1. Introduction

In the context of hydrocarbon-based economies, maintaining economic sustainability is crucial for ensuring the continued success of a country's economy. A significant portion of revenue in these economies is derived from the sale of hydrocarbons (Flamos, Roupas, & Psarras, 2013). According to Mishrif (2018) definition, economic diversification implies the development of policies that reduce dependence on a single industry or sector, such as oil, in terms of its contribution to Gross Domestic Product (GDP), export earnings, and government revenues. This diversification involves increasing reliance on non-hydrocarbon sectors like services, manufacturing, tourism, and agriculture, creating new sources of government income.

Economic diversification plays a vital role in fostering business development, generating job opportunities for a growing population, and, importantly, mitigating the risks associated with oil price dependence and high economic concentration (Schilirò, 2013). The backbone of hydrocarbon-based economies revolves around commodity prices, known for their volatile nature, creating unique economic circumstances (Smith, 2019). These economies are particularly susceptible to fluctuations in oil prices, making long-term predictions challenging (Cevik, 2014). The unpredictable nature of oil prices poses a primary concern for these economies, which have experienced various booms and busts over the last five decades (Smith, 2019).

The fluctuations in oil prices have left some major hydrocarbon-producing nations economically disadvantaged during periods of price drops (Ustaoğlu & İncekara, 2017). These crises underscore the need for diversifying revenue sources in hydrocarbon-based economies to ensure financial stability amid external factors (Darina & Daurtsev, 2018).

A significant challenge lies in the substantial decline in hydrocarbon prices over the past five decades. Countries dependent on hydrocarbon exports have adversely impacted budgetary conditions, income stress, urban development, and trade balance (Göçer, 2016). According to Mishrif (2018), the last decade witnessed a significant drop in hydrocarbon prices, plummeting by 70% in 2016 to around US$ 30 after reaching US$ 100 between 2010 and 2014. This volatility raised serious concerns about the sustainability of hydrocarbon economies, prompting calls for the development of diversified economies capable of withstanding such fluctuations (Ustaoğlu & İncekara, 2017).

Recent events have emphasized the importance of economic diversification in light of dramatic drops in hydrocarbon prices (Ustaoğlu & İncekara, 2017). Mishrif (2018) highlights the fragility of national economic cycles, citing the negative impacts of oil price fluctuations on export revenues, government income, and overall GDP growth. Evidence supports the idea that economic sustainability is crucial for a nation's success, necessitating a comprehensive, long-term approach to hydrocarbon revenue utilization (Aitzhanova et al., 2015).

Hydrocarbon-based economies are highly vulnerable to price drops, akin to the phenomenon known as "Dutch Disease" (Flamos et al., 2013). This economic condition, characterized by reduced export competitiveness after a significant influx of capital from gas exports, has been linked to adverse effects on national economies (Hien, Hong Vinh, Phuong Mai, & Kim Xuyen, 2020). Numerous studies emphasize the importance of a diversified economy for hydrocarbon-based nations, acknowledging the impact of Dutch Disease on financial development and economic stability (Adetutu, Odusanya, Ebireri, & Murinde, 2020; Parcero, 2019). These consequences include limitations in integrating commodities into other sectors, governance issues, challenges in managing financial and human resources, and the prevalence of rent-seeking behavior.

1.1. Problem Statement and Research Goal

In the dynamic landscape of global innovation, hydrocarbon-based economies face a critical challenge in transitioning from resource dependency to knowledge-driven sustainability. The traditional reliance on finite natural resources, exemplified by oil and gas, poses economic vulnerabilities to fluctuations in commodity prices, necessitating a shift toward diversified and knowledge-centric models. This transformation is imperative for sustained economic growth, mitigating risks associated with oil price dependence, and fostering resilience in the face of economic uncertainties. However, despite global recognition of the importance of knowledge-based economies, hydrocarbon-dependent nations grapple with economic diversification, educational reform, and technological integration complexities. Addressing these challenges is paramount to securing the long-term viability and success of nations seeking to escape the resource curse and embrace sustainable economic and educational paradigms.

This research aims to examine the challenges hindering economic sustainability in hydrocarbon-based economies and identify imperatives for innovation. The study aims to provide insights into transitioning from resource dependency to knowledge-driven sustainability. This research innovatively explores the intersection of economic sustainability and innovation challenges in hydrocarbon-based economies, offering a comprehensive analysis. It contributes novel perspectives on imperative strategies, fostering a paradigm shift towards sustainable and diversified economic models in the face of hydrocarbon market uncertainties through direct interviews with a diverse number of business and academic sector experts from several organizations.

1.2. Research Structure

This study spans five chapters, each contributing to a profound comprehension of innovation ecosystems and the economic sustainability of hydrocarbon-based economies. Our exploration begins with Chapter 1's contextual introduction, establishing the foundation for investigating the present state of innovation, education, and economic sustainability, along with the background of hydrocarbon-based economies. This chapter articulates the problem statement and research goal concerning hydrocarbon-based economies' challenges in transitioning to knowledge-driven sustainability, emphasizing the imperative to explore innovation, education, and economic diversification. In Chapter 2, the literature review examines the influence of hydrocarbon price fluctuations on economies, underscoring the necessity for diversification. It explores topics such as the resource curse, economic diversification, ecosystem frameworks, innovation, and Technology Transfer (TT) in hydrocarbon-based nations. The challenges of the Gulf Cooperation Council (GCC) and Qatar's initiatives, including the Qatar National Vision 2030 (QNV 2030) and government programs, are discussed. Chapter 3 outlines the research design, encompassing data collection, interview methods, and interview structure. This study employs a qualitative case study approach with semi-structured interviews to explore innovation in Qatar's hydrocarbon-based economies comprehensively. Chapter 4 presents an in-depth analysis of the main results and a discussion of the feedback obtained from business and academic interviews. Finally, Chapter 5 concludes with a comprehensive summary of key findings and recommendations for future research.

2. Literature Review

It is now well established that hydrocarbon price variations can impair the sustainability of hydrocarbon-based economies. However, as per Kong (2012), observations have indicated that in the Singapore economy success development case, policy subsystem and policy instrument approaches provided an integrated business development framework that considered political context and policy considerations. Lack of diversification in these hydrocarbon-based economies has existed as an economy sustainability problem for many years; for example, as per Mishrif (2018), most of the GCC strategies and development plans have identified economy diversification as a vital factor of economic sustainability due to depleted reserves of hydrocarbons.

Hydrocarbon-based economies have been deeply debated in recent years, and many researchers and economists have stressed the fundamental role governments play in escaping the resource curse and changing it positively. According to Elbra (2013), the resource curse can be defined as “the paradox by which mineral-rich states fail to keep pace, economically, with their non-mineral-rich peers”. On the other hand, Dadgar and Orooji (2020) defined it as mismanagement and waste of natural resources. As per Kassouri, Altıntaş, and Bilgili (2020), the fluctuation of oil prices significantly impacts stock returns, inflation rate, economic output, industrial production, exchange rate, investment expenditure, and bank performance. Evidence suggests that a diversified knowledge economy is among the most important factors for a sustainable economy (Schilirò, 2013).

This research provided an important opportunity to advance the understanding of a more sustainable economy and take advantage of the current high income from hydrocarbon to put a clear plan on how to avoid the high dependency on it as the main revenue source. Shreds of evidence suggest that economic sustainability is among the most important factors for a country’s success, as stated by Dadgar and Orooji (2020), “Owning Natural resources has been beneficial for some Countries, but hurtful for some others” as it’s all depend on the country strategy on utilizing these resources wisely.

2.1. Resource Curse

The resource curse, a paradox observed in nations with abundant non-renewable natural resources like oil, leads to economic stagnation or contraction. Extensive research, particularly in oil-rich countries, delves into the intricacies of this phenomenon. Kassouri et al. (2020) focused on the financial resource curse hypothesis in oil-exporting countries, exploring the threshold effect of democratic accountability. Their findings revealed that democratic accountability plays a crucial role in mitigating the financial curse, with proper institutions aiding in responsible financial management derived from oil sales.

Examining the impact of the 1970s oil price boom and subsequent bust, Smith (2019) coined the term Dutch disease. Manufacturing exports flourished during the boom, attributed to government policies promoting industrialization, while agricultural exports suffered from limited investment. Dadgar and Orooji (2020) associated the Dutch disease with governance issues, highlighting its varying impact on different countries.

Adetutu et al. (2020) investigated the resource curse in oil-rich countries, observing a decline in banks' total productivity factor during oil booms in Kazakhstan, indicating poor economic performance. Göçer (2016) identified oil price fluctuations as another factor affecting oil-exporting nations' economic performance, demonstrating a direct correlation between price increases and national income growth. However, this holds true for nations overly dependent on oil. With resource-rich countries facing economic uncertainty due to dependence on a single resource, Göçer (2016) advocates for economic diversification to mitigate the impact of oil price fluctuations and reduce vulnerability to the resource curse.

2.2. Economic Diversification

Economic diversification, the process of transitioning from a single income source to multiple sources, is a concept explored in various studies. Aitzhanova et al. (2015) projected a decline in oil production in Kazakhstan after 2035 based on proven reserves, urging the need for diversification to ensure long-term economic sustainability. Schilirò (2013) focused on the UAE, emphasizing the vulnerability of its oil-dependent economy to price fluctuations. Proposing a shift towards a knowledge economy, Schiliro suggested investments in higher education, business services, and technology development to cushion against oil price volatility.

Matallah (2020) examination of Middle East and North Africa (MENA) oil exporters revealed a positive correlation between oil rents and growth, emphasizing the role of governance in economic diversification. According to Matallah (2020), good governance is crucial for implementing policies that reduce budget deficits, enhance public expenditure management, and improve spending efficiency, addressing economic diversification and the resource curse. Despite these efforts, Flamos et al. (2013) suggested that oil remains the primary driver of GCC economies, indicating a need for further diversification to lessen dependence on oil.

2.3. Ecosystem Framework

In the pursuit of economic diversification, oil-rich nations, while making strides in reducing their reliance on oil, still grapple with the challenge of creating a robust ecosystem framework. This framework is essential for ensuring responsible resource production and utilization, aligning with societal and environmental benefits. Sun, Wu, and Yang (2018) advocate for a systematic thinking ecosystem framework in the context of business sustainability, emphasizing the interdependence between business operations and the environment. Applied to oil-rich countries, this approach can guide oil production methods that prioritize societal and environmental well-being.

Exploring innovation ecosystems, Xu, Wu, Minshall, and Zhou (2018) focus on 3D printing in China, showcasing its impact on science and technology. When applied to oil-dependent nations, this innovation ecosystem holds the potential to drive advancements in science, technology, and research, facilitating the transformation of these nations into knowledge-based economies (Wallner & Menrad, 2011). Su, Kajikawa, Tsujimoto, and Chen (2018) further underscore the significance of innovation ecosystems in value creation, particularly in improving business performance through technological development.

Mortati and Maffei (2018) examine European design policy ecosystems, proposing a model that identifies existing policy instruments and maps organizations supporting these policies. This model can be instrumental for oil-rich countries to evaluate existing policies in the context of resource curse and economic diversification. Isenberg (2011) introduces the entrepreneurship ecosystem strategy as a paradigm for economic policy, emphasizing the need for geographically concentrated ecosystems conducive to entrepreneurship. This strategy, if adopted by oil-dependent countries, can serve as a catalyst for economic diversification and improved sustainability.

2.4. Innovation and Technology Transfer

Innovation and TT stand as crucial factors facilitating economic diversification and the establishment of effective ecosystem frameworks in oil-rich nations. TT involves the movement of new technology from developers to secondary users, often occurring from developed to developing countries. García-Vega and Vicente-Chirivella (2020) study delves into the impact of TT from universities on firm innovation, revealing a substantial increase in innovativeness, particularly among small businesses. This underscores the pivotal role of technology in fostering innovation within companies.

Wonglimpiyarat (2016) examination of university business and innovation incubators highlights these programs as major policy mechanisms supporting innovation, acting as intermediaries between academia and industry. Such incubators facilitate the effective utilization of university research, contributing to entrepreneurial development. Similarly, Steruska, Simkova, and Pitner (2019) explore the influence of science and technology parks on TT, showcasing their role in creating spaces for knowledge exchange between companies, markets, and universities, ultimately enhancing research quality and driving innovation.

Phillips (2002) scrutinizes the impact of technology business incubators on TT effectiveness, revealing variations influenced by legal structures, conflict of interest policies, and diverse requirements. Depending on their design, these factors act as either promoters or barriers to TT.

In the realm of public TT, Min, Kim, and Vonortas (2020) identify key influencers of commercialization, including market competition, the absorptive capacity of the recipient company, effective technology supplier-recipient partnerships, and internal innovation capabilities. High absorptive capacity, a competitive market, and strong partnerships positively impact the commercialization of public TT, subsequently enhancing business growth (Ungureanu, Pop, & Ungureanu, 2016). This collective research emphasizes the interconnectedness of innovation and TT in fostering economic growth and diversification.

2.5. Gulf Cooperation Council and Qatar’s Ecosystem

The GCC nations, including Qatar, grapple with the resource curse and the imperative for economic diversification. Researchers, exemplified by Faghih and Sarfaraz (2014), focus on Qatar's innovation dynamics in its transition to a knowledge-based economy. Positive aspects include political stability, inbound tertiary mobility, and industry-university research collaborations. Yet, deficiencies in education, science expenditure, knowledge absorption, and scientific publications signal areas for improvement, as suggested by Abdulwahed (2017). Aljawareen (2017) analysis of innovation in GCC countries identifies obstacles: inadequate research and development (R&D) investment, limited high-tech exports, and low employment in knowledge-intensive activities. Abdulwahed and Hasna (2017) emphasize education and research investment in transforming resource-dependent economies into knowledge-based ones. Mohtar (2015) explores innovation opportunities and challenges in Qatar, highlighting political goodwill, capital investment, Science and Technology Park creation, and research strategy. Challenges include capacity-building gaps, merit neglect, and instability among scientists, limiting innovative idea generation. Ibrahim and Harrigan (2012) trace Qatar's economic evolution, which was initially oil-dependent. Post-1970s oil production peak, Qatar confronted declining oil fields, prompting a shift toward an innovative ecosystem for economic diversification. Cevik (2014) examination of GCC sans oil underscores limited investment in non-hydrocarbon sectors, exposing them to asymmetric shocks. Policy interventions are essential to mitigate economic vulnerabilities when oil prices decline. This collective research underscores the critical need for innovation, education, and diversified economic policies in addressing the challenges faced by oil-rich GCC nations like Qatar.

2.6. Innovation of Hydrocarbon Economies

Innovation emerges as a crucial factor in addressing the challenge of economic diversification and the resource curse in hydrocarbon economies. Considering this, Ben Hassen (2020) scrutinizes Qatar's economic diversification dynamics, spotlighting Information and Communications Technology (ICT), innovation, and entrepreneurship. Over the past two decades, Qatar has committed substantial investments to cultivate an innovation ecosystem marked by establishing R&D institutions. This strategic emphasis on innovation has been pivotal in Qatar's gradual evolution from a resource-centric to a knowledge-based economy.

Examining the broader context of GCC countries, Miniaoui and Schilirò (2017) underscore the significance of innovation and entrepreneurship as prime drivers of economic diversification. Notably, GCC nations have instituted innovation programs, signaling a shift towards knowledge-based economies. In a study by Tok (2020) exploring Qatari residents' attitudes toward innovation, a degree of aversion is identified. This reluctance is attributed to Qatar's resource-dependent economic structure and a lack of prior experience with innovation among citizens. Despite the pivotal role of innovation in transforming Qatar into a knowledge-based economy, Tok (2020) suggests limited citizen engagement in innovation activities.

Shifting the focus to Saudi Arabia, Hassan (2020) delves into the kingdom's economic diversification, emphasizing the transformative influence of Artificial Intelligence (AI). AI emerges as a potent force propelling Saudi Arabia toward becoming a technological hub, illustrating the transformative impact of technological innovation on hydrocarbon economies. Concluding the thematic exploration, Asheim (2015) draws attention to Kuwait's oil dependence and advocates for economic diversification. Identifying innovation as a primary driving force, Asheim (2015) underscores the need for policy frameworks supporting innovation to diversify Kuwait's economy successfully. Collectively, these studies underscore the pivotal role of innovation in steering hydrocarbon economies from resource-centric to knowledge-based paradigms.

2.7. QNV 2030: Strategies for Transformation

The developmental trajectory of Qatar is undergoing unprecedented growth, with the QNV 2030 delineating three pivotal and interconnected goals to steer policymaking in the ensuing decades (Ministry of Development Planning and Statistics, 2015). These goals encompass the maintenance of a high standard of living for all Qatari citizens, promoting and expanding domestic capacity for innovation and entrepreneurship, and aligning economic outcomes with economic and financial security. Emphasizing the imperative of economic diversification, QNV 2030 underscores the gradual reduction of dependence on hydrocarbon industries and the elevation of the private sector's role. Key elements include expanding industries and services derived from hydrocarbon industries, specialization in economic activities, and cultivating a knowledge-based economy characterized by innovation, entrepreneurship, education excellence, robust infrastructure, efficient public services, and transparent governance.

To realize this ambitious vision, Qatar relies on the National Development Strategy, positioning it as the vehicle to ensure unprecedented standards of living for all its citizens, fostering their potential across gender and age groups. Aligned with the National Economic Strategy, Qatar has initiated various projects aimed at catalyzing its transition into a sustainable economy. Noteworthy initiatives include boosting the value of Qatar's productive base, enhancing economic stability, improving technical efficiency, and fostering economic diversity (Ministry of Development Planning and Statistics, 2015).

The National Strategy's core pillar delineates a long-term economic and environmental sustainability plan. The strategy seeks to diversify Qatar's economy beyond the oil and gas sector, ensuring controlled growth and environmental preservation. A key focus lies in developing world-class infrastructure to maintain Qatar as a premier destination for regional and international visitors and investors, culminating in hosting the highly anticipated 2022 World Cup (Qatar General Secretariat for Development Planning, 2011).

2.8. Qatar Government Initiatives

In line with the QNV of building a strong industrial production base, supporting the local Qatari product to achieve balanced economic growth, away from oil revenues as a major source of income and diversification of its sources, as well as increasing the contribution of the industrial sector to GDP, there were many initiatives which have been established. The State of Qatar has been keen to provide a promising investment environment in the important sectors of the national economy and to provide it with an administrative and legislative system that stimulates business practice characterized by a legislative framework suitable for business development and attracting investments and the issuance of many laws aimed at stimulating and attracting local investments. The Qatari government has adopted a policy of preventing double taxation by concluding agreements with more than 70 countries, with the aim of reducing the tax burden on the investor.

2.8.1. Single Window

There was a big challenge in previous issuing approvals procedures that required the intervention of more than 40 relevant departments in government authorities involved in this process. Pointing out that this electronic platform will contribute to connecting the investor to about 18 government agencies in one place, thus integrating all the procedures of establishing in a comprehensive procedure shortens all steps of the establishment. This leading national initiative aims to facilitate business creation and direct investment flows to the priority sectors identified in the 2018-2022 National Development Strategy (Planning and Statistics Authority, 2018).

The Single Window initiative is targeted to provide a unified and integrated electronic platform for investors and facilitate the procedures for granting the necessary approvals and licenses to establish business in Qatar. It was inaugurated in 2019, which contributes to attracting more domestic and foreign investments and ensures the flow and ease of establishing investment projects in the country and directing them towards sectors that serve national priorities at the development level.

2.8.2. Qatar Development Bank

There are several initiatives by the Qatar Development Bank to support small and medium enterprises (SME) engineering projects through engaging special projects co-funded by Qatar Development Bank (QDB) and government entities in certain sectors, such as tourism, education, industrial, healthcare, residential and commercial sectors. QDB offers several initiatives to support SMEs and entrepreneurs, including Jahiz for leasing manufacturing facilities, Ithmar for Sharia-compliant institutional investment, Business Consultancy for project establishment, Entrepreneurship Leave Program allowing government employees to focus on their businesses, and CO-Working Office Space, a cost-effective incubation program providing shared office spaces for startups. These initiatives aim to foster innovation, provide financial support, and facilitate the growth of businesses in Qatar (Qatar Development Bank, 2023).

2.8.3. Manateq

Established in 2011, Manateq is responsible for managing the Manateq regions and building infrastructure to the highest international standards to facilitate the growth of the industry and services sectors, which contribute to the achievement of economic development goals as one of the four pillars of QNV 2030 (Ministry of Development Planning and Statistics, 2015). Manateq provides logistics services, industrial zones, and storage areas to investors with a wide variety of customer services, advanced infrastructure, and easy-to-establish procedures, as well as securing the necessary access to the Gulf and international markets and many other services.

2.8.4. Qatar Free Zone Authority

Qatar Free Zone Authority (QFZA), established in 2018, is a regulatory body established to promote economic diversification and attract foreign investment in Qatar. Designed to facilitate international businesses, QFZA oversees free zones, providing a conducive environment for trade and innovation. The authority offers incentives such as tax exemptions, streamlined administrative processes, and business-friendly regulations to enhance the ease of doing business. Through strategic initiatives, QFZA contributes to the realization of Qatar's economic goals outlined in the National Vision 2030, fostering sustainable development and positioning Qatar as a competitive global business hub. The free zones overseen by QFZA aim to drive economic growth and diversification across various sectors (Qatar Free Zone Authority, 2018).

2.8.5. Intangible Investment

World-class infrastructure in the heart of the Gulf, exemplified by landmarks such as Hamad International Airport, which was inaugurated in 2014, contributes significantly to Qatar's standing in the regional and global economic and tourism sectors. Hamad Port, inaugurated in 2017, signifies a pivotal shift towards achieving economic diversification and enhancing Qatar's competitiveness, aligning with the objectives outlined in QNV 2030.

The extensive highway network further strengthens the country's infrastructure, while Qatar Rail plays a crucial role in supporting the national strategy and vision by catalyzing significant economic growth through its expansive rail network. In the healthcare sector, strategically located hospitals equipped with the highest standards of healthcare facilities and well-distributed staffing effectively meet current and anticipated demands in Qatar.

Accredited colleges and universities play a pivotal role in providing quality education to students, ensuring that residents and citizens have access to a diverse range of majors and minors across various disciplines, and fostering a fair and inclusive educational environment. Qatar has instituted various innovation and development platforms across sectors, including energy, environment, transport, research funding, education, and more.

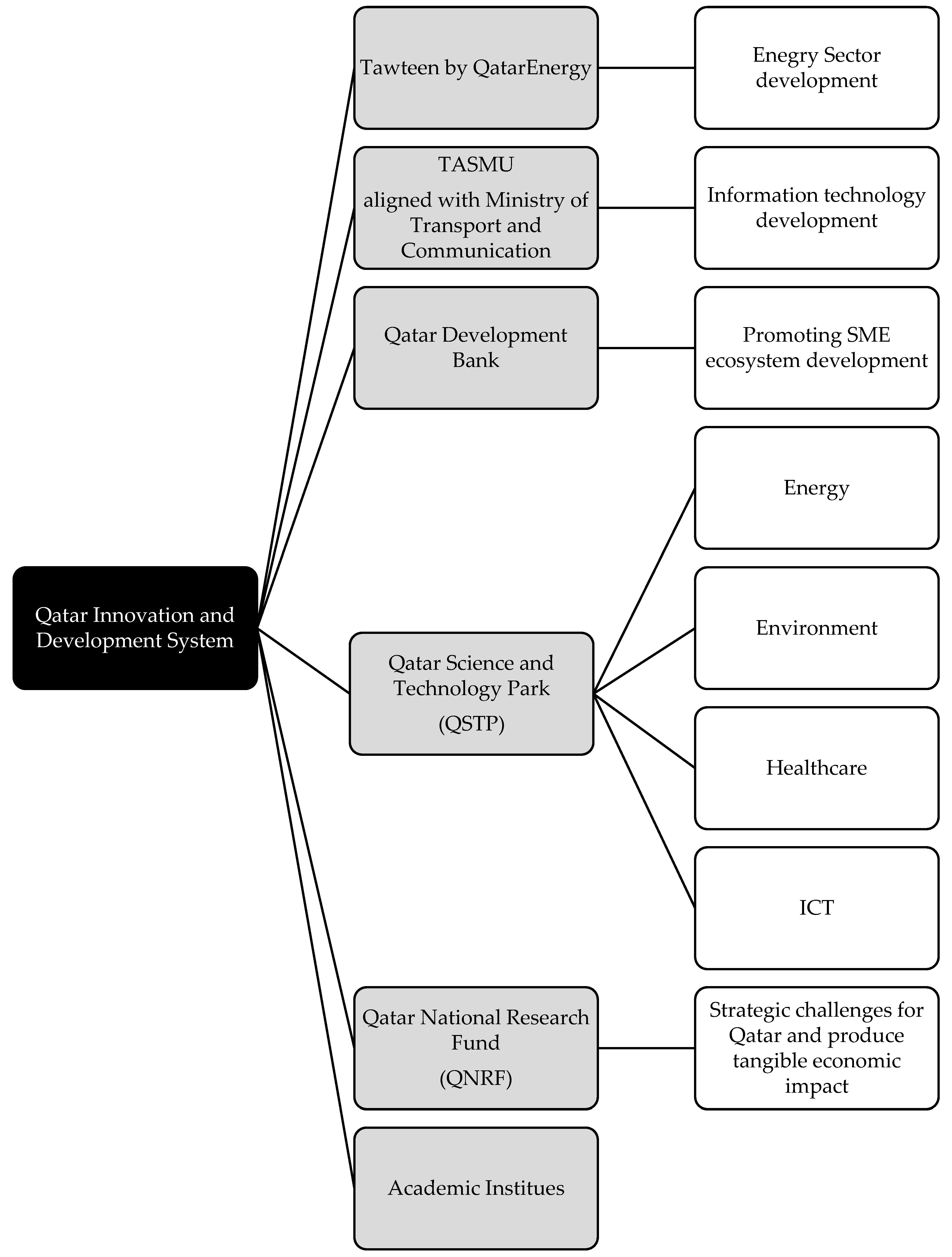

Figure 1 illustrates the comprehensive innovation and development system in Qatar.

The literature review provides insights into the existing state of innovation ecosystems and highlights the challenges faced by hydrocarbon-based economies, particularly Qatar, in managing resource dependency and navigating oil price fluctuations. Key findings underscore the adverse impact of the resource curse, underscoring the urgency of economic diversification. Recognizing a gap in current diversification efforts, the research proposes a comprehensive approach. This involves sustained initiatives for economic diversification, a nuanced understanding of innovations in education and business, and the active involvement of diverse stakeholders from various organizations within the community. The aim is to seize opportunities, address challenges, and formulate a robust innovation ecosystem strategy framework that ensures adaptability to emerging opportunities and challenges.

3. Methodology

In exploring the intricacies of innovation in Qatar's hydrocarbon-based economies, our research employs a qualitative case study approach. Through semi-structured interviews with business and academic professionals, we aim for depth and diversity. This research ensures comprehensive insights into innovation strategies and challenges. With an organized interview structure covering focus groups, opportunities, and challenges, we seek a nuanced understanding.

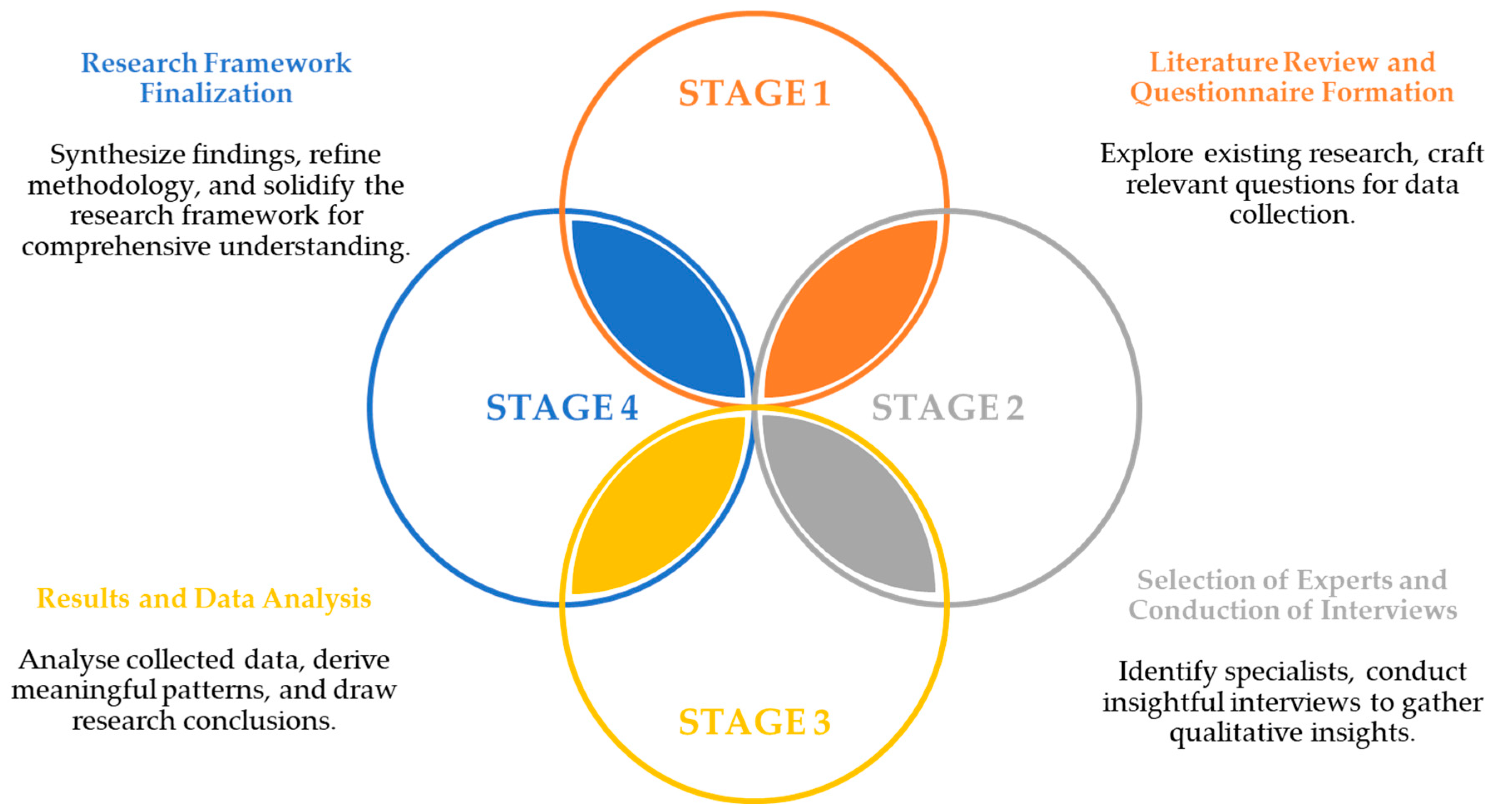

Figure 2 presents this research methodology, which is divided into four stages.

3.1. Research Design

To research the processes of developing a framework business model in an innovation ecosystem for hydrocarbon-based economies, we took a qualitative research approach using a case study methodology. This enabled us to gain in-depth insight into how the innovation ecosystem’s actors manage the tensions over time for several disciplines. The phenomena we studied are innovation ecosystems in which cross-sector actors develop innovative sustainable business models for hydrocarbon-based economies. The research design chosen for this study is a qualitative approach, aiming to explore and understand the perceptions and experiences of both business and academic professionals regarding innovation in Qatar. Qualitative research is appropriate for gaining in-depth insights into complex phenomena such as innovation strategies and challenges (Creswell & Creswell, 2017). The use of semi-structured interviews allows flexibility in gathering detailed responses while maintaining a certain level of consistency across participants. This approach enables the exploration of participants' subjective viewpoints on innovation, providing a rich and comprehensive dataset (Ortiz & Greene, 2007).

3.2. Data Collection

The primary data collection method is through semi-structured interviews conducted with two distinct groups: business professionals, represented by 5 participants, and academic professionals, represented by 11 participants. Each interview, with an average length of 60 to 90 minutes, was recorded and transcribed accurately. This purposive sampling strategy ensures representation from diverse sectors within Qatar, enhancing the generalizability of findings. The choice of interviews over other methods, such as surveys, is motivated by the need to capture detailed and nuanced responses, allowing for a deeper understanding of the participants' perspectives on innovation in Qatar (Rubin & Rubin, 2011). The round of interviews was conducted in January and February 2022 for a total period of two weeks. The interview questions are clearly mentioned in

Appendix A.

Appendix B and

Appendix C provides an analysis of business and academic entities and individuals involved in the interview-based research. The interviews included 8 outstanding organizations locally in the State of Qatar and externally as well.

3.3. Interview Method

The semi-structured interviews provide a balance between predefined questions and the flexibility to explore emerging themes (Patton, 2014). The participants were selected based on their expertise and experience in Qatar's different companies and academic sectors. The sample size is considered sufficient for qualitative research, as it allows for saturation, where new insights become redundant, indicating that enough perspectives have been gathered to address the research questions adequately.

The analytical process consisted of three stages combining strategies for analyzing process data. The interview data analysis stage involved a detailed reading of the interview transcripts and documents and viewing the audiovisual material. This resulted in deep discussions with the participants, focusing on the feedback relevant to their area of expertise during their experience, as well as professionals developing, understanding, and maintaining the innovation ecosystem for hydrocarbon-based economies in addition to the current educational motivation and research.

3.4. Interview Structure

The interview structure is organized into three main sections: focus group questions, opportunity questions, and challenges questions. Each section is designed to comprehensively explore specific aspects of innovation in Qatar. The focus group questions aim to define and understand participants' perceptions of innovation, covering its definition, approach, significance, common pitfalls, and strategies for development in Qatar. On the other hand, the opportunity questions focus on participants' visions for the future of innovation in Qatar, considering the role of education, institutions like Qatar Science & Technology Park (QSTP) / Qatar Research, Development, and Innovation (QDRI), and the opportunities arising from Qatar's position as a leading Liquified Natural Gas (LNG) producer. Lastly, the challenges questions explore the challenges faced by Qatar's innovation ecosystem, participants' views on the existence of an innovative ecosystem, and their expectations regarding its components, drawing inspiration from the UAE's innovation policy.

This methodological approach is intended to provide a comprehensive and nuanced understanding of innovation in Qatar, taking into account the perspectives of both business and academic professionals.

5. Conclusions and Recommendations

In conclusion, this research has addressed the pressing problem of hydrocarbon-based economies, particularly Qatar, grappling with the challenges of resource dependency and the adverse impacts of oil price fluctuations. The main aim was to advocate for a paradigm shift towards diversified and knowledge-centric economic models to ensure sustainability. The novelty of this study lies in its comprehensive exploration of the intricate interplay between economic sustainability, innovation, and education within the context of hydrocarbon-dependent nations. The literature review unveiled the vulnerabilities faced by hydrocarbon-based economies, emphasizing the fragility of national economic cycles and the emergence of the resource curse as a significant challenge. Innovatively, the study delved into the multifaceted dimensions of economic diversification, addressing governance issues, societal well-being, and the need for robust ecosystem frameworks. Employing a qualitative case study methodology, the research examined Qatar's initiatives, such as the QNV 2030 and government programs, to reduce dependence on hydrocarbons and foster innovation. Semi-structured interviews with business and academic professionals provided nuanced insights into innovation strategies, challenges, and opportunities in the hydrocarbon-based context. Key findings underscored the holistic perspective of innovation, associating it with practical solutions, adaptability, and transformative potential. Diverse approaches to innovation, ranging from business-centric to collaborative and user-centric methods, highlighted the dynamic nature of the innovation landscape. Challenges in the education system, the imperative for a matured innovation ecosystem, and opportunities in sustainable energy were identified.

The research recommends sustained efforts in economic diversification, educational reform, and technological integration for hydrocarbon-based economies. Policymakers, businesses, and academics can leverage these insights to navigate the complexities of resource dependency and ensure long-term viability. The study motivates further exploration into sector-specific innovation strategies, considering evolving global trends, to support Qatar's growth as an innovation-driven nation. Looking ahead, future research endeavors should focus on specific sectors, incorporate evolving global trends, and explore the evolving dynamics of innovation in hydrocarbon-based economies. Additionally, investigating the effectiveness of implemented strategies, tracking long-term impacts, and evaluating the adaptability of the innovation ecosystem to emerging challenges would provide valuable insights for sustainable development. The commitment to addressing the challenges faced by hydrocarbon-dependent nations remains paramount, with a dedication to fostering economic diversity, innovation, and educational excellence for a resilient and prosperous future.