1. Global Energy Challenge and Hydrogen

Energy requirements continue to increase as industrialization spreads and the standard of living rises. Most of the world’s power consumption is still generated from fossil fuel combustion, which, despite its advanced development, has only a maximum efficiency of about 50% and generates almost 35% of the greenhouse emissions, as well as becoming expensive and insecure with the recent instability of oil prices. Hence, security of supply and climate change represent two major concerns about the future of the energy sector, which give rise to the challenge of finding the best way to rein in emissions while also providing the energy required to sustain economies. Renewable energy sources such as wind, solar, micro-hydro, wave, geothermal, and biomass are potential solutions for the clean energy problem, but challenges exist. Storing energy harnessed from renewables using energy storage technologies allows the integration of such intermittent, weather-dependent energy sources while balancing the grid.Hydrogen Energy storage technology is proposed to enable the world to utilize its vast, but intermittent, renewable energy resources with increased reliance.

Hydrogen can help tackle various critical energy challenges. It offers ways to decarbonize a range of sectors, including long-haul transport, chemicals, and iron and steel, where meaningfully reducing emissions is proving to be difficult. It can also help improve air quality and strengthen energy security. Despite very ambitious international climate goals, global energy-related CO2 emissions reached an all-time high in 2018. Outdoor air pollution also remains a pressing problem, with around 3 million people dying prematurely each year because of it. Hydrogen is versatile. Technologies already available today enable hydrogen to produce, store, move, and use energy in different ways. A wide variety of fuels can produce hydrogen, including renewables, nuclear, natural gas, coal, and oil. It can be transported as a gas by pipelines or in liquid form by ships, much like liquefied natural gas (LNG). Also, it can be transformed into electricity and methane to power homes and feed industry, and into fuels for cars, trucks, ships, and planes. (IEA, 2019)

Hydrogen can enable renewables to provide an even greater contribution. It has the potential to help with variable output from renewables, like solar photovoltaics (PV) and wind, whose availability is not always well matched with demand. Hydrogen is one of the leading options for storing energy from renewables sources and looks promising to be the lowest-cost option for storing electricity over days, weeks, or even months. Hydrogen and hydrogen-based fuels can transport energy from renewable sources over long distances – from regions with abundant solar and wind resources, such as Australia or Latin America, to energy-hungry cities thousands of kilometers away. Hydrogen can be used much more widely. Today, hydrogen is used mostly in oil refining and to produce fertilizers. For it to make a significant contribution to clean energy transitions, it also needs to be adopted in sectors where it is almost completely absent at the moment, such as transport, buildings, and power generation. (IEA, 2019)

1.1. Role of Hydrogen in Transportation

To achieve a deep decarbonization of road transport, longer-term strategies must focus on developing alternative, low-carbon fuels and more efficient propulsion systems. Electric-drive vehicle options comprise pure-battery electric vehicles (BEV), using only electricity as “fuel,” which is charged to the battery. The other one is fuel cell electric vehicles (FCEV), using hydrogen as “fuel”, which is stored on board the vehicle and converted to electricity by means of a fuel cell; and lastly, plug-in hybrid electric vehicles (PHEV), which combine a battery system with an ICE or fuel cell system. Both the BEV and the FCEV, as well as the battery/fuel cell-based PHEV, are truly zero-emission vehicles, as they emit no CO2 emissions or local air pollutants during operation. A comparison of fuel costs between hydrogen and gasoline-based vehicles is outlined in

Table 1. This study is based on the same models with a gasoline engine and a hybrid engine running for a 100-kilometer journey. A few models, i.e., Audi A2H2, Volkswagen Touran HyMotion 2004, Volkswagen Touran HyMotion 2007, KIA Borrego FCEV, KIA Sportage, Mazda, and Hyundai, have almost equal or lower fuel, whether on gasoline or hydrogen. Once hydrogen is produced locally, assuming a 30% reduction in the price of production, the estimated cost of using hydrogen as a fuel is far lower than that of gasoline for any mentioned model.

1.2. Role of Hydrogen in Domestic Power

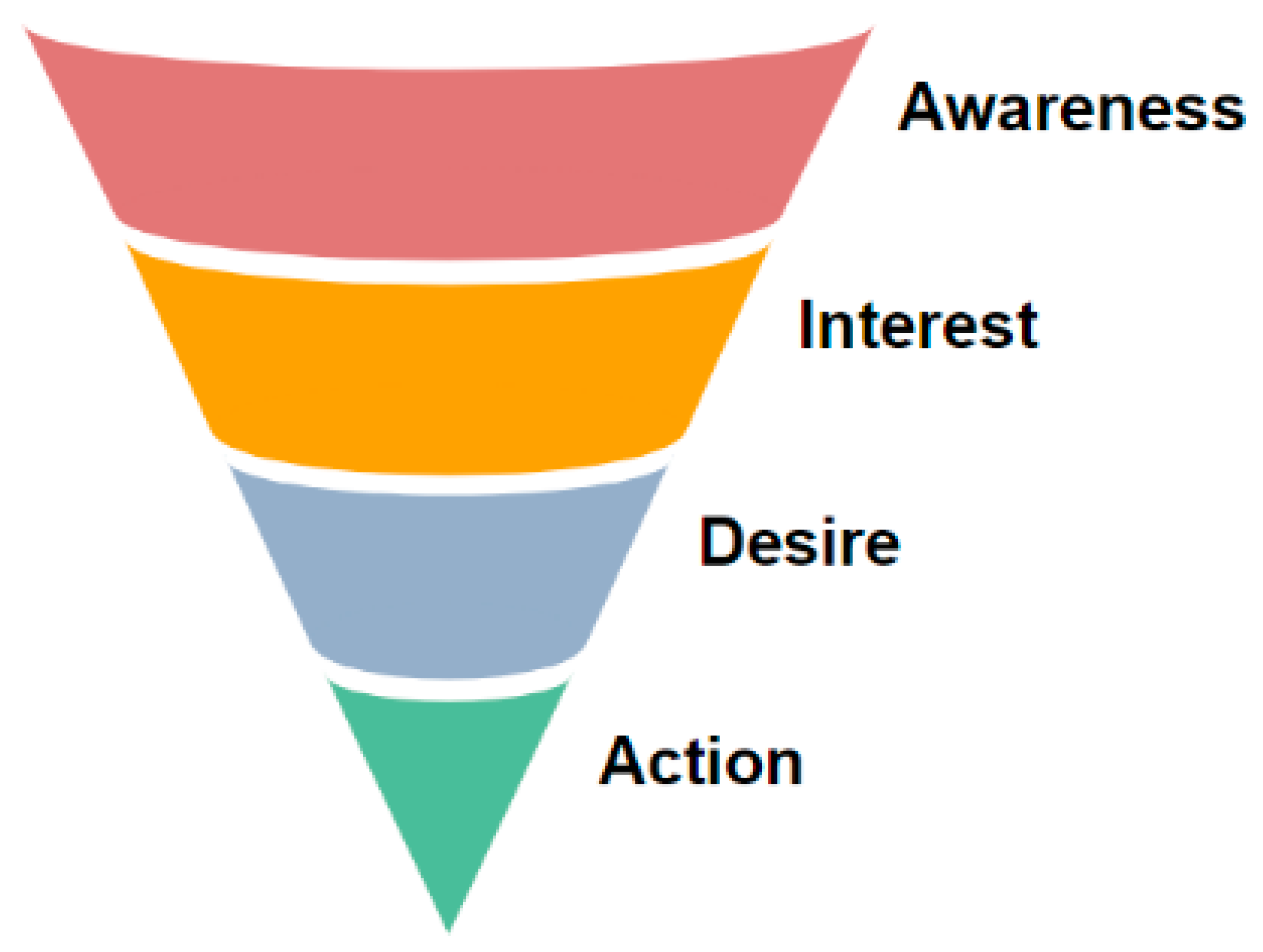

Hydrogen heaters use a fuel cell as an energy converter. In conventional heaters, gas or oil is burned to generate heat. In fuel cell heaters, hydrogen is used as the "fuel". The only difference is that hydrogen is not burned in the fuel cell, but it reacts with oxygen and generates electricity and heat. Hydrogen could be transported through our existing gas network and easily stored with conventional technology. This would be a more cost-effective solution, reducing the amount of expensive new infrastructure needed to build new hydrogen transmission and distribution networks, and minimizing disruption. A cost comparison of household heating by different hydrogen technologies is shown in

Figure 1.

The current natural gas demand vs. theoretical H2 demand for heating in buildings in seven countries is shown in

Table 2. For natural gas to be replaced by hydrogen fuel, the ease of using hydrogen fuel in existing heating equipment must be feasible; the cost of production, transmission, and distribution must also be comparable to that of natural gas- the existing fuel used for heating. This table assumes the demand for natural gas, for space heating and hot water production is following the building envelope improvement under the Paris- compatible pathway. Indicative demand shows the theoretical demand for hydrogen when its production, transmission, and distribution are within the competitive range. It is also based on the typical lifetimes of existing heating equipment, excluding the chances of early retirement of equipment. From the chart, we can derive that hydrogen technologies still have a long way to go to compete with natural gas for household heating, as the indicative demand is far lower than the current natural gas demand globally.

1.3. Role of Hydrogen in Power Generation

The role of hydrogen and hydrogen-based products already has a significant impact on power generation. Some examples of its role, for instance, flexibility in power generation, off-grid power supply, long term energy storage, are shown in this table. The table also includes present and upcoming sectors of demand and future opportunities or challenges in deployment. The main challenges faced in the deployment of Hydrogen-based products are competition with more flexible and feasible power generation options, high initial investment, and high conversion loss in energy storage. But future deployment opportunities like integration of variable renewable energy in the power system, an eco-friendly alternative to diesel generators, and low CAPEX cost for storage make hydrogen and hydrogen-based products an attractive option in power generation.

Table 3 summarizes the prospects of hydrogen for power generation and identify the challenge and opportunities.

1.4. Role of Hydrogen in Reducing GHG Emissions

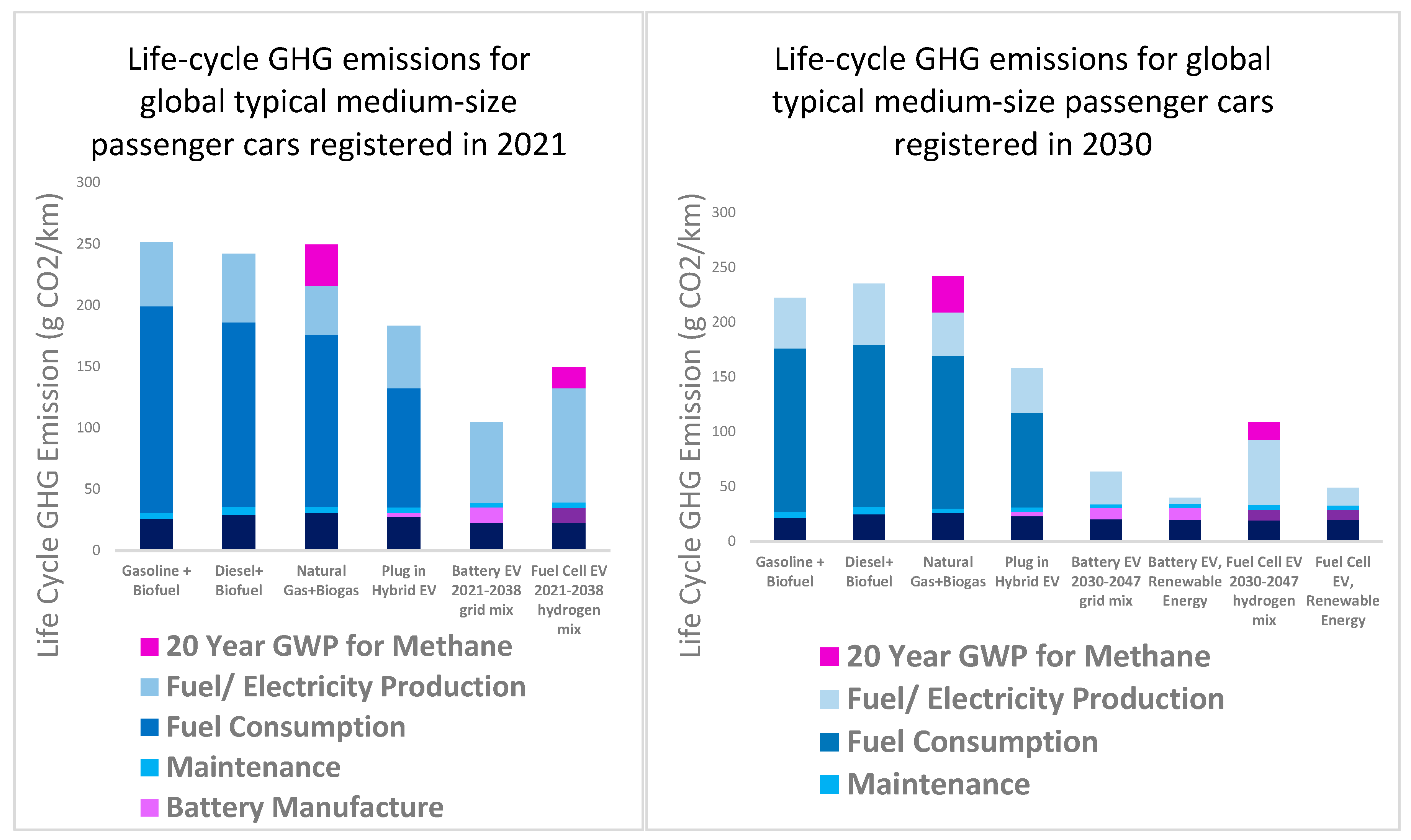

The charts show the full lifecycle GHG emissions of battery and fuel-cell EVs that are registered in 2021 and projected to be in use for the next 15 to 18 years. For battery EVs, the GHG emissions for “fuel/electricity” production are primarily from the coal and natural gas used in electricity generation. The total also accounts for the GHG emissions from manufacturing solar panels and wind turbines that produce renewable electrical power to fuel battery EVs, as well as energy losses in electricity transmission and EV charging.

In the second chart, the effect of rising renewable energy penetration becomes more pronounced in the lifetime climate performance of cars that are registered in the year 2030; therefore, the life cycle GHG emissions of both battery and hydrogen fuel-cell EVs are much lower for 2030 cars than 2021 cars. The GHG emissions of gasoline, diesel, and natural gas cars, on the other hand, are almost identical. The relative benefit of driving EVs compared to gasoline, diesel, and natural gas cars grows over time. Source: The ICCT.

Figure 2.

a) Life-cycle GHG emissions for global typical medium-size passenger cars registered in 2021; (b) Life-cycle GHG emissions for global typical medium-size passenger cars registered in 2030. (Bieker, 2021).

Figure 2.

a) Life-cycle GHG emissions for global typical medium-size passenger cars registered in 2021; (b) Life-cycle GHG emissions for global typical medium-size passenger cars registered in 2030. (Bieker, 2021).

2. Existing and Projection of Hydrogen Demand

2.1. Existing Global Hydrogen Demand

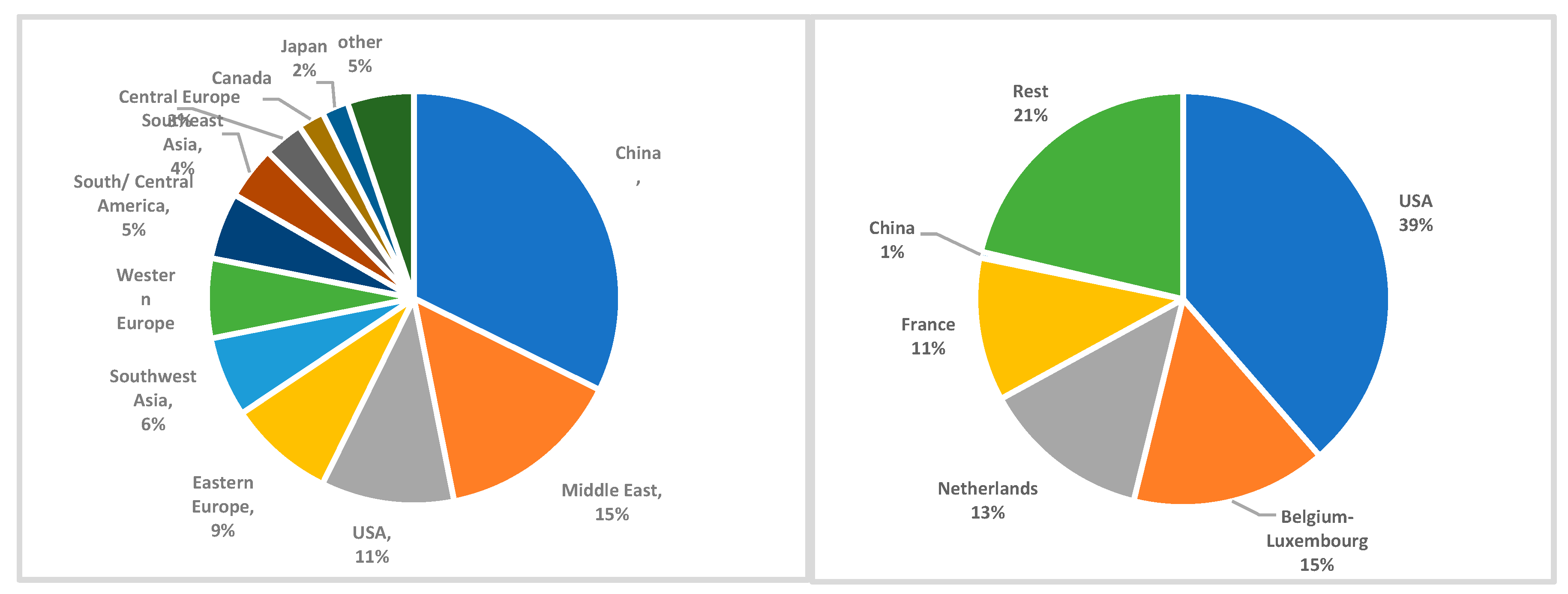

In terms of hydrogen consumption, China tops the other countries, with a consumption of 32%, but contributes only 1% of imported hydrogen, which shows China’s self-reliance in the hydrogen energy sector. The US imports 39% of the world’s hydrogen, making it the top importer, and in terms of consumption, it places 2nd, while being far below China.

Figure 3.

(a) Geographic split of hydrogen consumption, 2017; (b) Top importers of Hydrogen in 2017 (IHS Markit, 2017).

Figure 3.

(a) Geographic split of hydrogen consumption, 2017; (b) Top importers of Hydrogen in 2017 (IHS Markit, 2017).

2.2. Projection of Hydrogen Demand (2030-2050)

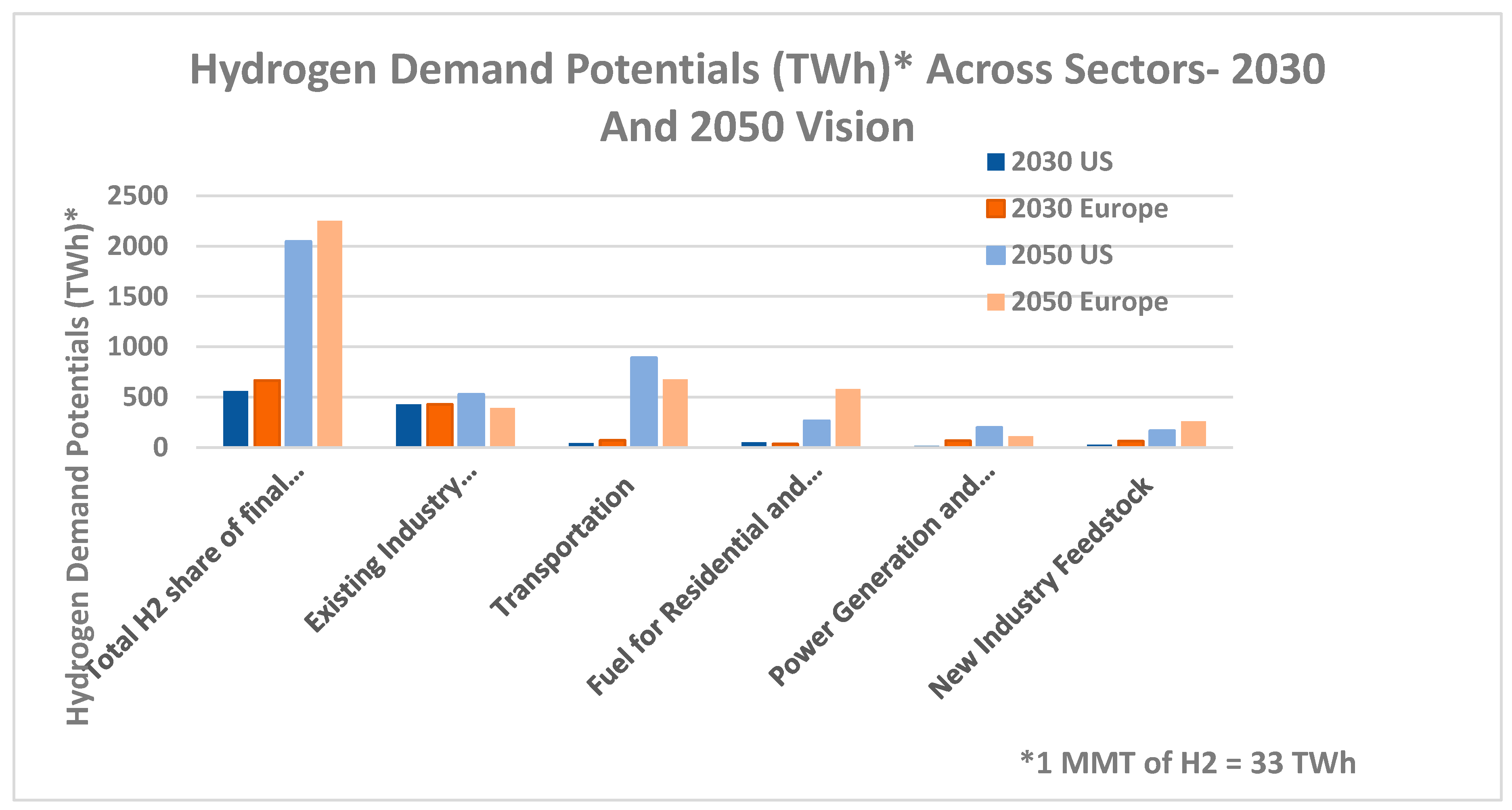

In the following chart, hydrogen demand potentials in TWh are shown for the 2030 and 2050 visions. The highest demand potential in the future will be existing industry feedstock, where the US will increase its potential, whereas, in Europe, it will decrease. The biggest difference in 2030 and 2050 potential is in the transportation field, where demand has grown exponentially in both the US and Europe.

Figure 4.

Hydrogen Demand Potentials (Twh) Across Sectors- 2030 And 2050 Vision. (FCHEA & 20 companies and organisations, 2020; Fuel Cells and Hydrogen 2 Joint Undertaking, 2019).

Figure 4.

Hydrogen Demand Potentials (Twh) Across Sectors- 2030 And 2050 Vision. (FCHEA & 20 companies and organisations, 2020; Fuel Cells and Hydrogen 2 Joint Undertaking, 2019).

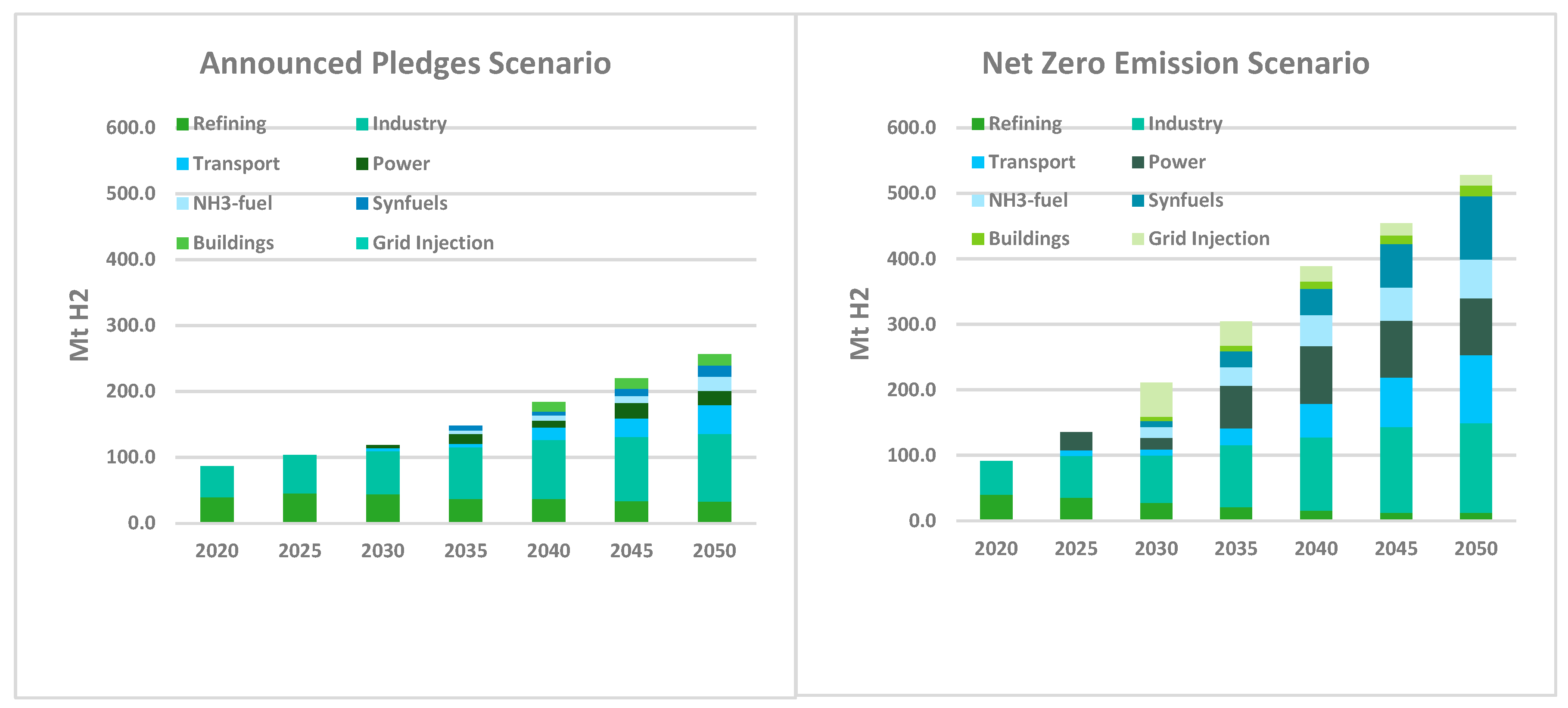

In the announced pledge scenario, hydrogen is mostly used in sectors like industry and transport. In the second chart, the effect of rising renewable energy penetration becomes more pronounced as it is projected for net zero carbon emissions. In terms of environmental effects, the second scenario wins, but the announced pledges scenario paints a more realistic picture of where we might see the world in 30 years in terms of hydrogen demand.

Figure 5.

(a) Global H2 Demand by Sector in the Announced Pledges Scenario (2020-2050); (b) Global H2 Demand by Sector in the Announced Pledges Scenario (2020-2050)(Global Energy Review 2021 – Analysis - IEA, 2021).

Figure 5.

(a) Global H2 Demand by Sector in the Announced Pledges Scenario (2020-2050); (b) Global H2 Demand by Sector in the Announced Pledges Scenario (2020-2050)(Global Energy Review 2021 – Analysis - IEA, 2021).

3. Global Strategies to Implement Hydrogen Energy

Table 4,

Table 5 and

Table 6 state that the UK, Czech Republic, Norway, and Hungary have the most updated strategies, while Germany, France, Japan, and the European Union show the highest investments in hydrogen energy production. Germany, Netherlands, Spain, EU, Chile, and Australia plan on taking an eco-friendly route-producing hydrogen from renewable sources, while others are mostly using carbon capture with fossil fuel technologies.

Table 4,

Table 5 and

Table 6 summarize the details of the adopted national hydrogen strategies for the countries planning to use hydrogen for Building, Electricity, Exports, Industry, Mining, Shipping, and Transport.

Countries planning to use hydrogen for only Industry, Refining, Transport:

A few countries, including Germany, Netherlands, Spain, United Kingdom, plan on using hydrogen for aviation along with the mentioned purposes.

4. Consumers of Hydrogen Based on Applications

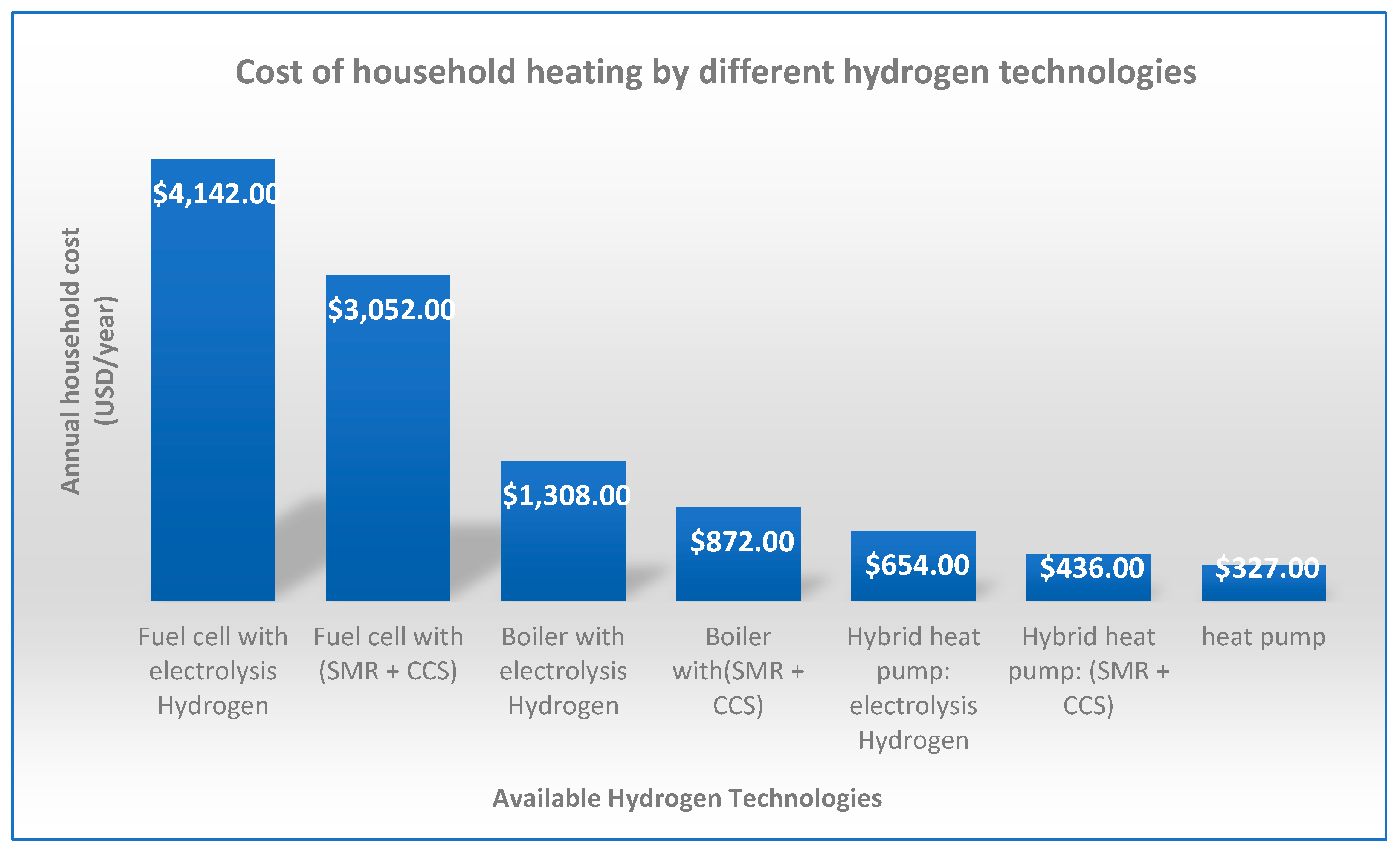

There is a large spectrum of applications for hydrogen-based products based on consumers. Hydrogen products can be categorized based on production, storage, transport, and consumption.

Figure 6 depicts the synopsis of numerous hydrogen-based products based on associate categories.

5. Challenges Faced in Hydrogen Launching and Possible Solutions

5.1. Production Costs

Lowering hydrogen costs remains a key issue in launching hydrogen as an alternative energy source. Japan's current 100% hydrogen power generation costs are estimated at Yen 97.3/kWh and Yen 20.9/kWh for 10% blending of hydrogen with re-gasified LNG for power output. Hydrogen imports to Japan of whatever color - be it gray, blue, or green are unlikely to achieve cost parity with LNG or coal in Japan for power generation in the foreseeable future, given LNG and coal projected pricing through 2035. Currently, hydrogen from renewable sources costs about $5 per kilogram to produce in the U.S., with the cost heavily driven by the cost required to acquire and install renewable power equipment, such as electrolyzers and hydrogen compressors. However, DOE has a goal to unlock new markets for hydrogen, including steel manufacturing, clean ammonia, energy storage, and heavy-duty trucks, to achieve an 80 percent cost reduction to bring the cost to $1 per kilogram. With technological advances and economies of scale, the cost of making hydrogen with solar photovoltaic (“PV”) electricity can become competitive with hydrogen made with natural gas, according to the IEA’s Roadmap to Net Zero by 2050. The roadmap provides a scenario in which hydrogen from renewable sources falls to as low as $1.30 per kilogram by 2030 in regions with excellent renewable resources and to $1 per kilogram in the longer term. This scenario makes clean hydrogen from solar PV cost-competitive with hydrogen from natural gas, even without carbon capture and sequestration (CCUS). The cost of automotive fuel cells and electrolyzer units is also expected to come down significantly due to technological advances and economies of scale, though we may ironically see cost increases in the short term due to demand for equipment significantly outstripping supply.(Takeo Kumagai & Fred Wang, 2021)

5.2. Infrastructure

The next biggest obstacle to the widespread adoption of green (and blue) hydrogen in the U.S. is the slow pace of development of low-carbon hydrogen infrastructure. Whereas large megaprojects are already beginning to be developed in Australia, the Middle East, the UK, Europe, and Africa, the U.S. is regarded by many as a sleeping giant, with world-leading production potential and consumption demand waiting to be unlocked. On the consumption side, hydrogen prices for consumers are highly dependent on how many refueling stations there are, how often they are used, and how much hydrogen is delivered per day, as well as the cost of competitor fuels and, of course, the market share increasingly occupied by battery electrification, which is very well-suited to personal vehicles. Tackling this will require planning and coordination that brings together federal, state, and local governments, industry, and investors. Achieving the Biden administration targets using green hydrogen, the cleanest hydrogen, would require massive investment in renewable sources and related power grid infrastructure to connect renewable power to green hydrogen producing hubs or plants.

5.3. Scaling Up to Industrial Applications

One of the largest barriers to any new technology, not just green hydrogen, is the scaling-up process. Going from small-scale demonstrations of viability to large-scale industrial processing involves a transition from purely scientific and technological challenges to logistical, economic, and, in some cases, political ones. A 2020 report from Material Economics found that grid expansion proved to have a “significant impact” on the speed of green hydrogen adoption. A key component of this challenge is capex and opex, with many investors hesitant to provide the funding required for a relatively unproven technology. The Material Economics report also noted that Europe has a political climate that could see greater encouragement for green hydrogen projects. The EGHAC, however, boasts several advantages in this area. Among these is its support by Breakthrough Energy, a network of energy reformers founded by Bill Gates, a name that gives the initiative considerable financial backing and reputability to attract further investment. The European Battery Alliance and the Clean Hydrogen Alliance are the policymakers who have taken steps to prepare Europe for greater hydrogen development. There is hope that the EGHAC can work alongside powerful bodies such as these to accelerate the acceptance and adoption of a new technology in what is, at times, a conservative energy industry.

5.4. Regulatory

The lack of regulation and proper incentives currently limits the development of a clean hydrogen industry. The U.S. government and industry would also need to work together to ensure the regulatory environment does not pose an unnecessary barrier to investment. U.S. regulations setting criteria for the description of hydrogen as green, and acceptable carbon limits for describing hydrogen as blue or “low carbon,” do not yet exist. Therefore, first-mover developers must be conservative so as to not inadvertently exclude themselves from a particular market. This drives up the time and cost of engineering and potentially reduces the operating efficiency of the projects, making hydrogen unnecessarily more expensive for consumers. Ideally, the U.S. would work with the European Union and Asian countries to set global standards allowing for a traded market similar to crude oil and LNG.

5.5. Attracting Investors

While green hydrogen and other renewable energy sources all work towards the same end goal, there exists an opinion that large-scale adoption of green hydrogen is an inherently flawed idea, as it would divert the products of other renewable power sources away from generating electricity. According to the International Renewable Energy Agency, the world will have to increase its green hydrogen capacity by up to 158.3 million tons a year to create a green hydrogen-driven energy mix. This would be a massive undertaking that would require the construction of 2,243 GW of onshore wind every year, more than four times the capacity of all onshore wind facilities already installed, according to the European energy publication Recharge. There is a question of efficiency here on a continent-wide scale: why invest in renewables to power green hydrogen when one could invest in renewables directly?

There is currently no merchant market for green hydrogen in the U.S. (or indeed elsewhere), and developers and lenders are grappling with how to manage the associated market risk exposure. To be considered bankable, green hydrogen projects will generally require long-term, fixed-price offtake contracts with creditworthy offtakers, structured on a take-or-pay basis, similar to early LNG projects.(Takeo Kumagai & Fred Wang, 2021)

6. An Approach of Commercial Launching of Hydrogen Based Products

This section will further analyze the probable approach of advertising and commercializing hydrogen-based products in the market. (Gaetano 2023, Whitehead, J. et al. 2023)

6.1. Core Aspects of Hydrogen Marketing

While hydrogen is very promising, there are significant commercialization and marketing issues that need to be addressed if it is to achieve its potential in powering the human race. Once the technological hurdles are overcome, the market for hydrogen must be developed and ready. We propose that a market push and a demand-pull strategy be implemented simultaneously.

Market Push Strategy: Energy suppliers need to work with manufacturers of automobiles, furnaces, home builders, and so on to make hydrogen products available. Governments might consider offering tax incentives like what is being done with electric vehicles in the U.S. currently.

Demand-Pull Strategy: The market needs to be read to adopt this new alternative fuel when hydrogen is commercialized on a large-scale. Currently, we surmise that awareness of hydrogen is very low. Even for automobiles, which have been powered by hydrogen in small numbers for over a half-century, we anticipate low awareness among consumers. This means that consumers are unaware of how hydrogen fuel-cell vehicles work, the benefits for the environment and their pocketbooks, and how and where to refill their vehicles.

As a first step, a study needs to be conducted as to which countries should first be targeted for hydrogen production and consumption. Research in the area of diffusion of innovation (Put in an Everett Rogers cite here) shows that technologies are adopted in some countries more rapidly than in others. Based on the costs of various fuels, weather, geography, government regulations and stance, distribution systems (like trains), and a host of other factors, some countries are more in need, or more ready to accept hydrogen fuel.

As a second step, marketing research studies need to be conducted on a per-nation basis to measure the level of awareness for hydrogen in different contexts (such as powering homes and vehicles). These studies might tie-in directly with those mentioned in Step 1. Once it is determined which product-markets are most desirable to target, a plan needs to be developed to move consumers through the four stages of the AIDA model shown below. Each of the four stages (that is, awareness, interest, desire, and action) is discussed below.

6.2. The AIDA Model for Hydrogen

The AIDA model, a tried-and-true marketing framework, finds its dynamic application in propelling hydrogen to the forefront of the energy revolution. Attention is captivated as hydrogen's potential is spotlighted, drawing stakeholders into a world of sustainable energy possibilities. Interest is then stoked by unraveling the intricate strategies employed by countries and industries, creating a compelling narrative of innovation and commitment. Desire is ignited as the economic, environmental, and technological benefits of hydrogen become unmistakably clear, kindling a fervor for adoption. Finally, the call to action resonates loudly, urging global players to actively participate in the hydrogen revolution, shaping a future where this versatile element becomes the bedrock of our energy landscape. The AIDA model, seamlessly applied to hydrogen, serves as a catalyst for awareness, engagement, and enthusiastic participation in the quest for a sustainable energy future.

Figure 7.

The AIDA model.

Figure 7.

The AIDA model.

The AIDA model for hydrogen is analyzed and described at

Table 7.

The Lagged Effect: Sometimes consumers do not act immediately after receiving a message. It delayed the response to a marketing communication campaign. It usually takes several exposures before a consumer completely processes the message. Measuring the effect of current campaigns became difficult sometimes due to this delayed response. As a new product, it can be a common phenomenon for hydrogen. But the campaign should engage more stakeholders and the public challenge that hydrogen is a safer and cheaper energy.

Significant perceived concerns about hydrogen need to be uncovered. Focus groups could be used as a starting point. For example, reactions to hydrogen might be unfavorable since individuals might be concerned about the flammability or explosiveness of hydrogen. An educational campaign might need to be developed to reduce these fears if they are unwarranted or overstated.

As a third step, marketing research will need to be conducted periodically to keep consumers moving through the AIDA steps. It is suggested that governments might work to fund and otherwise support this research, as it will be ongoing and take several years and resources.

6.3. Planning and Measuring Success of Hydrogen Business:

Goals: Strategic understanding of the desired outcome

Short Term: (i) Gathering customer inquiries about hydrogen product, (ii) Increasing awareness of hydrogen product safety

Long Term: (i) Increasing hydrogen-based product sales, (ii) Increase market share of hydrogen in the energy market, (iii) Getting customer loyalty for shifting energy usage to hydrogen.

Measuring Success Using Marketing Metrics:

Once the budget for marketing communication and its campaign is developed and implemented, it is necessary to measure the success of the campaign using various marketing metrics. While measuring the promotional effectiveness of the hydrogen market, the “lagged effect” must be considered. It may take several exposures before consumers shift to hydrogen energy from traditional fuel-based energy.

Traditional Media: When and how often have consumers been exposed to marketing communication? The measurement can be done by calculating the ‘’frequency” of exposure. Frequency states how often the audience is exposed to communication within a specific period of time. The other method is “reach” which states the percentage of the target population exposed to specific marketing communication, such as advertisements.

Gross Rating Points (GRP): GRP = “reach” × “frequency”. If 50% of the targeted population is reached by 7 advertisements, then GRP= 350.

Web- Based Media: Includes paid search, display adds, email and sponsorship.

While the percentage change in digital ad spending to total spending is slowing, the absolute level of spending (bar chart) and relative share of digital marketing are still increasing. Along with GRP, web-based communication also contributes to measuring the success rate.

7. Conclusion

In conclusion, this comprehensive literature review on Hydrogen Launching Strategies in Energy Market highlights the complexity inherent in transitioning to a new fuel paradigm. The complex character of this shift is evident in the diverse strategies implemented by nations worldwide to incorporate hydrogen-based products into the energy market. Recognizing hydrogen as a crucial alternative to traditional fuels, the review emphasizes its significance for environmental sustainability, future energy supply, and cost-effectiveness. The challenges associated with this paradigm shift are not to be underestimated, as evidenced by the barriers of cost structures, technical intricacies, and marketing challenges. Nevertheless, the necessity to adopt hydrogen as a fundamental element of the energy blend cannot be emphasized enough. Beyond its role in mitigating environmental impact, hydrogen holds immense promise for securing future energy supplies and maintaining lower costs in the long run. As the global community faces with the complexities of this transition, the findings of this literature review shed light on existing gaps in strategies that necessitate careful consideration. The proposal for marketing actions presented in this article serves as a guide for accelerating the commercialization and widespread adoption of hydrogen energy. Embracing hydrogen is not merely an option; it is a crucial step towards a sustainable and resilient energy future. Balancing the complexities of technological advancement, economic feasibility, and environmental stewardship will be crucial to unlocking the complete potential of hydrogen in the energy market.

References

- Ali, D.M. Energy capacity and economic viability assessment of the renewable hydrogen energy storage as a balancing mechanism in addressing the electric system integration issues inherent with variable renewable energy resources. Reliability of transmission and distribution networks (RTDN 2011): reliability of transmission distribution and networks conference. London: (Institution of Engineering and Technology. 2011. [Google Scholar]

- Ball, M.; Weeda, M. The hydrogen economy e Vision or reality? international journal of hydrogen energy 2015, 7903–7919. [Google Scholar] [CrossRef]

- Office, H. a. (2020). Hydrogen Production Processes. Washington DC: U.S. Department of Energy.

- Baldino, C. , Searle, S., Zhou, Y., & Christensen, A. (2020). Hydrogen for heating? Decarbonization options for households in the United Kingdom in 2050. Available online: www.theicct.orgcommunications@theicct.org.

- Bieker, G. (2021). A GLOBAL COMPARISON OF THE LIFE-CYCLE GREENHOUSE GAS EMISSIONS OF COMBUSTION ENGINE AND ELECTRIC PASSENGER CARS. Available online: www.theicct.orgcommunications@theicct.org.

- FCHEA, & 20 companies and organisations. (2020). Road Map to a US Hydrogen Economy.

- Fuel Cells and Hydrogen 2 Joint Undertaking. Hydrogen Roadmap Europe: A Sustainable Pathway For The European Energy Transition Hydrogen Roadmap Europe. Publications Office, 2019. [CrossRef]

-

Global Energy Review 2021 – Analysis - IEA, 2021. Available online: https://www.iea.org/reports/global-energy-review-2021.

- IEA. (2019). The Future of Hydrogen. Available online: https://www.iea.org/reports/the-future-of-hydrogen.

- IHS Markit. (2017). IHS Chemical Economics Handbook Hydrogen Report.

- Report Comparing Electric and Other Alternative Fuel Non-Tactical Vehicles with Internal Combustion Engine Vehicles. 2023.

- Sagaria, S.; Moreira, A.; Margarido, F.; Baptista, P. From Microcars to Heavy-Duty Vehicles: Vehicle Performance Comparison of Battery and Fuel Cell Electric Vehicles. Vehicles, 2021, 3, 691–720. [Google Scholar] [CrossRef]

- Kumagai, T.; Wang, F. Commodities 2021: Japan to enter new era of hydrogen in 2021 with launch of liquefied transport. S&P Global Commodity Insights. 2021.

- Gaetano Squadrito, Gaetano Maggio, Agatino Nicita. The green hydrogen revolution, Renewable Energy 2023, 216, 119041. [CrossRef]

- Whitehead, J.; Newman, P.; Whitehead, J.; et al. Striking the right balance: understanding the strategic applications of hydrogen in transitioning to a net zero emissions economy. Sustain Earth Reviews 2023. [CrossRef]

Figure 1.

Cost of Household Heating by Different Hydrogen Technologies (Baldino et al., 2020.).

Figure 1.

Cost of Household Heating by Different Hydrogen Technologies (Baldino et al., 2020.).

Figure 6.

Category of hydrogen products based on associate categories.

Figure 6.

Category of hydrogen products based on associate categories.

Table 1.

Fuel cost comparing a few hydrogens and gasoline-based vehicles. (Report Comparing Electric and Other Alternative Fuel Non-Tactical Vehicles with Internal Combustion Engine Vehicles, 2023; Sagaria et al., 2021).

Table 1.

Fuel cost comparing a few hydrogens and gasoline-based vehicles. (Report Comparing Electric and Other Alternative Fuel Non-Tactical Vehicles with Internal Combustion Engine Vehicles, 2023; Sagaria et al., 2021).

| Manufacturer |

Model |

Range with hydrogen fuel (km) |

Gasoline consumption (l/100 km)a

|

Hydrogen storage capacity (kg) |

Cost of a 100 km journey on gasoline (US$) |

Cost of a 100 km journey on hydrogen (US$) |

Estimated cost of a 100 km with locally produced hydrogen (US$)b

|

| BMW |

Hydrogen 7 (V12 6.0I ICE) |

201 |

13.9 |

8 |

13.43 |

19.90 |

13.93 |

| Audi |

A2H2 |

220 |

5 |

1.8 |

4.83 |

4.09 |

2.86 |

| Toyota |

FCHV bus |

690 |

–c

|

6 |

– |

4.35 |

3.04 |

| Volkswagen |

Touran HyMotion 2004 |

160 |

7.2 |

1.9 |

6.96 |

5.94 |

4.16 |

| Volkswagen |

Touran HyMotion 2007 |

230 |

6.5 |

3.2 |

6.28 |

6.96 |

4.87 |

| GM |

Hydrogen Minivan |

270 |

– |

3.1 |

– |

5.74 |

4.02 |

| GM |

H2H Hummer (V8 ICE) |

100 |

17 |

5.5 |

16.42 |

27.49 |

19.25 |

| KIA |

Borrego FCEV |

690 |

13 |

7.9 |

12.56 |

5.72 |

4.01 |

| KIA |

KIA Sportage |

400 |

8 |

3.5 |

7.73 |

4.37 |

3.06 |

| Honda |

FCX Clarity |

430 |

– |

2.7 |

– |

3.14 |

2.20 |

| Mitsubishi |

Lancer Evo IX Hydrogen |

110 |

8.7 |

2.2 |

8.40 |

10.00 |

7.00 |

| Peugeot |

207 Epure (ICE and FC) |

350 |

6.6 |

3 |

6.38 |

4.28 |

3.00 |

| Mazda |

Premacy Hydrogen RE Hybrid |

200 |

11 |

2.4 |

10.63 |

6.00 |

4.20 |

| Daimler |

B-Class F-Cell |

400 |

6 |

11.1 |

5.80 |

13.87 |

9.71 |

| Mercedes-Benz |

F125 Concept |

1000 |

– |

7.5 |

– |

3.75 |

2.62 |

| Hyundai |

Tucson FCEV |

650 |

7.5 |

5.6 |

7.25 |

4.31 |

3.01 |

ICE, internal combustion engine; FC, fuel cell; FCEV, fuel cell electric vehicle.

a Based on the same models with gasoline engines or the same vehicles with hybrid fuel consumption.

b Based on a 30% reduction in the costs of production.

c No gasoline model has been produced.

|

Table 2.

Demand of natural gas vs theoretical hydrogen for domestic heating(Global Energy Review 2021 – Analysis - IEA, 2021).

Table 2.

Demand of natural gas vs theoretical hydrogen for domestic heating(Global Energy Review 2021 – Analysis - IEA, 2021).

| Region |

Natural gas demand (MT) |

Competitive price for hydrogen ($/ kg H2) |

Indicative hydrogen demand (Mt/H2) |

| Canada |

21 |

0.8-1.2 |

0.7-1.1 |

| USA |

147 |

1.2-1.5 |

5.1-7.7 |

| Western Europe |

80 |

2.0-3.0 |

0.5-0.7 |

| Japan |

14 |

2.0-3.5 |

0.4-0.6 |

| Korea |

11 |

0.9-1.9 |

2.8-4.2 |

| Russia |

43 |

1.5-1.8 |

1.5-2.2 |

| China |

51 |

1.2-1.4 |

1.8-2.7 |

Table 3.

Role of hydrogen and hydrogen-based products in power generation(Global Energy Review 2021 – Analysis - IEA, 2021).

Table 3.

Role of hydrogen and hydrogen-based products in power generation(Global Energy Review 2021 – Analysis - IEA, 2021).

| |

Current role |

Demand

perspectives |

Future deployment

Opportunities |

Future deployment

Challenges |

Flexible

power

generation

|

Few commercial

gas turbines using hydrogen-rich

gases.

Installed Capacity: 363,000 fuel cell units (1,600 MW) |

Assuming 1% of global gas-fired power capacity would run on hydrogen by 2030, this would result in an electricity generation of 90 TWh and consuming 4.5 Mt H2 |

• Some gas turbine designs are run on high hydrogen percentages

• Supporting the integration of VRE in the power system |

• Availability of low-cost and low-carbon hydrogen and ammonia.

• Competition with other flexible generation options as well as other flexibility options (e.g. demand, storage) |

Back-up and off- grid

power

supply

|

•Demonstration

projects for electrification

of villages.

• Fuel cell

systems in combination

with storage. |

With increasing

growth of telecommunications, need for a reliable power supply is rising |

Fuel cell systems in combination with storage as a cost-effective and less polluting alternative to diesel generators |

• Often higher initial investment is needed compared with diesel generators |

Long-term and large-

scale

energy

storage

|

Three salt

cavern storage

sites for hydrogen in the United States; another three in the United Kingdom |

In the long term, with very high VRE shares, need for large-scale and long-term storage for seasonal imbalances or longer periods with no VRE generation.

In combination with long-distance trade, scope to take advantage of seasonal differences

in global VRE supply |

Due to high energy content of hydrogen, relatively low CAPEX cost for storage itself. Few alternative technologies for long-term and large- scale storage. Conversion losses can be reduced if stored hydrogen or ammonia can be directly used in end- use applications |

• High conversion losses. Geological availability of salt caverns for hydrogen storage region-specific.

• Little experience with depleted oil and gas fields or water aquifers for hydrogen storage (e.g. contamination issues) |

| Note: VRE = variable renewable energy. |

Table 4.

Adopted National Hydrogen Strategies; Sectors of Use: Building, Electricity, Exports, Industry, Mining, Shipping, And Transport(Global Energy Review 2021 – Analysis - IEA, 2021).

Table 4.

Adopted National Hydrogen Strategies; Sectors of Use: Building, Electricity, Exports, Industry, Mining, Shipping, And Transport(Global Energy Review 2021 – Analysis - IEA, 2021).

| Country |

Document, year |

Deployment

targets (2030) |

Production |

Public investment committed |

Australia

|

National Hydrogen

Strategy, 2019

|

None specified |

Coal with CCUS

Electrolysis (renewable)

Natural gas with CCUS |

AUD 1.3 bln

(~USD 0.9 bln) |

| Canada |

Hydrogen Strategy for Canada, 2020 |

Total use: 4 Mt H2/y |

Biomass

By-product H2

Electrolysis

Natural gas with CCUS |

USD 19 mil by 2026 |

| Chile |

National Green Hydrogen Strategy, 2020 |

25 GW electrolysis |

Electrolysis (renewable) |

USD 50 mln for 2021 |

| Hungary |

National Hydrogen Strategy, 2021 |

20 kt/yr of low-carbon H2

16 kt/yr of carbon-free H2 |

Electrolysis

Fossil fuels with CCUS |

n.a |

| Japan |

Green Growth Strategy, 2020, 2021 |

420 kt low-carbon H2

800000 FCEVs |

Electrolysis

Fossil fuels with CCUS |

2030 (~USD 6.5 bln) |

| Russia |

Hydrogen roadmap 2020 |

Exports: 2 Mt H2 |

Electrolysis

Natural gas with CCUS |

n.a |

| Norway |

Hydrogen Roadmap, 2021 |

n.a. |

Electrolysis (renewables)

Natural gas with CCUS |

for 2021 (~USD 21 mln) |

Table 5.

Adopted National Hydrogen Strategies; Sectors of Use Industry, Refining, Transport(Global Energy Review 2021 – Analysis - IEA, 2021).

Table 5.

Adopted National Hydrogen Strategies; Sectors of Use Industry, Refining, Transport(Global Energy Review 2021 – Analysis - IEA, 2021).

| Country |

Document, year |

Deployment targets (2030) |

Production |

Public investment committed |

| Czech Republic |

Hydrogen Strategy, 2021 |

Low-carbon demand: 97kt H2/yr |

Electrolysis |

n.a |

| European Union |

EU Hydrogen Strategy, 2020 |

40 GW electrolysis |

Electrolysis(renewable)

Natural gas with CCUS |

by 2030 (~USD 4.3 bln) |

Korea

|

Hydrogen Economy Roadmap, 2019 |

1.94 Mt H2/yr

2.9 million FC cars (plus 3.3 million exported) |

By-product H2 Electrolysis

Natural gas with CCUS |

in 2020 (~USD 2.2 bln) |

| France |

National Strategy for Decarbonised Hydrogen Development, 2020 |

6.5 GW electrolysis

20-40% industrial H2 decarbonised |

Electrolysis |

by 2030 (~USD 8.2 bln) |

Table 6.

Adopted National Hydrogen Strategies; Sectors of Use: Building, Electricity, Exports, Industry, Mining, Shipping, Transport and Aviation(Global Energy Review 2021 – Analysis - IEA, 2021).

Table 6.

Adopted National Hydrogen Strategies; Sectors of Use: Building, Electricity, Exports, Industry, Mining, Shipping, Transport and Aviation(Global Energy Review 2021 – Analysis - IEA, 2021).

| Country |

Document, year |

Deployment targets (2030) |

Production |

Public investment committed |

| Germany |

National Hydrogen Strategy, 2020 |

5 GW electrolysis |

Electrolysis (renewable) |

by 2030 (~USD 10.3 bln) |

| Netherlands |

Government Strategy on Hydrogen, 2020 |

3-4 GW electrolysis 300 000 FC cars 3 000 FC HDVs |

Electrolysis (renewables)

Natural gas with CCUS |

(~USD 80 mln/yr) |

| Spain |

National Hydrogen Roadmap, 2020 |

4 GW electrolysis 25% industrial H2 decarbonised |

Electrolysis (renewables) |

(~USD 1.8 bln) |

| United Kingdom |

UK Hydrogen Strategy, 2021 |

5 GW low-carbon production capacity |

Natural gas with CCUS Electrolysis |

(~USD 1.3 bln) |

Table 7.

The AIDA model for hydrogen.

Table 7.

The AIDA model for hydrogen.

| Awareness |

Brand awareness: refers to a potential customer’s ability to recall the brand name.

As hydrogen is a relatively new energy product, brand awareness is a must.

Aided Recall: When consumers indicate that they know the brand name when the name is presented to them. Top-of-mind awareness: The highest level of awareness occurs when a consumer mentions a specific brand name first when they are asked about a product. For hydrogen, repeatedly exposure to symbols, names, and advertisements can work to raise the mind . |

| Interest |

Once the customer is aware of the company, communication must work to increase the interest level. It is not enough to let people know that the product exists, consumers must be persuaded that the product is worth to invest. For the hydrogen business, interest can be developed by orientating marketing campaigns focusing on ‘real energy’; so that the users of existing fuels change their mind for hydrogen. Different tours at hydrogen production and distribution plants can be introduced for mass people to get interested in hydrogen energy. |

| Desire |

Once interest is expressed, the goal should be ‘I want it’ from ‘I like it’. The desire for hydrogen product can be developed to consumers through offering different lucrative packages, free samples, cheap and long-time supporting fuel containers, zero loss liquid hydrogen products. |

| Action |

The ultimate goal of marketing is to push the receiver towards an action. Once the message of the product catches the attention of consumers and the product can satisfy the consumer’s desire; they will likely to push for purchase. Different kinds of coupon can be provided to energy consumers for purchasing hydrogen product during their next transaction. |

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).