Submitted:

20 November 2023

Posted:

22 November 2023

You are already at the latest version

Abstract

Keywords:

1. Introduction

1.1. The importance of logistics and supply chains

1.2. Impact of COVID-19 on logistics and supply chains

1.3. The impact of COVID-19 on the automotive industry

1.4. Justification, aims and structure of the article

- identification and characterisation of the types of companies operating in automotive supply chains,

- identification of changes during a pandemic in automotive companies, depending on the type of business

- demonstrating disruptions in automotive supply chains and how to counteract these disadvantages depending on the type of business.

2. Materials and Methods

2.1. Data collection, processing, and limitations

2.2. Applied methods

3. Results

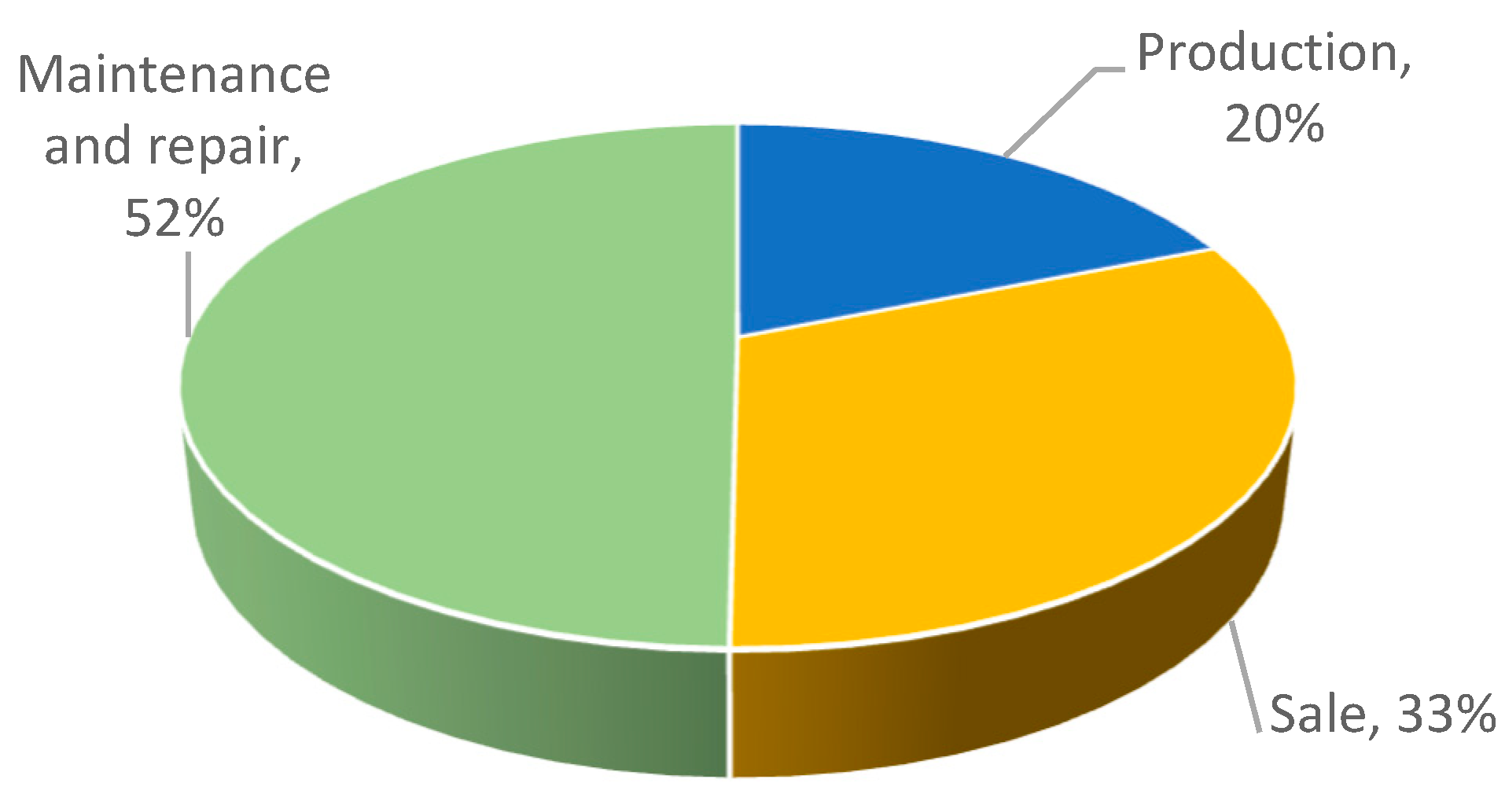

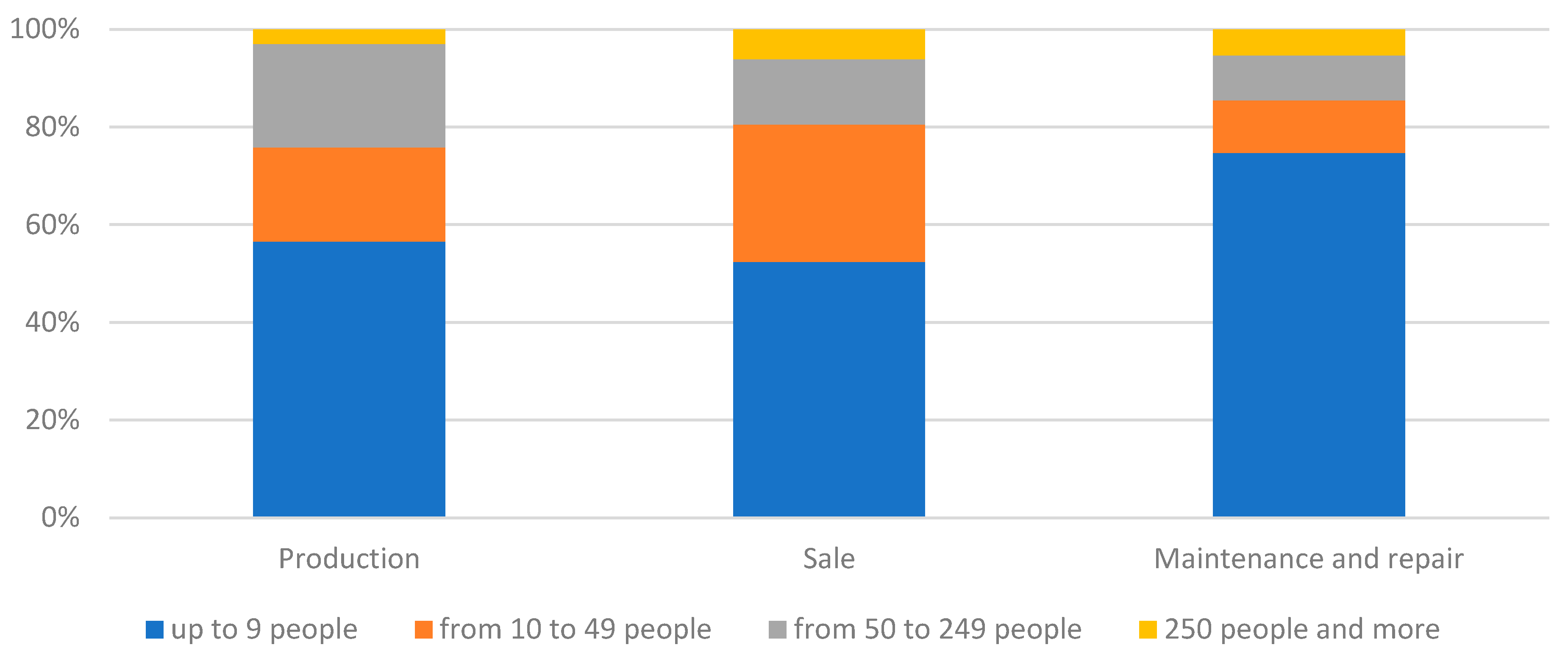

3.1. Basic data on the surveyed companies

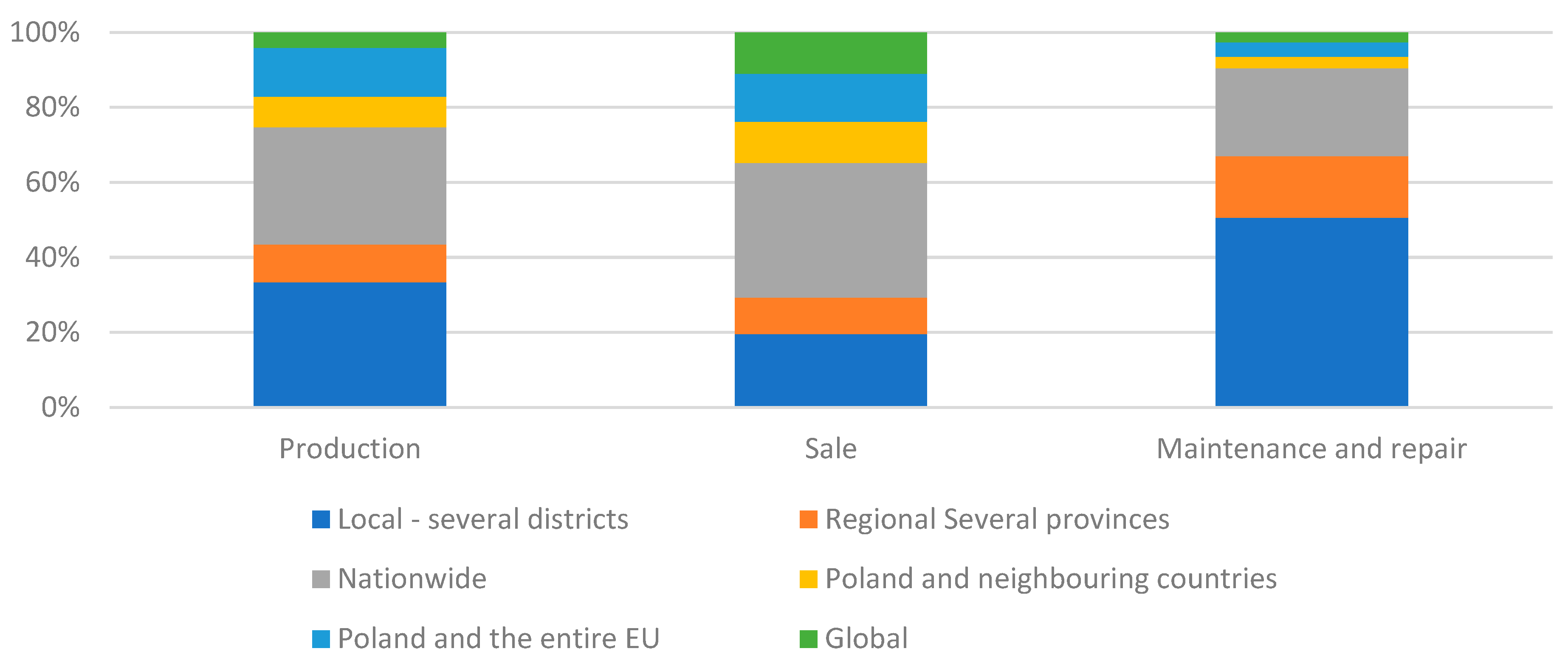

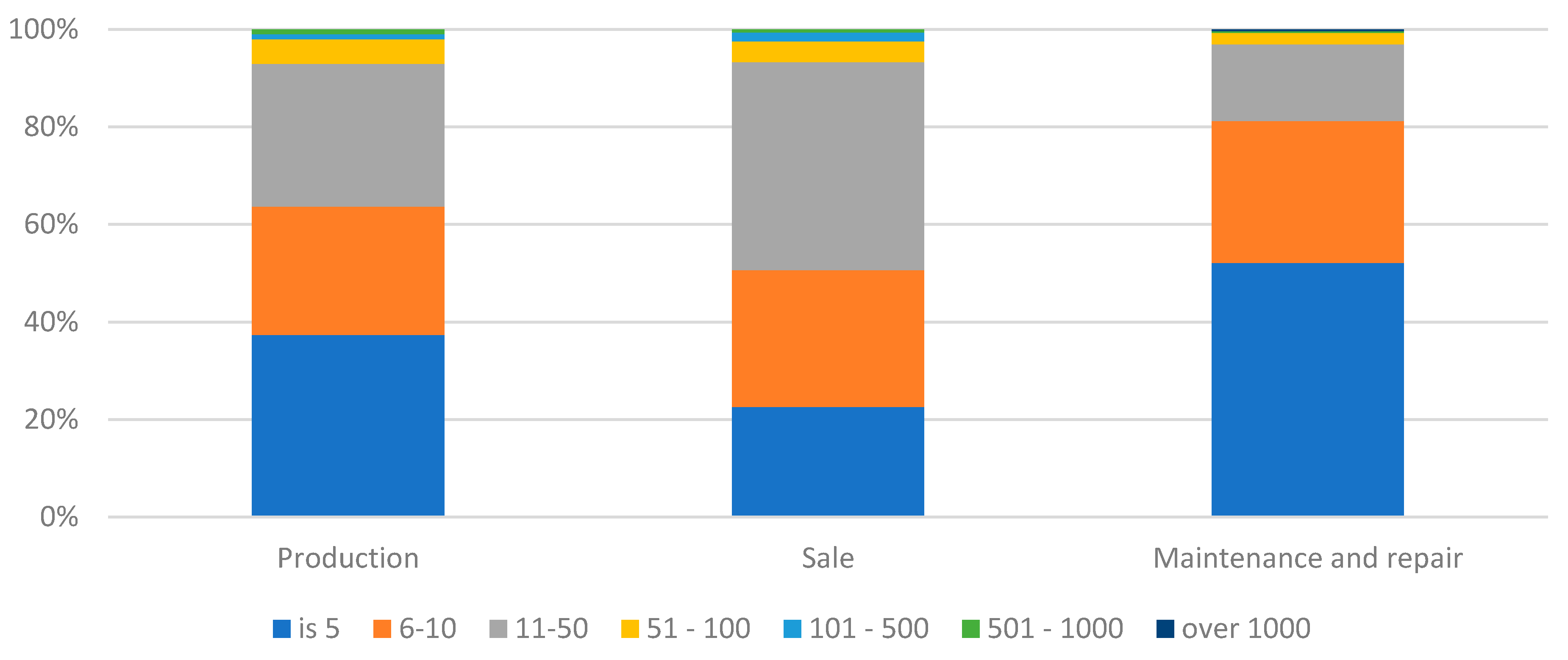

3.2. Organisation of procurement in the companies surveyed

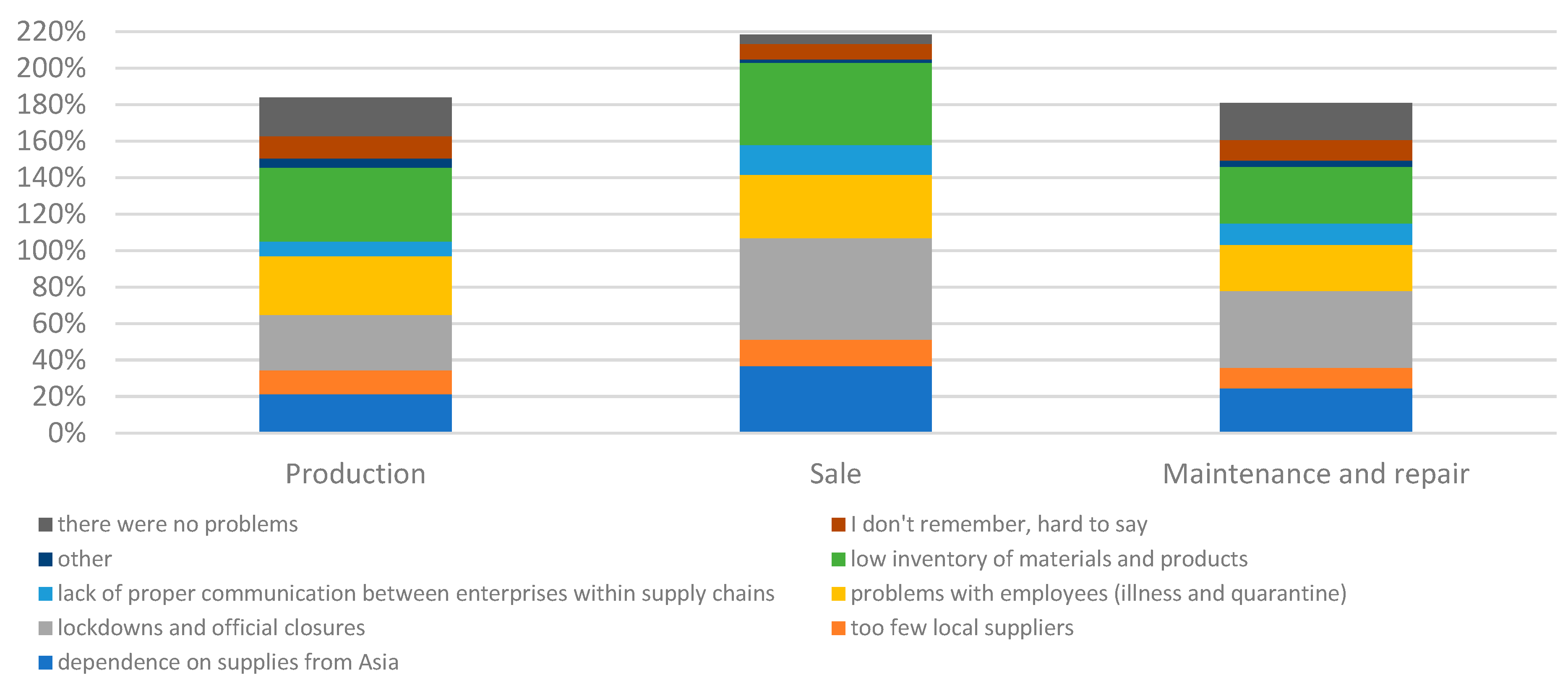

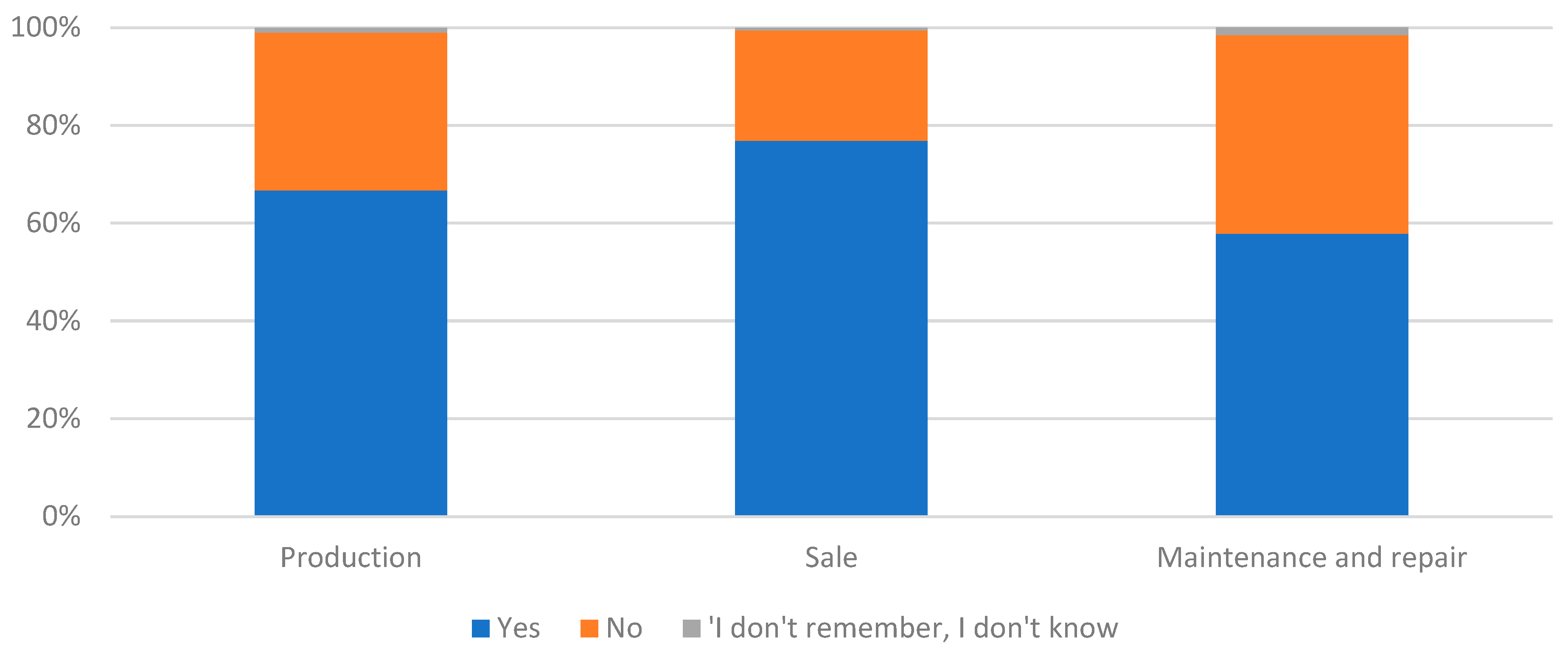

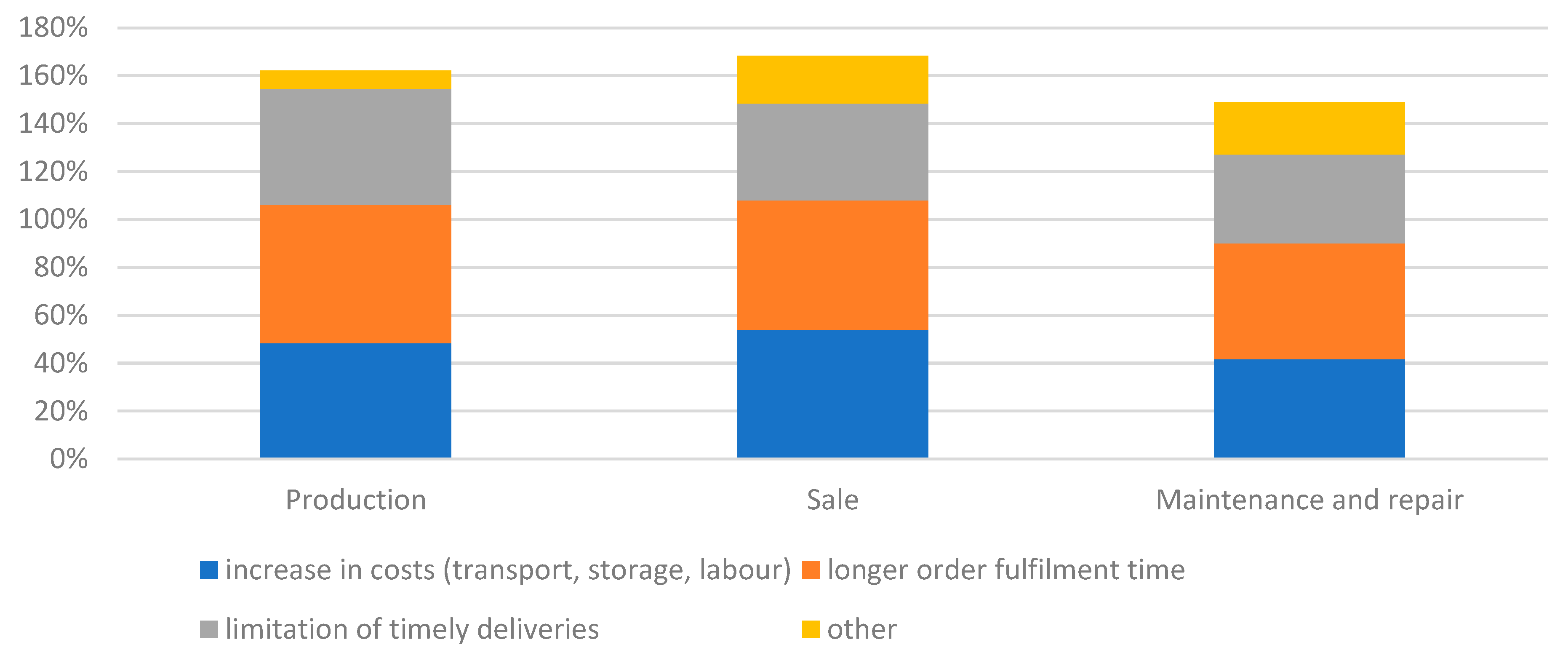

3.3. Types of disruption in the supply chains of the companies studied

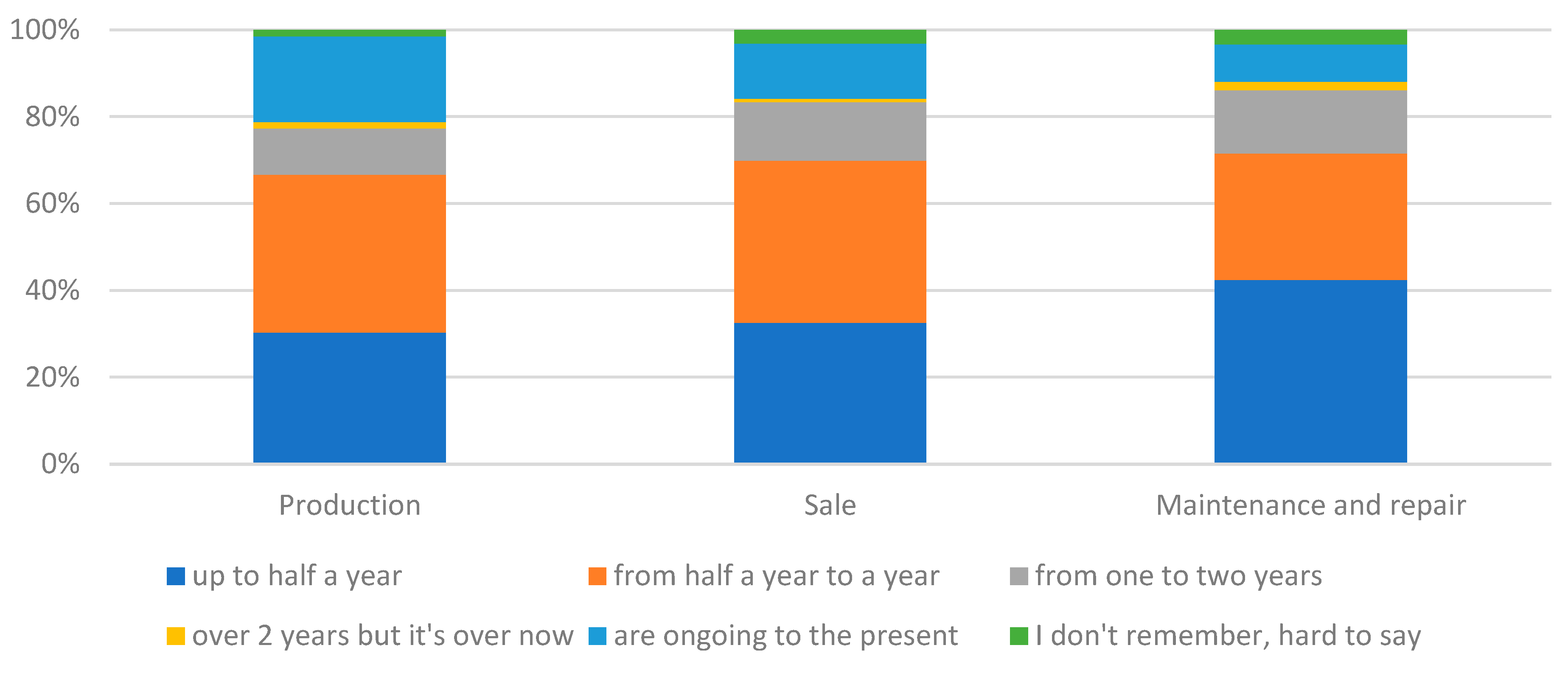

3.4. Tackling disruption in automotive supply chains

4. Discussion

5. Conclusions and recommendations

5.1. Conclusions

- The automotive industry in Poland was dominated by small-scale enterprises, which means high fragmentation. The largest proportion of large enterprises was among manufacturers. In contrast, the largest number of micro-enterprises was in the case of car maintenance and repair activities. The scale of the operation was related to the type of business.

- The majority of companies sourced from local and national suppliers, with dependence on these markets increasing for companies further down the supply chain (this was highest in car maintenance and repair operators). International or global sourcing was declared by a fairly large group of car manufacturers and dealers, but sourcing from closer markets dominated these groups of companies. Such a result indicates a low dependence of the surveyed companies on international or global supply chains. Interestingly, sourcing from closer markets was also associated with a small number of suppliers, which generally did not exceed 50. Most maintenance and repair companies had up to 5 suppliers. In contrast, the vendor group was dominated by companies with between 11 and 50 suppliers. There were differences between companies depending on the type of business.

- Regardless of the type of business, automotive companies experienced disruption in their supply chains. There was little variation by type of business. The most frequent disruptions were due to lockdowns and official closures, low stocks of materials and products, and problems with employees due to illness and quarantine. In all cases, the greatest number of disruptions were at car and parts dealers. In concretising the types of disruption, it was indicated that there was no difference by type of business. The research hypothesis was rejected. In all companies, problems with longer lead times, with increased costs of transport, storage, and work with on-time delivery were mainly indicated.

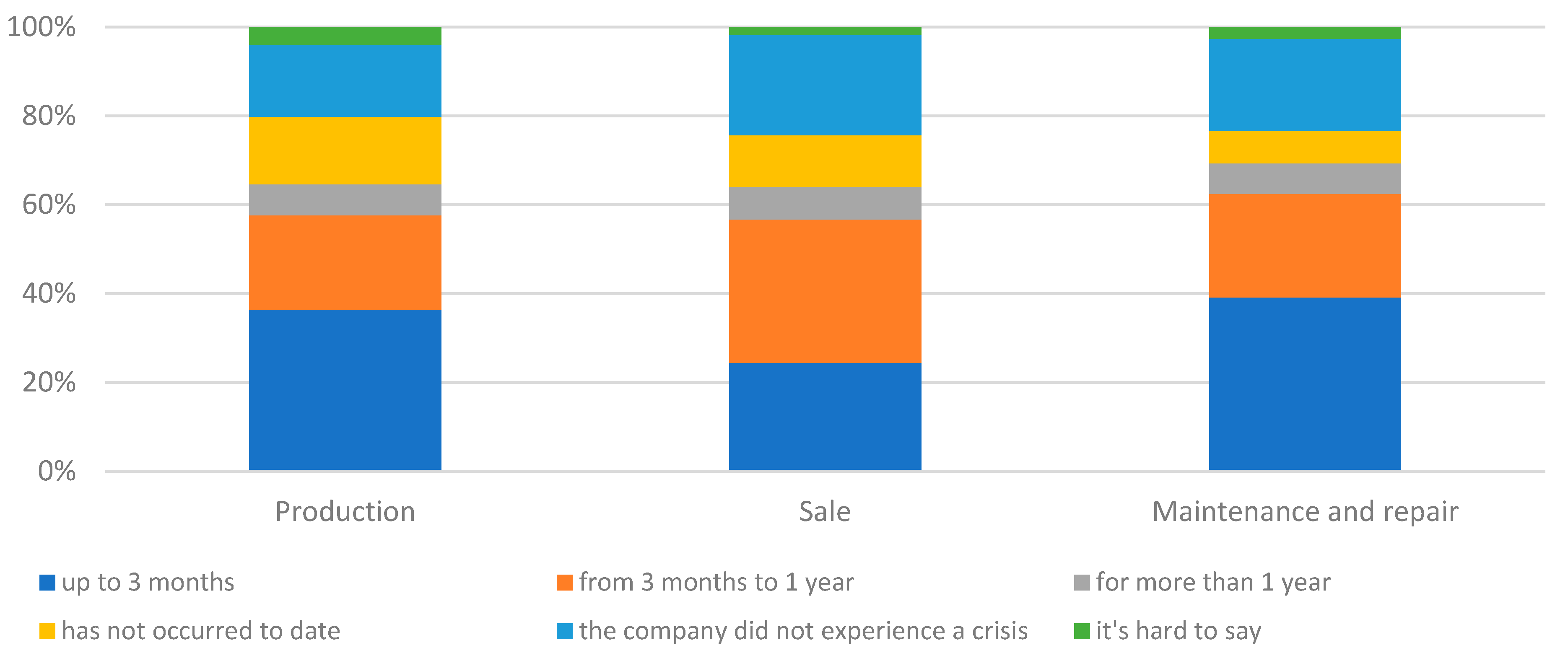

- Disruptions in supply chains were generally short-lived (up to 1 year). Companies at the beginning of the supply chain (manufacturers) indicated longer disruptions and even continued disruptions. Statistical tests, however, did not show a dependence of the duration of disruptions on the type of business.

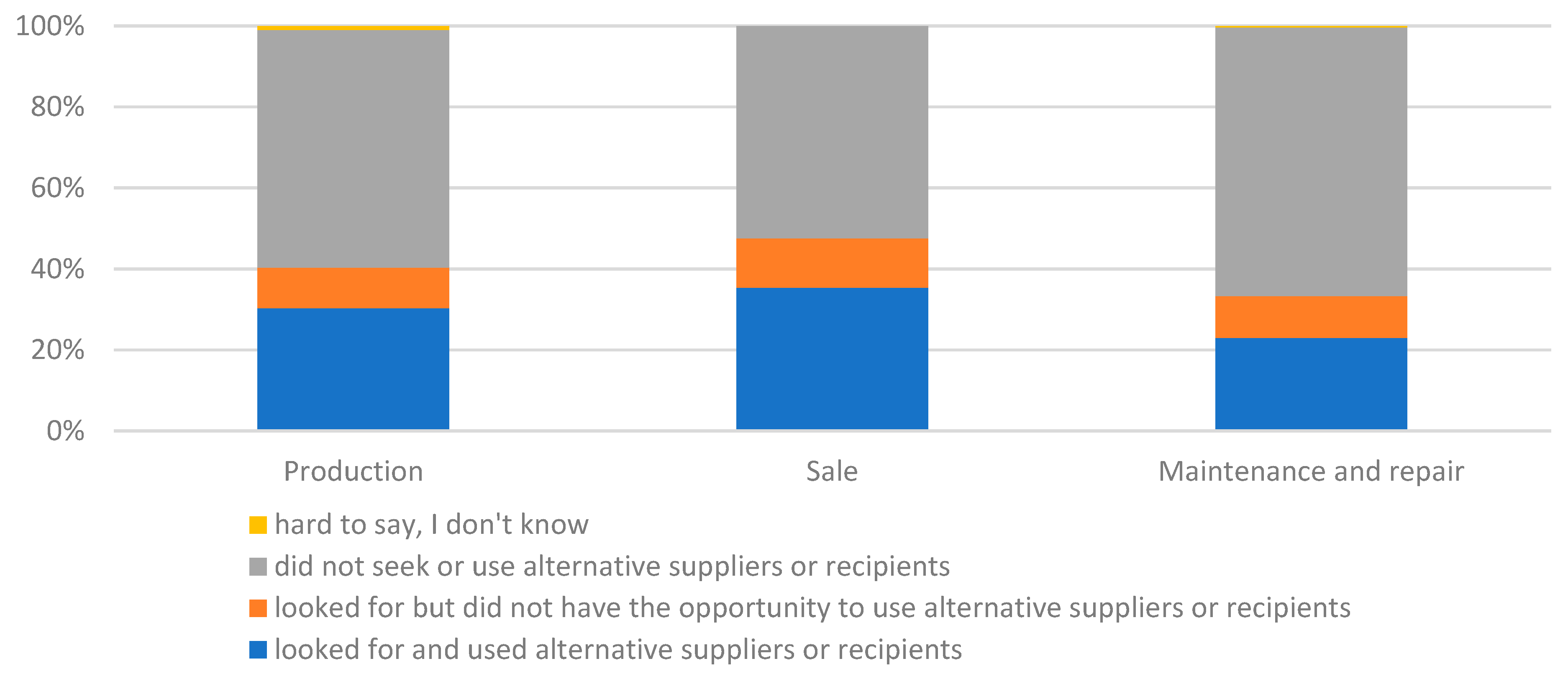

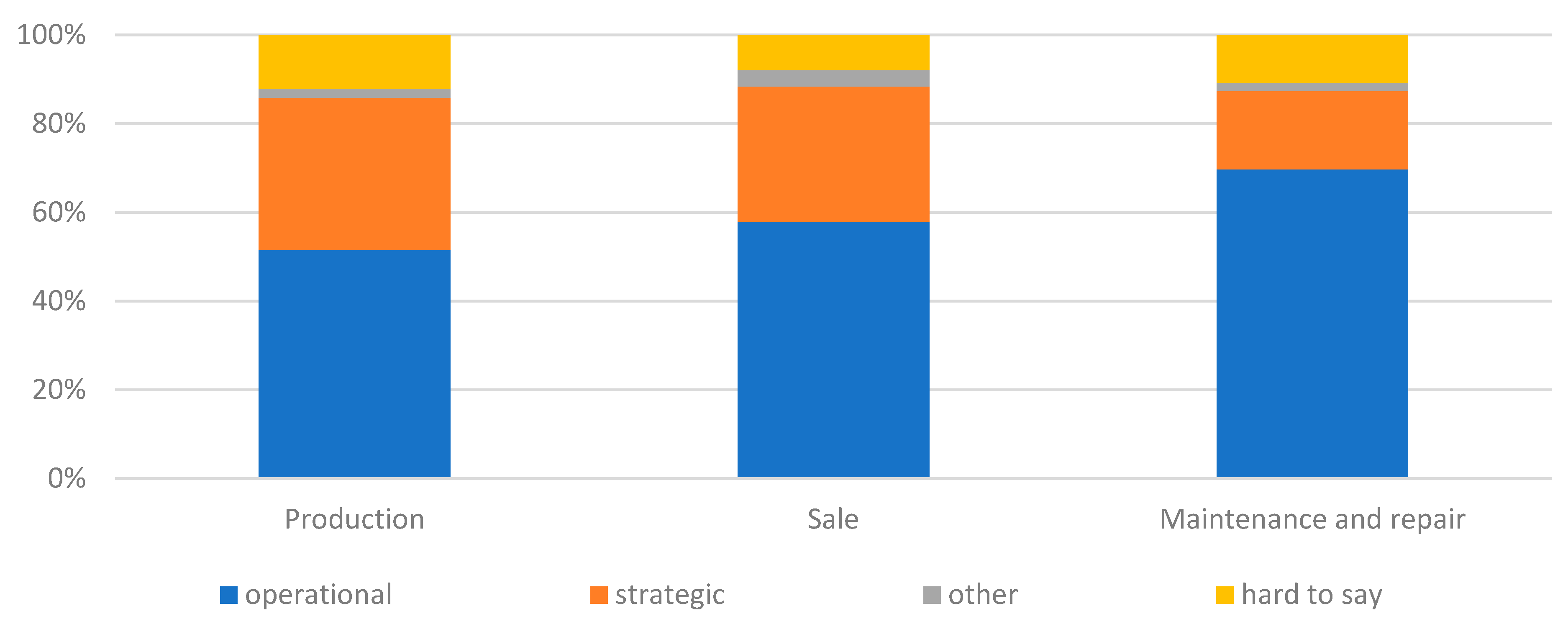

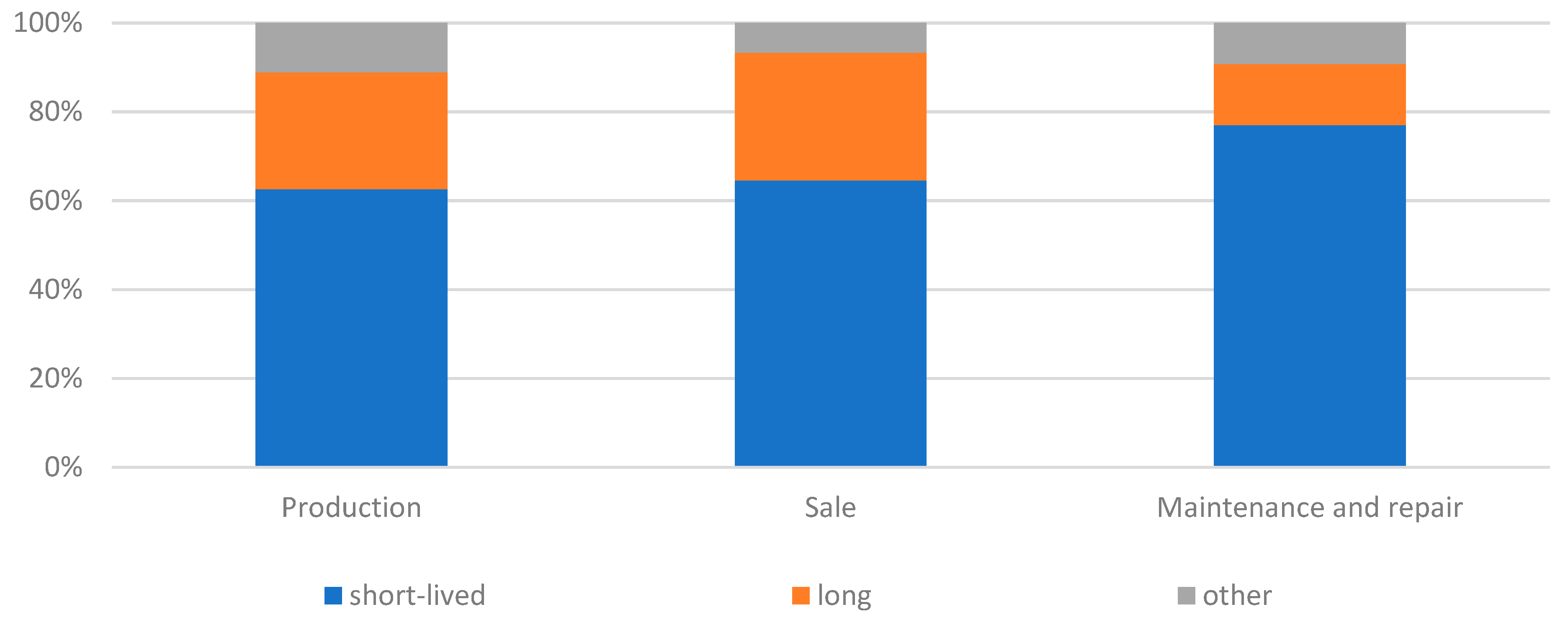

- To address disruptions in supply chains, operational measures were most commonly used. The scale of these actions increased further down the supply chain. There was a similar relationship in the actions taken by companies. These tended to be short-lived and their frequency increased further downstream in the supply chain. Most companies may have assumed that the pandemic was short-lived, so this type of action would be sufficient. Smaller companies, on the other hand, were only focusing on day-to-day operations, and on survival in the market. Therefore, strategic decisions such as looking for alternative suppliers were rarely taken.

5.2. Recommendations

References

- Erkan, B. The importance and determinants of logistics performance of selected countries. J. Emerg. Issues Econ. Financ. Bank 2014, 3, 1237–1254. [Google Scholar]

- Bashir, R.; Vijayalakshmi, H.; Bashir, N.A. Comparative Study on the Prices of Products in Logistics Companies and Their Impact on Economic Growth. In Proceedings of the 2020 8th International Conference on Reliability, Infocom Technologies and Optimization (Trends and Future Directions) (ICRITO), Noida, India, 4–5 June 2020; pp. 934–939. [Google Scholar]

- Es, H.A.; Hamzacebi, C.; Firat, S.U.O. Assessing the logistics activities aspect of economic and social development. Int. J. Logist. Syst. Manag. 2018, 29, 1–16. [Google Scholar] [CrossRef]

- Rokicki, T.; Bórawski, P.; Bełdycka-Bórawska, A.; Żak, A.; Koszela, G. Development of Electromobility in European Union Countries under COVID-19 Conditions. Energies 2022, 15, 9. [Google Scholar] [CrossRef]

- Huang, H.; Xu, T. Discussing about the relationship between logistics industry and economy development. Logistics Management 2005, 5. [Google Scholar]

- Tudor, F. Historical evolution of logistics. Rev. Des Sci. Polit. 2012, 36, 22–32. [Google Scholar]

- Rokicki, T. The importance of logistics in agribusiness sector companies in Poland. In Economic Science for Rural Development: Production and cooperation in agriculture/finance and taxes. In Proceedings of the International Scientific Conference; Jelgava, Latvia, 6 April 2013, pp. 116–120.

- Hanne, T.; Dornberger, R. Computational Intelligence in Logistics and Supply Chain Management; Springer: Cham, Switzerland, 2017; pp. 1–12. [Google Scholar]

- Pfohl, H.C. Characterization of the Logistics Conception. In Logistics Systems; Springer: Berlin/Heidelberg, Germany, 2022; pp. 21–45. [Google Scholar]

- Rokicki, T.; Koszela, G.; Ochnio, L.; Wojtczuk, K.; Ratajczak, M.; Szczepaniuk, H.; Bełdycka-Bórawska, A. Diversity and changes in energy consumption by transport in EU countries. Energies 2021, 14, 5414. [Google Scholar] [CrossRef]

- Chu, Z. Logistics and economic growth: A panel data approach. Ann. Reg. Sci. 2012, 49, 87–102. [Google Scholar] [CrossRef]

- Saidi, S.; Mani, V.; Mefteh, H.; Shahbaz, M.; Akhtar, P. Dynamic linkages between transport, logistics, foreign direct Investment, and economic growth: Empirical evidence from developing countries. Transp. Res. Part A Policy Pract. 2020, 141, 277–293. [Google Scholar] [CrossRef]

- Rokicki, T.; Bórawski, P.; Bełdycka-Bórawska, A.; Szeberényi, A.; Perkowska, A. Changes in Logistics Activities in Poland as a Result of the COVID-19 Pandemic. Sustainability 2022, 14, 10303. [Google Scholar] [CrossRef]

- Amin, H.M.; Shahwan, T.M. Logistics management requirements and logistics performance efficiency: The role of logistics management practices-evidence from Egypt. Int. J. Logist. Syst. Manag. 2020, 35, 1–27. [Google Scholar] [CrossRef]

- Chu, Z.; Wang, Q.; Lado, A.A. Customer orientation, relationship quality, and performance: The third-party logistics provider’s perspective. Int. J. Logist. Manag. 2016, 27, 738–754. [Google Scholar] [CrossRef]

- Wicki, L.; Rokicki, T. Differentiation of level of logistics activities in milk processing companies. In Information Systems in Management X: Computer Aided Logistics/Sci; Jałowiecki, P., Orłowski, A., Eds.; WULS Press: Warsaw, Poland, 2011; pp. 117–127. [Google Scholar]

- Rodrigue, J.P.; Notteboom, T. Comparative North American and European gateway logistics: the regionalism of freight distribution. Journal of Transport Geography 2010, 18, 497–507. [Google Scholar] [CrossRef]

- Ashby, A. From global to local: reshoring for sustainability. Operations Management Research 2016, 9, 75–88. [Google Scholar] [CrossRef]

- Stanczyk, A.; Cataldo, Z.; Blome, C.; Busse, C. The dark side of global sourcing: a systematic literature review and research agenda. International Journal of Physical Distribution & Logistics Management 2017, 47, 41–67. [Google Scholar]

- Onstein, A.T.; Tavasszy, L.A.; Van Damme, D.A. Factors determining distribution structure decisions in logistics: a literature review and research agenda. Transport Reviews 2019, 39, 243–260. [Google Scholar] [CrossRef]

- Kchaou Boujelben, M.; Boulaksil, Y. Modeling international facility location under uncertainty: A review, analysis, and insights. IISE Transactions 2018, 50, 535–551. [Google Scholar] [CrossRef]

- Kalchschmidt, M.; Birolini, S.; Cattaneo, M.; Malighetti, P.; Paleari, S. The geography of suppliers and retailers. Journal of Purchasing and Supply Management 2020, 26, 100626. [Google Scholar] [CrossRef]

- Cowen, D. The deadly life of logistics: Mapping violence in global trade; University of Minnesota Press: Minneapolis, USA, 2014. [Google Scholar]

- Arellana, J.; Márquez, L.; Cantillo, V. COVID-19 outbreak in Colombia: An analysis of its impacts on transport systems. J. Adv. Transp. 2020, 8867316. [Google Scholar] [CrossRef]

- Li, S.; Zhou, Y.; Kundu, T.; Sheu, J.B. Spatiotemporal variation of the worldwide air transportation network induced by COVID-19 pandemic in 2020. Transp. Policy 2021, 111, 168–184. [Google Scholar] [CrossRef]

- Łącka, I.; Suproń, B. The impact of COVID-19 on road freight transport evidence from Poland. Eur. Res. Stud. 2021, 24, 319–333. [Google Scholar] [CrossRef] [PubMed]

- Alaimo, L.S.; Fiore, M.; Galati, A. How the COVID-19 pandemic is changing online food shopping human behaviour in Italy. Sustainability 2020, 12, 9594. [Google Scholar] [CrossRef]

- Chang, H.H.; Meyerhoefer, C.D. COVID-19 and the demand for online food shopping services: Empirical Evidence from Taiwan. Am. J. Agric. Econ. 2021, 103, 448–465. [Google Scholar] [CrossRef]

- Abdelrhim, M.; Elsayed, A. The Effect of COVID-19 Spread on the e-Commerce Market: The Case of the 5 Largest e-Commerce Companies in the World 2022, 3621166.

- Izzah, N.; Dilaila, F.; Yao, L. The growth of reliance towards courier services through e-business verified during COVID-19: Malaysia. J. Phys. Conf. Ser. 2021, 1874, 012041. [Google Scholar] [CrossRef]

- Chornopyska, N.; Bolibrukh, L. The Influence of the Covid-19 Crisis on the Formation of Logistics Quality. Intellect. Logist. Supply Chain. Manag. 2020, 2, 88–98. [Google Scholar] [CrossRef]

- Atayah, O.F.; Dhiaf, M.M.; Najaf, K.; Frederico, G.F. Impact of COVID-19 on financial performance of logistics firms: Evidence from G-20 countries. J. Glob. Oper. Strateg. Sourc. 2021, 15, 172–196. [Google Scholar] [CrossRef]

- Rokicki, T.; Koszela, G.; Ochnio, L.; Perkowska, A.; Bórawski, P.; Bełdycka-Bórawska, A.; Dzikuć, M. Changes in the production of energy from renewable sources in the countries of Central and Eastern Europe. Frontiers in Energy Research 2022, 10, 993547. [Google Scholar] [CrossRef]

- Haren, P.; Simchi-Levi, D. How Coronavirus Could Impact the Global Supply Chain by Mid-March; Harvard Business Review: Harvard, UK, 2020. [Google Scholar]

- Remko, V.H. Research opportunities for a more resilient post-COVID-19 supply chain–closing the gap between research findings and industry practice. Int. J. Oper. Prod. Manag. 2020, 40, 341–355. [Google Scholar] [CrossRef]

- Chowdhury, P.; Paul, S.K.; Kaisar, S.; Moktadir, M.A. COVID-19 pandemic related supply chain studies: A systematic review. Transp. Res. Part E Logist. Transp. Rev. 2021, 148, 102271. [Google Scholar] [CrossRef] [PubMed]

- Gunessee, S.; Subramanian, N. Ambiguity and its coping mechanisms in supply chains lessons from the Covid-19 pandemic and natural disasters. Int. J. Oper. Prod. Manag. 2020, 40, 1201–1223. [Google Scholar] [CrossRef]

- Amankwah-Amoah, J. Note: Mayday, Mayday, Mayday! Responding to environmental shocks: Insights on global airlines’ responses to COVID-19. Transp. Res. Part E Logist. Transp. Rev. 2020, 143, 102098. [Google Scholar] [CrossRef] [PubMed]

- Xu, Z.; Elomri, A.; Kerbache, L.; El Omri, A. Impacts of COVID-19 on global supply chains: Facts and perspectives. IEEE Eng. Manag. Rev. 2020, 48, 153–166. [Google Scholar] [CrossRef]

- Heidary, M.H. The Effect of COVID-19 Pandemic on the Global Supply Chain Operations: A System Dynamics Approach. Foreign Trade Rev. 2022, 57, 198–220. [Google Scholar] [CrossRef]

- Choi, T.M. Innovative “bring-service-near-your-home” operations under corona-virus (COVID-19/SARS-CoV-2) outbreak: Can logistics become the messiah? Transp. Res. Part E Logist. Transp. Rev. 2020, 140, 101961. [Google Scholar] [CrossRef] [PubMed]

- Currie, C.S.; Fowler, J.W.; Kotiadis, K.; Monks, T.; Onggo, B.S.; Robertson, D.A.; Tako, A.A. How simulation modelling can help reduce the impact of COVID-19. J. Simul. 2020, 14, 83–97. [Google Scholar] [CrossRef]

- Ivanov, D. Viable supply chain model: Integrating agility, resilience and sustainability perspectives—lessons from and thinking beyond the COVID-19 pandemic. Ann. Oper. Res. 2020, 1–21. [Google Scholar] [CrossRef] [PubMed]

- Rokicki, T.; Bórawski, P.; Bełdycka-Bórawska, A.; Żak, A.; Koszela, G. Development of electromobility in european union countries under covid-19 conditions. Energies 2021, 15, 9. [Google Scholar] [CrossRef]

- Accenture, COVID-19: Impact on the Automotive Industry, 2020 (Online). Available: https://www.accenture.com/_acnmedia/PDF-121/Accenture-COVID-19-Impact-Automotive-Industry.pdf.

- ACEA, Passenger car registrations, 2020 (Online). Available: https://www.acea.be/press-releases/article/passenger-car-registrations-28.8-nine-months-into-2020-3.1-in-september.

- ACEA, Truck makers gear up to go fossil-free by 2040, but EU and Member States need to step up their game, 2021 (Online). Available: https://www.acea.

- McKinsey, Reimaginig the auto indsutry’s future its now or never, 2020 (Online). Available: https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/reimagining-the-auto-industrys-future-its-now-or-never.

- McKinsey, The second COVID-19 lockdown in Europe: Implications for automotive retail, 2020 (Online). Available: https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/the-second-covid-19-lockdown-in-europe-implications-for-automotive-retail.

- Ecorys, TRT Srl.; and M-Five GmbH, 2020 (Online). Available: Study on exploring the possible employment implications of connected and automated driving. Annexes, available at: https://www.ecorys.com/cad.

- Huisman, J.; Ciuta, T.; Mathieux, F.; Bobba, S.; Georgitzikis, K.; Pennington, D. RMIS–Raw materials in the battery value chain; Publications Office of the European Union: Luxembourg, 2020. [Google Scholar]

- Aczel, A.D.; Sounderpandian, J. Statystyka w zarządzaniu; Wydawnictwo Naukowe PWN: Warszawa, Poland, 2000. [Google Scholar]

- Kowal, J. Statystyka opisowa w zarządzaniu. W: Z. Knecht (red.), Zarządzanie przedsiębiorcze, 2011, 107-162.

- Łapczyński, M. Analiza porównawcza tabel kontyngencji i metody CHAID. Zeszyty Naukowe/Akademia Ekonomiczna w Krakowie 2005, 659, 149–163. [Google Scholar]

- Lampón, J.F.; Perez-Elizundia, G.; Delgado-Guzmán, J.A. Relevance of the cooperation in financing the automobile industry’s supply chain: the case of reverse factoring. Journal of Manufacturing Technology Management 2021, 32, 1094–1112. [Google Scholar] [CrossRef]

- Kordalska, A.; Olczyk, M. Is Germany a Hub of ‘Factory Europe’for CEE Countries? Ekonomista 2019, 734–759. [Google Scholar]

- Rodrigue, J.P. The geography of global supply chains: Evidence from third-party logistics. Journal of Supply Chain Management 2012, 48, 15–23. [Google Scholar] [CrossRef]

- Barbieri, P.; Boffelli, A.; Elia, S.; Fratocchi, L.; Kalchschmidt, M.; Samson, D. What can we learn about reshoring after Covid-19? Operations Management Research 2020, 13, 131–136. [Google Scholar] [CrossRef]

- Strange, R. The 2020 Covid-19 pandemic and global value chains. Journal of Industrial and Business Economics 2020, 47, 455–465. [Google Scholar] [CrossRef]

- Javorcik, B. Reshaping of global supply chains will take place, but it will not happen fast. Journal of Chinese Economic and Business Studies 2020, 18, 321–325. [Google Scholar] [CrossRef]

- Van Hassel, E.; Vanelslander, T.; Neyens, K.; Vandeborre, H.; Kindt, D.; Kellens, S. Reconsidering nearshoring to avoid global crisis impacts: Application and calculation of the total cost of ownership for specific scenarios. Research in Transportation Economics 2022, 93, 101089. [Google Scholar] [CrossRef]

- Ciravegna, L.; Michailova, S. Why the world economy needs, but will not get, more globalization in the post-COVID-19 decade. Journal of International Business Studies 2022, 1–15. [Google Scholar] [CrossRef] [PubMed]

- Azadegan, A.; Dooley, K. A typology of supply network resilience strategies: complex collaborations in a complex world. Journal of Supply Chain Management 2021, 57, 17–26. [Google Scholar] [CrossRef]

- Ivanov, D. Predicting the impacts of epidemic outbreaks on global supply chains: A simulation-based analysis on the coronavirus outbreak (COVID-19/SARS-CoV-2) case. Transportation Research Part E: Logistics and Transportation Review 2020, 136, 101922. [Google Scholar] [CrossRef] [PubMed]

- Ishida, S. Perspectives on supply chain management in a pandemic and the post-COVID-19 era. IEEE Engineering Management Review 2020, 48, 146–152. [Google Scholar] [CrossRef]

- Gereffi, G. What does the COVID-19 pandemic teach us about global value chains? The case of medical supplies. Journal of International Business Policy 2020, 3, 287–301. [Google Scholar] [CrossRef]

- Eldem, B.; Kluczek, A.; Bagiński, J. The COVID-19 impact on supply chain operations of automotive industry: A case study of sustainability 4.0 based on Sense–Adapt–Transform framework. Sustainability 2022, 14, 5855. [Google Scholar] [CrossRef]

- KPMG. 2020. Covid-19: Impact on the automotive sector. Available: https://assets.kpmg/content/dam/kpmg/ar/pdf/2020/covid-19-impact-on-the-automotivesector.pdf (20.11.2022).

- Ruggiero, S.; Kangas, H.L.; Annala, S.; Lazarevic, D. Business model innovation in demand response firms: Beyond the niche-regime dichotomy. Environmental Innovation and Societal Transitions 2021, 39, 1–17. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).