Submitted:

04 January 2024

Posted:

04 January 2024

You are already at the latest version

Abstract

Keywords:

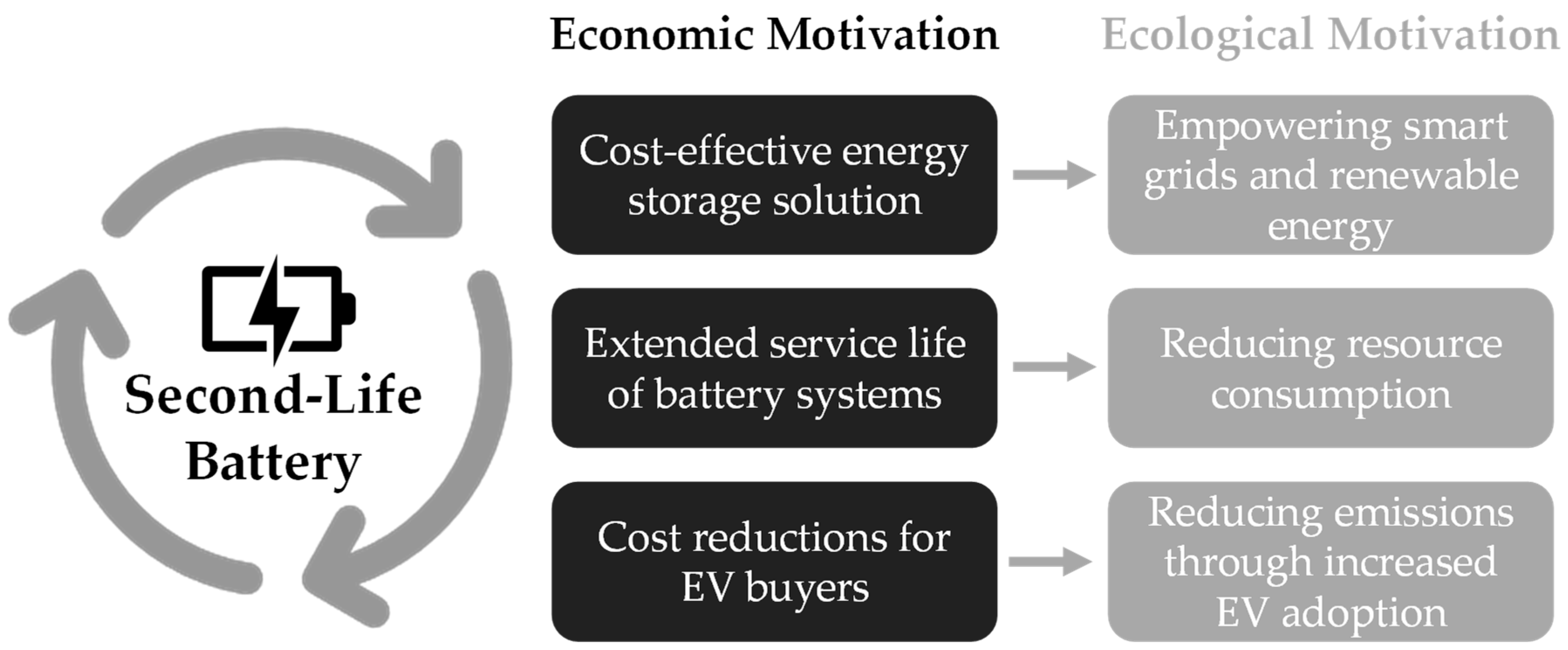

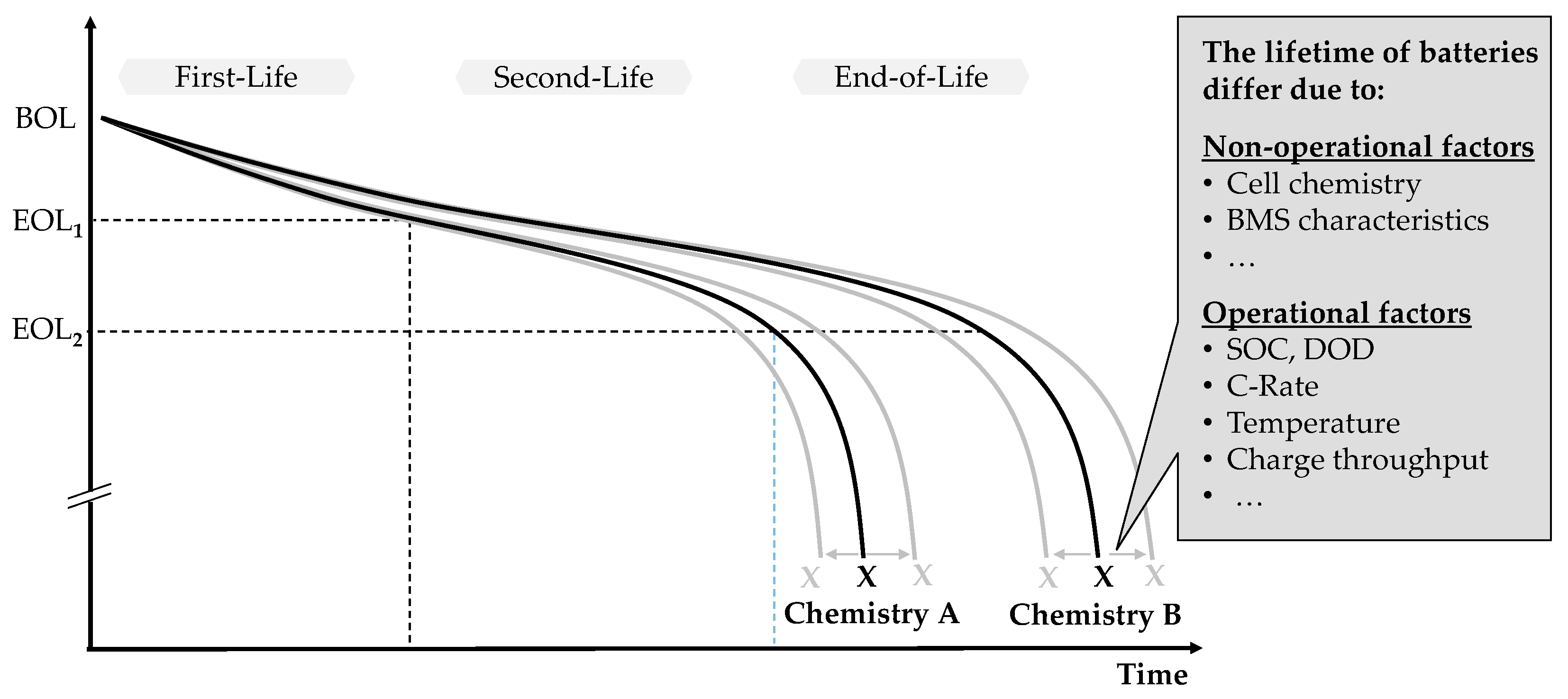

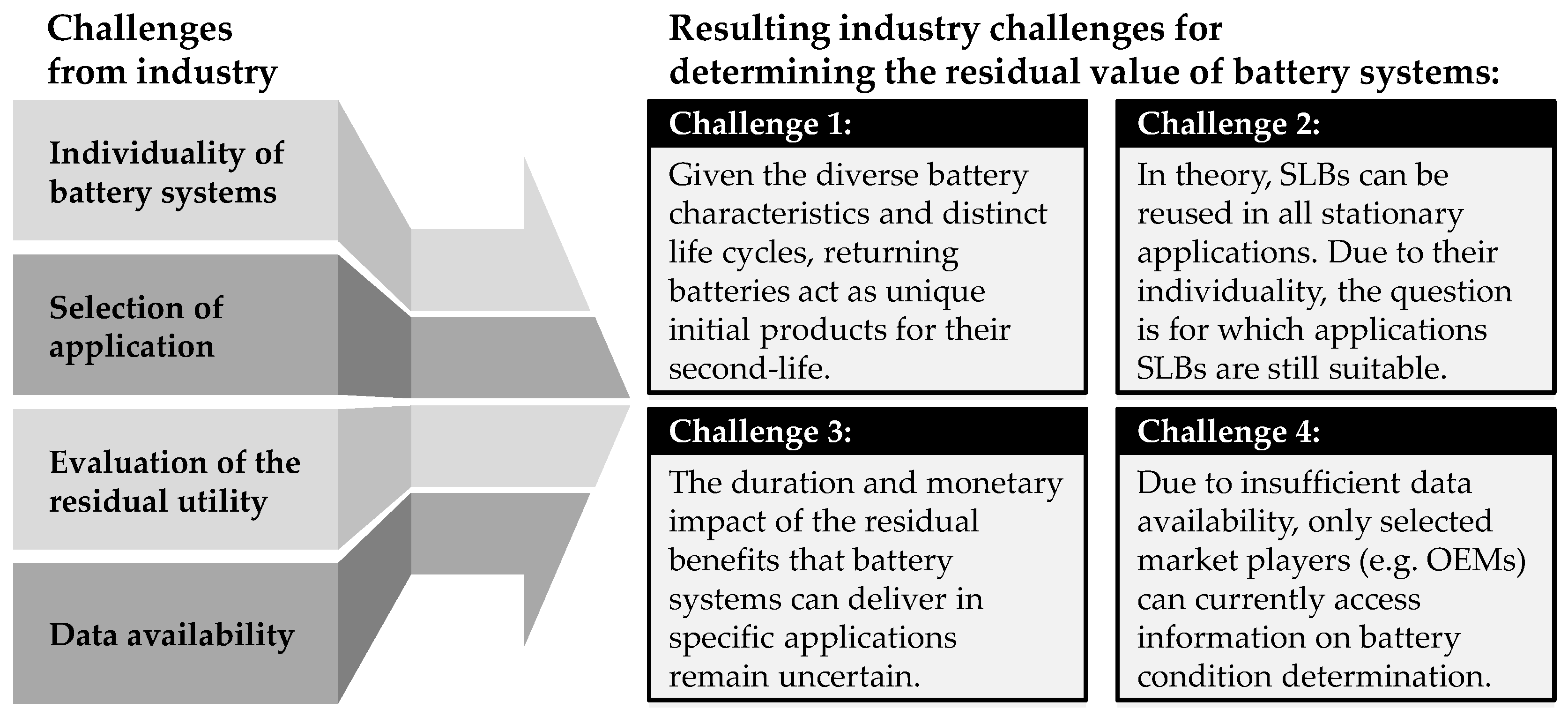

1. Introduction

2. Methodology

3. Results

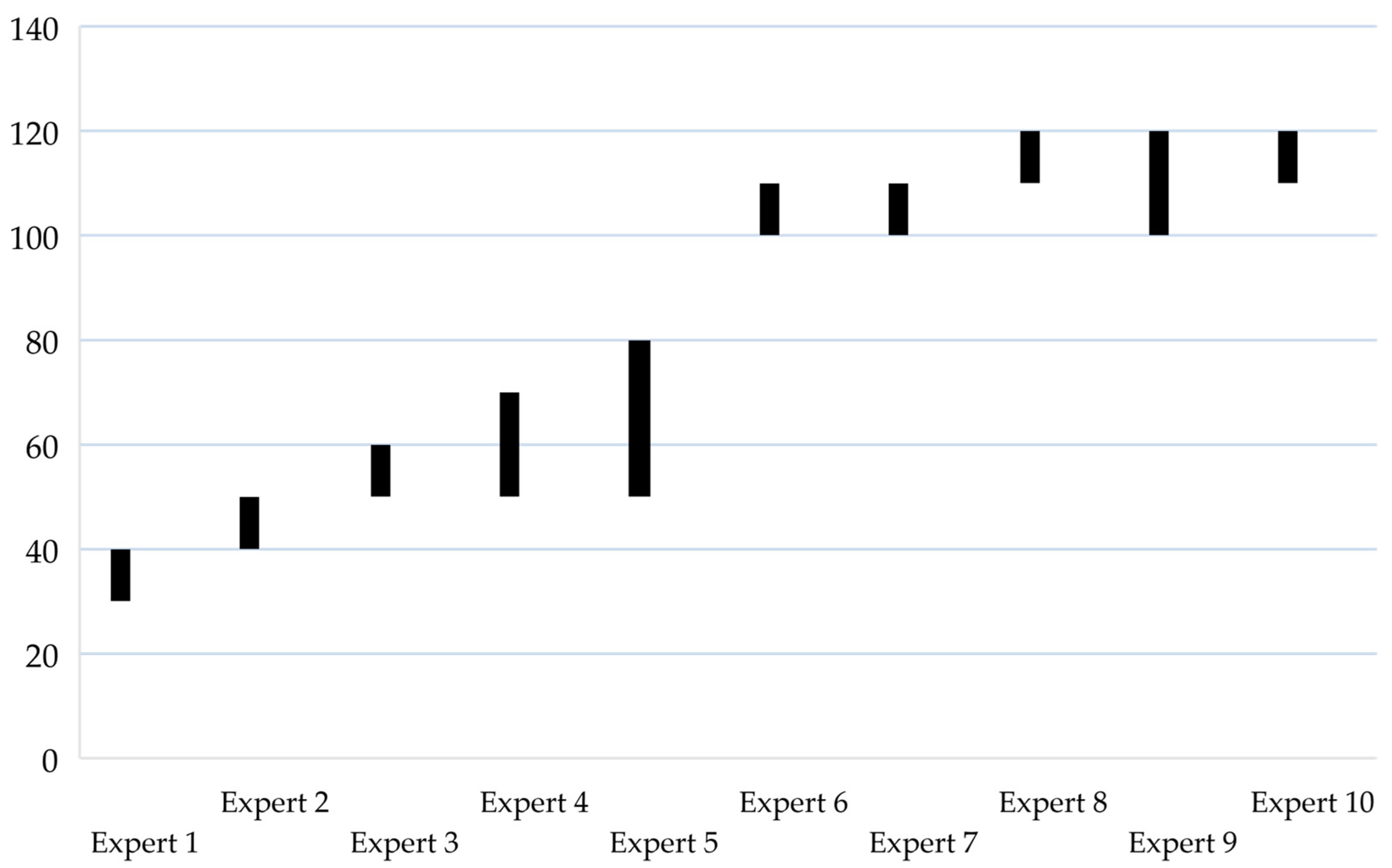

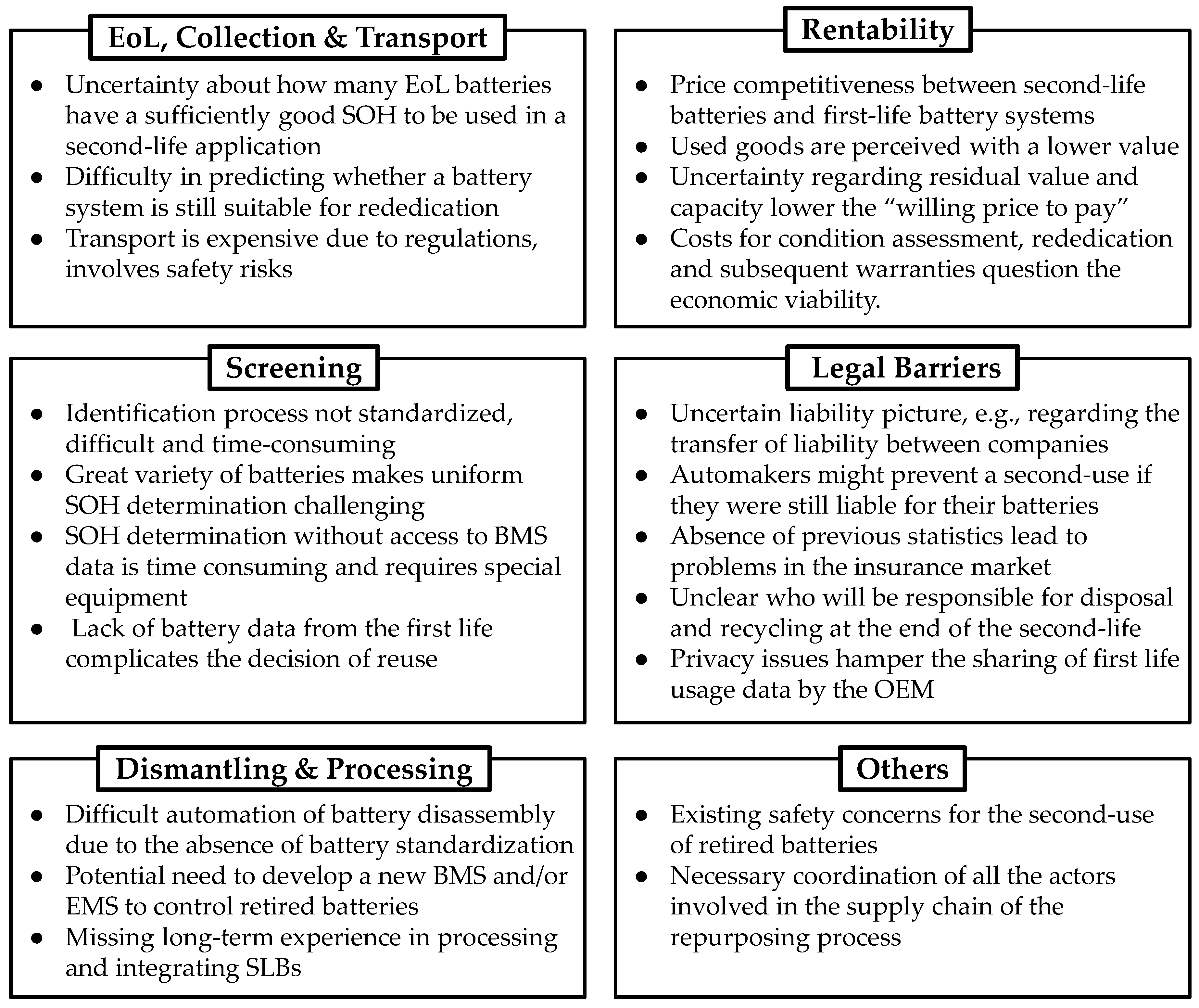

3.1. First industry study to rank existing challenges for SLBs

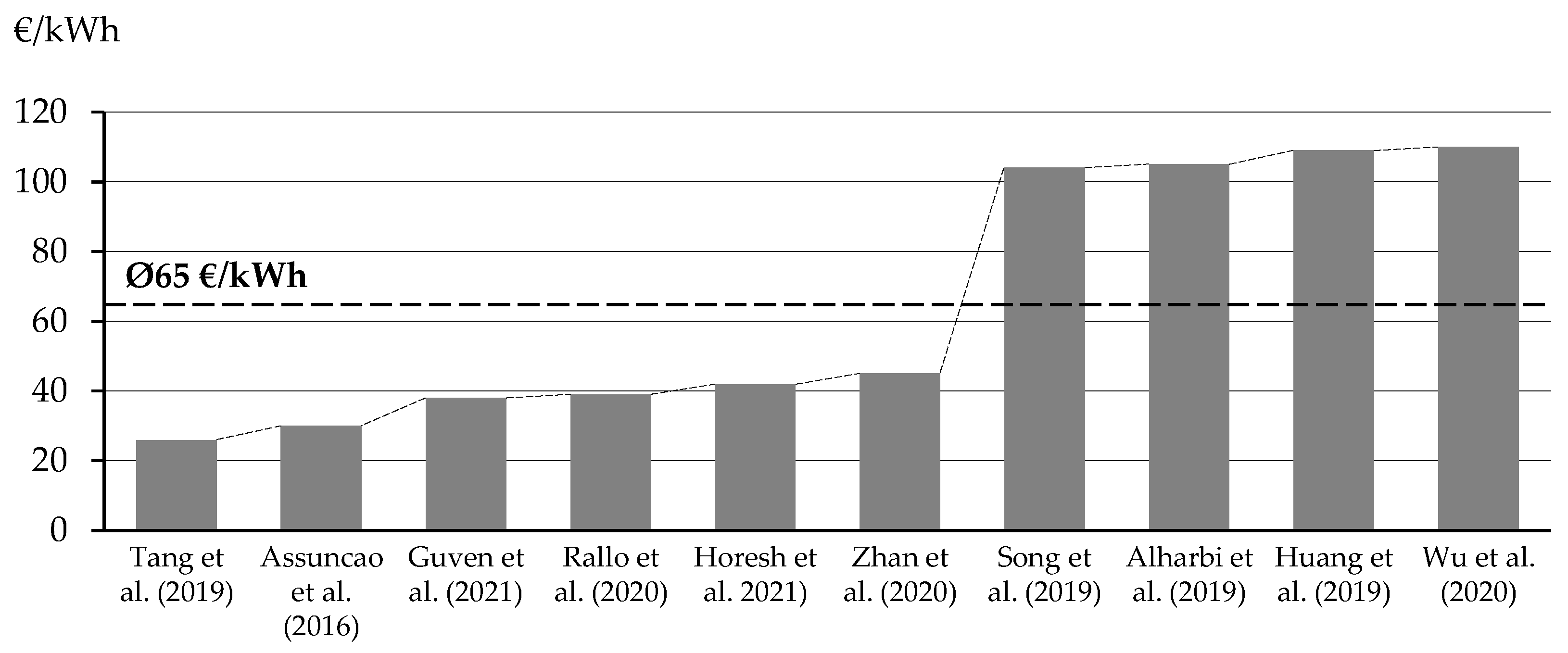

- Challenge 1: Uncertainty regarding profitability of a battery’s second-life

- Challenge 2: Price competition and competitiveness against new batteries and new storage technologies

- Challenge 3: Low return rate of batteries

- Challenge 4: Uncertainty about quality and remaining lifetime in second-life applications

- Challenge 5: Time consuming testing of suitable and compatible batteries

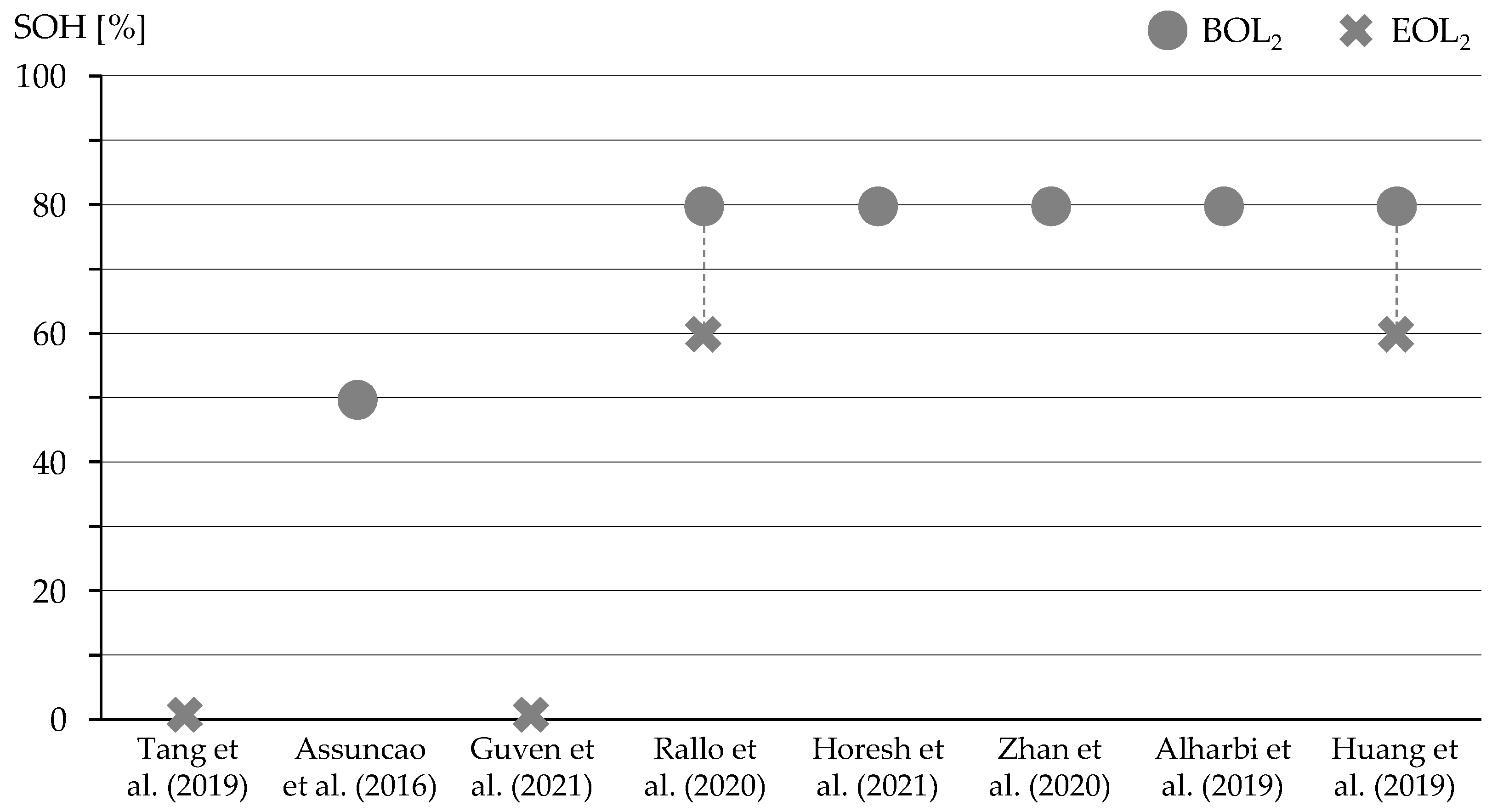

3.2. Second industry study to analyze the economic viability of aged battery systems

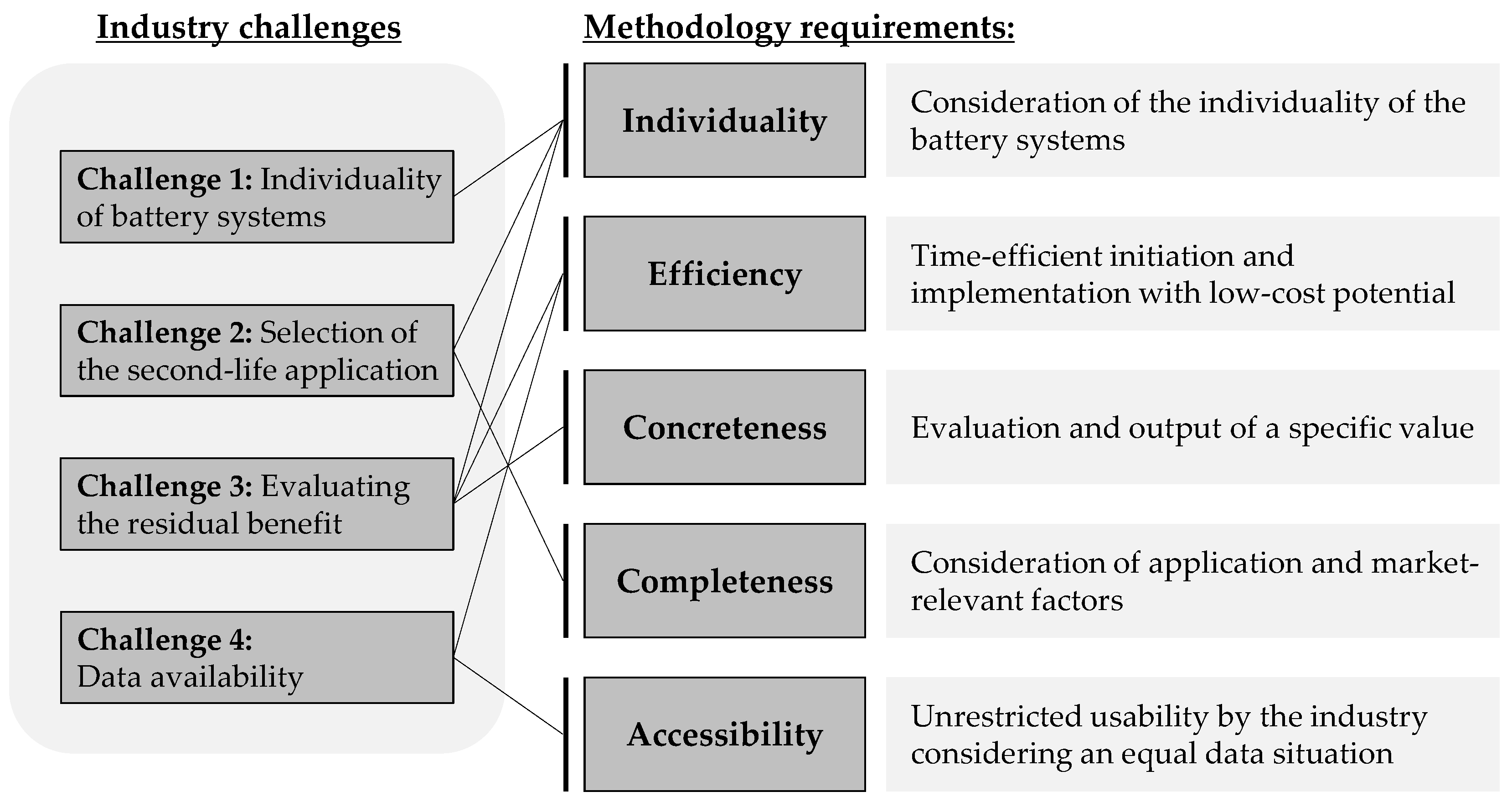

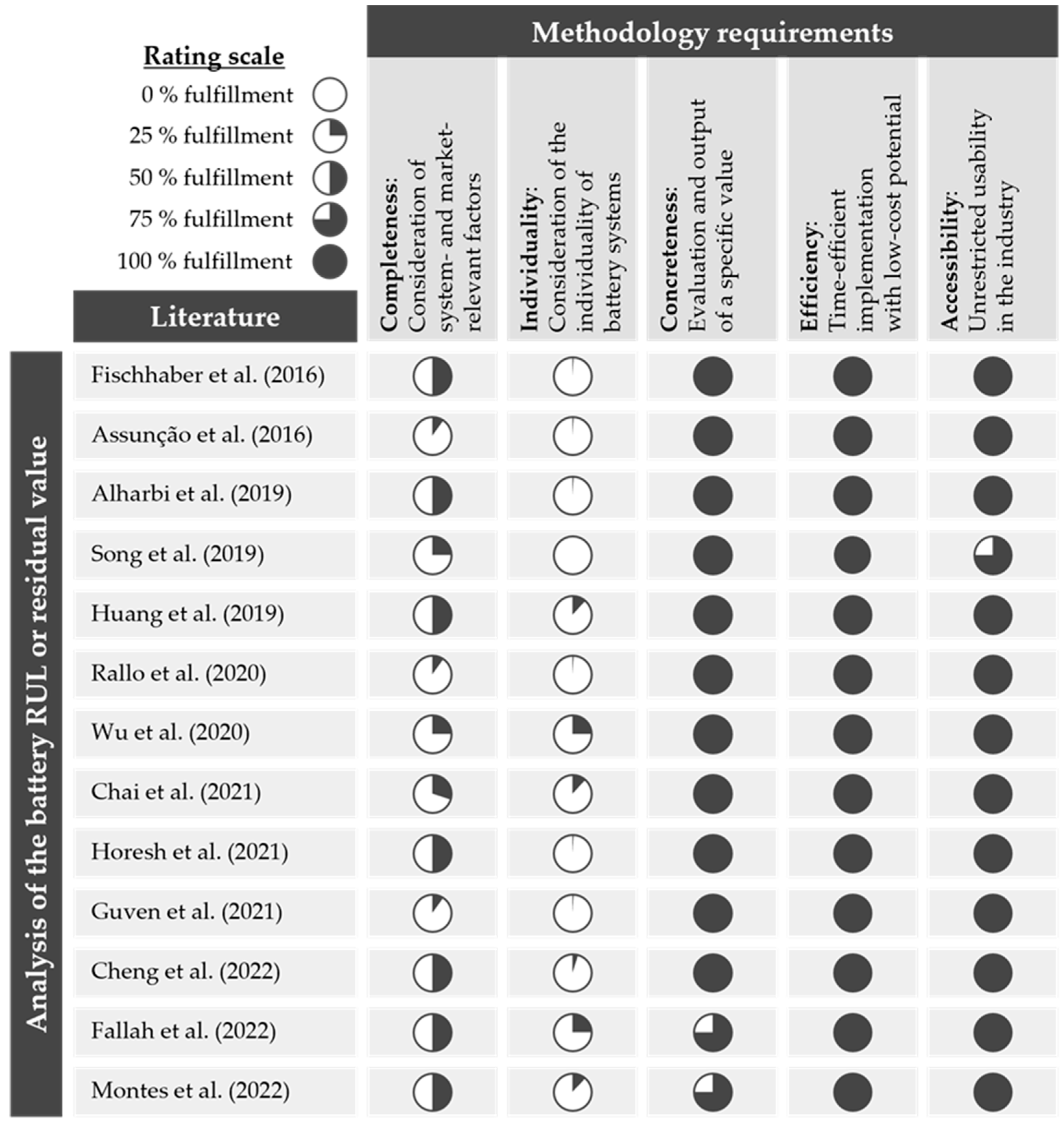

3.3. Derivation of the content-related requirements

3.4. Identification of the theory deficit

3.5. Formulation of a solution for overcoming second-life challenges

4. Conclusion

- Evaluation of the repurposing process for traction batteries on the basis of economic considerations: this includes calculating the costs, with the focus on understanding the repurposing process. This includes, among other things, multiple transportation, safety testing, condition diagnosis and, if necessary, dismantling if the battery is repurposed at module level. The meaningfulness of this sub-model depends in particular on the quality of the data’s quality, making the involvement of the industry indispensable.

- Selection of a suitable second-life application: this includes the identification of stationary second-life applications combined with an assessment of their technical and economic suitability for aged batteries.

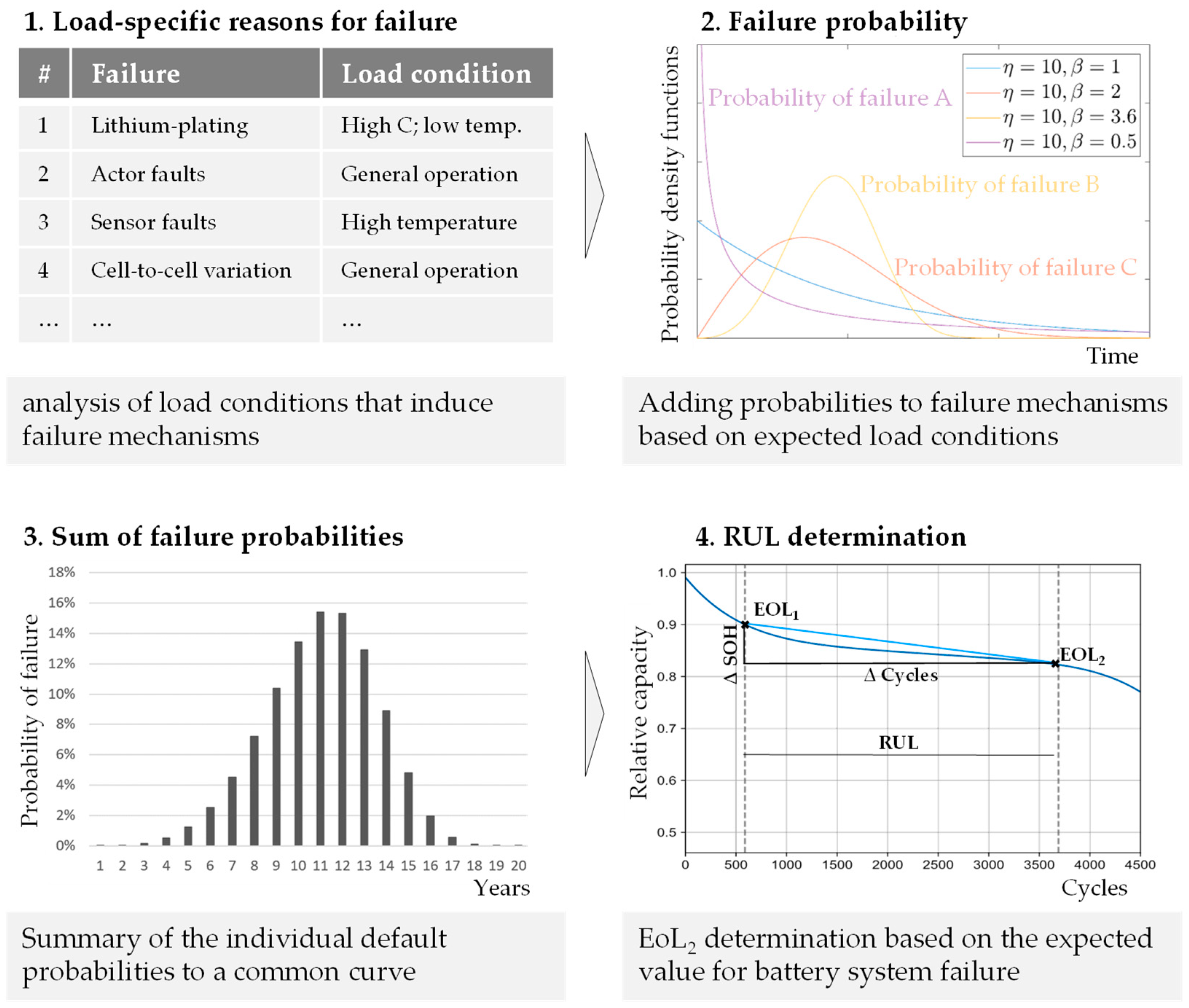

- Statistical determination of the residual lifetime of aged traction batteries by evaluating load profile-specific failure probabilities: this includes determining the condition of the individual battery system in order to assess the current ageing progress. In addition, the representative load profile of the stationary application is checked for negative operating conditions, which increase the probability of battery system failure.

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Statista. Electric Vehicles - Germany | Statista Market Forecast. Available online: https://www.statista.com/outlook/mmo/electric-vehicles/germany#unit-sales (accessed on 24 June 2023).

- Shahjalal, M.; Roy, P.K.; Shams, T.; Fly, A.; Chowdhury, J.I.; Ahmed, M.R.; Liu, K. A review on second-life of Li-ion batteries: prospects, challenges, and issues. Energy 2022, 241, 122881. [Google Scholar] [CrossRef]

- Nachhaltige Energieversorgung und Integration von Speichern: NEIS Conference 2016 = Sustainable energy supply and energy storage systems; Schulz, D., Ed.; Springer Vieweg: Wiesbaden, Heidelberg, 2017; ISBN 9783658150280. [Google Scholar] [CrossRef]

- Thein, S.; Chang, Y.S. Decision making model for lifecycle assessment of lithium-ion battery for electric vehicle – A case study for smart electric bus project in Korea. Journal of Power Sources 2014, 249, 142–147. [Google Scholar] [CrossRef]

- Zhu, J.; Mathews, I.; Ren, D.; Li, W.; Cogswell, D.; Xing, B.; Sedlatschek, T.; Kantareddy, S.N.R.; Yi, M.; Gao, T.; et al. End-of-life or second-life options for retired electric vehicle batteries. Cell Reports Physical Science 2021, 2, 100537. [Google Scholar] [CrossRef]

- Olsson, L.; Fallahi, S.; Schnurr, M.; Diener, D.; van Loon, P. Circular Business Models for Extended EV Battery Life. Batteries 2018, 4, 57. [Google Scholar] [CrossRef]

- Hesse, H.; Schimpe, M.; Kucevic, D.; Jossen, A. Lithium-Ion Battery Storage for the Grid—A Review of Stationary Battery Storage System Design Tailored for Applications in Modern Power Grids. Energies 2017, 10, 2107. [Google Scholar] [CrossRef]

- Second life-batterien als flexible speicher für erneuerbare energien; 2016.

- Lee, J.W.; Haram, M.H.S.M.; Ramasamy, G.; Thiagarajah, S.P.; Ngu, E.E.; Lee, Y.H. Technical feasibility and economics of repurposed electric vehicles batteries for power peak shaving. Journal of Energy Storage 2021, 40, 102752. [Google Scholar] [CrossRef]

- Ahmadi, L.; Yip, A.; Fowler, M.; Young, S.B.; Fraser, R.A. Environmental feasibility of re-use of electric vehicle batteries. Sustainable Energy Technologies and Assessments 2014, 6, 64–74. [Google Scholar] [CrossRef]

- Kamath, D.; Arsenault, R.; Kim, H.C.; Anctil, A. Economic and Environmental Feasibility of Second-Life Lithium-Ion Batteries as Fast-Charging Energy Storage. Environ. Sci. Technol. 2020, 54, 6878–6887. [Google Scholar] [CrossRef]

- Zhao, Y.; Pohl, O.; Bhatt, A.I.; Collis, G.E.; Mahon, P.J.; Rüther, T.; Hollenkamp, A.F. A Review on Battery Market Trends, Second-Life Reuse, and Recycling. Sustainable Chemistry 2021, 2, 167–205. [Google Scholar] [CrossRef]

- Haram, M.H.S.M.; Lee, J.W.; Ramasamy, G.; Ngu, E.E.; Thiagarajah, S.P.; Lee, Y.H. Feasibility of utilising second life EV batteries: Applications, lifespan, economics, environmental impact, assessment, and challenges. Alexandria Engineering Journal 2021, 60, 4517–4536. [Google Scholar] [CrossRef]

- CREADY, E.; LIPPERT, J.; PIHL, J.; WEINSTOCK, I.; SYMONS, P. Technical and Economic Feasibility of Applying Used EV Batteries in Stationary Applications; 2003. [Google Scholar] [CrossRef]

- Cicconi, P.; Landi, D.; Morbidoni, A.; Germani, M. Feasibility analysis of second life applications for Li-Ion cells used in electric powertrain using environmental indicators. In 2012 IEEE International Energy Conference and Exhibition (ENERGYCON). 2012 IEEE International Energy Conference (ENERGYCON 2012), Florence, Italy, 09–12 Sep. 2012; IEEE, 2012; pp. 985–990. ISBN 978-1-4673-1454-1. [Google Scholar] [CrossRef]

- Kampker, A.; Heimes, H.H.; Offermanns, C.; Vienenkötter, J.; Frank, M.; Holz, D. Identification of Challenges for Second-Life Battery Systems—A Literature Review. WEVJ 2023, 14, 80. [Google Scholar] [CrossRef]

- Nigl, T.; Rutrecht, B.; Altendorfer, M.; Scherhaufer, S.; Meyer, I.; Sommer, M.; Beigl, P. Lithium-Ionen-Batterien – Kreislaufwirtschaftliche Herausforderungen am Ende des Lebenszyklus und im Recycling. Berg Huettenmaenn Monatsh 2021, 166, 144–149. [Google Scholar] [CrossRef]

- Catton, J.; Walker, S.B.; McInnis, P.; Fowler, M.; Fraser, R.; Young, S.B.; Gaffney, B. Comparative safety risk and the use of repurposed EV batteries for stationary energy storage. In 2017 IEEE International Conference on Smart Energy Grid Engineering (SEGE). 2017 IEEE International Conference on Smart Energy Grid Engineering (SEGE), Oshawa, ON, Canada, 14–17 Aug. 2017; IEEE, 2017; pp. 200–209. ISBN 978-1-5386-1775-5. [Google Scholar] [CrossRef]

- Engel, H.; Hertzke, P.; Siccardo, G. Second-life EV batteries: The newest value pool in energy storage. McKinsey & Company [Online]. 30 April 2019. Available online: https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/second-life-ev-batteries-the-newest-value-pool-in-energy-storage (accessed on 24 June 2023).

- Elkind, E. Reuse and repower: How to save money and clean the grid with second-life electric vehicle batteries. Available online: https://escholarship.org/content/qt32s208mv/qt32s208mv.pdf.

- Fan, E.; Li, L.; Wang, Z.; Lin, J.; Huang, Y.; Yao, Y.; Chen, R.; Wu, F. Sustainable Recycling Technology for Li-Ion Batteries and Beyond: Challenges and Future Prospects. Chem. Rev. 2020, 120, 7020–7063. [Google Scholar] [CrossRef]

- Jiao, N.; Evans, S. Business Models for Repurposing a Second-Life for Retired Electric Vehicle Batteries. In Behaviour of Lithium-Ion Batteries in Electric Vehicles; Pistoia, G., Liaw, B., Eds.; Springer International Publishing: Cham, 2018; pp. 323–344. ISBN 978-3-319-69949-3. [Google Scholar] [CrossRef]

- Umwidmung und Weiterverwendung von Traktionsbatterien: Szenarien, Dienstleistungen und Entscheidungsunterstützung; Becker, J., Beverungen, D., Winter, M., Menne, S., Eds.; Springer Vieweg: Wiesbaden, Heidelberg, 2019; ISBN 9783658210205. [Google Scholar] [CrossRef]

- Viswanathan, V.V.; Kintner-Meyer, M.C. Repurposing of batteries from electric vehicles. In Advances in Battery Technologies for Electric Vehicles; Elsevier, 2015; pp. 389–415. ISBN 9781782423775. [Google Scholar] [CrossRef]

- Weng, A.; Dufek, E.; Stefanopoulou, A. Battery passports for promoting electric vehicle resale and repurposing. Joule 2023, 7, 837–842. [Google Scholar] [CrossRef]

- Fischhaber, S.; Schuster, S.F.; Regert, A.; Hesse, H. Second-Life-Konzepte für Lithium-Ionen-Batterien aus Elektrofahrzeugen; 2016. [Google Scholar]

- Assunção, A.; Moura, P.S.; Almeida, A.T. de. Technical and economic assessment of the secondary use of repurposed electric vehicle batteries in the residential sector to support solar energy. Applied Energy 2016, 181, 120–131. [Google Scholar] [CrossRef]

- Alharbi, T.; Bhattacharya, K.; Kazerani, M. Planning and Operation of Isolated Microgrids Based on Repurposed Electric Vehicle Batteries. IEEE Trans. Ind. Inf. 2019, 15, 4319–4331. [Google Scholar] [CrossRef]

- Song, Z.; Feng, S.; Zhang, L.; Hu, Z.; Hu, X.; Yao, R. Economy analysis of second-life battery in wind power systems considering battery degradation in dynamic processes: Real case scenarios. Applied Energy 2019, 251, 113411. [Google Scholar] [CrossRef]

- Huang, Z.; Xie, Z.; Zhang, C.; Chan, S.H.; Milewski, J.; Xie, Y.; Yang, Y.; Hu, X. Modeling and multi-objective optimization of a stand-alone PV-hydrogen-retired EV battery hybrid energy system. Energy Conversion and Management 2019, 181, 80–92. [Google Scholar] [CrossRef]

- Rallo, H.; Canals Casals, L.; La Torre, D. de; Reinhardt, R.; Marchante, C.; Amante, B. Lithium-ion battery 2nd life used as a stationary energy storage system: Ageing and economic analysis in two real cases. Journal of Cleaner Production 2020, 272, 122584. [Google Scholar] [CrossRef]

- Wu, W.; Lin, B.; Xie, C.; Elliott, R.J.; Radcliffe, J. Does energy storage provide a profitable second life for electric vehicle batteries? Energy Economics 2020, 92, 105010. [Google Scholar] [CrossRef]

- Chai, S.; Xu, N.Z.; Niu, M.; Chan, K.W.; Chung, C.Y.; Jiang, H.; Sun, Y. An Evaluation Framework for Second-Life EV/PHEV Battery Application in Power Systems. IEEE Access 2021, 9, 152430–152441. [Google Scholar] [CrossRef]

- Horesh, N.; Quinn, C.; Wang, H.; Zane, R.; Ferry, M.; Tong, S.; Quinn, J.C. Driving to the future of energy storage: Techno-economic analysis of a novel method to recondition second life electric vehicle batteries. Applied Energy 2021, 295, 117007. [Google Scholar] [CrossRef]

- Guven, D.; Kayalica, M.O.; Kayakutlu, G. Critical Power Demand Scheduling for Hospitals Using Repurposed EV Batteries. Technol Econ Smart Grids Sustain Energy 2021, 6. [Google Scholar] [CrossRef]

- Cheng, M.; Ran, A.; Zheng, X.; Zhang, X.; Wei, G.; Zhou, G.; Sun, H. Sustainability evaluation of second-life battery applications in grid-connected PV-battery systems. Journal of Power Sources 2022, 550, 232132. [Google Scholar] [CrossRef]

- Fallah, N.; Fitzpatrick, C. How will retired electric vehicle batteries perform in grid-based second-life applications? A comparative techno-economic evaluation of used batteries in different scenarios. Journal of Cleaner Production 2022, 361, 132281. [Google Scholar] [CrossRef]

- Montes, T.; Etxandi-Santolaya, M.; Eichman, J.; Ferreira, V.J.; Trilla, L.; Corchero, C. Procedure for Assessing the Suitability of Battery Second Life Applications after EV First Life. Batteries 2022, 8, 122. [Google Scholar] [CrossRef]

- Kampker, A.; Heimes, H.H.; Offermanns, C.; Frank, M.; Klohs, D.; Nguyen, K. Prediction of Battery Return Volumes for 3R: Remanufacturing, Reuse, and Recycling. Energies 2023, 16, 6873. [Google Scholar] [CrossRef]

- Zou, B.; Zhang, L.; Xue, X.; Tan, R.; Jiang, P.; Ma, B.; Song, Z.; Hua, W. A Review on the Fault and Defect Diagnosis of Lithium-Ion Battery for Electric Vehicles. Energies 2023, 16, 5507. [Google Scholar] [CrossRef]

- Zhao, Q.; Jiang, H.; Chen, B.; Wang, C.; Xu, S.; Zhu, J.; Chang, L. Research on State of Health for the Series Battery Module Based on the Weibull Distribution. J. Electrochem. Soc. 2022, 169, 20523. [Google Scholar] [CrossRef]

- Xing, J.; Zhang, H.; Zhang, J. Remaining useful life prediction of – Lithium batteries based on principal component analysis and improved Gaussian process regression. International Journal of Electrochemical Science 2023, 18, 100048. [Google Scholar] [CrossRef]

- Institute of Electrical and Electronics Engineers. IEEE International Energy Conference and Exhibition (ENERGYCON), 2012: 9 - 12 Sept. 2012, Florence, Italy; IEEE: Piscataway, NJ, 2012; ISBN 978-1-4673-1454-1. [Google Scholar]

| Subject | Content | Amount of Questions |

|---|---|---|

|

General information about the strategy alignment of the surveyed companies. | 3 |

|

SWOT- Analysis, Ecological and economic meaningfulness regarding SLB | 5 |

|

Impact of transport regulations, requirements for second-life supply chain | 3 |

|

Future battery availability, factors affecting lack of availability. | 3 |

|

Competitiveness with new batteries, effects of status determination, criteria for profitable rededication process | 6 |

|

Ownership and liability allocation, disposal responsibility, access to usage data | 5 |

|

Procedures used by the companies, hampering factors | 5 |

|

Impact of battery system variability, impact on profitability, need for disassembly | 6 |

|

Identification of highly relevant barriers | 2 |

|

Relevance of a european battery passport, impact of "Design for Circularity" | 5 |

| Findings | |

|---|---|

| 1 | Consensus that there is no generally recognized procedure for determining the residual value of aged battery systems. |

| 2 | Majority sees SOH determination alone as insufficient condition assessment. |

| 3 | Battery condition and dismantling costs are the most significant cost factors. |

| 4 | The battery's condition and the proceeds of the repurposing scenario cannot be determined in a universally applicable manner and require individual quantification. |

| 5 | No clear market price for used battery systems in the EU |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).