1. Introduction

Water resources play a crucial role in the food-energy nexus, also they are responsible for socio-economic sustainability and maintaining the integrity of ecosystems (Javidi Sabbaghian and Nejadhashemi, 2020). However, both groundwater and surface freshwater resources are non-uniformly distributed across the globe and often shared among various stakeholders, as the transboundary water resources. More than 40% of the planet’s water resources are transboundary in nature, crossing international borders (IGRAC, 2021; Matherne and Megdal, 2023).

These issues, especially in arid and semi-arid regions of the world such as Iran, has become a matter of great concern in both regional and beyond-regional policies implemented by various stakeholders (Roghani et al., 2020). It is thus imperative to adopt proactive and effective approaches to mitigate these conflicts and ensure long-term sustainability. To achieve this goal, formerly the Game Theory has been considered as the basic approach for water resources allocation. In this regard, Wang et al. (2003) proposed a Cooperative Game Theory (CGT) approach for resolving the conflicts amongst stakeholders, using the consensus-based water allocation with respect to the users’ water rights in the initial step and water reallocation based on the efficient water transfers in the final step. Parrachino et al. (2006) reviewed the several aspects of water consumptions and presented the CGT solutions to allocate water resources for beneficiaries. They concluded that the beneficiaries’ coordination over limited water resources such as the long-term investments in water infrastructure projects could be feasible under institutional consensus. Madani (2010) explored how Game Theory can be used to manage water resources and resolve conflicts amongst stakeholders through a series of non-cooperative water resource games. The relevant results showed that the nature of water resource problems is dynamic and taking into account the game’s evolution path is important. Akbari et al. (2015) presented sustainable water allocation policies for several stakeholders of the Zayandehrud Basin in Iran that ensure enough high quantitative and qualitative water supply, satisfying the environmental and socio-economic goals of the stakeholders. According to the results, the environmental beneficiary has an independent role in both the optimization model and the Game Theory. Chhipi-Shrestha et al. (2019) integrated Multi-Criteria Decision Analysis (MCDA) and CGT approaches to evaluate the eight water reuse options with respect to the environmental and socio-economic criteria, which caused to select a sustainable option and allocate it to the related stakeholders in the City of Penticton, Canada. The results indicated that the importance degrees of the sustainability criteria are determinant and the best solution is lawn, golf course, public park irrigation and toilet flushing with an equal sharing of municipal benefits between the municipality and citizens. Liu et al. (2020) presented a Combination of Game Theory and AHP with the Entropy weighting method for assessing the household level risks related to the three types of small systems including rainwater harvesting, combinational surface water and rainwater, and groundwater in Gansu Province, China. The results showed that the "Source water" is the most important factor among the fifteen risk factors. The combinational system in the driest year has the medium risk, while the groundwater system has the lowest risk consistently in the case study area. Hemati and Abrishamchi (2021) evaluated the climate change scenarios of the 5th Intergovernmental Panel on Climate Change (IPCC) report in the Zarinehrood basin in Iran, using the Artificial Neural Network (ANN) for downscaling process, also the Quantile Mapping (QM) for bias modification. Furthermore, the water resource was allocated for the beneficiaries based on the Nash Bargaining Solution (NBS) with the symmetric and Analytic Hierarchy Process (AHP). The results showed that water allocation can be implemented efficiently with water management policies and a cooperative Bargaining Game. Naghdi et al. (2021) combined the system dynamics simulation-optimization approach based on maximizing water supply and minimizing groundwater withdrawal and the Nash Bargaining Theory (NBT) for optimal surface water and groundwater resources allocations among the most important user sectors in the Najaf-Abad sub-basin in Iran. According to the results, the water supply was increased, while the aquifer extraction was decreased in 30% comparing with the current condition. In recent years, according to the following studies of Ghavami Azad and Rasi Nezami (2018), among the various cooperative Game Theory frameworks, the Bankruptcy Theory has emerged as a prominent approach. It offers a valuable solution for resolving conflicts among stakeholders and facilitating an equitable reallocation of available water resources among them.

To date, extensive research has been carried out worldwide to explore the application of bankruptcy approaches in resolving water disputes. Yuan et al. (2019) developed a new water reallocation model using the Bankruptcy Theory and Bargaining Game method for allocating the Mekong River water. The results showed that all countries except China and Vietnam received their full water demand, and the method was sustainable and enforceable. Wickramage et al. (2020) analyzed the five Bankruptcy methods for resolving conflicts arising from water scarcity in the Missouri River. The researchers concluded that the Modified Constrained Equal Awards (MCEA) and the Sequential Sharing based on Proportional Sharing (SSPS) methods were the most effective approaches for resolving these conflicts. Janjua and Hassan (2020) introduced two new Bankruptcy rules, namely the "groundwater-based rule" and "the proposed rule", for water reallocation within the Indus River Basin. These rules were compared with the seven different Bankruptcy methods and it was found that the groundwater-based rule outperformed all other methods. Wu et al. (2022) employed a Two-Step Allocation Negotiation Model (TSANM) using the Bankruptcy and Bargaining Game Theories to distribute disputed water resources of the Tigris-Euphrates River among Turkey, Syria, and Iraq. Tian et al. (2022) integrated the Bankruptcy Theory into a cooperative game model that accurately described the satisfaction levels of water demand in different regions of China’s Tarim River Basin. Their study showed that the model was more suitable for water reallocation and holds greater functional worth than the traditional Bankruptcy Theory.

Several studies have been conducted in Iran to address the resolution of water conflicts through practical methodologies. Zarezadeh et al. (2012) utilized the four Bankruptcy methods including Proportionality (PRO), Adjusted Proportionality (AP), Constrained Equal Losses (CEL) and Constrained Equal Awards (CEA) in different scenarios for developing fair reallocation of Qezelozan-Sefidrood River Basin resources. As the result of this study, it was determined that the CEA was preferred among all methods for the resources reallocation. Jalili Kamju and Khochiani (2020) used the Game Theory and the Bankruptcy methods namely PRO, CEA, CEL, Talmud (TAL), and Random Arrival (RA) to allocate the Zayanderud Basin surface and groundwater resources. Tayebzadeh Moghadam and Malekmohammadi (2020) examined the six Bankruptcy methods with the aim of determining the most effective approach for allocating resources within the Urmia Lake Basin among multiple stakeholders. The researchers identified the CEA as the optimal one for this purpose. Ashrafi et al. (2022) conducted a study aimed at developing effective Bankruptcy methods among the six rules to address the bankruptcy situation faced by the Zarrinehrud River Basin. The outcomes’ analysis obtained from the various Bankruptcy methods indicated that the TAL and CEL methods demonstrated superior performance. In the following,

Table 1 provides a comprehensive review on some of the important studies that have focused on the use of various Bankruptcy methods to reallocate water resources.

Table 1.

A review on some of important studies regarding the application of the Bankruptcy Theory to solve water disputes around the world.

Table 1.

A review on some of important studies regarding the application of the Bankruptcy Theory to solve water disputes around the world.

| Water resource type |

Study area |

Methodology |

Results |

Contribution |

Authors |

| Surface water |

The Tigris and Euphrates Rivers,

Turkey-Iraq-Syria |

PRO, CEA, CEL, the proposed method |

The more powerful and reasonable conflict management by using the proposed method |

Considering the agents’ contributions and the proposed method |

Mianabadi et al. (2013) |

| The Euphrates River, Turkey-Syria-Iraq and a Hypothetical case study |

PRO, CEA, CEL, SSR based on PRO, the proposed method |

The more potential of applying the proposed method for solving the conflicts |

Considering the agents’ contributions and the proposed method |

Mianabadi et al. (2014) |

| Qezelozan-Sefidrood River Basin, Iran |

PRO, AP, CEA, CEL, the proposed method |

Sensitivity of the reallocation rules’ acceptability to the hydrologic conditions and demand values |

Formulating the proposed method based on non-linear network flow optimization model and developing new method for evaluating the acceptability of results |

Madani et al. (2014) |

| The Tigris River, Turkey-Iraq |

PRO, CEA, CEL, WPRO, WCEA, WCEL, the Proposed method |

Facilitating the negotiation by using the proposed method |

Considering the agents’ contributions and their optional relative weights and the proposed method |

Mianabadi et al. (2015) |

| The Nile River, Burundi-Egypt-Ethiopia-Eritrea-Kenya-Rwanda-Sudan-Tanzania-Uganda |

PRO, AP, CEA, CEL, Nucleolus, Shapely |

The more equity and flexibility reallocation by new changes in methods |

New accounting based on the water contribution of riparian states and allotting new weighing mechanism for the water deficit |

Degefu and He (2016) |

| Guanting Reservoir Basin, China |

PRO, CEA, CEL, the proposed method |

The more effective water reallocation based on using the proposed method |

Considering the hydrological constraints and the proposed method |

Zeng et al. (2017) |

Table 1.

Continued. A review on some of important studies regarding the application of the Bankruptcy Theory to solve water disputes around the world.

Table 1.

Continued. A review on some of important studies regarding the application of the Bankruptcy Theory to solve water disputes around the world.

| Water resource type |

Study area |

Methodology |

Results |

Contribution |

Authors |

| Surface water |

Aras River, Turkey-Armenia-Iran-Azerbaijan |

PRO, CEA, CEL |

Superiority in allocating water resources, using the CEL method |

Using the optimization methods based on Particle Swarm Optimization (PSO) |

Sadat et al. (2019) |

| Dongjiang River Basin, South China |

PRO, CEA, CEL, the improved Bankruptcy method |

The more flexibility reallocation by applying the improved Bankruptcy method |

Considering the weighted contribution, the efficiency factors and the minimum satisfied water demands |

Li et al. (2020) |

| Colorado River, California, USA |

A model based on social planning and a Bankruptcy rules (PRO, CEA) |

The more conduciveness of the second model for regional welfare |

Quantifying the value of water for each stakeholder |

Rightnar and Dinar (2020) |

| Ezhou City, Hubei Province, China |

PRO, AP, CEA, CEL, TAL, the proposed Adjust Minimal Overlap (AMO) |

The more fairness and efficiency allocating water resources by applying the proposed method |

Considering the agents’ claims for reallocation and economic factors to evaluate feasibility of alternatives |

Zheng et al. (2022) |

| Karkheh River Basin, Iran |

PRO, CEA, CEL, TAL, RA, the modified Bankruptcy method |

The highest levels of satisfaction by using the modified Bankruptcy method |

Considering the environmental demands; Evaluating the impacts of limitations for the cultivation area on the water allocating |

Pournabi et al. (2022) |

| Groundwater |

Hypothetical aquifer |

PRO, AP, CEA, CEL, TAL, Pinile (PIN) |

The most acceptable rules recognized by the Plurality stability rule |

Using the Plurality rule to evaluate the acceptability of the methods |

Madani and Zarezadeh (2012) |

| Golestan Province, Iran |

PRO, CEA, CEL, TAL, PIN, AP and a Game Theory model |

The better managing the bankruptcy conditions by using the proposed method |

Using a simulation-optimization framework |

Yazdian et al. (2021) |

Table 1.

Continued. A review on some of important studies regarding the application of the Bankruptcy Theory to solve water disputes around the world.

Table 1.

Continued. A review on some of important studies regarding the application of the Bankruptcy Theory to solve water disputes around the world.

| Water resource type |

Study area |

Methodology |

Results |

Contribution |

Authors |

| Groundwater |

Hormozgan Province, Iran |

PRO, CEA, CEL, TAL, PIN |

Increasing the groundwater head and improving overall aquifer status |

Using the simulation model of the aquifer |

Jamalomidi and Moridi (2021) |

| Neyshabour-Sabzevar-Ataiyeh shared aquifer, Iran |

PRO, CEA, CEL, MCEL, WPRO, WCEA, WCEL |

Choosing the weighted CEA method as the most preferable and stable method for water reallocation |

Using the weighted Bankruptcy methods; Considering the sustainable development indicators in groundwater reallocation |

Bahrami Jovein et al. (2023) |

This study aims to address several key gaps in existing bankruptcy approaches, especially to shared groundwater resource reallocation. A novel aspect of this work is evaluating reallocation through a lens of sustainable development, incorporating social and environmental criteria. Additionally, a modified weighted reallocation method is proposed that holistically considers both stakeholders’ water demands and contributions. This two-level approach first reallocates water between regions, then reallocates within beneficiaries. Collectively, these contributions establish a comprehensive framework for a more fair, equitable and sustainable reallocation process. By systematically accounting for diverse stakeholders’ needs and impacts, the novel approach aims to enhance reallocation outcomes over the long term.

In the following, the paper is organized into three main sections: First, in the “Materials and methods” section, a detailed overview of the proposed process alongside of the other Bankruptcy methods is utilized in the reallocation process is provided. This includes an explanation of the hierarchical analysis-based weighting process, stakeholders’ participation, and other key factors considered in the study. Then, in the “Results and discussion”, a comparative analysis is presented, examining the outcomes of different Bankruptcy methods in both scenarios. Additionally, a comprehensive examination of the two-level approach to reallocation within each timespan is discussed. Finally, the "Conclusion" section summarizes the main results and highlights how the proposed process improves reallocation outcomes for stakeholders in a sustainable manner over the long-term. It also discusses potential opportunities to build on this work in future studies.

2. Materials and methods

2.1. Two-level bankruptcy process for shared groundwater resources

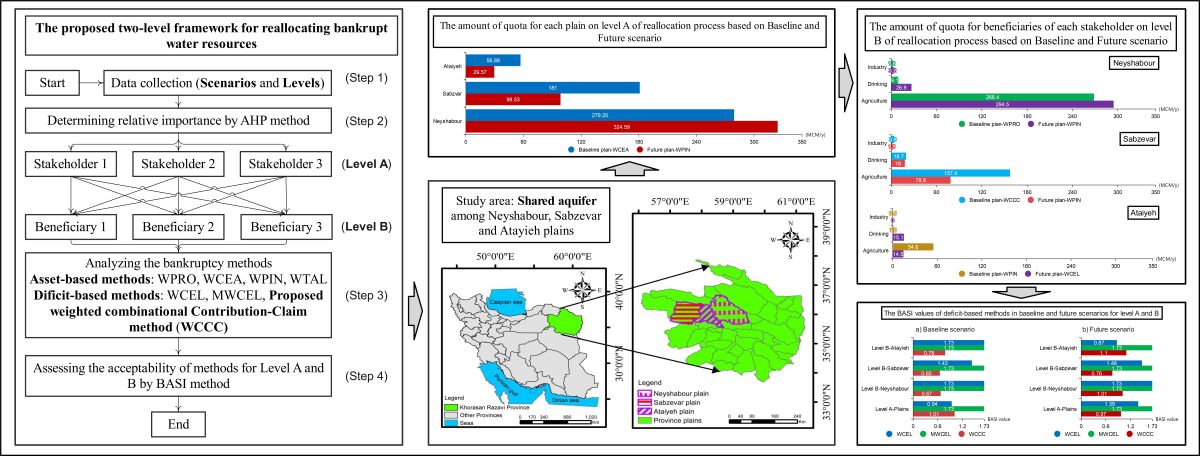

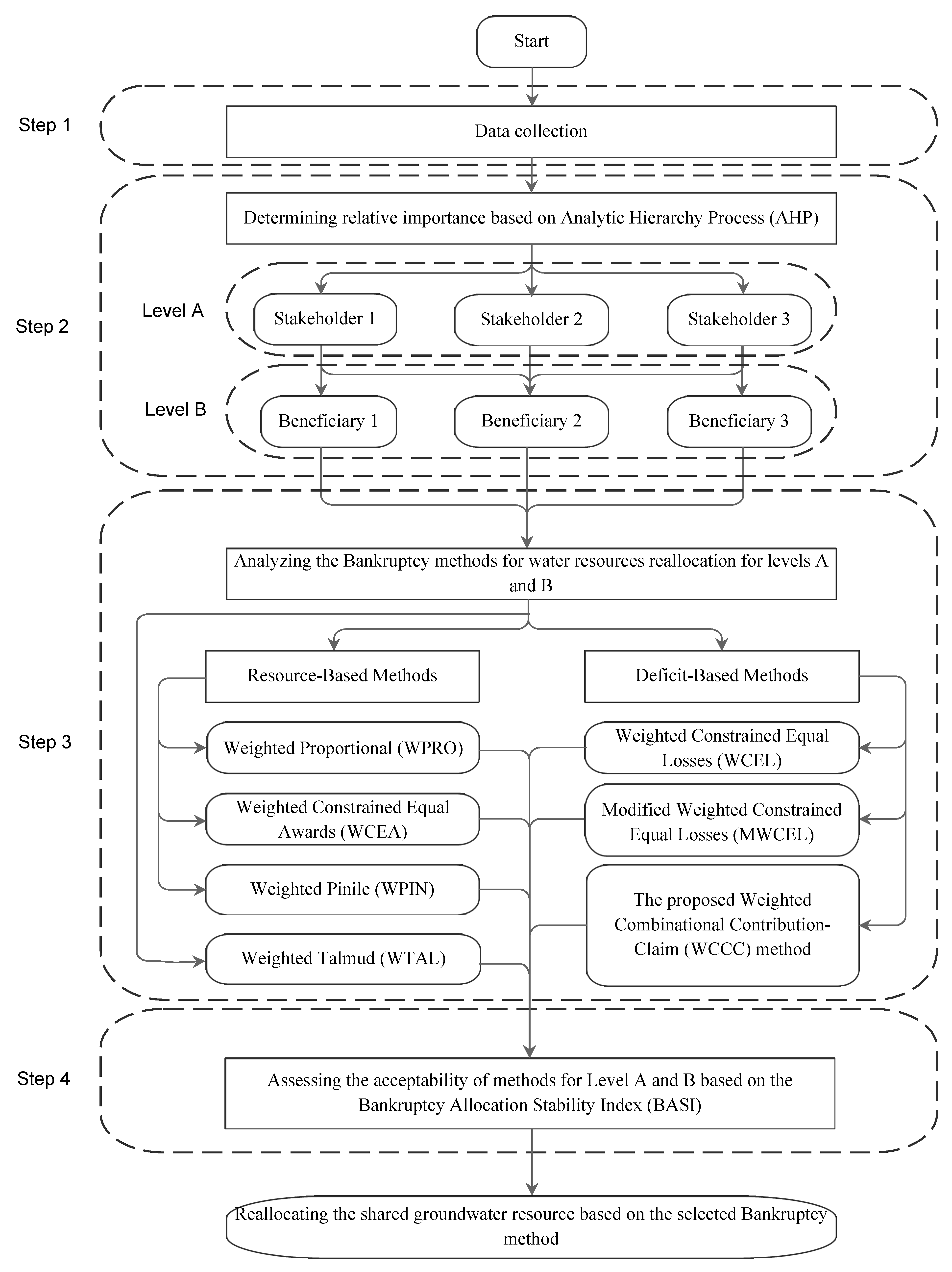

The proposed reallocation process in this study is illustrated in

Figure 1. The workflow comprises the four steps: Step 1) Data collection; Step 2) Determining the relative importance (weights) of stakeholders and their beneficiaries; Step 3) Analyzing the Bankruptcy methods for water resources reallocation in Levels A and B; and Step 4) Assessing the methods’ acceptability and selecting the most desirable method(s) for final water reallocation. Steps 2 to 4 pertain to the two complementary and sequential levels, namely Level A and Level B. Level A is designed for applying the reallocation process among the stakeholders (plains), and Level B is intended for applying the reallocation process among the different beneficiaries within each plain (e.g., Agricultural, Drinking, and Industrial). In this study, the process of reallocating water resources is underpinned by the concept of sustainable development goals (SDGs), which emphasizes on the use of natural resources, considering the supply of the present several demands without compromising the related future needs (The Brundtland Report, 1987). Furthermore, the reallocation process is conducted under the two distinct timespans of the “Baseline scenario” and the “Future scenario”. Under the Baseline scenario, the claims and contributions data of stakeholders from 2010-2011 are used for reallocating resources. While under the Future scenario, the estimated demands of shareholders for 2041, are obtained using the regression method based on the currently reported data.

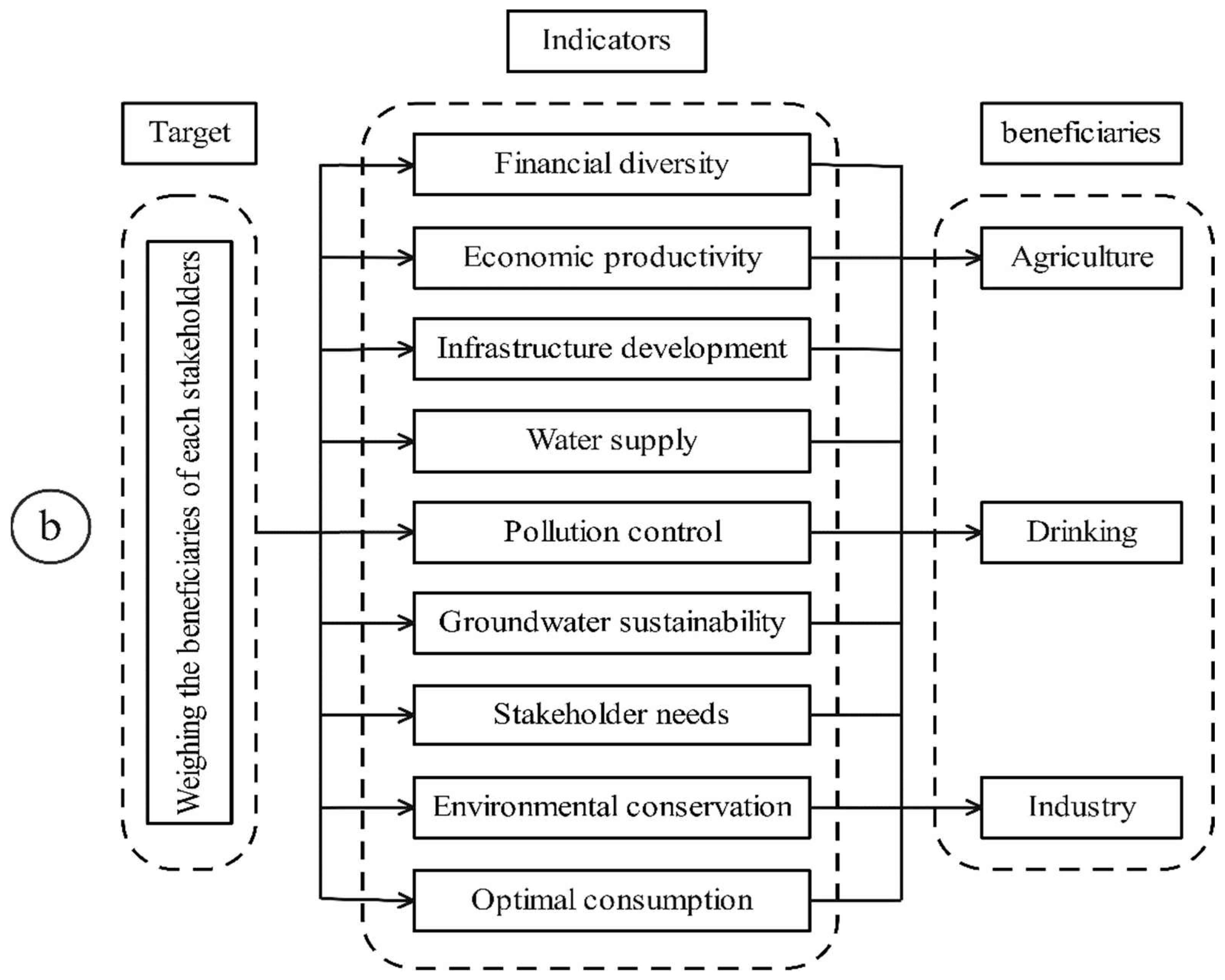

2.2. Weighting stakeholders and the beneficiaries based on the AHP

Weighting criteria and stakeholders are one of the most important steps in Multi-Criteria Group Decision-Making (MCGDM) process. One of the most frequently used methods for weighting is the AHP. This participatory approach-based method has the potential to enhance problem-solving efforts in a variety of settings, particularly those that require extensive analysis and strategic planning, like water resources management (e.g., Sar et al., 2015; Razandi et al., 2015; Ghosh and Kar, 2018). In this study, according to the importance of using weighted bankruptcy methods in shared groundwater reallocation, the AHP method is utilized to determine the weights of stakeholders and their beneficiaries. Accordingly, first, sustainable development indicators and sub-indicators are defined to help prioritize stakeholders (plains) and the related beneficiaries (agriculture, drinking, industry). Then, the two sequential step surveying process is implemented, receiving the comparative opinions of the effective stakeholders’ agents and the experts in the study area.

The first step, associated with the first level of reallocation among plains, is accomplished considering the comparative pairwise on the sustainable development indicators and sub-indicators for weighting the plains. The sub-indicators including: Area under cultivation, Agricultural productivity, Agricultural development, Infrastructure development, Water quality, Population growth, Industrial productivity, Industrial development, and Industrial employment, are related to indicators such as agriculture, drinking and industry that contribute for stakeholders’ weighting. The second step, related to the second level of reallocation among beneficiaries of plains, is done based on the comparative pairwise on the sustainable development indicators for weighting the beneficiaries. The indicators are including: Financial diversity, Economic productivity, Infrastructure development, Pollution control, Groundwater sustainability, Beneficiaries’ water needs, Environmental protection, Water supply, and Optimal consumption control (The sixth development plan of the Islamic Republic of Iran, 2017-2021).

Figure 2(a) and 2(b), illustrate the hierarchical structure based on the sustainable indicators and sub-indicators for weighting stakeholders and beneficiaries, respectively.

It is noteworthy that related to the pairwise comparisons between the indicators in

Figure 2(a) and 2(b), the utilization of comparative statements, such as "Equal," "Weakly better," "Definitely better," "Very strongly better," "Absolutely better," and intermediate values could be used. Also, it is recommended that the inconsistency ratio of each pairwise comparison matrix should be less than 0.1

. The calculation process of the AHP method has been expressed in the relevant studies (Ghosh and Kar, 2018; Veisi et al., 2022).

2.3. Reallocation of shared groundwater resources based on the Bankruptcy methods

In reallocation problems, the objective is sharing a set of resources among a group of stakeholders in an equitable and efficient manner. A specific class of reallocation problems arises in bankruptcy conditions, where the available resource must be shared among a set of N≥2 stakeholders (sometimes with relative weights) who have claims and contributions such that , ; and , , respectively. The aim of a Bankruptcy rule is determining appropriate reallocation for each stakeholder, which is denoted by such that for all and . Accordingly, the former limitation states that the sum of shares is equal to the available resource, which ensures that the resource is optimally utilized, preventing its under exploitation (Ansink and Weikard, 2012; Mianabadi et al., 2015). However, the latter constraint is to ensure equity and prevent inefficiencies, which emphasizes a stakeholder’s reallocation cannot exceed its claim in the resource reallocation, while it is positive. This constraint prevents resource depletion and concentration among certain stakeholders, promoting optimal resource utilization (Mianabadi et al., 2014; Mianabadi et al., 2015).

As mentioned earlier, there are numerous Bankruptcy methods that can be applied in the context of water resources reallocation. The Bankruptcy methods can be broadly categorized into two main categories based on the reallocation process they employ, including: the resource-based and the deficit-based methods. The resource-based methods utilize available resources to perform reallocation, while the deficit-based methods rely on shortage resulting from the difference between total demands and available resources. The former encompasses methods such as WPRO, WCEA and WPIN, while the latter includes methods such as WCEL, MWCEL and the proposed method. Also, it is noted that the WTAL could belong to the resource-based or deficit-based category depending on the relation between the total claim and the total available resource. In the following, an overview of the two categories is explained.

2.3.1. Weighted Proportional method (WPRO)

In this method, the available resources are reallocated among stakeholders based on their weights and the relative coefficient that calculated by the ratio between the total available resources and the overall demand (Equations 1 and 2):

where

denotes the allocated resources to the

ith stakeholder,

represents the

ith stakeholder’s demand,

is the corresponding weight of the

ith stakeholder,

N indicates the total number of stakeholders,

is the coefficient for assigning resources to each stakeholder,

E represents the total available resources, and

is the overall claims of stakeholders (Casas-Méndez et al., 2011; Mianabadi et al., 2015). The underlying assumption of this method is that regardless of each stakeholder’s weight, the coefficient "

λ" assigns equal importance to all stakeholders.

2.3.2. Weighted Constrained Equal Awards method (WCEA)

This reallocation method prioritizes stakeholders based on lower demands (Equation 3). This process entails first estimating the reallocations of stakeholders with minimum demands, followed by repeating the same procedure for other stakeholders (Yazdian et al., 2021).

One of the limitations of this approach is ignoring stakeholders with higher demands who might be more effective in Gross Domestic Product (GDP) and causes assigning higher cost for them. Accordingly, stakeholders with lower demands receive a larger share of the reallocated quotas (Herrero and Villar, 2001; Mianabadi et al., 2015). This might lead to inequitable reallocation of resources, which can be viewed as a potential drawback of this approach.

2.3.3. Weighted Pinile method (WPIN)

The process of reallocation in this method is carried out in two steps (Equations 4 and 5). First, each stakeholder is initially allocated half of its claim. Then, the remaining resources are shared among stakeholders using the WCEA method that ensures equal sharing of profits. This means that those who have lower demands will receive higher profits (Tayebzadeh Moghadam and Malekmohammadi, 2020).

2.3.4. Weighted Talmud method (WTAL)

To implement the WTAL method, the reallocation process begins by assigning each stakeholder half of its claim. If the total reallocation exceeds the available resource, then the WCEA is used, whereby a constrained value of

is assigned to each stakeholder (Equation 6). Conversely, if the total reallocation is less than or equal to the available resource, the WCEL is employed, with a constrained value of

being assigned to each stakeholder (Equation 7) (Tayebzadeh Moghadam and Malekmohammadi, 2020):

In Equation 7, once the condition is met, first half of the demand of each stakeholder from the total resources is allocated to it as the initial quota, and finally the final quota from sum of the initial quota and the amount of the quota calculated by the WCEL method based on the remaining amount of demands and the remaining resources are calculated.

2.3.5. Weighted Constrained Equal Losses method (WCEL)

The WCEL method stands in contrast to the WCEA method (Equation 8). The WCEL method seeks to share resources based on the highest demand among stakeholders (Moulin, 2000; Casas-Méndez et al., 2011; Pande and Ertsen, 2014; Mianabadi et al., 2015).

This approach is based on sharing the shortage resulted from the difference between the available resources and the total demands of stakeholders until all shortages are shared among stakeholders.

2.3.6. Modified Weighted Constrained Equal Losses method (MWCEL)

This method is established based on the fundamental notion that the deficit should be shared inversely proportional to the contribution of each individual stakeholder into the resources (Equations 9 and 10). In other words, the greater the contribution of a stakeholder, the smaller the deficit it receives. This principle ensures an equitable reallocation of resources among stakeholders. In essence, this method offers an approach to resources reallocation that considers contributions of each stakeholder in the system (Mianabadi et al., 2015).

where

is the total deficit that is the difference between total demand and available resources.

2.3.7. The proposed Weighted Combinational Contribution-Claim method (WCCC)

Beside considering the demands (claims) of stakeholders for reallocation, the effect of stakeholders’ contributions in shared water resources recharge also should be considered, which potentially cause to increase their motivation for helping the resources sustainability and improving mutual welfare. Indeed, it should encourage and support the stakeholders who have relatively greater contribution in the shared water resources recharge to receive smaller deficit in comparison with the stakeholders with smaller contribution. Furthermore, the real relative importance (weight) of stakeholders that is depended on the sustainable development indicators and sub-indicators should be implemented for reallocation. It means that the stakeholders who have higher weights in viewpoint of implementing sustainable development goals, should receive lower deficit. The deficit is related to the significant difference between total demand and available resources, especially in groundwater resources.

Accordingly, this study proposes a modified weighted combinational Bankruptcy method to resolve certain issues in the existing methods. The proposed method for the reallocation of resources in the current study involves consideration of the two factors. First, it considers the weights of each stakeholder and their respective beneficiaries. Also, it takes into account the impact of both contribution and claim of each stakeholder and their beneficiaries, simultaneously. In this regard, first, the total deficit is determined by (Equation 11):

Then, the process of reallocating each stakeholder’s share of the total deficit is determined by (Equation 12).

where

is the weighted deficiency reallocation factor. Finally, each stakeholder’s final share from resource is determined based on (Equation 13):

where

is the reallocated share of this method to

ith stakeholder.

2.4. Acceptability and stability assessment

Choosing the most favorable method for reallocating shared water resources in bankruptcy conditions is important for ensuring stable cooperation among stakeholders. Therefore, an ideal approach should be selected based on the stakeholders’ satisfaction. To achieve this goal, a quantitative comparison of stakeholders’ willingness to cooperate under various Bankruptcy methods would be beneficial for decision-makers. Considering the evaluation of stability, the most favorable method for resource reallocation can be chosen. There are various methods for assessing stability, which the most commonly used are the Plurality Index, the Power Index, and the Bankruptcy Allocation Stability Index (BASI). When there exists an uneven distribution of power among stakeholders, the Plurality Index and Power Index may not be suitable for identifying a viable solution (Dinar and Howitt, 1997; Madani et al., 2014). In this research, a lack of power balance can be observed among stakeholders, as the proportions between demands and contributions vary significantly. Therefore, in this research, the BASI method, which is a modification of the Power Index, is used to assess the methods’ stability.

2.4.1. Bankruptcy Reallocation Stability Index (BASI)

The BASI is used to determine how acceptable and stable a Bankruptcy method is within a given system. This finding has an important feature for securing cooperation among stakeholders over a shared aquifer (Madani et al., 2014). Accordingly, first the Bankruptcy power index is determined (Equation 14):

where

represents the Bankruptcy power index related to

ith stakeholder,

denotes the amount of resources allocated to

ith stakeholder by each Bankruptcy method,

represents the amount of resources allocated to

ith stakeholder by other stakeholders that is calculated by the difference between the total available resources and the sum of other stakeholders’ demands,

t refers to time periods over the entire total time,

n denotes the number of time intervals, and

represents the number of stakeholders (Madani et al., 2014). It should be noted that when water resource is reallocated in temporal steps (e.g., days, weeks, and months) over a planning horizon (e.g., one year, five years, and ten years), then the time parameter is reflected in the reallocation formulas. In this study, despite estimating the demand and supply parameters based on monthly data, the reallocation is not implemented in multi-temporal steps. Consequently, in calculating the BASI, the temporal aggregation does not play any role. In the next step, the value of the BASI stability index for allocating bankruptcy is determined according to (Equation 15):

where

represents the standard deviation of

and

represents the average of

. The lower the value of the

for the Bankruptcy method, the more stable the method is perceived among stakeholders (Madani et al., 2014).

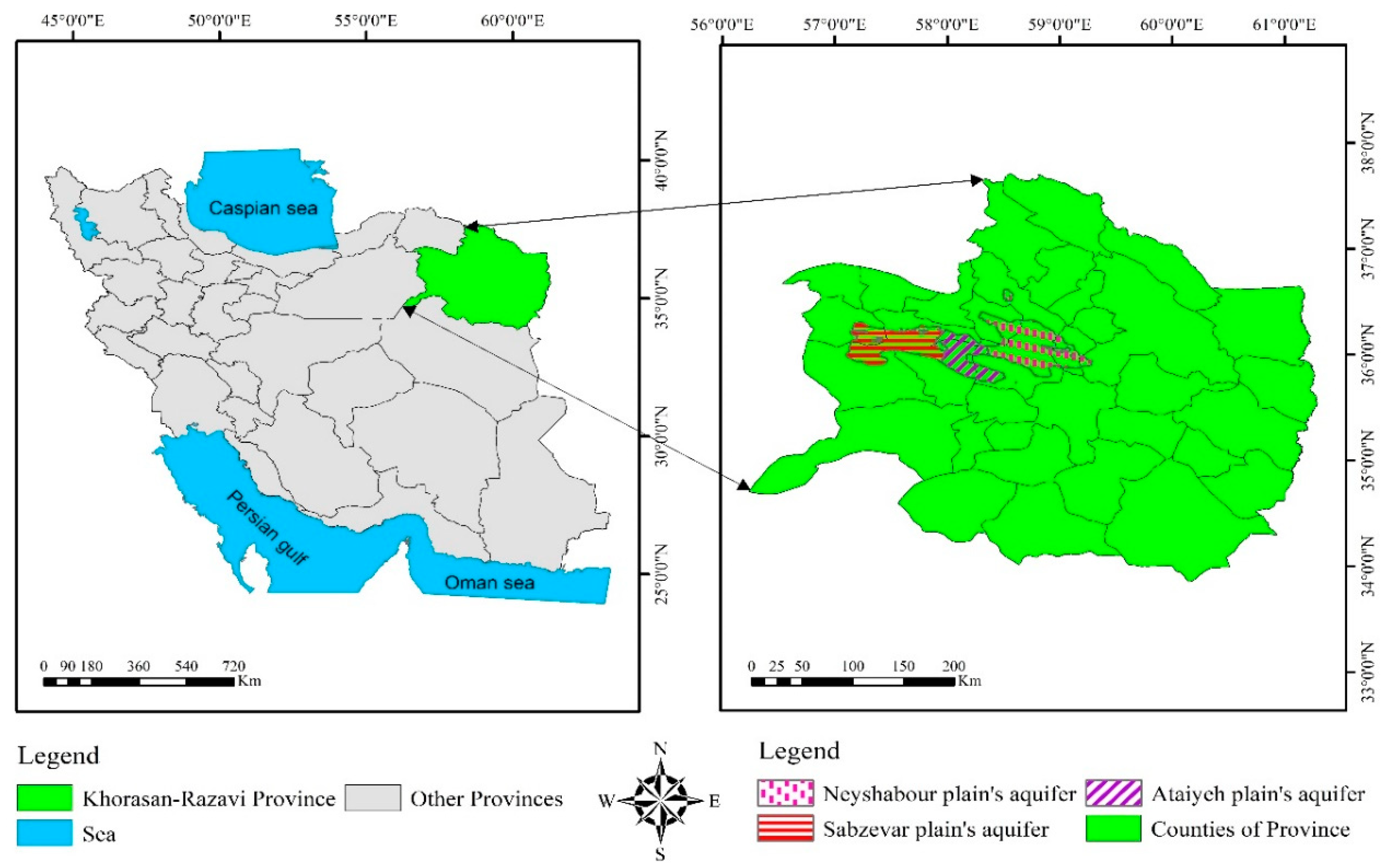

2.5. Data and study area

The study area encompasses the three plains as the stakeholders including Neyshabour, Ataiyeh and Sabzevar, which lie within the Kavir-e-Markazi Basin in Iran. The Neyshabour aquifer area is estimated 2891.2 km

2, which is located in the northeast region of the basin. The Sabzevar aquifer has 2152.9 km

2 area that is located on the west of the Khorasan Razavi Province. This aquifer has a hydrogeological connection with the Ataiyeh aquifer along its eastern boundary. The Ataiyeh aquifer spans a 1402.2 km

2 area, which is situated westward of Neyshabour aquifer that has a hydrogeological connection with the Neyshabour aquifer along its eastern boundary.

Figure 3 shows the location of these plains in Khorasan Razavi Province in Iran (Iran Ministry of Energy, 2017).

2.5.1. Baseline scenario

According to

Table 2, for the Baseline scenario, the total claim of stakeholders from the shared aquifer is 1106.19 (MCM/y), while their total contribution to the aquifer recharge (including the agricultural, drinking, and industrial return water) is 330.52 (MCM/y), and the recharge from rainfall is 186.61 (MCM/y), so the total recharge is 517.13 (MCM/y). It means that the total aquifer recharge, assumed as the extractable aquifer resource in this study, only meets 46.75% of the total claim, leaving the shared aquifer with the total deficit of 589.06 (MCM/y) to satisfy the claims. Therefore, the bankruptcy condition for the shared aquifer among the Neyshabour, Ataiyeh, and Sabzevar plains and their beneficiaries is evident. Accordingly, analyzing the Bankruptcy Theory to reallocate the shared groundwater resources among stakeholders is justified for resolving potential conflicts among stakeholders.

Table 2.

Claim and contributions of the stakeholders and beneficiaries in the Baseline scenario (2010-2011) and the Future scenario (2041) (MCM/y).

Table 2.

Claim and contributions of the stakeholders and beneficiaries in the Baseline scenario (2010-2011) and the Future scenario (2041) (MCM/y).

| Type of scenario |

Stakeholders |

Rainfall |

Beneficiaries |

Claim |

Contribution |

| Baseline |

Neyshabour |

106.27 |

Agricultural |

668.46 |

188.38 |

| Drinking |

39.67 |

26.18 |

| Industrial |

7.22 |

4.27 |

| Sabzevar |

49.91 |

Agricultural |

228.26 |

54.75 |

| Drinking |

30.73 |

12.8 |

| Industrial |

5.38 |

3.13 |

| Ataiyeh |

30.43 |

Agricultural |

122.31 |

38.76 |

| Drinking |

3.09 |

1.67 |

| Industrial |

1.07 |

0.58 |

Table 2.

continued. Claim and contributions of the stakeholders and beneficiaries in the Baseline scenario (2010-2011) and the Future scenario (2041) (MCM/y).

Table 2.

continued. Claim and contributions of the stakeholders and beneficiaries in the Baseline scenario (2010-2011) and the Future scenario (2041) (MCM/y).

| Type of scenario |

Stakeholders |

Rainfall |

Beneficiaries |

Claim |

Contribution |

| Future |

Neyshabour |

106.27 |

Agricultural |

619.61 |

173.49 |

| Drinking |

53.7 |

13.96 |

| Industrial |

6.44 |

3.8 |

| Sabzevar |

49.91 |

Agricultural |

157.24 |

37.74 |

| Drinking |

35.97 |

15.11 |

| Industrial |

3.85 |

2.23 |

| Ataiyeh |

30.43 |

Agricultural |

55.38 |

17.72 |

| Drinking |

3.09 |

1.67 |

| Industrial |

0.67 |

0.36 |

In this study, it should be noted that the extractable water amount from the aquifer is assumed equivalent to the concept of "sustainable yield" of the aquifer. This assumption leads to the aquifer budget becoming zero and prevents groundwater level depression. As such, the first concept associated with the aquifer withdrawal for groundwater sustainability is the safe yield, which over time lead to the definition of the sustainable yield concept considering factors such as groundwater level depression, water quality changes, etc. Indeed, sustainable yield is a realistic estimation of the water amount that can be extracted based on the groundwater inflow and outflow balance, in a way that prevents groundwater level depression in the long-term.

2.5.2. Future scenario

According to the reports of the Khorasan Razavi Regional Water Company, the claim and contribution data related to stakeholders and beneficiaries have been documented for the period spanning 2011 to 2026, encompassing three five-year intervals. Further, the year 2041 is considered for the Future scenario, as the horizon of integrated water resources management in Iran (Iran Ministry of Energy, 2009). Therefore, in order to analyze the reallocation process for the Future scenario, by leveraging the Regression method, the future claims within the upcoming three five-year periods, specifically targeting the year 2041 are estimated. In addition, the related future contributions are calculated for the year 2041 based on the ratio between the claims and contributions for each stakeholder and the relevant beneficiaries in the Baseline scenario. It is noted that the present research focuses on the implementation of demand management approach and the involvement of stakeholders in the reallocation of aquifer resources. Due to this fact, no action has been taken regarding the resource supply management approach. Accordingly, the rainfall amount in the Future scenario is deemed equivalent to that of the Baseline scenario and is incorporated into the reallocation process. Consequently, for the Future scenario, the total estimated demand of the stakeholders from the shared aquifer is reduced to 935.95 MCM/y, while their collective contribution towards recharging the aquifer stands at 266.08 MCM/y. As the result, 483.26 MCM/y deficit is observed in the shared aquifer.

As shown in

Table 2, the agricultural beneficiary for all three stakeholders will notably decrease its water demands in the Future scenario in comparison with the Baseline scenario. This reduction can be attributed to the implementation of modified policies aimed at optimizing cropping patterns and improving production efficiency with respect to water consumption. Similarly, the industrial beneficiary for all three stakeholders will implement the same policy of the agricultural beneficiary in water demand, which can be attributed to the application of sustainable development policies for water resources.

Conversely, in the Future scenario, the water demand for the drinking beneficiary for Neyshabour and Sabzevar is expected to be increased, which relates to growing population and the corresponding augmented demand for both future urban and rural drinking water. Moreover, the future drinking demand is assumed to be constant for Ataiyeh, due to the fact that it is a small plain with an almost constant population trend, which seems to have constant drinking demand in future.

3. Results and discussion

This section analyzes the outcomes of utilizing various weighted Bankruptcy techniques on the shared groundwater resource of the study area and discusses their efficacy for both the Baseline and Future scenarios. In the following, the results of each level of the proposed reallocation process are presented:

3.1. The relative importance of plains and their beneficiaries

The stakeholders’ agents and the experts’ opinions of the study area on the priority of sustainable development indicators and sub-indicators for the two levels, related to the plains and their beneficiaries, were sought through a surveying process.

Results indicate that the final weights for the stakeholders of Neyshabour, Sabzevar, and Ataiyeh were obtained 0.54, 0.35, and 0.11, respectively. It’s due to the fact that the Neyshabour plain holds a superior position compared to the other two plains, owing to its strong consideration of crucial sustainable development indicators such as agricultural development, infrastructure development, population growth, and industrial development. On the other hand, the Ataiyeh plain holds the lowest priority due to its smaller population, limited agricultural and industrial activities.

Furthermore, concerning the beneficiaries of the plains, the Neyshabour plain assigned final weights of 0.48, 0.25, and 0.27 to the agricultural, drinking, and industrial beneficiaries respectively. As for the Sabzevar plain, the corresponding weights were 0.51, 0.26, and 0.23, while for the Ataiyeh plain, they were 0.54, 0.25, and 0.21. This implies that across all three plains, the agricultural beneficiary plays the most crucial role and carries the highest relative importance in terms of sustainable development indicators such as financial diversity, economic productivity, groundwater sustainability, and meeting the needs of the beneficiaries.

Additionally, in Sabzevar and Ataiyeh, the drinking beneficiary carries more weight compared to the industrial beneficiary, whereas in Neyshabour, the opposite is true, reflecting the specific importance of industrial activities in that region.

3.2. The reallocated quotas for plains and their beneficiaries

3.2.1. Level A: Reallocation among stakeholders (plains)

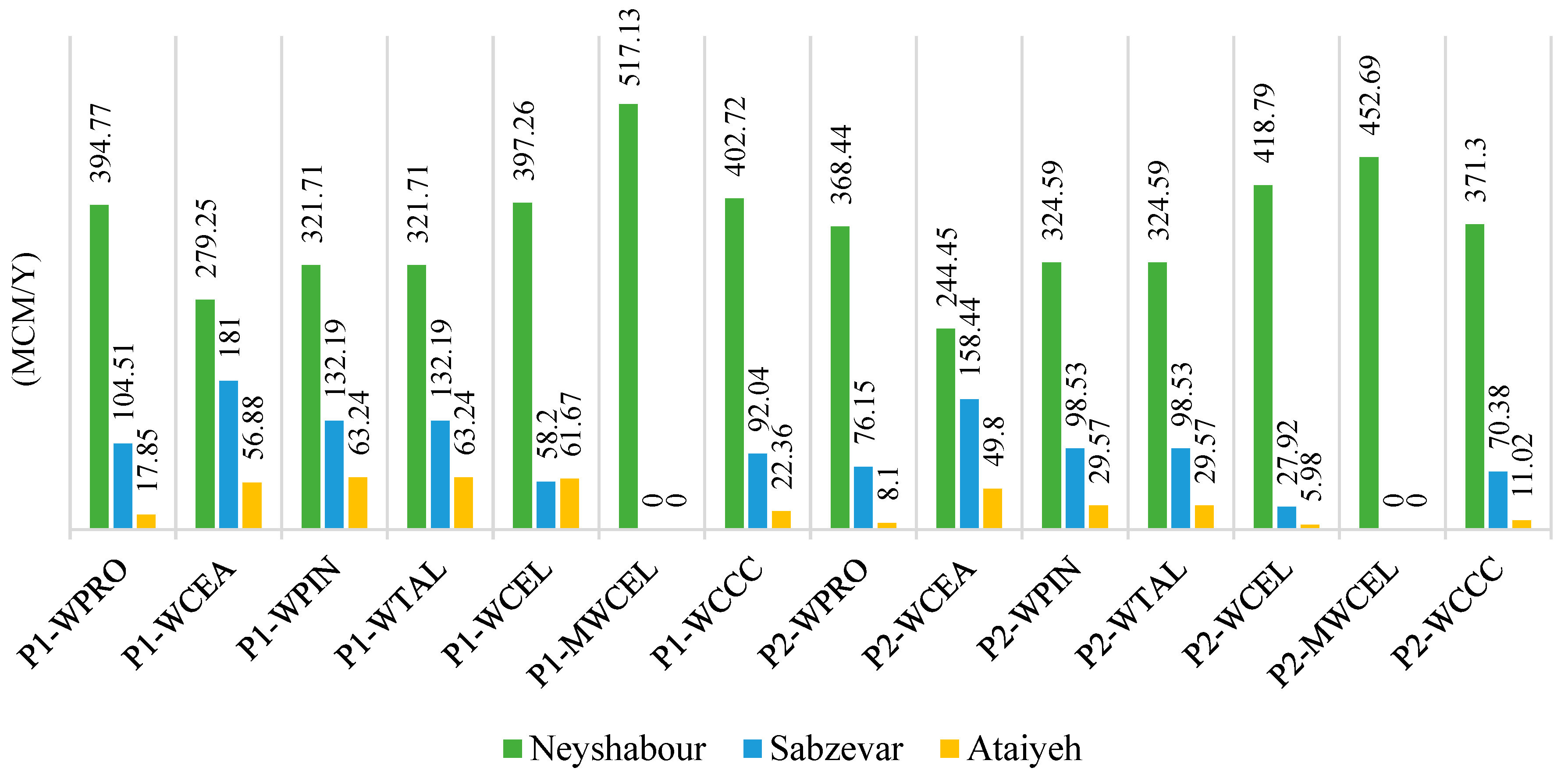

The results of implementing the weighted Bankruptcy methods in Level A of the proposed reallocation process among stakeholders (plains) for both Baseline and Future scenarios are represented in

Figure 4:

Upon analyzing the results of the first level of reallocation illustrated in

Figure 4, it can be inferred that the deficit-based methods reallocate greater quotas to stakeholders with higher claim and contribution compared to the resource-based techniques. For instance, the WCEL, as a deficit-based method, allocates nearly 77% and 92.5% of the shared resources for the Baseline and Future scenarios respectively to Neyshabour, which has the highest demand and contribution. In contrast, the resource-based method of WCEA assigns approximately 54% of the resources for both scenarios.

Furthermore, when comparing the proposed WCCC method with the other deficit-based methods, the results indicate a more realistic and equitable performance of the former. The reason for this is that the WCCC method directly takes into account the simultaneous claim and contribution of each stakeholder during the reallocation process, while the WCEL considers only the claim and the MWCEL method focuses solely on the contribution. For instance, in the Baseline scenario, the WCCC allocates around 78% of the resources to Neyshabour plain, 18% to Sabzevar, and 4% to Ataiyeh that matches with the demand and contribution patterns of the plains. On the other hand, the MWCEL method allocates 100% of the resources exclusively to Neyshabour plain.

Essentially, the proposed WCCC method overcomes the limitations of the deficit-based methods category. According to this method, the higher the weight of each stakeholder, the lower their quotas from the deficit. Additionally, the WCCC method incentivizes stakeholders to reduce their resource demands and increase their contribution to groundwater recharge in order to minimize the deficit and maximize their quotas, thereby promoting resource stability. Moreover, upon comparing the reallocated results of the Baseline and Future scenarios, it is logically observed that the allocated demands of the plains have predominantly decreased.

3.2.2. Level B: Reallocation among beneficiaries

This section pertains to the analysis of Level B of the proposed reallocation process about the quotas assigned to the beneficiaries of each stakeholder for the two scenarios (

Table 3):

Table 3.

The weighted Bankruptcy methods’ results in Level B of reallocation among beneficiaries (MCM/y).

Table 3.

The weighted Bankruptcy methods’ results in Level B of reallocation among beneficiaries (MCM/y).

| Level B |

Beneficiaries |

Resource-based methods |

|

Deficit-based methods |

| WPRO |

WCEA |

WPIN |

WTAL |

WCEL |

MWCEL |

WCCC |

| Baseline |

|

|

|

|

|

|

|

| Neyshabour |

Agricultural |

268.44 |

232.36 |

255.81 |

255.81 |

279.25 |

279.25 |

252.79 |

| Drinking |

9.05 |

39.67 |

19.84 |

19.84 |

0.00 |

0.00 |

22.82 |

| Industrial |

1.76 |

7.22 |

3.61 |

3.61 |

0.00 |

0.00 |

3.63 |

| Sum |

279.25 |

279.25 |

279.25 |

279.25 |

279.25 |

279.25 |

279.25 |

| Sabzevar |

Agricultural |

164.78 |

144.89 |

147.56 |

162.95 |

176.60 |

181.00 |

157.39 |

| Drinking |

14.00 |

30.73 |

28.06 |

15.37 |

4.40 |

0.00 |

19.67 |

| Industrial |

2.22 |

5.38 |

5.38 |

2.69 |

0.00 |

0.00 |

3.94 |

| Sum |

181.00 |

181.00 |

181.00 |

181.00 |

181.00 |

181.00 |

181.00 |

| Ataiyeh |

Agricultural |

55.76 |

52.72 |

54.80 |

54.80 |

56.88 |

56.88 |

55.25 |

| Drinking |

0.81 |

3.09 |

1.55 |

1.55 |

0.00 |

0.00 |

1.23 |

| Industrial |

0.30 |

1.07 |

0.54 |

0.54 |

0.00 |

0.00 |

0.39 |

| Sum |

56.88 |

56.88 |

56.88 |

56.88 |

56.88 |

56.88 |

56.88 |

| Future |

|

|

|

|

|

|

|

|

| Neyshabour |

Agricultural |

307.04 |

264.45 |

294.52 |

294.52 |

324.59 |

324.59 |

307.18 |

| Drinking |

15.56 |

53.70 |

26.85 |

26.85 |

0.00 |

0.00 |

13.56 |

| Industrial |

1.99 |

6.44 |

3.22 |

3.22 |

0.00 |

0.00 |

3.84 |

| Sum |

324.59 |

324.59 |

324.59 |

324.59 |

324.59 |

324.59 |

324.59 |

| Sabzevar |

Agricultural |

85.94 |

62.71 |

78.62 |

78.62 |

94.53 |

98.53 |

80.56 |

| Drinking |

11.48 |

31.97 |

17.99 |

17.99 |

4.00 |

0.00 |

15.75 |

| Industrial |

1.11 |

3.85 |

1.93 |

1.93 |

0.00 |

0.00 |

2.22 |

| Sum |

98.53 |

98.53 |

98.53 |

98.53 |

98.53 |

98.53 |

98.53 |

| Ataiyeh |

Agricultural |

21.48 |

19.14 |

19.36 |

19.36 |

14.46 |

29.57 |

21.61 |

| Drinking |

7.93 |

9.76 |

9.87 |

9.87 |

15.11 |

0.00 |

7.72 |

| Industrial |

0.16 |

0.67 |

0.34 |

0.34 |

0.00 |

0.00 |

0.24 |

| Sum |

29.57 |

29.57 |

29.57 |

29.57 |

29.57 |

29.57 |

29.57 |

As shown in

Table 3, the agricultural beneficiary receives the greater quotas among the drinking and industrial beneficiaries in the plains. This is related to its significant role in sustainable development indicators, as well as its high demand and contribution.

Additionally, when comparing the resource-based method of WCEA, with the deficit-based methods, WCEL and MWCEL, it is evident that WCEA prioritizes the beneficiary with the lowest claim (industrial beneficiary) and allocates the resources accordingly. On the other hand, WCEL and MWCEL consider the beneficiary with the highest claim and contribution, allocating the majority of the resources to that beneficiary. Furthermore, considering the deficit-based category, when comparing the WCEL and MWCEL methods with the proposed WCCC method, it is observed that the reallocation of resources for drinking and industrial beneficiaries in the plains is reduced to zero and all available resources are allocated to the agricultural beneficiary. In contrast, the WCCC method takes into account all beneficiaries in each plain, considering their respective claims and contribution.

Overall, similar to Level A, the results obtained from the proposed WCCC method in Level B demonstrate a more realistic and fairer reallocation as compared to the other deficit-based methods.

3.3. Acceptability and stability assessment and Prioritizing

3.3.1. Level A: Stability among stakeholders

One of the most important steps in the Bankruptcy-based reallocation process for shared water resources is selecting the most favorable method for reallocation, which can achieve the most satisfaction of all stakeholders. In this study, The BASI is considered as the best approach to assess the stability of the weighted Bankruptcy methods. The results of utilizing the BASI for assessing the weighted Bankruptcy methods are represented in

Table 4(a) for both scenarios in Level A of reallocation process.

According to

Table 4(a), in the first reallocation level, for the Baseline scenario, the WCEA method is deemed to be the most stable method from the perspective of all stakeholders with the minimum value (0.5) compared to the other methods. Similarly, for the Future scenario, the WPIN and WTAL methods are determined to be the most stable methods with the minimum value (0.59) among the other methods. This implies that both WPIN and WTAL methods yield identical results in the study area and have the same level of stability. Additionally, for the Future scenario, among the deficit-based methods, the proposed WCCC method, with a value of 0.97, could be considered as the potential candidate compared to the other deficit-based methods such as the WCEL and MWCEL.

Table 4.

(a) The BASI index of the weighted Bankruptcy methods in Level A. (b) The BASI index of the weighted Bankruptcy methods in Level B

Table 4.

(a) The BASI index of the weighted Bankruptcy methods in Level A. (b) The BASI index of the weighted Bankruptcy methods in Level B

| (a) |

| Time horizon |

BASI method |

Resource-based methods |

|

Deficit-based methods |

| WPRO |

WCEA |

WPIN |

WTAL |

WCEL |

MWCEL |

WCCC |

| Baseline |

Stakeholders |

0.98 |

0.5 |

0.51 |

0.51 |

0.94 |

1.73 |

1.01 |

| Future |

Stakeholders |

0.97 |

0.74 |

0.59 |

0.59 |

1.39 |

1.73 |

0.97 |

| (b) |

|

|

|

|

|

|

|

|

| Time horizon |

BASI method |

Resource-based methods |

|

Deficit-based methods |

| WPRO |

WCEA |

WPIN |

WTAL |

WCEL |

MWCEL |

WCCC |

| Baseline |

Neyshabour’s beneficiaries |

0.65 |

1.35 |

0.68 |

0.68 |

1.73 |

1.73 |

0.67 |

| Sabzevar’s beneficiaries |

0.75 |

1.36 |

1.16 |

0.68 |

1.43 |

1.73 |

0.65 |

| Ataiyeh’s beneficiaries |

1.05 |

1.13 |

1.13 |

0.57 |

1.73 |

1.73 |

0.78 |

| Future |

Neyshabour’s beneficiaries |

0.80 |

1.46 |

0.73 |

0.73 |

1.73 |

1.73 |

1.01 |

| Sabzevar’s beneficiaries |

0.99 |

1.22 |

0.74 |

0.74 |

1.48 |

1.73 |

0.76 |

| Ataiyeh’s beneficiaries |

1.09 |

0.94 |

1.65 |

0.97 |

0.87 |

1.73 |

1.10 |

3.3.2. Level B: Stability among beneficiaries

The BASI method is again employed to assess the stability of the weighted Bankruptcy methods for Level B of reallocation. The outcomes of using the BASI for assessing the weighted Bankruptcy methods’ results of

Table 3 are represented in

Table 4(b) for the both scenarios in Level B of reallocation process.

Depending on the category of Bankruptcy methods, the time horizon, and the involved stakeholder, the final selected Bankruptcy method for reallocating the shared resources among the beneficiaries is different. For the Baseline scenario, the WPRO and WCCC methods with minimum values of 0.65 and 0.67 are chosen for reallocation among Neyshabour’s beneficiaries. Additionally, the WCCC and WTAL methods, with minimum values of 0.65 and 0.68, are selected for water allocation among Sabzevar’s beneficiaries. Furthermore, the WTAL and WCCC methods, with values of 0.57 and 0.78 are considered for reallocation among Ataiyeh’s beneficiaries.

For the Future scenario, the beneficiaries in Neyshabour tend to select the WPIN, WTAL, and WCCC methods with minimum values of 0.73 and 1.01 for shared water reallocation. Meanwhile, the beneficiaries in Sabzevar prefer the WPIN, WTAL, and WCCC methods with minimum values of 0.74 and 0.76 for reallocating the quota. Additionally, the beneficiaries in Ataiyeh chose the WCEL and WCEA methods with minimum values of 0.87 and 0.94 for the resource reallocation.

Based on the overall stability assessment outcomes presented in

Table 4(b), the proposed WCCC method demonstrate more favorable results in terms of ensuring stability and group consensus compared to the other two deficit-based methods. Furthermore, for the Baseline scenario, the BASI values associated with the WCCC method are close to those derived from the resource-based methods. These findings indicate the ability and effectiveness of the WCCC as a deficit-based method.

4. Conclusions

This study developed and applied a two-level bankruptcy framework including a novel weighted approach for sustainably reallocating resources from a shared aquifer among three dependent plains. A hierarchical analysis determined the stakeholders’ importance degrees and the related beneficiaries’ weights based on the sustainable development indicators and the relevant sub-indicators. Various weighted Bankruptcy methods including the novel proposed approach were then employed under two distinct scenarios and reallocation levels. The approach consists of two levels of reallocation: the first level reallocates the shared resources between plains, while the second level distributes quotas among agricultural, drinking, and industrial beneficiaries. The stability of the reallocation scenarios is assessed using the BASI method.

The proposed methodology was applied to an aquifer shared by Neyshabour, Sabzevar, and Ataiyeh plains in Iran. The stability assessment of first reallocation level for the Baseline scenario revealed that the WCEA was the most desirable approach, as per BASI stability index. Also, for the Future scenario in the first level, the WPIN was selected as the suitable method for reallocation. Moreover, based on the results of the BASI index, in the second level of reallocation for the Baseline scenario, Neyshabour’s beneficiaries chose the WPRO method, Sabzevar’s beneficiaries selected the WCCC method, and the beneficiaries in Ataiyeh preferred the WTAL method for reallocation process among them. Similarly, for the Future scenario at the same level, the beneficiaries in Neyshabour and Sabzevar both selected the WPIN method, while the beneficiaries in Ataiyeh chose for the WCEL method as their preferred approach for reallocation.

In this study, due to the superior results of the BASI index related to the novel approach comparing with the other deficit-based methods, the potential of novel approach to achieve more equitable outcomes has been illustrated. This is particularly noteworthy given the bankruptcy of the under-study aquifer, which highlights the importance of considering a broad range of factors related to stakeholders, the relevant beneficiaries, and the resource itself in the reallocation process. A holistic reallocation approach that comprehensively accounts for all relevant stakeholders needs and resource conditions can help ensure a fair and sustainable outcome. Considering the diverse array of socio-economic, and environmental factors related to both stakeholders and the state of the shared resource allows for a reallocation that promotes equitable and just distribution in a manner supportive of long-term sustainability goals. A methodology incorporating these myriad, interrelated elements have the ability to substantially improve outcomes for all interested parties while supporting enhanced management of precious water resources into the future.

The suggestions for future studies can be summarized as follows: Developing the proposed weighted Bankruptcy novel approach based on optimization modeling; Analyzing the Bankruptcy methods including the proposed method for shared groundwater reallocation, based on conceptual and mathematical aquifer modeling considering the safe yield conditions; Using meteorological and climatic modeling in order to forecast rainfall for future scenarios by obtaining more precise results; Comparing the Bankruptcy methods with other cooperative approaches in relation to the shared groundwater resources reallocation problems and sensitivity analysis on the relevant results.

Acknowledgements

This paper is extracted from the master’s degree thesis at Hakim Sabzevari University, for which thanks are given. Also, the authors are grateful to the Departments of Civil and Environmental Engineering at Hakim Sabzevari University, Norwegian University of Science and Technology, University of Torbat Heydarieh, and University of Western Ontario for supporting this research work. Furthermore, the authors appreciate from Khorasan Razavi Regional Water Company for providing data of the study area.

References

- Akbari, N., Niksokhan, M. H., & Ardestani, M. (2015). Optimization of Water Allocation Using Cooperative Game Theory Case Study: Zayandehrud Basin. Journal of Environmental Studies, 40(4), 875-889.

- Ansink, E., and Weikard, H. P. (2012). Sequential Sharing Rules for River Sharing Problems. Social Choice and Welfare, 38, 187-210.

- Ashrafi, S., Mohammadpour Khoie, M. M., Kerachian, R., & Shafiee-Jood, M. (2022). Managing Basin-Wide Ecosystem Services Using the Bankruptcy Theory. Science of The Total Environment, 842, 156845.

- Bahrami Jovein, E., Javidi Sabbaghian, R., Tolouie Virani, M. A., Roghani, B., & Fereshtehpour, M. (2022). Development of a Model for Reallocation of Shared Aquifer Resources among Stakeholders Based on the Bankruptcy Approach; Case Study of Neyshabour-Sabzevar-Ataiyeh”, Journal of Iran Water Resources Research, 19, 39-56.

- Casas-Méndez, B., Fragnelli, V., & García-Jurado, I. (2011). Weighted Bankruptcy Rules and the Museum Pass Problem. European Journal of Operational Research, 215(1), 161-168.

- Chhipi-Shrestha, G., Rodriguez, M., & Sadiq, R. (2019). Selection of Sustainable Municipal Water Reuse Applications by Multi-Stakeholders Using Game Theory. Science of the Total Environment, 650(2), 2512-2526.

- Degefu, D. M., and He, W. (2016). Allocating Water under Bankruptcy Scenario. Water Resources Management, 30, 3949-3964.

- Dinar, A., and Howitt, R. E. (1997). Mechanisms for Allocation of Environmental Control Cost: Empirical Tests of Acceptability and Stability. Journal of Environmental Management, 49(2): 183-203.

- Ghavami Azad, B., and Rasi Nezami, S. S. (2018). Comparison of Application of Cooperative and Non-Cooperative Game Theory Approaches to Solving Conflicts of Water Resources. In The 13th National Conference on Watershed Management Science & Engineering of Iran and the 3rd National Conference on Conservation of Natural Resources and Environment (pp. 1-8).

- Ghosh, A., and Kar, S. K. (2018). Application of Analytical Hierarchy Process (AHP) for Flood Risk Assessment: A Case Study in Malda District of West Bengal, India. Natural Hazards, 94(1), 349-368.

- Hemati, H., and Abrishamchi, A. (2021). Water Allocation Using Game Theory under Climate Change Impact (Case Study: Zarinehrood). Journal of Water and Climate Change, 12(3), 759-771.

- Herrero, C., and Villar, A. (2001). The Three Musketeers: Four Classical Solutions to Bankruptcy Problems. Mathematical Social Sciences, 42(3), 307-328.

- IGRAC (International Groundwater Resources Assessment Centre), (2021). Transboundary Aquifers of the World [Map]. Edition 2021, Scale 1: 50 000 000. Delft, Netherlands: IGRAC, 2021.

- Iran Ministry of Energy (2009a) Water Resources Balance Studies in Scope Neyshabour Study Area, Year (2009). Summary of the Eighteenth Volume Report: Water Resources Report of Neyshabour Study Area (In Persian).

- Iran Ministry of Energy (2009b) Water Resources Balance Studies in Scope Sabzevar Study Area, Year (2009). Summary of the Eighteenth Volume Report: Water Resources Report of Sabzevar Study Area (In Persian).

- Iran Ministry of Energy (2017a) Water Resources Balance Studies in Scope of Kavir-Markazi Basin Area. Fifth Volume: Evaluation of Water Resources, Year (2010). Appendix No. 38: Water Resources Report of Neyshabour Study Area (In Persian).

- Iran Ministry of Energy (2017b) Water Resources Balance Studies in Scope of Kavir-Markazi Basin Area. Fifth Volume: Evaluation of Water Resources, Year (2010). Appendix No. 35: Water Resources Report of Sabzevar Study Area (In Persian).

- Iran Ministry of Energy (2017c) Water Resources Balance Studies in Scope of Kavir-Markazi Basin Area. Fifth Volume: Evaluation of Water Resources, Year (2010). Appendix No. 36: Water Resources Report of Ataiyeh Study Area (In Persian).

- Jalili Kamju, S. P., and Khochiani, R. (2020). Application of the Bankruptcy Theory and Conflicting Claims on Water Resources Allocation of Zayanderud. Journal of Economic Modeling Research, 10(39), 45-80.

- Jamalomidi, M., and Moridi, A. (2021). Bankruptcy Method in Reduction of Groundwater Resources Conflicts and Aquifer Balancing (Case Study: Haji Abad Aquifer). Iran-Water Resources Research, 16(4), 1-14.

- Janjua, S., and Hassan, I. (2020). Use of Bankruptcy Methods for Resolving Interprovincial Water Conflicts over Transboundary River: Case Study of Indus River in Pakistan. River Research and Applications, 36(7), 1334-1344.

- Javidi Sabbaghian, R., and Nejadhashemi, A. P. (2020). Developing a Risk-Based Consensus-Based Decision-Support System Model for Selection of the Desirable Urban Water Strategy: Kashafroud Watershed Study. Water, 12(5), 1305-1338.

- Li, S., He, Y., Chen, X., & Zheng, Y. (2020). The Improved Bankruptcy Method and its Application in Regional Water Resource Allocation. Journal of Hydro-Environment Research, 28, 48-56.

- Liu, B., Huang, J. J., McBean, E., & Li, Y. (2020). Risk Assessment of Hybrid Rain Harvesting System and Other Small Drinking Water Supply Systems by Game Theory and Fuzzy Logic Modeling. Science of the Total Environment, 708, 134436.

- Madani, K. (2010). Game Theory and Water Resources. Journal of Hydrology, 381(3-4), 225-238.

- Madani, K., and Zarezadeh, M. (2012). Bankruptcy Methods for Resolving Water Resources Conflicts. In World Environmental and Water Resources Congress 2012: Crossing Boundaries (pp. 2247-2252).

- Madani, K., Zarezadeh, M., & Morid, S. (2014). A New Framework for Resolving Conflicts over Transboundary Rivers Using Bankruptcy Methods. Hydrology and Earth System Sciences, 18(8), 3055-3068.

- Matherne, A. M., and Megdal, S. B. (2023). Advances in Transboundary Aquifer Assessment. Water, 15(6), 1208.

- Mianabadi, H., Mostert, E., Zarghami, M., & Van de Giesen, N. (2013). Transboundary Water Resources Allocation Using Bankruptcy Theory; Case Study of Euphrates and Tigris Rivers. In International Conference on Transboundary Water Management Across Borders and Interfaces: Present and Future Challenges (pp. 1-5).

- Mianabadi, H., Mostert, E., Zarghami, M., & Van de Giesen, N. (2014). A New Bankruptcy Method for Conflict Resolution in Water Resources Allocation. Journal of Environmental Management, 144, 152-159.

- Mianabadi, H., Mostert, E., Pande, S., & Van de Giesen, N. (2015). Weighted Bankruptcy Rules and Transboundary Water Resources Allocation. Water Resources Management, 29, 2303-2321.

- Moulin, H. (2000). Priority Rules and Other Asymmetric Rationing Methods. Econometrica, 68(3), 643-684.

- Naghdi, S., Bozorg-Haddad, O., Khorsandi, M., & Chu, X. (2021). Multi-Objective Optimization for Allocation of Surface Water and Groundwater Resources. Science of The Total Environment, 776, 146026.

- Pande, S., and Ertsen, M. (2014). Endogenous Change: On Cooperation and Water Availability in Two Ancient Societies. Hydrology and Earth System Sciences, 18(5), 1745-1760.

- Parrachino, I., Dinar, A., & Patrone, F. (2006). Cooperative Game Theory and its Application to Natural, Environmental, and Water Resource Issues: 3. Application to Water Resources. World Bank Policy Research Working Paper No. 4074.

- Pournabi, N., Janatrostami, S., Ashrafzadeh, A., & Mohammadi, K. (2022). Comparison of Bankruptcy Methods in the Operation Management of the Karkheh River Basin to Allocate More Water to the Hawr-Al-Azim Wetland. AQUA-Water Infrastructure, Ecosystems and Society, 71(11), 1263-1277.

- Razandi, Y., Pourghasemi, H. R., Samani Neisani, N., Rahmati, O. (2015). Application of Analytical Hierarchy Process, Frequency Ratio, and Certainty Factor Models for Groundwater Potential Mapping Using GIS. Earth Science Informatics, 8, 867-883.

- Rightnar, J., and Dinar, A. (2020). The Welfare Implications of Bankruptcy Allocation of the Colorado River Water: The Case of the Salton Sea Region. Water Resources Management, 34(8), 2353-2370.

- Roghani, B., Fereshtehpour, M., Olyaie, M. A. (2020). Hydropolitics of Transboundary Aquifers: Towards Practical Cooperation. Geopolitics Quarterly, 16(58), 187-216.

- Sadat, M., Shourian, M., & Moridi, A. (2019). Reallocation of Water Resources in Transboundary River Basins Using the Bankruptcy Approach. Iranian Journal of Soil and Water Research, 50(5), 1141-1151.

- Sar, N., Chatterjee, S., & Adhikari, M. D. (2015). Integrated Remote Sensing and GIS Based Spatial Modelling through Analytical Hierarchy Process (AHP) for Water Logging Hazard, Vulnerability and Risk Assessment in Keleghai River Basin, India. Modeling Earth Systems and Environment, 1(4), 1-21.

- Tayebzadeh Moghadam, N., and Malekmohammadi, B. (2020). Using Bankruptcy Theory Methods for Fair Allocation of Water Resources in order to Reduce Environmental Conflicts (Case Study: Lake Urmia Basin). Water Resources Engineering, 13(44), 95-105.

- The Brundtland Report by Brundtland Commission. (1987). Report of the World Commission on Environment and Development: Our Common Future.

- The Sixth Development Plan of the Islamic Republic of Iran, (2017-2021).

- Tian, J., Yu, Y., Li, T., Zhou, Y., Li, J., Wang, X., & Han, Y. (2022). A Cooperative Game Model with Bankruptcy Theory for Water Allocation: A Case Study in China Tarim River Basin. Environmental Science and Pollution Research International, 29(2), 2353-2364.

- Veisi, H., Deihimfard, R., Shahmohammadi, A., & Hydarzadeh, Y. (2022). Application of the Analytic Hierarchy Process (AHP) in a Multi-Criteria Selection of Agricultural Irrigation Systems. Agricultural Water Management, 267, 107619.

- Wang, L. Z., Fang, L., & Hipel, K. W. (2003). Water Resources Allocation: A Cooperative Game Theoretic Approach. Journal of Environmental Informatics, 2(2), 11-22.

- Wickramage, H. M., Roberts, D. C., & Hearne, R. R. (2020). Water Allocation Using the Bankruptcy Model: A Case Study of the Missouri River. Water, 12(3), 619.

- Wu, X., He, W., Yuan, L., Kong, Y., Li, R., Qi, Y., Yang, D., Degefu, D. M., & Ramsey, T. S. (2022). Two-Stage Water Resources Allocation Negotiation Model for Transboundary Rivers under Scarcity. Frontiers in Environmental Science, 10, 900854.

- Yazdian, M., Rakhshandehroo, G., Nikoo, M. R., Ghorbani Mooselu, M., Gandomi, A. H., & Honar, T. (2021). Groundwater Sustainability: Developing a Non-Cooperative Optimal Management Scenario in Shared Groundwater Resources under Water Bankruptcy Conditions. Journal of Environmental Management, 292, 112807.

- Yuan, L., He, W., Liao, Z., Degefu, D. M., An, M., Zhang, Z., & Wu, X. (2019). Allocating Water in the Mekong River Basin during the Dry Season. Water, 11(2), 400.

- Zarezadeh, M., Madani, K., & Morid, S. (2012). Resolving Transboundary Water Conflicts: Lessons Learned from the Qezelozan-Sefidrood River Bankruptcy Problem. In World Environmental and Water Resources Congress 2012: Crossing Boundaries (pp. 2406-2412).

- Zeng, Y., Li, J., Cai, Y., & Tan, Q. (2017). Equitable and Reasonable Freshwater Allocation Based on a Multi-Criteria Decision-Making Approach with Hydrologically Constrained Bankruptcy Rules. Ecological Indicators. 73, 203-213.

- Zheng, Y., Sang, X., Liu, Z., Zhang, S., & Liu, P. (2022). Water Allocation Management under Scarcity: A Bankruptcy Approach. Water Resources Management, 36(9), 2891-2912.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).