1. Introduction

The social responsibility activities of financial institutions are increasingly attracting the attention of investors, customers, suppliers, employees, and governments worldwide (Suhadak et al., 2018) (Mahrani & Soewarno, 2018). These activities have become more critical in recent years, especially after the problems that afflicted major financial institutions, which required financial institutions to disclose information related to social responsibility activities in their annual reports (Bachiller & Garcia-Lacalle, 2018) (Ding et al., 2018).

Corporate Social Responsibility (CSR), which has been attracting new attention in recent years from various entities in the capital market, including not only companies but also investors, governments, and academia, generally refers to employees, consumers, and the community, it is accepted as a voluntary and continuous corporate activity that takes into account the interests of various corporate stakeholders, including the environment. There is currently a lot of discussion in Saudi regarding these CSR activities, and one of the main issues is the necessity and incentive for companies to carry out CR continuously (Ali & Al-Aali, 2012).

Some argue that as companies grow and become more influential, they must faithfully perform their role in contributing to economic development and contributing to the needs and interests of various stakeholders as members of society. However, some argue that it is difficult for companies to continuously carry out voluntary CSR activities that are not linked to profits because CSR activities are viewed as a cost from the perspective of companies or investors. In the former case, when CSR activities are viewed from an altruistic perspective regardless of corporate value, problems arise in light of the current legal system that stipulates managers' fiduciary duty to shareholders and investors' tendency to seek profit maximization. It can happen. Because carrying out CSR activities at the expense of shareholders to benefit stakeholders who have not invested capital violates the principle of good faith. In this case, shareholders will no longer want to invest capital in the company. Therefore, for CSR activities to continue to be implemented within the current legal system, CSR must be linked to enhancing corporate value. If this happens, the interests of stakeholders and shareholders will be compatible through CSR activities, and CSR activities by companies will be able to be carried out continuously. The study attempts to answer the following question: Do the dimensions of social responsibility affect accounting information quality? By focusing on the main accounting information characteristics (relevance and reliability). This study might help (the management of the institution, shareholders, creditors, customers, the Tax and Zakat Authority, and society) make decisions.

2. Literature Review

The study (Teoh & Shiu, 1990) examines the

extent to which companies are aware of the characteristics and importance of

information related to social responsibility in making decisions taken by the

company. The study sample included (200) investment companies in Australia. The

results of the study indicated that there is an impact of information related

to social responsibility on the decisions taken by the companies under

investigation, with the possibility that this information may have other

effects if it is transformed into a quantitative form and its content is linked

to reality.

Article (Fan et al., 2023) discussed the impact of

mandatory disclosure of corporate social responsibility information on

corporate profit management in China. The results of the article confirmed a

positive relationship between mandatory corporate social responsibility

information disclosure and corporate profits. (Zahariev et al., 2023) discussed

the integration between the digitization of companies in Bulgaria and social

responsibility in light of the coronavirus pandemic, and the study concluded

that there is a positive relationship and interaction between digitally

advanced institutions and social responsibility activities. (Yaftian et al.,

2012) attempted to disclose the social responsibility of companies listed on

the Tehran Stock Exchange and test the relationships between corporate social

responsibility disclosure and four company characteristics: size,

profitability, financial leverage, and industry type. Among five essential

aspects of social disclosure (human resources, environmental performance and

policies, community activities, energy consumption, customer satisfaction, and

product quality), it was found that human resources are the most common type of

disclosure and that only the size of the disclosing company is significantly

related to the level of comprehensive disclosure of Social Responsibility. (Barauskaite

& Streimikiene, 2021) aimed to investigate some characteristics that

characterize companies and are associated with Disclosing information related

to their social responsibility. The study concluded that companies that. It

provides information related to social responsibility and is generally

distinguished by its size. It has advanced systems for measuring risk,

emphasizing the strength of its long-term position compared to companies That

refrain from revealing this information and found that there is A positive

relationship between the size of the company and the responsibility tasks it

performs Social, which it practices through its various activities. The article

(Rangan et al., 2015) discussed the reason behind refocusing CSR activities by

adopting a systematic method to control CSR processes, and the study concluded

that efficient management did not fully integrate its social responsibilities

with its profit goals. The article (Vilanova et al., 2009) explored the

interconnection between corporate social responsibility and competitive

advantage. The article suggests integrating corporate social responsibility and

business policies. (Chang & Yoo, 2023) conducted on 102 companies in Korea

revealed a positive impact of social responsibility activities on corporate

performance and that high-growth companies have significant social

responsibility activities. Paper (Li et al., 2023) also revealed a positive

relationship between corporate social responsibility information presentation

and investment success in Chinese companies.

3. Conceptual Framework and hypothesis development

3.1. CSR

The concept of corporate social responsibility

appeared during the seventies of the century when financial performance became

part of society. The concept of corporate social responsibility was based on

the existence of an implicit relationship between the company and society (Fifka,

2012); (Boztosun & Aksoylu, 2015)

Then, develop this concept so that companies have a

clear commitment to assume responsibility for society. Despite this, the

concept of social responsibility has been used as a synonym for work ethics (McWilliams

et al., 2006)

(Verboven, 2011)also believes that social

responsibility is all the actions that organizations do that are reflected on

society in a manner characterized by moral transparency following international

standards of conduct

Although many scholars and organizations have

defined CSR, the role and definition of CSR have not yet been established

theoretically (Frooman, 1997). CSR is corporate behavior affecting

stakeholders' wealth (McWilliams et al., 2006) CSR is a legal requirement and

an effort to create social goods beyond corporate interests.

Explain with effort. (Hopkins, 2004) regards CSR as

ethical or responsible for corporate stakeholders.

It is explained as a concept related to treating

things as they are; according to (Tsoutsoura, 2004) a company that fulfills

its social responsibilities contributes to the wealth of its key stakeholders

and meets minimum legal requirements.

Management practices and policies that exceed

requirements must be adopted and developed. Therefore, CSR is a comprehensive

set of policies, practices, and programs integrating corporate operations,

supply chain management, and overall corporate decision-making processes. Most

CSR includes corporate ethics, community investment, environmental issues, human

rights, and markets., and deals with issues related to the workplace. In

addition, many scholars explain CSR activities as a concept related to

obligations to society and stakeholders (Brown & Dacin, 1997) (Sen &

Bhattacharya, 2001) (Luo & Bhattacharya, 2006) seeking to improve society

and the environment. It is accepted as a voluntary act of a company (Mackey et

al., 2007) (Commission of the European Communities, 2002) defines CSR as a

concept in which companies voluntarily make decisions and carry out actions to

contribute to a better society and a cleaner environment, and socially

responsible behavior refers to human rights, the environment, and stakeholders.

He adds that it means complying and investing more in relationships with

others. Although the definition of CSR has not yet been established, in

general, CSR is a legal requirement for various company stakeholders, such as

employees, customers, communities, and the environment. The above is accepted

as a voluntary corporate activity. There is an urgent need for accounting to

define methods for calculating results for companies, taking the social and

economic approach into account, and for companies to pay attention in

particular to the social dimension of their performance in general (Vallverdú Calafell

et al., 2006)(Carroll, 1991) suggested four dimensions of social

responsibility, represented by the economic, legal, ethical, and charitable

aspects. (Rasche et al., 2017) Indicated that social responsibility aims to

encourage organizations to confront many challenges, such as activities related

to social exclusion, climate change, environmental degradation, and ethics.

Professionalism and labor protection. As (Rasche et al., 2017) pointed out, the

levels of social responsibility represent a hierarchical form that allows

moving to the higher levels by fulfilling the obligations at the lower levels,

as they divided them into responsibilities (economic, legal, Ethical, and

Philanthropic).

3.2. AIQ

Accounting information as data that has been

processed becomes more meaningful and can improve the quality of the

decision-making process (Agung, 2015) (Bodnar & Hopwood, 2013). Accounting

information is available to decision-makers in organizations. Accounting

information is the output of a financial-oriented accounting information

system (Wilkinson, 1989).

Accounting information plays an essential role in

financial markets in general and stock markets in particular. It serves as a

cornerstone in investors' decision-making. Poor earnings quality leads to information

asymmetry among investors, spreading the phenomenon. Investors make adverse

decisions in the financial markets. In turn, it increases the risks in

financial markets and investing in stocks in particular. (Bhattacharya et al.,

2013).

The concept of quality of accounting information

means that it must have characteristics that make it useful in making the right

decision. These profits greatly benefit financial evidence in preparing

financial reports and evaluating the information resulting from accounting

methods (Kieso et al., 2013), and explained (Kieso et al., 2019) that

relevance and reliability are the main characteristics of accounting

information. Relevant accounting information is that which has benefits and

positively affects the behavior of the decision-maker.(Abdelraheem et al.,

2021)indicated that essential characteristics of relevance, reliability,

comparability, and understandability characterize good accounting information.

Relevance means the ability of information to make a difference in a decision,

whether by helping to form predictions or confirming previous expectations (Kieso

et al., 2019). Reliability relates to the integrity of the information and the

possibility of relying on it. It is assumed that the information is free of errors

and bias to a reasonable degree and that it faithfully reflects economic events

and helps users make decisions (Bukenya, 2014).

3.3. CSR& AIQ

Social responsibility refers to the organization's

need to pursue corporate strategies and policies consistent with current

economic and legal conditions, work ethics, internal personnel, environment,

and other organizational expectations (Mosley et al., 1996).

Most research has shown that good accounting

information is prepared by generally accepted accounting principles and is

characterized by basic and secondary characteristics: relevance, reliability,

comparability, and understandability (Abdelraheem et al., 2021) (Pit-ten Cate

et al., 2020)

Accounting work must be carried out with a high

level of social responsibility following the principles of disclosure.

Accounting assumes the function of a necessary tool for the social environment

to achieve its goals and fulfill social responsibility obligations while

carrying out broader responsibilities than legal ones. Accounting creates and

reports financial information related to a business, but it has a relevant

impact on all areas of life because of the financial consequences of its

actions (Yilmaz et al., 2000). One of the main guidelines in accounting for

fulfilling these responsibilities is understanding the company's

responsibilities.(Aksoylu, 2013)referred to the dimensions of social

responsibility of companies in Turkey, which are: (economic, legal, social, and

Philanthropic) and explained that they impact accounting information systems. (Qatawneh

& Kasasbeh, 2022)indicated that the reliability and relevance of the

accounting system in small companies in Jordan positively impact the dimensions

of social responsibility (legal, economic, ethical, and Philanthropic) during

the COVID-19 (Kabir & Akinnusi, 2012)discussed the concept of corporate

social responsibility in Turkey, and concluded that there is a relationship

between the SCR and the accounting information disclosure.

The study hypotheses were proposed Based on the

theoretical background and study of (Qatawneh & Kasasbeh, 2022) (Kabir

& Akinnusi, 2012) (Aksoylu, 2013).

H1. The economic dimension of SCR affects the

relevance of accounting information.

H2. The economic dimension of SCR affects the

reliability of accounting information.

H3. The ethical dimension of SCR affects the

relevance of accounting information.

H4. The ethical dimension of SCR affects the

reliability of accounting information.

H5. The legal dimension of SCR affects the

relevance of accounting information.

H6. The legal dimension of SCR affects the

reliability of accounting information.

H7. The philanthropic dimension of SCR affects the

relevance of accounting information.

H8. The philanthropic dimension of SCR affects the

reliability of accounting information.

4. Methodology

The study explores the CSR dimensions and

accounting information quality and the effect of CSR dimensions on accounting

information quality. The questionnaire was used to collect data from the study

sample (managers, accountants, and internal auditors in the Riyadh region banks

- Saudi Arabia). 160 questionnaires were distributed, of which 156 were

collected and 151 were suitable for analysis. The descriptive analytical

approach was relied upon to verify the achievement of the study objectives.

Spss and Smart pls programs are used to analyze the

questionnaire data and test hypotheses.

5. Result & Discussion

5.1. Sample Characteristics

After analysis,

Table 1 indicated that 116 respondents had a bachelor's degree, 26 had a master's degree, and 9 had a secondary school. 77 of the respondents majored in accounting, 60 majored in business administration, and 33 majored in economics. 32 had less than five years of experience, 57 had more than 5 to 15 years of experience, and 11 had more than 15 years of experience.

All figures and tables should be cited in the main text as

Figure 1,

Table 1, etc.

5.2. Assessing Measurement Model:

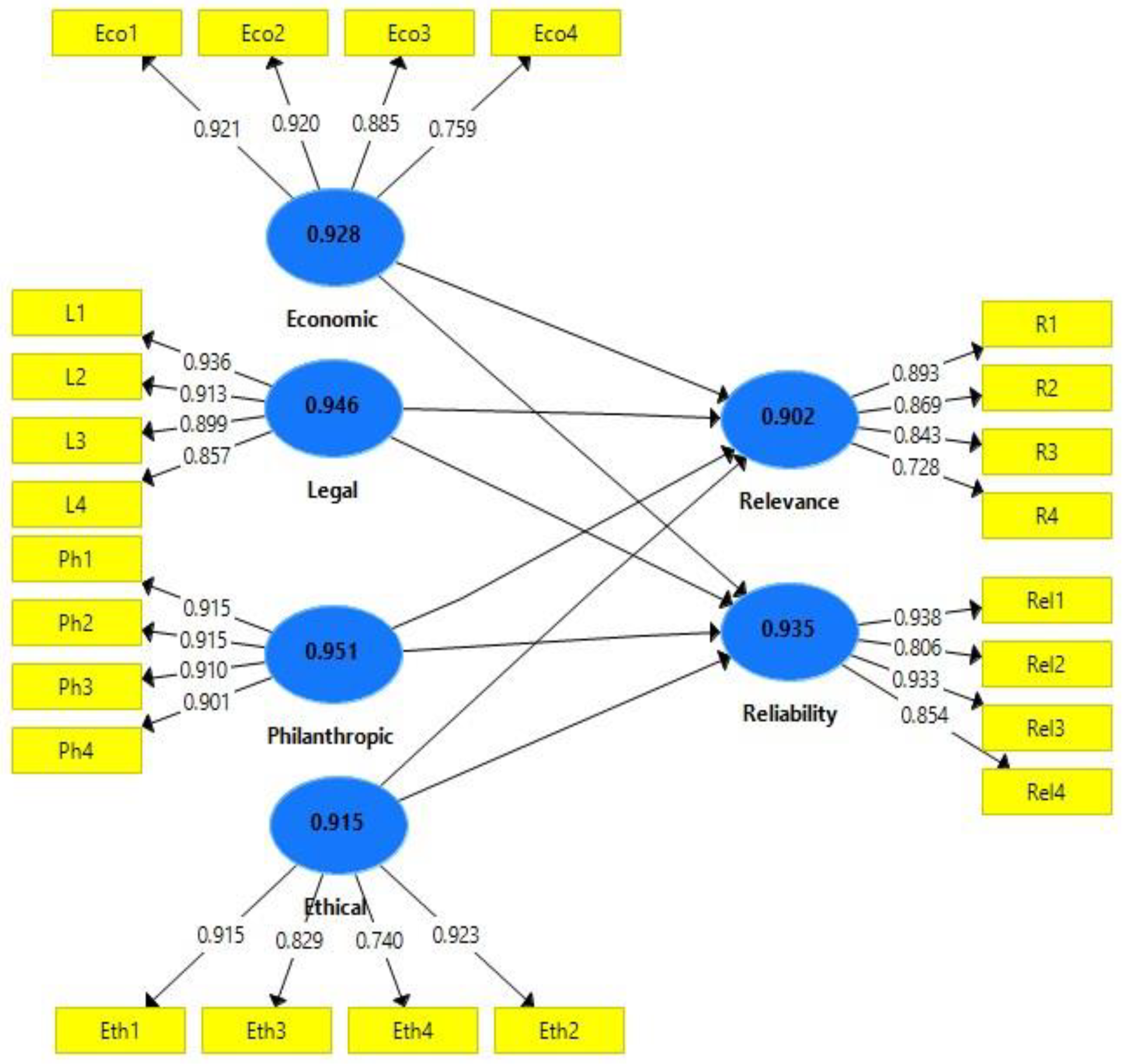

Convergent Validity: It measures the variance of

latent variable loadings. It is measured by average variance extracted (AVE)

and indicator loadings (Hair Jr, Joseph F. et al., 2010) (Fornell &

Larcker, 1981) (Chin, 1998). factor loading must be no less than 70%, and (AVE)

must be no less than 50% (Hair Jr, Joe et al., 2021) (Bagozzi & Yi, 1988);

Table 2 and

Figure 1 show that the AVE > 50%, and factor

loading is greater than 70%; this confirms high of convergent validity.

Consistency Reliability: Consistency Reliability is

used to measure the consistency of results across items in the same test (Hair

Jr, Joseph F. et al., 2010) internal consistency validity is measured by

Composite reliability (CR) and Cronbach's alpha (CA), and that CA must be no

less than 70% (Cronbach, 1951), (Hair Jr, Joe F. et al., 2017) (Gefen et al.,

2000)and CR must be no less than 70% (F. Hair Jr et al., 2014).

Table 2 and Figure

1 shows that the CA and CR values of all latent variables (CSR and

Accounting Information Quality dimensions) and their loadings are greater than

70%; this confirms the high internal consistency reliability.

After identifying validity and reliability,

discriminant validity must be confirmed.

Table 3

indicates the discriminant validity of the structure model, as it became clear

that the correlation of the latent variable with itself is higher than its

correlation with other variables, as explained by (Bagozzi & Yi, 1988), (Hair

Jr, Joseph F., 2006) therefore the discriminant validity was confirmed.

Figure 1.

Measurement Model.

Figure 1.

Measurement Model.

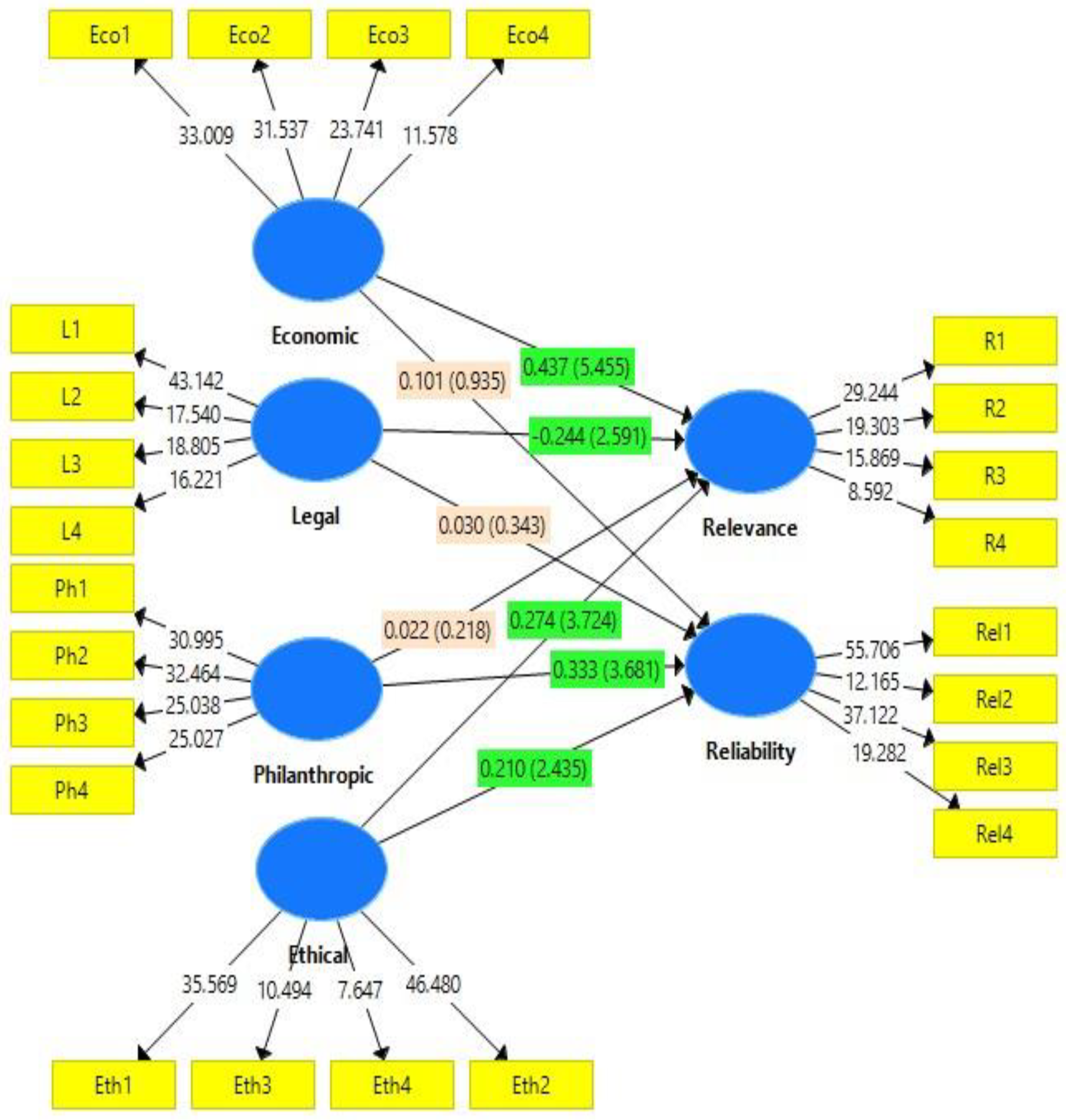

5.3. Assessing the Structural Model

There are several measures to ensure the

suitability of the structural model in PLS-SEM, the most important of which are

the coefficient of determination (R²) and effect size (F²).

(R²) It refers to the variance in the dependent

variable explained by the independent variable (Elliott & Woodward, 2007), (Hair

Jr, Joseph F. et al., 2010), (Hair Jr, Joseph F., 2006)refers to the variance

in the dependent variable that is explained by the independent variable. The

model is considered substantial if the R² greater than 0.67, moderate if the R²

between 0.33- 0.67, and weak if the R² between 0.19 - 0.33. (Chin, 1998) the

model is considered acceptable if the R² value is greater than 0.10.

Table 4 &

Figure

2 shows that the R² values are weak but acceptable (greater than 0.10),

confirming the structural model's suitability.

(F²) determines the effect size of independent variables on

the dependent variables (Hair et al., 2011)The model is considered to have a

large effect if the F² above 0.35, a medium effect if the F² between 0.15- 0.35,

a small effect if the F² between 0.02- 0.15, and no effect if the R² less than

0.02 (Chin, 1998).

Table 4 and

Figure 2 show the values of F², where we notice

that the size effect of social responsibility dimensions on the accounting

information quality is weak. There is no effect of the economic dimension on

accounting information reliability, no effect of the legal dimension on

accounting information reliability, and no effect of the philanthropic

dimension on accounting information relevance.

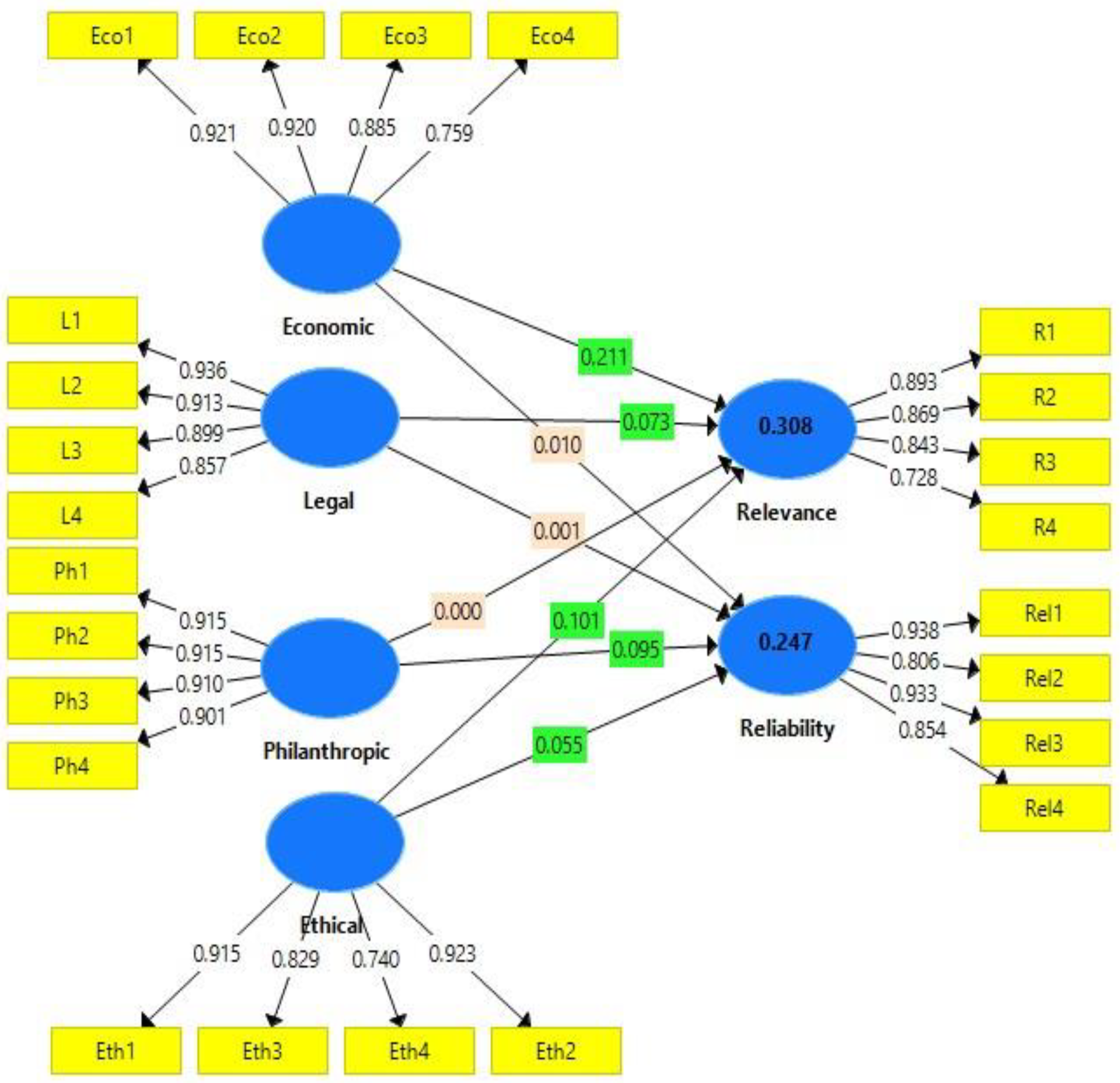

5.4. Structural Equation Model (SEM):

The (SEM) used to hypotheses test throw calculate

the standard beta (St. Beta), T value, and P value, which determines the

effects of the independent variables (CSR) on the dependent variables (AIQ) (Hair

et al., 2011)indicated that the T value at 1.96 (significant at 0.05), the T

value at 2.58 (significant at 0.01), and the T value at 3.29 (significant at

0.001).

Table 4 &

Figure 3 indicates that:

- -

The economic dimension of CSR has a positive effect on accounting information relevance at the significance level of 0.001, St Beta 0.437, and T value 5.455, which is greater than 3.29; this confirms that H1 is accepted.

- -

The economic dimension of CSR does not affect the accounting information reliability at a significance level of 0.05, a St Beta of 0.101, and a T value of 0.935, which is less than 1.96; this indicates that H2 is rejected.

- -

The ethical dimension of CSR positively affects accounting information relevance at the significance level of 0.001, St Beta 0.274, and T value 3.724, which is greater than 3.29; this confirms that H3 is accepted.

- -

The ethical dimension of CSR positively affects accounting information reliability at the significance level of 0.05, St Beta 0.210, and T value 2.435, which is greater than 1.96; this confirms that H4 is accepted.

- -

The legal dimension of CSR negatively affects accounting information relevance at the significance level of 0.01, St Beta -0.244, and T value 2.591, which is greater than 2.58; this confirms that H5 is accepted.

- -

The legal dimension of CSR does not affect the accounting information reliability at the significance level of 0.05, St Beta 0.030, and T value 0.334, which is less than 1.96; this confirms that H6 is rejected.

- -

The philanthropic dimension of CSR does not affect the accounting information reliability at the significance level of 0.05, St Beta 0.022, and T value 0.218, which is less than 1.96; this confirms rejected H7.

- -

The philanthropic dimension of CSR positively affects accounting information relevance at the significance level of 0.001, St Beta 0.333, and T value 3.681, which is greater than 3.29; this confirms that H8 is accepted.

Table 4.

Research Hypotheses Test.

Table 4.

Research Hypotheses Test.

| Hypo |

Effect |

St. Beta |

T Value |

P Values |

Result |

| H1 |

Economic -> Relevance |

0.437 |

5.455 |

0.000 |

Accepted*** |

| H2 |

Economic -> Reliability |

0.101 |

0.935 |

0.350 |

Rejected |

| H3 |

Ethical -> Relevance |

0.274 |

3.724 |

0.000 |

Accepted*** |

| H4 |

Ethical -> Reliability |

0.210 |

2.435 |

0.015 |

Accepted* |

| H5 |

Legal -> Relevance |

-0.244 |

2.591 |

0.010 |

Accepted** |

| H6 |

Legal -> Reliability |

0.030 |

0.343 |

0.732 |

Rejected |

| H7 |

Philanthropic -> Relevance |

0.022 |

0.218 |

0.828 |

Rejected |

| H8 |

Philanthropic -> Reliability |

0.333 |

3.681 |

0.000 |

Accepted*** |

Figure 3.

Structural Equation Model.

Figure 3.

Structural Equation Model.

6. Conclusion

The study revealed that the CSR dimensions are (economic, ethical, legal, and charitable), as specified by (Garcia-Piqueres & Garcia-Ramos, 2022) It also clarified that (relevance and reliability) are among the most important dimensions of accounting information quality, and this is what was confirmed by (Abdelraheem et al., 2021), (Pit-ten Cate et al., 2020).

Accounting studies regarding social responsibility focused on measuring and disclosing social costs and returns. They did not investigate the dimensions of social responsibility nor its relationship to the quality of accounting information. Although some studies have addressed the relationship between social responsibility and financial performance, some of them indicated the existence of a relationship and others did not find a relationship between them. In an inexplicit manner, these studies referred to the relationship between social responsibility and the quality of accounting information.

The study result agreed with (Qatawneh & Kasasbeh, 2022), (Kabir & Akinnusi, 2012) ,(Aksoylu, 2013) as it became clear that there is a positive effect of the CSR economic and ethical dimension on the relevance of accounting information and the study differed from these studies because there is a negative effect of the CSR legal dimension on the relevance of accounting information. It differed from them because the CSR philanthropic dimension had no effect on the relevance of accounting information. As for the effect of CSR dimensions on the reliability of accounting information, the study agreed with (McWilliams et al., 2006) as it became clear that there is a positive effect of the CSR ethical and philanthropic dimension on the reliability of accounting information and it agreed with (Soana, 2011) (Aupperle et al., 1985) the CSR economic and legal dimension no effect the reliability of accounting information.

Some limitations may explain the weakness of the study's results, the most important of which is the study's reliance on a small random sample, in addition to the study's application to the banking sector in the Riyadh region. Therefore, the researcher recommends conducting studies on other sectors (industrial, commercial).

Conflicts of Interest

The author declares no conflict of interest.

Funding

“This research was funded by Prince Sattam bin Abdulaziz University, project number (PSAU/2023/02/24856)”.

Institutional Review Board Statement

Not applicable.

Data Availability Statement

Available on request.

Acknowledgments

The author would like to acknowledge Prince Sattam bin Abdulaziz University for providing electronic libraries, citation and plagiarism programs. The author also expresses his gratitude to Asaad Mubarak for proofreading and reviewing empirical study results.

References

- Abdelraheem, A.; Hussaien, A.; Mohammed, M.; Elbokhari, Y. The effect of information technology on the quality of accounting information. Accounting 2021, 7, 191–196. [Google Scholar] [CrossRef]

- Agung, M. Accounting information system and improvement on financial reporting. International Journal of Recent Advances in Multidisciplinary Research 2015, 2, 950–957. [Google Scholar]

- Aksoylu, S. Relationships of corporate social responsibility (CSR) with accounting information systems: A study. Journal of Modern Accounting and Auditing 2013, 9, 1678–1686. [Google Scholar] [CrossRef]

- Ali, A.J.; Al-Aali, A. Corporate Social Responsibility in Saudi Arabia. Middle East Policy 2012, 19, 40–53. [Google Scholar] [CrossRef]

- Aupperle, K.E.; Carroll, A.B.; Hatfield, J.D. An empirical examination of the relationship between corporate social responsibility and profitability. Academy of Management Journal 1985, 28, 446–463. [Google Scholar] [CrossRef]

- Bachiller, P.; Garcia-Lacalle, J. Corporate governance in Spanish savings banks and its relationship with financial and social performance. Management Decision 2018, 56, 828–848. [Google Scholar] [CrossRef]

- Bagozzi, R.P.; Yi, Y. On the evaluation of structural equation models. Journal of the Academy of Marketing Science 1988, 16, 74–94. [Google Scholar] [CrossRef]

- Barauskaite, G.; Streimikiene, D. Corporate social responsibility and financial performance of companies: The puzzle of concepts, definitions and assessment methods. Corporate Social Responsibility and Environmental Management 2021, 28, 278–287. [Google Scholar] [CrossRef]

- Bhattacharya, N.; Desai, H.; Venkataraman, K. Does earnings quality affect information asymmetry? Evidence from trading costs. Contemporary Accounting Research 2013, 30, 482–516. [Google Scholar] [CrossRef]

- Bodnar, G.H.; Hopwood, W.S. Accounting information systems; Pearson, 2013. [Google Scholar]

- Boztosun, D.; Aksoylu, S. Relationships of corporate social responsibility with perceived financial performance of businesses: A study. China-USA Business Review 2015, 14, 557–565. [Google Scholar] [CrossRef]

- Brown, T.J.; Dacin, P.A. The company and the product: Corporate associations and consumer product responses. Journal of Marketing 1997, 61, 68–84. [Google Scholar] [CrossRef]

- Bukenya, M. Quality of accounting information and financial performance of Uganda’s public sector. American Journal of Research Communication 2014, 2, 183–203. [Google Scholar]

- Carroll, A.B. The pyramid of corporate social responsibility: Toward the moral management of organizational stakeholders. Business Horizons 1991, 34, 39–48. [Google Scholar] [CrossRef]

- Chang, Y.J.; Yoo, J.W. When CSR Matters: The Moderating Effect of Industrial Growth Rate on the Relationship between CSR and Firm Performance. Sustainability 2023, 15, 13677. https://www.mdpi.com/2071-1050/15/18/13677#. [CrossRef]

- Chin, W.W. The partial least squares approach to structural equation modeling. Modern Methods for Business Research 1998, 295, 295–336. [Google Scholar]

- Commission of the European Communities. Communication from the Commission concerning corporate social responsibility: A business contribution to sustainable development; Commission of the European Communities, 2002. [Google Scholar]

- Cronbach, L.J. Coefficient alpha and the internal structure of tests. Psychometrika 1951, 16, 297–334. [Google Scholar] [CrossRef]

- Ding, D.K.; Ferreira, C.; Wongchoti, U. Reading between the lines: not all CSR is good CSR. Pacific Accounting Review 2018, 30, 318–333. [Google Scholar] [CrossRef]

- Elliott, A.C.; Woodward, W.A. Statistical analysis quick reference guidebook: With SPSS examples; Sage, 2007. [Google Scholar]

- Hair, J.F., Jr.; Sarstedt, M.; Hopkins, L.; G. Kuppelwieser, V. Partial least squares structural equation modeling (PLS-SEM) An emerging tool in business research. European Business Review 2014, 26, 106-121. [CrossRef]

- Fan, Q.; Chun, D.; Ban, Q.; Jiang, Y.; Li, H.; Xu, L. Mandatory Disclosure of Corporate Social Responsibility and the Quality of Earnings Management. Sustainability 2023, 15, 13026. https://www.mdpi.com/2071-1050/15/17/13026#. [CrossRef]

- Fifka, M. The development and state of research on social and environmental reporting in global comparison. Journal Für Betriebswirtschaft 2012, 62, 45–84. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Frooman, J. Socially irresponsible and illegal behavior and shareholder wealth: A meta-analysis of event studies. Business Society 1997, 36, 221–249. [Google Scholar] [CrossRef]

- Garcia-Piqueres, G.; Garcia-Ramos, R. Complementarity between CSR dimensions and innovation: behaviour, objective or both? European Management Journal 2022, 40, 475–489. [Google Scholar] [CrossRef]

- Gefen, D.; Straub, D.; Boudreau, M. Structural equation modeling and regression: Guidelines for research practice. Communications of the Association for Information Systems 2000, 4, 7. [Google Scholar] [CrossRef]

- Hair Jr, J.F.; Matthews, L.M.; Matthews, R.L.; Sarstedt, M. PLS-SEM or CB-SEM: updated guidelines on which method to use. International Journal of Multivariate Data Analysis 2017, 1, 107–123. [Google Scholar] [CrossRef]

- Hair, J., Jr.; Hair, J.F., Jr; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M. A primer on partial least squares structural equation modeling (PLS-SEM); Sage publications, 2021. [Google Scholar]

- Hair, J.F., Jr. Successful strategies for teaching multivariate statistics. Paper presented at the Proceedings of the 7th International Conference On 2006, 1–5. [Google Scholar]

- Hair, J.F., Jr.; Babin, B.J.; Anderson, R.E. A global p-erspect-ivie; Kennesaw State University: Kennesaw, 2010. [Google Scholar]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. PLS-SEM: Indeed a silver bullet. Journal of Marketing Theory and Practice 2011, 19, 139–152. [Google Scholar] [CrossRef]

- Hopkins, M. (2004). Corporate social responsibility: an issues paper. [CrossRef]

- Kabir, H.; Akinnusi, D.M. Corporate social and environmental accounting information reporting practices in Swaziland. Social Responsibility Journal 2012, 8, 156–173. [Google Scholar] [CrossRef]

- Kieso, D.E.; Weygandt, J.J.; Warfield, T.D.; Wiecek, I.M.; McConomy, B.J. Intermediate Accounting, Volume 2; John Wiley & Sons, 2019. [Google Scholar]

- Kieso, D.E.; Weygandt, J.J.; Warfield, T.D.; Young, N.M.; Wiecek, I.M.; McConomy, B.J. Intermediate Accounting, 10th Canadian Edition, Volume 2; Wiley Global Education, 2013. [Google Scholar]

- Li, Z.; Li, S.; Huo, Z.; Liu, Y.; Zhang, H. Does CSR Information Disclosure Improve Investment Efficiency? The Moderating Role of Analyst Attention. Sustainability 2023, 15, 12310. [Google Scholar] [CrossRef]

- Luo, X.; Bhattacharya, C.B. Corporate social responsibility, customer satisfaction, and market value. Journal of Marketing 2006, 70, 1–18. [Google Scholar] [CrossRef]

- Mackey, A.; Mackey, T.B.; Barney, J.B. Corporate social responsibility and firm performance: Investor preferences and corporate strategies. Academy of Management Review 2007, 32, 817–835. [Google Scholar] [CrossRef]

- Mahrani, M.; Soewarno, N. The effect of good corporate governance mechanism and corporate social responsibility on financial performance with earnings management as mediating variable. Asian Journal of Accounting Research 2018, 3, 41–60. [Google Scholar] [CrossRef]

- McWilliams, A.; Siegel, D.S.; Wright, P.M. Corporate social responsibility: Strategic implications. Journal of Management Studies 2006, 43, 1–18. [Google Scholar] [CrossRef]

- Mosley, D.C.; Pietri, P.H.; Megginson, L.C. Management, leadership in action. (No Title), 1996. [Google Scholar]

- Pit-ten Cate, I.M.; Hörstermann, T.; Krolak-Schwerdt, S.; Gräsel, C.; Böhmer, I.; Glock, S. Teachers’ information processing and judgement accuracy: Effects of information consistency and accountability. European Journal of Psychology of Education 2020, 35, 675–702. [Google Scholar] [CrossRef]

- Qatawneh, A.M.; Kasasbeh, H. Role of Accounting Information Systems (AIS) Applications on Increasing SMES Corporate Social Responsibility (CSR) During COVID 19. In Digital economy, business analytics, and big data analytics applications; Springer, 2022; pp. 547–555. [Google Scholar]

- Rangan, K.; Chase, L.; Karim, S. The truth about CSR. Harvard Business Review 2015, 93, 40–49. [Google Scholar]

- Rasche, A.; Morsing, M.; Moon, J. Corporate social responsibility: Strategy, communication, governance; Cambridge University Press, 2017. [Google Scholar]

- Sen, S.; Bhattacharya, C.B. Does doing good always lead to doing better? Consumer reactions to corporate social responsibility. Journal of Marketing Research 2001, 38, 225–243. [Google Scholar] [CrossRef]

- Soana, M. The relationship between corporate social performance and corporate financial performance in the banking sector. Journal of Business Ethics 2011, 104, 133–148. [Google Scholar] [CrossRef]

- Suhadak, S.; Kurniaty, K.; Handayani, S.R.; Rahayu, S.M. Stock return and financial performance as moderation variable in influence of good corporate governance towards corporate value. Asian Journal of Accounting Research 2018, 4, 18–34. [Google Scholar] [CrossRef]

- Teoh, H.Y.; Shiu, G.Y. Attitudes towards corporate social responsibility and perceived importance of social responsibility information characteristics in a decision context. Journal of Business Ethics 1990, 9, 71–77. [Google Scholar] [CrossRef]

- Tsoutsoura, M. Corporate social responsibility and financial performance. 2004.

- Vallverdú Calafell, J.; Moya Gutiérrez, S.; Somoza López, A. Social responsibility and accounting: A possible binomial. International Advances in Economic Research 2006, 12, 125–130. [Google Scholar] [CrossRef]

- Verboven, H. Communicating CSR and business identity in the chemical industry through mission slogans. Business Communication Quarterly 2011, 74, 415–431. [Google Scholar] [CrossRef]

- Vilanova, M.; Lozano, J.M.; Arenas, D. Exploring the nature of the relationship between CSR and competitiveness. Journal of Business Ethics 2009, 87, 57–69. [Google Scholar] [CrossRef]

- Wilkinson, J.W. Accounting information systems: Essential concepts and applications; John Wiley & Sons, Inc., 1989. [Google Scholar]

- Yaftian, A.; Wise, V.; Cooper, K.; Mirshekary, S. Social reporting in the annual reports of Iranian listed companies. Corporate Ownership Control 2012, 10, 26–33. [Google Scholar] [CrossRef]

- Yilmaz, B.; Yilmaz, O.; Akmese, H. The role of accounting information system in business in terms of corporate governance and social responsibility of accounting in crisis periods and a research. Emergence 2000, 16. http://:10.19275/RSEPCONFERENCES013.

- Zahariev, A.; Ivanova, P.; Zaharieva, G.; Slaveva, K.; Mihaylova, M.; Todorova, T. Interplay between CSR and the Digitalisation of Bulgarian Financial Enterprises: HRM Approach and Pandemic Evidence. Journal of Risk and Financial Management 2023, 16, 385. [Google Scholar] [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).