2. Digital Traceability: An Overview

Digital Traceability in the agri-food industry can be defined as the use of digital technologies to monitor food products as they move through the supply chain system. Digitalized tracing in this industry has offered substantial contributions to enhancing food safety and quality, offering consumers authentic and trustworthy food products (Hong et al., 2017). The recent advancement in technologies have played a pivotal role in providing the agri-food sector with the intelligence required to address challenges and establish transparent agri-food supply chains (Rana et al., 2021). These advanced technologies include but are not limited to: information communication technology (ICT), the Internet of Things (IoT), blockchain technology, big data, cloud and edge computing, and artificial intelligence (AI). Additionally, tools such as smart sensors, autonomous tractors, and spray drones (leveraging 5G technologies) exemplify the digitalization of the agri-food industry in contemporary times. These technologies not only aim to revolutionize the agri-food value chain but also aspire to promote sustainability (Verdouw et al., 2016). Notably, blockchain technology, when applied to food chains, has offered the potential to refine traceability regarding pesticide usage and enhance the transparency of food information and product location as items traverse the supply chain from farm to fork (Hilten, 2020).

The main technology used in the agri-food industry is however, the usage of blockchain technology. This decentralized database system is crucial in transforming the way data is kept, handled, and shared along the supply chain, from the producer to the consumer, ensuring food product traceability and transparency (Xiong et al., 2022). The key characteristics of blockchain – decentralization, immutability, and consensus procedures – make it a trustworthy alternative to traditional centralized databases (Xiong et al., 2022). Data is kept in blocks in a blockchain system, which are then linked together in a chain, producing a secure and unalterable record of all transactions inside the network. This level of security and transparency is especially advantageous for the agri-food business, as it aids in product tracking, food safety, and consumer trust (Xiong et al., 2022).

In addition to the emergence of advanced technologies, digital traceability gained unprecedented importance in the aftermath of the COVID-19 pandemic. This was due to the pandemic exposing several significant shortcomings in food supply chains worldwide, resulting in substantial financial and social losses (OECD, 2020). According to the 2020 report from the Food and Agricultural Organization (FAO), food distribution plummeted by 60% as a consequence of these disruptions. The concept of Industry 4.0, which advocates for the integration of digital technologies into manufacturing and industrial processes, has been applied to agri-food supply chains. This integration encompasses the advanced technologies discussed earlier, and are poised to render agri-food businesses less vulnerable in the future. For instance, robots will reduce reliance on manual labor, while AI will revolutionize business processes and scenario management, thereby mitigating both costs and risks (Chui, 2023). Moreover, on farms, real-time data related to crops, livestock, fields, and environmental factors such as weather and water are increasingly employed by farmers to make more informed decisions (Chui, 2023). In some cases, manual farm control has become obsolete, exemplified by the fully automated climate systems.

Recently, OECD member countries have embarked on an exploration of the opportunities and challenges presented by digital technologies within the agri-food industry. This endeavor seeks to delineate the role that governments can play in enhancing the industry. The OECD has articulated its dedication to employing technologies such as analytical software, agronomic advisory services, and digital communication tools to engage with farmers. The overarching goal is to facilitate the adoption of modern farming techniques, thereby rendering the agri-food value chain more efficient and transparent.

The present report focuses on the implementation and impact of digital traceability within OECD member countries. A robust research methodology, replete with assessment questions, forms the foundation of this inquiry. Data will be systematically gathered from published articles and various secondary sources that offer insights into the execution of digital traceability initiatives. The findings will be presented comprehensively, incorporating informative tables and explanatory narratives. The paper will culminate with meticulous data analysis, an exploration of encountered challenges, and a consideration of potential future directions in this dynamic domain.

3. Methodology

GPT

The research endeavor embarked upon seeks to furnish an exhaustive and nuanced examination of digital traceability systems across the member nations of the Organisation for Economic Co-operation and Development (OECD). Within the purview of this introductory chapter, extensive investigations were conducted on all 38 member countries of the OECD, which encompass Austria, Australia, Belgium, Canada, Chile, Colombia, Costa Rica, Czech Republic, Denmark, Estonia, France, Finland, Germany, Greece, Hungary, Iceland, Ireland, Italy, Israel, Japan, Korea, Latvia, Lithuania, Luxembourg, Mexico, Netherlands, New Zealand, Norway, Poland, Portugal, Slovak Republic, Slovenia, Spain, Sweden, Switzerland, Turkey, the United Kingdom, and the United States. Additionally, the analysis extended to the European Union, particularly focusing on its 23 member states that are concurrently part of the OECD. A dedicated timeframe of one to two months was allocated exclusively for the procurement of data from a multitude of online databases. Following a thorough investigative process, seven member states were omitted from the detailed analysis due to insufficient data availability and their negligible advancements in digital traceability. These nations include Luxembourg, Estonia, Mexico, Slovenia, Turkey, Costa Rica, and the Czech Republic.

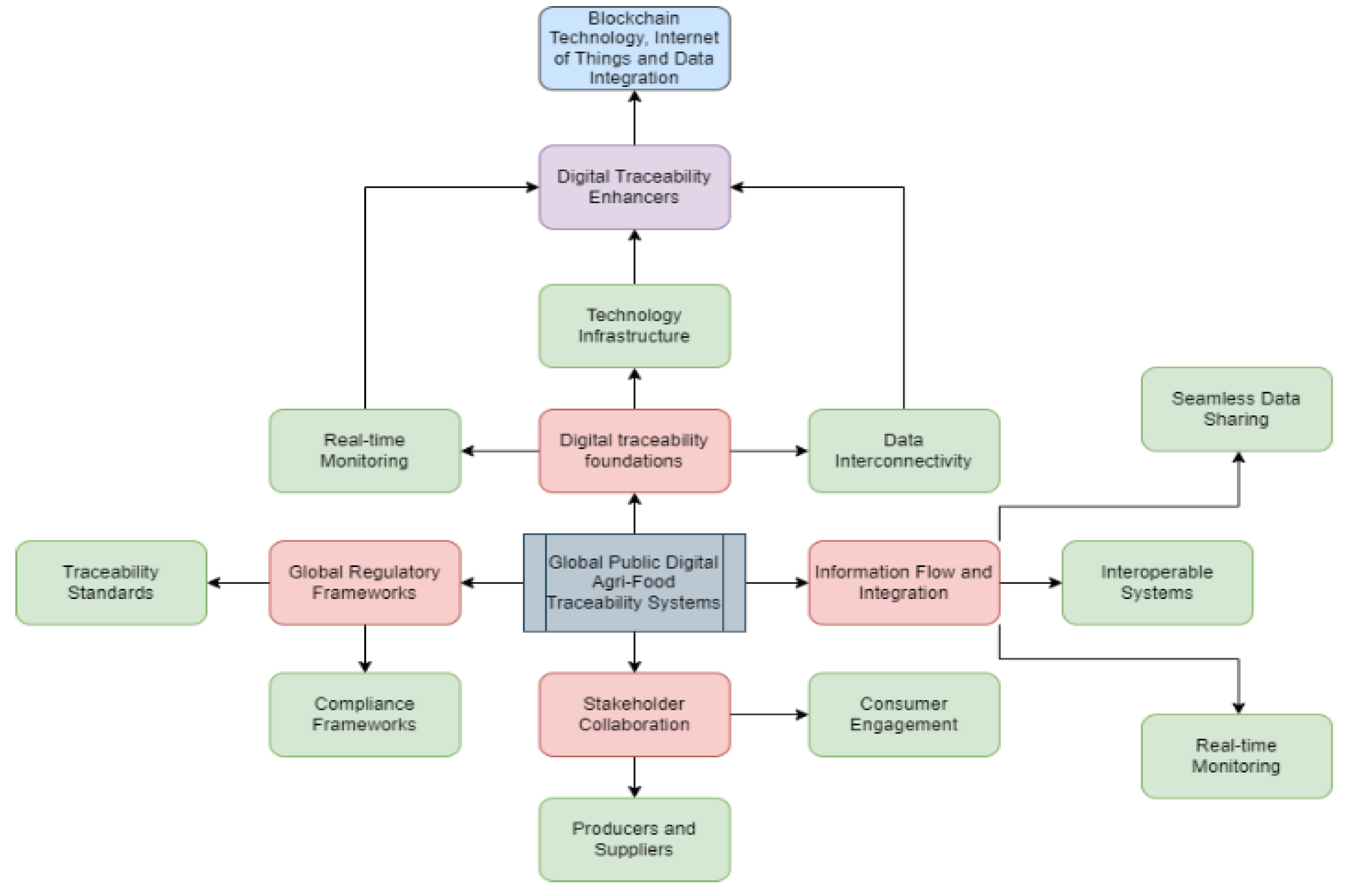

The inception of this research was marked by a detailed literature review, leveraging data from secondary sources. The corpus of resources amassed for this study was derived from authoritative sources, including official websites of national governments and regional organizations, alongside an assortment of secondary sources. These encompassed a diverse range of publications from esteemed outlets, not limited to academic journal articles, news articles pertaining to food and agricultural technology, government-sanctioned reports, and websites of international organizations. Furthermore, the investigation also included resources from the websites of private technology firms actively engaging in digital traceability efforts. Predominantly, the materials employed in this study were of recent origin, concentrating on literature published post-2015, thereby reflecting the endeavor to present the most contemporaneous insights and analyses. An unconventional source of information comprised podcasts, which offered additional data on certain countries. The gathered materials were subjected to a stringent review process, culminating in the creation of an evaluative matrix incorporating six critical questions. This matrix was instrumental in conducting a thorough comparative analysis of the digital traceability landscape within the OECD member states. In essence, the research methodology entailed meticulous investigative, data analysis, and assessment techniques to collate information regarding the countries and to delineate the progression of OECD member states in digitalizing the agri-food sector. Furthermore, a conceptual framework was developed to encapsulate the core elements of the overview, elucidating the key terms delineated in the study and the stakeholders involved in the entire process.

Figure 1.

Global Public Digital Agri-Food Traceability Systems.

Figure 1.

Global Public Digital Agri-Food Traceability Systems.

3.1. Assessment Questions

The six questions formulated to assess the digital traceability status within the OECD were devised with consideration of the rules, regulations, and the practical implementation of this concept. Subsequently, in the following section, titled 'Rationale for Metrics,' these questions will be presented along with explanations outlining the rationale behind the development of each question. The formulation of these questions stems from a strategic yet comprehensive way to analyze the digital agri-food supply chain. They will also provide a clear idea on the progress of each OECD member country within the realm of digital food traceability and its implementation in the regional framework both voluntarily and involuntarily.

Table 1.

Assessment Questions.

Table 1.

Assessment Questions.

| 1. |

Are there specific and well-defined digital traceability regulations or policies established at the national or regional level? |

| 2. |

What are the guidelines and practices regarding digital traceability when it comes to imported products? What are the practices involved in that? |

| 3. |

To what extent is the regulatory authority responsible for overseeing digital traceability regulations? |

| 4. |

In instances where there exist no mandatory regulations, are there voluntary digital traceability practices or industry-driven initiatives that have been adopted? |

5.

a)

b) |

Within the agri-food supply chain of the country, which specific products or commodities are subject to digital traceability regulations and monitoring?

What forms of digital identifiers or codes are employed for the purpose of tracking and registering imported products within the digital traceability system? This may encompass digital barcodes, RFID codes, or other such identifiers.

Does the country maintain an electronic database system dedicated to monitoring imports and exports, inclusive of their respective digital traceability data? |

| 6. |

What specific digital traceability information is provided on product packaging labels to empower consumers with insights into the product's origin and its journey within the supply chain? |

3.2. Rationale for Metrics

The following are the reasons why each metric was chosen since each of them comprehensively covers the arena of agri-food traceability in terms of digital initiatives taken. These questions will be holistically answered in the analysis section. Not all countries would have data on the questions but overall the goal would be to answer these questions in the country assessment.

Are there specific and well-defined digital traceability regulations or policies established at the national or regional level? This question aims to ascertain the existence of mandatory digital traceability regulations for domestically produced food items and their comprehensiveness across different product categories within each OECD country. The presence of such explicit regulations at the national level can aid in evaluating the amount of progress the member country has achieved throughout its digital traceability agri-food journey.

What are the guidelines and practices regarding digital traceability when it comes to imported products? What are the practices involved in that? This question explores the digital traceability regulations concerning imported food products, highlighting any distinctions from regulations applied to domestic items. It incorporates the different documentation requirements, technological identifiers and stakeholders that are involved in maintaining the digital traceability regulations across the border.

To what extent is the regulatory authority responsible for overseeing digital traceability regulations? The intention of this question is to assess the foundational strength that the regulatory body has within a country to ensure that it is part of the refinement of the national digital traceability framework. This metric aims towards providing an insight on how much discretion does the regulatory authority have in terms of managing regulations for digital traceability. There could be one regulatory entity or even multiple ones which are tasked with the enforcement of legislative guidelines for the matter.

In instances where there exist no mandatory regulations, are there voluntary digital traceability practices or industry-driven initiatives that have been adopted? This question investigates the presence of voluntary digital traceability initiatives in countries without compulsory regulations, acknowledging the significance of such voluntary efforts in enhancing food safety and quality. It also provides an overview of the responsiveness the country has towards the issue as well without the incorporation of the regulatory mandates a country has towards digital traceability.

Within the agri-food supply chain of the country, which specific products or commodities are subject to digital traceability regulations and monitoring?

- a)

What forms of digital identifiers or codes are employed for the purpose of tracking and registering imported products within the digital traceability system? This may encompass digital barcodes, RFID codes, or other such identifiers.

- b)

Does the country maintain an electronic database system dedicated to monitoring imports and exports, inclusive of their respective digital traceability data? The purpose of this metric is to encompass the scope of digital traceability by determining which products fall under the umbrella of the regulations put forth by the government and regulatory authorities. It provides an insight into the kinds of technology that are employed throughout the process. It also explores the adoption of electronic database systems for managing agri-food data, including the origin and identification information, and assesses the extent to which international trade is facilitated by this digital system.

What specific digital traceability information is provided on product packaging labels to empower consumers with insights into the product's origin and its journey within the supply chain? This question examines the regulatory requirements regarding information provided on product packaging labels, emphasizing the role of labels in empowering consumers, retailers, and regulatory entities to track product origin and detect any issues. The rationale behind this metric lies in recognizing the significance of comprehensive and accurate labeling which is a key factor in digital traceability.

4. Country and Regional Assessment

4.1. European Union

The EU having 22 OECD member states is quite focused on digitizing their continent. While all the member states will be talked about individually, it is crucial to see what regulations and initiatives the EU has taken to cohesively cover this notion of agri-food traceability across its countries. The whole arena is a multi-faceted system that encompasses various initiatives, platforms, and technologies that are aimed towards ensuring food safety on all imports and exports (European Commission, 2023). The primary digital system used by the European Union to improve the traceability of live animals and animal products both inside and outside of the EU is called TRACES (Trade Control and Expert System). TRACES ensures that these commodities meet EU health and safety regulations by offering an efficient and transparent way to follow their travel through the use of cutting-edge digital technologies (European Commission, 2023). The integrity of the EU food chain and the reduction of the danger of disease transmission depend on this digital traceability. TRACES is an indispensable resource for government agencies, corporations, and individuals seeking to protect the health and safety of animals and food by offering up-to-date statistics and a vast database of information (European Commission, 2023). Moreover, one of the major embedments in the EU framework is the Food Security Index. It lays a global foundation, and the EU has layered upon that by strengthening the agri-food sector by digital traceability. One such example of doing that is legally mandating an electronic certification for the agri-food products when being imported and exported (Economist, 2022). This system ensures that all food products adhere to the regulatory standards and all the information is found in a shared database. In tandem with these efforts, the Joint Research Centre of the European Commission developed a traceability and big data platform (Tomic, 2019). This platform acts as a centralized resource for stakeholders in the agri-food sector across the EU and provides a plethora of tools, and practices geared towards incorporating big data analytical systems into traceability systems apart from the paperwork too. Another critical component in the drive for a sustainable food system is the EU's Farm to Fork Strategy (European Commission, 2020). This strategy outlines a comprehensive roadmap that includes a variety of measures targeted at improving food traceability and transparency, with a focus on using the potential of digital technology. Furthermore, the AgriDataSpace project is a collaborative effort aimed at building a common (AgriDataSpace, 2023). These technologies have the potential to greatly improve traceability throughout the food supply chain, resulting in a more sustainable food system. This sentiment is shared by the Titan project, an EU-funded initiative that intends to create a decentralized platform that promotes effective data sharing among various parties in the food supply chain. Regulation (EC) No 178/2002, also known as the General Food Law, is one of the fundamental legal frameworks that govern digital traceability in the EU. This regulation specifies the broad principles and requirements of food law and outlines the traceability duties of food and feed industries (European Commission, 2023). It requires food industry operators to be able to identify and trace every actor in their supply chain, from producers to processors, distributors to retailers. This traceability must be maintained by digital records, which allow for prompt and precise information retrieval in the event of a food safety incident. Furthermore, the Regulation (EC) No 852/2004 on food hygiene is a vital piece of legislation that requires traceability in the food business (European Commission, 2023). This rule necessitates the establishment and maintenance of a traceability system capable of properly identifying and tracing food products at all stages of production, processing, and distribution (European Commission, 2020). The traceability system must be backed up by digital documentation that guarantees all necessary information is easily accessible for inspection by appropriate authorities (Economist, 2022). Overall, the legal landscape of the EU combined with the private initiatives being taken in the region pave the way for future technologies that can further ease out the complex agri-food supply chain (European Commission, 2020).

4.2. Australia

Having invested heavily in agricultural traceability, Australia has begun major efforts to increase digitization of the sector. Australia's Department of Agriculture, Water, and the Environment has taken several initiatives to enhance digital traceability in the agricultural sector (Australian Government, 2023). This was undertaken by the National Agriculture Traceability Grants Program, which focuses on regulatory technology (RegTech) to improve digitalization in traceability and food safety. Firstly, the Agrifood Connect Trace2Place mapped the red meat supply chain, allowing for the traceability of products within the supply chain in real time. Additionally, the Commonwealth Scientific and Industrial Research Organisation enforced a digital exchange system to streamline data collection in the red meat supply chain, acting as a risk assessment tool for red meat processors. FreshChain Systems Pty Ltd enhanced features on its traceability platform, allowing for its application to food safety. Another project funded by the program includes the investment into Horticulture Innovation Australia Limited, an initiative which utilizes the RegTech framework in horticultural supply chains. Another mainline initiative involve Meat & Livestock Australia Limited, which has adopted an Australian AgriFood Data Exchange to enhance compliance in the supply chain through a cloud-based platform (Australian Government, 2023). Other mainline initiatives involve initiatives which digitize farmer dairy and rice projects, as well as university led efforts. These practices have reflected upon Australia's commitment to digitization in the sector, ensuring a transparent, efficient, and secure food supply chain. As for privatized initiatives, Melons Australia, a local Melon producer, partnered with Freshchain to adopt digital traceability on their melons back in 2021 (AgTrace Australia, 2023). The successful initial trials in 2022 laid the foundations for the plan to kickstart, however, no updates have since been made. Australia has also incorporated an internal system for tracking Australian imports and exports (Australian Government, 2023). This is characterized by an electronic certification system named eCert that allows government agencies to internally exchange certificates on imports and exports (Australian Government, 2023).

4.3. Belgium

Belgium’s digital traceability practices are primarily based on EU led initiatives. Through the EU, Belgium has been able to track its beef steak as well as its orange food products. It is unclear, however, what exact technology is used but a QR code is provided on these food products (Food Safety - European Commission, 2007). In digital food safety, SGS Belgium, a private multinational world leader in testing and inspection services, partnered with technology company Eezytrace to offer an integrated approach to food safety management (SGS, 2023). This partnership offers a digital platform to automate all food safety control activities by employing a data analysis system which streamlines the process of food inspection in Belgium (SGS, 2023). They are currently looking to partner with food service brands and franchises to provide food safety and protect consumer health. With regards to policies, Belgium follows those of the EU’s.

4.4. Canada

The Government of Canada has adopted digitization in food safety by investing heavily into an already robust and effective regulatory system. Recent funding will allow the expansion of digital services, thus creating benefits for importers and exporters in risk management and inspection. Although digital traceability has been recognized by the Government of Canada as an avenue for advantage to the current agri-food system, its use is not widespread in the country as of yet. According to the Digital Identification and Authentication Council of Canada (DIACC), this can be attributed to the lack of funding and regulation that support such initiatives, as well as the lack of farmer adherence to new technologies (Government of Canada, 2023). Moreover, no current traceability regulations or related policies involve digitization in the sector. Despite the fact that Canada to-date has not adopted digital traceability in the agri-food industry, there are certainly some signs that that may change. This is attributed to the fact that the country already has a rigid traceability system and regulations, and that it has digitized traceability in other sectors such as the steel supply chain (LedgerInsights, 2020). Moreover, the country does take part in the GS1 global system of standards for digital safety. Within GS1 Canada, there is the Canada Digital Adoption Program which helps support the digital transformation of businesses (GS1CA, 2023). Thus, there is potential for Canada to digitize food traceability. As for industry-led initiatives, The Consortium of Parmigiano Reggiano recently partnered with Kaasmerk Matec and p-Chip Corporation to launch a digital identifier for its Parmigiano Reggiano cheese wheel product (Food in Canada, 2023).

4.5. Chile

Chile has a unique effort in the realm of digital traceability in the agri-food sector, characterized by American private company Shellcatch, which provides an integrated traceability solution of Chilean seafood produce (Shellcatch, 2023). It does this through the use of vessel, coastal, and scale cameras, all of which all feed information to a Cloud-based eMonitoring system (Shellcatch, 2023). This system collects, analyzes, and manages data with the help of AI, and is supplemented with a mobile app which provides full transparency for consumers regarding the catching process of local seafood produce (Shellcatch, 2023). Shellcatch operates as a Business-to-Business venture, allowing 1,000 fishermen across small, medium and large companies to access their database (Shellcatch, 2023). Through Shellcatch, these companies can provide full transparency with their fishing practices to end consumers. Typically, QR codes are provided on products as digital identifiers, which upon scanning, bring consumers straight to the database where they find full information on seafood products (Shellcatch, 2023). Although Shellcatch works with government bodies and the NGO sector, funding efforts reported are solely from private investors. Besides that, there is little to no efforts in digital traceability in Chile, along with no reported guidelines or policies.

4.6. Colombia

Due to the lack of network coverage in rural areas in Colombian agriculture, digital extension to farms is an issue for traceability in the entire supply chain. This is highlighted by the fact that only 30% of households in rural areas have access to internet (OECD Library, n.d). Despite this, Colombia is still able to digitize the traceability of one of their landmark foods: coffee. Being the world's third coffee producing country globally, Colombia has implemented several government led initiatives to help trace Coffee production. Specifically, the Coffee Information System (Sistema de Información Cafetera or SICA), run by the non-profit organization Colombian Coffee Growers Federation, is an information-based database whereby the profiles of coffee growers and their farms are presented (Federación Nacional de Cafeteros, n.d.). The private database offers transparency in the coffee production supply chain to key stakeholders in coffee production. Although Blockchain was shown to be effective in the digital traceability of coffee in an exploratory study, researchers found drawbacks to coffee production in Colombia which may explain why the technology has not been locally adopted (Díaz et al., 2022). Specifically, the manual labor by coffee growers and farmers is rarely shared or concerted, making it troublesome to have information integrity on the chain. Recently, however, digital startups in Colombia have begun to take their place in the agri-food industry. Curuba Tech is a private startup focused on implementing platforms which help connect Colombian farmers with experts by digitalizing the agricultural sector (Curuba Tech, 2023). This, as a result, will connect the agrifood chain, creating a digitally traceable supply chain. Since it is quite new, Curuba Tech is yet to implement this solution and has deemed it as still in progress. It is notable to note that Trusty, an Italian innovative traceability platform, has onboarded cacao and coffee producers in Colombia for their platform (Trusty, 2023). In terms of digital traceability guidelines, they are currently non implemented by Colombian government bodies.

4.7. Denmark

Despite being considered a highly digitalized country, Denmark remains several steps behind in the investment of start-ups and initiatives in the agri-food industry. Although the need for digitization was recognized and emphasized in 2020 by the Danish Growth Fund, a state-governed investment fund, no initiatives have kickstarted since (Enterprise Europe Network, 2021). Arla foods, a Danish-Swedish dairy producer, produced major digital traceability initiatives in Finland, however, remained silent in Denmark. With regards to regulations and policies, Denmark closely follows the legislation set out by the EU.

4.8. Finland

Finland’s national efforts towards digital traceability are primarily industry based, as digitization initiatives in the agri-food sector have commenced by local companies. These initiatives go back to 2018, when Arla Foods in Finland employed blockchain technology to provide information on its supply chain (Arlafoods, 2018). At the time, they were the first in the dairy field to use blockchain technology. Their pilot project was termed “Arla Milkchain” and allowed consumers track the origin and production of the company’s milk products (Arlafoods, 2018). Additionally, in 2019, AI was implemented to give consumers up-to-date information on animal welfare. The initial success of the system drove Arla Finland to add more dairy products onto their technology for traceability in 2021 (Arlafoods, 2018). In the same year, the company announced their efforts in increasing the automation within the blockchain technology through the use of IOT throughout the supply chain . Another major industry-led initiative was by Finnish meat manufacturer, HKScan (Mtech, 2022). Through their recently proposed partnership network, they aimed to improve digital traceability in meat supply chains through operating models. However, the details of these models are unclear, with a lack of information provided regarding the digital hardware and software that is used (Mtech, 2022). Nonetheless, this partnership network had high hopes according to Esa Wrang, head of the official government-funded food program at Food from Finland, who stated that “Finland has the potential to be the first country in the world to have a fully transparent, safe and responsible food chain.” (Mtech, 2022). Unfortunately, since 2021, no updates have been provided on this initiative. One publicly funded initiative involving Finnish researchers from Aalto University recently tried a blockchain-backed app that offers insights into the impacts of certain foods (Ferrer, 2022). Researchers highlighted the use of the app in the integration and transparency of food. This study was part of the EU-ATARCA project, an EU-funded initiative (Ferrer, 2022). Finland follows the digital traceability guidelines and regulations set out by the EU. In all, Finland has recognized the benefits in utilizing digital technology for food traceability and have kickstarted industry-driven initiatives for their 2 most consumed food products, meat and milk.

4.9. France

Given that France is a major producer of agricultural products and also a big consumer of food in the EU, digital traceability is crucial in maintaining transparency across its supply chain. France solely has industry driven initiatives in the digital traceability of the agri food industry. Connecting Food is a private French startup that uses blockchain technology to track and digitally audit imported and exported food products in real-time (ConnectingFood, 2023). It collects data from various parts along the supply chain, including producers, manufacturers, and retailers and links it all together forming a robust digital traceability system (ConnectingFood, 2023). The company uses a digital identifier in the form of a QR code for consumers to track food products. Connecting Food deployed its technology to a range of companies, including Herta, a multinational meat production company, as well as Ingredia Dairy Experts, a French producer of dairy products (ConnectingFood, 2023). Another initiative is by private French retailer Auchan, which rolled out digital traceability in France after their partnership with Te Foods, a Vietnamese specialist in digital traceability (Auchan Retail., 2019). Through the use of their blockchain technology, Auchan implemented digital traceability in France to provide transparency regarding vegetable products, including organic and potato ( Auchan Retail., 2019). The company also has launched digital traceability in its exported products, such as tomato, carrot and chicken. With this technology, French consumers are able to scan digital identifiers in the form of QR codes to view food history through the supply chain (Auchan Retail, 2019) Another major initiative involved French grocery giant Carrefour, which used IBM’s blockchain technology to track items in its supply chain system (CarreFour 2018). The platform allows consumers at Carrefour stores to digitally track its own chicken brand and microgreens through the use of a QR code attached to the product (CarreFour 2018). As for rules and regulations surrounding digital traceability, France simply follows those set out by the EU.

4.10. Germany

Besides those of the EU, Germany has nation-specific initiatives in digital traceability of the agri food industry. In 2019, the Government set an initiative named the SiLKe project to adopt a safe food chain based on block chain technology (SiLKe, 2023). This 3 year long project, which commenced in 2022, made a strategic plan to enable stakeholders along the entire value chain to share the data, thus allowing consumers to access such information (SiLKe, 2023). This strategy is outlined in Figure X and is currently being used in the German food supply chain. The SiLKe project involved partnership with 7 research and industry firms to work together and propose solutions (SiLKe, 2023). As for policies, Germany follows the various rules and regulations set out by the EU.

4.11. Greece

Although many research papers have outlined the importance and produced strategies for the adoption of a digital traceability system, especially with Greek meat, Greece currently does not have any specialized initiatives or follow any guidelines besides those of the EU (Bosona & Gebresenbet, 2023).

4.12. Hungary

Hungary currently has no initiatives or planned initiatives in improving the digitalization of food systems. However, they do plan to generally adopt digital systems in the agricultural sector (Netherlands Enterprise Agency, 2022). Being an EU member, Hungary aims to utilize the digital programme set by the EU to improve digital technology usage and follow the EU guidelines and policies regarding traceability. Specifically, they strive to use EU data space, AI testing facilities, and digital innovation hubs in order to develop a digitized system in agriculture (Netherlands Enterprise Agency, 2022).

4.13. Iceland

Icelands measures in digital traceability are limited. In 2018, Nordic IT service provider Advania reached an agreement with Matís Iceland, a government owned food science research company, to utilize blockchain technology to trace Icelandic lamb production from farmers (Cision, 2018). However, no update regarding the progress of the project has been provided ever since. Despite not being part of the EU, Iceland is in the Rapid Alert System for Food and Feed (RASFF), a platform which allows for the exchange of information between European countries regarding the food chain (Cision, 2018). Iceland's regulations regarding food safety involve all non-digital policies.

4.14. Ireland

Ireland has recently begun contributing to research initiatives to adopt digitization of supply chains in the agri-food industry. The Department of Agriculture, Food and the Marine (DAFM) kick started these initiatives in 2022 when they invested over €1 million in the European Research Area (ERA) Network for Information and Communications Technology (ICT) Agri-Food (Government of Ireland, 2022). This initiative aimed to bring many key researchers together in the agri food sector, including primary producers, small and medium-sized enterprises, retailers, consumers, and public policy makers in order to drive the embracement of digital agri-food systems. A year later, in 2023, DAFM spent over just over €0.5 million towards 2 projects in the ERA Network for ICT Agri-Food (Government of Ireland, 2023). Researchers at the University College Dublin and the Munster Technological University were given these funds to examine AI applications for farming, and ICT for traceability in food (University College of Dublin, 2023). The Minister, Martin Heydon said “The research being supported in the area of agri-digitalisation, particularly the use of artificial intelligence, is also exciting and has the potential to transform our agri-food systems to become more efficient, sustainable, and resilient.” (Government of Ireland, 2023). All of the funding towards these initiatives are part of Food Vision 2030, Ireland’s ten year strategy to become a world leader in Sustainable Food Systems (Government of Ireland, 2023). One key part of their mission involves fully embracing the digital revolution to provide improved food system transparency for Irish natives. Being a member of the EU, Ireland follows similar policies and regulations surrounding digital traceability.

4.15. Israel

Israel’s efforts in digital traceability stemmed from a rapid response to the COVID-19 pandemic in 2020. Initiatives solely involve industry-led efforts from Brandmark, a joint venture between Israeli-based venture capital company Blackbird Ventures and Japanese technology giant Emurgo Ltd (Solomon, 2020). This company provides consumers information regarding food products journey throughout the supply chain through the use of Blockchain technology. Brandmark has a diverse clientele of large fast food chains and producers in Israel, including McDonald’s, Nestlé S.A., Burger King, Angel Bakeries, and various Indonesian coffee producers (Solomon, 2020). Brandmark uses an app platform to provide consumers information about the food products quality, origins, conditions, freshness, and expiration date. This is done through the use of a barcode which is provided on each of the verified food products. Brandmark works in cooperation with Israel’s government bodies including the Ministry of Science and Technology; Ministry of Agriculture; and non-profit organization’s to ensure the food security of their client’s products (Solomon 2020). Despite this being a major initiative for Israel in digital traceability of the agri-food industry, no updates regarding its progress have been provided since the 2020 calendar year. To date, Israel’s regulations regarding food safety involve all non-digital policies.

4.16. Italy

Current practices in Italy are characterized by those that are industry-based for local products. Trusty is a platform developed by private software company Apio srl that uses Blockchain technology to certify information regarding food products through the supply chain. The platform has numerous partnerships with local food brands which use its technology to provide consumers with accurate data regarding the products journey throughout the supply chain. For their digital identifier, they have also created customized and regulated smart-labels to be placed on food products. Trusty has strong partnerships with key figures in the Italian agri-food industry including but not limited to: GS1 Italy, ICC Agri-Food Hubs, and the ABC Abruzzo BlockChain program. Notably, the Abruzzo BlockChain program, an Italian platform which allows companies to generate a digital authenticity certificate outlining the entire history of a product, highlighting all steps of production. Another Italian digital platform called Trackyfood is an integrated technological solution for the food sector supported by blockchain technology. The platform allows for traceability, quality, and security certification for numerous products in the food chain. This technology was used in many leading “Made in Italy” companies, and serves as a partner for various food producers, large-scale distributors, retailers, and consumers. Other industry based initiatives involve Italian producers and retailers collaborating with technology companies. Notably, Barilla Group, an Italian multinational food company and the world's largest pasta producer, is a leader of digital technology use in the agri-food industry through embracement of their IoT platform. As early as 2015, Barilla has partnered with multiple multinational information technology (IT) service providers to implement multiple digital traceability initiatives for their products. These products consist of pasta and their tomato sauces. They began their initiatives by piloting the Safety4Food platform, which involved partnership with Cisco and NTT Data to trace each step of the supply chain for its food products. This platform combined a variety of digital technologies, forming a network of sensors, wireless networks, and the cloud with analytics to enable this transparency. For consumers, a QR code was provided on its food products which directed them to Barilla’s website where they were able to examine a detailed digital passport. This passport outlined each stage of the supply chain for the product, allowing for full traceability. Barilla also partnered with IBM Italy to enforce blockchain technology on its branded pesto sauce. Specifically, they inserted all the data related to the cultivation, watering, and application of basil plantations into blockchain based on the IBM cloud infrastructure, allowing for full traceability of their Basil product. As a result of their advancements in improving digital food traceability in the Italian agri-food industry, Barilla received the first ever Blockchain Award in 2019. Another industry-based initiative involved Spinosa, an Italian producer of cheese, which used blockchain technology to certify the Protected Designation of Origin (PDO) of its Buffalo Mozzarella product. PDO designation allows for traceability of the product at every single stage of the certified supply chain, with a full blockchain label and QR code for the product. Furthermore, Almaviva, an Italian IT service provider, enforced blockchain technology for numerous “Made in Italy” food products, such as Wine and Sicilian red oranges. These products were labeled with smart labels such as Near Field Communication (NFC) and QR Codes, which led to data regarding the source, date of harvesting, and the distribution methods of local food products. In all, Italy’s efforts in digital traceability in the agri-food industry consists solely of industry driven initiatives. As for its policies and regulations surrounding digital traceability, Italy strictly follows those set out by the EU.

4.17. Japan

After extensive research, it was found that Japan does have stringent market requirements and quality standards when it comes to food safety norms. The rise in digital traceability in Japan was sparked by an outbreak of the Bovine Spongiform Encephalopathy also known as ‘mad cow disease’ in the early 2000s (Setboonsarng, 2009). A key digital component in response to that was the development of the Individual Identification Register system (Setboonsarng, 2009). This digital system was launched by the government and it used unique 10 digit identification numbers to each calf, along with an ear tag. This electronic system tracked vital information such as the calf’s birth date, breed and even the shipment details when exported. While this system is just for beef, Japan is trying to extend its digital traceability to other food products too. The government in collaboration with private companies has been making concerted efforts to integrate the advanced information and technology in the agriculture sector. The regulatory authority mostly responsible for this is the Ministry of Agriculture, Forestry and Fisheries (MAFF) (IDIAF, 2008). Since 2001, there have been a number of pilot projects undertaken and the country has spent about 10-20 million US dollars for a number of initiatives but only a few were actually adopted. These included integrated circuit tags to reduce the cost of reading unique codes of food products in the supply chain, usage of handheld devices instead of paper documentation to record products and web based service technology to keep and transfer data between server computers in trade through the Internet. Despite the large investment in digital traceability, the government and regulatory authority realized that the budget and time allocated to this arena was insufficient (IDIAF, 2008). MAFF does try to incorporate ICT in Japan’s food traceability system but for the short term it is mostly ensuring traceability through conventional paper documents except for their robust beef electronic tracking system. Outside of the supply chain, in terms of consumer assurance, Japan is fairly progressive. To build consumer trust, Aeon, a company based in Japan which really builds consumer’s trust by having RFID technology and barcodes so that consumers can easily access the food supply journey of the product (Clemens, 2023). They, like the government and the regulatory authority, have more focus on beef. For example; the company provides certificates and point of sale information, assuring the buyers that the beef meets safety standards and is free from genetically modified feed materials (Clemens, 2023). Overall, the country has started to incorporate more digital elements towards its agri-food supply chain but cannot be said to be extremely progressive and an example to follow since there are certain barriers it has to overcome in order to be technologically advanced in digitizing its traceability sector.

4.18. Korea

South Korea has begun to adapt to blockchain technology to tackle the issue of digital food traceability, specifically beef. The country has launched a joint initiative between the Ministry of Agriculture, Food and Rural Affairs and the Ministry of Science and ICT which focuses on electronically tracing beef throughout the supply chain (Asia Blockchain Review, 2019). While Korea utilizes blockchain technology and has electronic based systems in other sectors; the agri-food sector is still on the way to be revolutionized completely. In addition to the steps taken by the government; major companies within the country have also formed partnerships for enhanced digital food traceability (Insights, 2019). An example can be of the Korea Telecom and Nongshim Data System example where the aim of the project was to make agricultural produce and processed foods digitally traceable. The aim of the project was to leverage KT’s 5G blockchain network, GiGa Chain Blockchain as a Service and NDS’s experience in this field (Insights, 2019). The platform had two major benefits. One being the costs cut by producers due to automated processing, and contracts being verified electronically for food. The second one being a QR code being available for consumers to scan in the supermarkets. Moreover, the company has also planned to develop a global digital traceability system to track halal food specifically which has to be produced from Islamic law (Wood, 2020). KT and its partners will be digitizing the halal certificates and adding a QR code to the food product to verify its status (Wood, 2020). While these initiatives are meant to be tested out globally; it shows the dedication of Korea towards minimizing human labor and tailoring it towards digital food traceability (Wood, 2020).

4.19. Latvia

Latvia comes under the smaller European countries and it mostly follows the rules and regulations set up by the European Union. The digital traceability system that Latvia itself has initiated is fairly new based on the literature that was found (Riekstins, 2020). It started from 1st June, 2018, when the fisheries products traceability module was embedded into the Latvian Fisheries Integrated Control and Information System. This program is controlled by the Ministry of Agriculture in Latvia (Riekstins, 2020). This system involved QR codes on the fish products which provides the mandatory information on the fisheries product and its origin which is available all the way from the operators to custom clearance and to the customers using the mobile application associated with this (Riekstins, 2020). This system is more prominent in Latvia’s fishery industry and other commodities are starting to incorporate that too (Riekstins, 2020).

4.20. Lithuania

Lithuania, being another EU member has an economy where agriculture plays a significant role has been categorized as a country with a huge potential to become the leader in AgriFood Tech Solutions (EIT Food, 2023). There is an EIT Food Hub in Lithuania called the AgriFood Lithuania DIH which is working towards incorporating AI and distributional block chain systems in the country apart from the EU regulations that it follows (EIT Food, 2023). They also have initiated a Food RIS Consumer Lab which aims to promote not only the development of new products but also on how to make sure consumers are more aware of the products that are exported and imported. While the country has begun to take action and pave the way for digital initiatives; it still hasn’t embedded other policies in its framework besides following the strict mandates that the EU has taken (EIT Food, 2023).

4.21. Netherlands

The Netherlands has strict rules and regulations with regards to digital food safety and traceability; many being the EU’s standards. While the country does take part in the GS1 global system of standards for digital safety; it also has its own organization known as the (NVWA Nederlandse Voedsel-en Warenautoritiet) which actively works towards the digitization of the agri-food sector (Ministry of Agriculture, 2023). This chapter from the government as well as the Ministry of Agriculture, Nature and Food Quality introduced the e-CertNL system. This electronic system aids in the issuance of export and health certificates for agricultural products. It is the official application for Dutch exporters to verify the authenticity and validity of the goods (Ministry of Agriculture, 2023). This change in the region grew from the issues it faced in the mid 2000s with regards to salmonella and the ‘sick cow’ disease which indicated a need for a more effective traceability system. Local initiatives that the government has funded have initiated the use of blockchain technology within the agri-food sector. Albert Heijns, the biggest supermarket in the Dutch World recently introduced blockchain technology in the orange juice supply chain (Morris, 2018). This implementation allows customers to trace the journey from the farms in Brazil to how they reach the supermarkets in the Netherlands. Each bottle of the juice comes with a QR code which when scanned showcases the detailed information about its origin (Morris, 2018). This falls under the industry-driven initiatives which serve as voluntary practices to make the supply chain experience better (Morris, 2018). This nation also utilizes GS1 standards and involves the global standardized barcodes and RFID tags. While the nation is one of the leading exporters in terms of agri-foods, the majority of its digital food safety comprises the plans adopted by the EU.

4.22. New Zealand

New Zealand’s agricultural industry does have a good reputation of being at the forefront of technological innovation. While the main kind of regulation in terms of certifying food products and ensuring their safety still relies on heavy paperwork, the country is moving towards digital methodologies for traceability (Siegner, 2018). A traceability system developed in New Zealand uses QR codes so that consumers with smartphones can easily access the history of the source or the status of the item (Siegner, 2018). The company IDlocate is relatively a new product that is an electronic database driven tool which generates particular URLs for each food product. The country specifically has an elaborate electronic beef supply chain traceability (Halliday, 2022). From the farm to the slaughter house, each carton of meat is currently achievable through barcodes, QR codes or even RFID transponders that are applied to the packaging. There are three key areas where blockchain is applied in the food supply chain; firstly in the whole life of the animal, secondly from the processor to consumer traceability and lastly the pasture to plate traceability for prime cuts (Halliday, 2022). It was observed that New Zealand was more particular about red meat traceability than others. The implementation of this kind of new technology by private industries was only achieved via government intervention. The NAIT (National Animal Identification and Tracing Act) scheme was introduced in 2012 which placed a legal requirement on livestock owners to appropriately tag animals and record their identities in the national electronic database (Siegner, 2018). Currently, the government is seeing the development of government-proposed integrated farming planning which targets the agri-food industries to have a shared electronic blockchain driven database (Ministry of Agriculture, 2023).

4.23. Norway

Norway faced an E-coli outbreak in food in 2006 and ever since then, it has been on the move towards digital traceability in its food supply chain. In response to that, the Government introduced the Norwegian eSporing Traceability project (Askew, 2020). The pilot for this project included commodities like beef, grain, fish, and dairy products. This was fully owned by the Norwegian Ministry of Food and Agriculture, Norwegian Ministry of Fisheries and Coastal Affairs, and the Norwegian Ministry of Health Care and Services (Askew, 2020). It focuses on establishing electronic infrastructure for exchange of information in the food supply chain. The eSporing project has had a greater aim than the one step back/one step forward focus in the food value chain. The use of this technology was not a compulsory step the country had to take and falls under the voluntary participation (Askew, 2020). Then later in 2008, the International Business Machines (IBM) signed an agreement with Matiq, the subsidiary of Nortura which is Norway’s largest food supplier (The Poultry Site, 2008). This basically mandated the use of radio frequency identification technology to track the poultry products from the farm to the supermarket shelf (Foras, 2012). By using that software, the Norwegian industry was able to comply with the GS1 electronic product code standards. Another project that Norway took over was a cross country collaboration in 2020 that leverages blockchain to share the supply chain data across the country’s seafood sector (Foras, 2012). The blockchain network uses IBM Blockchain Transparent Supply which allows organizations to build out their own blockchain based system which is highly sustainable too. Norway has been way ahead of its times in terms of digital traceability and continues to embark on projects that are more digital rather than manual (OECD, 2023).

4.24. Poland

Overall, Poland complies with the EU regulations and requirements in terms of digital agri-food traceability. The initiatives taken by the country on its own for this arena, are little to none. While they are pretty strict on their food regulations, research indicates that most of their own system is mostly conventional rather than being digitized (Rucinski & Kobuzsynska, 2019). There are however startups and private companies which focus on enhancing the digital agri-food traceability (Rucinski & Kobuzsynska, 2019). Poland does not have its own well established digitized ways of tracking food in the supply chain but it rather adopts the EU’s main food traceability system (TRACES). The only place where an electronic system can be seen is the change of the country from paper based agri-food customs clearance to an electronic certificate. This eases the trade and also enhances food safety by having an electronic database system for trade instead (Rucinski & Kobuzsynska, 2019).

4.25. Portugal

Portugal’s path of digital traceability can be outlined by the adaptation of blockchain technology in its biggest supermarket, Auchan. Auchan implemented TE-Food’s traceability system (TE-Food, 2020). This voluntary collaboration with them initiated with a digital traceability system for its fresh salad and then will be implemented on the other agri-food products too. This initiative was sparked in 2018 and this improved ability for consumers to track their product in the country (TE-Food, 2020). While the rest of the mandates are mostly what the EU has in place, Portugal has indicated a broader shift in the agri-food and trading industry for a more digital approach to foster enhanced sustainability (TE-Food, 2020). Apart from private Portuguese industries taking initiatives, the government strictly follows the EU guidelines.

4.26. Slovak Republic

The use of technology to mandate food chains in the Slovak Republic is an evolving field. This country also has its national framework and policies regulated within what the EU entails. The country has however been proactive in terms of transparency through incorporating blockchain technologies in some aspects of its food supply chain (TE-Food, 2020). The TE-Food blockchain system which is the world’s largest publicly accessible solution to traceability was supported by the Slovakian government (TE-Food, 2020). It introduced the system of tracking the origin of food within the entire Slovak retail sector including the hotels and cafes too. While in-depth implementation strategies and plans are not known; the country did decide to partner up with the big blockchain company to introduce digitization in the supply chain.

4.27. Spain

In Spain, food production accounts for a substantial portion of the economy and hence food safety becomes a significant issue. The digital transformation in the agri-food sector in Spain is driven by the surge in Food Tech investments (FWS, 2023). The Spanish government dedicated around 1 million euros to enhance the digitalization, competitiveness and traceability. This was done via the approval of the strategic project for economic recovery and transformation (PERTE) (FWS, 2023). The biggest example of digital traceability in Spain’s supply chain is the usage of blockchain technology. In 2018, Carrefour launched its platform for traceability using that and it became the first of its kind in the country (FWS, 2023). Then, by the end of 2021, Navidul, Spain’s well-known ham company utilized blockchain for ham shoulders specifically and it involved all consumers to access the product’s information. Another company utilizing this was Signeblock which basically covered the tracking of cold meats. It also guarantees the Denomination of Origin and the source of the raw materials used in their chorizo with IGP certification (Signeblock, 2022). The IGP Sierra de Guadarrama is basically a certification established by the Spanish government to measure the food quality standards, especially for meat. This funding and commitment towards improving transparency really makes Spain stand out from the other European countries (Signeblock, 2022). Moreover, the government also promotes research and development on this narrative a lot and so has funded a number of startup companies that have developed innovative systems to do so. For instance, the company Digitanimal has developed an intelligence scale for the livestock industry which allows one to keep track of the animal health status. This ensures more digital food safety. Another company Nulab, in partnership with the country’s National Centre for Food Technology and Safety has developed a sensory technology that measures real time food quality and safety. This also includes hyperspectral technology which classifies raw material for determining the quality parameters in the agri-food products (Signeblock, 2022). There are other startups that include Mercatrace and Trazable, both which are companies that offer traceability from the source to the table using blockchain technology-backed platform called ‘Food Track’ (FWS, 2023). These startups enhance digital food safety domestically, ultimately leading to sustainable food production in Spain’s global food chain (FWS, 2023).

4.28. Sweden

Apart from the EU guidelines Sweden has introduced a national food strategy which aims to promote food safety, transparency and traceability (Government Offices of Sweden, 2023). Its vision for 2030 revolves around sustainable and innovative food chain policies that enable growth.In February 2016, the Government directly mandated the Swedish National Food Agency to promote digital innovation by making information in the food supply chain easily accessible (Langmoen, 2021). The government has set the milestone by introducing the concepts of digital ‘Product Passports’ in its plan to achieve a circular economy. Product passports will serve as tools to tell the consumer about the life cycle of the product (Wibeck, 2022). While the EU will officially pass this regulation soon, Sween is at the forefront of testing it out and coming up with novel solutions for digital traceability (Wibeck, 2022). The agri-food retail market the classic electronic barcodes are being use to identify a product in its supply chain but 2D codes will be implemented in the systems by 2027 which will serve as both traditional scanning at the checkout in retail as well as the consumers being to able to gain information about it via their smartphone (Government Offices of Sweden, 2023). The country has initiated it’s path towards digitization and does have a lot of potential to do more than just the EU guidelines.

4.29. Switzerland

Switzerland is very much at the forefront of incorporating digital traceability in the agri-food industry. The fTrace solution by GS1 Switzerland is a prime example of this. fTrace is an innovative traceability solution which answers a food product’s origin, processing and quality. One of the key features of this is its reliance on the GS1 global standards (GS1, 2022). It uses the Global Location Number which is used as its unique identification number in the international supply chain (GS1, 2022). The Global Trade Number on the other hand is used for ensuring consistency and the reliability of the data. Moreover, fTrace has advantages from using the Electronic Product Code Information Services (EPCIS) to record every event along the supply chain of the raw material. Every processing step of the product is stored in the cloud based fTrace database which reduces the time-consuming process of data collection and maintenance by retailers (GS1, 2022). This solution also allows consumers to gain an insight into the product by having a DataBar on the product which can be scanned by those who get the smartphone app. Moreover, Switzerland like other countries has partners with the food traceability firm TE-FOOD (Wood, 2020). The particular partnership happened between TE-FOOD and Migros, which is Switzerland’s largest supermarket. The plan is to store the information about the products in TE’s Hyperledger based blockchain database (Wood, 2020). This would be shared across all the Migros’ outlets so that it leads to a more sustainable food supply chain. Overall, Switzerland has already established digital databases to monitor agri-food products voluntarily and apart from the guidelines that have been set up by the EU (Wood, 2020).

4.30. United Kingdom

Digital traceability has been facilitated by a range of projects and initiatives in the United Kingdom. One such project is the Digital Sandwich Project. It was launched in 2020 and was given the award of £147 million to the winning applications in the UKRI Manufacturing Challenge (Government of the UK, 2023). This project aims to provide end-to-end visibility of the supply chain for sandwich ingredients (Digital Sandwich, 2023). It’s a major collaboration between multiple stakeholders including the academic, industrialists, government bodies and it truly resonates with the UK's commitment towards digital traceability (Government of the UK, 2023). It alongside many countries utilizes blockchain technology as well as integrated DNA technology to address a number of challenges that include; consumer safety and international supply chains (Digital Sandwich, 2023). The Food Standards Agency has also recognized the potential of blockchain for improving food traceability and has also invested in it to provide more transparency. It took part in three trial blockchain projects which were funded by the government (HM Government, 2022). They involved the beef supply chain, wine imports regulation and also pork traceability (Insights, 2021). In fact, with the formation of consortia like SecQual in recent years; the use of smart labels and digital IDs for products has really enhanced the farm to fork mindset (HM Government, 2022). To illustrate the usefulness of this technology, SecQuAL's inaugural project centered on the pig producing sector. Here, smart labels may keep an eye on things like temperature to make sure pork products are kept at the right temperature to keep them from spoiling (HM Government, 2022). Additionally, this data can be utilized to forecast the product's shelf life, giving consumers and retailers useful information. UK’s trade also involves a lot of digital components which make traceability more effective (Government of the UK, 2023). The UK has passed a number of regulations with regards to import and export activities and one of them includes the usage of the Defra Digital Assistance Scheme which allows traders and 3rd party software developers to share Export Health Certificates for livestock electronically (Government of the UK, 2023).

4.31. United States

The United States’ Food and Drug Administration department has taken a significant step towards digitizing the food supply chain. The FDA launched this 10 year plan in July 2020 to improve food safety (FDA, 2020). And so it has embarked on the journey towards a ‘New Era of Smarter Food Safety’ (FDA, 2020). Until recently the records involved in moving food through the supply chain were largely paper based and they still are. However, this initiative wants to make sure that the digital food safety culture transcends borders (FDA, 2020). The Food Traceability Rule was passed by the government to mandate this FDA Food Safety Modernization Act. It requires the manufacturing, processing, packing or holding of foods that are on the national Food Traceability List (National Archives, 2022). The FSMA rule basically outlines the commodities that need to be recorded and also the ones who are at high-risk to go through additional traceability regulations (National Archives, 2022). These records are stored in the national electronic database. When it comes to imported food products; they are subject to the same FSMA regulations and requirements as the domestically produced foods. Importers need to verify with the US food safety standards (Center for Food Safety and Applied Nutrition, 2023). While regulations like the FSMA and the Food Traceability Rule provide a solid framework for implementing digital agri-food traceability; there are a lot of companies that have adopted voluntary practices. These are mostly industry driven initiatives and consumer demand based commitments to transparency and food safety (Center for Food Safety and Applied Nutrition, 2023). Examples are of the produce traceability initiative and various mega companies like Costco, Wegmans, and even Walmart (National Archives, 2022). It can also be seen how the worldwide total investments in Agri Food tech companies have grown from just over 2 billion dollars in 2012 to 17 billion dollars in 2018 with about half of investments in 2018 around 8 billion dollars done by the US. This shows their commitment towards not only incorporating digital traceability in their own country but also encouraging other nations to adopt it (National Archives, 2022).