Submitted:

02 April 2024

Posted:

02 April 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. The Model

2.1. GM(1,1) Model

2.2. Markov Chain Residual Modification

3. Case Study

4. Conclusions

- Extending the model to other countries and regions to compare and contrast energy mix transitions on a global scale.

- Incorporating additional variables such as technological advancements, policy changes, and economic factors that could impact the power generation mix.

- Exploring the potential impacts of increased renewable energy adoption on grid stability, energy prices, and environmental outcomes.

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Deng, J.L. Control problems of grey system. System & Control Letters 1982, 1, 288–294. [Google Scholar]

- Julong, D.; others. Introduction to grey system theory. The Journal of grey system 1989, 1, 1–24. [Google Scholar]

- Javed, S.A.; Liu, S. Evaluation of outpatient satisfaction and service quality of Pakistani healthcare projects: application of a novel synthetic grey incidence analysis model. Grey Systems: Theory and Application 2018, 8, 462–480. [Google Scholar] [CrossRef]

- Ma, X.; Lu, H.; Ma, M.; Wu, L.; Cai, Y. Urban natural gas consumption forecasting by novel wavelet-kernelized grey system model. Engineering Applications of Artificial Intelligence 2023, 119, 105773. [Google Scholar] [CrossRef]

- Raheem, I.; Mubarak, N.M.; Karri, R.R.; Manoj, T.; Ibrahim, S.M.; Mazari, S.A.; Nizamuddin, S. Forecasting of energy consumption by G20 countries using an adjacent accumulation grey model. Scientific Reports 2022, 12, 13417. [Google Scholar] [CrossRef]

- Wang, Y.; Gao, Y.; Sun, L.; Li, Y.; Zheng, B.; Zhai, W. Effect of physical properties of Cu-Ni-graphite composites on tribological characteristics by grey correlation analysis. Results in Physics 2017, 7, 263–271. [Google Scholar] [CrossRef]

- Tao, L.; Liang, A.; Xie, N.; Liu, S. Grey system theory in engineering: a bibliometrics and visualization analysis. Grey Systems: Theory and Application 2022, 12, 723–743. [Google Scholar] [CrossRef]

- Candra, C.S. Evaluation of barriers to electric vehicle adoption in Indonesia through grey ordinal priority approach. International Journal of Grey Systems 2022, 2, 38–56. [Google Scholar] [CrossRef]

- Tseng, M.L. Using linguistic preferences and grey relational analysis to evaluate the environmental knowledge management capacity. Expert systems with applications 2010, 37, 70–81. [Google Scholar] [CrossRef]

- Jing, K.; Zhi-Hong, Z. Time prediction model for pipeline leakage based on grey relational analysis. Physics Procedia 2012, 25, 2019–2024. [Google Scholar] [CrossRef]

- Delcea, C.; Cotfas, L.A. Advancements of grey systems theory in economics and social sciences; Springer, 2023.

- Delcea, C.; Javed, S.A.; Florescu, M.S.; Ioanas, C.; Cotfas, L.A. 35 years of grey system theory in economics and education. Kybernetes 2023. [Google Scholar] [CrossRef]

- Sifeng, L. Memorabilia of the establishment and development of grey system theory (1982–2021). Grey Systems 2022, 12, 701–702. [Google Scholar]

- Al-shanini, A.; Ahmad, A.; Khan, F.; Oladokun, O.; Nor, S.H.M. Alternative prediction models for data scarce environment. In Computer Aided Chemical Engineering; Elsevier, 2015; Vol. 37, pp. 665–670.

- Deng, J. Gray decision and prediction. Huazhong University of Science and Technology Press, Wuhan, 1986. [Google Scholar]

- Huang, M.; He, Y.; Cen, H. Predictive analysis on electric-power supply and demand in China. Renewable Energy 2007, 32, 1165–1174. [Google Scholar] [CrossRef]

- He, Y.; Bao, Y. Grey-Markov forecasting model and its application. System Engineering-Theory & Practice 1992, 9, 59–63. [Google Scholar]

- Morcous, G.; Lounis, Z. Maintenance optimization of infrastructure networks using genetic algorithms. Automation in construction 2005, 14, 129–142. [Google Scholar] [CrossRef]

- Li, G.D.; Yamaguchi, D.; Nagai, M. A GM (1, 1)–Markov chain combined model with an application to predict the number of Chinese international airlines. Technological Forecasting and Social Change 2007, 74, 1465–1481. [Google Scholar] [CrossRef]

- Sun, X.; Sun, W.; Wang, J.; Zhang, Y.; Gao, Y. Using a Grey–Markov model optimized by Cuckoo search algorithm to forecast the annual foreign tourist arrivals to China. Tourism Management 2016, 52, 369–379. [Google Scholar] [CrossRef]

- De Rosa, L.; Castro, R. Forecasting and assessment of the 2030 australian electricity mix paths towards energy transition. Energy 2020, 205, 118020. [Google Scholar] [CrossRef]

- Álvarez-Arroyo, C.; Vergine, S.; D’Amico, G.; Escaño, J.M.; Alvarado-Barrios, L. Dynamic optimisation of unbalanced distribution network management by model predictive control with Markov reward processes. Heliyon 2024, 10. [Google Scholar] [CrossRef]

- Hu, Y.C.; Jiang, P.; Chiu, Y.J.; Tsai, J.F. A novel grey prediction model combining markov chain with functional-link net and its application to foreign tourist forecasting. Information 2017, 8, 126. [Google Scholar] [CrossRef]

- Zhan-Li, M.; Jin-Hua, S. Application of Grey-Markov model in forecasting fire accidents. Procedia Engineering 2011, 11, 314–318. [Google Scholar] [CrossRef]

- Guan, J.; Feng, Y.; Ying, M. Decomposition of quantum Markov chains and its applications. Journal of Computer and System Sciences 2018, 95, 55–68. [Google Scholar] [CrossRef]

- Jia, Z.q.; Zhou, Z.f.; Zhang, H.j.; Li, B.; Zhang, Y.x. Forecast of coal consumption in Gansu Province based on Grey-Markov chain model. Energy 2020, 199, 117444. [Google Scholar] [CrossRef]

- D’Amico, G.; Di Biase, G.; Manca, R. Income inequality dynamic measurement of Markov models: Application to some European countries. Economic Modelling 2012, 29, 1598–1602. [Google Scholar] [CrossRef]

- Barbu, V.S.; D’amico, G.; De Blasis, R. Novel advancements in the Markov chain stock model: analysis and inference. Annals of Finance 2017, 13, 125–152. [Google Scholar] [CrossRef]

- Ritchie, H.; Rosado, P. What’s the difference between direct and substituted primary energy? Our World in Data 2021. https://ourworldindata.org/energy-substitution-method.

- Energy Institute. Statistical Review of World Energy, 2023.

- Kalligeris, E.N.; Karagrigoriou, A.; Parpoula, C. On stochastic dynamic modeling of incidence data. The International Journal of Biostatistics 2023. [Google Scholar] [CrossRef]

| Year | Biofuel | Coal | Gas | Hydro | Nuclear | Oil | Solar | Wind |

|---|---|---|---|---|---|---|---|---|

| 2000 | 0 | 145.580 | 678.785 | 130.699 | 0 | 1124.703 | 0.053 | 1.665 |

| 2001 | 0 | 154.697 | 680.646 | 137.521 | 0 | 1102.603 | 0.056 | 3.464 |

| 2002 | 0 | 159.678 | 676.029 | 115.349 | 0 | 1106.428 | 0.061 | 4.098 |

| 2003 | 0 | 172.299 | 745.332 | 106.348 | 0 | 1095.877 | 0.070 | 4.228 |

| 2004 | 2.754 | 193.013 | 773.418 | 122.003 | 0 | 1072.420 | 0.084 | 5.322 |

| 2005 | 1.933 | 191.534 | 827.695 | 103.275 | 0 | 1039.467 | 0.089 | 6.709 |

| 2006 | 2.178 | 193.911 | 810.588 | 105.263 | 0 | 1038.177 | 0.100 | 8.454 |

| 2007 | 1.977 | 189.848 | 814.561 | 92.788 | 0 | 1005.712 | 0.110 | 11.407 |

| 2008 | 7.983 | 183.701 | 808.515 | 116.963 | 0 | 946.612 | 0.542 | 13.660 |

| 2009 | 12.885 | 143.823 | 743.176 | 137.228 | 0 | 875.992 | 1.891 | 18.273 |

| 2010 | 15.864 | 159.028 | 791.499 | 141.879 | 0 | 853.391 | 5.289 | 25.330 |

| 2011 | 15.672 | 178.270 | 742.161 | 126.410 | 0 | 828.881 | 29.782 | 27.190 |

| 2012 | 17.494 | 182.733 | 713.566 | 114.819 | 0 | 772.214 | 51.718 | 36.761 |

| 2013 | 14.687 | 157.403 | 667.404 | 143.831 | 0 | 706.480 | 58.838 | 40.601 |

| 2014 | 12.546 | 153.447 | 589.716 | 158.604 | 0 | 671.279 | 60.430 | 41.119 |

| 2015 | 15.486 | 143.395 | 643.154 | 122.631 | 0 | 710.444 | 61.783 | 39.974 |

| 2016 | 15.401 | 127.732 | 675.458 | 113.592 | 0 | 704.790 | 59.174 | 47.353 |

| 2017 | 15.610 | 111.904 | 715.788 | 96.335 | 0 | 713.695 | 64.876 | 47.216 |

| 2018 | 15.979 | 102.567 | 692.141 | 129.177 | 0 | 730.328 | 59.936 | 46.873 |

| 2019 | 9.359 | 77.534 | 707.906 | 122.194 | 0 | 709.052 | 62.443 | 53.252 |

| 2020 | 13.227 | 59.253 | 676.252 | 125.100 | 0 | 585.492 | 65.504 | 49.273 |

| 2021 | 13.822 | 65.182 | 723.737 | 118.766 | 0 | 652.068 | 65.519 | 54.760 |

| 2022 | 12.217 | 84.773 | 652.692 | 73.416 | 0 | 686.015 | 71.749 | 53.870 |

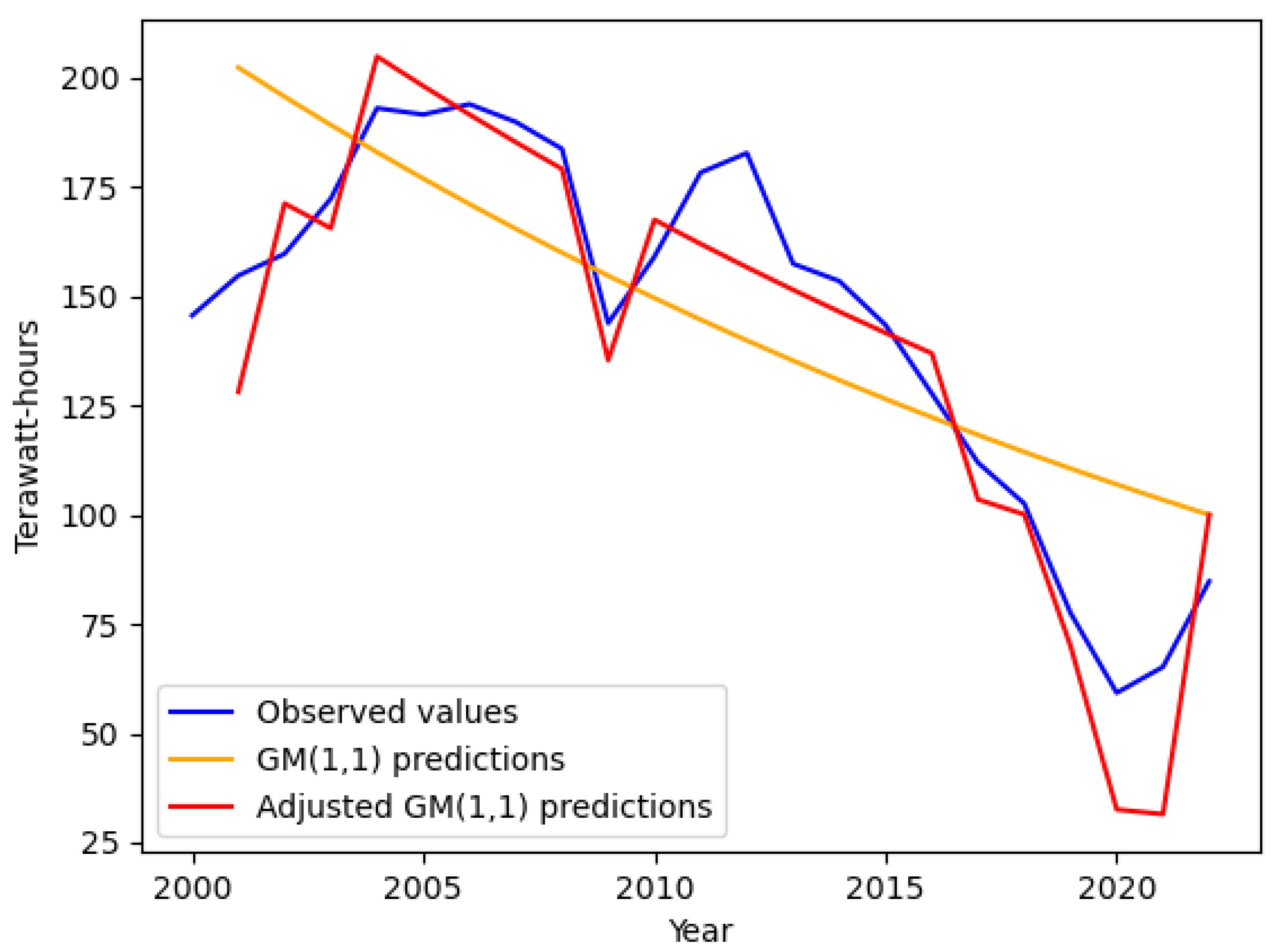

| Year | Observed value | GM(1,1) prediction | Absolute residual | Relative error | States | Residual Adjustment | Adjusted GM(1,1) prediction |

|---|---|---|---|---|---|---|---|

| k | w | ||||||

| 2001 | 154.697 | 202.299 | 47.602 | 30.771 | 3 | -36.692 | 128.071 |

| 2002 | 159.678 | 195.623 | 35.945 | 22.511 | 2 | -12.490 | 171.190 |

| 2003 | 172.299 | 189.167 | 16.868 | 9.790 | 2 | -12.490 | 165.540 |

| 2004 | 193.013 | 182.924 | 10.089 | -5.227 | 1 | 11.974 | 204.828 |

| 2005 | 191.534 | 176.887 | 14.647 | -7.647 | 1 | 11.974 | 198.068 |

| 2006 | 193.911 | 171.049 | 22.862 | -11.79 | 1 | 11.974 | 191.531 |

| 2007 | 189.848 | 165.404 | 24.444 | -12.875 | 1 | 11.974 | 185.210 |

| 2008 | 183.701 | 159.945 | 23.756 | -12.932 | 1 | 11.974 | 179.098 |

| 2009 | 143.823 | 154.667 | 10.844 | 7.540 | 2 | -12.490 | 135.349 |

| 2010 | 159.028 | 149.562 | 9.466 | -5.952 | 1 | 11.974 | 167.472 |

| 2011 | 178.27 | 144.627 | 33.643 | -18.872 | 1 | 11.974 | 161.945 |

| 2012 | 182.733 | 139.853 | 42.880 | -23.466 | 1 | 11.974 | 156.600 |

| 2013 | 157.403 | 135.238 | 22.165 | -14.082 | 1 | 11.974 | 151.432 |

| 2014 | 153.447 | 130.775 | 22.672 | -14.775 | 1 | 11.974 | 146.434 |

| 2015 | 143.395 | 126.459 | 16.936 | -11.811 | 1 | 11.974 | 141.602 |

| 2016 | 127.732 | 122.285 | 5.447 | -4.264 | 1 | 11.974 | 136.928 |

| 2017 | 111.904 | 118.250 | 6.346 | 5.671 | 2 | -12.490 | 103.481 |

| 2018 | 102.567 | 114.347 | 11.780 | 11.485 | 2 | -12.490 | 100.065 |

| 2019 | 77.534 | 110.573 | 33.039 | 42.613 | 3 | -36.692 | 70.002 |

| 2020 | 59.253 | 106.924 | 47.671 | 80.454 | 4 | -69.540 | 32.569 |

| 2021 | 65.182 | 103.395 | 38.213 | 58.626 | 4 | -69.540 | 31.495 |

| 2022 | 84.773 | 99.983 | 15.210 | 17.942 | 2 | -12.490 | 87.495 |

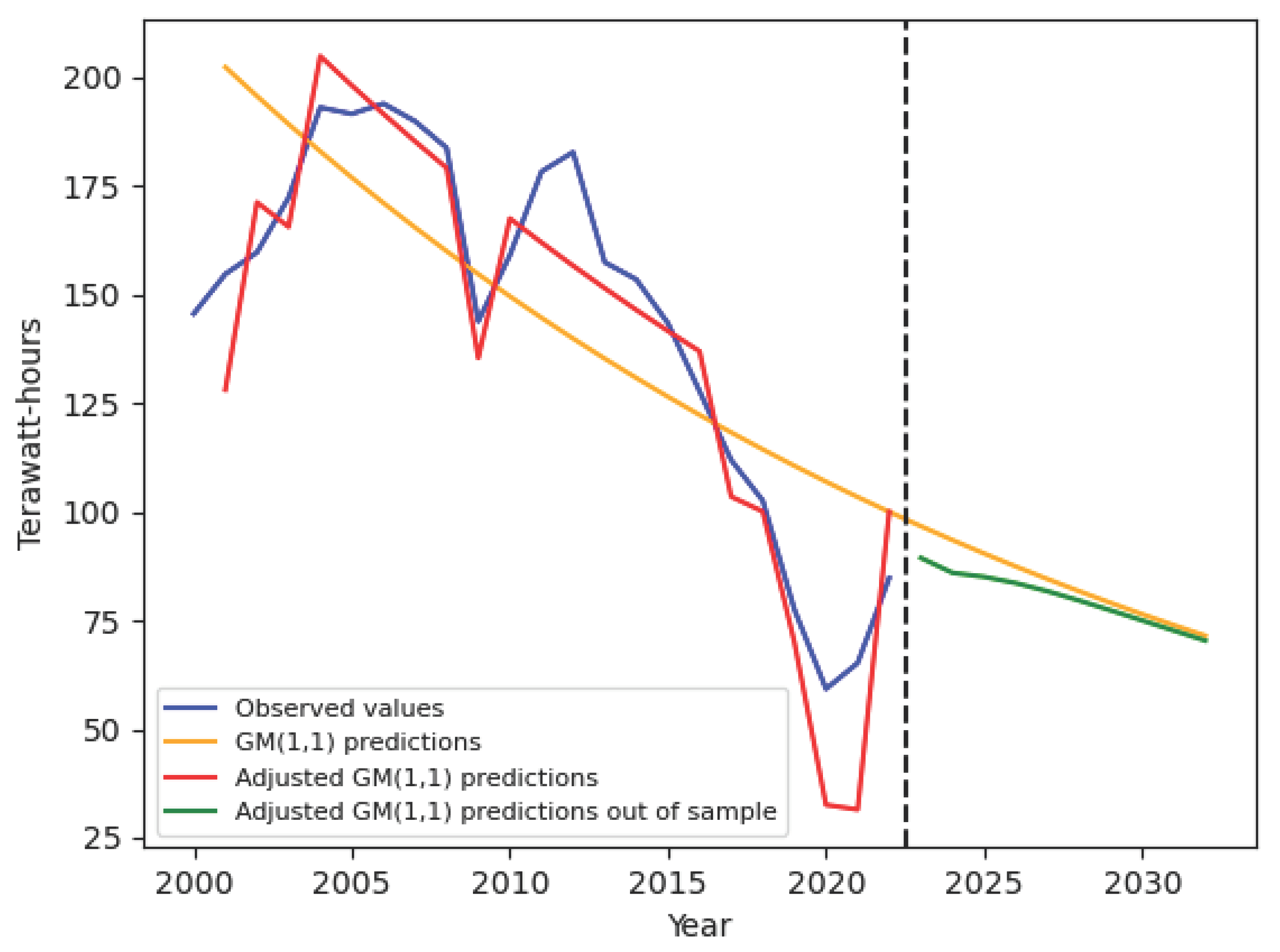

| Year | GM(1,1) prediction | Residual Adjustment | Adjusted GM(1,1) prediction |

|---|---|---|---|

| k | |||

| 2023 | 96.683 | -7.545 | 89.389 |

| 2024 | 93.493 | -8.062 | 85.955 |

| 2025 | 90.407 | -5.951 | 85.027 |

| 2026 | 87.424 | -4.378 | 83.596 |

| 2027 | 84.538 | -3.329 | 81.724 |

| 2028 | 81.748 | -2.639 | 79.591 |

| 2029 | 79.050 | -2.185 | 77.323 |

| 2030 | 76.442 | -1.887 | 74.999 |

| 2031 | 73.919 | -1.691 | 72.669 |

| 2032 | 71.479 | -1.562 | 70.363 |

| Year | Biofuel | Coal | Gas | Hydro | Oil | Solar | Wind |

|---|---|---|---|---|---|---|---|

| 2023 | 11.461 | 89.389 | 694.271 | 94.266 | 573.561 | 70.008 | 76.235 |

| 2024 | 12.234 | 85.955 | 669.458 | 110.202 | 548.961 | 72.172 | 83.317 |

| 2025 | 11.370 | 85.027 | 675.409 | 111.143 | 537.014 | 73.477 | 91.057 |

| 2026 | 11.212 | 83.596 | 664.983 | 110.941 | 525.465 | 75.121 | 99.517 |

| 2027 | 10.991 | 81.724 | 663.762 | 110.773 | 512.196 | 76.688 | 108.762 |

| 2028 | 10.709 | 79.591 | 657.744 | 110.583 | 497.767 | 78.346 | 118.867 |

| 2029 | 10.471 | 77.323 | 654.454 | 110.387 | 482.989 | 80.010 | 129.910 |

| 2030 | 10.231 | 74.999 | 649.780 | 110.192 | 468.365 | 81.726 | 141.979 |

| 2031 | 9.995 | 72.669 | 645.926 | 109.997 | 454.118 | 83.469 | 155.169 |

| 2032 | 9.766 | 70.363 | 641.687 | 109.802 | 440.312 | 85.256 | 169.584 |

| Year | Biofuel | Coal | Gas | Hydro | Oil | Solar | Wind |

|---|---|---|---|---|---|---|---|

| 0.023 | 0.034 | 0.006 | 0.002 | 0.031 | -0.021 | -0.089 | |

| (0.008) | (0.006) | (0.003) | (0.005) | (0.001) | (0.003) | (0.010) | |

| 16.745 | 210.598 | 777.177 | 121.821 | 1198.075 | 54.432 | 10.875 | |

| (0.922) | (13.320) | (26.369) | (8.766) | (24.775) | (1.170) | (2.765) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).