Submitted:

26 October 2023

Posted:

30 October 2023

You are already at the latest version

Abstract

Keywords:

1. Introduction

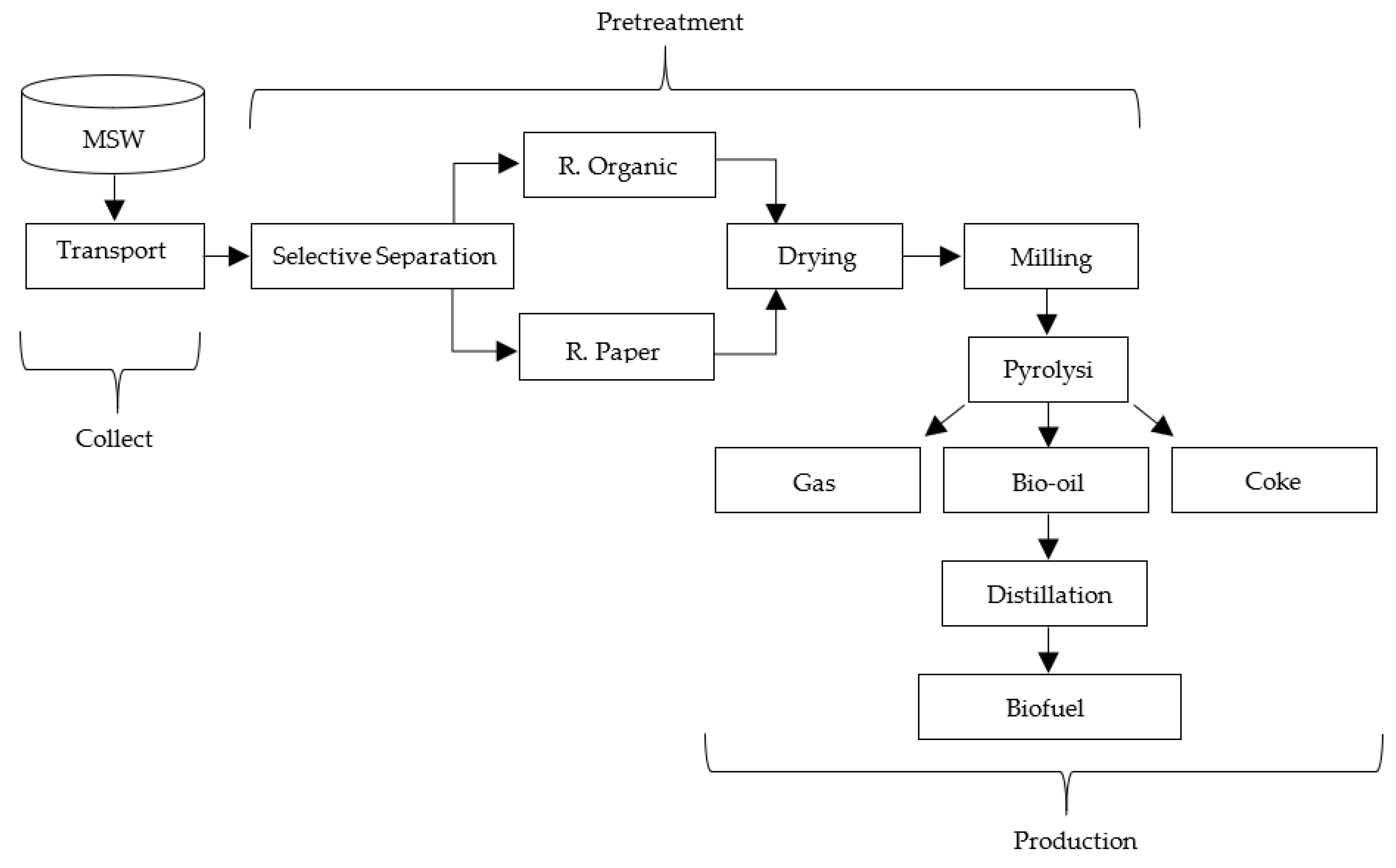

2. Materials and Methods

2.1. Materials

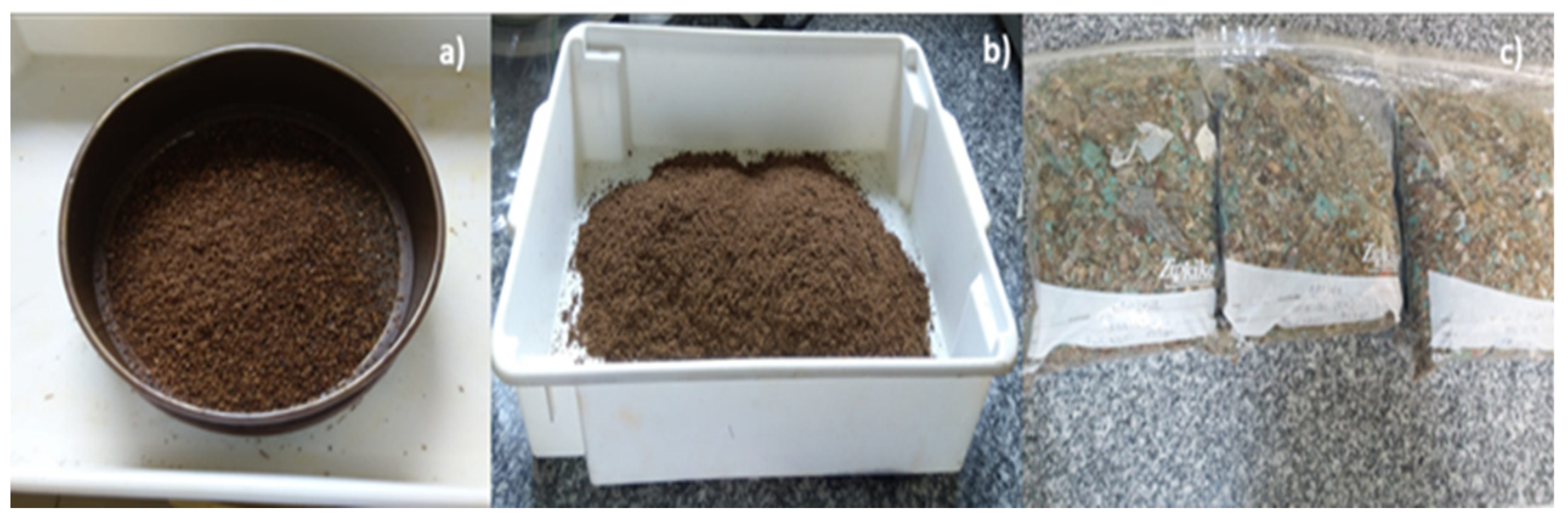

2.1.1. Organic fraction (organic matter + paper)

2.2. Pyrolysis of Materials

2.3. Gerenciamento e os Critérios de Avaliação de Projetos

2.4. Calculation Methodology

2.4.1. Sieving

2.4.2. Drying

2.4.3. Crusher

3. Results

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Acknowledgments

Conflicts of Interest

References

- Simões, A.L.G; Polastri, P; Vereschini, D. T.; Gimenes, M. L.; Schalch, V. Panoama Geral dos Residuos Sólifos Urbanos no Âmbito Mundial 2019. Derpatamento de Egenharia química, Universidade Estadual de Mirangá.

- Pinto, W. L. H; Moraes C. S., B; Capparol, D. C. A.; Oliveira, J. C.; Ansanelli, S. L. M.; Dilphine, L. M. Prosposta de indicadores de sustentabilidade para gestão de residuos solidos 2020.

- Filho, C.; Appelqvist, B. O futuro do setor de gestão de resíduos: Tendências, oportunidades e desafios a década; Equipe da ISWA 2020.

- Uedja Tatyane Guimarões Medeiros Lima.; Gilson Lima sa Silva. Maria do Carmo Martins Sobral 2022. Universidade Federal de Pernanbuco (UFPE).

- NESS, D. Sustainable urban infrastructure in China: Towards a Factor 10 improvement in resource productivity through integrated infrastructure systems. International Journal of Sustainable Development and World Ecology 2018, 15, 288–3011. [Google Scholar]

- GEISENDORF, S.; PIETRULLA, F. The circular economy and circular economic concepts – a literature analysis and redefinition. Thunderbird International Business Review, 2017. [CrossRef]

- GEISSDOERFER, M., et al., The Circular Economy e A new sustainability paradigm? Journal of Cleaner Production, 2016. [CrossRef]

- KIRCHHERR J, REIKE D, HEKKERT M, DE OLIVEIRA IA. Conceptualizing the circular economy: an analysis of 114 definitions. Resour Conserv Recycl, v. 127, p. 221-232, 2017.

- Valéria Cristina Palmeira Zago.; Raphael Tobias de Vasconcelos Barros. Management of solid organic in Brazil: fron legal ordinace to reality 2019. Revista Eng. Sanit. Ambient.

- Meireles, J.F. O Planejamento Urbano na Gestão de Resíduos Sólidos e Mudanças Climáticas. Pleiade, 17(38): 05-12, Jan.-Mar., 2023. [CrossRef]

- R. Bras. Planej. Desenv., Curitiba, v. 12, n. 01, p. 28-54, jan./abr. 2023.

- FEDERAÇÃO DAS INDÚSTRIAS DO ESTADO DO RIO DE JANEIRO – FIRJAN. Índice Firjan De Gestão Fiscal 2019. Rio de Janeiro: Firjan, 2012-2019. Bienal. Disponível em: https://www.firjan.com.br/data/files/8F/50/19/81/B2E1E610B71B21E6A8A809C 2/IFGF-2019_estudo-completo.pdf. Acesso em: 20 mai. 2022.

- DOURADO, Juscelino; TONETO JUNIOR, Rudinei; SAIANI, Carlos César Santejo. Resíduos sólidos no Brasil: oportunidades e desafios da lei federal nº 12.305 (lei de resíduos sólidos). Rio de Janeiro: Manole, 2014.

- Ronaldo Leão de Miranda.; Andréia Rodrigues Soares. A LOOK AT THE SUSTAINABILITY OF THE MUNICIPALITIES OF RONDÔNIA THROUGH THE LENS OF MUNICIPAL SOLID WASTE MANAGEMENT. Revista Livre de Sustentabilidade e Empreendedorismo, v. 8, n. 2 p. 187-210, mar-abr, 2023. ISSN 2448-2889.

- ABRELPE [ASSOCIAÇÃO BRASILEIRA DE EMPRESAS DE LIMPEZA PÚBLICA E RESÍDUOS ESPECIAIS]. Panorama de Resíduos Sólidos no Brasil 2012.

- Christian Riuji Lohri, Stefan Diener, Imanol Zabaleta, Adeline Mertenat, Christian Zurbrügg. Tecnologias de tra-tamento de biorresíduos sólidos urbanos para criação de produtos de valor: uma revisão com foco em cenários de baixa e média renda. Rev Environ Sci Biotechnol 2017, 16, 81–130. [CrossRef]

- Yin Ding, Jun Zhao, Jia-Wei Liu, Jizhi Zhou, Liang Cheng, Jia Zhao, Zhe Shao, Çagatay Iris, Bingjun Pan, Xiaonian Li, Zhong-Ting Hu. Uma revisão dos resíduos sólidos urbanos (RSU) da China e comparação com regiões interna-cionais: gestão e tecnologias em tratamento e utilização de recursos. Jornal da Produção Mais Limpa 2021, 293, 126144.

- Norbert Miskolczi, Funda Ates, Nikolett Borsodi. Comparação da pirólise de resíduos reais (RSU e MPW) em reator em batelada sobre diferentes catalisadores. Parte II: Propriedades de contaminantes, carvão e óleo de pirólise. Tecnologia de Biorecursos 2013, 144, 370–379.

- Guilheme Ricchini Leme, Dangela Maria Fernandes, Carla Limberg Lopes. Use of pyrolysis for waste treatment in Brazil. Universidade tecnológica federal do paraná, medianeira, Pará, Brazil, 2017.

- Hauschild, T.; Basegio, T; Kappler, G.; Bender, F.; Bergmam, C.; Produção de òleo por meio de pirólise catalítica.

- Luiz Felipe Nunes de Oliveira. ANÁLISE DA VIABILIDADE ECONÔMICA E ESPECIFICAÇÕES TÉCNICAS DE UM PROCESSO DE PIRÓLISE LENTA 2018. Universidade Federal rural do Semi-árido.

- Shu-Kuang Ning; Ming-Chien Hung; Ying-Hsi Chang b, Hou-Peng Wan; Hom-Ti Lee; Ruey-Fu Shih. Benefit assessment of cost, energy, and environment for biomass pyrolysis oil 2013.

- Amaral, A.R.; Bernar, L.P.; Ferreira, C.C.; Pereira, A.M.; Dos Santos, W.G.; Pereira, L.M.; Santos, M.C.; Assunção, F.P.d.C.; Mendonça, N.M.; Pereira, J.A.R.; et al. Economic Analysis of Thermal–Catalytic Process of Palm Oil (Elaeis guineesensis, Jacq) and Soap Phase Residue from Neutralization Process of Palm Oil (Elaeis guineensis, Jacq). Energies 2023, 16, 492. [Google Scholar] [CrossRef]

- Fabio Pizzino Bittencourt. SIMULAÇÃO E ANÁLISE TÉCNICO-ECONÔMICA DE UMA PLANTA DE PIRÓLISE MULTIPROPÓSITO PARA OBTENÇÃO DE BIO-ÓLEO A PARTIR DE DIFERENTES BIOMASSAS. Universidade Federal Fluminense, 2018. Niterói, Rio de Janeiro.

- Alberto Jorge da Mota Silveira. Viabilidade Técnica da Pirólise da Biomassa bo coco: Produção de Bioóleo, Biocarvão e Biogás. Universidade Federal de Alagoas. Rio Largo, 2018.

- Luis Guilherme Diniz Martins. ANÁLISE DA VIABILIDADE TÉCNICO E CONÔMIC A PARA IMPLANTAÇÃO DE UMA UNIDADE DE PROCESSAMENTO DE POLÍMEROS, PROVENIENTES DOS RESÍDUOS S ÓLID OS URBANOS, ATRAVÉS DA PIRÓLISE. Universidade Estadual Paulista, 2021. São Paualo, Guaratinguetá.

- Gzille Inacio Almerindo, Henrique Veeck Rossol. Analysis of the economic feasibility of industrial production of charcoal from malt bagasse. Eng Sanit Ambient v. 28, e20220183, 2023. [CrossRef]

- Assunção, F.P.d.C.; Pereira, D.O.; Silva, J.C.C.d.; Ferreira, J.F.H.; Bezerra, K.C.A.; Bernar, L.P.; Ferreira, C.C.; Costa, A.F.d.F.; Pereira, L.M.; Paz, S.P.A.d.; et al. A Systematic Approach to Thermochemical Treatment of Municipal Household Solid Waste into Valuable Products: Analysis of Routes, Gravimetric Analysis, Pre-Treatment of Solid Mixtures, Thermochemical Processes, and Characterization of Bio-Oils and Bio-Adsorbents. Energies 2022, 15, 7971. [Google Scholar] [CrossRef]

- Project Management Institute, Inc. Disponível emhttps://www.pmi.org Acesso em 05 de janeiro de 2023.

- BRIGHAM, E.; GAPENSKI, L.; EHRHARDT, M. C. Administração financeira: teoria e prática. São Paulo: Atlas, 2001.

- Amaral, A.R.; Bernar, L.P.; Ferreira, C.C.; de Oliveira, R.M.; Pereira, A.M.; Pereira, L.M.; Santos, M.C.; Assunção, F.P.d.C.; Bezerra, K.C.A.; Almeida, H.d.S.; et al. Economic Feasibility Assessment of the Thermal Catalytic Process of Wastes: Açaí Seeds (Euterpe oleracea) and Scum from Grease Traps. Energies 2022, 15, 7718. [Google Scholar] [CrossRef]

- Iliane Colpo, Flaviani Souto Bolzan Medeiros, Andreas Dittmar Weise. ANÁLISE DE RETORNO DO INVESTIMENTO: UM ESTUDO APLICADO EM UMA MICROEMPRESA. RACI, Getúlio Vargas, v.10, n.21, Jan./Jul. 2016. ISSN 1809-6212.

- Adriano Leal Bruni, Rubens Famá, José de Oliveira Siqueira. Análise do riso na avaliação de projetos de investimentos: uma placa do método de monte carlo. Caderno de pesuisas em administração, São Paulo, v.1, n° 6,1 Trim./98.

- BRIGHAM, E.; GAPENSKI, L.; EHRHARDT, M. C. Administração financeira: teoria e prática. São Paulo: Atlas, 2001.

- Goret, P. P.; Spritzer, I. M. A.; Zotes, L. P. Viabilidade economica-financeira.4º Ed. Editora FVG.

- Michele Chargas da Silva, Gemmelle Oliveira dos Santos. Densidade Aparente de resíduos sólidos recém coletados. Institutor Federeal de Educação, Ciência e Tecnologia do Ceará (IFCE). Benfica, Fotaleza-CE.

- Copyright Petrobras 2022. Disponível em https://precos.petrobras.com.br/web/precos-dos-combustiveis/w/glp/pa Acesso em 15 de junho de 2023.

- Garré, S. O.; Luz, M. L. G. S.; Luz, C. A. S.; Gadotti, I.; Navroski, R. Economic analysis for implantation of a composting plant of urban organic residue. Revista ESPACIOS. ISSN 0798 1015 Vol. 38 (Nº 17), 2017.

- Nettle – Máquinas Inteligentes. Disponível em https://nettle.com.br/produtos/misturador-ribbon-blender-nt5000l-duplicate-1/ Acesso em 10 de junho de 2023.

- Equatorial Energia. Disponível em https://pa.equatorialenergia.com.br/informacoes-gerais/valor-de-tarifas-e-servicos/ Acesso em 15 de maio de 2023.

- Trapp. Disponível em https://www.trapp.com.br/pt/produto/tr-600e/ Acesso em 10 de junho de 2023.

- 7LAB EQUIPAMENTOS E SERVICOS. Disponível em https://www.7lab.com.br/equipamentos-para-laboratorio/estufa-de-secagem-e-esterilizacao/estufa-de-secagem-e-esterilizacao-digital-de-alta-precisao-7lab-480-l-250-c-220v-com-timer Acesso em 10 de junho de 2023.

- Santos, M. C. Estudo do processo de craqueamento termocatálico da borra de neutralização do óleo de palma para a produção de biocombustível. Douturado. Tese, Universidade Federal do Pará, Belém, Brazil, 2015.

- Oliveira, C.; Tippayawong, N.; Análise Técnica e Econômica de uma Planta de Pirólise de Biomassa. Energia Procedia 2015, 79, 950–955.

| Process parameters | 475 (°C) | |||

|---|---|---|---|---|

| 0.0 (wt.) |

5.0 (wt.) |

10.0 (wt.) |

15.0 (wt.) |

|

| Mass of the organic fraction of municipal solid waste (g) | 50.49 | 40.0 | 40.0 | 40.0 |

| Cracking time (min) | 70 | 75 | 70 | 70 |

| Initial cracking temperature (°C) | 318 | 220 | 206 | 268 |

| Mass of solids (Coke) (kg) | 17.82 | 14.11 | 13.56 | 12.16 |

| Mass of liquid (Bio-oil) (kg) | 4.75 | 2.21 | 2.27 | 3.16 |

| Mass of H2O (kg) | 14.43 | 14.15 | 13.72 | 13.73 |

| Gas mass (kg) | 13.49 | 9.53 | 10.45 | 10.95 |

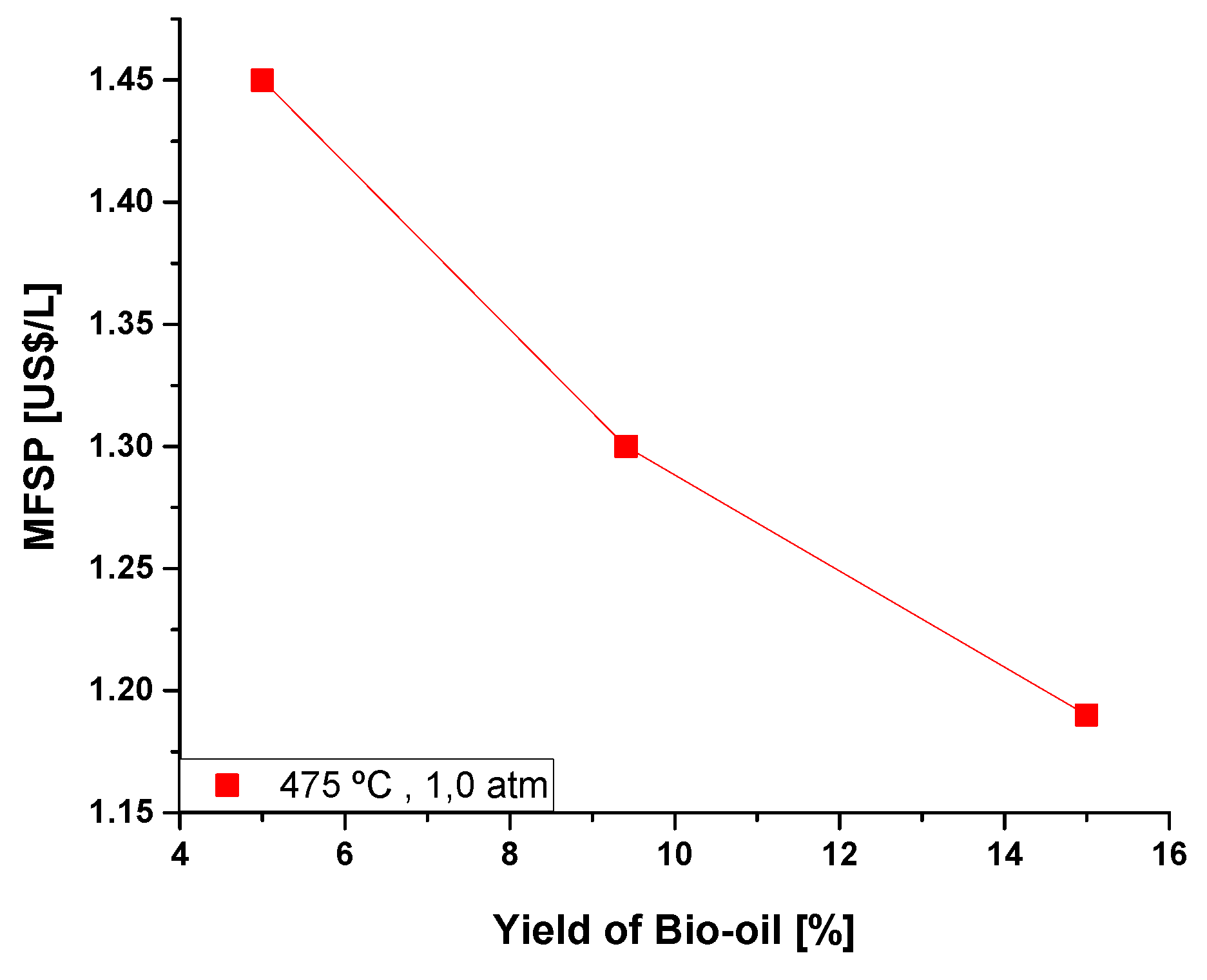

| Bio-oil yield (by weight) | 9.41 | 5.52 | 5.67 | 7.90 |

| H2O yield (by weight) | 28.58 | 35.37 | 34.30 | 34.32 |

| Coke Yield (by weight) | 35.29 | 35.27 | 33.90 | 30.40 |

| Gas Yield (in weight) | 26.72 | 23.82 | 26.12 | 27.37 |

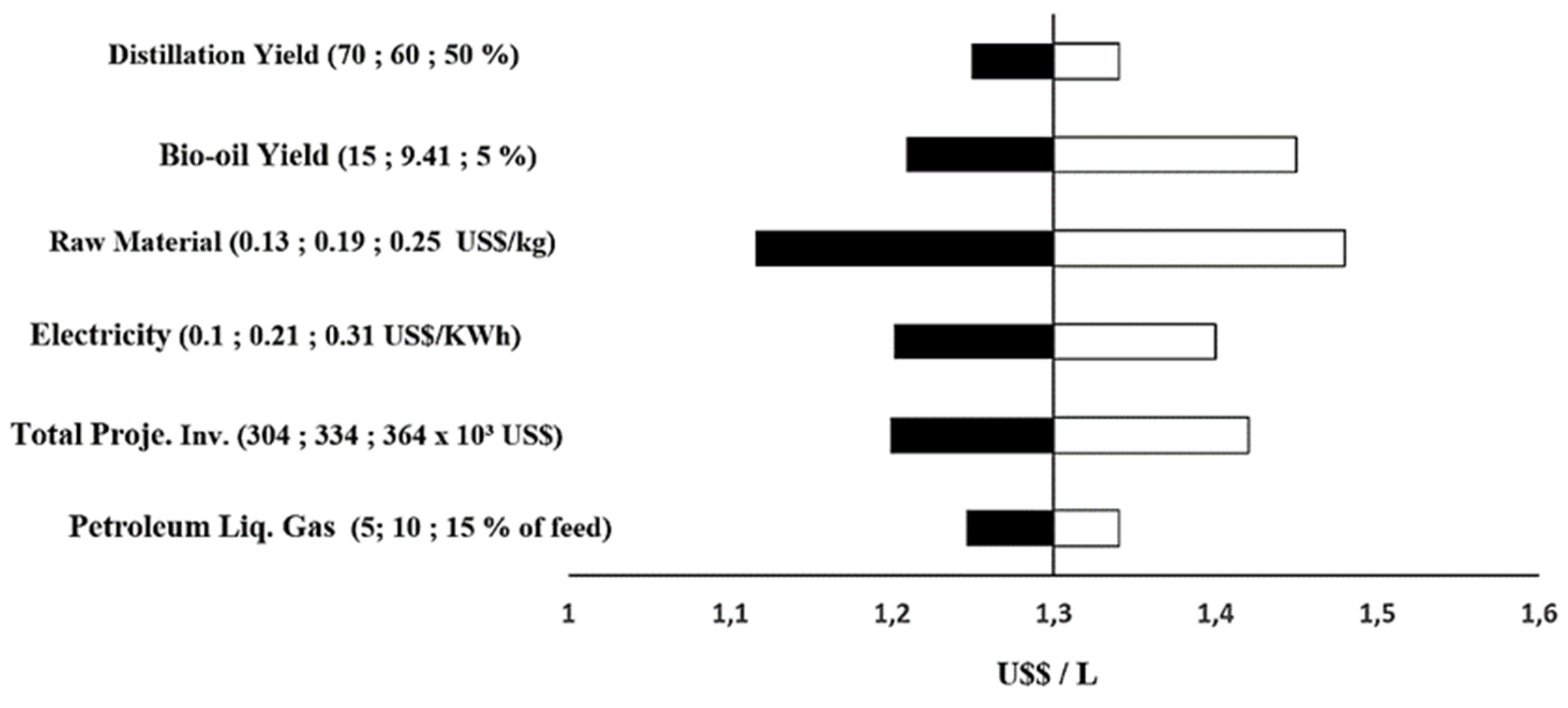

| Process Parameters | Value | Unit | Reference |

|---|---|---|---|

| M = is the mass of organic material + paper | 2.610 | Kg/ day | author |

| Nsh = number of shifts per day | 3 | - | author |

| d = density of organic material + paper | 1.213 | Kg/L | [36] |

| Ybio-oil = yield of the bio-oil pyrolysis process | 9.41 | % | [28] |

| Ycoke = material coke yield in the pyrolysis process | 35.29 | % | [28] |

| Pcoke = price of coke | 0.224 | US$/kg | [31] |

| dcoke = coke density | 1*10-3 | Kg/L | [31] |

| Ygas = yield of methane gas from the material's pyrolysis process | 2672 | % | [28] |

| PLPG = price of liquefied petroleum gas | 0.275 | US$/L | [37] |

| dgas = density of methane gas | 0.72*10-3 | Kg/L | [31] |

| Yd,bio-oil = yield of the material distillate process | 60 | % | author |

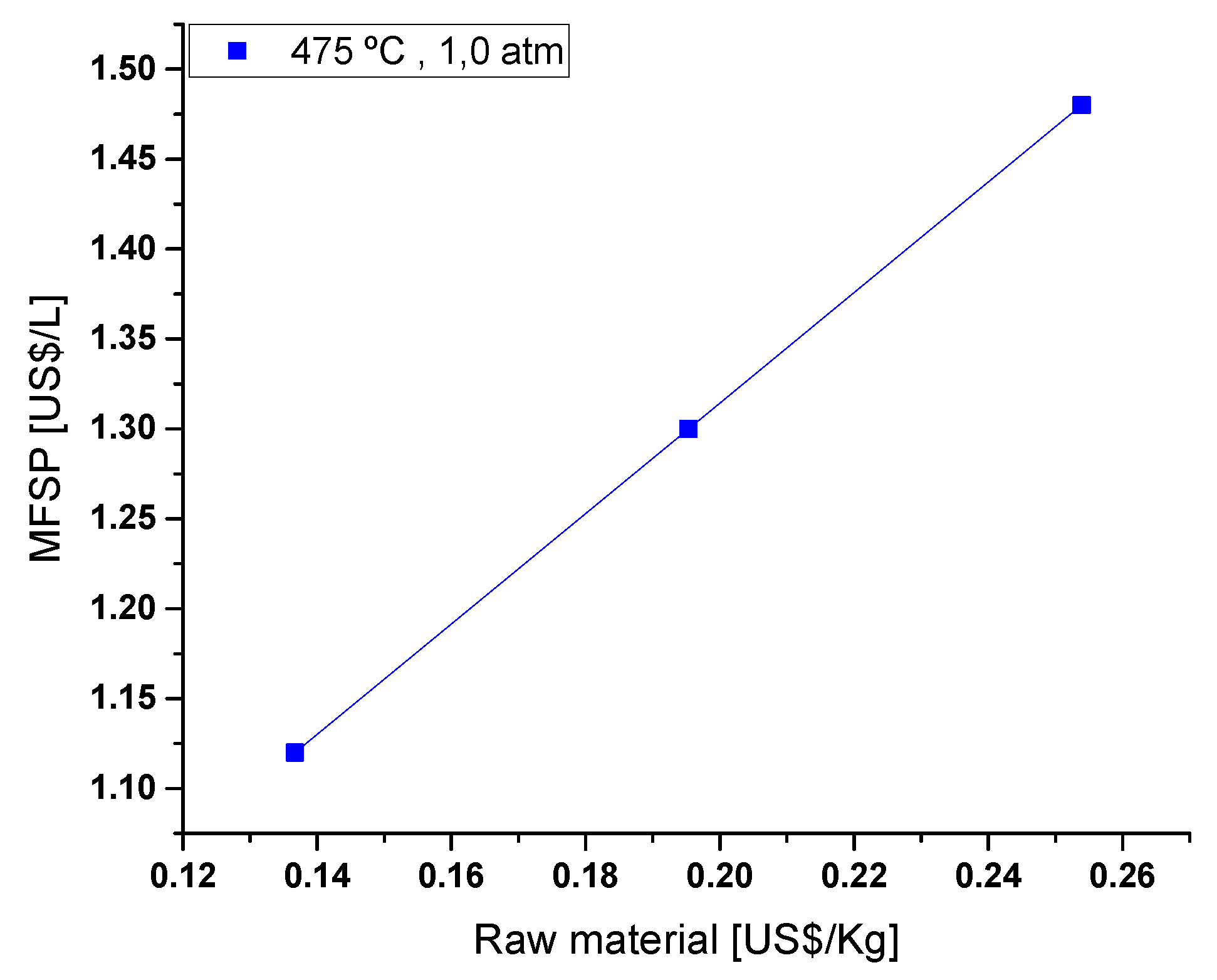

| PRM = raw material price of the material | 0.1953 | US$/kg | [38] |

| Psieve = power of the sieve equipment | 0.7457 | KW | [39] |

| tsieve = sieving time per day | 2 | h | author |

| Nsieve = number of sieving batches per day | 2 | - | author |

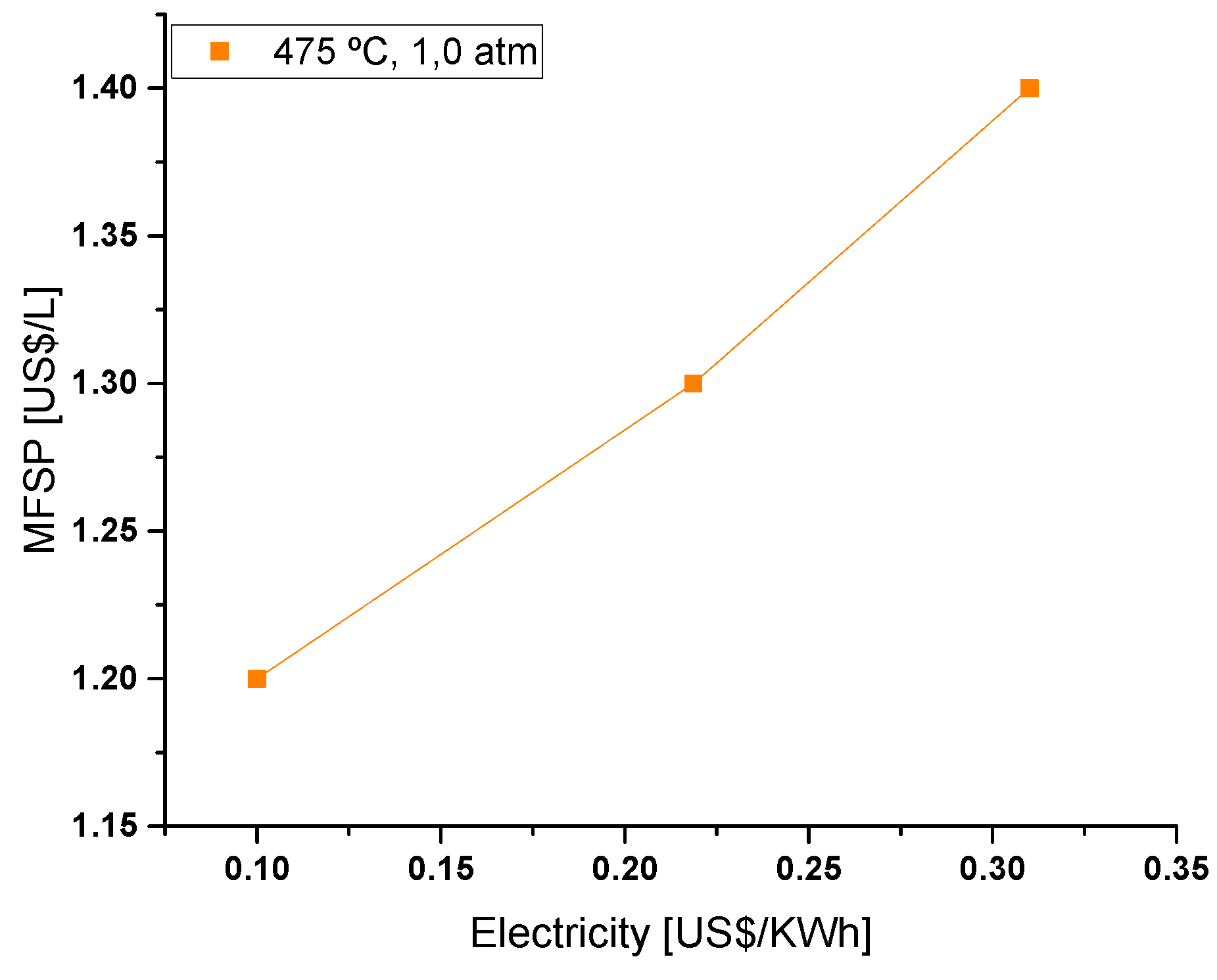

| PKWh = price of KWh | 0.2186 | US$/KWh | [40] |

| Pdry = drying equipment power | 3 | KW | [41] |

| tdry = drying time per day | 24 | h | author |

| Ndry = number of drying batches per day | 5 | - | author |

| Pcrus = power of crusher equipment | 11 | KW | [42] |

| tcrus = crusher time per day | 1 | h | author |

| Ncrus = number of crusher batches per day | 1 | - | author |

| mLPG = percentage of liquefied petroleum gas in relation to the feed rate | 10 | % | [43] |

| Cm = labor cost in thirty days | 2343.7 | US$/month | author |

| PKWd = distillation column power | 5 | KW | [31] |

| td = distillation operating time during one day | 24 | h | author |

| Ndest. = number of distillation batches per day | 2 | - | author |

| %T = tax percentage | 10 | % | [31] |

| SPbio = selling price of biofuels produced with organic material + paper | 1.30 | US$/L | author |

| Lifespan | 10 | years |

| Plant Size/Feeding Rate | 2610 | kg/ day |

| Discount rate | 10 | % per year |

| Financing | 100 | % own capital |

| Depreciation | - | % per year |

| Investment recovery period | 10 | years |

| Taxes | 10 | % |

| Start-up | - | months |

| Raw material cost | 0.1953 | US$ / kg |

| Plant availability | 87.5 | % |

| Plant operating time | 7665 | h |

| Reference year | 2023 | |

| Electricity price | 0.2186 | US$ / KWh |

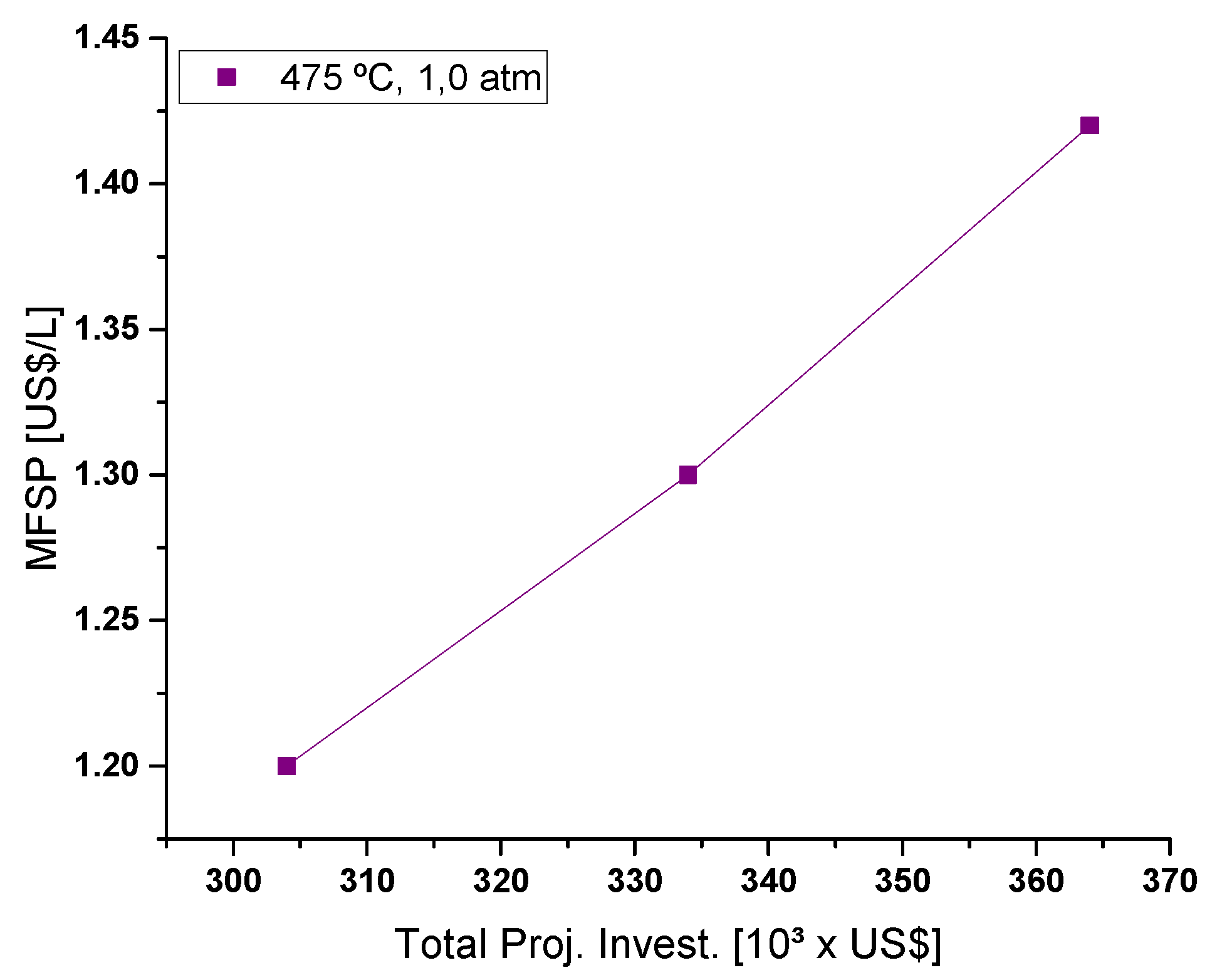

| Total equipment cost (CTE) | 112793.25 | US$ |

| Direct costs (include installation of equipment, instrumentation and control, piping, electricity and buildings) | 68803.88 | US$ (61% CTE) |

| Total equipment installation cost (CTIE) | 181597.13 | US$ (61% CTE + CTE) |

| Storage | 2723.96 | US$ (1,5% CTIE) |

| Space construction - warehouse | 8171.87 | US$ (4,5% CTIE) |

| Total installation cost (CTI) | 192492.96 | US$ (CTIE + warehouse + space development) |

| Field Indirect Costs (CI) | ||

| - Field expenses | 38498.59 | US$ (20% CTI) |

| - Offices and building fees | 48123.24 | US$ (25% CTI) |

| - Contingency | 5774.79 | US$ (3% CTI) |

| - Prominent costs | 19249.30 | US$ (10% CTI) |

| Total Capital Investments (ITC) | 304138.88 | US$ (CTI + CI) |

| Other costs (start-up, licenses, etc.) | 30413.89 | US$ (10% ITC) |

| Total project investment (ITP) | 334552.77 | US$ (ITC+ other costs) |

| Revenues | ||

| Feed_87.50 % (Availability)_Cracking (1) | 2151.69 | L/ day_d=1.213 kg/m³ |

| PLO product / bio-oil_9.41 % (2) | 202.47 | L/ day_Fre. distillation |

| Solid product (coke)_35.29 % (3) | 170.55 | US$/day |

| Gaseous Product (biogas)_26.72 % (4) | 11.23 | US$/day |

| Biofuel Product Distillation_60% (5) | 121.5 | US$/day |

| Sale price (6) | 1.30 | US$/L |

| Total expenses (7) = (8)+(9)+(10)+(11)+(12)+(13)+(14)+(15) | 1.24 | US$/L |

| Raw Material (Neutralization Waste)_1 US$/Kg (8) | 0.543 | US$/L |

| Sieving (0.7457 kW)_(2T/h) (9) | 0.0003 | US$/L |

| Drying (3 kW)_(0.582 T/h) (10) | 0.1118 | US$/L |

| Crusher (11 KW)_0.425 t/h (11) | 0.0026 | US$/L |

| Liquefied Petroleum Gas (LPG)_10% (12) | 0.063 | US$/L |

| Manpower (8MIL) (13) | 0.333 | US$/L |

| Distillation (Heating)_5 KW (14) | 0.056 | US$/L |

| Taxes_10% (15) | 0.130 | US$/L |

| Profit Margin (16) = (6) - (7) | 0.06 | US$/L |

| Total Profit | 189.1 | US$/day |

| Month | 5.672 | US$/month |

| Year | 68.063 | US$/year |

| Year | 0 | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|---|

| Cash flow | -334552.77 | 68062.78 | 68062.78 | 68062.78 | 68062.78 | 68062.78 |

| Accumulated value | -33452.77 | -266489.98 | -198427.20 | -130364.42 | -62301.64 | 5761.14 |

| Year | 6 | 7 | 8 | 9 | 10 | |

| Cash flow | 68062.78 | 68062.78 | 68062.78 | 68062.78 | 68062.78 | |

| Accumulated value | 73823.92 | 141886.70 | 209949.49 | 278012.27 | 346075.05 |

| Year | 0 | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|---|

| Cash flow | -334552.7 | 68062.78 | 68062.78 | 68062.78 | 68062.78 | 68062.78 |

| Present value | -334552.77 | 61875.26 | 56250.23 | 51136.57 | 46487.80 | 42261.63 |

| Accumulated value | -334552.77 | -272677.51 | -216427.28 | -165290.70 | -118802.91 | 76541.27 |

| Year | 6 | 7 | 8 | 9 | 10 | |

| Cash flow | 68062.78 | 68062.78 | 68062.78 | 68062.78 | 68062.78 | |

| Present value | 38419.67 | 34926.97 | 31751.79 | 28865.26 | 26241.15 | |

| Accumulated value | -38121.61 | -3194.64 | 28557.15 | 57422.41 | 83663.56 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).