1. Literature review

Successful marketing starts with understanding how and why consumers show a behavior (Bai, Yao & Dou, 2015). Environmental changes, especially economic crises, and the growing influence of digital technologies have led to many changes in consumer behavior and shopping habits (Liao, To, Wong, Palvia & kakhki 2016). Thus, the study of consumer needs, the priority of these needs, and the analysis of consumer behavior are among the target topics (Bigné, Llinares, & Torrecilla, 2016). Some studies state that consumers' desire to purchase a product or service reflects their understanding of the purchase. A number of studies show that purchase decisions are largely influenced by consumers' need for a product or service to be unique (Shen, Jung, Chow & Wong, 2014). Oliver (2014) stated that when people buy, they are involved in psychological, emotional, and physical processes and expect their choices to influence the creation and promotion of their status and power (Oliver, 2014). One of the most important manifestations is the perceptions of buyers in their decisions to choose a brand of a product, because the brand is one of the studies conducted in the field of identifying individual factors affecting customer attraction (Bigné, Llinares, & Torrecilla, 2016). Based on the available evidence and criteria, customers review and compare market brands and finally choose the brand that meets their needs. Therefore, the first attempt of the marketer is to extract the features and characteristics of the product considered important by the target market and to check the extent the brand has those features, the percentage of buyers who consider these factors in their purchase, and whether there is such an attitude toward its production, marketing, and sales policy makers or not (Karimian, Sanayei, & Mohammad Shafiee, 2019). Dairy industry is one of the most important and advanced conversion and complementary industries in the agricultural sector, ranking first in the consumer market and value added among other conversion and complementary industries in this sector. This shows the lucrative investment in this sector and the importance of its future policies, among the food industry subgroups, with the highest share of value added (22%). Accordingly, given the importance of dairy products in the nutrition and health of society, policy makers and planners in the country have always considered the production and consumption of these products (Fuzooni Ardakani, Farhadian and Pezeshki Rad, 2017). Hence, it is important to investigate the relationship between dairy consumption and consumer behavior because of the contribution of these products to health and economy (Bousbia et al, 2017). In a study conducted by Fuzooni Ardakani et al. (2017), Khorasan Razavi province was introduced as having the highest rate of development in the dairy industry. This province produces 10% of the country's milk, with an average annual production of 900,000 tons of milk per year. It has more than five thousand industrial, semi-industrial, and small rural farms with 320 thousand productive and non-productive heavy livestock, of which 100 thousand are productive cattle. There are a total of 14 million and 600 thousand livestock units in Khorasan Razavi, and 1.2 million tons of products are produced annually in the field of livestock and poultry in this province. There are also 35 dairy production units in Khorasan Razavi (Deputy for Coordination of Economic Affairs and Resource Development of Khorasan Razavi Governorate, 2018). Meanwhile, reports indicate that there are a total of 104 dairy factories in Khorasan Razavi, of which 8 have completely revoked their licenses and 47 are closed. The rest of the factories are operating at 30% of their capacity, and yet about 20% of their products remain in warehouses and have no customers. On the other hand, there is no market for exporting products. The head of the Khorasan Razavi Dairy Manufacturers Association says that the only export destinations for dairy producers in Khorasan Razavi are Iraq and Afghanistan. People's livelihood problems have reduced their purchase from the market, and this problem together with the loss of export markets has made it difficult for dairy units to continue operating (President of the Khorasan Razavi Dairy Manufacturers Association, 2016; Baluchi, 2016). These problems and challenges for the leading province in the field of dairy industry are a warning signal for this industry in this province and the country. Therefore, efforts should be made to improve the current situation with proper planning and a careful look at the issues (Baluchi, Maleki Minbash Razgah, Feyz & Hasangipour Yasouri, 2018). It can be said that increasing the competitiveness of the dairy industry at home and in domestic companies and achieving a good competitive position at the international and domestic levels requires identifying the influencing factors on the operational success of companies in today's dynamic environment. Such assessments can help to better understand consumer behavior, which can be a useful indicator of market orientation to increase the consumption of dairy products (Bousbia et al., 2017). There is little information on consumer behavior, especially their choice towards buying and consuming dairy products in developing countries. Therefore, this study aims to understand the factors that affect consumer behavior towards dairy products in Iran (Rahnama & Rajabpour, 2017). Thus, a full understanding of these factors, both in the dairy industry and in the corporate market, is crucial. On the other hand, it is important to pay attention to customers in order to meet their needs and expectations from companies. Identifying these factors will lead to a better understanding of the market and intelligence for dairy companies and is crucial in designing competitive marketing strategies.

2. Customer Decisions

Consumer behavior involves a set of psychological and physical processes that begin before purchase and continue after consumption. This behavior aims to satisfy the needs and desires of different individuals and groups by examining the effective processes during the selection, purchase, and use of products and services, ideas, and experiences (Peter & Olson, 2007: Solomon, 2011). Selection models provide a valid approach to analyzing consumer preferences, as these models provide an opportunity to examine many influencing aspects on the consumer behavior (Ahmadi Kaliji, Mojaverian, Amirnejad & Canavari, 2019). In this process, the decision stage is one of the most important steps through which the consumer passes according to the criteria and options available. In other words, the consumer's decision-making and the style of decision-making indicate the mental and cognitive tendencies used when choosing and making decisions (Karimian, Sanayei, & Mohammad Shafiee, 2019). According to Sprolls and Kendall (1986), consumer decision-making styles are a mental orientation determining the consumer approach in the decision-making and product selection stage. Researchers have focused on three approaches to build a model for better identifying consumer decision-making styles, including the lifestyle, the consumer typology, and the consumer characteristics approaches (Bae, Lu-Anderson, Fujimoto & Richelieu, 2015). The consumer typology approach seeks to define consumer attitudes and purchasing motivations by categorizing consumers into a limited number of species that differ from one another. Psychological research assumes that the interests and activities of the consumers can be very effective in measuring their personality and thus predicting their behaviors (Park, 2007). Consumer lifestyle emphasizes how consumers live; in other words, it is a patterned way of life that fits different consumer products, activities, and resources. It also determines how individuals spend their time and financial resources on activities, interests, and ideas. The consumers’ lifestyle characteristics affect their acquisition, consumption, and disposal activities in daily life. A consumer-based approach has been widely used to examine consumer tendencies and decision-making styles. In other words, this approach tries to categorize consumers based on their buying behavior, rooted in their different characteristics. This approach focuses on emotional and cognitive tendencies that are particularly relevant to consumer decision-making (Bae, Lu-Anderson, Fujimoto & Richelieu, 2015). In the literature on identifying consumer buying decision-making styles, which has a long history in consumer behavior research and marketing, the approach based on consumer characteristics is more comprehensive and has been used more widely and has had a stronger and clearer effect on consumer buying tendencies. This approach assumes that consumers follow certain decision-making characteristics such as quality sensitivity or brand and store loyalty in the implementation of their purchasing duties (Bae, Lu-Anderson, Fujimoto & Richelieu, 2015).

3. Research Background

Yahyazadehfar et al. (2015) prioritized the factors and explained the model in their study titled “Prioritizing Effective Factors on Kaleh Company Customer Loyalty”. Among factors effective on customer loyalty, quality of the services, customer satisfaction and innovation in presenting the products, maintaining customers’ trust, relation with customers and fast and easy servicing to them, variety of the products, positive proceeds of the company, and superficial characteristics of the products ranked first to seventh, respectively in respondents’ view. The authors suggest that managers of Kaleh Company should pay more attention to the quality of their productions and study more on the ways to improve customer satisfaction. They also emphasize that customers are the vital forces of all organizations and meeting their satisfaction is one of the most important aims of each company. Sajdakowsk et al. (2020) showed that food quality (in dairy products) is generally perceived by consumers through the attributes of freshness, naturalness, production method, appearance, taste, and smell, but when it comes to the quality of food from animal origin, convenience connected with the availability, nutritional value, and health benefits are of primary importance. Bousbia et al. (2017) used contingency analysis to analyze indicators of consumers’ perceptions towards milk and milk products using classification criteria. Factors determining the annual quantitative consumption were analyzed using a covariance analysis. Results from perception analysis showed the most important socio-economic variables explaining individual differences in consumer behaviors as follows: taste trust, health benefits, packaging, type of shop, brand, the origin of product, and publicity. Moreover, a covariance analysis allowed the identification of 4 major factors in the variation of dairy products consumption, including the geographic area, the number of children per household, the income level, and the price. Bimbo et al. (2017) found that female consumers showed high acceptance for some functional dairy products, such as yogurt enriched with calcium, fiber, and probiotics. Acceptance for functional dairy products increases among consumers with higher diet/health related knowledge, as well as with aging. General interest in health, food-neophobia, and perceived self-efficacy also seem to contribute to shaping the acceptance for functional dairy products. Furthermore, products with “natural” consistency between carriers and ingredients have the highest level of acceptance among consumers. Last, they found that brand familiarity motivated consumers with low interest in health to increase their acceptance and preference for health-enhanced dairy products, such as probiotic yogurts, or those with a general functional claim. Rahnama & Rajabpour (2017) indicated that functional, social, emotional, and epistemic values have a positive impact on the selection of dairy products, but conditional value did not have a positive impact. It was concluded that the main influential factors for consumers' selection behavior towards dairy products included their experience from positive emotions (e.g., enjoyment, pleasure, comfort, and feeling relaxed) and functional value-health. This study emphasized the proper pricing of dairy products by producers and sellers.

Ahmadi Kaliji et al. (2019) indicated that yoghurt, milk, and cheese were the most preferred among the dairy products, and consumers had more tendencies towards using low fat than full-fat dairy products. The results of influencing factors on the selection of dairy products indicated that price and family cost decreased the probability of product selection, while age, education, and attention to exercise increased this probability. Marketing mixed variables (4p) also had a significant effect on the choice of dairy products.

Kubicová et al. (2019) indicated Most consumers are trying to maintain a healthy lifestyle and rational diet, which is just the consumption of milk and dairy products. Consumers especially prefer consuming milk, cheese, and yoghurt, whose consumption is still low, attributed to the high prices of the products compared to consumers’ income. On the other hand, the results showed the main factors determining the consumption of milk and dairy products, among which quality, composition, price, durability, and nutrition data can be mentiond.

Paskaš et al. (2020) indicated Mostly the young population (18-25 years) does not consume goat milk. The study identified the odor (42.3 %) and taste (22.5 %) as the main barriers for consuming goat milk. Regarding the purchase, more than half of interviewed respondents did not buy goat milk and dairy products (67 % and 70.5 %, respectively) while the rest of respondents expressed very low purchasing frequencies. Health benefits represent the most important reason for potential consumption of goat milk and dairy products (66.5 %). On the other hand, the main motives for purchasing cow milk and dairy products are taste and quality (55.5 %). In particular, the oldest surveyed population (40-55 years) seemed to be the most positive group toward goat milk and also the most interested in the product’s nutritional value and its health impact.

Arora & Gupta (2020) indicated that there was a correlation between awareness and interest, interest and desire, while desire had no correlation with action. The results also showed that sex, pocket money, father’s occupation, number of family members, awareness, interest, and action had a correlation with consumption frequency of Fapet’s milk and processed products. Awareness, interest, and action variables also had a correlation with consumption quantity of Fapet’s milk and processed products. The enhancement of awareness and action would increase consumption frequency and quantity of Fapet’s milk and processed products.

Widaryani & Retnaningsih (2018) indicated hat taste, price, easy availability, and brand were the significant attributes for the purchase of packaged milk. It was found that family income and qualification played a very significant role in the consumers' preference for the purchase of packaged milk. Factors such as packaging, quality, and safety for health were found to be the non-significant factors for the purchase decision of packaged milk. The study found that consumers perceived packaged milk to be more hygienic, safe, and of better quality

4. Research Methodology

The current research is in the category of mixed research (first qualitative and then quantitative) in terms of approach and strategy. The research strategy includes theme analysis of the focus group interviews in the qualitative stage and survey in the quantitative stage. This study included the identification and impact of factors affecting the purchase of the dairy products in of two stages. At first, the results of the focus group and the analysis of the themes from the focus group interviews were presented. In the next step (quantitative), these factors were categorized and labeled using exploratory analysis, and finally, the confirmatory factor of the exploratory analysis process was confirmed. The first part was allocated to answering the research question: What are influencing factors on the purchase of dairy products by customers in Mashhad? This section seeks to identify important and influential factors on people's purchases. Accordingly, theme analysis was used to extract the factors from the interviews and gather information from the focus group and the focus group interviews. In the second part, which is conducted quantitatively, data were first collected using a questionnaire. Then, based on the performance data from the customers' point of view, exploratory factor analysis was performed and the themes (indicators related to the theme analysis process) were classified and labeled in the identified structures. Then these structures were confirmed using confirmatory factor analysis, followed by the examination of the influencing factors on customers' purchases.

4-1. Qualitative Section (Focus Group and Theme Analysis)

In this study, information saturation was reached after holding 5 groups of the center, and the process of the center group was terminated. The method of focus group was used to get people's opinions about the influencing factors on the purchase of dairy products. At this stage, the participants were asked about the various dimensions of the issue after explaining the objectives of the meeting. Note-taking, blackboard, and voice recording were used as data collection tools in these sessions. The results of this step were identified as output themes to prepare the ground for quantitative research. Data collection through the mentioned tools continued until information saturation. Table below shows the demographic information of the respondents.

Table 1.

Demographic characteristics of the respondents of the first stage of the qualitative study.

Table 1.

Demographic characteristics of the respondents of the first stage of the qualitative study.

| Family income |

|

Age status |

|

Gender |

|

| Under two million |

6 |

Under 30 years |

10 |

Male |

9 |

| 2 to 4 million |

9 |

31 to 40 |

6 |

Female |

14 |

| 4 to 6 million |

4 |

41 to 50 |

5 |

marital status |

|

| 6 to 8 million |

2 |

51 years and older |

1 |

Single |

8 |

| Over 8 million |

2 |

|

|

Married |

15 |

In the present study, the retest reliability of the test was used to calculate the reliability of the interviews conducted. The focus groups of a group of interviewees (the third group) were selected to calculate the reliability of the retest, and each of them was coded twice at a 15-day time interval by the researcher. A total number of 30 codes were obtained through the interviews with the group in two 15-day intervals. The total number of agreements and disagreements between the codes at these two intervals was equal to 16 and 7, respectively. The reliability of retesting the interviews was calculated in this study using the mentioned formula, the results of which showed a reliability rate of 1 for the whole interview, confirming the reliability of coding given the reliability rate of >60% (Kvale, 1996).

4-2. Quantitative Section (Exploratory and Confirmatory Factor Analysis)

Exploratory and confirmatory factor analyses were performed in this stage of the research. Accordingly, a questionnaire was prepared using the extracted themes in the previous stage and provided to the customers of the dairy industry, who were asked to answer the questions. Exploratory factor analysis was then performed to classify the components, while confirmatory factor analysis was used to confirm these categories. The community of this stage consisted of the customers of Mashhad dairy industry. Due to the high volume of statistical population (n= 3057679), the minimum sample size for this section was 384 people according to Morgan Table. Given the social differences as well as cultural and living standards of different areas of Mashhad, stratified sampling method was used in different areas of the city according to the population of each area. Considering the 13 districts of Mashhad, 700 questionnaires were distributed among the consumers of dairy products. These questionnaires were distributed based on the regions in different areas, and through face-to-face methods. From this number of questionnaires, 616 questionnaires were collected. After the initial review, 99 questionnaires were excluded from the analysis process due to defective completion, leading to 517 usable questionnaires for statistical tests. A questionnaire was prepared for customers using the results of the qualitative stage (focus group). The aim was to examine the importance of indicators for customers. The tool used to collect data in this section was a questionnaire consisting of 60 indicators, distributed among customers of the dairy industry. Likert Scale was used for rating from completely disagree (1) to strongly agree (5). To ensure the content validity of the measurement, the questionnaire was sent to 5 professors of management, who reviewed the questionnaires to ensure having the necessary questions to measure the research variables. The divergent validity of the questionnaire was confirmed using exploratory factor analysis, and the convergent validity of the questionnaire was confirmed using construct validity (confirmatory factor analysis). In order to evaluate the reliability of the questionnaire, Cronbach's alpha was used, the results of which are presented in the table below.

Table 2.

Cronbach's questionnaires and variables.

Table 2.

Cronbach's questionnaires and variables.

| Extractive agent |

Cronbach's alpha |

KMO |

Extractive agent |

Cronbach's alpha |

KMO |

| Intrinsic |

865/0 |

821/0 |

Production power |

915/0 |

849/0 |

| Structure |

842/0 |

777/0 |

Competitive power |

885/0 |

802/0 |

| External |

924/0 |

866/0 |

Distribution power |

821/0 |

702/0 |

| Health |

92/0 |

824/0 |

competitive price |

857/0 |

662/0 |

| Personality |

867/0 |

859/0 |

Awareness factors |

897/0 |

869/0 |

| Psychological |

863/0 |

824/0 |

social factors |

875/0 |

716/0 |

| Company ID |

834/0 |

72/0 |

Store capability |

855/0 |

724/0 |

| The whole questionnaire |

951/0 |

895/0 |

|

|

|

5. Findings

5.1.Findings of the Quality Section: Identifying the Influencing Factors on the Purchase

The data collected by the researcher in the focus group were the basis for theme analysis. The main question of this section was "What are the factors affecting the purchase of dairy products?" The answers of each interviewee were recorded in the group of the center. The notes were then documented and provided to the interviewees for approval and review to express their views on the accuracy and precision of the data evaluation and code extraction by the researcher and to mention the forgotten points. After this step, the coding process began. Overall, 205 codes were identified after analyzing the interview data of the focal group. These codes were categorized based on similarity in the 60 themes extracted from the interviews of the focal group. The table below shows the analysis results. Finally, the themes were completely extracted. As mentioned earlier, 205 extraction codes (factors influencing purchasing) were identified, which were categorized into 60 main themes based on their similarities. The table below shows the extracted themes.

Table 3.

Extractive and final themes of the focus group process.

Table 3.

Extractive and final themes of the focus group process.

| Extractive theme |

Extractive theme |

Extractive theme |

Extractive theme |

| Taste |

Health |

Diversity |

Durability |

| Scent |

Geographical location of the factory |

Eye and Ocular |

Novelty seeking |

| flavor |

Being traditional |

Being natural |

standards |

| Product quality |

Packaging quality |

Prestige |

Export power |

| A sense of nostalgia |

Product appearance (packaging) |

Production and sales volume |

Company specialization |

| Paint color |

Relative price |

Taste |

Expiration dates |

| Packing size |

Fair price |

Experience |

Company credit |

| Superior technology |

Complete product portfolio |

Buy from Familiar |

Variety of products |

| Recyclable container |

Seller's recommendation |

How to maintain (logistics) |

after sales services |

| Compounds |

Oral advertisements |

Price stability |

Use of others |

| Preservatives |

Company advertising |

Store cleanliness |

Family |

| Raw materials used |

Awareness of the company's production process |

The opinion of those around |

Company distribution |

| Store order |

brand |

Innovation |

Availability |

| Novelty of products |

Ability to reuse the container |

Expert and staff advice |

Social verification |

| Company history |

Local bias and sweat |

fat percentage |

Store brand |

5.2. Quantitative part

In this section, exploratory factor analysis was used to identify the main factors and reduce and summarize the data. This section consists of four steps: The first step was to identify the amount of KMO and Bartlett's Test. The results of KMO sample adequacy test were equal to 0.895 (> 0.7), indicating the adequacy of the sampling amount. As a result, factor analysis was possible for these data and suitable for discovering a new structure of data (factor structure).

Table 4.

KMO and Bartlett's Test.

Table 4.

KMO and Bartlett's Test.

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy. |

.895 |

| Bartlett's Test of Sphericity |

Approx. Chi-Square |

23299.117 |

| df |

1770 |

| Sig. |

.000 |

The second output of the test was the initial subscription table and the extracted subscription. These results showed that all questions (indicators) had a score > 0.5; thus, according to the mentioned rule, these indicators were confirmed and factor analysis was analyzed on them.

Table 5.

Communalities.

| |

Initial |

Extraction |

|

Initial |

Extraction |

|

Initial |

Extraction |

| Q1 |

1.000 |

.682 |

Q21 |

1.000 |

.723 |

Q41 |

1.000 |

.787 |

| Q2 |

1.000 |

.723 |

Q22 |

1.000 |

.810 |

Q42 |

1.000 |

.772 |

| Q3 |

1.000 |

.787 |

Q23 |

1.000 |

.886 |

Q43 |

1.000 |

.798 |

| Q4 |

1.000 |

.798 |

Q24 |

1.000 |

.687 |

Q44 |

1.000 |

.796 |

| Q5 |

1.000 |

.663 |

Q25 |

1.000 |

.794 |

Q45 |

1.000 |

.685 |

| Q6 |

1.000 |

.711 |

Q26 |

1.000 |

.688 |

Q46 |

1.000 |

.766 |

| Q7 |

1.000 |

.744 |

Q27 |

1.000 |

.759 |

Q47 |

1.000 |

.754 |

| Q8 |

1.000 |

.735 |

Q28 |

1.000 |

.692 |

Q48 |

1.000 |

.697 |

| Q9 |

1.000 |

.819 |

Q29 |

1.000 |

.636 |

Q49 |

1.000 |

.744 |

| Q10 |

1.000 |

.838 |

Q30 |

1.000 |

.733 |

Q50 |

1.000 |

.790 |

| Q11 |

1.000 |

.736 |

Q31 |

1.000 |

.702 |

Q51 |

1.000 |

.779 |

| Q12 |

1.000 |

.769 |

Q32 |

1.000 |

.728 |

Q52 |

1.000 |

.812 |

| Q13 |

1.000 |

.681 |

Q33 |

1.000 |

.673 |

Q53 |

1.000 |

.788 |

| Q14 |

1.000 |

.653 |

Q34 |

1.000 |

.725 |

Q54 |

1.000 |

.768 |

| Q15 |

1.000 |

.733 |

Q35 |

1.000 |

.754 |

Q55 |

1.000 |

.833 |

| Q16 |

1.000 |

.799 |

Q36 |

1.000 |

.706 |

Q56 |

1.000 |

.836 |

| Q17 |

1.000 |

.724 |

Q37 |

1.000 |

.658 |

Q57 |

1.000 |

.445 |

| Q18 |

1.000 |

.795 |

Q38 |

1.000 |

.615 |

Q58 |

1.000 |

.793 |

| Q19 |

1.000 |

.715 |

Q39 |

1.000 |

.759 |

Q59 |

1.000 |

.769 |

| Q20 |

1.000 |

.785 |

Q40 |

1.000 |

.869 |

Q60 |

1.000 |

.716 |

The third output was the total value of variance, the results of which showed that 14 factors were obtained from the 60 extracted themes. All factors 1 to 14 had eigenvalues >1 and remained in the analysis. It was possible to measure questionnaire indices, including a total of 14 factors with a total variance of more than 74.358%This indicates the validity of the appropriate structure of the questions in this area.

Table 6.

Total Variance Explained .

Table 6.

Total Variance Explained .

| Component |

Initial Eigenvalues |

Extraction Sums of Squared Loadings |

Rotation Sums of Squared Loadings |

| Total |

% of Variance |

Cumulative % |

Total |

% of Variance |

Cumulative % |

Total |

% of Variance |

Cumulative % |

| 1 |

16.105 |

26.842 |

26.842 |

16.105 |

26.842 |

26.842 |

4.544 |

7.574 |

7.574 |

| 2 |

4.865 |

8.109 |

34.951 |

4.865 |

8.109 |

34.951 |

4.464 |

7.440 |

15.013 |

| 3 |

3.549 |

5.915 |

40.866 |

3.549 |

5.915 |

40.866 |

4.044 |

6.740 |

21.754 |

| 4 |

2.963 |

4.938 |

45.804 |

2.963 |

4.938 |

45.804 |

3.776 |

6.293 |

28.047 |

| 5 |

2.488 |

4.146 |

49.951 |

2.488 |

4.146 |

49.951 |

3.693 |

6.154 |

34.201 |

| 6 |

2.286 |

3.809 |

53.760 |

2.286 |

3.809 |

53.760 |

3.329 |

5.549 |

39.750 |

| 7 |

2.180 |

3.633 |

57.392 |

2.180 |

3.633 |

57.392 |

3.204 |

5.340 |

45.090 |

| 8 |

1.794 |

2.990 |

60.382 |

1.794 |

2.990 |

60.382 |

2.916 |

4.859 |

49.949 |

| 9 |

1.775 |

2.959 |

63.341 |

1.775 |

2.959 |

63.341 |

2.771 |

4.618 |

54.567 |

| 10 |

1.561 |

2.602 |

65.943 |

1.561 |

2.602 |

65.943 |

2.588 |

4.314 |

58.881 |

| 11 |

1.471 |

2.452 |

68.395 |

1.471 |

2.452 |

68.395 |

2.443 |

4.071 |

62.952 |

| 12 |

1.270 |

2.116 |

70.511 |

1.270 |

2.116 |

70.511 |

2.336 |

3.893 |

66.846 |

| 13 |

1.225 |

2.042 |

72.554 |

1.225 |

2.042 |

72.554 |

2.304 |

3.841 |

70.686 |

| 14 |

1.083 |

1.805 |

74.358 |

1.083 |

1.805 |

74.358 |

2.203 |

3.672 |

74.358 |

| 15 |

.898 |

1.496 |

75.855 |

|

|

|

|

|

|

| 16 |

.709 |

1.182 |

77.037 |

|

|

|

|

|

|

| 17 |

.669 |

1.116 |

78.153 |

|

|

|

|

|

|

| 18 |

.660 |

1.101 |

79.253 |

|

|

|

|

|

|

| 19 |

.635 |

1.058 |

80.311 |

|

|

|

|

|

|

| 20 |

.619 |

1.031 |

81.342 |

|

|

|

|

|

|

| 21 |

.565 |

.942 |

82.284 |

|

|

|

|

|

|

| 22 |

.535 |

.892 |

83.177 |

|

|

|

|

|

|

| 23 |

.518 |

.863 |

84.039 |

|

|

|

|

|

|

| 24 |

.494 |

.823 |

84.862 |

|

|

|

|

|

|

| 25 |

.474 |

.791 |

85.653 |

|

|

|

|

|

|

| 26 |

.461 |

.769 |

86.422 |

|

|

|

|

|

|

| 27 |

.451 |

.752 |

87.174 |

|

|

|

|

|

|

| 28 |

.429 |

.714 |

87.888 |

|

|

|

|

|

|

| 29 |

.408 |

.680 |

88.569 |

|

|

|

|

|

|

| 30 |

.393 |

.655 |

89.223 |

|

|

|

|

|

|

| 31 |

.374 |

.623 |

89.846 |

|

|

|

|

|

|

| 32 |

.358 |

.597 |

90.444 |

|

|

|

|

|

|

| 33 |

.348 |

.580 |

91.024 |

|

|

|

|

|

|

| 34 |

.328 |

.546 |

91.570 |

|

|

|

|

|

|

| 35 |

.311 |

.518 |

92.088 |

|

|

|

|

|

|

| 36 |

.305 |

.509 |

92.596 |

|

|

|

|

|

|

| 37 |

.298 |

.496 |

93.092 |

|

|

|

|

|

|

| 38 |

.289 |

.482 |

93.574 |

|

|

|

|

|

|

| 39 |

.284 |

.474 |

94.048 |

|

|

|

|

|

|

| 40 |

.273 |

.456 |

94.504 |

|

|

|

|

|

|

| 41 |

.269 |

.449 |

94.953 |

|

|

|

|

|

|

| 42 |

.258 |

.429 |

95.382 |

|

|

|

|

|

|

| 43 |

.237 |

.395 |

95.777 |

|

|

|

|

|

|

| 44 |

.220 |

.366 |

96.144 |

|

|

|

|

|

|

| 45 |

.217 |

.361 |

96.505 |

|

|

|

|

|

|

| 46 |

.205 |

.342 |

96.847 |

|

|

|

|

|

|

| 47 |

.198 |

.330 |

97.177 |

|

|

|

|

|

|

| 48 |

.183 |

.306 |

97.482 |

|

|

|

|

|

|

| 49 |

.176 |

.294 |

97.776 |

|

|

|

|

|

|

| 50 |

.168 |

.280 |

98.056 |

|

|

|

|

|

|

| 51 |

.164 |

.273 |

98.328 |

|

|

|

|

|

|

| 52 |

.160 |

.267 |

98.595 |

|

|

|

|

|

|

| 53 |

.143 |

.238 |

98.834 |

|

|

|

|

|

|

| 54 |

.133 |

.222 |

99.055 |

|

|

|

|

|

|

| 55 |

.123 |

.204 |

99.260 |

|

|

|

|

|

|

| 56 |

.105 |

.175 |

99.435 |

|

|

|

|

|

|

| 57 |

.102 |

.171 |

99.606 |

|

|

|

|

|

|

| 58 |

.094 |

.157 |

99.763 |

|

|

|

|

|

|

| 59 |

.086 |

.143 |

99.906 |

|

|

|

|

|

|

| 60 |

.056 |

.094 |

100.000 |

|

|

|

|

|

|

The fourth output was the rotated matrix of components to obtain a final solution. In this step, the rotated matrix of components was used to classify the items based on their factor loadings. This table shows the correlation matrix between items and factors after rotation. In this table, the researcher considers the largest factor loading of individual items to classify them according to the degree of correlation with each other.

Table 7.

Total Variance Explained Rotated Component Matrix.

Table 7.

Total Variance Explained Rotated Component Matrix.

| |

Component |

| 1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

14 |

| Q1 |

.141 |

.241 |

.145 |

.212 |

.009 |

.093 |

.019 |

.654 |

.098 |

.075 |

-.005 |

.032 |

.284 |

.069 |

| Q2 |

.102 |

.091 |

.055 |

.071 |

.009 |

.057 |

-.029 |

.776 |

.134 |

.135 |

-.048 |

.131 |

.093 |

.157 |

| Q3 |

.122 |

.107 |

.185 |

.131 |

.104 |

.004 |

.105 |

.803 |

.078 |

.134 |

.004 |

-.044 |

.117 |

-.049 |

| Q4 |

.129 |

.205 |

.173 |

.157 |

.041 |

.102 |

.097 |

.782 |

.097 |

.055 |

.103 |

-.010 |

.072 |

.154 |

| Q5 |

.190 |

.619 |

.216 |

.065 |

.021 |

.098 |

.063 |

.137 |

.167 |

.270 |

-.003 |

.095 |

.161 |

.155 |

| Q6 |

.272 |

.674 |

.226 |

.143 |

.082 |

.043 |

.092 |

.140 |

.151 |

.146 |

.022 |

.065 |

.113 |

.114 |

| Q7 |

.111 |

.805 |

.157 |

.091 |

.085 |

-.002 |

.079 |

.113 |

.098 |

.065 |

.041 |

.051 |

.028 |

.076 |

| Q8 |

.200 |

.746 |

.175 |

.075 |

.119 |

.141 |

.019 |

.147 |

.110 |

.044 |

.134 |

.072 |

.083 |

.047 |

| Q9 |

.219 |

.826 |

.148 |

.059 |

.071 |

.080 |

.122 |

.086 |

.123 |

.005 |

.045 |

.053 |

.090 |

.041 |

| Q10 |

.211 |

.845 |

.137 |

.065 |

.054 |

.101 |

.124 |

.077 |

.107 |

.010 |

.017 |

.050 |

.067 |

.056 |

| Q11 |

.104 |

.135 |

.182 |

.163 |

.100 |

.122 |

.106 |

.044 |

.768 |

.038 |

.045 |

.088 |

.084 |

-.036 |

| Q12 |

.068 |

.087 |

.106 |

.164 |

.112 |

.049 |

.051 |

.144 |

.810 |

.032 |

.065 |

.032 |

.098 |

.088 |

| Q13 |

.061 |

.269 |

.142 |

.077 |

.192 |

.103 |

.101 |

.133 |

.676 |

.012 |

-.039 |

.043 |

.021 |

.206 |

| Q14 |

.087 |

.201 |

.023 |

.058 |

.201 |

.027 |

.175 |

.094 |

.669 |

.015 |

.012 |

.072 |

-.036 |

.255 |

| Q15 |

.768 |

.204 |

.114 |

-.028 |

-.001 |

.113 |

-.019 |

.037 |

.088 |

.105 |

-.043 |

.110 |

.134 |

.148 |

| Q16 |

.846 |

.165 |

.072 |

.060 |

.014 |

.051 |

-.040 |

.064 |

.035 |

.094 |

-.039 |

.060 |

.005 |

.157 |

| Q17 |

.779 |

.081 |

.036 |

-.023 |

.108 |

.120 |

-.076 |

.139 |

.100 |

.134 |

-.023 |

-.041 |

.079 |

.147 |

| Q18 |

.823 |

.213 |

.138 |

.159 |

.069 |

.003 |

.070 |

.114 |

-.026 |

.041 |

.026 |

-.028 |

-.019 |

-.009 |

| Q19 |

.784 |

.146 |

.074 |

.163 |

.079 |

-.072 |

.125 |

.037 |

.065 |

-.018 |

.106 |

.035 |

-.018 |

-.010 |

| Q20 |

.821 |

.162 |

.138 |

.138 |

.133 |

-.026 |

.091 |

.082 |

.058 |

.058 |

.049 |

-.052 |

-.034 |

-.017 |

| Q21 |

-.010 |

.133 |

-.021 |

.030 |

.046 |

.092 |

.109 |

-.045 |

-.008 |

-.019 |

.805 |

-.043 |

.169 |

-.008 |

| Q22 |

.043 |

.041 |

.100 |

.128 |

.089 |

.086 |

.086 |

.062 |

.039 |

-.007 |

.846 |

.186 |

-.006 |

-.015 |

| Q23 |

.028 |

.002 |

.115 |

.120 |

.043 |

.071 |

.040 |

.025 |

.051 |

-.029 |

.910 |

.121 |

.023 |

.047 |

| Q24 |

.195 |

.070 |

.070 |

.733 |

.071 |

.112 |

.141 |

.080 |

.136 |

.038 |

.037 |

.144 |

.126 |

-.016 |

| Q25 |

.124 |

.160 |

.097 |

.794 |

.083 |

.121 |

.096 |

.134 |

.054 |

.126 |

.096 |

.076 |

.174 |

-.007 |

| Q26 |

.073 |

.046 |

.042 |

.720 |

.139 |

.241 |

.151 |

.060 |

.071 |

.033 |

.046 |

.003 |

.075 |

.205 |

| Q27 |

.035 |

.081 |

.108 |

.758 |

.074 |

.155 |

.153 |

.175 |

.155 |

.169 |

.091 |

.005 |

.112 |

.093 |

| Q28 |

.089 |

.082 |

.024 |

.704 |

.160 |

.209 |

.222 |

.130 |

.104 |

.073 |

.103 |

.066 |

.095 |

.074 |

| Q29 |

.023 |

.203 |

.008 |

.236 |

.117 |

.178 |

.567 |

.000 |

.261 |

.073 |

.077 |

.181 |

.035 |

.243 |

| Q30 |

-.027 |

.145 |

.020 |

.240 |

.150 |

.185 |

.707 |

.087 |

.180 |

.112 |

.099 |

.037 |

.120 |

.136 |

| Q31 |

.061 |

.166 |

.062 |

.121 |

.236 |

.265 |

.677 |

.027 |

.085 |

-.030 |

-.018 |

.227 |

.070 |

.055 |

| Q32 |

.065 |

.055 |

.081 |

.241 |

.198 |

.119 |

.750 |

.072 |

.031 |

-.035 |

.095 |

.110 |

.107 |

.014 |

| Q33 |

.029 |

.031 |

.161 |

.068 |

.149 |

.199 |

.732 |

.031 |

.054 |

.030 |

.080 |

.162 |

.051 |

-.062 |

| Q34 |

.030 |

.071 |

.061 |

.155 |

.127 |

.774 |

.070 |

.135 |

.048 |

.164 |

.064 |

.062 |

.101 |

.073 |

| Q35 |

-.004 |

.116 |

.007 |

.275 |

.099 |

.756 |

.157 |

.074 |

.112 |

.145 |

.012 |

.031 |

.131 |

.046 |

| Q36 |

.056 |

.007 |

.106 |

.144 |

.129 |

.738 |

.180 |

.057 |

.044 |

-.040 |

.035 |

.198 |

.088 |

.148 |

| Q37 |

.031 |

.197 |

.150 |

.182 |

.057 |

.656 |

.218 |

-.018 |

.123 |

-.035 |

.144 |

.191 |

-.062 |

.067 |

| Q38 |

.079 |

.051 |

.120 |

.098 |

.031 |

.614 |

.349 |

-.008 |

.012 |

.201 |

.125 |

.090 |

.120 |

.063 |

| Q39 |

.110 |

.107 |

.118 |

.044 |

.050 |

.050 |

.073 |

.167 |

.027 |

.810 |

-.028 |

-.002 |

.113 |

.110 |

| Q40 |

.114 |

.079 |

.040 |

.141 |

-.046 |

.106 |

-.015 |

.061 |

.025 |

.886 |

-.026 |

.129 |

.035 |

.084 |

| Q41 |

.134 |

.110 |

.011 |

.168 |

.033 |

.167 |

.037 |

.126 |

.030 |

.791 |

-.009 |

.143 |

.114 |

.147 |

| Q42 |

.116 |

.162 |

.121 |

.164 |

-.054 |

.162 |

.142 |

.305 |

.048 |

.114 |

.103 |

.023 |

.721 |

.049 |

| Q43 |

-.041 |

.121 |

.075 |

.204 |

.037 |

.093 |

.046 |

.075 |

.110 |

.113 |

.093 |

.125 |

.807 |

.128 |

| Q44 |

.066 |

.150 |

.071 |

.207 |

-.035 |

.115 |

.183 |

.201 |

.018 |

.089 |

.052 |

.165 |

.761 |

.125 |

| Q45 |

.139 |

.170 |

.261 |

.098 |

.016 |

.172 |

-.005 |

.181 |

.164 |

.100 |

.049 |

.135 |

.142 |

.647 |

| Q46 |

.135 |

.170 |

.226 |

.135 |

-.001 |

.050 |

.100 |

.136 |

.164 |

.170 |

.018 |

.092 |

.051 |

.743 |

| Q47 |

.176 |

.075 |

.159 |

.089 |

.045 |

.181 |

.113 |

.050 |

.150 |

.166 |

-.030 |

.045 |

.150 |

.747 |

| Q48 |

.081 |

.112 |

.762 |

.100 |

.018 |

.054 |

.047 |

.116 |

.073 |

.087 |

.068 |

.072 |

-.014 |

.212 |

| Q49 |

.162 |

.129 |

.787 |

.050 |

.031 |

.055 |

-.013 |

.165 |

.096 |

.043 |

.030 |

.024 |

.014 |

.189 |

| Q50 |

.153 |

.144 |

.831 |

.055 |

.041 |

.099 |

.093 |

.072 |

.030 |

.026 |

.066 |

.034 |

.112 |

.086 |

| Q51 |

.102 |

.213 |

.827 |

.020 |

.072 |

.093 |

.106 |

.041 |

.075 |

.048 |

.031 |

.021 |

.061 |

.004 |

| Q52 |

.044 |

.222 |

.839 |

.074 |

.033 |

.052 |

.076 |

.107 |

.144 |

-.003 |

.028 |

.046 |

.073 |

.029 |

| Q53 |

.027 |

.115 |

-.057 |

.130 |

.844 |

.069 |

.109 |

.029 |

.062 |

-.037 |

.085 |

.006 |

-.018 |

.109 |

| Q54 |

.103 |

.062 |

.053 |

.101 |

.838 |

.043 |

.127 |

.049 |

.068 |

-.065 |

-.010 |

.082 |

-.011 |

-.048 |

| Q55 |

.079 |

.106 |

.038 |

.157 |

.826 |

.140 |

.118 |

-.019 |

.216 |

.065 |

.064 |

.098 |

.084 |

-.042 |

| Q56 |

.084 |

.085 |

.035 |

.146 |

.849 |

.148 |

.102 |

-.017 |

.180 |

.038 |

.036 |

.085 |

.062 |

-.016 |

| Q57 |

.067 |

-.007 |

.100 |

-.057 |

.616 |

.009 |

.143 |

.079 |

.018 |

.051 |

.029 |

-.077 |

-.097 |

.053 |

| Q58 |

.006 |

.125 |

.070 |

.216 |

.096 |

.114 |

.212 |

.042 |

.020 |

.167 |

.133 |

.780 |

.043 |

.023 |

| Q59 |

.045 |

.165 |

.050 |

.113 |

.011 |

.222 |

.189 |

.106 |

.065 |

.088 |

.061 |

.775 |

.049 |

.095 |

| Q60 |

.009 |

.010 |

.063 |

-.049 |

.051 |

.125 |

.143 |

-.033 |

.120 |

.046 |

.098 |

.775 |

.183 |

.099 |

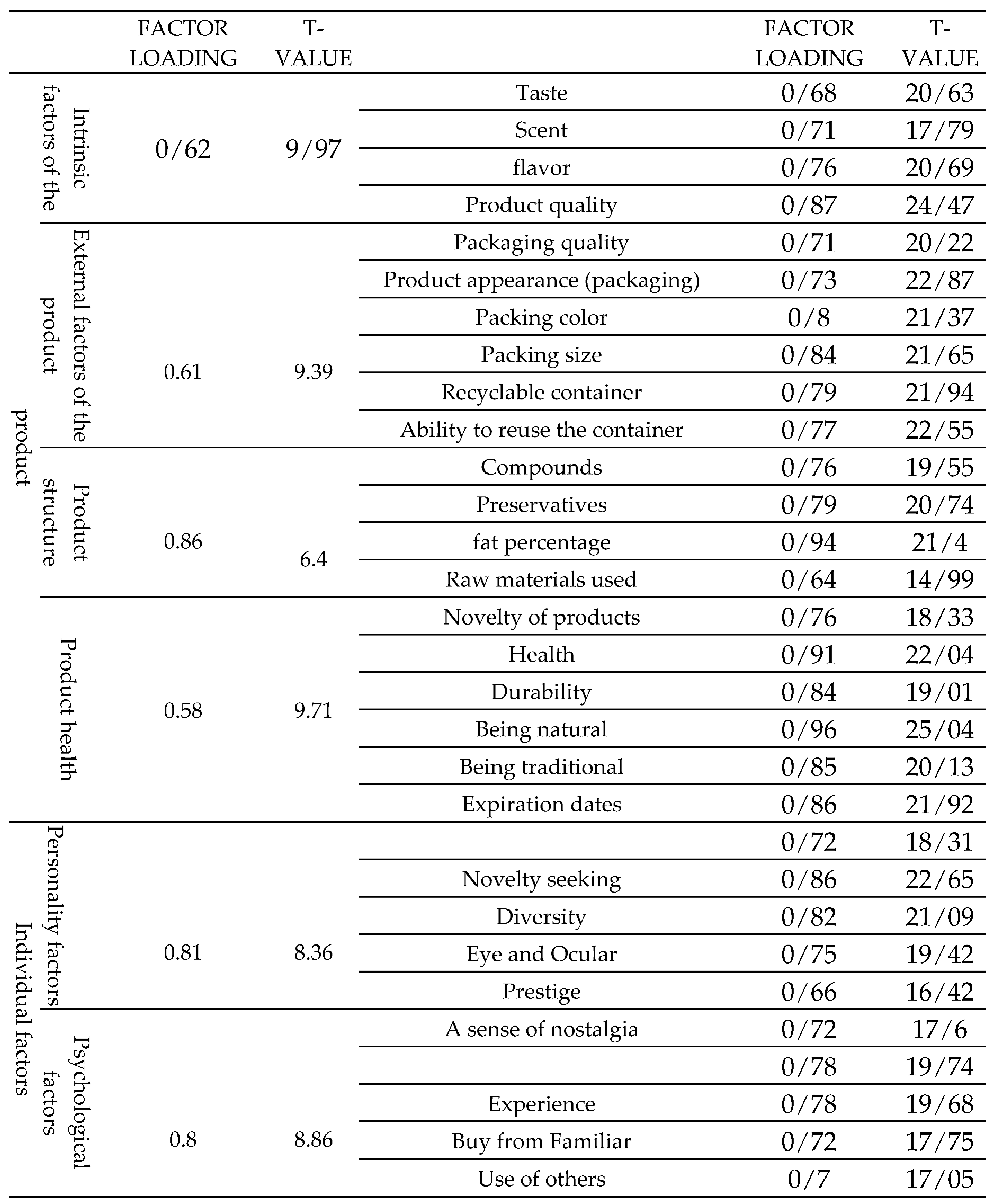

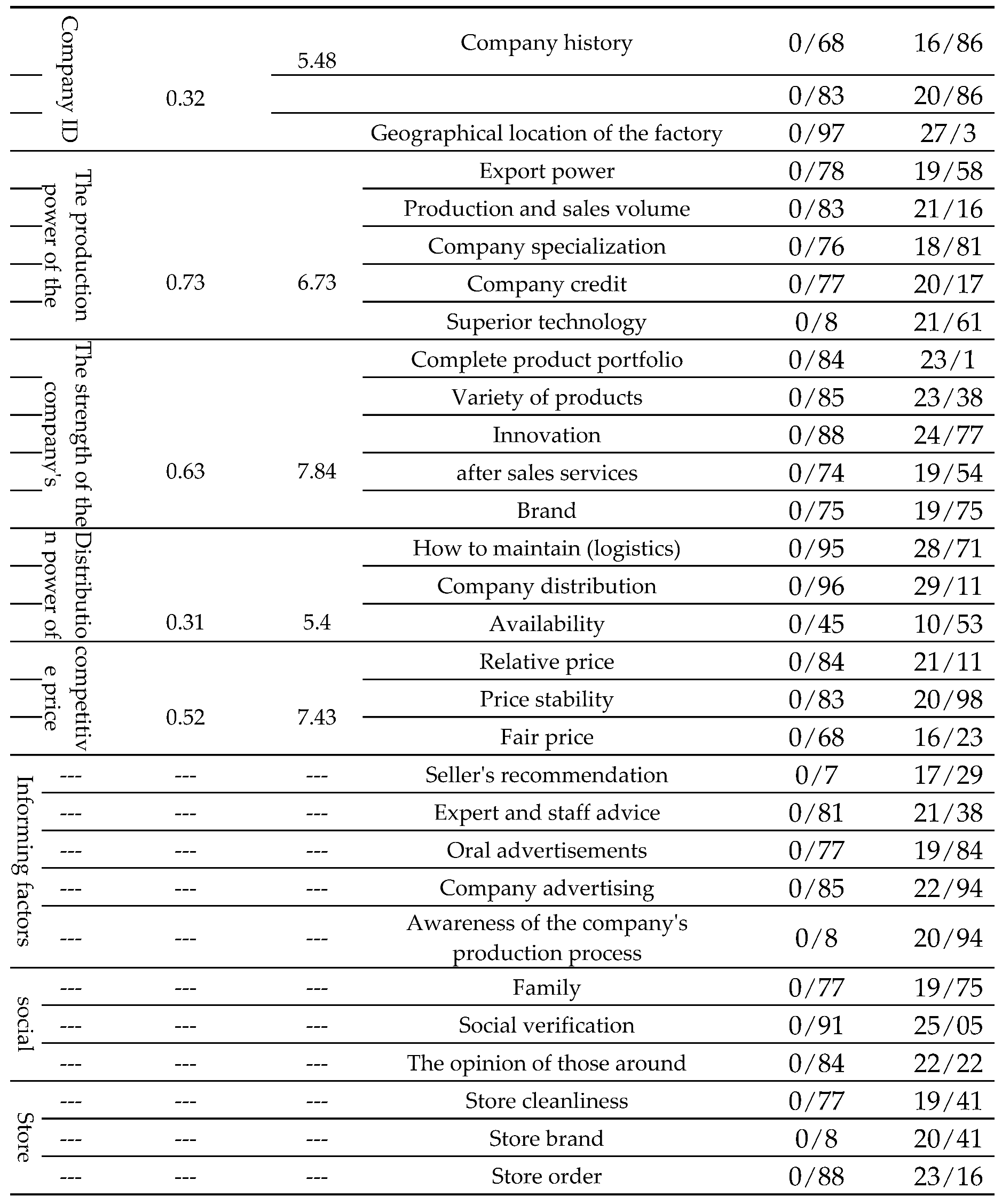

5-2-1. Factor Labeling

The analysis of each factor clearly shows the decisive role of each in customers' purchases. Thus, it can be concluded that each of these factors has been identified as an effective and key factor in the customers’ purchase of dairy products according to their priority. At this stage, the factors are labeled according to the items in each of the factors. This section answers the research question regarding the influencing factors on the purchase of dairy products by customers. Two general criteria of controllability/or non-controllability and generality/or specificity were used to label the factors. Factor 1 consists of 5 items that explain 7.574% of the total variance and are product freshness, hygiene (pasteurization), durability, naturalness, traditionality, and date. These 5 items have two distinct features. They are under the control of the company and specific to the production and supply process of the product. Based on the literature and the nature of the items, it can be said that these themes occur in the nature of the product. In other words, this factor refers to the health of the products that the company must ensure to its customers. For this reason, items were labeled under "product health". Factor 2 includes components of packaging quality, product appearance (package), color, package size, recyclable and usable container. These factors are in the control of the company and specific to the product, explaining 7.44% of the total variance. This factor was called the "external factor of the product" given the characteristics and commonalities between these factors. Factor 3 consists of 5 items that explain 6.74% of the total variance and are export power, production and sales volume, company specialization, company reputation, and company technology. Due to the nature of the factors, they are in the control of the company and specific to the production method and production process of the company. As a result, this factor was named the "production power factor" of the company. Factor 4 includes 5 items that explain 6.293% of the total variance and are seller recommendation, expert and staff advice, word of mouth, company advertising, and knowledge of the production process. Due to the nature of the factors, they are in the control of the company and customers and specific to the issue of product recognition; hence, the name of this factor was called "product awareness". Factor 5 includes 5 items that explain 6.154% of the total variance. These 5 factors are complete product portfolio, product variety, innovation, after-sales services, and brand. Given the nature of these factors, they are all under the control of the company and also specific to the company's competitiveness. As a result, according to the literature and the convergence of these factors, they were labeled under "competitiveness". Factor 6 includes 5 items that explain 549.5% of the total variance. These items include a sense of nostalgia, taste, experience, purchase from acquaintances, and recommendation by others. These factors are in the control of customers and specific to their minds. As a result, according to the literature, this factor was named as "psychological factors". Factor 7 includes 5 items that explain 5.34% of the total variance. These factors include local bias and prejudice in shopping, novelty, diversity, emulation, and prestige. These factors are in the control of customers and specific to their personality. As a result, according to the literature, this factor was labeled under "personality". Factor 8 includes 4 items that explain 4.859% of the total variance. These factors include taste, smell (odor), flavor, and quality of the product. These factors are in the control of the company and also product-specific; hence, they were labeled the "product essence" factor. Factor 9 includes 4 items that explain 4.618% of the total variance. These factors include compounds, preservatives, percentage of fat, and raw materials used. These factors are in the control of the company and product-specific. Accordingly, the items were inside the product and labeled under the "product structure". Factor 10 consists of 3 items that explain 4.314% of the total variance. These items include family, social approval, and the recommendations of others. These factors are not in the control of the company and are specific to society; hence, they were labeled under the "social factor” based on the nature of the factor. Factor 11consists of 3 items that explain 4.071 percent of the total variance. These items include a fair price, relative price, and price stability. These factors are under the control of the company and specific to the issue of price mixing; hence, they are labeled under "competitive price" based on the nature of the factor. Factor 12 includes 3 items that explain 3.893% of the total variance. These items are maintenance (logistics), distribution, and availability. These items are under the control of the company and specific to the distribution of the company. Due to the nature of the items, the factor was named "logistic capability". Factor 13 includes 3 items that explain 3.841% of the total variance. These items are store cleanliness, store brand, and store order. These factors are not under the control of the company and are specific to the retailer. Due to the nature of the items, the factor was called "store capabilities". Factor 14includes 3 items that explain 3.672% of the total variance. These items are company history, standards, and geographical location of the company. These factors are specific and related to the company; therefore, due to the nature of the items, they were labeled under the "company identity (company demographic factors)". The classification of factors made of items (themes) was carried out according to the above categories and labeling. Then, confirmatory factor analysis was used to confirm the components.

Table 8.

Total Variance Explained Rotated Component Matrix.

Table 8.

Total Variance Explained Rotated Component Matrix.

6. Discussion

11. Qualitative Study - Identifying the Influencing Factors on the Purchase of Dairy Products by Customers

This part of the research identifies the factors affecting customers’ purchase in the dairy industry. The focus group was used to identify the factors from the opinions of customers and understand their views. As a result, 23 interviewees were used in 5 focus groups, discussing about dairy products, dairy companies, and the success factors of some companies, the factors considered in the customers’ purchase, and the factors affecting their purchase. The statements of each interviewee in each group were recorded separately to make the interview process more accurate. In this process, the researcher and another person (colleague) were in charge of meeting and discussion to perform the interview process properly without deviations from its path. All comments of the interviewees were recorded after data collection. At the end of each group discussion, the interview process was performed by the two coders. Given the high commonality of the fifth group interview with the previous groups, the focus process of the focus group reached saturation, and the interview process ended. Finally, two coders (researcher and colleague) examined the interviews and extracted the codes using the theme analysis method. A total number of 205 codes were extracted from the coding process, categorized into 60 themes according to their thematic focus. The method of reliability of two coders and retest was used to confirm the reliability in this section. The results confirmed the reliability of the interview and coding processes. A questionnaire was designed based on the themes extracted from the focus interview process. This section aimed to provide data on the performance data collected from the respondents about dairy companies. The extracted themes can be summarized in the form of several categories of factors using exploratory factor analysis in SPSS software. Then, the extracted components (factors) are confirmed using confirmatory factor analysis. This test was performed by confirmatory factor analysis in LISREL software. The minimum number of samples for this section was 384 questionnaires according to Morgan Table. Sampling from different urban areas, determining the number of respondents in each area, and distributing the questionnaires were the next steps. A total number of 700 questionnaires was distributed in 13 districts of Mashhad, considering the possibility of the non-return of the questionnaires or their improper completion. Finally, 517 useable questionnaires were collected as the source of analysis. The first statistical test was the quantitative part of the exploratory analysis test, based on which the extracted themes were summarized in the factors. The output of the exploratory factor analysis test was equal to 0.895 according to the KMO sample adequacy test, indicating that the exploratory factor analysis process is appropriate and useful and the number of data is sufficient for this task. The significance level of the test is equal to (0.000), which is less than 0.05, indicating that factor analysis is suitable to discover a new structure of data (factor structure). Hence, it was possible to trust the results of the factor analysis. According to the next output of the table, all themes (similar to the questionnaire questions) had factor loadings of >0.5, and given that the minimum factor loading was 0.3, all themes were verified, removing no items from the analysis process. The next output showed the amount of variance extracted and the number of extracted factors. According to the results, 14 factors were identified with a total variance of 74.358% and categorized in the final table, which was the rotated matrix of factors. The factor analysis clearly shows the decisive role of each of these factors in the customers' purchase. Thus, each of these factors can be considered as an effective and key factor in the customers' purchase of dairy products, according to their priority. At this stage, the factors were labeled based on the items in each factor. For a more detailed study of the extracted components and factors, confirmatory factor analysis was used, the results of which are presented below. Among the themes related to the external factor of the product, the package size had the highest explanatory value (0.84) followed by the packaging color (0.8). According to the opinions of customers and consumers, these two factors were the determinants of the purchase behavior. Many consumers pay attention to the ability to maintain the product and the cost-effectiveness of the purchase. For example, families with low population prefer packages, used a smaller size to stay healthy, and did not store the products for a long time. Large families liked economical products, so they bought a larger, more economical size. Packaging color indicates low-fat and high-fat because most dairy products are based on color, so it is a factor for health in the minds of customers. The next factor was the recyclability (0.79) and reusability (0.77) of the containers, which were related to the attention of many customers to the preservation of the environment and the nature of the country. Finally, the appearance of the product (0.73) and the quality of the packaging (0.71) explained the external factors of the product. Perhaps the reason for these low values was that customers did not feel much difference in the packaging of dairy products, and most companies were in close categories in terms of appearance and packaging quality. The next factor was the product structure factor, which had the highest explanatory rate for the fat percentage theme (0.94) followed by preservatives (0.79), compounds (0.76), and finally raw materials used (0.64). Fat percentage was especially important for women, as high fat was considered harmful to their health and that of their families. Some customers equated a high fat percentage with more preservatives, and as the percentage of fat in the minds of customers has shaped the structure of the product, the higher factor loading for its preservatives confirms this argument. Finally, some customers paid attention to the ingredients, such as the amount of salt used, etc., depending on the type of product. There were two different views on raw materials, one of which acknowledged that raw material factories were healthy, not thinking about the supply chain because of various tests and trials. This means that few people were aware of the quality of milk used in factories, which can explain why this factor had the explanatory value. The next factor was the health of the product, in which the themes related to naturalness (0.96) and health (0.91) had the highest explanatory value, followed by the expiration date (0.86), being traditional (0.85), durability (0.84), and freshness of products (0.76). For many people, being natural means not having supplements, having less preservatives, and having less harmful chemicals as the criterion of consumption, which was called naturalness. The next factor was associated with health, which explains many people buy factory products because of the pasteurization of the process. This factor was related to the homogeneity of the production process or the health and attention to the health of production. When buying products, the date from production to expiration is important for customers. Customers want reasonable dates, neither high-shelf nor short-term dates were attractive to them, which confirms the importance of the shelf-life factor for them. Being traditional is one of the factors that go back to the feelings of customers and their mental background. Customers still believe that traditional products are healthier, while they still follow the nostalgic feeling and real taste in products that are traditional, such as Liqvan cheese, etc. It can be acknowledged that Iranian customers and consumers are people who look for and pay attention to appearances in shopping, which means that they are visual people. Thus, this external factor had the highest explanatory value. Then, because of their selfishness, they want to buy products that they like, which are pleasant and desirable for them. Structural and health factors were at different levels from the customers’ perspectives because of the little knowledge that customers have about factory production. Some considered the factory production process to be purely healthy, and because the factories were under the supervision of the Health Organization and the government, its health was confirmed. Some also had a completely negative view, based on which purchase from factories was not good due to a lot of fraud and other factors in factories. Hence, this view preferred traditional method of purchase. Regarding the company's identity card, the factors of the obtained standards (0.83) had the highest explanatory value, followed by the company's production history (0.78) and the geographical location of the company (0.76). The company's standards show the customers' trust in the government, based on which they accept the health standards that the company has acquired. Therefore, customers accept the standards considering the importance they attach to their health. The production history indicates the years of production and the company's reputation that makes people trust it easily. Finally, the geographical location is associated with two biases of buying from local factories or supplying from close factories to them. Customers believe that transportation and long distances reduce the quality and increase spoilage due to the high sensitivity of dairy products. The next factor of company production power, called the theme of superior technology, had the highest explanatory value (0.88), followed by company reputation (0.85), company specialization (0.84), company production volume (0.8), and the company's export power (0.76). The production power of the company shows the ability of the company to produce. Companies that have up-to-date technologies, like Kaleh and Mihan companies, have gained high prestige and expertise with a high daily production rate, leading to their considerable growth. They can export to countries around the world and have a better position in the minds of customers. The next factor is the company's competitiveness, with the themes of brand theme (0.96), innovation (0.95), product diversity (0.75), complete product portfolio (0.74), and good after-sales services (0.45). The brand theme has the highest explanatory value due to the nature of the product in the dairy production process. Accordingly, a good brand for both the company (Kaleh) or for the product (Sun Kaleh, Lactovia Kaleh, Haft Grineh, Abali carbonated dough) encourages more purchase. Innovation confirms the result of modern technologies, according to which the innovative companies have a variety of products, complete their portfolio, and are successful and lasting in the minds. Due to the nature of dairy products (being consumed) after-sales services had a lower explanatory power. The next factor is the distribution factor, with a factor loading equal to (0.84) for the theme of how to maintain (logistics), indicating the highest explanatory value in the distribution factor. The next theme is the distribution, which has a factor loading equal to (0.83), followed by the product availability with a factor loading of (0.68). These results show that storage, transportation, and distribution are very important. Availability has the lowest factor loading, perhaps because customers buy their brand and if they need a particular brand, they will find it anywhere. Although availability is important, the distribution, maintenance, and distribution system are more important. The final component of the company is to have a competitive price, in which the fair price had the highest explanatory value (0.97), followed by price stability (0.83), and relative price (0.68). This shows that in terms of pricing, price fairness is very important for customers. Customers will constantly compare the prices of products in both rows and categories for different companies. Companies must be careful about their price level and constantly consider the level of price satisfaction and customer perspectives. Next, price stability is important. Companies with high price changes create a negative view in the customers’ minds and customers will feel unfair about this price instability. The relative price must also be observed, i.e., the price adjusted based on the quality level, brand, type of product, etc. The next factor is the character factor, which includes 5 themes. Novelty as the first theme had the highest value with a factor loading of 0.86, followed by diversity (0.82). This result shows a sense of novelty and variety and the pleasure of buying from Iranian consumers. The next factor is emulation with a factor loading of 0.75, followed by local bias and prejudice (0.72), and prestige (0.66). This factor shows that the emulation factor is seen in shopping, which is particularly high among women. In buying dairy products, prestige has the lowest factor loading because it is not a luxury product. The next factor is the psychological factor, which includes 5 themes. The most important factors were taste and experience with the highest loading of 0.78). This shows the high importance of the customer experience and personal desire in buying products, followed by nostalgia (0.72), buying from acquaintances (0.72), and psychological factors (0.7). Information includes 5 themes. Word-of-mouth advertising had the highest exploratory value with a factor loading of 0.85, followed by the recommendations of experts and personnel (0.81). Awareness of the production process of the company (0.8), company advertisements (0.77) and the seller's recommendation (0.7) explained the information factor. This shows the importance of the word of mouth and the advice of experts and staff. This result shows that the promotion by individuals and others plays an important role. Social factor consists of three themes. The factor of social verification in purchasing with factor loading of 0.91 and social verification with a factor loading of 0.84 had the highest explanatory values. The family also had an explanatory power with a factor loading of 0.77. According to these results, people's views on the purchase and the role of the opinions of people and others were very important in the purchase of dairy products. Store factor has three themes. The theme of store order with a factor loading of 0.88 had the highest explanatory value. The next factor was the brand of the store with a factor loading of 0.8, followed by the cleanliness of the store (0.77). This shows that order is very important for customers. Accordingly, offering products in branded, stylish, orderly, and clean stores will lead to a competitive advantage for the company in the process of distributing its products, increasing the company's distribution power.

References

- Ahmadi Kaliji, S., Mojaverian, S. M., Amirnejad, H., & Canavari, M. (2019). Factors affecting consumers' dairy products preferences. AGRIS on-line Papers in Economics and Informatics, 11(665-2019-4000), 3-11.

- Arora, A. K., & Gupta, V. P. (2020). Conjoint Analysis of Consumers' Preference towards Packaged Milk. Indian Journal of Marketing, 50(12), 40-51.

- Bae, J., Lu-Anderson, D., Fujimoto, J., & Richelieu, A. (2015). East Asian college consumer decision-making styles for sport products. Sport, Business and Management: An International Journal, 5(3), 259-275.

- Bai, Y.; Yao, Z. & Dou, Y. F. (2015), Effect of ssocial commerce factors on user purchase behavior: An empirical investigation from Renren.Com, International Journal of Information Management, 35(5), 538-550.

- Bigné, E., Llinares, C., & Torrecilla, C. (2016). Elapsed time on first buying triggers brand choices within a category: A virtual reality-based study. Journal of Business Research, 69(4), 1423-1427.

- Bimbo, F., Bonanno, A., Nocella, G., Viscecchia, R., Nardone, G., De Devitiis, B., & Carlucci, D. (2017). Consumers’ acceptance and preferences for nutrition-modified and functional dairy products: A systematic review. Appetite, 113, 141-154.

- Bousbia, A., Boudalia, S., Chelia, S., Oudaifia, K., Amari, H., Benidir, M., ... & Hamzaoui, S. (2017). Analysis of factors affecting consumer behavior of dairy products in Algeria: A case study from the region of Guelma. International Journal of Agricultural Research, 12(2), 93-101.

- Karimian, M., Sanayei, A., & Mohammad Shafiee, M. (2019). Surveying of Criteria for Purchasing Television Set and Recognizing Customers' Decision Making Styles in Isfahen. Journal of Business Management, 11(3), 631- 650.

- Kubicová, Ľ., Predanocyová, K., & Kádeková, Z. (2019). The importance of milk and dairy products consumption as a part of rational nutrition. Potravinarstvo Slovak Journal of Food Sciences, 13(1), 234-243.

- Kvale, S. (1996). Interview Views: An Introduction to Qualitative Research Interviewing. Thousand Oaks, CA: Sage Publications.

- Liao, C.; To, P. L.; Wong, Y. C.; Palvia, P. & Kakhki, M. D. (2016), The impact of presentation mode and product type on online impulse buying decisions, Journal of Electronic Commerce Research, 17(2), 153.

- Park, Y. A. (2007). Investigating online decision-making styles (Doctoral dissertation, Texas A&M University).

- Paskaš, S., Miočinović, J., Lopičić-Vasić, T., Mugoša, I., Pajić, M., & Becskei, Z. (2020). Consumer attitudes towards goat milk and goat milk products in Vojvodina. Mljekarstvo: časopis za unaprjeđenje proizvodnje i prerade mlijeka, 70(3), 171-183.

- Peter, P. & Olson, J., (2007), Consumer Behaviour and Marketing Strategy, 8th Edition, Mcgraw-hill/Irwin.

- Rahnama, H., & Rajabpour, S. (2017). Factors for consumer choice of dairy products in Iran. Appetite, 111, 46-55.

- Sajdakowska, M., Gębski, J., Guzek, D., Gutkowska, K., & Żakowska-Biemans, S. (2020). Dairy Products Quality from a Consumer Point of View: Study among Polish Adults. Nutrients, 12(5), 1503.

- Solomon, M. (2011). Consumer Behavior (9th ed). Boston, Mass; London: Boston, Mass.

- Sproles, G. B., & Kendall, E. L. (1986). A methodology for profiling consumer decision making styles. Journal of Consumer Affairs, 20 (2), 67–79.

- Ting, H., Thaichon, P., Chuah, F., & Tan, S. R. (2019). Consumer behaviour and disposition decisions: The why and how of smartphone disposition. Journal of Retailing and Consumer Services, 51, 212-220.

- Widaryanti, W. B., & Retnaningsih, R. (2018). Analysis Of Milk Consumption Behavior and Processed Products on IPB Students with AIDA and CRI Methods. Journal of Consumer Sciences, 3(1), 50-64.

- Yahyazadehfar, M., Aghajani, H., Rezaei, A. (2015). Prioritizing Effective Factors on Kaleh Company Customer Loyalty. New Marketing Research Journal, 5(1), 219-234.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).