1. Introduction

A contemporary understanding of corporate footprints that encompasses the needs of internal and external stakeholders, the impacts we make, and that which impacts us is needed. Nielsen [

1] argues the case for re-formulating the current accountability debate concerning corporate social responsibility reporting, Environment, Social and Governance (ESG) information and sustainability reporting in its many varying formats so that it focuses on the most significant impacts and connects with firm performance [

2].

Due to the ever-increasing awareness of ethical and sustainable business practices, organisations are pressured to connect their business practices and strategies to impacts on the environment, society and the stakeholders they interact with [

3]. The European Sustainability Reporting Standards [

4] specify the information that an organisation should disclose about such material impacts, as well as the risks and opportunities concerning environmental, social, and governance sustainability matters the company faces. According to ESRS, a sustainability report must describe “the key elements of the undertaking’s general strategy that relate to or affect

sustainability matters and the key elements of the undertaking’s

business model and

value chain to provide an understanding of its exposure to

impacts, risks and

opportunities and where they originate” [

5].

The current focus of governments and supra-national bodies emphasises the importance of creating transparency. One example is the OECD’s Financing SMEs for Sustainability [

6] platform. Assisting SMEs in becoming transparent regarding their impact is essential in ensuring accountability and sustainability in global value chains. In a recent contribution, Roslender and Nielsen [

7] find that one of the fundamental mechanisms that can hold businesses accountable for their sustainability goals is the interest and power of the customers.

However, they also conclude that the importance of customers as stakeholders is under-emphasised in current corporate reporting frameworks. They risk becoming merely an elaborate marketing material better described as ‘doing-good reporting’. In donating towards and investing in the United Nations’ Sustainable Development Goals, doing good is a potential addition to impacts. Still, it is also aired that the focus on sustainability should be based on arguments about the company's impacts on its surroundings stemming from its core activities to provide concise information on your business's impacts

1.

In today’s globally oriented economy, companies seldom operate in isolation; they often work in complex global value chains and ecosystems, interacting with many other organisations and individuals. Therefore, an integral part of a value chain and due diligence analysis is concerned with describing how the focal firm affects and is affected by its nearest business partners and how value creation, value capture and value destruction are dispersed among the companies in the value chain. Value destruction could, for example, negatively affect a value chain's climate through excessive Greenhouse Gas (GHG) emissions. In these supply chains, every company needs to focus on how value creation and destruction are dispersed across the stakeholders. If it is difficult to project these values across the value chain – and often it is – then what would be necessary to improve this type of transparency?

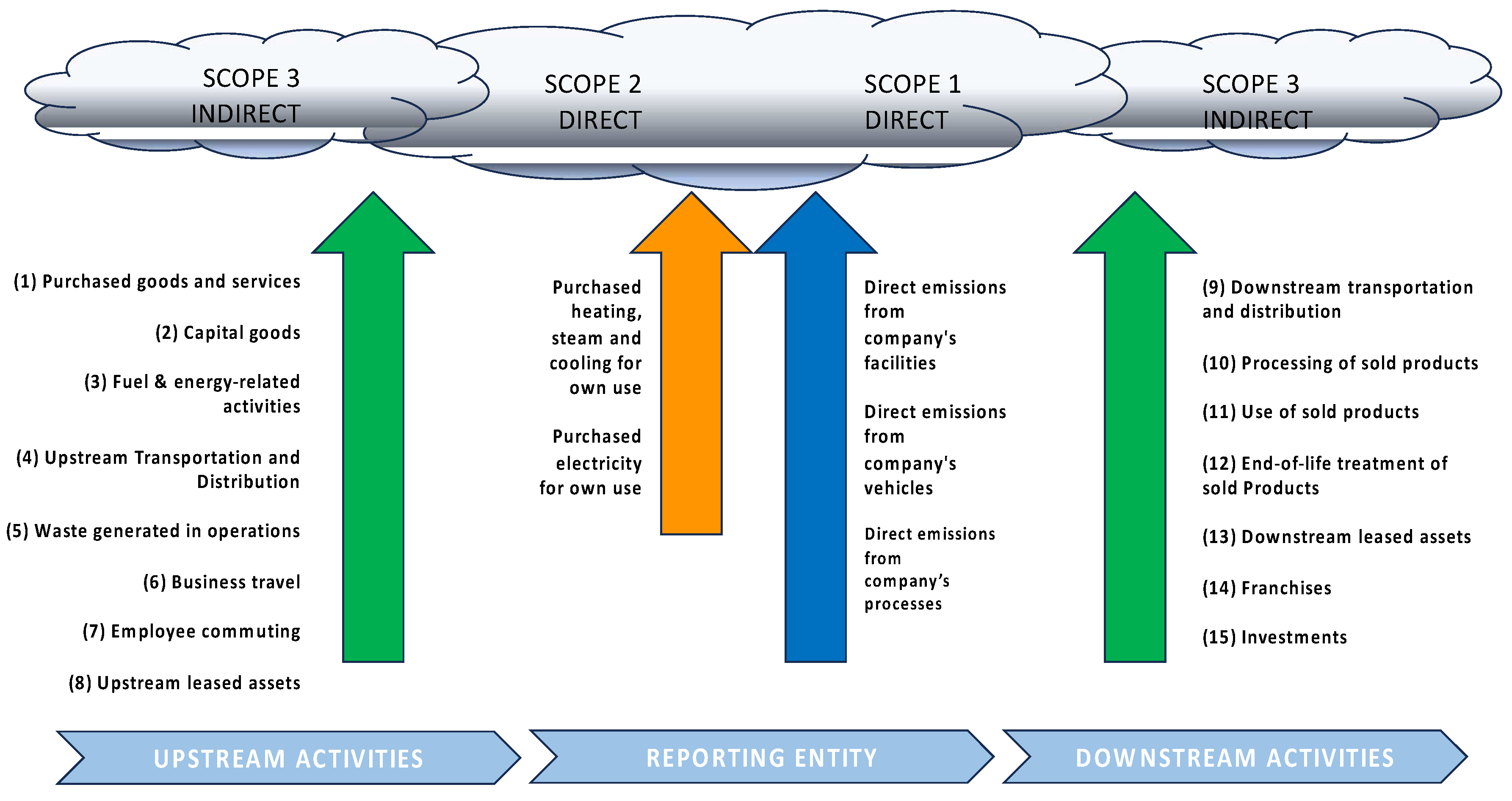

In the forthcoming sustainability reporting standards, assessing an organisation's material impacts, risks, and opportunities must be validated by a due diligence process to cover the relevant parts of that organisation's value chain. For example, the impact of GHG emissions is categorised according to Scope 1, 2 and 3 [

8]. Scope 1 covers direct emissions from owned or controlled sources. Scope 2 covers indirect emissions from the generation of purchased electricity, steam, heating and cooling consumed by the reporting company. Scope 3 includes all other indirect emissions in a company's value chain. Therefore, when considering value creation and value destruction, it is advisable to consider direct and indirect effects throughout the value chain and, more broadly, than just GHG emissions.

Figure 1.

Scope 1, 2 and 3 (own production following [

9]).

Figure 1.

Scope 1, 2 and 3 (own production following [

9]).

What is deemed relevant can be assessed based on the business model analysis of the company and the closeness of the business relationships a given organisation has. A due diligence process could involve performing the following steps [

10]:

Integrating due diligence into policies and management systems

Identifying and assessing adverse human rights and environmental impacts

Preventing, ceasing or minimising actual and potential negative human rights and environmental impacts,

Evaluate the effectiveness of measures

Communicating

Providing remediation

Hence, due diligence takes the analyses performed on value creation, value capture and value destruction a step further and takes action. The crucial link to the remainder of the paper is identifying measures that assist due diligence.

'If your performance measures do not reflect your business model, you are probably not getting what you bargained for’ [

11]. In a similar vein, and leaning on the notions of Nielsen et al. [

12], it can be argued that if a company's chosen KPIs do not enable it to assess the effectiveness of actions by the due diligence process, it is likely that it will not help managers to understand whether the company is performing well or not.

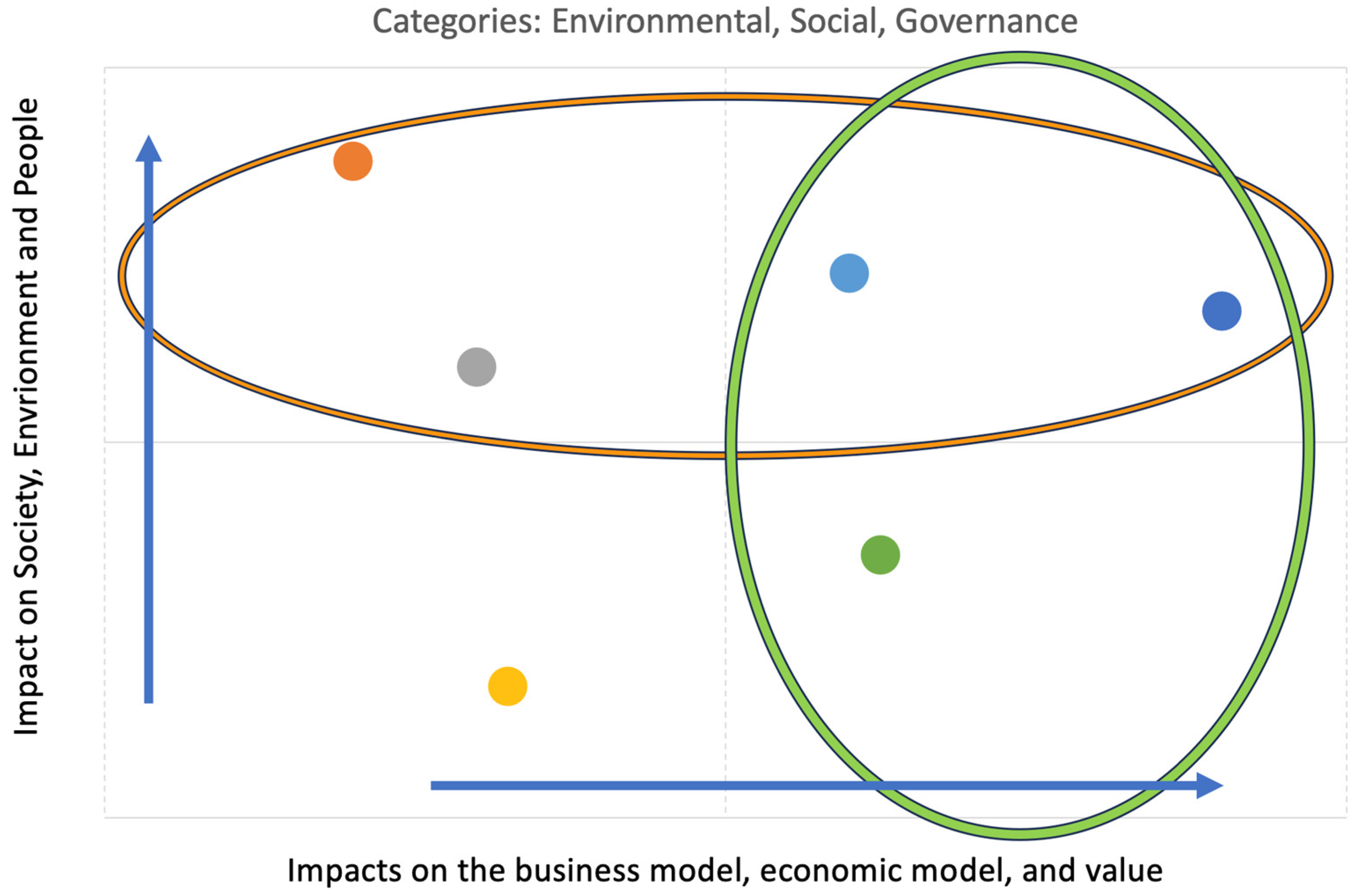

2. Background: Identifying Double Materiality

More research needs to be conducted into actual double materiality reporting practices. One recent study [

13] highlights that in its infancy, the notion of double materiality has led to a relatively wide variety in both double materiality assessments and adoption disclosures, as well as related criticalities. Describing how the organisation affects people, the planet and society while creating profits is at the core of sustainability reporting. This is denoted as having an impact. ESRS states that when describing the process to identify material impacts, risks and opportunities, the company should disclose all relevant criteria used in the process. An example of this clarity is found in ESRS:

“ESRS 2 SBM-2 requires the undertaking to provide an understanding of if and how it considers whether its strategy and business model plays a role in creating, exacerbating or (conversely) mitigating significant material impacts on

consumers and end-users, and whether and how the business model and strategy are adapted to address such material impacts” [

14].

The ESRS and other forthcoming international sustainability reporting standards use the expression: “materiality of the impacts”. This means that organisations must evaluate the extent of their impact or footprint, for example, by starting with understanding the business model. This means that organisations must focus on areas where impacts, risks and opportunities are likely to arise based on the nature of the activities, business relationships, geographies or other factors. Double materiality means that the company has to evaluate its footprint on the environment and society on the one hand and how environmental and societal factors influence the organisation on the other. The former is called impact materiality, and the latter is financial materiality. From ESRS, we get the following definitions:

Impact materiality

A sustainability matter is “material from an impact perspective when it pertains to the undertaking’s material actual or potential, positive or negative impacts on people or the environment over the short-, medium- or long-term.

Impact materiality considers the company’s most significant impacts outwards for the most significant stakeholders and should be presented in the sustainability report primarily for external non-financial stakeholders.

Financial materiality

when a sustainability matter generates risks or opportunities that have a material influence, or could reasonably be expected to have a material influence, on the undertaking’s development, financial position, financial performance, cash flows, access to finance or cost of capital over the short-, medium- or long-term.

Financial materiality considers the company’s most significant impacts inwards and should be presented in the annual report. It is specifically intended for investors, lenders and other creditors.

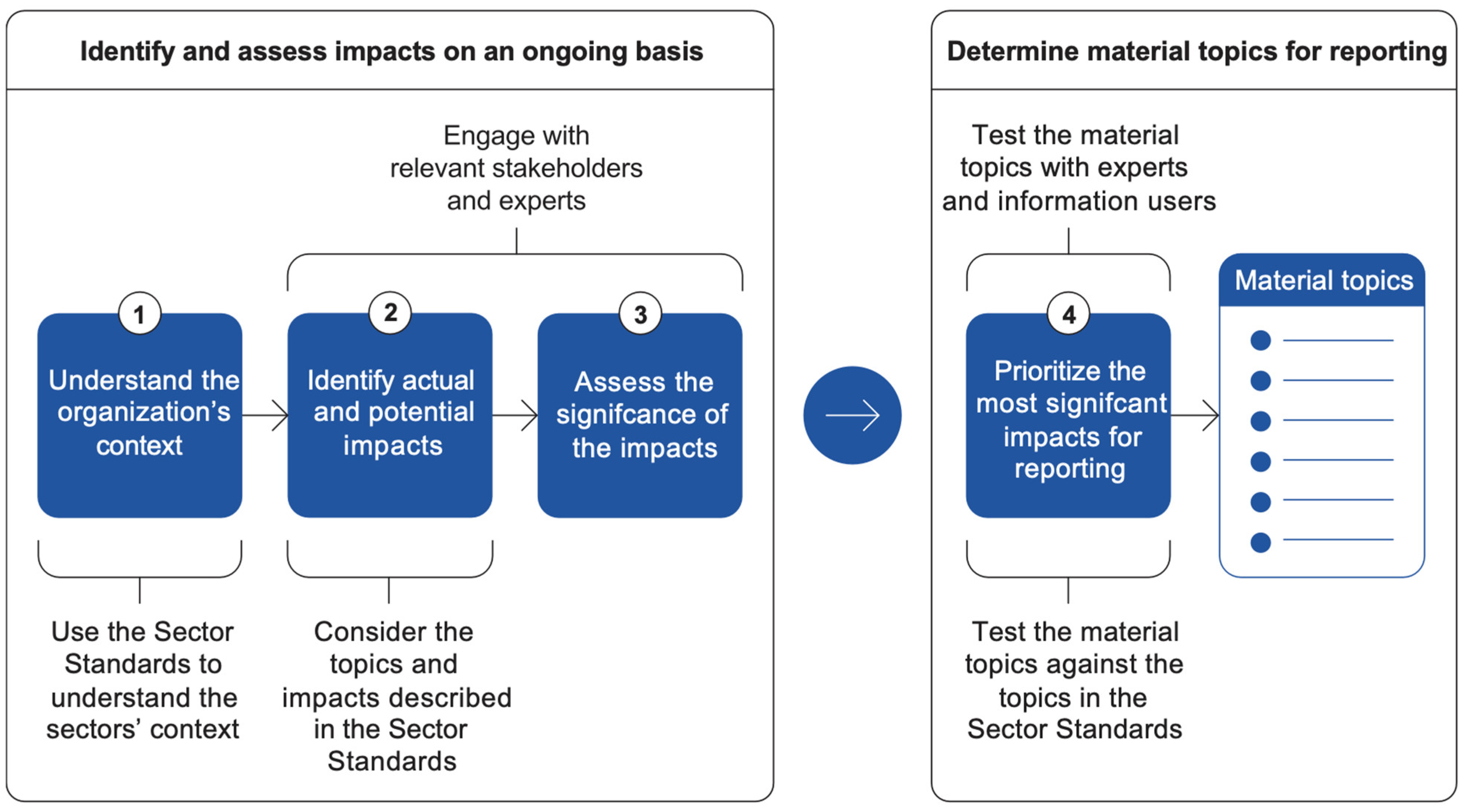

A process for determining material topics is depicted in

Figure 2. The first phase examines the context, the strategy and the business model. It is recommended that companies engage with their stakeholders in such discussions. In determining the most significant impacts, the company must look beyond its limits and include the stakeholders and the value chain it affects, as was argued above regarding due diligence. Therefore, a natural starting point for such an analysis is to specify how the company creates value, i.e., the business model. This also determines the degree and manner of collaboration outside the immediate organisation. The information derived here is equally relevant to managerial decision-making and external communication. In the second phase, the impacts are prioritised for reporting purposes. Here, the Global Reporting Initiative (GRI) [

15] proposes double-checking the materiality of topics and prioritising with potential information users and experts that can verify significance.

Figure 2.

Identifying impacts and determining their materiality15.

Figure 2.

Identifying impacts and determining their materiality15.

A series of analyses can be conducted to become more precise on the utility of products and services from the perspective of customers, value creation, and value destruction. This could include describing the business model configuration, the type of utility it aims to create for the company’s customers and users (the value propositions), and the primary value-creating activities. A helpful question is, ‘What are the particular value drivers of our business model?’ Conducting such a business model analysis makes it possible to identify the company's impact and footprints on society, individuals, and the environment. A helpful starting point is to contemplate areas where the company’s value creation depends on the use of resources and which could potentially cause value destruction of natural resources or materials and components.

Clarifying the firm’s value creation and types of value destruction and how the processes and activities affect other companies and the environment makes it possible to create a clear and transparent illustration of impact. An effective way to communicate this is to use the Future Fit framework [

16] or the six capitals from the Integrated Reporting Framework [

17]. These two frameworks are among the most widespread for illustrating the impacts and footprints of companies, but they do not distinguish between the two sides of double materiality.

The Future Fitness Benchmark tool is a free online strategic management tool that can assist companies in assessing and managing the impact of their activities – environmentally, socially, and financially. The tool lists 23 Break-Even Goals across eight categories (energy, water, natural resources, pollution, waste [

18], physical presence, and human drivers of Future Fit pursuits). Not all classes are relevant for a given company. Which goals should be focused on can be determined by considering the business model and the types of value creation as articulated above. Similarly, Integrated Reporting identifies categories that could be relevant, such as natural capital, physical capital, human capital, intellectual capital, social capital, and financial capital. There are three overall categories according to which we can analyse footprints: (1) the footprint of the inputs to your company’s production, (2) the footprint of the processing in your company’s production, including value delivery and effects on the workforce, and (3) the footprint of product use, including costs of circularity, reuse, and discarded materials. When illustrating a footprint, companies should clarify the following:

Why do they choose to report this particular footprint?

What are the key stakeholders affected by your business regarding this footprint?

Who else would you like to affect and why? You can choose to invest or donate here. For example, which SDG goals would you as a company like to invest in that are not directly affected by your current operations or products?

When an organisation has identified its impact materiality and financial impacts, it needs to prioritise the "most significant impacts” and validate the potential effects. One way of handling this analysis is to create an overview using a double materiality matrix like the one depicted below which is inspired by the SASB and GRI in

Figure 3. The double materiality matrix and explanatory text are integral to the sustainability report. They should identify which impacts are of most significant concern to the organisation both outwards and inwards and in combination.

3. Identifying ESG KPIs

A core part of creating reliability of sustainability reporting and working towards greater comparability and transparency for financial stakeholders is to have such reports assured and audited. The forthcoming ISSA 5000 auditing standard [

19] will provide a basis for sustainability auditing and assurance. Financial reporting provides criteria that auditors can use to evaluate a company. For external stakeholders, it is essential that reporting accurately represents (faithful representation) the company's condition and that the information is comparable across time and other entities. The International Auditing and Assurance Standards Board’s exposure draft, which proposes General Requirements for Sustainability Assurance Engagements

19, expands upon these criteria along five dimensions:

72 (c) Evaluate whether the criteria exhibit the following characteristics: (Ref: Para. A172-A178)

(i) Relevance; (Ref: Para. A179-A180)

(ii) Completeness; (Ref: Para. A181)

(iii) Reliability; (Ref: Para. A182)

(iv) Neutrality; (Ref: Para. A183-A184) and

(v) Understandability; and (Ref: Para. A185)

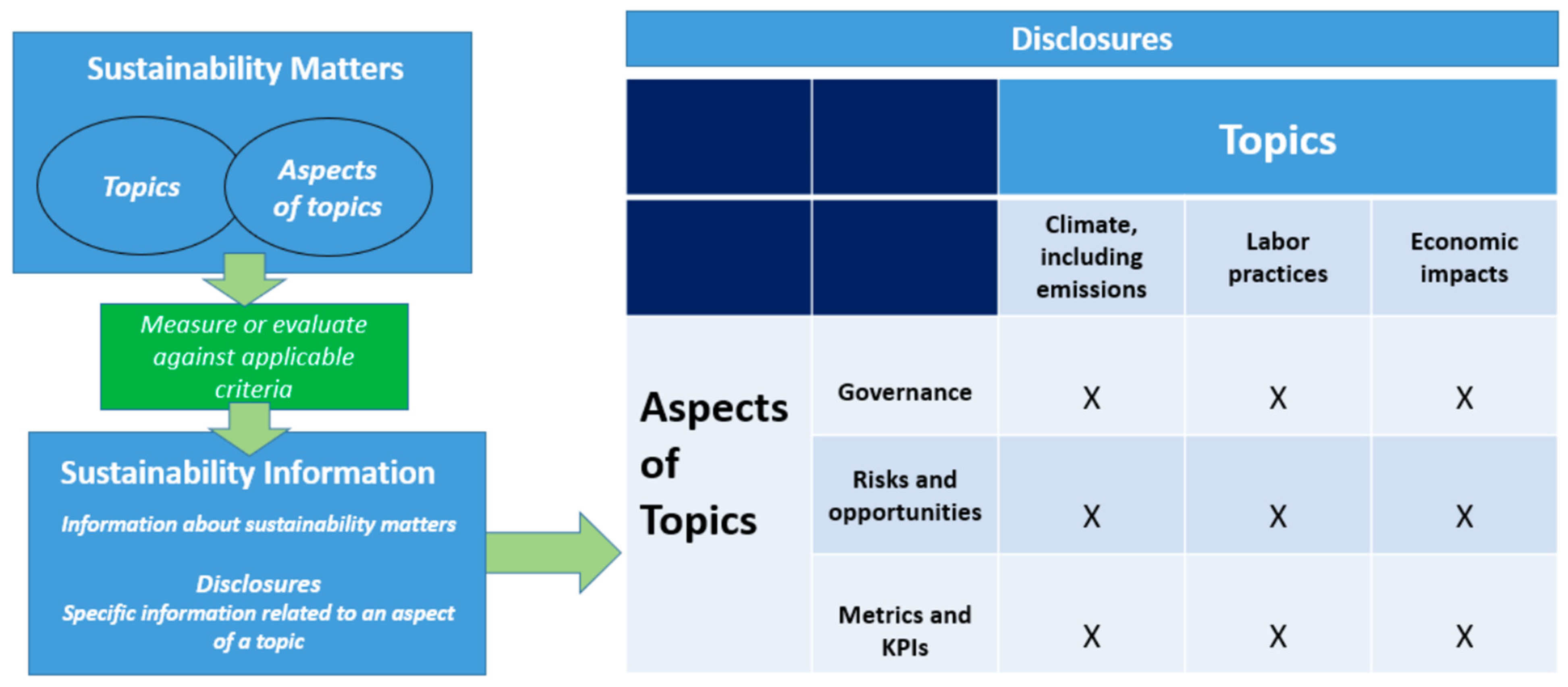

On page 57, the ISSA 5000

19 states that sustainability information relates to “information about sustainability matters and may cover several topics and aspects of those topics.” The relationship between topics and aspects of topics is depicted in

Table 1.

Regarding measuring financial materiality, the outside-in effect, the International Sustainability Standards Board (ISSB) states in IFRS S1 [

20] that:

46 An entity shall disclose, for each sustainability-related risk and opportunity that could reasonably be expected to affect the entity’s prospects:

48 Metrics disclosed by an entity applying paragraphs 45–46 shall include metrics associated with particular business models, activities or other common features that characterise participation in an industry.

This stresses the importance of creating links between risks and opportunities and how they impact the business, how these can be measured, and the systems in which the data for these KPIs are generated. Therefore, companies must accentuate the connections between these elements and provide longitudinal explanations to increase reliability, trustworthiness, comparability and relevance in sustainability reporting. The data links to information systems are equally important for internal control and auditing purposes. Hence, the new regulations are pressuring companies to build and employ a methodology that links value creation and impact to KPIs that can be used for managerial purposes and simultaneously as a verified basis for sustainability reporting. The ISSA 5000

19 exposure draft illustrates the connections between sustainability matters, disclosure and how an overview can be created in

Figure 4.

The main principle for choosing to report a KPI should be that it provides relevant insights from a managerial perspective. For a KPI to make sense from a managerial perspective, it needs to inform management about the status and direction of something meaningful to the organisation. This means that the KPI should say something about one of three things:

Whether the organisation is investing appropriate resources into the strategic activity

Whether the strategic activities are on track in terms of activity level, intensity or efficiency

Whether the activities are having the anticipated effects

Multiple international associations, bodies, and organisations have proposed lists of KPIs for ESG reporting. Among these are organisations such as the European Commission, the European Federation of Financial Analysts, the Global Reporting Initiative, the Sustainability Accounting Standards Board, an array of financial data platform providers such as Bloomberg, consulting firms such as KPMG and ERP providers such as SAP. Currently, the maturity of some of these KPI lists could be better, and the most trusted benchmark list to date is that of the Global Reporting Initiative. Like the ESRS2, the GRI15 distinguishes between general disclosures and sector-specific disclosures.

When looking at the largest firms in the US, they have mostly adopted environmentally oriented business model archetypes (the E) and, to a much lesser extent, archetypes associated with societal and governance-oriented (the S and G) dimensions of business models [

21]. This is also reflected in the KPIs suggested by data providers such as Refinitiv Datastream, Bloomberg and the SASB. Naturally, companies start their experimentation with the E of ESG because these types of metrics are calculable in manners closely related to existing accounting frameworks [

22].

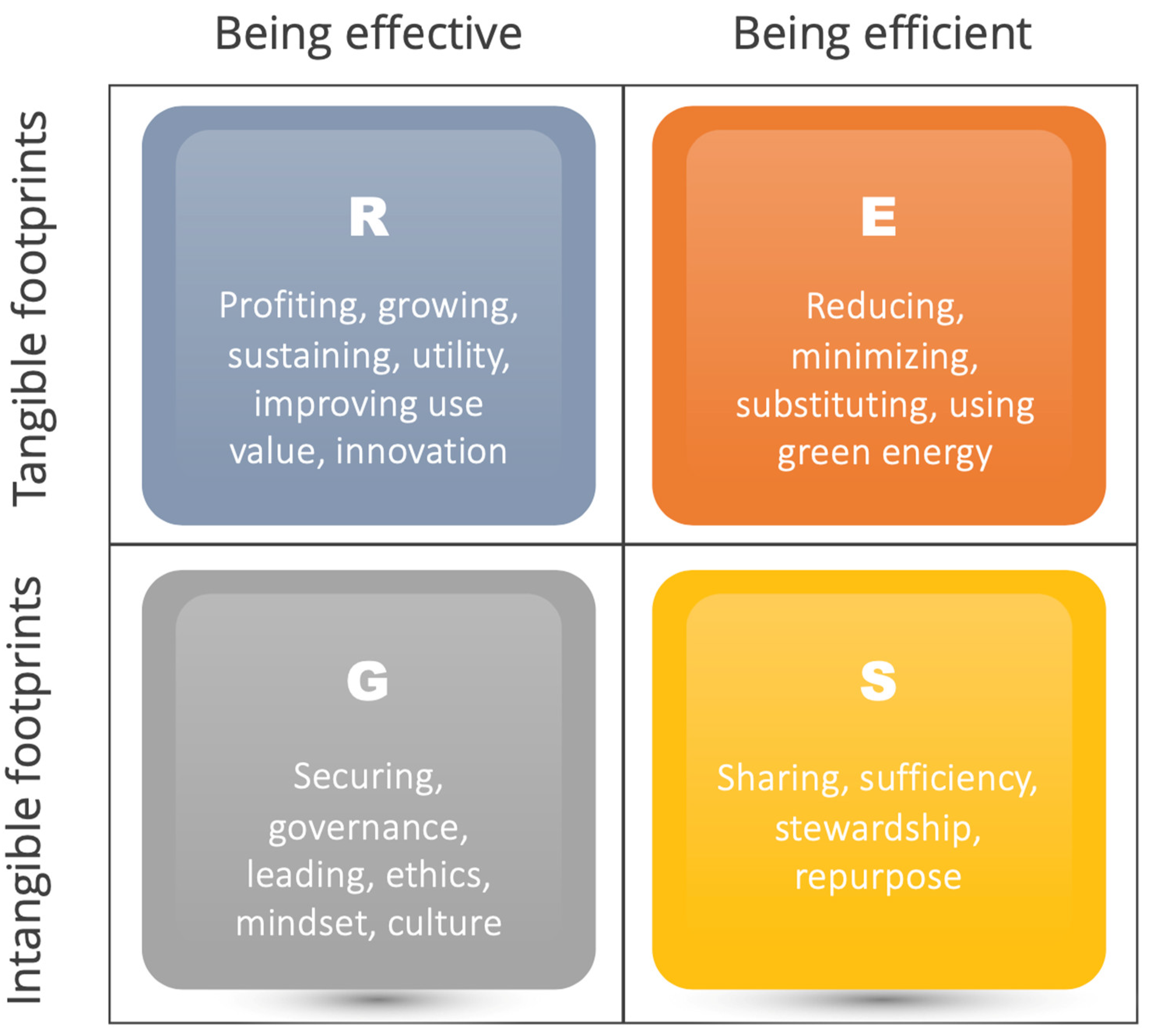

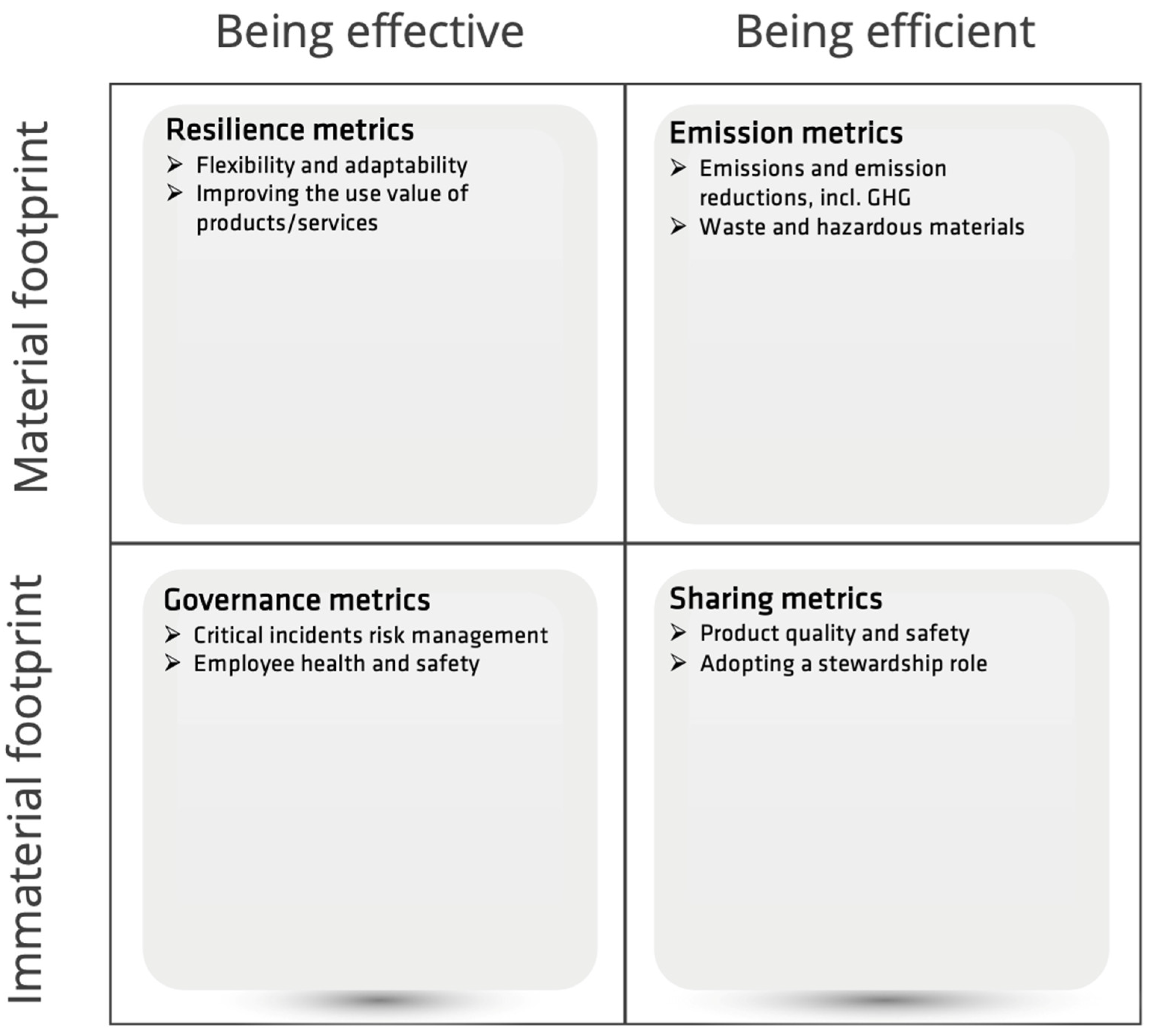

One way to begin the journey towards a more holistic measurement of sustainability is to use the REGS model [

23], which reconciles the CSR and ESG sides of the great sustainability divide. One of the advantages of the REGS model is that it creates common dimensions and boundaries from which it is possible to link CSR and sustainability activities to ESG metrics. In this reconciliation between CSR and ESG, the REGS model identifies four primary ways in which an organisation can pursue sustainability:

Seeking out sustainability as a strategy to stay resilient

An emission-efficiency perspective on becoming more sustainable

Ethical behaviour as a sustainability trait

Sharing and stewardship-based sustainability

Typically, companies pursue several of these strategies simultaneously, and therefore, the REGS model is both a platform to identify relevant performance metrics and indicates the organisation’s focus on sustainability.

Figure 5.

The REGS model23.

Figure 5.

The REGS model23.

4. Research Design and Methods

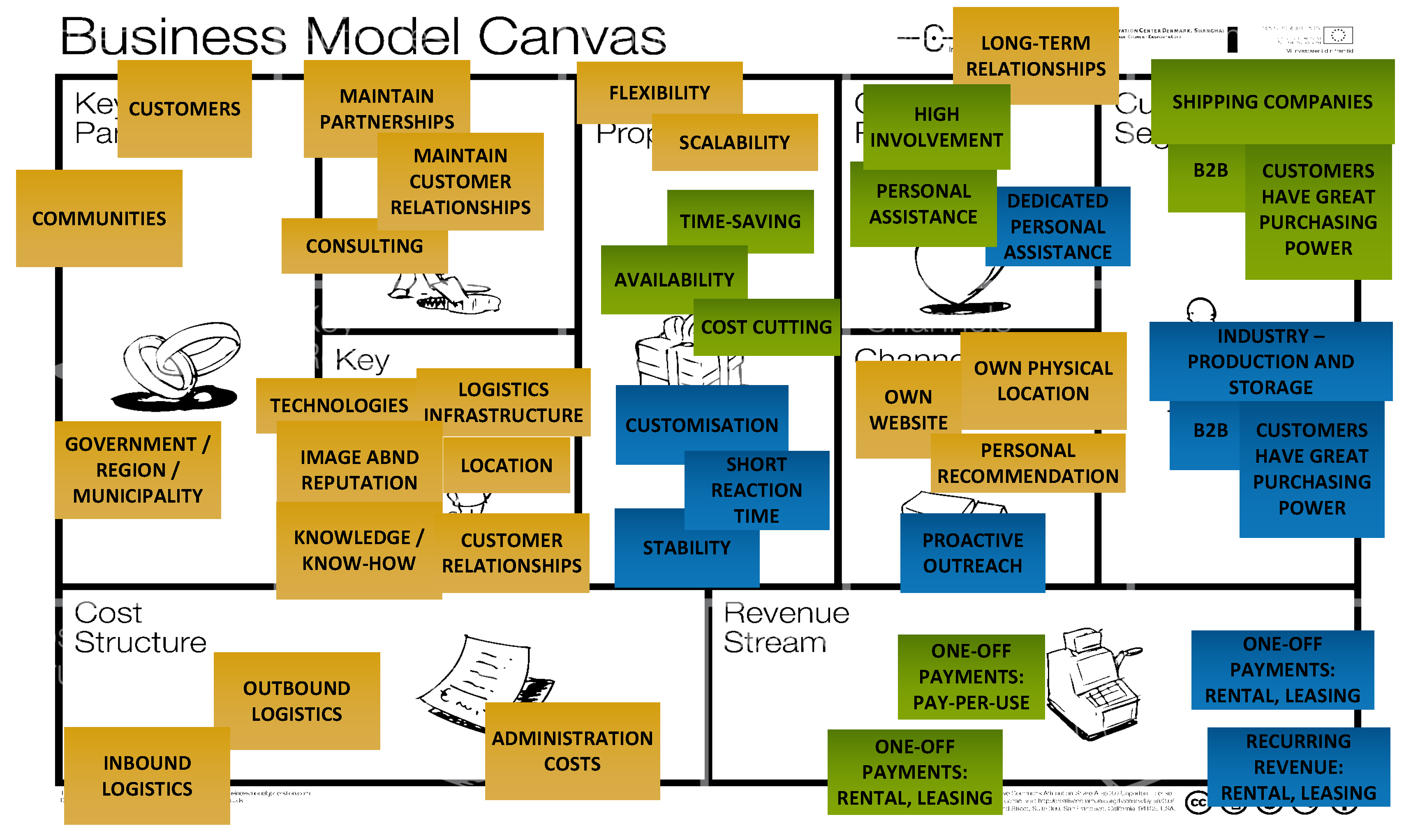

The qualitative case study method is used to explore the link between double materiality and ESG metrics [

24]. The data collection included gathering written documents about the company’s products and service offerings and semi-structured interviews. Initially, various written documents about Port Esbjerg were collected to enhance the understanding and support a preliminary business model mapping using a Business Model Canvas [

25]. Framing the mapping in a Business Model Canvas allowed us to identify missing pieces and information needs requiring further elaboration [

26]. Semi-structured interviews with two internal stakeholders contributed to this [

27], whereafter the interviewees mapped out Port Esbjerg’s current business model using the QUANT tool [

28]. These research steps gave us an overview of several fundamental business model changes in Port Esbjerg in the past 20 years. A final data collection exercise was organised as a participative workshop in which participants from the research team and three participants from the case company discussed the prospective business model configurations of the company, related value drivers, and material opportunities and challenges relating to sustainability and digitalisation.

4.1. Introducing the Case of Port Esbjerg

Port Esbjerg is an international, multimodal transport centre and an important Scandinavian gateway to the whole world. Over 200 companies are gathered at the port, the workplace for 10,000 people and €2.2 billion in total revenue. The port has been a hub for sea transport and trade between Denmark and the rest of the world since 1874. It was decided to build Port Esbjerg in 1868 because Denmark had lost Altona Harbour after the defeat to Prussia in 1864. With the loss of Altona Harbour, Denmark needed a new port to the west. Early on, trade with England was an important business area for the port and today, the port is connected to the whole of Europe via a widely branched route network.

In 1910, it was Denmark's most prominent fishing harbour, with around 600 fishing vessels. Fishing has since experienced a structural change, with many small fishermen being replaced by significant players. From about 2000, that change meant that many small fishing companies moved away from the city, and today, only a few fishing trawlers are left in Esbjerg. They are primarily engaged in catching shrimp, crabs and mussels. At that time, Esbjerg had already established itself as Denmark's oil and gas capital. The Danish Underground Consortium (DUC) found the first traces of oil in the North Sea in 1966, and in 1971, the first oil from the Dan field in the North Sea was picked up. The offshore industry flourished in the North Sea, and several large oil and gas companies established themselves in Esbjerg, which is the base port for the Danish offshore industry.

Around the turn of the millennium, a new business area emerged: offshore wind. Some companies in Esbjerg contributed when the first large-scale Danish offshore wind farm, Horns Rev I, was built in the North Sea in 2002. Since then, the offshore wind industry has developed explosively, and today, the Port of Esbjerg is the leading port in Europe in handling and shipping wind turbines. More than four-fifths of the current offshore wind capacity installed in Europe is shipped from the Port of Esbjerg.

Port Esbjerg is Denmark's leading roll-on, roll-off port, also called a RoRo port. Over 4.5 million tons of goods pass through the port annually.

In 2000, Port Esbjerg passed from state ownership to becoming a municipal self-governing port. From 2003-2014, the port invested around €130 million in new facilities and areas to meet the demand from the offshore industry and pave the way for future growth. In 2013, the new port area Oesthavnen opened on 650,000 m2, primarily used for assembly, testing, and shipping of wind turbines. Since then, Oesthavnen has been expanded in several stages, and from autumn 2017, it will cover an area of one million m2. The total area of Port Esbjerg is today 4.5 million m2, which makes it Denmark's largest port in terms of size. The current focus in Port Esbjerg is on the oil and gas and offshore wind sectors. Concerning the latter, Denmark has so much expertise that the wind industry will have an automatic attachment. This will also lead to infrastructure needs on shipping and transportation and infrastructure requirements relating to Power-to-X facilities.

The competitors to Port Esbjerg are not Danish ports but similar ports in other parts of Northern Europe, such as Hull and Cuxhaven. Port Esbjerg offers various services such as 1) Engineering services, including calculations, drawing, and tasks on existing vessels; 2) Mobilisation, including customising ships for the specific wind turbines to be erected; 3) De-mobilisation of the ships so they are ready for new projects; 4) Rig-services; 5) Decommissioning and; 6) Stacking.

5. Results and Discussion

Port Esbjerg serves the three primary industries: Gas, Oil, and Wind. Across these three industries, revenues are generated from renting out ground and storage space (40%). Here, the customers in the three industries and their suppliers value flexibility and scalability [

29] because their activities typically are project-based. Another 40% of revenues comes from ship- and goods taxes, while the remaining 20% are from crane services and power supply. Port Esbjerg’s customers generally value flexible work and contact hours, fast execution and the possibility of hiring dockworkers to complement fixed staff in peak situations. Oil and Gas have been the cash cows for Port Esbjerg, but given the recent focus and expertise in Wind energy, the harbour is transitioning towards this specialisation. Most of their business, however, is still grounded in Oil and Gas.

The business model analysis led to the identification of two customer segments across the three industries. These two segments are significantly different across the building blocks of the business model canvas, and the value propositions associated with them are also considerably different.

The first segment, shipping companies, predominantly connected via local agents, require a high degree of involvement, interaction and personal assistance. Typically, revenues are made as pay-per-use/service and based on predetermined fixed prices. In instances, they can perform some forms of self-service. The second segment is industrial companies, which can be on-site production companies and companies looking to stock goods before shipping them out. This customer segment requires dedicated personal assistance, and there needs to be more room for self-service. Revenues are one-time payments, pay-per-use and ongoing payments based on predetermined fixed prices.

5.1. Defining the Business Model and Identifying Its Value Drivers

The first step in defining the business model of Port Esbjerg was to use the Business Model Canvas25 to organise the data from the interviews and the secondary data. Combined with this, the output from the QUANT mapping was discussed and confirmed as part of a participative observation process with the respondents from the case company.

Figure 6.

Port Esbjerg’s business model canvas.

Figure 6.

Port Esbjerg’s business model canvas.

The analysis accentuated that three main business model configurations were being applied in the company. These were the Integrator business model, the Leasing business model and the Procurement business model. The Integrator and Procurement business models have their epicentre of value creation in the value configuration [

30] part of the business model canvas. This means that the critical value drivers of these two configurations relate to activities, resources and cost structure management. The Leasing business model has its value creation epicentre in the value capture part of the business model canvas because leasing is also a specific type of revenue stream. In addition to leasing revenues, Port Esbjerg also gets paid in one-time and ongoing payments in both customer segments.

There were slight differences in the value propositions associated with the two customer segments. While it was clear that all customers value a harbour with flexibility in terms of service and scalability regarding leasing more space or hiring more dock workers at short notice, the two customer segments differed on a number of other value propositions. The shipping company segment, which typically interacted with the port through several local agents, also valued aspects of the availability of the service and that interacting with Port Esbjerg saved time in the overall production. This was also connected to the value proposition of saving costs due to the time aspects and transferring otherwise fixed costs into flexible costs. The second customer segment includes industrial companies, manufacturers and companies assisting with functions related to the stocking and storing of goods valued at short reaction times from the port. In addition, it was essential for them to know that Port Esbjerg could and would customise their services and deliver consistent and stable service levels.

The value propositions identify the competitive parameters Port Esbjerg utilises to meet its goals and objectives. Fast execution from order to delivery is an asset that both customer segments desire. In addition, the port competed for the shipping company segment by being good at reducing customers’ costs and being trusted and reliable. Port Esbjerg was competitive in the industrial customer segment due to its customised solutions and the limited availability of its products/services.

It is a pain for the Maritime industry to have idle time because the logistics, equipment and ships require significant investments and much coordination. For example, having "idle" rigs is extremely expensive in the oil and gas industry. For the wind turbine industry, the ability to coordinate equipment shipping to the building of wind parks is a significant risk for multinational wind turbine producers and energy companies. Amongst potential business opportunities for ports such as the one in Esbjerg is to act as a value chain service coordinator, facilitating the direction of customers and workflows.

5.2. Impact, Footprint and Double Materiality

For Port Esbjerg, the green transition is essential in several ways. First, it plays a significant role in the company's future business opportunities. Secondly, it is also a competitive parameter appearing in the port industry. It is expected to influence the maritime industry's choice of partner ports to a much greater extent in the future. Therefore, a strategic focus on enhancing the port's and customers' environmental performance will become an essential competitive parameter for Port Esbjerg. The company is also motivated by opportunities to create a CSR-oriented image by becoming certified in different quality and environmental aspects. This is a part of enhancing the possibility of attractive and long-term partnerships because the green transition and corporate stewardship are seen as a requirement from customers, business partners, employees, and the local community, including the politicians on the company's executive board.

Tightened legal requirements are both an opportunity and a challenge. On the one hand, being at the forefront of environmental and safety regulations in the maritime industry is an opportunity. On the other, such regulations may be at odds with the core operations and possibilities to attract new industrial segments to the port. An example of the latter is the environmental approval of the areas designated to move new wind turbine wings out to sea and the necessity of increasing the depth in the harbour to receive the new jack-up ships, as there must be a minimum depth of 12.5 meters for the new larger ships. In being able to deliver on these environmental aspects, the company is challenged by a need for internal competencies to initiate the green transition, and our analyses reveal that changes are generally a challenge for the organisation. Port Esbjerg sees the intensity of technological development in the industry as insignificant. However, digital transformation may be an overlooked strategic opportunity with the spurring importance of Artificial Intelligence, Blockchains, 6G, digital twins, and other digital potentials in the Metaverse [

31].

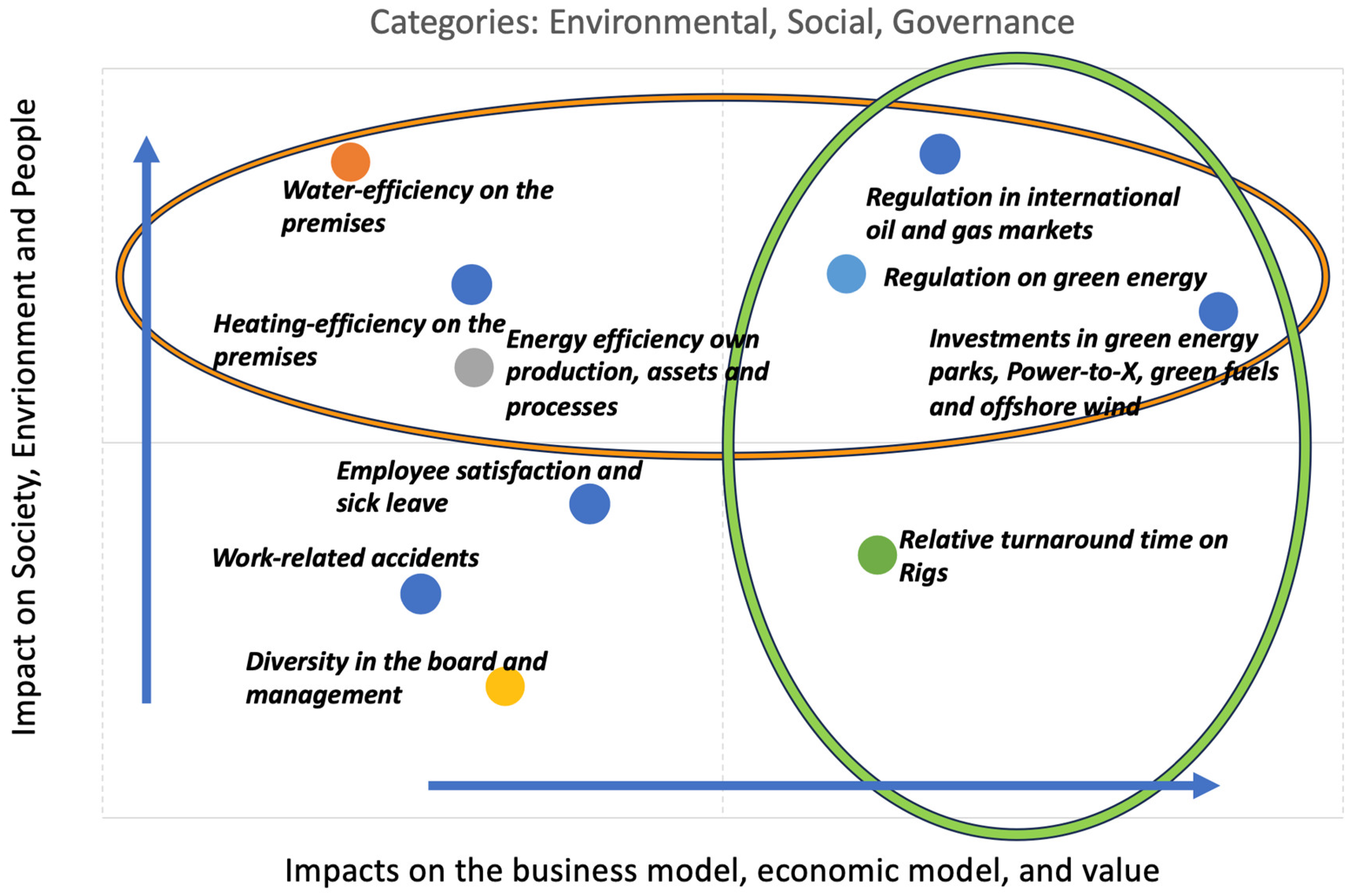

The analysis of the company’s business model, its material impacts, and the financial materiality of its industrial setting identified ten significant material impacts. These were then prioritised according to their materiality degree, as shown in

Figure 7 below.

Combining with the REGS model, the double materiality matrix identifies KPIs in all four quadrants: Resilience, Emissions, Governance and Sharing, as illustrated in

Figure 8.

These ESG metrics represent precisely the objective of the present article, namely, to identify KPIs based on a double materiality assessment. The double materiality assessment performed in the present case study used a business model analysis approach to identify relevant business model configurations for the company’s customer segments. These business model configurations helped to identify value drivers and competitive parameters, which again formed the basis of understanding what the material impacts and footprints of this given organisation comprised. Had this analysis been performed on another port, the results would likely have differed due to strategic focus, competencies, location and corporate culture, to name a few contingent factors.

6. Conclusions

Recent accounting regulation imposes the perspective of double materiality upon sustainability reporting. This is to reconcile the financially oriented ESG perspective with the socially oriented CSR perspective. An orientation towards financial materiality drives the financially oriented ESG perspective. This means that investors, analysts, creditors and the like are focused on how climate risks will affect the future Return on Assets and Investments, denoted ROA and ROI. The socially oriented CSR perspective is concerned with doing good for the planet, the people and society. Therefore, it comprises an impact materiality perspective.

Business models have been shown to hold the promise of increasing the transparency of companies and their value creation [

32], also when that value creation needs to consider aspects of sustainability [

33] such as environmental, social [

34] or governance aspects. Therefore, using the business model as a natural connection between double materiality and ESG metrics and ESG reporting is a natural step

32. Despite this, companies need to be aware of potential problems that arise when prioritising what is material and what is not [

35], what the thresholds for disclosure should be and how such information should be disclosed. This aspect needs more thorough research in the future.

This article contributes to the extant literature on double materiality by illustrating how business models can articulate the missing link between value chain analysis and KPIs based on double materiality assessments through a case study. The practical implications of the paper lie in the combinatorial application of existing strategy and business modelling methods to demystify and solve recent regulatory requirements with which many companies, including small and medium-sized enterprises, are anxious. In conclusion, the case illustrated in this paper also provides evidence that it is possible to turn the recent regulatory requirements from accounting standard-setters from being just another costly reporting exercise into a strategy-improvement routine that can inspire business model innovation and business opportunities for future resilience.

Funding

This research received external funding from the Port of Aalborg, Denmark.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

The author wishes to thank research assistants Sebastian Stück, Peter Thomsen and Brian Andersen for their work on data collection and initial analyses.

Conflicts of Interest

The author declares no conflict of interest.

References

- Nielsen, C. The Impact Report: The Report that all Companies with a Conscience should be Disclosing. Working paper, University of Bologna, 2023a, available at https://ssrn.com/abstract=4594438.

- Zhang, J.; Liu, Z. Study on the Impact of Corporate ESG Performance on Green Innovation Performance—Evidence from Listed Companies in China A-Shares. Sustainability 2023, 15, 14750. [Google Scholar] [CrossRef]

- Lehenchuk, S.; Zhyhlei, I.; Ivashko, O.; Gliszczyński, G. The Impact of Sustainability Reporting on Financial Performance: Evidence from Turkish FBT and TCL Sectors. Sustainability 2023, 15, 14707. [Google Scholar] [CrossRef]

- European Sustainability Reporting Standards, Annex 1, European Commission, Brussels, 31.7.2023, C(2023) 5303 final.

- European Sustainability Reporting Standards, Annex 1, European Commission, Brussels, 31.7.2023, C(2023) 5303 final; clause 39, page 43, italics and bold as in original publication).

- OECD 2021/2022, (https://www.oecd.org/cfe/smes/financing-smes-sustainability.htm).

- Roslender, R. & C. Nielsen, Accounting for the value expectations of customers: re-imagining the Integrated Reporting initiative, 2022, Critical Perspectives on Accounting, Vol. 81, 102244, pp. 1-14.

- Ducoulombier, F. Understanding the Importance of Scope 3 Emissions and the Implications of Data Limitations. The Journal of Impact and ESG Investing 2021, 1, 63–71. [Google Scholar] [CrossRef]

- https://www.climatepartner.com/en/scope-1-2-3-complete-guide and Nielsen, C. The Impact Report: The Report that all Companies with a Conscience should be Disclosing. Working paper, University of Bologna, 2023a, available at https://ssrn.com/abstract=4594438.

- European Commission's proposal for a directive on Corporate Sustainability Due Diligence A comprehensive analysis, 2022. https://corporatejustice.org/wp-content/uploads/2022/04/ECCJ-analysis-CSDDD-proposal-2022.pdf.

- Montemari, M.; Chiucchi, M.S.; Nielsen, C. Designing Performance Measurement Systems Using Business Models. Journal of Business Models 2019, 7, 48–69, page 49. [Google Scholar]

- Nielsen, C.; Lund, M.; Thomsen, P. Killing the balanced scorecard to improve internal disclosure. Journal of Intellectual Capital 2017, 18, 45–62. [Google Scholar] [CrossRef]

- De Cristofaro, T.; Gulluscio, C. In Search of Double Materiality in Non-Financial Reports: First Empirical Evidence. Sustainability 2023, 15, 924. [Google Scholar] [CrossRef]

- European Sustainability Reporting Standards, Annex 1, European Commission, Brussels, 31.7.2023, C(2023) 5303 final; p. 231).

- Global Reporting Initiative, https://www.globalreporting.org.

- Future Fit Business. www.futurefitbusiness.org, Website accessed 3 June 2022.

- The International <IR> Framework, London: International Integrated Reporting Council. 2013.

- Lombardi, P.; Todella, E. Multi-Criteria Decision Analysis to Evaluate Sustainability and Circularity in Agricultural Waste Management. Sustainability 2023, 15, 14878. [Google Scholar] [CrossRef]

- Proposed International Standard on Sustainability Assurance (ISSA) 5000: General Requirements for Sustainability Assurance Engagements. Exposure Draft, August 2023, International Auditing and Assurance Standards Board.

- IFRS S1, IFRS Sustainability Disclosure Standard: General Requirements for Disclosure of Sustainability-related Financial Information. 2023, Delaware: International Sustainability Standards Board.

- Ritala, P., Huotari, P., Bocken, N., Albareda, L. and Puumalainen, K., 2018. Sustainable business model adoption among S&P 500 firms: A longitudinal content analysis study. Journal of cleaner production, 170, pp.216-226.

- Kaplan, R.S. and Ramanna, K., 2021. How to fix ESG reporting. Harvard Business School Accounting & Management Unit Working Paper, (22-005).

- Nielsen, C. The REGS Model. Working paper, University of Bologna, 2023b, available at https://ssrn.com/abstract=4594453.

- Yin, RK. Case study research: Design and methods. sage; 2009.

- Osterwalder, A., & Pigneur, Y. Business model generation: a handbook for visionaries, game changers, and challengers, 2010, John Wiley & Sons.

- Sort, J.; Nielsen, C. Using the Business Model Canvas to Improve Investment Processes. Journal of Research in Marketing and Entrepreneurship 2018, 20(1), 10–33. [Google Scholar] [CrossRef]

- Kvale, S. and Brinkmann, S., 2015. Interviews. Sage.

- Simoni, L.; Schaper, S.; Nielsen, C. Business Model Disclosures, Market Values, and Earnings Persistence: Evidence From the UK. Abacus 2022, 58, 142–173, Montemari, M.; Taran, Y.; Schaper, S.; Nielsen, C.; Thomsen, P.; Sort, J. Business model innovation or Business model imitation–That is the question. Technology Analysis and Strategic Management. 2022, https://doi.org/10.1080/09537325.2022.2034780; Taran, Y.; Nielsen, C.; Thomsen, P.; Montemari, M.; Paolone, F. “Business model configurations: a five-V framework to map out potential innovation routes”. European Journal of Innovation Management 2016, Vol. 19. No. 4, pp. 492-527.). [Google Scholar] [CrossRef]

- Nielsen, C.; Lund, M. Building Scalable Business Models. MIT Sloan Management Review 2018, 59, 65–69. [Google Scholar]

- Taran, Y.; Nielsen, C.; Thomsen, P.; Montemari, M.; Paolone, F. “Business model configurations: a five-V framework to map out potential innovation routes”. European Journal of Innovation Management 2016, 19, 492–527. [Google Scholar] [CrossRef]

- Nielsen, C. Business model innovation in the era of digital technologies and societal challenges. Journal of Business Models 2023, 11, 1–10. [Google Scholar] [CrossRef]

- Nielsen, C.; Roslender, R. Enhancing financial reporting: the contribution of business models. British Accounting Review 2015, 47, 262–274. [Google Scholar] [CrossRef]

- Lüdeke-Freund, F.; Rauter, R.; Pedersen, E.R.G.; Nielsen, C. Sustainable value creation through business models: The what, the who and the how. Journal of Business Models 2020, 8, 62–90. [Google Scholar]

- Roslender, R.; Nielsen, C. Documenting the Contribution of People to Successful Business Model Implementation: An Exercise in Integrated Reporting. Journal of Business Models 2022, 10, 58–66. [Google Scholar] [CrossRef]

- Nielsen, C.; Madsen, M.T. Discourses of transparency in the Intellectual Capital reporting debate: Moving from generic reporting models to management defined information. Critical Perspectives on Accounting, special edition on intellectual capital 2009, 20, 847–854. [Google Scholar] [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).