Submitted:

09 November 2023

Posted:

13 November 2023

You are already at the latest version

Abstract

Keywords:

I. INTRODUCTION

II. BACKGROUND

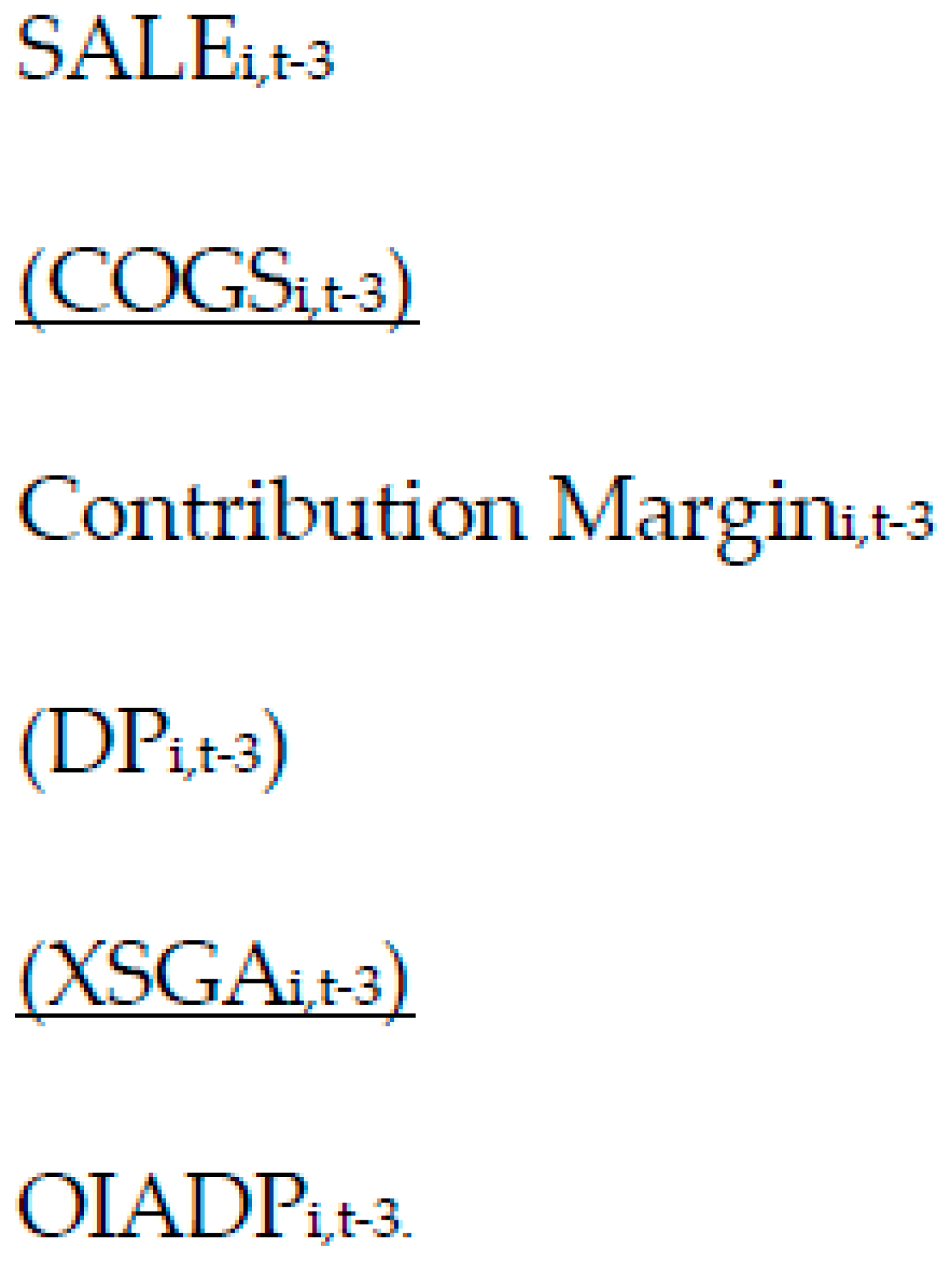

- Using the Casey et al. (2016) identity that Compustat SALE - COGS - DP - XSGA equates to Compustat OIADP

- Predicting OIADP operating income as opposed to Return on Equity (ROE)

- Specifying Compustat depreciation and amortization (DP) and selling, general, and administrative costs (XSGA) as sticky costs following Shust and Weiss (2014) and Chen et al. (2019)

- Employing COGS as a proxy for total variable costs following Chen et al. (2019)

- Predicting future COGS by using estimated future SALE-to-COGS ratio

III. METHODOLOGY

Data

Methodology for Predicting Quarterly OIADP

Restating Operating Leverage For Constant SALE / COGS Ratio For Quarters

Consideration of Dow Jones Industrial Average (DJIA) Firms

IV. RESULTS AND DISCUSSION

Results for Estimating Quarterly OIADP

| Strata of Abs ERRORS | Count of Company-Years | Percent of Total Company-Years | Cumulative Percent of Company-Years | Percentiles of Company Years | Ordered Obs. | Percentile Abs ERROR |

|---|---|---|---|---|---|---|

| 0% to 5% | 25,531 | 10.59% | 10.59% | 1st Percentile: | 2,411 | 0.46% |

| 5% and 10% | 23,020 | 9.55% | 20.14% | 5th Percentile: | 12,055 | 2.29% |

| 10% and 15% | 19,239 | 7.98% | 28.12% | 10th Percentile: | 24,111 | 4.71% |

| 15% and 20% | 15,962 | 6.62% | 34.74% | 25th Percentile: | 60,276 | 12.97% |

| 20% and 25% | 13,663 | 5.67% | 40.40% | Median: | 120,553 | 35.61% |

| 25% and 50% | 45,670 | 18.94% | 59.35% | 75th Percentile: | 180,829 | 93.24% |

| 50% and 100% | 41,436 | 17.19% | 76.53% | 90th Percentile: | 216,995 | 245.35% |

| > 100% | 56,585 | 23.47% | 100.00% | 95th Percentile: | 229,050 | 499.47% |

| Total: | 241,106 | 100.00% | 100.00% | 99th Percentile: | 238,694 | 2498.45% |

| Linear Regression Results | ||||||

| N | Adj R-square | Coeff | t-value | p-value | ||

| 241,105 | 0.106 | 0.523 | 169.009 | 0.000 | ||

Results for Estimating Annual OIADP

V. CONCLUSIONS, SUMMARY, AND FUTURE RESEARCH

Appendix A

Proof:

- (St - Vt - Ft) + {[(St+n – St)/St] * [(St - Vt ) / (St - Vt - Ft)] * (St - Vt - Ft)} =

- (St - Vt - Ft) + {[(St+n – St)/St] * [(St - Vt )]} =

- (St - Vt - Ft) + St+n*St/ St - St*St/ St - St+n*Vt/ St + St*Vt / St =

- St - Vt - Ft + St+n - St - St+n*Vt/ St + St*Vt / St =

- -Vt - Ft + St+n - St+n*Vt/ St + St*Vt / St =

- -Vt - (Ft) + St+n - St+n*(Vt/ St) + St* (Vt / St) =

- Substituting using Assumptions 1 and 2:

- -Vt - (Ft+n) + St+n - St+n*(Vt+n/ St+n) + St* (Vt / St) =

- -Vt - Ft+n + St+n - Vt+n + Vt =

- St+n - Vt+n - Ft+n

Appendix B

Applying ABJ Methodology to Compute Sticky Factors for XSGA and DP Quarterly

| Regression Specification Models based on ABJ: log [COGSi,t / COGSi,t-3] = β0 + β1 log[SALEi,t / SALEi,t-3] + β2 * Decrease_Dummyi,t-3 to t * log [SALEi,t / SALEi,t-3)] + εi,t log [DPi,t / DPi,t-1] = β0 + β1 log[SALEi,t / SALEi,t-1-3] + β2 * Decrease_Dummyi,t-3 to t * log [SALEi,t / SALEi,t-3)] + εi,t log [XSGAi,t / XSGAi,t-1] = β0 + β1 log [SALEi,t / SALEi,t-1] + β2 * Decrease_Dummyi,t * log [SALEi,t / SALEi,t-1)] + εi,t | |||||||

| Coefficient Estimates (t-statistics) | |||||||

| Dependent Variable | N | Adj. R-square |

% Increase in Dependent Variable for 1% increase in Sales (β1) |

SALE Change * Decrease Dummy (β2) |

% Decrease in Dependent Variable for 1% Decrease in Sales (β1+ β2) |

β1 p-value (t value) |

β2 p-value (t value) |

| COGS | 241,043 | .445 | .879 | -.162 | .717 | .000 296.380 | .001 -36.064 |

| DP | 241,043 | .105 | .484 | -.279 | .205 | .000 139.327 | .000 -52.839 |

| XSGA | 241,043 | .150 | .377 | -.142 | .235 | .000 154.402 | .000 -38.349 |

Appendix C

| Regression Specification Models based on ABJ: log [COGSi,t / COGSi,t-1] = β0 + β1 log[SALEi,t / SALEi,t-1] + β2 * Decrease_Dummyi,t * log [SALEi,t / SALEi,t-1)] + εi,t log [DPi,t / DPi,t-1] = β0 + β1 log[SALEi,t / SALEi,t-1] + β2 * Decrease_Dummyi,t * log [SALEi,t / SALEi,t-1)] + εi,t log [XSGAi,t / XSGAi,t-1] = β0 + β1 log [SALEi,t / SALEi,t-1] + β2 * Decrease_Dummyi,t * log [SALEi,t / SALEi,t-1)] + εi,t | |||||||

| Coefficient Estimates (t-statistics) | |||||||

| Dependent Variable | N | Adj. R-square |

% Increase in Dependent Variable for 1% increase in Sales (β1) |

SALE Change * Decrease Dummy (β2) |

% Decrease in Dependent Variable for 1% Decrease in Sales (β1+ β2) |

β1 p-value (t value) |

β2 p-value (t value) |

| COGS | 188,808 | .589 | .880 | -.046 | .834 | .000 404.713 | .001 -11.050 |

| DP | 188,808 | .267 | .647 | -.254 | .393 | .000 227.362 | .000 -46.695 |

| XSGA | 188,808 | .310 | .440 | -.131 | .309 | .000 245.616 | .000 -38.125 |

| 1 | We denote the names of items reported in financial statements in lower case and the names of Compustat items in upper case. For example, cogs in an income statement versus COGS in Compustat. |

| 2 | We choose Compustat OIADP for operating income because S&P computes OIADP before deducting income taxes and interest and because it subsumes the revenues and expenses that firms include in continuing operations on an accrual accounting basis. Also, OIADP represents the parsimonious set of aggregate Compustat variables shown in [1]. |

| 3 | Bostwick et al. (2016) found that S&P subtracts (DP – AM) from cogs to derive COGS when entities disclose and quantify allocation of amortization (AM) but not depreciation. |

| 4 | For all observations, we require OIADP - (SALE - COGS - DP - XSGA) < .001 and SALE, COGS, DP, and XSGA > 0. |

| 5 | In the results that follow, we revisit the same company quarters in Tables 3, 4, and 5 as analyzed in Table 1. |

References

- Abarbanell, J. and B. Bushee. 1997. Fundamental analysis, future earnings, and stock prices. Journal of Accounting Research 35: 1-24. [CrossRef]

- Anderson, M., R. Banker, and S. Janakiraman. 2003. Are selling, general, and administrative costs ‘sticky’? Journal of Accounting Research 41: 47–63. [CrossRef]

- Banker, R., and D. Byzalov. 2014. Asymmetric cost behavior. Journal of Management Accounting Research 26 (2): 43–79. [CrossRef]

- Banker, R., D. Byzalov, S. Fang, and Y. Liang. 2018. Cost management research. Journal of Management Accounting Research 30 (3): 187–209. [CrossRef]

- Banker, R., and L. Chen. 2006. Predicting earnings using a model based on cost variability and cost stickiness. The Accounting Review 81 (2): 285–307. [CrossRef]

- Bernstein, L. 1988. Financial Statement Analysis. Homewood, Ill.: Irwin, 1988.

- Bostwick, E., S. Lambert, and J. Donelan. 2016. A wrench in the COGS: an analysis of the differences between cost of goods sold as reported in Compustat and in the financial statements. Accounting Horizons 30 (2): 177–193. [CrossRef]

- Casey, R., F. Rutgers, M. Kirschenheiter, S. Li, and S. Pandit. 2016. Do Compustat financial statement data articulate? Journal of Financial Reporting 1 (1): 37-59. [CrossRef]

- Chang, T., S. Hartzmark, D. Solomon, and E. Soltes. 2017. Being surprised by the unsurprising: Earnings seasonality and stock returns. Review of Financial Studies 30 (1): 281-323. [CrossRef]

- Chen, J. 2023. Blue Chip Meaning and Examples. Investopedia. Available at https://www.investopedia.com/terms/b/bluechip.asp.

- Chen, H.; M. Kacperczyk, and H. Ortiz-Molina. 2011. Firm-specific attributes and the cross-section of momentum. Journal of Financial and Quantitative Analysis 46 (1): 25-58.

- Chen, Z., J. Harford, and A. Kamara. 2019. Operating Leverage, Profitability, and Capital Structure. Journal of Financial and Quantitative Analysis 54 (1): 369-392. [CrossRef]

- Ciftci, M., R. Mashruwala, and D. Weiss. 2016. Implications of cost behavior for analysts’ earnings forecasts. Journal of Management Accounting Research 28 (1): 57–80. [CrossRef]

- Ciftci, M., and T. Zoubi. 2019. The magnitude of sales change and asymmetric cost behavior. Journal of Management Accounting Research 31 (3): 65–8. [CrossRef]

- Donangelo, A. 2014. Labor mobility: Implications for asset pricing. Journal of Finance 69 (3): 1321–1346. [CrossRef]

- Fairfield, P., R. Sweeney, and T. Yohn. 1996. Accounting Classification and the Predictive Content of Earnings. The Accounting Review 71 (3): 337-355.

- Griffin, P. 1977. The time-series behavior of quarterly earnings: preliminary evidence. Journal of Accounting Research 15 (1): 71-83. [CrossRef]

- Gulen, H., Y. Xing, and L. Zhang. 2011.Value versus growth: time-varying expected stock returns. Financial Management 40 (2): 381-407. [CrossRef]

- Hayn, C. 1995. The information content of losses. Journal of Accounting and Economics 20 (2): 125-153. [CrossRef]

- Hilton. 2023. Managerial Accounting Creating Value In A Dynamic Business Environment, 13th edition, McGraw Hill.

- Jones, C., and R. Litzenberger. 1969. Is earnings seasonality reflected in stock prices? Financial Analysts Journal 25 (6): 57-59. [CrossRef]

- Lev, B. 1974. On the association between operating leverage and risk. Journal of Financial and Quantitative Analysis 9 (4): 627-41. [CrossRef]

- Lev, B., and R. Thiagarajan. 1993. Fundamental information analysis. Journal of Accounting Research 31 (Autumn): 190-215. [CrossRef]

- Lipe, R. 1986. The information contained in the components of earnings. Journal of Accounting Research 24 (3): 37-64. [CrossRef]

- Mandelker, G., and S. Rhee. 1984. The impact of the degrees of operating and financial leverage on systematic risk of common stock. Journal of Financial and Quantitative Analysis 19 (1): 45–57. [CrossRef]

- Novy-Marx, R. 2011. Operating leverage. Review of Finance 15: 103-134. [CrossRef]

- Rouxelin, F., W. Wongsunwai, and M. Yehuda. 2018. Aggregate cost stickiness in GAAP financial statements and future unemployment rate. The Accounting Review (93) 3: 299-325. [CrossRef]

- Sagi, J., and M. Seasholes. 2007. Firm-specific attributes and the cross-section of momentum. Journal of Financial Economics 84 (2): 389-434. [CrossRef]

- Shust, E., and D. Weiss. 2014. Discussion of asymmetric cost behavior-sticky costs: expenses versus cash flows. Journal of Management Accounting Research 26 (2): 81-90. [CrossRef]

- Simintzi, E., V. Vig, and P. Volpin. 2015. Labor protection and leverage. Review of Financial Studies 28 (2): 561–591. [CrossRef]

- Sloan, R. 1996. Do stock prices fully reflect information in accruals and cash flows about future earnings? The Accounting Review 71: 289–316.

- Welch, P. 1984. A generalized distributed lag model for predicting quarterly earnings. Journal of Accounting Research (22) 2: 744-757. [CrossRef]

|

Model |

Linear Regression Results |

Median Abs. Value Error |

||||

|

N |

Adj. R-square |

Coeff |

t-value |

p-value |

||

| BASE MODEL: No adjustment for constant SALE-to-COGS or sticky DP or XSGA [6] | 241,106 | 0.015 | 0.121 | 61.415 | 0.000 | 40.40% |

| INTERMEDIATE MODEL: restated SALE-to-COGS but no adjustment for sticky DP or XSGA [9] | 241,106 | 0.099 | 0.378 | 162.314 | 0.000 | 38.70% |

| FULL MODEL: adjustment for SALE-to-COGS and adjusting for sticky DP and XSGA as shown in Table 1 [11] | 241,106 | 0.106 | 0.523 | 169.009 | 0.000 | 35.61% |

| Strata of Abs Value Errors |

Count of Company-Years | Percent of Total Company-Years | Cumulative Percent of Company-Years | Percentiles of Company Years | Ordered Obs. | Percentile Abs Value Errors |

|---|---|---|---|---|---|---|

| 0% to 5% | 22,456 | 14.19% | 14.19% | 1st Percentile: | 1,582 | 0.33% |

| 5% and 10% | 19,889 | 12.57% | 26.76% | 5th Percentile: | 7,912 | 1.70% |

| 10% and 15% | 16,322 | 10.31% | 37.08% | 10th Percentile: | 15,824 | 3.46% |

| 15% and 20% | 13,136 | 8.30% | 45.38% | 25th Percentile: | 39,559 | 9.23% |

| 20% and 25% | 10,729 | 6.78% | 52.16% | Median: | 79,119 | 23.28% |

| 25% and 50% | 32,233 | 20.37% | 72.53% | 75th Percentile: | 118,678 | 55.27% |

| 50% and 100% | 21,288 | 13.45% | 85.98% | 90th Percentile: | 142,413 | 143.86% |

| > 100% | 22,185 | 14.02% | 100.00% | 95th Percentile: | 150,325 | 295.20% |

| Total: | 158,238 | 100.00% | 100.00% | 99th Percentile: | 156,655 | 1527.25% |

| Linear Regression Results | ||||||

| N | Adj R-square | Coeff | t-value | p-value | ||

| 158,237 | 0.147 | 0.453 | 165.018 | 0.000 | ||

| Strata of Abs Value Errors | Count of Company-Years | Percent of Total Company-Years | Cumulative Percent of Company-Years | Percentiles of Company Years | Ordered Obs. | Percentile Abs Value Errors |

|---|---|---|---|---|---|---|

| 0% to 5% | 380 | 20.42% | 20.42% | 1st Percentile: | 19 | 0.24% |

| 5% and 10% | 341 | 18.32% | 38.74% | 5th Percentile: | 93 | 1.32% |

| 10% and 15% | 276 | 14.83% | 53.57% | 10th Percentile: | 186 | 2.46% |

| 15% and 20% | 184 | 9.89% | 63.46% | 25th Percentile: | 465 | 6.15% |

| 20% and 25% | 145 | 7.79% | 71.25% | Median: | 930 | 13.84% |

| 25% and 50% | 319 | 17.14% | 88.39% | 75th Percentile: | 1,395 | 27.60% |

| 50% and 100% | 107 | 5.75% | 94.14% | 90th Percentile: | 1,674 | 55.22% |

| > 100% | 109 | 5.86% | 100.00% | 95th Percentile: | 1,767 | 110.55% |

| Total: | 1,861 | 100.00% | 100.00% | 99th Percentile: | 1,841 | 686.40% |

| Linear Regression Results | ||||||

| N | Adj R-square | beta | t-value | p-value | ||

| 1,860 | 0.338 | 0.750 | 165.018 | 0.000 | ||

| Strata of Abs Value Errors | Count of Company-Years | Percent of Total Company-Years | Cumulative Percent of Company-Years | Percentiles of Company Years | Ordered Obs. | Percentile Abs Value Errors |

|---|---|---|---|---|---|---|

| 0% to 5% | 19,400 | 10.28% | 10.28% | 1st Percentile: | 1,888 | 0.48% |

| 5% and 10% | 17,613 | 9.33% | 19.61% | 5th Percentile: | 9,439 | 2.45% |

| 10% and 15% | 15,155 | 8.03% | 27.63% | 10th Percentile: | 18,878 | 4.87% |

| 15% and 20% | 12,899 | 6.83% | 34.47% | 25th Percentile: | 47,194 | 13.24% |

| 20% and 25% | 10,770 | 5.71% | 40.17% | Median: | 94,389 | 36.15% |

| 25% and 50% | 34,904 | 18.49% | 58.66% | 75th Percentile: | 141,583 | 97.33% |

| 50% and 100% | 32,026 | 16.97% | 75.63% | 90th Percentile: | 169,899 | 264.52% |

| > 100% | 46,010 | 24.37% | 100.00% | 95th Percentile: | 179,338 | 536.49% |

| Total: | 188,777 | 100.00% | 100.00% | 99th Percentile: | 186,889 | 2760.82% |

| Linear Regression Results | ||||||

| N | Adj R-square | beta | t-value | p-value | ||

| 188,776 | 0.064 | 0.259 | 113.678 | 0.000 | ||

| Strata of Abs ERRORS | Count of Firm-Years | Percent of Total Firm-Years | Cumulative Percent of Firm-Years | Percentiles of Firm Years | Ordered Obs. | Percentiles of Abs. Value of Estimate Errors |

|---|---|---|---|---|---|---|

| 0% to 5% | 211 | 24.25% | 24.25% | 1st Percentile: | 9 | 0.30% |

| 5% and 10% | 199 | 22.87% | 47.13% | 5th Percentile: | 44 | 1.05% |

| 10% and 15% | 112 | 12.87% | 60.00% | 10th Percentile: | 87 | 1.88% |

| 15% and 20% | 71 | 8.16% | 68.16% | 25th Percentile: | 218 | 5.20% |

| 20% and 25% | 54 | 6.21% | 74.37% | Median: | 435 | 11.00% |

| 25% and 50% | 119 | 13.68% | 88.05% | 75th Percentile: | 653 | 26.09% |

| 50% and 100% | 55 | 6.32% | 94.37% | 90th Percentile: | 783 | 58.06% |

| > 100% | 49 | 5.63% | 100.00% | 95th Percentile: | 827 | 112.23% |

| Total: | 870 | 100.00% | 100.00% | 99th Percentile: | 861 | 475.18% |

| Linear Regression Results | ||||||

| N | Adj R-square | beta | t-value | p-value | ||

| 869 | 0.354 | 0.936 | 21.846 | <.001 | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).