Submitted:

18 March 2024

Posted:

18 March 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Materials and Methods

2.1. Preparation and Creation of the Semi-Structured Interview Questionnaire

2.2. Data Collection

2.3. Data Analysis

3. Results

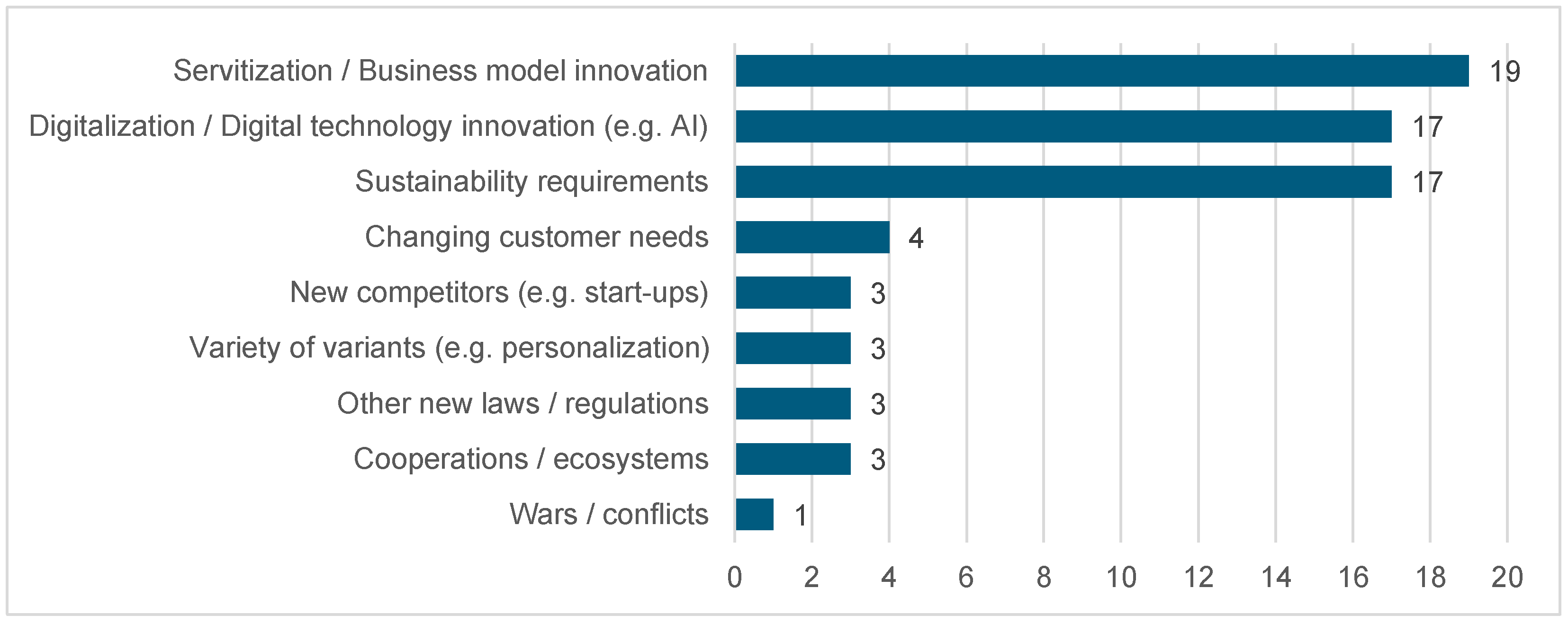

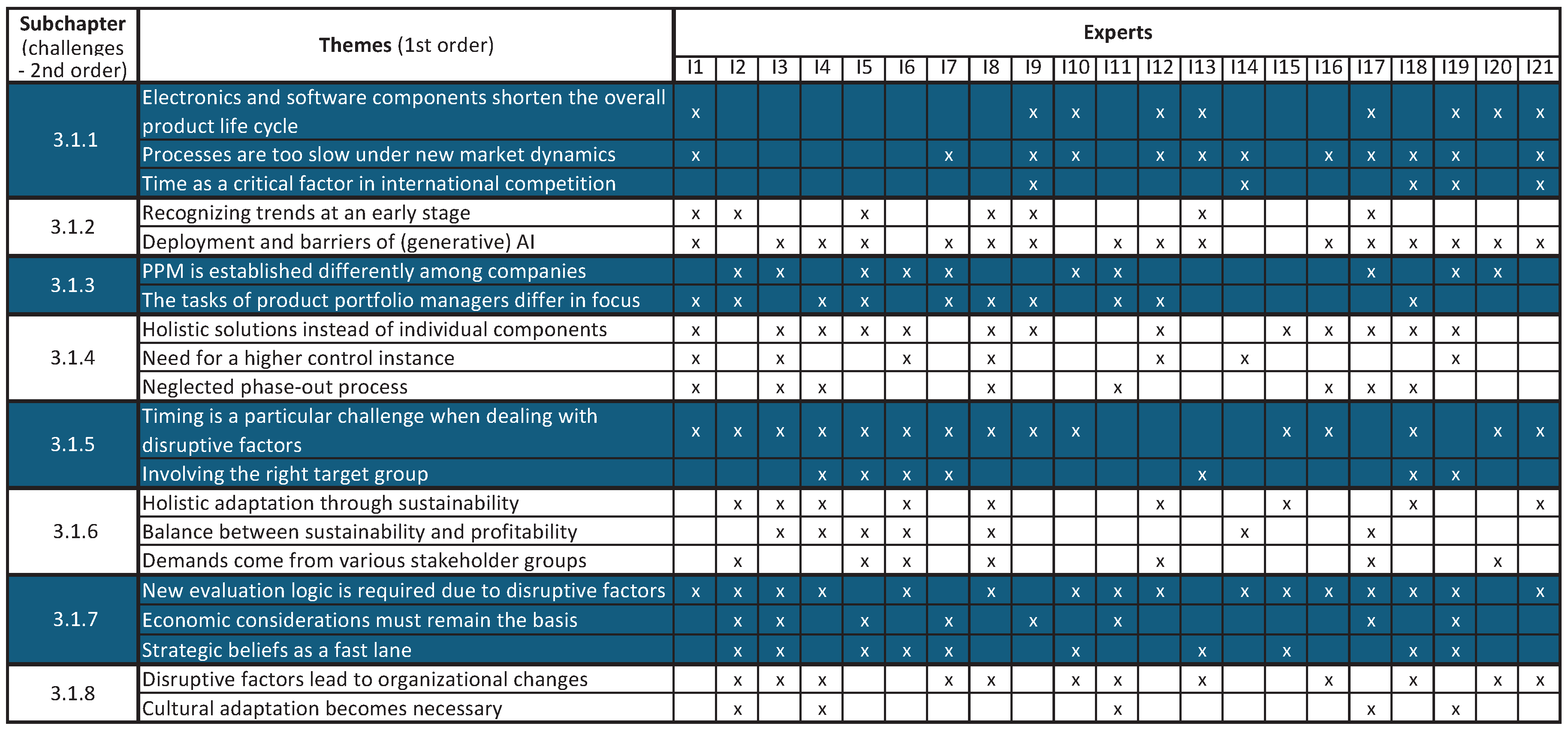

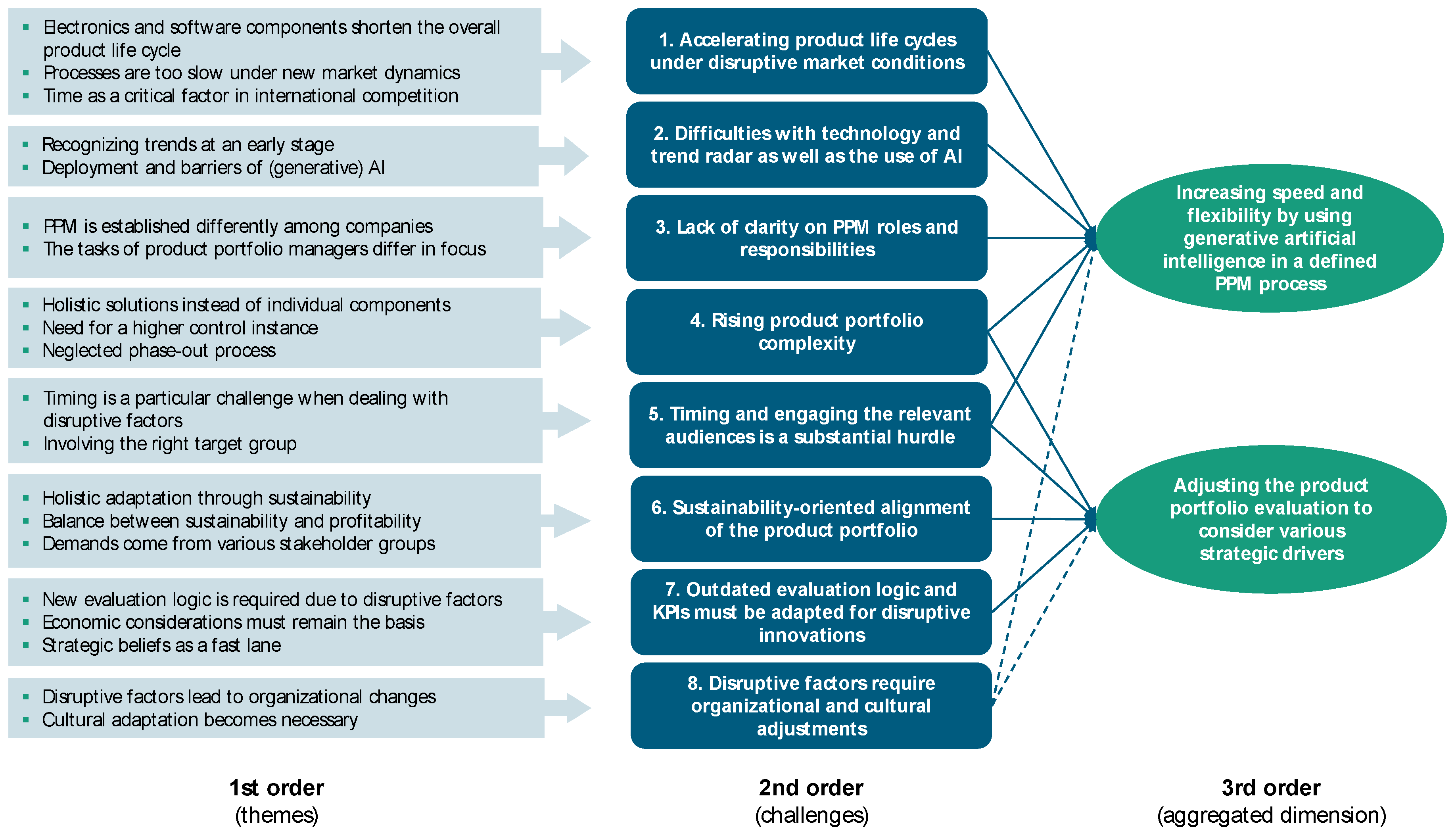

3.1. Eight Second-Order Challenges in PPM Due to Disruptive Factors

3.1.1. Accelerating Product Life Cycles under Disruptive Market Conditions

3.1.2. Difficulties with Technology and Trend Radar as Well as the Use of AI

3.1.3. Lack of Clarity on PPM Roles and Responsibilities

3.1.4. Rising Product Portfolio Complexity

3.1.5. Timing and Engaging the Relevant Audiences Is a Substantial Hurdle

3.1.6. Sustainability-Oriented Alignment of the Product Portfolio

3.1.7. Outdated Evaluation Logic and KPIs Must be Adapted for Disruptive Innovations

3.1.8. Disruptive Factors Require Organizational and Cultural Adjustments

3.2 Aggregated Dimensions of Action (3rd Order)

4. Discussion

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Dunst, K.H. Portfolio Management: Konzeption für die strategische Unternehmensplanung. Zugl.: Darmstadt, Techn. Hochsch., Diss. u.d.T.: Dunst, Klaus H.: Entwicklung einer Portfolio-Management-Konzeption für die strategische Planung in Multiprodukt-Unternehmen, 2., verb. Aufl.; de Gruyter: Berlin, 1983; ISBN 3-11-008876-2. [Google Scholar]

- European Commission. A Clean Planet for all: A European strategic long-term vision for a prosperous, modern, competitive and climate neutral economy. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52018DC0773.

- Axelson, M.; Oberthür, S.; Nilsson, L.J. Emission reduction strategies in the EU steel industry: Implications for business model innovation. J of Industrial Ecology 2021, 25, 390–402. [Google Scholar] [CrossRef]

- Wyns, T.; Khandekar, G.; Axelson, M.; Sartor, O.; Neuhoff, K. Industrial Transformation 2050: Towards an Industrial strategy for a Climate Neutral Europe, 2019. Available online: ies.be.

- 5. European Commission. Der europäische Grüne Deal, b: online: https://eur-lex.europa.eu/resource.html?uri=cellar, 0021.

- Henkel. Henkel treibt Nachhaltigkeitsziele voran – mit Fortschritten bei Klimaschutz und sozialem Engagement. Available online: https://www.henkel.de/presse-und-medien/presseinformationen-und-pressemappen/2023-03-07-henkel-treibt-nachhaltigkeitsziele-voran-mit-fortschritten-bei-klimaschutz-und-sozialem-engagement-1807096 (accessed on 29 February 2024).

- Siemens. Siemens will bis 2030 klimaneutral sein. Available online: https://press.siemens.com/global/de/pressemitteilung/siemens-will-bis-2030-klimaneutral-seinhttps://press.siemens.com/global/de/pressemitteilung/siemens-will-bis-2030-klimaneutral-sein (accessed on 29 February 2024).

- Alvarez, S.; Rubio, A. Carbon footprint in Green Public Procurement: a case study in the services sector. Journal of Cleaner Production 2015, 93, 159–166. [Google Scholar] [CrossRef]

- Special types of life cycle assessment; Finkbeiner, M. , Ed.; Springer: Dordrecht, 2016; ISBN 978-94-017-7608-0. [Google Scholar]

- PwC. Wachstumsstrategien für das B2B Service-Geschäft, 2023. Available online: https://www.pwc.de/de/im-fokus/customer-transformation/wachstumsstrategien-fuer-das-b2b-service-geschaeft.pdf (accessed on 29 February 2024).

- Deloitte. Der zweite Frühling für den Maschinenbau, 2020. Available online: https://www2.deloitte.com/content/dam/Deloitte/ch/Documents/energy-resources/deloitte-ch-digitale-services-maschinenbau-DE_KS8.pdf (accessed on 29 February 2024).

- Menter, M.; Göcke, L.; Zeeb, C. The Organizational Impact of Business Model Innovation: Assessing the Person-Organization Fit. J Management Studies 2022. [Google Scholar] [CrossRef]

- Trumpf. Pay-per-part: TRUMPF offers new business model to utilize spare machine capacity. Available online: https://www.trumpf.com/en_INT/newsroom/global-press-releases/press-release-detail-page/release/pay-per-part-trumpf-offers-new-business-model-to-utilize-spare-machine-capacity/ (accessed on 29 February 2024).

- Rix, C.; Leiting, T.; Holst, L. Herausforderungen der Preisbildung datenbasierter Geschäftsmodelle in der produzierenden Industrie. In Datenwirtschaft und Datentechnologie; Rohde, M., Bürger, M., Peneva, K., Mock, J., Eds.; Springer Berlin Heidelberg, 2022; pp 49–69, ISBN 978-3-662-65231-2.

- Vandermerwe, S.; Rada, J. Servitization of business: Adding value by adding services. European Management Journal 1988, 6, 314–324. [Google Scholar] [CrossRef]

- Stich, V.; Schumann, J.H.; Beverungen, D.; Gudergan, G.; Jussen, P. Digitale Dienstleistungsinnovationen; Springer Berlin Heidelberg, 2019, ISBN 978-3-662-59516-9.

- Linde, L.; Frishammar, J.; Parida, V. Revenue Models for Digital Servitization: A Value Capture Framework for Designing, Developing, and Scaling Digital Services. IEEE Trans. Eng. Manage. 2023, 70, 82–97. [Google Scholar] [CrossRef]

- Eggert, A.; Hogreve, J.; Ulaga, W.; Muenkhoff, E. Revenue and Profit Implications of Industrial Service Strategies. Journal of Service Research 2014, 17, 23–39. [Google Scholar] [CrossRef]

- McKinsey. Five digital and analytics battlegrounds for B2B aftermarket growth, 2022. Available online: https://www.mckinsey.com/capabilities/operations/our-insights/five-digital-and-analytics-battlegrounds-for-b2b-aftermarket-growth (accessed on 29 February 2024).

- Raddats, C.; Kowalkowski, C.; Benedettini, O.; Burton, J.; Gebauer, H. Servitization: A contemporary thematic review of four major research streams. Industrial Marketing Management 2019, 83, 207–223. [Google Scholar] [CrossRef]

- Altenfelder, K.; Schönfeld, D.; Krenkler, W. Services Management und digitale Transformation; Springer Fachmedien Wiesbaden, 2021, ISBN 978-3-658-33974-6.

- Business Fortune Insights. Market Research Report: Software as a Service - Market Size & Growth FBI102222, 2023. Available online: https://www.fortunebusinessinsights.com/software-as-a-service-saas-market-102222 (accessed on 29 February 2024).

- Christensen, C.; Raynor, M.; McDonald, R. What Is Disruptive Innovation? Harvard Business Review 2015. [Google Scholar]

- Kleinaltenkamp, M.; Gabriel, L.; Morgen, J.; Nguyen, M. Marketing und Innovation in disruptiven Zeiten – Eine Einführung und eine Einordnung der Beiträge dieses Buches. In Marketing und Innovation in disruptiven Zeiten; Kleinaltenkamp, M., Gabriel, L., Morgen, J., Nguyen, M., Eds.; Springer Fachmedien Wiesbaden: Wiesbaden, 2023; ISBN 978-3-658-38571-2. [Google Scholar]

- Rauch, S. Strategisches Management technologischer Wandlungsprozesse; Dr. Hut: München, 2024; ISBN 978-3-8439-5410-5. [Google Scholar]

- Wendt, S. Strategisches Portfoliomanagement in dynamischen Technologiemärkten; Gabler Verlag: Wiesbaden, 2013; ISBN 978-3-8349-4272-2. [Google Scholar]

- Homburg, C. Marketingmanagement; Springer Fachmedien Wiesbaden: Wiesbaden, 2020; ISBN 978-3-658-29635-3. [Google Scholar]

- Cooper, R.G.; Edgett, S.J.; Kleinschmidt, E.J. New Product Portfolio Management: Practices and Performance. J of Product Innov Manag 1999, 16, 333–351. [Google Scholar] [CrossRef]

- Kohlborn, T.; Fielt, E.; Korthaus, A.; Rosemann, M.; Davern, M. ; Scheepers. Towards a service portfolio management framework. Proceedings of the twentieth Australasian Conference on Information Systems Understanding shared services: an exploration of the IS literature 2009.

- Schicker, G.; Strassl, J. Produkportfolio-Management im Zeitalter der Digitalisierung, Weiden i.d. OPf., 2019.

- Tolonen, A.; Shahmarichatghieh, M.; Harkonen, J.; Haapasalo, H. Product portfolio management – Targets and key performance indicators for product portfolio renewal over life cycle. International Journal of Production Economics 2015, 170, 468–477. [Google Scholar] [CrossRef]

- Eckert, T.; Hüsig, S. Innovation portfolio management: a systematic review and research agenda in regards to digital service innovations. Manag Rev Q 2022, 72, 187–230. [Google Scholar] [CrossRef]

- Riesener, M.; Kuhn, M.; Boβmann, C.; Schuh, G. Concept for the Portfolio Management of Industrial Solution Providers in Machinery and Plant Engineering. Procedia CIRP 2023, 119, 1152–1157. [Google Scholar] [CrossRef]

- Boßmann, C.; Kuhn, M.; Riesener, M.; Schuh, G. Planning of Hybrid Portfolios for Industrial Solution Providers in Machinery Engineering. In Production at the Leading Edge of Technology; Bauernhansl, T., Verl, A., Liewald, M., Möhring, H.-C., Eds.; Springer Nature Switzerland: Cham, 2024; ISBN 978-3-031-47393-7. [Google Scholar]

- Mikkola, J.H. Portfolio management of R&D projects: implications for innovation management. Technovation 2001, 21, 423–435. [Google Scholar] [CrossRef]

- Gross, E.; Schrader, P.; Gramberg, T.; Schneider, M.; Bauernhansl, T. Identifikation und Auswahl von digitalen Services/Identification and selection of digital services. wt 2023, 113, 376–381. [Google Scholar] [CrossRef]

- Jank, M.-H. Produktportfoliosteuerung mittels präskriptiver Datenanalyseverfahren, 1st ed.; Apprimus Wissenschaftsverlag: Aachen, 2021; ISBN 978-3-86359-963-8. [Google Scholar]

- Li, F. The digital transformation of business models in the creative industries: A holistic framework and emerging trends. Technovation 2020, 92-93, 102012. [Google Scholar] [CrossRef]

- Söllner, C. Methode zur Planung eines zukunftsfähigen Produktportfolios. Dissertation; Heinz Nixdorf Institut.

- Leitner, C.; Ganz, W.; Satterfield, D.; Bassano, C. Advances in the Human Side of Service Engineering; Springer International Publishing: Cham, 2021; ISBN 978-3-030-80839-6. [Google Scholar]

- Villamil, C.; Hallstedt, S. Sustainabilty integration in product portfolio for sustainable development: Findings from the industry. Bus Strat Env 2021, 30, 388–403. [Google Scholar] [CrossRef]

- Weinreich, S.; Şahin, T.; Karig, M.; Vietor, T. Methodology for Managing Disruptive Innovation by Value-Oriented Portfolio Planning. Journal of Open Innovation: Technology, Market, and Complexity 2022, 8, 48. [Google Scholar] [CrossRef]

- Cenamor, J.; Rönnberg Sjödin, D.; Parida, V. Adopting a platform approach in servitization: Leveraging the value of digitalization. International Journal of Production Economics 2017, 192, 54–65. [Google Scholar] [CrossRef]

- Kowalkowski, C.; Gebauer, H.; Kamp, B.; Parry, G. Servitization and deservitization: Overview, concepts, and definitions. Industrial Marketing Management 2017, 60, 4–10. [Google Scholar] [CrossRef]

- Bortz, J.; Döring, N. Forschungsmethoden und Evaluation: In den Sozial- und Humanwissenschaften, 5. Aufl.; Springer-Verlag: Berlin, 2016; ISBN 978-3-540-33305-0. [Google Scholar]

- Dengel, A.; Gehrlein, R.; Fernes, D.; Görlich, S.; Maurer, J.; Pham, H.H.; Großmann, G.; Eisermann, N.D.g. Qualitative Research Methods for Large Language Models: Conducting Semi-Structured Interviews with ChatGPT and BARD on Computer Science Education. Informatics 2023, 10, 78. [Google Scholar] [CrossRef]

- Gioia, D.A.; Corley, K.G.; Hamilton, A.L. Seeking Qualitative Rigor in Inductive Research. Organizational Research Methods 2013, 16, 15–31. [Google Scholar] [CrossRef]

- Mees-Buss, J.; Welch, C.; Piekkari, R. From Templates to Heuristics: How and Why to Move Beyond the Gioia Methodology. Organizational Research Methods 2022, 25, 405–429. [Google Scholar] [CrossRef]

- Schrader, P.; Gross, E.; Bauernhansl, T.; Hoeborn, G. Digitale und nachhaltige Organisationen/Systematic literature review on modes of organizational ambidexterity – Digital and sustainable organizations. wt 2023, 113, 518–524. [Google Scholar] [CrossRef]

- Seifert, R.W.; Tancrez, J.-S.; Biçer, I. Dynamic product portfolio management with life cycle considerations. International Journal of Production Economics 2016, 171, 71–83. [Google Scholar] [CrossRef]

- Cooper, R.G.; Sommer, A.F. New-Product Portfolio Management with Agile. Research-Technology Management 2020, 63, 29–38. [Google Scholar] [CrossRef]

- McAfee, A.; Rock, D.; Brynjolfsson, E. Der ultimative Leitfaden für KI-Pioniere: Wie lässt sich das Potenzial von KI nutzen. Harvard Business manager 2024, 19–28. [Google Scholar]

- Preetham, F. Product Management will be taken over by AI in 5 years. Available online: https://medium.com/the-simulacrum/product-management-will-be-taken-over-by-ai-in-5-years-780d1302fefc.

- Stettina, C.J.; Hörz, J. Agile portfolio management: An empirical perspective on the practice in use. International Journal of Project Management 2015, 33, 140–152. [Google Scholar] [CrossRef]

- Horlach, B.; Schirmer, I.; Drews, P. Agile Portfolio Management: Desgin Goals and Principles. Proceedings of the 27th European Conference on Information Systems (ECIS) 2019. [Google Scholar]

- Villamil Velasquez, C. Guidance in developing a sustainability product portfolio in manufacturing companies; Blekinge Tekniska Högskola: Karlskrona, 2023; ISBN 978-91-7295-448-9. [Google Scholar]

- Hakanen, T.; Jähi, M. Central activities of solution portfolio management. IJSTM 2021, 27, 104. [Google Scholar] [CrossRef]

- Huang, G.; Huang, K. ChatGPT in Product Management. In Beyond AI; Huang, K., Wang, Y., Zhu, F., Chen, X., Xing, C., Eds.; Springer Nature Switzerland: Cham, 2023; ISBN 978-3-031-45281-9. [Google Scholar]

- Pradhan, D.; Dash, B.; Sharma, P.; Ullah, S. The Impact of Generative AI on Product Management in SMEs 2023.

- Kanbach, D.K.; Heiduk, L.; Blueher, G.; Schreiter, M.; Lahmann, A. The GenAI is out of the bottle: generative artificial intelligence from a business model innovation perspective. Rev Manag Sci 2023. [Google Scholar] [CrossRef]

- Li, Y.; Wang, S.; Ding, H.; Chen, H. Large Language Models in Finance: A Survey. In 4th ACM International Conference on AI in Finance. ICAIF '23: 4th ACM International Conference on AI in Finance, Brooklyn NY USA, 27 11 2023 29 11 2023; ACM: New York, NY, USA, 2023; ISBN 9798400702402. [Google Scholar]

- Paletta, M. Overview of Product Portfolio Management; Cuvillier Verlag: Göttingen, 2019; ISBN 9783736989450. [Google Scholar]

| Categories in questionnaire |

Sample questions for the categories of the questionnaire |

|---|---|

| Classification of the experts and current situation of PPM |

|

| Challenges and influencing factors in PPM |

|

| Best practice approaches to coping with disruptive influencing factors |

|

| Requirements for a new methodology to cope with challenges |

|

|

| No. | Position | Core business of the company or the relevant business unit | Company size(revenue) | ||

|---|---|---|---|---|---|

| I1 | Product Portfolio Manager | Measurement and control technology | 1-5 bn € | ||

| I2 | Director of Future Portfolio Management and Strategy |

System provider for the food, beverage and pharmaceutical industries | 5-10 bn € | ||

| I3* | Director Global Product & Technology Management |

Adhesive technologies | >20 bn € | ||

| I4 | Vice President Product Portfolio Management |

Panel building and switchgear manufacturing | 1-5 bn € | ||

| I5 | Senior Manager Corporate Strategy and Development |

Printing machine manufacturing | 1-5 bn € | ||

| I6 | Head of research group for Product / Portfolio Management |

Research institution | n/a | ||

| I7 | Head of Portfolio Management | Machine tools and laser technology | 5-10 bn € | ||

| I8 | Head of Product Management | Hydraulic components and systems | 100-499 mio € | ||

| I9 | Product Portfolio Manager | Diverse technology solutions | >20 bn € | ||

| I10 | Vice President Product Management and Segment Markeitng |

Automation technology | 500-999 mio € | ||

| I11 | Head of Product Management | Machine tools and laser technology | 5-10 bn € | ||

| I12* | Head of Solution and Service Portfolio Management |

Diverse technology solutions | >20 bn € | ||

| I13 | Product Consultant (former Product Manager) |

IT and strategy consulting | <100 mio € | ||

| I14 | Product Portfolio Manager | Machine tools and laser technology | 5-10 bn € | ||

| I15 | Global Product Manager | Connection technology | 500-999 mio € | ||

| I16 | Product Manager Digital Service |

Plant engineering for steelworks | 5-10 bn € | ||

| I17 | Director Central Marketing and Product Management | Woodworking machinery | 500-999 mio € | ||

| I18 | Head of Product Management | Labeling solutions | < 100 mio € | ||

| I19 | Global Product Manager | Machine and plant construction | 5-10 bn € | ||

| I20 | Partner | Strategy Consulting | n/a | ||

| I21 | ChatGPT in the role of Product Portfolio Manager in a medium sized B2B manufacturing company. | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).