1. Introduction

The CEMAC zone emerged without sparing any effort from the 2016 currency crisis linked to the fall in the price of petroleum products and the brake on Chinese economic growth to come up against a global health crisis. Indeed, in Wuhan in the province of Hubei in the Republic of China, an epidemic was declared in November 2019 which over time has gradually spread around the world. From epidemic to pandemic, Covid 19 has exposed the vulnerability of economic agents. With a rapid spread, the pandemic leads to a historically unprecedented economic and societal crisis with the simultaneous and combined aspect of their intervention. The immediate and direct consequence on the level of revenue for public treasuries is clear. Following the fall in the price of oil and raw materials, the modes of transport brought to a halt, the reduction in the active population and the level of trade, the collection of public revenue by the States has gradually deteriorated and a reorganization of public institutions has become essential to meet the physiological needs of populations. In addition, the confinement of populations and the drop in demand have led to a decline in global economic growth. The situation of 2016 in the ECCAS

1 zone is reproduced with the scarcity of foreign currency which forces the 06 States to adjust the economic and financial reform program (PREF

2 ECCAS).

The situation in Cameroon is hardly brilliant, despite a low morbidity of the populations (African in general) linked to the coronavirus compared to European countries under various justifications which suggests a negligible impact on the economy. Indeed, in 2020, Cameroon's growth level fell to 0.5 points, the inflation level reached 2.4% and the unemployment rate stood at 3.84% (AfDB, 2021) . A socio-economic survey conducted by INS (national statistics institute) Cameroon on a sample of around 770 formal and informal companies showed that the economic and social crisis of Covid-19 has modified the activities of firms. The results reveal that about 80% of business leaders in the formal sector experience a medium or significant slowdown in their activity compared to 82% in the informal sector. In general, 82.6% of business leaders believe that their production has fallen even though this situation is more accentuated in the formal sector. With regard to turnover, 95.5% of companies note a drop. For half of these companies, the turnover is down by more than 50%. This decrease concerns the activities which employ the most, in this case transport and storage (8.3%), accommodation and catering (2.2%), agriculture (7.7%), wood industry except furniture manufacturing (1.8%), extractive industries (0.5%) according to INS Cameroon (2019).

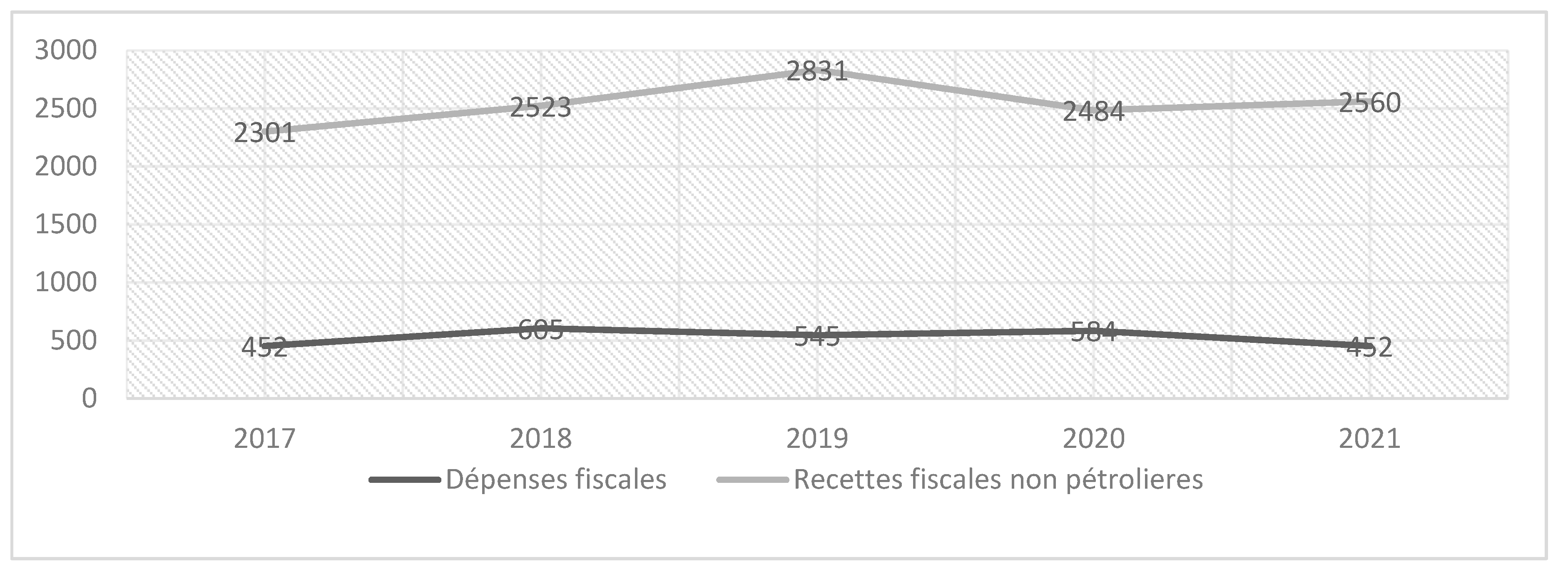

The reduction in business turnover contributes to reducing the government's tax receipts (this downward movement is amplified by the oil shock). Indeed, the tax base of companies decreases and affects the collection of taxes on the one hand and on the other hand the containment or tax evasion affects the payment of tax obligations. In the same period, there is a need for the government to increase its public expenditure, in particular on health, to absorb the effects of the coronavirus. As a result, the simultaneity of the increase in expenditure and the fall in revenue should worsen the budget deficit, which was already at -2.6% of GDP in 2019. Conversely, the budget deficit fell by 3. 1 points in 2021 and GDP growth accelerated to 3.5% (AfDB, 2021). Fiscal consolidation measures aimed at reducing expenditure and increasing non-oil budget revenues explain this performance, as an illustration the evolution of non-oil tax revenues and the amount of tax expenditures over the last 5 years are presented in

Graph 1 . On the other hand, the unemployment rate fell to 6.5 points and this is reflected in the low contribution of around 7% of personal income tax to tax revenue in 2020 and 2021 (DGI

3 2022). The inflation rate is decreasing to 2.4%, but this remains only a respite with the Russian-Ukrainian diplomatic crisis which affects the prices of agricultural and oil products worldwide.

Graph 1.

Evolution of the last 5 years of non-oil tax revenue and tax expenditure. Sources: DGI Cameroon.

Graph 1.

Evolution of the last 5 years of non-oil tax revenue and tax expenditure. Sources: DGI Cameroon.

As Ngomba Bodi (2020) points out, the effects of the Covid 19 health crisis are causing the Cameroonian economy to face five shocks: an epidemiological shock, a supply shock, an internal demand shock, an oil shock and a foreign demand shock. Faced with these 5 shocks, Cameroonian public institutions must demonstrate flexibility and a strong capacity to adapt in a short period of time in order to minimize the impact and the consequences as much as possible. They must demonstrate a lower level of vulnerability in order to meet the needs of the populations and guarantee development prospects as best as possible with the available resources.

The measure of vulnerability to the impact of crises of different natures is economic, social and environmental resilience. Tax collection institutions must make choices to increase the level of resilience of their economies in order to maintain performance indicators at a sustainable level. Resilience is the ability to get back on your feet, to stay the course, to ensure the sustainability of an organization or a society, to maintain it with a certain permanence in a turbulent environment (Paquet 1999). The literature identifies four dimensions of the resilience of public institutions: resistance, which measures sensitivity in terms of regional income or jobs in the face of an exogenous shock; recovery, which measures the speed of return to balance; the reorientation which indicates how the institution changes after a shock by modifying for example its tax revenue mobilization strategy (TRM) and the renewal which is the capacity of an institution to renew its potential and its path of growth. These four dimensions are linked to two perspectives of an organization's resilience. The first ensures the integral conservation of a certain state of the economy (stationary = resistance + recovery) to maintain the level of the organization and these performances. The second ensures a renewal regime (dynamic = reorganization + renewal) to improve the level of performance of the organization during or after the crisis (Martin et Sunley 2015).

From this perspective, Briguglio (2016) defines economic resilience as the ability to maintain output close to its potential despite a shock. In this sense, to understand how public institutions and regional economies react and recover in the face of shock, Talandier & Calixte (2021) conceive of resilience as the capacity of public institutions to overcome a shock (first perspective), by absorbing, adapting or transforming deeply (second perspective).

Under both resilience lenses, any organization faces a cycle of economic resilience during and after the crisis. It designates the study of periods of crisis in two axes: either different points of observed reversal which makes it possible to measure the intensity of the resilience between two points, but also of the sub-periods; or a period between two economic crises or shocks. This research is identified with the study of different turning points to measure the intensity of resilience. This choice is justified by the identical effects of the crises on the ECCAS economies which are at the end of the economic value chains with moderately industrialized sectors.

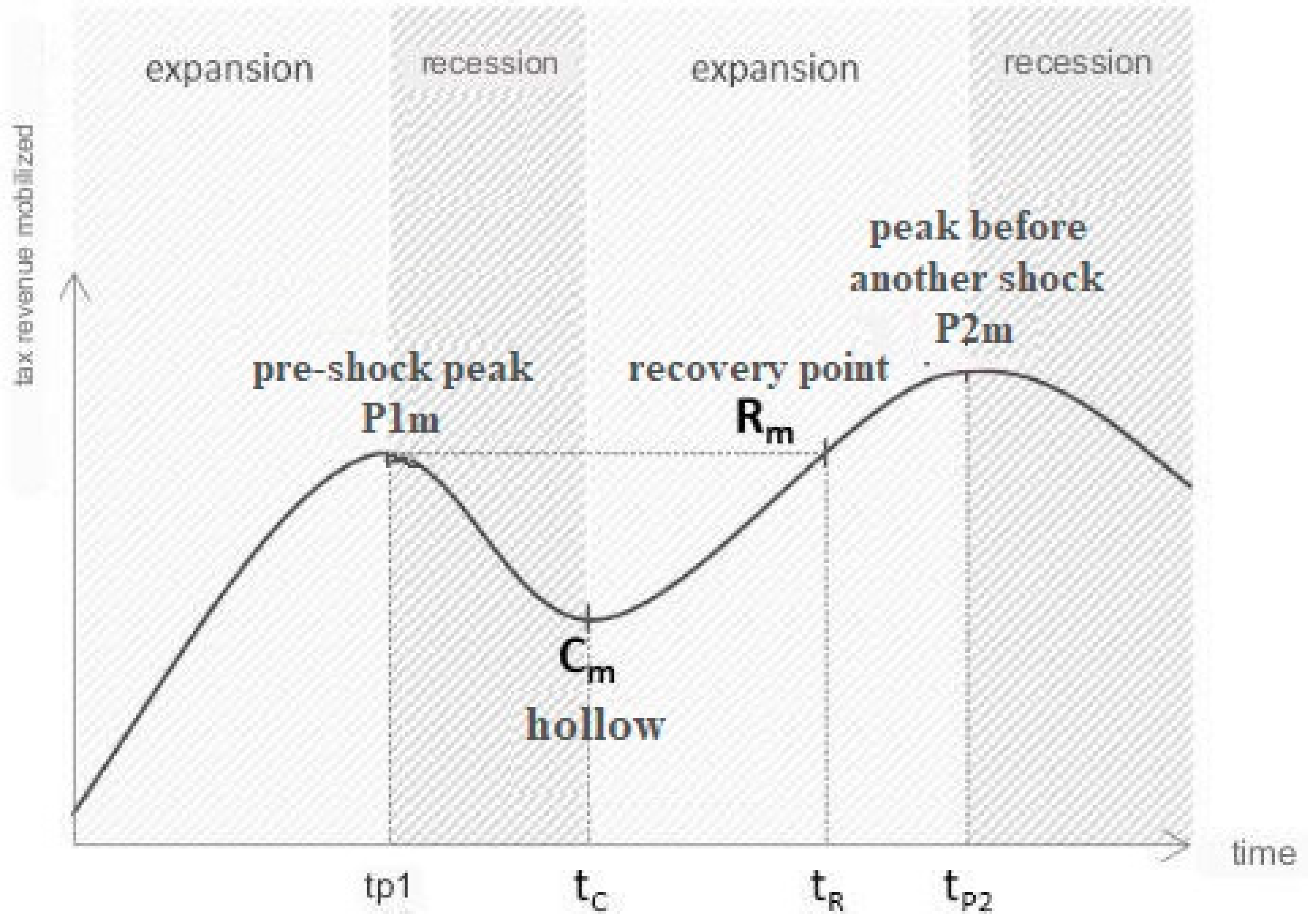

Figure 1 presents the resilience cycle of public cooperation establishments.

The temporalities t relate for tp1 , tc , tr and tp2 respectively to reaching the peak of tax yield before the shock (P1m ), the trough of tax yield during the period of the shock (Cm ), the point of recovery of the level of tax return and the new peak of return before another crisis (P2m ).

Public Revenue Mobilization Centers (PRMCs) in Cameroon must maintain a level of revenue to ensure national fiscal resilience. The level of performance of public institutions must help to overcome the shock that can deviate them from the path of balanced development or from the potential for achievement with resilience capacities specific to their contexts. At the regional level, in the name of the principle of solidarity as with the 2016 crisis, Cameroon must maintain a level of budgetary resilience capable of supporting the local and sub-regional economy. In this perspective, this research revolves around the following question: what are the factors of the resilience of the Tax Revenue Mobilization Centers (TRMC) in Cameroon?

In the literature, two debates revolve around the resilience of public institutions. The first debate relates to the measurement of resilience which is done with two indicators which are the level of production and employment. The consequences of past economic crises revealed that the cycle of resilience measured by output lasts 1.9 years while that measured by employment lasts 4.2 years (Martin et Sunley 2015). We are going straight from performance analysis to study the resilience of TRMCs. This choice is explained firstly by the low turnover of jobs in the TRMCs with the health crisis favored by the particularities of employment in public institutions in Cameroon which makes it very difficult the possibility of de-registration or dismissal as in private institutions. . Secondly, it is explained by the duration of the health crisis. Indeed, it is less than 4 years old and therefore makes it difficult to analyze its impact on the level of employment. The second debate concerns the factors accepted to qualify resilience. The literature retains three groups of factors of the resilience of public institutions, namely: compositional factors, collective factors and institutional factors. This research revolves around the last two groups of factors.

Public decision-makers have made some reductions in the tax and customs preparation and payment procedure modestly (some permanently) during the 2020 budget year in progress during the period of the health crisis. This instrumental function has had an effect on the yield of tax centres (Bilounga 2021). The objective of this investigation is to identify the organizational and contextual characteristics that attribute resilience capacities to the TRMC in the face of the Covid 19 health crisis. The study on the factors of resilience remains of great theoretical and practical interest. . On a theoretical level, it makes it possible to grasp the effect of Covid on MRF in a developing country and to perceive the possibility of remedying it with the resources, behaviors and policies available. On a practical level, evaluate the policy of modernization of the tax system undertaken by public decision-makers and the use of available resources to resist and recover from a shock.

For the investigation, a binary logit model is used to estimate the capacities of the resilience levels of 94 TRMCs in Cameroon with data from related services at the Directorate General of Taxes (DGI) and from a survey carried out among the agents of the tax. The rest of the document is organized as follows: section 1 gives a brief state of the art of the resilience of public organizations;

Section 2 presents the methodology for studying the resilience of TRMCs and

Section 3 is devoted to the results, contribution and limitations of the research.

2. State of the art and theoretical positioning

This section briefly presents the main explanatory theories and an empirical synthesis of the resilience of public organizations.

2.1. R Esilience of public organizations: a theoretical synthesis

In the abundant literature on resilience in various scientific fields (physics, computer science, biology, psychology, demography, etc.) and various types of shocks (financial, economic, demographic, health, climate, etc.), we retain three axes of analysis of the resilience of private or public organizations.

The first axis of analysis comes from the economic approach of the institutional theory which defends the hypothesis according to which the norms enacted by the institutions guide the behavior of organizations in order to make them resilient. In this sense, organizations that do not comply with the standards enacted are not resilient. In contrast, compliant organizations avoid uncertainty with respect to decreasing transaction costs (North 1990). The institution must be able to influence economic performance with the reduction of uncertainties and transaction costs for both private and public organizations. In developing countries, trust in institutions is very limited among private organizations and households, but public institutions follow the standards with some resistance linked to bureaucracy. Populations regularly move towards rational expectations to replace the norm of the institution (Moungou et Ondoua 2020).

The second axis comes from the sociological approach of institutional theory which defends the hypothesis that resilience depends on the interlocking and interconnection of organizations. Three movements make it possible to appreciate the resilience of organizations ( DiMaggio and Powell 1983): coercive and normative isomorphism which respectively alludes to legal obligations and the choice of adherence to these obligations (wearing a mask, choice to wear it or not) ; mimetic isomorphism which refers to the conscious or unconscious imitation of successful role models or the leader in the same context. In public institutions, the different isomorphisms depend on the hierarchical orders to ensure the public service.

The last axis is drawn from the theory of capabilities which defends the hypothesis that the resilience of organizations depends on these capacities to be reactive with the available resources. Dynamic capacities in Teece 's sense (2018) make the organization agile to reconfigure itself immediately in order to react quickly and effectively to the shock. Dynamic capacities are more relevant for the renewal of the organization even in the case where it has not absorbed the shock.

This research is articulated around the three axes, because it must be specified that the policies of the State or the strategies of the TRMC have no guarantee of success (Moungou et Ondoua 2020). John Maynard Keynes describes this situation as radical uncertainty. Indeed, the future is non-probabilistic so no organization can make rational predictions or anticipations, but random trials based on context and experiences. As a result, the literature, faced with the proliferation of work on the resilience of organizations caused by the successive occurrence of various crises, proposes three sets of factors that are regularly accepted to qualify the resilience of public organizations.

The first set consists of compositional or structural factors. It is the mix of economic activities and the sectoral structure (composition) of the local economy. The main objective of this set is to measure the resilience of public organizations located in economies (national, regional) , diversified or specialized globally or in various branches of activity.

The second set concerns institutional factors. These are the factors related to the governance of the organization. The resources of the organization and the local capacities to react and adapt to the shock. The main objective of this set is to measure the resilience of public organizations according to the public policy applied by the State to absorb the shock and renew itself.

The last set brings together the macroeconomic factors of transmission of the crisis. These are contextual factors and existing relationships between organizations in the economic environment. The main objective of this set is to study the resilience of institutions based on contextual factors such as population, level of human capital and other macro-regional indicators of the locality.

This research focuses on the study of the last two groups of factors because of the unavailability of data relating to the first group of factors. For a developing country like Cameroon, it is difficult to obtain regional industrial structure indicators because of the low level of industrialization.

2.2. The resilience of public organizations: an empirical synthesis.

Much of the investigation of resilience on public performance is carried out on communities (Talandier et Calixte 2021, Tazviona, Geyer et Horn 2022), regions (Martin, Sunley et Gardiner , et al. 2016, Xiaowen et Meiyue 2022), nations (williams, et al. 2020) or socio-economic systems (Hundt et Grun 2022, Pinheiro, Frigotto et Young 2022). Three methodological orientations are regularly used in the literature.

Comparative or exploratory analysis of the resilience of public organizations or regions with a view to determining the specific characteristics of the most resilient socio-economic systems. This empirical grounding dates back to the study by Martin et al. (2016) which investigated the resilience of the level of employment in the regions of the United Kingdom in the face of 4 major recessions. In the same perspective, Talandier & Calixte (2021)study 1,236 public establishments for inter-municipal cooperation between the 2008 crisis and the 2020 health crisis to find that access to the telecommunications network and financial development infrastructures are the most significant factors of resilience. to absorb the shock and renew itself. In another lens to analyze resilience on public performance of regions, Hundt & Grun (2022)analyze 96 regions in Germany over the recession period between 2007 and 2017 using an exploratory approach to find that regions with multiple Export-oriented manufacturing industries characterized by low state intervention have low absorptive capacity and high renewal capacity. Comparative and explanatory analyzes do not measure the direct causality between the factor and the resilience of the sample studied.

The second orientation applies econometric methods. In developed countries, studies on regions have demonstrated that industrial diversity and the level of urbanization are factors of resilience (Yuxim, et al. 2022, Arcidiacono et Torrisi 2022). Arcidiacono & Torrisi (2022) study decentralized communities in Europe and demonstrate that decentralized policies as an institutional factor are more likely to lead to resilience relating to public returns to the detriment of resilience on the level of employment. In Africa, a study in Zimbabwe demonstrates that contextual factors (population, level of infrastructure development) do not have a significant effect on the resilience relative to city performance (Tazviona, Geyer et Horn 2022). Other works have used logistic models to capture the individual effect of each factor on the possibility of being resilient or not. Xiaowen & Meiyue (2022) use a binomial logit regression model on 248 Chinese cities to find that contextual factors (human capital, level of financial development, income inequality) and institutional factors (public intervention) significantly affect the resilience at the level of public performance during the recession period between 2003 and 2018. In the same context, but preferably on 31 provinces in China, Guan & Jitong (2022)study the effect of public innovation on economic resilience. Using a tobit regression model, they find that innovation has a positive relationship with the economic resilience of provinces.

The abundant literature based on comparative or econometric analyzes of resilience finds a consensus on the fact that the concentration of companies and urbanization are factors of resilience of the level of performance of public institutions characterized by weak absorption, but strong renewal (Martin et Sunley 2015, Talandier et Calixte 2021, Xiaowen et Meiyue 2022, Arcidiacono et Torrisi 2022). The difficulty of collecting data relating to the structural diversification of localities does not allow us to analyze the structural diversity of regions or the level of urbanization. Faced with identical limits, following Klimanov V. et al. (2020), we test the following hypothesis to capture these measures in an available indicator.

H1.

the location area of a TRMC positively affects its resilience.

The third orientation is based on a contextual and theoretical analysis of resilience. It mainly includes work on public administrations and is based on analyzes mainly related to institutional factors. Profiroiu & Nastaca (2021) studied the institutional factors of resilience of public administrations to propose a contextual framework based on a meta-analysis of existing studies on other samples (regions, economies, institutions). The results of the study show that the capacity for innovation, learning, use of NICTs, transparency and the quality of leadership linked to the involvement of stakeholders in the decision-making process make public administrations more resilient. Following this, a study based on the lessons of organizational theory and the literature on the resilience of socio-economic systems shows that the type of leadership has an effect on the resilience of public organizations according to its performance indicator (Miley et Jiwani 2014, Antonio 2016). In addition, a contextual analysis of Moroccan public administrations showed that the pillars of innovation (trust, responsibility, fulfillment, collaboration, agility and creativity) are factors of organizational resilience of administrations (Malak, Bal et Benrich 2022). The result of these three investigations is shared in the literature (Pinheiro, Frigotto et Young 2022).

In Cameroon, the innovation in the TRMCs in times of health crisis is the digitization of tax procedures and processes linked to the reform of the modernization of the tax system. Moreover, based on the previous arguments, we insist on another institutional factor of the resilience of TRMCs and we test the following two hypotheses:

H2.

digitizing theTRMCs procedures positively affects its resilience

H3.

leadership in aTRMC positively affects its resilience

On the state of the art of the resilience of public establishments, two observations emerge. First, investigations of resilience relative to the yields of regions, communities and public institutions use various empirical strategies related to the study context and the objective of the investigation. Secondly, the literature on public economic resilience is rich in developed countries, on the other hand in underdeveloped countries, particularly in Africa, it focuses on households in the face of natural disasters on the one hand and on the other hand businesses in the face of disasters. economic crises. Consequently, the field of investigation on public resilience is vast on varied samples.

3. The Trmc Resilience Methodology

All the investigations on the resilience of organizations go through three points for the presentation of the methodology: the measurement of the resilience of the TRMCs, the specification of the analytical model and the presentation of the data.

3.1. Measuring the resilience of TRMCs

The resilience cycle provides two indicators based on the intensity of the resilience of public organizations (Talandier et Calixte 2021). Resilience is measured with two indices which are respectively linked to the absorption capacity and the renewal capacity of the TRMC. These two indices relate the impact of the crisis on the TRMCs and on the supervisory institution, the DGI. Beforehand, we determine the intensities of resilience of each TRMC. We determine the resilience intensities of the DGI on tax revenue collection. They are respectively associated with the capacity for absorption and renewal, the intensities of resistance and recovery make it possible to determine, in the face of the crisis, the rate of growth or decline of the tax revenues mobilized by the DGI.

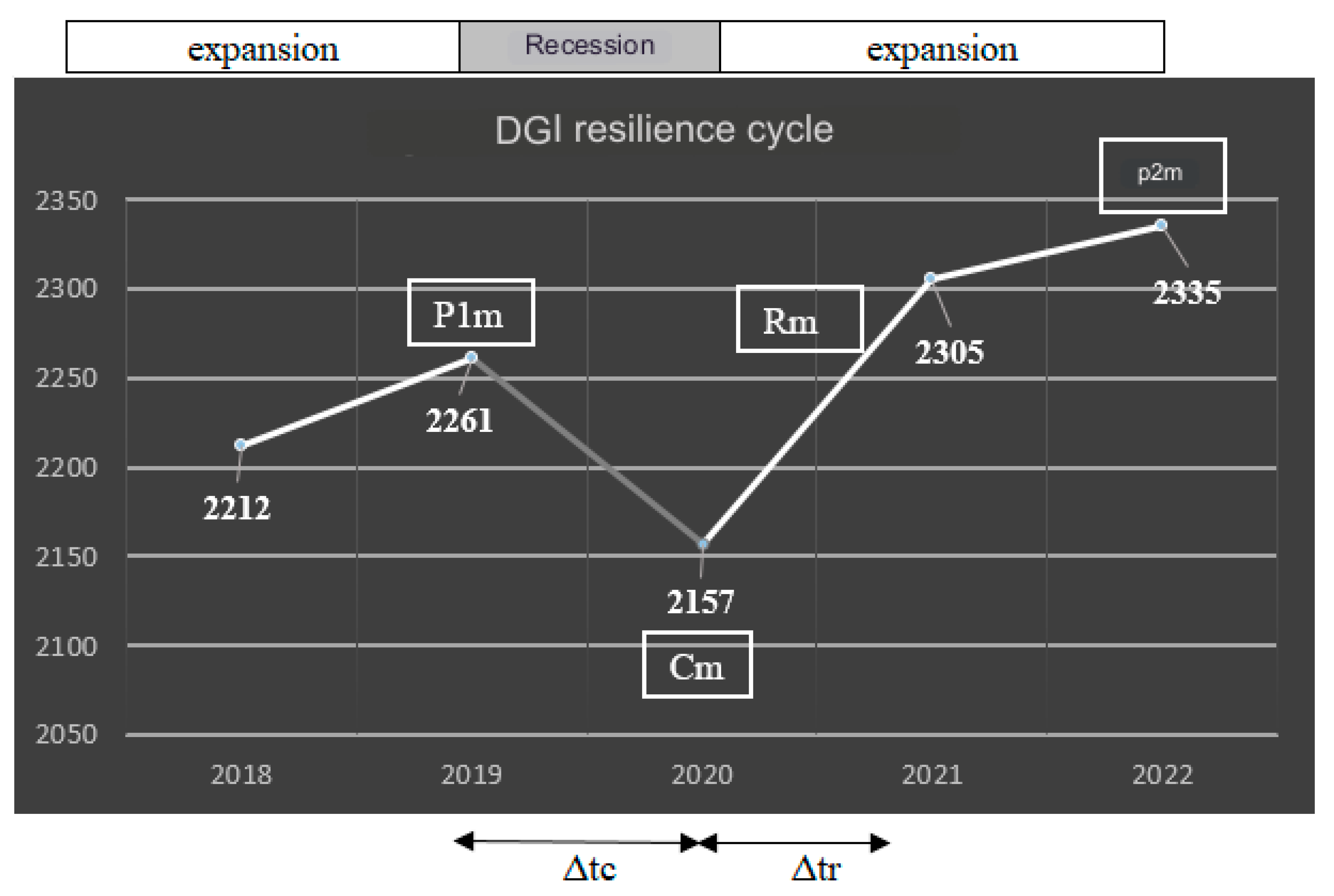

Figure 2 presents the resilience cycle of the DGI in relation to the tax revenue mobilized in billions of FCFA.

To calculate the resilience intensities, we use the revenues mobilized at the peak, trough and second peak periods. We distinguish MRF

P1m , MRF

Cm and MRF

P2m as being the tax revenues collected in each of the periods. We determine the intensities of resilience with the following formulas:

denotes the rate of decline or intensity of resistance of TRMCs tax revenue mobilization. In the case of the DGI, it is negative up to -4.6%, but for the TRMCs, it can be positive and this means that the health crisis has had no effect on the yield or the level of Center MRF.

denotes the growth rate or recovery intensity of TRMCs tax revenue mobilization. In the case of DGI it is positive up to 8.2%, but for TRMC it can be negative and this means that the recovery point is not reached and the MRF level of the center has been decreasing since the occurrence of shock. This situation is likely in TRMCs located in regions characterized by security crises, for example.

Following the model proposed by Martin et al. (2016) and several works in the literature (Yuxim, et al. 2022, Guan et Jitong 2022), we construct a two-dimensional resilience indicator from the two intensity variables. The two indices are defined in the following equations:

The sensitivity index ( ) corresponds to the rate of decline in the level of tax revenue mobilization of a TRMC compared to the average decline of the DGI during the crisis.

The recovery index ( ) corresponds to the growth rate of the level of tax revenue mobilization of a TRMC compared to the average expansion of the DGI during the crisis.

A positive value of the sensitivity index indicates that a TRMC is more resistant to recession than the national average, while a negative value shows that it is less resistant. In the same perspective, a TRMC that has a positive recovery index value has a higher recovery capacity than the national average, and vice versa if it has a negative value.

3.2. The specification of the analytical model

The model for analyzing the resilience of public institutions, regions and socio-economic systems varies in the literature. In our case study, we used a binomial logit regression model following Xiaowen and Meiyue (2022) . We evaluate the resilience of each TRMC with the two resilience indices (sensitivity and recovery) that allow us to construct the dependent variable.

The choice of this model is first justified with the non-linear relationship that exists between the characteristics of an organization and its capacity for resilience in a context of uncertainty. Second, it is justified with the explained variable which is dichotomous. Indeed, it takes the value 1 if the TRMC is resilient with resilience indices greater than or equal to 0 and otherwise it takes the value 0.

The objective is to distinguish TRMCs that are resilient from those that are not. The model will make it possible to quantify the intensity of the connection between the explanatory variables characterizing the TRMC and the explained variable noted R ij * , which constitutes the i th tax center which obtains the level of resilience j. resilience levels are measured on two dimensions: sensitivity index and recovery index . The logistics function is as follows:

We have

Where Pr(R ij ) denotes the probability of the TRMC being resilient. β j are the coefficients linked to each factor x i which are the explanatory variables of the model which correspond to the resilience factors. The logit model looks like this:

3.3. Overview of Variables and Sample Data

The factors analyzed in this research are institutional and contextual. The contextual factors are composed of access to the telecommunication network and electricity for the TRMC, the area of location, the density of the population. The resources of the tax center are made up of the number of taxpayers, the total number of employees and the number of women in the TRMC. Institutional factors firstly include variables related to the actions of the public institution, the type of center and the digitization of procedures related to the DGI modernization reform. Secondly, variables related to the management of the TRMC (head of center) such as the gender of the strategic agent, his ethnicity in the region where he exercises, his type of leadership in the direction of the tax center.

Table 1 shows summary statistics for the variables in the model.

In this analysis, the TRMCs included in the sample are the Divisional Tax Centers (CDI), Special Centers for the Liberal Profession (CSPLI) and the Tax Centers for Medium-sized Enterprises (CIME) respectively numbering 76, 3 and 15 centers in Cameroon. Sampling is non-random in order to have all the TRMCs in the territory in the sample responsible for tax collection.

The data used in this research has three main sources: the DGI's additional services, populationData and a survey of center agents for data linked to the hierarchical superior. The collection of survey results was done using a Google form tool and physical form in other centers which are in the city of Douala. The data relating to the factors are collected for the year 2020 and 2022 respectively the year of occurrence of the health crisis (period Cm to measure the sensitivity of the TRMC to the shock) and the year of occurrence of the peak of mobilization of tax revenues (P2m period to measure TRMC recovery after shock).

4. The results and implications of the study

We present on the one hand the results obtained and on the other hand the contribution and the limits of the study.

4.1. The results of the economic resilience analysis of the TRMCs

We present the results obtained following the examination of the factors specific to the two dimensions of the resilience of our study. The analysis of the results is done according to two cases: firstly, we examine a general model and secondly an analysis by area of location of the center. The general model analyzes all the TRMCs and two other models which discriminate the tax centers by location area.

In

Table 2 below, it appears that digitalization, type of center, coaching leadership and participatory leadership are the significant factors. The digitization of tax procedures linked to the modernization of the tax system has a significant effect on the shock absorption capacity of a TRMC in accordance with the work of Guan and Jitong (2022), Profiroiu and Nastaca (2021). During the outbreak of Covid 19, specific activities resulted in opportunities for tax revenue collection. Indeed, firstly, the public and private markets linked to the purchase of hydroalcoholic masks have been taxed by the tax authorities downstream and upstream. Second, the transparency of information on imports has allowed the taxation of imported goods notwithstanding the reduction in customs charges. This situation explains the significance of access to the telecommunications network and the digitization of procedures in urban areas. CDIs are more resilient than CSPLIs or CIMEs. Indeed, the type of center has a significant relationship with the shock absorption capacity. Digitalized CDIs continued to collect taxes and business continuity in commercial enterprises without the application of total containment allowed them to maintain their activities. On the other hand, for the medium-sized companies of the CIME and CSPLI which do not distribute direct consumer goods, they have lost enormously in terms of activity. The most common types of leadership in tax centers (coaching-based, participatory, and delegated) have a significant negative relationship with crisis absorption capacity. Authoritarian leadership has therefore reduced the sensitivity level of TRMCs. The work of Profiroiu and Nastaca (2021), Pinheiro, Frigoto and Young (2022) insists on the quality of leadership to involve the workforce in order to create capacities for resilience.

The density of the population covered by the center and the resources of the center have no effect on its capacity to absorb the crisis. This result is in line with the work of Tazviona, Geyer and Horn (2022) in Zimbabwe for the performance of cities. In Africa, public institutions have difficulty getting people to follow public policies (World Bank 2016). The participation of the populations in the processes of resistance to national crises is regularly individualistic and non-cooperative (Tazviona, Geyer et Horn 2022).

Moreover, in rural areas, the number of years of seniority of the strategic team (head of center, tax collector and head of management unit) has an inverse relationship with the probability of absorbing the shock of the TRMC. Indeed, the increase in the number of years of the team in the center leads to a decrease of 12.5 points in the probability of resisting the health crisis of COVID-19. Tax officers had to be trained in the use of digitized processes and procedures, which led to a reshuffle of staffing in the centers in 2021. An increase of 39.6 points in the absorption capacity of the center is caused by a female center manager during a crisis.

In urban areas, the number of women in TRMCs leads to an increase in the capacity to absorb the effects of the crisis. In contrast, the total strength of the center has an inverse relationship with the absorptive capacity. The explanation for this result comes from the confinement of the workforce during the crisis to protect taxpayers and agents with the dispatching of schedules. The absorptive capacity of CDIs relative to other centers intensifies, as in metropolises taxpayers have continued to make payments in urban versus rural areas. In March 2020, the DGI digitized the procedures for permanent contracts in metropolitan areas and other towns such as Limbé, where the telephone penetration rate is high.

In

Table 3, it appears that the access to electricity, the total staff of the center, the number of women in the center and the population covered by the center are the significant factors in enabling the TRMCs to recover after the crisis. Access to electricity leads to an increase in the renewal capacity of the TRMC according to the study by Yuxim, et al. (2022). The result can be explained with the digitization of procedures for all tax centers in 2021; therefore, the level of access to electricity is essential for the user of the digitalized tax system. The size of the center has a significantly positive effect on the recovery of the level of tax revenue by the TRMC. The DGI has applied a taxpayer compliance strategy with recovery dialogues (DGI 2021). This collection action plan to limit behavior requires having sufficient human resources to help collect tax revenue despite the transparency provided by the digitization of tax procedures. On the other hand, the number of women and the population covered by the center have an inverse relationship with the renewal capacity of TRMCs.

Moreover, in rural areas, the significant number of staff at the center and the population covered by the center increase the capacity for renewal. The female center leader causes a renewal capacity of 22.2 points. Access to the telecommunications network intensify the renewal capacity of 15.4 points as in the study of (Talandier et Calixte 2021). Access to the network with the digitization of tax procedures makes it possible to regain the level of tax revenue before the crisis. Indeed, the DGI has implemented since 2021 the payment by mobile Tax to allow taxpayers who do not have access to the internet to pay their taxes by the mobile money services of telecommunication operators. Most of the TRMCs that have been digitized since the onset of the crisis have a shorter recovery time than those digitized during 2021, such as those located in the Septentrion region.

In urban areas, access to the network and telecommunications, the number of staff in the center and the number of women in the center remain significant in the TRMCs. In urban areas, their effect on the ability to recover the level of tax revenue is stronger.

In all the results, it is important to note first that the digitization of tax procedures has a positive effect on the absorption capacity of TRMCs. Then, the center location area has no effect on the two dimensions of the economic termination of a TRMC. In rural areas, women as heads of centers intensify the two dimensions of resilience capacity. Finally, the factors that determine the economic resilience capacity of TRMCs are different to reduce sensitivity during the crisis and improve post-crisis recovery on the level of government revenue collection.

4.2. Contribution and limit of the study

Our research contributes to analyzing the resilience capacity of public institutions in Central Africa and completes the gap in the literature related to the study of the resilience of public institutions on the tax performance of tax revenue mobilization centers. Studies such as this one has investigated the level of resilience of public institutions on the level of employment in France (Talandier et Calixte 2021). The main limitations of our study come from the analysis sample and the lack of data on compositional factors. The study sample did not allow us to use a methodology that allows us to analyze each level of resilience by a categorical variable.

In all the results, it is important to note first that the digitization of tax procedures has a positive effect on the absorption capacity of TRMCs. Then, the center location area has no effect on the two dimensions of the economic termination of a TRMC. In rural areas, women as heads of centers intensify the two dimensions of resilience capacity. Finally, the factors that determine the economic resilience capacity of TRMCs are different to reduce sensitivity during the crisis and improve post-crisis recovery on the level of government revenue collection.

4.3. Contribution and limit of the study

Our research contributes to analyzing the resilience capacity of public institutions in Central Africa and completes the gap in the literature related to the study of the resilience of public institutions on the tax performance of tax revenue mobilization centers. Studies such as this one have investigated the level of resilience of public institutions on the level of employment in France (Talandier et Calixte 2021). The main limitations of our study come from the analysis sample and the lack of data on compositional factors. The study sample did not allow us to use a methodology that allows us to analyze each level of resilience by a categorical variable.

5. Conclusion

The objective of this research was to identify the factors of the resilience of TRMCs in Cameroon. We have divided resilience into two dimensions following the work of Martin and Sunley (2015) . From the secondary data is constituted on 94 TRMC, the estimation of the binomial logistic model allowed to have some results. Indeed, on the one hand, authoritarian leadership and the digitization of procedures are determining factors in the capacity to absorb the effects of the COVID-19 crisis. It is important to point out that centers that integrate small businesses absorb the shock better. On the other hand, the resources of the center such as the number of agents and the level of access to electricity are the determining factors of the TRMC's capacity for renewal.

All of the determining factors are more significant in urban areas which have fewer TRMCs than rural areas. In rural areas, a tax center headed by a woman has a better probability on economic resilience capacity. The probability of being resilient is greatly affected by the level of access to electricity in urban areas, so for TRMCs the possession of a generator is essential to maintain the use of digitalized devices.

This study suggests that public actions should be implemented to promote securing the level of tax revenue during crises. In other words, the DGI can improve the staffing level of the tax centers and build secondary centers or tax kiosk to reduce the population density covered by the centers in rural areas specifically. As a result of a particular aptitude in public organizations in rural areas, increasingly allow women to lead TRMCs. Improving the digitalization of procedures by insisting on the modernization reform of the tax system is important to enable the TRMC to absorb the shock of taxing business opportunities during a crisis that the literature has named in the case of the crisis health economy of Covid-19 (VV Klimanov, et al. 2020).