1. Introduction

In the dynamic realm of financial trading, the precision and timeliness of data are not merely operational requirements but are fundamental in maintaining client trust and ensuring market stability. Rapid and accurate resolution of discrepancies is critical for sustaining client confidence and avoiding financial losses. This necessity underscores the demand for an advanced real-time monitoring and alerting system. Our research paper focuses on the development of such a system, utilizing SpringBoot, a platform well-suited for constructing complex, high-availability applications that require scalability and swift development cycles.

Our methodology begins by leveraging SpringBoot to address the key challenges in monitoring trade inquiries: the need for real-time processing, data accuracy, and system reliability. We explore the architectural design of the alert system, utilizing SpringBoot’s features to build a solution that meets these challenges effectively. The paper then transitions to the implementation phase, where we outline the strategic selection of technologies and methodologies that complement SpringBoot, enhancing the system’s capability in managing data and detecting discrepancies. The final section of our paper presents a comprehensive evaluation of the system, including performance testing under various operational scenarios. This assessment aims to demonstrate the effectiveness of our system in a real-world trading environment. By covering each stage of the development cycle – from conceptualization and design to implementation and evaluation – we provide a thorough overview of the system’s development. This approach highlights the challenges encountered, the solutions implemented, and the outcomes achieved, offering valuable insights and best practices for similar projects in the future.

2. Main body

2.1. Introduction

In the dynamic and complex world of finance, where precision and speed are crucial, the increasing complexity and interconnectivity of markets demand advanced, technology-driven solutions for real-time monitoring, analysis, and alerting of data discrepancies. SpringBoot, with its microservices-oriented architecture, stands out as an ideal framework for this challenge. Its agility and scalability, coupled with the ability to seamlessly integrate with various data sources and services, make it an optimal choice for developing reliable and efficient financial trading systems. This framework addresses the critical need for prompt discrepancy detection and response, ensuring minimal impact on profit and loss in the fast-paced financial sector.

2.2. Addressing Core Challenges

The development of a real-time monitoring system in financial trading faces multiple challenges, both technical and in terms of broader market implications. In this fast-paced domain, where market conditions can shift rapidly, processing trade inquiries instantaneously becomes critical. Equally important is maintaining the accuracy of complex and multifaceted financial data, as any errors can have significant repercussions. Furthermore, robust system reliability is non-negotiable. The system must ensure minimal downtime and be equipped to handle peak loads effectively. In the financial sector, where trust is paramount, the reliability of such a system directly influences client confidence. This underscores the need for a monitoring system that is not only technologically sound but also steadfast and dependable, contributing to the stability and integrity of the trading environment.

2.3. Architectural Design and Technology Selection

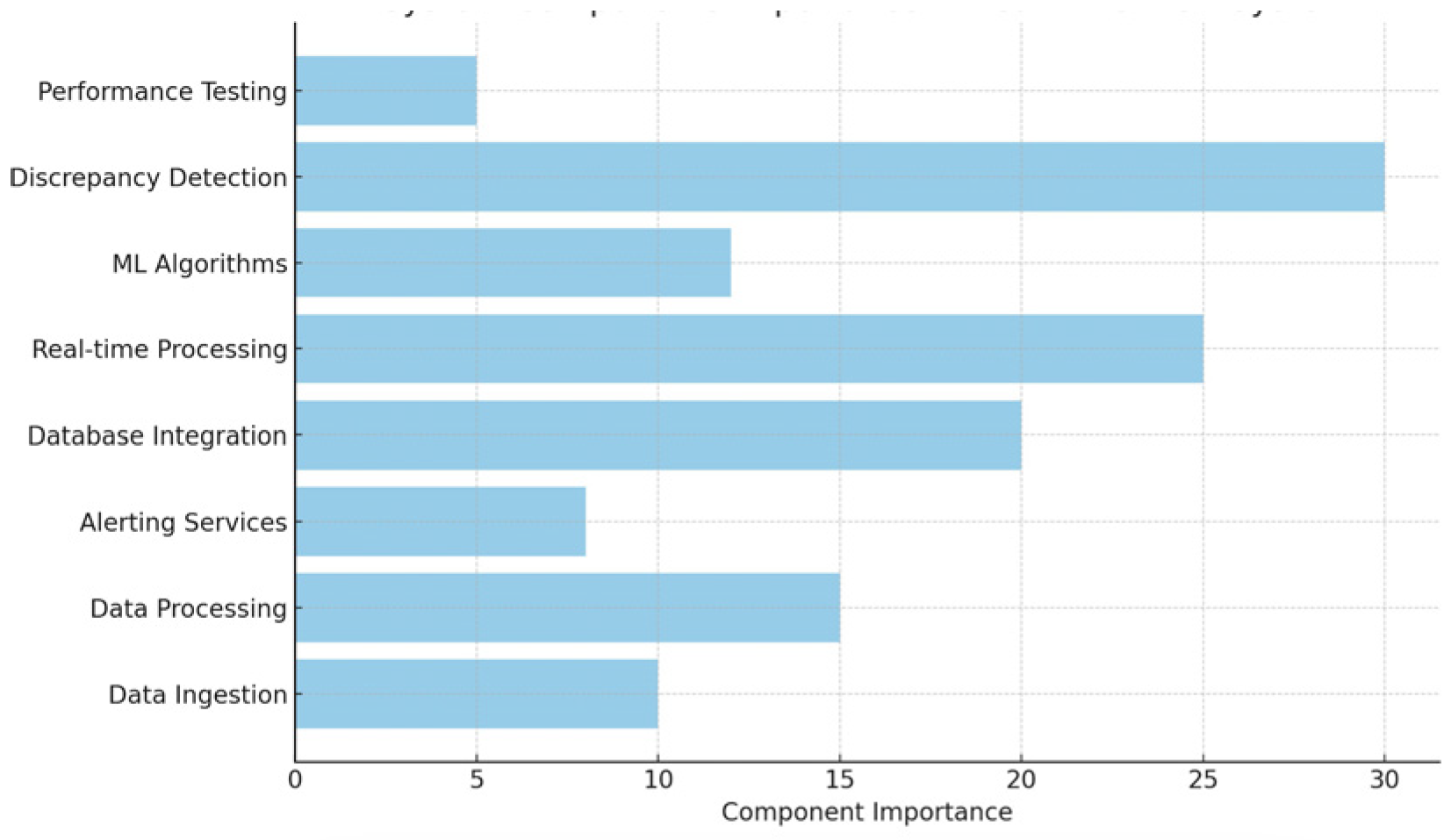

In our project, we leverage SpringBoot’s robust and flexible microservices architecture to create a high-performing, real-time alert system for financial trading. Key components include integrating real-time data processing frameworks for their performance and compatibility with SpringBoot, and employing a combination of SQL and NoSQL databases to manage diverse data efficiently. Advanced discrepancy detection algorithms are integrated for accurate, real-time analysis, complemented by Apache Kafka for effective stream processing. The user interface features an intuitive dashboard for analytics and alert management. Emphasizing security, our system adheres to stringent compliance standards and employs robust security protocols. Cloud integration and deployment are also integral, enhancing the system’s scalability and reliability. This holistic approach ensures that our system is not only technologically advanced but also tailored to meet the dynamic needs of the financial trading sector.

Figure 1.

System Components Importance in Real-Time Alert System.

Figure 1.

System Components Importance in Real-Time Alert System.

2.4. System Implementation and Discrepancy Detection

The development of our real-time alert system is centered around achieving seamless and efficient operations, especially in discrepancy detection within trade inquiries. Configuring the SpringBoot environment is a critical step, where specific dependencies and properties are tailored to align with our system’s unique requirements. To enhance functionality and maintenance, the system architecture adopts a microservices approach, with distinct services dedicated to processes like data ingestion, processing, and alerting.

Database integration is a vital component, with the system adeptly handling both SQL and NoSQL databases within the SpringBoot framework to ensure versatile and efficient data management. For real-time processing of high-volume data streams, technologies like Apache Kafka, and possibly Apache Storm, are integrated, significantly enhancing our data streaming capabilities. Machine learning libraries, such as Deeplearning4j or TensorFlow’s Java API, are incorporated within the SpringBoot environment. These libraries facilitate advanced analytics and the development of sophisticated algorithms for real-time anomaly, outlier, and pattern detection. Additionally, machine learning models are trained on historical data to recognize standard trading patterns and accurately identify potential discrepancies.

The system is meticulously designed to process and analyze data promptly as it arrives, enabling immediate detection of discrepancies. An effective alert mechanism is established to quickly notify relevant stakeholders through various channels, including email, SMS, or in-app notifications, whenever discrepancies are identified. To ensure the system’s robustness and reliability, extensive performance testing is conducted, focusing on its ability to manage expected data volumes and maintain operational accuracy. Furthermore, the precision of discrepancy detection algorithms is rigorously evaluated, with a keen focus on minimizing false positives and negatives, thereby guaranteeing the system’s efficacy in real-world financial trading scenarios.

2.5. Evaluation and Real-world Application

Our system undergoes an intensive evaluation process, encompassing both performance and accuracy testing, to ensure it meets theoretical designs and excels in real-world trading applications. This includes Scenario-Based Testing for robustness under various market conditions, Response Time Assessment to ensure swift discrepancy detection, and Load Testing for peak data volume management. Accuracy is scrutinized through Algorithm Effectiveness and Data Integrity Testing. Crucial to our process is real-world user feedback, focusing on user experience and practical effectiveness, which informs continuous improvements and adaptations. Pilot Testing in real trading environments precedes full deployment, ensuring the system’s readiness and reliability, followed by ongoing monitoring and updates to stay aligned with dynamic market needs and user feedback. This holistic evaluation ensures the system is not only technologically advanced but also practical and user-oriented in the fast-paced trading sector.

2.6. Conclusion and Future Work

In conclusion, our research on developing a real-time alert system for financial trading using SpringBoot has demonstrated significant advancements in handling high-speed and accurate operations, thereby enhancing the efficacy and reliability of financial trading processes. The system’s innovation lies in its integration of advanced technologies, including machine learning algorithms and real-time data processing within a SpringBoot environment. Future research directions are promising, focusing on exploring more sophisticated Machine Learning Models, integrating Blockchain for enhanced security, adapting the system to various global market conditions, and improving Scalability and Cloud Optimization. Additionally, efforts will be directed towards refining the User Interface for better user experience and ensuring ongoing Regulatory Compliance Monitoring. These forward-looking initiatives are set to further revolutionize the landscape of financial technology.

3. Conclusion

In conclusion, this research paper effectively details the creation and implications of a real-time alert system for financial trading, leveraging SpringBoot’s robust and adaptable framework. This system critically addresses the essential needs of the financial trading sector: real-time processing, high data accuracy, and unwavering system reliability, all vital for sustaining client trust and market stability. Our comprehensive study spanned across key areas including Architectural Design and Technology Selection, System Implementation and Discrepancy Detection, and thorough Evaluation in Real-world Applications. The system’s effectiveness is rigorously validated through performance and accuracy testing across various operational scenarios. Moving forward, the scope for future research and development is vast, offering numerous opportunities to enhance and evolve financial technology. This work not only contributes significantly to the current financial domain but also lays a foundational blueprint for developing similar systems in other critical sectors where real-time accuracy and reliability are crucial.

4. Disclaimer

During the preparation of this work the author(s) used ChatGPT in order to modify the content. After using this tool/service, the author(s) reviewed and edited the content as needed and take(s) full responsibility for the content of the publication.

References

- “Real-time alert and notification platform for financial markets,”Oneture Case Study, 2024, https://oneture.com/case-studies/real-time-alert-platform.

- Chloe, “Implementing real-time notifications with spring boot and websocket,”Moments Log, May, 2023, https://www.momentslog.com/development/web-backend/implementing-real-time-notifications-with-spring-boot-and-websocket.

- L. Huang, “Real-time financial risk management for legacy trading transactions,”Confluent Blog, November, 2023, https://www.confluent.io/blog/real-time-financial-risk-management-for-legacy-trading-transactions.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).