1. Introduction

Increasingly, interest in ESG (Environmental, Social, and Governance) has risen, with a broad range of movements taking place to apply it across various areas. This growing emphasis reflects a significant shift in business approaches to sustainability and corporate responsibility. Influenced by factors like technological advancements, evolving societal norms, and a heightened focus on sustainable practices, this change marks a departure from historical struggles to adopt technologies and practices aligned with environmental and social responsibility. Now, there is a shift towards integrating technology with sustainability and planetary health, underscored by legal, social, moral, and financial changes [

1]. The United Nations has played a pivotal role in addressing global challenges. Recently, interest in ESG (Environmental, Social, and Governance) has risen, with a broad range of movements taking place to apply it across various areas. This growing emphasis reflects a significant shift in business approaches to sustainability and corporate responsibility. Influenced by factors like technological advancements, evolving societal norms, and a heightened focus on sustainable practices, this change marks a departure from historical struggles to adopt technologies and practices aligned with environmental and social responsibility. Now, there is a shift towards integrating technology with sustainability and planetary health, underscored by legal, social, moral, and financial changes [

1]. The United Nations has played a pivotal role in addressing global challenges such as climate change and environmental degradation, advocating for corporate participation in these efforts [

2]. Consequently, new ESG-related standards and frameworks are emerging to guide companies in aligning their business goals with global environmental concerns [

3].

The prominence of ESG among global firms is driven by several factors. First, the investor community's growing focus on sustainable and responsible investments recognizes the impact of ESG factors on long-term financial performance and risk management [

4]. This shift motivates companies to adopt ESG practices to attract and retain investment. Second, ESG is crucial for risk mitigation, as environmental and social risks can significantly affect a company's operations, reputation, and financial standing [

5]. Third, ESG practices provide a competitive advantage, as consumers and stakeholders often prefer companies with strong ESG commitments, enabling these firms to differentiate themselves and enhance market performance [

6]. Additionally, regulatory compliance has become a key driver behind ESG adoption. With governments and regulatory bodies enforcing ESG standards, proactive implementation helps companies minimize compliance costs and legal risks [

7]. Finally, ESG offers opportunities for long-term value creation through initiatives like renewable energy use and responsible supply chain management, leading to cost savings and operational efficiency [

8].

Considering the evolving business environment, ESG has transcended its status as a mere buzzword to become an integral part of corporate strategy. Effective ESG management allows companies to align their business objectives with broader societal and environmental goals, thus enhancing financial performance and stakeholder relations [

9]. This paper examines the ESG practices, including strategies, activities, and performance indicators, of five major Korean global companies, aiming to identify common features and differences among them. The insights gained from the ESG approaches of these Korean global companies are believed to offer valuable lessons for companies worldwide.

2. Literature Review

The Literature Review section provides a comprehensive analysis of existing research and theories related to Environmental, Social, and Governance (ESG) concepts, tracing their evolution and impact on corporate strategies and societal outcomes. It critically evaluates diverse scholarly perspectives and empirical findings, setting the foundation for understanding the multifaceted nature of ESG in the business context.

2.1. An Overview of ESG Concept Development

Over the past decades, the concept of ESG (Environmental, Social, and Governance) has evolved, incorporating several ideas along the way. This evolution reveals distinct conceptual development paths:

Introduction to ESG: The ESG concept gained prominence with the 2004 UN report "Who Cares Wins" [

10]. This report marked a significant shift in how global financial institutions approach sustainable investment, emphasizing the need to incorporate environmental, social, and governance factors into business strategies. ESG encompasses a range of issues, from environmental concerns like pollution and climate change to social aspects such as employment diversity and community engagement, as well as governance elements including ethical leadership and anti-corruption practices [

11].

Differentiation from CSR and CSV: The development of ESG can be contrasted with Corporate Social Responsibility (CSR) and Creating Shared Value (CSV). CSR, conceptualized by Howard Bowen in 1953 [

12], traditionally focuses on philanthropy and social responsibility post-profit. In contrast, ESG integrates ethical practices within the core business model. CSV, introduced by Michael Porter in 2011 [

13], advances this idea by suggesting that businesses can create economic value in ways that also create value for society, moving beyond the traditional scope of CSR.

Connection with Sustainability: The concept of sustainability, defined in the 1987 Brundtland Report by the World Commission on Environment and Development [

14], is essential for contextualizing ESG. While sustainability focuses on meeting the present generations' needs without compromising future generations' benefits, ESG centers on non-financial factors crucial for societal values, indirectly supporting sustainability [

14].

The Rise of the Triple Bottom Line: The Triple Bottom Line (TBL) framework, first articulated by Freer Spreckley in 1981 [

15] and later popularized by John Elkington in 1997 [

16], laid the groundwork for ESG. This framework advocates for a comprehensive approach to business performance, encompassing financial, social, and environmental aspects, and redefining corporate responsibility.

Global Trends in ESG Disclosure: The global emphasis on ESG is evident in regulatory trends. The EU's Non-Financial Information Reporting Directive (NFRD) since 2018 [

17] and the US SEC’s mandatory climate-related disclosures in 2024 [

18] underscore this paradigm shift. Additionally, the widespread adoption of Global Reporting Initiative (GRI) standards, managed by the Global Sustainability Standard Board (GSSB), illustrates the importance of detailed and sector-specific ESG reporting [

19]. As ESG disclosure becomes normative, its integration into corporate management becomes crucial. The evolving business environment underscores the importance of research that views ESG as a fundamental aspect of business strategy, aligning corporate objectives with societal and environmental goals [

9].

2.2. ESG Research Trend

The field of ESG research has seen a remarkable evolution, reflecting the growing integration of sustainability and governance in the business lexicon. This expansion has led to a diverse array of studies focusing on various aspects of Environmental, Social, and Governance (ESG) issues, underscoring their increasing relevance in the modern corporate and societal context. Examining the ESG research trend highlights several important issues as follows:

To find performance factors as compliance with regulations: In past decades, studies of CSR, mostly from a financial viewpoint, focused on finding evidence of CSR’s impact on financial performance. A firm’s carbon emissions positively impact its stock returns because investors demand carbon risk premiums[

20]. Institutional shareholders initiate engagement in environmental and social responsibility of firms to protect their portfolios’ financial performance from externalities, such as ESG risks (i.e., financial performance affected by CSR activities) [

21]. These studies, conducted on both conceptual and empirical research, yielded mixed results. Most research indicates that firms’ ESG performance has a positive impact on financial performance [

21,

22,

23,

24,

25,

26,

27]. Conversely, some studies show that ESG activities have a negative impact [28; 29; 30; 20], or no impact on a firm’s performance [31; 28]. These differing results could be attributed to the varied composition and activities of a firm’s ESG by region or country.

To respond to social needs: Customers, users, and other stakeholders are interested in the transparency a company can provide. There are various reasons why companies should implement CSR programs and continuously examine their impact on stakeholder groups [

32]. Companies that perform CSR and quickly identify their impact on society gain legitimacy and reputation, resulting in competitive advantages in the market and influencing customer preferences, investors, and job seekers [

33].

To satisfy consumers and Investors: Recent studies involving actual consumers [

34] suggest that awareness of corporate CSR activities among consumers is generally low, posing a challenge for companies to strategically engage in rewarding CSR activities. For evaluations and research on stakeholder reactions to CSR to be meaningful, it is necessary to academically validate the content of CSR. Furthermore, marketing researchers and practitioners claim that the impact of CSR in practice is more multifaceted than currently acknowledged by academics. Recent studies [35; 36; 37] argue that there are individuals likely to maintain various stakeholder relationships (e.g., prospective investors and employees). They can respond to corporate CSR initiatives not only by purchasing more products but also by influencing the behavior of other stakeholders, such as job seekers [38; 39].

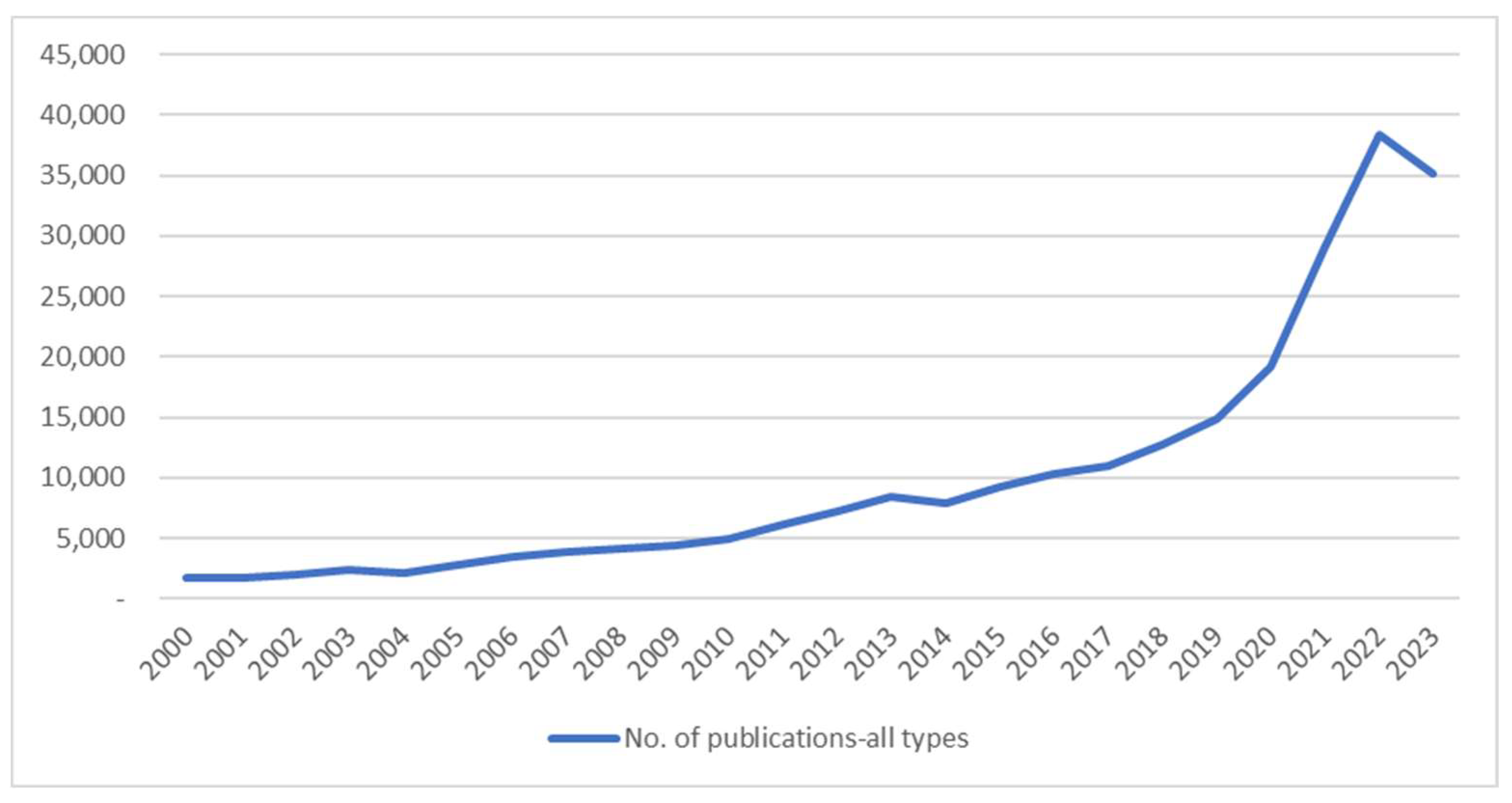

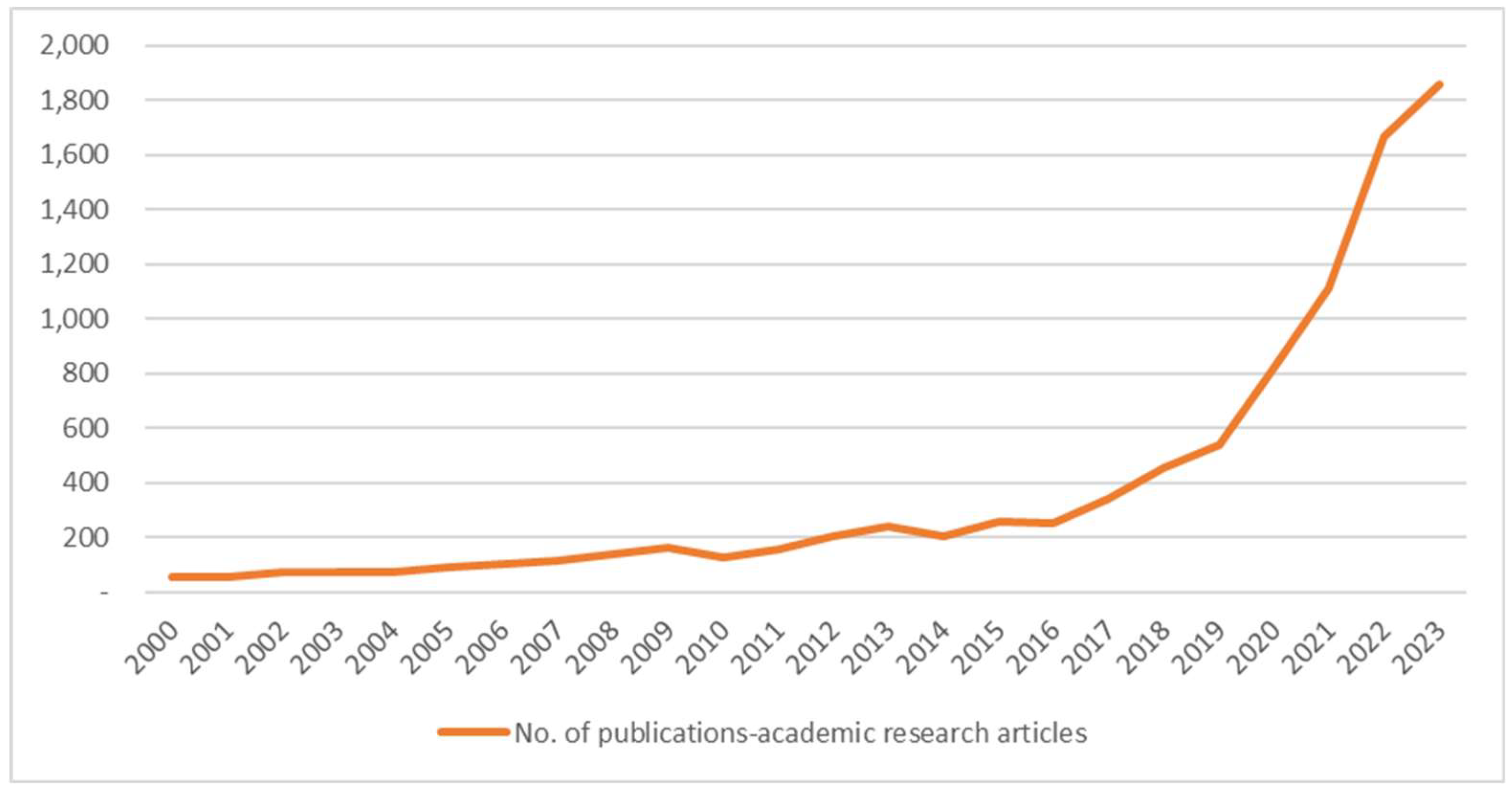

Figure 1 and

Figure 2 illustrate the increasing number of publications and academic research articles on Environmental, Social, and Governance (ESG) issues over time, highlighting a growing global interest and awareness in these areas. This trend is significant for several reasons. First, it reflects the expanding recognition of the importance of ESG issues in both the academic and corporate sectors, indicating a societal shift toward prioritizing sustainability, ethical business practices, and corporate responsibility. The growth in publications also underscores the need for continuous research to inform policy and strategic decisions in businesses and governments, ensuring a balance between profitability, sustainability, and ethical considerations.

Furthermore, the increasing academic focus on ESG topics, as illustrated in

Figure 2, is critical for understanding and managing the risks associated with environmental, social, and governance aspects. This research plays a key role in guiding investment decisions, with more investors now relying on ESG metrics to assess the sustainability and ethical standards of companies. Additionally, it is essential for benchmarking corporate performance, adapting to regulatory changes, and enhancing public perception and trust. The trend depicted in these figures underscores the significance of ESG research in shaping future business practices and policies, and in contributing to a more sustainable and ethically responsible global economy.

2.3. Growing Attention to Korean Global Firms

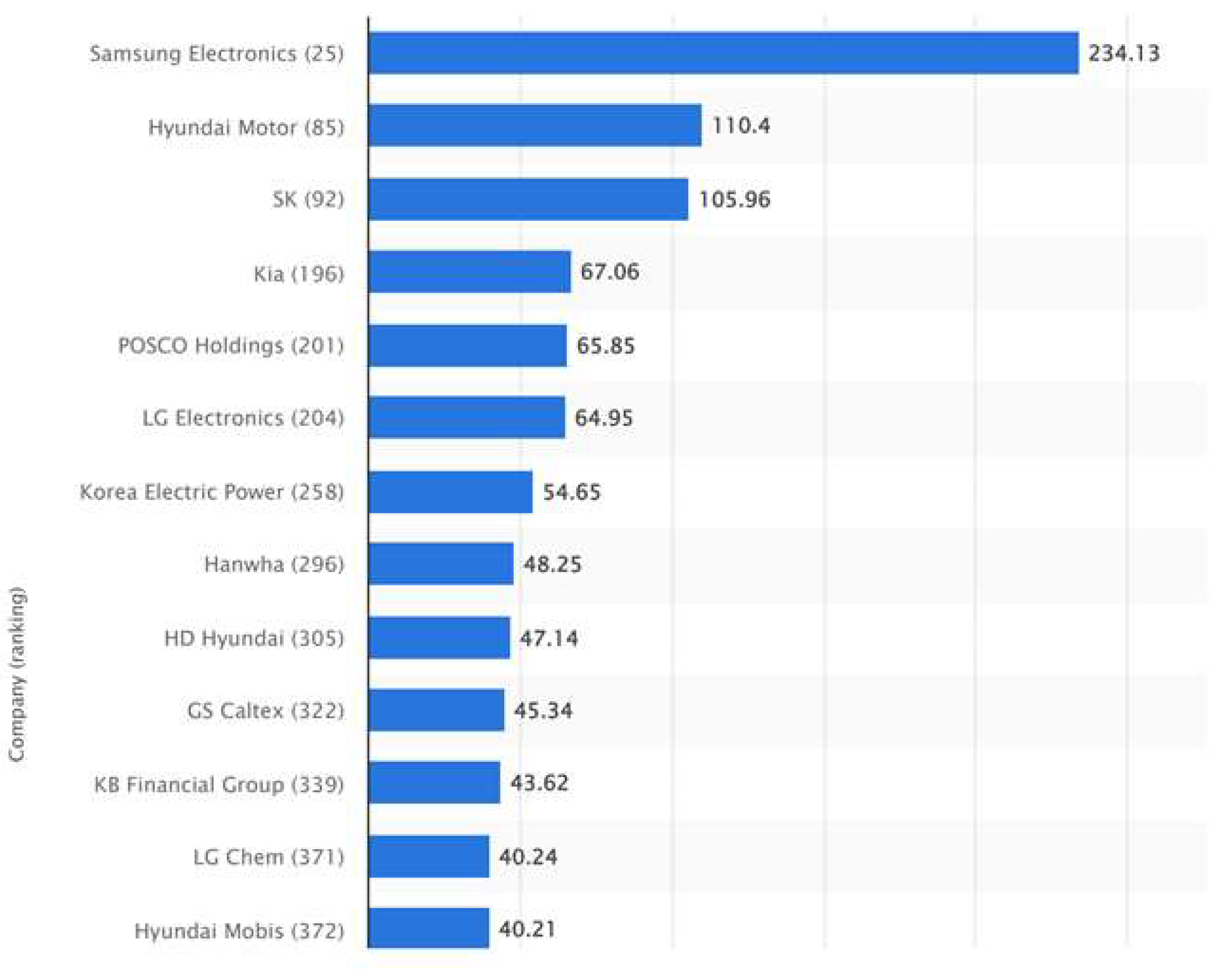

The Korean economy has been growing steadily since the 1950s and is now ranked among the top 15 countries by GDP. As depicted in

Table 1 and

Figure 3, Korea is a significant player in the global market, actively participating in global trade. However, despite their growing influence, the ESG practices of Korean firms remain underrepresented. This paper analyzes the ESG practices of five prominent Korean firms in the global market. There are several reasons why Korean global firms serve as good examples for ESG practices. Firstly, they have demonstrated a strong commitment to environmental sustainability by implementing various green initiatives, such as reducing carbon emissions, energy consumption, and waste generation in their operations. Secondly, Korean firms have made significant strides in social and political democracy by addressing issues like labor rights and employee well-being, and by demonstrating corporate social responsibility through investments in community development and education. Thirdly, there has been a notable improvement in corporate governance practices among Korean firms, particularly in enhancing transparency in decision-making and reporting, and actively engaging with various stakeholders, including customers, employees, and investors. As Korea has uniquely transitioned from a very underdeveloped country to a successful OECD member since the Second World War, it could serve as an exemplary model for developing and emerging economies in the Global South.

Figure 4 illustrates the increasing trend in the number of Korean companies publishing Environmental, Social, and Governance (ESG) reports. This upward trajectory is significant for several reasons. It signals a growing commitment among Korean businesses to ESG practices, reflecting a broader movement toward sustainability and corporate responsibility. The rising participation of Korean companies in ESG reporting positions them as potential leaders or early adopters in this area, making them valuable subjects for case studies. These studies can offer insights into successful ESG practices for business firms in the global market, especially considering Korea's growing importance and position in the world economy.

The case study of Korean companies is crucial for understanding ESG implementation in diverse corporate structures and cultures. It provides insights into how businesses adapt to specific regulatory environments and integrate ESG into their operational strategies. Known for their technological and industrial innovation, Korean companies can also illuminate innovative ESG solutions. Their diverse range of industries allows for a comprehensive analysis of ESG practices across different sectors, providing benchmarks for global companies. Therefore, studying Korean companies in ESG research contributes not only to understanding region-specific practices but also offers valuable lessons for global sustainable development and ethical business practices.

3. Case Research Methods

3.1. Case Selection Criteria

Five Korean global firms have been selected for this case study. The criteria for selecting these firms are as follows. Firstly, they are leading and prominent firms in the global market, thus having significant influence in their respective fields. Their ESG practices are considered benchmarks for other firms. The selected companies are Samsung Electronics, Hyundai Motors, POSCO, SK Hynix, and LG Chemical, representing key industries crucial for ESG management, including electronics, auto manufacturing, steelmaking, and the chemical industry.

Samsung Electronics is a major manufacturer of electronic components, supplying clients such as Apple, Sony, HTC, and Nokia, and is the world's largest manufacturer of mobile phones and smartphones. Hyundai Motors, a multinational automotive manufacturer, sells vehicles in almost 200 countries and, as of 2022, is the world's third-largest carmaker, behind Toyota and Volkswagen. POSCO, a steel-making company, produces over 40 million metric tons of crude steel annually, ranking as the world's sixth-largest steelmaker and the largest by market value. SK Hynix is a key supplier of dynamic random-access memory (DRAM) chips and flash memory chips, standing as the world's second-largest memory chipmaker after Samsung Electronics and the third-largest semiconductor company. LG Chemical is ranked as the 10th largest chemical company in the world by sales.

3.2. Data Source and Scope of Analysis

The primary sources for this study are the annual and ESG reports of the selected companies from 2018 to 2022. The analysis focuses on the ESG practices of these companies, with a comparison of their common characteristics and differences summarized in the tables. These tables encompass aspects like vision and rationale, general goals and priorities, activities performed, and key performance measures. Additionally, the study involves a detailed examination of the ESG fields, related business KPIs, and qualitative performance evaluations as presented in the reports. It also tracks the evolution of each company’s ESG management strategies, including changes in KPIs and goals over time.

4. Case Analysis

4.1. ESG strategies

In

Table 2, the Environmental, Social, and Governance (ESG) strategies of five major companies – Samsung, Hyundai Motors, LG Chem, POSCO, and SK Hynix – are outlined, revealing both shared and unique aspects of their approaches. Each company is implementing ESG management strategies tailored to its industry and corporate structure.

Samsung Electronics focuses on making a positive impact on people's lives through innovative technology. Their ESG goals include eco-conscious manufacturing, reducing energy consumption, utilizing recycled materials, and introducing eco-packaging. Hyundai Motors aspires to create a desirable future through responsible actions. Their ESG goals are directed toward planetary well-being, corporate growth, and societal change. LG Chem aims to bridge science with life for a better future. Their ESG strategy encompasses climate action, a circular economy, environmental protection, and a responsible supply chain. POSCO's vision of building a better future together involves transitioning to low-carbon, eco-friendly steelmaking processes, developing smart steelworks, enhancing product competitiveness, innovating corporate culture, and establishing ESG management based on corporate citizenship. SK Hynix's "Double Bottom Line" vision balances economic and social values. Their strategy includes uncovering growth drivers, strengthening ESG management, expanding R&D, and responding to COVID-19 by establishing a safe work environment, supporting local communities, and focusing on employee mental health.

The case study highlights two common characteristics across these companies. First, despite varying industrial contexts, there is a concerted effort to integrate ESG factors into management systems and business structures. This reflects a global trend towards adopting ESG management paradigms. Second, these companies prioritize environmental aspects in response to climate change, focusing on activities like reducing greenhouse gas emissions and implementing eco-friendly practices. For instance, Samsung Electronics emphasizes environmental aspects in its ESG goals, particularly in the supply chain. Their activities include GHG emission reduction, renewable energy usage, managing electronic waste, and water resource management. They also aim to establish a sustainable supply chain through a mutual growth partner management system. SK Hynix has developed a PRISM framework for its ESG strategy, with 'R' (restore) and 'I' (innovate) focusing on environmental activities. 'Restore' involves climate action, water stewardship, and a circular economy, while 'Innovate' covers sustainable manufacturing and green technology. In summary, these leading Korean companies are actively integrating ESG into their core business strategies, emphasizing environmental conservation and sustainability as key components of their corporate agendas.

Despite these commonalities, the companies exhibit distinct differences in their ESG strategies. Samsung's approach centers on reducing energy consumption and using recycled materials, whereas Hyundai Motors emphasizes planet-friendly actions and societal change. LG Chem focuses on climate action and a circular economy, while POSCO is geared towards transitioning to low-carbon steelmaking and establishing robust ESG management. SK Hynix differentiates itself by addressing COVID-19 related challenges, including employee well-being and community advancement. These differences highlight the individualized strategies of each company, reflecting their specific corporate visions and operational contexts.

4.2. ESG activities

This section analyzes the Environmental, Social, and Governance (ESG) activities of five leading Korean companies: Samsung Electronics, Hyundai Motors, LG Chem, POSCO, and SK Hynix. Their ESG activities, in response to global sustainability trends and regulations, are categorized into environmental, social, and governance aspects.

Table 3 provides a detailed look into the specific Environmental, Social, and Governance (ESG) activities of five companies: Samsung, HD Motors, LG Chem, POSCO, and SK Hynix. Commonly, all companies demonstrate a commitment to environmental sustainability, such as GHG reduction, renewable energy usage, and waste management. They also engage in social responsibility through employee volunteer work and focus on strong governance, including ethics management and cybersecurity.

Samsung Electronics focuses on GHG reduction, renewable energy use, managing e-waste, and water resource management. Hyundai Motors has joined the RE100 initiative, aiming for net-zero emissions by 2045, and has increased eco-friendly vehicle sales. LG Chem plans for carbon-neutral growth by 2030 and net-zero emissions by 2050, transitioning to green fuels and improving energy efficiency. POSCO commits to net-zero by 2050, expanding eco-friendly material sales, and focusing on biodiversity conservation and by-product recycling. SK Hynix emphasizes climate action, water stewardship, a circular economy, sustainable manufacturing, and green technology.

Samsung Electronics engages in employee volunteer work, supports SMEs and startups, and ensures workplace compliance and ethics. Hyundai Motors strengthens workplace safety and ESG management in its supply chain, also focusing on human rights risk management. LG Chem's social activities are not specifically listed. POSCO aims to create a great workplace while reinforcing safety, health, and supply chain management. SK Hynix focuses on establishing a social safety net, supporting supplier ESG, and workplace safety and health.

Samsung Electronics respects labor and human rights, promotes diversity and inclusion, and focuses on human resources development. Hyundai Motors operates a Sustainability Management Committee under the Board of Directors, enhances board diversity, and strengthens shareholder communication. LG Chem does not have specific governance activities listed. POSCO enhances its governance structure and focuses on ethics management and fair trade. SK Hynix engages in responsible supply chain management, emphasizes robust governance, and promotes an inclusive workplace.

These companies prioritize environmental activities, reflecting a global focus on sustainability, particularly in response to the EU's net-zero 2050 goal. While environmental strategies are prominent, especially in industries directly impacting climate change, there's also a significant emphasis on social and governance activities. Hyundai Motors, SK Hynix, and POSCO, for example, underscore workplace safety and supply chain sustainability. Governance activities across these companies include enhancing corporate governance structures, ethical management, and diversity initiatives. Notably, social activities tend to focus on internal stakeholders like employees and partners, with less emphasis on broader societal impact. The analysis also reveals a need for more proactive investment in managing suppliers' ESG risks, as well as attention to diversity issues such as female leadership.

In summary, these companies demonstrate a strong commitment to ESG, with a notable emphasis on environmental sustainability. However, there is an opportunity for more comprehensive integration of social and governance aspects, particularly in terms of broader societal impact and more active management of supply chain risks.

4.3. ESG performance indicators

This section reviews the ESG (Environmental, Social, and Governance) performance indicators of five prominent Korean companies: Samsung Electronics, Hyundai Motors, LG Chem, POSCO, and SK Hynix. The analysis reveals both common and unique aspects in their approach to ESG.

Table 4 provides an overview of the Environmental, Social, and Governance (ESG) performance indicators for five companies. There are common aspects across all five companies and also unique aspects pertaining to each company.

the governance standards, each company has governance indicators including ethics training, anti-corruption measures, and cybersecurity initiatives. Despite these similarities, each company has distinct performance indicators tailored to their specific goals and operations.

In environmental focus, all companies track greenhouse gas (GHG) emissions, energy consumption, and waste management. In terms of social responsibility metrics, they measure employee volunteer work, support for local communities, and workforce diversity. As for the governance standards, each company has governance indicators including ethics training, anti-corruption measures, and cybersecurity initiatives. Despite these similarities, each company has distinct performance indicators tailored to their specific goals and operations.

Samsung Electronics emphasizes water conservation and reuse, manages suppliers’ working environments, and supports small and medium-sized enterprises (SMEs). However, no specific governance indicators are listed. Hyundai Motors tracks a broad range of environmental metrics, including VOC emissions, air pollutants, and green purchasing. Their social indicators include employee training expenses and hiring youth interns, while governance focuses on compliance and personal information security. LG Chem includes product responsibility and chemical stewardship in environmental indicators, with a notable number of regular suppliers in social metrics. Governance covers contributions to public policy and regulation. POSCO measures by-product gases and eco-friendly product sales. Their social focus includes green purchasing and product development, with a primary focus on ethics training in governance. SK Hynix highlights renewable electricity use and ZWTL Gold certification in environmental aspects, job creation for disadvantaged groups in social metrics, and synchronization of sustainability efforts with suppliers in governance. These varied indicators reflect how each company addresses ESG challenges unique to their industry and operational framework, highlighting the diversity in their approach to achieving sustainability and ethical business practices.

In summary, each company, while adhering to a general framework of ESG metrics, has tailored their performance indicators to align with their specific operational priorities and strategic goals. Environmental aspects are consistently prominent, reflecting a universal commitment to sustainability. Social and governance activities, though varied, highlight an emphasis on internal stakeholder management and ethical business practices. This analysis underscores the diversity in approaches to sustainability and ethical practices across different industries and operational frameworks.

4.4. Findings and Discussions

Studying the ESG strategies, activities, and performance indicators of Korean global firms offers several lessons and implications for a global perspective on sustainability and corporate governance. First of all, the case study demonstrates the importance of using industry-specific ESG approaches. Korean companies demonstrate that ESG strategies need to be tailored to specific industry requirements. For instance, a tech company like Samsung Electronics focuses on reducing e-waste and energy consumption, while a steel manufacturer like POSCO emphasizes low-carbon processes and eco-friendly materials. This industry-specific approach can guide global companies in developing ESG strategies that are both effective and relevant to their operations.

Secondly, Korean firms show the importance of integrating ESG factors into their core business strategies rather than treating them as peripheral concerns. This integration ensures that sustainability and corporate responsibility are central to the company's operations and long-term planning. Also, this study shows that it is important to balance the economic and social goals when developing ESG strategies. Companies like SK Hynix, with its "Double Bottom Line" vision, exemplify the balance between economic and social values. This approach can serve as a model for global companies looking to harmonize profitability with social and environmental responsibilities.

Thirdly, successful ESG implementation requires a variety of approaches. Korean companies often employ innovative solutions to meet ESG challenges. For example, LG Chem's focus on green fuels and energy efficiency demonstrates how innovation can drive sustainability. This approach can inspire global firms to leverage technology and innovation in addressing ESG issues. In addition, the case study shows the importance of transparency in governance, local community engagement, and adaptation to local context. The focus on transparency and fairness in governance, as seen in Korean companies, highlights the importance of ethical management and stakeholder trust. Establishing independent boards and strengthening internal controls are practices that can enhance governance standards globally. Korean companies’ efforts in engaging with local communities and addressing social issues underline the significance of creating social value. This approach can guide global companies in making meaningful contributions to the communities they operate in. The way Korean companies tailor their ESG strategies to align with regional and cultural characteristics provides a lesson in the importance of contextual understanding in ESG implementation. Global firms can benefit from considering the cultural and regional norms that impact their operations.

Finally, setting appropriate performance indicators is the final puzzle to achieve ESG management. The detailed performance indicators used by Korean companies offer a framework for measuring and reporting on ESG performance. This can serve as a benchmark for global companies aiming to track and improve their ESG initiatives.

5. Conclusions

This study has provided an in-depth exploration of strategic ESG integration, illustrating how it encompasses the incorporation of sustainability and ethical considerations into the core business strategies of companies. Strategic ESG integration is not merely about compliance; it's about embedding environmental, social, and governance factors into the very fabric of business operations. This approach enables companies to align their economic objectives with societal and environmental responsibilities, thereby fostering sustainable growth and innovation in addressing complex ESG challenges.

Examining a non-Western context is both important and timely due to their significant role in the global economy and their pioneering efforts in ESG practices. As these firms have expanded their global presence, their influence and responsibility in shaping sustainable practices have increased. Korean firms provide a unique context for understanding ESG integration, given their rapid economic growth, technological advancement, and dynamic adaptation to global market demands. Their experiences offer valuable insights into how large corporations can effectively navigate and contribute to the evolving landscape of global sustainability.

The case of Korean global firms is pivotal in enhancing our understanding of ESG. This approach acknowledges that challenges and opportunities in ESG practices vary significantly across different industries. By focusing on the industry-specific strategies of Korean global firms, this study illuminates how firms in various sectors, such as electronics, automotive, and chemicals, tailor their ESG practices. This granular perspective enriches our understanding of ESG by demonstrating how contextualized strategies are more effective and relevant, taking into account each industry's unique operational and environmental impacts.

The findings of this study contribute substantially to the broader discourse on ESG, highlighting how Korean firms have developed and implemented nuanced ESG strategies. By focusing on industry-specific approaches, the study reveals the complexity and diversity of ESG practices, moving beyond one-size-fits-all solutions. This enriched understanding underscores the need for customized strategies that consider the specific challenges and opportunities of each industry, leading to more effective and impactful ESG integration.

Building on the findings of this study, future research can delve deeper into the specific mechanisms and processes through which ESG integration occurs in different industrial contexts. Comparative studies across other geographical regions and economic sectors would further enrich the global understanding of ESG practices. Additionally, longitudinal studies observing the long-term impact of these ESG strategies on corporate performance and societal outcomes would be invaluable. Such research would not only broaden the theoretical understanding of ESG integration but also provide practical guidelines for companies striving to achieve sustainable and responsible business growth.