Introduction

Global maritime trade has grown rapidly in recent decades and has experienced relatively strong growth due to high demand for goods passed through by sea. In addition, over 80% of all trade is seaborne (Stopford, 2009; UNCTAD, 2015). Recently, maritime industries have evolved mainly to adapt to the evolution of maritime trade in terms of ship size, which has allowed a very large volume of containers to be shipped by sea. In the last few years, the average container vessel size has increased continually, from 400-1000 TEUs in 1960 to 7000-9000 TEUs in 2000 and 18000-20000 TEUs in 2015(loo & Hook, 2002; Shen, 2015). Maritime industries have played an essential role in supporting and encouraging the country’s development, according to the evolution of maritime trade with highly efficient infrastructure but also more efficient and modern terminals. Furthermore, maritime transport has promoted the growth of the industrial and transportation sectors of less developed countries in Africa, representing great support and facilitating imports and export trade between countries. In recent decades, it has been one of the most widely used means of transporting goods by sea, due to its efficiency in carrying out very large tonnage shipments at very low cost.

According to data from the United Nations Conference on Trade and Development (UNCTD) international trade has seen international shipping gradually decline, representing a fall in the international economy since the crisis in 2008, as well as total global economic output, which has declined by 3.5 percent with a 5.4 percent drop in merchandise trade. In 2020, maritime trade volumes were impacted by the COVID-19 pandemic, but fell less dramatically than expected, and rebounded by the end of the year, but still ended the year down by 3.8 percent, or 10.65 billion tons (UNCTAD, 2021). By mid-April 2020, nearly 90 percent of the world economy had been affected by some form of lockdown (United Nations, 2020b). Thus, the port has played the role of a driver of the country’s economic development, considered an essential point that facilitates the improvement and development of the country’s economic activities. Also, it has played an indispensable role in the movement of goods from the country to the international market. As explained by De Langen and Haezendock (2012), the port can be seen as a cluster of economic activities that supports and promotes economic growth. Major ports located in coastal areas are vital international trade hubs (Dwarakish & Salim, 2015). In recent years, import and export trade has contributed to the promotion of the country’s economic development prospects and the expansion of port. In particular, the trade of African countries has experienced strong growth in recent decades. Port development is represented as the backbone for the country’s development, which promotes the development of the country’s economic sectors such as industries, trade, and technology.

Furthermore, some previous research such as Jung (2011) who studied in South Korea as well as the studies in China done by (Deng et al., 2013) concluded that the port mainly did not have a significant effect on the regional and national economy. As the recent study was carried out by Jung (2011), a supporting local economy may not have benefited enormously from the proximity to the port. Similarly, Gripaios and Gripaios (1995) who study on the case of PLYMOUTH and Kinsey (1981) found that the port did not have significant benefits on the local economy. On the other hand, several other researchers such as Bottasso et al., 2013, Shan et al., 2014, Ferrari et al., 2010, Chang et al., 2014, Yochum & Agarwal, 1987 have argued that the port plays a critical role in contributing to the economic growth of a region or country.

In the last few years, Doraleh Container Terminal has been heavily modernizing the terminal equipment and infrastructure to serve the majority of containers that are destined for or coming to Ethiopia. It provides transshipment service with large storage, management of the container in transit to the landlocked country, and also containerized goods for export and import from the country. In Djibouti, the port sector is one of the critical sectors that promotes the economic and social development of Djibouti through the creation of direct or indirect jobs.

This study aims to analyze the influence of port development on Djibouti’s economic growth and identify other significant variables. This research usually takes into account many variables, such as the container throughput of the Doraleh Terminal, the total volume of imports and exports from Djibouti, and foreign direct investment (FDI). We mainly use the multiple regression model to analyze the existing influence, which focuses on determining the relationship between port development and economic growth in Djibouti, as well as other variable factors. In the empirical analyses, the datasets used to analyze this research were collected mainly from various relevant and appropriate sources, such as the official World Bank website, the official website of the SGTD Doraleh Terminal, and UNCTAD. To analyze clearly and maintain the reliability and validity of the research, the set of analyses is performed using Eview software.

In this study, we will first describe the literature review, in which many previous and recent studies are discussed. Additionally, the data collection and methodology adopted in this research were described. The next section is the analysis and the results obtained, followed by the discussion. Finally, the conclusion of the research is discussed, and then we describe the limitations and future research.

2. Literature Review

The research by Tongzon (1995) explains that the notion of performance has always been a concern in all companies to ensure their development and profit growth, and that performance is an important key to improving port development based on the effectiveness and efficiency of the port. Nevertheless, Li-Zhuo (2012) showed that the development of port logistics in Qinhuangdao City can boost economic growth. Additionally, Tongzon (1995) indicated that the concept of performance is mainly considered light of the presence of important components such as effectiveness and efficiency and that other important factors appear to be important in defining the concept, such as resilience.

However, the results of this recent research believe that port performance is related to the importance of ensuring the development of port activities, which leads to an increase in container throughput (TEU), and facilitates the increase in import and export trade that influences the country’s GDP growth. The previous studies highlighted that globalization is a strategic concept that facilitates the growth of international trade and promotes the country’s port development. Port development plays a vital role in facilitating and improving the country’s economic activities, such as import and export trade. Thus, the port authority plays an important role in ensuring port development, in particular improving the efficiency of port terminal services and ensuring performance, such as total container loading and number of berths per hour. As Tongzon (1995) points out, there are important determinants for performance, such as loading and unloading cargo or the stay of ships in port, but there are also determinants such as the quality of transport and storage and the rate of loading and unloading of cargo. De Langen, Nijdam, & Horst (2007) explained that the performance of the port will determine several functions, such as the determined volume of goods handled and the amount of throughput of the container (TEU). The operational performance of the port can generally be measured in terms of the quality of the services offered to accommodate the ships as well as the efficiency of the terminal equipment according to the maximum size of the ship that can dock in this port. The development of the port makes it possible to improve the competitiveness of the port according to the maritime connectivity and the hinterland, as well as the speed of container handling, which leads to the offer of a quality service to ships that pass by the sea coast. Increase competitively different ports and challenges for maritime evolution, resulting from the port focus on other aspects, such as productivity, quality, time, flexibility, and customer satisfaction (Bititci et al., 2012; Neely, 1999; Nudurupati et al., 2011).

In Addition, some relevant previous studies argued that port development is crucial for economic development, especially in terms of promoting the country’s economic activities such as import and export trade as well as attracting foreign investment. Port development is mainly dependent on the capacity of the port, logistics efficiency, and available transport that promote the expansion of port activities. Furthermore, Hausman et al. (2013, p. 236) believe that logistics performance is strongly important and significant for increased volume of trade, and cost and execution time are the keys to ensuring the development and operation performance. Similarly, Yap (2020) believed that the logistics performance and costs of transport, as well as their efficiency of services, are important to promote and attribute to the competitiveness of the port. Some studies showed that the performance of the port has a direct influence on the development of the country, adapting the port infrastructure and equipment such as dockside cranes, tugboats, and storage facilities, which occupy an important role in port development. Sánchez et al. (2003) pointed out that port efficiency is very important in determining a country’s competitiveness.

Some previous studies show that port development contributes an important benefit to the country’s development, with infrastructure playing a critical role in accelerating the development of port activities and regional economic integration. Furthermore, countries with better logistics performance have a higher probability of exporting to international markets and attracting foreign direct investment (Hausman et al., 2013). The availability of equipment improved port capacity and adapted to the evolving technologies facing the growth of the maritime industry, using advanced technologies and equipment such as dockside cranes, tugs, and storage facilities to improve port development. Advanced technologies facilitate better logistics performance through reengineering transport routes, scales, modes, or frequencies (Helling and Poister, 2000). In addition, de Langen (2004) showed that different port service offerings are very important for development and efficiency activities such as storage, the existing transport network, and production, as well as the critical advantages of port position and infrastructure. Minim and Schramm (2018) reveal that improving the quality of port infrastructure using logistics performance is vital to enable increased maritime trade and economic growth. In this regard, port development plays a crucial role in promoting import and export trade as well as attracting international investors in the country’s economic sector. In particular, it represents an essential key to promoting the development and competitiveness of the country in various sectors such as industries, agriculture, and trade with modern technologies. Nevertheless, Adhitama and Tan (2009) argued that port is essential for the economy as a major supporting quality infrastructure for economic growth and observe that investment infrastructure is undoubtedly a key enabler of port activity, trade development, social development, and the environment.

However, Sukumaran et al. (2021) studied ports facing challenges that impact the development and that determine a critical role for development, and these challenges could also impact port competitiveness in the region. On the other hand, Yap (2020) showed that the competitiveness of the port is also determined by the ability of smart technology, which helps to reduce costs and improve the productivity of the port. Minim and Schramm (2018) argued that the quality of port infrastructure directly influences the national economy of the country. In recent decades, port development has played a crucial role in supporting the country’s economy and facilitating the country’s participation in global and regional trade through the efficiency of the available logistics services, but it has also supported the economic development of the hinterland. According to Musso, Ferrari, and Benacchhio (2006), port development creates direct and indirect benefits for social development as well as employment, a source of revenue for the government, and taxation. In addition, the development of ports involves various parties, which constitute complex organizations in economic, social, cultural, and administrative aspects (Puig, Wooldridge, and Darbra 2014).

Port development facilitates the growth of the country’s international trade through the availability of modern infrastructure and efficient port service to improve port performance. It provides adequate facilities to serve the port of call of ships during container loading and unloading operations, as well as offering various services such as refueling and repairing ships. Also, port development occupies an essential point in promoting the circulation of the country’s import and export trade, which has a significant influence on the country’s economic growth. Some recent studies such as Shan et al. (2014) and also on studies carried out by Chang et al. (2014), mentioned that port has a significant impact for the development of national and regional economies. Furthermore, ports play an important role in domestic and international trade, they seem to have an effect on the local and national economic development (Jung, 2011). Similarly, Sukumaran et al. (2021) showed that ports represent the gateways for trade in the country and play an important role in the growth of the country’s various economic activities. In addition, the port becomes a cluster and an economic centre and contributes to the national, regional, or local economy (de Langen, 2004; Li-zhuo, 2012).

Over the last few decades, the port has faced a change in ship size that requires adaptation of large terminal capacity and more modern infrastructure to increase port activities through logistics and efficient transport. The history of the port shows port has gradually changed from being a single transportation transit point to a modern logistics service center, and it plays an increasingly important role in the economic development of the port city and the region radiated by the port (H. Wu et al., 2020). Bottasso et al. (2013) pointed out that port throughput has a strong impact on local employment, as the result shows port creates opportunities for industries and logistics that contribute to the development of the economy. Moreover, Li-zhuo (2012) argued that port activities share an important relationship with local development and are also critical to the economy. It is widely accepted that ports play an important role in the growth and development of economies on local, regional, and national levels (Li-zhuo, 2012; Deng et al., 2013). Furthermore, Kinsey (1981) identified that the economic impact of the Port of Liverpool on the local economy is declining and showed that the total number of jobs dependent on the port is less than 15,000. Chen et al., 2021 studied the analysis of the advantages of the port and mentioned that the development of a port is based on crucial conditions such as geographic location, hinterland accessibility, and existent network connectivity, which explain how ensure and increase the development of activities in the port. In addition, the construction or development of a port depends on its location and determines its operational performance (Liu,1995; Song and Yeo, 2004; Tongzon and Heng,2005). Calderinha et al. (2009) showed that the location of a port is an essential variable key that directly affects the operational performance of the port.

3. Data Collection and Methodology

3.1. Analyse the Port Development and Economy in Djibouti

This section provides an overview of the Doraleh Container Terminal and determines the influence of port activities on the country’s economy. Finally, this section describes the various selected variables that influence economic growth.

3.1.1. Overview of the Doraleh Container Terminal

In general, the historical growth of the activities of the various ports of Djibouti is related to the development of the country of Djibouti and the growth of its various economic activities, as well as the economics of the hinterland in recent years. In history, the first port was established in 1888 by Leance Lagarde and is located in the capital of Djibouti, as ports continued to improve commercial activities during the French colony in 1892. In 1917, the port of Djibouti was in a strong strategic position to serve international and regional trade but also to facilitate the country’s small economic activities, such as fishing and accommodation for ferry passengers. Since its construction in 2009, the development of the Doraleh container terminal is vital to facilitate the growth of import and export trade, which has a direct influence on Djibouti economic growth as well as in the management of containerized goods in the hinterland. It has an annual capacity of 1.6 million TEUs, a berthing depth of 18 m, and allows entry into the terminal to accommodate the latest generation of vessels, such as the Ivan Hoe operated by CMA CGM. According to information from the Port Authority, DCT has 30 rubber gantry cranes (RTGs) and a total berthing line covering nearly 1050 m and is equipped with 8 super post-Panamax quay cranes.

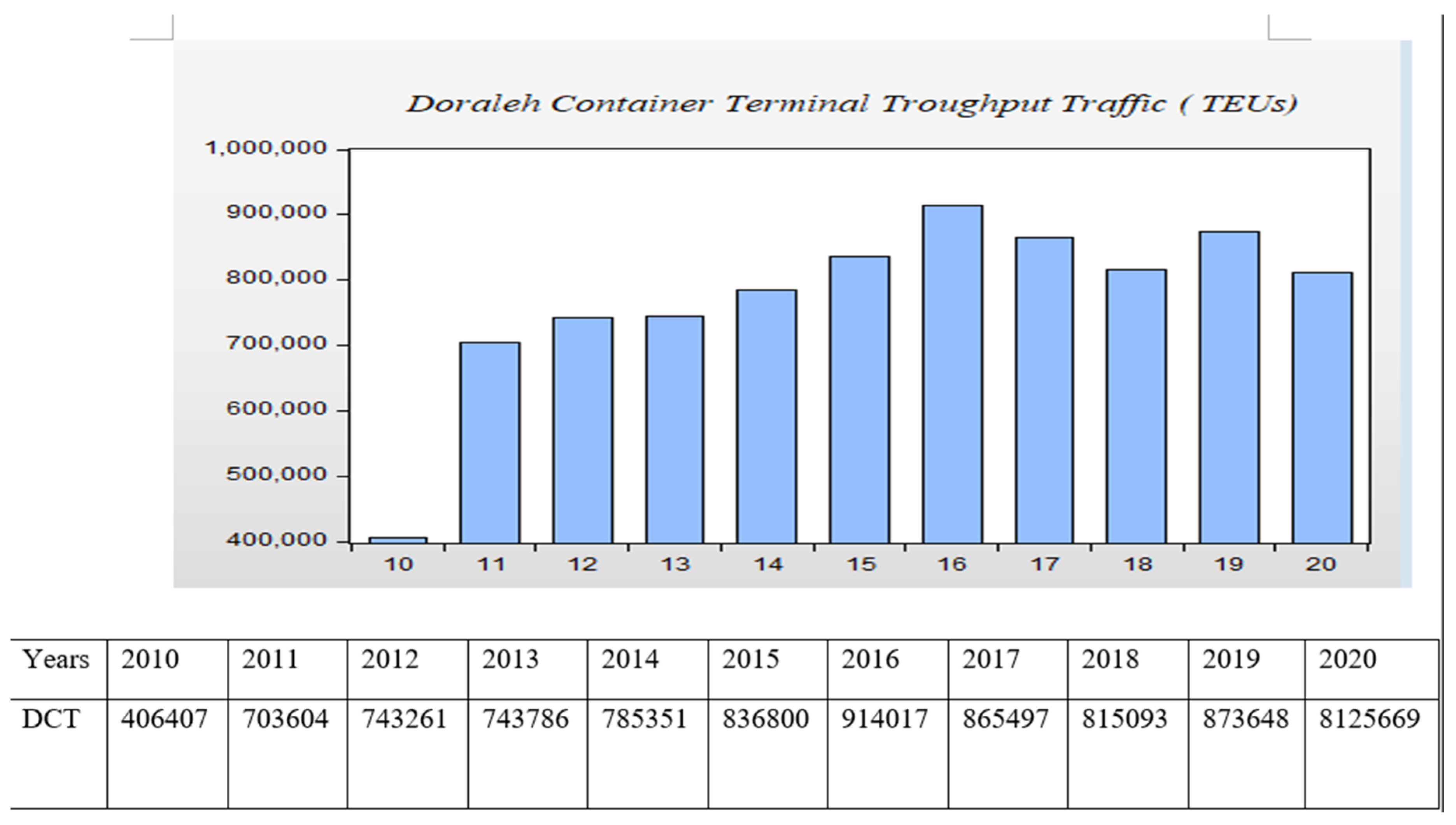

In recent years, the Doraleh Container Terminal has become a key pillar of the country’s economic growth, providing numerous maritime services such as ship refueling and storage depots and having modern technology and efficient terminal equipment. Doraleh Terminal provides a reliable logistics service to facilitate the movement of trade in the region and a transshipment service for the ships that transits from the Red Sea to the Mediterranean Sea through the Suez Canal or to the Indian Ocean through the Gulf of Aden. The development activities of the Doraleh container terminal contributes to regional economic integration through its performance of terminal services. As can be seen in the

Figure 1 below, there is a very significant increase in the number of containers throughput at the Doraleh Port Terminal recently, which mainly contributes to the economic development in Djibouti.

3.1.2. Analyses of the Influence of Port Activities on the Economy of Djibouti

It is located on the southern coast of the Tadjoura Gulf, near the Gulf of Aden, and has an exceptional asset to ensure the development of port activities in the region, due to its geostrategic position of being close to one of the busiest routes in the world. According to World Bank data, the annual growth rate of GDP per capita was 3.1% in 2018. In addition, the port sector has become a priority sector that attracts foreign investment to Djibouti, such as the construction of infrastructure and modernized terminals to ensure optimization of container handling. The annual rate of GDP per capita increased to 3.9% in 2019. On the other hand, DCT achieved a high container throughput to reach 914,017 TEUs in 2016 and 873,648 TEUs in 2019.

As clearly explained, DCT has experienced important port connectivity to the hinterland through the construction of a railway link in the Doraleh Terminal inaugurated in 2018, which facilitates the development of foreign trade related to the import and export of the country and also to the landlocked countries of the region, such as Ethiopia. According to data selected from SGTD Container Throughput was 812,569 TEUs in 2020. During this period, terminal activities declined and there was no significant container handling, with GDP per capita rebounding by 0.3% in 2020. The activities of the Doraleh terminal influence the development of the Djibouti through the creation of jobs, promote the country’s industrial, and commercial sectors. The development of Doraleh terminal activities is faced with economic obstacles related to COVID-19 and regional challenges.

3.1.3. Analyses of the Various Factors that Influence the Economic Development

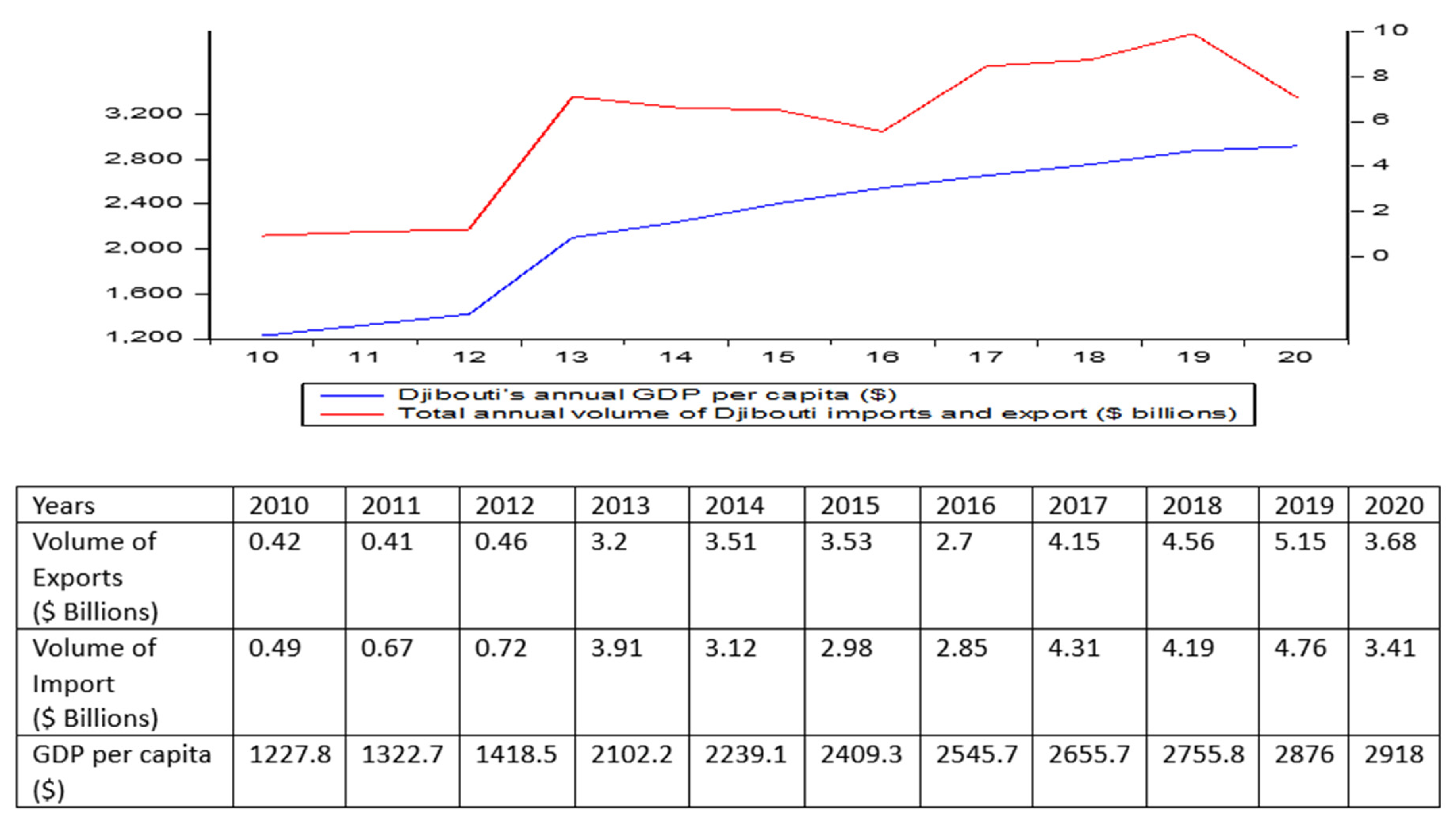

In the last few decades, Djibouti’s economy has experienced rapid development linked to the establishment of various national and international industrial companies, as well as a strong link with landlocked countries such as Ethiopia. The Djiboutian government encourages trade in imports and exports from efficient settlements, which has a significant relationship with the economy, as shown in the following

Figure 2.

As the chart above explains, there is a similar growth between total import and export trade and GDP per capita in Djibouti. Since 2010, the total volume of imports and exports trade has been recorded at $0.91 billion and has increased to $7.09 billion in 2020.

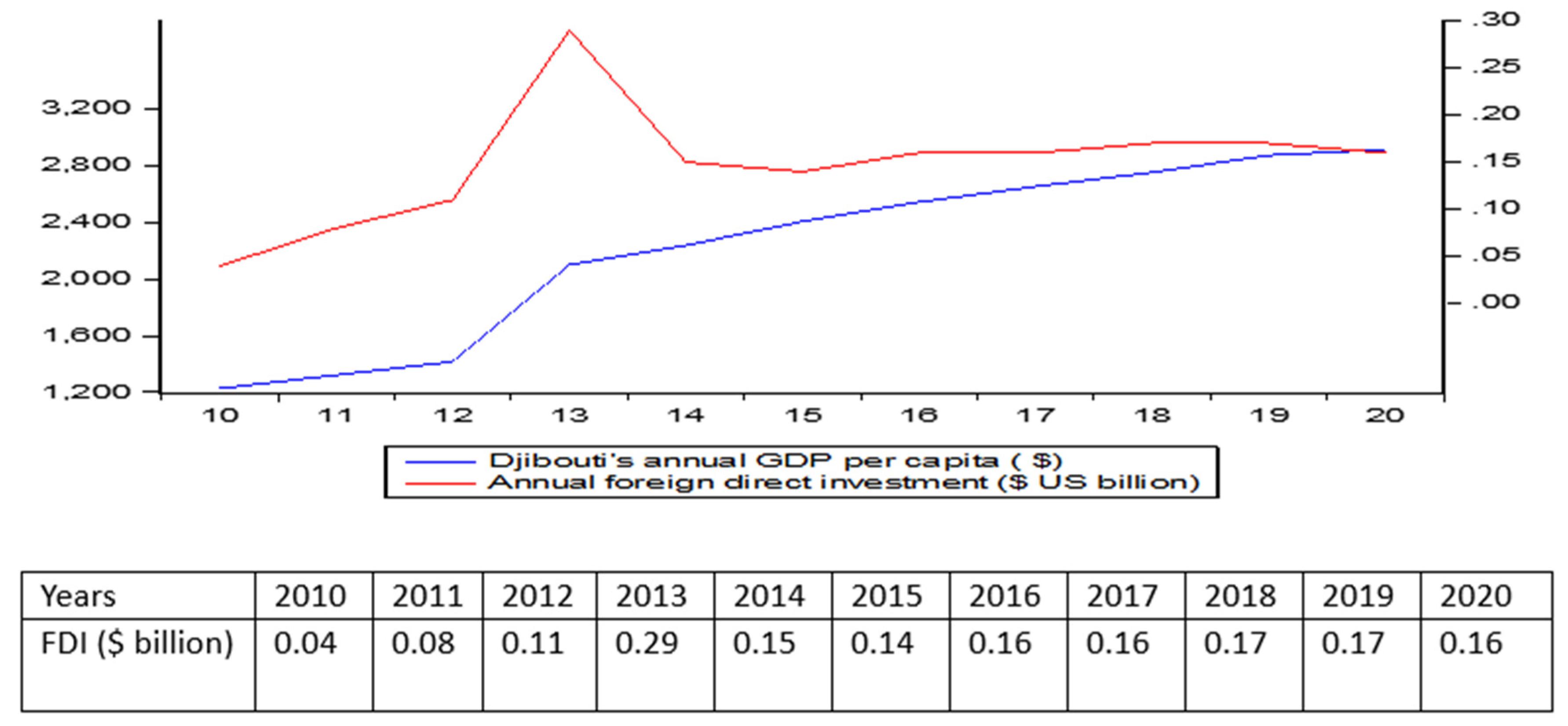

In recent years, Djibouti has experienced strong foreign direct investment (FDI) in the country’s various economic sectors, such as port infrastructure investment, which is crucial to economic growth, as well as the construction of railway lines, industry, and agriculture. The construction of essential infrastructure for development, such as roads, modernization, and expansion of the port, such as the Port of Damerjog, also represents significant benefits that play a crucial role in the economic growth of Djibouti. Since 2010, investment has experienced strong growth and contributed to the acceleration of the country’s sectors of activity, as can be seen in the following

Figure 3.

As shown in the chart above, foreign direct investment and GDP per capita increased significantly between 2010 and 2011.

3.2. Hypotheses Development

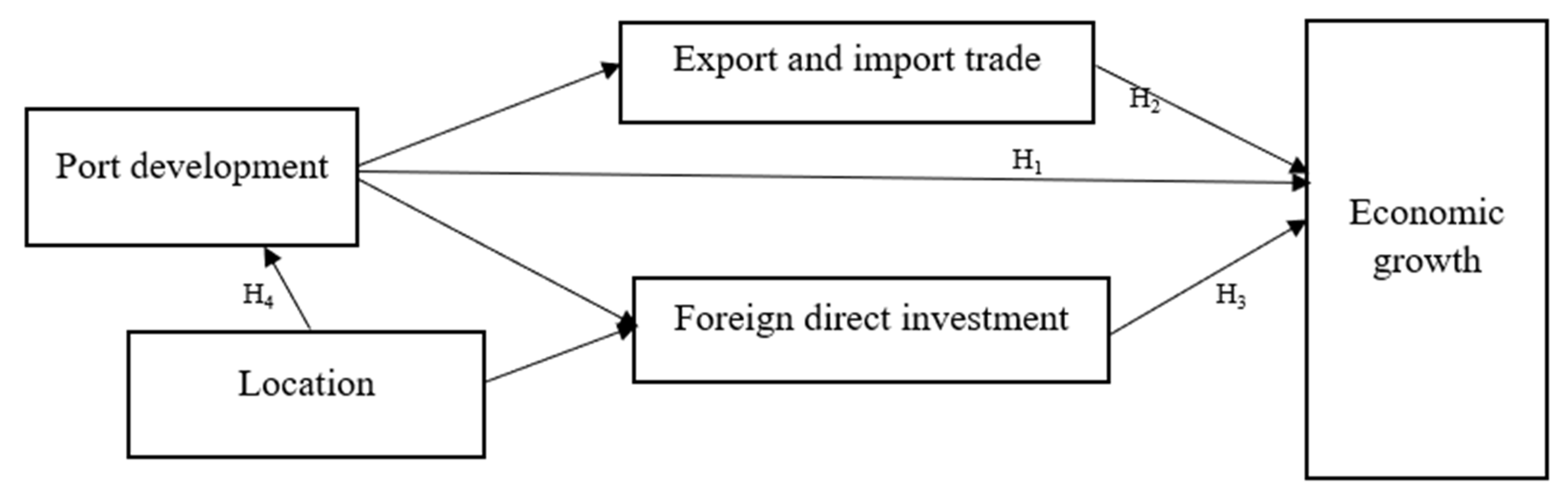

Based on the literature review of this research, we selected a conceptual model to determine the current influence of port development on economic growth and other important variables. In this context, we formulate the following figure in order to determine the influence and relationship with the mediating variables. This will allow the research hypothesis to be applied.

Figure 4.

Conceptual model.

Figure 4.

Conceptual model.

Based on this model, a hypothesis will be drawn to analyze the influence of port development and these mediating variables on economic growth. However, the location of the port will be discussed to determine the importance of its development. According to the question set up in this research, this general hypothesis will be examined:

The general Hypothesis of this research is that there is a positive influence of port development and other important variables on economic growth.

However, in order to analyze and determine this hypothesis above, we continue to divide numerous sub-hypotheses to deepen and follow these hypotheses based on the arguments drawn from the review of previous studies.

In general, some relevant studies conclude that port is essential to promoting other economic sectors but also supports the country with creation opportunities such as job creation. As Musso, Ferrari, and Benacchio (2006) show that the development of the port is an important investment that promotes direct benefits to society and represents a source of revenue for the country. Adhitama and Tan (2009) determined the relationship between economic growth and port development. Port development promotes the development of the country’s infrastructure according to high technology and terminal innovations, and also encourages the country’s economic sectors. Based on this argument explained above, the following hypothesis will be drawn:

H1: port development has a direct and positive influence on economic growth.

The same relevant previous studies, such as PADONOU et al. (2021) explain that the development of import and export trade plays an essential role in Benin, and the country’s economy is highly dependent on foreign trade, 90% of which is often carried out through port activities and by sea. In this case, the following hypothesis will be established:

H2: imports and export trade have a significant influence on economic growth.

In addition, investment plays a critical role in encouraging and promoting the development of economic sectors in the country, such as infrastructure, industries, and agricultural sectors. FDI was the principal source of flow to developing countries in 1990(Mahmoodi & Mahmoudi, 2016). Also, investments are the engine of economic growth (Liesbeth et al., 2009). At this point, the following hypothesis will be noted:

H3: foreign direct investment has a direct and strong influence on economic growth.

The location of the port plays an essential role in promoting port development, attracting numerous international investments in the various economic sectors, and facilitating the expansion of port facilities in the region. As explained by Chen et al., 2021, the location of the port contributes to the evolution of the port, which also depends on critical conditions such as the accessibility of traffic and the economy of the hinterland. On this point, the following hypothesis will be formulated:

H4: The location influences the expansion and development of port activities.

In the context of this research, data on the determinant location of port development are not available and will not be tested in empirical analysis. the other hypotheses, such as H1, H2, and H3, will be executed with the available data. In addition, the general hypothesis will be tested and determined.

3.3. Data Description

In this research, the data collection will mainly be selected over the period from 2010 to 2020, generally based on Djibouti’s GDP per capita (

$), container traffic throughput (TEUs), total import and export of goods and services from Djibouti (per billion

$) and foreign direct investment (FDI per billion

$). Moreover, data collection methods are techniques or ways to obtain or collect data needed in research analysis (Creswell, 2008; Ferdinand, 2016). For this empirical analysis, we collected data from official sources of several series of data on this period, are collected the official website of the World Bank (

https://data.worldbank.org/), and the official statistical website of the Doraleh Container Terminal (

https://www.sgtd-terminal.com/), as well as the UNCTAD databases (

https://unctadstat.unctad.org/). In this research, the datasets are analyzed using the statistical software Eviews. In this case, to make the analysis more appropriate to the object of this study, we use regression models and adapt the analysis to this research. To avoid the heteroscedasticity effect of this regression, we describe the variables in this equation in this way, such as LNGDP, LNFDI, LNCT, and LNIET.

The equation established in this research is as follows:

This equation above takes on the following meaning:

LNGDP: Annual GDP per capita (in US dollars)

LNCT: Annual Container Throughput at the Doraleh Terminal

LNIET: Annual total import and export trade (in billions of US dollars)

LNFDI: Annual Foreign Direct Investment (in billions of US dollars)

ε: represent a Random Error term of the regression

t: represent the time period(years)

In addition, β0 is the estimated intercept, and based on this equation, β1, β2, and β3 are the estimated slope coefficients of this regression. X1, X2, and X3 are independent variables for this regression.

3.4. Explanation of the Selected Variable and Descriptive Statistics

As explained in the previous part of the data, the analyses will be done according to the existing dependent and independent variables using an analysis of the regression model. In the context of this research, we will adapt different analyses on this dataset applied to this study, such as regression and data analysis tools that allow us to analyze the relationship between variables. First, the dependent variable of this study is the GDP per capita of Djibouti. Moreover, economic growth is one indicator to see the results of the development that has been carried out and is also useful for determining the direction of development in the future (Esfahani & Ramírez, 2003). As part of this research, the independent variables are the container throughput of Doraleh Terminal (TEUs), foreign direct investment (FDI), and total import and export of goods and services in the country (by billions of US dollars) over the period from 2010 to 2020. For the explanation of this variable, export is the number of goods sent abroad through ports in a period, the most common period is yearly, measured by the US Dollars (UNCTAD,2014). On the other hand, import is a number of goods which received from abroad through ports in a period, measured by the US Dollars (UNCTAD,2014).

In this research, the independent and dependent variables consist of the appropriate variables to evaluate and analyze the influence of port development on economic growth. In addition, container throughput is an important indicator for measuring the development of the port, and, as we have explained, GDP per capita is an important indicator for measuring economic growth. In this empirical analysis, Djibouti’s economic growth can be determined by GDP per capita, as several previous researchers have done, such as Shan et al. (2014), Munium and Schramm (2018), and Deng et al., 2013. Therefore, the port development will be able to determine in this analysis by annual container throughput in twenty-foot equivalent units (TEUs). The following table shows us the descriptive statistics result of the selected variables.

Table 1.

Descriptive statistics.

Table 1.

Descriptive statistics.

| |

LNGDP |

LNIET |

LNCT |

LNFDI |

| Mean |

2224.618 |

5.743636 |

772730.3 |

0.148182 |

| Median |

2409.3 |

6.63 |

812569.0 |

0.16 |

| Maximum |

2918 |

9.91 |

914017 |

0.29 |

| Minimum |

1227.8 |

0.91 |

406407 |

0.04 |

| Std. Dev. |

631.0617 |

3.237373 |

136775.5 |

0.062740 |

| Skewness |

-0.572035 |

-0.567974 |

-1.823510 |

0.526074 |

| Kurtosis |

1.809349 |

1.900581 |

5.855884 |

4.016153 |

| Jarque-Bera |

1.249666 |

1.145420 |

9.834380 |

0.980641 |

| Probability |

0.535351 |

0.563995 |

0.007320 |

0.612430 |

| Sum |

24470.80 |

63.18000 |

8500033. |

1.630000 |

| Sum Sq.Dev |

3982389. |

104.8059 |

1.87E+11 |

0.039364 |

| Observation |

11 |

11 |

11 |

11 |

As can be seen from the table above, the GDP per capita variables have a maximum of 2918, and Std. Dev equal to 631.0617, with a Mean of 2224.618. Import and export trade has a maximum value of 9.91, Std. Dev equal to 3.237373. In addition, container throughput at the Doraleh Terminal has a maximum of 914017 and Std. Dev equal to 136775.5 with a Mean of 772730.3. Furthermore, we can also see that the Jarque-Bera values obtained in each variable are all greater than the significant level of 0.05%. Therefore, this may indicate we do no reject null hypothesis, consisting that the data are normally distributed.

4. Analysis and Result Data

In this research, after explaining the data and the various appropriate variables in this study. We will pass directly through the different analyses to determine the result of the research, and this study will be selected for the period 2010-2020. In this section, different appropriate analyses such as unit rout test, correlation, analyses of covariance, regression models, Chow test and Residual Diagnostic will be discussed and the result will be made for each analysis.

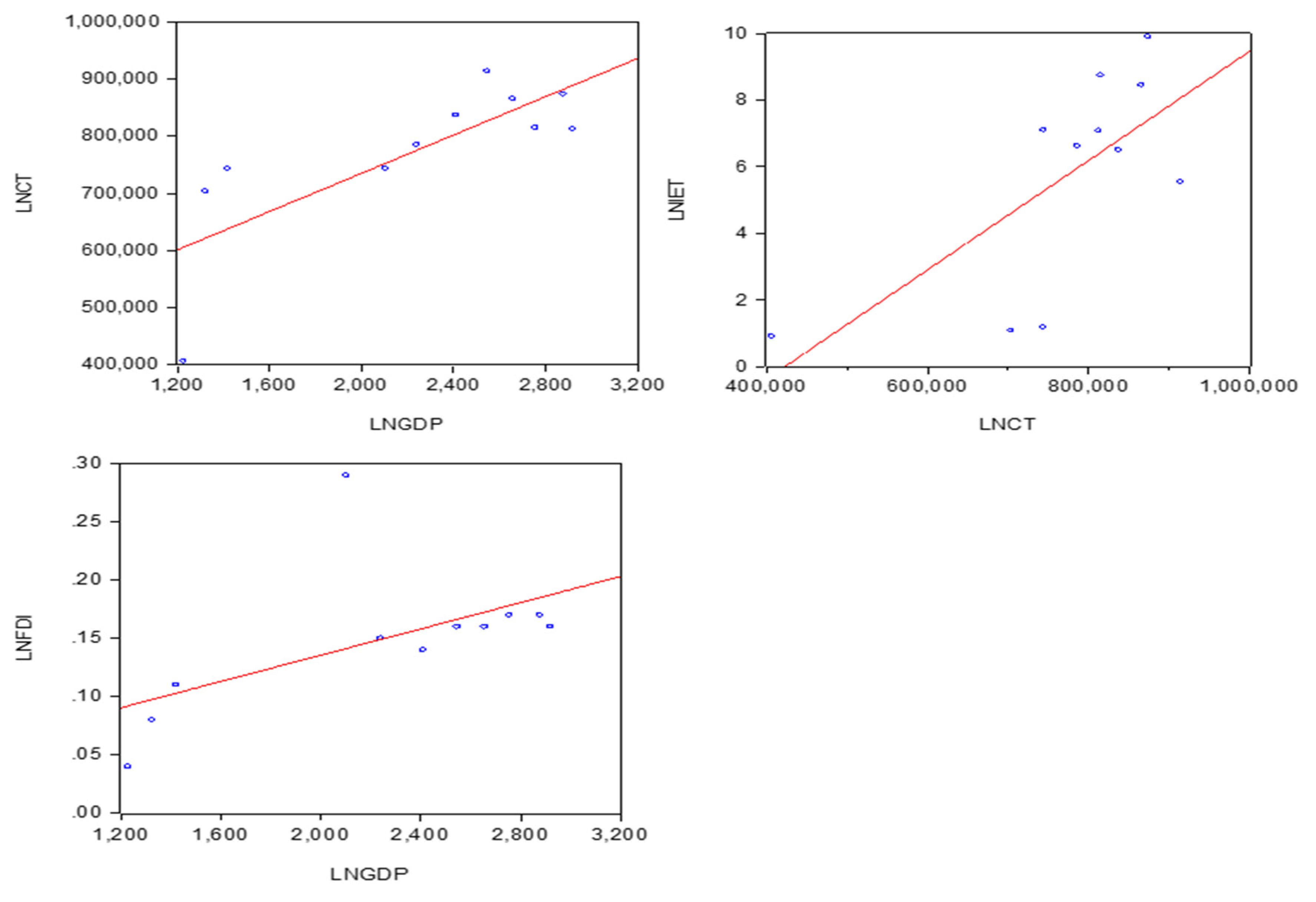

Figure 5.

the linear relationship between the independent variable and GDP scatterplots.

Figure 5.

the linear relationship between the independent variable and GDP scatterplots.

According to the result shown in this graph, we can see that there is a positive linear relationship between the independent variables and GDP per capita in the period from 2010 to 202 We find that the LNCT and the LNGDP show the existence of a linear relationship. As observed in the figure above, LNIET and the LNGDP also share a strong linear relationship on this graph. However, LNFDI and the LNGDP have a positive relationship, but they exist little separately, which indicates that the close relationship is not so strong.

4.1. Panel Unit Root Test of All Selected Variables

As can be seen, the variables GDP per capita and foreign direct investment and total import and export trade are not stationary at the level, which p-value greater than 0.05 percent by ADF test, and become stationary after the first differentiation. Some variables, such as the container throughput of the terminal at Doraleh are stationary at level. The following

Table 2 shows the result of the unit root test in each of the variables selected by the ADF test.

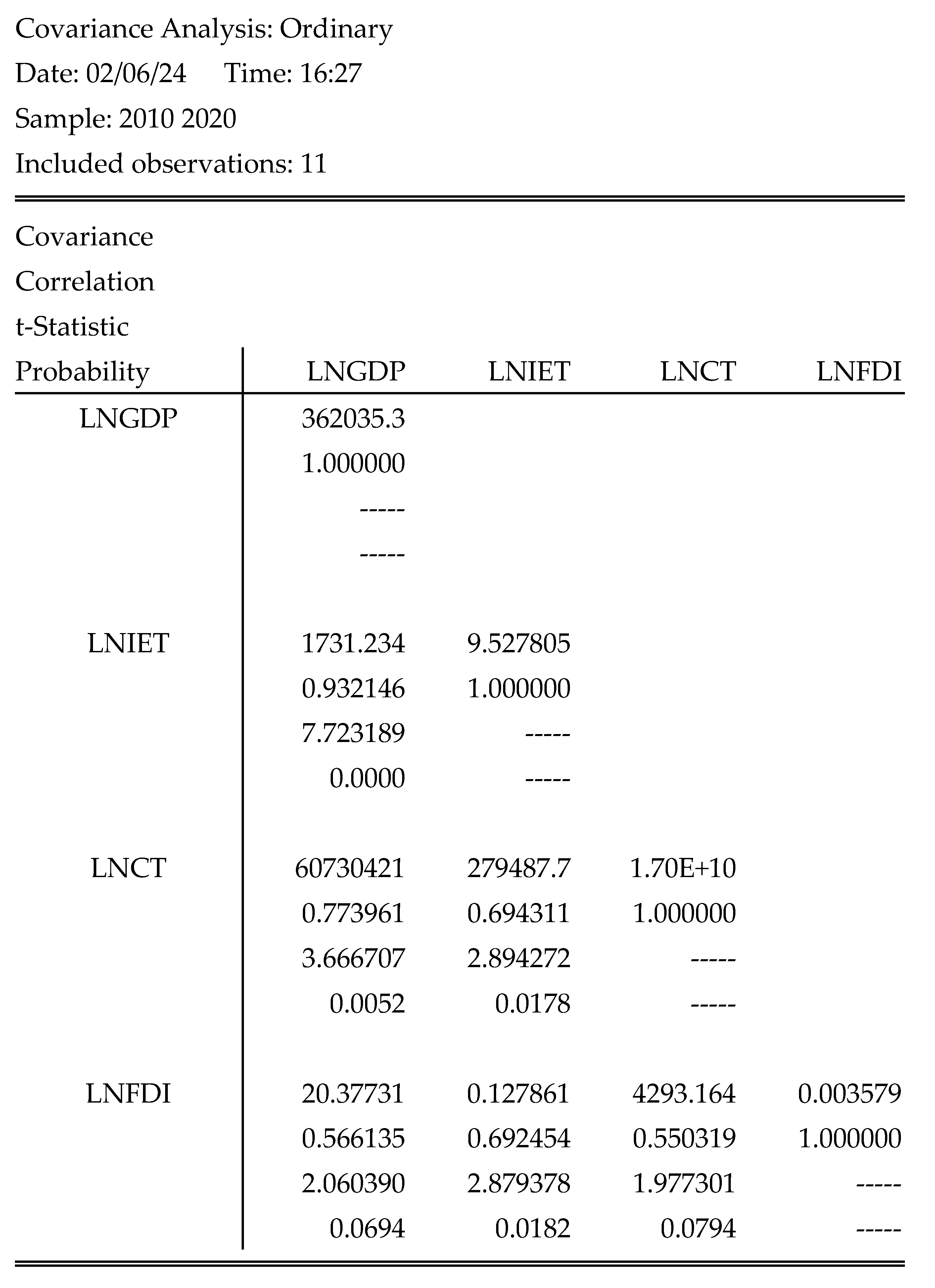

4.2. Correlation Analysis

In the first step, in order to analyze the influence of port development on the economic growth of Djibouti, we begin by determining the relationship between the variables specified in the previous section using appropriate statistical methods. In addition, we specifically use the software EViews to evaluate this analysis and assess the correlation between these variables. The result obtained from this analysis of the correlation between the variables shown in the

Table 3 below:

In this research, the datasets collected will be examined and interpreted to determine whether a correlation exists between these variables. As we can see in the result above, Djibouti’s GDP per capita (in US dollars) and container throughput from the Doraleh Terminal in Djibouti in twenty-foot equivalent units (TEUs), total import and export volume from Djibouti (in billions of US of dollars) and foreign direct investment from Djibouti (in billions of US dollars) have been evaluated on this test. This Table 3 above justifies that there is a strong positive correlation between these selected variables over this period. This obviously shows that there is a positive influence on the different variables tested in this study. In this regard, the above result shows the container throughput at the Doraleh Terminal have a strong positive and significant correlation with the GDP per capita of Djibouti on a correlation coefficient of 0.773961 very close to +1, and we also demonstrate a high p value of a significant statistical equivalent to 0.0052 (see in the appendix 1). At the same time, the result shows that the container throughput at the Doraleh Terminal has a positive and significant relationship with trade (imports and exports), with a correlation coefficient of 0.694311 and a probability of 0.0178, less than 0.05 of significance level.

Moreover, we can clearly see that the correlation coefficient of total imports and exports (in billions of US dollars) is a positive with the GDP per capita of Djibouti and is very significant, equal to 0.932146. As we can see in this Table 3 above, the total imports and exports trade coefficient is very close to +1, with a very significant probability of 0.0000 (see appendix 1), indicating that the linear relationship is statistically significant. However, there is still a positive correlation between foreign direct investment (in billions of US dollars) in Djibouti and GDP per capita equivalent to 0.566135 close to +1, but we found that the p value is not very strongly significant. Based on this result, we can also move to the next step of the test by using regression analysis to identify the relationship existing between the selected independent variables and GDP per capita (in US dollars) and determine the descriptive adjusted R-squares for this regression.

4.3. Covariance Analysis

In this research, we also examine the analysis of the covariance of this equation between all the dependent and independent variables in this study. In addition, the result of this analysis is obtained using the Eviews software, as shown in the

Table 4 below.

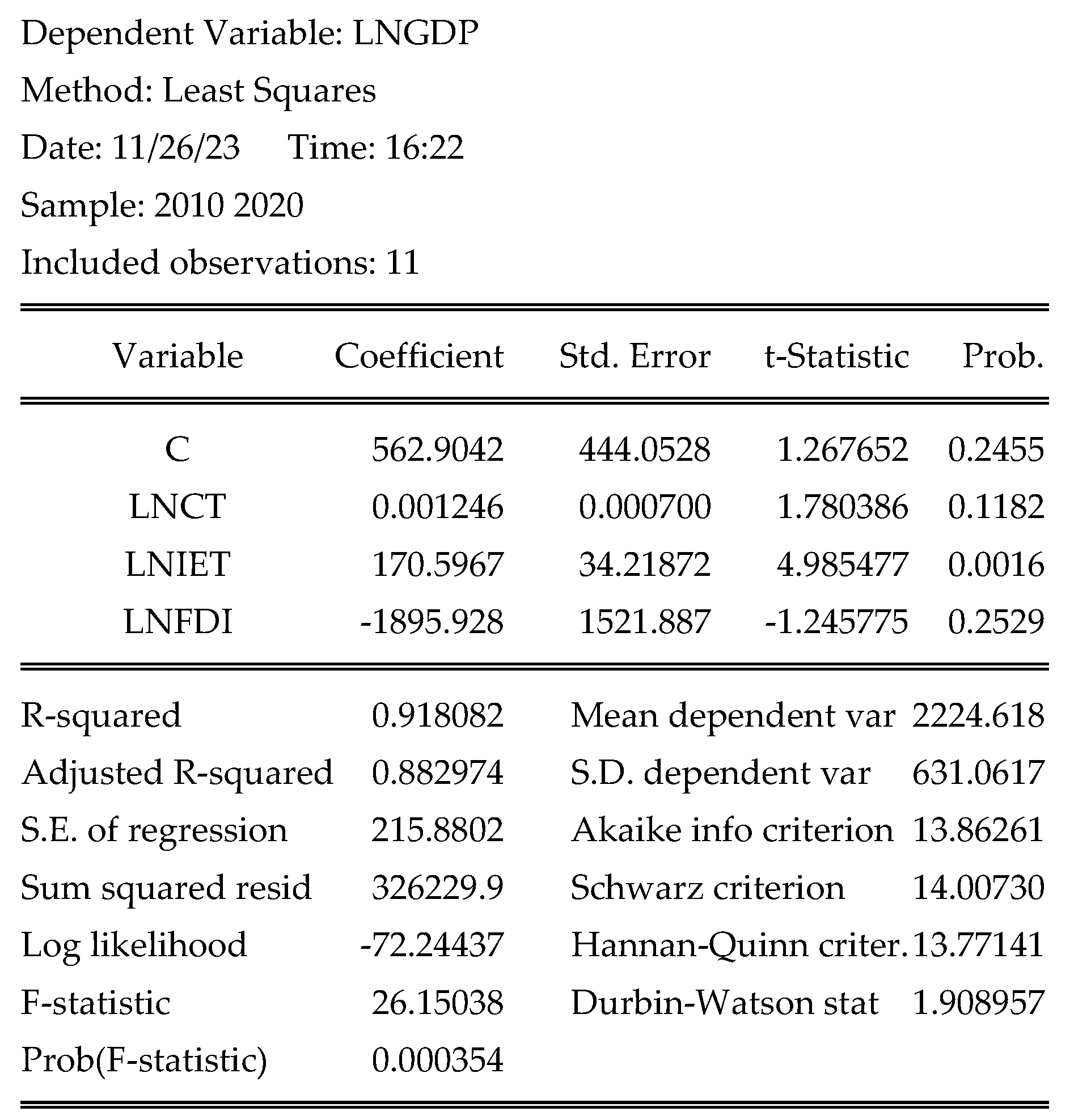

4.4. Regression Analysis

Based on the positive correlation between the variables, we will also use the appropriate method of statistical analysis to determine the relationship between the variables. Regression analysis seems to be the most appropriate analysis to identify the linear relationship between dependent variables and the other independent variables in this study. We carried out this analysis using the statistical software Eviews with dependent variables consisting of GDP per capita (US Dollars) and independent variables such as container throughput at Doraleh terminal (TEUs), foreign direct investment (in billion US Dollars), total Djibouti import and export (in billion US Dollars). We established the multiple regression model to analyze all the data selected in this study, The equation of this regression model is as follows:

εt is represent a random error term.

The regression analysis is established using ordinary least squares (OLS) in this analysis for each variable and examines the linear relationship between the dependent variables and the independent variable. The result obtained from the regression analysis is as follows.

Table 5.

regression analysis test.

Table 5.

regression analysis test.

Based on the interpretation of the table above, we can see that the total imports and exports to Djibouti (in billions of US Dollars) of the independent variable title are significant at the 0.05 level of significance. As well, we can also see in this table that the overall regression test P value of 0.000354 is less than the significance level of 5% respectively, justifies that the regression model of this analysis is very significant. In addition, the goodness of fit adjusted for this regression value R2 is equal to 0.882974, which R2 represents the squared multiple correlations and all the values are above the recommended level of 0.50 (Bollen, 1989; Lu et al., 2007). That indicates that the effect of the fitting for this regression equation is very good. Moreover, the equation of this regression is as follows:

In this model, we can explain that the total of Djibouti’s imports and exports trade (in billions of US Dollars) in this regression is very significant, with t statistics equal to 4.985477. As we can see from this regression equation, that the relationship between the total volume of imports and exports (in billions of US Dollars) and the GDP per capita of Djibouti is strongly significant. The regression coefficient of total imports and exports trade is 170.5967 and the statistically significance p value is 0.0016, less than 0.05 at a 95 percent confidence level, which shows that there are strongly significant linear relationships. Furthermore, this result can explain if the total imports and exports trade increase by 1 unit and then the GDP per capita of Djibouti increases by 170.5967 value units. On the other hand, the regression coefficient of Djibouti’s foreign direct investment (in billions of US Dollars) is negative, equal to -1895.928, indicating that it does not have a strong significant relationship with GDP per capita in Djibouti (in billions of US Dollars), which is 0.2529 is greater than 0.05 in 95 percent of the confidence level in this regression. Finally, the container throughput at the Doraleh Terminal (TEU) of the regression coefficient of this regression is strongly positive, which explains that the increase in container throughput at the terminal will also contribute to the increase in Djibouti’s GDP per capita (in US dollars). Based on this regression result above, the container throughput of the Doraleh Terminal (TEU) of t value does not pass the established significance test of using a 95 percent confidence level, but the result of the regression shows that there is a good logical reason to believe an existing positive relationship with GDP per capita of Djibouti (in US Dollars).

Based on this model, we can conclude that increasing container throughput at the Doraleh Terminal has a strong positive relationship and influence on Djibouti’s GDP per capita. Therefore, we also conclude that there is a positive and significant relationship between trade (imports and exports trade) on GDP per capita in Djibouti (in US Dollars).

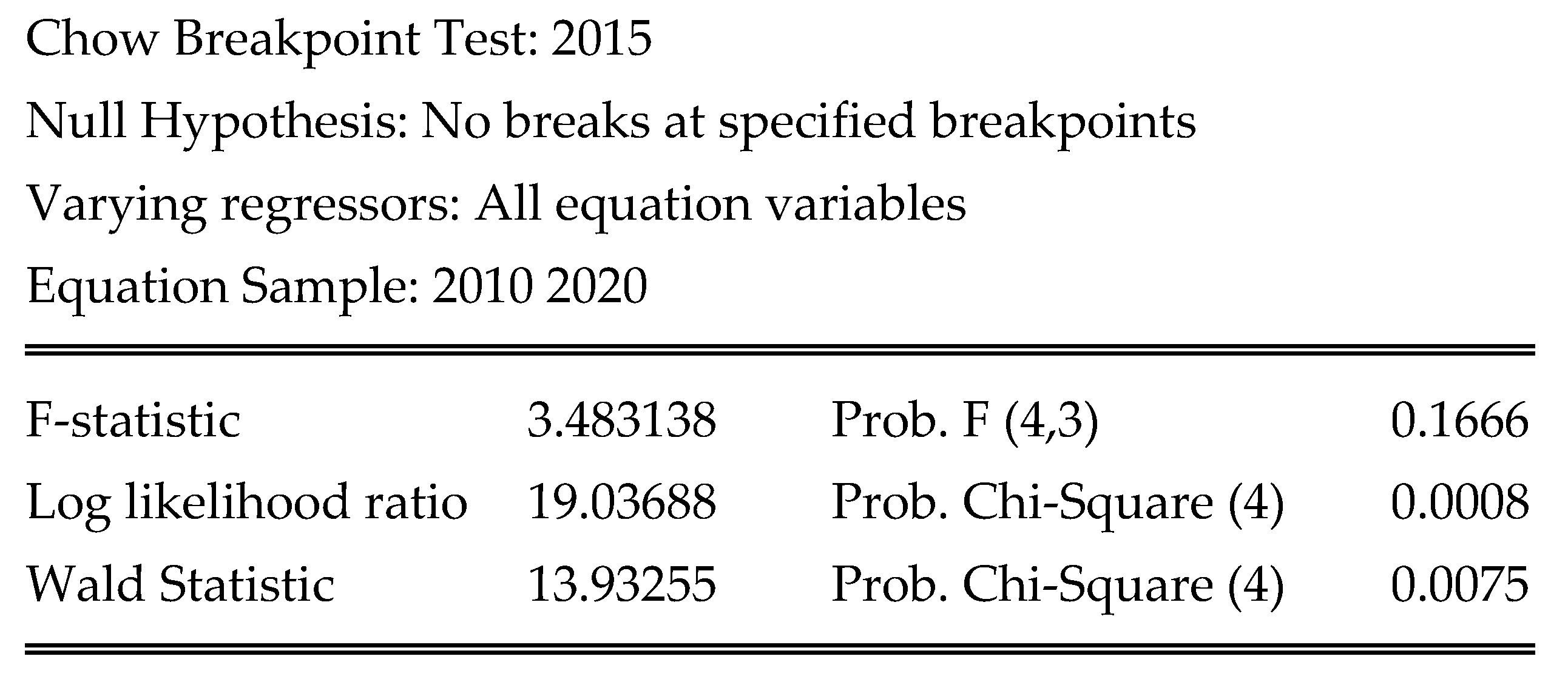

4.5. Chow Test

Based on this result, as we can see that the F statistics has a probability of 0.1666, which is greater than 0.05 at a 95 percent confidence level. Moreover, indicating that there is no breaking point, the coefficient is stable, and it can be seen that there is no structural change in this model and the model structure is stable in this data. from the result above, we do not reject the null hypothesis of no structural change and no break at the level of 5% significance.

4.6. Residual Diagnostic Test and Stability of Regression Result

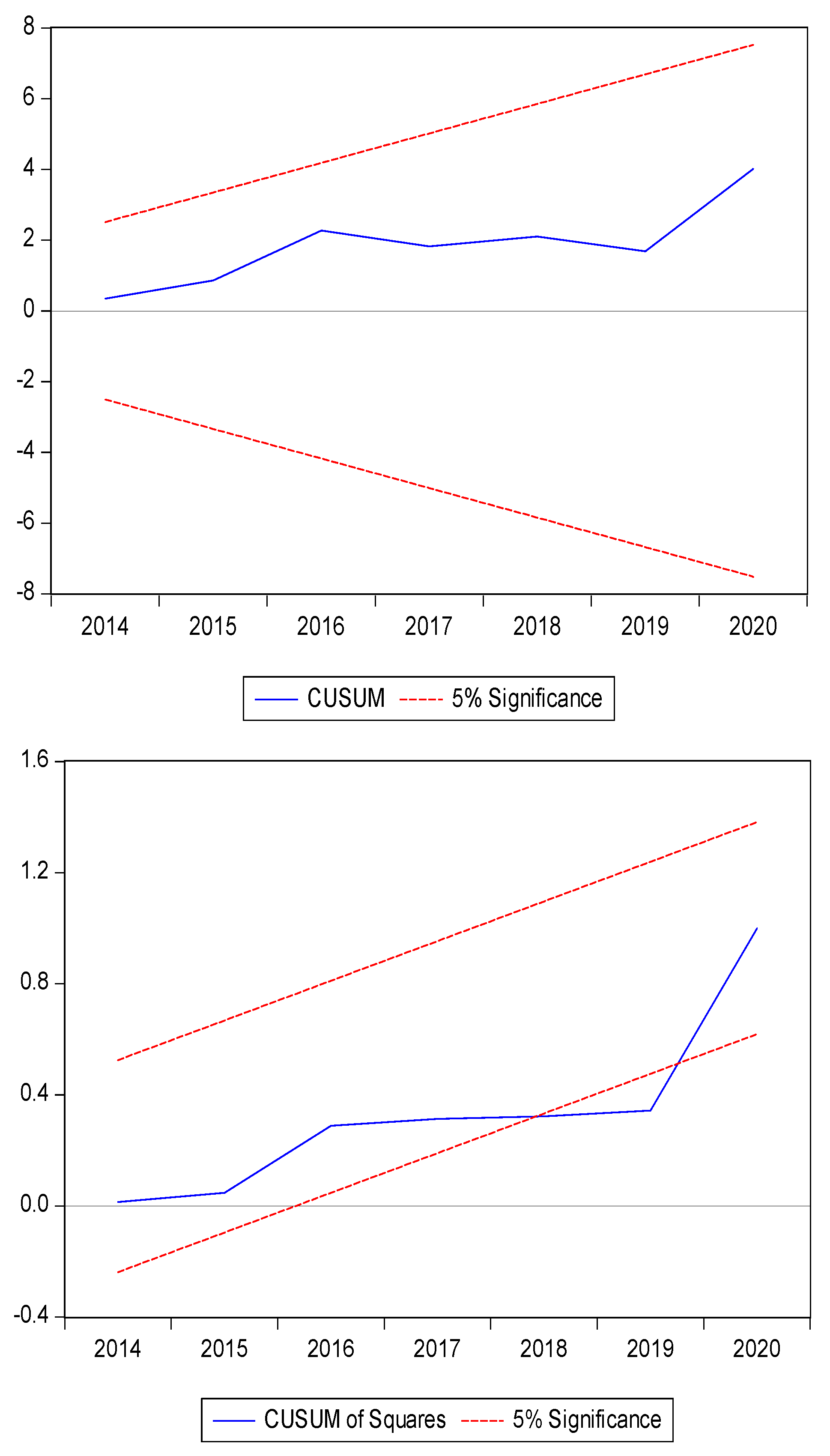

The following

Table 7 shows the various residual tests established, as can be seen Jarque-Bera Test has a p-value of 0.098470, greater than 5% at significance level, respectively. Several Heteroskedasticity Test such as the Breusch-Pagan-Godfrey Test and the Harvey Test have a p-value of 0.9307, 0.8142, both are greater than 5 % significance.

From the result of the

Table 7 above, we can confirm that there are no risks or problems of heteroscedasticity on this regression, while the probability of performing both tests (Breusch-Pagan-Godfrey Test and Harvey Test) is not significant, greater than 5% of significant level, respectively. There is no serial correlation of this applied regression and found that the selected data are normally distributed on this regression. In addition, the null hypothesis is accepted which variables are normally distributed. As can be seen in the

Table 7 above, we also established the Ramsey Test to determine the stability of the parameter in this model. The Ramsey RESET Test reveals that the regression model is stable and good over a t equal to 0.946908, F of 0.896635, and P value of 0.3802, greater than 5% level significance, respectively. On the other hand, we also apply the CUSUM and CUSM of Squares test to verify and confirm the stability of the parameters in the model. We can see that the model of this established regression passes all the diagnostic tests used and shows the reliable parameter except for this CUSUM AND CUSUMSQ test, which reveals the model suffers the stability of the structure at a level of 5%, as can be seen in the following

Figure 6.

5. Discussion

This study determines that port development has a direct influence on Djibouti’s economic growth, and import and export trade is important variable that has a significant influence on Djibouti economic growth. This research demonstrates that there is a strong relationship between port development and trade (total imports and exports) with economy of Djibouti.

The analysis shows that port development has a positive and direct relationship with import and export trade, which also promotes the development of the country’s economic sector. The development of port, as measured by container throughput, has a relatively positive correlation with Djibouti trade. The result justifies port development have a strong influence on Djibouti’s economic growth. In addition, the result obtained from this research also supports research made by Chang et al. (2014), Ferrari et al. (2010) and others, who found a significant and positive impact of the port on the national or regional economy. The relevant research supports the previous study by Shan et al. (2014), who noted that a 1% increase in port freight contributes to the 7.6% GDP per capita growth affecting port throughput and has a positive influence on the city’s economic development. The result is consistent with the analysis made by Shan et al. (2014), which shows that port freight throughput has a positive effect on the city’s economic growth Therefore, the study confirms that port development plays a vital role and directly influences Djibouti economic growth, so the H1 hypothesis is confirmed in this research. Analysis shows that import and export trade have a significant influence on the economy of Djibouti, which justifies that H2 is also approved.

The result shows that foreign direct investment does not have a direct and positive relationship with Djibouti’s economic growth and is statistically insignificant. Thus, FDI does not statistically significant and has a negative correlation with economic growth, which justifies why H3 is rejected for this research. Furthermore, the study highlights the importance of investment in many sectors, such as port logistics and infrastructure, to promote the country’s development. As pointed out by some previous studies by Coto-Millan et al. (2013), logistics performance is essential for economic growth, and L-Zhuo 2012 shows that port logistics has an effect on regional economic growth. Similarly, this result argues that port activity development influences Djibouti’s economic growth. The study also supports the study by Calderinha et al. (2009) that port location is a crucial variable in the performance of port operations. Furthermore, result presented by this study justifies that hypothesis 4 is approved for this research.

6. Conclusion

This research analyzed the influence of port development on Djibouti’s economic growth and other important factors. This study was carried out in the case of the development of the Doraleh Container Terminal using datasets from different official sources over the period 2010 to 2020.

The literature review of this research shows that port development influences the country’s economic growth, as well as determining certain factors, such as trade related to imports and exports and investment, play an important role in promoting economic growth. This research examines the importance of the port’s advantages and considers the strategic location as the significant key to promoting the expansion of the country’s port activities. In addition, port development appears to have a strong relationship with the country’s trade, as well as foreign investment, which is a key driver for the country’s economic activities. On the other hand, port development is essential to support trade but also attracts many foreign investments, as it is crucial for the country’s development. This study includes numerous analyses established to test the general hypotheses proposed to determine the influence of port development on economic growth and the variable mediating factors. The result shows that total trade (imports and exports) have a significant influence on the economic growth of Djibouti with a statistically significant (0.0016< 0.05). Furthermore, the study found that port development has a strong positive relationship with the economic growth of Djibouti but is not statistically significant, which probably explains the very short selection duration or multicollinearity effects. The result also found that foreign direct investment is not statistically significant in this period (0.2529>0.05).

This study concludes that port development directly influences the economic growth of Djibouti through the container throughput of Doraleh Terminal. the study also reveals that import and export trade plays a significant role in Djibouti’s economic growth. FDI has a negative influence on Djibouti’s economic growth, but it has a positive correlation and can influenced by mediating factors that require further research. In addition, the result also demonstrates that the development of the Doraleh Container Terminal plays a key role in promoting and facilitating import and export trade in Djibouti and at the regional level. Djibouti’s economic development depends on optimizing the efficiency of port infrastructure through modern technology and logistics, which allows Djibouti to maximize its strategic position to become a hub for trade and logistics in East Africa. Therefore, Djibouti can maximize its geostrategic position through more efficient port facilities and development to support international trade, which plays a crucial role in Djibouti’s economic growth.

6.1. Limitations of the Research

This paper has a major limitation related to the availability of data for some mediating variables and the need to add other factors used as control variables to apply to this regression equation. Moreover, the period selected in this research is short to explain the relationship between these variables and the location applied as a control variable, but adding more sectors such as hinterland economy also promotes port development.

6.2. Recommendation for Further Research

For a future study, it may be preferable to study with the addition of important new variable factors that influence the economic development of Djibouti. It should also focus more on the mediating variables and determine an in-depth analysis of FDI, for which the result could be different and more effective. However, it is also recommended to add factors determining port location, which could be added to the empirical analysis to obtain a stronger result.

Funding

This research did not receive any specific financial funding regardless of the public sector organization or others.

Acknowledgments

The author would like to express sincere gratitude for everyone participating in the reading of the article and we appreciate their warm cooperation in developing the quality of the writing. The author also expresses his warm gratitude for the motivation of my supervisor, DAI Minghua, to guide me and provide me with the best direction through and their unconditional support as well as their invaluable contribution, which has been the fundamental pillar for the writing of this Article.

Data Availability Statement

Data generated and additional material used during the current study are available from the corresponding author on reasonable request.

Appendix A

Table A1.

The Result of the Analysis correlation Test using Eviews software.

Table A1.

The Result of the Analysis correlation Test using Eviews software.

References

- Adhitama, M.N. , & Tan, G.W. (2009). The link between Economic growth and Port Development for study of the Southeast Asian Region from 2000-2006, at Erasmus University Rotterdam in 07/14/2009.

- Bititci, U. , Garengo, P., Dörfler, V., & Nudurupati, S. (2012). Performance measurement: Challenges for tomorrow. International journal of management reviews, 14:305-327. [CrossRef]

- Bollen, K.A. (1989). Structural equations with latent variables. Wiley, New York. [CrossRef]

- Bottasso, A. , Conti, M., Ferrari, C., Merk, O., Tei, A. (2013). The impact of port throughput on local employment: evidence from a panel of European regions. Transp Policy, 27:32-38. [CrossRef]

- Caldeirinha, V.R., Felício, J.A., & Coelho, J. (2009). The influence of characterizing factors on port performance, measured by operational, financial and efficiency indicators. Recent Advance in Environment, Energy Systems and Naval Science, 58-70.

- Chang, Y-T., Shin, S-H., Lee, P. (2014). Economic impact of port sectors on south African economy: an input-output analysis. Transport Policy, 35:333-340. [CrossRef]

- Chen, J. , Mou, N., Wang, C et al., 2021. Spatial pattern of location advantage of ports along the Maritime Silk Road. Published in 14 January 2021. Journal of Geographical Sciences, 31: 149-176. Retrieved from https://link.springer.com/article/10.1007/s11442-021-1837-9.

- Coto-Milan, P. , Agüeros, M., Casares-Hontañón, P., Pesquera, M. Á. (2013). Impact of logistics performance on world economic growth (2007-2012). World Review of Intermodal Transportation Research 4(4):300-310. [CrossRef]

- Creswell, J.W. (2008). Educational Research’s: Planning, Conducting, and Evaluating Quantitative and Qualitative Research. New Jersey, Pearson Education Inc, Hal.326.

- De Langen, P.W. (2004). Analysing the performance of seaport clusters. Business, Geography. Published in 6 July 2004. [CrossRef]

- De Langen, P.W. , & Haezendonck, E. (2012). Ports as Cluster of Economic Activity. Published 9 February 2012. [CrossRef]

- De Langen, P.W. , Nijdam, M., & Van der Horst, M. (2007). New indicators to measure port performance. Journal of Maritime Research 4(1). Retrived from https://www.researchgate.net/publication/28199982_New_indicators_to_measure_port_performance.

- Deng, P., Lu, S., & Xiao, H. (2013). Evaluation of the relevance measure between ports and regional economy. Transport Policy, 27, 123-133. [CrossRef]

- Dwarakish, G.S. , & Salim, A. (2015). Review on the Role of Ports in the Development of a Nation. Aquatic Procedia 4(4), 295-301,2015. [CrossRef]

- Esfahani, H. , and Ramı́rez, M.T. (2003). Institutions, Infrastructure, and Economic Growth. Journal of DevelopmentEconomics70(2):443-477. [CrossRef]

- Ferdinand, P.D.A. (2016). Metode Penelitian Manajemen: Pedoman Penelitian untuk Skripsi, Tesis and Disertasi Ilmu Manajemen. Undip, Semarang.

- Ferrari, C. , Percoco, M., Tedeschi, A. (2010). Ports and local development: Evidence from Italy. International Journal of Transport Economics 37(1).

- Gripaios, P. , and Gripaios, R. (1995). The impact of a port on its local economy: the case of Plymouth. Marit Polocy Manag 22(1): 13-23. The flagship journal of international shipping and port research. [CrossRef]

- H. Wu and C. Fu. (2020). The Influence of Marine Port Finance on Port Economic Development. Journal of Coastal Research, 103, SI: 163-167. [CrossRef]

- Hausman, W. , Lee, HL., & Subramanian, U. (2013). The Impact of Logistics Performance on Trade. Prod Oper Manag 22(2): 236-252. [CrossRef]

- Helling, A. , Poister, T.H. (2000). US maritime ports: trends, policy implications, and research needs. Econ Dev Q 14(3): 300-317. [CrossRef]

- Jung, B-M (2011). Economic Contribution of Ports to the Local Economies in Korea. The Asian Journal of Ports and Logistics 27(1): 1-30: South Koea. [CrossRef]

- Kinsey, J. (1981). The economic impact of the port of Liverpool on the economy of Merseyside-using a multiplier approach. Geoforum 12(4): 331-347. [CrossRef]

- Liesbeth, C. , Maertens, M., & Swinnen, J. (2009). Foreign direct investment as an engine for economic growth and human development: A review of the arguments and empirical evidence. [CrossRef]

- Liu, Z. (1995). The comparative performance of public and private enterprises: the case of British ports. Journal of Transport Economics and Policy, 29(3): 263-274.

- Li-zhuo, L. (2012). Analysis of the Relationship Between QinHuangDao Port Logistics and Economic Growth. International Journal on Advances in information Sciences and Service Sciences (AISS), 4(4), 105-114. [CrossRef]

- Loo, B.P. , & Hook, B. (2002). Interplay of international, national and local factors in shaping container port development: A case study of Hong Kong. Tranport Reviews: A Transnational Transdisciplinary Journal, 22(2), 219-245. [CrossRef]

- Lu, C-S., Lai, K-H., Cheng, T.C.E. (2007). Application of structural equation modelling to evaluate the intention of shippers to use Internet service in liner shipping. European Journal of Operational Research, 180(2):845-867. [CrossRef]

- Mahmoodi, M. , & Mahmoodi, E. (2016). Foreign direct investment, exports and economic growth: evidence from two panels of developing countries. Economics Research- Ekonomska Istraživanja, 29 (1), 938–949. [CrossRef]

- Munium and Schramm (2018) the impacts of port infrastructure and logistics performance on economic growth: the mediating role of seaborne trade journal published journal of shipping and trade (2018) 3:1. [CrossRef]

- Musso, E. , Ferrari, C., & Benacchio, M. (2006). Port Investment: Profitability, Economic Impact and Financing. Research in Transportation Economics, 16: 171-218. [CrossRef]

- Neely, A. (1999). The Performance Measurement Revolution: Why Now and What Next? International Journal of operations and Production Management, 19(2): 205-228. [CrossRef]

- Nudurupati, S.S. , Bititci, U.S., Kumar, V., & Chan, F.T.S. (2011). State of the art literature review on performance measurement. Computers & Industrial Engineering, 60(2): 279-290. [CrossRef]

- Puig, M. , Wooldridge, C., Darbra, R.M. (2014). Identification and selection of Environmental Performance Indicators for sustainable port development. Marine Pollution Bulletin, 81(1): 124-130. [CrossRef]

- Sánchez, R.J. , Hoffmann, J., Micco, A., Pizzolittto, G., Wilmsmeier,G., & Sgut, M. (2003). Port Efficiency and International Trade: Port Efficiency as a Determinant of Maritime Transport Costs. Maritime Economics & Logistics. [CrossRef]

- Shan, J. , Lee, C-Y., Yu, M. (2014). An empirical investigation of the seaports economic impact: Evidence from major ports in China. Transportation Research Part E: Logistics and Transportation Review, 68: 41-53. [CrossRef]

- Shen, C. (2015, 1 April). Six 20,000 teu containerships on order for OOCL. Retrieved July 7, 2015, from http://www.lloydslist.com/ll/sector/containers/article459548.ece.

- Song, D-W, and Yeo, K-T. (2004). A competitive Analysis of Chinese Container Ports Using the Analytic Hierarchy Process. Maritime Economics & Logistics, 6: 34-52. [CrossRef]

- Stopford, M. (2009). Maritime economics 3e. Routledge, Abingdon. [CrossRef]

- Sukumaran, S. , Chakkambath, R.S., & Jacob, N. (2021). PORT CHALLENGES AND ISSUES OF PORT AND CONTAINER TERMINAL. International Journal of Scientific Research in Engineering and Management (IJRSEM) ISSN: 2582-3930.

- Tongzon, J. , and Heng, W. (2005). Port privatisation, efficiency and competitiveness: Some empirical evidence from container ports (terminals). Transportation Research Part A: Policy and Practice, 39(5): 405-424. [CrossRef]

- Tongzon, J.L. (1995). Determinants of port performance and efficiency. Transportation Research Part A: Policy and Practice, 29(3): 245-252. [CrossRef]

- UNCTAD (2014). United Nations Conference on Trade and Development, Annual Report 2014. Available from: https://unctad.org/publication/trade-and-development-report-2014.

- UNCTAD (2015) Review of maritime transport. United Nations conference on trade and development. United Nations Publication, Geneva.

- UNCTAD (2021). Review of Maritime Transport 2021. Geneva: UNCTAD. Available from: https://unctad.org/webflyer/review-maritime-transport-2021.

- United Nations Global Compact (2020b). Sustainable Ocean Business Action Platform. Available from: www.unglobalcompact.org/take-action/action-platforms/ocean.

- PADONOU, V.A. , ALLAGBE, B.S., TAMBA, J.G. (2021). Port ofCotonou and Accessibility of landlocked ECOWAS Countries to the International Market. International Journal of Progressive Sciences and Technologies (IJPSAT). [CrossRef]

- Yap, W.Y. (2020). Competitiveness and competitive advantage of ports. In book: Business and Econ of Port Manag, 10: 210-235, Routledge. [CrossRef]

- YOCHUM, G.R. , AGARWAL, V.B. (1987). Economic impact of a Port on a Regional Economy: Note. Growth and Change 18(3): 74-87. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).