Introduction

The modern economic environment is characterized by an accelerated growth of competitiveness due to the rapid development of knowledge and technology. The knowledge-based economy has spurred a shift from a labor-based business strategy to a knowledge-based one. A company's intellectual capital, which is formed from the knowledge and experience of employees, databases and information systems, business connections, as well as other intangible factors, becomes the driving force for research and development.

The formation of an economic paradigm based on knowledge, which has been taking place over the last two decades, further increases the interest in the study of intellectual capital as the main resource for creating firm value. First of all, this is justified by the loss of significance of a company's traditional resources, based on material assets in the processes of creating the added value of the company and maintaining competitive advantages (Andriessen, 2004). In today's economic era, intellectual capital is becoming the most important factor in ensuring business success, as it is represented by the value of ideas, abilities and high-tech infrastructure that create value and unique competitive advantages of a company in the market. Research on the role of intangible factors in creating the value of companies reduces investment risks, which accordingly increases their market attractiveness on the market (Sveiby, 1997). All such changes in the perception of the role of intellectual capital in the knowledge economy lead to an increase in the amount of scientific literature on the methods of managing it and analyzing its impact on the performance of companies, taking into account the regional and industry contexts.

Studying the role of intellectual capital in industrial companies in Oman is important for owners, corporate governance actors and managers seeking to increase competitiveness and ensure the sustainable development of companies. The management of intellectual capital itself is becoming increasingly important for industrial companies in Oman and the GCC (Gulf Cooperation Council) region, as they face increasing competition in the global market in recent years and need to constantly innovate and improve their products and services. Industrial companies in Oman are facing challenges in a changing economic environment, driven both by the need to diversify the economy away from oil dependence and the need to integrate technology into their operations (Food and Agriculture Organization of the United Nations, 2019). Better intellectual capital management will help companies overcome these challenges, by enabling them to adapt to new conditions and processes, adopt innovative business models, and shape policies and strategies to develop new products and services that will meet market demands. Firms with higher levels of intellectual capital tend to have better financial performance and are more likely to grow steadily over time (Bontis, 1998). Understanding the relationship between intellectual capital and business performance makes it important to study the practical application of intellectual capital management methods.

One of the most important aspects of intellectual capital management is its impact on the financial results of companies. In addition, effective management of intellectual capital allows companies to reduce the risks associated with the loss of knowledge and the outflow of talented and experienced employees. By investing in human capital development, knowledge sharing mechanisms, and organizational learning initiatives, companies can develop a culture of continuous improvement and knowledge creation that promotes sustainable and progressive financial development.

This study aims to explore the relationship between intellectual capital and financial performance in the context of Oman's listed industrial companies. By analyzing empirical data and using regression analysis techniques, the study seeks to contribute to the existing body of knowledge about intellectual capital management and its implications for financial performance. The findings will provide valuable insights for companies seeking to improve their financial performance through more effective intellectual capital management policies and strategies.

Literature Review

Intellectual capital includes various sources of value creation that contribute significantly to the overall value of a company. This phenomenon is due to the fact that intellectual capital covers a wide range of components such as knowledge, experience, unique technologies, innovations, trademarks, relationships with customers and suppliers, etc. Together, these elements have a powerful potential to help maintain existing and create new competitive advantages for the company in the market.

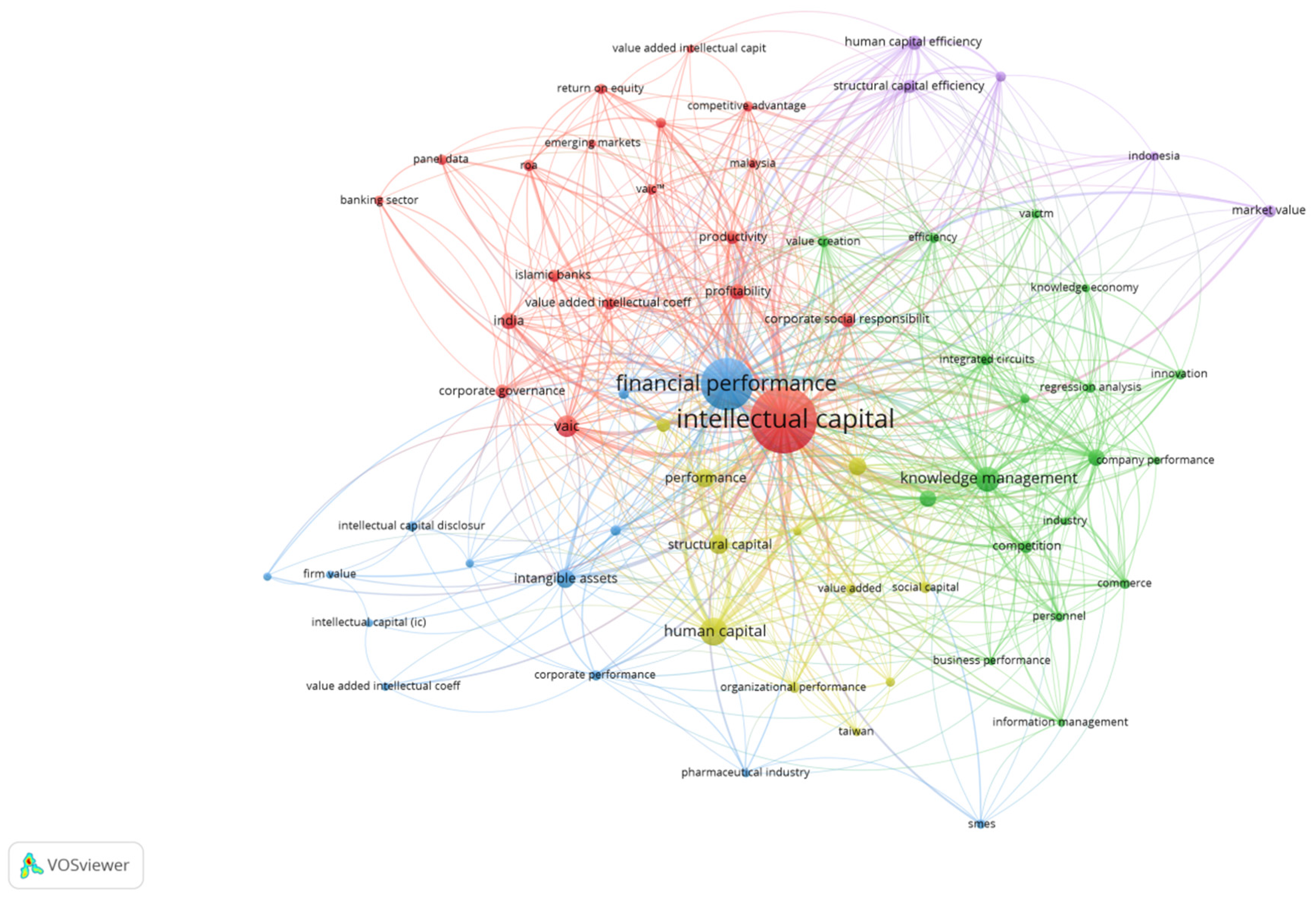

Analysis of the Scopus scientometric database indicates the relevance of joint research of objects such as "Intellectual capital" and "Financial performance" by modern scientists (

Figure 1).

The analysis of the generated bibliometric map made it possible to establish that the most problematic aspect is to determine the impact of knowledge management on financial performance and its characteristics (profitability, productivity). In a number of articles, the authors explore the influence of the constituent elements of intellectual capital (human capital, structural capital) on financial performance, in particular, using the VAIC (Value Added Intellectual Coefficient) method. Some studies also analyze the role of a company's intellectual capital in improving the functioning of the corporate governance system and corporate social responsibility of enterprises.

By industry, most of the publications studied analyze the features of intellectual capital management in technology and science-intensive companies, the banking sector, and the pharmaceutical industry, which are characterized by a high level of innovation. A number of works study the role of intellectual capital in the functioning of banking institutions, in particular, Islamic banks. This emphasizes the general tendency of scientists to find ways to more effectively manage intellectual capital in Islamic countries.

Geographically, a significant number of articles studying intellectual capital management and its impact on financial performance relate to the activities of technological enterprises from developing countries such as India, Indonesia, Malaysia, and Taiwan. This feature also confirms the feasibility of analyzing the impact of intellectual capital on the financial performance of companies using the example of a developing country like Oman.

There are few direct studies analyzing the impact of intellectual capital on the financial performance of Omani companies, as Mohamed and Al Ani (2020) confirm. Therefore, the research object in this paper are also works devoted to similar issues in the GCC countries and in the countries of the Arab region, since in general such countries have similar economic structures largely dependent on oil exports and government support. This makes them vulnerable to fluctuations in world oil prices and increases the importance of economic diversification efforts. These countries simultaneously face similar problems of intellectual capital development and technology adoption (Al-Musali et al., 2016; Al-Hamadany et al., 2020). Thus, studying the processes of intellectual capital management at enterprises in the Gulf countries and the Arab region, one can obtain important information about its role in improving the efficiency of the functioning of Omani companies. In addition, a harmonized regulatory framework has been created in the GCC countries (GCC Standardization Organization, 2023) to develop a unified business environment and entrepreneurial activity, aimed at ensuring consistency in terms of intellectual capital management practices, which also confirms the expediency of taking into account the experience of GCC and Arab region countries in this study.

A number of modern studies consider the issue of the influence of intellectual capital on various types of financial performance of companies from Oman, GCC and Arab region countries. Thus, Al-Musali and Ku Ismail (2016) analyzed the features of the influence of intellectual capital on the performance of banks in the GCC countries for the period from 2008 to 2010 and established the positive impact of VAIC on financial performance in all GCC countries. The impact of the modified VAIC model (MVAIC) and its components on the financial performance of 49 Islamic banks from 2014 to 2018 was also studied by Asutay and Ubaidillah (2023). The authors found that MVAIC has a positive and significant effect on profitability (ROA, ROE), but is inconclusively associated with productivity (ATO). CEE and HCE have the most significant impact on financial performance, while SCE has no impact.

Dzenopoljac et al. (2017) studied the impact of intellectual capital (VAIC and its elements) on the corporate performance of top 100 companies of the Arab region, which was measured using a whole group of indicators (EBIT, EBITDA, ROE, ROA, NPM, GPM, EBITDA, ATO, Market to Book Value). In general, their findings do not confirm a direct positive relationship between all the analyzed factors, although the main impact on earnings of companies is exerted by SC and CEE. Dalwai, Mohammadi and Al Siyabi (2018) examined the impact of VAIC and its subcomponents on financial performance (ROA, ROE) of 35 Omani financial sector enterprises from 2012 to 2016. They also found no significant relationship between VAIC and financial performance indicators, but confirmed the important role of CEE in the value creation process, suggesting that intellectual capital rarely creates value independently of physical capital.

Hamdan (2018) analyzed the relationship between intellectual capital and firm performance based on a study of 198 firms from GCC countries (Kingdom of Saudi Arabia and Kingdom of Bahrain) over the period 2014–2016. The author also used VAIC elements as independent variables, and ROA and Tobin's Q as independent variables. If all VAIC elements have a significant relationship with ROA, then only HCE has a positive impact on Tobin's Q and only for enterprises from the Kingdom of Bahrain. Mohamed and Al Ani (2020) also examined the effect of calculated intangible assets (Excess Returns) of Omani industrial companies listed on the MSE on Tobin’s Q and found a positive and significant relationship between them at the 0.01 level.

Dalwai and Salehi (2021) examined the impact of the Augmented VAIC model (A-VAIC) and its elements on the performance and risk of bankruptcy of Omani non-financial sector companies using 380 companies listed on the MSE from 2015 to 2019. Empirical results indicated no effect of A-VAIC on firm performance Altman Z-score and established a positive relationship between SCE and ROA.

Dalwai and Sewpersadh (2023), based on a regression analysis of 45 listed travel companies from nine Middle Eastern countries for the period 2014–2018, analyzed the impact of intellectual capital performance on capital structure. The authors found that the performance of intellectual capital is not closely related to firm performance, but CEE has a more significant effect on travel firms along with leverage. Another study on the effectiveness of intellectual capital and working capital management in the industrial sector of the GCC countries and its potential impact on the performance of companies was carried out by Habib and Dalwai (2023). Having studied 40 industrial firms for the 2015–2019 period, they found that intellectual capital and working capital significantly and positively affect ROE and ROA at a significance level of 0.01. However, the authors emphasize that most companies in the industrial sector of the GCC countries do not effectively use their intellectual investments, and therefore their management methods need to be improved.

Aim

The purpose of the article is to measure, using the VAIC and MVAIC models, the impact of intellectual capital and its elements on the financial performance of Omani industrial companies listed on the MSE from 2017 to 2021.

Methods

Sample Selection. Analysis of the impact of intellectual capital on financial performance measures was carried out using regression analysis of panel data. The industrial sector of Oman is chosen as the object of study in the paper, in particular, the activities of 34 industrial companies for the period 2017–2021 listed on the MSE. A total of 36 industrial companies are registered on the MSE, but two of them (Omani Euro F.Ind and Al Hassan Eng.) were excluded from the study object due to the lack of all the necessary panel data on them for regression analysis. Financial information to shape the data panel on the activities of industrial companies in Oman was obtained from the official MSE website, which publishes indicators characterizing the financial performance of companies, as well as from the published financial statements of such companies (Balance Sheet, Income Statement) and notes thereto.

Variables. As characteristics of the financial performance of industrial companies in Oman (PERF), a number of dependent variables were used, reflecting various aspects of such performance – earnings (Earnings before interest, taxes, depreciation and amortization (EBITDA)), profitability (Return on Assets (ROA), Return on Equity (ROE)), and productivity (Assets turnover ratio (ATO)). These financial performance measures are quite often used by scientists when conducting such studies (Xu & Wang, 2018; Xu & Wang, 2019; Öner et al., 2021; Lehenchuk et al., 2022, Serpeninova et al., 2022). Based on suggestions by Xu and Wang (2019), this paper also uses the logged value of EBITDA. The procedure for calculating all dependent variables is given in

Table 1.

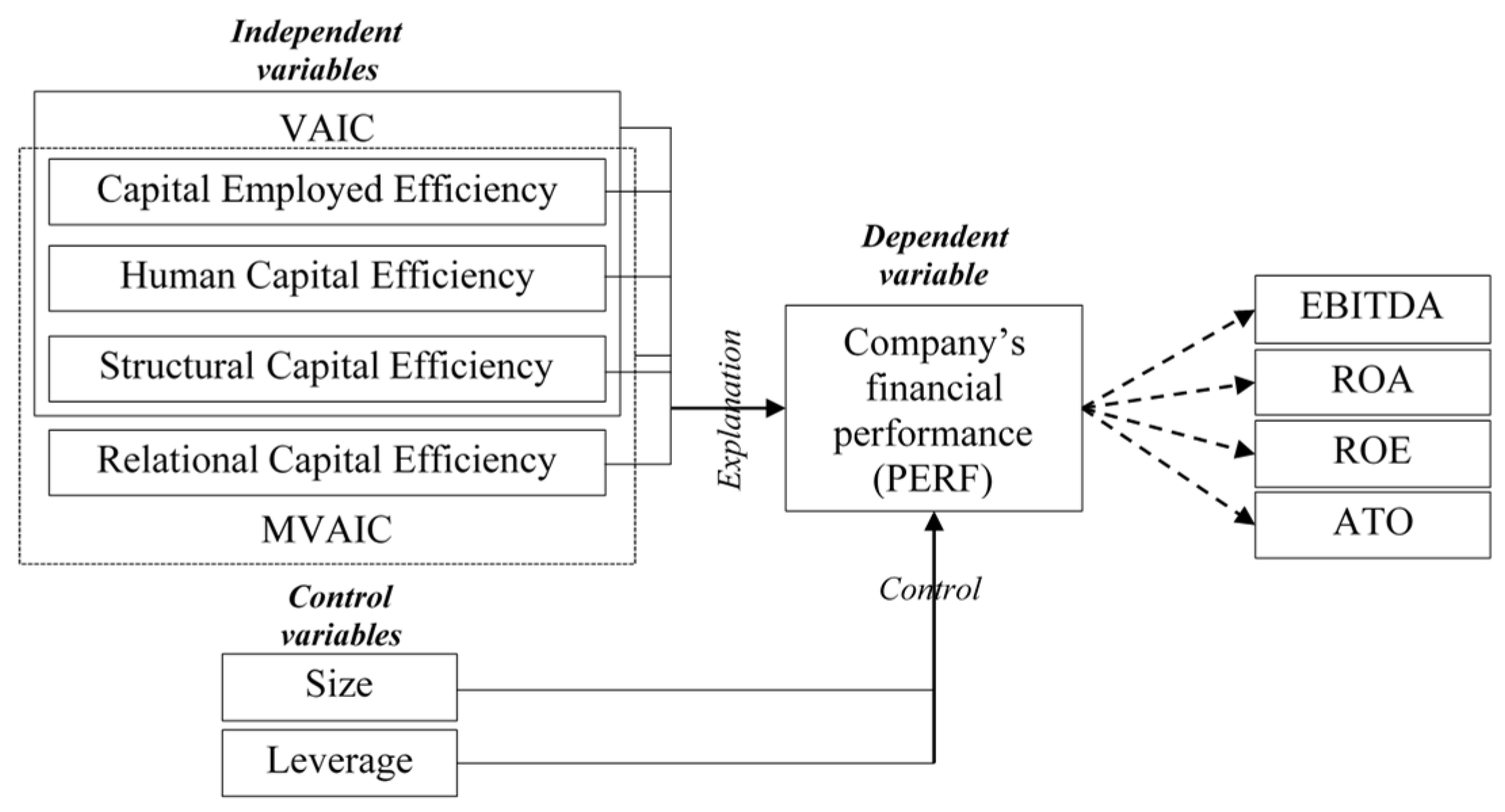

The influence of intellectual capital on the selected dependent variables was analyzed using the Value Added Intellectual Coefficient (VAIC) developed by A. Pulic (Pulic, 2000), its modified version, MVAIC, as well as the structural elements of these indicators. Their use is justified by the possibility of their calculation on the basis of indicators published by companies, as well as by the connection with the basic provisions of the theory of intellectual capital in terms of understanding its structural elements.

According to Pulic's approach, VAIC consists of three types of capital efficiency, namely capital employed efficiency (CEE), human capital efficiency (HCE), and structural capital efficiency (SCE), which numerically characterize the efficiency of using a specific type of capital at an enterprise. To determine the effectiveness of each type of intellectual capital, the calculation procedure for which is given in

Table 1, the VA indicator is used, i.e. the sum of value added for the company (net income, wages and salaries, interest expenses, and taxes paid).

Since the Pulic VAIC approach includes only two elements of intellectual capital – human capital (HC) and structural capital (SC) – a number of researchers have proposed expanding the classical VAIC model by adding new types of efficiency of individual intellectual capital elements to its composition. In particular, the most common options for the formation of MVAIC are the addition of VAIC with new elements such as Research and Development Capital Efficiency (RDCE) and Relational Capital Efficiency (RCE) (Alazzawi et al., 2018; Xu & Wang, 2018; Xu & Wang, 2019; Dalwai & Salehi, 2021; Aybars & Öner, 2022; Asutay & Ubaidillah, 2023). However, to date, accounting systems in many countries do not allow smooth calculation of RDCE and RCE (Hyk, Vysochan & Vysochan, 2021; Serpeninova et al., 2022), which limits the ability to identify their impact on financial performance. In this study, RCE is used as an independent variable to analyze the impact of relational capital on financial performance of industrial companies in Oman. To calculate RCE, relational capital is understood as the sum of a company's marketing, selling and advertising costs.

To control the impact of additional variables that can also affect financial performance measures, in addition to independent variables characterizing intellectual capital (intellectual capital variables), the paper uses two control variables – Size of the company (l_SIZE) and Leverage (LEV). To avoid data distribution skewness, Size of the company is calculated as the natural logarithm of its total assets (Serpeninova et al., 2022), while Leverage is calculated as the ratio of a company's total debt to its assets (Ievdokymov et al., 2020). The general procedure for calculating all dependent and independent variables used in the article is given in

Table 1.

Models. This study aims to explore the impact of VAIC, MVAIC and its elements on financial performance of Omani industrial companies. Based on the set of dependent and independent variables used, the following functional representation of this effect can be provided using four types of PERF models:

where PERF are different types of dependent variables,

i = entity, and

t = time;

α – identifier;

β – regression coefficient;

CEE, HCE, SCE, RDE, and RCE – independent variables;

LEV, l_S, DVS – control variables, where i = entity and t = time;

εit – error term.

Since this article discusses the impact of VAIC, MVAIC and its elements on four types of dependent variables (l_EBITDA, ROA, ROE, and ATO), based on the four types of PERF models given, 16 direct models were built, subject to regression analysis using the Gretl software package.

The conceptual framework used in this study is shown in

Figure 2.

Results

Descriptive Statistics and Correlations.Table 2 provides descriptive statistics for all variables from the 16 analyzed models.

Based on the values of descriptive statistics for 34 companies (

Table 2), it was found that since all the mean values of dependent variables (l_EBITDA, ROA, ROE, ATO) are positive, this means that most of these companies have positive financial performance. The presence of a significant deviation between the minimum and maximum HCE values indicates significant differences in the effectiveness of managing available human resources. In particular, individual companies (Jazeera Steel Prod) have a very high level of this indicator or publish unreliable information about the costs of maintaining and developing human resources. The excess of the mean over the standard deviation for some variables (l_EBITDA, SCE, l_SIZE) indicates that the data in these variables has a small distribution. Close mean and median values for l_EBITDA (13.3 and 13.8), ROA (0.133 and 0.130), SCE (0.788 and 0.829), and l_SIZE (16.3 and 16.4) confirm the presence of a high level of symmetry in the distribution of range values.

As a result of the analysis of multicolinearity problem between the independent variables used to build four types of models, it was found that it does not exist. The existing high values of correlation coefficients were found only between independent variables (VAIC and MVAIC, HCE and VAIC, MVAIC), which were not simultaneously used in any of the four types of models identified in the article (

Table 3).

Selection of Estimate Panel Data Parameter.To ensure adequate processing of panel data in the process of regression analysis, for each of the 16 generated models, it is necessary to choose the most relevant estimate panel data parameter. For this, panel diagnostic tools were used such as the F-statistics test, the Breusch-Pagan test and the Hausman test, which made it possible to obtain the following results (

Table 4).

The use of parameters determined based on the application of the F-statistics test, the Breusch-Pagan test and the Hausman test panel data estimate parameters (

Table 4) allows ensuring adequate correlation of models with the data used in the corresponding model. Along with Pooled OLS, the expediency of using FEM as an estimate parameter for individual models was justified. This involves taking into account the presence of various object-specific constants, as well as REM, which considers, when determining the influence of independent variables on the dependent variable, the effect of omitted or unobserved variables that describe the individual characteristics of the studied objects.

Assumption Test Results. The adequacy of panel data on the activities of industrial companies in Oman was assessed on the basis of testing three classical assumptions, namely normality, autocorrelation and heteroscedasticity. As a result of applying the normality test, the absence of a normal distribution of residuals was found for all analyzed models. Using the Wooldridge test, the autocorrelation problem was found only for those models in which the dependent variable is the ATO productivity indicator – 1.ATO, 2.ATO, 3.ATO, and 4.ATO. For models that used Pooled OLS as a panel data estimate parameter, heteroscedasticity was tested using the Wald test, and for models that used FEM, using the White test. As a result, heteroscedasticity was found for models 1.ROA, 1.ATO, 2.ROA, 2.ATO, 3.ROE, 3.ATO, 4.ROE, and 4.ATO. To eliminate the negative impact of outliers in models in the presence of heteroscedasticity, it is proposed to use the robust standard errors (RSE) technique to adjust the estimate parameters used (Pooled OLS, FEM), which is also proposed to be carried out in similar studies by Öner et al. (2021) and Serpeninova et al. (2022).

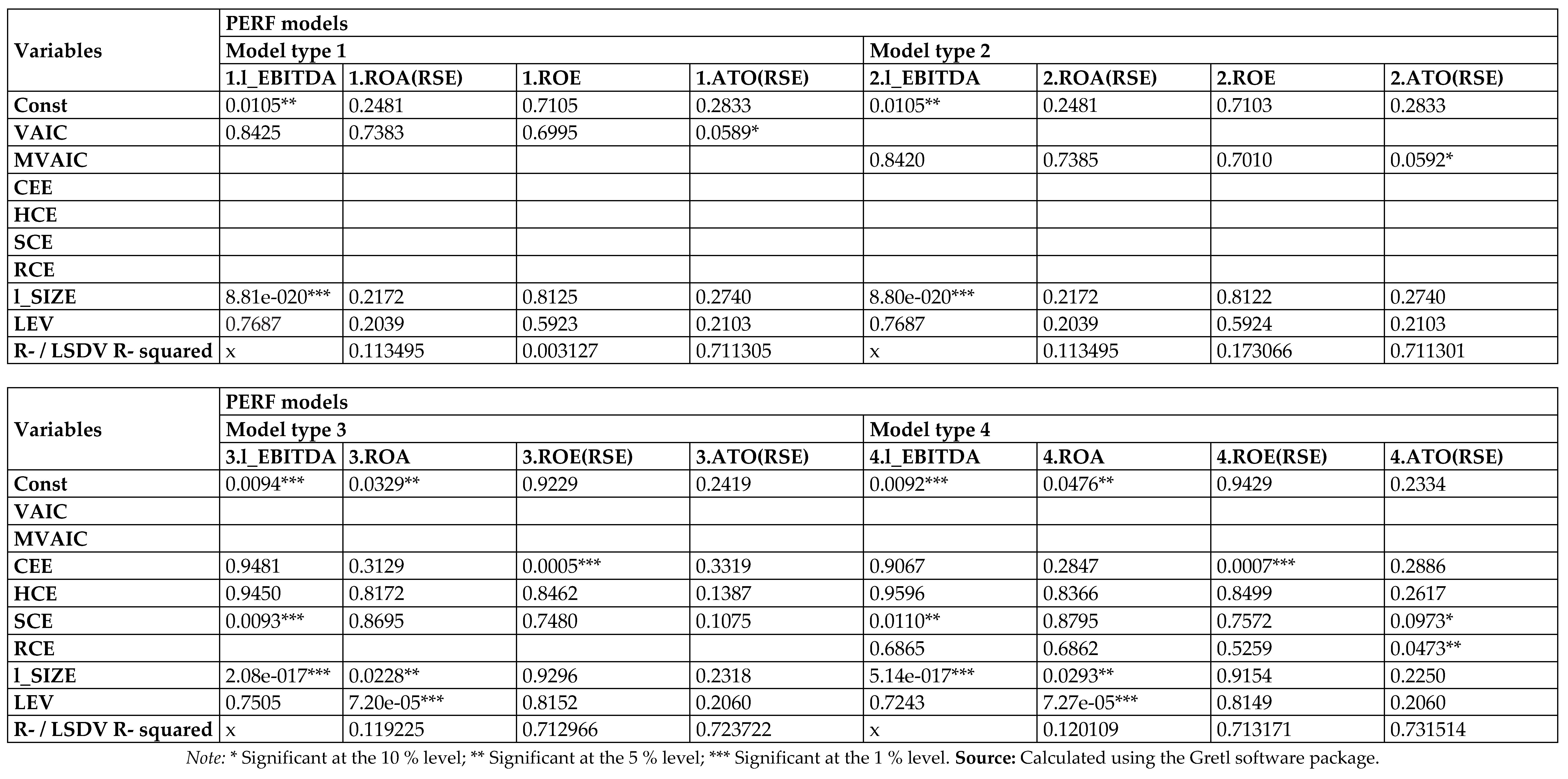

Panel Data Regression Results. Appendix A presents the results of applying regression analysis of panel data, grouped by types and 16 types of selected models (p-value and significance level). Independent variables with more asterisks (*) have the most significant impact on the independent variable in each of the analyzed models.

As a result of the regression analysis of the impact of indicators characterizing intellectual capital (VAIC and MVAIC) and its elements on financial performance measures of industrial companies in Oman, only one of the indicators was found to be affected. In particular, VAIC and MVAIC have a significant positive impact (at the 10% level) only on ATO, without affecting other financial performance measures at all. Thus, the positive impact of VAIC and MVAIC on ATO suggests that if a company creates VAIC or MVAIC for one more unit, Omani listed industrial companies' earnings are expected to increase by 0.0017 and 0.0016 units, respectively.

In general, the results obtained regarding the influence of VAIC and MVAIC indicate that the role of intellectual capital in ensuring the financial performance of industrial companies in Oman is not very important, and necessitate the development of a number of measures that will increase the efficiency of its use. In addition, the analysis of PERF models of the first and second types made it possible to establish the presence of a significant influence at the 1% level of the control variable l_SIZE on l_EBITDA, which indicates the expediency of scaling the activities of industrial companies in Oman to increase this indicator.

Analysis of the impact of VAIC and MVAIC structural elements on financial performance measures has yielded rather contradictory results regarding the role of some of them. Analysis of models 3.ROE(RSE) and 4.ROE(RSE) allowed establishing a negative significant effect at the 1% level of CEE on ROE. This indicates that the physical capital involved in the use of industrial companies in Oman is not used very efficiently, and the increase in its volume negatively affects ROE.

Analysis of the models 3.l_EBITDA and 4.l_EBITDA revealed a positive significant impact (1% and 5% level) of SCE on l_EBITDA. A similar positive relationship was found in the 4.ATO(RSE) model regarding the effect of SCE on ATO. Thus, SCE, as an integral part of VAIC and MVAIC, plays an important positive role in improving the performance of Omani industrial companies, along with physical and financial assets. Also, for PERF models of the third and fourth types, a significant effect of l_SIZE on l_EBITDA and ROA (1% and 5% level), as well as the effect of LEV on ROA (1% level) was revealed. The data obtained indicate the positive role of increasing the activity of industrial companies in Oman and increasing the share of resources attracted in improving certain financial performance measures.

The analysis of PERF models of the fourth type revealed that RCE has a significant and negative impact only on ATO, and does not affect other financial performance measures at all. This indicates that investments in marketing and advertising activities do not play a significant role, and in some cases even have a negative effect on financial performance, which justifies the expediency of their reduction.

The study found that there was no significant impact of HCE on all financial performance measures used in the article (EBITDA, ROA, ROE, and ATO). This indicates the need for industrial enterprises in Oman to pay more attention to improving the skills, abilities and experience of employees, which should potentially lead to improved value creation processes.

Discussion

In contrast to publications that confirmed the positive and significant role of intellectual capital in creating the long-term value of industrial enterprises (Xu & Li, 2020; Öner et al., 2021; Asutay & Ubaidillah, 2023; Habib & Dalwai, 2023), the results of this study largely deny the importance of VAIC and MVAIC to the financial performance of Omani industrial companies. However, as noted by Mohamed and Al Ani (2020), a large number of industrial companies have a significant amount of intangible assets, which indicates a lack of efficiency in their use. The findings correlate with those of Dalwai and Salehi (2021) that MVAIC does not affect the performance of non-financial sector companies listed on the MSE. At the same time, Dalwai, Mohammadi and Al Siyabi (2018) and Asutay and Ubaidillah (2023), in contrast, found a positive significant impact of VAIC and MVAIC on financial performance measures for banks in Oman and for Islamic banks. This indicates that the role of intellectual capital in ensuring financial performance varies significantly for different sectors of the Omani economy.

In general, the results of the analysis of the impact of VAIC and MVAIC on financial performance of Omani industrial companies confirm the conclusion of Habib and Dalwai (2023) that such companies inefficiently use their own investments in intellectual capital, as a result of which the existing management policies need to be improved in terms of its individual types.

The study of the influence of the VAIC and MVAIC elements showed more variable results, which are characterized by a different focus and strength of influence on different types of financial performance measures, confirming the findings of Dzenopoljac et al. (2017). Thus, scientists explain the predominant influence of CEE on the financial performance of companies by the fact that the industrial sector still does not change its traditional production patterns in the process of economic transformation (Xu & Li, 2020). However, the significant negative impact of CEE on ROE found in this article refutes this statement in the context of Omani companies, contradicting the results of Al-Musali and Ku Ismail (2016) and Asutay and Ubaidillah (2023) for Omani and Islamic banks. Comparing such contradictory conclusions with the results of other scientists, it can be assumed that an excess amount of attracted physical and financial capital slows down the processes of creating value of enterprises due to the existence of a U-inverted relationship between CEE and financial performance measures.

The complete absence of an effect of HCE on VAIC and MVAIC fully confirms the conclusions of Dzenopoljac et al. (2017) that human capital does not affect company revenues in the Arab region. Comparing these results with the findings of Al-Musali and Ku Ismail (2016), Hamdan (2018), Dalwai, Mohammadi and Al Siyabi (2018), Asutay and Ubaidillah (2023), who found that firms from two GCC countries and Oman's banking and financial sector are heavily influenced by HCE, one can also find that for the industrial sector, the abilities, special knowledge and skills of employees are not a significant factor in creating value. On the other hand, the revealed lack of influence of SCE on ROA confirms the results of studies by Dalwai, Mohammadi and Al Siyabi (2018) and Asutay and Ubaidillah (2023), which is common for Oman's industrial and financial sector.

The analysis performed does not confirm the results of Habib and Dalwai (2023) regarding the positive significant impact of LEV on ROE. At the same time, a positive effect of LEV on ROA has been found, which calls into question Mohamed and Al Ani's (2020) proposals regarding the feasibility of reducing dividends for stockholders in order to improve the processes of value creation and use of dividends as a source of finance for industrial companies in Oman.

Conclusion

The purpose of the article is to measure, using VAIC and MVAIC models, the impact of intellectual capital and its elements on the financial performance of Omani industrial companies listed on the Muscat Stock Exchange (MSE) in the period from 2017 to 2021. As a theoretical basis for the formation of a number of independent variables, the Value Added Intellectual Coefficient model developed by A. Pulic was used, and regression analysis of panel data was chosen as the main research method.

This paper makes an original contribution to the existing scientific literature by providing empirical evidence of the relationship between VAIC, MVAIC, its elements and company financial performance (earnings, profitability, productivity) in the context of a knowledge-based economy. The results obtained allow us to adjust current policies and formulate strategic decisions regarding the management of intellectual capital and its components in the industrial enterprises of Oman, which in general will ensure sustainable value creation.

The regression analysis of the impact of VAIC, MVAIC and its elements on the financial performance of industrial companies in Oman has yielded rather ambiguous results. VAIC and MVAIC in general have a significant positive impact (at the 10% level) only on productivity (ATO) and do not affect earnings (EBITDA) and profitability (ROA and ROE) at all. For individual elements of VAIC and MVAIC, the following most significant relationships with financial performance measures were found: CEE has a negative impact on ROE; SCE has a positive impact on l_EBITDA and ATO; l_SIZE positively affects l_EBITDA and ROA; RCE negatively affects ATO; and LEV has a positive effect on ROA. It was also found that there was no significant impact of HCE on all financial performance measures (EBITDA, ROA, ROE, and ATO) of industrial companies in Oman.

The study provides some practical implications for better use of intellectual capital by company management. To improve the process of value creation, Oman's industrial leaders from all components of intellectual capital should pay attention to the more efficient use of structural capital (organizational structure, design and culture, technological innovation, etc.) and reduce investment in relational capital (trademarks, company reputation, customer loyalty, etc.). The development of structural capital can be achieved through the formation of a more flexible organizational culture, the formalization of existing technological knowledge, development of innovations, improvement of internal policies for the registration of intellectual property rights, etc.

The study has certain limitations that should be addressed in future research. First, data were used from Omani industrial companies for the period 2017–2021 registered on the MSE. However, the lack of data for some reporting periods led to the exclusion of some companies from the scope of the study. Therefore, the research results can be more accurate and relevant if they are based not only on the analysis of the activities of Omani industrial companies listed on the MSE, but also cover a longer time horizon. Secondly, financial performance was analyzed using four dependent variables (EBITDA, ROA, ROE and ATO) in the context of selected areas such as earnings, profitability, and productivity. The range of such variables and directions can be expanded depending on those aspects of financial performance to which scientists will directly pay attention. Thirdly, to analyze the impact on the financial performance measures used, in addition to RCE, other elements of MVAIC can be used that characterize the intellectual capital of an enterprise.

Appendix A

Analyzed PERF models (Pooled OLS, FEM, REM)

References

- Akkas, E. & Asutay, M. (2022). The impact of intellectual capital formation and knowledge economy on banking performance: a case study of GCC’s conventional and Islamic banks. Journal of Financial Reporting and Accounting, ahead-of-print. [CrossRef]

- Alazzawi, A., Upadhyaya, M., El-Shishini, H., & Alkubaisi, M. (2018). Technological capital and firm financial performance: Quantitative investigation on intellectual capital efficiency coefficient. Academy of Accounting and Financial Studies Journal, 22(2), 1-10.

- Al-Hamadany, R.I., Rashee, I.M., & Mohammed, M.D. (2020). A Systematic Review of Literature on Intellectual Capital in the Gulf Cooperation Countries. International Journal of Innovation, Creativity and Change, 14(10), 269-283.

- Al-Musali, M.A., & Ku Ismail, K.N.I. (2016). Cross-country comparison of intellectual capital performance and its impact on financial performance of commercial banks in GCC countries. International Journal of Islamic and Middle Eastern Finance and Management, 9(4), 512-531. [CrossRef]

- Andriessen, D. (2004). IC valuation and Measurement Classifying the State of the Art. Journal of Intellectual Capital, 5, 230-242. [CrossRef]

- Asutay, M., & Ubaidillah (2023). Examining the Impact of Intellectual Capital Performance on Financial Performance in Islamic Banks. Journal of the Knowledge Economy. [CrossRef]

- Aybars, A., & Öner, M. (2022). The impact of intellectual capital on firm performance and value: An application of MVAIC on firms listed in Borsa Istanbul. Gazi İktisat ve İşletme Dergisi, 8(1), 47-60. [CrossRef]

- Bontis, N. (1998). Intellectual capital: an exploratory study that develops measures and models. Management Decision, 36(2), 63-76. [CrossRef]

- Dalwai, T., & Mohammadi, S.S. (2020). Intellectual capital and corporate governance: An evaluation of Oman’s financial sector companies. Journal of Intellectual Capital, 21(6), 1125-1152. [CrossRef]

- Dalwai, T., & Salehi, M. (2021). Business strategy, intellectual capital, firm performance, and bankruptcy risk: evidence from Oman's non-financial sector companies. Asian Review of Accounting, 29(3), 474-504. [CrossRef]

- Dalwai, T., & Sewpersadh, N.S. (2023). Intellectual capital and institutional governance as capital structure determinants in the tourism sector. Journal of Intellectual Capital, 24(2), 430-464. [CrossRef]

- Dalwai, T., Mohammadi, S.S., & Al Siyabi, K. (2018). An empirical analysis of intellectual capital and firm performance of Oman’s financial sector companies. 3rd International Conference on Banking and Finance Perspectives (ICBFP). Famagusta.

- Dzenopoljac, V., Yaacoub, C., Elkanj, N., & Bontis, N. (2017). Impact of intellectual capital on corporate performance: evidence from the Arab region. Journal of Intellectual Capital, 18(4), 884-903. [CrossRef]

- GCC Standardization Organization. (2023). Standards. Retrieved from https://www.gso.org.sa/en/standards/.

- Habib, A.M., & Dalwai, T. (2023). Does the Efficiency of a Firm’s Intellectual Capital and Working Capital Management Affect Its Performance? Journal of the Knowledge Economy. [CrossRef]

- Hamdan, A. (2018). Intellectual capital and firm performance: Differentiating between accounting-based and market-based performance. International Journal of Islamic and Middle Eastern Finance and Management, 11(1), 139-151. [CrossRef]

- Hyk, V., Vysochan, O., & Vysochan, O. (2021). Modeling the options for accounting for the innovation costs of industrial enterprises in Ukraine. Intellectual Economics, 15(1), 88-103. [CrossRef]

- Ievdokymov, V., Ostapchuk, T., Lehenchuk, S., Grytsyshen, D., & Marchuk, G. (2020). Analysis of the impact of intangible assets on the companies’ market value. Naukovyi Visnyk Natsionalnoho Hirnychoho Universytetu, 3, 164-170. [CrossRef]

- Lehenchuk, S., Ostapchuk, T., Raboshuk, A., Vyhivska, I., & Makarovych, V. (2022). The inverted-U relationship between R&D and profitability: evidence from the Slovak medical device industry. Intellectual Economics, 16(2), 121-137. DOI: 10.13165/IE-22-16-2-07.

- Mohamed, Z.O., & Al Ani, M.K. (2020). The Effect of Intangible Assets, Financial Performance and Financial Policies on the Firm Value: Evidence from Omani Industrial Sector. Contemporary Economics, 14(3), 379-391. DOI: 10.5709/ce.1897-9254.411.

- Food and Agriculture Organization of the United Nations. (2019). Oman Vision 2040. Retrived from https://www.fao.org/faolex/results/details/en/c/LEX-FAOC201987/.

- Öner, M., Aybars, A., Çinko, M., & Avcı, E. (2021). Intellectual Capital, Technological Intensity and Firm Performance: The Case of Emerging Countries. Scientific Annals of Economics and Business, 68(4), 459-479. [CrossRef]

- Pulic, A. (2000). VAICTM – an accounting tool for IC management. International Journal of Technology Management, 20(5-8), 702-714.

- Serpeninova, Yu., Lehenchuk, S., Mateášová M., Ostapchuk T., & Polishchuk I. (2022). Impact of intellectual capital on profitability: Evidence from software development companies in the Slovak Republic. Problems and Perspectives in Management, 20(2), 411-425. [CrossRef]

- Sveiby, E.K. (1997). The Intangible Assets Monitor. Journal of Human Resource Costing & Accounting, 2(1), 73-97. [CrossRef]

- Xu J., & Li J. (2020). The interrelationship between intellectual capital and firm performance: evidence from China's manufacturing sector. Journal of Intellectual Capital, 23(2), 313-341. [CrossRef]

- Xu, J., & Wang, B. (2019). Intellectual Capital Performance of the Textile Industry in Emerging Markets: A Comparison with China and South Korea. Sustainability, 11(8), 2354. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).