1. Introduction

In recent years, technology has been evolving rapidly, affecting the everyday life of citizens. Citizens of modern societies are required to have skills for every new aspect of technology that is introduced into their daily lives. Nowadays, digital currencies such as Bitcoin, Ethereum, Ether, etc., are increasingly being introduced in modern digital transactions. Given the fact that the Internet is dominating, the use of digital currencies is considered widespread. For younger citizens this may be quite normal, while for older citizens this is seen as a not-so-understandable progression οf technology. However, the use of digital currencies is not always an easy process. It requires specific skills, mainly of a technological nature. These digital skills are not just related to transactions, but mainly to issues such as the management of digital currencies, the security of transactions and, of course, to a greater extent, the management of information related to digital currencies [

1].

Modern society is experiencing one of the most rapid technological developments recorded in history, and one of the main catalysts of this change is cryptocurrencies. Since the emergence of Bitcoin in 2009, cryptocurrencies have transformed the way we think about and use money, opening new avenues for the digital economy and social interaction. Cryptocurrencies are defined as decentralized digital currencies that use encryption to secure their transactions [

2]. Unlike traditional currencies, they operate without the need for intermediaries such as banks, allowing direct transactions between users. The core technology underpinning cryptocurrencies is blockchain, a distributed database that stores all transactions on a network of computers. This technology ensures data integrity and prevents the falsification of transactions, creating a secure environment for financial activities [

3].

However, the increase in the use of cryptocurrencies has also created challenges, particularly in the area of regulatory compliance and money laundering. The European Union, recognizing the importance of cryptocurrencies, has proceeded to develop a comprehensive legislative framework for the digital economy and cryptocurrencies [

4]. The MiCA (Markets in Crypto-Assets) regulation, which will apply from July 2024, provides legal certainty and promotes innovation, consumer protection, and market stability. This regulation sets uniform rules for service providers and issuers of cryptocurrencies in the EU, ensuring that consumers are informed about the risks and costs of their transactions [

5].

The digital society, through cryptocurrency technology, also promotes financial inclusion, particularly in regions and communities that have limited access to traditional financial services. Cryptocurrencies provide users with the ability to transact and store value without the need for a bank account, thus lowering the barriers to entry for many [

6]. Despite all the positive effects, the digital divide remains a significant challenge. Inequalities in the access and use of technology, particularly between developed and developing countries, exacerbate social and economic inequalities. Communities without access to the Internet and digital technologies are deprived of the opportunities offered by the digital society, exacerbating existing inequality [

7]. Overall, the digital society and cryptocurrencies represent a major advance in the economy and society. However, achieving full digital equality requires concerted efforts by governments, organizations, and civil society [

8]. Infrastructure development, digital literacy education, and the implementation of affordability policies are critical steps in bridging the digital divide and achieving a fair and inclusive digital society [

9].

In the current paper, we approach the issue of digital skills from a different but contemporary perspective. Although in the literature, there is a deep analysis of transaction technology through digital currencies, in this work, a different, more viable approach is carried out. An exploration of the necessary digital skills, which ordinary citizens using digital currencies for everyday transactions should have, is carried out. This approach is based on the literature and specifically on the issue of digital skills and their subcategories for managing digital currencies in everyday transactions. In addition, a quantitative survey was conducted by using a questionnaire based on the use of the DigComp framework. This is the second pillar of our literature review. Then, a presentation of the hypotheses, the methodology used, and the results of the research are given. Using the Structural Equation Modeling (SEM) method, a statistical analysis of the five axes of the questionnaire used (based on the DigComp framework) is performed in order to unveil latent relationships concerning the hypotheses of this study [

10].

2. Literature Review

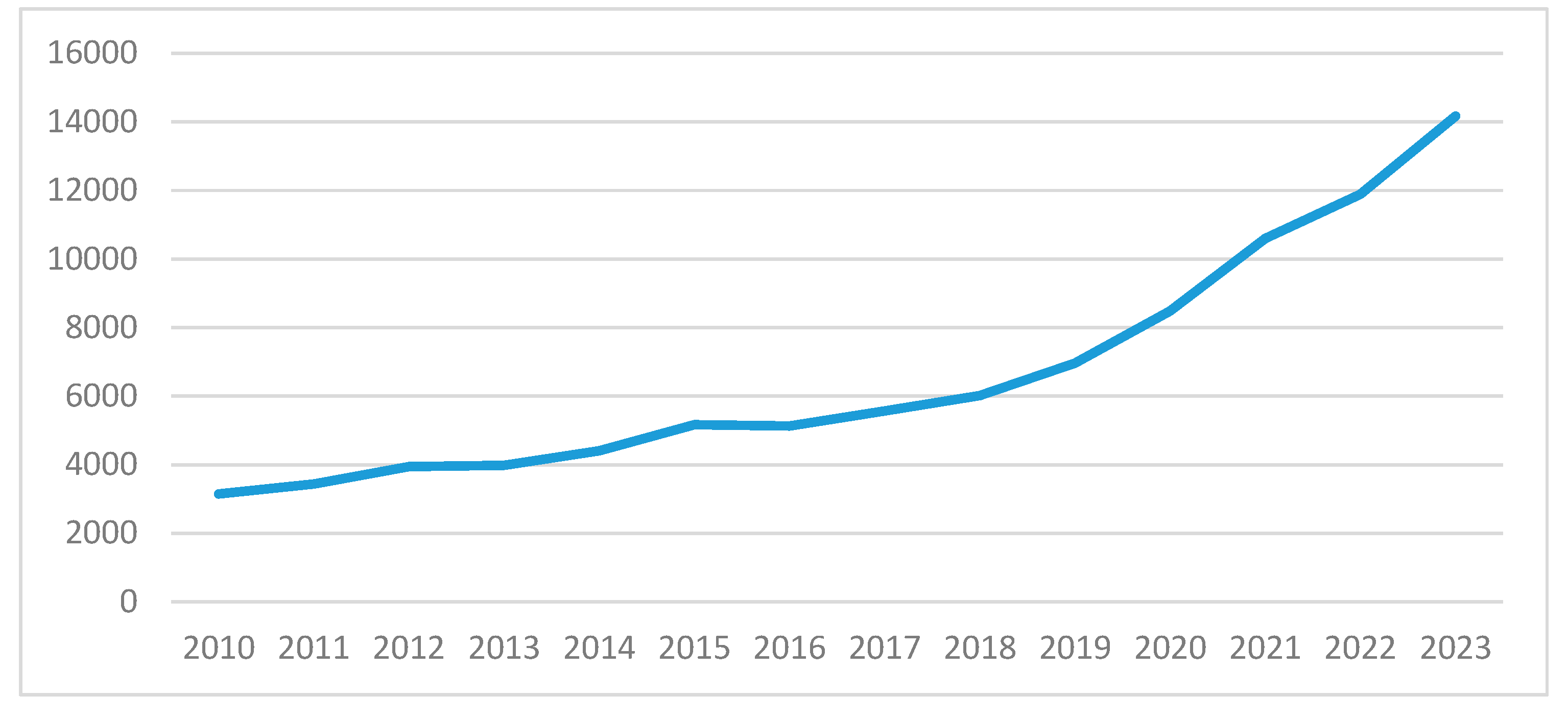

Searching the keywords “Digital Skills”, “Cryptocurrencies”, and “Digital Currencies” in the electronic database ScienceDirect, the following data were found and listed (

Figure 1).

For the word “Digital Skills”, 128,770 sources were found on ScienceDirect matching this word. The data are represented by number of sources per year [

11].

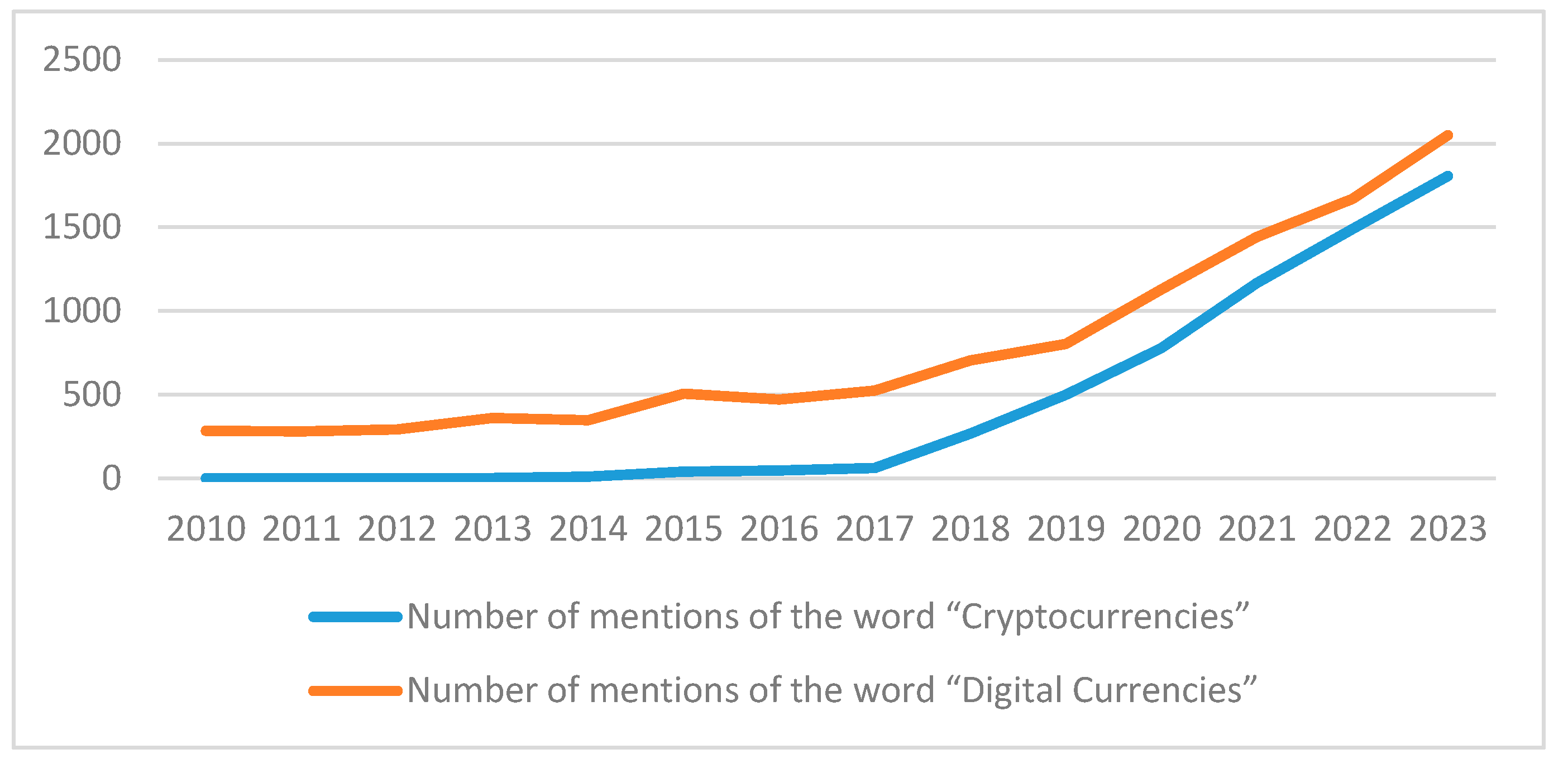

For the word “Cryptocurrencies”, 6415 sources were found on ScienceDirect matching this word. The data are represented by number of sources per year [

12] (

Figure 2). On the other hand, for the word “Digital Currencies”, 14,357 sources were found on ScienceDirect matching this word. The data are represented by number of sources per year [

13].

The keyword search was performed in the abstracts of the scientific articles. The articles were primarily searched in the electronic database ScienceDirect based on the keywords mentioned above.

The rise of millennials in shaping the investment and fintech landscape, particularly through their influence on hot trends like cryptocurrency, is indeed a noteworthy phenomenon. Traditionally, millennials were seen as passive participants in the financial markets, but now they are actively driving some of the most significant shifts. The Federal Reserve’s response to the economic challenges posed by the COVID-19 pandemic has also played a pivotal role in the surge of interest in alternative assets, including cryptocurrencies. The expansionary policies, such as interest rate cuts and quantitative easing, led many millennials to explore assets offering higher returns than traditional options, like cash. Cryptocurrencies, characterized by their high volatility, have become a focal point for millennials seeking investment opportunities. The ease of transferability and the potential for substantial returns have attracted speculators to this nascent asset class. Despite the risks associated with trading cryptocurrencies, their popularity continues to grow. The global financial system is witnessing the early stages of cryptocurrency development, with uncertainty about when these digital assets will maturely integrate into global markets. Whether cryptocurrencies achieve their goals remains uncertain, but their influence on the financial world is undeniable, ushering in changes that are likely to shape the financial landscape for years to come [

14].

The research conducted by Venkatachalam and Kannusamy in 2023 delves into the challenges faced by small businesses in recruiting digital skills, with a specific focus on the role of blockchain technology. Industry projections suggest that blockchain has the potential to generate approximately USD 3.1 trillion in new businesses by 2030, highlighting its significance in fostering economic growth [

15]. While these digital technologies offer opportunities for enterprises of all sizes, they also pose unique challenges for small businesses attempting to integrate them into their operations. The study recognizes the explicit growth and impact of digital technologies but emphasizes the struggle of small enterprises in recruiting and training individuals with the necessary digital skills to effectively leverage these technologies. To address this issue, this research employs a literature survey to explore how blockchain can contribute to the benefits of small enterprises. Through an analysis of blockchain social ecosystems, the study introduces the concept of a National Digital Skills Recruitment Chain (NDSRC) model. This model aims to elucidate how specific characteristics of blockchain, such as digital trust, data immutability, privacy, and security, can play a pivotal role in mitigating the challenges associated with recruiting digital skills in small enterprises. Through this model, the research aims to provide a strategic framework that aligns blockchain attributes with the unique needs and constraints of small businesses, thereby facilitating the effective recruitment and utilization of digital skills in this sector [

16].

A survey of deep learning applications in cryptocurrency was recorded by scientists. This study aims to comprehensively review a recently emerging multidisciplinary area related to the application of deep learning methods in cryptocurrency research. We first review popular deep learning models employed in multiple financial application scenarios, including convolutional neural networks, recurrent neural networks, deep belief networks, and deep reinforcement learning. We also give an overview of cryptocurrencies by outlining the cryptocurrency history and discussing primary representative currencies. Based on the reviewed deep learning methods and cryptocurrencies, we conduct a literature review on deep learning methods in cryptocurrency research across various modeling tasks, including price prediction, portfolio construction, bubble analysis, abnormal trading, trading regulations, and initial coin offering in cryptocurrency. Moreover, we discuss and evaluate the reviewed studies from the perspectives of modeling approaches, empirical data, experiment results, and specific innovations. Finally, we conclude this literature review by informing future research directions for deep learning in cryptocurrency [

17,

18].

A paper by Yoo outlines the key points of a business plan centered around digital asset trading, particularly in the realm of cryptocurrency [

19]. The narrative emphasizes the transformative impact of digital assets on the global financial ecosystem since their invention in 1998, leading to the emergence of blockchain technology and decentralized digital currency. Other scientists note that despite the existence of various digital assets, cryptocurrencies stand out as the most widely recognized [

20]. The landscape includes central bank digital currencies (CBDCs), stable coins, non-fungible tokens (NFTs), and utility tokens. The surge in digital asset popularity has resulted in a proliferation of cryptocurrency exchanges and institutions managing these assets. Blockchain technology, a cornerstone of this evolution, has not only transformed the financial sector but also left its mark on non-financial industries. The technology’s groundbreaking nature is underscored by verifiable records shared among nodes across various continents. Public blockchain networks exist within the digital community, while private blockchain networks cater to business needs. One business plan introduced, named ZeakXchain, is positioned as a financial technology management company. It aims to offer two primary services: digital asset management/advice with a focus on cryptocurrency trading and blockchain-related consultancy services concentrating on private blockchain networks. The choice to establish ZeakXchain in the United Arab Emirates (UAE) is justified by the increasing demand for such services and favorable regulations in the region. In essence, the business plan aims to leverage the evolving landscape of digital assets and blockchain technology, aligning with the global shift towards decentralized and innovative financial solutions [

19,

20,

21].

Digital currency vs. cryptocurrency and blockchain was studied by scientists [

22]. Despite the Reserve Bank of India consistently raising concerns over the dangers of cryptocurrencies, primarily its use is facilitating money laundering and terror financing, India has emerged as a blossoming crypto market contributing billions of dollars in trading volume. In recent years, although cryptocurrencies have gained momentum with various investors, they have not made any significant impact due to the volatility of the transactions. One of the major shortcomings is that the cryptocurrency network can only validate the payment but not the delivery of various products and services. Hence, buyers of products and services are handicapped as the network does not simultaneously validate both sides of the transactions. The sharp volatility in the value of cryptocurrencies over a relatively short period of time is a major issue due to which maintaining price stability becomes extremely difficult. Furthermore, the absence of regulatory mechanisms and the decentralized nature of the transactions raises various fears and apprehensions that cryptocurrencies may be used for illegal activities. The solution to get over some of the shortcomings of cryptocurrencies is the issue of digital currency by the Central Bank [

23]. The International Monetary Fund (IMF) has warned of the risks posed by cryptocurrencies, especially in emerging and developing countries, and has suggested coordinated action to put in place global standards for cryptocurrencies. According to the IMF, determining valuation is not the only challenge in the crypto ecosystem; identification, monitoring, and management of risks which challenge regulators and firms are areas of concern. These include operational and financial integrity, risks from crypto asset exchanges and wallets, investor protection, inadequate reserves, and inaccurate disclosure for some stable coins [

22,

23,

24].

In Ozili’s exploration of the potential impact of CBDC on the existence of cryptocurrencies, his chapter critically examines the suggestion that CBDC issuance might lead to the collapse of private digital currencies. The research employs discourse analysis and literature review methods to assess the possibility of central bank digital money undermining the role of cryptocurrencies as a medium of exchange. The chapter elucidates how the introduction of a digital currency by a central bank could have profound implications for private digital currencies like Bitcoin. A key argument put forth is that the creation of a central-bank-issued digital currency has the capacity to diminish the trust placed in private digital currencies. This erosion of trust, he posits, may be a critical factor contributing to the eventual downfall of cryptocurrencies. Notably, the chapter advances the groundbreaking perspective that fiat digital money, backed by government authority, should prevail over private digital currency. In sum, this research chapter provides a novel and thought-provoking analysis of the dynamics between central bank digital currency and private digital currencies, suggesting that the former might exert a transformative influence on the latter, potentially leading to their collapse [

24,

25].

The study by Pattnaik, Hassan, Dsouza, Tiwari, and Devji offers a thorough analysis of the academic trends and thematic dimensions within the field of cryptocurrency research. The cryptocurrency market has garnered substantial support globally, with investors and traders appreciating its transparency, portability, divisibility, and resistance to inflation. The rising popularity of cryptocurrencies has prompted numerous central banks to consider launching their own digital currencies. This growth trend has significantly influenced academic research, leading to a proliferation of publications in the field. The study employs bibliometrics to track ten thematic clusters in cryptocurrency research, including the followng [

24]:

Cryptocurrency as a tool for risk management;

Decentralization of crypto transactions using blockchain and fintech;

Regulatory and digital framework of cryptocurrencies;

Market efficiency of cryptocurrencies;

Pricing efficiency of cryptocurrencies;

Price clustering and liquidity in crypto transactions;

Cryptocurrency as an investment asset;

Portfolio diversification using cryptocurrency;

Trading volume, return, and volatility of cryptocurrencies;

The role of information in the volatility of cryptocurrency prices.

Each thematic cluster is subject to detailed analysis within the study, providing insights into the current state of research in these areas. The authors also present directions for future research, acknowledging the dynamic nature of the cryptocurrency landscape and the need for ongoing exploration and analysis in these thematic dimensions [

24,

25].

The study by Yeong, Kalid, Savita, Ahmad, and Zaffar aimed to evaluate the inclination of Malaysian individuals towards adopting cryptocurrency and to investigate the key factors influencing their behavior in adopting this digital currency. Survey data were gathered from Malaysians with cryptocurrency knowledge, and a partial least square structural equation modeling (PLS-SEM) approach was employed to estimate the model. The findings indicate a high level of intention among Malaysian individuals to adopt cryptocurrency. Notably, performance expectancy, social influence, facilitating conditions, and price value were identified as significant factors influencing an individual’s adoption behavior. Given the unique regulatory landscape of cryptocurrency across nations, further exploration could enhance the understanding of the study’s results, particularly in relation to government support, which was identified as a non-predictor of an individual’s behavioral intention to use cryptocurrency [

23,

26].

The rapid integration of technology into our daily lives has created a dynamic that education and training systems struggle to keep up with. The need for digital skills is now more critical than ever, as the COVID-19 pandemic has highlighted inequalities in access and education, widening the digital divide. Research, such as that of Mostova, Taranenko, and Shcholokova [

27], shows that digital literacy and the use of advanced technologies, such as big data and artificial intelligence, are essential for the competitiveness of businesses and their inclusion in the Digital Single Market of the EU. In addition, the Digital Future Society study highlights the need for a clear framework of metrics to monitor digital inclusion, which will help political actors take targeted actions to reduce inequalities [

28].

Finally, the study by Kulbhaskar and Subramaniam explores the impact of publicly available information, particularly cryptocurrency news headlines, on shaping investor sentiments in the cryptocurrency market. The research employs a classification of sentiments into positive and negative categories and examines their distinct effects on cryptocurrency trading activity. The findings reveal that positive news has a confidence-boosting effect, leading to increased investor returns, while negative news induces uncertainty. Focusing on Bitcoin, the most prominent cryptocurrency, the study identifies a “negativity effect”, in which the impact of negative news on returns is more pronounced than that of positive news. Additionally, the study delves into the effects on volatility and liquidity, demonstrating that positive news contributes to higher volatility and liquidity, while negative news has the opposite effect. The study suggests that positive news may attract uninformed traders driven by the “fear of missing out” phenomenon and pump-and-dump schemes [

29]. Conversely, negative news is associated with reduced liquidity, stemming from increased uncertainty among both informed and uninformed traders. This research sheds light on the intricate relationship between news sentiment and various aspects of cryptocurrency market dynamics [

30,

31].

5. Methodology

The methodology followed for this research was based on a sequence of steps. Initially, a literature review was performed, based on journals of known value that were searched through major databases, such as Scopus and JSTOR. Then, the hypotheses were formulated, arising from the findings of the literature review. In the methodology as analyzed below, reference is made to the development of digital skills by society for the more effective and efficient use of digital currencies. In practice, this does not mean that only digital skills contribute to this. There are other important factors, such as the regulatory framework, technology and infrastructure, and economic stability, as well as education and information. But in the current work, the research carried out aims to investigate digital skills, since as this arises from the literature; this is an extremely important factor [

47]. As the topic under development was related to digital skills, particular attention was given to the implementation of a questionnaire that would be weighted and at the same time would address different aspects of the digital skills issue. Among the available options, it was decided to select the DigComp framework, which was proposed by the EU and through its five axes covers a wide range of the study of individual factors as presented in the previous sections of this paper [

48].

The axes of DigComp were kept as they were, while the construction of the questions under investigation was primarily based on the literature review. Because the literature review showed significant gaps in specific concepts, extensive use was made of white papers from fintech companies to cover concepts related to the management of digital currencies by the general population. The configuration of the questions kept the number of questions as in the original model, while the use of generic questions helped to better profile the respondents. At the same time, general questions were used in order to carry out a descriptive analysis of the sample. Following the directions for creating the individual questions as formulated in the DigComp framework, the questions were parameterized based on the literature review [

33].

The structure of the questionnaire used was based on the DigComp framework. Its five main axes were retained, as well as the individual number of questions for each axis. In particular, we respected the individual coverage of the variables of each axis and the individual questions were based on the analysis of these variables. In this way, each axis has the same weight in the final formulation of the result as provided in the DigComp framework [

49]. At the same time, there was a specific design in order to cover every individual hypothesis. In this context, the hypotheses are found in combination in the five axes of the questionnaire and in the questions of each axis.

Then, the questionnaire was transferred to a digital environment and specifically to the Survey Monkey site (“

https://www.surveymonkey.com/ (accessed on 12 February 2024)”). Because the questionnaire is considered as a quantitative survey tool, a significant sample size was required to complete it. Survey Monkey was considered the most suitable tool as it has many digital versions of question display available and even some more complex ones, such as matrix questions. In addition to this, data collection is carried out in a file that is easily configurable for statistical analysis.

The questionnaire consisted of three parts. The first part included demographic characteristics, specifically four questions of general interest. The second part included fourteen on/off questions, which also served as questions to control the respondents’ digital currency management. In the case that a respondent did not manage digital currencies, they could not continue the survey, as they did not have the knowledge to answer the following questions related to digital skills. The third part was purely based on the existence of the five pillars of the DigComp tool. The survey was conducted over a nine-month period, from January 2023 to October 2023, and was completed via a special link created by Survey Monkey.

The questionnaire was initially sent to around five thousand emails. The emails came from mailing lists available on the Internet and in specific financial institutions like mezz. We deliberately targeted these as there was a greater chance of targeting individuals who manage digital currencies and therefore would form the sample of our research. The rate of acceptance and subsequently completion of the questionnaire was low, around 8.8%, and this was largely due to individuals either not being willing to complete the questionnaire or not managing digital currencies. As the response was low, within 15 days of sending each automated email, a follow-up procedure was implemented as a reminder for completion. Also, participants were given the survey in the form of a tiny url in order to forward it to people who were aware of it and would be probably willing to complete it.

The survey sample consisted of a total of 443 respondents. This sample represents those who actually answered the questions, as compulsory questions were asked. Therefore, those who did not answer all the questions were not recorded. The questionnaire was completely anonymized throughout its completion. To ensure that participants were informed about the processing of their responses, there was an initial screen informing them and, by extension, explicit consent was requested via a checkbox.

The statistical analysis was along two axes. The first axis is the descriptive statistics for the first and second part, i.e., demographic characteristics and on/off data. In the third part, SEM (Structural Equation Modeling) analysis was performed. SEM analysis was chosen as it presents significant advantages, especially when complex variables analysis has to be performed. First of all, it is a complete and comprehensive analysis that fully combines elements of Factor and ANOVA analysis. It is also a valid analysis using specific complex models that takes a multifaceted approach to the final result. In addition to these, SEM analysis also provides specific model fit indices, most notably the Comparative Fit Index (CFI), which corresponds to a score of 0.705 for our research, and the Tucker–Lewis Index (TLI), which shows a score of 0.661 concerning the fit of our research model.

6. Results

6.1. Descriptive Analysis and Results

The statistical analysis of the questionnaire responses showed that the issue of skills is indeed a very important issue. In order to better understand the results, it is important to present the descriptive statistics.

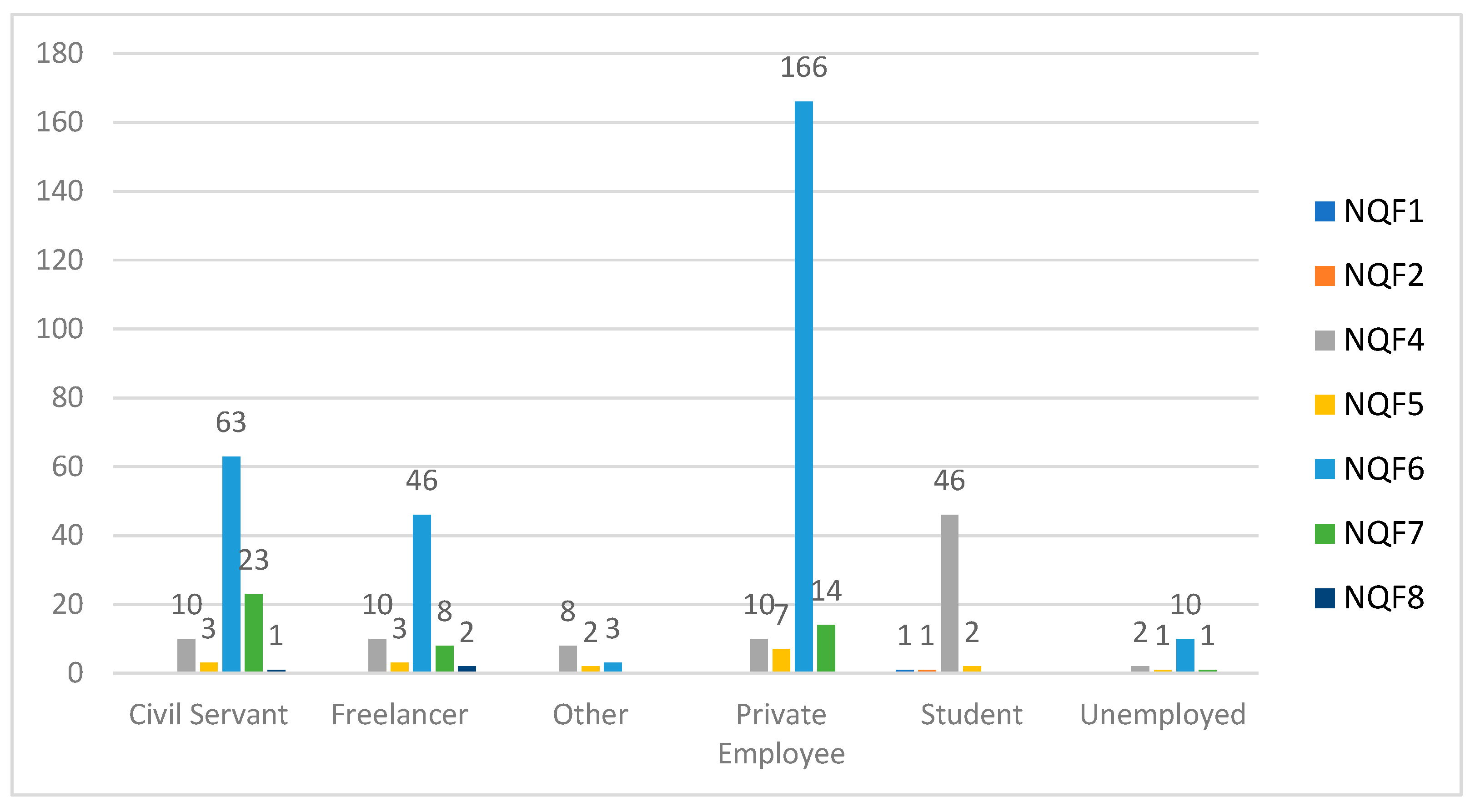

Figure 3 represents the sample of respondents to the survey. It shows a combined analysis of their occupation and educational level. The educational level follows the axes of EU education policy and the Bologna Education Charter and distinguishes educational levels based on the National Qualifications Frameworks (NQFs), with NQF4 typically corresponding to secondary school graduates, NQF6 to higher education graduates, and NQF7 to postgraduate degree holders [

50].

Based on the descriptive analysis, most participants in the survey are employees of the private sector at a rate of 44.47%, followed by civil servants at a rate of 22.57%, freelancers at a rate of 15.58%, followed by other population groups. Having a broader picture of the European society, we could emphasize that the sample is representative as it is expected that these population groups mainly deal with digital currencies as their economic background usually allows it, but they are also influenced by developments in their professional field.

Figure 3 combines the educational level with the employment status of the respondents. Thus, there is a significant concentration of respondents in the NQF6 higher education spectrum at 65.01%. The next ranked educational category of respondents is secondary education NQF4 at 19.41%, followed by post-secondary education NQF7 and post-secondary education NQF5 graduates with lower percentages. The above picture as presented appears to show normal levels, as it was expected from the beginning that digital currency users would have a higher educational level as the literature shows a correlation between educational and perceptual level for the use of the new technology in transactions. Considering that digital currencies constitute a modern technology, which requires digital skills, the majority of the respondents could not correspond to any other educational level.

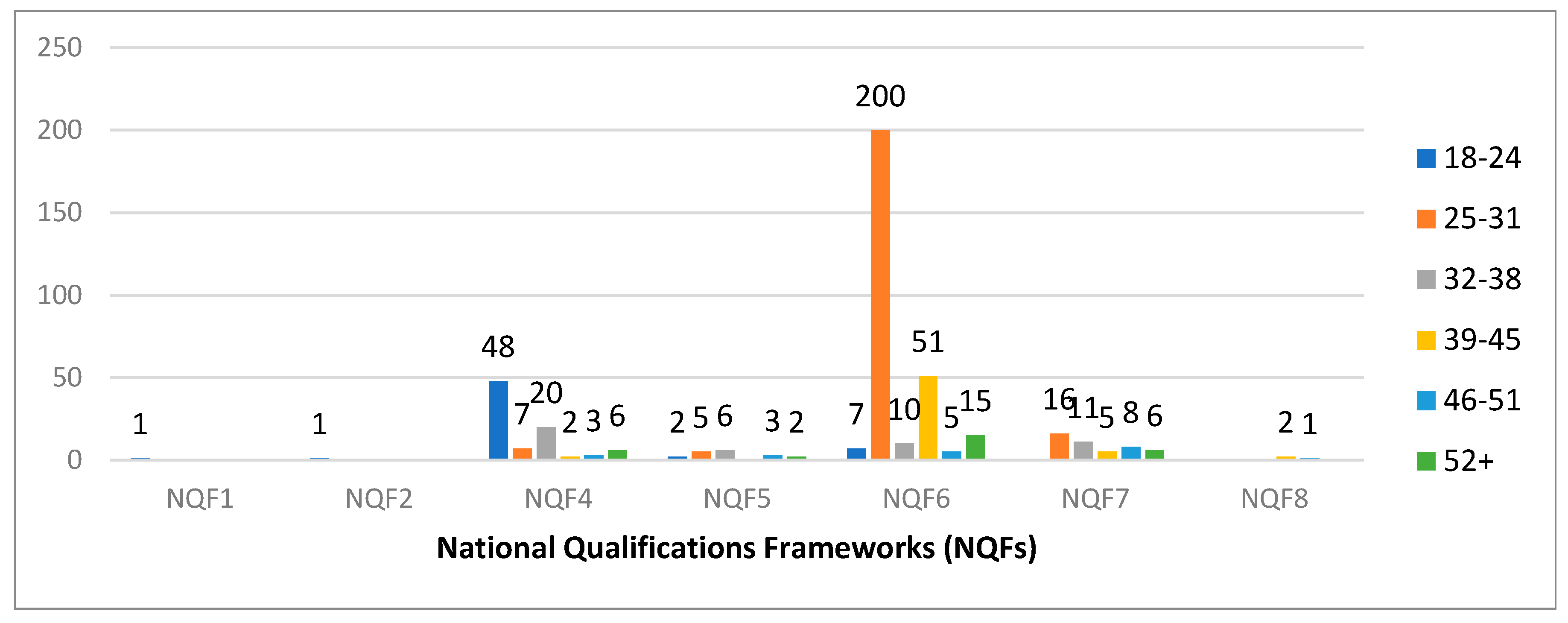

In

Figure 4, the combination of educational level and age of respondents is shown. This is extremely important, as research shows that the acquisition of digital skills is usually easier for younger people. In contrast, older people have been proven to have difficulty in acquiring and/or improving their digital skills, which means that it is not as easy for them to assimilate and use these skills in their daily lives. This is also seen as a factor that works against the acceptance of new technologies for everyday situations, such as transactions.

The picture of the participants of the current survey confirms the above, as the vast majority of the respondents belong to the age range of 25–31 years at 51.47%. These individuals have usually finished their studies and are already working, having secured an income which provides them with independence in managing it. The next important category is people aged 39–45 with 13.54%, followed by respondents aged 18–24 with 13.31% and the remaining categories are next in line. The trends here are based on two important assumptions. The first is the financial independence required to invest or engage in digital currencies while the second assumption relates to the ease of managing digital skills, an element usually seen in younger age groups. Finally, the vast majority of participants, as confirmed in

Figure 3, come from higher education.

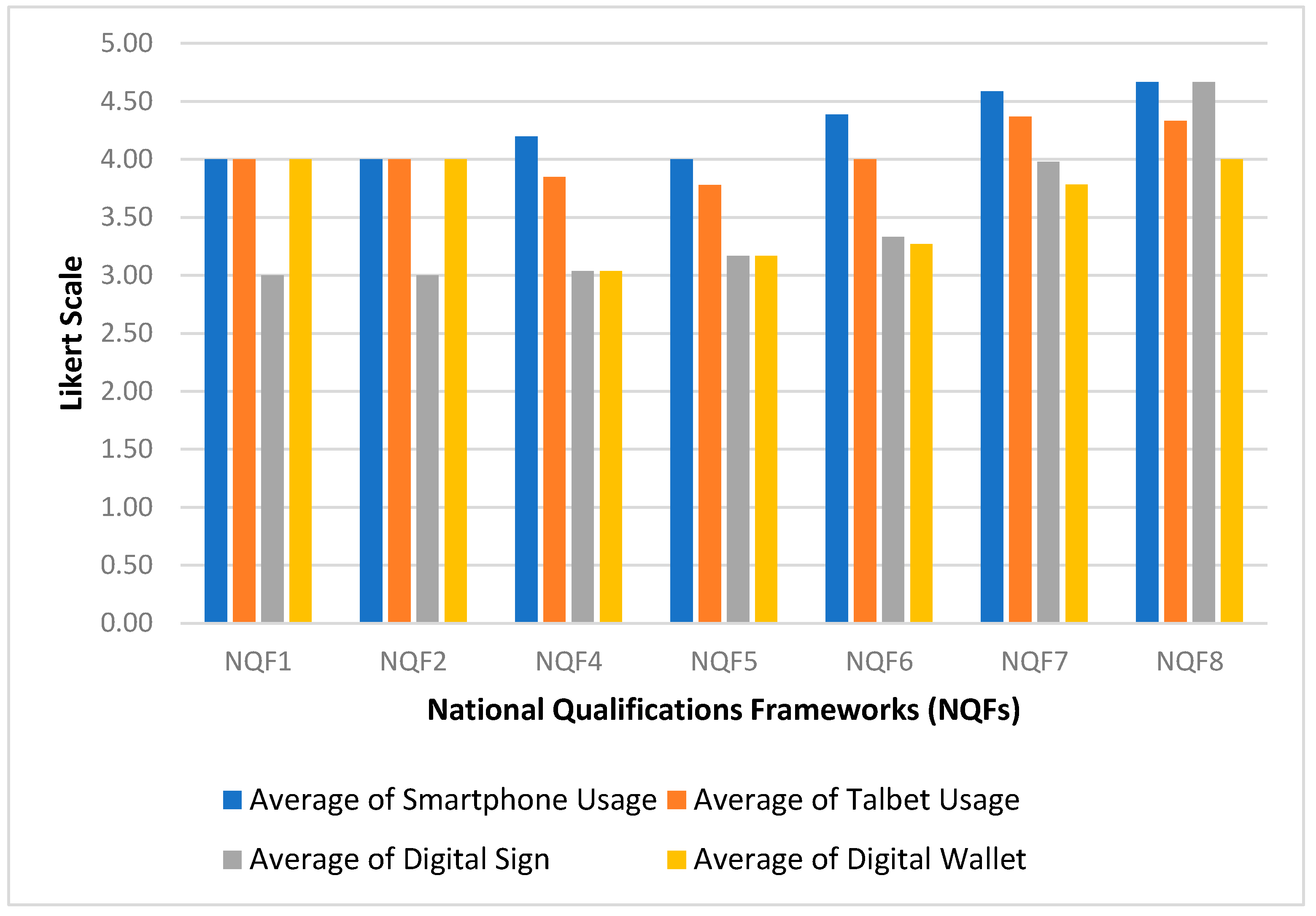

Figure 5 shows a combined analysis of the educational level and the degree of use of different devices by the respondents. These are questions that go back to the five-point Likert scale and are self-identification questions on the part of the respondents. One of the questions was related to their level of digital skills in using smartphones, tablets, digital signatures, and digital wallets. In related studies in the literature, it is found that skills are presented as proportional to the educational level of the respondents. Thus, as the educational level increases, there is greater ease and fluency in using digital devices or functions, such as those included in the question.

Practically, what is mentioned in the literature is confirmed in our research as well, as in all categories there is a harmonious increase in skills and ease of use of digital devices or functions depending on the educational level of the respondents [

51]. As a result, as one’s knowledge and expertise increases, so does the effectiveness in using particular devices/functions.

6.2. Technical Analysis and SEM Results

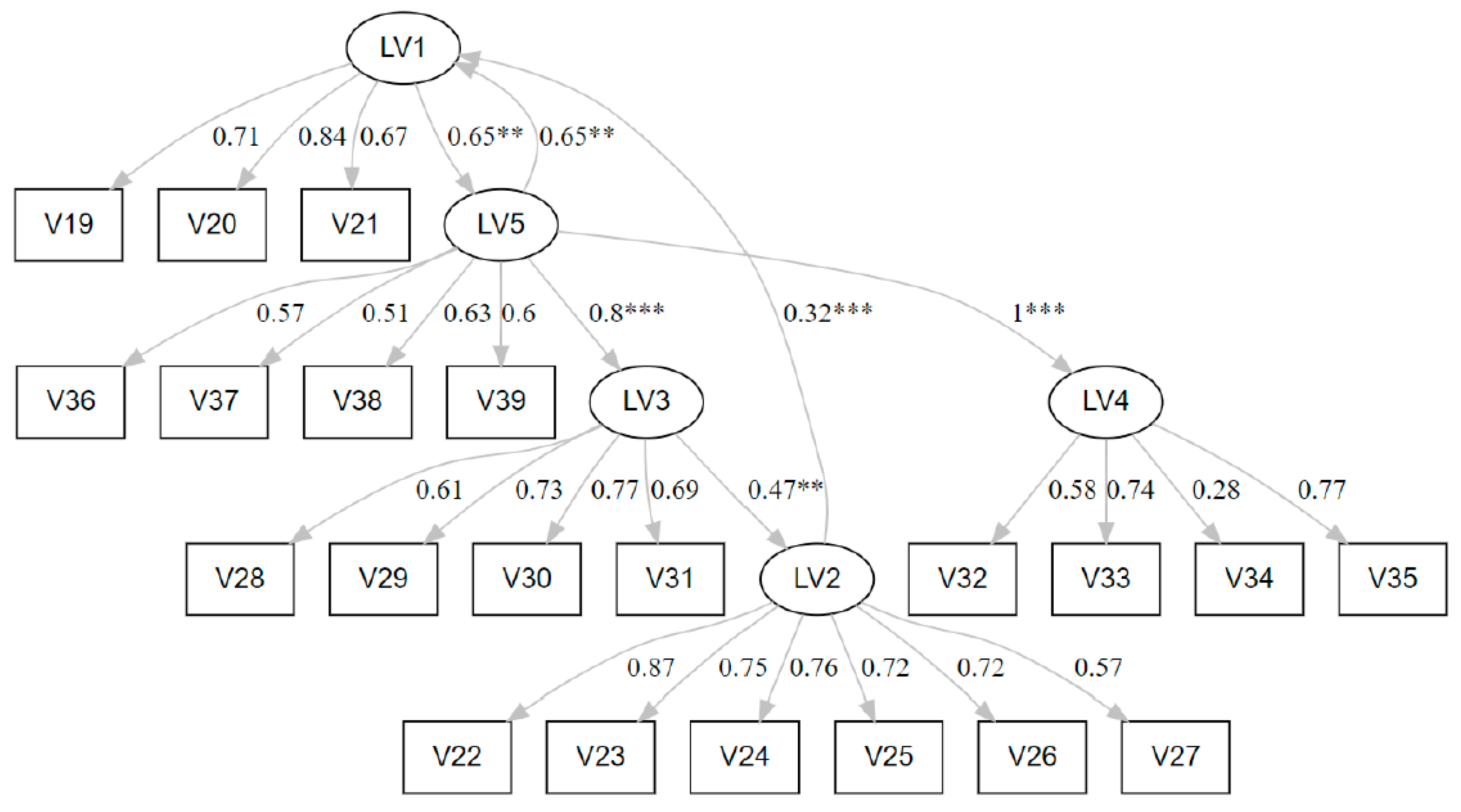

Regarding the hypotheses of

Section 5, we grouped the five topics of the questionnaire based on DigComp into latent variables as follows:

LV1: Information and data knowledge;

LV2: Communication and collaboration;

LV3: Digital content creation;

LV4: Security;

LV5: Problem resolution.

We used the statistical language R with various libraries, such as Lavaan, Mplus, SEM, etc.

To create latent variables in a Confirmatory Structural Equation Modeling (CSEM) analysis, we followed the following steps:

Define the theoretical constructs: identify the latent variables that represent the theoretical constructs. These are unobserved variables that cannot be directly measured but can be inferred from observed indicators.

Select indicators: determine the observed indicators or measurements for each latent variable. These are observable variables that provide information about the underlying construct.

Specify measurement models: specify how the observed indicators relate to their corresponding latent variables through measurement models. This involves assigning factor loadings that indicate the strength of the relationship between each indicator and its corresponding latent variable.

Connect latent variables: define structural models by specifying relationships between different latent variables in the model. This involves identifying paths or connections between the latent variables and assigning regression coefficients to indicate their strength and direction.

Assess model fit: evaluate how well the CSEM model fits the data using various fit indices, such as chi-square, the Comparative Fit Index (CFI), Root Mean Square Error of Approximation (RMSEA), etc.

Refine and modify: if necessary, refine the model by modifying paths, adding or removing indicators or adjusting factor loadings based on statistical indices and theoretical considerations.

Estimate parameters: use statistical software specifically designed for CSEM (e.g., Mplus v.8.3 and Lavaan v. 0.6-12 in R) to estimate parameters in the model based on maximum likelihood estimation or other appropriate methods.

Interpret results: examine estimates of factor loadings and regression coefficients to understand how each indicator contributes to its respective construct and how different constructs relate to each other within the model.

Having all these in consideration, we created the aforementioned five groups after testing all the possible combinations of regressions, one to another or to all others, and we arrived at these accepted results with a p-value lower than 0.05, meaning acceptable significant statistical dependency or the alternative statistical hypothesis being accepted.

The above results (

Table 2 and

Table 3) show the accepted statistically significant dependency regressions, with the estimate coefficients all having

p-values lower than 0.009, which means a very strong dependency.

Overall, the SEM model fit is good, with an RMSEA of 0.143. The CFI and TLI are both 0.7, indicating that the model fits the data well (

Table 2 and

Table 3). The latent variables are well estimated, the regressions between the latent variables are significant, and the variances of the observed variables are significant too.

As we can see from the above results, the most important topics are the following:

LV5: Problem resolution;

LV2: Communication and collaboration;

LV1: Information and data knowledge;

LV3: Digital content creation;

LV4: Security.

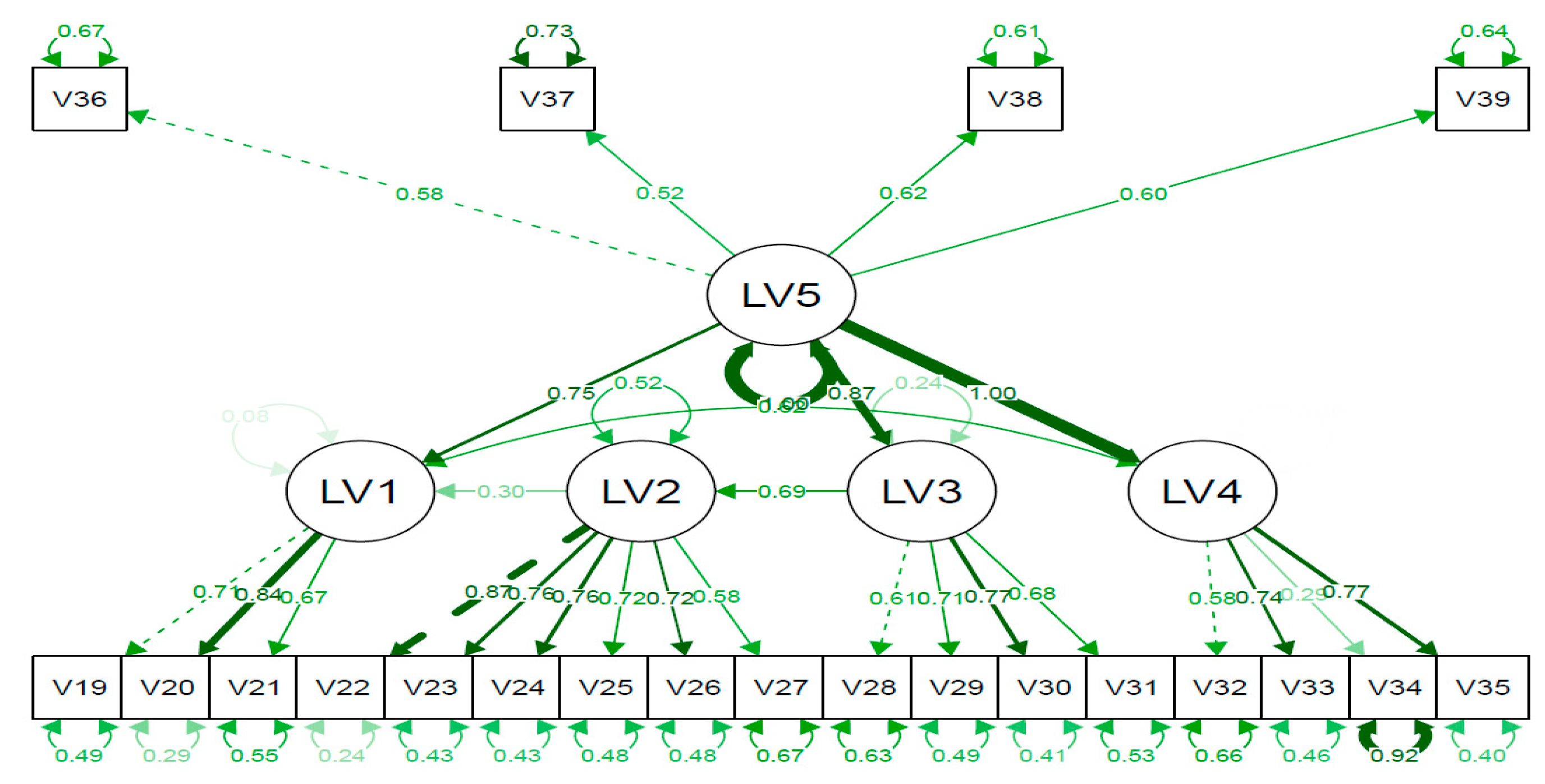

Problem resolution (LV5) is the most important latent variable, having the most appearances and estimate coefficients among all the latent variables. Also, it has statistically significant dependency with three of the four remaining latent variables (LV1, LV3, and LV4) with a

p-value lower than 0.05 [see

Figure 6 and

Figure 7].

The weakest latent variable is, unexpectedly, security (LV4), having a very high statistically significant dependency only with problem resolution (LV5). This result is a very interesting and important research finding.

We expected the security topic to be very important, but the study showed us that other topics, such as problem resolution and communication and collaboration, proved to be the most important and having the heaviest statistically significance above all.

Last but not least, we considered that for this specific analysis, the appropriate method was Structural Equation Modeling (SEM). This is because SEM practically applies the analysis of complex models with significantly high accuracy and reliability in the final results. In particular, the DigComp framework on which our research application was based, covers an important research area, through five variables (information and data knowledge, communication and collaboration, digital content creation, and safety and problem resolution) that examine digital skills. The ANOVA analysis shows that the most important parameter of digital skills for the use of digital currencies is the security variable. However, this did not emerge from the SEM analysis. The SEM analysis through the application of latent variables (LVs) and the use of multiple statistical indicators revealed that the problem resolution variable is the most important one, as it actively interacts with all the others. In essence, SEM analysis maximizes the value of the results, as it analyzes relationships that are not considered obvious, especially in matters concerning society, and can incorporate parameters that improve efficiency in matters of daily living [

52,

53,

54].

7. Discussion

Studying the necessity of digital skills for simple users of digital currencies is of considerable value. Digital skills are now a necessity for a wide range of everyday functions. The modern economy is increasingly pushing the use of digital methods of monetization. In addition to the concept of fintech, affecting not only businesses but also consumers, something similar is happening with digital currencies. The use of digital currencies will undoubtedly begin to grow in the near future at a spectacular rate. The digital currencies of central banks (CBDCs) will begin to be universally used and citizens of modern societies will be forced to use modern technologies. The development of digital skills will therefore become a modern necessity for the whole range of simple daily operations [

26].

On the other hand, in terms of the research carried out, important conclusions emerged. Although according to the first hypothesis (H1), the issue of security was expected to be directly related to digital skills, this was not confirmed by our research. Instead, security continues to be an important variable but only for the problem-solving issue. Digital currency users consider that only the issue of solving problems, which will occur when using digital currencies, requires security knowledge. This can practically be interpreted to mean that banking and financial institutions largely provide security in the minds of users in terms of the transactions that take place [

43].

Also, an equally important issue is the resolution of the problems that users face when using digital currency management software. Based on the research conducted and presented, this is fully confirmed by the second research hypothesis. Practically, the variables LV1: information and data knowledge, LV5: problem resolution, and LV2: communication and collaboration are incorporated in the second hypothesis (H2). The use of software is undoubtedly inextricably linked to LV1, as the knowledge of handling software requires the knowledge of information about the use of digital currencies. The process of solving the problems (LV5) that will be created is usually a dynamic process, considering the nature of the problem and the synthesis of information that the user has to perform, while the issue of communication and collaboration (LV2) is something that users face in their attempt to communicate either with other user communities or with the call center of the company in question. In summary, as can be seen from the preceding SEM analysis, the variables have LV1 as their center of correlation, which has bidirectional communication with a significant degree of dependence on LV5. Finally, there is also a significant correlation with the variable LV2 through LV1 in a straightforward manner and indirectly with LV5 through LV3, as shown in

Figure 6.

Regarding the third hypothesis (H3), the results are also very encouraging. H3 examines in a more basic but also more substantial way the variable LV1 related to information and data knowledge. Practically, the users of digital currencies, by improving their digital skills, will be able to avoid fake news. This follows, as the variable LV1 is considered to be directly nodal with the variables LV5 and LV2, and indirectly with the variables LV3 and LV4 through LV5. Therefore, the concept of information and data knowledge shows a dynamic two-way correlation with the variable LV5 (problem resolution) and in general with the sub-questions which were related to the concept of fake news. In any case, digital skills clearly contribute to the easier identification of fake news and reduce the risk of threat to users’ data from unknown sources of online risks [

55,

56].

In summary, the above issues are considered extremely important, as the development of digital skills is inextricably linked to a more effective management of digital currencies by the general population. In particular, citizens of modern societies will need to develop their digital skills over time [

22,

48,

50], because of the following:

They will be able to use digital currency management software more effectively.

They will be able to more easily identify the risks, threats, and fraud that will be presented online.

They will evaluate any form of information as valid or fake, wherever it comes from.

They will be able to solve problems encountered in digital currency management applications, such as e-wallets, through communication.

They will contribute to optimal communication through the use of terminology between experts (computer application technicians, economists, and other professionals).

They will participate in the better dissemination of essential information on the use of digital currencies, making them active citizens.

At the same time, the development of digital skills will also have a positive impact on institutional partners, such as the state or various banking institutions. In particular, the development of citizens’ skills in managing digital currencies will contribute [

15,

22,

39], because of the following:

Citizens will be able to understand and deal with risks by making the tools and software of banking institutions more effective.

In the event of a cyber-attack by unknown persons, citizens will be able to effectively protect themselves by reducing the risk of destabilizing the system of digital currency transactions.

The state will reduce losses from any cyber-attack as citizens will be significantly informed about not responding to messages that compromise cybersecurity.

The state will be able to extend all its traditional financial activities more effectively to digital systems as citizens will be adequately educated and knowledgeable, thus increasing the degree of efficiency and effectiveness of the public tax collection system.

8. Conclusions

This research, as presented in this article, deals with a very important issue that most developed countries will be faced with within the next few years. The issue of digital currencies is already preoccupying societies and in the coming years it will preoccupy them to a greater extent. Businesses have already made significant adjustments to trade in digital currencies, following the fintech trend. In the coming years, digital currencies are expected to dominate simple users, who will have to adopt a different way of managing transactions. This function is not only related to the issue of security but incorporates a very important range of skills that are part of digital skills.

Through the specific research carried out, it is established that users of digital currencies do not consider security as the only variable. In practice, the development of their digital skills is not only limited to security skills. In the coming years, digital currency users will need to develop to a significant degree skills related to the management of specialized digital currency software such as e-wallets in order to be able to solve daily micro-problems that will arise in their transactions. It will also be necessary to develop digital skills in the area of information and knowledge, as it is expected that there will be a significant increase in fake news, so their timely recognition will act as something necessary for their daily transactions [

18].

The modern digital society requires the development of new digital skills to meet the challenges of the digital age. The first step is to integrate digital skills into the education system from the earliest stages of education. The use of interactive tools and digital platforms, such as online courses and educational games, can enhance students’ understanding and practice [

47]. In addition, empowering teachers with digital skills through training programs is crucial to creating a dynamic educational environment [

57]. This integration is not only limited to technical knowledge but also includes skills such as critical thinking and problem solving through the use of digital tools. The social inclusion of digitally excluded groups is equally important. Findings show that young people who do not have access to technology struggle to develop the necessary skills [

58]. To address these inequalities, digital literacy programs are proposed that will be accessible to all, regardless of socio-economic background. These programs should include both the provision of logistical infrastructure and support through coaches and mentors to help participants understand and use new technologies effectively. These strategies are necessary to bridge the digital divide and promote equality in access to education [

59].

In every case, developing a culture of lifelong learning is critical to adapting to continuous technological change. Workers and professionals must be able to upgrade their skills continuously through education and professional training [

60]. Businesses and organizations can play an important role by offering retraining and training programs to their staff. In addition, public–private partnerships can strengthen initiatives to spread digital skills to a wider audience. Cultivating such a culture of lifelong learning will help promote innovation and competitiveness in the digital society [

58].

Last but not least, the main limitation in the present study is related to the geographical completion of the questionnaire. Ideally, we would have chosen to distribute the questionnaire in two large groups of users. The first group would have been exposed to digital currency transactions because they were imposed either horizontally or sporadically on transactions, while the second group would consist of users who were going to be exposed to transactions [

61]. Through this analysis, we could come to even more useful conclusions in order to have a more effective preparation framework for citizens of modern societies. This framework of preparation would include specific e-courses or informative videos and would certainly give a more substantial time frame for citizens and businesses to adapt to the new transactional data that will be formed in society.