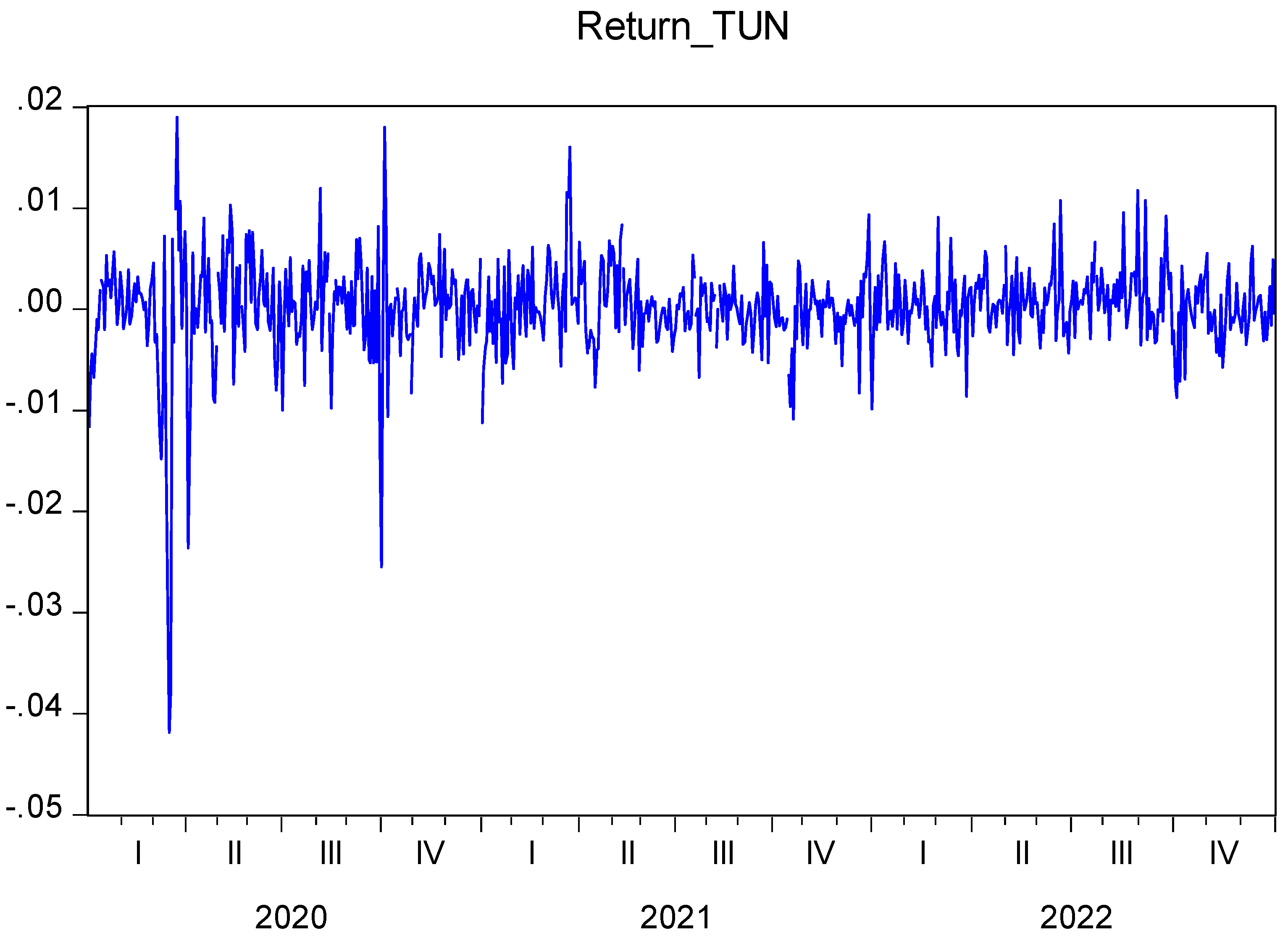

4.1. Impact of COVID-19 announcements and government intervention on TUNINDEX stock return volatility

Table 3 shows that GJR-GARCH is the preferred one as the conventional information criteria exhibit the lowest values. To examine the impact of COVID-19 announcements and the government intervention variables, we regress the conditional stock return variance that results from the GJR-GARCH(1,1), AR(1) model on the variables of interest and a set of controls (see Ibrahim et al., 2020; Bakry et al., 2022):

where CR: cases_rate, DR: death_rate, GRI: Government intervention index (this includes stringency_index, containment_health_index, economic_support_index, government_response_index, and subindicators of the stringency index (s1 to s9), Oil_Vol: Conditional WTI oil volatility from GJR-GARCH(1,1) with a constant.

To handle the multicollinearity issue, we include the government intervention indicators separately. Further, we control for autocorrelation and heteroscedasticity by estimating the equation with the Newey-West method. Results are available in

Table 4 and

Table 5. We re-estimate the variants of the equations while skipping for the cases_rate variable. All results duplicate mostly the ones in

Table 4 and

Table 5, except that death_rate becomes statistically significant (see

Table 6 and

Table 7).

According to Kamal and Wohar (2023), "

Considering global market integration (Solnik, 1974) and to remove misspecification error, [..]. We also lagged the independent variables by one period to examine the slow response of the market. Slow response supports the underreaction hypothesis, which suggests investors adjust slowly to new information.". We replicate the output while considering the variables of interest and controls lagged with one period (see

Table 8,

Table 9,

Table 10 and

Table 11).

The observed incidence of confirmed cases and mortality rates exhibit a positive association with heightened volatility in the TUNINDEX in addition to the WTI conditional volatility. Moreover, there exists a positive correlation between the stringency index and volatility in the Tunisian stock market. Conversely, the indices about containment health economic support and government response do not manifest a discernible impact on market volatility. Those observations can be attributed to increased uncertainty and economic impacts. Rising cases make investors cautious, leading to market fluctuations. Stringent government measures, reflected in the stringency index, also correlate positively with market volatility, indicating economic repercussions. However, indices related to health economic support and government response show no significant impact on volatility, suggesting that other factors may be more influential in shaping the Tunisian stock market.

Table 4.

Effect of COVID-19 announcements and government intervention on TUNINDEX volatility.

Table 4.

Effect of COVID-19 announcements and government intervention on TUNINDEX volatility.

| Eq Name: |

EQ01 |

EQ02 |

EQ03 |

EQ04 |

| C |

0.000011 |

0.000011 |

0.000011 |

0.000011 |

| |

[10.9061]*** |

[11.0044]*** |

[11.6222]*** |

[11.3206]*** |

| CASES_RATE |

0.000359 |

0.000358 |

0.000389 |

0.000366 |

| |

[3.3678]*** |

[3.3480]*** |

[3.2211]*** |

[3.2644]*** |

| DEATH_RATE |

0.000049 |

0.000053 |

0.000010 |

0.000037 |

| |

[0.7213] |

[0.7701] |

[0.1111] |

[0.4705] |

| CONDVAR_WTI |

0.001224 |

0.001220 |

0.001185 |

0.001219 |

| |

[2.3954]** |

[2.3831]** |

[2.3961]** |

[2.3998]** |

| DSTRINGENCYINDEX |

0.000001 |

|

|

|

| |

[0.9286] |

|

|

|

| DCONTAINMENTHEALTHINDEX |

|

0.000001 |

|

|

| |

|

[0.7738] |

|

|

| DECONOMICSUPPORTINDEX |

|

|

0.000001 |

|

| |

|

|

[1.2960] |

|

| DGOVERNMENTRESPONSEINDEX |

|

|

|

0.000001 |

| |

|

|

|

[0.9220] |

| Observations: |

654 |

654 |

654 |

654 |

| R-squared: |

0.4811 |

0.4794 |

0.4907 |

0.4823 |

| F-statistic: |

150.4010 |

149.4343 |

156.3274 |

151.1775 |

| Prob(F-stat): |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

Table 5.

Effect of stringency index sub-indicators on TUNINDEX volatility.

Table 5.

Effect of stringency index sub-indicators on TUNINDEX volatility.

| Eq Name: |

EQ01 |

EQ02 |

EQ03 |

EQ04 |

EQ05 |

EQ06 |

EQ07 |

EQ08 |

EQ09 |

| C |

0.000011 |

0.000011 |

0.000011 |

0.000011 |

0.000011 |

0.000011 |

0.000011 |

0.000011 |

0.000011 |

| |

[10.4573]*** |

[10.8456]*** |

[10.3587]*** |

[17.3295]*** |

[10.6964]*** |

[11.0051]*** |

[10.7373]*** |

[10.4448]*** |

[10.4588]*** |

| CASES_RATE |

0.000348 |

0.000355 |

0.000346 |

0.000367 |

0.000353 |

0.000368 |

0.000345 |

0.000348 |

0.000348 |

| |

[3.4899]*** |

[3.4638]*** |

[3.5209]*** |

[10.9008]** |

[3.4494]*** |

[3.3898]*** |

[3.3523]*** |

[3.5048]*** |

[3.4969]*** |

| DEATH_RATE |

0.000077 |

0.000058 |

0.000075 |

0.000024 |

0.000068 |

0.000041 |

0.000082 |

0.000076 |

0.000076 |

| |

[1.3980] |

[0.9628] |

[1.3625] |

[0.9679] |

[1.1819] |

[0.6740] |

[1.3229] |

[1.3816] |

[1.3822] |

| CONDVAR_WTI |

0.001212 |

0.001233 |

0.001221 |

0.001232 |

0.001209 |

0.001203 |

0.001213 |

0.001213 |

0.001213 |

| |

[2.3589]** |

[2.4250]** |

[2.3817]** |

[8.2596]*** |

[2.3672]** |

[2.3704]** |

[2.3559]** |

[2.3603]** |

[2.3588]** |

| D(S1) |

-0.000002 |

|

|

|

|

|

|

|

|

| |

[-0.7363] |

|

|

|

|

|

|

|

|

| D(S2) |

|

0.000008 |

|

|

|

|

|

|

|

| |

|

[1.0688] |

|

|

|

|

|

|

|

| D(S3) |

|

|

0.000005 |

|

|

|

|

|

|

| |

|

|

[0.6859] |

|

|

|

|

|

|

| D(S4) |

|

|

|

0.000011 |

|

|

|

|

|

| |

|

|

|

[4.5894]*** |

|

|

|

|

|

| D(S5) |

|

|

|

|

0.000007 |

|

|

|

|

| |

|

|

|

|

[0.8645] |

|

|

|

|

| D(S6) |

|

|

|

|

|

0.000016 |

|

|

|

| |

|

|

|

|

|

[1.6222] |

|

|

|

| D(S7) |

|

|

|

|

|

|

-0.000002 |

|

|

| |

|

|

|

|

|

|

[-0.3753] |

|

|

| D(S8) |

|

|

|

|

|

|

|

-0.000002 |

|

| |

|

|

|

|

|

|

|

[-0.7549] |

|

| D(S9) |

|

|

|

|

|

|

|

|

0.000004 |

| |

|

|

|

|

|

|

|

|

[4.7152]*** |

| Observations: |

654 |

654 |

654 |

654 |

654 |

654 |

654 |

654 |

654 |

| R-squared: |

0.4766 |

0.4808 |

0.4773 |

0.4928 |

0.4777 |

0.4938 |

0.4767 |

0.4764 |

0.4764 |

| F-statistic: |

147.7157 |

150.2575 |

148.1492 |

157.6232 |

148.3977 |

158.2759 |

147.8009 |

147.6410 |

147.6070 |

| Prob(F-stat): |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

Table 6.

Effect of COVID-19 announcements and government intervention on TUNINDEX volatility, excluding cases_rate.

Table 6.

Effect of COVID-19 announcements and government intervention on TUNINDEX volatility, excluding cases_rate.

| Eq Name: |

EQ01 |

EQ02 |

EQ03 |

EQ04 |

EQ05 |

| C |

0.000012 |

0.000012 |

0.000012 |

0.000012 |

0.000012 |

| |

[10.9188]*** |

[10.7714]*** |

[11.0068]*** |

[11.7608]*** |

[11.1964]*** |

| DEATH_RATE |

0.000226 |

0.000217 |

0.000221 |

0.000212 |

0.000218 |

| |

[4.7771]*** |

[4.4689]*** |

[4.3267]*** |

[3.4279]*** |

[3.9955]*** |

| CONDVAR_WTI |

0.001680 |

0.001692 |

0.001686 |

0.001689 |

0.001689 |

| |

[2.0681]** |

[2.0647]** |

[2.0570]** |

[2.0576]** |

[2.0545]** |

| DSTRINGENCYINDEX |

|

0.000000 |

|

|

|

| |

|

[0.6286] |

|

|

|

| DCONTAINMENTHEALTHINDEX |

|

|

0.000000 |

|

|

| |

|

|

[0.3755] |

|

|

| DECONOMICSUPPORTINDEX |

|

|

|

0.000000 |

|

| |

|

|

|

[0.8845] |

|

| DGOVERNMENTRESPONSEINDEX |

|

|

|

|

0.000000 |

| |

|

|

|

|

[0.5446] |

| Observations: |

654 |

654 |

654 |

654 |

654 |

| R-squared: |

0.3916 |

0.3923 |

0.3916 |

0.3928 |

0.3919 |

| F-statistic: |

139.4355 |

139.8593 |

139.4782 |

140.1365 |

139.6133 |

| Prob(F-stat): |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

Table 7.

Effect of stringency index sub-indicators on conditional stock return volatility, excluding cases_rate.

Table 7.

Effect of stringency index sub-indicators on conditional stock return volatility, excluding cases_rate.

| Eq Name: |

EQ01 |

EQ02 |

EQ03 |

EQ04 |

EQ05 |

EQ06 |

EQ07 |

EQ08 |

EQ09 |

| C |

0.000012 |

0.000012 |

0.000012 |

0.000012 |

0.000012 |

0.000012 |

0.000012 |

0.000012 |

0.000012 |

| |

[10.9181]*** |

[11.0699]*** |

[10.8839]*** |

[11.1801]*** |

[11.0729]*** |

[10.9574]*** |

[11.1625]*** |

[10.9210]*** |

[10.9188]*** |

| DEATH_RATE |

0.000227 |

0.000216 |

0.000223 |

0.000195 |

0.000225 |

0.000207 |

0.000238 |

0.000226 |

0.000226 |

| |

[4.8043]*** |

[4.3602]*** |

[5.0099]*** |

[3.8221]*** |

[4.5418]*** |

[4.3190]*** |

[4.6804]*** |

[4.7765]*** |

[4.7771]*** |

| CONDVAR_WTI |

0.001679 |

0.001700 |

0.001689 |

0.001712 |

0.001681 |

0.001693 |

0.001668 |

0.001681 |

0.001680 |

| |

[2.0665]** |

[2.0838]** |

[2.0807]** |

[2.0813]** |

[2.0665]** |

[2.0689]** |

[2.0528]** |

[2.0688]** |

[2.0681]** |

| D(S1) |

-0.000002 |

|

|

|

|

|

|

|

|

| |

[-0.8260] |

|

|

|

|

|

|

|

|

| D(S2) |

|

0.000005 |

|

|

|

|

|

|

|

| |

|

[1.0467] |

|

|

|

|

|

|

|

| D(S3) |

|

|

0.000008 |

|

|

|

|

|

|

| |

|

|

[0.8771] |

|

|

|

|

|

|

| D(S4) |

|

|

|

0.000008 |

|

|

|

|

|

| |

|

|

|

[1.5721] |

|

|

|

|

|

| D(S5) |

|

|

|

|

0.000001 |

|

|

|

|

| |

|

|

|

|

[0.3585] |

|

|

|

|

| D(S6) |

|

|

|

|

|

0.000012 |

|

|

|

| |

|

|

|

|

|

[1.5046] |

|

|

|

| D(S7) |

|

|

|

|

|

|

-0.000006 |

|

|

| |

|

|

|

|

|

|

[-1.6216] |

|

|

| D(S8) |

|

|

|

|

|

|

|

-0.000001 |

|

| |

|

|

|

|

|

|

|

[-0.3842] |

|

| D(S9) |

|

|

|

|

|

|

|

|

0.000006 |

| |

|

|

|

|

|

|

|

|

[6.3409]*** |

| Observations: |

654 |

654 |

654 |

654 |

654 |

654 |

654 |

654 |

654 |

| R-squared: |

0.3920 |

0.3933 |

0.3939 |

0.3999 |

0.3915 |

0.4004 |

0.3948 |

0.3915 |

0.3916 |

| F-statistic: |

139.6728 |

140.4515 |

140.8341 |

144.3825 |

139.3918 |

144.7011 |

141.3569 |

139.3879 |

139.4355 |

| Prob(F-stat): |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

Table 8.

Effect of lagged COVID-19 announcements and government intervention on conditional stock return volatility.

Table 8.

Effect of lagged COVID-19 announcements and government intervention on conditional stock return volatility.

| Eq Name: |

EQ01 |

EQ02 |

EQ03 |

EQ04 |

EQ05 |

| C |

0.000011 |

0.000011 |

0.000011 |

0.000011 |

0.000011 |

| |

[12.7748]*** |

[12.5856]*** |

[12.7677]*** |

[13.5131]*** |

[12.9403]*** |

| CASES_RATE(-1) |

0.000286 |

0.000298 |

0.000296 |

0.000300 |

0.000301 |

| |

[2.9352]*** |

[2.8389]** |

[2.8335]*** |

[2.8340]*** |

[2.7877]*** |

| DEATH_RATE(-1) |

0.000093 |

0.000064 |

0.000070 |

0.000069 |

0.000061 |

| |

[1.8091] |

[0.9606] |

[1.0295] |

[0.7853] |

[0.7971] |

| CONDVAR_WTI(-1) |

0.001005 |

0.001017 |

0.001013 |

0.000996 |

0.001011 |

| |

[2.2048]** |

[2.2664]** |

[2.2434]** |

[2.2277]** |

[2.2419]** |

| DSTRINGENCYINDEX(-1) |

|

0.000001 |

|

|

|

| |

|

[0.9800] |

|

|

|

| DCONTAINMENTHEALTHINDEX(-1) |

|

|

0.000001 |

|

|

| |

|

|

[0.8861] |

|

|

| DECONOMICSUPPORTINDEX(-1) |

|

|

|

0.000000 |

|

| |

|

|

|

[0.6285] |

|

| |

|

|

|

|

|

| DGOVERNMENTRESPONSEINDEX(-1) |

|

|

|

|

0.000001 |

| |

|

|

|

|

[0.9491] |

| Observations: |

653 |

653 |

653 |

653 |

653 |

| R-squared: |

0.4440 |

0.4499 |

0.4475 |

0.4459 |

0.4484 |

| F-statistic: |

129.3621 |

132.4748 |

131.2354 |

130.3794 |

131.6918 |

| Prob(F-stat): |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

Table 9.

Effect of lagged stringency index sub-indicators on TUNINDEX volatility.

Table 9.

Effect of lagged stringency index sub-indicators on TUNINDEX volatility.

| Eq Name: |

EQ01 |

EQ02 |

EQ03 |

EQ04 |

EQ05 |

EQ06 |

EQ07 |

EQ08 |

EQ09 |

| C |

0.000011 |

0.000011 |

0.000011 |

0.000011 |

0.000011 |

0.000011 |

0.000011 |

0.000011 |

0.000011 |

| |

[12.7748]*** |

[12.4731]*** |

[12.4731]*** |

[19.4073]*** |

[12.9331]*** |

[13.1147]*** |

[13.1060]*** |

[12.7608]*** |

[12.7727]*** |

| CASES_RATE(-1) |

0.000286 |

0.000278 |

0.000278 |

0.000308 |

0.000288 |

0.000297 |

0.000276 |

0.000286 |

0.000286 |

| |

[2.9352]*** |

[3.0439]*** |

[3.0439]*** |

[9.7976]** |

[2.9264]** |

[2.9031]*** |

[2.8274]*** |

[2.9395]** |

[2.9380]** |

| DEATH_RATE(-1) |

0.000093 |

0.000090 |

0.000090 |

0.000031 |

0.000089 |

0.000073 |

0.000110 |

0.000092 |

0.000092 |

| |

[1.8091] |

[1.8281] |

[1.8281] |

[1.3184] |

[1.5830] |

[1.1912] |

[1.8552] |

[1.8018] |

[1.8017] |

| CONDVAR_WTI(-1) |

0.001005 |

0.001035 |

0.001035 |

0.001029 |

0.001005 |

0.001001 |

0.001005 |

0.001006 |

0.001006 |

| |

[2.2048]** |

[2.3250]* |

[2.3250]** |

[7.3751]*** |

[2.2097]** |

[2.2029]** |

[2.2010]** |

[2.2054]** |

[2.2049]** |

| DS1(-1) |

-0.000001 |

|

|

|

|

|

|

|

|

| |

[-0.4926] |

|

|

|

|

|

|

|

|

| DS2(-1) |

|

0.000016 |

|

|

|

|

|

|

|

| |

|

[1.1974] |

|

|

|

|

|

|

|

| DS3(-1) |

|

|

0.000016 |

|

|

|

|

|

|

| |

|

|

[1.1974] |

|

|

|

|

|

|

| DS4(-1) |

|

|

|

0.000013 |

|

|

|

|

|

| |

|

|

|

[5.8101]*** |

|

|

|

|

|

| DS5(-1) |

|

|

|

|

0.000002 |

|

|

|

|

| |

|

|

|

|

[0.4818] |

|

|

|

|

| DS6(-1) |

|

|

|

|

|

0.000009 |

|

|

|

| |

|

|

|

|

|

[1.4857] |

|

|

|

| DS7(-1) |

|

|

|

|

|

|

-0.000007 |

|

|

| |

|

|

|

|

|

|

[-1.4505] |

|

|

| DS8(-1) |

|

|

|

|

|

|

|

0.000000 |

|

| |

|

|

|

|

|

|

|

[0.0492] |

|

| DS9(-1) |

|

|

|

|

|

|

|

|

0.000004 |

| |

|

|

|

|

|

|

|

|

[5.3218]*** |

| Observations: |

653 |

653 |

653 |

653 |

653 |

653 |

653 |

653 |

653 |

| R-squared: |

0.4440 |

0.4571 |

0.4571 |

0.4714 |

0.4441 |

0.4501 |

0.4483 |

0.4439 |

0.4439 |

| F-statistic: |

129.3621 |

136.3843 |

136.3843 |

144.4733 |

129.4049 |

132.6088 |

131.6345 |

129.2985 |

129.3374 |

| Prob(F-stat): |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

Table 10.

Effect of lagged COVID-19 announcements and government intervention on TUNINDEX volatility, excluding cases_rate.

Table 10.

Effect of lagged COVID-19 announcements and government intervention on TUNINDEX volatility, excluding cases_rate.

| Eq Name: |

EQ01 |

EQ02 |

EQ03 |

EQ04 |

EQ05 |

| C |

0.000012 |

0.000012 |

0.000012 |

0.000012 |

0.000012 |

| |

[12.4786]*** |

[11.6893]*** |

[12.0227]*** |

[13.4926]*** |

[12.1689]*** |

| CASES_RATE(-1) |

|

|

|

|

|

| DEATH_RATE(-1) |

0.000216 |

0.000203 |

0.000209 |

0.000225 |

0.000210 |

| |

[3.3319]*** |

[3.3824]*** |

[3.3369]*** |

[2.8312]*** |

[3.2388]*** |

| DSTRINGENCYINDEX(-1) |

|

0.000000 |

|

|

|

| |

|

[0.6574] |

|

|

|

| CONDVAR_WTI(-1) |

0.001389 |

0.001405 |

0.001398 |

0.001385 |

0.001396 |

| |

[2.0659]** |

[2.0877]** |

[2.0750]** |

[2.0566]** |

[2.0696]** |

| DCONTAINMENTHEALTHINDEX(-1) |

|

|

0.000000 |

|

|

| |

|

|

[0.4969] |

|

|

| DECONOMICSUPPORTINDEX(-1) |

|

|

|

-0.000000 |

|

| DGOVERNMENTRESPONSEINDEX(-1) |

|

|

|

|

0.000000 |

| |

|

|

|

|

[0.4215] |

| Observations: |

653 |

653 |

653 |

653 |

653 |

| R-squared: |

0.3757 |

0.3772 |

0.3759 |

0.3762 |

0.3757 |

| F-statistic: |

130.2065 |

130.9974 |

130.3240 |

130.4563 |

130.1818 |

| Prob(F-stat): |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

Table 11.

Effect of lagged stringency index sub-indicators on TUNINDEX volatility, excluding cases_rate.

Table 11.

Effect of lagged stringency index sub-indicators on TUNINDEX volatility, excluding cases_rate.

| Eq Name: |

EQ01 |

EQ02 |

EQ03 |

EQ04 |

EQ05 |

EQ06 |

EQ07 |

EQ08 |

EQ09 |

| C |

0.000012 |

0.000012 |

0.000012 |

0.000012 |

0.000012 |

0.000012 |

0.000012 |

0.000012 |

0.000012 |

| |

[12.4786]*** |

[12.4489]*** |

[12.4489]*** |

[11.8281]*** |

[12.6835]*** |

[12.5178]*** |

[12.9708]*** |

[12.4828]*** |

[12.4783]*** |

| CASES_RATE(-1) |

|

|

|

|

|

|

|

|

|

| DEATH_RATE(-1) |

0.000216 |

0.000208 |

0.000208 |

0.000174 |

0.000217 |

0.000207 |

0.000235 |

0.000215 |

0.000215 |

| |

[3.3319]*** |

[3.7286]*** |

[3.7286]*** |

[2.8572]*** |

[3.2616]*** |

[3.1008]*** |

[3.4991]*** |

[3.3297]*** |

[3.3299]*** |

| CONDVAR_WTI(-1) |

0.001389 |

0.001412 |

0.001412 |

0.001432 |

0.001390 |

0.001396 |

0.001370 |

0.001390 |

0.001390 |

| |

[2.0659]** |

[2.1157]** |

[2.1157]** |

[2.1208]** |

[2.0670]** |

[2.0679]** |

[2.0482]** |

[2.0679]** |

[2.0676]** |

| DS1(-1) |

-0.000002 |

|

|

|

|

|

|

|

|

| |

[-0.5970] |

|

|

|

|

|

|

|

|

| DS2(-1) |

|

0.000018 |

|

|

|

|

|

|

|

| |

|

[1.2257] |

|

|

|

|

|

|

|

| DS3(-1) |

|

|

0.000018 |

|

|

|

|

|

|

| |

|

|

[1.2257] |

|

|

|

|

|

|

| DS4(-1) |

|

|

|

0.000010 |

|

|

|

|

|

| |

|

|

|

[1.3438] |

|

|

|

|

|

| DS5(-1) |

|

|

|

|

-0.000002 |

|

|

|

|

| |

|

|

|

|

[-0.5121] |

|

|

|

|

| DS6(-1) |

|

|

|

|

|

0.000005 |

|

|

|

| |

|

|

|

|

|

[1.0782] |

|

|

|

| DS7(-1) |

|

|

|

|

|

|

-0.000010 |

|

|

| |

|

|

|

|

|

|

[-2.5152]** |

|

|

| DS8(-1) |

|

|

|

|

|

|

|

0.000001 |

|

| |

|

|

|

|

|

|

|

[0.3804] |

|

| DS9(-1) |

|

|

|

|

|

|

|

|

0.000005 |

| |

|

|

|

|

|

|

|

|

[6.2728]*** |

| Observations: |

653 |

653 |

653 |

653 |

653 |

653 |

653 |

653 |

653 |

| R-squared: |

0.3757 |

0.3927 |

0.3927 |

0.3931 |

0.3756 |

0.3775 |

0.3855 |

0.3755 |

0.3756 |

| F-statistic: |

130.2065 |

139.9066 |

139.9066 |

140.1240 |

130.1326 |

131.2005 |

135.7357 |

130.0510 |

130.1076 |

| Prob(F-stat): |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

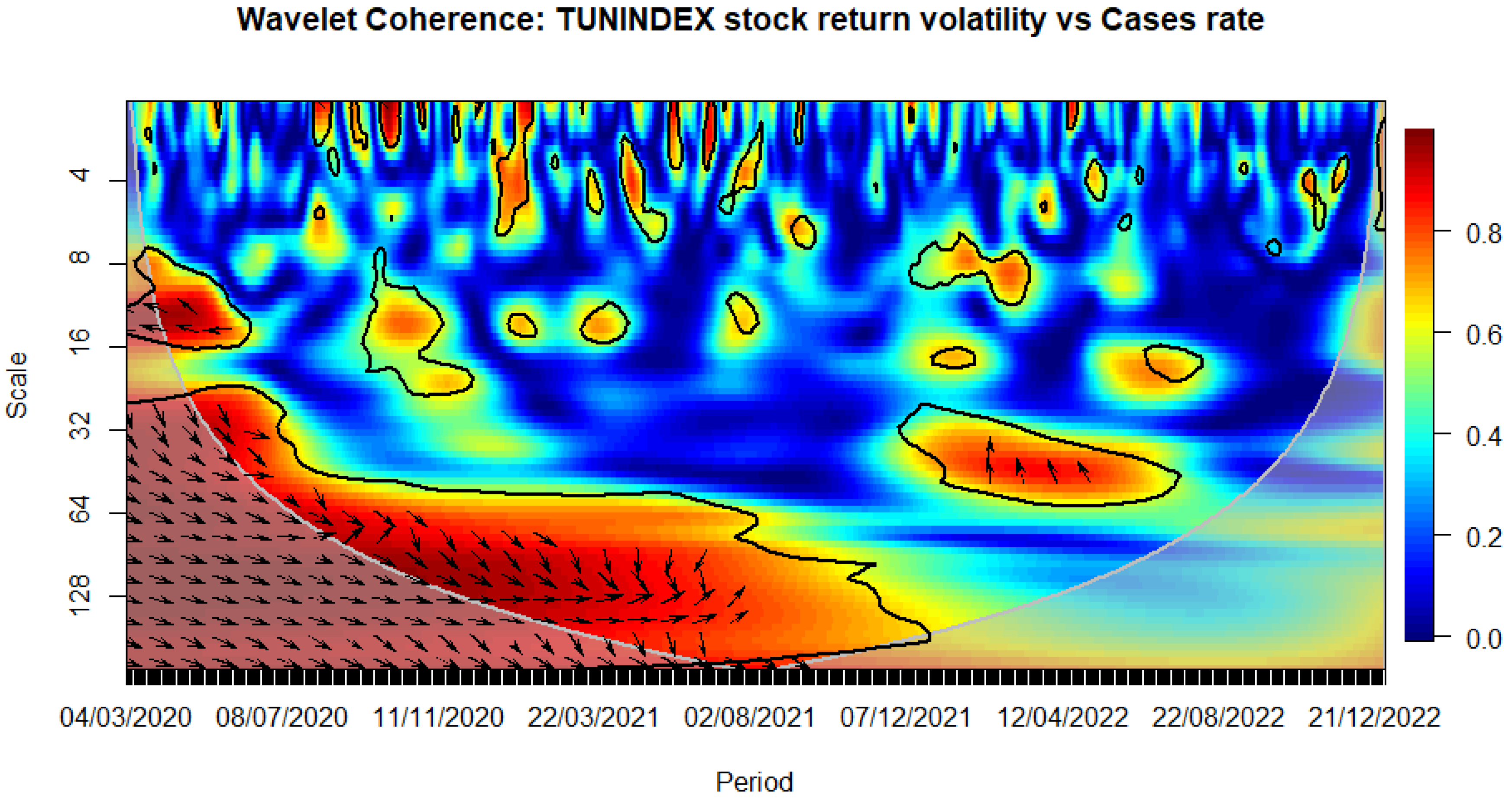

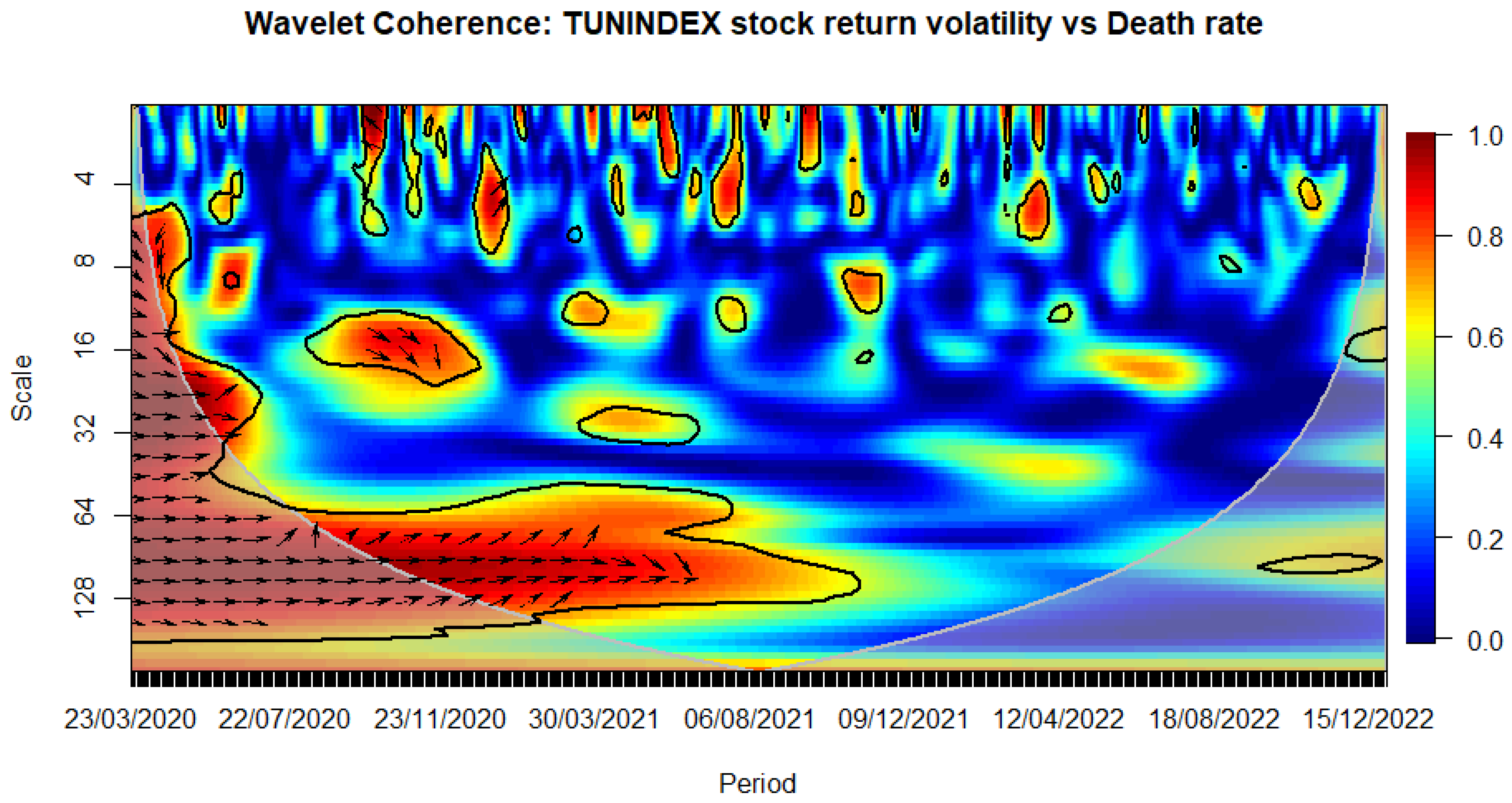

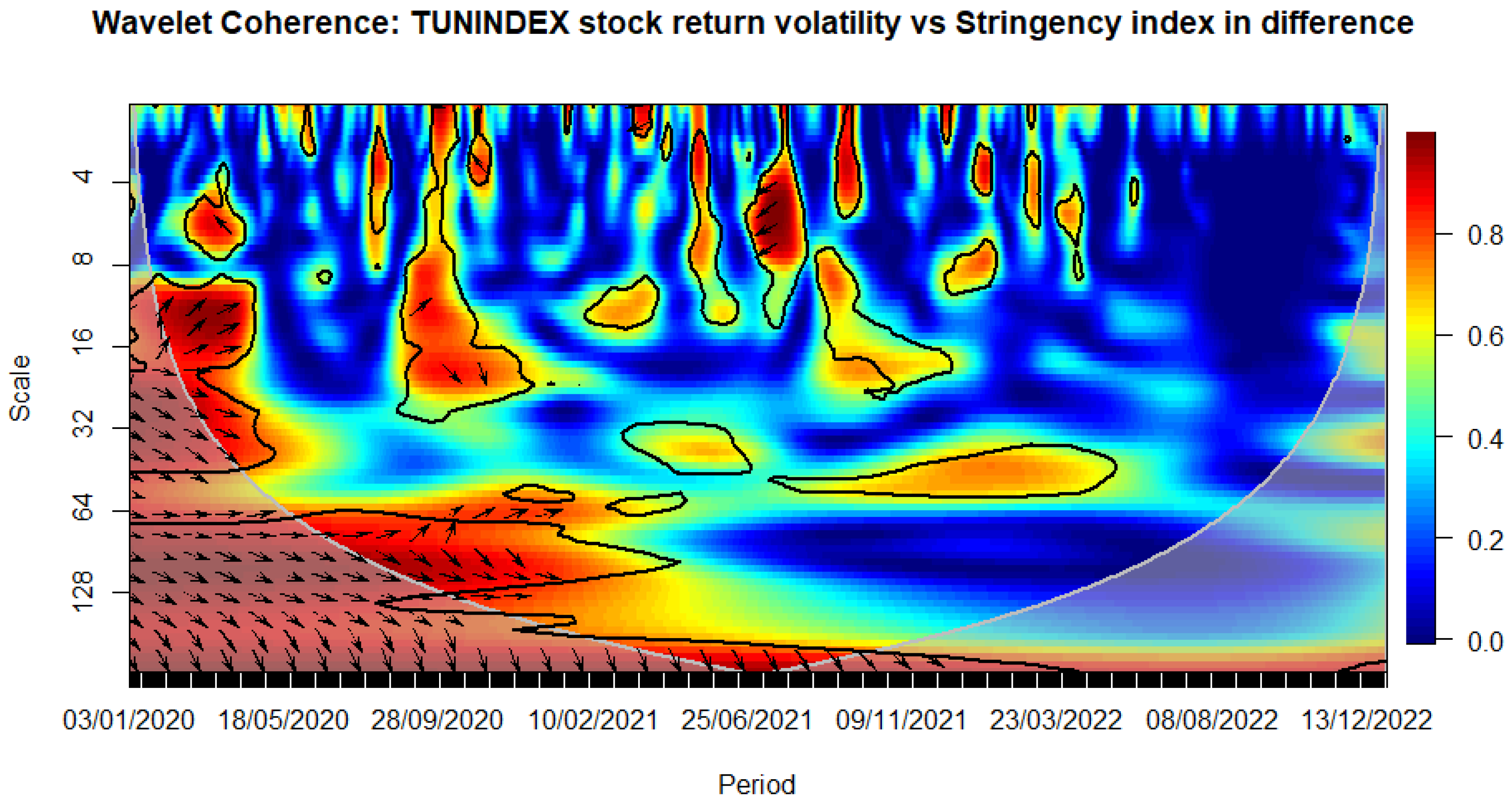

4.2. Wavelet coherence analysis

Wavelet coherence analysis is a method used to investigate the relationship between two-time series in both the time and frequency domains. It is particularly useful for exploring the coherence between signals that vary in time and is well suited to handle series with both stationary and non-stationary properties. Then, we can explore the coherence or synchronization between two signals across different scales and time intervals, making it a valuable tool in the analysis of complex and dynamic relationships between time-varying processes (see Torrence and Webster, 1998; Grinsted et al., 2004; Liu et al., 2007, Cazelles et al., 2008; Rouyer et al., 2008, Veleda et al., 2012).

Bias-corrected wavelet analysis refines traditional methods by mitigating edge effects and leakage issues associated with finite-length time series. This approach provides more accurate estimates of wavelet coefficients, enhances statistical inference, and improves the interpretability of time-frequency characteristics. It is particularly valuable for handling challenges related to discreteness and non-stationarity in signals, offering a robust tool for understanding the dynamics of time-varying processes. In this part, we follow this approach (e.g., Dhanya and Gupta, 2014; Hosseini et al., 2023).

The mathematical expressions provided will be based on Tissaoui et al. (2021), Tissaoui et al. (2022), and Li et al. (2022). A wavelet is a function Ψ(.) that can be either real-valued or complex-valued, and it meets the criterion of being square-integrable.

A wavelet is characterized as a compact or small-sized wave if

where

is the normalization factor, such that

,

stands for the location parameter, providing the exact position of the wavelet, and

denotes the scale dilatation parameter of the wavelet.

The cross-wavelet technique can break down the

function initially and subsequently reconstruct it such that

The process involves projecting a particular wavelet to achieve the desired outcome. The primary goal of wavelet coherence is to calculate localized correlations within a time-frequency domain across a series. We have

The given expression is assessed using the absolute smooth cross-wavelet value. is very similar to the correlation coefficient between two signals and .

The phase discrepancy serves as an indicator of the timing variation between oscillations in two variables about their frequency. The analysis of this phase difference involves examining the orientation of arrows depicted in wavelet coherence graphs. More precisely, the identification of the lead-lag relationship between two-time series is made by observing the directional alignment of arrows. When arrows point in the right direction, it signifies the in-phase alignment of the two signals, whereas leftward-pointing arrows indicate an anti-phase alignment.

The horizontal axis of the graph displays time, while the vertical axis depicts frequency, with higher scales corresponding to lower frequencies. The wavelet coherence identifies regions in time-frequency space where two-time series co-vary. Significantly related areas are represented by warmer colors (red), indicating a strong interrelation, whereas colder colors (blue) signify lower dependence between the series. Cold regions outside the significant areas indicate time and frequencies where there is no dependence in the series. In the wavelet coherence plots, arrows indicate lead/lag phase relations between the examined series. A zero-phase difference denotes that the two-time series move together at a particular scale. Arrows pointing to the right (left) indicate in-phase (anti-phase) relationships between the time series.

Globally, the COVID-19 virus persisted in causing anxiety, uncertainty, and distress in Tunisia. This situation heightened volatility in financial markets and led to liquidity challenges. The Tunisian stock market was not exempt from the profound effects of the COVID-19 outbreak, as evidenced by the ratios of confirmed cases and death cases, respectively (see

Figure 2 and

Figure 3).

Figure 2.

WAVELET TRANSFORM COHERENCE: Tunisian Stock return volatility versus COVID-19 cases rate. Notes: The black contour shows where the spectrum is significantly different from red noise at the 5% level. The lighter shade represents the cone of influence, marking high-power areas and indicating autocorrelation of wavelet power at each scale. The horizontal axis represents time from March 3rd, 2020, to December 30, 2022, and the vertical axis denotes scale bands with daily frequency. Arrows to the right (left) indicate in-phase (out-of-phase) relationships, meaning a positive (negative) connection. If arrows move right and up (down), the first variable "m" (Cases rate) drives (follows), while if arrows move left and up (down), variable "n" (TUNINDEX volatility) leads (lags). This visualization helps understand the dynamic relationships between variables. Source: The Author.

Figure 2.

WAVELET TRANSFORM COHERENCE: Tunisian Stock return volatility versus COVID-19 cases rate. Notes: The black contour shows where the spectrum is significantly different from red noise at the 5% level. The lighter shade represents the cone of influence, marking high-power areas and indicating autocorrelation of wavelet power at each scale. The horizontal axis represents time from March 3rd, 2020, to December 30, 2022, and the vertical axis denotes scale bands with daily frequency. Arrows to the right (left) indicate in-phase (out-of-phase) relationships, meaning a positive (negative) connection. If arrows move right and up (down), the first variable "m" (Cases rate) drives (follows), while if arrows move left and up (down), variable "n" (TUNINDEX volatility) leads (lags). This visualization helps understand the dynamic relationships between variables. Source: The Author.

Figure 3.

WAVELET TRANSFORM COHERENCE: Tunisian stock Return volatility versus COVID-19 death rate. Notes: The black contour identifies areas where the spectrum is statistically significant at the 5% level compared to red noise. The lighter shade designates the cone of influence, outlining high-power regions. Time, ranging from March 23rd, 2020, to December 30, 2022, is represented on the horizontal axis, while the vertical axis denotes scale bands with daily frequency. Source: The Author.

Figure 3.

WAVELET TRANSFORM COHERENCE: Tunisian stock Return volatility versus COVID-19 death rate. Notes: The black contour identifies areas where the spectrum is statistically significant at the 5% level compared to red noise. The lighter shade designates the cone of influence, outlining high-power regions. Time, ranging from March 23rd, 2020, to December 30, 2022, is represented on the horizontal axis, while the vertical axis denotes scale bands with daily frequency. Source: The Author.

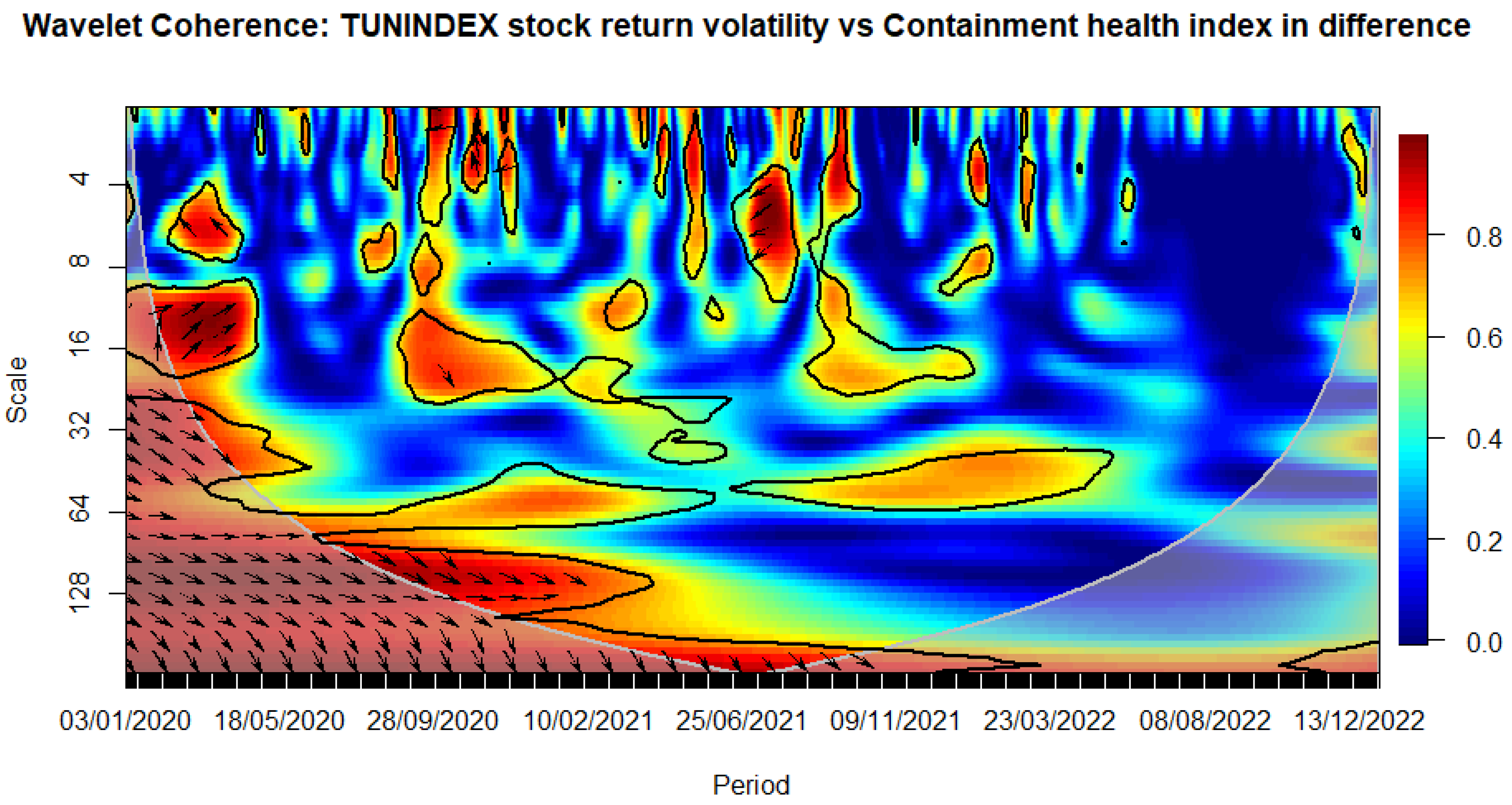

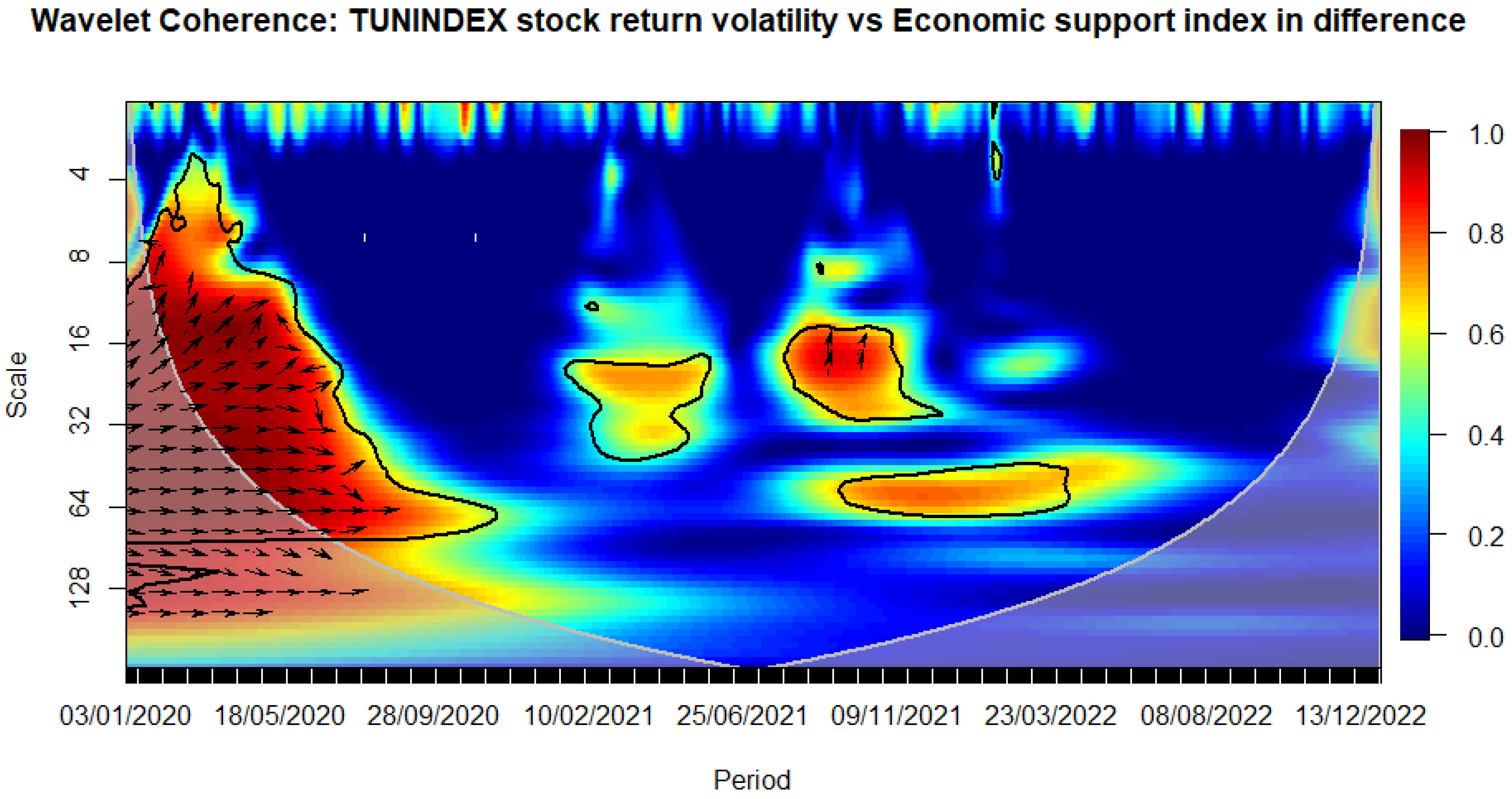

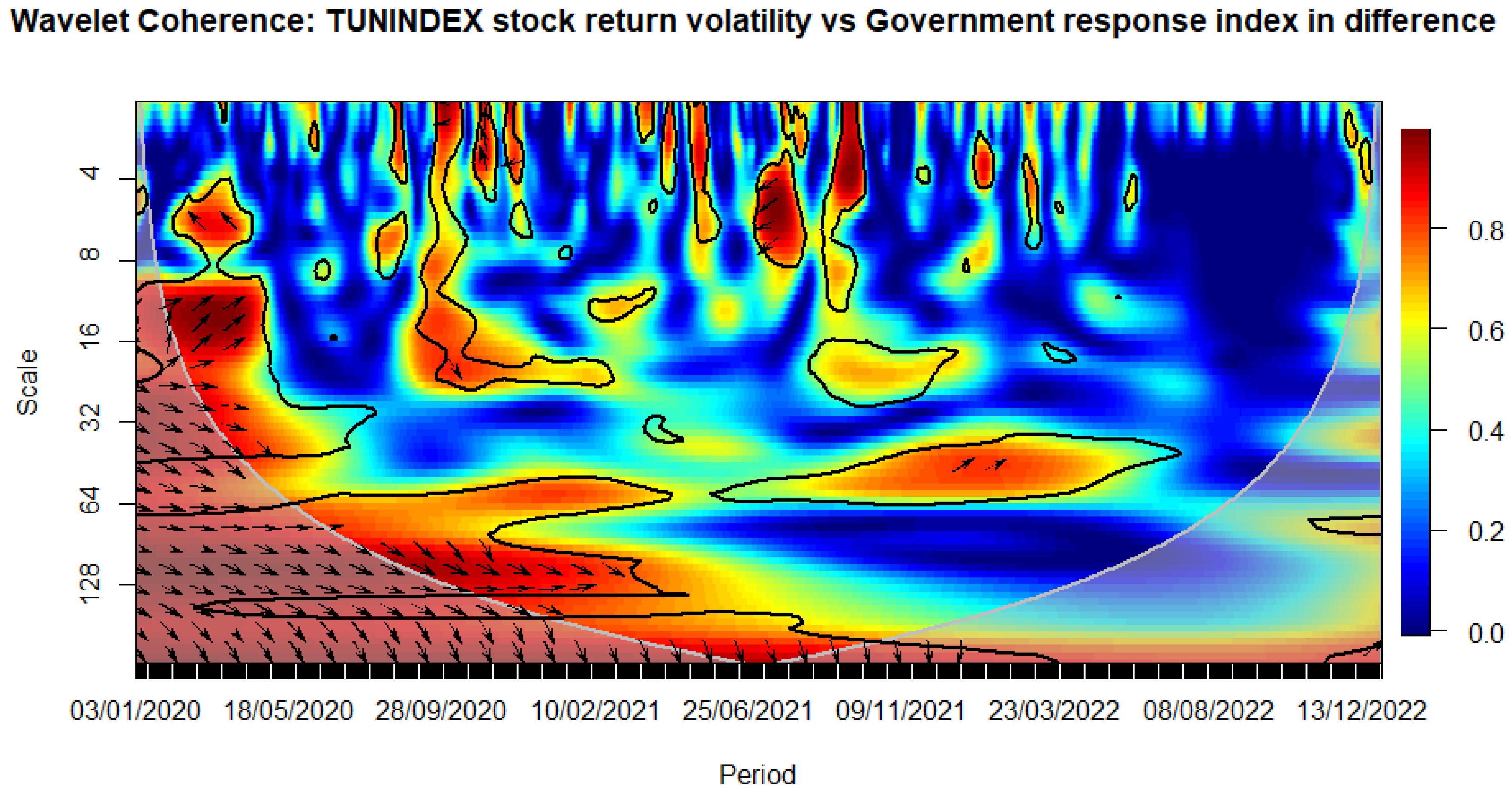

Among the government intervention metrics, the stringency index, the containment health index, and government response indices seem to affect the most stock market volatility during the COVID-19 times, while the economic support index had a neglected impact in the same period (see

Figure 4,

Figure 5,

Figure 6 and

Figure 7), confirming partially our previous results (see

Table 4,

Table 5,

Table 6,

Table 7,

Table 8,

Table 9,

Table 10 and

Table 11).

Figure 4.

WAVELET TRANSFORM COHERENCE: Tunisian stock return volatility versus Stringency index. Notes: The black contour identifies areas where the spectrum is statistically significant at the 5% level compared to red noise. The lighter shade designates the cone of influence, outlining high-power regions. Time, ranging from January 3rd, 2020, to December 30, 2022, is represented on the horizontal axis, while the vertical axis denotes scale bands with daily frequency. Source: The Author.

Figure 4.

WAVELET TRANSFORM COHERENCE: Tunisian stock return volatility versus Stringency index. Notes: The black contour identifies areas where the spectrum is statistically significant at the 5% level compared to red noise. The lighter shade designates the cone of influence, outlining high-power regions. Time, ranging from January 3rd, 2020, to December 30, 2022, is represented on the horizontal axis, while the vertical axis denotes scale bands with daily frequency. Source: The Author.

Figure 5.

WAVELET TRANSFORM COHERENCE: Tunisian stock return volatility versus Containment health index. Notes: The black contour identifies areas where the spectrum is statistically significant at the 5% level compared to red noise. The lighter shade designates the cone of influence, outlining high-power regions. Time, ranging from January 3rd, 2020, to December 30, 2022, is represented on the horizontal axis, while the vertical axis denotes scale bands with daily frequency. Source: The Author.

Figure 5.

WAVELET TRANSFORM COHERENCE: Tunisian stock return volatility versus Containment health index. Notes: The black contour identifies areas where the spectrum is statistically significant at the 5% level compared to red noise. The lighter shade designates the cone of influence, outlining high-power regions. Time, ranging from January 3rd, 2020, to December 30, 2022, is represented on the horizontal axis, while the vertical axis denotes scale bands with daily frequency. Source: The Author.

Figure 6.

WAVELET TRANSFORM COHERENCE: Tunisian stock return volatility versus Economic support index. Notes: The black contour identifies areas where the spectrum is statistically significant at the 5% level compared to red noise. The lighter shade designates the cone of influence, outlining high-power regions. Time, ranging from January 3rd, 2020, to December 30, 2022, is represented on the horizontal axis, while the vertical axis denotes scale bands with daily frequency. Source: The Author.

Figure 6.

WAVELET TRANSFORM COHERENCE: Tunisian stock return volatility versus Economic support index. Notes: The black contour identifies areas where the spectrum is statistically significant at the 5% level compared to red noise. The lighter shade designates the cone of influence, outlining high-power regions. Time, ranging from January 3rd, 2020, to December 30, 2022, is represented on the horizontal axis, while the vertical axis denotes scale bands with daily frequency. Source: The Author.

Figure 7.

Tunisian stock return volatility versus government response index. Notes: The black contour identifies areas where the spectrum is statistically significant at the 5% level compared to red noise. The lighter shade designates the cone of influence, outlining high-power regions. Time, ranging from January 3rd, 2020, to December 30, 2022, is represented on the horizontal axis, while the vertical axis denotes scale bands with daily frequency. Source: The Author.

Figure 7.

Tunisian stock return volatility versus government response index. Notes: The black contour identifies areas where the spectrum is statistically significant at the 5% level compared to red noise. The lighter shade designates the cone of influence, outlining high-power regions. Time, ranging from January 3rd, 2020, to December 30, 2022, is represented on the horizontal axis, while the vertical axis denotes scale bands with daily frequency. Source: The Author.

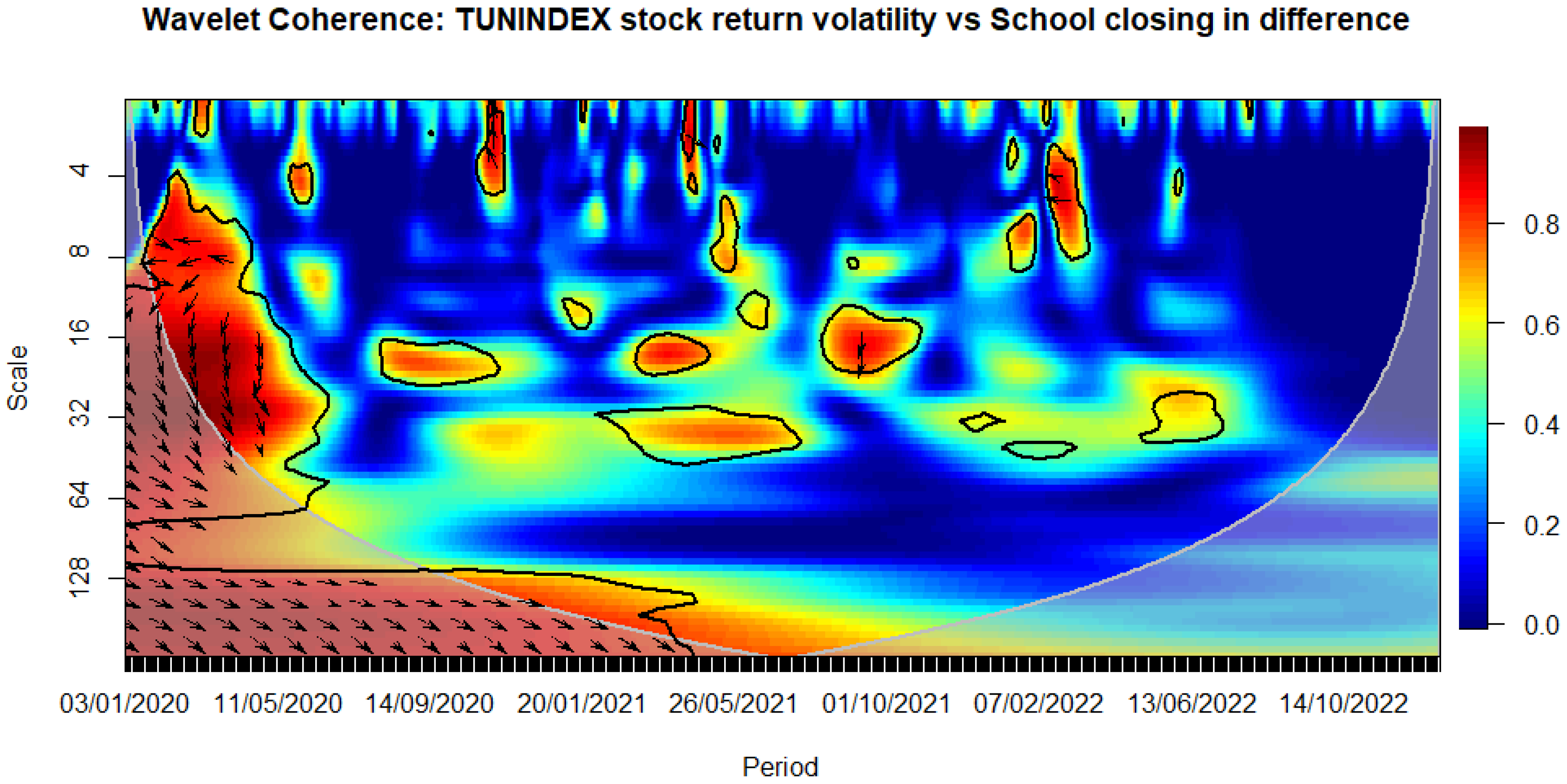

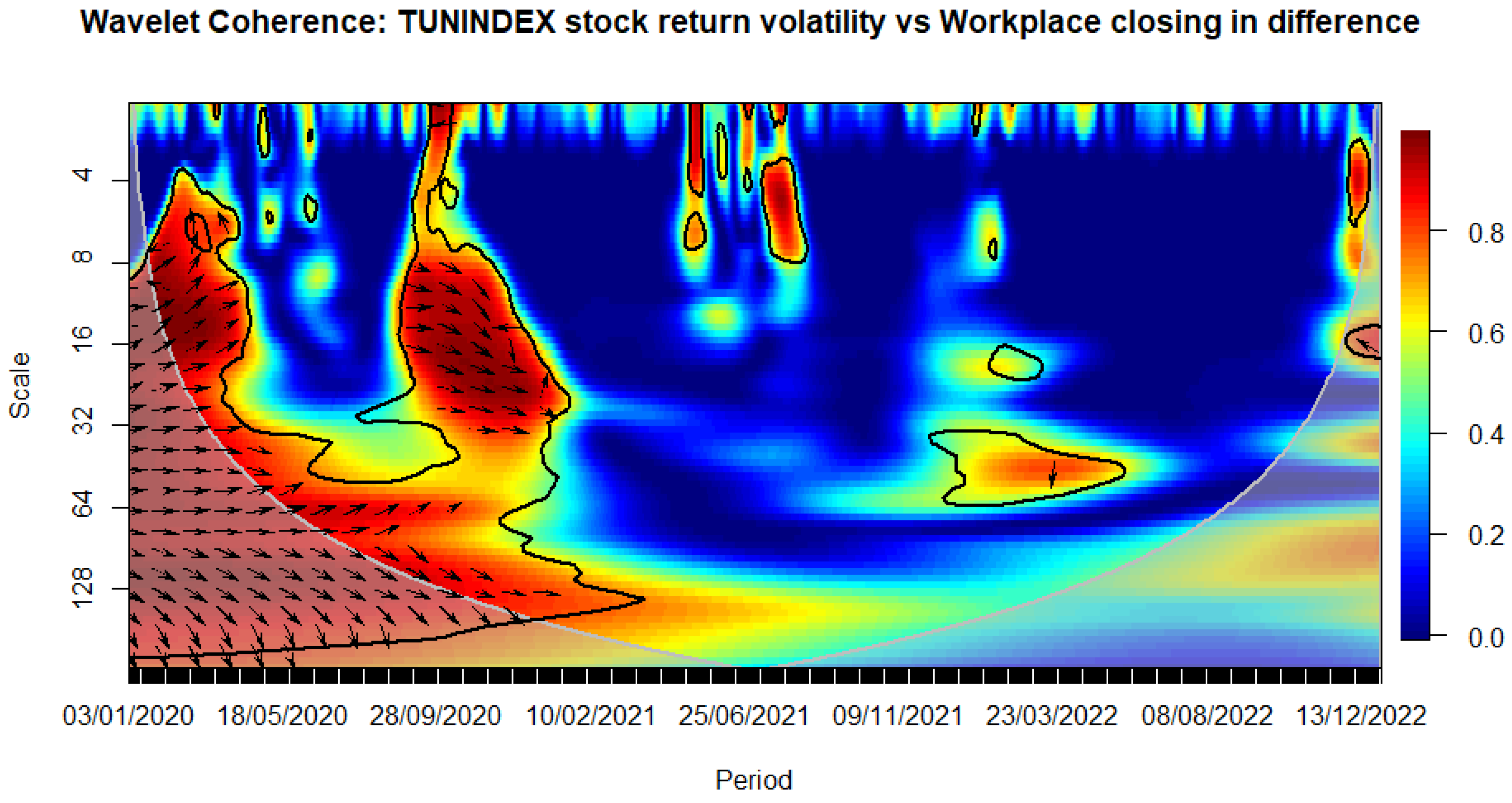

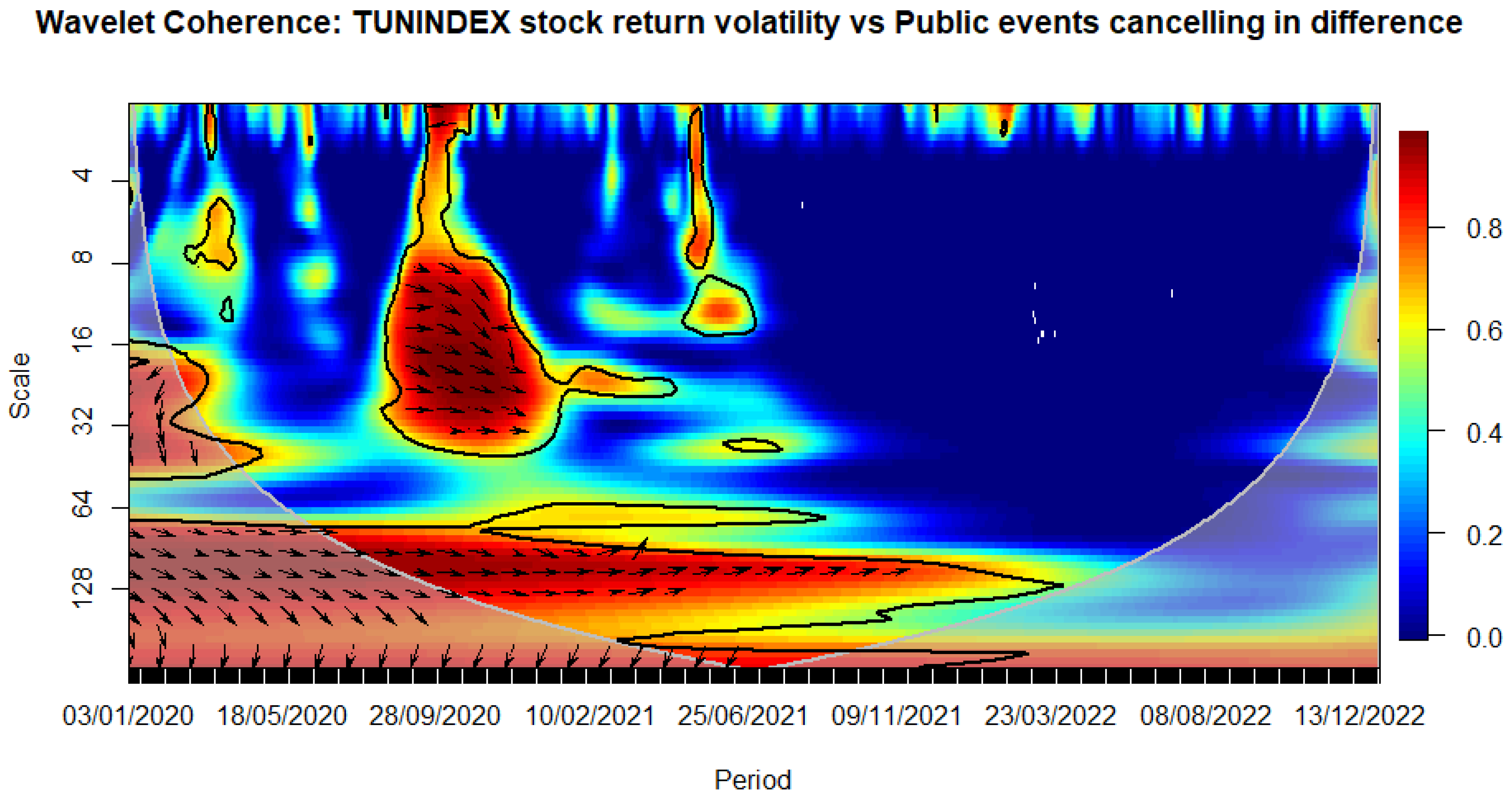

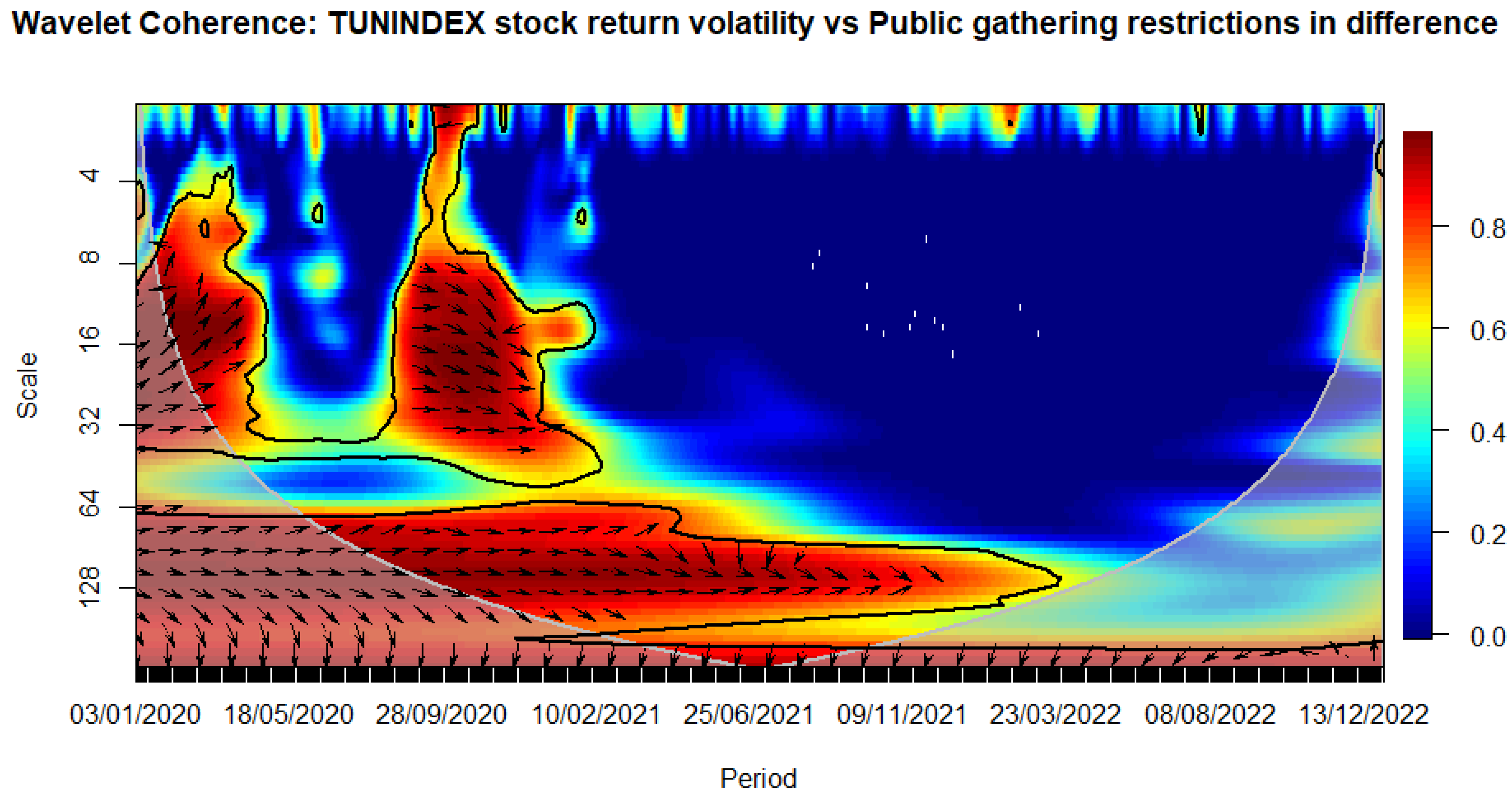

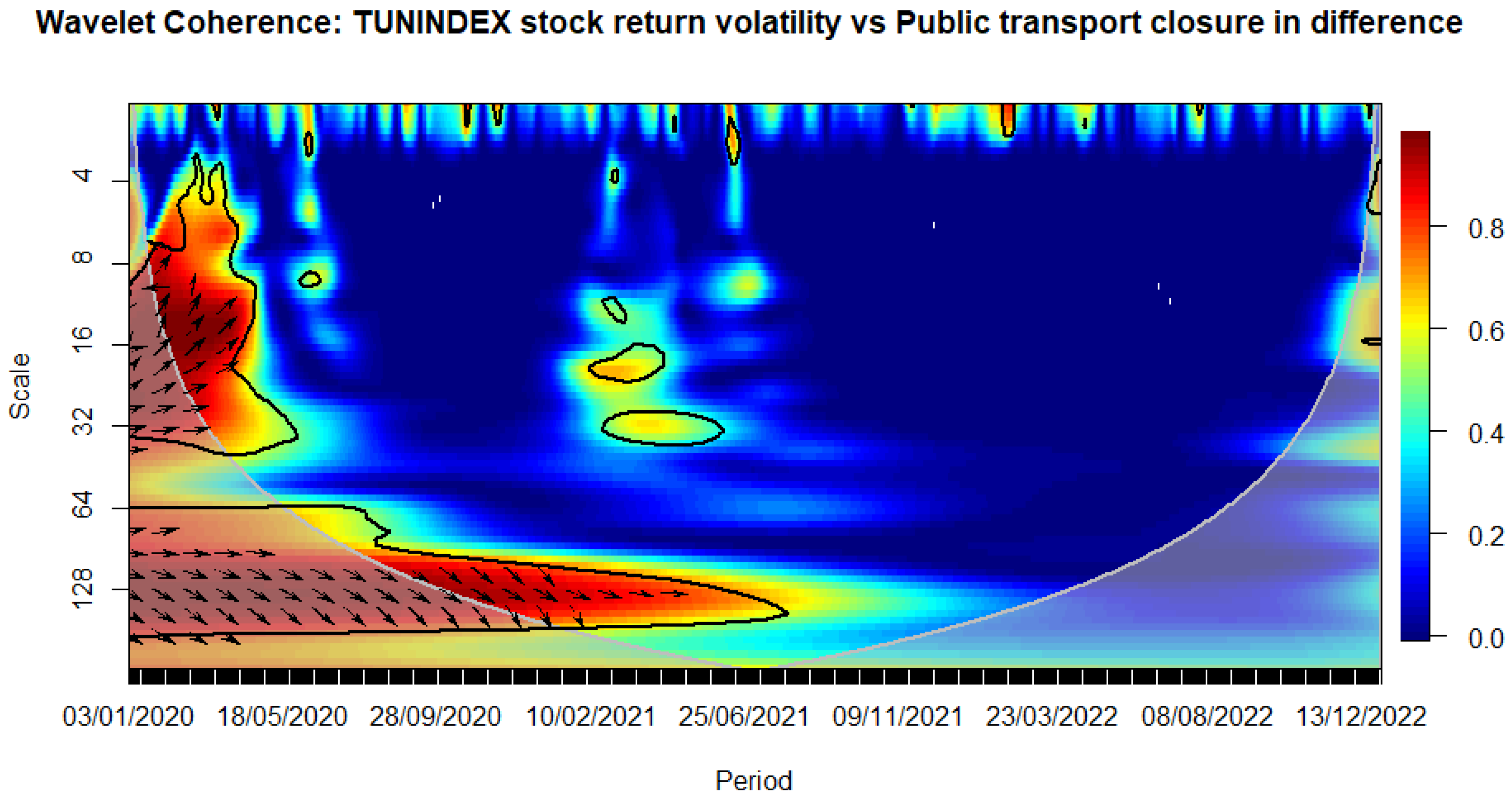

We observe that the closure of schools immediately influences volatility during the sanitary crisis (see

Figure 8). Similarly, workplace closures exhibit an immediate impact, persisting over a medium-term horizon (see

Figure 9). The cancellation of public events appears to have a notable and enduring impact over a longer-term horizon, as evidenced by a relatively high correlation with stock market volatility that persists beyond the COVID-19 period (see

Figure 10). This pattern is evident when considering the stringency subindex related to restrictions on public gatherings (see

Figure 11). Restrictions on public gatherings seem to impact conditional volatility over a short-term horizon (see

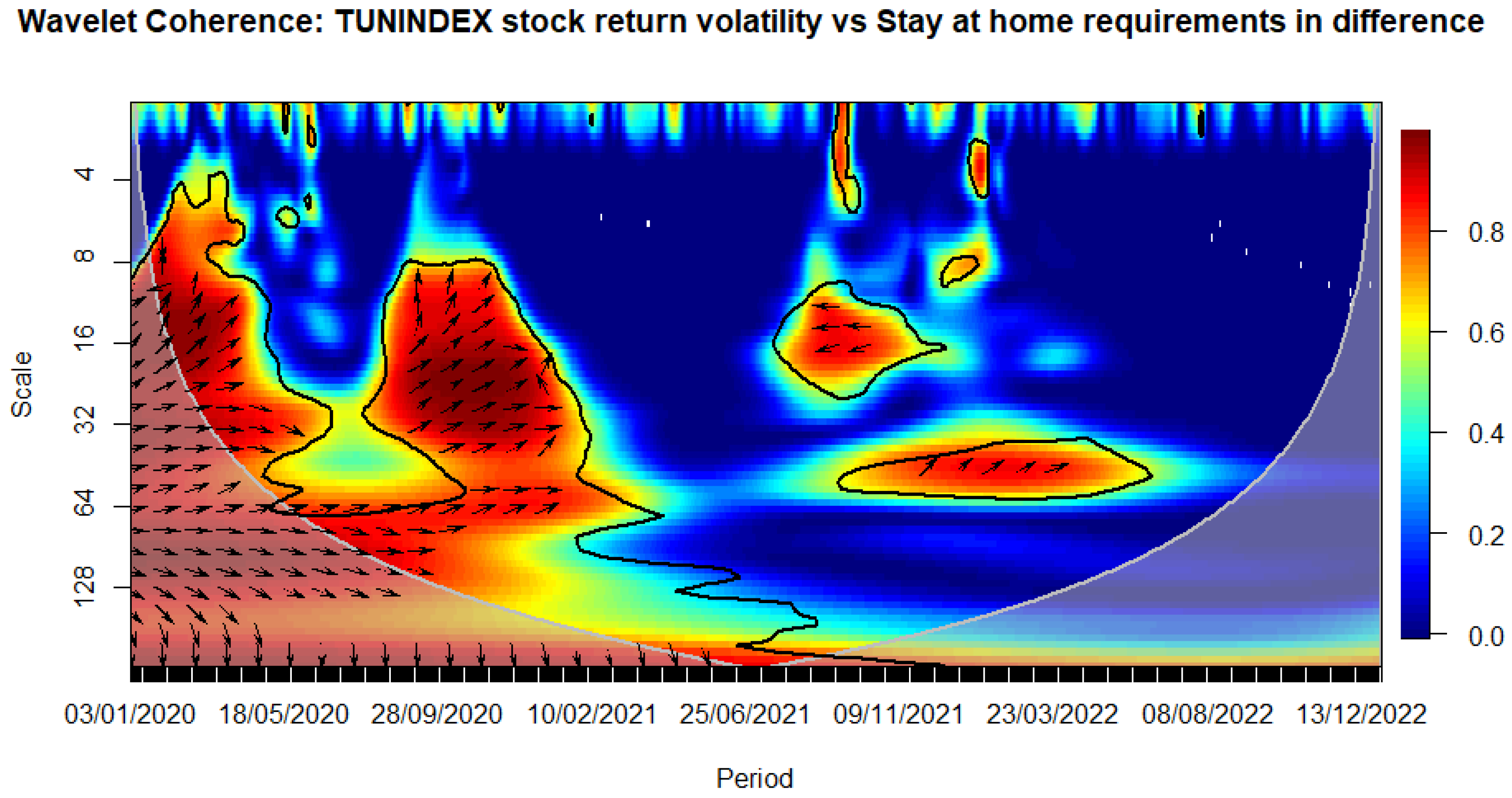

Figure 12). Stay-at-home requirements distinctly impact volatility over short to medium-term horizons (see

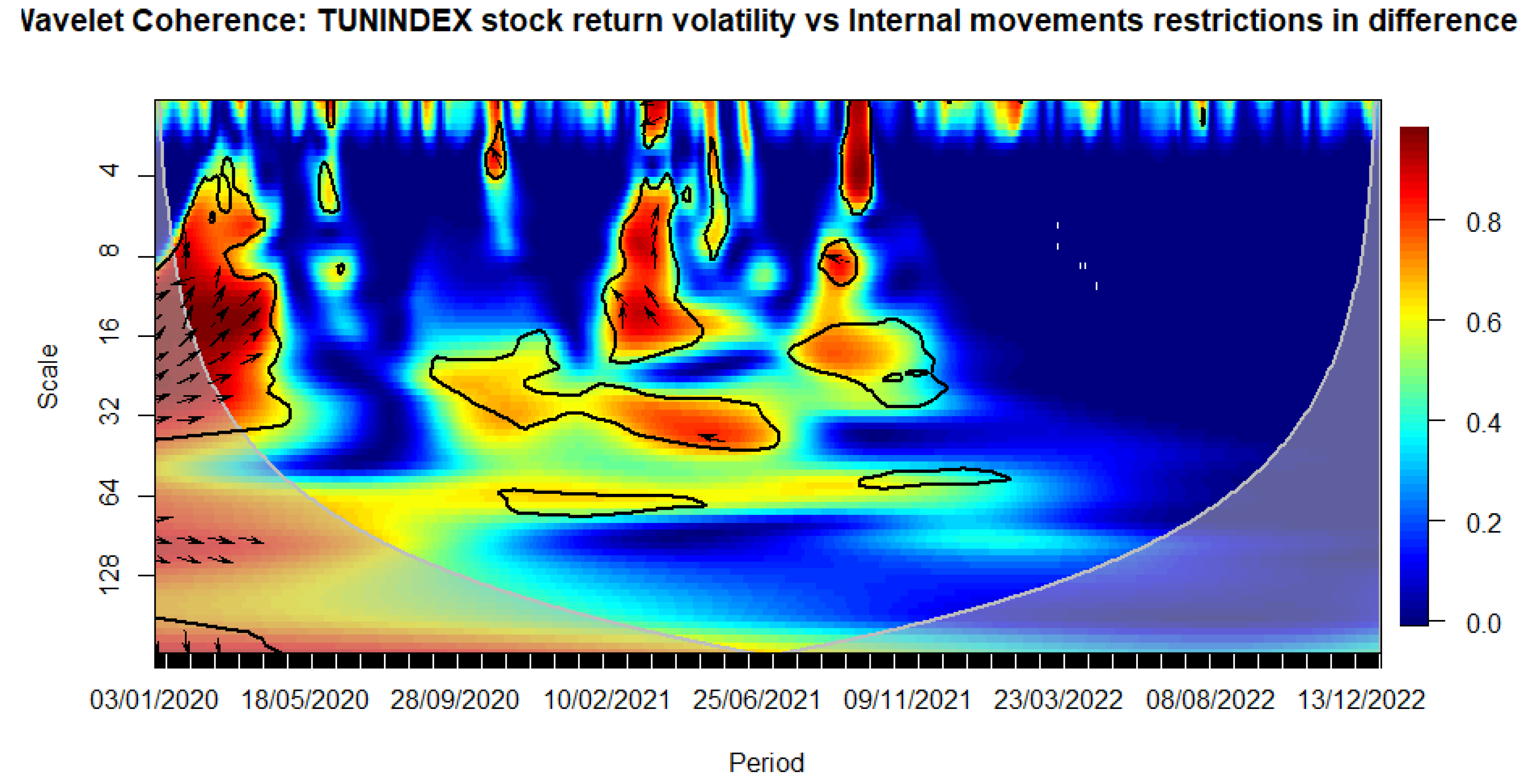

Figure 13). Restrictions on internal movements have an immediate impact on volatility triggered by the pandemic (see

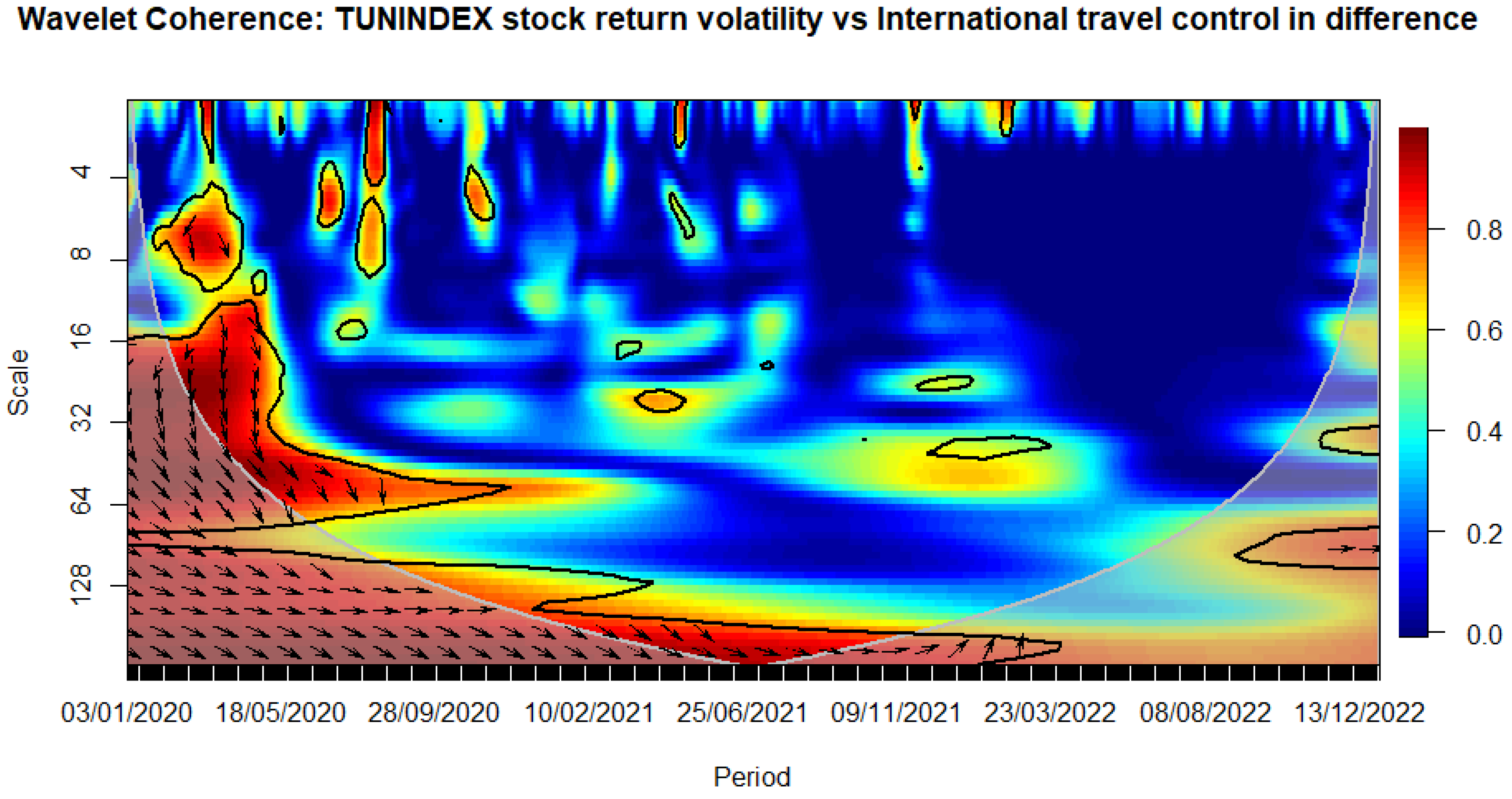

Figure 14). Control measures on international travel affect volatility over a medium-term horizon, with the effect extending post-COVID (see

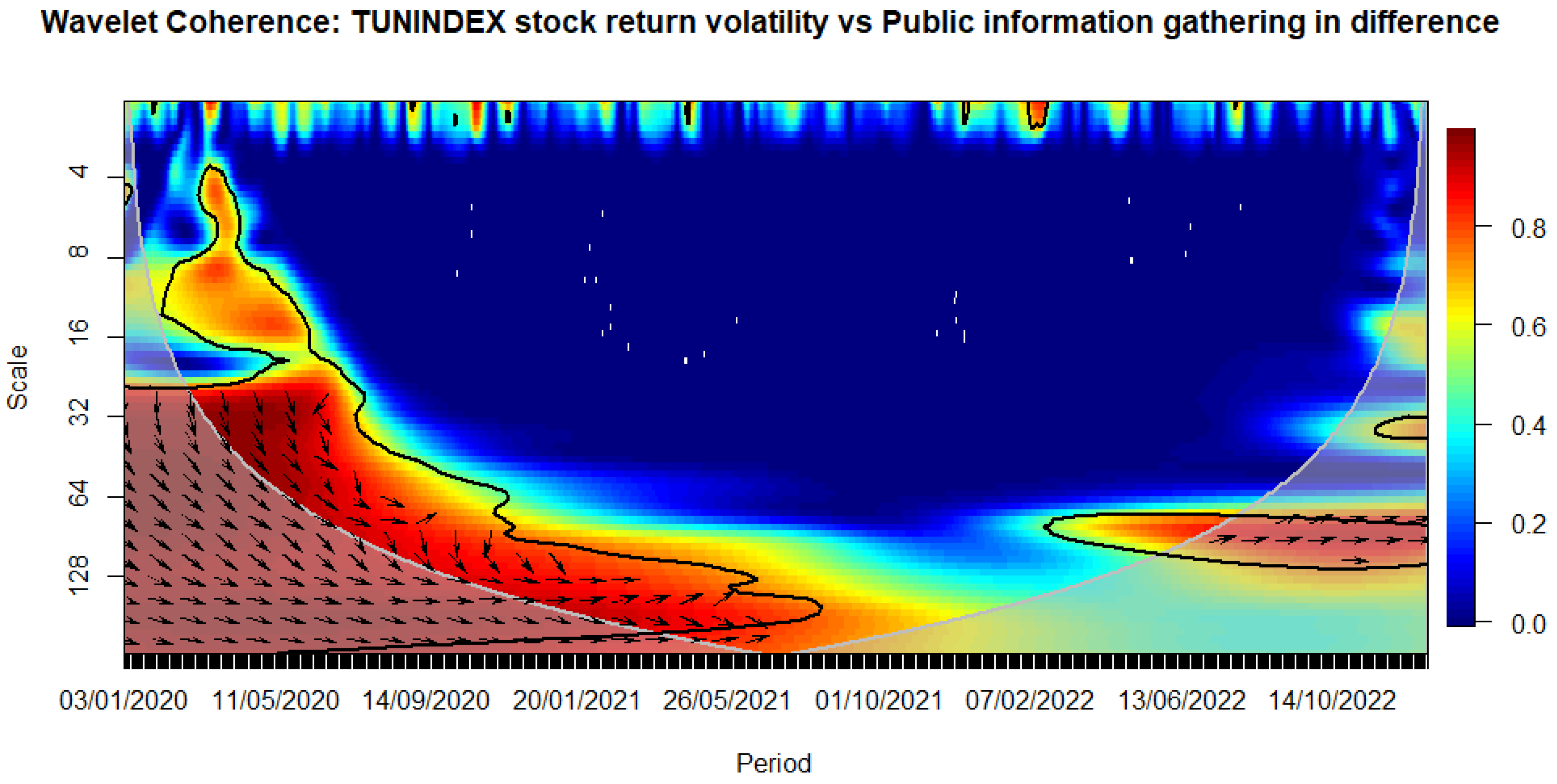

Figure 15). The gathering of public information influences volatility in the long run (see

Figure 16).

The observed impact of various stringency measures on market volatility during the COVID-19 crisis holds significant implications for policymaking. Measures such as school closures and workplace shutdowns immediately contribute to volatility during the sanitary crisis, necessitating swift and targeted interventions to stabilize financial markets. Notably, workplace closures exhibit a sustained impact over a medium-term horizon, underscoring the importance of measures to counter prolonged market uncertainties. Public event cancellations demonstrate a lasting influence, emphasizing the need for strategies to manage and recover from enduring economic disruptions. The stringency subindex related to restrictions on public gatherings affects conditional volatility over a short-term horizon, requiring a delicate balance in policymaking to ensure public health measures without causing prolonged market disruptions. Stay-at-home requirements distinctly impact volatility over short to medium-term horizons, necessitating adaptive financial measures. Internal movement restrictions trigger an immediate market response, highlighting the importance of swift financial interventions. International travel control affects volatility over a medium-term horizon, prompting policymakers to consider strategies supporting industries reliant on international travel and trade. Lastly, the influence of public information gathering on long-term volatility underscores the importance of transparent communication for maintaining market stability. Policymakers can leverage these insights to design targeted interventions addressing both immediate and prolonged economic implications during crises.

Figure 8.

WAVELET TRANSFORM COHERENCE: Tunisian stock return versus School closing index. Notes: The black contour identifies areas where the spectrum is statistically significant at the 5% level compared to red noise. The lighter shade designates the cone of influence, outlining high-power regions. Time, ranging from January 3rd, 2020, to December 30, 2022, is represented on the horizontal axis, while the vertical axis denotes scale bands with daily frequency. Source: The Author.

Figure 8.

WAVELET TRANSFORM COHERENCE: Tunisian stock return versus School closing index. Notes: The black contour identifies areas where the spectrum is statistically significant at the 5% level compared to red noise. The lighter shade designates the cone of influence, outlining high-power regions. Time, ranging from January 3rd, 2020, to December 30, 2022, is represented on the horizontal axis, while the vertical axis denotes scale bands with daily frequency. Source: The Author.

Figure 9.

WAVELET TRANSFORM COHERENCE: Tunisian stock return versus Workplace closing. Notes: The black contour identifies areas where the spectrum is statistically significant at the 5% level compared to red noise. The lighter shade designates the cone of influence, outlining high-power regions. Time, ranging from January 3rd, 2020, to December 30, 2022, is represented on the horizontal axis, while the vertical axis denotes scale bands with daily frequency. Source: The Author.

Figure 9.

WAVELET TRANSFORM COHERENCE: Tunisian stock return versus Workplace closing. Notes: The black contour identifies areas where the spectrum is statistically significant at the 5% level compared to red noise. The lighter shade designates the cone of influence, outlining high-power regions. Time, ranging from January 3rd, 2020, to December 30, 2022, is represented on the horizontal axis, while the vertical axis denotes scale bands with daily frequency. Source: The Author.

Figure 10.

WAVELET TRANSFORM COHERENCE: Tunisian stock return versus Public events canceling. Notes: The black contour identifies areas where the spectrum is statistically significant at the 5% level compared to red noise. The lighter shade designates the cone of influence, outlining high-power regions. Time, ranging from January 3rd, 2020, to December 30, 2022, is represented on the horizontal axis, while the vertical axis denotes scale bands with daily frequency. Source: The Author.

Figure 10.

WAVELET TRANSFORM COHERENCE: Tunisian stock return versus Public events canceling. Notes: The black contour identifies areas where the spectrum is statistically significant at the 5% level compared to red noise. The lighter shade designates the cone of influence, outlining high-power regions. Time, ranging from January 3rd, 2020, to December 30, 2022, is represented on the horizontal axis, while the vertical axis denotes scale bands with daily frequency. Source: The Author.

Figure 11.

WAVELET TRANSFORM COHERENCE: Tunisian stock return versus Public gathering restrictions. Notes: The black contour identifies areas where the spectrum is statistically significant at the 5% level compared to red noise. The lighter shade designates the cone of influence, outlining high-power regions. Time, ranging from January 3rd, 2020, to December 30, 2022, is represented on the horizontal axis, while the vertical axis denotes scale bands with daily frequency. Source: The Author.

Figure 11.

WAVELET TRANSFORM COHERENCE: Tunisian stock return versus Public gathering restrictions. Notes: The black contour identifies areas where the spectrum is statistically significant at the 5% level compared to red noise. The lighter shade designates the cone of influence, outlining high-power regions. Time, ranging from January 3rd, 2020, to December 30, 2022, is represented on the horizontal axis, while the vertical axis denotes scale bands with daily frequency. Source: The Author.

Figure 12.

WAVELET TRANSFORM COHERENCE: Tunisian stock return versus Public transport closure. Notes: The black contour identifies areas where the spectrum is statistically significant at the 5% level compared to red noise. The lighter shade designates the cone of influence, outlining high-power regions. Time, ranging from January 3rd, 2020, to December 30, 2022, is represented on the horizontal axis, while the vertical axis denotes scale bands with daily frequency. Source: The Author.

Figure 12.

WAVELET TRANSFORM COHERENCE: Tunisian stock return versus Public transport closure. Notes: The black contour identifies areas where the spectrum is statistically significant at the 5% level compared to red noise. The lighter shade designates the cone of influence, outlining high-power regions. Time, ranging from January 3rd, 2020, to December 30, 2022, is represented on the horizontal axis, while the vertical axis denotes scale bands with daily frequency. Source: The Author.

Figure 13.

WAVELET TRANSFORM COHERENCE: Tunisian stock return versus Stay-at-home requirements. Notes: The black contour identifies areas where the spectrum is statistically significant at the 5% level compared to red noise. The lighter shade designates the cone of influence, outlining high-power regions. Time, ranging from January 3rd, 2020, to December 30, 2022, is represented on the horizontal axis, while the vertical axis denotes scale bands with daily frequency. Source: The Author.

Figure 13.

WAVELET TRANSFORM COHERENCE: Tunisian stock return versus Stay-at-home requirements. Notes: The black contour identifies areas where the spectrum is statistically significant at the 5% level compared to red noise. The lighter shade designates the cone of influence, outlining high-power regions. Time, ranging from January 3rd, 2020, to December 30, 2022, is represented on the horizontal axis, while the vertical axis denotes scale bands with daily frequency. Source: The Author.

Figure 14.

WAVELET TRANSFORM COHERENCE: Tunisian stock return versus Internal movements restrictions Notes: The black contour identifies areas where the spectrum is statistically significant at the 5% level compared to red noise. The lighter shade designates the cone of influence, outlining high-power regions. Time, ranging from January 3rd, 2020, to December 30, 2022, is represented on the horizontal axis, while the vertical axis denotes scale bands with daily frequency. Source: The Author.

Figure 14.

WAVELET TRANSFORM COHERENCE: Tunisian stock return versus Internal movements restrictions Notes: The black contour identifies areas where the spectrum is statistically significant at the 5% level compared to red noise. The lighter shade designates the cone of influence, outlining high-power regions. Time, ranging from January 3rd, 2020, to December 30, 2022, is represented on the horizontal axis, while the vertical axis denotes scale bands with daily frequency. Source: The Author.

Figure 15.

WAVELET TRANSFORM COHERENCE: Tunisian stock return versus International travel control. Notes: The black contour identifies areas where the spectrum is statistically significant at the 5% level compared to red noise. The lighter shade designates the cone of influence, outlining high-power regions. Time, ranging from January 3rd, 2020, to December 30, 2022, is represented on the horizontal axis, while the vertical axis denotes scale bands with daily frequency. Source: The Author.

Figure 15.

WAVELET TRANSFORM COHERENCE: Tunisian stock return versus International travel control. Notes: The black contour identifies areas where the spectrum is statistically significant at the 5% level compared to red noise. The lighter shade designates the cone of influence, outlining high-power regions. Time, ranging from January 3rd, 2020, to December 30, 2022, is represented on the horizontal axis, while the vertical axis denotes scale bands with daily frequency. Source: The Author.

Figure 16.

WAVELET TRANSFORM COHERENCE: Tunisian stock return versus Public information gathering. Notes: The black contour identifies areas where the spectrum is statistically significant at the 5% level compared to red noise. The lighter shade designates the cone of influence, outlining high-power regions. Time, ranging from January 3rd, 2020, to December 30, 2022, is represented on the horizontal axis, while the vertical axis denotes scale bands with daily frequency. Source: The Author.

Figure 16.

WAVELET TRANSFORM COHERENCE: Tunisian stock return versus Public information gathering. Notes: The black contour identifies areas where the spectrum is statistically significant at the 5% level compared to red noise. The lighter shade designates the cone of influence, outlining high-power regions. Time, ranging from January 3rd, 2020, to December 30, 2022, is represented on the horizontal axis, while the vertical axis denotes scale bands with daily frequency. Source: The Author.