Submitted:

28 November 2023

Posted:

29 November 2023

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Materials and Methods

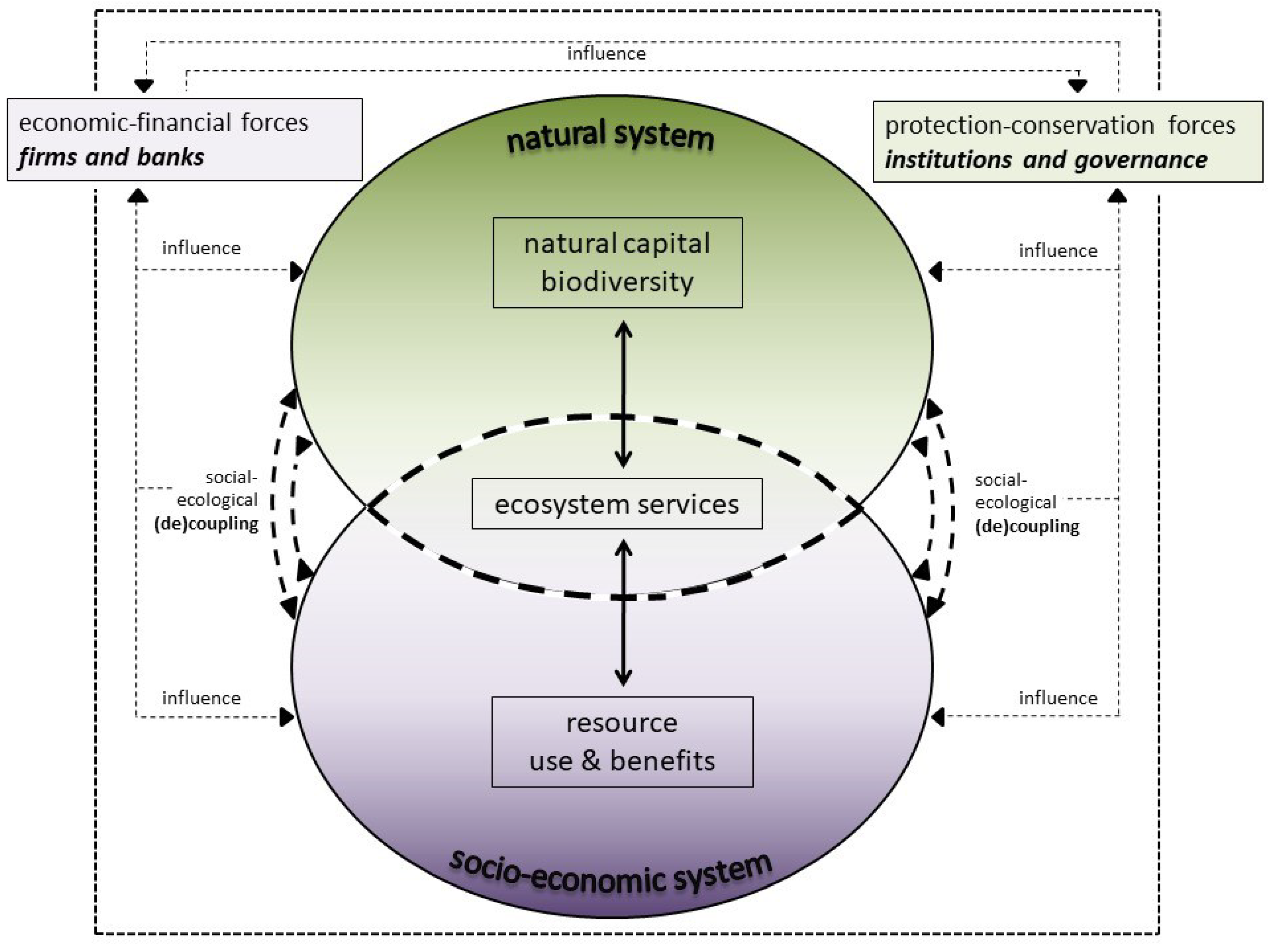

2.1. Modelling framework

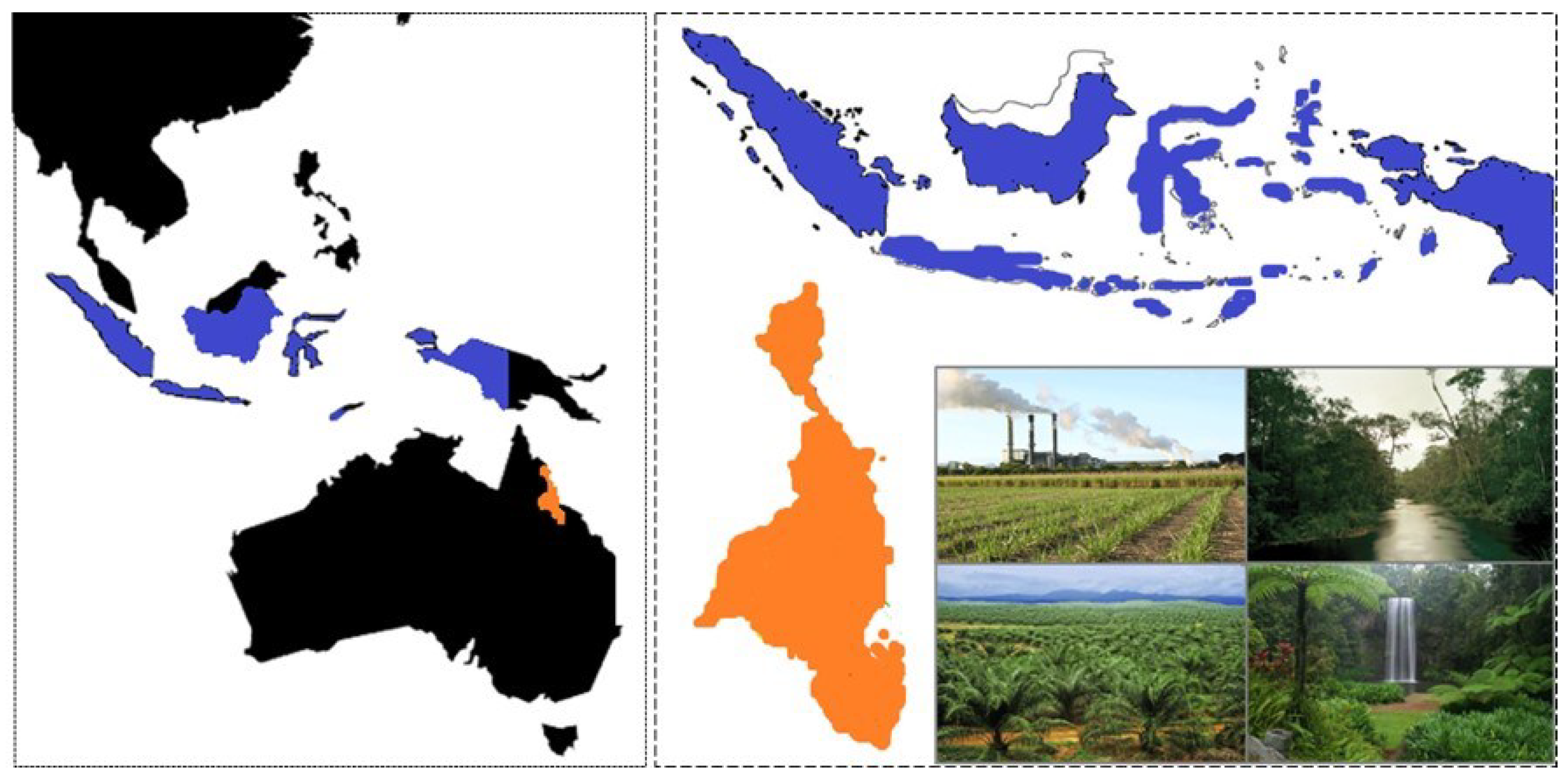

2.2. Context and study years

2.3. Agent-Based Modelling

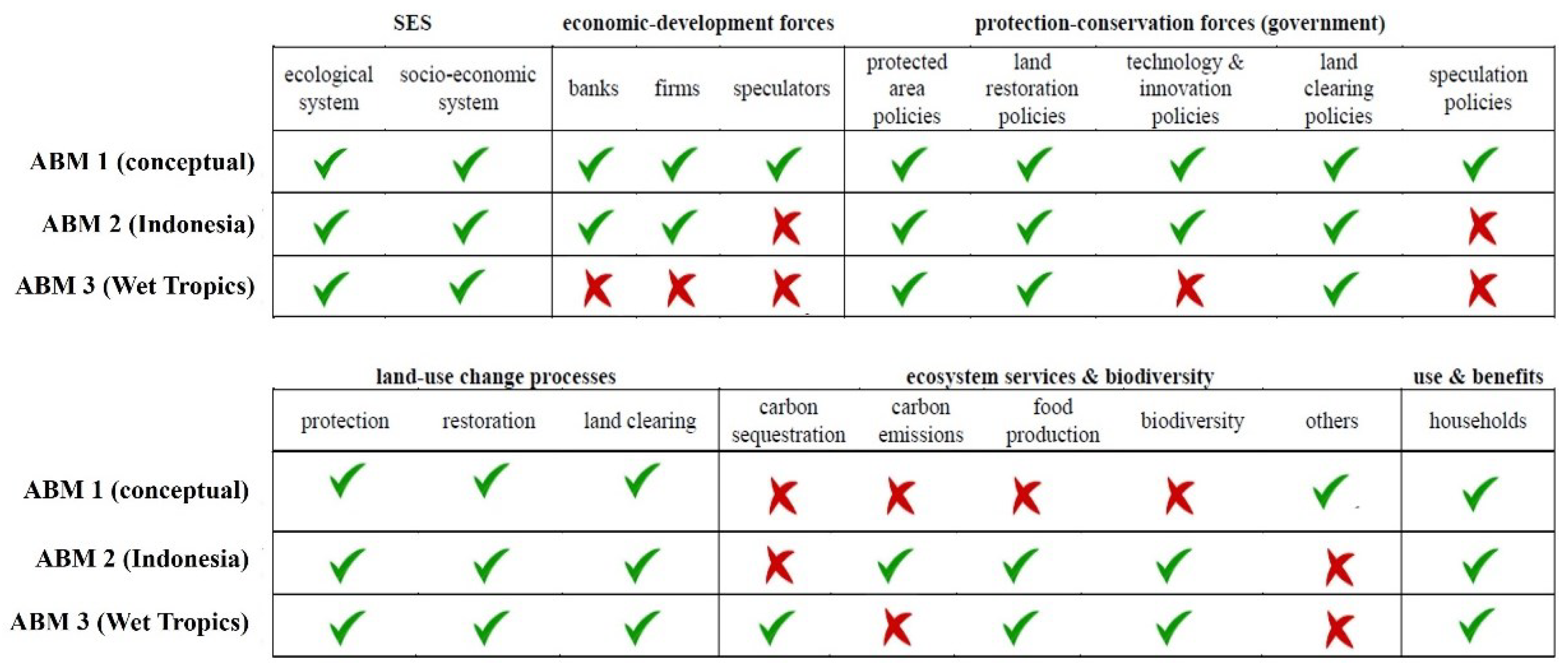

2.4. Models’ description

3. Results

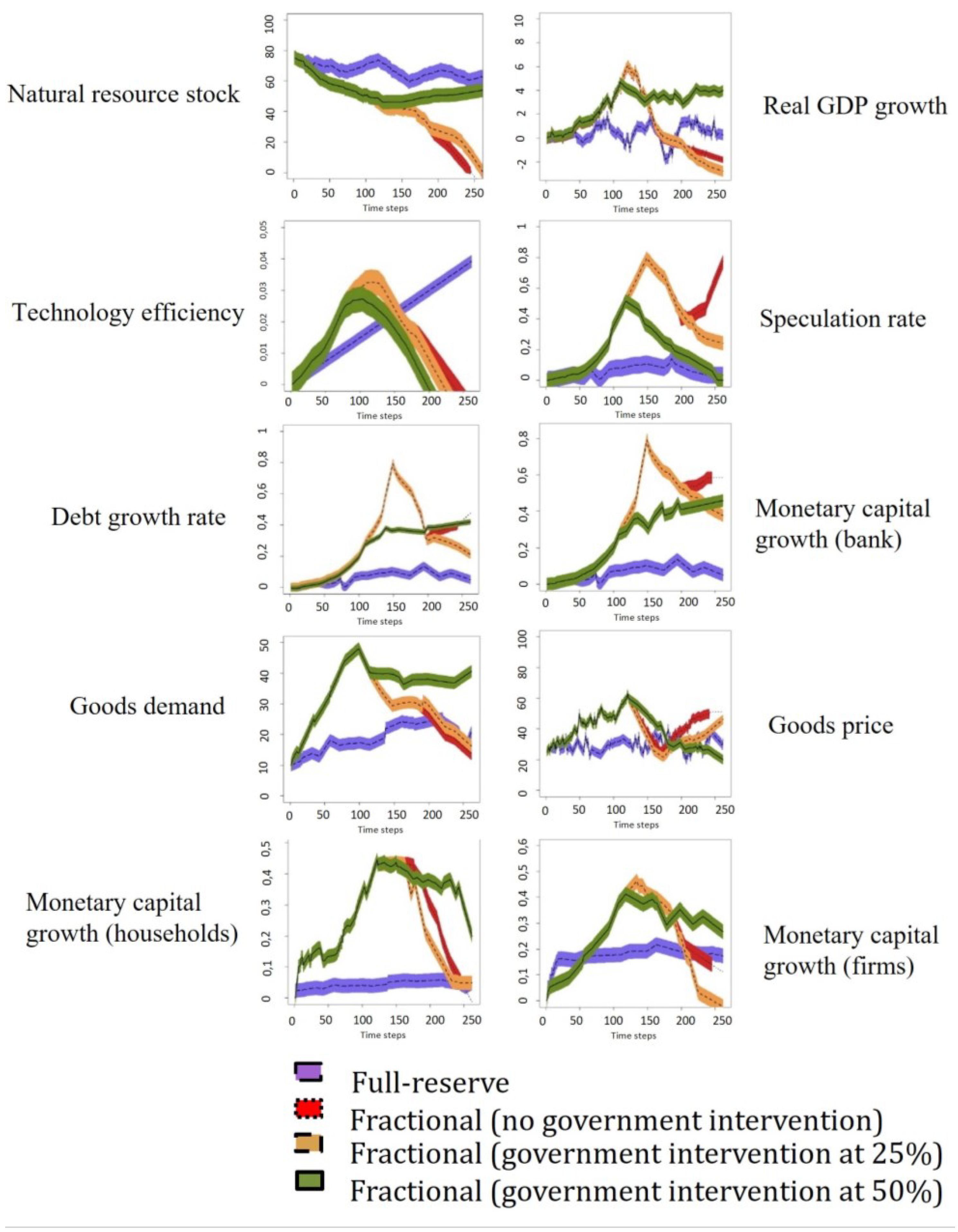

3.1. ABM 1 (SES: conceptual): re-coupling economic growth and natural resource availability

3.1.1. Debt-based fractional-reserve system (no government intervention)

3.1.2. Non-debt based full-reserve system

3.1.3. Government intervention in fractional-reserve systems

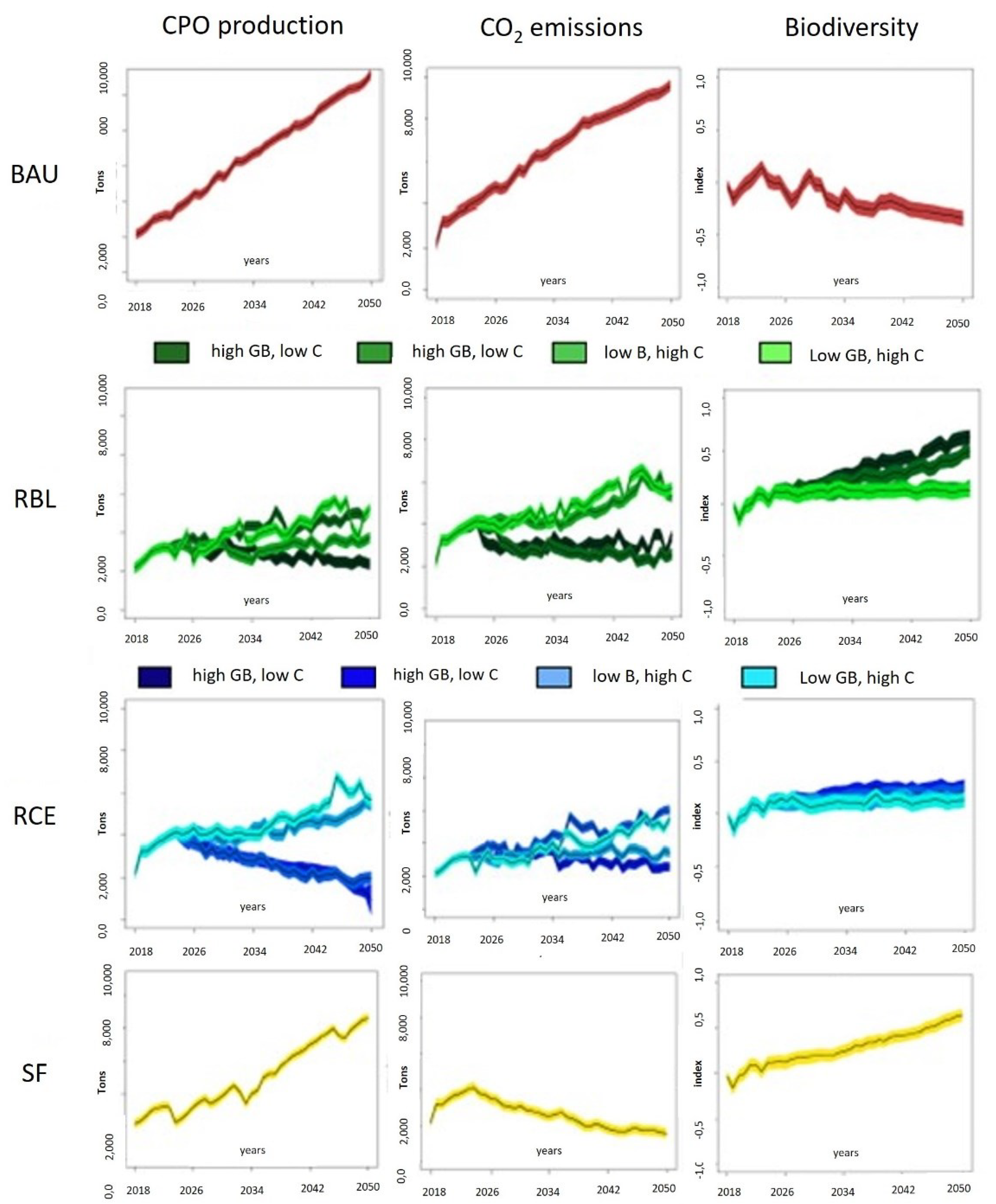

3.2. ABM 2 (SES: Indonesia): the how, instead of the what, to achieve sustainability

3.2.1. Business As Usual (BAU)

3.2.2. Reducing Biodiversity Loss (RBL) and Carbon Emissions (RCE)

3.2.3. Sustainable Futures (SF)

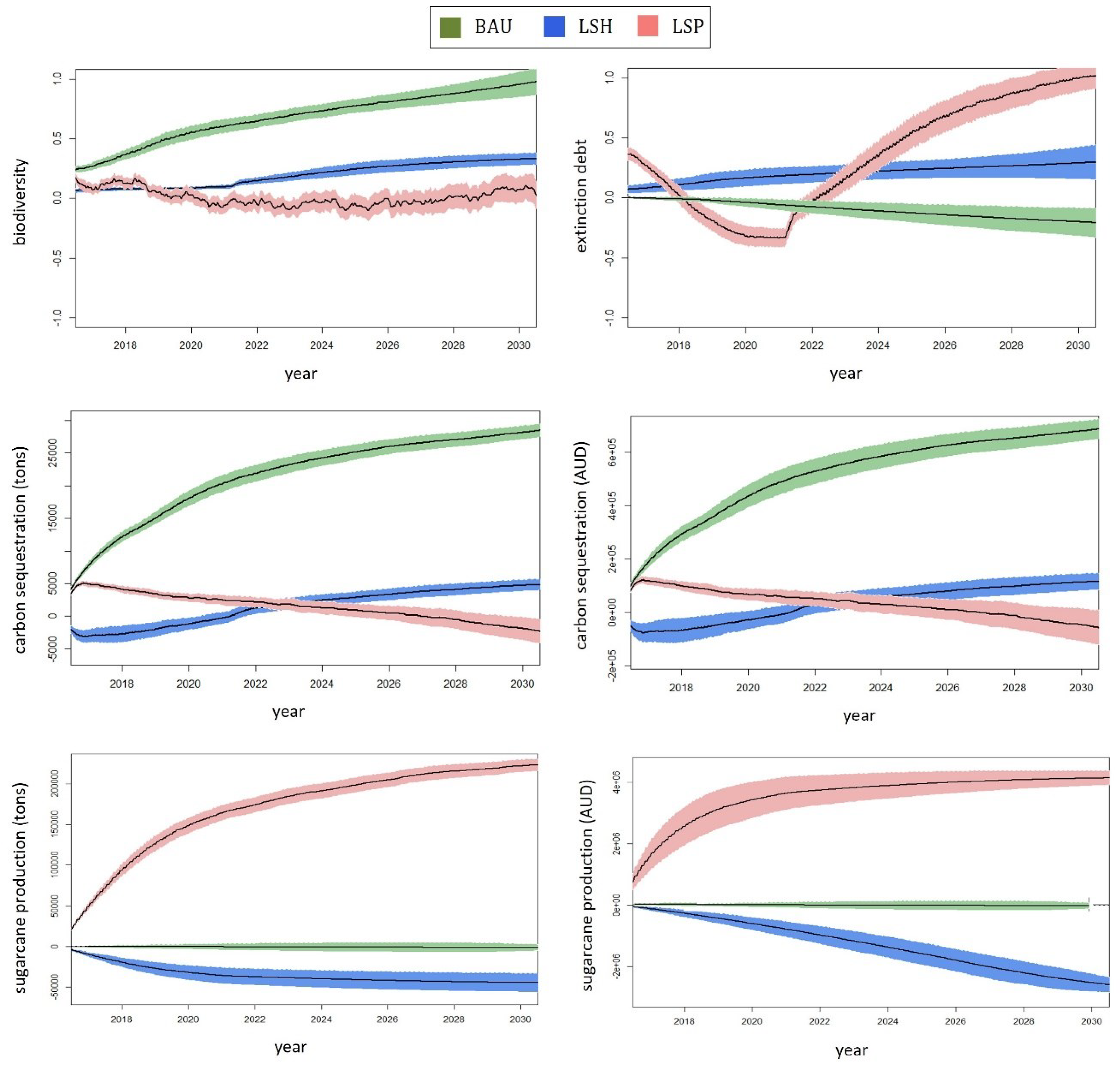

3.3. ABM 3 (SES: Wet Tropics): evidencing a sustainable Business As Usual scenario

3.3.1. Estimated spatial impacts

3.3.2. Estimated impacts

4. Discussion

4.1. It is not the what, but the how

4.2. What factors drive (un)sustainability in social-ecological systems?

4.2.1. Monetary debt and financial entities: avoiding the blindness of the market economy

4.2.2. Technological development: two sides of the same coin

4.2.3. Speculation and price volatility: the need to recouple economic and natural systems

4.2.4. Government timely interventions: the importance of tipping points and supporting long-term views

4.2.5. Overcoming government powerlessness and unwillingness to protect the environment: the need to combine bottom-up and top-down conservation forces

4.2.6. Careful with extrapolations: considering specific factors and conditions to each social-ecological system

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Agrawal A (2003) Sustainable governance of common-pool resources: context, methods, and politics. Annual Review of Anthropology 32: 243-262. [CrossRef]

- Abel N, Cumming DHM and Anderies JM (2006) Collapse and Reorganization in Social-Ecological Systems: Questions, Some Ideas, and Policy Implications. Ecology and Society 11(1): 17.

- AgriFutures. (2017). Sugarcane-Overview [Online]. Available at: < https://www.agrifutures.com.au/publications-resources/farm-diversity-search/> [Accessed 27 Jul 2021].

- Alamgir M et al. (2016) Assessing regulating and provisioning ecosystem services in a contrasting tropical forest landscape. Ecological Indicators 64: 319-334. [CrossRef]

- Alaniz AJ, Carvajal MA, Nuñez-Hidalgo I and Vergara PM (2019) Chronicle of an Environmental Disaster: Aculeo Lake, the Collapse of the Largest Natural Freshwater Ecosystem in Central Chile. Environmental Conservation 46(03):0-4. [CrossRef]

- An, L., et al. (2014) Agent based modelling in coupled human and natural systems (CHANS): lessons from a comparative analysis. Ann. Assoc. Am. Geogr. 104 (4): 723-745. [CrossRef]

- Angelsen A ed. (2008) Moving Ahead with REDD: Issues, Options and Implications. (CIFOR, Bogor, Indonesia).

- Axelrod R and Michael DC (2001) Harnessing Complexity: Organizational Implications of a Scientific Frontier. Reprint edition. New York: Basic Books.

- Balmford A et al. (2002) Economic Reasons for Conserving Wild Nature. Science 297(5583): 950-953. [CrossRef]

- Beddington JR, Agnew DJ and Clark CW (2007). Current problems in the management of marine fisheries. Science. [CrossRef]

- Berkes F and Folke C (Eds.). (1998) Linking Social and Ecological Systems: Management Practices and Social Mechanisms for Building Resilience. Cambridge University Press, New York.

- Bonabeau E (2002). Agent-based modelling: Methods and techniques for simulating human systems. PNAS 99(3): 7280-7287. [CrossRef]

- Brock WA and Carpenter SR (2007) Panaceas and diversification of environmental policy. Proceedings of the National Academy of Sciences USA 104: 15206-15211. [CrossRef]

- Brown JH, Burnside WR, Davidson AD, DeLong JP, Dunn WC, Hamilton MJ, et al. (2011) Energetic Limits to Economic Growth. BioScience 61(1): 19-26. [CrossRef]

- Burg, M. - Cairns and Far North Environment Center. (2017) How The Wet Tropics Was Won – CAEFNEC. [online] Available at: <https://cafnec.org.au/about/how-the-wet-tropics-was-won/> [Accessed 27 Jul. 2021].

- Ceddia MG et al. (2014) Governance, Agricultural Intensification, and Land Sparing in Tropical South America. Proceedings of the National Academy of Sciences of the United States of America 111(10:, 7242-7247. [CrossRef]

- Costanza R et al. (1997) The value of the world’s ecosystem services and natural capital. Nature 387: 253-260. [CrossRef]

- Cox CC (1976) Futures trading and market information. J. Polit. Econ 84: 1215-1237 24. [CrossRef]

- Daily GC (2000) Management objectives for the protection of ecosystem services. Environmental Science and Policy 3: 333-339. [CrossRef]

- Daly H (1991) Towards an environmental macroeconomics. Land Econ 67(2): 255-259. [CrossRef]

- Dawson TP, Rounsevell MDA, Kluva´nkova´-Oravska´ T, Chobotova V and Stirling A (2010) Dynamic properties of complex adaptive ecosystems: implications for the sustainability of service provision. Biodiversity and Conservation: 19(10): 2843-2853. [CrossRef]

- DeAngelis DL and Mooij WM (2005) Individual-based modelling of ecological and evolutionary processes. Annual Review of Ecology, Evolution, and Systematics 36: 147-168. [CrossRef]

- Dearing JA, Bullock S, Costanza R, Dawson TP, Edwards ME, Poppy GM and Smith GM (2012) Navigating the Perfect Storm: research strategies for socio-ecological systems in a rapidly evolving world, Environmental Management 49: 767-775. [CrossRef]

- De Greene KB (1993) A systems-based approach to policy making. Kluwer Academic, Boston, Massachussetts, USA.

- Diamond J (2005) Collapse: How Societies Choose to Fail or Succeed. Viking press, United States.

- Diaz S et al (2018) Assessing nature’s contributions to people. Science 359(6373): 270-272. [CrossRef]

- DSITI (2016). Land-use Summary 1999–2015: Wet Tropics, Department of Science, Information Technology and Innovation, Queensland Government [online]. Available at: <https://www.publications.qld.gov.au/dataset/land-use-summary-1999-2015> [Accessed 27 Jul 2021].

- Epstein JM (2006). Generative Social Science: Studies in Agent-Based Computational Models. Princeton University Press.

- FAO – Food and Agriculture Organization of the United Nations (2004). The state of food and agriculture. Agriculture Series 27.

- Farley J and Costanza R (2010) Payments for ecosystem services: From local to global. Ecological Economics 69(11): 2060-2068. [CrossRef]

- Farmer JD and Foley D (2009) The economy needs agent-based modelling. Nature 460(7256): 685-686. [CrossRef]

- Fedoroff NV et al. (2010) Radically rethinking agriculture for the 21st century. Science 327 (5967): 833-834. [CrossRef]

- Ferber J (1999) Multi-agent systems: an introduction to distributed artificial intelligence. Addison-Wesley Longman, Harlow, UK, 509.

- Filatova T, Verburg PH, Parker DC and Stannard CA (2013) Spatial agent-based models for socio-ecological systems: challenges and prospects. Environ. Model. Softw 45 (0): 1-7. [CrossRef]

- Folke C. et al. (2002) Resilience and sustainable development: building adaptive capacity in a world of transformations. Ambio 31: 437-440. [CrossRef]

- Folke C (2006) Resilience: the emergence of a perspective for social-ecological systems analyses. Global Environmental Change 16: 253-267. [CrossRef]

- Gleick P (2003) Global freshwater resources: soft-path solutions for the 21st Century. Science 302: 1524-1528. [CrossRef]

- Gonzalez-Redin, J (2018) Sustainable development: Why is it not delivering on its promises? Preprint at: https://discovery.dundee.ac.uk/ws/files/49341283/PhD_Thesis_Julen_Gonzalez_Redin.pdf.

- Gonzalez-Redin J, Polhill JG, Dawson TP, Hill R, Gordon IJ (2018) It’s not the ’what’, but the ’how’: Exploring the role of debt in natural resource (un)sustainability. PLoS ONE 13(7): e0201141.

- Gonzalez-Redin J, Gordon IJ, Rosemary Hill, Polhill JG and Dawson TP (2019a) Exploring sustainable land use in forested tropical social-ecological systems: A case-study in the Wet Tropics. Journal of Environmental Management 231: 940-952. [CrossRef]

- Gonzalez-Redin J, Polhill JG, Dawson TP, Hill R and Gordon iH (2019b) Exploring sustainable scenarios in debt-based social-ecological systems: The case for palm oil production in Indonesia. Ambio 49: 1530-1548. [CrossRef]

- Grimm V (1999) Ten years of individual-based modelling in ecology: what have we learned and what could we learn in the future? Ecological Modelling 115(2–3): 129-148. [CrossRef]

- Gunderson LH, CS Holling and SS Light (Eds.) (1995) Barriers and bridges to the renewal of ecosystems and institutions. Columbia University Press, New York, USA.

- Gunderson LH and L Pritchar Jr. (Eds.) (2002) Resilience and the behavior of large-scale systems. Island Press, Washington, D. C., USA.

- Heckbert S, Baynes T and Reeson A (2010) Agent-based modelling in ecological economics. Annals of the New York Academy of Sciences. Issue: Ecological Economics Reviews.

- Helpman E (Eds.) (1998) General Purpose Technologies and Economic Growth. MIT Press, Cambridge MA.

- Hill R et al. (2013) The maturation of biodiversity as a global social-ecological issue and implications for future biodiversity science and policy. Futures 46: 41-49. [CrossRef]

- Hill R et al. (2015) Why biodiversity declines as protected areas increase: the effect of the power of governance regimes on sustainable landscapes. Sustainability Science 10(2): 357-369. [CrossRef]

- Hirawan FB (2011) The impact of palm oil plantations on Indonesia’s rural economy. Agricultural Development, Trade and Regional Cooperation in Developing East Asia, 66, ERIA, Jakarta.

- Holling CS and Meffe GK (1996) Command and control and the pathology of natural resource management. Conservation Biology 10: 328-337. [CrossRef]

- Holling CS, Berkes C, Folke C. (1998) Science, Sustainability, and Resource Management. In: Berkes F. and Folke C. (Eds.) Linking Social and Ecological Systems: Management Practices and Social Mechanisms for Building Resilience, pp. 342-362. Cambridge, UK: Cambridge University Press.

- Holling CS and CR Allen (2002) Adaptive inference for distinguishing credible from incredible patterns in nature. Ecosystems 5: 319-328. [CrossRef]

- ICCT (2016) International Council on Clean Transportation. Ecological Impacts of Palm Oil Expansion in Indonesia. White Paper.

- Jackson T (2009) Prosperity without Growth–economics for a finite planet. London: Routledge.

- Jackson T and Victor PA (2015). Does slow growth lead to rising inequality? Some theoretical reflections and numerical simulations. Ecological Economics 121: 206-219. [CrossRef]

- Jevons WS (1865) The Question of Coal. Macmillan, London.

- Jones IM (2015). Homo Economicus: A Terrible Economic Theory. Uffpost [online]. Available at: <https://www.huffingtonpost.co.uk/ioan-marc-jones/terrible-economic-theory_b_6803380.html > [Accessed 28 Jul 2021].

- Keen S (2009) Household Debt-the final stage in an artificially extended Ponzi Bubble, Australian Economic Review 42: 347-357.

- Keen S (2020) The appallingly bad neoclassical economics of climate change. Globalizations.

- Koh LP and Ghazoul J (2010) Spatially explicit scenario analysis for reconciling agricultural expansion, forest protection, and carbon conservation in Indonesia. Proc. Natl. Acad. Sci. 107: 11140-11144. [CrossRef]

- Lafforgue G (2008) Stochastic technical change, non-renewable resource and optimal sustainable growth. Resource and Energy Economics 30(4): 540-554. [CrossRef]

- Lambin EF et al. (2001) The causes of land-use and land-cover change: moving beyond the myths. Global Environmental Change 11: 261-269. [CrossRef]

- Lang C (2010) Brazil: The double role of Norway in conserving and destroying the Amazon. REDD-Monitor [online]. Available at: <http://www.redd-monitor.org/2010/05/26/brazil-the-double-role-of-norway-in-conserving-and-destroying-the-amazon/> [Accessed 28 Jul 2021].

- Lang C (2017) After seven years, Norway’s US$1 billion REDD deal in Indonesia is still not stopping deforestation. REDD-Monitor [online]. Available at: <http://www.redd-monitor.org/2017/12/28/after-seven-years-norways-us1-billion-redd-deal-in-indonesia-is-still-not-stopping-deforestation/> [Accessed 28 Jul 2021].

- Lee KN (1993) Compass and gyroscope. Integrating science and politics for the environment. Island Press, Washington D. C.

- Ludwig D (2001) The era of management is over. Ecosystems 4: 758-764. [CrossRef]

- MEA – Millennium Ecosystem Assessment (2005) Ecosystems and human well-being: Synthesis. Washington DC.

- Meadows DH and Robinson JM (1985) The electronic oracle: computer models and social decisions. John Wiley, Chichester, UK; New York, New York, USA.

- Meadows DH, Meadows DL and Randers J (2004) Limits to Growth: The 30-Year Update. Chelsea Green Publishing Co., White River Junction, Vermont.

- Molotoks A, Smith P and Dawson TP (2020) Impacts of land use, population, and climate change on global food security. Food and Energy Security 10 (1): e262. [CrossRef]

- Morrison T, et al. (2019) The black box of power in polycentric environmental governance. Global Environmental Change 57: 101934. [CrossRef]

- Neldner VJ et al. (2017) Scientific review of the impacts of land clearing on threatened species in Queensland. Queensland Government, Brisbane.

- Nelleman C et al. (2009) The Environmental Food Crisis: The Environment’s Role in Averting Future Food Crises. A UNEP Rapid Response Assessment. United Nations Environment Program, GRID-Arendal, Arendal, Norway.

- Newell B et al. (2005) A conceptual template for integrative human–environment research. Global Environmental Change 15. 299-307. [CrossRef]

- Nordhaus WD (2007) A review of the Stern Review on the economics of climate change. Journal of Economic Literature 45: 686-702.

- OECD (2011). Towards green growth–A summary for policy makers. OECD Meeting of the Council at Ministerial Level, 25-26.

- Omoju O (2014) Environmental Pollution is Inevitable in Developing Countries. Breaking Energy[online]. Available at: <https://breakingenergy.com/2014/09/23/environmental-pollution-is-inevitable-in-developing-countries/> [Accessed 28 Jul 2021].

- Ostrom E (2007) A diagnostic approach for going beyond panaceas. Proceedings of the National Academy of Sciences of the United States of America 104: 15181-15187. [CrossRef]

- Ostrom E. (2009) A general framework for analyzing sustainability of social-ecological systems. Science 325: 419-422. [CrossRef]

- Pahl-Wostl C (1995) The Dynamic Nature of Ecosystems: Chaos and Order Entwined. Wiley, Chichester: 288.

- Pahl-Wostl C (2009) A conceptual framework for analysing adaptive capacity and multi-level learning processes in resource governance regimes. Global Environmental Change 19: 354-365. [CrossRef]

- Pearce DW and Turner RK (1990) Economics of Natural Resources and the Environment. Harvester Wheatsheaf, Hertfordshire England.

- Rankin DJ (2010) The social side of Homo economicus. Trends in Ecology & Evolution 26(1): 1-3.

- Redfield E (1996) North Queensland’s Tropical Rainforests: The World Heritage Controversy. In: Palo M., Mery G. (Eds.), Sustainable Forestry Challenges for Developing Countries. Environmental Science and Technology Library, 10. Dordrecht: Springer.

- Redman CL (1999). Human dimensions of ecosystem studies. Ecosystems 2: 296-298. [CrossRef]

- Redman CL, Grove JM and Kuby LH (2004) Integrating Social Science Into the Long-Term Ecological Research (LTER) Network: Social Dimensions of Ecological Change and Ecological Dimensions of Social Change. Ecosystems 7(2): 161-171. [CrossRef]

- Ritter FE, Schoelles MJ, Quigley KS and Klein LC (2011) Determining the number of simulation runs: Treating simulations as theories by not sampling their behaviour. In: Narayanan S. and Rothrock L. (Eds.). Human-in-the-loop Simulations: Methods and Practice. London: Springer-Verlag: 97-116.

- Ruysschaert D, Darsoyo A, Zen R, Gunung G. and Singleton I. (2011) Developing palm-oil production on degraded land – Technical, economic, biodiversity, climate and policy implications [online]. Available at: <https://www.ifc.org/wps/wcm/connect/534db066-91a5-4816-a277-97eb687c0dd5/Developing+OP+plantation+on+degraded+land-draft_Output+22.pdf?MOD=AJPERES&CVID=kjG1KkB> [Accessed 28 Jul 2021].

- Scholz RW (2011) Environmental literacy in science and society: from knowledge to decisions. Cambridge University Press, Cambridge, UK.

- Schulze J et al. (2017) Agent-Based Modelling of Social-Ecological Systems: Achievement, Challenges, and a Way Forward. JASSS 20(2): 8. [CrossRef]

- Sealey K, Burch RK and Binder P-M (2018) Will Miami Survive? The Dynamic Interplay between Floods and Finance. SpringerBrief.

- Sedjo RA and Simpson RD (1999) Tariff Liberalization, Wood Trade Flows, and Global Forests – Dicussion Paper 00-05. Resources for the Future, Washington DC.

- Smith M, Hargroves KC, Desha, C (2010) Cents and Sustainability—Securing Our Common Future by Decoupling Economic Growth from Environmental Pressures, London: Earthscan.

- Sodhi NS et al. (2010) The state and conservation of Southeast Asian biodiversity. Biodivers. Conserv. 19: 317-328. [CrossRef]

- Stern N (2007) The Economics of Climate Change: The Stern Review. Cambridge and New York: Cambridge University Press.

- Swamy L, Drazen E, Johnson WR and Bukoski JJ (2018) The future of tropical forests under the United Nations Sustainable Development Goals. Journal of Sustainable Forestry 37(2): 221-256. [CrossRef]

- Taylor M (2010) Queensland land clearing is undermining Australia’s environmental progress. The Conversation [online]. Available at: <http://theconversation.com/queensland-land-clearing-is-undermining-australias-environmental-progress-54882> [Accessed 28 Jul 2021].

- TEEB Foundations (2010) The Economics of Ecosystems and Biodiversity: Ecological and Economic Foundations. Earthscan, London and Washington.

- Turner RK and Daily GC (2008) The Ecosystem Services Framework and Natural Capital Conservation. Environmental and Resource Economics 3981: 25-35. [CrossRef]

- UNCTAD (2011). Price Formation in Financialized Commodity Markets–The Role of Information, United Nations.

- USDA (United States Department of Agriculture) (2014) Indonesia palm oil exports by year [online]. Available at: <http://www.indexmundi.com/agriculture/?country=id&commodity=palm-oil&graph=exports> [Accessed 28 Jul 2021].

- Valentine PS and Hill R (2008) The Establishment of a World Heritage Area. In: Living in a Dynamic Tropical Forest Landscape, edited by N.E. Stork and S. M. Turton, 81-93. Oxford: Blackwell Publishing.

- Vanclay JK (1993) Tropical Rainforest Logging in North Queensland: Was It Sustainable? Ann. For 1(1) 54-60.

- Vanclay JK (1994). Contrasts between biologically-based process models and management-oriented growth and yield models Sustainable timber harvesting: simulation studies in the tropical rainforests of north Queensland. Forest Ecology and Management 69: 299-320.

- Victor PA and Rosenbluth G (2007) Managing without growth. Ecological Economics 61: 492-504. [CrossRef]

- Weber ET, Catterall CP, Locke J, Ota LS, Prideaux B, Shirreffs L, Talbot L and Gordon IJ (2021) Managing a World Heritage Site in the Face of Climate Change: A Case Study of the Wet Tropics in Northern Queensland Earth 2021 2:248-271. [CrossRef]

- Wet Tropics Management Authority (2015) State of the Wet Tropics Report 2014/15: Economic Value of the Wet Tropics World Heritage Area.

- Wet Tropics Management Authority (2021). Experience de Wet Tropics. Available at: < https://www.wettropics.gov.au/visit> [Accessed 28 Jul 2021].

- WHC-UNESCO (2010) The Gondwana Rainforests of Australia World Heritage Area (extension to existing property). Available at: < https://whc.unesco.org/en/tentativelists/5541/> [Accessed 27 Jul 2021].

- Wilensky U (1999) NetLogo [computer software]. Center for Connected Learning and Computer-Based Modeling. Northwestern University, Evanston, IL. Available from: http://ccl.northwestern.edu/ netlogo. Cited 26 July 2021.

- World Economic Forum (2014) The Future Availability of Natural Resources: A New Paradigm for Global Resources Availability. World Scenario Series [online]. Available at: <http://www3.weforum.org/docs/WEF_FutureAvailabilityNaturalResources_Report_2014.pdf> [Accessed 28 Jul 2021].

- Zen Z, Barlow C and Gondowarsito R (2005) Oil Palm in Indonesian Socioeconomic Improvement. A Review of Options. Working Paper (Australian National University, Canberra, Australia).

| SCENARIO | DESCRIPTION |

|---|---|

| Fractional-reserve banking | The Most common form of banking practised by commercial banks worldwide. Involves accepting deposits from customers and making loans to borrowers while holding in reserve an amount only equal to a fraction of the bank’s deposit liabilities. |

| Full-reserve banking | Also known as 100% reserve banking; banks are required to keep the full amount of depositors’ funds in cash, ready for immediate withdrawal on demand. |

| SCENARIO | DESCRIPTION |

|---|---|

| Business As Usual (BAU) |

Rising global demand for vegetable oils drives oil palm plantation expansion in Indonesia, which consequently enhances increasing amounts of borrowed credits from overseas banks to finance CPO production. This process is financially beneficial for both banks and palm oil companies, yet it incurs biodiversity loss and global warming. The Government of Indonesia is more focused on creating jobs and reducing poverty through expanding the area of oil palm plantations. This situation is reinforced by weak environmental governance, as well as lack of funding allocated by international organizations for conservation. |

| Reduce Biodiversity Loss (RBL) | Funding for (international) conservation increases, thus benefiting biodiversity by enlarging the protected area network and restoring moderately degraded forests in Indonesia. Furthermore, biodiversity loss is halted by firms using credits and public funding to cover the additional costs of creating new plantations in degraded lands and to increase production efficiency in existing plantations. |

| Reduce Carbon Emissions (RCE) | The government of Indonesia receives international funding to maximize above-ground biomass accumulation and reduce carbon emissions. Highly degraded forests are restored due to their high potential to sequestrate carbon. The protected area network is enlarged, yet investments are lower than in RBL since area protection benefits biodiversity conservation more. Carbon sequestration is also enhanced by firms using credits and public funding to create plantations in degraded lands (with low carbon stocks) and increasing productivity in existing cultivations. |

| Sustainable Futures (SF) |

Economically supported by international bodies and developed countries, the government’s goal is to enhance win-win contexts regarding climate change mitigation and biodiversity conservation. Restoration of degraded land takes place in both highly and moderately degraded lands, which benefit biodiversity and carbon conservation. Furthermore, firms use credits and public funding to increase production efficiency in existing cultivations and create plantations in degraded lands. |

| SCENARIO | DESCRIPTION |

|---|---|

| Business As Usual (BAU): “World Heritage” |

The number and extent of protected areas in the Wet Tropics NRM Region keep increasing to be able to meet conservation targets as a World heritage listing site. The total extent of semi-natural areas increases slightly following the trends from the period 1999-2015. Production (mainly sugarcane) remains stable over time due to other regions in Queensland (e.g., Mackay-Whitsundays) being more focused on meeting national production demands. |

| Land Sparing (LSP): “World Heritage and Queensland’s ‘food bowl’ region” |

The region continues to meet conservation targets by increasing the number and extent of protected areas. However, this is combined with increases in the amount of land focused on agricultural (sugarcane) production, enhanced by the Queensland and Australian governments. The goal is for the Wet Tropics NRM Region to improve its contribution to the so-known Australian ‘food bowl’ process. |

| Land Sharing (LSH): “Multifunctional landscapes” |

Queensland and Australian Governments lead a transition towards more multifunctional discourses and governance framework, where wildlife-friendly farming practices are enhanced at the expense of lower sugarcane yields. Thus, the Wet Tropics NRM Region follows opposite trends than in the LSP scenario, where both protected areas and sugarcane lands decrease in exchange for semi-natural areas (above all production forestry). |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).