Submitted:

30 October 2023

Posted:

30 October 2023

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Fundamentals of Blockchain Architectures

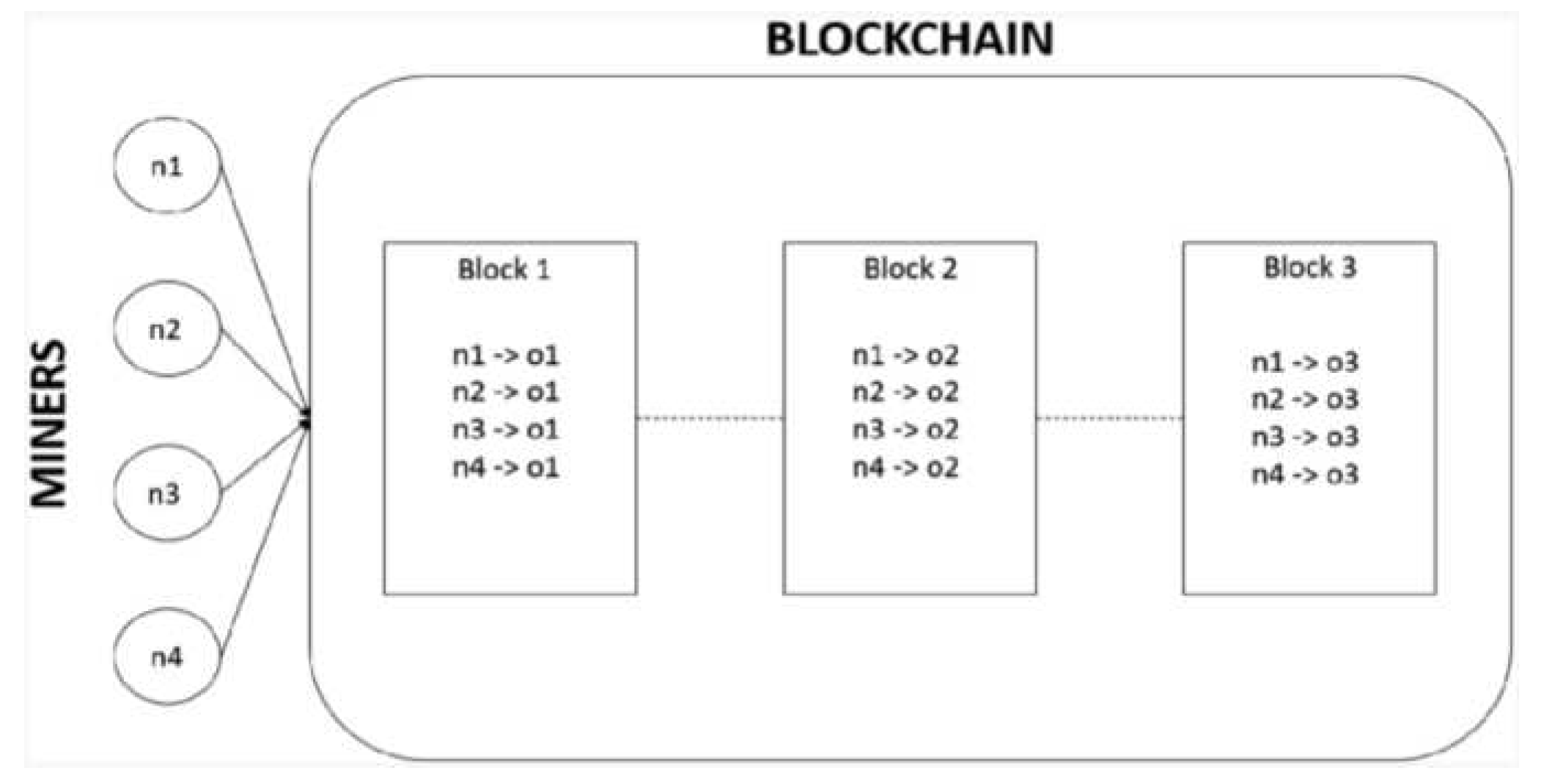

- Nodes: are active participants in the blockchain network. Its principal function is to validate, record, and maintain transactions on the blockchain. Each node owns a complete copy of the blockchain ledger and participates in verifying transactions.

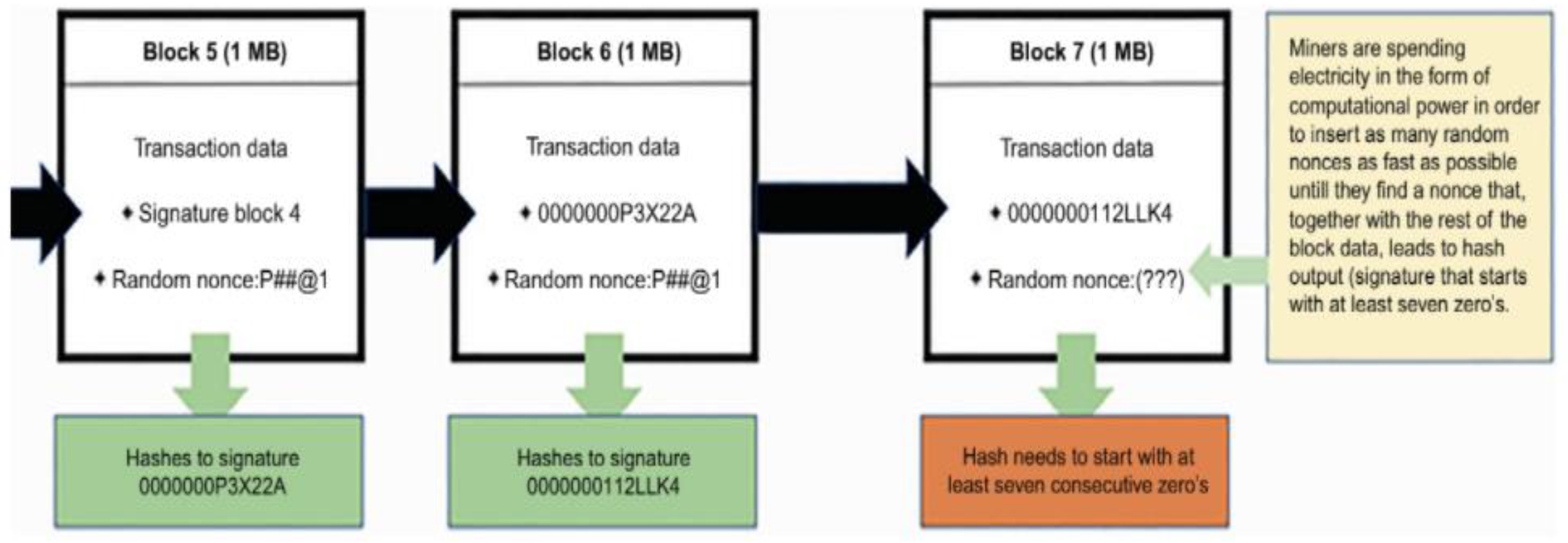

- Miners: These are particular nodes that play a central role in the security and integrity of the blockchain. They compete with each other to add a new block to the chain. To achieve this, they solve complex cryptographic problems depending on the specific consensus algorithm of the blockchain they are using.

- Users: These are the entities that carry out transactions on the blockchain. These users can be individuals and corporate entities actively participating in the digital economy.

- Public Blockchain: In this type of blockchain, the network is open to anyone who wants to join. There are no restrictions on participation, and anyone can read, write, and validate transactions. Public blockchains are entirely transparent and are generally used in applications such as cryptocurrencies, where accessibility and decentralization are essential.

- Private Blockchain: Unlike public blockchains, these restrict access to a select group of participants. Only authorized nodes can participate and validate transactions. This architecture is used in enterprise applications requiring control and privacy, such as supply chain tracking systems, electronic medical records, etc.

- Consortium Blockchain: They are a hybrid between public and private. A group of predefined actors operates the network and shares the authority to validate transactions. This architecture suits companies and organizations that want to collaborate in a trusted environment, such as shared records management in the financial sector.

- Hybrid Blockchain: Hybrid blockchains combine elements of several architectures to take advantage of the advantages of each. For example, a hybrid network may use a public blockchain for certain transactions and a private blockchain for others. This flexibility allows us to adapt to various needs and use cases.

3. Evolution of Blockchain Architectures

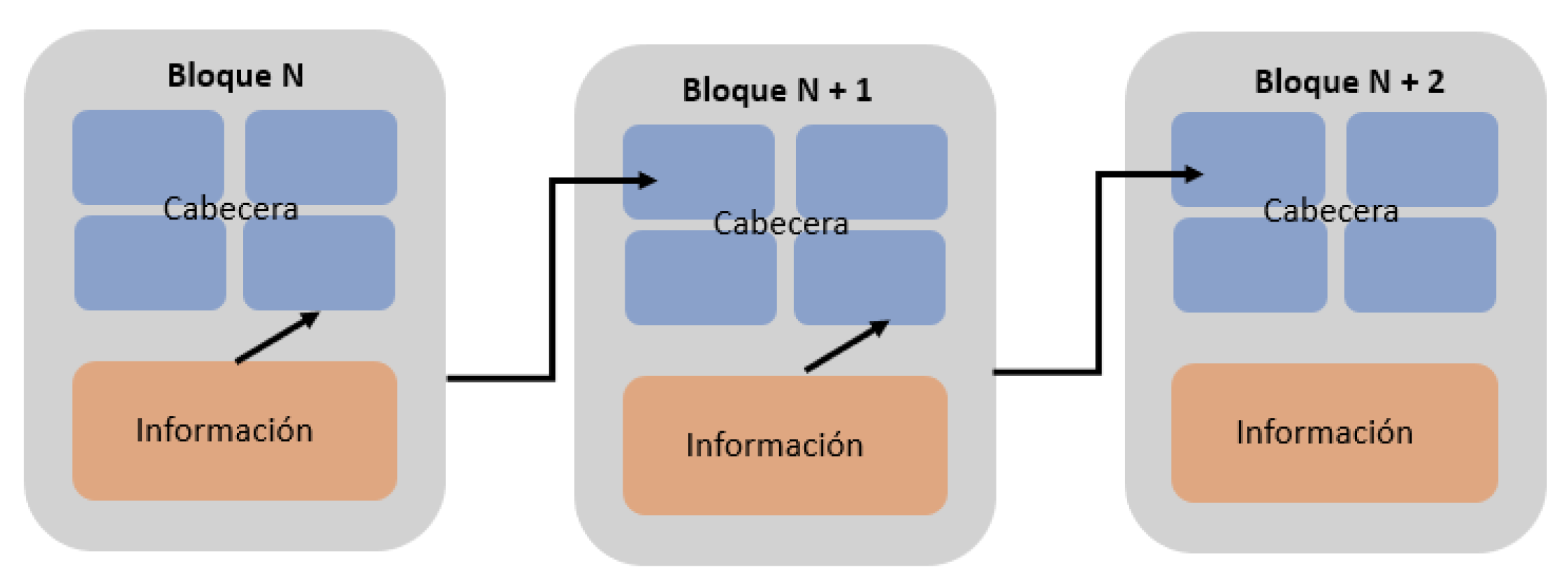

- A hash value of the previous block: This value allows the sequential linking of the blocks, thus forming an immutable chain.

- Timestamp: The timestamp allows identifying when the block was created.

- Nonce: This value is found by brute force during the mining process.

- Root hash: This root hash serves as a reference for all the information in the block. It allows efficient and secure queries about the content of the block.

- Information: It is additional information, which, in the case of Bitcoin, is the transactions made with the cryptocurrency. Additionally, one of these transactions rewards the miner who created the block. This reward decreases by half every 210,000 blocks, equivalent to approximately four years. In 2009, the reward was 50 bitcoins, currently at approximately 12.5 bitcoins.

4. Current trends in Blockchain Architectures

- Business Blockchain: One of the most notable trends is the growing adoption of blockchain in companies and organizations. Authors such as Tapscott and Tapscott (2016) have argued that blockchain has the potential to revolutionize the way transactions and contracts are carried out in the business environment. Specific blockchain architectures are being developed for enterprise applications that offer greater privacy, scalability, and efficiency.

- Interoperability: Interoperability between different blockchain networks is a significant trend. The projects are working on solutions that allow different blockchains to communicate and share information more seamlessly, facilitating collaboration and the transfer of assets between different platforms. Authors such as Zamani, Movahedi, and Raykova (2018) have investigated solutions enabling fluid and secure communication between blockchains. Interoperability is considered crucial for the future of blockchain in the digital economy.

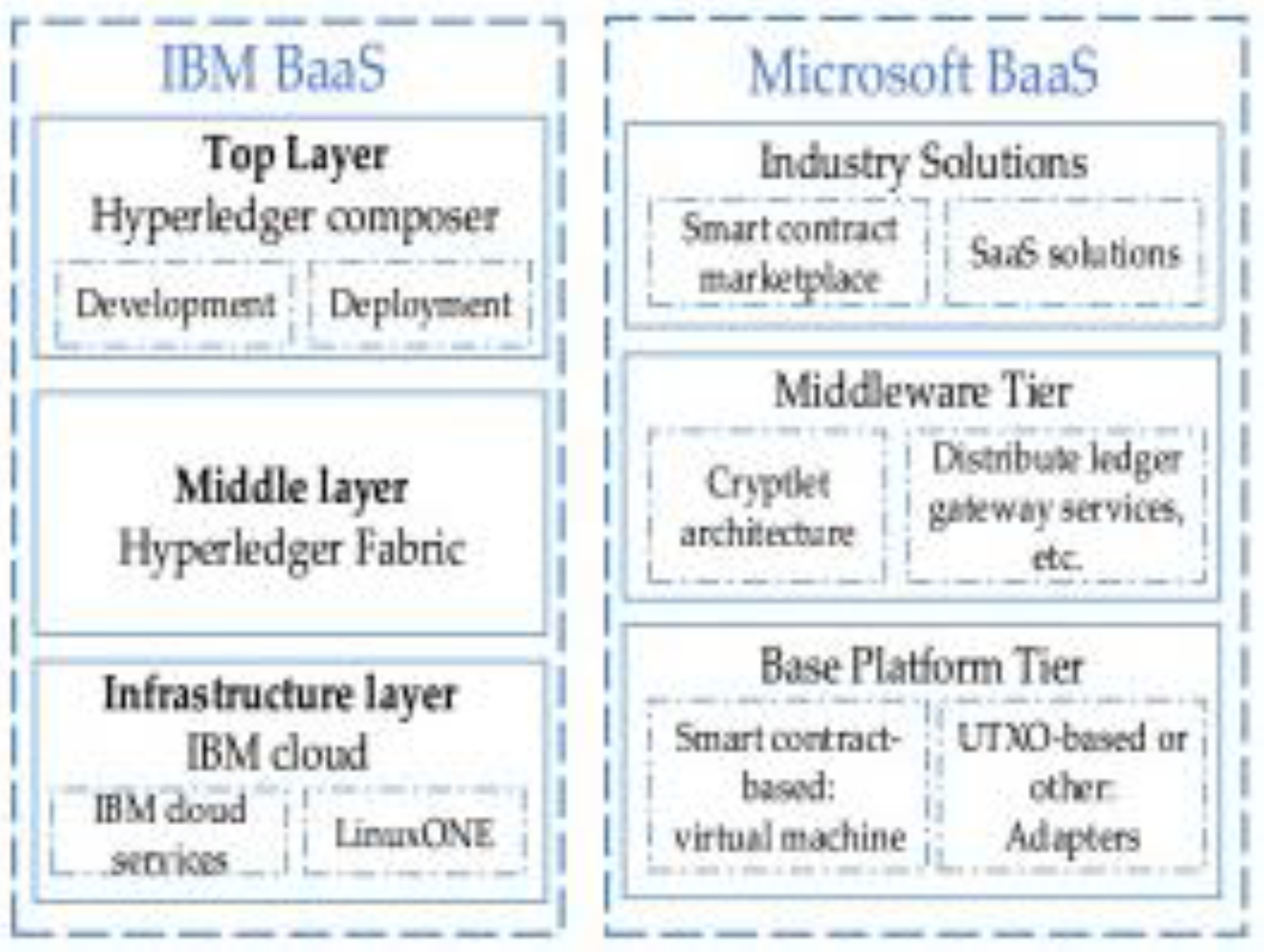

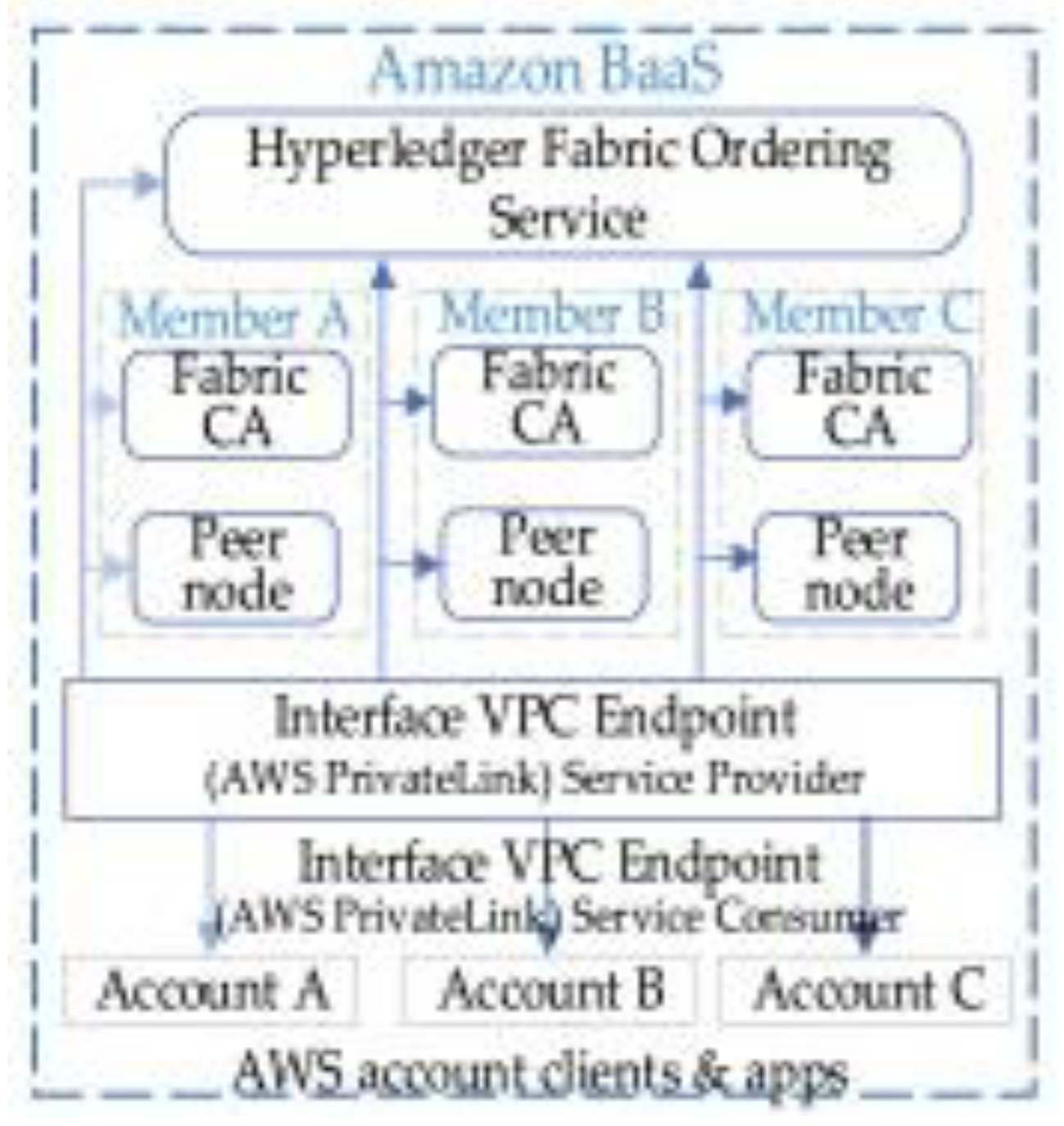

- Blockchain in the Cloud: Cloud service providers, such as AWS, Azure, and Google Cloud, offer managed blockchain services that simplify the implementation and management of blockchain networks. Simplifying the implementation makes the technology more accessible to businesses that want to take advantage of its benefits without the complexity of infrastructure management.

- Hybrid and Consortium Blockchains: Hybrid blockchain networks combine public and private blockchain elements and are gaining popularity. Authors such as Mougayar (2016) have pointed out that these architectures allow organizations to maintain control over certain aspects of their network while taking advantage of the security and decentralization of public blockchains.

- Smart Contracts and Defi Blockchain: Smart contract programming has become fundamental to many blockchains. Authors such as Szabo (1997) coined the term “smart contract,” and they are now used in a variety of applications, from decentralized financial services (DeFi) to identity management and more. Blockchain architectures must support the secure and efficient execution of these contracts. The DeFi ecosystem continues to grow and experiment with new blockchain-based financial applications. This scenario includes lending, decentralized exchanges, staking, and much more. DeFi has become an area of high growth and experimentation in cryptocurrencies.

- Blockchain and Non-Fungible Tokens (NFTs): The emergence of non-fungible tokens, representing unique and scarce digital assets, has given rise to new blockchain architectures and applications. Authors such as Chevet (2018) have explored how blockchain is used to support the ownership and authenticity of NFTs.

- Sustainability: Sustainability has become an important topic in the blockchain world due to the high energy consumption associated with some blockchains, such as Bitcoin. Trends are leaning towards adopting cleaner energy sources and more efficient consensus solutions regarding energy consumption.

- Digital Identity: Digital identity management is another area where blockchain impacts. Decentralized identity systems allow people greater control over personal information and reduce identity theft risk.

- Blockchain as a Service (BaaS): BaaS offerings continue to expand, allowing businesses to take advantage of the benefits of blockchain without the need to build and maintain their infrastructure. This facilitates the adoption of blockchain in a variety of applications.

- Government and Regulation: As blockchain matures, governments and regulatory agencies are developing laws and regulations to address security, privacy, and taxes related to cryptocurrencies and blockchain networks. Authors such as Larimer (2014) have discussed decentralized governance models for making decisions about updates and changes to the network.

5. Application Opportunities in the Digital Economy

- (1)

- Transformation of the financial industry: [1] point out that blockchain architectures have transformed the financial sector by enabling fast and secure transactions without intermediaries. As the first blockchain-based cryptocurrency, Bitcoin has challenged the traditional financial system by enabling the transfer of value directly from person to person.

- (2)

- Supply chain digitization: In the opinion of [13], blockchain architectures have the potential to revolutionize the supply chain by providing complete and transparent visibility of all processes. This scenario can lead to greater efficiency, product authentication, and reduced supply chain fraud.

- (3)

- Digital asset management: [14] notes that blockchain architectures allow asset tokenization, meaning physical and digital assets can be represented as digital tokens. This opens up opportunities for investing in and trading digital assets, such as art, real estate, and more, in a more accessible and efficient way.

- (4)

- Smart contracts and automation: [15] introduced the concept of smart contracts, self-executing programs that operate on a blockchain. These contracts offer opportunities to automate a wide range of processes, from legal agreements to complex business processes, which can save time and costs.

- (5)

- Digital identity: Digital identity management is a growing field that benefits from blockchain architectures. Authors such as [13] suggest blockchains can provide a more secure and user-controlled digital identity system by allowing people to control their identity information.

6. Challenges and obstacles to overcome

7. Relevant Case Studies

- (1)

- Cross-Border Payments and Transfers: Companies like Ripple use blockchain technology to facilitate faster and cheaper international payments. This is especially useful in global e-commerce and remittances.

- (2)

- Cryptocurrencies: Cryptocurrencies like Bitcoin and Ethereum are critical examples of how blockchain is used as digital money. Users can make online purchases, investments, and value transfers without intermediaries.

- (3)

- Decentralized Finance (DeFi): DeFi platforms such as Aave, Compound, and MakerDAO use blockchain-based smart contracts to offer decentralized financial services, such as loans, exchanges, and interest generation.

- (4)

- Asset Tokenization: Blockchain is used to tokenize physical assets, such as real estate and art. This allows investors to buy fractions of expensive assets and trade them online.

- (5)

- Secure Electronic Voting: Some countries and organizations have explored blockchain-based electronic voting to improve security and transparency in elections.

- (6)

- Digital Identity Management: Blockchain ensures the security of people’s digital identity. Users can control their personal information and share only necessary information online.

- (7)

- Product Authentication: In the luxury goods industry, blockchain is used to authenticate the authenticity of products, which helps prevent counterfeiting.

- (8)

- Transparent Supply Chains: Large companies, like Walmart, track products throughout their supply chains using blockchain. This provides transparency and faster response to quality or safety issues.

- (9)

- Online Games and Digital Collectibles: Some online games use blockchain to allow ownership and trading of in-game objects and characters as digital assets.

- (10)

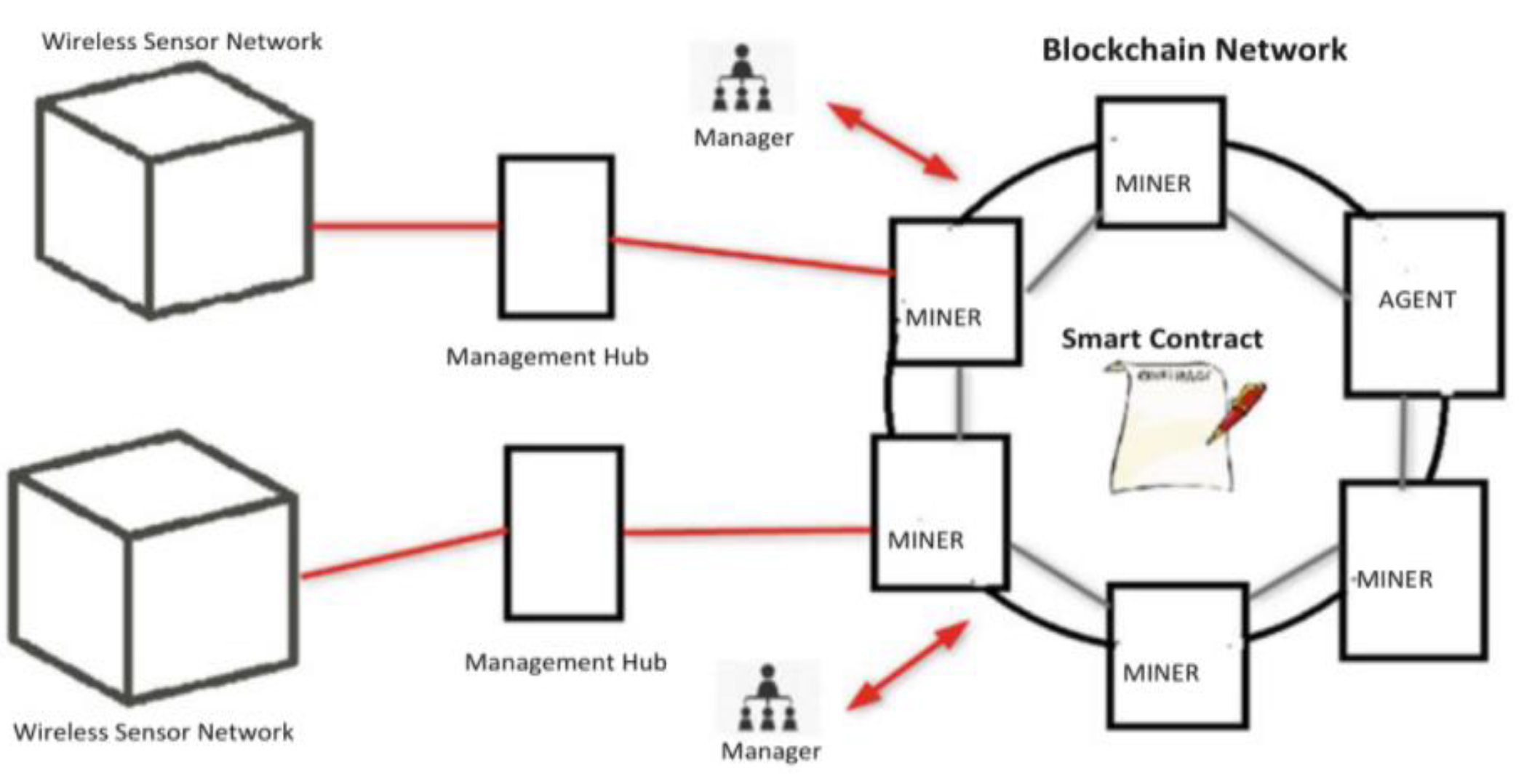

- Internet of Things (IoT): Blockchain is used in IoT applications to ensure secure communication and transactions between connected devices, such as smart meters and industrial sensors.

- Transfer of Value: Bitcoin is the most well-known cryptocurrency and is used to transfer value online without the need for intermediaries. People can buy goods and services online, invest, and transfer funds globally.

- Smart Contracts: Ethereum allows the creation and execution of smart contracts, which are self-executing programs that automate agreements and transactions. They are used in various applications, from decentralized finance (DeFi) to online gaming and electronic voting.

- Supply Chain Management: Companies like IBM use Hyperledger Fabric to track and verify the product supply chain, increasing transparency and reducing fraud.

- Financial markets: Corda is used in financial market applications, where financial assets can be traded and settled more efficiently and securely.

- Banking and Finance: Quorum has been used in banking applications, including cross-border payments and bond issuance.

- Decentralized Finance (DeFi): BSC has become a popular platform for DeFi applications, including decentralized exchanges, lending, and cryptocurrency staking.

- Education and Electronic Voting: Cardano has been used to create electronic voting systems and provide verifiable academic certifications.

- Asset Tokenization: Algorand has been used to tokenize physical and digital assets, such as real estate and art.

- Authentication and Traceability: VeChain is used in product authentication and tracking applications, such as luxury product authenticity and food traceability.

- Internet of Things (IoT): IOTA focuses on the machine economy and facilitates transactions and communication between IoT devices.

8. Perspectives and Future of Blockchain Architectures

9. Ethical and Safety Considerations

10. Conclusions

- (1)

- Recent trends and developments in blockchain architectures drive their adoption in various sectors and applications. These advances address key challenges, such as scalability and interoperability, while driving new business and smart contracts. The continued evolution of blockchain is critical to its role in the digital economy and the transformation of numerous industries.

- (2)

- Blockchain architectures represent a disruptive innovation that significantly impacts the digital economy. As these technologies continue to evolve, exciting opportunities present themselves for a variety of sectors, from finance to logistics to healthcare. The most recent trends in blockchain architectures reflect their growing adoption and ability to address challenges in the digital economy.

- (3)

- Blockchain architectures open new perspectives in the digital economy by offering innovative and secure solutions in various sectors. Experts in the field have identified these opportunities and are exploring how to make the most of this technology to drive growth and efficiency in the digital economy.

- (4)

- The application of blockchain in the digital economy has proven to be a promising solution for creating immutable records, securing transactions, and eliminating costly intermediaries. Concrete examples, such as transparent supply chains and asset tokenization, illustrate how these architectures can generate efficiency and trust in various sectors.

- (5)

- Ultimately, the future of blockchain architectures in the digital economy looks promising, potentially transforming business processes and providing new opportunities. Informed and ethical adoption of this technology will be vital to maximizing its benefits and overcoming the challenges that arise along the way. As advances and research in this field continue, it is important to stay up to date and be prepared to adapt to an ever-changing environment.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Tapscott, D., & Tapscott, A. (2016). Blockchain Revolution: How the Technology Behind Bitcoin Is Changing Money, Business, and the World. New York: Penguin Random House.

- Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic cash system. Available at: https://bitcoin.org/bitcoin.pdf.

- Munoz, J. L. , Forne, J., Esparza, O., & Soriano, M. (). Certificate revocation system implementation based on the Merkle hash tree. International Journal of Information Security 2004, 2, 110–124. [Google Scholar]

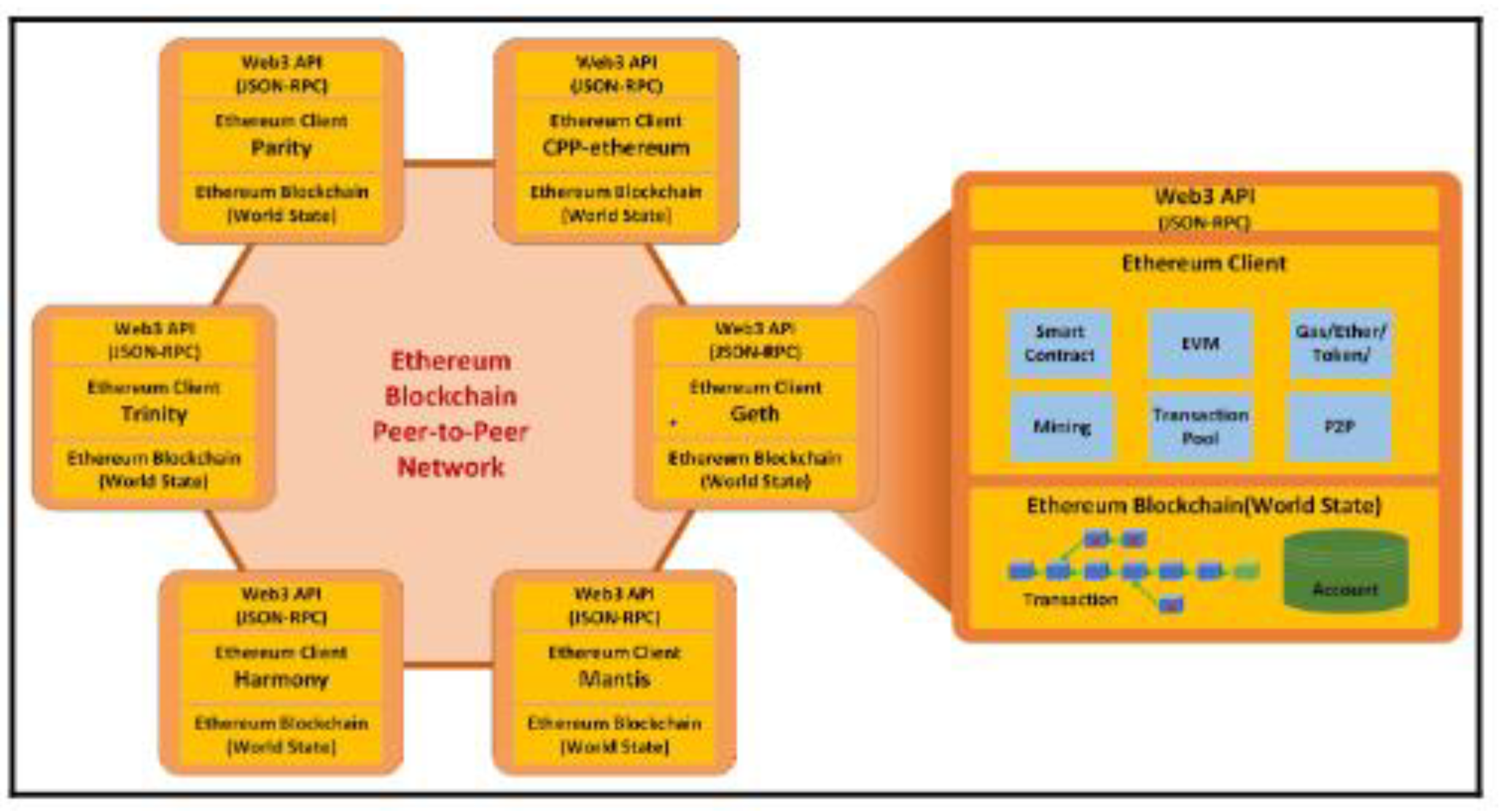

- Zhang, W., & Anand, T. (2022). Ethereum architecture and overview. In Blockchain and Ethereum Smart Contract Solution Development: Dapp Programming with Solidity (pp. 209-244). Berkeley, CA: Apress.

- Jie, S. O., Zhang, P., Alkubati, M., Yubin, B. A., & Ge, Y. U. (2021). Research advances on blockchain-as-a-service: architectures, applications and challenges. Digital Communications and Networks.

- Aggarwal, S., & Kumar, N. (2021). Architecture of blockchain. In Advances in Computers (Vol. 121, pp. 171-192). Elsevier.

- Chhabra, S., Mor, P., Mahdi, H. F., & Choudhury, T. (2021). Block Chain and IoT Architecture. In Blockchain Applications in IoT Ecosystem (pp. 15-27). Cham: Springer International Publishing.

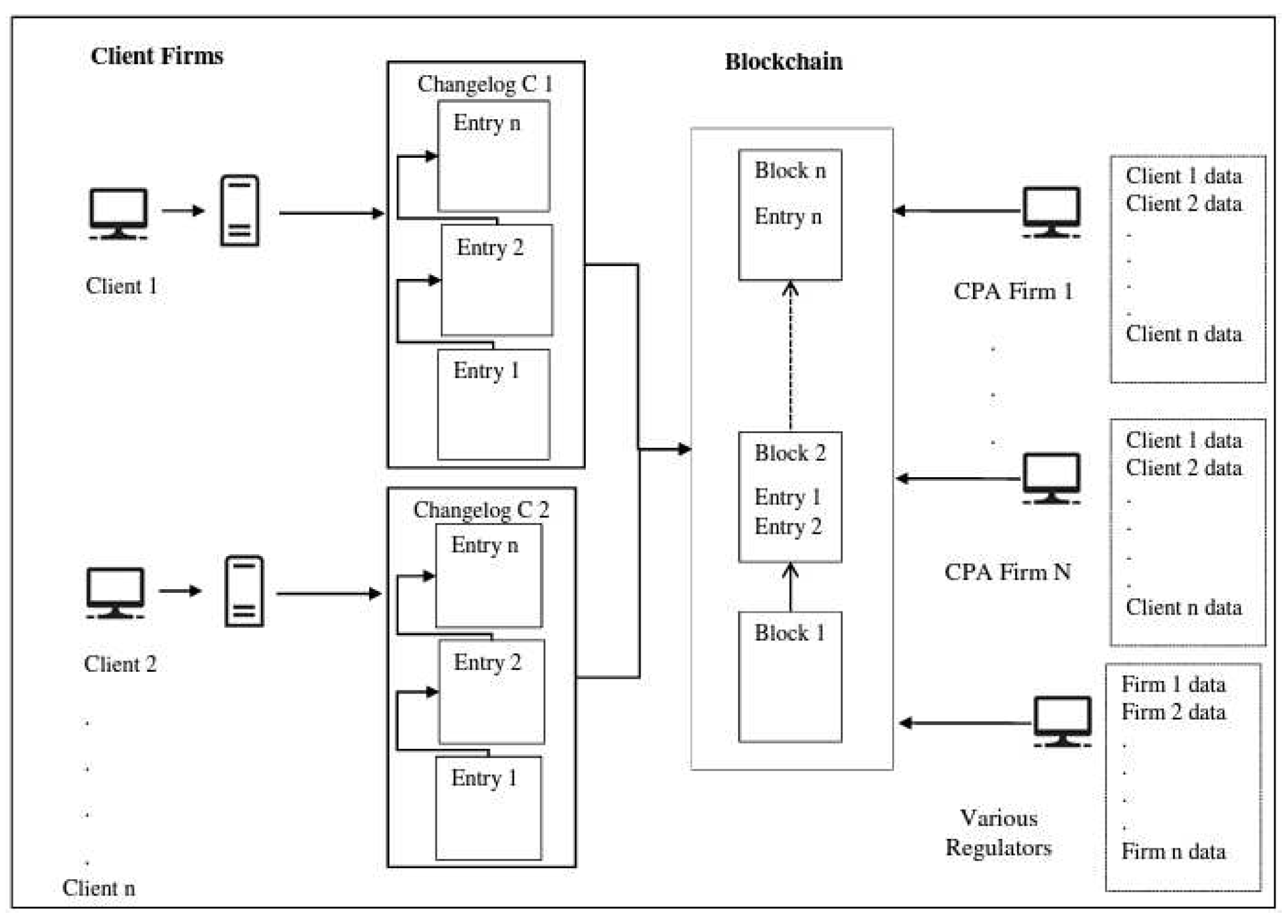

- Vincent, N. E., Skjellum, A., & Medury, S. (2020). Blockchain architecture: A design that helps CPA firms leverage the technology. International Journal of Accounting Information Systems, 38, 10046.

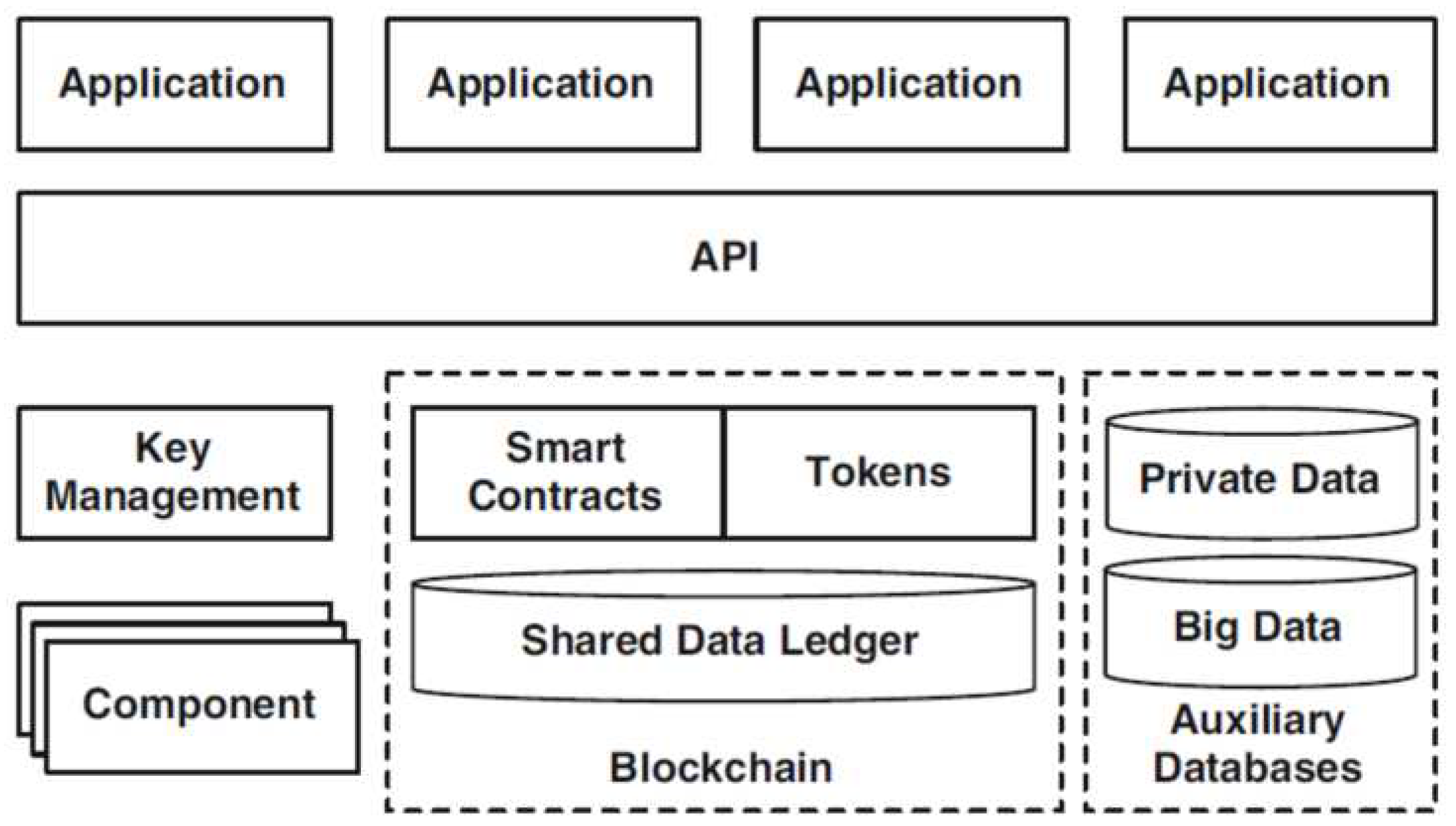

- Xu, X., Weber, I., & Staples, M. (2019). Architecture for blockchain applications (pp. 1-307). Cham: Springer.

- Saghiri, A. M. (2020). Blockchain architecture. Advanced applications of blockchain technology, 161-176.

- Xu, X., Pautasso, C., Zhu, L., Lu, Q., & Weber, I. (2018, July). A pattern collection for blockchain-based applications. In Proceedings of the 23rd European Conference on Pattern Languages of Programs (pp. 1-20).

- Ochoa, I. S., de Mello, G., Silva, L. A., Gomes, A. J., Fernandes, A. M., & Leithardt, V. R. (2019, September). Fakechain: A blockchain architecture to ensure trust in social media networks. International conference on the quality of information and communications technology (págs. 105-118). Springer.

- Mougayar, W. (2016). The business blockchain: promise, practice, and application of the next Internet technology. John Wiley & Sons.

- Swan, M. (2015). Blockchain: Blueprint for a new economy. “ O’Reilly Media, Inc.”.

- Szabo, N. (1994). Contratos inteligentes. Recuperado de https://www. fon. hum. uva. nl/rob/Courses/InformationInSpeech/CDROM/Literature/LOT winterschool2006/szabo. best. vwh. net/smart. contracts. html.

- Brown, R. (2016). Introducing R3 Corda™: A Distributed Ledger Designed for Financial Services. Available at: http://www.r3cev.com/blog/2016/4/4/introducing-r3-corda-a-distributed-ledger-designed-for-financial-services Buterin, V. (2015). On Public and Private Blockchains. Available at: https://blog.Ethereum. org/2015/08/07/onpublic-and-private-blockchains/.

- Aini, Q., Manongga, D., Rahardja, U., Sembiring, I., Elmanda, V., Faturahman, A., & Santoso, N. P. L. (2022). Security level significance in dapps blockchain-based document authentication. Aptisi Transactions on Technopreneurship (ATT), 4(3), 292-305.

- Aponte, F., Gutierrez, L., Pineda, M., Merino, I., Salazar, A., & Wightman, P. (2021). Cluster-based classification of blockchain consensus algorithms. IEEE Latin America Transactions, 19(4), 688-696.

- Attia, O., Khoufi, I., Laouiti, A., & Adjih, C. (2019, June). An IoT-blockchain architecture based on hyperledger framework for health care monitoring application. In NTMS 2019-10th IFIP International Conference on New Technologies, Mobility and Security (pp. 1-5). IEEE Computer Society.

- Besançon, L., Da Silva, C. F., Ghodous, P., & Gelas, J. P. (2022). A blockchain ontology for DApps development. IEEE Access, 10, 49905-49933.

- Bhutta, M. N. M., Khwaja, A. A., Nadeem, A., Ahmad, H. F., Khan, M. K., Hanif, M. A., ... & Cao, Y. (2021). A survey on blockchain technology: Evolution, architecture and security. Ieee Access, 9, 61048-61073.

- Birch, D. (2017). Before Babylon, Beyond Bitcoin: From money that we understand to money that understands Us. London Publishing Partnership.

- Chang, L., & Hsieh, M. Y. (2022). Five ways to create customer values with blockchain. International Journal of Organizational Innovation, 14(4), 1-19.

- Charles, W., Marler, N., Long, L., & Manion, S. (2019). Blockchain compliance by design: Regulatory considerations for blockchain in clinical research. Frontiers in Blockchain, 2, 18.

- Chen, C., Zhang, L., Li, Y., Liao, T., Zhao, S., Zheng, Z., ... & Wu, J. (2022). When digital economy meets web 3.0: Applications and challenges. IEEE Open Journal of the Computer Society.

- Chevet, S. (2018). Blockchain technology and non-fungible tokens: Reshaping value chains in creative industries. Available at SSRN 3212662.

- Condon, F., Franco, P., Martínez, J. M., Eltamaly, A. M., Kim, Y. C., & Ahmed, M. A. (2023). EnergyAuction: IoT-Blockchain Architecture for Local Peer-to-Peer Energy Trading in a Microgrid. Sustainability, 15(17), 13203.

- IO, E. (2017). EOS. IO technical white paper. EOS. IO (accessed 18 December 2017) https://github. com/EOSIO/Documentation, 9.

- Grigg, I. (2017). Eos-an introduction. White paper. https://whitepaperdatabase. com/eos-whitepaper.

- Larimer, D. (2014). Delegated proof-of-stake (dpos). Bitshare whitepaper, 81, 85.

- Larimer, D., Hoskinson, C., & Larimer, S. (2017). Bitshares: a peer to-peer polymorphic digital asset exchange. BitShares% 20A% 20Peer-to-Peer% 20Polymorphic% 20Digital% 20Asset% 20Exchange. pdf.

- De Filippi, P., & Wright, A. (2018). Blockchain and the law: The rule of code. Harvard University Press.

- Brynjolfsson, E., & McAfee, A. (2014). The second machine age: Work, progress, and prosperity in a time of brilliant technologies. WW Norton & Company.

- Elghaish, F., Hosseini, M. R., Kocaturk, T., Arashpour, M., & Ledari, M. B. (2023). Digitalised circular construction supply chain: An integrated BIM-Blockchain solution. Automation in Construction, 148, 104746.

- ElMessiry, M., ElMessiry, A., & ElMessiry, M. (2019). Dual Token Blockchain Economy Framework: The Garment Use Case. In Blockchain–ICBC 2019: Second International Conference, Held as Part of the Services Conference Federation, SCF 2019, San Diego, CA, USA, June 25–30, 2019, Proceedings 2 (pp. 157-170). Springer International Publishing.

- Ertz, M., & Boily, É. (2019). The rise of the digital economy: Thoughts on blockchain technology and cryptocurrencies for the collaborative economy. International Journal of Innovation Studies, 3(4), 84-93.

- Fernandes, A., Rocha, V., Da Conceicao, A. F., & Horita, F. (2020, March). Scalable Architecture for sharing EHR using the Hyperledger Blockchain. In 2020 IEEE International Conference on Software Architecture Companion (ICSA-C) (pp. 130-138). IEEE.

- Firdayati, D., Ranggadara, I., Afrianto, I., & Kurnianda, N. R. (2021). Designing architecture blockchain of hyperledger fabric for purchasing strategy. Int. J, 10(2).

- Hardjono, T., & Smith, N. (2021). Towards an attestation architecture for blockchain networks. World Wide Web, 24(5), 1587-1615.

- Huang, J., Lei, K., Du, M., Zhao, H., Liu, H., Liu, J., & Qi, Z. (2019). Survey on blockchain incentive mechanism. In Data Science: 5th International Conference of Pioneering Computer Scientists, Engineers and Educators, ICPCSEE 2019, Guilin, China, September 20–23, 2019, Proceedings, Part I 5 (pp. 386-395). Springer Singapore.

- Ismail, L., & Materwala, H. (2019). A review of blockchain architecture and consensus protocols: Use cases, challenges, and solutions. Symmetry, 11(10), 1198.

- Jie, S. O., Zhang, P., Alkubati, M., Yubin, B. A., & Ge, Y. U. (2021). Research advances on blockchain-as-a-service: architectures, applications and challenges. Digital Communications and Networks.

- Kolehmainen, T., Laatikainen, G., Kultanen, J., Kazan, E., & Abrahamsson, P. (2020, November). Using blockchain in digitalizing enterprise legacy systems: An experience report. In International Conference on Software Business (pp. 70-85). Cham: Springer International Publishing.

- Kučera, J., & Bruckner, T. (2019). Blockchain and ethics: A brief overview of the emerging initiatives. In BIR Workshops (Vol. 2443, pp. 129-139).

- Lao, L., Li, Z., Hou, S., Xiao, B., Guo, S., & Yang, Y. (2020). A survey of IoT applications in blockchain systems: Architecture, consensus, and traffic modeling. ACM Computing Surveys (CSUR), 53(1), 1-32.

- Li, X., Zheng, Z., & Dai, H. N. (2021). When services computing meets blockchain: Challenges and opportunities. Journal of Parallel and Distributed Computing, 150, 1-14.

- Liu, J., Zhang, H., & Zhen, L. (2023). Blockchain technology in maritime supply chains: Applications, architecture and challenges. International Journal of Production Research, 61(11), 3547-3563.

- MOHANTY, P., & BEHERA, S. K. PEER-TO-PEER ELECTRONIC CASH SYSTEM IN BITCOIN TECHNOLOGY.

- Moudoud, H., Cherkaoui, S., & Khoukhi, L. (2019, September). An IoT blockchain architecture using oracles and smart contracts: the use-case of a food supply chain. In 2019 IEEE 30th Annual International Symposium on Personal, Indoor and Mobile Radio Communications (PIMRC) (pp. 1-6). IEEE.

- Liu, X., Peng, D., & Wen, Y. (2018). Analysis of R & D Capability of China’s Blockchain Technologies. Theoretical Economics Letters, 8(10), 1889.

- Murthy, C. V. B., Shri, M. L., Kadry, S., & Lim, S. (2020). Blockchain based cloud computing: Architecture and research challenges. IEEE access, 8, 205190-205205.

- Paul, T., Islam, N., Mondal, S., & Rakshit, S. (2022). RFID-integrated blockchain-driven circular supply chain management: A system architecture for B2B tea industry. Industrial Marketing Management, 101, 238-257.

- Peck, M. E. (2017). Blockchains: How they work and why they’ll change the world. IEEE spectrum, 54(10), 26-35.

- Pennino, D., Pizzonia, M., Vitaletti, A., & Zecchini, M. (2022). Blockchain as IoT Economy enabler: A review of architectural aspects. Journal of Sensor and Actuator Networks, 11(2), 20.

- Ramadoss, R. (2022). Blockchain technology: An overview. IEEE Potentials, 41(6), 6-12.

- Ray, P. P., Dash, D., Salah, K., & Kumar, N. (2020). Blockchain for IoT-based healthcare: background, consensus, platforms, and use cases. IEEE Systems Journal, 15(1), 85-94.

- Reghunadhan, R. (2020). Ethical considerations and issues of blockchain technology-based systems in war zones: a case study approach. In Handbook of research on blockchain technology (pp. 1-34). Academic Press.

- Shaikh, Z. A., Khan, A. A., Baitenova, L., Zambinova, G., Yegina, N., Ivolgina, N., ... & Barykin, S. E. (2022). Blockchain hyperledger with non-linear machine learning: A novel and secure educational accreditation registration and distributed ledger preservation architecture. Applied Sciences, 12(5), 2534.

- Shrimali, B., & Patel, H. B. (2022). Blockchain state-of-the-art: architecture, use cases, consensus, challenges and opportunities. Journal of King Saud University-Computer and Information Sciences, 34(9), 6793-6807.

- Sigley, G., & Powell, W. (2023). Governing the digital economy: An exploration of blockchains with Chinese characteristics. Journal of Contemporary Asia, 53(4), 648-667.

- Singh, P., Elmi, Z., Lau, Y. Y., Borowska-Stefańska, M., Wiśniewski, S., & Dulebenets, M. A. (2022). Blockchain and AI technology convergence: Applications in transportation systems. Vehicular Communications, 100521.

- Seffinga, J., Lyons, L., & Bachman, A. (2017). The Blockchain (R) evolution–The Swiss Perspective. Deloitte, Feb.

- Sutriyan, H., Sunaryadi, A., & Sinambela, M. (2022, December). Blockchain-Based Multiple Server Database System Prototype on BMKG Automatic Weather Station (AWS) Center Architecture. In 2022 Seventh International Conference on Informatics and Computing (ICIC) (pp. 1-6). IEEE.

- Viriyasitavat, W., Da Xu, L., Bi, Z., & Pungpapong, V. (2019). Blockchain and internet of things for modern business process in digital economy—the state of the art. IEEE transactions on computational social systems, 6(6), 1420-1432.

- Wang, B., Luo, W., Zhang, A., Tian, Z., & Li, Z. (2020). Blockchain-enabled circular supply chain management: A system architecture for fast fashion. Computers in Industry, 123, 103324.

- Wang, S., Ouyang, L., Yuan, Y., Ni, X., Han, X., & Wang, F. Y. (2019). Blockchain-enabled smart contracts: architecture, applications, and future trends. IEEE Transactions on Systems, Man, and Cybernetics: Systems, 49(11), 2266-2277.

- Wu, K., Ma, Y., Huang, G., & Liu, X. (2021). A first look at blockchain-based decentralized applications. Software: Practice and Experience, 51(10), 2033-2050.

- Zamani, M., Movahedi, M., & Raykova, M. (2018, October). Rapidchain: Scaling blockchain via full sharding. In Proceedings of the 2018 ACM SIGSAC conference on computer and communications security (pp. 931-948).

- Zhang, A., Zhong, R. Y., Farooque, M., Kang, K., & Venkatesh, V. G. (2020). Blockchain-based life cycle assessment: An implementation framework and system architecture. Resources, Conservation and Recycling, 152, 104512.

- Zheng, Z., Xie, S., Dai, H., Chen, X., & Wang, H. (2017, June). An overview of blockchain technology: Architecture, consensus, and future trends. In 2017 IEEE international congress on big data (BigData congress) (pp. 557-564). Ieee.

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).