1. Introduction

The financial sector has undergone tremendous transformation as a result of the broad adoption of digital technologies, especially the emergence of blockchain technology. According to Nakamoto, the blockchain is a decentralized digital database that enables safe and transparent transactions. without the use of intermediaries. Blockchain technology has the potential to improve efficiency, save costs, boost transparency and improve security in the financial sector. Blockchain has been the focus of significant study and development over the past few years and its potential financial applications have received a lot of attention. The potential uses of blockchain in finance are numerous and range from reducing fraud in financial transactions to enabling new forms of digital currencies and decentralized financial systems [

1].

Although blockchain adoption in the financial sector is still in its early stages, interest in its potential uses is growing. The application of blockchain in the financial services sector is being investigated for a number of goals, such as lowering financial transaction fraud, enabling new types of digital currencies and developing decentralized financial systems. Additionally, blockchain has the ability to enhance a number of financial procedures, such as banking operations, digital identity management and supply chain management. Despite all the excitement surrounding blockchain technology in finance, there are still issues that need to be resolved. For instance, legal concerns, interoperability and scalability limitations, as well as a lack of standards, are all challenges that must be overcome for blockchain technology to be successfully implemented in the financial sector.

This study conducts a systematic literature review of the existing research on blockchain in finance, with a focus on its potential uses, benefits and challenges. The literature review offers a thorough summary of the state of research on blockchain in finance at present and emphasizes the need for more study to fully fulfill this technology’s potential. The report also sheds light on the potential advantages of blockchain for various financial processes and services, such as supply chain management, digital identity management, financial services and infrastructure [

2].

The rest of the paper is organized as follows.

Section 2 provides a review of the existing literature on blockchain in finance.

Section 3 provides the research methodology of the study. Results are presented in section 4. Finally,

Section 5 concludes the study and provides recommendations for future research.

2. Related Work

There are some reviews about the blockchain used in the financial ecosystem. For instance, R. B ̈ohme et al. [

3] provide a detail review of the blockchain in finance. This study provides an overview of the current state of blockchain technology in the financial industry and discusses potential use cases, challenges and future directions for research. V. Gattesch et al. [

4] conducted a study that examines the potential benefits and challenges of using blockchain technology in the insurance industry and discusses possible use cases and future research directions. This study conducted by D. K. Wardhani et al. [

5] in order to provides an overview of the potential benefits and challenges of using blockchain technology in capital markets and discusses current and future use cases. Another study on blockchain technology in banking performed by M. U. Chowdhury et al. [

6] that provides a value-based analysis of blockchain technology in the banking sector, examining how it could be used to create new value for customers and banks and discussing the challenges that need to be overcome for successful implementation. M. Mainelli et al. [

7] examined the potential impact of blockchain technology on the securities transaction lifecycle, including the benefits and challenges that it could bring, as well as discussing its potential to reduce costs and improve efficiency. In this study, M. Javaid et al. [

8] provided a comprehensive overview of the current and potential future applications of blockchain technology in the financial services industry, including use cases in payments, securities trading and insurance, as well as discussing the challenges and opportunities that it presents. S. Grima et al. [

9] examined the potential effects of blockchain technology on the insurance sector, including the advantages and drawbacks it might present as well as how it might boost productivity, boost transparency and cut costs. Another study conducted by S. E. Chang et al. [

10] provided an overview of the use of blockchain technology in trade finance and the opportunities it presents. It also examines the challenges that need to be overcome for successful implementation and the future possibilities of the technology. In research she conducted, M. Morini [

11] gives a broad overview of the potential applications of blockchain technology in the capital markets, including both the advantages such as in creased effectiveness and lower costs and the obstacles that must be overcome before adoption can take place. Another study examined by I. Amsyar et al. [

12] provided a comprehensive review of the existing literature on blockchain and cryptocurrencies, examining the benefits and challenges of the technology, as well as the current state of research and future directions. In another blockchain study on banking P. Garg et al. [

13] examined the feasibility of blockchain technology in the banking industry, including the benefits that it could bring, such as improved efficiency and increased security, as well as discussing its potential to improve transparency. A-E. Panait et al. [

14] studied the possible effects of blockchain technology on digital identity management, as well as the difficulties it might pose in terms of increased privacy and security.

3. Research Methodology

The related study covers current trends and technologies used in the use of blockchain in finance. In addition, we aim to review the basic features of blockchain for finance studies to be developed using blockchain. Thus, this study can provide an accelerating support to both academic and project studies in this field in the future. By doing this, we are conducting a preliminary SLR study of the benefits and challenges of using blockchain.

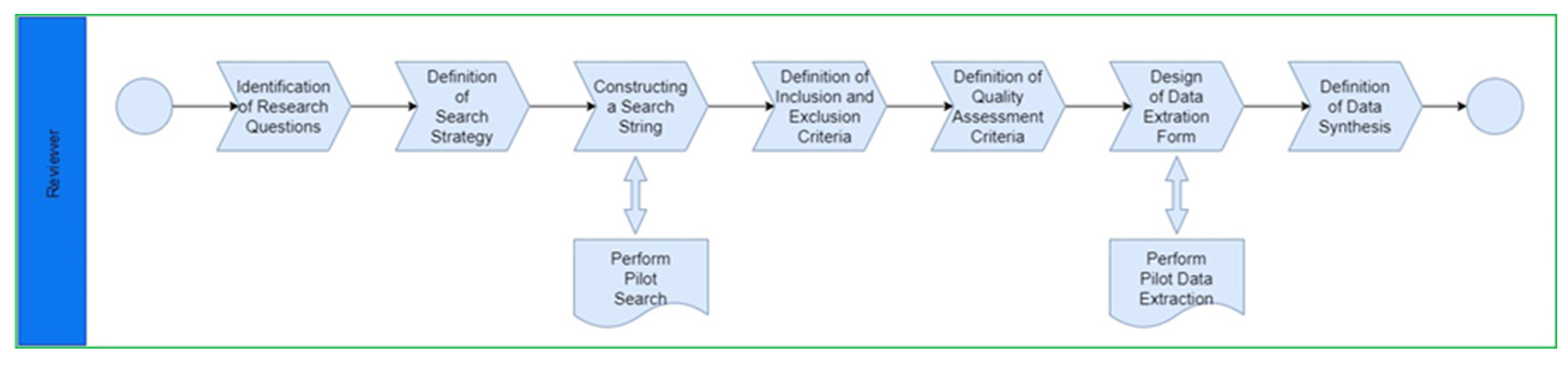

Before conducting the SLR, we developed a review methodology based on studies from [

15,

16] that were cited by field experts who emphasized that a protocol reduces bias among researchers and promotes repeatability. The review protocol is shown in

Figure 1.

A list of research questions for the SLR is provided in

Table 1. The SLR’s scope, search techniques and search string are all described in

Section 3.2 to

Section 3.2.3. The inclusion/exclusion criteria for the obtained literature are described in

Section 3.2.4. and the quality evaluation criteria for the retrieved literature are included in

Section 3.3.

3.1. Research Questions

We created a set of research questions that the SLR needs to answer. These inquiries came about from a developer’s perspective. While conducting a blockchain study in finance, infrastructures (1), technology (2), benefits (3), consensus methods (4), permission types (5), future applications (6), most known use cases (7), smart contracts (8) and difficulties (9) were addressed as research questions.

3.2. Search Strategy

The literature search focuses on blockchain studies related to finance while excluding irrelevant studies. It needs a well-thought-out search technique to get high recall and precision levels. The review’s search strategy is described in detail in this part, including the search string, search method and search scope.

3.2.1. Search Scope

While conducting the research, the criteria for publication date and publication venue were taken into account. The literature review is conducted in January 2023 and the papers were chosen between January 2017 and January 2023. The following articles were searched according to the publication venue;

IEEE, Springer Nature, Elsevier, Mdpi, Wiley, Assoc Computing Machinery, British Blockchain Assoc, Emerald Group Publishing, Fac Law - Univ Zagreb, Federal Reserve Bank St Louis, Frontiers Media Sa, Higher Education Press, Incisive Media, Keai Publishing Ltd., Pageant Media Ltd., Springer Int Publ Ag, Slovensko Drustvo Informatika, Univ Illinois, Walter De Gruyter, World Scientific.

3.2.2. Search Method

We performed an automated literature search for this systematic review. Automatic search is the process of searching via electronic databases for specific search terms. For each publication venue, mainly “ISI Web of Knowledge Web of Science” website was used and an automatic search was conducted.

3.2.3. Search String

We used the following search string to find blockchain related articles in finance:

(ALL=(Blockchain) AND (ALL=(Finance) OR ALL=(Fintech)) AND ALL=(infrastructure) AND (ALL=(Smart Contracts) OR ALL=(Permission Types) OR ALL=(Distributed Ledger) OR ALL=(Consensus)))

Table 2 displays the search query results. The automatic search retrieved a total of 52 articles. Those who were unable to answer the SLR questions were removed and 34 articles were selected.

3.2.4. Study Selection Criteria

The terms “Blockchain” and “Finance” provided many work output. We identified relevant studies using the study selection criteria given in

Table 3. In this table, IC refers to the inclusion criteria.

3.3. Study Quality Assessment

The quality of the selected literature was evaluated in addition to the inclusion criteria. To evaluate whether any variables would skew the study’s findings, quality standards were developed.

Table 4 lists the standards for quality. We used the summary quality checklist for quantitative and qualitative studies as recommended by [

16] and [

17] for creating the criteria for evaluating the level of quality. More than a hundred articles were checked against the inclusion criteria and quality checklist, resulting in 34 articles to be reviewed in the SLR.

3.4. Data Extraction

We extracted baseline data from the thirty-four studies using a standardized procedure called a data extraction form. First, the research questions in

Table 1 were used to develop an extraction form with key elements. The data extraction form was revised and improved after numerous pilot extractions were carried out and additional articles were read.

Table 5 displays the completed data extraction form. This form comprises generic metadata, such as publication year and title, as well as the 10 data extraction items that address the research question. The table lists the ten components of the research questions as R1–R9.

3.5. Data Synthesis

On the form of extracted data, we conducted data analysis. For important terms, many articles utilize synonyms. So, we started by standardizing these words. We produced several bar charts, pie charts and heat maps using Excel. These graphs reveal information about data patterns.

5. Result

The main statistics of the 34 selected studies are initially explained in the findings section. The outcomes for each study topic are then presented.

5.1. Main Statistics

Table 6 lists the 34 studies generated after criteria selection and quality queries. These 34 studies answer at least three research questions.

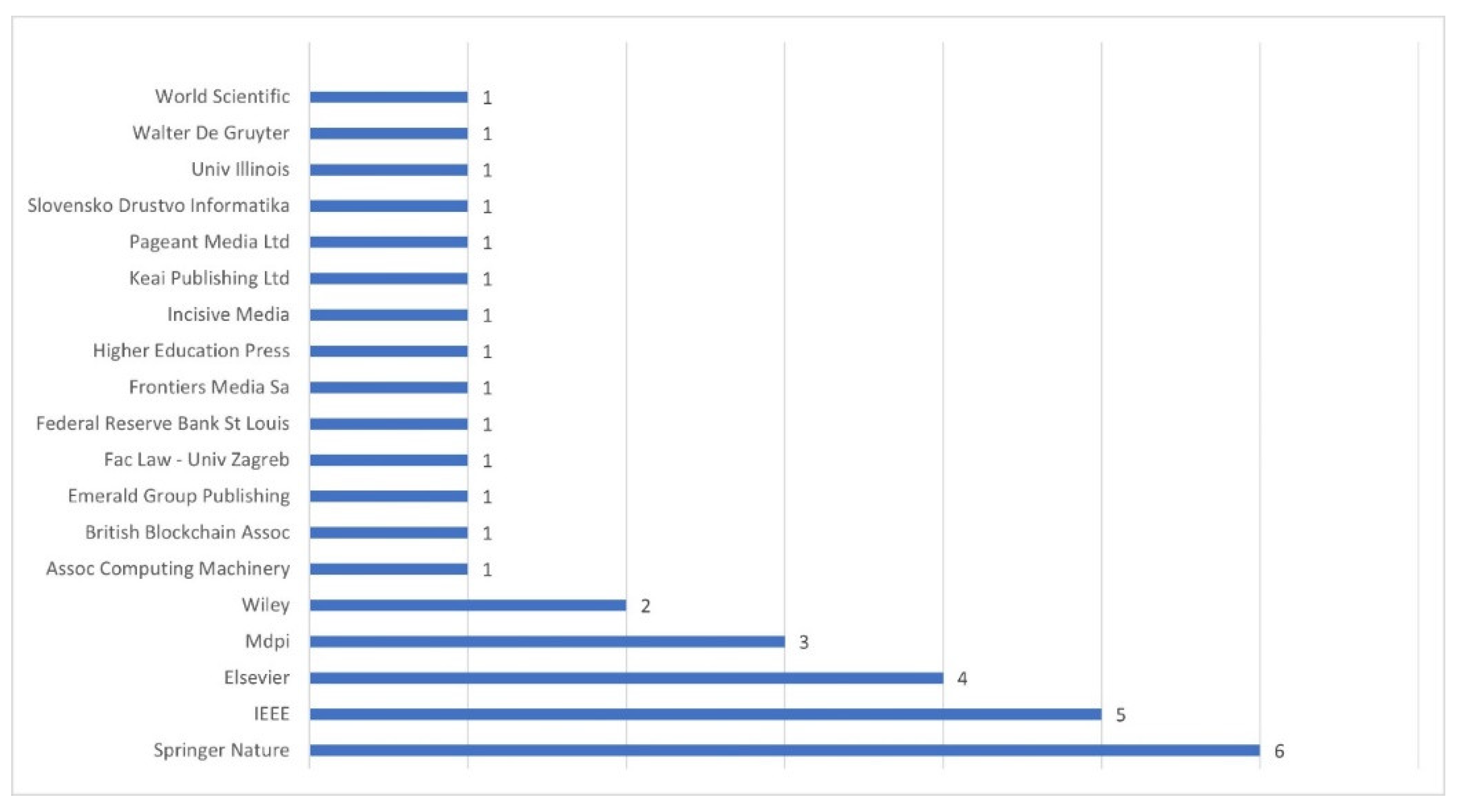

Figure 2 shows the distribution of studies according to the research database in a bar diagram. There are 6 of them Springer Nature, 5 of them IEEE, 4 of them Elsevier, 3 of them Mdpi, 2 of them Wiley and other publishers. Of the studies included in SLR, 21 are articles, 9 are proceeding papers, 4 are review articles and 1 is a book chapter. The study by Angela Walch [

48] is published as both an article and a book chapter.

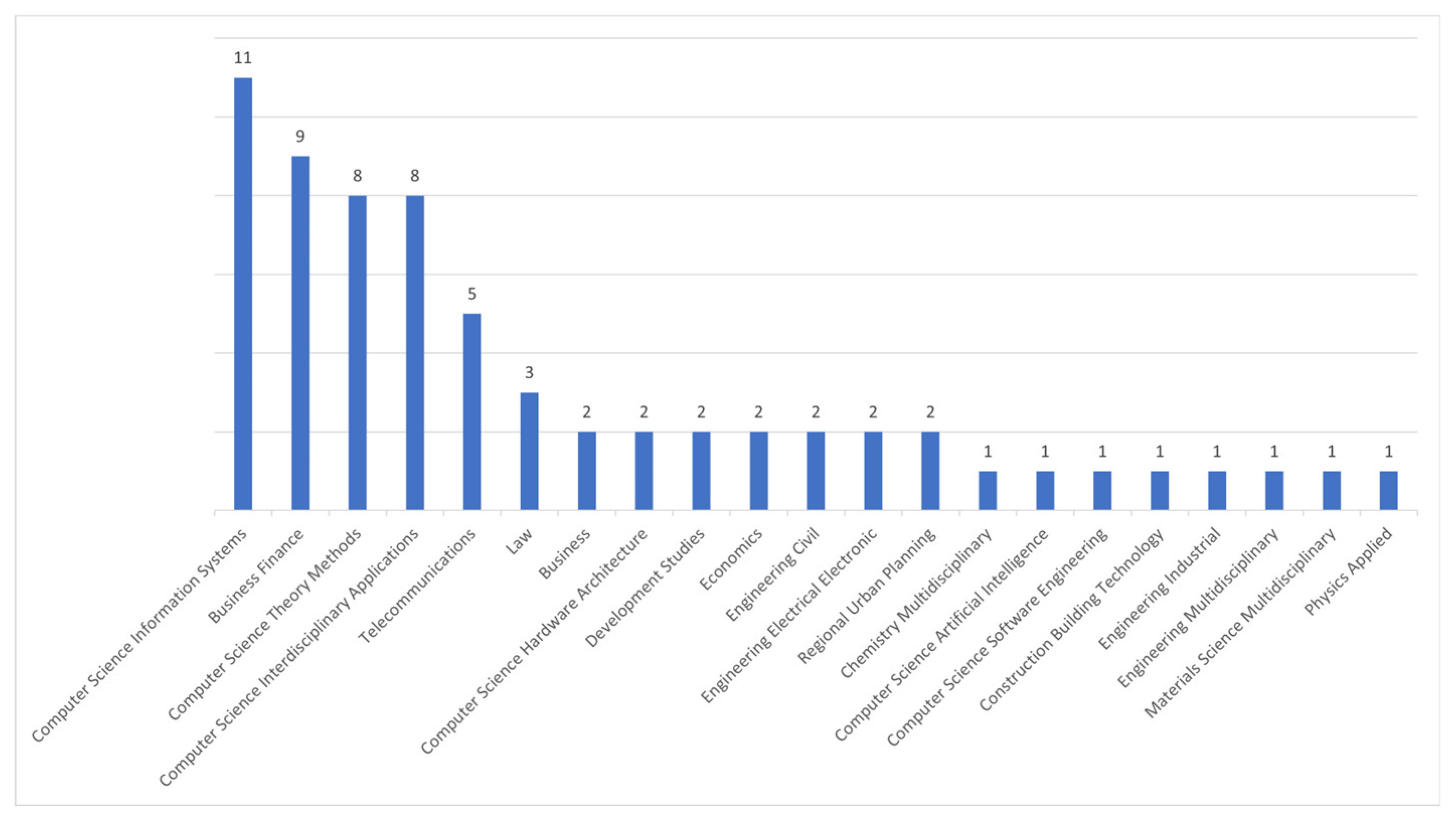

Figure 3 shows the categories of papers included in the SLR. Many studies appear in journals related to computer science and its sub-branches. In addition, there are also journals whose categories are business, finance and economy. Apart from these, there are also a few journals that approach finance indirectly, such as law, construction building technology and urban planning.

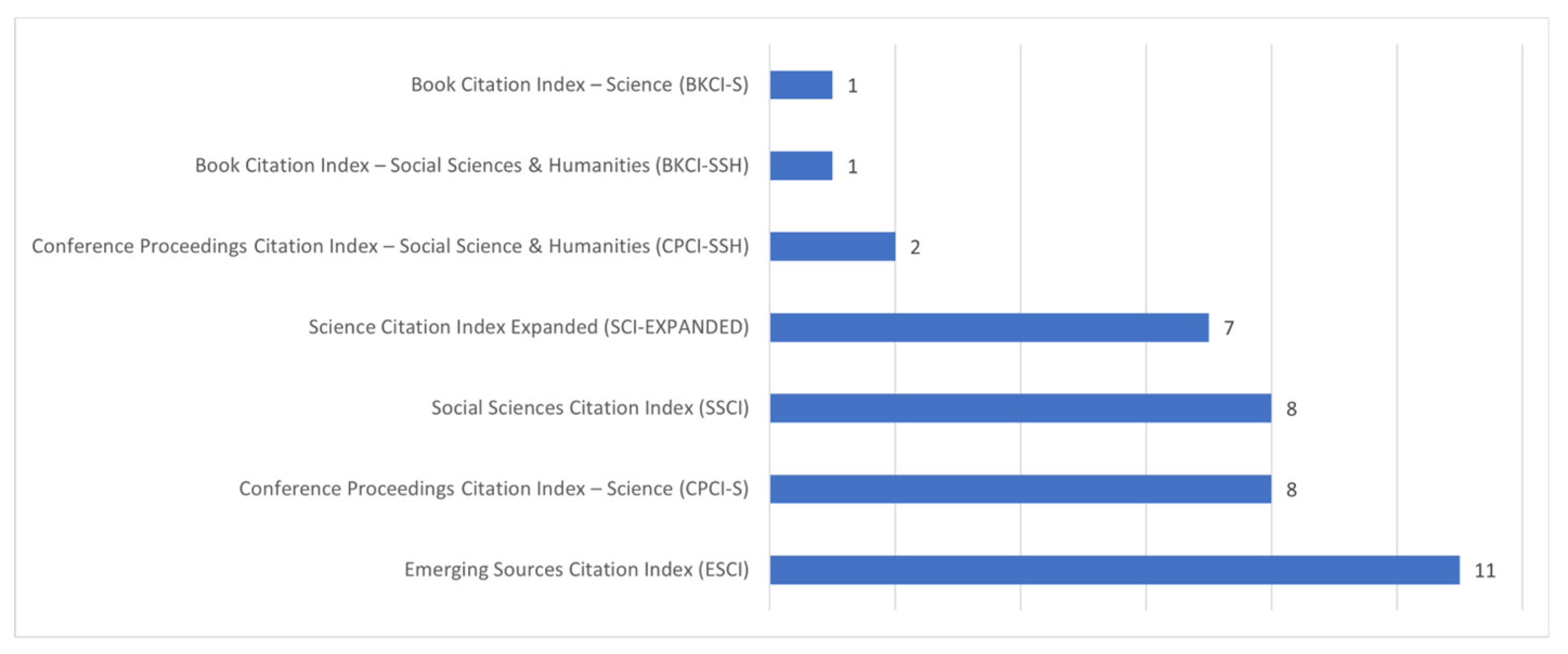

Figure 4 shows the index types of the papers. The study mainly includes journals of the Emerging Sources Citation Index, Conference Proceedings Citation Index – Science, Social Sciences Citation Index and Science Citation Index Expanded types. There are also a few conference and book index journals.

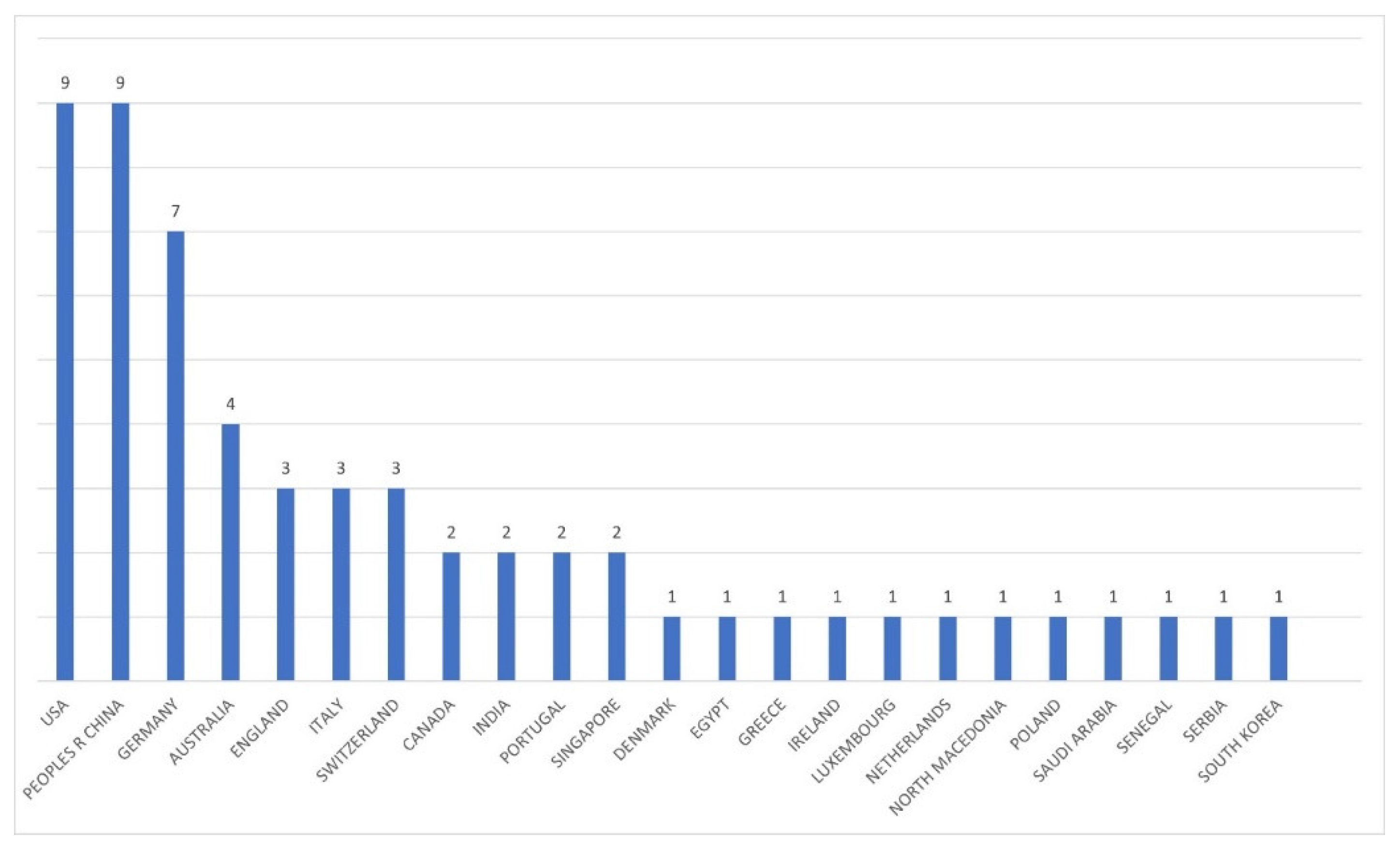

The countries of the authors are included in the bar chart in

Figure 5. The United States and China are at the top of the list, followed by Germany, Australia, England, Italy and Switzerland. Other studies are shown as belonging to two or one country. Apart from these, one record does not contain data in the field being analyzed.

5.2. RQ1: Which Blockchain Infrastructures Are Used in Finance?

Blockchain technology became known with bitcoin. However, bitcoin did not offer a programmable infrastructure. In 2013, Vitalik Buterin, the inventor of Ethereum [

52], introduced the idea of a programmable blockchain. Ethereum is both a programmable infrastructure and a coin. Since then, different programmable blockchain infrastructures have emerged. Hyperledger Fabric [

53], Corda [

54] and Ripple [55] are the most well-known. Hyperledger Fabric is a permissioned blockchain infrastructure created by the Linux Foundation and can be used for different business areas. Corda and Ripple are blockchain infrastructures specialized for use in finance. Corda is a permissioned infrastructure created by R3 Company and is not associated with a crypto coin. Ripple is both a coin and a permissioned blockchain infrastructure developed by the XRPL Foundation. In addition to these blockchain infrastructures, there are many others such as Nem, Stellar, Eos, Tron and Neo.

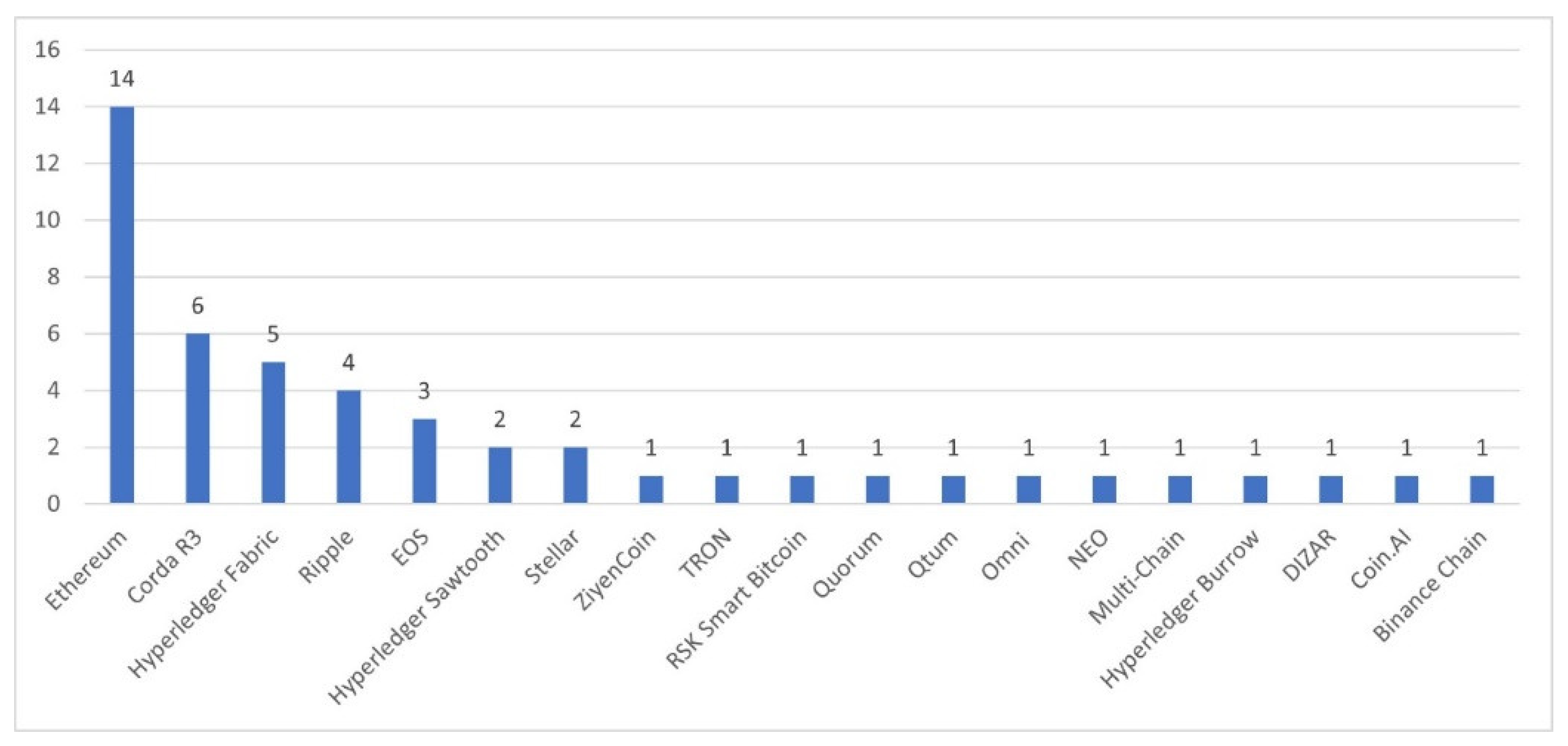

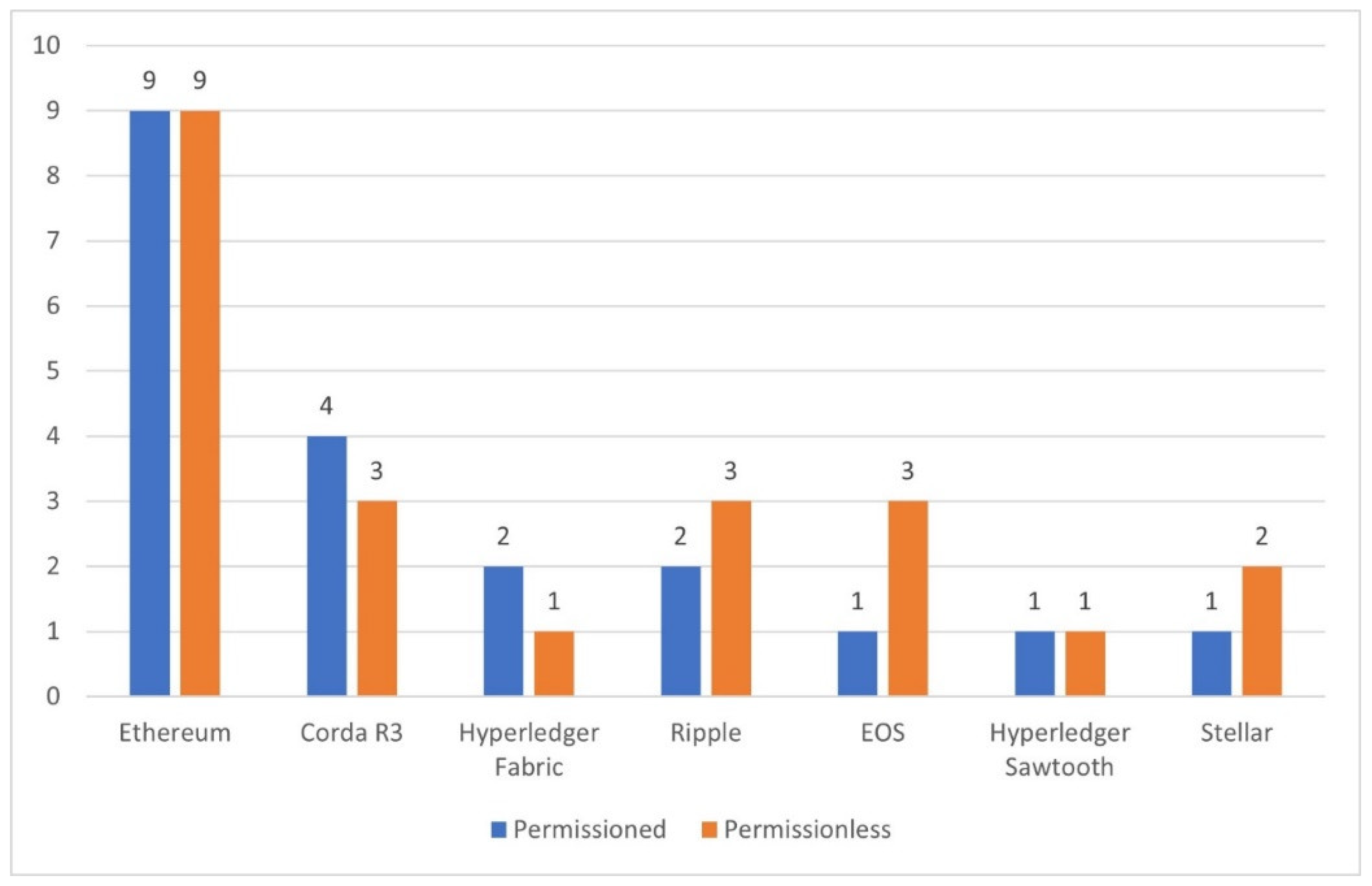

Figure 6 shows the count of blockchain infrastructures used in the field of finance. In the SLR study, it is seen that Ethereum infrastructure is mostly used in finance. Ethereum is followed by Hyperledger Fabric and Corda. Corda is created for the sole purpose of developing blockchain applications in finance. These blockchain infrastructures are followed by Ripple, Eos, Hyperledger Sawtooth and Stellar. One of each of the other blockchain infrastructures is seen in the study.

While existing blockchain infrastructures are generally used, specialized blockchain infrastructures such as Dizar [

21] are also used. Among the infrastructures for the use of blockchain in finance, Ethereum is seen in 14 studies [

20,

23,

26,

28,

34,

35,

38,

40,

41,

42,

45,

47,

48,

49], Corda R3 in 6 [

18,

26,

30,

32,

37,

48], Hyperledger Fabric in 5 [

18,

24,

29,

36,

37,

48], Ripple in 4 [

26,

30,

44,

47], Eos in 3 [

20,

23,

42], Hyperledger Sawtooth in 2 [

24,

29], Stellar in 2 [

20,

30] and different blockchain infrastructures in others.

5.3. RQ2: What Technologies Are Used in Finance with Blockchain?

The uses of technology cover a wide range of fields. Technology is used in many different industries, including business, the health sector, finance, education, transportation, the entertainment industry and communication. In these fields, technology can boost output, present innovative goods and services and simplify people’s lives.

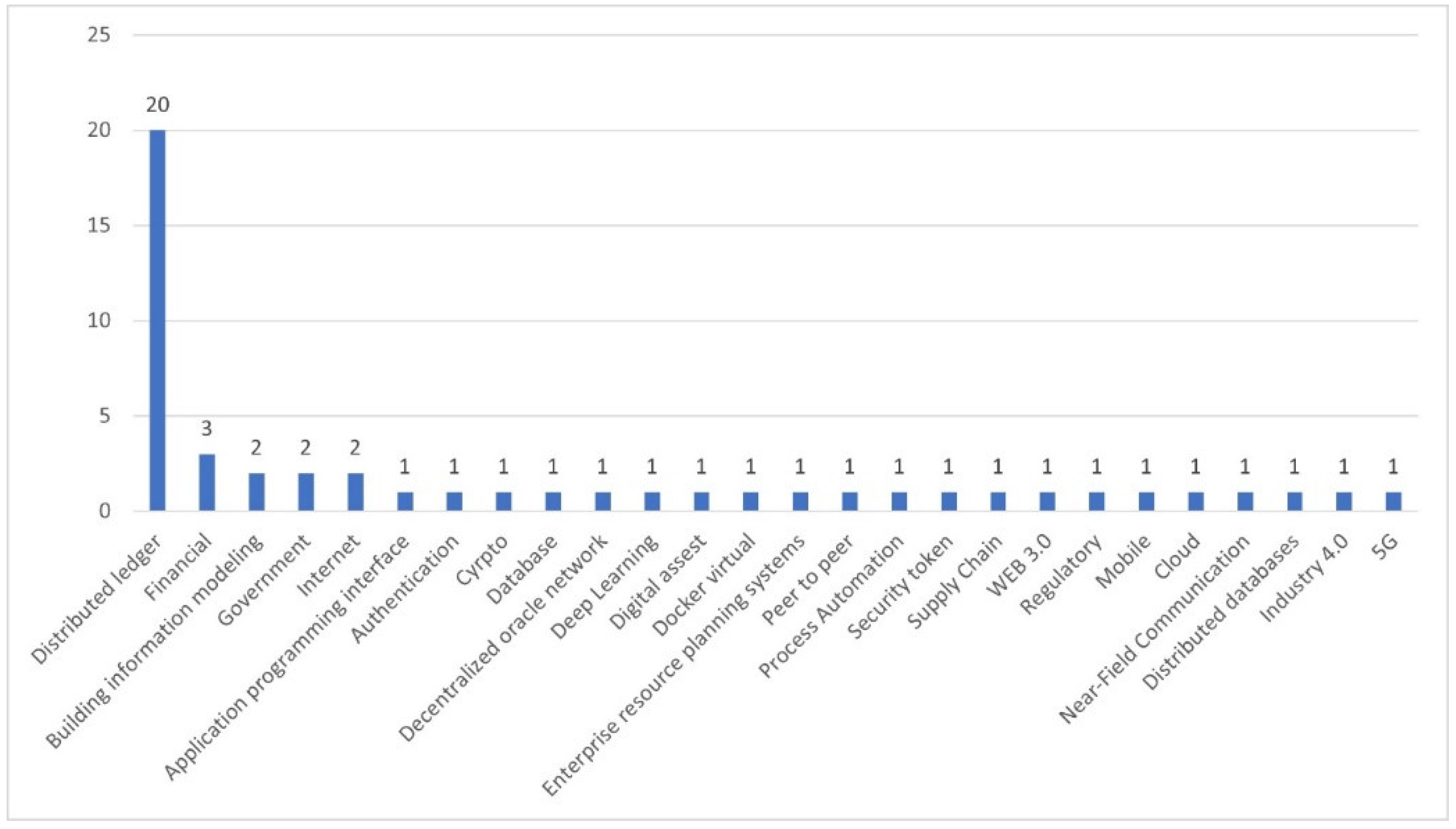

Blockchain can often be used with different technologies. In the SLR study, Blockchain is also called as distributed ledger technology due to its distributed structure. That’s why, blockchain is often mentioned together with distributed ledger technology. As seen in

Figure 7, the ”Distributed Ledger” is expressed 20 times [

22,

23,

24,

25,

26,

27,

28,

29,

30,

31,

33,

37,

40,

41,

43,

44,

46,

47,

48,

51], the ”Financial” 3 times [

44,

46,

47], the ”Building information modeling” 2 times [

39,

50], the ”Government” 2 times [

41,

43], the ”Internet” 2 times [

29,

45] and other technologies is seen one time each.

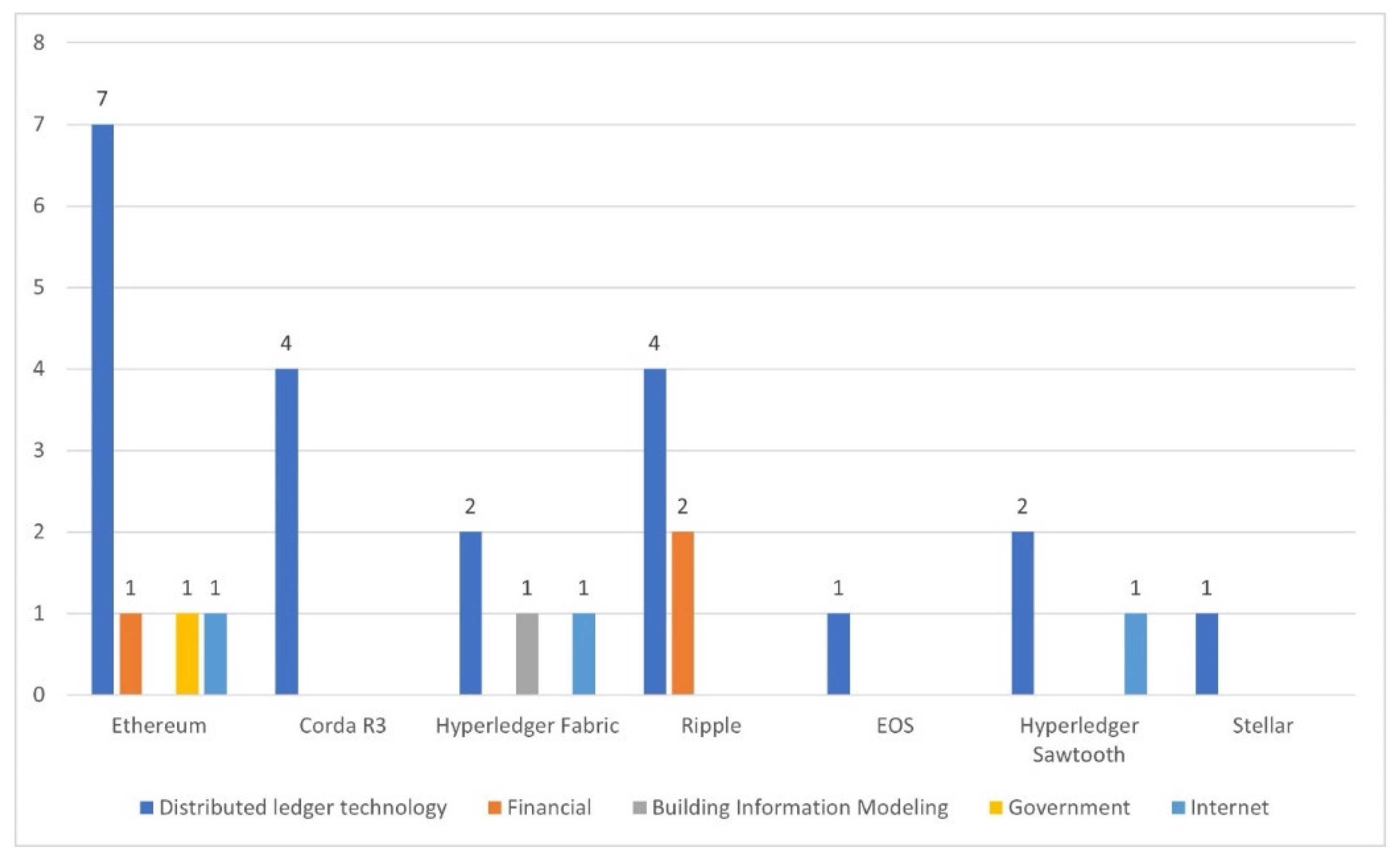

Figure 8 shows the relationship between blockchain infrastructures and the technologies used with blockchain. Due to the distributed structure of the blockchain, distributed ledger technology is included in all infrastructures. In addition to distributed ledger technology, “Financial”, ”Government” and ”Internet” technology are also used with Ethereum infrastructure. While Corda is only used with “Distributed ledger” technology, the use of Ripple with financial technologies is remarkable.

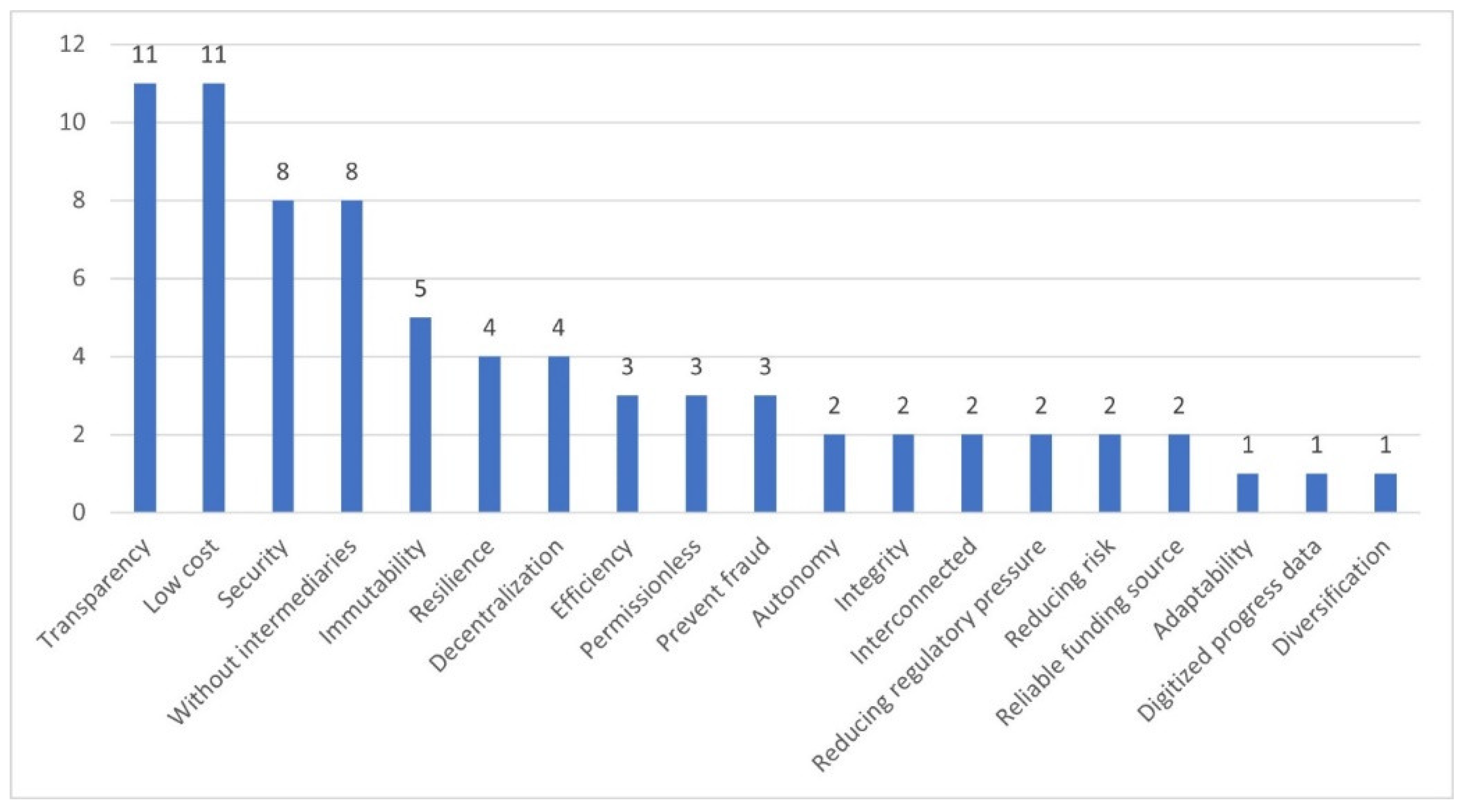

5.4. RQ3: What Are the Benefits of Implementing Blockchain in Finance?

Blockchain is a system that enables real-time, immutable digital asset transactions without the need for a reliable third party. The financial sector benefits from blockchain in numerous ways, including increased transparency and confidence, decreased costs and simplified operations.

The SLR study contains different expressions for the benefits of blockchain in finance. We grouped these expressions and reduced them to 19. For example, we singularized expressions such as “improving network resiliency”, “durability” and “improved fault-tolerance” as “Resilience”. We performed this process for all expressions.

As seen in

Figure 9, the “Transparency” expression is included in 11 papers [

22,

23,

24,

25,

27,

37,

46,

47,

48,

49,

51], the “Low cost” expression in 11 papers [

26,

28,

30,

32,

42,

45,

46,

47,

49,

50,

51], the “Security” expression in 8 papers [

24,

25,

32,

34,

36,

38,

47,

49], the “Without intermediaries” in 8 papers [

18,

20,

22,

23,

26,

40,

42,

48], the ”Immutability” in 5 papers [

18,

24,

37,

40,

48], the “Resilience” in 4 papers [

22,

24,

41,

48], the “Decentralization” in 4 papers [

23,

24,

37,

40], the “Efficiency” in 3 papers [

26,

46,

51], the “Permissionless” in 3 papers [

23,

37,

41], the ”Prevent fraud” in 3 papers [

24,

30,

36], the “Autonomy” in 2 papers [

23,

37], the “Integrity” in 2 papers [

24,

40], the “Interconnected” in 2 papers [

23,

31], the “Reducing regulatory pressure” in 2 papers [

20,

43], the “Reducing risk” in 2 papers [

22,

32], the “Reliable funding source” in 2 papers [

19,

39] and the others once in the papers.

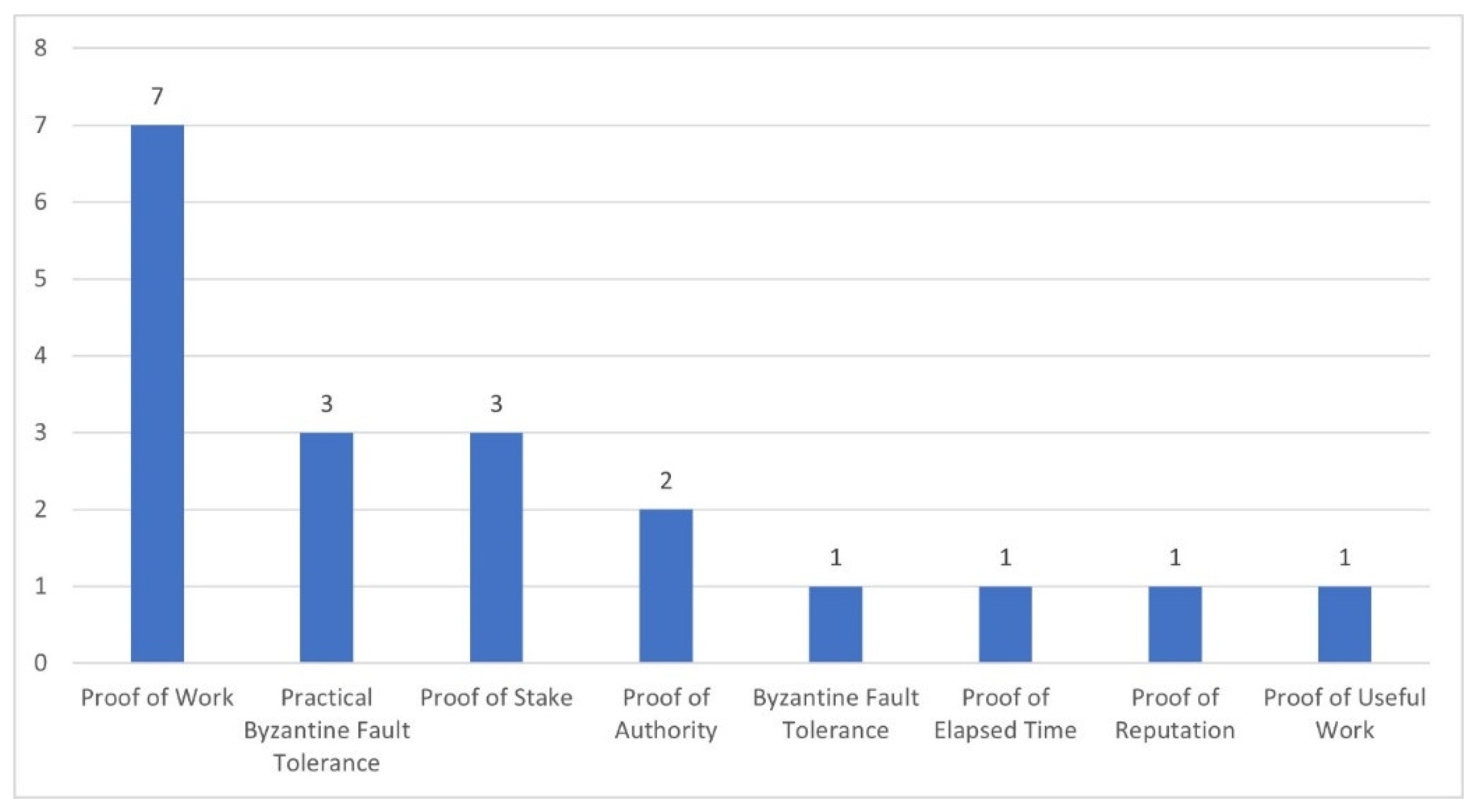

5.5. RQ4: Which Consensus Methods of Blockchain Are Used in Finance?

The process by which a network of distributed nodes or participants agree on the validity of transactions and the state of the blockchain ledger is referred to as consensus in the context of blockchain technology. Consensus is essential for guaranteeing that all participants have a consistent and unchangeable record of transactions. There would be no trust in the blockchain network if there is no consensus.

Blockchain infrastructures have their own consensus methods. For example, Ethereum uses the Proof of Work consensus method, while Hyperledger Fabric uses the Byzantine Fault Tolerance consensus method.

As seen in

Figure 10, the “Proof of Work” expression is included in 7 papers [

18,

21,

26,

36,

40,

45,

47], the “Practical Byzantine Fault Tolerance” in 3 papers. [

25,

31,

37], the “Proof of Stake” in 3 papers [

28,

43,

47], the “Proof of Authority” in 2 papers [

34,

38] and the other consensus methods once in the papers.

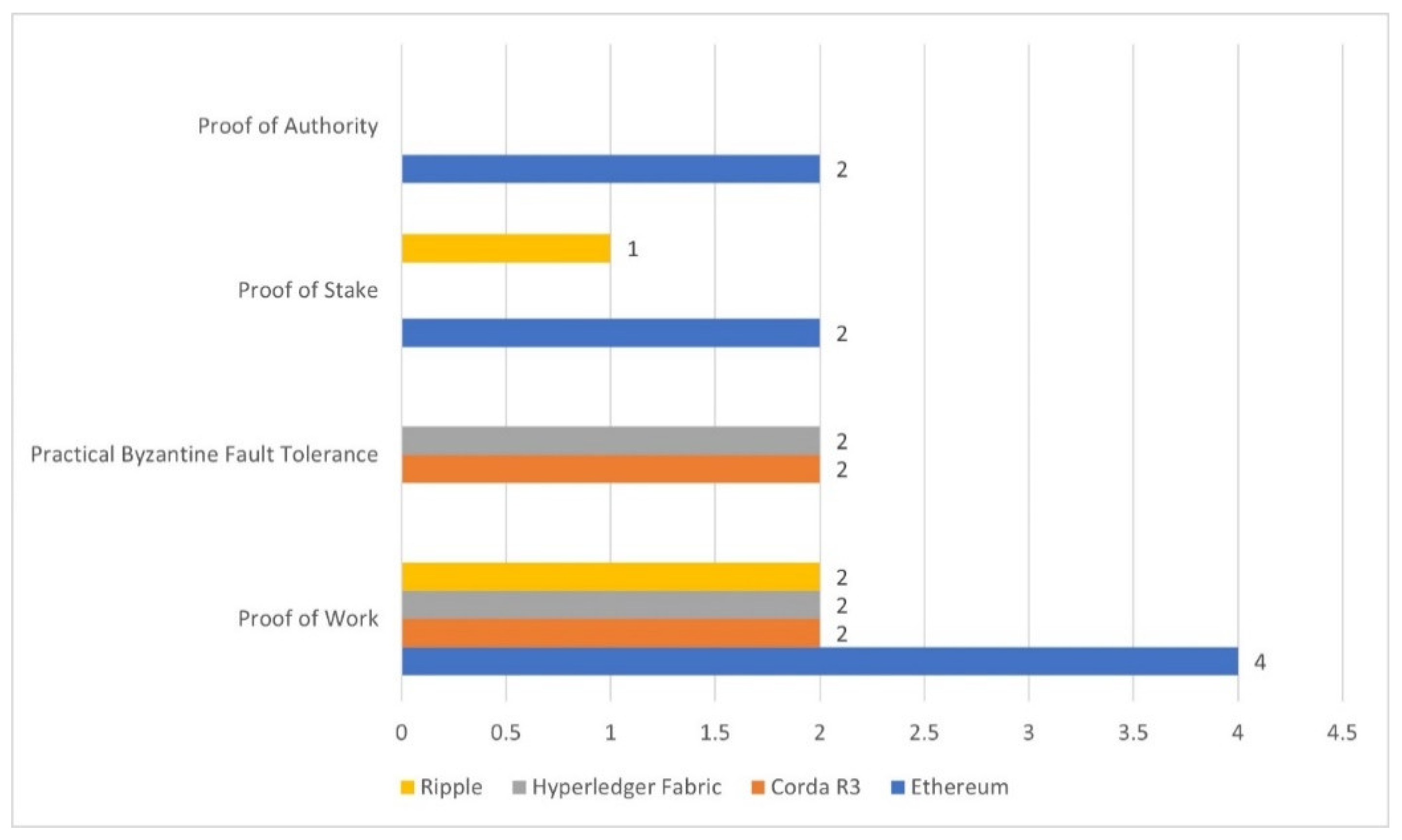

Consensus methods are directly related to the blockchain infrastructure. For example, while ethereum used Proof of Work before 2022, it switched to Proof of Stake consensus method for energy efficiency, security and validation reasons. As mentioned above, blockchain infrastructures can change consensus methods. As seen in

Figure 11, the “Proof of work” consensus method is valid in all blockchain infrastructures in the field of finance. The “Practical Byzantine Fault Tolerance” method is available in Hyper ledger Fabric and Corda R3, the “Proof of Stake” method is available in Ethereum and Ripple, the “Proof of Authority” method is only available in the paper related to Ethereum.

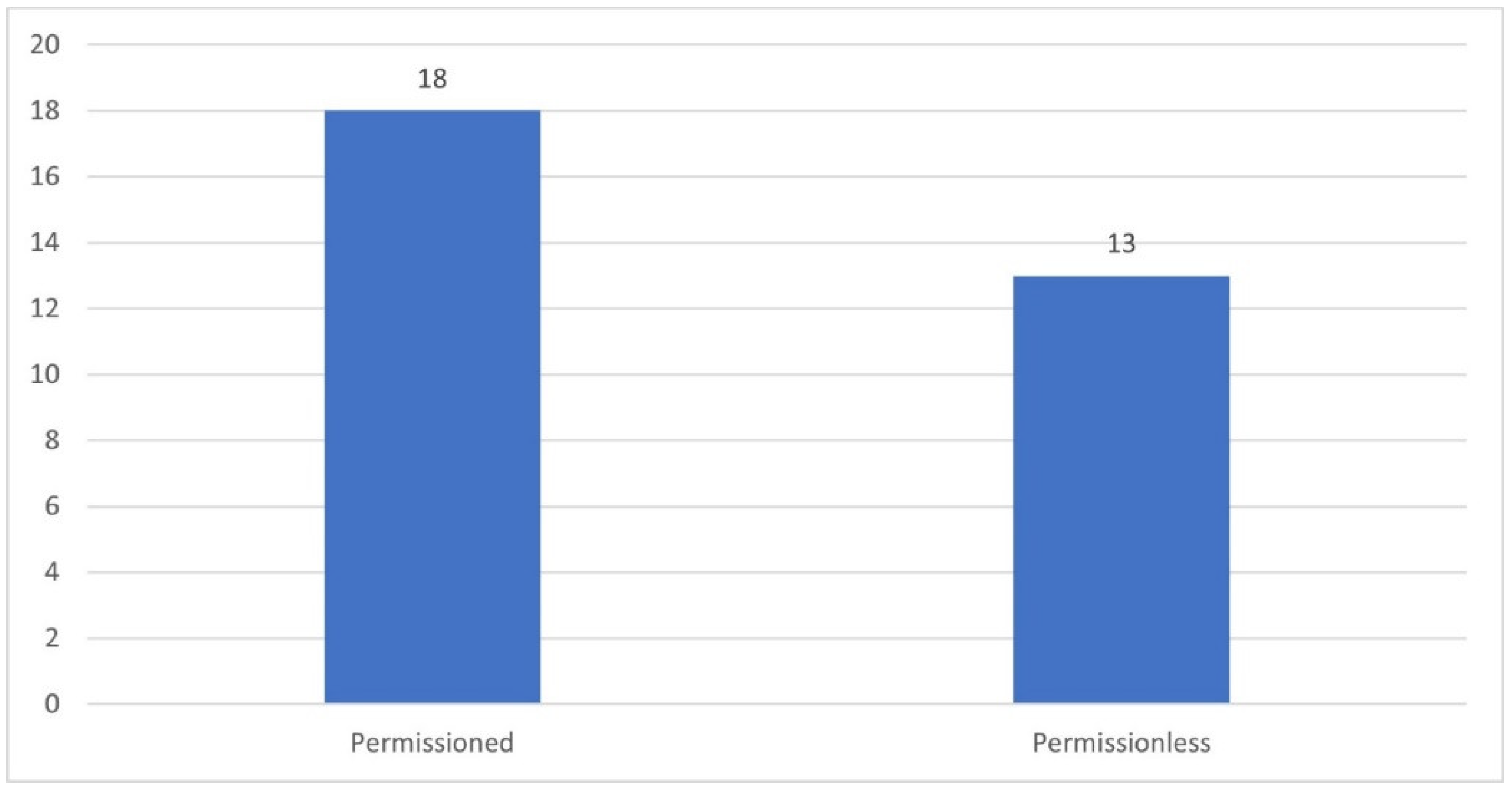

5.6. RQ5: What Permission Types of Blockchain Are Used in Finance?

There are four types of blockchain that are widely accepted. These networks are public blockchain networks, private blockchain networks, hybrid blockchain networks and consortium blockchain networks [56]. They can be permissioned or permissionless depending on their type and blockchain infrastructures support different types of permission. For example, Ethereum supports the permissionless, while Corda and Hyperledger Fabric provide the Permissioned type. Some blockchain infrastructures have both permissioned and permissionless types. Permission type is an important issue when developing blockchain-based applications in finance and permissioned type is generally preferred.

As seen in

Figure 12, among the permission types for the use of blockchain in finance, the “Permissioned” is seen in 18 studies [

18,

19,

20,

21,

22,

24,

25,

26,

28,

31,

32,

36,

38,

40,

41,

45,

47,

48], and the “Permissionless” in 13 studies [

20,

23,

24,

26,

30,

34,

36,

40,

42,

45,

46,

47,

48] in the papers. Some blockchain infrastructures provide either permissioned or permissionless functions, while others provide both. As seen in

Figure 13, both permission types are at an equal in the papers where Ethereum infrastructure is included. In the SLR study, the number of permissioned is higher in Hyperledger Fabric and Corda R3, while the number of permissionless is higher in Ripple, EOS and Stellar. In Hyperledger Sawtooth, both are equal.

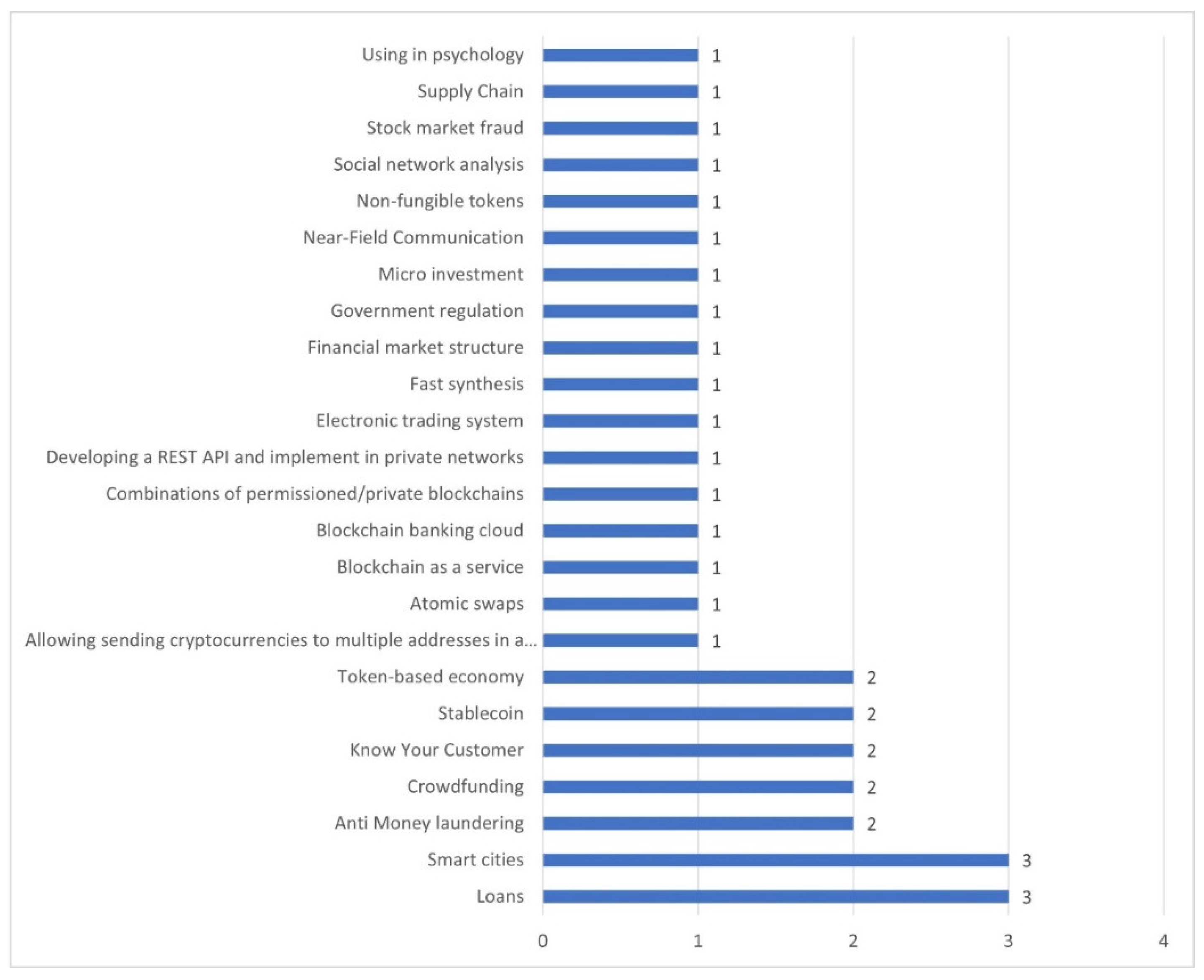

5.7. RQ6: What Are the Potential Future Applications of Blockchain Technology in Finance?

Blockchain became a key subject after Bitcoin entered our lives. However, Bitcoin did not provide a programmable blockchain solution. Ethereum, founded in 2013 by Vitalik Buterin, provided both a crypto asset and a programmable blockchain technology. Since then, some apps utilizing blockchain technology have been developed. Although some blockchain-based applications have been made in the field of finance [56], they have not become widespread at the desired level.

Although we currently see a small number of blockchain applications, it has great potential for the future thanks to its transparency, security and without intermediaries.

Potential future applications of blockchain technology in finance is seen

Figure 14. Among these, the “Loans” is mentioned 3 times [

20,

34,

50], the “Smart cities” 3 times [

19,

41,

51], the “Anti money laundering” 2 times [

26,

43], the “Crowdfunding” 2 times [

20,

40], the “Know your customer” 2 times [

23,

26], the “Stablecoin” 2 times [

20,

44], the “Token-based economy” 2 times [

46,

49] and the other future applications once in the papers.

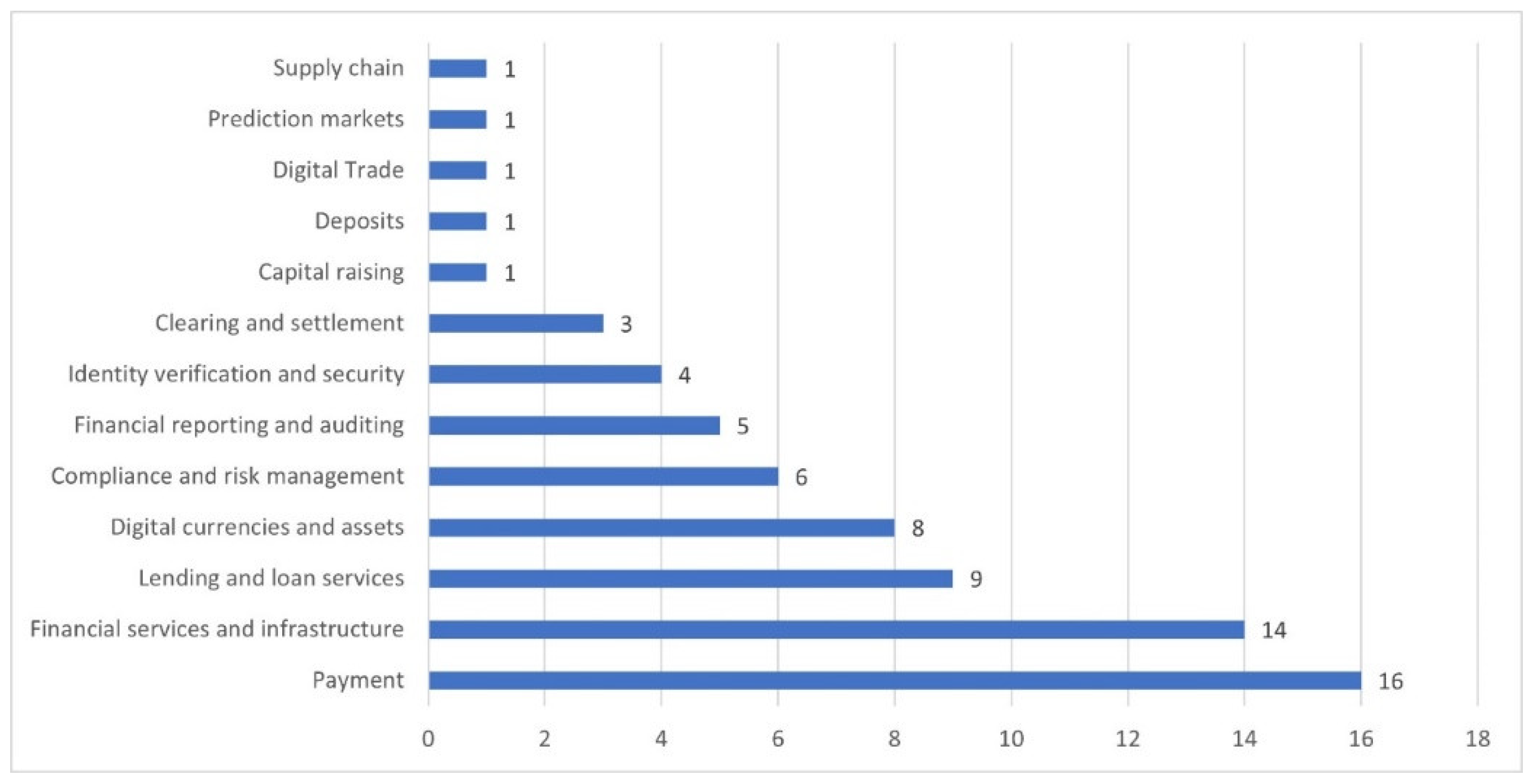

5.8. RQ7: What Are the Most Common Uses of Blockchain Technology in the Financial Industry?

Nearly a hundred answers are obtained for this question. These answers are then reduced to 13 different groups. For example, expressions such as “Digital currencies”, “Digital asset exchange”, “Tokenization process”, “Digital rights to ownership” are grouped as “Digital currencies and assets”. Similarly, expressions such as “Authentication”, “Digital signature algorithm”, “Identity verification”, “Verification”, “Identification”, “Digital identity” are grouped as “Identity verification and security”. This grouping process took place for eight groups.

As seen in

Figure 15, expressions belonging to the group “Payment” in 16 papers [

18,

22,

23,

26,

27,

28,

29,

30,

34,

37,

41,

43,

46,

47,

50,

51], the “Financial services and infrastructure” are mentioned in 14 papers [

23,

27,

28,

30,

35,

37,

44,

45,

46,

47,

48,

49,

50,

51], the ”Lending and loan services” in 9 papers [

18,

20,

23,

25,

26,

27,

30,

38,

45], the “Digital currencies and assets” in 8 papers [

18,

19,

27,

30,

37,

40,

42,

46], the “Compliance and risk management” in 6 papers [

31,

32,

33,

40,

42,

43], the “Financial reporting and auditing” in 5 papers [

24,

29,

30,

34,

37], the “Identity verification and security” in 4 papers [

18,

30,

36,

37], the “Clearing and settlement” in 3 papers [

22,

26,

30] and other non-group expressions once in the papers.

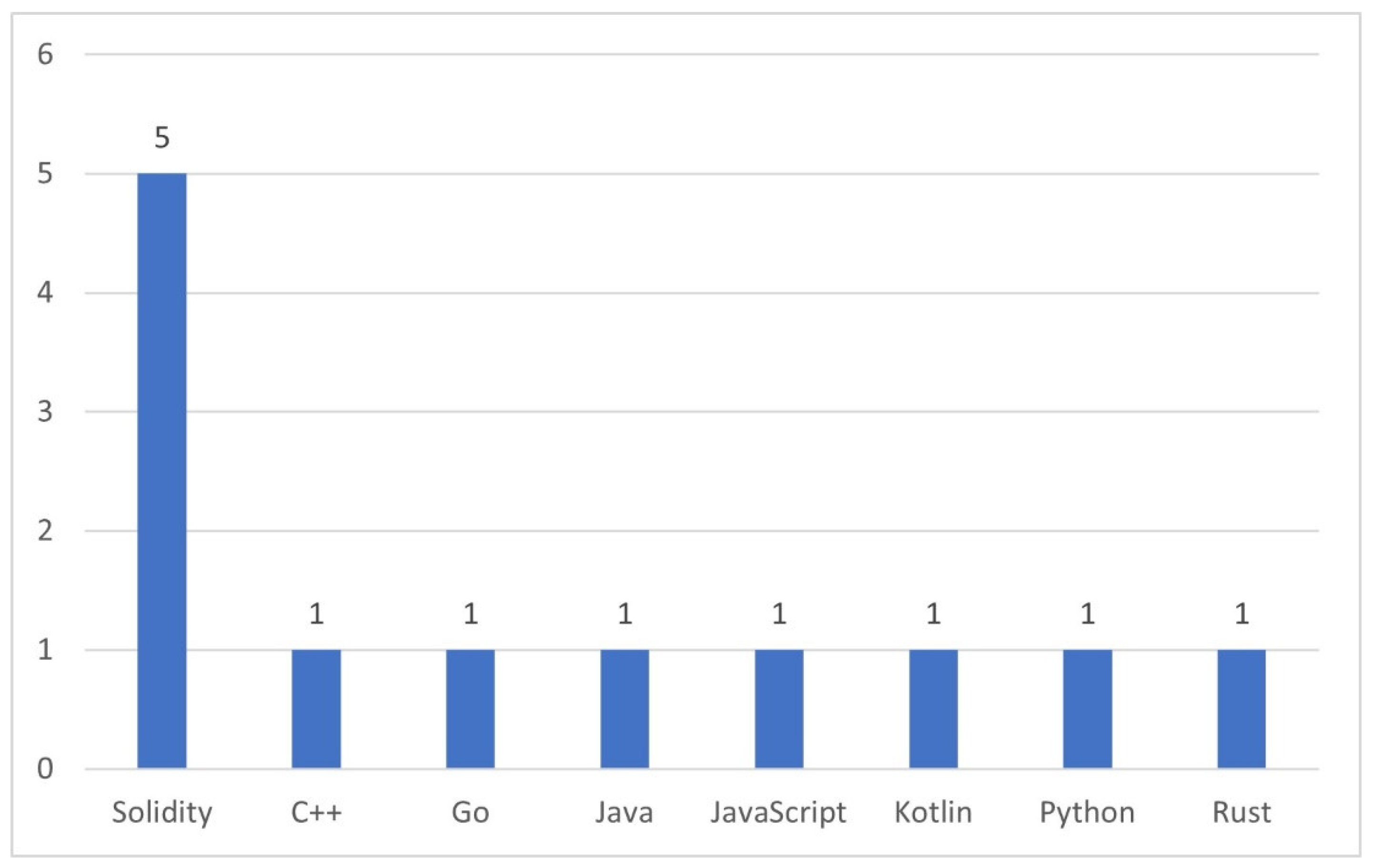

5.9. RQ8: Which Smart Contracts Programming Languages of Blockchain Are Used in Finance?

Although the idea of smart contracts is not new, Ethereum is the first to apply them in the field of blockchain technology. Solidity, a programming language, is used to create smart contracts on Ethereum. A variety of smart contract software languages are available on other blockchain infrastructures that came into existence after Ethereum. Kotlin in Corda, Go, Node.js, Java in Hyperledger Fabric, JavaScript, Java, Go in Stellar, and JavaScript, Java, Python in Ripple are a few examples of programming languages that can be used to build smart contracts.

As seen in

Figure 16, among the smart contracts programming languages of blockchain in finance, the “Solidity” appears in 5 papers [

18,

19,

34,

35,

45] and the other programming languages (C++, Go, Java, JavaScript, Kotlin, Python, Rust) once in the papers.

5.10. RQ9: What Are the Challenges of Implementing Blockchain in Finance?

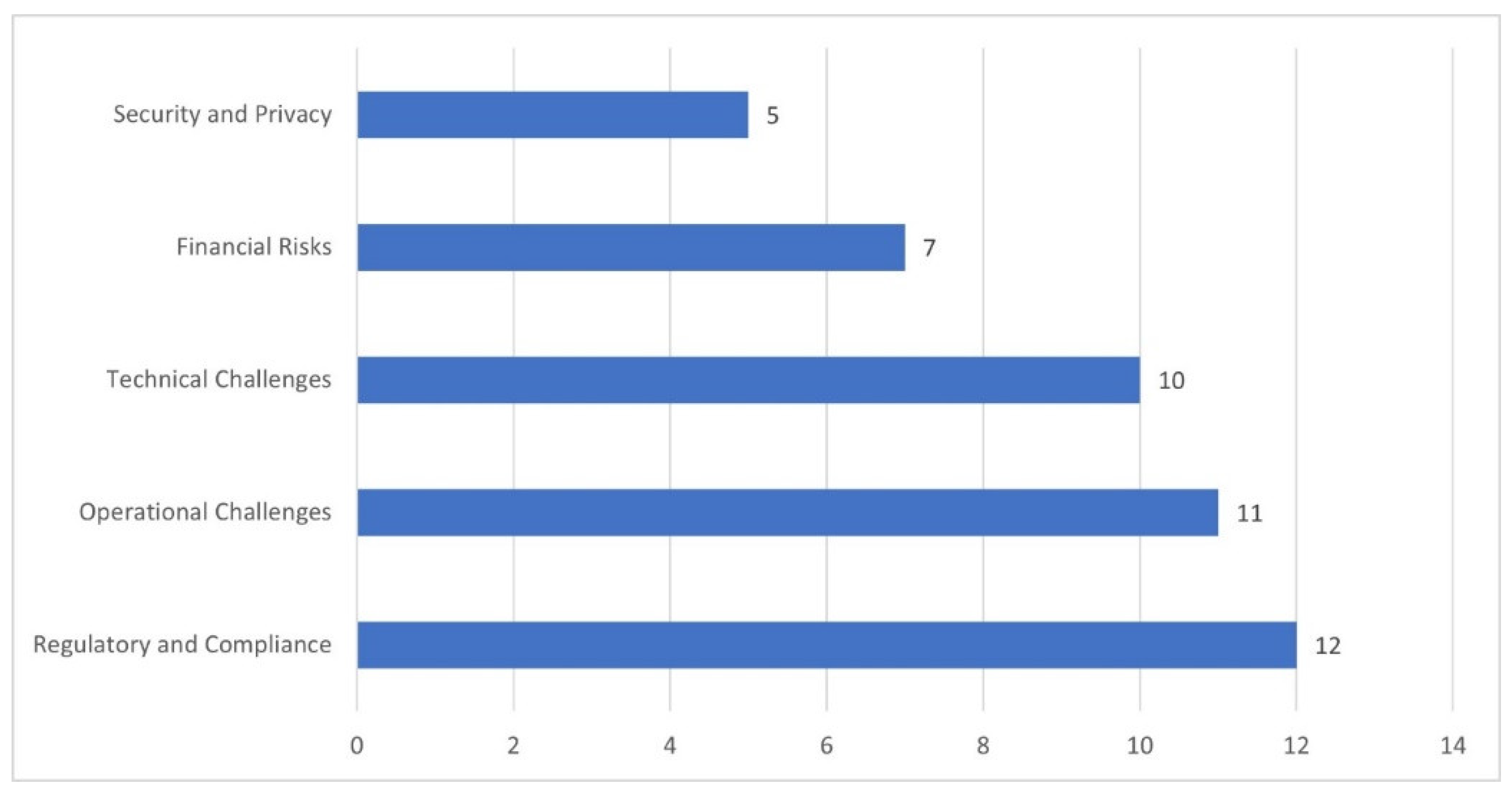

The implementation of blockchain in finance has some challenges. Especially on the side of regulated institutions such as banks and insurance companies, difficulties are more common. In this SLR study, 45 different challenge expressions are identified in the papers. Then, these difficulty expressions are categorized into 5 groups. For example, expressions such as “Computing power”, “Energy consumption”, “Scalability of block data”, “Run smart contracts” are grouped as “Technical Challenges”. Similarly, expressions such as “Legal”, “Open source”, “Regulatory”, “Settlement”, “Oracles” are grouped as “Regulatory and Compliance”.

As seen in

Figure 17, expressions belonging to the group “Regulatory and Compliance” in 12 papers [

22,

23,

28,

30,

31,

37,

38,

39,

41,

46,

48,

49], the “Operational Challenges” in 11 papers [

19,

20,

21,

22,

28,

36,

37,

39,

47,

50,

51], the “Technical Challenges” in 10 papers [

18,

20,

23,

25,

29,

36,

38,

40,

47,

48],the “Financial Risks” in 7 papers [

22,

23,

26,

27,

32,

40,

43] and the “Security and Privacy” in 5 papers [

19,

23,

25,

26,

38] are included.

5. Discussion

The most comprehensive systematic literature review on blockchain technology in the field of finance is presented in this paper. Nine questions were evaluated as research questions, covering both the technology of blockchain and its benefits and challenges. Technical questions were not adequately answered at the necessary level. However, the responses to the questions about benefits and challenges were quite good. The answers to the research questions varied widely as technical aspects such as blockchain infrastructure, consensus method, permission type, smart contract programming language, etc., varied. However, the answers to the questions on benefits, challenges, use cases, and potential future applications were similar. Blockchain cannot be used at the desired level in the financial sector due to issues like regulation and compliance. This is why the majority of studies are still theoretical. If the regulatory issues are resolved, systematic literature review studies can be conducted more effectively in the future with the use of blockchain technology.

While blockchain technology is generally closely related to the field of finance, there are not enough articles and real-life applications available. Therefore, based on the search results, 52 articles were identified. After conducting a quality assessment and applying selection criteria, this number was reduced to 34 articles. Due to the fact that Ethereum is older than other infrastructures, the number of statistics of Ethereum stands out. Although some studies on infrastructures such as Hyper Ledger, Corda R3, Ripple and Stellar are available, other blockchain infrastructures are not available in academic publications.

6. Conclusion and Future Work

This study is a systematic literature review (SLR) on the use of Blockchain technology in finance. In the study, 52 articles were evaluated and 34 articles were included in the study after quality and evaluation checks. We asked 9 research questions to these articles and tried to find answers. The questions were generally in three categories. The first type of questions tried to find technical answers. For example, which Blockchain infrastructure is used, which technology is used with blockchain technology, which permission and consensus method is applied. The second category of questions tried to find the benefits and challenges. The most satisfactory answers came from these research questions. Almost all articles included expressions showing the benefits and challenges of blockchain. Questions in the third category were related to current and future application areas. We tried to find answers to the use cases of blockchain in finance and potential use cases in the future. The answers to these questions were also satisfactory. Thanks to the study, it is predicted that it is applied in different areas and potentially its use will become widespread in the future.

The study’s findings will clear the way for individuals who choose to pursue this field of study. There has never been an SLR study that examined blockchain’s use in finance. In-depth information about the sectoral sectors that can apply blockchain technology is provided in this study, along with its infrastructures, benefits and challenges. This initiative is for those who plan to work on this topic.

Future SLR studies can be carried out for several industries. In addition to finance, a similar study might also be conducted in other fields, such as insurance, supply chains, government relations, and health. Additionally, with the growth of blockchain in the financial sector, a more in-depth study can be conducted in the near future.

Author Contributions

Conceptualization, methodology, SLR questions preparation, writing—original draft preparation, Bulut Karadag and Akhan Akbulut; project administration, supervision, Abdul Halim Zaim; writing—review and editing, Bulut Karadag; validation, investigation, Akhan Akbulut and Abdul Halim Zaim; All authors have read and agreed to the published version of the manuscript.

Funding

This article was supported the Neova Research and Innovation Center, Pendik, Istanbul, Turkiye.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The research data supporting the conclusions of this article will be made available by the authors on request.

Conflicts of Interest

Bulut Karadag was employed by the company Neova Research & Innovation Center Co., Ltd. The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

References

- 1. K. Werbach, Trust, but verify: Why the blockchain needs the law, Berkeley Tech. L.J.. Berkeley Technology Law Journal 33 (IR) (2018) 487. URL http://lawcat.berkeley.edu/record/1128548.

- 2. N. Kshetri, 1 blockchain’s roles in meeting key supply chain management objectives, International Journal of Information Management 39 (2018) 80-89. [CrossRef]

- R. B ̈ohme, N. Christin, B. Edelman, T. Moore, Bitcoin: Economics, technology, and governance, Journal of Economic Perspectives 29 (2) (2015) 213–38. [CrossRef]

- V. Gatteschi, F. Lamberti, C. Demartini, C. Pranteda, V. Santamar ́ıa, Blockchain and smart contracts for insurance: Is the technology mature enough?, Future Internet 10 (2) (2018). [CrossRef]

- D. K. Wardhani, T. Sawarjuwono, S. Budisusetyo, Blockchain in capital markets: A revolution of the trading system in stock exchange, The Indonesian Accounting Review 12 (1) (2018). [CrossRef]

- M. U. Chowdhury, K. Suchana, S. M. E. Alam, M. M. Khan, Blockchain application in banking system, Journal of Software Engineering and Applications 14 (1) (2021) 298–311. [CrossRef]

- M. Mainelli, A. Milne, The impact and potential of blockchain on the securities transaction lifecycle, SWIFT Institute Working (2015-007) (2016).

- M. Javaid, A. Haleem, R. P. Singh, R. Suman, S. Khan, A review of blockchain technology applications for financial services, Bench Council Transactions on Benchmarks, Standards and Evaluations 2 (3) (2022) 100073. [CrossRef]

- S. Grima, J. Spiteri, I. Rom ̄anova, A steep framework analysis of the key factors impacting the use of blockchain technology in the insurance industry, Geneva Pap Risk Insur Issues Pract 45 (2020) 398–425. [CrossRef]

- S. E. Chang, H. L. Luo, Y. Chen, Blockchain-enabled trade finance innovation: A potential paradigm shift on using letter of credit, Sustainability 12 (1) (2020). [CrossRef]

- 11. M. Morini, From ’blockchain hype’ to a real business case for financial markets (2016). [CrossRef]

- I. Amsyar, E. Christopher, A. Dithi, A. N. Khan, S. Maulana, The challenge of cryptocurrency in the era of the digital revolution: A review of systematic literature, Aptisi Transactions on Technopreneurship (ATT) 2 (2) (2020) 153–159. [CrossRef]

- P. Garg, B. Gupta, A. K. Chauhan, U. Sivarajah, S. Gupta, S. Modgil, Measuring the perceived benefits of implementing blockchain technology in the banking sector, Technological Forecasting and Social Change 163 (2021) 120407. [CrossRef]

- A.-E. Panait, R. F. Olimid, A. Stefanescu, Identity management on blockchain– privacy and security aspects (2020). arXiv:2004.13107.

- M. S. Ali, M. A. Babar, L. Chen, K.-J. Stol, A systematic review of comparative evidence of aspect-oriented programming, Information and software Technology 52 (9) (2010) 871–887.

- B. Kitchenham, S. Charters, Guidelines for performing systematic literature reviews in software engineering (2007). [17] H. G. Gurbuz, B. Tekinerdogan, Model-based testing for software safety: a systematic mapping study, Software Quality Journal 26 (2018) 1327–1372.

- 17. M. Hamilton, Blockchain distributed ledger technology: An introduction and focus on smart contracts, Journal of Corporate Accounting & Finance 31 (2) (2020) 7–12. [19] Y. Tian, Z. Lu, P. Adriaens, R. E. Minchin, A. Caithness, J. Woo, Finance infrastructure through blockchain-based tokenization, Frontiers of Engineering Management 7 (4) (2020) 485–499.

- 18. F. Sch ̈ar, Decentralized Finance: On Blockchain- and Smart Contract-Based Financial Markets, Review 103 (2) (2021) 153–174.

- Q. Dai, K. Xu, L. Dai, S. Guo, Dizar: An architecture of distributed public key infrastructure based on permissoned blockchain, in: X. Si, H. Jin, Y. Sun, J. Zhu, L. Zhu, X. Song, Z. Lu (Eds.), Blockchain Technology and Application, Springer Singapore, Singapore, 2020, pp. 156–186.

- D. Mills, K. Wang, B. P. Malone, A. Ravi, J. C. Marquardt, C. Chen, A. Badev, T. Brezinski, L. Fahy, K. Liao, V. Kargenian, M. Ellithorpe, W. Ng, M. Baird, Distributed ledger technology in payments, clearing and settlement, Vol. 6.2017/18, The journal of financial market infrastructures., London, 2017, pp. 207–249.

- H. Amler, L. Eckey, S. Faust, M. Kaiser, P. Sandner, B. Schlosser, Defi-ning defi: Challenges & pathway, in: 2021 3rd Conference on Blockchain Research & Applications for Innovative Networks and Services (BRAINS), 2021, pp. 181–184. [CrossRef]

- V. Osmov, A. Kurbanniyazov, R. Hussain, A. Oracevic, S. M. A. Kazmi, F. Hussain, On the blockchain-based general-purpose public key infrastructure, in: 2019 IEEE/ACS 16th International Conference on Computer Systems and Applications (AICCSA), 2019, pp. 1–8. [CrossRef]

- F. N. Mbodji, G. Mendy, A. B. Mbacke, S. Ouya, Proof of concept of blockchain integration in p2p lending for developing countries, in: R. Zitouni, M. Agueh, P. Houngue, H. Soude (Eds.), e-Infrastructure and e-Services for Developing Countries, Springer International Publishing, Cham, 2020, pp. 59–70.

- D. A. Zetzsche, R. P. Buckley, D. W. Arner, The distributed liability of dis tributed ledgers: Legal risks of blockchain, University of Illinois Law Review (2018) 1361.

- Y. Chen, U. Volz, Scaling up sustainable investment through blockchain-based project bonds, Development Policy Review 40 (3) (2022) e12582. [CrossRef]

- C. Burger, J. Weinmann, Blockchain platforms in energy market ;a critical assessment, Journal of Risk and Financial Management 15 (11) (2022). [CrossRef]

- 27. R. Campbell Sr., Evaluation of post-quantum distributed ledger cryptography, The Journal of The British Blockchain Association 2 (1) (3 2019). [CrossRef]

- 28. T. Do, An architecture for blockchain-based cloud banking, in: IACR Cryptology ePrint Archive, 2021. URL https://api.semanticscholar.org/CorpusID:233176327.

- L. Guo, J. Chen, S. Li, Y. Li, J. Lu, A blockchain and iot-based lightweight framework for enabling information transparency in supply chain finance, Digital Communications and Networks 8 (4) (2022) 576–587. [CrossRef]

- X. Ding, H. Zhu, Blockchain-based implementation of smart contract and risk management for interest rate swap, in: X. Si, H. Jin, Y. Sun, J. Zhu, L. Zhu, X. Song, Z. Lu (Eds.), Blockchain Technology and Application, Springer Singapore, Singapore, 2020, pp. 210–219.

- Y. Zhang, Y. Liu, C.-H. Chen, Survey on blockchain and deep learning, in: 2020 IEEE 19th International Conference on Trust, Security and Privacy in Computing and Communications (TrustCom), 2020, pp. 1989–1994. [CrossRef]

- Z. Xu, T. Jiao, Q. Wang, C. B. Van, S. Wen, Y. Xiang, An efficient supply chain architecture based on blockchain for high-value commodities, in: Proceedings of the 2019 ACM International Symposium on Blockchain and Secure Critical Infrastructure, Association for Computing Machinery, 2019, p. 81–88. [CrossRef]

- M. Ferreira, S. Rodrigues, C. I. Reis, M. Maximiano, Blockchain: A tale of two applications, Applied Sciences 8 (9) (2018). [CrossRef]

- P. Centobelli, R. Cerchione, P. D. Vecchio, E. Oropallo, G. Secundo, Blockchain technology design in accounting: Game changer to tackle fraud or technological fairy tale?, Accounting, Auditing & Accountability Journal 35 (7) (2021) 1566–1597. [CrossRef]

- M. Mijoska, B. Ristevski, Possibilities for applying blockchain technology–a survey, Informatica 45 (3) (2021) 319–333.

- T. Alladi, V. Chamola, R. M. Parizi, K.-K. R. Choo, Blockchain applications for industry 4.0 and industrial iot: A review, IEEE Access 7 (2019) 176935–176951. [CrossRef]

- P. Raval, D. Sarkar, D. Devani, Application of analytical-network-process (anp) for evaluation of key-performance-indicators (kpi) for application of blockchain technology in infrastructure projects, Innovative Infrastructure Solutions 7 (2022).

- J. Ducr ́ee, M. Etzrodt, S. Bartling, R. Walshe, T. Harrington, N. Wittek, S. Posth, K. Wittek, A. Ionita, W. Prinz, D. Kogias, T. Paix ̃ao, I. Peterfi, J. Lawton, Unchaining collective intelligence for science, research, and technology development by blockchain-boosted community participation, Frontiers in Blockchain 4 (2021). [CrossRef]

- J. Potts, E. Rennie, J. Goldenfein, Blockchains and the crypto city, it-Information Technology 59 (6) (2017) 285–293.

- N. K. Ostern, J. Riedel, Know-your-customer (kyc) requirements for initial coin offerings, Business & Information Systems Engineering 63 (5) (2021) 551–567.

- T. Jovanić, An overview of regulatory strategies on crypto-asset regulation-challenges for financial regulators in the western balkans, in: Tatjana Jovanić, An Overview of Regulatory Strategies on Crypto-Asset Regulation-Challenges for Financial Regulators in the Western Balkans, in: EU Financial Regulation and Markets-Beyond Fragmentation and Differentiation (Eds. I. Bajakić, M. Bŏzina Berŏs), Conference Proceedings, Zagreb, 2020.

- A. Flori, Cryptocurrencies in finance: Review and applications, International Journal of Theoretical and Applied Finance 22 (05) (2019) 1950020. [CrossRef]

- X. Su, Y. Liu, C. Choi, A blockchain-based p2p transaction method and sensitive data encoding for e-commerce transactions, IEEE Consumer Electronics Magazine 9 (4) (2020) 56–66. [CrossRef]

- A. Ferreira, P. Sandner, Eu search for regulatory answers to crypto assets and their place in the financial markets’ infrastructure, Computer Law & Security Review 43 (2021) 105632. [CrossRef]

- R. Low, T. Marsh, Cryptocurrency and blockchains: Retail to institutional, Journal of Investing 29 (1) (2019) 18–30. [CrossRef]

- A. Walch, Chapter 11 - open-source operational risk: Should public blockchains serve as financial market infrastructures?, in: Handbook of Blockchain, Digital Finance, and Inclusion, Volume 2, Academic Press, 2018, pp. 243–269. [CrossRef]

- K. Li, D. J. Kim, K. R. Lang, R. J. Kauffman, M. Naldi, How should we understand the digital economy in asia? critical assessment and research agenda, Electronic Commerce Research and Applications 44 (2020) 101004. [CrossRef]

- M. Assaf, M. Hussein, B. T. Alsulami, T. Zayed, A mixed review of cash flow modeling: Potential of blockchain for modular construction, Buildings 12 (12) (2022). [CrossRef]

- K. H. Y. Chung, D. Li, P. Adriaens, Technology-enabled financing of sustainable infrastructure: A case for blockchains and decentralized oracle networks, Technological Forecasting and Social Change 187 (2023) 122258.

- Ethereum, Ethereum whitepaper (2023). URL https://ethereum.org/en/whitepaper/.

- H. community, An introduction to hyperledger (2023). URL https://www.hyperledger.org/learn/white-papers.

- R. G. B. Mike Hearn, Corda:adistributedledger (2019). URL https://r3.com/blog/corda-technical-whitepaper/.

- B. Chase, E. MacBrough, Analysis of the XRP ledger consensus protocol, CoRR abs/1802.07242 (2018). arXiv:1802.07242. URL http://arxiv.org/abs/1802.07242.

- B. Karadag, A. Akbulut, A. H. Zaim, A review on blockchain applications in fintech ecosystem, in: 2022 International Conference on Advanced Creative Networks and Intelligent Systems (ICACNIS), 2022, pp. 1–5. [CrossRef]

Figure 1.

Systematic literature review protocol.

Figure 1.

Systematic literature review protocol.

Figure 2.

Bar diagram of the distribution of publishers.

Figure 2.

Bar diagram of the distribution of publishers.

Figure 3.

Bar diagram of the distribution of categories.

Figure 3.

Bar diagram of the distribution of categories.

Figure 4.

Bar diagram of the distribution of index types.

Figure 4.

Bar diagram of the distribution of index types.

Figure 5.

Bar diagram of the distribution of countries.

Figure 5.

Bar diagram of the distribution of countries.

Figure 6.

Blockchain infrastructures used in finance.

Figure 6.

Blockchain infrastructures used in finance.

Figure 7.

Technologies used with blockchain in finance.

Figure 7.

Technologies used with blockchain in finance.

Figure 8.

The relationship between blockchain infrastructures and the technology used with blockchain.

Figure 8.

The relationship between blockchain infrastructures and the technology used with blockchain.

Figure 9.

Benefits of implementing blockchain in finance.

Figure 9.

Benefits of implementing blockchain in finance.

Figure 10.

Consensus methods of blockchain in finance.

Figure 10.

Consensus methods of blockchain in finance.

Figure 11.

The relationship between blockchain infrastructures and consensus methods.

Figure 11.

The relationship between blockchain infrastructures and consensus methods.

Figure 12.

Permission types of blockchain in finance.

Figure 12.

Permission types of blockchain in finance.

Figure 13.

The relationship between blockchain infrastructures and permission types.

Figure 13.

The relationship between blockchain infrastructures and permission types.

Figure 14.

Potential future applications of blockchain in finance.

Figure 14.

Potential future applications of blockchain in finance.

Figure 15.

Most common uses of blockchain in finance.

Figure 15.

Most common uses of blockchain in finance.

Figure 16.

Smart contracts programming languages of blockchain in finance.

Figure 16.

Smart contracts programming languages of blockchain in finance.

Figure 17.

Challenges of implementing blockchain in finance.

Figure 17.

Challenges of implementing blockchain in finance.

Table 1.

Research questions.

Table 1.

Research questions.

| No |

Research Question (RQ) |

| RQ1 |

Which blockchain infrastructures are used in finance? |

| RQ2 |

What technologies are used in finance with blockchain? |

| RQ3 |

What are the benefits of implementing blockchain in finance? |

| RQ4 |

Which consensus methods of blockchain are used in finance? |

| RQ5 |

What permission types of blockchain are used in finance? |

| RQ6 |

What are the potential future applications of blockchain technology in finance? |

| RQ7 |

What are the most common uses of blockchain technology in the financial industry? |

| RQ8 |

Which smart contracts programming languages of blockchain are used in finance? |

| RQ9 |

What are the challenges of implementing blockchain in finance? |

Table 2.

An overview of search results at two phases of the SLR process.

Table 2.

An overview of search results at two phases of the SLR process.

| Source |

Source After Automated Search |

Search After Quality Assessment |

| IEEE |

14 |

6 |

| Springer Nature |

6 |

6 |

| Elsevier |

4 |

4 |

| Mdpi |

4 |

3 |

| Wiley |

4 |

2 |

| Assoc Computing Machinery |

2 |

1 |

| Asoc Economia Aplicadad |

1 |

0 |

| British Blockchain Assoc |

1 |

1 |

| Emerald Group Publishing |

1 |

1 |

| Fac Law - Univ Zagreb |

1 |

1 |

| Federal Reserve Bank St Louis |

1 |

1 |

| Frontiers Media Sa |

1 |

1 |

| Higher Education Press |

1 |

1 |

| Incisive Media |

1 |

1 |

| Iop Publishing Ltd. |

1 |

0 |

| Keai Publishing Ltd. |

1 |

1 |

| Now Publishers Inc |

1 |

0 |

| Pageant Media Ltd. |

1 |

1 |

| Springer Int Publ Ag |

1 |

1 |

| Slovensko Drustvo Informatika |

1 |

1 |

| Taylor & Francis |

1 |

0 |

| Univ Illinois |

1 |

1 |

| Walter De Gruyter |

1 |

1 |

| World Scientific |

1 |

1 |

Table 3.

Study inclusion criteria.

Table 3.

Study inclusion criteria.

| No. |

Criteria |

| IC1 |

The study is not published in a language other than English |

| IC2 |

The study is published after 2010 |

| IC3 |

The study must be related to finance using blockchain |

| IC4 |

The study must have full text (e.g., abstract-only papers are not considered) |

Table 4.

Quality checklist.

Table 4.

Quality checklist.

| No. |

Question |

| Q1 |

Are the aims of the study clearly declared? |

| Q2 |

Are the scope and context of the study clearly defined? |

| Q3 |

Is the proposed solution clearly explained and validated by an empirical study? |

| Q4 |

Are the variables used in the study likely to be valid and reliable? |

| Q5 |

Is the research process documented adequately? |

| Q6 |

Are at least three questions answered? |

| Q7 |

Are the challenge findings presented? |

| Q8 |

Are the main findings stated clearly in terms of credibility, validity, and reliability? |

Table 5.

The data extraction form.

Table 5.

The data extraction form.

| No. |

Extraction Item |

| 1 |

Author |

| 2 |

Title |

| 3 |

Inclusion criteria Status |

| 4 |

Publisher |

| 5 |

Article Source |

| 6 |

Type |

| 7 |

Language |

| 8 |

Country |

| 9 |

ISSN |

| 10 |

Publication Year |

| 11 |

DOI |

| 12 |

Index |

| 13 |

Category |

| 14 |

Infrastructure |

| 15 |

Technology |

| 16 |

Benefits |

| 17 |

Consensus methods |

| 18 |

Permission types |

| 19 |

Future applications |

| 20 |

Most known use cases |

| 21 |

Smart contracts |

| 22 |

Difficulties |

Table 6.

The 34 studies used in this systematic literature review.

Table 6.

The 34 studies used in this systematic literature review.

| ID |

Title |

Year |

Reference |

| 1 |

Blockchain distributed ledger technology: An introduction and focus on smart contracts |

2020 |

[18] |

| 2 |

Finance infrastructure through blockchain-based tokenization |

2020 |

[19] |

| 3 |

Decentralized Finance: On Blockchain- and Smart Contract-Based Financial Markets |

2021 |

[20] |

| 4 |

Dizar: An Architecture of Distributed Public Key Infrastructure Based on Permissioned Blockchain |

2020 |

[21] |

| 5 |

Distributed ledger technology in payments, clearing and settlement |

2017 |

[22] |

| 6 |

DeFi-ning DeFi: Challenges & Pathway |

2021 |

[23] |

| 7 |

On the Blockchain-based General-Purpose Public Key Infrastructure |

2019 |

[24] |

| 8 |

Proof of Concept of Blockchain Integration in P2P Lending for Developing Countries |

2020 |

[25] |

| 9 |

The distributed liability of distributed ledgers: Legal risks of blockchain |

2018 |

[26] |

| 10 |

Scaling up sustainable investment through blockchain-based project bonds |

2022 |

[27] |

| 11 |

Blockchain Platforms in Energy Markets-A Critical Assessment |

2022 |

[28] |

| 12 |

Evaluation of Post-Quantum Distributed Ledger Cryptography |

2019 |

[29] |

| 13 |

An Architecture for Blockchain-Based Cloud Banking |

2021 |

[30] |

| 14 |

A blockchain and IoT-based lightweight framework for enabling information transparency in supply chain finance |

2022 |

[31] |

| 15 |

Blockchain-Based Implementation of Smart Contract and Risk Management for Interest Rate Swap |

2020 |

[32] |

| 16 |

Survey on Blockchain and Deep Learning |

2020 |

[33] |

| 17 |

An Efficient Supply Chain Architecture Based on Blockchain for High-value Commodities |

2019 |

[34] |

| 18 |

Blockchain: A Tale of Two Applications |

2018 |

[35] |

| 19 |

Blockchain technology design in accounting: Game changer to tackle fraud or technological fairy tale? |

2021 |

[36] |

| 20 |

Possibilities for Applying Blockchain Technology - a Survey |

2021 |

[37] |

| 21 |

Blockchain Applications for Industry 4.0 and Industrial IoT: A Review |

2019 |

[38] |

| 22 |

Application of analytical-network-process (ANP) for evaluation of key-performance-indicators (KPI) for application of blockchain technology in infrastructure projects |

2022 |

[39] |

| 23 |

Unchaining Collective Intelligence for Science, Research, and Technology Development by Blockchain-Boosted Community Participation |

2021 |

[40] |

| 24 |

Blockchains and the crypto city |

2017 |

[41] |

| 25 |

Know-Your-Customer (KYC) Requirements for Initial Coin Offerings Toward Designing a Compliant-by-Design KYC-System Based on Blockchain Technology |

2021 |

[42] |

| 26 |

An Overview of Regulatory Strategies on Crypto-Asset Regulation-Challenges for Financial Regulators in the Western Balkans |

2020 |

[43] |

| 27 |

Cryptocurrencies in finance: Review and applications |

2019 |

[44] |

| 28 |

A Blockchain-Based P2P Transaction Method and Sensitive Data Encoding for E-Commerce Transactions |

2020 |

[45] |

| 29 |

Eu search for regulatory answers to crypto assets and their place in the financial markets’ infrastructure |

2021 |

[46] |

| 30 |

Cryptocurrency and Blockchains: Retail to Institutional |

2019 |

[47] |

| 31 |

Open-Source Operational Risk: Should Public Blockchains Serve as Financial Market Infrastructures? |

2018 |

[48] |

| 32 |

How should we understand the digital economy in Asia? Critical assessment and research agenda |

2020 |

[49] |

| 33 |

A Mixed Review of Cash Flow Modeling Potential of Potential of Blockchain for Modular Construction |

2022 |

[50] |

| 34 |

Technology-enabled financing of sustainable infrastructure: A case for blockchains and decentralized oracle networks |

2023 |

[51] |

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).