeszów. By 2025, there will be over 200 of them throughout Poland. The company initially chose the Volkswagen e-Crafter, which has a range of 120 km and a payload of 837 kg. In 2021, InPost's electric fleet exceeded 300 cars. It consists of over 250 Nissan e-NV200s and 10 eSprinters from Mercedes Benz. – InPost parcel lockers are already the most ecological form of delivery, as they reduce CO2 emissions by as much as 75%. By switching the courier fleet to electric cars, the negative impact of e-commerce logistics on the environment is further reduced [

20], [

21], [

22], [

23].

3. Application of electromobility in the courier market on a selected example using AHP analysis and computer simulation

The examined company is a medium-sized courier company providing services in Poland. Until recently, the entire fleet consisted of conventionally powered vehicles, but over time, technological progress and the widely promoted trend of caring for the environment by reducing pollutant emissions, it was decided to make changes and purchase non-conventional vehicles. The potential of electric vehicles is constantly growing, which can be seen not only in passenger cars, but also in delivery vans. The market is developing very quickly and dynamically, thus providing a wide range of opportunities. This phenomenon is positive but requires careful analysis before purchasing a vehicle. Many factors will be important here, such as range on one charge. The analyzed company reviewed the market in terms of available electric cars and selected four types in which they were potentially interested and selected the basic parameters to select the final solution, as shown in

Table 3. For the purposes of this article, no names or brands of cars are provided, they are marked as: A, B, C, D; however, all their data is downloaded from the manufacturers' websites and is consistent with reality. All models were considered with the same, i.e., standard, equipment.

To select the appropriate delivery vehicle for the examined company, an AHP (analytic hierarchy process) analysis was performed. Due to the nature of the company, not only the price of the vehicle is important, but also the cargo space. The car should be as universal as possible because the company cannot predict what the customer will order or what he will want to send. All-important parameters that should be considered are summarized in table 4 and described using criteria.

Seven car parameters were adopted as criteria, which were then sorted according to hierarchy and compared in the criteria priority matrix (

Table 5).

where:

1 - no priority 1 - no priority

2 - slight priority 1/2 - slight subordination

3 - clear priority 1/3 - clear subordination

4 - very clear priority 1/4 - very clear subordination

5 - undisputed priority 1/5 - unquestionable subordination

The matrix table was normalized (

Table 6).

The next step was to determine mutual preferences in relation to individual criteria and carry out standardization (

Table 7).

The next step was to normalize the preference matrix according to the C1-C7 criterion (

Table 8).

As a result of the AHP analysis steps developed in this way, a winner emerged as a vehicle for the examined company (

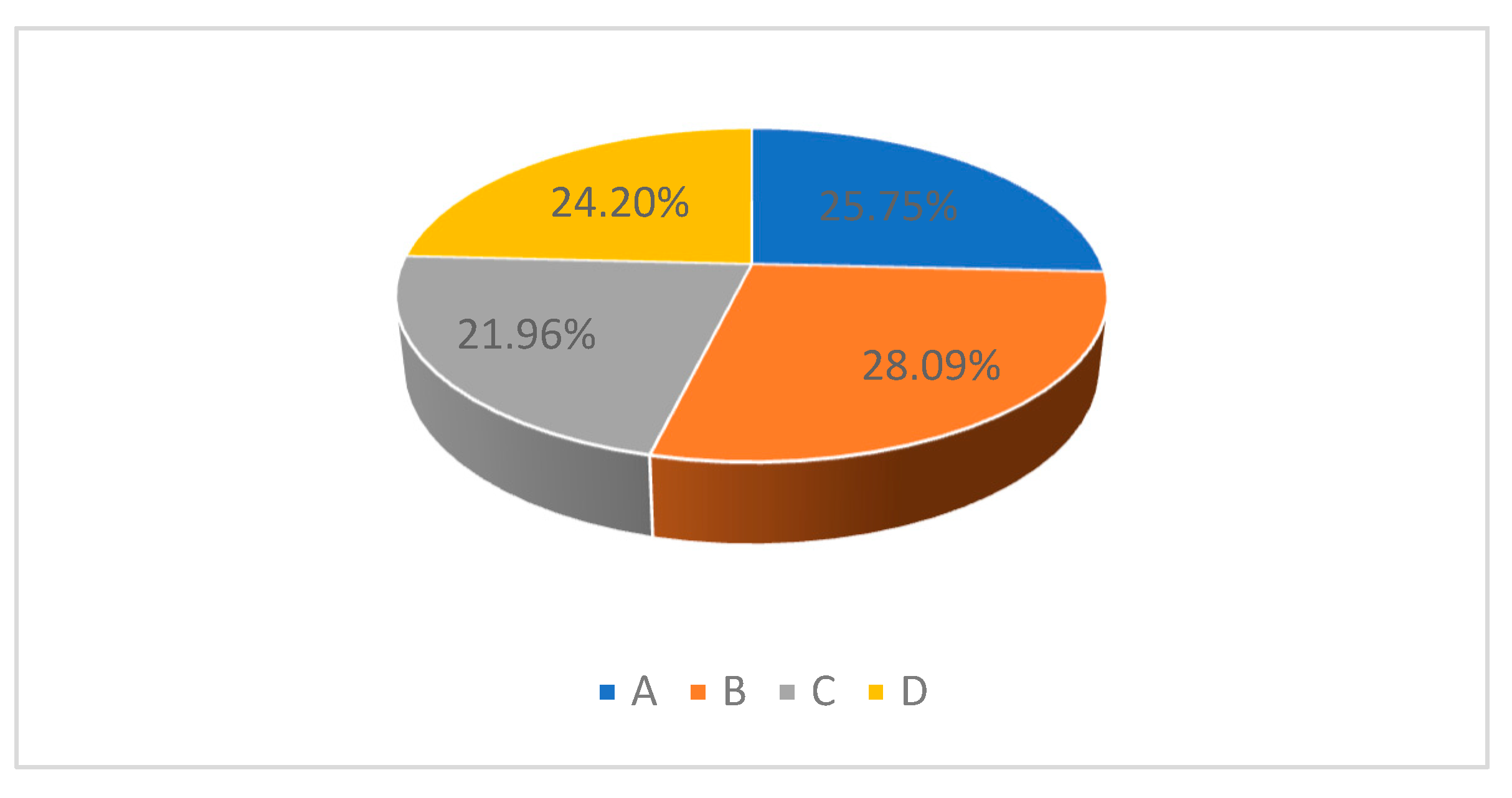

Figure 5). According to previously adopted markings, vehicles are classified as: A, B, C, D.

The obtained classification shows that the best choice will be vehicle B. The battery capacity is of great importance in its parameters, with a significantly lower price compared to vehicle C. A range of 220 km on one charge allows it to be used both in the city and outside it. Additionally, it also has the largest load capacity of all the proposed cars, which gives greater opportunities to optimize courier routes. The examined company operates in Warsaw and the surrounding area. Several regions were selected for the research to check whether electric cars will be suitable for their operation, even if it is necessary to reorganize courier routes, which is an indispensable element of this industry. The surveyed company serves a total of 35 regions, each with an average of 5 routes. For the purposes of the article, 5 regions (and their individual routes) were selected, including those where, with current planning, they cannot be served by electric vehicles and will have to be replanned. Of all 35 regions, only 4 require replanning, the remaining 31 can be served by conventional and electric vehicles without the need to modify them. The regions are marked with numbers 0d 1 to 35, and the routes according to the region number. Examples of 6 regions considered for the study are presented in table 9.