1. Introduction

Grain is the material basis for the sustainable development of the national economy and society, providing the prerequisites for national stability and the active and healthy production and living of the population. As the world's most populous developing country, with agriculture as its key strategic base, China has always attached great importance to grain security. Grain security is not only a matter of national economic development and social stability, but also a matter of national security and national self-reliance. Since 2013, China's grain production has been maintaining stable development, with output steadily increasing and the linkages between the various links in the supply chain gradually being strengthened. However, it should also be realized that China's grain supply chain is facing challenges due to a large population base, limited arable land and water resources, especially the frequent occurrence of natural disasters, and other factors. In early 2020, the new Crown Pneumonia epidemic led to abnormal fluctuations in the world grain market prices, and China's grain circulation was greatly challenged [

1]. In early 2022, the Russian-Ukrainian situation changed abruptly, and the international trade pattern of agricultural commodities and the grain price shock intensified, and the "European breadbasket" was also affected. Intensification of the "European breadbasket" grain supply chain fracture has caused the global grain supply chain to further tighten, leading to gradually increasing grain, fertilizer, and feed prices in China. Against this backdrop, China's grain supply chain has witnessed unconventional incidents of poor operating systems and even faces a crisis of chain breakage, seriously jeopardizing grain security. Strengthening the resilience of the grain supply chain and promoting the stability and safe operation of the grain supply chain have gradually become hotspots of concern for all walks of life.

The current world pattern has undergone profound changes, and the international environment is unpredictable [

2]. China's grain industry should not only adapt to the new normal of continuous economic decline, but also need to pay attention to the impact that various types of black swan events may bring. In the face of major changes not seen in a hundred years, profound changes in the external environment, difficulties, and risks have increased significantly. To enhance the resilience of the grain supply chain can lay a solid foundation for the rapid recovery and high-quality development of China's agricultural economy. This paper takes the resilience of the grain supply chain as the research object, makes a comprehensive evaluation of the resilience of the grain supply chain, gives the time evolution characteristics of the resilience of China's grain supply chain, analyzes the impacts of the main external shock factors on the resilience of China's grain supply chain, and puts forward suggestions and strategies for enhancing the resilience of China's grain supply chain on this basis, in order to provide theoretical references for strengthening and stabilizing the chain of China's grain supply.

2. Literature Review

Based on concepts from physics and engineering, resilience initially referred to the ability of a system to return to its original state after being stressed [

3]. In the perspective of economics, some scholars, based on the equilibrium theory, focus on how an economy can return to the initial equilibrium state after suffering a shock [

4]. Currently, most scholars have studied economic resilience based on evolutionary theory, which views resilience as the ability of a region to achieve its sustainable development through the adjustment of its society, economy, and system in the face of environmental changes. The theory of evolutionary resilience suggests that there is not a stable equilibrium for regions, and Keith proposes that regional economic resilience is a transformational and upgrading capacity that enables changes in its own institutional and organizational structure when it is subjected to external shocks [

5]. Martin and others argue that the resilience exhibited by regional economies in response to shocks consists of four dimensions, which are resistance, resilience, readjustment capacity, and economic growth path-creating capacity, and examined how employment in the major regions of the UK responded to the four Great Recessions of the last 40 years [

6]. Chen Mengyuan distinguishes the essential difference between equilibrium theory and evolutionary theory and explains the formation mechanism of regional resilience from the perspective of evolutionary theory [

7]. Su Rengang and Zhao Xianglian addressed the issue of sustainable urban development by modeling with a panel quantile model and found, through their investigation, that manufacturing development and entrepreneurial dynamics have a kind of multiplier effect on improving the economic resilience of cities. The significance of the multiplier effect varies in each city [

8]. Wei Ye and Xiu Chunliang proposed the concept of urban network resilience based on evolutionary resilience, in which the economic network resilience involves the aspect of regional economic resilience [

9].

Regarding resilience measurement, two methods are mostly used. One is the comprehensive indicator system method, which involves selecting specific indicators reflecting resilience through theoretical analysis to constitute the indicator evaluation system. Zeng Bing attempted to establish a corresponding comprehensive evaluation indicator system from seven dimensions, including robustness, risk vulnerability, intrinsic stability, high liquidity, structural balance, innovativeness, and changeability [

10]. Chen Yiwei and Ding Guanliang chose five indicators, namely, the degree of industrial agglomeration, the level of economic growth, the gap between the rich and the poor, the degree of optimization of the industrial structure, and the sensitivity of the urban economy, to examine the level of the city's economic resilience [

11]. Liu Zhen and others established the resilience indicator of cities in the city cluster in the middle reaches of the Yangtze River. They established the indicator of urban resilience from four perspectives: economy, society, ecology, and urban construction. They used the entropy value method to measure and analyze the economic resilience of each prefecture in the city cluster in the middle reaches of the Yangtze River, resulting in the indicator of economic resilience of each prefecture-level city [

12]. The other is the single indicator method, which selects a central variable that responds to external perturbations, and based on this, analyzes the gap value of this central variable under the influence of external perturbations. Both Davies and Brakman use the unemployment rate and GDP to measure the regional resilience of European countries after 2008 [

13]. Bergeijk uses the financial crisis-induced world inter-country trade reduction caused by the financial crisis to indicate economic resilience between countries [

14]. Martin examined economic resilience in different regions of the UK by analyzing changes in the composition of the workforce in nine industries in different regions of the UK [

15].

Compared to resilience research, supply chain resilience appears to be more microscopic and specific, and there is less literature directly studying the resilience of the grain supply chain. Currently, research on the grain supply chain mainly focuses on the aspects of risk assessment and control. Larson started from the cross-cutting and complexity of grain and put forward the risk of grain quality and safety in the whole process from production to consumption, pointing out the high risk of the grain supply chain [

16]. Tah and others proposed an assessment method for the hierarchical risk of the grain supply chain in order to fill the deficiencies in the existing risk management process, management tools, and technological means [

17]. Garcia and others focused on the nodes of the agricultural supply chain as well as the whole framework and constructed a structural model for the grain supply chain system, which is useful for realizing the risk management of it. The grain supply chain and the real-time traceability have a certain reference role [

18]. Panicker believes that grain is an essential necessity for human beings, which highlights the importance of risk control of the grain supply chain [

19]. The literature on the resilience of China's grain supply chain is extremely scarce, and the relevant literature mainly focuses on the risk composition system, risk indicator weights, and risk dimensions of the grain supply chain. Jonas Chen reorganized the concept of the grain supply chain and its internal dimensions, summarized the risk characteristics of the grain supply chain, and based on these characteristics, put forward the scientific proposal of constructing the emergency response linkage mechanism and risk early warning mechanism of the grain supply chain [

20]. Ding Dong and Yang Yinsheng summarized the characteristics of China's grain supply chain, identified eight potential risk factors, and provided relevant preventive measures [

21]. Wang Xiaoyi and others constructed a comprehensive indicator system of grain supply chain risks from different perspectives, scientifically evaluated the risk level of the grain supply chain, and arranged the root causes of various risks according to priorities [

22].

With the deepening of the global integration process, the synergistic effect of countries’ economic development is gradually strengthened, and external shocks have become an important aspect of a country's macroeconomic development. Swanepoel selected crude oil prices, exchange rates, and the price of non-oil imports as the most important external shock variables to study their role in South Africa's economic development and came up with the relative importance of various external shocks [

23]. Gosse and Guillaumin analyzed the shocks to the economies of Southeast Asia from three perspectives: the oil crisis, the currency crisis in the United States, and the fiscal crisis in the U.S. [

24]. Anetor empirically analyzed the impact of foreign capital entry into Nigeria using quarterly information for the period 1986-2016 and gave the corresponding policy responses [

25]. In the empirical analysis conducted by Jones, it was found that African countries are affected by crude oil shocks and increasing financial market volatility through trade and financial agglomeration. Among these modes of transmission, trade agglomeration was identified as the most significant in transmitting these exogenous shocks [

26]. Liu Jinquan categorizes external shocks into two types based on their effects: inward and outward. Inward shocks impact various elements within the economic system, while outward shocks have a certain degree of influence on the transmission and penetration of the entire economic system [

27]. According to Liu Shucheng, in an open macroeconomic environment, the negative effects encountered by an economy caused by other economies, such as import and export trade deficits, rising crude oil prices, interest rate fluctuations, etc., are all exogenous shocks [

28].As for the effect of external shocks on a certain industry or product, the existing literature mainly focuses on the price of agricultural products and grain price [

29,

30,

31].

From the previous review, the current scholars on resilience research are mostly focused on regional economic resilience, urban resilience, and enterprise resilience perspective. There are more studies from a macro or micro perspective, and fewer research results from the meso-industry perspective, especially regarding the resilience of the industrial supply chain. In terms of the research on the impact of external shocks, most of the current research on these issues is centered on the impact of external shocks on domestic prices, as well as the synergistic effect of external shocks and inter-regional or world economic fluctuations on this issue. There are fewer studies specifically studying the impact of external shocks on the resilience of China's grain supply chain. Therefore, this paper starts from a meso perspective, takes the grain supply chain as the research object, evaluates the resilience of the grain supply chain, and researches the degree of its influence by external shocks.

3. Theoretical Analysis and Hypotheses

3.1. Grain Supply Chain Resilience

As a complex industrial system, the grain supply chain, after being hit by external shocks, relies on the supply chain's own historical accumulation and resource endowment, as well as the supply chain's external safeguards and internal links, to form the ability to withstand shocks, rapidly recover, and transform and upgrade. Therefore, on the basis of the concept of supply chain resilience, this paper considers that the resilience of the grain supply chain is the ability of the grain supply chain to maintain a stable state and recover, adjust, and transform from shocks by relying on its inherent properties, external safeguards, and internal links after suffering an external shock.

In physics, fracture resilience is considered as a measure of a substance's ability to prevent the destabilizing expansion of macroscopic cracks, as well as a resilience parameter of a material to resist brittle damage. It does not have any relationship with the size and shape of the crack itself and the magnitude of the applied force.Fracture resilience is an inherent property of a material and is only related to the material itself in terms of its heat treatment and machining process [

32]. Impact resilience is regarded as the ability of a material to absorb plastic deformation work and fracture work under impact loading, and it is a response to external impact loading [

33].

According to the classification of supply chain resilience, the resilience of the grain supply chain is divided into three parts: the fracture resilience of the grain supply chain, the impact resilience of the grain supply chain, and the collaborative resilience of the grain supply chain. The fracture resilience of the grain supply chain is its intrinsic inherent property, which includes the volume scale, condition endowment, stability, and complexity within the system accumulated over a long period of time, just like the material organization in engineering, which belongs to its own intrinsic properties. The impact resilience of the grain supply chain is a deeper extension of the basic concept of physical impact resilience, which not only contains the negative impact but also contains the positive impact. The supply chain will also be affected by external security support and scientific and technological innovation support to enhance its disaster-resistant capacity. Comprehensively speaking, it is the impact of the system outside the system. The collaborative resilience of the grain supply chain is the expansion of the theory of synergy in the field of resilience, which includes the multidimensional impacts of grain production, acquisition, warehousing, processing, and sales. It includes multiple supply chain links, such as grain production, acquisition, storage, processing, and sales. The ability of resource integration and coordination between and within the links of the supply chain is reflected in the grain supply chain’s ability to cope with internal and external changes.

3.2. Mechanisms of External Shocks on the Resilience of China's Grain Supply Chain

There are two main meanings of external shocks: the first is defined by the Dictionary of Modern Economics, compiled by Liu Shucheng of the Institute of Economics of the Chinese Academy of Social Sciences in 2005 [

28], as the negative impact of a macroeconomy on the global economy in an open environment, and in particular, the large negative impact on the terms of trade of a given economy. Negative effects include, among others, a significant drop in demand for exports, a sharp rise in international interest rates, and a sharp increase in the prices of imported goods (especially those with a strong dependence on imports, such as crude oil). The second is the meaning of Modern Macroeconomic Shock Theory published by Jilin University Press in September 2000 [

27], which divides economic fluctuations into two categories: those that arise from within the economic system and those that come from outside the economic system. An internal shock refers to an economic shock that occurs within an economic system (e.g., energy crisis, exchange rate changes, etc.), and most of its results are directed at factors internal to an economy, but it may also have an impact on the external aspects of an economy (e.g., social order), with some spillover effects. External economic shocks are those that occur outside the economic system (e.g., natural disasters, terrorist attacks, etc.) and they also affect factors within the economic system.

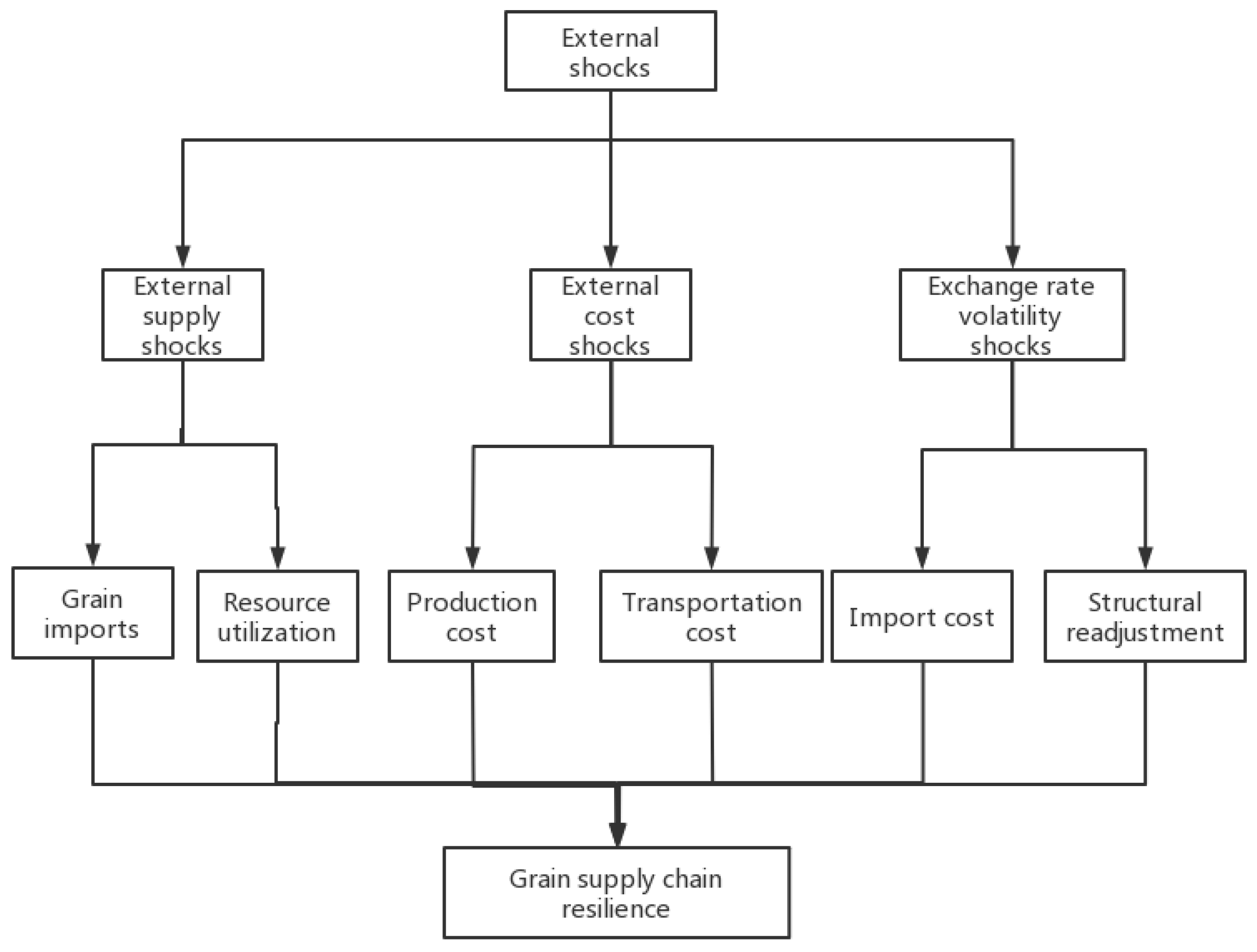

Combining the above two definitions and the research purpose of this paper, the external shocks in this paper include external supply shocks, cost change shocks, and exchange rate fluctuation shocks, among others. These shocks are not within the control of the grain supply chain system itself and have a significant impact on the overall supply system. This paper analyzes the impact mechanism of external shocks on the resilience of the grain supply chain through the above three levels of research, as shown in

Figure 1.

The impact on our grain supply chain, as a result of external supply shocks, comes mainly from the international trade route. At present, our country's external dependence on some grain varieties remains high, while the sources of grain imports are relatively concentrated. On the one hand, an increase in world grain exports can increase the sources of China's grain imports, thus reducing China’s single dependence of on grain imports and guaranteeing the stability of China's grain supply. On the other hand, the volume of world grain exports allows China to use its limited land and water resources for the cultivation of other agricultural products, such as high-value-added agricultural products or grain-processing raw materials, according to its resource advantages and climatic conditions. This can improve the efficiency of agriculture and the income of farmers. Accordingly, this paper proposes Hypothesis 1.

H1: External supply shocks have a positive effect on grain supply chain resilience

Cost change shocks mainly refer to the shocks brought about by international commodity price fluctuations, and the transmission mechanism affecting the resilience of China's grain supply chain is mainly cost transmission. On the one hand, international crude oil prices affect the supply chain’s generating capacity and, therefore, its resilience, by increasing production costs. As China's agricultural mechanization continues to advance, but when international crude oil prices continue to rise, the cost of grain production will continue to increase, thus affecting the level of supply chain resilience. On the other hand, by increasing the transportation cost, it affects the supply chain logistics capacity and thus affects the supply chain resilience. Since 2009, in the case of sustained high international oil prices, domestic crude oil prices have increased several times, resulting in an average annual increase of about 20% in the cost of grain transportation. In 2011, two additional crude oil price increases were experienced, which made the increase in the cost of oil transportation much greater than the cost before the oil price increase. Accordingly, this paper develops Hypothesis 2.

H2: Cost variation shocks have a negative effect on grain supply chain resilience

The impact of exchange rate fluctuations is mainly on foreign liquidity, both from the perspective of international trade and financial markets, and will have an impact on the domestic grain supply chain. Because the U.S. dollar is the most important payment currency internationally, the RMB exchange rate mentioned in this paper refers to the ratio of the RMB to the U.S. dollar and is expressed using the indirect markup method. Changes in the RMB exchange rate have a certain impact on the resilience of China's grain supply chain. On the one hand, an appreciating exchange rate reduces the cost of imported grain, especially for agricultural products on which China relies for imports. It may provide more choices and a stable supply for regions that rely on imported grain. More imported grain can be purchased at a relatively lower cost, thus increasing domestic supply and easing the pressure on grain supply. On the other hand, it can promote agricultural restructuring. The appreciation of the RMB reduces the cost of imported grain and puts pressure on the competitiveness of domestic agricultural products, which helps to promote China's agricultural restructuring. The optimization and modernization of the agricultural structure will further enhance the resilience and self-sufficiency of China's grain supply chain and reduce its dependence on the international market. Accordingly, this paper proposes Hypothesis 3.

H3: Exchange rate volatility shocks have a positive effect on grain supply chain resilience

4. Materials and Methods

4.1. The Construction of China's Grain Supply Chain Resilience Indicator System

Considering the use of the multivariate comprehensive indicator method is more comprehensive, this paper refers to the research of Cao De et al. and combines the origin of resilience, the connotation of resilience in the grain supply chain, and the theory of supply chain synergy when constructing the comprehensive indicator system for grain supply chain resilience [

34]. The total resilience of the grain supply chain is taken as the primary indicator, and the supply chain fracture resilience, supply chain impact resilience, and supply chain synergy resilience are taken as three secondary indicators.

Table 1.

Indicator system for evaluating the resilience of grain supply chains.

Table 1.

Indicator system for evaluating the resilience of grain supply chains.

| Primary indicators |

Secondary indicators |

Tertiary indicators |

Interpretation of indicators |

Indicator

Attributes |

Supply chains

total resilience |

Supply chain fracture resilience |

Production capacity |

Grain production/average number of people in industry |

+ |

| Warehousing capacity |

Grain production + net grain imports - grain sales |

+ |

| Transport capacity |

Total agricultural logistics |

+ |

| Processing capability |

Finished goods/average number of workers |

+ |

| Sales ability |

Expressed in terms of the number of grain product movements, calculated as: grain sales/average grain stocks |

+ |

| Supply chain impact resilience |

Financial support |

Financial support for agriculture |

+ |

| Financial support |

Balance of loans to financial institutions for manufacturing agricultural production materials in local and foreign currencies as a percentage of all loans |

+ |

| External Dependence |

Grain imports/total grain production |

- |

| R&D capability |

Number of valid invention patents |

+ |

| Innovation capacity |

Senior Agricultural Technician |

+ |

| Capacity to translate results into action |

Contractual turnover of the State Fund for the Transformation of Agricultural Science and Technology Achievements |

+ |

| Resilience to disasters |

The area of the disaster/become the area of the disaster |

+ |

| Supply chain synergy resilience |

Synergy between production and marketing |

Grain production in the year/grain sales in the year |

+ |

| Synergy between purchase and sale |

Grain purchases in the year / grain sales in the year |

+ |

| Information synergy |

Informatization development indicator |

+ |

| Transportation network |

Road density |

+ |

| Circulation efficiency |

Grain cargo turnover |

+ |

Based on the availability of data, this paper selects the time series data related to the grain supply chain from 1996 to 2020 as a sample. The research data in this paper mainly comes from the China Statistical Yearbook, China Grain Yearbook, China Grain Network Database, and China Rural Statistical Yearbook. Since the China Grain Yearbook was able to obtain the volume of grain purchases and grain sales from 1996-2016, but the statistical items of the subsequent data statistical yearbooks were changed, it was supplemented with the China Grain and Material Reserve Yearbook. In addition, the data on total agricultural logistics came from the China Logistics Yearbook; the data on financial support indicators came from the China Financial Yearbook; the data on R&D capacity indicators came from the China Science and Technology Yearbook; the data on innovation capacity indicators came from the China Ethnic Statistical Yearbook; the data on achievement transformation capacity indicators came from the China Torch Statistical Yearbook; and the information development indicator came from the China Information Yearbook. Due to the large number of indicators and the long time span of the data required for the study, there is a small amount of missing data, which is supplemented by the linear interpolation method and regression fitting method.

4.2. Model Construction

To further examine the external shock factors on the resilience of China's grain supply chain, the following econometric model is constructed.

In model (1), the subscript t represents the year. res represents the total resilience indicator of the grain supply chain. exp represents the total world grain export. oil represents the international oil price. ex represents the RMB exchange rate. X represents the control variable. α0 is the error item. is the intercept term. α1、α2、α3、α4 represent the explanatory variable coefficients.

4.3. Selection of Variables

4.4. Data Sources

The data used in this chapter are annual data from 1996-2021, and the original data for the explanatory variables are mainly from the China Statistical Yearbook, China Agricultural Statistical Yearbook, Crude Oil Petroleum Price Network, Grain and Agriculture Organization of the United Nations, and World Bank databases. In order to eliminate the heteroskedasticity present in the time series and to linearize the trend, some of the variables are therefore subjected to a natural logarithmic transformation.

Table 2.

Descriptive statistics of main variables.

Table 2.

Descriptive statistics of main variables.

| Variable |

Connotation |

Mean |

Me |

Max |

Min |

SD |

| res |

Total grain supply chain resilience |

0.3447 |

0.34 |

0.65 |

0.12 |

0.186 |

| lnexp |

World grain exports |

1.3806 |

1.33 |

1.86 |

0.88 |

0.308 |

| lnoil |

International oil price |

3.8611 |

3.98 |

4.60 |

2.67 |

0.568 |

| ex |

RMB exchange rate |

0.1383 |

0.14 |

0.16 |

0.12 |

0.016 |

| urban |

Urbanization rate |

0.4756 |

0.48 |

0.65 |

0.30 |

0.102 |

| ind |

Rationalization of industrial structure |

5.6329 |

4.51 |

11.04 |

3.10 |

2.377 |

| lninv |

Investment in rural fixed assets |

7.7114 |

7.92 |

10.02 |

4.69 |

1.776 |

| lncap |

Total reservoir capacity |

8.8180 |

8.85 |

9.20 |

8.43 |

0.249 |

| lngas |

Price of natural gas |

3.2787 |

3.24 |

4.27 |

2.64 |

0.480 |

3. Results

5.1. Results and Trend Analysis of China's Grain Supply Chain Resilience Measurements

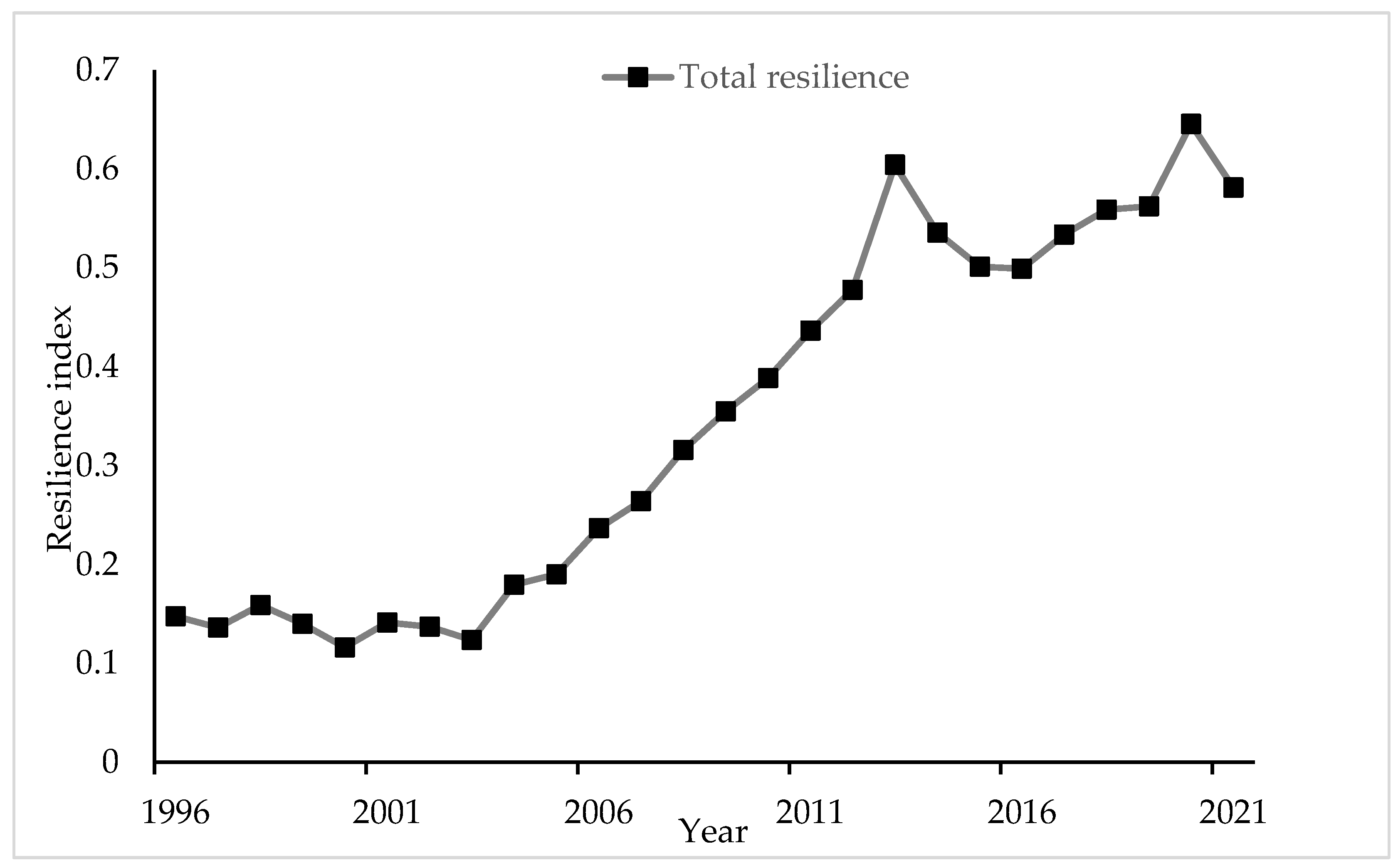

The growth trend of China's grain supply chain resilience indicator, calculated by the entropy method with independence adjustment, is shown in

Figure 2 below.

From 1996 to 2021, China's grain supply chain resilience indicator showed a phased fluctuation growth trend. According to the fluctuation of the resilience indicator, the growth trend of the resilience of the grain supply chain can be divided into three phases. 1996-2003 is a stable phase with a low level of resilience of the grain supply chain, which indicates that the comprehensive resilience of China's grain supply chain is at a relatively low level. From 2004 to 2013, China's grain supply chain was in a growth phase, with successive increases in the level of grain supply chain resilience. From 2014 to 2021, China's grain supply chain was in a high-level growth phase, which indicates that China's grain supply chain resilience has continued to develop in an obvious way during this period.

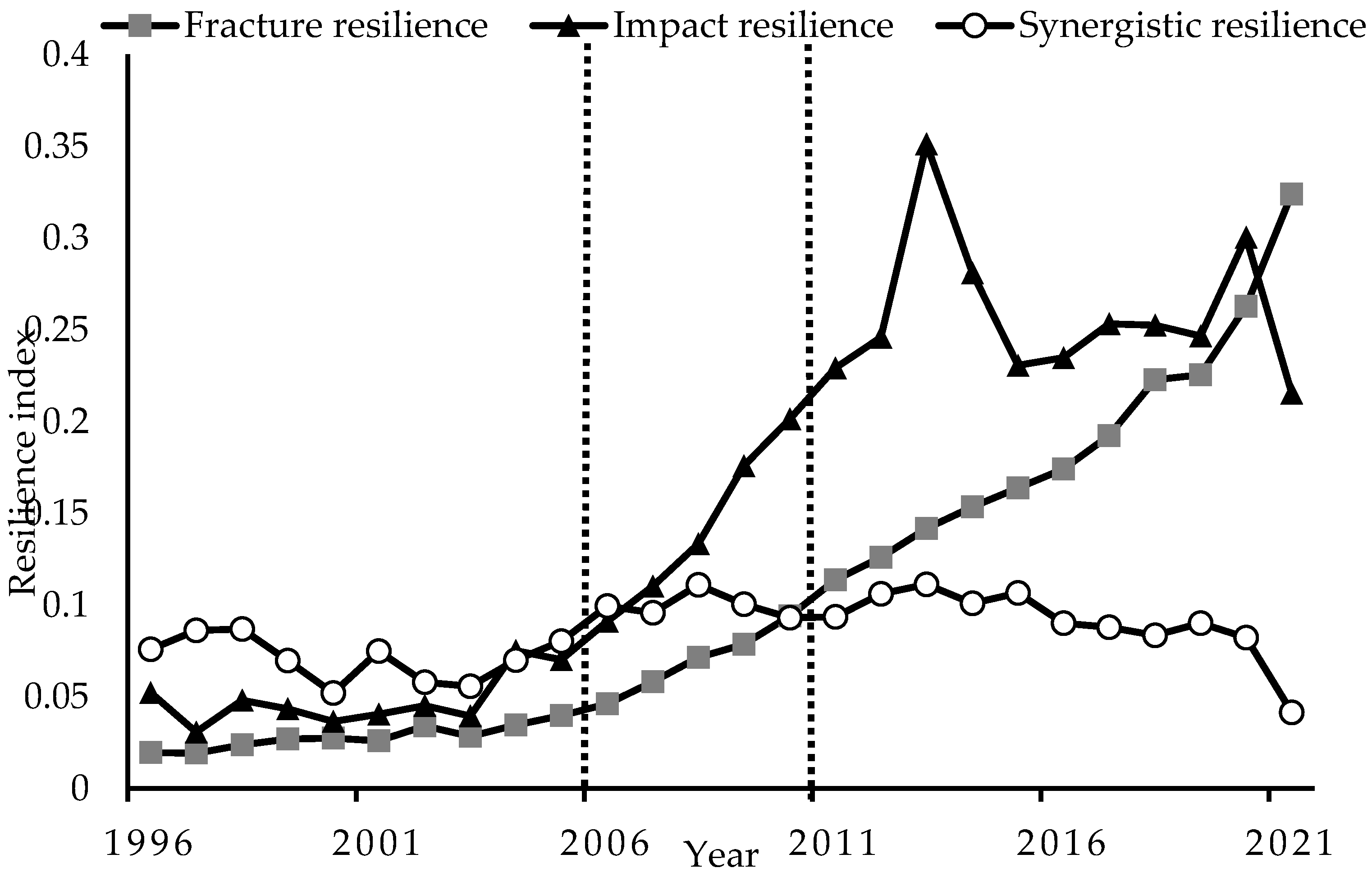

As shown in

Figure 3, there is an overall increase in grain supply chain fracture resilience, supply chain impact resilience, and supply chain synergy resilience from 1996-2021.

As can be seen in

Figure 3, supply chain fracture resilience grows steadily, supply chain impact resilience fluctuates more significantly, and supply chain synergy resilience changes more gently. During the study period, with 2006 as the demarcation time point, the overall supply chain synergy resilience is greater than the supply chain impact resilience before 2006, and the supply chain impact resilience is greater than the supply chain synergy resilience after 2006. This indicates that when the grain supply chain faced a major natural disaster in 2003, the role of supply chain synergy resilience is greater than that of the supply chain's resistance to the impact resilience of the ability to resist external shocks. In addition, with 2011 as the cut-off time point, supply chain synergy resilience is greater than supply chain fracture resilience before 2011, and supply chain fracture resilience is greater than supply chain synergy resilience after 2011.

5.2. Results and Trend Analysis of China's Grain Supply Chain Resilience Measurements

Table 3 reports the results of the base model estimation of the resilience of China's grain supply chain to external shocks. Columns (1) to (3) represent the impacts of world grain exports, international oil prices, and RMB exchange rate on the resilience of China's grain supply chain, in turn. Columns (4) to (6) add control variables such as urbanization rate, industrial structure rationalization, rural fixed asset investment, total reservoir capacity, and natural gas price based on columns (1) to (3). The subsequent analysis is based on the regression results of columns (4) to (6).

According to the results in column (4), the impact of world grain export volume on China's grain supply chain is significant at the 1% level, and the coefficient is 0.5646. In other words, for every 1% increase in the indicator of world grain export volume, the indicator of the total resilience of the grain supply chain increases by 0.5646%. This indicates that an overall increase in the level of world grain export volume enhances the level of total resilience of China's grain supply chain. According to column (5), the impact of international oil prices on China's grain supply chain is significant at the 1% level, and the coefficient is -0.1030. In other words, for every 1% increase in international oil prices, the total resilience of the grain supply chain decreases by -0.1030%. This indicates that an overall increase in the level of international oil prices will weaken China's total resilience of the grain supply chain. According to column (6), the impact of the RMB exchange rate on China's grain supply chain is significant at the 1% level, and the coefficient is 4.5744. In other words, for every 1% increase in the international oil price, the indicator of the total resilience of the grain supply chain improves by 4.5744%. This indicates that overall, the appreciation of the RMB increases the level of China's total resilience of the grain supply chain.

5.3. Robustness Tests

Grain supply chain resilience is closely related to agricultural policies. The empirical sample of this paper is selected from 1996 to 2021, and in 2006, the country abolished the agricultural tax. In order to illustrate whether the abolition of agricultural tax changes the impact on the resilience of the grain supply chain, therefore, this paper takes the agricultural policy (poil) as a dummy variable, which takes the value of 0 before 2006 and the value of 1 in 2006 and later. The coefficients of the world's grain export volume and the exchange rate of the RMB are still significantly positive, and the coefficient of the international petroleum price is significantly negative. This indicates that an increase in the level of the world's grain export volume and an appreciation of the RMB will improve the conclusion that higher levels of world grain exports and RMB appreciation will increase the total resilience of China's grain supply chain, and that higher international oil prices will weaken the total resilience of China's grain supply chain is robust.

Table 4.

Consideration of policy influences.

Table 4.

Consideration of policy influences.

| Variables |

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

| res |

res |

res |

res |

res |

res |

| lnexp |

0.4638***

|

|

|

0.4564**

|

|

|

| |

(0.0601) |

|

|

(0.2013) |

|

|

| lnoil |

|

-0.1458***

|

|

|

-0.1068***

|

|

| |

|

(0.0402) |

|

|

(0.0287) |

|

| ex |

|

|

8.2040***

|

|

|

4.0013**

|

| |

|

|

(1.8813) |

|

|

(1.5519) |

| urban |

|

|

|

0.5921 |

0.0592 |

0.9706 |

| |

|

|

|

(0.8791) |

(0.6003) |

(0.8372) |

| ind |

|

|

|

0.0343**

|

0.0290**

|

0.0168 |

| |

|

|

|

(0.0149) |

(0.0116) |

(0.0135) |

| lninv |

|

|

|

0.0655*

|

0.0301 |

0.0072 |

| |

|

|

|

(0.0357) |

(0.0276) |

(0.0341) |

| lncap |

|

|

|

0.1978 |

0.0488 |

-0.1638 |

| |

|

|

|

(0.2902) |

(0.2411) |

(0.3059) |

| lngas |

|

|

|

-0.0343 |

-0.0831**

|

-0.0363 |

| |

|

|

|

(0.0311) |

(0.0293) |

(0.0289) |

| poil |

0.0858**

|

0.3639***

|

0.0885 |

0.0441 |

-0.0073 |

0.0288 |

| |

(0.0373) |

(0.0689) |

(0.0613) |

(0.0341) |

(0.0326) |

(0.0330) |

| _cons |

-0.3483***

|

0.2976 |

-0.8445***

|

-1.6643 |

-0.6446 |

0.7250 |

| |

(0.0663) |

(0.2006) |

(0.2286) |

(2.2612) |

(1.8730) |

(2.3128) |

| N |

26 |

26 |

26 |

26 |

26 |

26 |

| adj. R2

|

0.919 |

0.715 |

0.840 |

0.961 |

0.974 |

0.966 |

| F-statistics |

141.94 |

32.30 |

66.56 |

89.44 |

135.01 |

103.91 |

In this section, the robustness of the impact of external shocks on the level of aggregate resilience of the grain supply chain is analyzed by testing the regression of external shocks on the resilience of the grain supply chain shocks (

ri), aggregate grain production (

grain), and per capita grain production (

grainp). The results of the test are shown in

Table 5, which shows that world grain exports and the RMB exchange rate have a significant positive effect on the resilience of grain supply chain shocks, total grain production, and per capita grain production, while international oil prices have a significant negative effect on the resilience of grain supply chain shocks, total grain production, and per capita grain production. This result is generally consistent with

Table 3, indicating that the results in

Table 3 are robust.

6. Discussion and Conclusions

This paper draws on the definition of resilience in physics to construct a comprehensive evaluation indicator system for the resilience of the grain supply chain.The system includes supply chain fracture resilience, impact resilience, and synergy resilience as secondary indicators. It adopts the entropy value method to calculate China's grain supply chain total resilience indicator, fracture resilience indicator, impact resilience indicator, and synergy resilience indicator for each year from 1996 to 2021. Additionally,it constructs an econometric model to investigate the effects of external shocks, such as supply shock, cost change shock, and exchange rate fluctuation shock, on China's grain supply chain resilience. The study also constructs an econometric model to investigate the impact of external shocks, such as external supply shocks, cost shocks, and exchange rate fluctuation shocks, on the resilience of China's grain supply chain. The study found that: from the view of China's grain supply chain resilience indicator growth trend map, China's total grain supply chain resilience in 1996-2021 was a stage-like fluctuation growth trend, mainly divided into three growth stages, respectively, a low level of stability stage, continuous growth stage, and a high level of stability stage; from the view of the resilience trend change map, the supply chain fracture resilience steadily increased in 1996-2021, the supply chain impact resilience level fluctuated significantly, the supply chain resilience level fluctuated markedly, and the supply chain impact resilience level fluctuated markedly. Supply chain impact resilience level fluctuates significantly, and supply chain synergy resilience changes are flat.

The main reason for the high level of growth of China's grain supply chain in 2014-2021 is reflected in the fact that, on the one hand, the state implemented reforms from both a policy and system perspective to prevent the impact of external shocks on China's grain supply chain. This was done in order to reduce the uncertainty caused by external shocks and to restore the level of grain supply chain resilience in a timely manner. In 2015, China established the grain risk fund system to promote the stable growth of grain production and maintain the normal grain circulation order. In 2016, China further deepened the reform of the grain supply chain system, improving production and marketing as well as purchase and marketing reform. Therefore, at this stage, China's grain supply chain resilience is in the recovery stage. On the other hand, pay attention to the scientific and technological development of the grain supply chain and cultivate excellent talents in the grain industry. At this stage, the research and development capacity of China's grain supply chain system has been improving year by year, and the number of effective invention patents has increased from 4,858 in 2014 to 13,432 in 2021. The growth rate of senior agricultural technicians during this period was 6.06%, and scientific and technological innovation serves as the driving force for the adjustment and renewal of the grain supply chain and its long-term development. This not only promotes the recovery of the resilience level of China's grain supply but also enables further improvement of the resilience level.

In exploring the external shocks to the resilience of China's grain supply chain, it is found that world grain exports and the RMB exchange rate have a significant positive impact on the total resilience level of China's grain supply chain, and international oil prices have a significant negative impact on the total resilience level of China's grain supply chain.

Based on these findings, this paper draws the following policy implications.

First, to ensure stable production and supply in the grain market. We will start by improving the overall quality of China's grain, so as to ensure the effective supply of Chinese grain and reduce China's dependence on grain exports. The first is to hold fast to the bottom line of arable land, resolutely sticking to the bottom line of 1.8 billion mu of arable land, and accelerating agricultural capital construction in an effort to raise the level of land productivity. The second is to promote the development of the seed industry by building a new variety selection and breeding system that combines production, breeding, and promotion. This includes the basic theory of seed sources and focuses on breakthroughs in the yields of soybeans and corn. The goal is to consolidate China's grain security and lay a solid theoretical and practical foundation. Third, the strength of agricultural support needs to be increased. The policy should be implemented in place and must consider the minimum purchase price of grain crops and related policies. It should also take into account the international rules of constraints and constantly optimize the subsidy policy for corn and soybean output. This should be done practically, from the interests of the farmers, to ensure that they are incentivized to grow grain. This will provide effective protection against the risks of the international grain market, while maintaining stable grain production.

Secondly, the structure of foreign trade in grain should be improved. China's four major grain crops have almost all been net imports in recent years, and in order to optimize the structure of China's foreign trade in grains, it is necessary to implement a diversified import strategy. In particular, since the current domestic soybean production is small and mainly imported, the only way to optimize the structure of China's foreign trade in grain is to adopt a diversified import strategy and to share as much as possible the adverse effects of the changes in the economic situation of the world's countries on the domestic grain market. In addition, the use of mergers and acquisitions and expansion around the world can extend their business areas to all areas of the agricultural business and gradually establish a global grain industry chain. This is helpful in better grasping the world grain market and realizing the improvement of the resilience of the grain supply chain.

Third, actively responding to international commodity price shocks. As can be seen from the above, international oil prices have a significant negative impact on the level of total resilience of China's grain supply chain. Therefore, coping with the impact of global price increases is an urgent issue in China's current economic development. The following measures can be taken: first, pay close attention to the price changes of various major products and formulate a long-term development strategy to maintain sufficient stocks of various major products, especially energy products. Secondly, foreign futures markets should be monitored, and further improvements should be made to domestic futures markets. Most international primary products are priced through a futures market that can forecast spot prices and guide their movements. By monitoring the dynamics of the international futures market and conducting further research on the domestic and foreign futures markets, it can help us better understand and grasp the international price trends. Third, the linkage between agricultural futures and spot should be strengthened. China's grain production has a large time span and obvious seasonal characteristics, and its response to price changes lags behind, making it difficult to effectively respond to market risks. However, its price discovery and hedging role can just make up for this shortcoming. In China's grain and agricultural enterprises, the use of futures for hedging can effectively avoid and eliminate all kinds of hedging risks and safeguard their production benefits. To this end, the linkage between domestic grain prices and futures market prices should be further strengthened, giving full play to the forecasting role of futures prices on grain prices, and realizing the smooth operation of grain prices in order to reduce the volatility of grain prices.

Funding

2022 Hebei Provincial Social Science Fund "Research on the Coupling Mechanism and Driving Factors of Hebei Digital Village and the Whole Agricultural Industry chain" (HB22YJ050).

References

- Chang, J.; Jiang, H. Spatio-Temporal Differentiations and Influence Factors in China's Grain Supply Chain Resilience. Sustainability 2023, 15, 8074. [CrossRef]

- Liao, H.; Hu, X.L.; Liu, S.Q. Analysis of supply chain resilience in China under unfavorable external shocks. Ent. Econ. 2021, 40, 50-59.

- Li, L.G.; Zhang, P.Y.; Tan, J.T.; Guan, H.M. Evolution of the resilience concept and progress of regional economic resilience research. Hum. Geog. 2019, 34, 1-7.

- Fingleton, B.; Garretsen, H.; Martin, R. Recessionary shocks and regional employment: Evidence on the resilience of UK regions. J. Reg. Sci. 2012, 52, 109-133. [CrossRef]

- Shaw, K. Managing for local resilience: towards a strategic approach. Pub. Pol. Admin. 2013, 28, 43-65. [CrossRef]

- Martin, R.; Ben, G.; Andy, P.; Peter, S. Economic Shocks and the Differential Resilience of Places. Reg. Sts. Pol. Adm. 2013, 28, 43-65.

- Chen, M.Y. Progress of international regional economic resilience research: An introduction to the theoretical analysis framework based on evolutionary theory. Prog. Geo. Sci. 2017, 36, 1435-1444.

- Su, R.G.; Zhao, X.L. Manufacturing development, entrepreneurial vigor, and urban economic resilience. Fin. Sci. 2020, 9, 79-92.

- Wei, Z.; Xiu, C.L. Exploring the concept and analyzing the framework of urban network resilience. Advs. Geosci. 2020, 39, 488-502.

- Zeng, T. Regional Economic Resilience Connotation Analysis and Indicator System Construction. Reg. Fin. Res. 2020, 7, 74-78.

- Chen, Y.W.; Ding, G.L. Measurement of urban economic resilience of prefecture-level cities in China. Stats. Dec. Mk. 2020, 36, 102-106.

- Liu, Z.; Pan, Z.Y.; Yu, G.X. Measurement of urban resilience level and spatial characteristic differentiation in city clusters in the middle reaches of the Yangtze River. Economy. 2021, 3, 27-34.

- Brakman, S.; Garretsen, H. Regional resilience across Europe: On urbanization and the initial impact of the Great Recession. Cam. J. R. 2015, 8, 225-240.

- Bergeijk, P.; Brakman, S.; Marrewijk, C. Heterogeneous economic resilience and the great recession's world trade collapse. Pprs. Reg. Sci. 2017, 96, 3-12.

- Martin, R. Rebuilding the economy from the Covid crisis: time to rethink regional studies?. Reg. Sts. Reg. Sci. 2021, 8, 143-161.

- Larson, P.D. Designing and Managing the Supply Chain: Concepts, Strategies, and Case Studies. J. Bus. Log. 2001, 22, 259-261. [CrossRef]

- Tah, J.; Carr, V.; Effectively Managing Vertical Supply Relationships: A Risk Management Model for Outsourcing. Sup. Ch. Mgt. Intl. J. 2001, 4, 176-183.

- Garcia, L.; Steinberger, G.; Rothmund, M. A model and prototype implementation for tracking and tracing agricultural batch products along the grain chain. Grain. Ctrl. 2010, 21, 112-121.

- Panicker, V.; Akhil, U.S.; Vadlamani, P.S.; et al. Simulation modelling and analysis of warehouse operations in a grain supply chain. Int. J. Log. Sys. Mgmt. 2020, 1, 1. [CrossRef]

- Chen, Z. Research on Risk Analysis and Prevention of Grain Supply Chain. Rural. Econ. 2011, 12, 24-28.

- Ding, D.; Yang, Y.S. Identification and prevention of key risk points in China's grain supply chain. Soc. Sci. Front. 2019, 5, 247-250.

- Wang, X.Y.; Wang, Z.N.; Kong, J.L. Multidimensional data-driven comprehensive risk evaluation of grain supply chain hazards. J. Grain. Sci. Tech. 2019, 37, 129-138.

- Swanepoel, J.A. The impact of external shocks on South African inflation at different price stages. J. Studies. Econ. Econ. 2006, 30, 1-22.

- Gosse, J.B.; Guillaumin, C. Can external shocks explain the Asian side of global imbalances? Lessons from a structural VAR model with block exogeneity. Rev. Int. Econ. 2013, 21, 85-102. [CrossRef]

- Anetor, F.O. Foreign capital inflows, financial development, and growth in Nigeria: a structural VAR approach. J. Developing. As. 2020, 54, 69-86. [CrossRef]

- Omoshoro, J.; Oyeyinka, S. Global imbalances, external adjustment, and propagated shocks: an African perspective from a global VAR model. Int. Econ. 2021, 165, 186-203.

- Liu, J.Q. Modern Macroeconomic Shock Theory, 1st ed.; Jilin University Press: Jilin, China, 2000; pp. 26-27.

- Liu, S.C. Modern Economic Dictionary, 1st ed.; Jiangsu People's Publishing House: Jiangsu, China, 2005; pp. 113-119.

- Li, X.; Zhou, Y.; Analysis of the impact of external shocks on domestic agricultural products price fluctuation. Tech. Eco. 2013, 4, 116-119.

- Zhang, L.; Zhang, X.; Study on the impact of external shock on the price fluctuation of agricultural products in China: Based on the perspective of the agricultural industry chain. J. Mgmt Wld. 2011, 1, 71-81.

- Luo, F. The impact of external shocks on the price fluctuation of agricultural products in China: Empirical study based on the SVAR model. Agri Tech. Econ. 2011,10,4-11.

- Man, K. Study on the instability criterion for dynamic fracture resilience testing of rocks. Science.Tech. Eng. 2016, 16, 147-152.

- Li, S.Q.; Chen, W.; Zha, Y. Study on transverse and longitudinal differences in impact resilience of large forged bars of TC18 alloy. R. Mt. Mats. Eng. 2021, 50, 911-917.

- Cao, D.; He, Z.; Zhang, J. Resilience-vulnerability study of the whole industry chain of the rail transportation industry. Econ. Maths. 2020, 37, 16-26.

- Wang, B.H. An empirical study on the impact of international grain price volatility on China's grain security. Master, Jiangxi University of Finance and Economics, China, 2018.

- Zhang, L. Analysis of the impact mechanism of external shocks on the price volatility of agricultural products in China. Master, Northeast University of Finance and Economics, China, 2012.

- Guo, F.J.; Ding, J.P. Research on the interaction among RMB internationalization, exchange rate, and cross-border capital flows. Cont. Econ. Sci. 2023, 45, 1-12.

- Hao, A,M.; Tan, J.Y. The impact of digital village construction on the resilience of China's grain system. J. S. China. Agri. Univ. 2022, 21, 10-24.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).