1.1. Background

With the dissemination of new technologies and various digital devices based on the Fourth Industrial Revolution, the production of related data is expected to exponentially increase by more than 90 times, from approximately 2 zettabytes in 2010 to 181 zettabytes by 2025 [

1]. In the maritime industry, the shipbuilding and shipping markets are expected to expand from the traditional technology market, which includes ship management, communication, security, and eco-friendly propulsion systems based on maritime domain data, to the service market, which includes port cargo handling and smart logistics systems, owing to the development of maritime autonomous surface ship(MASS)technology. Therefore, in the future, the data used in the maritime domain are expected to be recognized as tangible values similar to the value of petroleum in the 21st century [

2]. Especially maritime data produced via the operation of ships is essential for the commercial operation of autonomous ships. The data from autonomous ships are important resources for the decision-making processes of various stakeholders in the maritime, shipping, and shipbuilding sectors. Thus, they are expected to create considerable economic and environmental ripple effects [

3].

Recently, maritime data has evaluated the following key functions in activating autonomous ships and the smart-port industry.

First, maritime data play an important role in creating new industries as the digital transformation of the maritime domain expands. New industries based on the utilization of maritime data include sensors related to maritime data, IT manufacturing industries related to smart devices, low-orbit satellites for maritime data transmission, communication industries including LTE-M, cloud storage for accumulating maritime data, and cybersecurity.

Second, maritime data enable decision-making based on scientific and objective data (eliminates intuition and promotes better decision-making) by supporting smart decision-making through big-data-based prediction algorithms. This is then applied to difficulties in shipping management owing to unpredictable internal and external variables. For example, the Maritime and Port Authority (MPA) of Singapore signed a memorandum of understanding with IBM, i.e., the MPA-IBM Project SAFER, to obtain sense-making analytics for maritime-event recognition [

6]. This project aimed to develop a platform that could predict vessel arrival times and estimate traffic congestion at the port using fusion analytics, thereby improving productivity and marine safety. The data assists in predicting equipment failures well in advance and keeping their machinery updated. The Hamburg Port in Germany uses a cloud-based analytics tool called Smart Port Logistics, which helps regulate vessel operations on a mobile application with real-time data [

7].

Therefore, the competitiveness of a company depends on the ownership of data in the maritime domain as well as in general industries [

4], and such data need to be re-evaluated as important corporate assets [

5].

In the Republic of Korea, it is important to investigate the perceptions people have on maritime data, which are the core of the digital transformation of the maritime domain. Therefore, this study conducted interviews and surveys with experts in the field. It was determined that a large amount of data is created and accumulated in the maritime sector. However, there are reservations about additionally creating added value and the cost to be incurred in the future due to continued data accumulation.

While it is still unclear whether shipping companies recognize and determine maritime data as assets in financial accounting, it can be said that shipping companies have not attempted to accurately evaluate the maritime data actively accumulated for digital transformation [

8]. As indicated by Muschalle et al., there are insufficient valuation models in the shipping market because most shipping companies remain at a management level where the vast amount of maritime data they produce is simply accumulated [

9]. Therefore, in the future, active corporate strategies are required to reflect maritime data in the values of shipping companies as assets by recognizing the importance of utilizing maritime data and evaluating the data as profit assets instead of liabilities or costs [

10].

Markets, market prices, and market players are required to trade tangible and intangible commodities. Therefore, similar organizations and groups are also required to trade maritime data. If maritime data are commercialized, and a stable connection is formed between consumers and suppliers by calculating the price according to a standard unit, a trading system for maritime data can be established. A key question for maritime-data trading is related to assessing the appropriate value of maritime data. Therefore, it is necessary for academia to preemptively prepare theories and grounds to support valuation [

11].

1.2. Aim of the Study

Maritime data essential for the commercial operation of autonomous ships are recognized as financial resources that can improve the efficiency of shipping companies, and they have already been traded as commodities at VesselsValue, Clarkson Research, IHS Markit, and Baltic Exchange within a limited range, according to the market economy system. Because maritime data are traded in the market as commodities, they can be considered assets of shipping companies. In particular, maritime data can be evaluated as intangible assets when used for research and development, capital investment, and management decision-making. It is necessary to measure the value of data to improve corporate value. In fact, many global companies recognize various data as intangible assets, such as patents and business rights, and reflect these in accounting [

12]. For example, AT&T, which is a telecommunications company in the United States, already included a data asset of

$2.7b in its account book in 2011, and approximately 20% of European countries evaluate data as corporate assets [

13]. There is a lack of recognition of the value of corporate data assets in financial statements, and insufficient efforts to measure the value of such data in South Korea. This is particularly relevant in the shipping industry, where there is a large amount of maritime data generated, such as sea conditions, port operation, and navigational traffic information. Despite the potential benefits of utilizing maritime data for safe and economical ship operation, fundraising, and enhancing the competitiveness of freight services, there is a lack of standardized platforms for the collection, storage, analysis, management, processing, and sale of such data for shipping companies. This presents an opportunity for innovation and investment in developing infrastructure and tools for effectively utilizing such data, which could create new opportunities for businesses and increase competitiveness in the industry.

In particular, no research has been conducted on objective valuation models, making it difficult to create additional values using data. Therefore, the value of this research is that methodologies were examined to assess the value of the data produced in the maritime domain using previous studies and selected the optimal valuation model using the AHP analysis. The main result is that the market approach (A2) is the optimal maritime data valuation model; there is no previous research regarding this issue. The market approach will enable the development of a platform for data trading and contribute to the completion of a maritime-data-economy virtuous cycle.

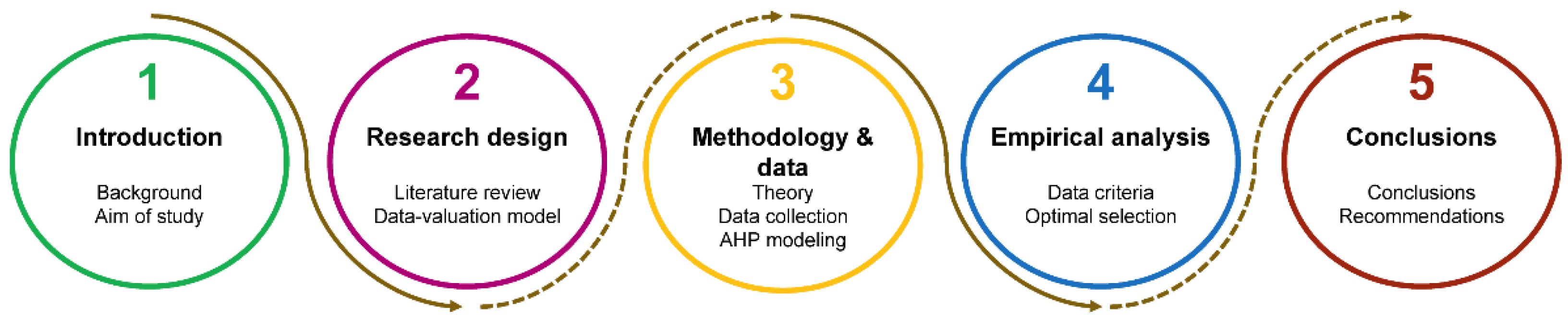

Therefore, this study was conducted based on the research process shown in

Figure 1 to review previous studies on data-valuation models, Identify the optimal valuation model for businesses by considering the characteristics of maritime data. Utilize the Analytic Hierarchy Process (AHP) analysis method to identify crucial factors and establish priorities in the selection process for measuring the value of maritime data assets. Consequently, this study presents the factors that affect the asset valuation model.

The remainder of this study is organized as follows.

Section 2 presents a literature review of maritime data and the data-valuation model. In

Section 3 and

Section 4, AHP is used to analyze the important factors in selecting priorities to identify the optimal valuation model to assess the value of maritime data.

Section 5 provides concluding comments and insights for future research.

2. Literature Review

This section examines the definition, literature review involved in determining a valuation model for maritime data using the AHP method. The value of maritime data is strongly associated with its quality and accessibility, and it is important to maintain transparency and objectivity to ensure quality. Trading must be activated based on supply and demand, and stakeholders in the shipping industry prefer to secure sufficient information in terms of both quality and quantity of data.

2.1. Definition of Maritime Data

The United Nations Conference on Trade and Development (UNCTAD) definition of data covers all aspects of human life. Specifically, it defines human life as events, such as products and actions, coded through digitalization; that is, machine-readable information [

14]. Simply put, maritime data comprises information on ships and other maritime vessels, particularly their movements around the globe [

15]. From this perspective, maritime data can be defined as all data produced independently or through interactions with third parties and other objects during ship operations [

16] and are different from big data.

For many companies, there are research cases related to data trading and data valuation, especially in the fields of public services [

17], mobility [

18], marketing [

19], and healthcare [

20]. Various research cases have been applied in these industries. However, the form, processing level, time point, quantity, and type of required data differ depending on the characteristics of each industry [

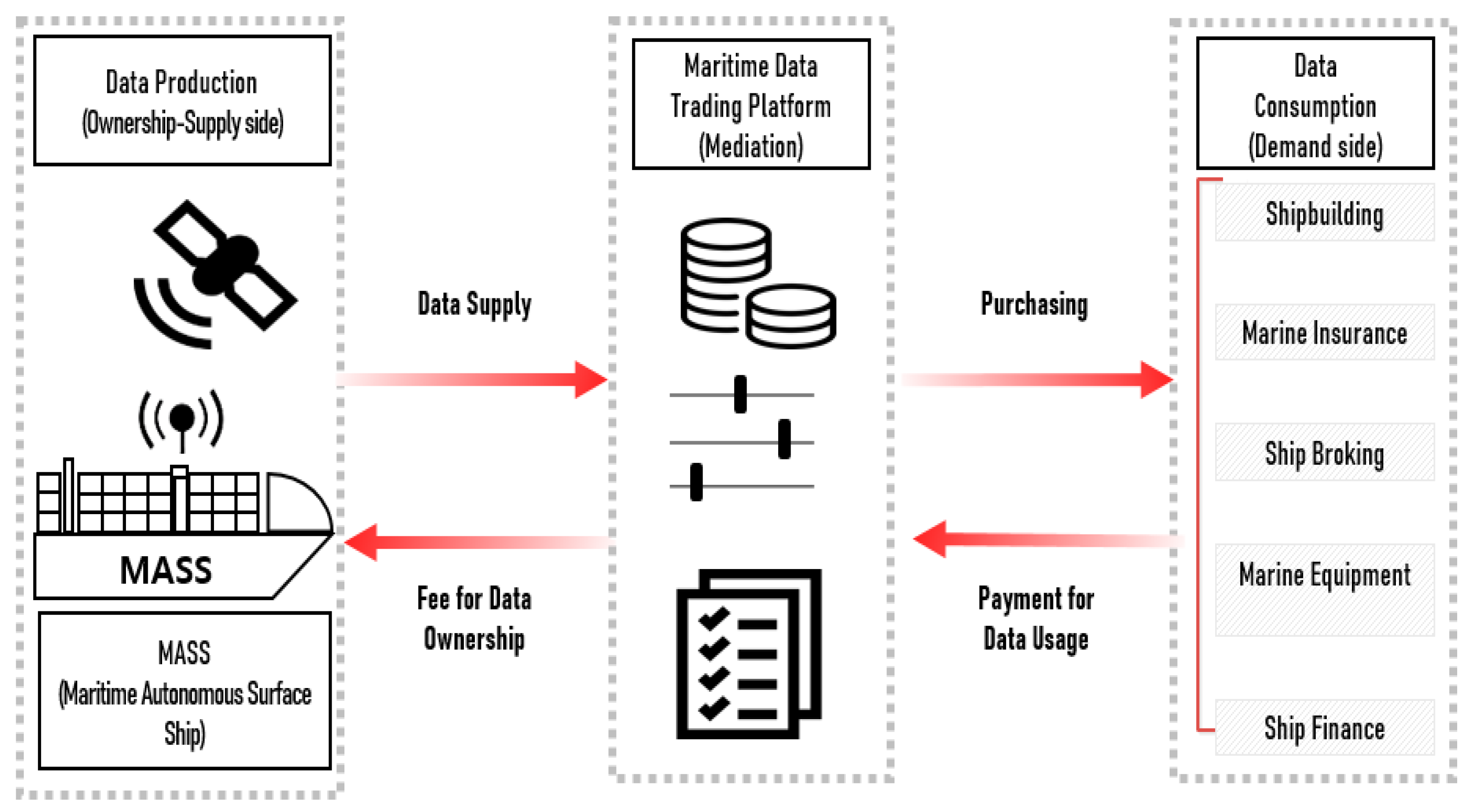

21]. From the perspective of application to commercial operation of autonomous ships, the value of maritime data will also be assessed differently, depending on the demand level of the participants in the shipping and maritime industries and related markets. Therefore, based on the maritime data defined in the study, the conceptual structure of maritime data trading, including production and purchasing, is shown in

Figure 2 below.

2.2. Literature Review

The purpose of this study is to identify the most important factors involved in determining a valuation model for maritime data. Therefore, the AHP analysis method was used to derive priorities via pairwise comparisons between the elements that constitute the hierarchical structure of decision=making. This study selected the AHP method because it can obtain the weight and importance of competing factors, which could be challenging to analyze quantitatively. In addition, recent literature studies analyzed the asset data value and established the evaluation index system using the AHP method.

The AHP method, developed by Professor Thomas Saaty of the University of Pennsylvania in the early 1970s, is a decision-making methodology for capturing the knowledge, experience, and intuition of the assessor through judgment using the pairwise comparison. [

22] The AHP provides a structured approach to decision-making, which helps decision-makers to identify the most important criteria and alternatives. It has flexibility that can handle both quantitative and qualitative criteria. This allows decision-makers to consider a wide range of factors when making decisions. The AHP ensures consistency in decision-making by allowing decision-makers to compare criteria and alternatives against each other. This helps to eliminate inconsistencies and biases in the decision-making process. In addition, the AHP provides a transparent decision-making process by allowing decision-makers to explain their choices and rationale. This helps to build trust among stakeholders and ensures that decisions are made based on objective criteria. The AHP is a user-friendly method that is easy to understand and use. This makes it accessible to a wide range of decision-makers, even those without specialized knowledge or training in decision science [

23,

24]. The AHP is widely used in various fields, including environment [

25,

26], finance [

27], and healthcare [

28]. The AHP is a powerful method that can help decision-makers to solve complex problems by breaking them down into smaller components, prioritizing the criteria, and selecting the best alternative.

In recent years, research has been actively conducted on information utilization and data collection because the importance of data utilization has increased across industries. In particular, Liang et al. [

30] presented data as a type of commodity in a digital market, where both the data owners and consumers are able to connect and share the utility of data. Reed [

29] explained that there is a growing tendency to assess the value of data as intangible assets using several cases. Hu et al. [

5] showed that a data trading system evaluates data quality based on the evaluation results of the data users’ application revenue to the data provider, according to the evaluated data quality. Muschalle et al. [

9] observed that vendors move the functionality of data warehouses to digital platforms that provide services for integrating and analyzing data from commercial data sources.

In a previous study on big data, Mihet and Philippon [

12] analyzed the expansion of big data and artificial intelligence technologies. They argued that these technologies are likely to affect the matching between firms and consumers. Regarding data platforms, Birch et al. [

31] showed that Big Tech firms turn users and user engagements into assets through performative measurement, control, and valuation, instead of extending data ownership. In addition, Kim et al. [

32] promoted the growth of a technology-transfer-based company and ran various technology-based financial support activities. They also proposed a new artificial intelligence, a deep learning-based data platform that enables technology holders to estimate the economic values of their own data.

The Organization for Economic Co-operation and Development (OECD) [

33] explained that data portability could empower users to perform a more active role in the reuse of their data across digital platforms. They also examined how data portability can help increase interoperability and enhance competition and innovation by reducing switching costs and lock-in effects. Reed [

29] explained why many companies exhibit growing trends toward the valuation of intangible assets between customers and prospect data, which is the engine of commercial relationships.

Langley [

34] argued that digitization leads to efficient business models that revolve around adapting the value proposition to the insights gained from the continual analysis of data, thereby shifting the emphasis of product-service systems towards the service end of the spectrum. Koltay [

35] focused on the characteristics of collecting data quality and aimed to cover the most important aspects of addressing data quality, which would be unimaginable without considering big data.

While many studies have covered data trading in the maritime domain, this field has not developed value assessment and management, commercial utilization, policy, and regulation. It lacks basic research to determine the maritime industry’s optimal commercial asset valuation method. Thus, this study identifies a methodology for evaluating data produced in the maritime industries as an asset and selects and presents an optimal valuation model based on an expert group via AHP analysis. In the future era of the intelligent technology industry, such as active autonomous ships in the maritime market, accumulating and valuing data will be a more critical issue. This study on the valuation model of maritime data is expected to provide a clue to promoting the commercialization of autonomous ships.

2.3. Data Valuation Model

According to the 2019 OECD Digital Economy Papers [

36], it is reasonable to view data as intangible assets based on the definition of intangible assets by the International Accounting Standard [

31]. For a model to assess the value of intangible assets, it is necessary to consider legal rights and relationships, such as attributes, ownership, and intellectual property rights, depending on the purpose and use of the assets, and to assess value according to market principles.

The OECD proposed a market trading-based valuation method and a survey-based willingness-to-pay method for personal information [

33]. In addition, the 2019 Data Sharing Handbook provided by the Singapore banking association proposed a market, cost, and income approach [

37]. Slotin also suggested benefit monetization and impact-based approaches [

38]. Among these methods, the methods proposed in [

37] (shown in

Table 1) were selected for this study because maritime data, which are the target of this study, are related to the operation of ships, and the demand for this data is also limited to industries with specific interests. Based on these methods, the data-valuation methods identified in previous studies were examined, and the AHP analysis method was used to derive the most suitable model for maritime data valuation.

First, the cost approach determines the value of the data by calculating the value of the cost invested in developing the asset of the assessment target. Alternatively, the approach estimates the cost required to develop a technology with the same economic profit or purchase a technology with the same value. For data asset valuation using this approach, the cost of duplicate or unused data is excluded. Accounting standards, such as direct and indirect costs, are applied to the remaining costs. These costs are classified into the user/producer connection and brokerage cost, data platform operation cost, device or sensor purchase and connection cost, data purchase/integration/processing cost, data transmission/security cost, and data collection/recording cost, depending on the data process steps, such as the collection, storage, processing, and utilization of data.

Second, the market approach determines the value of data via its price in the market or surveys and research by experts. In general, the market value is determined through an agreement between users and sellers, and the data-trading cost is paid with cash, goods, or services. In the data market, the determined value can be considered as the price of data trading instead of a value. Because there are few data marketplaces, the auction method is applied, or a method for experimenting/investigating the willingness of a consumer to download or subscribe to trade data is conducted. The market approach is suitable for companies that directly collect, process, sell, and distribute data. When there is no trading case in the market, the Relief-from-Royalty method can be used [

30].

Third, the income (benefit) approach assesses the current value by applying a discount rate to the monetary sales (profit) that are expected to occur within the economic life of data assets in a company. Additionally, this method assesses the value of all the data assets of a company [

32]. The income approach is known to overestimate the asset value compared to the cost and market approaches.

2.4. Factors for Maritime Data Valuation

According to a report from UNCTAD, data differ from general goods or services in terms of value, and it is necessary to understand their intrinsic characteristics [

14]. In fact, data have unlimited characteristics that can be used by anyone because they are intangible, non-rival, and do not deplete over time (except by becoming out-of-date or loss), owing to their multidimensional nature. However, their value or characteristics may vary depending on accessibility. Such accessibility may limit the value of data because the data may be limited by technical and legal measures. In addition, data classification from various perspectives is required, owing to the various forms and types of data that are available according to the needs of the market [

37].

According to the Infocomm Media Development Authority (IMDA) and the Personal Data Protection Commission (PDPC), the key value drivers of data include completeness, consistency, accuracy, timeliness, exclusivity, usage restriction, liability and risks, interoperability, and accessibility [

36]. Raw data can have value owing to these key value drivers. Because monetization is performed while data are processed according to the needs of the market, the value of the processing should also be considered.

In addition, the value of maritime data is strongly associated with its quality, which requires considerable objectivity. These characteristics significantly affect the usability of data. Therefore, it is important to maintain the transparency and objectivity of the data to ensure quality [

34,

41].

Trading must be activated in terms of supply and demand for the formation and activation of the maritime data market. Specifically, consumers will be willing to purchase maritime data based on motives such as new product/service development, optimal investment, and operational efficiency improvement. However, suppliers will supply maritime data to the market based on motives such as profit creation, cost reduction, and social contribution [

37]. If there are sufficient market players with such motives, the market can be stably maintained. Moreover, stakeholders in the shipping industry make decisions based on a variety of data, and they prefer to secure sufficient information in terms of both the quality and quantity of data [

39]. Therefore, the quality of the data is important, but varied and quantitatively sufficient data need to be available.

Maritime data may act as risk factors for initial, maintenance, and management costs and a failure for producers, buyers, and platform operators because maritime data can be considered as both assets and liabilities. Additionally, the market can be trusted when security is used to maintain the stability of the system [

35].

The factors considered for the valuation of maritime data analyzed in

Section 2.2,

Section 2.3 and

Section 2.4 were derived and classified according to their characteristics, as shown in

Table 2. As mentioned in the previous section and literature review, three hierarchies are identified as important factors: the characteristics of maritime data, features of the maritime data market, and features of maritime-data valuation. In addition, three alternatives that are applicable to maritime-data valuation are presented: the cost approach, market income, and income approach.

3. Theory and Method

The section describes the AHP (Analytic Hierarchy Process) methodology that is used in the study to select the optimal maritime data-valuation model. AHP is a Multi-Criteria Decision Making (MCDM) method used to choose the best alternative by considering multiple factors. This methodology is considered to be the most appropriate research method to address this problem, as it provides a reasonable judgment on multiple criteria based on expert judgment, without the need to set the weights of factors.

3.1. Theory

This study focuses on the selection of models to evaluate maritime data. Therefore, it is necessary to select the optimal valuation model by comprehensively considering the characteristics of maritime data, the features of the maritime-data market, and the features of the maritime data-valuation model, which have been addressed in previous studies. In this study, AHP is used among the MCDM methods to select the optimal alternative considering multiple factors. The AHP analysis applied in this study is a representative decision-making method that uses the MCDM as a scientific methodology. It is necessary to compare factors in the same hierarchy in pairs and express the degree of preference. In addition, the factors to be compared must be homogeneous to derive a result based on a predetermined scale within a limited range [

41].

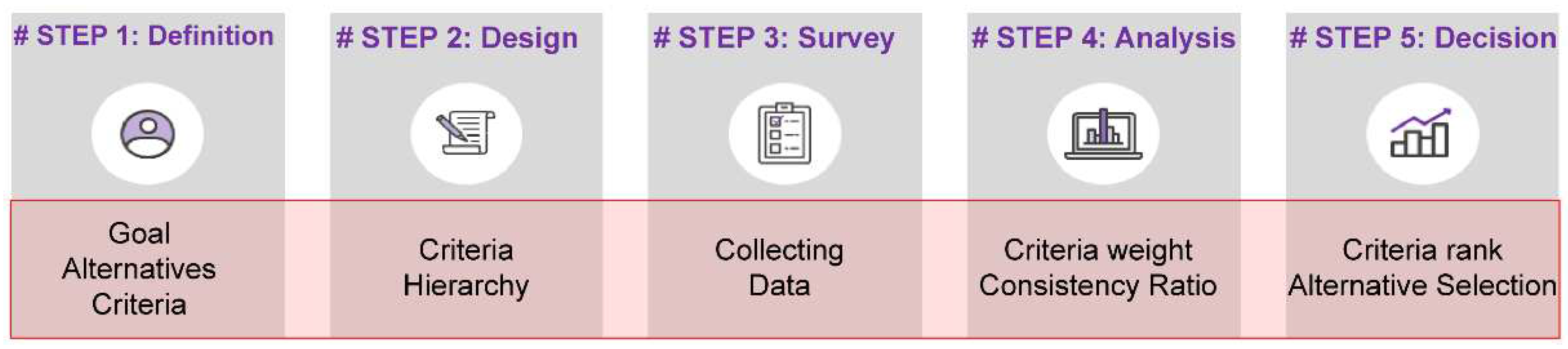

Figure 3 illustrates the AHP procedure.

First, the problem is defined. This process clarifies the final decision and factors that need to be considered to achieve the final goal. This process is performed using systematic literature research, brainstorming, and the Delphi method.

Second, hierarchical models are created for decision-making. Homogeneous sets are clustered and stratified for each factor. The purpose of problem-solving is presented at the top of the stratification, with multiple criteria for selecting alternatives in the middle and alternatives at the bottom. This process is the most important step in the AHP methodology, and the decision-making problem acts as an interrelated determinant for the analyst [

42]. Although constructing hierarchies is the first and most important step of AHP, a theoretical structure for stratifying the decision-making problem is constructed by selecting hierarchies and factors, defining concepts, and establishing questions.

Third, factors at the same level in the hierarchical structure are compared in pairs using a nine-point scale in the form of matrix A. Here, the main diagonal elements are 1, and for the off-diagonal elements

, where i and j denote the hierarchical factors at the same level and the element a

ij is the value on a nine-point scale indicating a preference that the i-th factor is better than the j-th factor.

In this study, pairwise comparisons are performed using a nine-point scale based on the result that “humans can compare 7 ± 2 objects simultaneously without confusion” from Miller’s psychological experiment conducted in 1956 [

43]. Various methods may be used to obtain measurements with a nine-point scale, including linear, square, square-root, geometric, and inverse linear values. Decision makers may use various methods for each problem; however, linear values according to the “Saaty scale” are the most preferred, as shown in

Table 3 [

44]. For example, if

, this value indicates that a respondent thinks the 1st factor is more important than the 3rd factor in the same hierarchy.

Fourth, logical consistency is examined for each response to the AHP questionnaire. To verify the response reliability, the consistency index (CI, shown in Equation (2)) and consistency ratio (CR), which is a measure of how consistent the pairwise comparisons made by AHP questionnaire respondents are, are obtained. If the CR is less than 0.1, the pairwise comparison is judged to have reasonable consistency. The λ are the eigenvalue of the pairwise comparison matrix. From

matrix, n values of λ can be obtained. In AHP, the max value of λ (

) among them is selected and is used to determine the degree of consistency in pairwise comparisons. CR can be measured from the CI and random index (RI), as shown in Equation (3) below [

45]. In addition, as shown in

Table 3, RI is calculated by averaging the CI of the matrix. The inverse matrix is created by randomly setting the numbers from 1 to 9. For this matrix, the CI is referred to as the average random index. In general, if the CR value is 0.1 or less, the response is considered to be logically consistent [

46].

Table 4 shows the RI when n changes from 1 to 10. As a rule of thumb, if the CR obtained in Equation (3) is within 10%, the pairwise comparison matrix is corrected for consistency.

Fifth, the relative weights of the factors are calculated hierarchically. To estimate the weight vector

in matrix

, the determinant

is calculated from the

relationship. The maximum eigenvalue (

) of matrix A is found, and the elements of its corresponding eigenvector are used as the weights, which indicate the importance of the criterion. In this instance,

is referred to as the principal eigenvector of matrix

and is expressed as in Equation (4). The comprehensive rankings of multiple alternatives are derived using this weight

.

Based on the five structured procedures mentioned above, this paper selected the AHP as the core methodology in this study. It is necessary to consider various factors when choosing a maritime data-valuation model, determine priorities among various factors considering their importance, and present a conclusion as an alternative based on the final calculated value. Thus, the weights of determinants through the AHP method can be provided, and reasonable judgment on multiple criteria is possible. Therefore, this study considered the AHP model to be the most appropriate research method to address this problem because the weights and priorities of multiple criteria are quantitatively derived automatically if pairwise comparisons between factors are performed in a sequence based on expert judgment, without the need to set the weights of the determinants using guesswork or some other more subjective means [

47].

3.2. Data Collection and Method

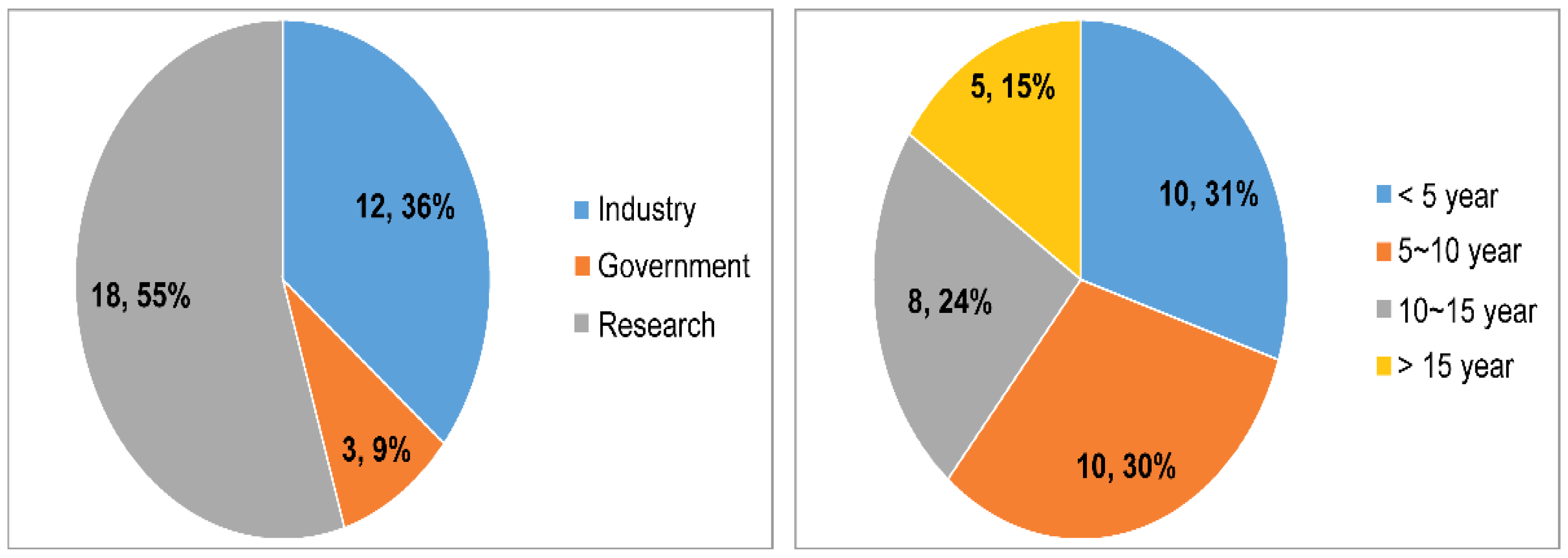

When preparing the AHP questionnaire for the selection of a maritime data-valuation model, in-depth interviews were conducted with the personnel in charge and experts in the fields of information, data, IT, and education in the maritime domain. Additionally, related international cases and literature were examined. The survey was conducted from January to February 2022 through visits and e-mail correspondence with experts and personnel in charge with a high understanding of maritime data based on sufficient experience in related industries, such as the shipping and shipbuilding industries, software industry, academia and research institutes, and marine public agencies. Among the 40 distributed questionnaires, 35 were recovered and analyzed using Expert Choice (Expert Choice Inc., USA) and Microsoft Excel (Microsoft Corp., USA). Then, 33 valid questionnaires, excluding two that had a low CR value, were analyzed through pairwise comparisons.

Figure 4 shows the demographic characteristics of the AHP-survey respondents. In the case of AHP research, much survey response data is not required for analysis, and analysis can be applied even in the presence of only one response [

48]. Considering this, the 33 questionnaire responses used in this study are large in number compared to the responses used in other studies. In addition, the responses can be considered reliable because the survey was conducted with experts in each field [

49].

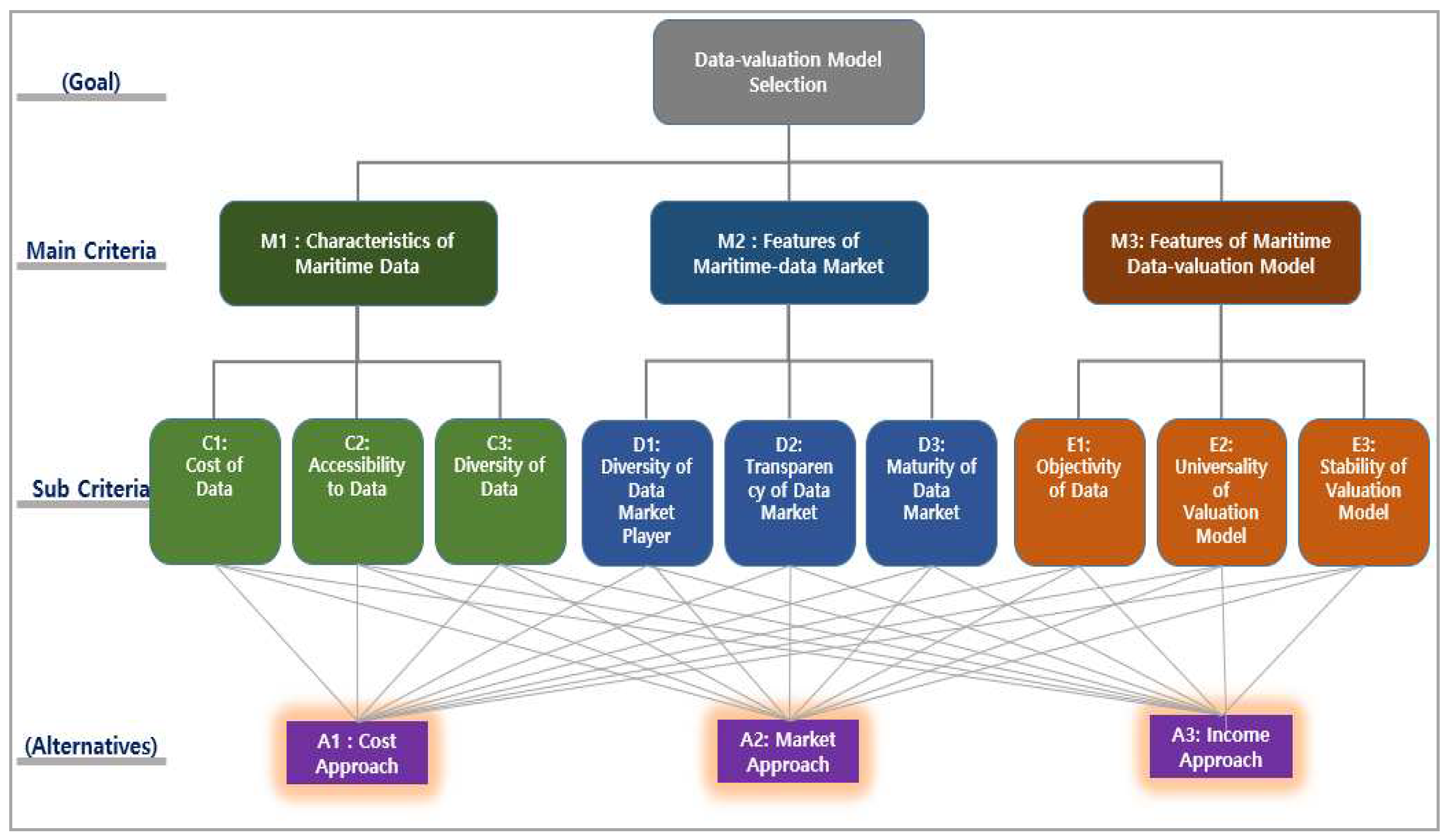

3.3. AHP Research Model

To design the AHP model, three main criteria, namely, the characteristics of maritime data, features of the maritime-data market, and features of the maritime data-valuation model, were constructed, and three sub-criteria were constructed for each main criterion. Consequently, a research model was designed with three main criteria and nine sub-criteria, as shown in

Figure 5.

4. Empirical Analysis

The section described the AHP method to prioritize criteria for selecting a maritime data-valuation model. Results showed that the cost of data was the most important factor, followed by accessibility to data and maturity of the data market. The market approach was found to be the most appropriate model based on the analysis.

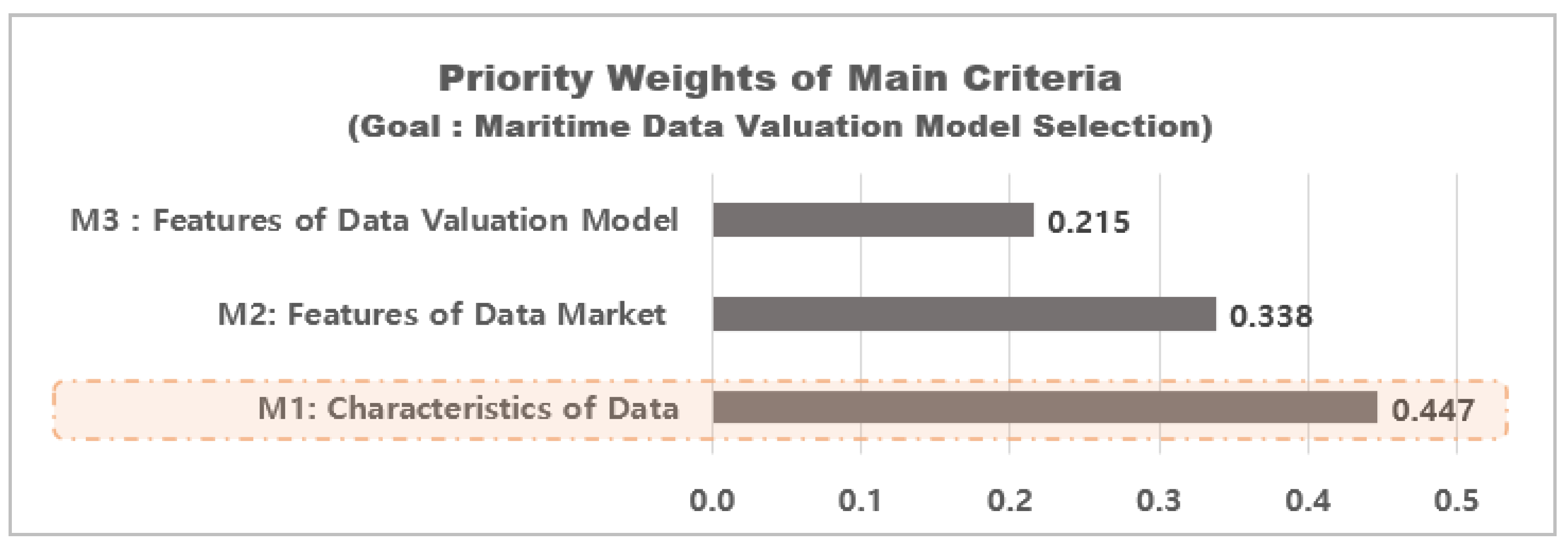

4.1. Main Criteria

The priorities from the AHP method were derived from selecting a maritime data valuation model. The characteristics of maritime data (M1) exhibited the highest importance (0.447), which was followed by the features of the maritime data market (M2) (0.338), and features of the maritime data-valuation model (M3) (0.215), among the main criteria, as shown in

Figure 6.

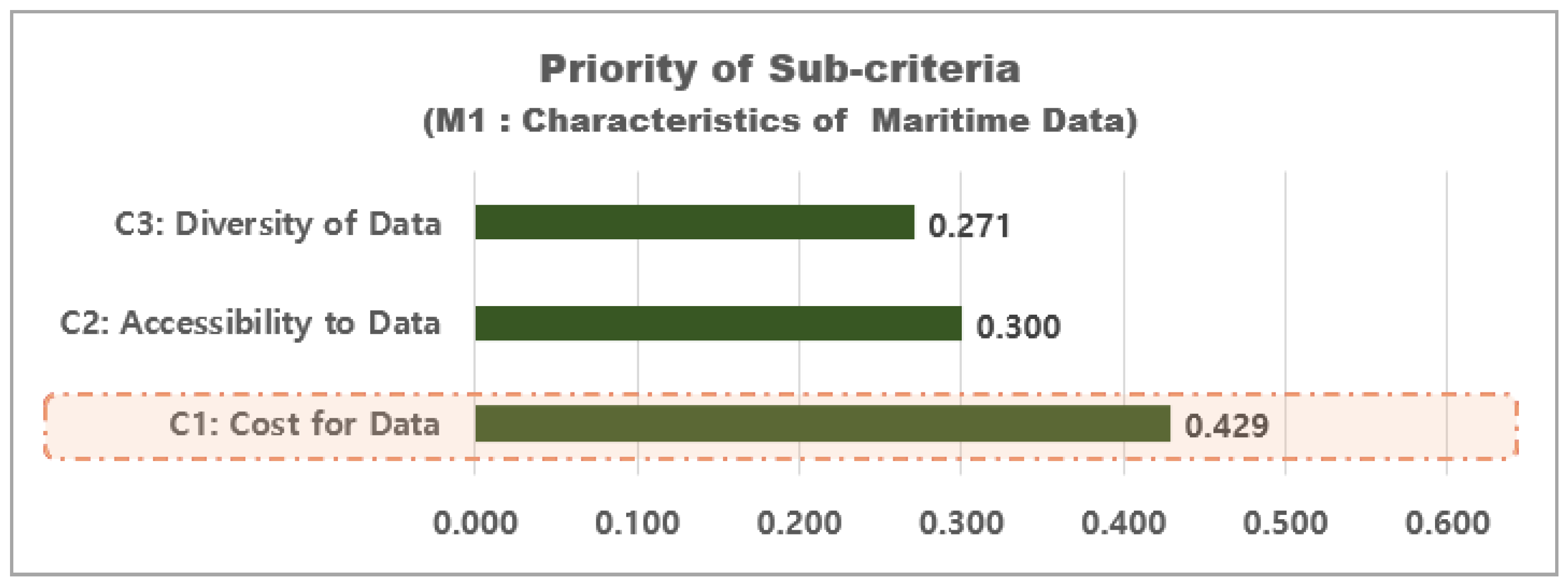

4.2. Sub-Criteria

Figure 7 shows the important level of the sub-criteria of the characteristics of maritime data (M1), which exhibited the highest importance among the main criteria. The cost of data (C1) had the highest importance, with a value of 0.429, followed by the accessibility to data (C2) with 0.300, and the diversity of data (C3) with 0.271. This indicates that the cost factor is the most important criterion in the characteristics of maritime data to consider when selecting a maritime data valuation model.

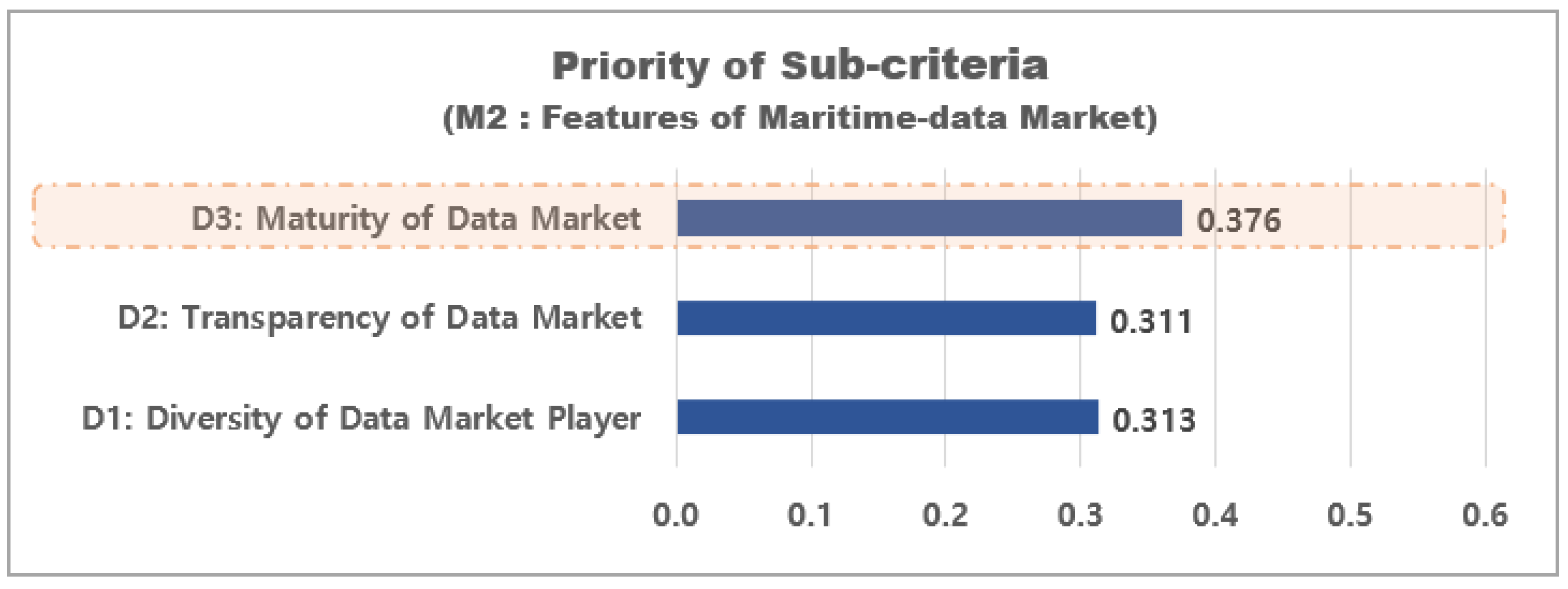

Figure 8 shows the important level of the sub-criteria of the maritime data market (M2), which is the second factor of the main criteria. The maturity of the data market (D3) exhibited the highest importance, with a value of 0.376, which was followed by the diversity of the data-market players (D1), with a value of 0.313, and the transparency of the data market (D2), with a value of 0.311. Thus, the maturity of the data market is the most important feature of the maritime data market when selecting a valuation model.

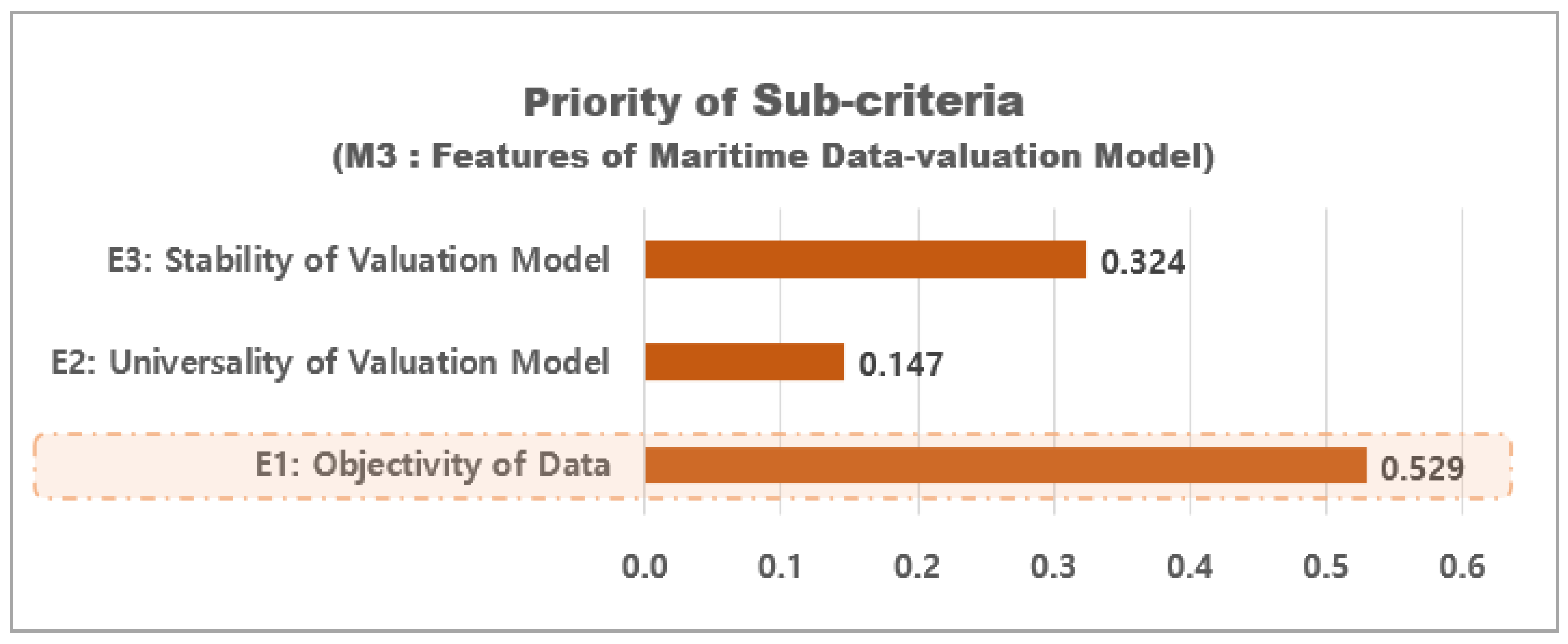

Figure 9 shows the important level of the sub-criteria of the maritime data-valuation model (M2), which is the last factor of the main criteria. The objective of the data (E1) was the most important, with a value of 0.529, followed by the stability of the valuation model (E3), with a value of 0.324, and the universality of the valuation model (E2), with a value of 0.147.

Based on the AHP survey analysis results, the relative importance of each factor by the hierarchy is summarized in

Table 5. Among the main criteria, the most important factors in selecting a maritime data valuation model are the characteristics of maritime data (M1), followed by the features of the maritime data market (M2), and the features of the maritime data valuation model (M3). This indicates that the characteristics of the data and the features of the market are considered more important than the features of the model when selecting a maritime data-valuation model. Considering the weights of the sub-criteria, the cost of the data (C1) ranked first in terms of importance, followed by accessibility (C2), and maturity of the data market (D3).

4.3. Selection of Alternative

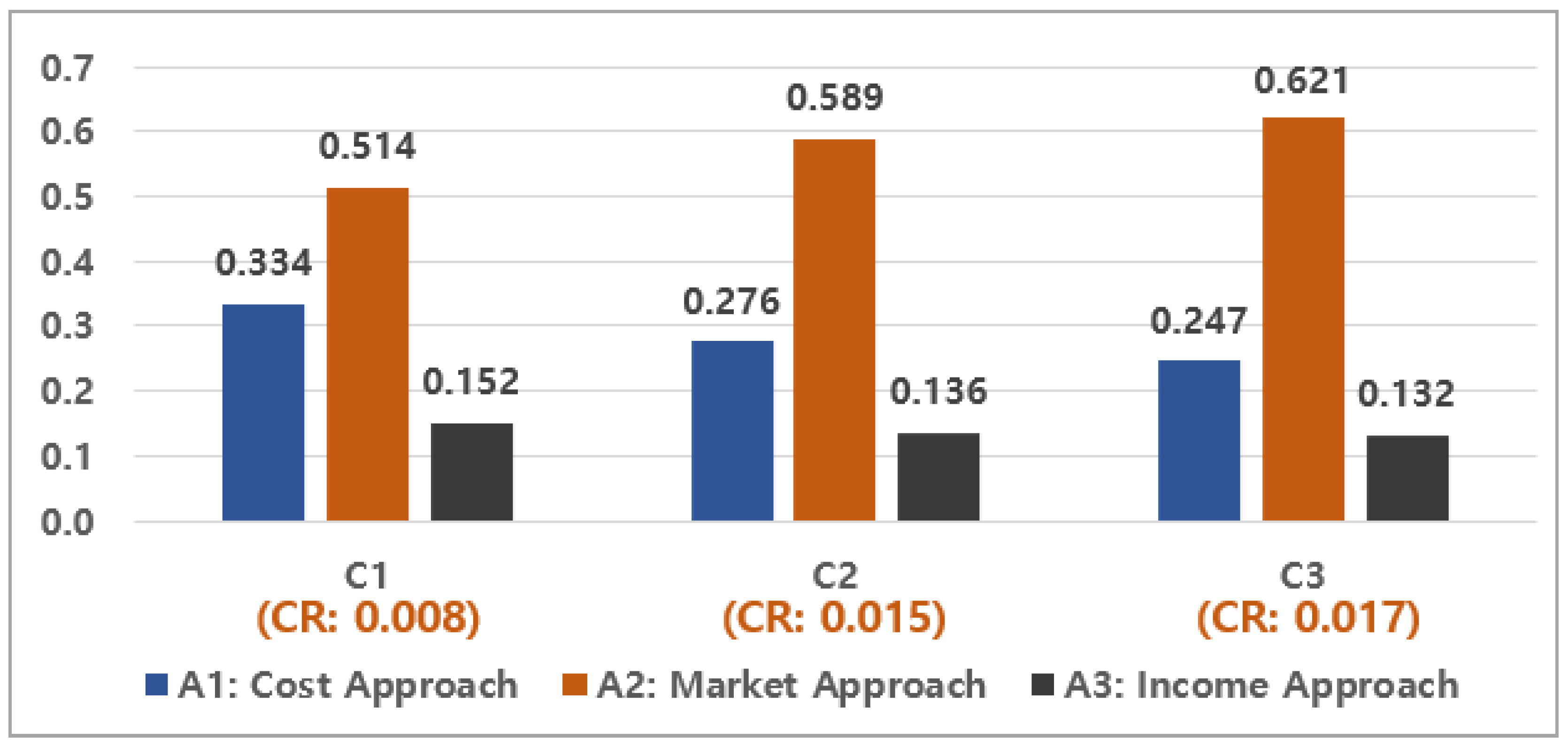

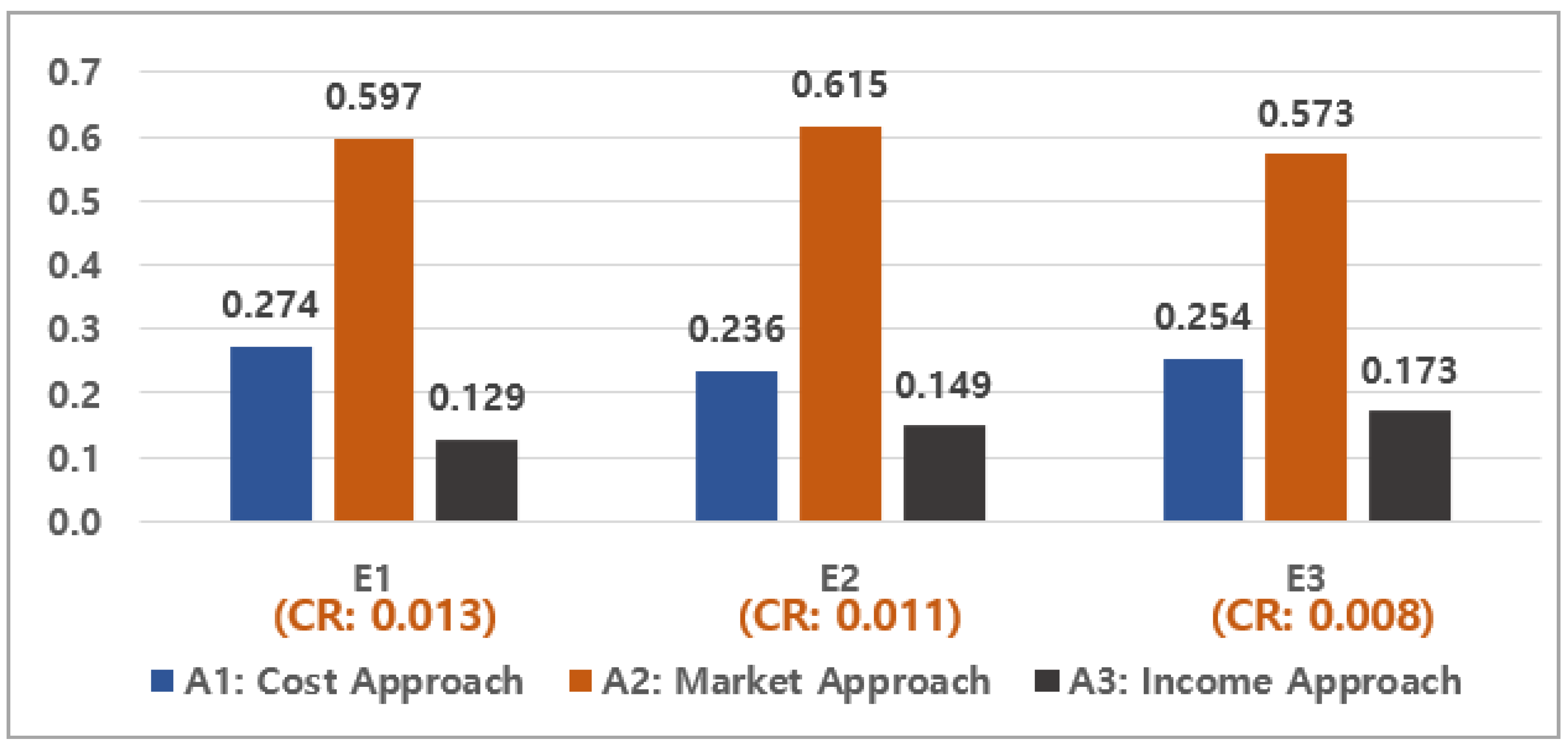

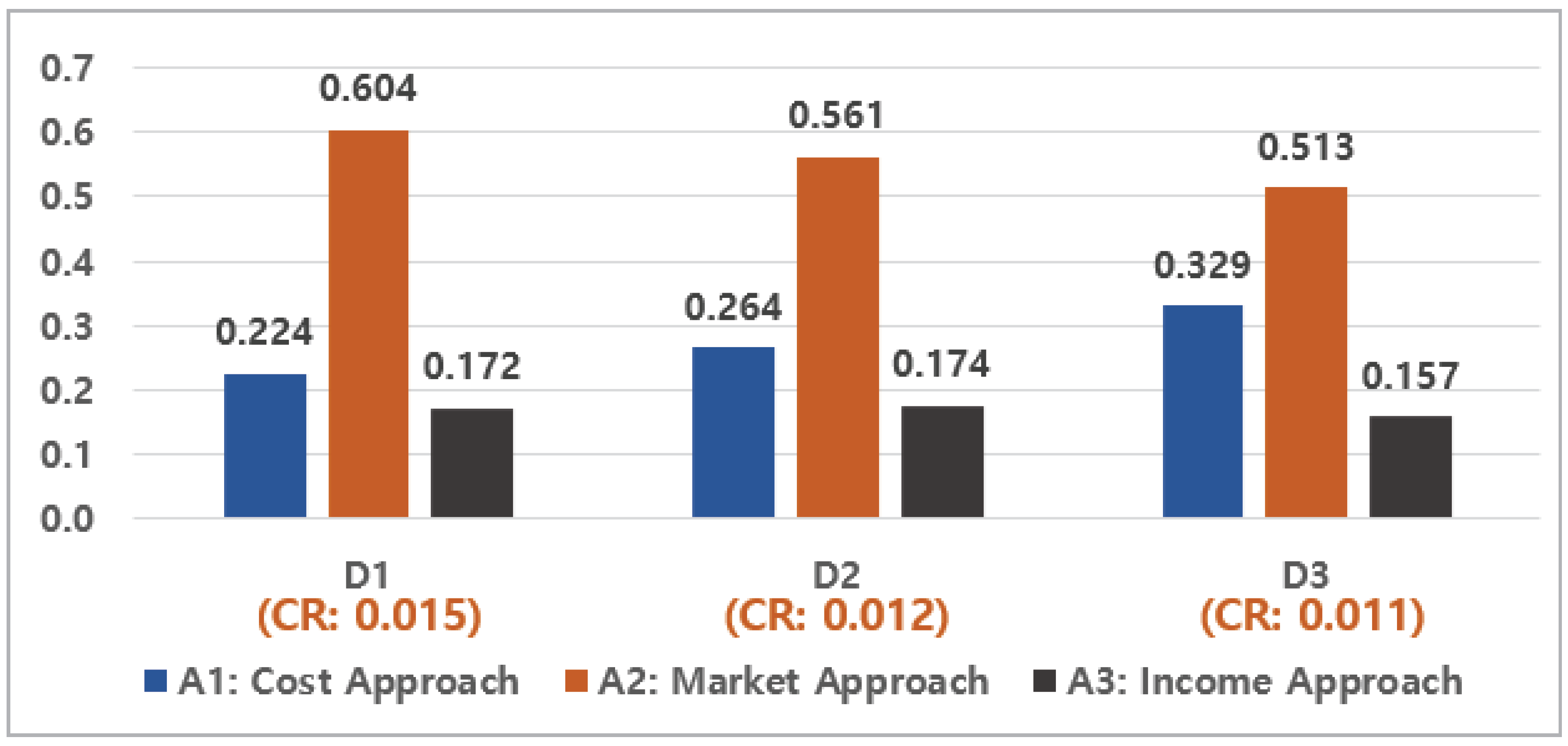

Figure 10,

Figure 11 and

Figure 12 show the results of evaluating the priorities for the three alternatives based on the factors of the sub-criteria from C1 to E3. The market approach (A2) is the highest priority for each sub-criteria, such as the costs for data (C1), the accessibility to data (C2), and the diversity of data (C3), as shown in

Figure 10. With similar results, the market approach (A2) was evaluated as the highest priority alternative in the diversity of data market players (D1), the transparency of the data market (D2), and the maturity of the data market (D3), as shown in

Figure 11. Similarly, in the objectivity of data (E1), the universality of the valuation model (E2), and the stability of the valuation model (E3), the market approach was evaluated as the highest alternative, as shown in

Figure 12. The market approach indicated values 2 to 3 times higher than the cost and income approaches.

The importance scores of each alternative were comprehensively calculated for each factor of the main criteria and sub-criteria, and the optimal alternative was selected, as shown in

Table 6. Based on the AHP analysis results, the market approach (A2) was selected as the most appropriate maritime data-valuation model.

5. Conclusions

The importance of data is recognized in various domains of our society, and there are high expectations for the added value that can be created using data. However, research on the value of data is insufficient compared with the recognition of the importance of data. In particular, no such research has been conducted in the maritime domain. According to a survey by the Korea Ocean Business Corporation, the amount of data collected by shipping companies in South Korea is increasing by 40% annually. Vast amounts of various maritime data remain with companies as liabilities because of maintenance costs; therefore, active efforts are required to assess the value of data using valuation methods and recognize the data as assets of companies.

In this study, the optimal model for the valuation of maritime data was selected by considering the valuation factors identified in previous studies to quantify the importance of maritime data in terms of value, including keeping pace with the growth of autonomous ships. Under the AHP survey, opinions of academic researchers and field experts in the maritime domain were collected and analyzed.

In the analysis of AHP, the market approach(A2) was selected as the most suitable valuation model to assess the value of maritime data. The main factors of the model selection were identified, and it was observed that priority must be given to the characteristics of maritime data (M1) over the features of the maritime data market (M2) and the features of the maritime data-valuation model (M3). That is, the diversity (C3), accessibility (C2), and cost (C1) of the data are the most important factors that must be considered for data valuation.

Among the data-valuation models, the most important factor of the cost approach (A1) is the cost (C1) invested in platform construction for the collection, storage, processing, and sale of data, and the value calculated based on the cost is recognized as the minimum data value. In the case of the income approach (A3), the added value that can be created with data is reflected more. Thus, the calculated value is considered the maximum data value. The market approach (A2) is based on the data value that is currently traded in the market. Thus, the calculated value is estimated to be between the maximum and minimum data values. Therefore, the market approach (A2) was selected as the optimal maritime data-valuation model in this study because it can be considered to be the most reasonable method for estimating the value of data.

The demand for ocean and ship data can vary depending on the commercial services utilizing the data, but its scalability is limitless. For example, by collecting and analyzing ship navigation data, services can be developed to optimize ship routes, speed, and fuel consumption. This can reduce shipping costs and environmental impact. Furthermore, by analyzing data collected from various sensors on ships, services can be developed to monitor the ship’s condition in real-time and provide predictive maintenance. This can increase the ship’s safety and lifespan. Additionally, by analyzing ocean data collected through various sensors installed on ships, services for monitoring the marine environment can be provided. This can detect changes in the marine environment and be used to inform government or corporate policy-making and decision-making. In addition, ship safety can be evaluated by using ship operation and sensor data to develop ship insurance services. This can allow insurance companies to more accurately assess risks associated with ship operation, and ship operators to focus on improving safety. In particular, data collected through ship data trading can be useful for developing autonomous ships, which are vessels that can navigate and operate on their own using technologies such as AI and robotics. This requires ship operation data from various environments. As such, there is a demand for maritime data, and a value assessment is necessary for trading. Currently, there is no research on how to estimate the value of maritime data. Although some maritime data is being traded, the price is mainly determined through individual negotiations for each dataset.

In this study, the AHP methodology was used to assess the value of maritime data. To do this, experts’ opinions were collected and the AHP methodology was used to select an evaluation model for maritime data. The study found that the market approach (A2) was the optimal model for evaluating maritime data using the AHP method. This research is the first of its kind to explore the identification and assessment of the value of maritime data. The key findings have the potential to facilitate the development of data trading platforms and play a significant role in completing the maritime data economy cycle in preparation for the era of autonomous shipping. This advancement is timely, aligning perfectly with the preparatory phase for the era of autonomous shipping, while steadfastly upholding the principles of environmental stewardship and sustainable maritime industry.

Author Contributions

Conceptualization, J.Y and S.L.; Methodology, C.L. and J.Y.; Validation, J.Y. and C.L.; Investigation, S.L.; Resources, S.L.; Data Curation, C.L. and J.Y.; Writing Preparation, S.L. and S.L.; Writing ration, Sand Editing, J.H. and C.L.; Visualization, C.L. and S.L.; Supervision, J.Y. and C.L.; Project Administration, S.L. and J.Y.; Funding Acquisition, J.Y. and J.H. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by a grant from the National R&D Project, “Digital Engineering Co-work Verification Platform based on AI”, funded by the Ministry of Trade, Industry, and Energy, South Korea, grant number P0018420.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflicts of interest. The funder had no role in the design of the study; collection, analyses, or interpretation of data; writing of the manuscript; or decision to publish the results.

References

- Statista. Volume of Data/Information Created, Captured, Copied, and Consumed Worldwide from 2010 to 2025. 2021. Available online: https://www.statista.com/statistics/871513/worldwide-data-created/ (accessed on 1 January 2024).

- The Economist. The World’s Most Valuable Resource is No Longer Oil, but Data. 2017. Available online: https://www.economist.com/leaders/2017/05/06/the-worlds-most-valuable-resource-is-no-longer-oil-but-data (accessed on 1 January 2024).

- Coyle, D.; Diepeveen, S.; Wdowin, J.; Kay, L.; Tennison, J. The Value of Data—Policy Implications. The Bennett Institute for Public Policy, Cambridge, and the Open Data Institute. 2020. Available online: https://www.bennettinstitute.cam.ac.uk/publications/value-data-policy-implications/ (accessed on 1 January 2024).

- Sadowski, J. When data is capital: Datafication, accumulation, and extraction. Big Data Soc. 2019, 6, 2053951718820549. [Google Scholar] [CrossRef]

- Hu, D.; Li, Y.; Pan, L.; Li, M.; Zheng, S. A blockchain-based trading system for big data. Comput. Netw. 2021, 191, 107994. [Google Scholar] [CrossRef]

- Yeo, G.; Lim, S.H.; Wynter, L.; Hassan, H. MPA-IBM Project SAFER: Sense-making analytics for maritime event recognition. Informs. J. Appl. Anal. 2019, 49, 269–280. [Google Scholar] [CrossRef]

- Heilig, L.; Voilig, S. A cloud-based SOA for enhancing information exchange and decision support in ITT operations. In International Conference on Computational Logistics; Springer: Cham, Switzerland, 2014; pp. 112–131. [Google Scholar] [CrossRef]

- Forbes. Why Your Company Doesn’t Measure the Value of Its Data Assets. 2021. Available online: https://www.forbes.com/sites/douglaslaney/2021/03/26/why-your-company-doesnt-measure-the-value-of-its-data-assets (accessed on 1 January 2024).

- Muschalle, A.; Stahl, F.; Ltahl, F.; Vossen, G. Pricing approaches for data markets. In Enabling Real-Time Business Intelligence. BIRTE 2012. Lecture Notes in Business Information Processing; Castellanos, M., Dayal, U., Rundensteiner, E.A., Eds.; Springer: Berlin/Heidelberg, Germany, 2013; Volume 154. [Google Scholar] [CrossRef]

- Baum-Talmor, P.; Kitada, M. Industry 4.0 in shipping: Implications to seafarers’ skills and training. Transp. Res. Interdiscip. Perspect. 2022, 13, 100542. [Google Scholar] [CrossRef]

- PwC. Putting a Value on Data. 2019. Available online: https://www.pwc.co.uk/data-analytics/documents/putting-valueon-data.pdf (accessed on 1 January 2024).

- Mihet, R.; Philippon, T. The economics of Big Data and artificial intelligence. In Disruptive Innovation in Business and Finance in the Digital World (International Finance Review, Vol. 20); Choi, J.J., Ozkan, B., Eds.; Emerald Publishing Limited: Bingley, UK, 2019; pp. 29–43. [Google Scholar] [CrossRef]

- Available online: https://investors.att.com/investor-profile (accessed on 1 January 2024).

- UNCTAD. Digital Economy Report. 2021. Available online: https://unctad.org/webflyer/digital-economy-report-2021 (accessed on 1 January 2024).

- Jovic, M.; Tijan, E.; Marx, R.; Gebhard, B. Big data management in maritime transport. Pomorski Zbornik. 2019, 57, 123–141. [Google Scholar] [CrossRef]

- Lee, C.; Kim, Y.; Shin, Y. Data usage and the legal stability of transactions for the commercial operation of autonomous vessels based on digital ownership in Korean civil law. Sustainability. 2021, 13, 8134. [Google Scholar] [CrossRef]

- HM Treasury. The Economic Value of Data: A Discussion Paper. 2018. Available online: https://www.gov.uk/government/publications/the-economic-value-of-data-discussion-paper (accessed on 1 January 2024).

- Transport Systems Catapult. The Case for Government Involvement to Incentivise Data Sharing in the UK Intelligent Mobility Sector, Briefing Paper. 2017. Available online: https://cp.catapult.org.uk/wp-content/uploads/2021/07/Transport_Data_Sharing_in_the_UK_Report.pdf (accessed on 1 January 2024).

- Bourreau, M.; Cailaud, B.; De Nijs, R. The value of consumer data in online advertising. Rev. Netw. Econ. 2017, 16, 269–289. [Google Scholar] [CrossRef]

- Fontana, G.; Ghafur, S.; Torne, L.; Goodman, J.; Darzi, A. Ensuring that the NHS realises fair financial value from its data. Lancet Digit. Health. 2020, 2, e10–e12. [Google Scholar] [CrossRef]

- Jang, W.-J.; Lee, S.-T.; Kim, J.-B.; Gim, G.-Y. A Study on data profiling: Focusing on attribute value quality index. Appl. Sci. 2019, 9, 5054. [Google Scholar] [CrossRef]

- Saaty, T.L. A scaling method for priorities in hierarchical structures. J. Math. Psychol. 1977, 15, 234. [Google Scholar] [CrossRef]

- Saaty, T.L. Decision making with the analytic hierarchy process. J. Serv. Sci. 2008, 1, 83–98. [Google Scholar] [CrossRef]

- Vaidya, O.S.; Kumar, S. Analytic hierarchy process: An overview of applications. Euro. J. Oper. Res. 2006, 169, 1–29. [Google Scholar] [CrossRef]

- Torres-Lozada, P.; Manyoma-Velásquez, P.; Gaviria-Cuevas, J.F. Prioritization of Waste-to-Energy Technologies Associated with the Utilization of Food Waste. Sustainability 2023, 15, 5857. [Google Scholar] [CrossRef]

- Zeng, X.; Yang, X.; Zhong, S.; Wang, Z.; Ding, Y.; Meng, D.; Gao, K. Comprehensive Evaluation of Resource and Environmental Carrying Capacity at a National Scale: A Case Study of Southeast Asia. Sustainability 2023, 15, 5791. [Google Scholar] [CrossRef]

- Gupta, S.; Raj, S.; Gupta, S.; Sharma, A. Prioritising crowdfunding benefits: A fuzzy-AHP approach. Qual. Quant. 2023, 57, 379–403. [Google Scholar] [CrossRef]

- Costa, W.S.; Pinheiro, P.R.; dos Santos, N.M.; Cabral, L.d.A.F. Aligning the Goals Hybrid Model for the Diagnosis of Mental Health Quality. Sustainability 2023, 15, 5938. [Google Scholar] [CrossRef]

- Reed, D. Database valuation: Putting a price on your prime asset. J. Database Mark. Cust. Strategy Manag. 2007, 14, 104–110. [Google Scholar] [CrossRef]

- Liang, F.; Yu, W.; An, D.; Yang, Q.; Fu, X.; Zhao, W. A Survey on Big Data Market: Pricing, Trading and Protection. IEEE Access 2018, 6, 15132–15154. [Google Scholar] [CrossRef]

- Birch, K.; Cochrane, D.; Ward, C. Data as asset? The measurement, governance, and valuation of digital personal data by Big Tech. Big Data Soc. 2021, 8, 20539517211017308. [Google Scholar] [CrossRef]

- Kim, M.-S.; Lee, C.-H.; Choi, J.-H.; Jang, Y.-J.; Lee, J.-H.; Lee, J.; Sung, T.-E. A study on intelligent technology valuation system: Introduction of KIBO patent appraisal system II. Sustainability 2021, 13, 12666. [Google Scholar] [CrossRef]

- OECD. Exploring the Economics of Personal Data: A survey of Methodologies for Measuring Monetary Value. OECD Digital Economy Papers, No. 220 (2013. 4. 2.), OECD Publishing, Paris. Available online: https://www.oecd-ilibrary.org/science-and-technology/exploring-the-economics-of-personal-data_5k486qtxldmq-en (accessed on 1 January 2024).

- Langley, D.J. Digital product-service systems: The role of data in the transition to servitization business models. Sustainability 2022, 14, 1303. [Google Scholar] [CrossRef]

- Koltay, T. Quality of open research data: Values, convergences and governance. Information 2020, 11, 175. [Google Scholar] [CrossRef]

- OECD. Vectors of Digital Transformation. OECD Digital Economy Papers, 2019, No. 273, OECD Publishing, Paris. Available online: https://www.sipotra.it/wp-content/uploads/2019/03/VECTORS-OF-DIGITAL-TRANSFORMATION.pdf (accessed on 1 January 2024).

- IMDA and PDPC. Guide to Data Valuation for Data Sharing. 2019. Available online: https://www.imda.gov.sg/-/media/Imda/Files/Programme/AI-Data-Innovation/Guide-to-Data-Valuation-for-Data-Sharing.pdf (accessed on 1 January 2024).

- Slotin, J. What Do We Know about the Value of Data? Global Partnership for Sustainable Development. 2018. Available online: http://www.data4sdgs.org/news/what-do-weknow-about-value-data (accessed on 1 January 2024).

- MTS Market, Market Participants Need both Quantity and Quality of Data. 2021. Available online: https://www.mtsmarkets.com/news/insights/market-participants-need-both-quantity-and-quality-data (accessed on 1 January 2024).

- Morey, T.; Forbath, T.; Schoop, A. Customer data: Designing for transparency and trust. Harv. Bus. Rev. 2015, 93, 96–105. [Google Scholar]

- Mawer, C. Valuing Data is Hard, Silicon Valley Data Science Blog Post. 2015. Available online: https://www.svds.com/valuing-data-is-hard/ (accessed on 1 January 2024).

- Sałabun, W.; Ziemba, P.; Wątróbski, J. The rank reversals paradox in management decisions: The comparison of the AHP and COMET methods. In Intelligent Decision Technologies; Spring: Cham, Switzerland. [CrossRef]

- Tian, G.; Zhang, H.; Zhou, M.; Li, Z. AHP, gray correlation, and TOPSIS combined approach to green performance evaluation of design alternatives. IEEE Trans. Syst. Man Cybern. Syst. 2017, 48, 1093–1105. [Google Scholar] [CrossRef]

- Miller, G.A. The Magical Number Seven, Plus or Minus Two: Some Limits on Our Capacity for Processing Information. Psychol. Rev. 1956, 101, 343–352. [Google Scholar] [CrossRef]

- Moslem, S.; Farooq, D.; Ghorbanzadeh, O.; Blaschke, T. Application of the AHP-BWM Model for Evaluating Driver Behavior Factors Related to Road Safety: A Case Study for Budapest. Symmetry. 2020, 12, 243. [Google Scholar] [CrossRef]

- Misran, M.F.R.; Roslin, E.N.; Mohd Nur, N. AHP-consensus judgement on transitional decision-making: With a discussion on the relation towards open innovation. J. Open Innov. Technol. Mark. Complex. 2020, 6, 63. [Google Scholar] [CrossRef]

- Aguaron, J.; Moreno-Jimenez, J.M. The geometric consistency index: Approximated thresholds. Eur. J. Oper. Res. 2003, 147, 137. [Google Scholar] [CrossRef]

- Wu, Y.; Zhang, J.; Yuan, J.; Geng, S.; Zhang, H. Study of decision framework of offshore wind power station site selection based on ELECTRE-III under intuitionistic fuzzy environment: A case of China. Energy Convers. Manag. 2016, 113, 66–81. [Google Scholar] [CrossRef]

- Abduh, M.; Omar, M.A. Islamic-bank selection criteria in Malaysia: An AHP approach. Bus. Intell. J. 2012, 5, 281. [Google Scholar] [CrossRef]

- Shen, L.; Mathiyazhagan, K.; Kannan, D.; Ying, W. Study on analysing the criteria for selection of shipping carriers in Chinese shipping market using analytical hierarchy process. Int. J. Shipp. Transp. Logist. 2015, 7, 742. [Google Scholar] [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).