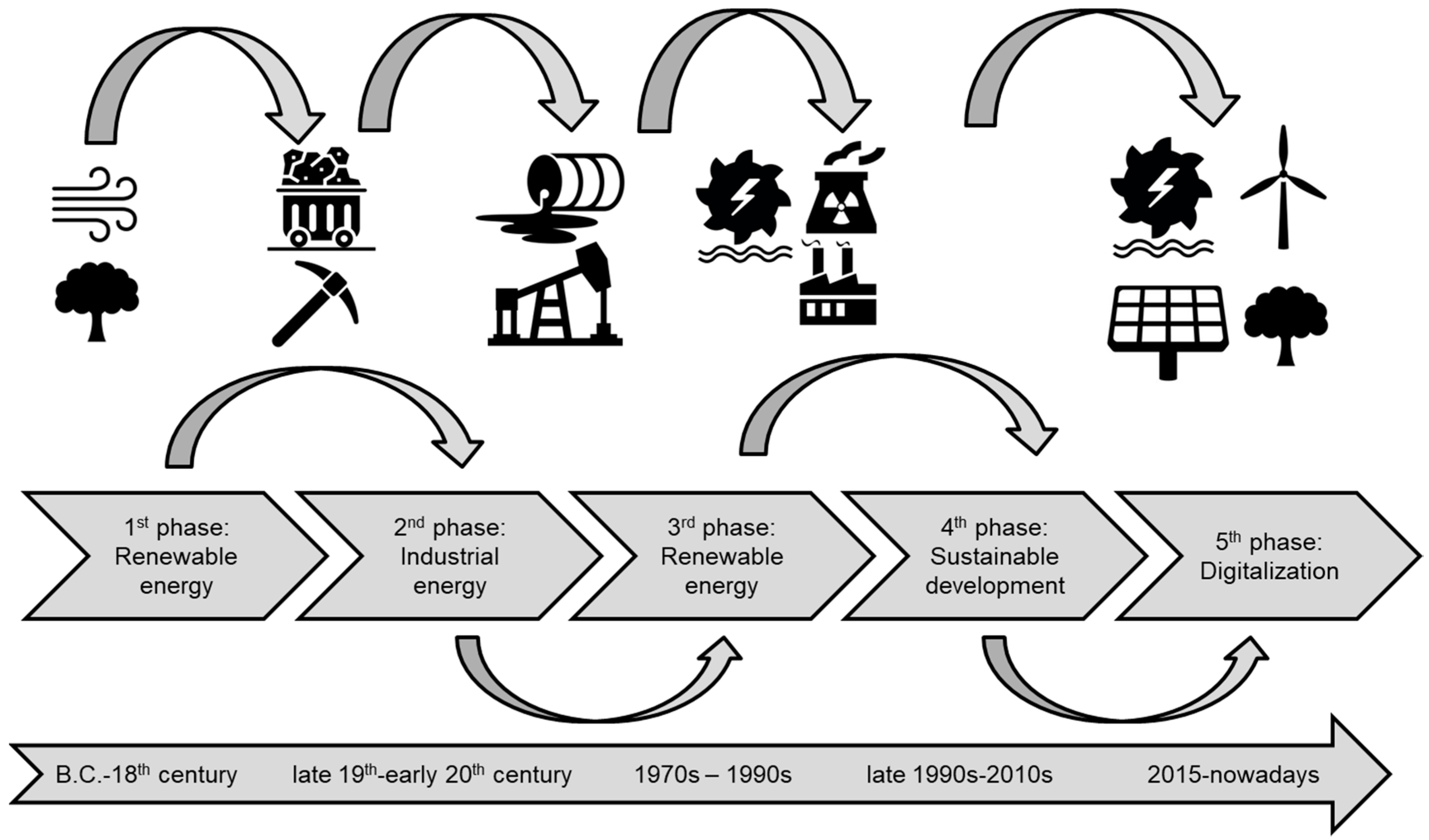

Within this context, it would probably be right to say that human history is always cyclical: the new is always the well-forgotten past. Before the 18

th century and the 1

st Industrial Revolution, all energy produced by humankind for its own use was renewable (see

Figure 1 above).

Before the 1st Industrial Revolution, people used horsepower to get around on land, wind power to travel across seas and oceans, burned wood in stoves and fireplaces to heat their homes, and harnessed the power of streams and rivers to run mills and other simple machinery (Strielkowski, 2019). From today's perspective, all these energy sources were renewable and sustainable and now, after 250 years humanity is coming back to renewable energy (now powered by digitalization) again (Strielkowski, 2021).

The transition from wood to coal became a superior alternative given the abundance of coal reserves in Britain. The switch to coal became a significant factor in fostering industrial growth. It powered the new technologies such as the steam engine that became the symbol of the 1st Industrial Revolution. As a result, the growth in industrial output necessitated and stimulated financial developments. Investments into opening new coalmines, creating the transportation infrastructure such as water canals and railways, and expanding the steel and textiles industries required lots of capital and called for new pathways of financing.

The next step was the expansion and evolution of the British banking and credit system as many new banks were founded and services crucial to supporting industrial ventures, such as providing short-term credit to businesses, started to be offered. This era also brought the expansion of financial markets. The demand for massive and long-term investments led to the growth of the stock market which allowed companies to raise capital by issuing shares. In 1801, the London Stock Exchange was founded to become the key institution for these activities. New forms of securities, such as bonds and debentures, which were used to finance public works and industrial ventures, emerged and insurance companies began offering coverage for new and expanding enterprises (Taylor, 2021).

Figure 1.

Global energy sector transition: from renewable energy to smart renewable energy. Source: Own results based on Strielkowski et al. (2021).

Figure 1.

Global energy sector transition: from renewable energy to smart renewable energy. Source: Own results based on Strielkowski et al. (2021).

Furthermore, British public finance was affected by the energy transition as the government invested in infrastructure and subsidized technological innovations and had to come up with more sophisticated methods of taxation and public debt management.

The energy transition from wood to coal also had international financial implications. As the British economy was burgeoning, the country emerged as a global economic and financial leader with London as its main international financial center, a status it maintains to this day. British financial practices, institutions, and instruments influenced global finance, laying the groundwork for modern international financial systems.

Surely, the transition also brought about some new challenges. There was a need for new regulations and institutions to manage these changes, which included labor laws, business practices, and urban policies. Financial institutions had to adapt to these challenges, balancing profit motives with emerging social responsibilities. In addition, the environmental impact of coal usage, though not fully understood at the time, started to become apparent. This early environmental cost laid the groundwork for future considerations in energy policy and financial investment, foreshadowing contemporary concerns about sustainable development and green finance.

All in all, the transition from wood to coal in the late 18th and early 19th century Britain was marked by the profound changes in financial development that were driven by and supported the massive industrial growth underpinned by coal as a new energy source. The financial developments of this era laid the foundational structure for the modern financial world, illustrating the inextricable link between energy sources and financial systems that made London the world’s leading financial center. The legacy of this period is still evident in today's financial institutions and practices, highlighting the lasting impact of this transformative era in British and global financial history. It is highly likely that the same paradigm might be applied to today’s energy transitions, in particular to the transition to the renewable and sustainable energy (Strielkowski et al., 2021). Further research on this topic might shed more light on the energy transition being the engine of financial transition and the creation of great financial centers.

References

- Moe, E. (2010). Energy, industry and politics: Energy, vested interests, and long-term economic growth and development. Energy, 35(4), 1730-1740. [CrossRef]

- Strielkowski, W. (2019). Social Impacts of Smart Grids: The Future of Smart Grids and Energy Market Design. Elsevier: London. [CrossRef]

- Strielkowski, W. (2021). Energy research and social sciences: thinking outside the box. E3S Web of Conferences, 250, 07001. [CrossRef]

- Strielkowski, W., Civín, L., Tarkhanova, E., Tvaronavičienė, M., & Petrenko, Y. (2021). Renewable energy in the sustainable development of electrical power sector: A review. Energies, 14(24), 8240. [CrossRef]

- Taylor, J. (2021). Inside and outside the London Stock Exchange: stockbrokers and speculation in late Victorian Britain. Enterprise & Society, 22(3), 842-877. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).