For the purposes of this paper, we will assume there are no pool fees. Because geometric mean market makers have an Exchange Rate Level Independence property [

5], we can consider impermanent loss in terms of price ratios rather than actual prices. As such, we can greatly reduce the required number of parameters to calculate impermanent loss. Consider the following general formula [

3]:

Where

is the fiat value of the pool,

is the fiat valuation of the tokens had they been held outside of the pool,

is the fiat price of token

t, and

is the weight of token

t. This formula provides impermanent loss (as a percentage) for a complex pool with

n tokens, requiring

parameters. However, for our analysis of asset-pair pools, the formula can be rewritten for two tokens:

For ease of optimization and modeling, we will assume that only one token’s value is fluctuating. We will choose

as our numeraire, and assume the fiat value of

remains constant. Thus,

, such that:

This equation allows us to express impermanent loss in terms of only two parameters,

and

. Because the sum of all token weights must add up to 1, we are able to calculate

using

. We will now provide a derivation for this formula. First, we will use the Exchange Rate Level Independence property to express the pool value in terms of token 1, beginning by establishing the spot price formula given in the Balancer whitepaper [

4].

We can equate the fiat value of the pool to the sum of each token’s fiat value times its quantity:

Using Definition 2.1, we can express the pool value in terms of token 1:

Note that

simply equals 1. It follows that the pool’s fiat value can be expressed as the product of the pool value in terms of token 1 and the fiat value of token 1:

Such that:

Using Equation (2.6) and letting

be the new value of the pool in terms of token 1, we can rewrite

as:

Referring to Theorem 2.2 (at the end of the section), we know:

Substituting into Equation (2.9):

Notice the substitution of Equation (2.6) into Equation (2.12). Recall a property of Definition 2.1, such that

. Continuing Equation (2.13):

As such, we have shown that the change in the pool’s value in terms of token 1 is equal to the change in token 2’s value in terms of token 1, raised to the power of token 2’s weight. Inserting this into Equation (2.8):

Recall

. Thus:

This matches the expression for

we set out to derive in Equation (2.2). To compute impermanent loss, we must now derive an expression for

. Because there is a constant value distribution [

4], we can express the total fiat value of the pool as such:

Since the tokens are being held outside the pool, we may express the new held fiat value as being directly proportional to the fiat price changes of the tokens:

As such:

We can now substitute Equation (2.17) and Equation (2.20) into Equation (2.1), yielding:

However, because we are modeling impermanent loss according to fluctuation of only one token’s fiat value, we let

. Thus:

Rewriting

in terms of

yields a function of two parameters:

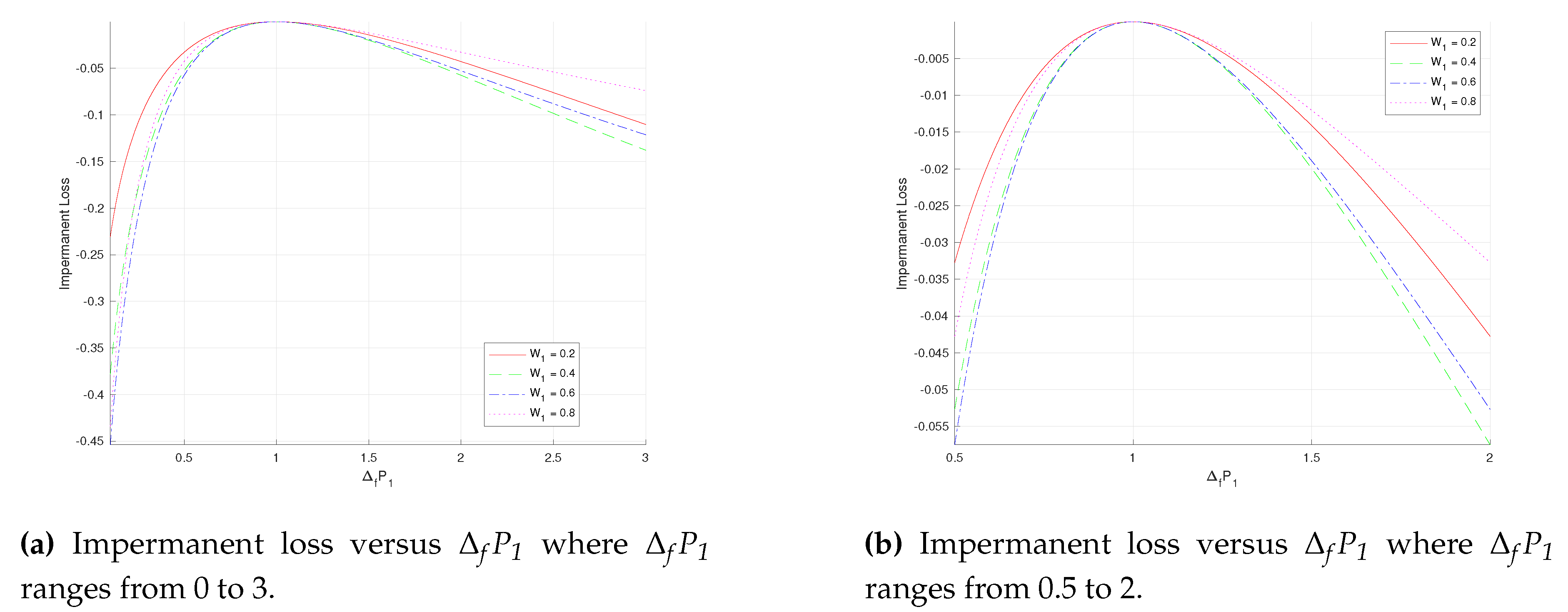

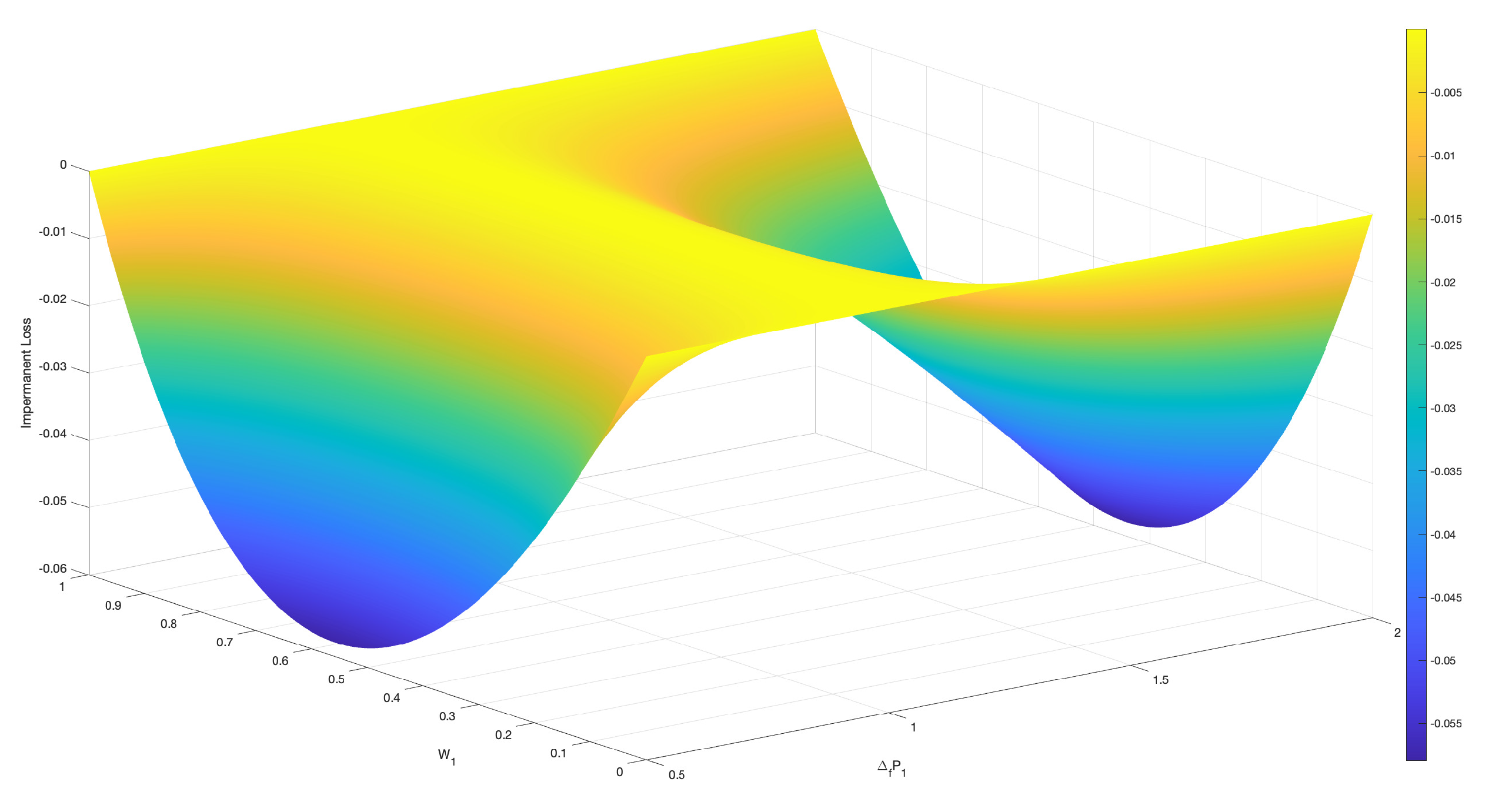

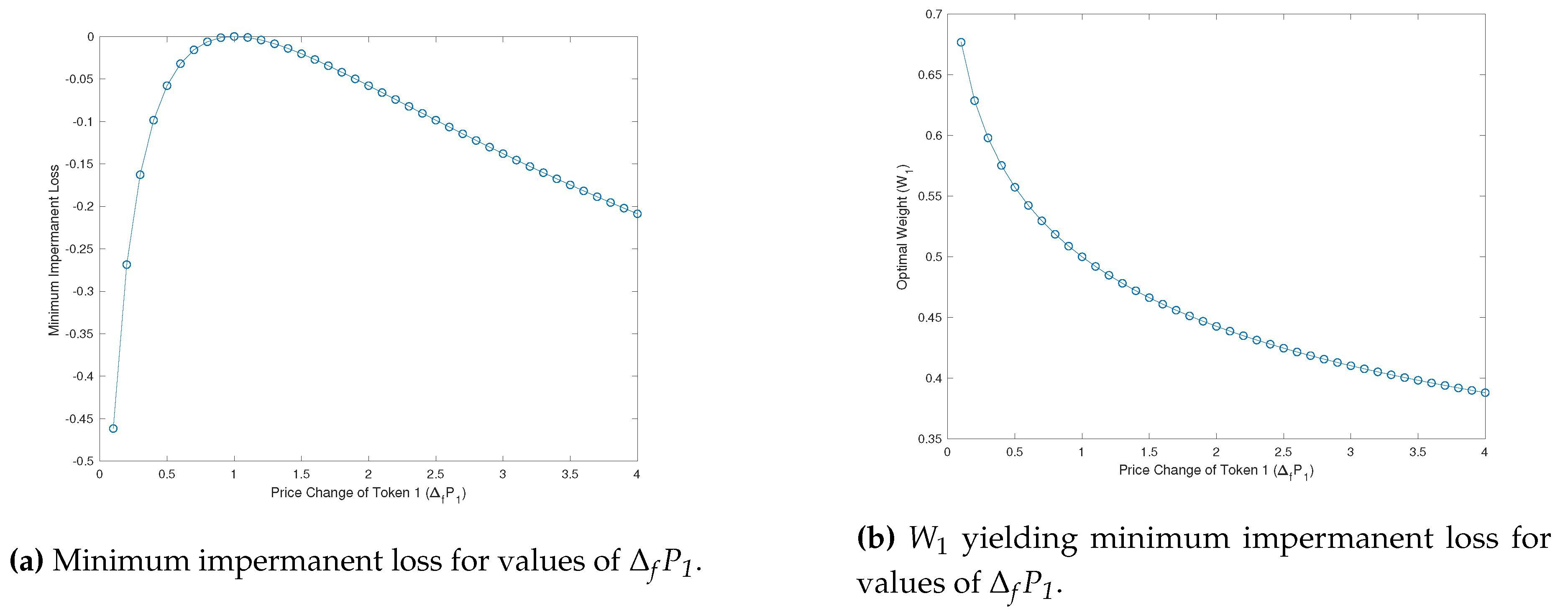

In

Section 3, we will analyze this function further to determine which weighting scheme is optimal for reducing impermanent loss in asset-pair pools. We will now prove the expression for

presented in Equation (2.10).