1. Introduction

Nowadays, global warming and

environmental change emerge as a challenge facing governments and the

United Nations (UN). This can be attributed to the dramatic increase in greenhouse gas (GHG) over the last decade with a rate of increase,

almost twice as that recorded for the last three decades [1]. The impact of such increase has forced governments to design regulations to limit GHG

emissions omitted into the environment. Carbon emission reduction regulations

may comprise carbon tax, carbon offset, carbon caps, or carbon cap-and-trade

policies. These polices have been established by the UN and the European Union

(EU) to reflect the 2030 Agenda for Sustainable Development Goals (SDGs) [2]. In response to the regulations, several

countries made a commitment to limit GHG emissions.

Manufacturing and transportation are among the biggest

sectors in the world that contribute to GHG emissions [3]. For, example, 29% of

total GHG emissions in the U.S. is omitted by transportation activities, which

is recognized as the largest sector that generates GHG emissions [4]. To comply with the GHG

emissions policies established by the governments, the

manufacturers need to focus on sustainable development of logistics

systems that minimize overall emissions. In this regard, adopting

green technology is one of the most effective strategies to

reduce carbon dioxide (CO2) emissions in their supply chain

activities [5,6]. Implementing green technology leads to green production

that reflects environmentally friendly inventions. The

aim is to use renewable energy, reduce energy use, generate lower

emissions, and emphasize awareness of health and safety

concerns. Although green production reduces GHG

emissions dramatically when compared with the regular production, it may

result in higher operating costs [7–9].

Therefore, it is perhaps more cost effective if the

manufacturer uses a hybrid production system that combines green and regular

productions. This entails a mechanism that balances green and regular

production activities considering operating costs.

Supply chain management (SCM) aims to decrease

costs and enhances coordination between supply chain members. One of the main

objectives of such coordination is to achieve economic balance among supply

chain entities. This can be attained by sharing accurate and

timely information towards effective use of recourses. In the classical

two-level supply chain consisting of a vendor and a buyer, the lot sizing

strategy is optimized independently. Whereas a joint economic lot sizing (JELS)

refines traditional independent inventory control methods for a joint strategy

that simultaneously determines optimal production quantity and the number of

shipments per time interval [10–13]. It has

been introduced by many researchers to show that a joint

production and inventory policy is a key determinant in carbon

emission reduction [14–16].

The Vendor-Managed Inventory (VMI) represents a two-echelon supply chain system

that involves information sharing between the vendor and the buyer. Through

collaborative relationship, the vendor adjusts the production-inventory policy

to replenish multiple lot sizes to the buyer subject to the buyer’s information

related to demand and stock-level. Sustainable supply chain cooperation between

a vendor and a buyer emerges as an opportunity beyond cost-sharing efficiency.

In the VMI systems, a collaborative relationship may lead to a more profitable

joint policy, carbon emissions reduction, inventory cost reduction, and

logistic flexibility. This partnership also implies that economic, social

interests, and environmental aspects are nested inside each other, i.e., the

system becoming more sustainable [17–19]. The

highlights of this manuscript are summarized below:

A two-echelon supply chain inventory model is

developed for a VMI system. The developed model considers a

hybrid production system involving green and regular

production methods with optimal allocation fraction of green and regular

productions. The proposed model accounts for carbon

emissions omitted from production and storage activities

related to green and regular produced items along with transportation activity.

The cost function includes penalty charge for exceeding the permissible

emissions limits, however, the system earns revenue by selling excess

quota in the case that the total emissions generated by the system is less than

that of the emission cap, which reflects the cap-and-trade policy. The

mathematical formulation considers that the initial on-hand inventory of the

buyer is zero in the first-time interval, which can be attributed to the fact

that no items have been produced yet. Therefore, two models are developed. The

first model reflects the mathematical formulation of the first cycle, whereas

the second considers subsequent cycles. Each cycle is independent from the

previous one, and consequently, the input parameters can be adjusted to be

responsive to the dynamic nature of demand rate and price fluctuation. Results show that the base closed-form formula of the proposed model generates optimal results with considerable

total system cost reduction when compared with the existing literature. The

optimal production rate generated by the proposed model is the one that minimizes

the emission production function. That is, it generates

the lowest emission possible when compared with the existing literature. For

subsequent cycles, production process starts at the time needed to produce and

deliver the first lot size. Such displacement in time prevents keeping items at

the vendor’s warehouse for extra time that is associated with the consumption

of the last lot that has been delivered to the buyer from previous cycle.

2. Literature Review

The first approach that formulate a joint inventory

model was introduced by Goyal [20]. The author

investigated the vendor production-inventory policy assuming instantaneous

production rate, where a lot-for-lot (LFL) policy is considered for delivering

the lot sizes to the buyer. Banerjee [13]

considered the model of Goyal [20] under the

assumption of a finite production rate. Wahab et al. [21]

proposed inventory models considering emissions costs from transportation

activity. The models determine the optimal production quantity and shipments

frequency for imperfect quality items. Hua et al. [22]

investigated the model for carbon footprints along with carbon emissions

trading. They examined the effects of carbon taxes, carbon cap, and carbon

trade on total cost, order quantity, and carbon emissions. Wangsa [23] examined the JELS model considering industrial

and transport emissions under penalties and incentives. Ben-Daya and Hariga [24] investigated the model where the lead time is a

function of the lot size quantity. Hariga et al. [25]

evaluated the effect of carbon emissions in a multistage supply chain of a cold

item during storage and transportation activities. Gautam et al. [26] studied the model, where the carbon emission is

caused by transportation activity. Halat and Hafezalkotob [27] considered a

multi-stage green supply chain inventory model under four different types of

carbon regulations. They examined the effect of coordinated and non-coordinated

structures on inventory cost and carbon emissions. Khouja and Mehrez [28] investigated

the case when the unit production cost is a function of the production

rate. They assumed that the increase of the

production rate deteriorates the quality of the production process. Eiamkanchanalai and Banerjee [29] considered

the case when the unit production cost is a quadratic function of the production

rate in a single-level inventory model. Ghosh et al. [30] considered strict carbon cap policy on a multi-echelon

supply chain inventory model. They considered emissions related to production,

inventory, and transportation activities. Saga et al. [31] investigated the

model for imperfect production processes and inspection errors. The carbon emissions are related to energy generated from

transportation and production activities, where incentive and penalty policy

are assumed for carbon emission reduction. Huang et al. [32] investigated the

effect of green technology on a two-echelon supply chain with carbon emissions

related to production, transportation, and storage activities along with carbon

taxes, limited total carbon emissions, and cap-and-trade policies.

Chen et al. [33]

provided conditions to reducing emission by modifying order quantities. They

discussed factors affecting emission reduction and cost increase. Kumar and

Uthayakumar [34] considered five different

stock control policies for unequal shipments to the buyer. The cost function

comprises taxes and penalties to reducing emission from production. Zanoni et

al. [35] presented a JELS model with

consignment stock (CS) agreement considering emissions taxes, penalty costs,

and an emission-trading scheme. Jaber et al. [36]

examined the effect of carbon emissions on the JELS inventory models. They

accounted for carbon taxes and penalties, where the production rate is assumed

as a function of the rate of the carbon emission. Turken et al. [37] considered various environmental regulations in

a multiple buyers-single vendor inventory model. Bazan et al. [38] proposed two models that investigate emissions

costs from transportation activity along with energy used for production. The

first model underlies the traditional coordination strategy and the second

underlies CS agreement strategy.

Astanti et al. [39]

considered a VMI model for imperfect quality items and deterioration. The model

is associated with carbon emissions related to transportation and production

operations. Malik and Kim [40] investigated

the model considering defect from production operation, where the production

rate is a function of the carbon emission. Jauhari et al. [41] proposed a VMI model for a

hybrid production system involving green and regular productions. They assumed carbon emissions related to transportation, storage, and production

activities.

The above-cited references are

directly relevant to the proposed model. However, the effects of carbon emission reduction on the JELS models have been

extended in several ways. Many researchers have accounted for cases that are

not limited to, deterministic and stochastic demand, imperfect quality items

related to production process, equal or unequal shipments policies, and

deterioration [42–55]. For

more details on the mathematical modeling of the

JELS and the related research (see [6,10]). Recently, Alamri [56] pointed out that the classical

formulation of the joint VMI system assumed an infinite planning horizon and

ignored the fact that the inventory level at the buyer’s warehouse is zero in

the first cycle since the production process has not yet started. The

author rectified the model of Jaber et al. [36]

and provided a closed-form formula that generates considerably lower total

cost. Two models were developed involving carbon emissions

from production, storage, and transportation activities. The first model

formulates the total cost function for the first cycle, whereas the second

formulates the function of subsequent cycles. The author also showed

that ignorance of the physical transportation cost does not affect the optimal

production quantity. Table 1 below depicts and compares the proposed model with some related

previously published works.

Table 1.

A comparison between the proposed model with respect to some selected previous studies.

Table 1.

A comparison between the proposed model with respect to some selected previous studies.

| No |

Authors |

First cycle |

Adjustable parameters |

Adjustable production rate |

Hybrid production |

Emissions |

Carbon regulations |

| 1 |

Wahab et al. [21] |

|

|

|

|

Transportation |

Carbon tax |

| 2 |

Hariga et al. [25] |

|

|

|

|

Storage, Transportation |

Carbon tax |

| 3 |

Jaber et al. [36] |

|

|

|

|

Production |

Carbon tax, Penalty |

| 4 |

Bazan et al. [38] |

|

|

|

|

Production, Transportation |

Carbon tax, Penalty |

| 5 |

Kumar and Uthayakumar [34] |

|

|

|

|

Production |

Carbon tax, Penalty |

| 6 |

Zanoni et al. [35] |

|

|

|

|

Production |

Carbon tax, Penalty |

| 7 |

Konur [57] |

|

|

|

|

Transportation |

Carbon cap |

| 8 |

Astanti et al. [39] |

|

|

|

|

Production, Transportation |

Carbon tax |

| 9 |

Malik and Kim [40] |

|

|

|

|

Production |

|

| 10 |

Bouchery [58] |

|

|

|

|

Transportation |

|

| 11 |

Jauhari et al. [41] |

|

|

|

|

Production, Transportation, Storage |

Carbon tax |

| 13 |

Alamri [56] |

|

|

|

|

Production, Transportation, Storage |

Carbon tax,Carbon cap |

| 14 |

Proposed model |

|

|

|

|

Production, Transportation, Storage |

Carbon tax, Carbon cap, Penalty |

3. Research Contribution

The mathematical formulation of the classical JELS

inventory model generates an equal production quantity in all

cycles. This can be attributed to the fact that the formulation assumes

an infinite planning horizon. Such assumption suggests a

static production process that is associated with a fixed multiplier in all

cycles including the first cycle. However, the initial on-hand inventory of the

buyer is zero in the first-time interval since no items have been produced yet.

This necessitates a production policy that distinguishes the first cycle from

subsequent cycles. Therefore, two mathematical formulations that reflect the

behavior of the first and subsequent cycles are needed. The first mathematical

formulation derives distinct optimal solution for the first cycle, while the

other generates distinct optimal solution for subsequent cycles. Therefore,

each subsequent cycle can be associated with its distinct input parameters to

ensure that it is independent from the previous one. It is worth noting here

that such consideration overcomes the implicit assumption associated with the

classical formulation that input parameters remain static indefinitely. This is

so, because the classical formulation assumes that the production process for

subsequent cycles begins to generate the same lot sizes equal that of the last

lot that has been produced in previous cycle, which represents the initial

on-hand inventory of the buyer. Accordingly, if the situation warrants and the

decision-maker obliged to deviate from the current policy, then the optimal

production quantity as the classical formulation would then suggest cannot be considered as the optimal

quantity for subsequent cycles.

The proposed model considers the abovementioned

issues and, therefore, allowing for the adjustment of the input parameters for

any subsequent cycle. This also guarantees that the model remains viable and

keeps generating optimal results for subsequent cycles subjected to the

desirable adjustment of the input parameters. In practice, input parameters

encounter adjustment due to many realistic situations. Such adjustment may

occur because of external competitiveness and/or internal

challenges or as a response to the dynamic nature of demand rate and/or

price fluctuation. Moreover, implementing of a new policy due to acquiring new

knowledge, periodic review applications, and machine maintenance scheduling

activities may trigger situations that force the decision-maker to consider a

suitable adjustment of the input parameters [59,60].

In this paper, we propose a VMI inventory model

that investigates the effect of carbon emissions together with the

implementation of green technology. The developed model

considers a hybrid production system that simultaneously focuses on

green and regular production methods with optimal allocation

fraction of green and regular productions. In this model, emissions are

released from production and storage activities related to

green and regular produced items along with transportation activity. The

carbon emissions are relatively associated with carbon taxes and penalties for

exceeding the allowable emissions limits. The model also

assumes that the system earns revenue by selling excess quota in the case

that the total emission generated by the system is less than that of the emission

cap, which reflects the cap-and-trade policy. Unlike traditional modeling,

hybrid production implies simultaneous production fractions associated with

green and regular productions, where each is associated with its distinct released

emission level. In this case, the demand is satisfied from a collection of

green and regular produced items. This method enables decision-maker to

trade-off between the production cost and emissions. For subsequent cycles, the

production process starts at the time needed to produce and deliver the first

lot size. Such displacement in time prevents keeping items at the vendor’s

warehouse for extra time that is associated with the consumption of the last

lot that has been delivered to the buyer.

Transportation service that is associated with

inventory mathematical modeling is either the Truck Load (TL) or Less than

Truck Load (LTL) services. An TL service applies such that the cost incurs for

the whole truck [57,61,62]. Whereas an LTL

service refers to the case when the cost is paid per unit of item that is

transported. To entice manufacturers, logistics companies often offer the option

for utilizing both LT and LTL services. Therefore, the decision-maker needs to

allocate the fraction based on the capacity of the truck that renders LT

transportation service or a mixed services of LT and LTL minimizes the

transportation cost. That said, the allocation fraction is associated with a

positive integer multiplier representing the number of trucks (TL) required for

each shipment along with the remaining quantity that needs to be transported by

(LTL) service. The remainder of this paper is organized as follows:

In section 4, the cost components related to the

joint hybrid production system are presented to formulate the first and

subsequent cycles. Illustrative examples and special cases that reflect the

application of the joint model are given in Section

5. Section 6 represents model

overview and managerial insights. In Section 7,

the concluding remarks and further research are provided. Finally, the holding

cost functions related to the joint hybrid model are given in Appendix A, whereas the solution procedure for

the first and subsequent cycles are given in Appendix

B.

4. Formulation of the Joint Model

4.1. Notations

The list of notations used to develop the joint hybrid

inventory system are given in Table 2

below:

Table 2.

List of notations used to develop the hybrid green and regular production joint model.

Table 2.

List of notations used to develop the hybrid green and regular production joint model.

|

denotes regular production

|

|

refers to the first cycle and refers to the subsequent cycles |

|

Buyer’s demand rate (units/unit time) |

|

The time to produce units |

|

The lead time (order point) to deliver the order quantity of size |

|

The time to consume units |

|

Cycle time |

|

The time to consume units |

|

The idle time before commencing the production process for subsequent cycles |

|

CO2 emissions from electricity (ton CO2/kWh) |

|

Buyer’s energy consummation for keeping items in storage (kWh/unit/unit time) |

|

Vendor’s energy consummation for keeping items in storage (kWh/unit/unit time) |

|

CO2 emissions generated by the buyer’s facility (ton CO2/unit) |

|

Buyer’s CO2 emissions tax ($/ton CO2) |

|

The truck capacity (units/truck) |

|

Fixed transportation cost per truck ($/truck) |

|

Fixed transportation cost per unit ($/unit), where |

|

Product’s weight (ton/unit) |

|

Distance from the freight to the vendor (km) |

|

Distance from the vendor to the buyer (km) |

|

The amount of fuel consumed by an empty truck (liters/km) |

|

The amount of fuel consumed by a truckload (liters/km/ton) |

|

Variable transportation cost associated with fuel consumption ($/liter) |

|

CO2 emissions from truck fuel (ton CO2/liter) |

|

CO2 emissions generated by the vendor’s facility (ton CO2/unit) |

|

The total amount of CO2 emissions (ton CO2/unit), where |

|

CO2 emissions limit (ton CO2/unit time) |

|

CO2 emissions penalty that the system incurs for exceeding emissions limit ($ /unit time) |

|

CO2 emissions cap (ton CO2), where |

|

Vendor’s CO2 emissions tax ($/ton CO2) |

|

Vendor’s CO2 emissions revenue earned for selling excess quota ($/ton CO2) |

|

Vendor’s CO2 emissions tax for transportation ($ /ton CO2) |

|

CO2 emissions function parameter for production (kg CO2 unit time2/unit3) |

|

CO2 emissions function parameter for production (kg CO2 unit time/unit2) |

|

CO2 emissions function parameter for production (kg CO2/unit) |

|

The per unit time cost to run the machine independent of production rate ($/unit time) |

|

The increase in unit machining cost associated with the increase of one unit in production rate ($ unit time/unit2); |

|

Buyer’s ordering cost |

|

Vendor’s set-up cost |

|

Vendor’s holding cost |

| |

|

| Decision variables: |

|

|

Vendor’s coordination multiplier, where and integer |

|

Vendor’s allocation fraction of green production, where |

|

Production rate (units/unit time), where |

|

Order quantity (units/unit time), where |

|

Number of trucks required to deliver , where and integer |

4.2. Assumptions

The following assumptions have been considered:

A

single item is manufactured by a combination of green and regular production

methods.

The

demand rate is satisfied from a collection of green and regular produced items.

Any

order size of

placed at time

arrives the

buyer just prior to the depletion of the on-hand inventory of that same period.

In the first period of the first cycle, the buyer’s initial inventory is zero

because no items have been manufactured yet. Accordingly, the vendor delivers

the first lot size,

once

it has been accumulated from green and regular produced items by time

and, will

reach the buyer after a transportation time

.

Therefore, shortages are allowed in the first period of the first cycle and

fully backordered by time

.

Thus, we restrict that

in

the first cycle, i.e., the second replenishment will reach the buyer before the

depletion of the on-hand inventory of the first period, i.e., no later than

time

.

4.3. The Mathematical Formulation of the Joint Model

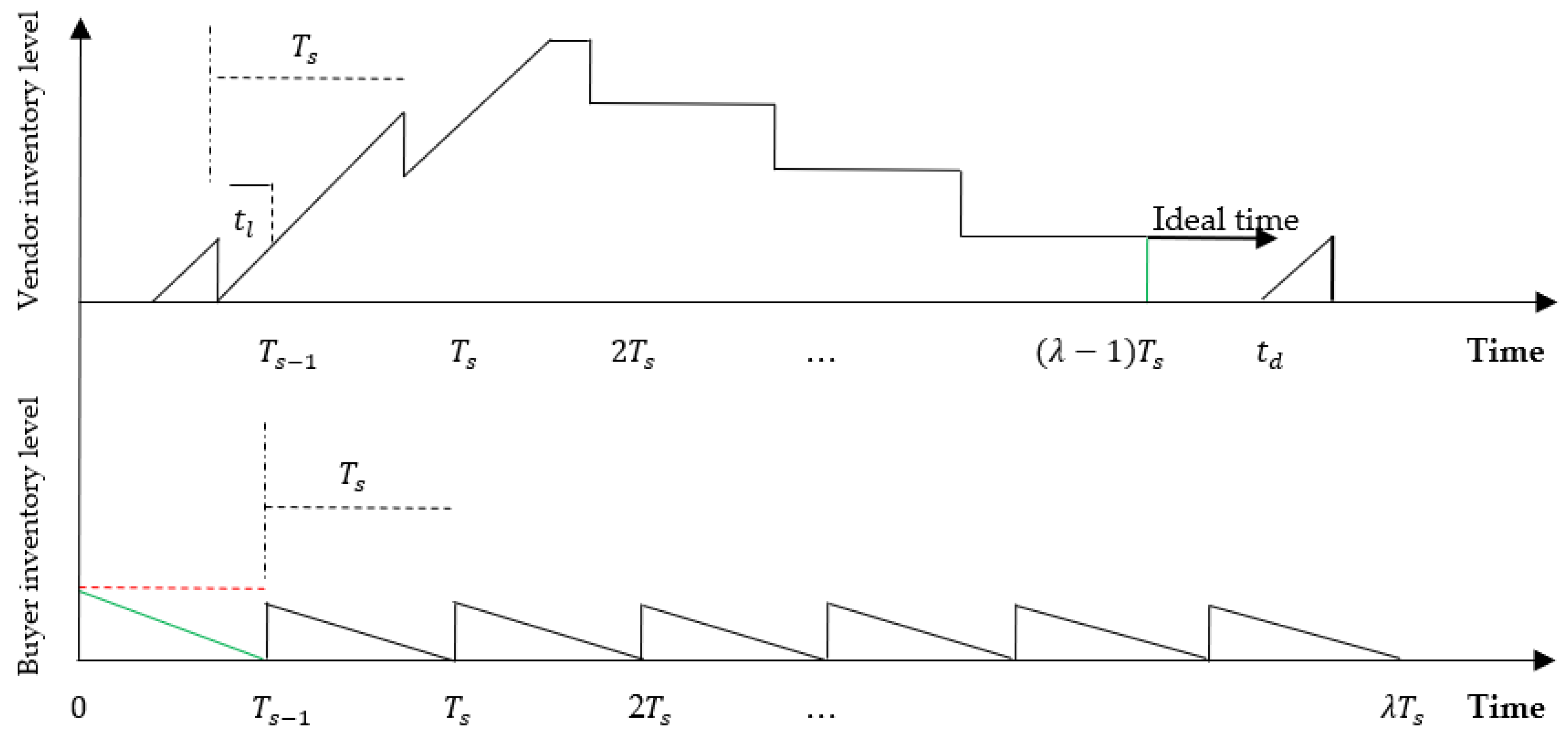

Figures 1 and 2

depict, respectively, inventory variation of the proposed joint model for a

tow-echelon supply chain consisting of a vendor and a buyer for the first and

subsequent cycles. At the beginning of the first cycle, the production process

of green and regular produced items starts at a rate . At time , the vendor delivers the first lot of size units that have been accumulated from green and

regular produced items. This quantity satisfies demand and shortages that has

been accumulated during time . As can been seen from Figures 1 and 2, holding cost are applied for lots for both the vendor and the buyer. This is so,

because the vendor must deliver two lots by time to avoid shortages for the second period.

Therefore, the first lot that has been replenished at time reaches the buyer at time to satisfy demand and shortages. Whereas the second

reaches the buyer just before the inventory level becomes zero, i.e., by time . In the subsequent cycles, the production process

starts at time . That is, the production time is displaced until

the time required to produce and deliver the first lot.

Figure 1.

Inventory variation for a coordinated two-echelon supply chain in the first cycle

Figure 1.

Inventory variation for a coordinated two-echelon supply chain in the first cycle

Figure 2.

Inventory variation for a coordinated two-echelon supply chain in the subsequent cycles

Figure 2.

Inventory variation for a coordinated two-echelon supply chain in the subsequent cycles

Figure 3 represents the

direct and indirect CO2 emissions generated by the buyer and the

vendor activities. The buyer experiences direct CO2 emissions, which

are related to amount of GHG emissions generated for keeping items in storage.

Whereas the vendor experiences both direct and indirect CO2 emissions.

The direct CO2 emissions occur due to production and storge

activities for both green and regular produced items. The vender is responsible

for transportation activity, which is associated with direct and indirect CO2

emissions. The direct CO2 emissions related to transportation

involves product’s weight. Whereas the indirect CO2 emissions

related to transportation includes shipments frequency, distance travelled from

freight to vendor, distance travelled from vendor to buyer, and fuel

consumption.

Figure 3.

Classification of CO2 emissions of the joint hybrid model for the vendor and the buyer.

Figure 3.

Classification of CO2 emissions of the joint hybrid model for the vendor and the buyer.

4.3.1. The Mathematical Formulation of the First Cycle

The

per unit time holding cost function (see

Appendix

A) for

the base model depicted by

Figure 1 (first cycle) is

given by:

Below we introduce the relevant elements related to

the inventory model with environmental effect:

In addition to the holding cost that is applied for

the buyer’s base model represented by the first three terms of Equation (1),

the buyer incurs an ordering cost per lot size. The buyer also encounters a

cost related to the emissions generated during inventory storage of items

because of warehousing activities, which depends on the buyer’s inventory level

[27,39,58,63]. Considering the above and

Equation (1), the per unit time total cost function for the buyer in the first

cycle is given by:

The CO

2 emissions generated by the buyer

is given by:

Similarly, in addition to the holding cost that is

applied for the vendor’s base model, the vendor incurs a set-up cost as well as

the following transportation and carbon emissions costs:

As that of the buyer, the vendor also incurs a cost

related to the emissions generated during inventory storages, which depend on

the vendor’s inventory levels of green and regular produced items.

Transportation is associated with direct and

indirect carbon emissions. The direct emission level underlies the wight of the

product transferred to the buyer. The indirect emission level underlies the

shipments frequency, distance travelled from freight to vendor, distance

travelled from vendor to buyer, and fuel consumption [58].

Transportation is also associated with a cost for delivering each lot size to

the buyer. In this regard, the vendor may deliver each lot size using a

combination of LTL and TL services. Hence, let

represents the quantity with identical transportation

cost by either service. In addition, let

denotes the portion of truck capacity that needs

to be delivered using either TL or LTL. If

, then it is more cost effective for the vendor to

use a combination of LTL and TL services, i.e.,

. Alternatively, if

then it is more beneficial for the vendor to use TL

service, i.e.,

trucks. Accordingly, we set

if the TL service is utilized and

if a mixed policy of LTL and TL services is

implemented. Therefore, the physical and emissions transportation costs per

unit time for the vendor are given by:

The vendor has two production options, i.e., green,

and regular production, where each generates distinct emission level. In this

case, is produced by the green production method with a

production rate and the rest, i.e., is produced by the regular production method with

a production rate . This implies that the first lot size , is delivered to the buyer once both quantities

accumulate the sum of units, i.e., at time . Accordingly, the mathematical modeling of the

duration time for holding inventories in storage for both methods is identical

with that of the base model except that each method is associated with its distinct

input parameters.

The production costs associated with the green

production are higher than those of the regular one. This can be attribute to

the fact that the green production is equipped with machine tools that are

based on green technology, and consequently,

. Here, we assume that

decreases (increases) as production rate increases

(decreases). For example, the more items that are accomplished by the worker,

the lower the wage per unit time is paid by the company. Similarly, as the

production rate increases, tools and rework cost increase due to the increase

off defective items resulting from tool wear [64].

Therefore, the production costs per unit time are, respectively, given by:

Carbon emission released from production is

represented by a function that links the production rate with the rate of emission

[36,38]. However, the vendor invests in the green

production facility aiming to reduce CO

2 emissions. Therefore, the

vendor reaps the benefit of such investment that renders produced items greener,

and consequently, the vendor reduces the cost incurred for emissions. The emissions

costs for green and regular productions per unit time are, respectively, given

by:

According to Fandel [65]

and Narita [66], machines constructed for

green production generate a lower level of emission due to the use of green

technology, and consequently,

. Thus, the CO

2 emissions generated by

the green and regular facilities are, respectively, given by:

Note that the emissions related to transportation

applies only once, therefore it is included either for or .

In addition, the joint system either earns revenue

from selling excess quota or incurs a penalty cost for exceeding the allowable

limits [36,38]. The penalty cost is given by:

where

, if and , otherwise, where .

The cap-and-trade regulations is given by:

where

, if and , otherwise.

Now, considering the above and Equation (1), the

total cost functions per unit time for the vendor in the first cycle for green

and regular productions are, respectively, given by:

Note that the physical and emissions transportation

costs, cap-and-trade revenue, and penalty cost apply only once, therefore they

are included either for

or

. Therefore, the per unit time total joint cost

function in the first cycle considering Equations (2), (13) and (14) is given

by:

For simplicity, let

. Thus, Equation (15) can be rewritten as:

4.3.2. The Mathematical Formulation of the Subsequent Cycles

The per unit time holding cost function (see Appendix A) for the base model depicted by Figure 2 (subsequent cycles) is given by:

Therefore, by a similar above-discussed approach

for the first cycle, the per unit time total joint cost function for subsequent

cycles is given by:

From Equation (18) we note that the CO

2

emissions generated by the buyer in subsequent cycles is:

From Equation (18), the CO

2 emissions

generated by the green and regular facilities in subsequent cycles are,

respectively, given by:

Our goal is to minimize given by Equations (16) and (18) subject to

integer values of .

Therefore, the goal is to solve the following

optimization problem.

From Equations (A.51) and (A.52) (see Appendix B),

and

are, respectively, given by Equations (23) and (24)

below:

As can be seen, Equations (23) and (24) still

depend on and , therefore, no closed form formulation have been

found for and . Thus, their optimal values can be obtained using

numerical search from which Equations (23) and (24) are minimized subject to and . Then, from Equations A.49 (A.50) (see Appendix B) we can find , if , then we set in Equations 16 (18). Otherwise, i.e., , then we set in Equations 16 (18). Note that represents the integer value of plus the fraction .

5. Numerical Examples

In this section, we present examples and special

cases to illustrate the application of the proposed model in different sittings.

The problems have been coded in MATLAB for the set of

input parameters that are listed in Tables 3 and

4 below. Table 3 shows the input

parameters illustrating the application of the proposed model, whereas Table 4 represents the emissions penalties

schedule for exceeding allowable limits.

Table 3.

Input parameters for Example 1.

Table 3.

Input parameters for Example 1.

|

|

|

|

|

|

| 2500 |

2000 |

0.0008 |

0.0004 |

1.6 |

2 |

| USD/month |

USD/month |

USD month /unit2

|

USD month /unit2

|

USD/ton CO2

|

USD/ton CO2

|

|

|

|

|

|

|

| 0.0026 |

0.064 |

0.32 |

0.01 |

2 |

0.75 |

| ton CO2/liter |

liters/km/ton |

liters/km |

ton/unit |

USD/ton CO2

|

USD/liter |

|

|

|

|

|

|

| 80 |

300 |

400 |

5 |

4 |

3 |

| km |

km |

ton CO2/month |

USD/unit/month |

USD/unit/month |

USD/unit/month |

|

|

|

|

|

|

| 0.08 |

2 |

2 |

1000 |

4000 |

1200 |

| month |

USD/ton CO2

|

USD/ton CO2

|

units/month |

units/month |

units/month |

|

|

|

|

|

|

| 1200 |

800 |

400 |

500 |

300 |

2 |

| USD/set-up |

USD/set-up |

USD/order |

USD/truck |

units/truck |

USD/unit |

|

|

|

|

|

|

| 0.0000003 |

0.0012 |

1.4 |

0.0000005 |

0.0008 |

1.5 |

| ton CO2 month 2/unit3

|

ton CO2 month /unit2

|

ton CO2/unit |

ton CO2 month 2/unit3

|

ton CO2 month /unit2

|

ton CO2/unit |

|

|

|

|

|

|

| 1.44 |

1 |

1.44 |

0.0005 |

|

|

| kWh/unit/month |

kWh/unit/month |

kWh/unit/month |

ton CO2/kWh |

|

|

| |

|

|

|

|

|

Table 4.

CO2 emissions penalties scheme.

Table 4.

CO2 emissions penalties scheme.

|

(ton CO2/unit time) |

Penalty scheme |

(USD /unit time) |

| 1 |

400 |

|

0 |

| 2 |

500 |

|

500 |

| 3 |

600 |

|

1000 |

| 4 |

700 |

|

1500 |

| 5 |

800 |

|

2000 |

| 6 |

800 |

|

2500 |

5.1. Example 1

In

this example, we consider the set of values that are presented in

Tables 3 and 4 to observe the behavior of the system.

Table 5

depicts the effect of the hybrid production system on the first and subsequent

cycles and summarizes the optimal values of .

Table 5.

Optimal results for a hybrid production system for example 1.

Table 5.

Optimal results for a hybrid production system for example 1.

| First cycle |

|

|

|

|

|

|

|

Mixed strategy |

| |

0.686 |

2635.15 |

755.76 |

2 |

2 |

516.74 |

12,163.86 |

|

| Subsequent cycles |

|

|

|

|

|

|

|

|

| |

0.647 |

3427.72 |

1053.79 |

1 |

3 |

586.39 |

13,197.82 |

|

In the first cycle, the optimal production quantity of green and regular items is , which satisfies demand and shortages that have been accumulated in the first period, with . The optimal production rate is , with (68.6%) that comes from green production facility and the remaining fraction is produced in the regular production facility. Note that the demand is satisfied from a collection of green and regular produced items. From Equation (A.49), , where This is so, since . Therefore, indicates the fraction of truck capacity that needs to be transported by LTL service. In this case, . That is, we set and in Equation (16). The total cost per month is , with GHG emissions being generated due to production, storage, and transportation activities equals to . The vast majority (71.82%) of the emissions is related to regular production activities () even though less than 32% of the production quantity has been produced in the regular facility. Note that this amount does not include emissions related to transportation activity (recall Equation (10)). The amount of GHG emissions related to green production is , with being released due to transportation activity. Whereas the emissions related to storage activity of green and regular produced items at both warehouses are negligible, i.e., and , respectively. The emissions related to keeping items at the buyer’s warehouse is . Note that , i.e., .

In subsequent cycles, the optimal production quantity of green and regular items is 1053.79 , which satisfies demand in the first period, with and . That is, 64.7% of the demand is satisfied from green production and the remaining quantity is fulfilled from regular production with a production rate equals to . From Equation (A.50), we have . Thus, , which represents the fraction of truck capacity that needs to be transported by LTL service. Therefore, , from which we set and in Equation (18). The total cost per month is , with GHG emissions being generated from production, storage, and transportation activities equals to . The GHG emissions associated with regular production activities is , which represents 76.25% of the total emissions released into the environment. As that of the first cycle, this amount does not comprise emissions related to transportation activity (recall Equation (21)). The amount of GHG emissions related to green production is , with being generated from transportation activity. The amount of GHG emissions associated with keeping items in storage at both warehouses are and 0.066 , for green and regular produced items, respectively. Whereas the emissions related to keeping items at the buyer’s warehouse is . The system incurs penalties costs for exceeding the emissions allowance limit (), which occurs in both the first and subsequent cycles. That is, (recall Table 4).

Note that

, i.e., the second cycle behaves differently and, therefore, it is independent form the first cycle. That is, the proposed model ensures that

holds for subsequent cycles, which implies that the input parameters can be adjusted in any cycle. However,

if the input parameters remain identical for the subsequent cycle (e.g., the third cycle). This also can be observed in both, the mathematical formulation and

Figure 1 and

Figure 2. That is, the associated costs of the last lot that has been delivered to the buyer from the previous cycle (the first lot that appears (shaded) for subsequent cycle for illustrative purposes only) are ignored in cycle

but are considered in cycle

(the same previous cycle) (Alamri [

56]). Note also that the constraint

does not apply for subsequent cycles. In this case, the constraint

is sufficient.

Note that if the emission cap increased from its current allowance limit (), to , then the cap-and-trade regulations is applied, and the system earns revenue by selling excess quota. This revenue is set equal to . Note that in this case, the system also does not incur a cost applies for penalty charge. Therefore, , where the first term refers to the total cost of the first cycle of example 1 and the second term represents the penalty charge, whereas the third term refers to the revenue gained by selling excess quota. The same applies for subsequent cycles if the allowance limit increases from to .

It is worth noting here that the beginning of production time for subsequent cycles is displaced, i.e., the re-start-up production time is . This is key in the mathematical formulation and has two main roles. The first one stems from the fact that this displacement reduces the holding cost. That is, it prevents keeping items at the vendor’s warehouse for extra time that is associated with the consumption of the last lot that has been delivered to the buyer. The second ensures each subsequent cycle is independent from the previous one. Therefore, allowing for the adjustment of the input parameters for any subsequent cycle as a response to the dynamic nature of demand and/or price fluctuation. The latter also guarantees that the model remains viable and keeps generating optimal results for subsequent cycles subjected to the desirable adjustment of the input parameters. Further discussion related to this point is given in the next example.

5.2. Example 2

In this example, we observe the behavior of the system if the demand rate increases in the third cycle from 1000 units to 1200 units. The rest of the input parameters remain as that listed in

Table 3 and

Table 4. Such adjustment is important since the demand rate or any other input parameters are subject to adjustment due to many realistic situations. Moreover, such adjustment constitutes evidence that the proposed model remains as a viable solution and continues to generate optimal values that reflect the adjustment that might occur for subsequent cycles.

Table 6 shows the behavior of the optimal values of

when the demand rate increases in the third cycle from 1000 units to 1200 units. Note that the fourth raw of Table 6 represents the optimal values that were already derived for the subsequent cycles in Example 1, which now, is referred to as the second cycle.

Table 6.

Optimal results for example 1 when the demand rate increased to 1200 units in the third cycle.

Table 6.

Optimal results for example 1 when the demand rate increased to 1200 units in the third cycle.

| First cycle |

|

|

|

|

|

|

|

Mixed strategy |

| |

0.686 |

2635.15 |

755.76 |

2 |

2 |

516.74 |

12,163.86 |

|

| Second cycle |

|

|

|

|

|

|

|

|

| |

0.647 |

3427.72 |

1053.79 |

1 |

3 |

586.39 |

13,197.82 |

|

| Subsequent cycles |

|

|

|

|

|

|

|

|

| |

0.654 |

3102.41 |

667.01 |

2 |

2 |

663.81 |

16,776.23 |

|

A comparison between the results in Table 6 reveals that increasing the demand rate decreases both the optimal production quantity and the production rate. However, increasing the demand rate slightly increases the proportion of green production, i.e., it increased from

to

. The optimal production quantity is

, which is lower than that of the second cycle. The total cost per month is

, which can be attributed to the fact that,

(

Table 2). That is, the system encounters an additional penalty charge of

. The system also experiences an extra cost associated with the increase in the amount of emissions generated by the system compared with that of the second cycle. It is worth noting here that the production rate decreased from

to

even though the emissions increased from

to

. This result is consistent with the finding in Alamri [

56], i.e., the amount of GHG emissions generated by the system increases (decreases) as the demand rate increases (decreases). That is, fixing the production rate and increasing (decreasing) the demand rate increases (decreases) the amount of GHG emissions generated by the system. Note that the production rate that minimizes the emission production function is that of

and

. Given the input parameters of

Table 3, then

. Therefore, any deviation from

, i.e., increasing (decreasing)

increases the emissions generated by each production function. Note that from

Table 6, we have

. On the other hand, Equations (16) and (18) indicate that the demand rate is linked with each production function. In this case, increasing (decreasing) the demand rate increases (decreases) the emissions generated by the system, which is reflected in this example (Example 2). Therefore, we can deduce that the lower the demand rate the lower the emissions, which implies fewer multiple penalties charge associated with the boundaries of emissions (

Table 4).

As can be seen, the proposed model is a viable solution and generates optimal values that reflect the adjustment of the demand rate, i.e., the validity and robustness of our model are ascertained.

5.3. Example 3

In this example, we repeat example 1 to investigate the behavior of the model in different settings for sensitivity analysis purposes subject to the set of values as listed in

Table 3 and

Table 4. Namely, the direct input parameters that affect the behavior of the model are considered and the results are summarized in

Table 7 below.

Table 7.

Sensitivity analysis for optimal results for a hybrid production system in different settings.

Table 7.

Sensitivity analysis for optimal results for a hybrid production system in different settings.

| Parameter |

First cycle |

|

|

|

|

|

|

|

Mixed strategy |

|

|

0.697 |

2644.95 |

789.51 |

2 |

2 |

503.01 |

12,037.37 |

|

| Subsequent cycles |

|

|

|

|

|

|

|

|

| |

0.666 |

3083.21 |

636.70 |

2 |

2 |

537.83 |

13,000.38 |

|

|

First cycle |

|

|

|

|

|

|

|

Mixed strategy |

| |

0.648 |

3221.85 |

1189.00 |

1 |

4 |

566.89 |

12,213.34 |

|

| Subsequent cycles |

|

|

|

|

|

|

|

|

| |

|

0.648 |

3403.90 |

961.65 |

1 |

3 |

582.27 |

12,773.99 |

|

|

First cycle |

|

|

|

|

|

|

|

Mixed strategy |

| |

0.655 |

3166.62 |

1235.95 |

1 |

4 |

499.75 |

9,862.99 |

|

| Subsequent cycles |

|

|

|

|

|

|

|

|

| |

|

0.647 |

3423.41 |

1015.44 |

1 |

3 |

526.92 |

12,323.63 |

|

|

First cycle |

|

|

|

|

|

|

|

Mixed strategy |

| |

0.701 |

2476.57 |

767.30 |

2 |

2 |

508.67 |

11,968.41 |

|

| Subsequent cycles |

|

|

|

|

|

|

|

|

| |

|

0.649 |

3367.31 |

1050.79 |

1 |

3 |

577.90 |

13,050.79 |

|

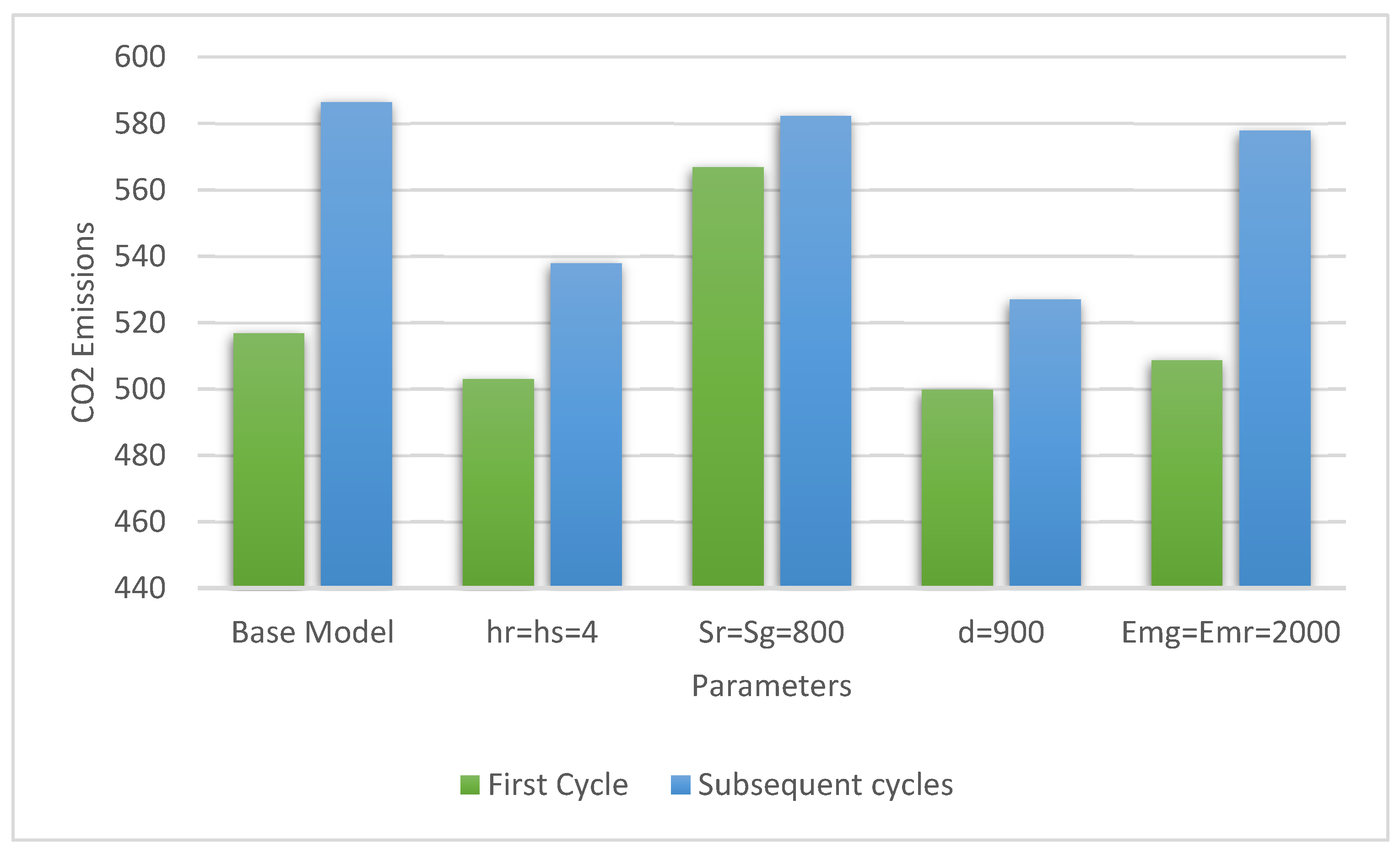

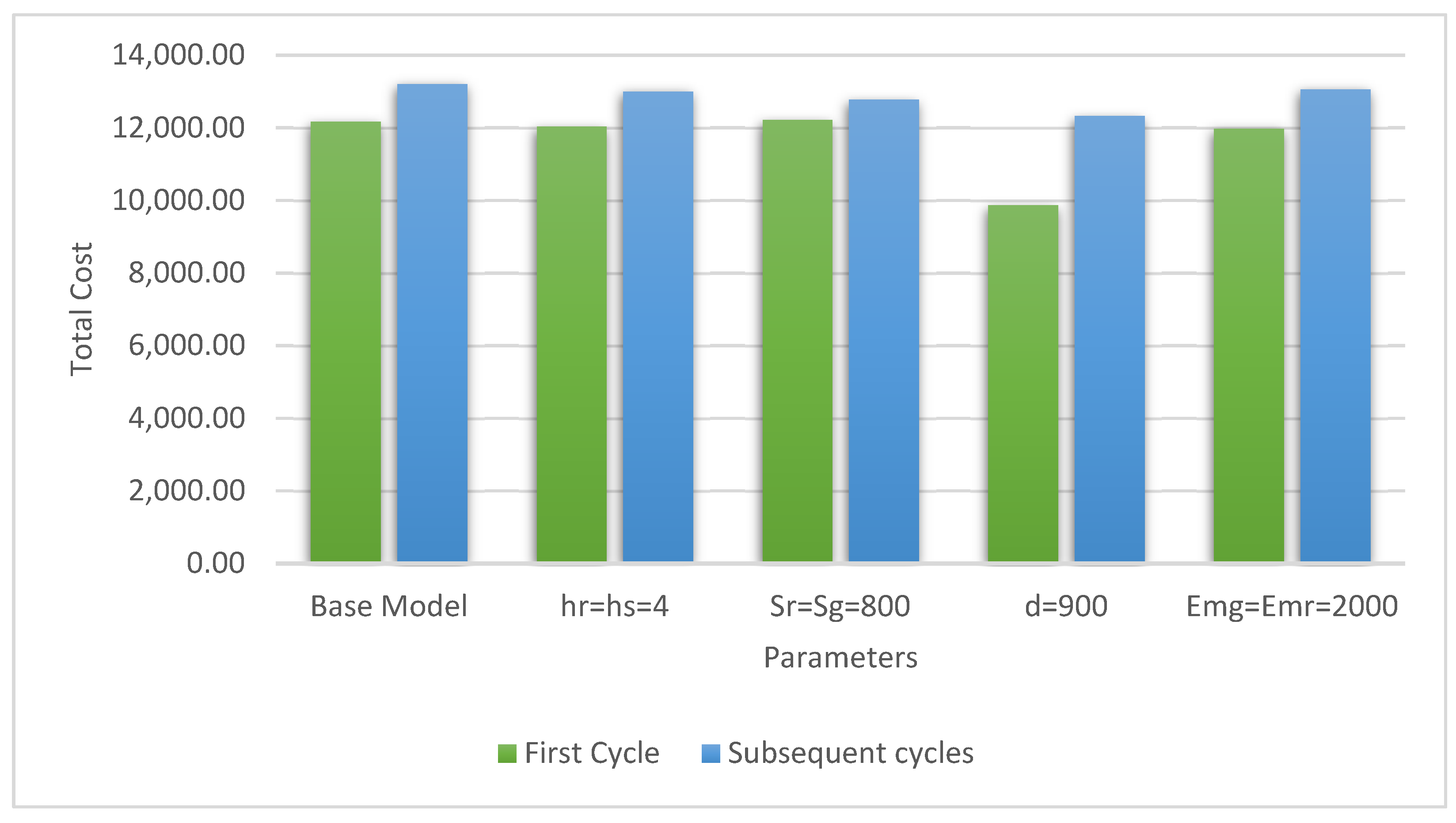

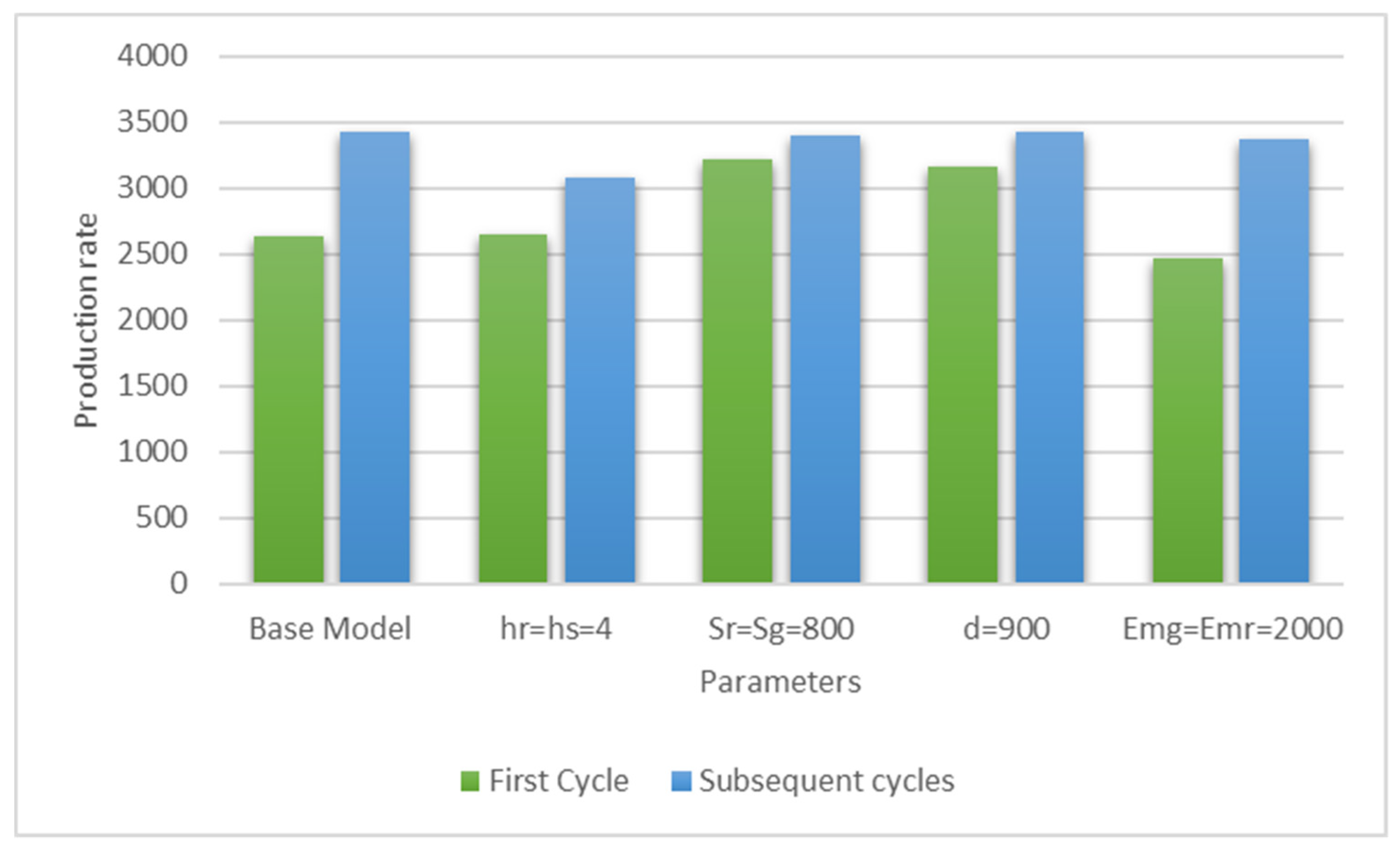

Table 7 shows that the model behaves as expected in all cases. For instance, when the vendor allocates equal holding costs for the green and regular produced items, i.e.,

, then the model generates grater quantity in the first cycle than that of example 1, which is associated with lower total minimum cost. For subsequent cycles, both the total minimum cost per month and the optimal production quantity are lower than those of example 1. The total amount of GHG emissions generated by the system in both the first and subsequent cycles are lower than those of example 1. The production rate is higher (lower) in the first cycle (subsequent cycles) than that of example 1. The allocation fraction of green production in both the first and subsequent cycles is higher than that of example 1. For equal set-up costs, i.e.,

, the per unit time total minimum cost, total amount of GHG emissions, production rate, and the optimal production quantity in the first cycle (subsequent cycles) are higher (lower) than those of example 1. The allocation fraction of green production in the first cycle is lower than that of example 1 and slightly increases in subsequent cycles.

Decreasing the demand rate from 1000 units to 900 units decreases the total minimum cost per month and total amount of GHG emissions in the first and subsequent cycles. The optimal production quantity and the production rate increase (decrease) in the first cycle (subsequent cycles) compared with those of example 1. The allocation fraction of green production decreases in the first cycle and remains identical in subsequent cycles when compared with that of example 1. Finally, when the per unit time costs to run the machine independent of production rate are equal, i.e., , the model behaves differently. In particular, the per unit time total minimum cost, total amount of GHG emissions, and production rate in the first and subsequent cycles are lower than those of example 1. Whereas the allocation fraction of green production in the first and subsequent cycles is higher than that of example 1. The optimal production quantity in the first cycle (subsequent cycles) is higher (lower) than that of example 1.

As can be seen from the results obtained in

Table 5,

Table 6 and

Table 7, the total amount of emissions generated by the system increases (decreases) with demand rate.

Figure 4,

Figure 5,

Figure 6,

Figure 7 and

Figure 8 depict and compare the behavior of the model on the optimal production quantity, the amount of CO

2 emissions released by the system, the per unit time total cost, production rate, and the allocation fraction of green production for the joint system in different settings.

5.4. Example 4

In this example, we investigate the behavior of the model for regular production option to observe the advantageous associated with the hybrid production scenario and how much saving the system may gain if a hybrid production option is considered. In this case we set

in Equations (16) and (18) where the rest of the input parameters remain as that listed in

Table 3 and

Table 4.

Table 8 depicts the behavior of the model for regular production option.

Table 8.

Optimal results for regular production scenario for example 1 when

Table 8.

Optimal results for regular production scenario for example 1 when

| First cycle |

|

|

|

|

|

|

Mixed strategy |

Saving due to hybrid production |

| |

2000.00 |

652.06 |

2 |

2 |

1900.08 |

19,745.98 |

|

38.40% |

| Subsequent cycles |

|

|

|

|

|

|

|

|

| |

1200.00 |

385.46 |

4 |

1 |

1261.00 |

19,765.70 |

|

33.23% |

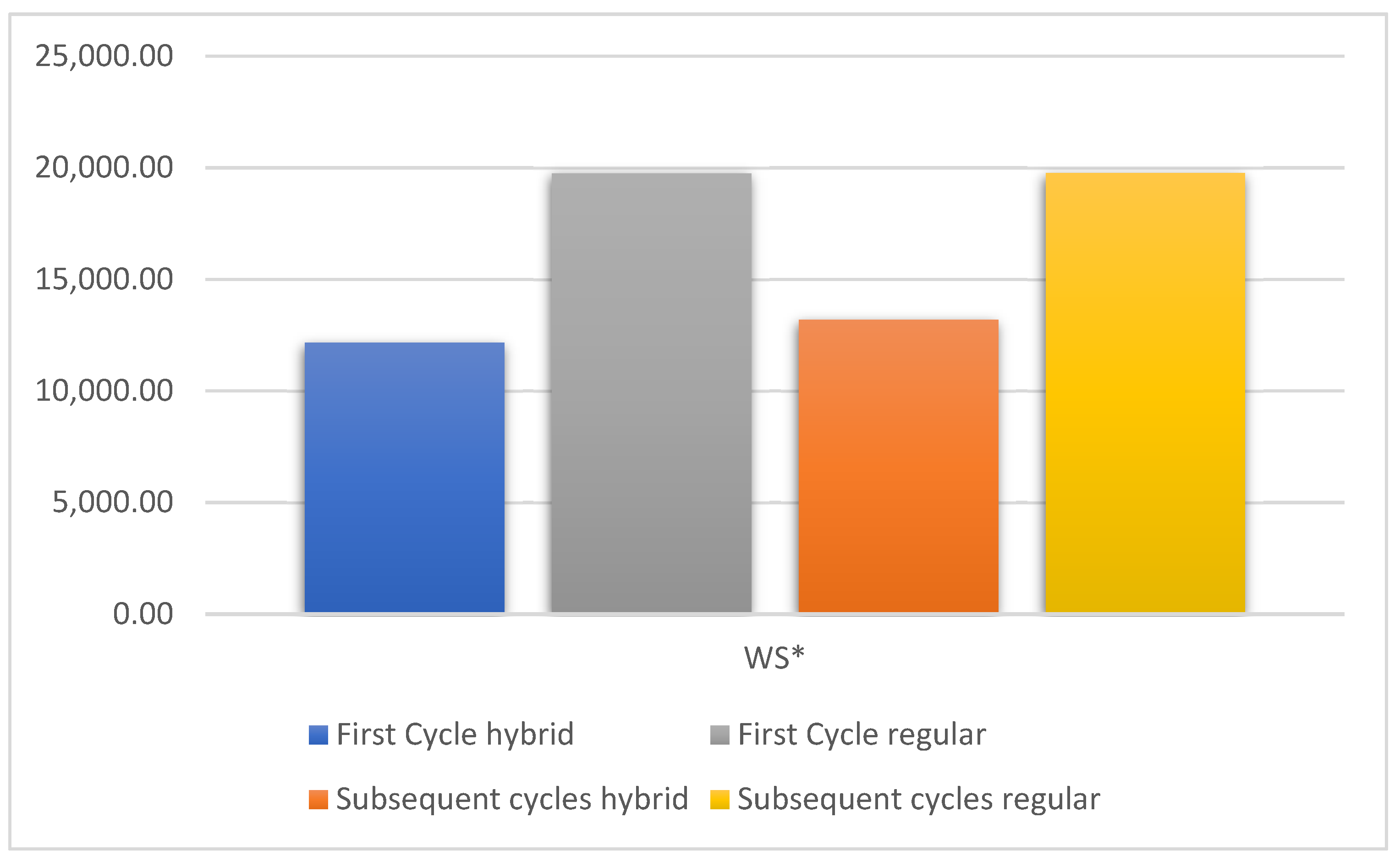

A comparison between

Table 5 and

Table 8 indicates that adopting a hybrid production mode decreases the GHG emissions dramatically, which in turn reduces the per unit time total cost by 38.40% (33.23%) in the first cycle (subsequent cycles). From

Table 8 we can see that the production rate and the optimal production quantity are less than those of hybrid production (

Table 5). The total cost per month is

in the first cycle and

in the subsequent cycles, which can be attributed to the fact that,

(

Table 4). That is, the system encounters an additional penalty charge of

in all cycles due to the dramatic increase of GHG emissions generated by the regular production. The GHG emissions related to storage and transportation activities are negligible, i.e.,

and 0.81

in the first cycle and subsequent cycles, respectively.

Figure 9 and

Figure 10 show and compare the behavior of the model on the optimal production quantity, the amount of CO

2 emissions released by the system, the per unit time total cost, and production rate, with respect to hybrid and regular production options.

5.5. Example 5

In this example, we compare our model for the regular production scenario with the existing literature. In particular, the models of Jaber et al. [

36] and Bazan et al. [

38] since they have been extensively adopted by many researchers in the field. Therefore, only the input parameters that were considered by [

36,

38] have been addressed for comparison purposes and the rest of the values have been omitted from our regular model. The input parameters as that of example 3 (page 76) in Jaber et al. [

36] are:

.

Table 9 represents CO

2 emissions penalties scheme similar to that suggested by Jaber et al. [

36].

Table 9.

CO2 emissions penalties scheme for comparison example.

Table 9.

CO2 emissions penalties scheme for comparison example.

|

(ton CO2/unit time) |

Penalty scheme |

(USD /unit time) |

| 1 |

220 |

|

0 |

| 2 |

330 |

|

1000 |

| 3 |

440 |

|

2000 |

| 4 |

550 |

|

3000 |

| 5 |

600 |

|

4000 |

| 6 |

600 |

|

5000 |

The per unit time total cost functions that are presented for comparison purposes are, respectively, given by:

Equation (25) represents the model of the regular production in the first cycle, which is a modified version of Equation (23). Note that the lead time, i.e.,

as this time is not considered by Jaber et al. [

36] and Bazan et al. [

38]. Similarly, Equation (26) represents the model of the regular production in the subsequent cycles, which is a modified version of Equation (24). Equation (27) represents the models of Jaber et al. [

36] and Bazan et al. [

38]. It is clear to deduce that only the first term of Equations (25), (26), and (27) affects the optimal production quantity. In addition, the first term of Equations (25) and (26), is identical with that of Alamri [

56], from which we conclude that the work of Alamri [

56] constitutes a special case of our proposed model.

Now, by implementing the values determined above in Equations (25), (26), and (27), we obtain the following results:

The per unit time total minimum cost generated by Equation (27) is

with a production rate equals to

when

. The amount of GHG emissions generated is

. Therefore, no penalty charge is imposed though the emissions tax is

. These results are identical with that of Jaber et al. [

36] and Bazan et al. [

38]. The per unit time total minimum cost generated by Equation (25) is

with an optimal production rate quals to

when

. The amount of GHG emissions generated by our regular production model is

. Similarly, no penalty charge is imposed though the emissions tax is

. Note that the production rate that minimizes the emissions production function is that of

(recall example 2). The optimal production quantity is

, from which

. For subsequent cycles, the minimum total cost generated by Equation (26) is

with an optimal production rate quals to

when

and

. The amount of GHG emissions is identical with that of the first cycle, i.e.,

with no penalty charge is imposed and the system incurs an emissions tax of

. As that of the first cycle, the production rate that minimizes the emissions production function is that of

.

As illustrated above, our model generates an optimal production quantity with a dramatic cost reduction. That is, in the first cycle the cost generated by our model is less than that of Jaber et al. [

36] and Bazan et al. [

38] by

. For subsequent cycles, Equation (26) generates an optimal production quantity with a cost less than that of Jaber et al. [

36] and Bazan et al. [

38] by

. This, indeed, constitutes a considerable saving and may interest both practitioners and researchers. Therefore, our model achieves three main features: (1) The proposed model generates optimal results associated with lower minimum total system cost; (2) The initial on-hand inventory at the buyer’s warehouse is zero in the first cycle, which reflects real-life settings and implies that the subsequent cycle is independent from the first one. Moreover, each subsequent cycle can be associated with its distinct input parameters to ensure that it is independent from the previous one (see also Example 2). This is key in the mathematical formulation, which implies that the input parameters can be adjusted for subsequent cycles; (3) The optimal production rate generated by our model is the one that minimizes the emissions production function. That is, the model generates the lowest emissions possible when compared with the existing literature.

6. Summary of implications and managerial insights

Unlike the classical JELS inventory model that generates an equal production quantity in all cycles, the proposed model distinguishes the first cycle from subsequent cycles.

Two mathematical models that reflect the behavior of the first and subsequent cycles are developed. The first model derives distinct optimal solution for the first cycle, while the other generates distinct optimal solution for subsequent cycles.

The initial on-hand inventory of the buyer is zero in the first-time interval since no items have been produced yet.

Each subsequent cycle can be associated with its distinct input parameters to ensure that it is independent from the previous one.

The proposed model allowing for the adjustment of the input parameters for any subsequent cycle.

The model remains viable and keeps generating optimal results for subsequent cycles subjected to the desirable adjustment of the input parameters as a response to the dynamic nature of demand rate and/or price fluctuation. Such adjustment may also reflect situations such as implementing of a new policy due to acquiring new knowledge, periodic review applications, or machine maintenance scheduling activities that may force decision-maker to consider a suitable adjustment of the input parameters.

The developed model considers a hybrid production system that simultaneously focuses on green and regular production methods with optimal allocation fraction of green and regular productions.

The proposed model enables decision-maker to utilize a mixed transportation policy that combines LT and LTL services, which reduces transportation cost.

The demand is satisfied from a collection of green and regular produced items.

The proposed model enables decision-maker to trade-off between the production cost and emissions.

For subsequent cycles, production process starts at the time needed to produce and deliver the first lot size. Therefore, prevents keeping items at the vendor’s warehouse for extra time that is associated with the consumption of the last lot that has been delivered to the buyer, which implies further cost reduction.

Emissions are released from production and storage activities related to green and regular produced items along with transportation activity.

The carbon emissions are relatively associated with carbon taxes and penalties for exceeding the allowable emissions limits. However, the system earns revenue by selling excess quota in the case that the total emissions generated by the system is less than that of the emission cap, which reflects the cap-and-trade policy.

The base closed-form formula of the proposed model produces optimal results with considerable total system cost reduction, i.e., 33.59% (16.13%) in the first cycle (subsequent cycles) when compared with existing literature.

The optimal production rate generated by the proposed model is the one that minimizes the emissions production function. That is, it generates the lowest emissions possible when compared with the existing literature.

Adopting a hybrid production method decreases the GHG emissions dramatically, which in turn reduces the per unit time total cost by 38.40% (33.23%) in the first cycle (subsequent cycles) when compared with regular production.

The results indicate that the total amount of emissions generated by the system increases (decreases) with demand rate.

7. Conclusion and Further Research

This study developed a VMI model for a JELS policy under a multi-level emission-taxing scheme. Two mathematical formulations that reflect the behavior of the first and subsequent cycles are developed. This implies that each model generates distinct optimal solution associated with distinct fixed multiplier in all cycles to ensure that each cycle is independent from the previous one. Therefore, the model for subsequent cycles remains viable and keeps generating optimal results subjected to the desirable adjustment of the input parameters. Such adjustment is a response to the real-life settings that may reflect situations such as the dynamic nature of demand rate and/or price fluctuation, implementing of a new policy due to acquiring new knowledge, periodic review applications, or machine maintenance scheduling activities that may force decision-maker to consider a suitable adjustment of the input parameters.

This study investigated the effect of carbon emissions together with the implementation of green technology. The developed model considers a hybrid production system that simultaneously focuses on green and regular production methods with optimal allocation fraction of green and regular productions. In this model, emissions are released from production and storage activities related to green and regular produced items along with transportation activity. The carbon emissions are relatively associated with carbon taxes and penalties for exceeding the allowable emissions limits. The model also assumes that the system earns revenue by selling excess quota in the case that the total emissions generated by the system is less than that of the emission cap, which reflects the cap-and-trade policy. Hybrid production implies simultaneous production fractions associated with green and regular productions, where each is associated with its distinct released emissions level. In this case, the demand is satisfied from a collection of green and regular produced items.

This study enables decision-maker to trade-off between the production cost and emissions. For subsequent cycles, production process starts at the time needed to produce and deliver the first lot size, i.e., it prevents keeping items at the vendor’s warehouse for extra time that is associated with the consumption of the last lot that has been delivered to the buyer, which implies further cost reduction. In addition, the system reaps further cost reduction by utilizing a mixed transportation policy that combines LT and LTL services.

Illustrative examples emphasized the significant impact of the first cycle on the optimal results, i.e., the first cycle is associated with distinct optimal values. The viability, validity, and robustness of the proposed model are ascertained, where the optimal values are divergent for the case that the input parameters are adjusted. Sensitivity analysis is evaluated in different realist situations to highlight some important opportunities that may interest decision-makers. The results emphasized the significant impact of the demand rate on the total amount of emissions generated by the system, which increases (decreases) with demand rate. The results also emphasized the significant impact of green production on emissions. That is, the higher the allocation fraction of green production the lower the total amount of emissions generated by the system, i.e., the system becoming more sustainable. One of the main findings is that the total system cost generated by the base closed-form formula of the proposed model is considerably lower than that of the existing literature, i.e., 33.59% (16.13%) lower in the first cycle (subsequent cycles) when the regular production method is assumed. Moreover, the optimal production rate generated by the proposed model is the one that minimizes the emissions production function. That is, it generates the lowest emissions possible when compared with the existing literature. Adopting a hybrid production method not only decreases the GHG emissions dramatically, but also reduces the per unit time total cost by 38.40% (33.23%) in the first cycle (subsequent cycles) when compared with regular production.

Further research may include the formulation of imperfect quality items in the production process where each lot size is subjected to a 100 per cent inspection. Extending the model accounting for general functions of time of demand and deterioration rates is another interesting line of further research. The formulation of a closed-loop supply chain model involving manufacturing, remanufacturing, along with transportation under GHG emissions is also possible. Furthermore, it seems plausible to consider the formulation of single-vendor multi-buyers inventory model along with different emissions trading schemes. Finally, the proposed mathematical formulation can be further adopted to rectify existing VMI models or accounting for further inquiry related to VMI mathematical modeling.

Funding

This research received no external funding.

Conflicts of Interest

The author declares no conflict of interest.

Appendix A

Below we formulate the average inventory functions for the joint model.

Buyer’s average inventory function.

As can be seen from figure 1, the vendor delivers the first lot size, once it has been accumulated from green and regular produced items by time and, will reach the buyer after a transportation time .

Note that shortages are allowed in the first period of the first cycle and fully backordered by time . In this case, the maximum inventory level for the buyer is units, where .

In the first period, the buyer’s average inventory function is given by:

Figure 1 indicates that the buyer’s initial inventory level is zero and the last lot produced by the vendor represents the last lot consumed by the buyer. Therefore, we have

From Equation (A.1) and

Figure 1, the average inventory function for the remaining lots is given by:

Therefore, the buyer average inventory function is given by:

From which, the per unit time holding cost function is given by:

Note that Equation (A.2) is identical with that of Alamri [

56].

Vendor’s average inventory function.

From

Figure 1, the average inventory function for green production is given as follows:

Therefore, the per unit time holding cost function for green production is given by:

Similarly, the per unit time holding cost function for regular production is given by:

Note that for

, Equations (A.4) and (A.5) reduce to that of Alamri [

56].

Buyer’s average inventory function.

As can be seen from

Figure 2, the buyer average inventory function is that of the EOQ. Therefore, the per unit time holding cost function is given by:

Vendor’s average inventory function.

From

Figure 2, the average inventory function for green production is given as follows:

Therefore, the per unit time holding cost function for green production is given by:

Similarly, the per unit time holding cost function for regular production is given by:

Note that for

, Equations (A.7) and (A.8) reduce to that of Alamri [

56].

Appendix B

The goal here is to derive the solution procedure that render achieves the unique and global optimal solution.

Solution Procedure

According to Alamri [

56], ignoring the physical transportation cost does not affect the optimal production quantity, therefore, Equations (16) and (18) can be rewritten as:

Any existing solution of

is a minimizing solution to

if its Hessian matrix

is positive definite calculated at any critical point

of

given by Equation A.11 (A.12) below:

where

Equation , if only the first two terms of Equation (A.14) are considered, then Equation if . Recall that and , then Equation . Note that and , from which Equation .

Similarly, for

we have

Equations , if only the first term of Equation () is considered, then Equation if . Recall that and , from which Equation .

Moreover, by Stewart [

67], Balkhi and Benkherouf [

68], Emet [

69], and Alamri [

70], the symmetric matrix

is positive definite if

Therefore, if conditions A.33-A.36 (A.37-A.40) hold, then they constitute the sufficient conditions under which the Hessian matrix is positive definite.

Thus, any existing solution of for which conditions A.33-A.36 (A.37-A.40) hold is the unique and global optimal solution to .

The necessary conditions for the minimum cost for

are:

Similarly, the necessary conditions for the minimum cost for

are:

Hence, from Equations (A.49) and (A.50),

and

are, respectively, given by Equations (A.51) and (A.52) below:

The minimum and maximum values for can be found by setting the first partial derivative of Equations (A.51) and (A.52) with respect to equals to zero, where infeasible values of are omitted to get:

where

, are respectively, given by:

For the subsequent cycles.

References

- Wang, X.J.; Choi, S.H. Impacts of Carbon Emission Reduction Mechanisms on Uncertain Make-To-Order Manufacturing. Int J Prod Res 2016, 54, 3311–3328, doi:10.1080/00207543.2015.1106606. [CrossRef]

- Benjaafar, S.; Li, Y.; Daskin, M. Carbon Footprint and the Management of Supply Chains: Insights from Simple Models. IEEE transactions on automation science and engineering 2012, 10, 99–116. [CrossRef]

- Pachauri, R.K.; Reisinger, A. Climate Change 2007: Synthesis Report. Contribution of Working Groups I, II and III to the Fourth Assessment Report of the Intergovernmental Panel on Climate Change. Climate Change 2007. Working Groups I, II and III to the Fourth Assessment 2007.

- EPA. Carbon Pollution from Transportation. U.S. Environmental Protection Agency; 2022. Available online: https://www.epa.gov/transportation-air-pollution-and-climate-change/carbon-pollution-transportation#transportation.

- Damert, M.; Feng, Y.; Zhu, Q.; Baumgartner, R.J. Motivating Low-Carbon Initiatives among Suppliers: The Role of Risk and Opportunity Perception. Resour Conserv Recycl 2018, 136, 276–286. [CrossRef]

- Das, C.; Jharkharia, S. Low Carbon Supply Chain: A State-of-the-Art Literature Review. Journal of Manufacturing Technology Management 2018, 29, 398–428. [CrossRef]

- Phouratsamay, S.-L.; Cheng, T.C.E. The Single-Item Lot-Sizing Problem with Two Production Modes, Inventory Bounds, and Periodic Carbon Emissions Capacity. Operations Research Letters 2019, 47, 339–343. [CrossRef]

- Gong, X.; Zhou, S.X. Optimal Production Planning with Emissions Trading. Oper Res 2013, 61, 908–924. [CrossRef]

- Hong, Z.; Chu, C.; Yu, Y. Dual-Mode Production Planning for Manufacturing with Emission Constraints. Eur J Oper Res 2016, 251, 96–106. [CrossRef]

- Utama, D.M.; Santoso, I.; Hendrawan, Y.; Dania, W.A.P. Integrated Procurement-Production Inventory Model in Supply Chain: A Systematic Review. Operations Research Perspectives 2022, 100221. [CrossRef]

- Devy, N.L.; Ai, T.J.; Astanti, R.D. A Joint Replenishment Inventory Model with Lost Sales. In Proceedings of the IOP Conference Series: Materials Science and Engineering; IOP Publishing, 2018; Vol. 337, p. 12018.

- Dong, Y.; Xu, K. A Supply Chain Model of Vendor Managed Inventory. Transp Res E Logist Transp Rev 2002, 38, 75–95. [CrossRef]

- Banerjee, A. A Joint Economic-lot-size Model for Purchaser and Vendor. Decision sciences 1986, 17, 292–311. [CrossRef]

- Schaefer, B.; Konur, D. Economic and Environmental Considerations in a Continuous Review Inventory Control System with Integrated Transportation Decisions. Transp Res E Logist Transp Rev 2015, 80, 142–165. [CrossRef]

- Hovelaque, V.; Bironneau, L. The Carbon-Constrained EOQ Model with Carbon Emission Dependent Demand. Int J Prod Econ 2015, 164, 285–291. [CrossRef]

- Bouchery, Y.; Ghaffari, A.; Jemai, Z.; Dallery, Y. Including Sustainability Criteria into Inventory Models. Eur J Oper Res 2012, 222, 229–240. [CrossRef]

- Gunasekaran, A.; Irani, Z.; Papadopoulos, T. Modelling and Analysis of Sustainable Operations Management: Certain Investigations for Research and Applications. Journal of the Operational Research Society 2014, 65, 806–823. [CrossRef]

- Taleizadeh, A.A.; Soleymanfar, V.R.; Govindan, K. Sustainable Economic Production Quantity Models for Inventory Systems with Shortage. J Clean Prod 2018, 174, 1011–1020. [CrossRef]

- Montabon, F.; Pagell, M.; Wu, Z. Making Sustainability Sustainable. Journal of Supply Chain Management 2016, 52, 11–27. [CrossRef]

- Goyal, S.K. An Integrated Inventory Model for a Single Supplier-Single Customer Problem. The International Journal of Production Research 1977, 15, 107–111. [CrossRef]

- Wahab, M.I.M.; Mamun, S.M.H.; Ongkunaruk, P. EOQ Models for a Coordinated Two-Level International Supply Chain Considering Imperfect Items and Environmental Impact. Int J Prod Econ 2011, 134, 151–158. [CrossRef]

- Hua, G.; Cheng, T.C.E.; Wang, S. Managing Carbon Footprints in Inventory Management. Int J Prod Econ 2011, 132, 178–185. [CrossRef]

- Wangsa, I. Greenhouse Gas Penalty and Incentive Policies for a Joint Economic Lot Size Model with Industrial and Transport Emissions. International Journal of Industrial Engineering Computations 2017, 8, 453–480. [CrossRef]

- Ben-Daya, M.; Hariga, M. Integrated Single Vendor Single Buyer Model with Stochastic Demand and Variable Lead Time. Int J Prod Econ 2004, 92, 75–80. [CrossRef]

- Hariga, M.; As’ ad, R.; Shamayleh, A. Integrated Economic and Environmental Models for a Multi Stage Cold Supply Chain under Carbon Tax Regulation. J Clean Prod 2017, 166, 1357–1371. [CrossRef]

- Gautam, P.; Kishore, A.; Khanna, A.; Jaggi, C.K. Strategic Defect Management for a Sustainable Green Supply Chain. J Clean Prod 2019, 233, 226–241. [CrossRef]

- Halat, K.; Hafezalkotob, A. Modeling Carbon Regulation Policies in Inventory Decisions of a Multi-Stage Green Supply Chain: A Game Theory Approach. Comput Ind Eng 2019, 128, 807–830. [CrossRef]

- Khouja, M.; Mehrez, A. An Economic Production Lot Size Model with Imperfect Quality and Variable Production Rate. Journal of the Operational Research Society 1994, 45, 1405–1417. [CrossRef]

- Eiamkanchanalai, S.; Banerjee, A. Production Lot Sizing with Variable Production Rate and Explicit Idle Capacity Cost. Int J Prod Econ 1999, 59, 251–259. [CrossRef]

- Ghosh, A.; Jha, J.K.; Sarmah, S.P. Optimal Lot-Sizing under Strict Carbon Cap Policy Considering Stochastic Demand. Appl Math Model 2017, 44, 688–704. [CrossRef]

- Saga, R.S.; Jauhari, W.A.; Laksono, P.W.; Dwicahyani, A.R. Investigating Carbon Emissions in a Production-Inventory Model under Imperfect Production, Inspection Errors and Service-Level Constraint. International Journal of Logistics Systems and Management 2019, 34, 29–55. [CrossRef]