1. Introduction

The open bidding system can not only standardize the market order, improve the efficiency of procurement fund utilization, and reasonably allocate resources, but also enhance the competitive and innovative awareness of social enterprises. This will be conducive to select supplier enterprises that are scientific and international for bidding.

Competitive bidding is one of the most common methods for tenders to select suppliers [

1,

2]. Open bidding is an important measure to standardize procurement behavior and improve the efficiency of capital use [

3]. Since 2015, open bidding has made great progress and achieved an outstanding effect in material supply of Sinopec. But there have been a lot of complaints about collusive bidding in recent years. Among Sinopec’s complaint cases in the past three years, 48.6% were complaints about collusive bidding.

Collusive bidding will pose a serious challenge to the fair competition with suppliers [

4,

5]. Contracts awarded on the basis of collusive bidding by bidders may result in increased costs for material procurement projects [

6,

7]. The essence of collusive bidding is that bidders quote higher or lower than the reasonable price of the project [

8,

9], aiming to gain an advantage over other competitors and achieve higher profits [

10,

11]. As far as the tender is concerned, the collusive bidding will damage the interests of the tender [

12]. Through the formal bidding process, the tender could have obtained high-quality services or products at a lower purchase price, but the collusive bidding behavior makes the high-quality bidders unable to win the bid. The result is that the tender has to pay a higher price for a relatively inferior service or product [

13]. For the society, collusive bidding not only disrupts the fair competition in the market, but also interferes with the effective allocation of social and economic resources, thus reducing the economic benefits and production efficiency of the whole society.

The phenomenon of collusion bidding has existed for a considerable period of time, but its timely detection and identification is a pervasive challenge [

14,

15]. Therefore, a scientific and effective analysis model is needed to identify the collusive bidding behavior of bidders. Taking the framework agreement bidding of material A of Sinopec as an example, this paper establishes a statistical model based on historical quotations, which can be widely used in the bidding and procurement of the framework agreement of materials to prevent the collusive bidding behavior of bidders.

2. Materials and Methods

2.1. The procurement process of material A

At present, the number of professional manufacturers producing the material A is nearly 100, and there are differences in product quality and price among various manufacturers. In general, suppliers can be divided into three levels. The first level of manufacturers is less than 10%, and its production scale is large, technology research and product series have reached the international advanced level. The second level of manufacturers accounted for about 30%, with considerable production capacity and research and development capabilities, but in the product series and qualification certification is slightly inferior. Other manufacturers are the third level, and their product series have a higher degree of general research and development capabilities, and relatively low product prices.

Due to the large demand for material A in petrochemical enterprises, the procurement methods are mainly based on framework agreements. First of all, through the centralized open bidding of the headquarters to determine the shortlisted suppliers, and sign a unified framework agreement with them. Subsequently, each enterprise signed specific orders with suppliers according to the framework agreement of the headquarters.

In the bidding process, business rating is usually calculated by the benchmark price method. Among them, the arithmetic average price of each bidder is taken as the price benchmark, and the business score of each bidder is calculated according to the difference between the price and the benchmark price [

16]. This method can avoid the risk of winning bids at low prices and defective products, and is the most commonly used business score calculation method for large-scale or important material procurement [

17]. However, the large interest drives some bidders to form a community to raise the benchmark price and win the bid at a high price for illegal profit, thus increasing the risk of collusion bidding.

2.2. Establishment of a statistical model for identifying collusive bidding

In order to prevent the occurrence of collusion bidding by bidders, this paper aims to determine the price rule based on the statistical analysis of the historical quotations for material A, and establish a statistical model that can identify the collusion bidding, to be applicable to the bidding and procurement under various material frameworks agreements.

2.2.1. Analysis of historical quotations for material A

The historical quotations database is the most commonly used tool for purchasing personnel [

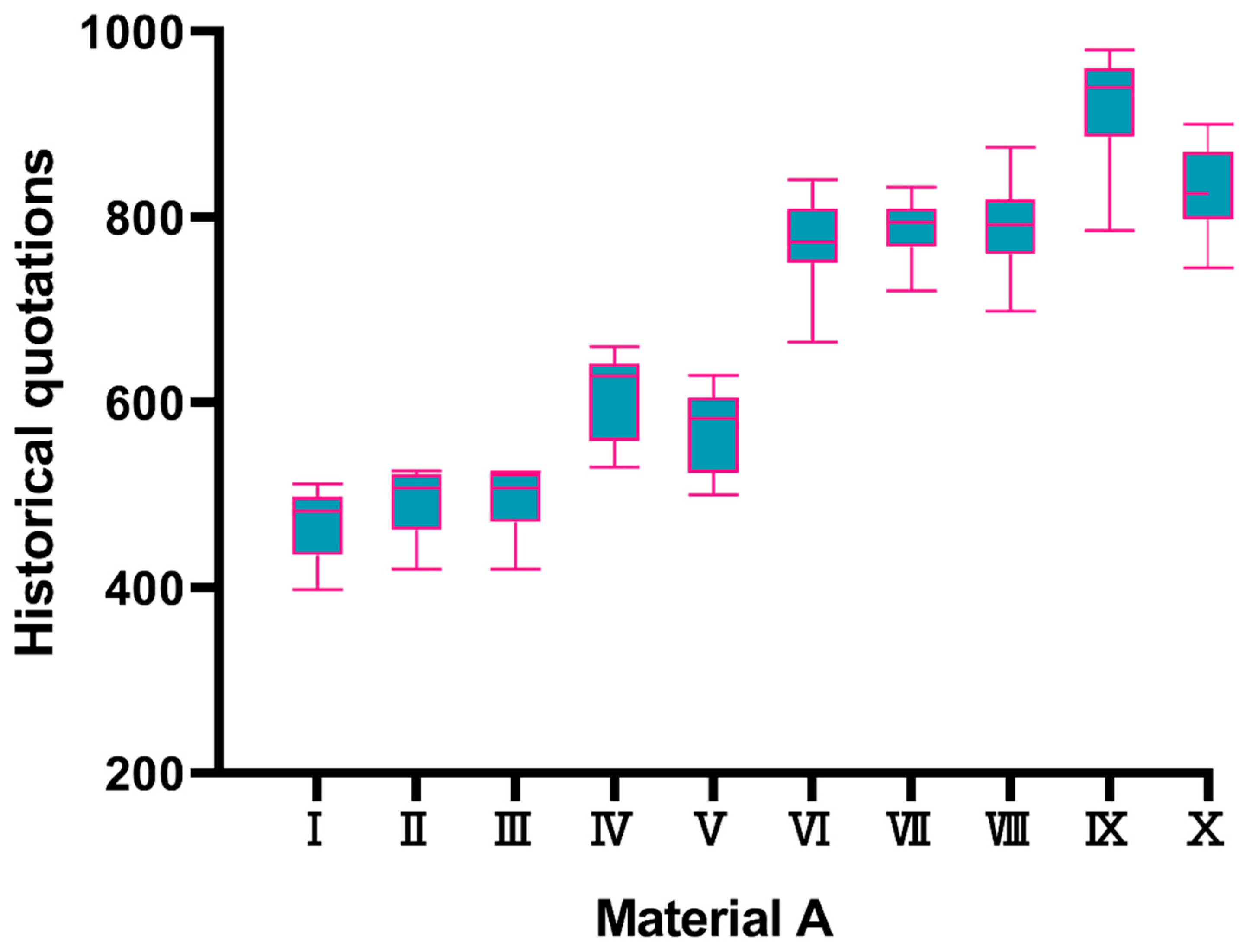

18]. Using the principle of statistics to analyze the historical quotations, we can determine the market price rule of this kind of material. The historical quotations of 10 commonly used types of material A are shown in

Table 1 and

Figure 1.

2.2.2. Statistics of historical quotations for material A

The average quotations

, standard deviation

S, coefficient of variation

cv and deviation rate

δ between the maximum and minimum value of the material A are calculated by historical quotations, where

The results are shown in

Table 2. Excluding the factors of inflation and rising cost, the price rule of material A is found through these statistics as follows:

a) The historical quotations are relatively stable, and the coefficient of variation cv is no more than 10%;

b) The difference between bid quotations is small, and the deviation ratio δ between the maximum and the minimum value does not exceed 30%.

2.2.3. Estimate of the market price for material A

Then the statistics of historical quotations for the material A are used as the sample to estimate the range of the market price of this set of materials.

The market price distribution of the material A conforms to the normal distribution,

Where, the equation for calculating the average quotations

and standard deviation

S based on historical quotations for material A is

According to Equation 2, the population mean of the market price of material A in the confidence interval 1- α is

Considering the increase in raw material and labor costs during the framework agreement period, the market price is multiplied by the increase correction coefficient

K, and the

K of the material A is taken as 1.05 per year. The average market price of the material A with 95% confidence interval can be calculated, as shown in

Table 3.

2.2.4. Evaluation indicators of statistical model for identifying collusive bidding

(A) Quotation coefficient of variation cv: The coefficient of variation is a characteristic quantity representing the degree of data dispersion, that is, the ratio of the standard deviation of the data to its corresponding average, which is mainly used to compare the statistical dispersion of different samples [

19]. Here, the quotation coefficient of variation is used to test the deviation level of each supplier. Due to the similar raw materials and no significant differences in production processes for the material A, there is not a significant price difference. Based on the analysis of historical quotations as a sample in the previous section, it can be seen that the coefficient of variation of the material A is within 10%, and the maximum value of other categories of materials does not exceed 15%. Therefore, we presumed that a quotation coefficient of variation cv exceeding 15% is considered a possibility of collusive bidding.

(B) Ratio of high to low average quotation rP: Collusive bidding will increase the benchmark price, resulting in the supplier winning the bid at a high price. How many collusion bidders will result in the benchmark price being raised?

Based on the deviation rate between the maximum and minimum historical quotations mentioned above, it was found that collusion suppliers would increase their prices by at least 20% of profit, resulting in a deviation in the benchmark price. Excluding the annual increase in labor costs, we presume that there is collusion behavior when the benchmark price is raised by 7%.

The calculation equation for the number of collusion bidders is as follows:

where

N represents the total number of bidding suppliers,

n represents collusive bidding suppliers, and P represents the average quotation of materials.

The result calculated by Equation 6 is

We found that when about 1/3 of suppliers engage in collusion bidding, it will cause a deviation in the benchmark price.

Therefore, after ranking the quotations of bidders from high to low, we set the ratio of high to low average prices as

where P

1/3 is the average high price quoted by the top 1/3 bidders, and P

2/3 is the average low price quoted by the bottom 2/3 bidders.

When the rP exceeds 20%, it indicates a deviation in the benchmark price quoted by the bidder, and we speculate that there is a possibility of collusion bidding.

(C) Deviation rate of quotation δ: One of the important characteristics of collusive bidding is that the bidding quotations are similar. According to the analysis results above, 1/3 of the bidders colluding may lead to an increase in the benchmark price.

The deviation rate that characterizes the proximity of higher bidders’ quotations is:

where P

max is the highest price, and P

1/3 is the average high price quoted by the top 1/3 bidders.

When δ is less than 5%, it indicates that bidders with high quotations have similar prices and there is a possibility of collusion bidding.

2.2.5. Analysis results of statistical model for identifying collusive bidding

By combining the three important parameters of

cv,

rP and

δ, the statistical model can be established to identify collusive bidding. The analysis results are shown in

Table 4.

Case 1: When cv ≧ 15%, the coefficient of variation has exceeded the statistical dispersion of the market price. The benchmark price can no longer represent the market price and it is considered a collusive bidding.

Case 2: When 10% ≦ cv < 15%, the dispersion of bidding quotations is relatively high, which may be due to collusive bidding or cost differences caused by factors such as materials and raw materials. This case requires further analysis of other indicators.

When rP ≧ 20% and δ < 5%, it indicates that the quotations are similar and can be considered as collusive bidding. When rP ≧ 20% and δ ≧ 5%, it indicates that the benchmark price quoted by the bidder is relatively high and can be considered as suspicious.

When rP < 20%, it indicates that there is no deviation in the benchmark price although the quotations are discrete and may be caused by cost differences.

Case 3: When cv < 10%, the bidding quotations are stable and concentrated, indicating a low possibility of collusion bidding.

However, when rP ≧ 20% and δ ≧ 5%, there is a possibility that the statistical dispersion does not deviate significantly due to a small number of collusive suppliers, which requires special attention.

Other cases: Except for the three cases mentioned above, the bidding quotations conform to the market price rule and there is no collusion.

2.3. Statistical analyses

All data were analyzed by GraphPad Prism 8.0 software (GraphPad Software Inc., USA).

3. Results and discussion

3.1. Statistics of quotations for material B

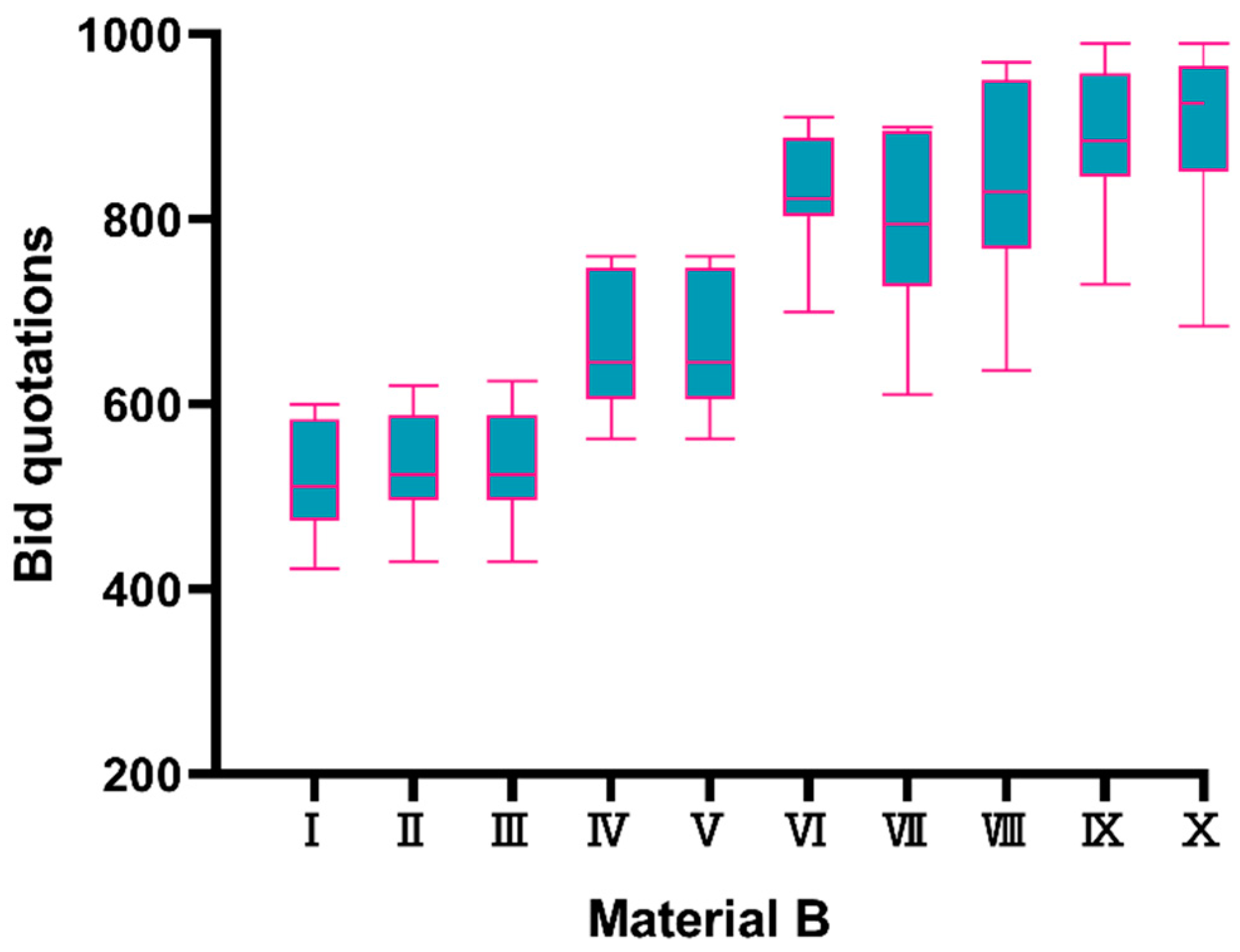

It is necessary to verify the validity of the statistical model for identifying collusive bidding. We take the framework agreement bidding for material B as a case study, and the quotations of 12 suppliers are shown in

Table 5.

According to

Figure 2 and

Table 5, the characteristics of the quotations can be analyzed as follows:

a) The standard deviation of bid quotations was large, and 10% ≦ cv < 15% indicates that these quotations are discrete.

b) There was a price gap in bid quotations. For example, bidders 1, 5, 8, and 10 quoted 40% higher for type Ⅷ than other suppliers, and rP ≧ 20%.

c) Some bidders have quoted high and similar prices. For example, the prices quoted by bidders 1, 5, 8, and 10 are significantly higher than the average price, and δ < 5%.

3.2. Analysis results of statistical model in material B

The statistical model for identifying collusive bidding was used to analyze the quotations of material B. The results in

Table 6 indicate that there is a possibility of collusion bidding for types I, V, VII, VIII, and IX of material B. Further analysis revealed that the abnormal bidding quotations were from bidders 1, 5, 8, and 10. After investigation and evidence collection, it was found that there were indeed four suppliers colluding in this bidding. Therefore, the statistical model for identifying collusive bidding has been verified in practice.

4. Conclusions

Based on the statistical analysis of the historical quotations for the material A, we proposed a statistical model for identifying collusive bidding using the coefficient of variation cv, the ratio of high to low average quotation rP and deviation rate of quotation δ as indicators. The validity and applicability of this statistical model were further verified through a case study of the framework agreement bidding for material B.

This statistical model could be used in multiple large-scale framework agreement bidding by Sinopec in the future. This will help the tender quickly and effectively identify the possibility of collusive bidding without conducting market analysis or investigating historical prices, thereby improving the quality of bidding. Furthermore, this is also beneficial for preventing the collusive bidding.

Author Contributions

Conceptualization, Jieni Li and Hongchao Guo; Data curation, Fei Xie; Formal analysis, Jieni Li; Investigation, Jieni Li; Methodology, Jieni Li, Fei Xie and Hongchao Guo; Software, Jieni Li, Fei Xie and Hongchao Guo; Supervision, Hongchao Guo; Validation, Fei Xie and Hongchao Guo; Writing – original draft, Jieni Li; Writing – review & editing, Fei Xie and Hongchao Guo.

Funding

This research was funded by the Technology Transformation and Development Project of Sinopec Yanshan Petrochemical (grant nos. YSAC190181).

Data Availability Statement

All other data that support the findings of this study are available from the corresponding author upon reasonable request.

Conflicts of Interest

The authors declare that there are no conflicts of interest.

References

- Takano, Y.; Ishii, N.; Muraki, M. Determining bid markup and resources allocated to cost estimation in competitive bidding. Autom. Constr. 2018, 85, 358–368. [Google Scholar] [CrossRef]

- Cattell, D.W.; Bowen, P.A.; Kaka, A.P. Review of unbalanced bidding models in construction. J. Constr. Eng. Manag. -Asce 2007, 133, 562–573. [Google Scholar] [CrossRef]

- Li, H.; Su, L.; Zuo, J.; An, X.; Dong, G.; Wang, L.; Zhang, C. The framework of data-driven and multi-criteria decision-making for detecting unbalanced bidding. Eng. Constr. Archit. Manag. 2021, 30, 598–622. [Google Scholar] [CrossRef]

- Hyari, K.H. A Procedure for Rebalancing Unbalanced Bidding in Unit Price Contracts. J. Leg. Aff. Disput. Resolut. Eng. Constr. 2023, 15. [Google Scholar] [CrossRef]

- Choi, S.; Choi, S.; Kim, J.; Lee, E.-B. AI and Text-Mining Applications for Analyzing Contractor’s Risk in Invitation to Bid (ITB) and Contracts for Engineering Procurement and Construction (EPC) Projects. Energies 2021, 14, 4632. [Google Scholar] [CrossRef]

- Alhyari, O.; Hyari, K.H. Handling Unbalanced Pricing in Bidding Regulations for Public Construction Projects. J. Leg. Aff. Disput. Resolut. Eng. Constr. 2022, 14, 04522011. [Google Scholar] [CrossRef]

- Hu, H.; Deng, X.; Mahmoudi, A. A cognitive model for understanding fraudulent behavior in construction industry. Eng. Constr. Archit. Manag. 2021, 30, 1423–1443. [Google Scholar] [CrossRef]

- Lee, J.-S. Simulating Competitive Bidding in Construction Collusive Bidding Cases. J. Manag. Eng. 2022, 38, 04022050. [Google Scholar] [CrossRef]

- Alhyari, O.; Hyari, K.H. An International Overview of Unbalanced Pricing under Bidding Regulations for Public Construction Projects. J. Leg. Aff. Disput. Resolut. Eng. Constr. 2023, 15, 04522064. [Google Scholar] [CrossRef]

- An, X.; Li, H.; Zuo, J.; Ojuri, O.; Wang, Z.; Ding, J. Identification and Prevention of Unbalanced Bids Using the Unascertained Model. J. Constr. Eng. Manag. 2018, 144. [Google Scholar] [CrossRef]

- Padhi, S.S.; Mohapatra, P.K.J. Detection of collusion in government procurement auctions. J. Purch. Supply Manag. 2011, 17, 207–221. [Google Scholar] [CrossRef]

- Kwas, M.; Rubaszek, M. Forecasting Commodity Prices: Looking for a Benchmark. Forecasting 2021, 3, 447–459. [Google Scholar] [CrossRef]

- Bergeron, C. Benchmark, relative return, and asset pricing. Appl. Econ. Lett. 2021, 29, 1498–1503. [Google Scholar] [CrossRef]

- Abrantes-Metz, R.M.; Bajari, P. Screens for conspiracies and their multiple applications. Compet. Policy Int. 2010, 6, 129–144. [Google Scholar]

- Signor, R.; Love, P.E.D.; Oliveira, P.S. Public Infrastructure Procurement: Detecting Collusion in Capped First-Priced Auctions. J. Infrastruct. Syst. 2020, 26, 1–12. [Google Scholar] [CrossRef]

- Lee, J.-S. Simulating Competitive Bidding in Construction Collusive Bidding Cases. J. Manag. Eng. 2022, 38, 04022050. [Google Scholar] [CrossRef]

- Mehrbod, A.; Zutshi, A.; Grilo, A.; Jardim-Gonsalves, R. Application of a semantic product matching mechanism in open tendering e-marketplaces. J. Public Procure. 2018, 18, 14–30. [Google Scholar] [CrossRef]

- Gunadi, M.P.; Evangelidis, I. The Impact of Historical Price Information on Purchase Deferral. J. Mark. Res. 2022, 59, 623–640. [Google Scholar] [CrossRef]

- Kvålseth, T.O. Coefficient of variation: The second-order alternative. J. Appl. Stat. 2016, 44, 402–415. [Google Scholar] [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).