1. Introduction

The pandemic crisis by COVID-19 had severe impacts on society and economic activity. The real GDP per capita decreased by 4.1% in 2020 globally, exports by 8.7% and imports by 8.8% (World Development Indicators). As a result of the isolation measures, a crucial public health strategy to curb the virus’s spread, has particularly impacted high-contact activities including hospitality and tourism, entertainment and recreation, and personal services. In 2019, the contribution of the Travel and Tourism sector to the global GDP was 10.4% and was the third largest export sector, representing 7% of global trade [

1]. However, the contribution of this sector to GDP declined by 49.1% in 2020 due to the COVID-19 pandemic [

1,

2]. In contrast, other sectors “that facilitate non-contact activities, like ICT support or delivery of services”, have been little affected [

3] (p.1).

To alleviate the negative effects of the pandemic crisis on the economy and society, the authorities have implemented crisis response policies. These responses included fiscal, monetary, and financial measures, among others, aimed mainly at the healthcare sector, households, and businesses [

4]. Governments implemented fiscal policies such as tax cuts, direct cash transfers, and subsidies to assist businesses and workers in the affected sectors and families facing financial difficulties ([

5,

6]. These comprehensive measures aimed to address the severe impact of this crisis and mitigate its adverse effects on the economy and society.

Some authors argue that the policy response to the COVID-19 crisis can be influenced by specific characteristics of the country, such as the dimension of intensive contact sectors like tourism, the level of ICT adoption that had an essential role during the pandemic crisis, the healthcare policy, and pandemic-related variables [

4,

7,

8,

9,

10]. Although during the COVID-19 pandemic, many governments worldwide increased their focus on ICT to address challenges posed by the pandemic, recognizing the importance of technology in healthcare, education, remote work, and communication during lockdowns and social distancing measures, economies with higher ICT development may not need higher fiscal policy efforts to reinforce its key role in enhancing economic resilience. These factors can play a crucial role in shaping the strategies and approaches adopted by governments worldwide, but very few studies analyze the determinants of the fiscal policy response. This paper aims to analyze if fiscal policies' response to the pandemic crises is influenced by the level of ICT adoption and tourism in the economy.

2. Literature Review

The new human coronavirus disease, first identified in the Chinese city of Wuhan in December 2019, quickly spread to other parts of Asia and around the world in early 2020. In January 2020, the World Health Organization declared the outbreak a Public Health Emergency of International Concern, and in March of the same year, COVID-19 was characterized as a pandemic. Isolation measures were immediately put in place to prevent the spread of the disease, which included national and global travel restrictions aimed at reducing the movement of people. This significantly impacted several industries and activities mainly those that involve close human contact, such as travel and tourism, hospitality and restaurants, entertainment and events, retail, health and fitness, education, and personal services, among others. The COVID-19 pandemic caused strong economic activity contraction, supply disruption, lower demand, more expensive funding, and declining consumer and business confidence [

11].

This health and economic crisis led authorities to pursue policies, including fiscal policies, to mitigate the adverse effects on public health and economic activity. Fiscal policy is generally defined as the use of public expenditure and revenue by governments to influence the economy. Fiscal policy is a tool used for macroeconomic stabilization, seeking to keep the economy's output in line with its production potential, and for income redistribution, among others. According to [

12], the main policy objectives concerning the pandemic were: 1) to address the immediate health crisis by enhancing healthcare systems, testing, and vaccine development; 2) to mitigate the economic impact through targeted support for households and businesses during confinement; 3) to facilitate fast economic recovery with well-timed and sustained stimulus programs; and 4) to strengthen the overall resilience of health and economic systems, including early epidemic response and robust supply chains.

Besides the effects of the automatic stabilizers, governments have implemented several discretionary measures quickly to slow down the spread of the virus, help businesses, support families, and sustain jobs [

12], and according to [

12] (p.1), this readiness to act helped to boost confidence. Fiscal policy was designed to reduce the number of deaths, the spread of the disease, and alleviate the negative economic repercussions on the most affected businesses and households "by providing unemployment benefits, wage subsidies, income support, and social assistance, as well as limiting layoffs and bankruptcies in affected firms, areas, and sectors” [

13] (p. 1). “At the global level, spending and revenue measures amount to

$3.3 trillion, and loans, equity injections, and guarantees total

$4.5 trillion” [

13] (p. 1).

Intensive-contact services such as travel, tourism, and hospitality were the sectors most affected by the pandemic [

14,

15]. On the contrary, activities that facilitate non-contact activities, like ICTs, there was an increasing global demand [

16]. ICT service exports (in % of service exports) increased by about 3.7 pp. in 2020 and ICT goods exports (in % of total goods exports) by 1.5 pp.

The disruption caused by the COVID-19 pandemic has changed social structures around the world, and the use of ICT stands out as an effective means of maintaining social order during this difficult time [

17]. Before the COVID-19 pandemic, ICTs were already integrated into social life and social work practices, however, the sudden necessity to shut down non-essential workplaces led to an unprecedented adoption of digital technology on a global scale [

16,

18,

19].

In healthcare, ICTs facilitated real-time data collection, analysis, and dissemination, enhancing healthcare management during the pandemic. Digital tools have allowed for the monitoring of infection rates and the distribution of crucial health information [

20]. Using digital technology to offer assistance, conduct medical consultations, provide healthcare services, and monitor the virus's spread has been recognized as a crucial strategy to mitigate the transmission of the virus [

21,

22]. Traditional in-person consultations have been substituted with remote appointments. Effective communication was vital during the public health crisis and ICTs served as channels for disseminating accurate information, guidelines, and updates to the public [

18,

20]. Social media platforms, mobile apps, and websites became crucial in fostering public awareness and compliance with preventive measures. This digital transformation contributed to more efficient and responsive governance.

The closure of educational institutions has led to a shift towards online learning modalities. ICT has facilitated the continuity of education by providing virtual classrooms, online resources, and interactive learning platforms [

17,

18,

23,

24].

In business, although the use of digital technologies has already been in place for several years, the emergence of this crisis has forced enterprises to accelerate their adoption of digital tools due to mobility restrictions, leading to a significant shift or heightened reliance on digital technologies. These circumstances reinforced the crucial role of digital technologies in sustaining business operations through remote work [

18] and in enhancing the economic resilience of businesses [

25]. The ability to facilitate remote access to an enterprise's resources, such as email and other ICT systems, enabled employees to maintain their tasks, ensuring the continuity of business activities. Additionally, the use of video conferencing, collaborative platforms, and cloud-based technologies enabled continuous internal communication within enterprises and interactions with external entities [

25,

26]. This not only preserved economic activities but also demonstrated the adaptability of ICTs to ensure business continuity. In 2020, a significant portion of EU enterprises experienced changes in their remote work practices. About 33% increased staff access to company e-mail or other ICT systems, and 91% of those enhancing e-mail access attributed it partly to the impact of COVID-19. Similarly, 94% of enterprises increasing remote access to broader ICT systems cited COVID-19 as a contributing factor. Additionally, half of EU enterprises increased remote meetings, with 97% of these changes linked, at least in part, to the effects of the COVID-19 pandemic [

25].

Despite the evident benefits, the advancement of digital transformation faces obstacles due to limited resources. There are countries where a significant portion of the population still lacks access to ICT tools. Consequently, during the pandemic, governments are inclined to invest in enhancing digital technologies [

9]. [

9] analyzed the effect of the level of digitalization on the economic response by governments and found a negative impact when interacting with the level of income. According to the authors in the scenario where a majority of households and businesses possess adequate technological infrastructure to seamlessly conduct their daily operations in an online base, governmental responses through assertive fiscal or monetary policy interventions may be attenuated. Enhanced digital capabilities and resources dispersed among the population in select developing nations could facilitate the uninterrupted continuation of routine activities.

Tourism, a global industry that is grounded on exploration, cultural exchange, and economic growth, is very vulnerable to crises, either health or economic crises.

In recent times, health crises have emerged as a remarkable disruptor, impacting the tourism sector on a large scale. Severe Acute Respiratory Syndrome (SARS) was caused by a coronavirus (SARS-CoV) and led to a global health crisis in 2002-2003. The H1N1 influenza virus, also known as swine flu, caused a global pandemic in 2009. Ebola virus outbreaks in West Africa, particularly in 2014-2016, had a significant impact on tourism in the affected regions. The Zika vírus (2015-2016) primarily transmitted by mosquitoes, raised concerns about travel to affected regions, particularly for pregnant women and some popular tourist destinations in Latin America and the Caribbean experienced a decline in tourism as travelers were cautious about the virus. This vulnerability to health crises is due to its reliance on the movement of people. Outbreaks of infectious diseases, such as the COVID-19 pandemic, can immediately lead to the closure of borders, travel restrictions, and a decline in consumer confidence. These factors together contribute to a profound negative impact on the tourism ecosystem. In the short term, cancellations of bookings, a significant decline in tourist arrivals, and economic losses for businesses in the travel and hospitality sector are common. Governments often implement rigorous health and safety measures, which affect travel logistics.

Throughout several regions, there has been the implementation of policies in response to the effects of the COVID-19 pandemic [

27]. A study by the [

27] published in June, reveals that of the 220 countries and regions analyzed, the majority have implemented stimulus measures aimed at the most affected sectors, and among these, "undeniably tourism is one of the most directly affected" (p. 6). According to this report, fiscal stimulus measures primarily involve actions such as waiving or delaying Value Added Tax (VAT) and corporate income tax, establishing emergency economic funds, providing financial assistance to support small and medium enterprises and self-employed individuals, and implementing investment programs designed to alleviate the immediate impacts of the pandemic.

[

9] conducted a comprehensive investigation involving 118 countries, wherein they observed a positive correlation between the magnitude of the travel and tourism industry and the level of economic policy endeavors undertaken to address the adverse repercussions of the COVID-19 pandemic. The study revealed that as the scale of the travel and tourism sector increased, there was a concurrent elevation in the intensity of economic policy measures implemented to mitigate the deleterious effects of the pandemic. The empirical results derived from the investigation by [

7] also indicated a positive correlation between the magnitude of the tourism sector within a destination country and the implementation of an economic stimulus package designed to alleviate the adverse repercussions of the COVID-19 pandemic. Nations exhibiting a great dependence on the tourism industry demonstrate a proclivity towards adopting more expansive economic stimulus measures in response to the challenges posed by the pandemic.

[

14] conducted simulations to explore the potential impact of two fiscal policy interventions (tax reduction and financial subsidies) aimed at alleviating the consequences of the COVID-19 pandemic in Macau. This region heavily relies on gambling and casinos for its economic activity and has pursued a policy of diversifying activities towards non-gaming activities. Their findings indicated that neither of these measures alone was effective in achieving a rapid post-pandemic economic recovery. They suggested that these fiscal interventions should be supplemented with supply-side policies, including measures to support employment and the capital chain. They concluded that financial subsidies to households provide a stronger potential to mitigate the effects of the pandemic and to facilitate the recovery than the tax policy (a reduction of tax liabilities to businesses) neither of these measures alone was effective in achieving a rapid post-pandemic economic recovery, that could speed up the recovery of the economy. They suggested that these fiscal interventions should be supplemented with supply-side policies, including measures to support employment and the capital chain. Their conclusion emphasized that providing financial subsidies directly to households holds greater potential for alleviating the impacts of the pandemic and promoting recovery compared to implementing tax policies, such as reducing tax burdens on businesses. They found that relying solely on either of these measures was insufficient for achieving a swift post-pandemic economic rebound. As an appropriate solution, they recommended complementing these fiscal interventions with supply-side policies, specifically advocating for measures that support both employment and the stability of the capital chain to expedite overall economic recovery.

3. Methodology

To study the influence of the level of tourism activity and the degree of ICT adoption on the dimension of the fiscal policy response to the crisis, it was estimated the following model:

Fiscal Stimulus is the fiscal policy response to the pandemic to stimulate economic activity and was proxied by the measures “above the line” using the Fiscal Monitor database developed by IMF [

11]. These measures include additional spending, capital grants and targeted transfers, tax measures, and tax deferrals [

11,

13] (p.20).

Tourism was proxied by the international tourism receipts in 2019 in constant 2010 US$ (log-transformed) and calculated by deflating current prices. The international tourism receipts series at current prices and the Price Index were gathered from the World Development Indicators (WDI) database of the World Bank.

For ICT adoption it was used the number of individuals using the Internet in the percentage of the population in 2019 (WDI).

The remaining variables included in the model correspond to control variables selected according to the literature review. The health care policy was measured by the level of current health expenditure expressed as a percentage of GDP. The health expenditure includes healthcare goods and services (but “does not include capital health expenditures such as buildings, machinery, IT and stocks of vaccines for emergency or outbreaks”, WDI). Data refers to 2019 and were gathered from the WDI database. Population ageing was assessed by the share of the population aged 65 or older in the total population in 2019 and obtained from the WDI. For the variables related to COVID-19, it was used the mortality rate by COVID-19, calculated by the ratio between the cumulative deaths and the cumulative cases. Data was obtained from the World Health Organization.

The sample consists of 154 countries for which the necessary information was available.

4. Results and Discussion

4.1. Sample Descriptive Analysis

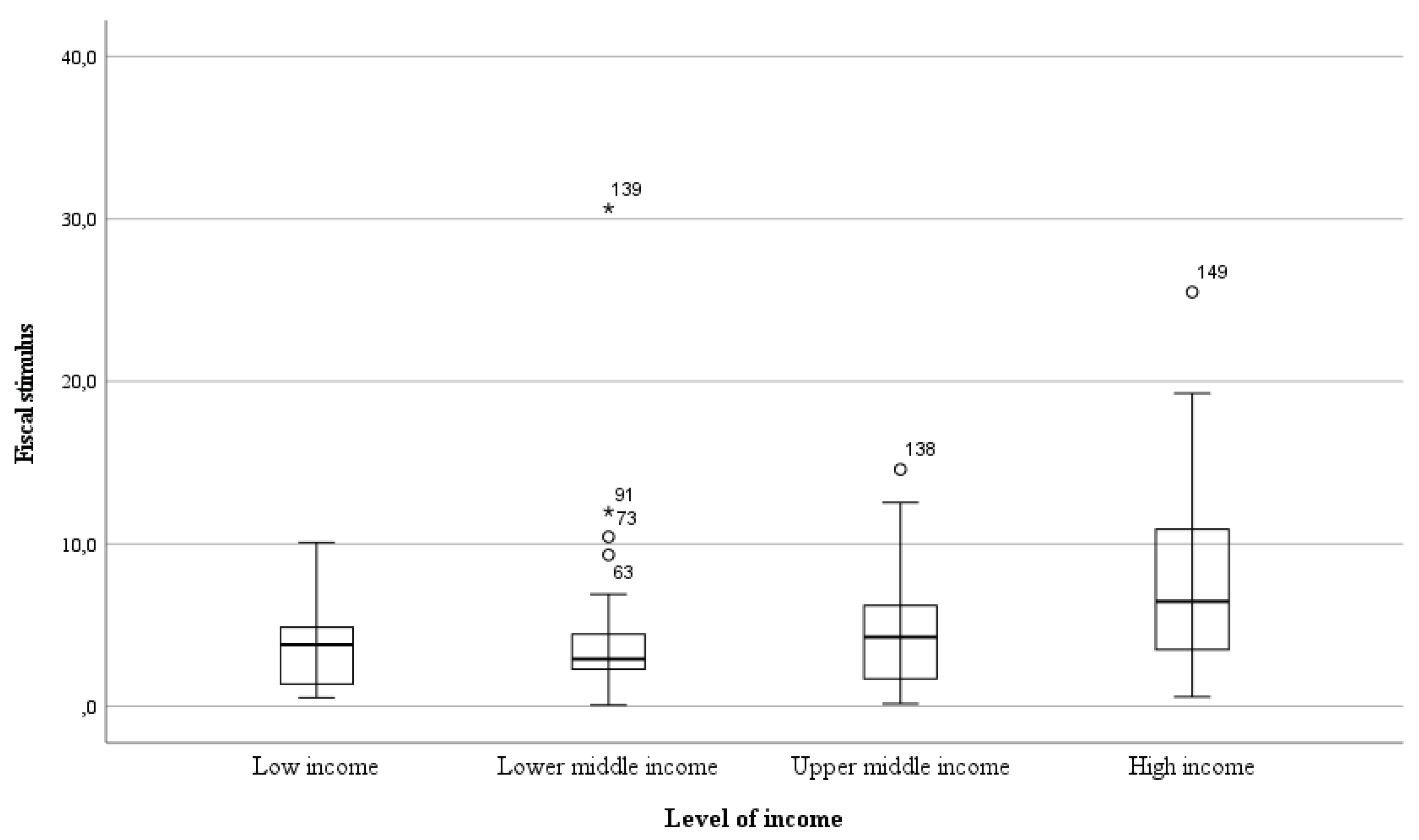

Table 1 reports the descriptive statistics of the variables under examination. The fiscal stimulus exhibits considerable variation across the sampled countries, ranging from a minimum of 0.09% of GDP in LAO People’s Democratic Republic to a maximum of 30.66% in Timor-Leste. While high-income countries implemented fiscal policy measures in response to the pandemic crisis amounting to approximately 8.17% of GDP, low-income countries allocated less than half (3.63%) (

Figure 1). The Kruskal-Wallis test results suggest statistically significant differences in the fiscal stimulus implemented by countries according to their income level (

=22.905, p<0.001). Pairwise comparisons indicate significant statistical differences between high-income countries and low-income (p*=0.006), upper middle income (p*=0.036), and with lower middle income (p*=0.000), where p* is the level of significance adjusted by Bonferroni correction. Some outliers are observed, particularly in low-middle-income countries, such as Timor-Leste (the country with the highest value of fiscal stimulus in the sample), Mongolia, Kiribati, and Indonesia. Also, in high-income countries, the United States behaves as an outlier in the observed fiscal stimulus distribution.

International tourism receipts have the lowest value in South Sudan and the maximum in the United States. The average value is 7,192.8 million US$ with a standard deviation of 19,485.0 million US$.

Regarding internet usage, the sample indicates an average of 60.43% of the population accessing the internet. More than 99% of the population in Bahrain, Qatar, Kuwait, and the United Arab Emirates use the internet while Burundi, South Sudan, Uganda, Congo Republic, and Burkina Faso have less than 10% internet access.

Current health expenditure as a percentage of GDP ranges from 1.8% of GDP in Djibouti (a lower middle-income country) to 23.96% in Tuvalu, an upper-middle income, with an average value in the sample of 6.45%. Although high-income countries spend more on healthcare as a percentage of GDP (7.78%), followed by upper-middle-income countries (7.04%), low-income countries spend more (5.72%) than lower-middle-income countries (4.79%).

While there are countries with ageing population problems, such as Japan, Italy, Finland, Portugal, Bulgaria, Greece, Germany, Croatia, France, and Serbia (more than 20% of the population is 65 years old or above), among others, in Qatar, United Arab Emirates, and Uganda less than 2% falls into the 65 years and above category.

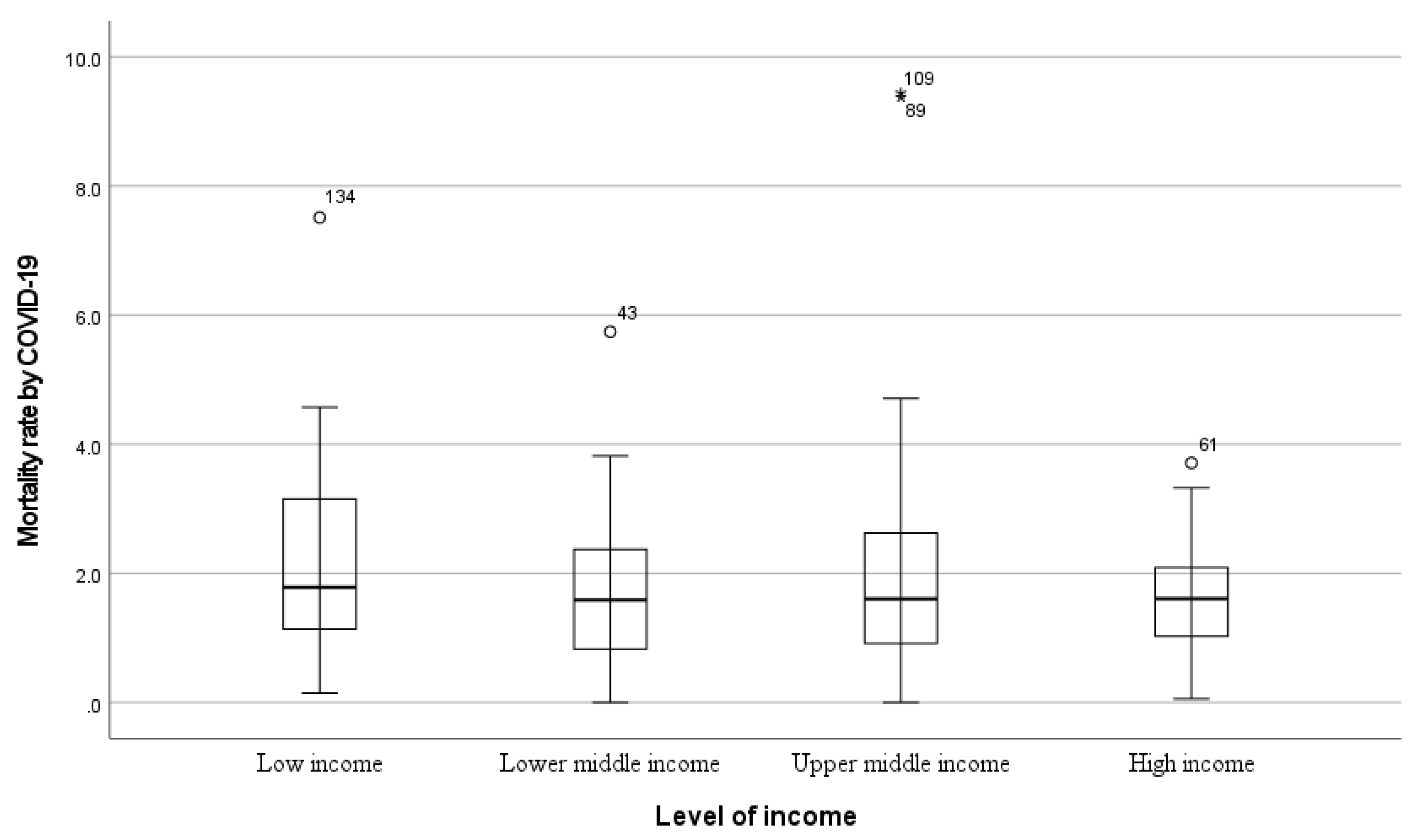

The mortality rate attributed to COVID-19 was between 5% and 10% in México, Peru, Sudan and Egypt. By geographical area, Latin America & Caribbean recorded an average of 2.74% deaths of total cases, followed by Sub-Saharan Africa (2.06%), Europe & Central Asia (1.94%), North America (1.82%), Middle East & North Africa (1.62%), South Asia (1.34%), and East Asia & Pacific (0.82%). The mortality rate by COVID-19 does not exhibit significant differences between low-income countries (2.25%), upper middle income (2.09%), lower middle income (1.74%), and high-income (1.63%) (

=1.046 p=0.79) (

Figure 2).

4.2. Regression Analysis: Results and Discussion

The model was estimated by the Ordinary Least Squared method.

Table 2 reports the correlation coefficients among the variables, all of which are below 0.75. The Variance Inflation Factors (VIF) values were analyzed, revealing values consistently below 10, indicating that there is no evidence of multicollinearity. The Breusch-Pagan test (

=24.52, p=0.0002) concludes that heteroskedasticity is present in the regression model. Heteroskedasticity-robust standard errors were used to address this problem. The results are presented in

Table 3.

The model is statistically significant (F=13.38; p<0.001), and the variables included explain 32.2% (Adjusted R-squared) of the variance in fiscal stimulus. All the variables included are significant in explaining the variance in fiscal stimulus at levels of significance of 1%, 5%, and 10%.

The estimated coefficient for ln international tourism receipts stands at 0.4695 with a t-statistic=2.59, indicating a positive relationship between international tourism receipts and the fiscal effort undertaken by governments. In other words, the higher the international tourism receipts, the greater the fiscal effort made by governments. Given that the tourism industry has experienced one of the most significant declines in demand, governments have introduced a set of fiscal policy measures and these incentives have played a key role in overcoming the short-term shocks faced by enterprises and workers [

28]. These findings align with previous studies in the literature, which have also found a positive correlation between tourism and the level of economic stimulus by authorities [

7,

8]. By contrast, the fiscal stimulus required is less in countries where internet use is more widespread. An increase of 1 percentage point in internet use decreases the fiscal stimulus by 0.0296 percentage points. To [

17] (p. 1) ICTs were the “best chance to maintain social order during a pandemic”. In the investigation of [

9], although internet use negatively impacts the economic response to COVID-19, the coefficient is insignificant. However, when the authors estimate the interaction between internet use and income level, its effect becomes both negative and statistically significant. Policymakers may need to leverage digital technologies for effective crisis management.

The estimate of the coefficient of the mortality rate by COVID-19 is negative but statistically significant only at a 10% significance level. This may be explained by the fact that countries with higher mortality rates may have faced significant challenges in managing the spread of the virus, limiting the resources available for fiscal stimulus.

Countries that spend more on health adopted broader fiscal policy packages. This may be related to the greater financial capacity of these countries [

7,

8].

Furthermore, the results also suggest a positive and statistically significant association (at a 1% level of statistical significance) between the ageing population and fiscal stimulus. This result is in line with the research of [

4], concluding that the median age positively influences economic stimulus, meaning that countries with higher levels of elderly populations implemented broader economic stimulus packages.

4. Conclusions

The COVID-19 pandemic has had a profound impact worldwide, affecting health, huge falls in economic growth, and disruptions in supply chains, education, and social structures. Governments globally have responded with discretionary fiscal policy measures to combat the negative effects of this public health and economic crisis. On the economic level, contact-intensive industries, such as tourism and hospitality, have been particularly affected due to isolation measures to reduce the spread of the disease. But this global pandemic can also be viewed as a sudden disturbance that has stimulated digital development, making digital technology a vital force in people's lives and workplaces.

This research aimed to analyze whether the level of effort in terms of fiscal policy was influenced by the level of digital development and the size of the tourism industry. The results reveal that countries exhibiting higher levels of internet penetration tended to adopt comparatively lower fiscal policy measures. This inverse association suggests that countries with greater digital development would be better prepared to face the challenges arising from the pandemic, which would lead to less financial effort by governments. The findings also suggest a positive correlation between fiscal policy efforts and the importance of the tourism industry within a nation. Countries that rely more on tourism demonstrated a propensity for strengthening fiscal policy interventions. This aligns with the economic vulnerability of the tourism sector, necessitating more substantial government support to offset the severe impact of travel restrictions and reduced tourism activities.

The COVID-19 pandemic has transformed human life, with enormous challenges and opportunities, bringing a “new normal”. The role of the digital during the pandemic has emphasised the centrality of technology in the post-pandemic era. Governments contemplating fiscal interventions should recognise the interconnection between digital development, economic dependencies, and the nature of the industries affected.

The results of this research suggest that nations with less robust digital development may need to define fiscal policies that leverage technological advancements for economic recovery. Conversely, countries heavily reliant on tourism may find merit in implementing more substantial fiscal measures to leverage a sector crucial to their economic fabric.

This research thus contributes to the debate on effective policy responses for sustainable recovery during unprecedented global crises, emphasizing the importance of context-specific strategies that consider both digital and industry compositions.

Authors should discuss the results and how they can be interpreted from the perspective of previous studies and of the working hypotheses. The findings and their implications should be discussed in the broadest context possible. Future research directions may also be highlighted.