1. Introduction

This article is dedicated to a comprehensive investigation of the dynamics of web sales activities among companies that employ at least 10 individuals, focusing on those targeting end customers spread across the various Italian regions. This inquiry is particularly centered on dissecting how differences in socio-economic environments and the degrees of digitalization and technological innovation across these regions play a pivotal role in shaping the digital commerce strategies and outcomes of these businesses. Acknowledging the vast regional disparities in Italy—from the technologically advanced Lombardy in the north to the traditionally less digitalized regions in the south—this study aims to delve deep into the factors that influence digital commerce success rates among small to medium-sized enterprises (SMEs) in these areas. To achieve a thorough understanding, the study will utilize a mixed-methods research approach. This will involve an intricate blend of quantitative data analysis based on static analysis, clusterization, econometric techniques and machine learning algorithms. These methods are intended to delve deeper into the experiences, challenges, and strategies of companies navigating the digital commerce space in their unique regional contexts. Using this approach, the research aspires to uncover the subtle and complex ways in which regional disparities influence the adoption and effectiveness of web sales channels. The objective is to identify the main barriers that hinder digital transformation efforts among Italian companies, as well as the facilitators that support their path towards successful digital integration. The objective is to map the digital commerce landscape in the different Italian regions, highlighting the specific needs and opportunities that emerge in the different socio-economic contexts. Through this detailed exploration, the research expects to offer valuable insights into the economic policy adjustments needed for businesses to thrive in the digital marketplace. It aims to outline how economic policy can lead companies to exploit regional strengths and overcome local challenges to unlock the full potential of digital trade. The aim of this article is to provide practical recommendations that can help bridge the digital divide between Italian regions, ensuring that businesses, regardless of their geographical location, can thrive in a rapidly evolving context. digital landscape.

The article continues as follows: the second section shows the analysis of the literature, the third section contains the static analysis, the fourth section presents the clustering with k-Means algorithm, the fifth section shows the results of the econometric model , the sixth section presents the machine learning algorithms used for prediction, the seventh section contains the economic policy implications, the eighth section concludes.

2. Literature Review

Hussain et al. (2022) explore the impact of e-commerce on SME performance, emphasizing the moderating role of entrepreneurial competencies. This study suggests that entrepreneurial skills significantly enhance the benefits of e-commerce for SMEs, indicating that not just the technological infrastructure, but also the human capital, is crucial for leveraging e-commerce advantages. The moderating role of entrepreneurial competencies is a valuable insight, underscoring the multifaceted nature of e-commerce benefits. Kim & Lim (2022) investigate the international dynamic marketing capabilities of SMEs from emerging markets through e-commerce. Their findings highlight how SMEs can leverage e-commerce for international marketing, suggesting a strategic pathway for emerging-market SMEs to globalize efficiently. This perspective complements the first study by focusing on the external, market-facing capabilities enabled by e-commerce. Hussain, Shahzad, & Hassan (2020) delve into organizational and environmental factors affecting SME performance, with e-commerce serving as a mediating role. This study broadens the scope by considering the ecosystem within which SMEs operate, suggesting that e-commerce effectiveness is contingent on both internal organizational factors and the external business environment. The mediating role of e-commerce in this relationship is a critical insight, suggesting e-commerce as a tool for SMEs to navigate their operational context. Yang, Xun, & Chong (2022) focus on the role of complementary resources and external readiness in enhancing SME performance through e-commerce. By highlighting the importance of external readiness and the functionality of e-commerce platforms, this study adds to the discourse on the prerequisites for SMEs to successfully exploit e-commerce, suggesting a need for a strategic alignment between SME resources and their e-commerce initiatives. Pan, Fu, & Li (2023) examine SME participation in cross-border e-commerce as a mode of entry into foreign markets, questioning its role as a driver of innovation. This study challenges the assumption that e-commerce inherently facilitates innovation, instead suggesting that its impact on innovation depends on how SMEs engage with e-commerce for internationalization. This nuanced view presents e-commerce not as a universal solution, but as a strategic tool that can offer various benefits, including innovation, depending on its application.

Syafrizal (2021) investigates the development of a web-based online marketing system for SMEs, emphasizing the role of technological infrastructure in enabling SMEs to compete in the digital marketplace. This study highlights the importance of accessible and user-friendly e-commerce platforms for SME engagement in online marketing, suggesting that technology development directly influences SMEs' ability to leverage e-commerce. Almtiri, Miah, & Noman (2023) delve into the application of e-commerce technologies to boost the operational success of SMEs. By focusing on the technological aspect of e-commerce, this work underlines the critical role of adopting advanced e-commerce solutions for enhancing SME efficiency and competitiveness. The emphasis on technology application provides a forward-looking perspective on the potential for e-commerce to transform SME operations. Cheong et al. (2020) conduct a systematic literature review to assess the impact of COVID-19 on SMEs' adoption of e-commerce. This study is particularly relevant for understanding the pandemic as a catalyst for digital transformation among SMEs. It offers insights into the accelerated adoption of e-commerce by SMEs in response to the challenges posed by COVID-19, highlighting the resilience and adaptability of SMEs in times of crisis. Hasan & Mardhani (2021) present an overview of e-commerce adoption among Indonesian SMEs, providing a geographical and cultural context to the discussion. This study sheds light on the specific challenges and opportunities faced by Indonesian SMEs in embracing e-commerce, offering a nuanced view that considers the local business ecosystem, infrastructure, and digital literacy levels. Prasetya et al. (2022) explore the optimization of digital marketing strategies through e-commerce to increase sales for Batik Cikadu, a specific SME in Indonesia. This case study approach allows for a detailed examination of practical strategies and outcomes associated with e-commerce adoption, illustrating the tangible benefits of digital marketing for SME sales and brand visibility.

Nurjaman (2022) discusses the empowerment of e-commerce among SMEs in Indonesia, focusing on the capacity-building aspect of digital platforms. This study underlines the significance of e-commerce as a tool for enhancing the operational capabilities and market reach of SMEs in a developing country context. The emphasis on empowerment highlights the socio-economic benefits of e-commerce adoption beyond mere technological adoption. Özbek et al. (2024) examine the institutional theory perspective on e-commerce adoption by internationalizing retail SMEs, exploring the responses to mimetic pressures. This research provides insights into how SMEs navigate institutional pressures to adopt e-commerce, suggesting that the decision-making process is influenced by external benchmarks and perceived industry standards. This perspective adds depth to the understanding of e-commerce adoption, framing it within the broader context of institutional norms and pressures. Guo et al. (2023) delve into the intersection of e-commerce, supply chain finance, and green innovation for SMEs. By linking e-commerce with sustainable practices within the supply chain, this study presents a novel angle on how e-commerce can contribute to both financial performance and environmental sustainability. The role of green innovation underscores the potential for e-commerce to support broader sustainability goals. Demiroglu (2021) views e-commerce as a developmental tool for small businesses, emphasizing its role in facilitating business growth and adaptation to market dynamics. This work contributes to the discourse by presenting e-commerce as a critical enabler of small business development, highlighting the transformative potential of digital platforms in enhancing competitiveness and innovation. Salazar & Mauricio (2024) provide a comprehensive review of SME e-commerce performance factors and metrics over a decade, offering a longitudinal perspective on how e-commerce impacts SME performance. This study contributes to a deeper understanding of the effectiveness of e-commerce strategies, identifying key performance indicators and success factors. The longitudinal approach allows for an assessment of evolving trends and the long-term impact of e-commerce on SMEs.

Octavia et al. (2020) investigate the effect of e-commerce adoption on entrepreneurial and market orientations in SME business performance. This study underscores the importance of strategic orientations as mediators in the relationship between e-commerce adoption and business performance. By linking e-commerce adoption to entrepreneurial and market orientations, the research highlights how digital platforms can enhance business agility and market responsiveness, leading to improved performance outcomes. Wimpertiwi et al. (2023) focus on the mediation role of e-commerce capability in the relationship between strategic orientation and business performance, including hybrid channel effectiveness. This empirical analysis extends the understanding of how e-commerce capabilities enable SMEs to translate strategic orientations into performance gains. By examining hybrid channels, the study contributes insights into the integration of online and offline operations, emphasizing the importance of a cohesive strategy for leveraging e-commerce. Ilham & Ratnamiasih (2021) delve into the impact of e-commerce and competence on business performance, with a specific focus on the implementation of e-commerce by university students. This empirical study provides a unique perspective on the role of individual competencies in maximizing the benefits of e-commerce for business performance. Highlighting the intersection between education, digital literacy, and e-commerce adoption, this research underscores the critical role of competence in leveraging e-commerce technologies effectively. Sun (2021) explores the relationship between internet usage and SME participation in exports, providing evidence of how digital connectivity facilitates SME access to international markets. This study broadens the scope of e-commerce research by linking internet accessibility to export activities, suggesting that digital platforms can serve as a significant enabler for SME internationalization. The focus on exports adds an important dimension to the discourse on e-commerce, highlighting the potential for digital technologies to bridge geographical barriers and open new market opportunities. Riadi et al. (2022) assess the benefits of e-commerce for small enterprises before and during the COVID-19 pandemic, offering insights into how digital platforms have supported business continuity and resilience. By comparing pre-pandemic and pandemic periods, this research highlights the accelerated adoption and increased reliance on e-commerce as a survival strategy during crises. This study emphasizes the role of e-commerce in enabling business adaptability and continuity, particularly in the face of unprecedented challenges.

Yun, J. J., et al. (2020) explore the sustainability condition of open innovation, particularly through the dynamic growth of Alibaba from an SME to a large enterprise. This study highlights the critical role of open innovation in sustaining the growth and transformation of businesses in the digital age. By focusing on Alibaba, a prominent success story, the research provides valuable insights into how open innovation practices can support scalability and sustainability in the e-commerce sector. However, the generalizability of findings from a singular case study, especially one as unique as Alibaba, to other SMEs could be limited. Chang, S., et al. (2023) delve into the optimal combination of platform channel contract and guarantee financing strategy in the e-commerce market. This research contributes to understanding the financial mechanisms that underpin e-commerce operations, offering a quantitative analysis of how e-commerce platforms can structure contracts and financing strategies to optimize performance. While this study adds depth to the financial aspect of e-commerce, its technical nature and focus on optimization models may limit its applicability for practitioners without a strong background in finance or operations research. Wang, J. (2024) examines the use of artificial intelligence to analyze SME e-commerce utilization and growth strategies. This forward-looking study underscores the potential of AI in enhancing the strategic decision-making of SMEs in the e-commerce domain. By demonstrating how AI can be leveraged to identify growth opportunities and optimize e-commerce strategies, the study points to the future of digital entrepreneurship. The challenge remains in the accessibility of such AI tools for SMEs and the need for digital literacy to fully exploit this potential. Harto, B., & Komalasari, R. (2020) focus on the optimization of online internet marketing platforms for SMEs, specifically Little Rose Bandung. This case study offers practical insights into how SMEs can leverage online platforms for marketing and sales enhancement. While the localized context provides in-depth understanding, the scalability and applicability of these strategies to other SMEs in different contexts or industries may require further exploration. Priambodo, I. T., et al. (2021) assess the e-commerce readiness of the creative industry during the COVID-19 pandemic in Indonesia. This timely study highlights the challenges and opportunities faced by the creative industry in transitioning to e-commerce amidst the pandemic. By providing an overview of readiness levels, the research sheds light on the factors that enable or hinder e-commerce adoption among creative SMEs. The specificity to the COVID-19 context and the creative industry in Indonesia, while insightful, may limit the study's broader applicability.

Goldman et al. (2021) examine the strategic orientations and digital marketing tactics of SMEs engaged in cross-border e-commerce, comparing practices in developed and emerging markets. This study is valuable for understanding how strategic choices in digital marketing are adapted to different market conditions and for highlighting the nuanced approaches required for success in diverse environments. However, the study may not fully capture the rapidly evolving landscape of digital marketing and e-commerce, necessitating ongoing research to keep pace with technological advancements and market dynamics. Rawash (2021) focuses on the adoption of e-commerce by SMEs in Jordan, using the Technology-Organization-Environment (TOE) model. This study provides insights into the factors influencing e-commerce adoption in a specific cultural and economic context, contributing to the literature on technology adoption in SMEs. While offering valuable localized insights, extending the findings to broader or different contexts may require additional consideration of regional and sectoral specificities. Tong & Gong (2020) discuss the impact of COVID-19 on SME digitalization in Malaysia, providing an empirical look at how the pandemic has accelerated the move towards digital business models. This research highlights the role of external shocks in digital transformation but may benefit from a longitudinal approach to assess the sustainability of these changes post-pandemic. Ismail & Masud (2020) explore the prospects and challenges of improving e-commerce connectivity in Malaysia, contributing to the understanding of infrastructural and regulatory needs for facilitating e-commerce. This study is crucial for policymakers and business leaders in strategizing e-commerce development but might need to be complemented with stakeholder perspectives for a holistic view. Parvin, Asimiran, & Ayub (2022) analyze the impact of introducing e-commerce on logistics providers, a case study focusing on SMEs. By shedding light on a specific aspect of the e-commerce ecosystem, this research offers practical insights into how e-commerce adoption can transform traditional business operations. The case study approach provides in-depth analysis but might limit generalizability across different sectors and geographies.

Barata et al. (2023) explore the determinants of e-commerce, artificial intelligence (AI), and agile methods in SMEs. This study provides a comprehensive look at how technological and methodological advancements can significantly impact SME efficiency and adaptability. By integrating AI and agile methodologies with e-commerce strategies, SMEs can enhance their competitiveness and innovation capacity. However, the study may not fully address the challenges SMEs face in adopting these advanced technologies and methodologies, including financial and human resource constraints. Kosobutskaya et al. (2020) discuss the advantages and opportunities for the development of small business e-commerce in the B2B sector. This research underscores the potential for SMEs to leverage e-commerce for growth and expansion in the B2B realm, highlighting the strategic benefits of digital platforms. While offering valuable insights, the study might benefit from a more detailed examination of the barriers to e-commerce adoption in the B2B sector, such as integration with existing business processes and systems. Awe & Ertemel (2021) investigate the enhancement of micro-small businesses in The Gambia through digitalization, focusing on youth entrepreneurs' perceptions, usage, and inhibitors of e-commerce technology. This paper offers critical insights into the role of digital technologies in empowering entrepreneurs in developing countries. It sheds light on both the opportunities and challenges faced by young entrepreneurs in adopting e-commerce, emphasizing the need for supportive policies and infrastructure. However, the study's focus on a specific demographic and geographical location may limit its generalizability. Kadir & Shaikh (2023) examine the effects of e-commerce businesses on SMEs, particularly through media techniques and technology. The study highlights the importance of digital marketing and social media in enhancing the visibility and reach of SMEs in the e-commerce landscape. While it emphasizes the transformative potential of media technologies, further research could explore the specific strategies and tools that SMEs can adopt to maximize their effectiveness. Kirom et al. (2022) analyze e-commerce strategies for MSME innovation development in the new normal era. This research is timely, addressing how MSMEs can navigate post-pandemic challenges through innovative e-commerce strategies. It provides a strategic framework for MSMEs to adapt to changing market demands and consumer behaviors. The focus on the "new normal" is crucial, but continuous updates and research will be necessary as the post-pandemic business environment evolves.

Gao et al. (2023) assess the impact of e-commerce and digital marketing adoption on the financial and sustainability performance of MSMEs during the COVID-19 pandemic through an empirical study. This research is valuable for its timely investigation into how digital strategies have influenced business performance in a crisis context, highlighting the resilience and adaptability afforded by digital tools. However, it would be beneficial if the study also explored the long-term sustainability of these adaptations post-pandemic and the potential challenges businesses may face as the global economy transitions to a new normal. Lestari et al. (2021) delve into the differential impact of the COVID-19 pandemic on the performance of small enterprises that are e-commerce adopters versus non-adopters. By contrasting these two groups, the study provides evidence of the protective effects of e-commerce adoption against the pandemic's adverse impacts. This study's focus offers critical insights but may benefit from a broader consideration of the various factors influencing e-commerce adoption and performance beyond the pandemic, including technological, managerial, and environmental barriers. Fan & Ouppara (2022) examine how SMEs can survive disruption and uncertainty through digital transformation, using case studies. This contribution is particularly useful for its practical insights into how businesses have navigated the challenges posed by the pandemic, showcasing specific strategies and outcomes of digital transformation efforts. While rich in practical implications, the generalizability of case study findings to a wider SME audience may require further empirical validation. Madias & Szymkowiak (2022) focus on the functionalities of social commerce used by SMEs during the pandemic. This study highlights the innovative use of social media platforms for commerce, underscoring the importance of social commerce as a tool for business continuity and customer engagement during crises. It would be enriching to explore the potential limitations and challenges SMEs face in implementing social commerce strategies, including issues related to privacy, security, and digital literacy. Kujala & Halonen (2020) investigate business growth through the use of open source e-commerce and ERP (Enterprise Resource Planning) systems in small businesses. This research offers an interesting perspective on the technological underpinnings necessary for e-commerce success, emphasizing the cost-effectiveness and flexibility of open source solutions. Further analysis could extend to the scalability of such systems as businesses grow and the support ecosystem available for open source technologies in the SME context.

Costa & Castro (2021) argue that e-commerce represents an essential strategy for SMEs to enhance their resilience and survivability, especially in challenging times such as during the COVID-19 pandemic. This study provides a valuable perspective on e-commerce as a critical tool for business continuity, emphasizing the urgent need for SMEs to adopt digital platforms. However, the research could benefit from deeper insights into the specific strategies SMEs can employ to effectively transition to e-commerce and overcome barriers to digital adoption. Suryani et al. (2022) explore the impact of digital literacy and e-commerce adoption on SME performance, with a particular focus on the online-to-offline (O2O) business model. This study contributes to understanding how digital skills and the strategic use of e-commerce can enhance SME competitiveness and market reach. Future research might further investigate the role of digital literacy training programs and government policies in facilitating e-commerce adoption among SMEs. Ushada et al. (2024) delve into the trust decision-making process of Indonesian food and beverage SMEs in adopting Industry 4.0 technologies. By modeling trust factors, this research sheds light on the psychological and social dimensions influencing technology adoption, offering a novel angle on the challenges of digital transformation. It would be interesting to extend this analysis to other sectors and geographical contexts to assess the generalizability of these findings. Khodjayev (2021) examines the efficiency of modern ICT in small business operations, highlighting the transformative potential of technology for improving business processes and customer engagement. This contribution underscores the importance of ICT for operational efficiency but might explore more deeply the barriers small businesses face in accessing and implementing these technologies, including cost and technical expertise. Singh et al. (2023) investigate the relationship between e-commerce adoption, digital marketing strategies, online customer engagement, and the performance of small businesses. This study provides comprehensive insights into how a coherent digital strategy can significantly impact SME performance, emphasizing the role of technology infrastructure and online engagement. Further research could explore the long-term effects of digital marketing strategies on customer loyalty and business growth.

Ardiansah et al. (2021) examine the impact of e-commerce on accounting information systems and organizational performance. This study provides insights into how digital commerce integration can enhance the accuracy, efficiency, and overall performance of accounting systems within organizations. It underscores the potential for e-commerce to drive operational improvements but might explore further how these systems can be adapted to various business models and the specific features that contribute to performance enhancement. Sidek et al. (2020) explore the factors influencing awareness of e-commerce among small businesses in Kelantan. By focusing on proclivity factors, the research contributes to understanding the barriers to e-commerce adoption and the importance of raising awareness among SMEs. This study's geographical focus offers valuable regional insights, though further research could examine whether these factors are consistent across different cultural and economic contexts. D AL-TAYYAR et al. (2021) address the challenges and obstacles facing SMEs in adopting e-commerce in developing countries, with a case study in Saudi Arabia. This research highlights critical barriers such as infrastructure, regulation, and digital literacy, offering a comprehensive overview of the hurdles SMEs face in digital transformation. The focus on developing countries is crucial, though comparative studies with SMEs in developed countries could provide additional insights into universal vs. region-specific challenges. Setiawan et al. (2023) investigate the impact of e-commerce on the performance of micro and small industries, considering firm size as a moderating factor. This study provides a nuanced view of how e-commerce benefits can vary based on firm size, suggesting that smaller firms may face distinct challenges or realize different advantages from e-commerce adoption. The role of firm size as a moderator is an interesting angle, but the study could also consider other potential moderators, such as industry type or market reach. Susanty et al. (2020) apply the push-pull-mooring framework to e-commerce adoption in SMEs. This framework offers a comprehensive approach to understanding the factors that drive businesses towards or away from e-commerce adoption, including internal motivations, external pressures, and the ease of transitioning to digital platforms. While providing a robust theoretical model, empirical studies applying this framework in various contexts would enrich the understanding of its applicability across different sectors and cultural settings.

3. Rankings and Regional Disparities

Istat counts companies with at least 10 employees with web sales and end customers. The variable is defined as the percentage of companies with at least 10 employees who sold via the web to end customers (B2C) during the previous year. From the survey year 2021, economic activities from division 10 to 82 are considered based on the new Ateco 2007 classification (excluding the K-Financial and insurance activities section). From the same year of survey, the unit of analysis for which the estimates are provided is the enterprise, i.e. a statistical unit that can be made up of one or more legal units. The data refers to the Italian regions between 2013 and 20221.

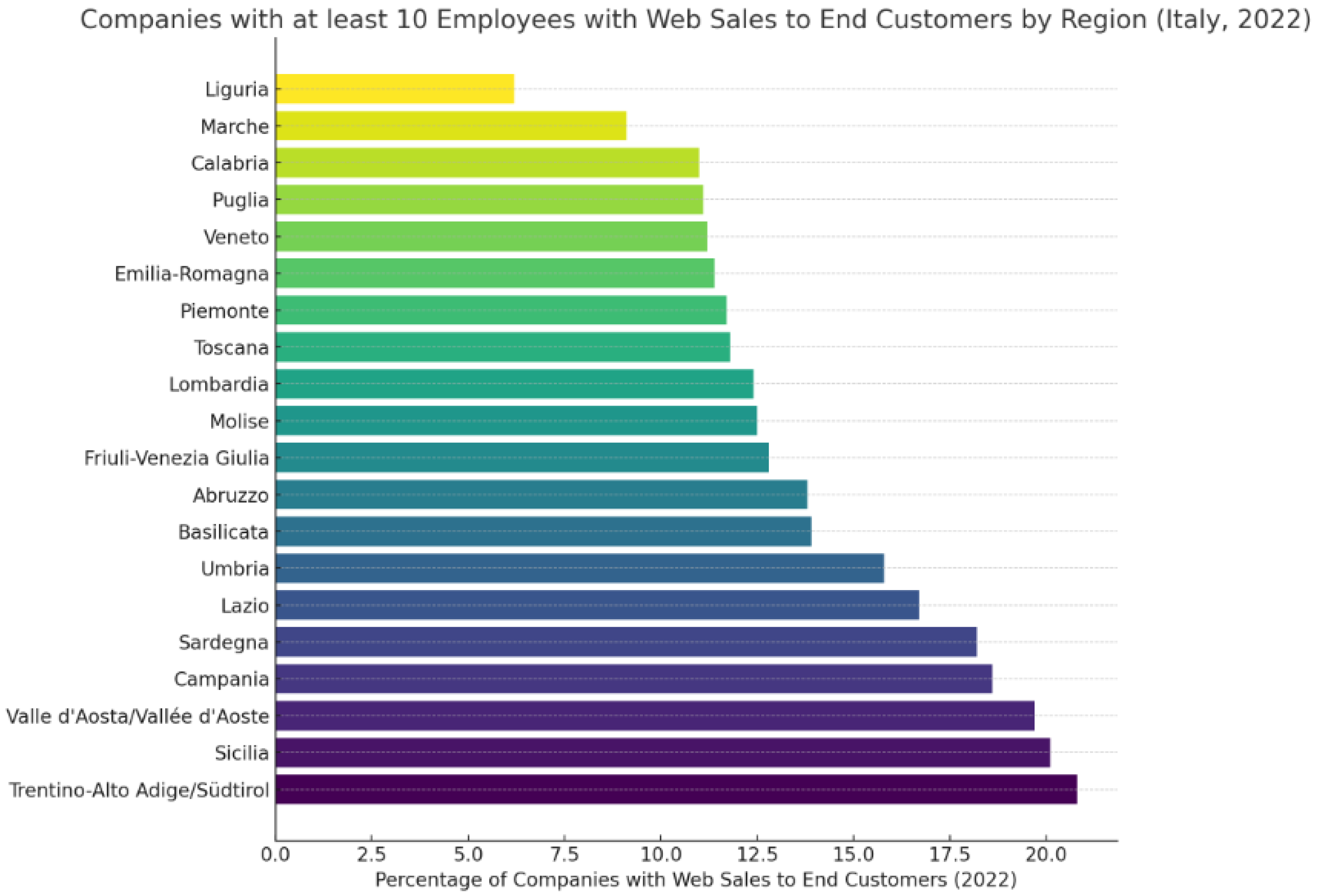

Companies with at least 10 employees with web sales to end customers in 2022. The analysis of data relating to companies with at least 10 employees carrying out web sales to end customers in 2022 reveals a varied adoption of e-commerce among the Italian regions , with percentages ranging from 6.2% to 20.8%. At the top of the list we find Trentino-Alto Adige/Südtirol with 20.8%, closely followed by Sicily with 20.1% and Valle d'Aosta/Vallée d'Aoste with 19.7%. This data points to an interesting phenomenon: geographically and socioeconomically diverse regions rank at the top when it comes to e-commerce adoption, suggesting that the willingness to engage in online sales is not limited to traditionally more industrialized or affluent areas. Particularly notable is the case of Sicily, a region which, despite economic challenges, shows robust e-commerce penetration among local businesses. Likewise, the presence of Valle d'Aosta and Campania among the top positions dispels the myth that Northern Italy is significantly more advanced than the South in terms of business digitalisation. On the other hand, regions such as Lombardy and Emilia-Romagna, notoriously among Italy's economic engines, record relatively low percentages of businesses selling online, only 12.4% and 11.4% respectively. This could reflect a different composition of the business fabric, with a greater weight of sectors less inclined to online sales, or it could indicate areas of growth for e-commerce in these regions. The position of Liguria is surprising, in last place with 6.2%, a figure significantly lower than the other regions. This could suggest specific barriers to e-commerce adoption in this region, such as a lower propensity for digital innovation or logistical and infrastructure difficulties. In conclusion, these data highlight a map of Italian e-commerce that does not necessarily follow the traditional North-South economic divisions or expectations linked to the size and economic strength of the regions. Rather, they indicate an evolving landscape, where e-commerce emerges as a growth opportunity for businesses throughout the country, underlining the importance of targeted support strategies and investments in digitalisation for the regions that are lagging behind.

Figure 1.

Percentage of companies with at least 10 employees that have web sales to end customers in Italy for 2022. .

Figure 1.

Percentage of companies with at least 10 employees that have web sales to end customers in Italy for 2022. .

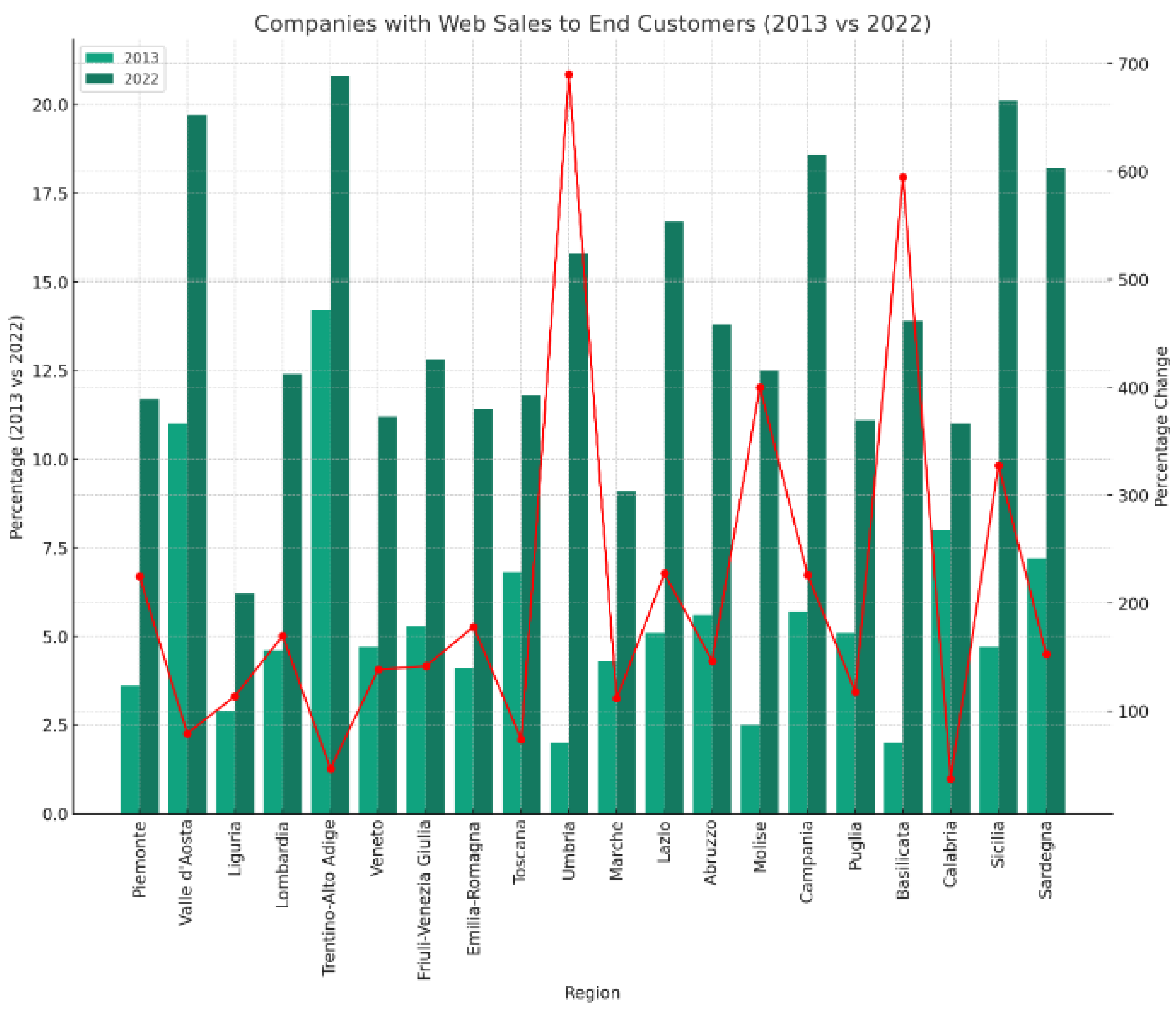

The analysis of data on Italian companies with at least 10 employees carrying out web sales to end customers between 2013 and 2022 highlights a significant growth trend of e-commerce in the Italian business landscape. This growth is evidenced by both the absolute and percentage change in web sales, reflecting a digital transformation across different regions. In particular, regions such as Umbria and Basilicata show notable increases, with percentage variations of 690% and 595% respectively. This data suggests that even regions with a relatively low starting point in terms of online sales have embarked on exponential growth paths. On the other hand, regions with a more developed economy and a denser entrepreneurial fabric such as Lombardy and Emilia-Romagna also recorded significant increases, albeit starting from higher bases, with percentage variations of 169.56% and 178.04% respectively. Valle d'Aosta/Vallée d'Aoste, despite an absolute increase of 8.7 percentage points, shows a lower percentage variation (79.09%) compared to the others, suggesting that some smaller regions or with local specificities may have already had relatively high e-commerce penetration prior to the period considered. Trentino-Alto Adige/Südtirol and Calabria present more moderate increases, of 46.47% and 37.5% respectively, perhaps indicating a more gradual growth or saturation in terms of adoption of e-commerce by businesses. Sicily, with a jump of 327.65%, and Sardinia, with 152.77%, highlight how the islands are also significantly embracing online sales, benefiting from the opportunities offered by e-commerce to overcome barriers geographical. These data indicate a substantial transformation in the way Italian companies approach the market, with an increasingly marked orientation towards digital. E-commerce emerges as a crucial commercial channel, capable of offering new business opportunities and reaching customers outside traditional boundaries. The widespread growth of e-commerce in Italy reflects not only the adaptation of businesses to new technologies but also a greater propensity of Italian consumers to purchase online, a phenomenon perhaps also accelerated by the circumstances imposed by the COVID-19 pandemic. This change poses new challenges and opportunities for companies, which must navigate in an increasingly digitalized and competitive environment, but also offers the possibility of expanding their market and innovating their business models.

Figure 2.

Companies with at least 10 employees with web sales to end customers in the Italian regions between 2013 and 2022.

Figure 2.

Companies with at least 10 employees with web sales to end customers in the Italian regions between 2013 and 2022.

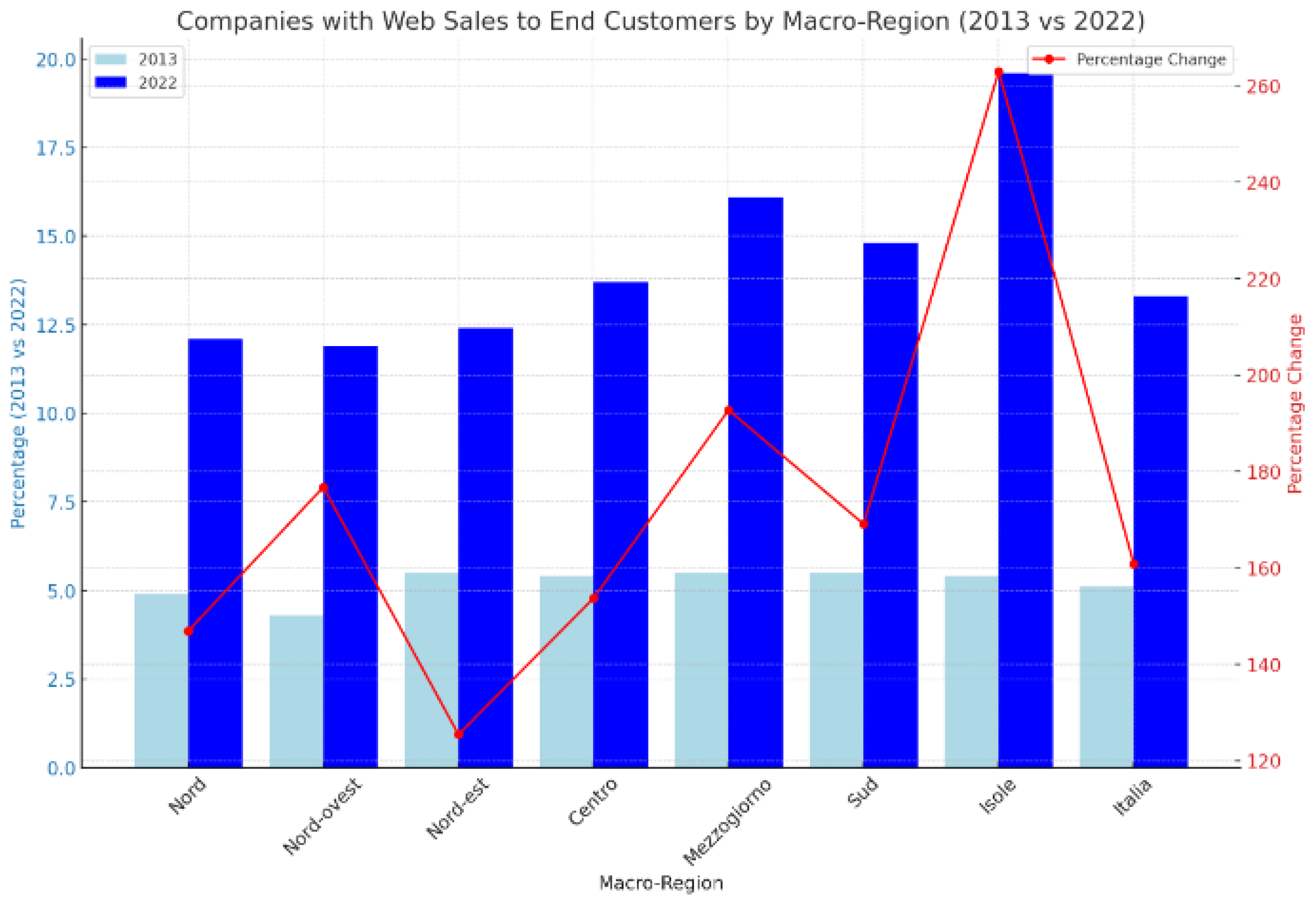

The analysis of data relating to Italian companies with at least 10 employees who have recorded web sales to end customers shows significant growth in the period considered, from 2013 to 2022. In particular, a general trend of increasing adoption of the electronic commerce between businesses, with absolute and percentage variations reflecting a significant change in sales behaviour. The Islands region stands out for having recorded the highest percentage change, with an increase of 262.96%, going from 5.4% to 19.6%. This suggests not only rapid adoption of online sales in this area, but also untapped potential at the start of the reporting period. On the contrary, the North-East, despite having shown a solid increase, records the lowest percentage growth among the macro-regions, with an increase of "only" 125.45%, which in any case almost doubles the share of companies engaged in web sales to 2022. The macro-region of the South, including the South and the Islands, also shows notable growth, underlining a dynamic of rapid expansion of online sales which exceeds the national average, with the South reaching an increase of 192.73% and the South with an increase of 169.09%. These data highlight how regions traditionally considered less dynamic from an economic point of view are rapidly catching up in e-commerce, potentially reducing the development gap with the Northern regions. The North, divided into North-West and North-East, although starting from a lower percentage base than other regions in 2013, saw a strong increase in online sales, with the North-West showing the highest absolute variation (7.6%) and a percentage growth of 176.74%, underlining the solidity and resilience of the entrepreneurial fabric of this area. The Central region, which includes the capital and other vital areas of the Italian economy, is no exception, with an increase of 8.3% in absolute terms and a percentage growth of 153.70%, which testifies to a broad adoption of online sales. In conclusion, these data reflect a profound transformation in the way Italian companies approach the market, with an increasingly marked inclination towards digital. This trend, highlighted by the growth of online sales in all Italian macro-regions, not only testifies to the adaptability and innovativeness of the country's entrepreneurial fabric, but also opens up reflections on future strategies of economic development, digitalisation and territorial inclusion (

Figure 3).

The value of companies with at least 10 employees with web sales to end customers grew by 154.84% on average between 2013 and 2022 in the Italian regions. To increase the number of Italian companies with at least 10 employees who carry out online sales to end customers, it is essential to implement a composite strategy that includes tax incentives and contributions dedicated to companies that invest in digitalisation and e-commerce. Training and consultancy play a crucial role, helping SMEs understand the benefits of selling online and develop effective digital marketing strategies. It is also essential to invest in the development of digital infrastructure, especially in less developed regions, to ensure that all businesses have access to fast and reliable internet connections. Facilitated access to credit would allow small and medium-sized businesses to invest in digital technologies, while public-private partnerships could promote the creation of e-commerce platforms beneficial to small regional businesses. Simplifying e-commerce regulations, including cross-border sales, and supporting the digitalisation of production processes would improve the efficiency and competitiveness of Italian businesses. Finally, territorial promotion through digital marketing could enhance local specificities and attract new customers. By implementing these policies, a favorable environment would be created that would stimulate Italian businesses to expand online sales, supporting economic growth at both a regional and national level.

4. Clusterization with k-Means Algorithm with a Comparison between the Optimization with the Silhouette Coefficient and the Elbow Method

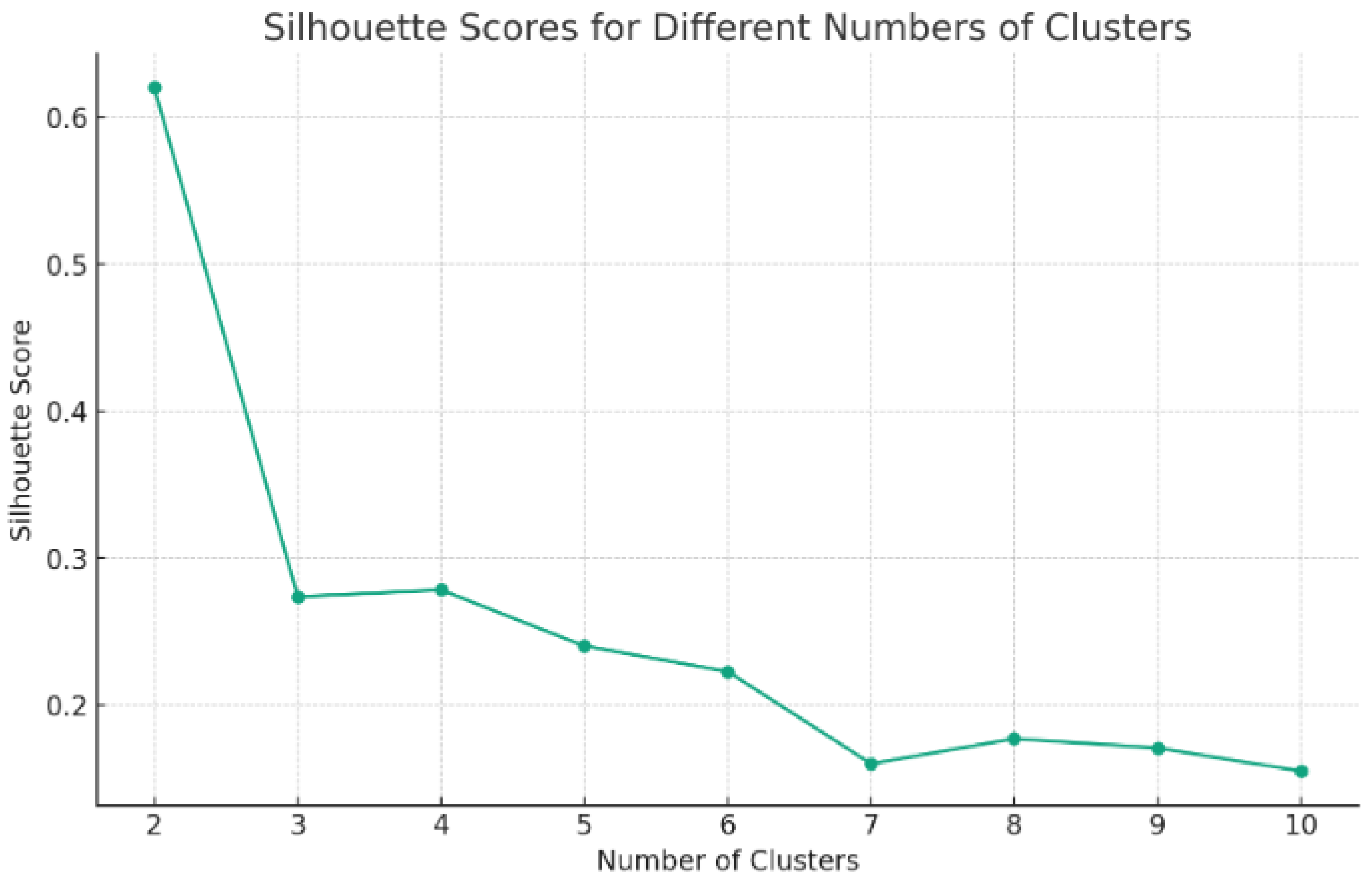

Clusterization with k-Means algorithm optimized with the Silhouette Coefficient. The silhouette score measures how similar an object is to its own cluster compared to other clusters. A higher silhouette score indicates that the object is well matched to its own cluster and poorly matched to neighboring clusters, suggesting a good clustering configuration. From the plot (

Figure 4), we can see how the silhouette score varies with the number of clusters. The optimal number of clusters, based on the highest silhouette score, is 2 clusters. This suggests that when we segment the dataset into 2 clusters, we achieve the best trade-off between having the data points well matched to their own cluster and poorly matched to neighboring clusters, thus providing a meaningful grouping.

The highest Silhouette score is for 2 clusters (0.62), suggesting that dividing the regions into 2 clusters provides the most meaningful and compact grouping according to the Silhouette Coefficient. The final k-Means clustering with 2 clusters resulted in the following cluster assignments for each region:

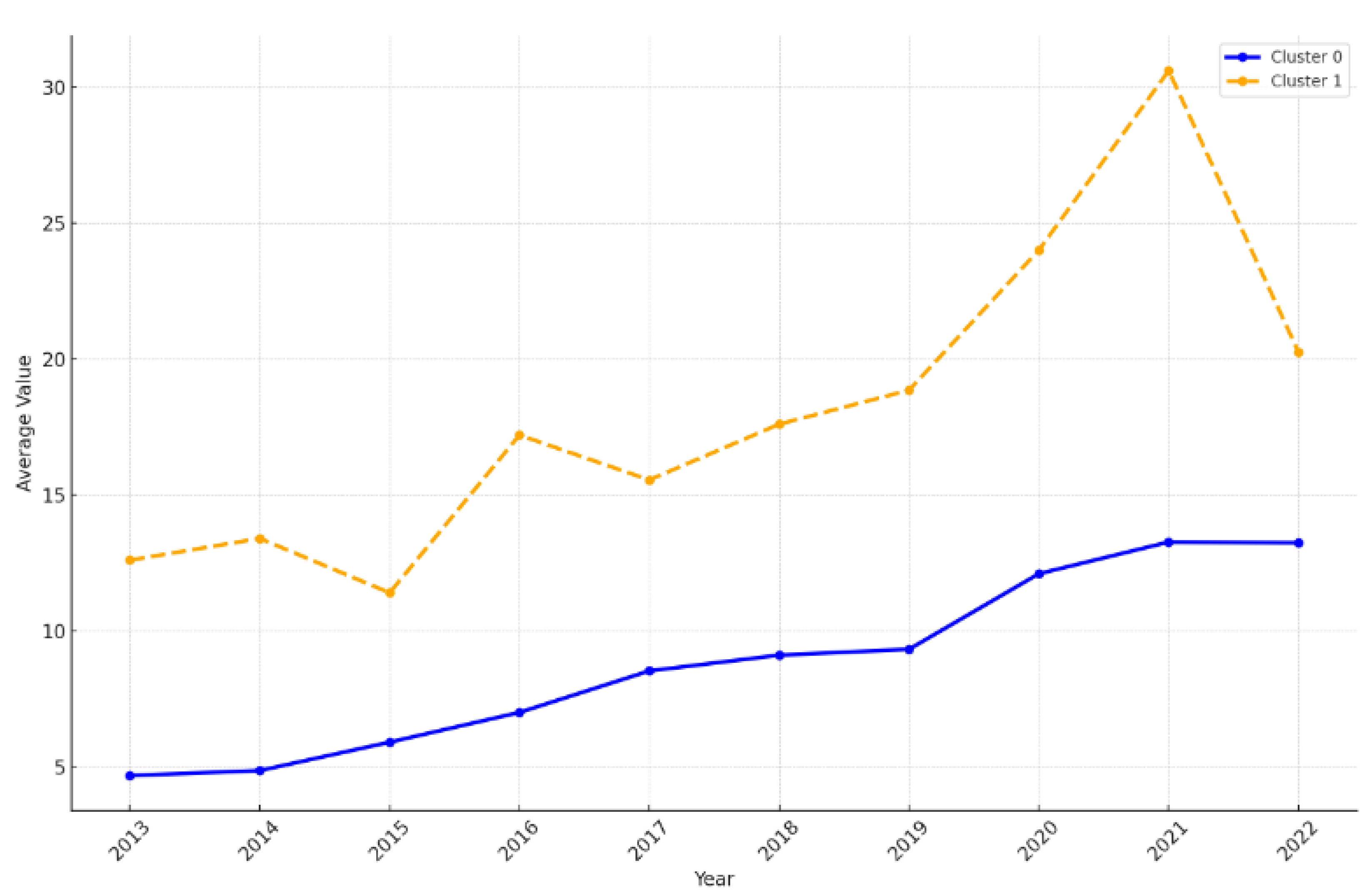

Cluster 0: Piemonte, Liguria, Lombardia, Veneto, Friuli-Venezia Giulia, Emilia-Romagna, Toscana, Umbria, Marche, Lazio, Abruzzo, Molise, Campania, Puglia, Basilicata, Calabria, Sicilia, and Sardegna.

Cluster 1: Valle d'Aosta and Trentino-Alto Adige.

Cluster 0 comprises a wide array of regions from various parts of Italy, including major economic centers like Lombardia and emerging regions like Calabria and Sicilia. The inclusion of these diverse regions in a single cluster suggests that, despite geographical and possibly sectoral differences, there's a commonality in the way these regions' companies, with at least 10 employees, engage in web sales to end customers. It could indicate that businesses in these regions, regardless of their specific local economic context, have similarly embraced online sales channels to reach end customers, potentially driven by broader national or global trends in consumer behavior and digital transformation. Cluster 1 exclusively containing Valle d'Aosta and Trentino-Alto Adige, might reflect a distinct scenario. These are regions known for their unique geographic and economic features, including significant tourism sectors, higher levels of local autonomy, and possibly unique consumer behaviors. Their separation into a distinct cluster could indicate that companies with at least 10 employees in these regions engage in web sales to end customers in a way that is significantly different from the rest of Italy. This could be due to several factors, such as a different mix of products and services offered online, unique marketing strategies tailored to their specific tourist or local markets, or higher levels of digital maturity and innovation in e-commerce practices (

Figure 5).

In essence, the clustering underscores the variability in e-commerce adoption and practices among SMEs (Small and Medium-sized Enterprises) across Italy. While Cluster 0 regions may represent a national trend of embracing digital sales channels, the distinct nature of Cluster 1 suggests regional nuances, particularly in areas with unique economic structures or consumer markets.

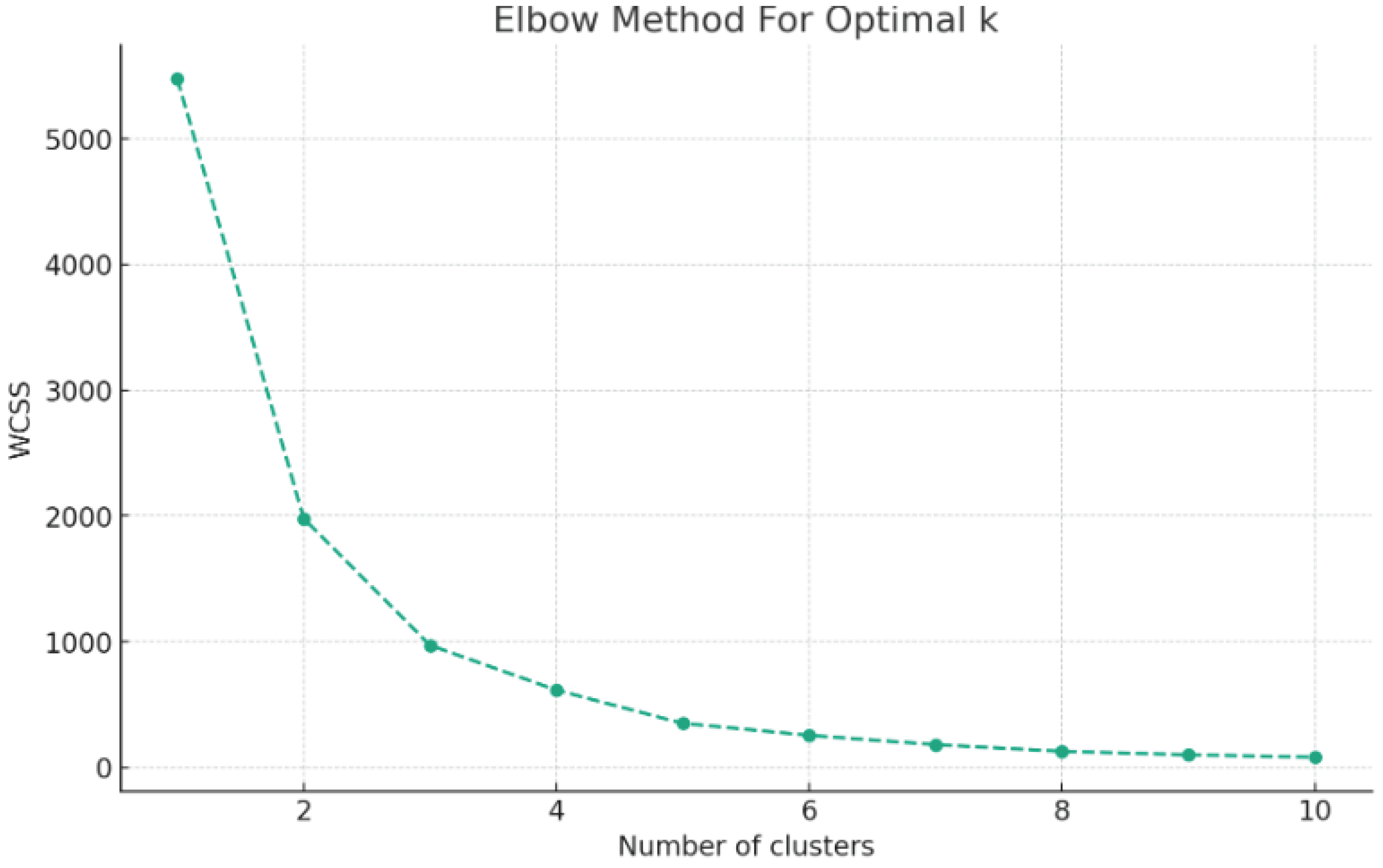

Clusterization with k-Means algorithm optimized with the Elbow Method. The Elbow Method graph helps determine the optimal number of clusters for the k-means clustering algorithm by plotting the number of clusters against the within-cluster sum of squares (WCSS). From the graph in

Figure 6, we look for the "elbow" point, where the rate of decrease in WCSS significantly slows down, indicating that adding more clusters does not significantly improve the model's performance. Based on the graph, the elbow point appears to be around 3 or 4 clusters, as the rate of decrease in WCSS becomes less steep after this point. This suggests that choosing either 3 or 4 clusters could be optimal for clustering the dataset on "Companies with at least 10 employees with web sales to end customers" over the years.

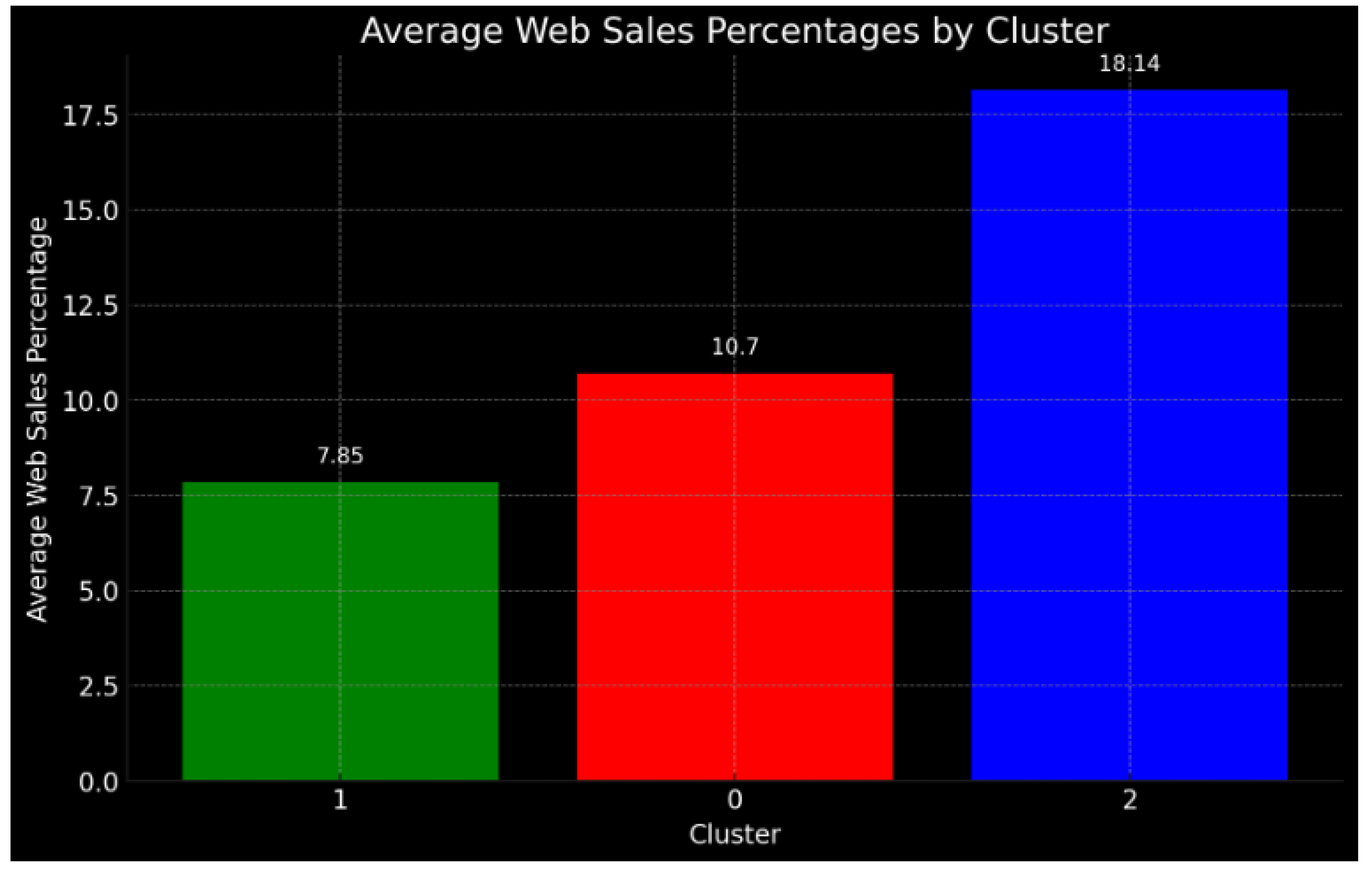

I chose to create a clustering with k=3. Here's a summary of the regions categorized by their respective clusters:

Cluster 0: Toscana, Lazio, Campania, Calabria, Sicilia, Sardegna. This cluster includes regions that have shown significant growth or high percentages in web sales to end customers. The presence of Toscana and Lazio, regions known for their robust economies and innovation hubs, suggests a mature digital commerce environment. Campania, Calabria, Sicilia, and Sardegna showing up in this cluster may indicate a strong growth in digital commerce, possibly driven by the necessity to reach wider markets beyond local and tourist-based economies. These regions, combining both central and southern parts of Italy, highlight a successful expansion of web sales activities, possibly supported by improvements in digital infrastructure and a strong entrepreneurial spirit focused on leveraging online sales channels.

Cluster 1: Piemonte, Liguria, Lombardia, Veneto, Friuli-Venezia Giulia, Emilia-Romagna, Umbria, Marche, Abruzzo, Molise, Puglia, Basilicata. This cluster is the largest and includes a mix of regions from the north, center, and south of Italy, featuring some of the country's industrial and commercial powerhouses like Lombardia and Emilia-Romagna. The presence of regions such as Piemonte and Veneto, known for their industrial output and export activities, suggests that companies in these areas have a consistent but possibly more moderate growth in web sales. This could be due to a variety of factors, including already established sales channels, the nature of goods and services offered (which may not always be suitable for web sales), or the gradual adoption of e-commerce practices. The diversity of this cluster also reflects the widespread nature of e-commerce adoption across different types of regional economies, from the highly industrialized north to the more agricultural and traditionally less industrialized regions like Puglia and Basilicata.

Cluster 2: Valle d'Aosta, Trentino-Alto Adige. This cluster stands out due to its smaller size and the specific characteristics of Valle d'Aosta and Trentino-Alto Adige. These regions are known for their high quality of life, significant tourist appeal, and strong local economies that may not rely heavily on web sales. The clustering here might indicate a lower growth rate in web sales to end customers, potentially because of a strong focus on tourism and local/in-person sales channels, or possibly due to the types of products and services that predominate these economies (e.g., artisanal, agricultural products, and tourism services). Despite this, the presence in this cluster does not necessarily mean these regions are lagging in digital adoption but rather suggests a different economic structure where web sales have not been the primary focus or have grown at a different pace.

This categorization reveals insights into the web sales performance trends across different Italian regions, with each cluster representing a distinct pattern over the observed period (

Figure 7).

This ordering reveals that, on average, Cluster 2, despite being the smallest cluster, has the highest web sales percentages, suggesting that regions in this cluster, although few, have significantly embraced web sales to end customers. Cluster 0 comes in second, indicating robust growth and adoption of e-commerce practices. Cluster 1, the largest cluster, has the lowest average, which might reflect a more gradual and diverse integration of e-commerce across various types of economies within these regions (

Figure 8).

Considering the average value of the clusters it is possible to verify the following ordering: Cluster 2>Cluster 0>Cluster 1. These results may appear paradoxical, in fact many regions that present very high levels of digitalisation and innovation are part of Cluster 1 or the cluster that presents the lowest levels in terms of orientation of small and medium-sized enterprises towards online sales. The reference is to Piedmont, Lombardy, Veneto, Emilia Romagna, which are within the same cluster with Molise, Puglia and Basilicata. Evidently many of the small and medium-sized businesses operating in North-East and North-West Italy do not sell products online through e-commerce, and perhaps operate through the production of goods and services in the business sector. to Business-B2B. This result appears paradoxical, however it can be understood if we consider that the economy of Northern Italy is made up of small and medium-sized enterprises that operate in the B2B supply chain both in the service sector and in the manufacturing sector.

Choose the optimal number of clusters. In the previous analysis we presented the maximized clustering through two methods, namely the Silhouette coefficient and the Elbow method. The results proposed by the two methods are very different from each other. In the case of the Silhouette Coefficient the optimal value of k identified is 2. In the case of the Elbow method the optimal value is set at k=3. Looking at the composition of the clusters, and having to choose between k=2 and k=3, I prefer to choose k=3. The motivation consists in the fact that at k=2 a condition is determined: the dominant cluster is made up exclusively of Valle d'Aosta and Trentino Alto Adige, while the less performing cluster includes the remaining 18 Italian regions. This is an unequal and excessively radical distribution which does not offer the possibility of grasping the complexity and heterogeneity of the Italian regions. Therefore, in light of the comparison between the optimal number of clusters indicated by the Silhouette coefficient and the Elbow method, I intend to choose the value of k=3 suggested by the Elbow method. This value of k in fact allows us to give greater representativeness of the complexity of the digitalisation levels of the Italian regions.

5. The Econometric Model

Below I present an econometric model for estimating the value of companies with at least 10 employees with web sales to end customers in the Italian regions. To analyze this variable I acquired data from the ISTAT-BES database for the 20 Italian regions in the period 2004-2022. The data were analyzed with the panel data technique. The variables used in the model are shown below (

Table 1).

The estimated equation is shown below:

Where i=20 and t=[2004;2022].

We find that the level of SME is positively associated to:

CCE: the intricate link between digital commerce and the flourishing of cultural and creative industries in Italy reveals more than just a surface-level connection; it underscores a transformative economic and cultural dynamic. The advent of e-commerce, particularly among businesses with significant employee numbers engaging in direct sales to consumers, has catalyzed a renaissance in the cultural and creative domains. This phenomenon is not merely coincidental but a reflection of how digital platforms have democratized the distribution of cultural goods and services, breaking down traditional barriers to entry for creators and consumers alike. In this digital age, companies are no longer confined by geographical limitations, allowing Italian cultural products—be it art, music, literature, or fashion—to reach a global audience. This global reach is critical, not only for the economic vitality of these sectors but also for the cultural exchange and appreciation it fosters. Furthermore, the digital platform serves as a feedback loop, where the popularity and consumption of cultural products can be directly measured and responded to, allowing creators to adapt and innovate in ways previously unimaginable. This digital empowerment has led to a significant cultural shift within regions known for their strong e-commerce presence. It elevates the value placed on creative professions, making them more viable and respected career paths. This, in turn, encourages a more vibrant cultural ecosystem, attracting talent and investment. The economic benefits are manifold, from job creation in the digital and creative sectors to the promotion of tourism as global audiences become more engaged with Italy's rich cultural heritage presented online. However, this positive cycle also presents challenges, such as ensuring equitable access to digital tools and platforms for all creatives and maintaining the authenticity and quality of cultural products in the face of commercial pressures. The relationship between digital commerce and cultural proliferation, while overwhelmingly positive, thus demands careful stewardship to sustain its growth and ensure it benefits the broad spectrum of society. The burgeoning relationship between digital commerce and cultural industries in Italy illustrates the potential for technology to enhance cultural engagement and economic opportunity. It's a testament to the power of the digital age to transform traditional industries and cultural paradigms, heralding a new era of economic development that is inclusive, dynamic, and culturally enriched (

Figure 9).

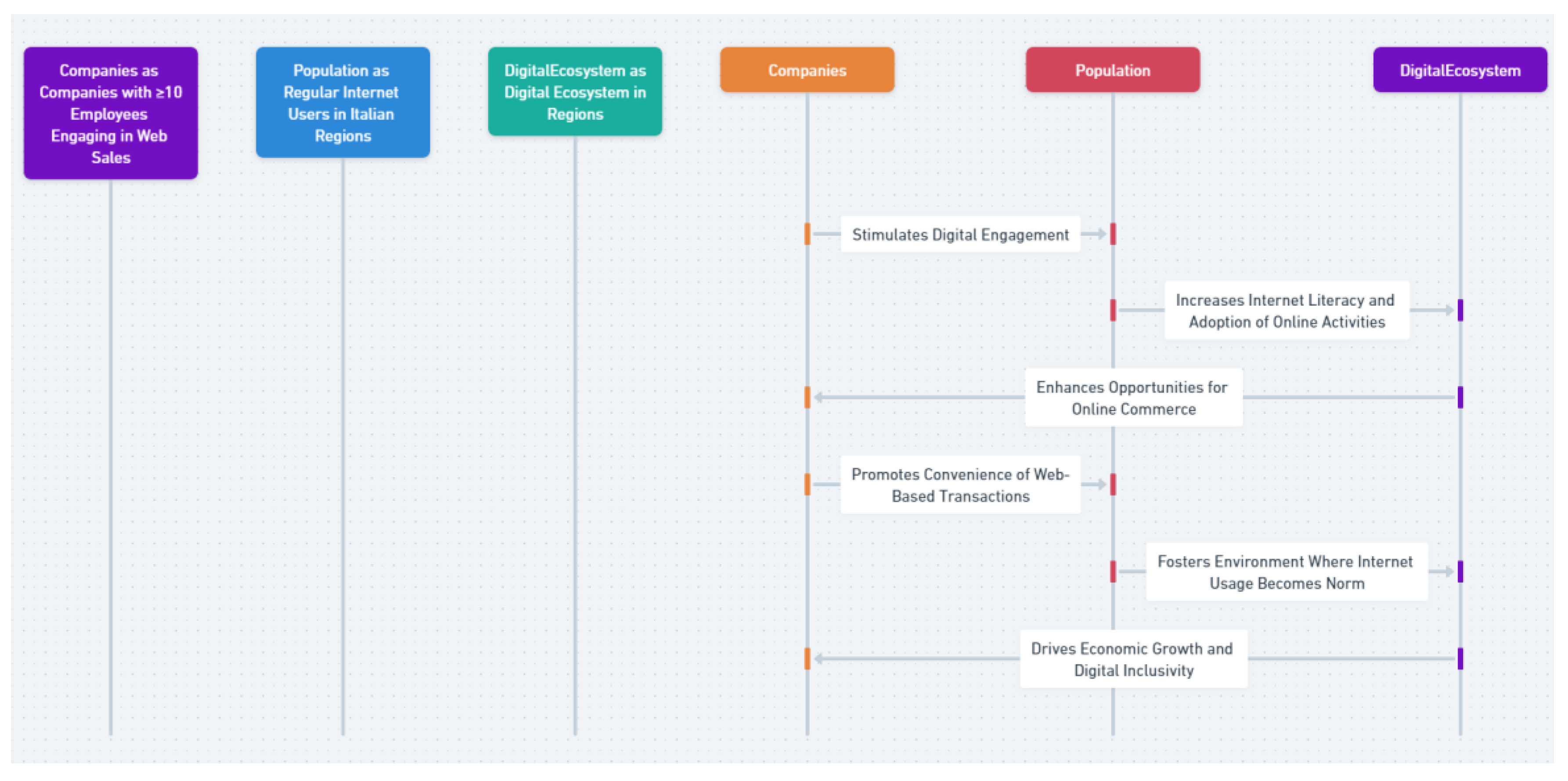

RIU: the positive relationship between digitally adept companies and the widespread use of the internet among the population in Italian regions not only signifies a mutual benefit but also serves as a cornerstone for socio-economic development. This symbiotic relationship amplifies the impacts of digital literacy, economic diversification, and social inclusion, fostering a more interconnected and resilient society. Firstly, the presence of companies that are proficient in utilizing digital platforms for sales directly contributes to the enhancement of digital literacy across the population. As these companies innovate and provide services online, they inadvertently act as educators, prompting individuals to develop the skills necessary to navigate the digital landscape. This educational dynamic is crucial, especially in areas where access to digital education resources might be limited, thereby democratizing digital knowledge through practical, everyday interactions. Secondly, this relationship catalyzes economic diversification. As regions become more digitally integrated, new niches and markets emerge, offering opportunities for entrepreneurship and innovation. The digital economy is inherently diverse, encompassing sectors from e-commerce and digital marketing to software development and online entertainment. This diversification not only strengthens the economic fabric of these regions but also makes them more adaptable to global economic shifts and technological advancements. Furthermore, the integration of digital commerce significantly contributes to social inclusion. By fostering regular internet use, these companies ensure that various demographic groups—regardless of age, socio-economic status, or geographical location—can participate in the digital economy. This participation ranges from accessing online services and goods to engaging in remote work and educational opportunities. Consequently, the digital divide, a critical concern in many regions, begins to narrow, enabling a more inclusive society where access to information, opportunities, and connectivity is not a privilege but a norm. Moreover, the environmental advantages of digital commerce should not be overlooked. By promoting online transactions and operations, the necessity for physical infrastructure is reduced, leading to lower carbon footprints and a more sustainable approach to business and consumer behavior. This environmental consciousness, in turn, aligns with growing global demands for eco-friendly practices, further positioning Italian regions as forward-thinking and responsible in the face of global challenges. In conclusion, the dynamic interplay between companies engaged in web sales and the prevalence of regular internet users fosters a comprehensive ecosystem that benefits not only the economy but also the social and environmental landscape of Italian regions. This virtuous cycle of digital engagement and economic growth, underpinned by inclusivity and sustainability, highlights the transformative potential of digital commerce in shaping resilient and progressive societies (

Figure 10).

Figure 10.

The positive relationship between SME and RIU.

Figure 10.

The positive relationship between SME and RIU.

We also find that the level of SME is negatively associated to:

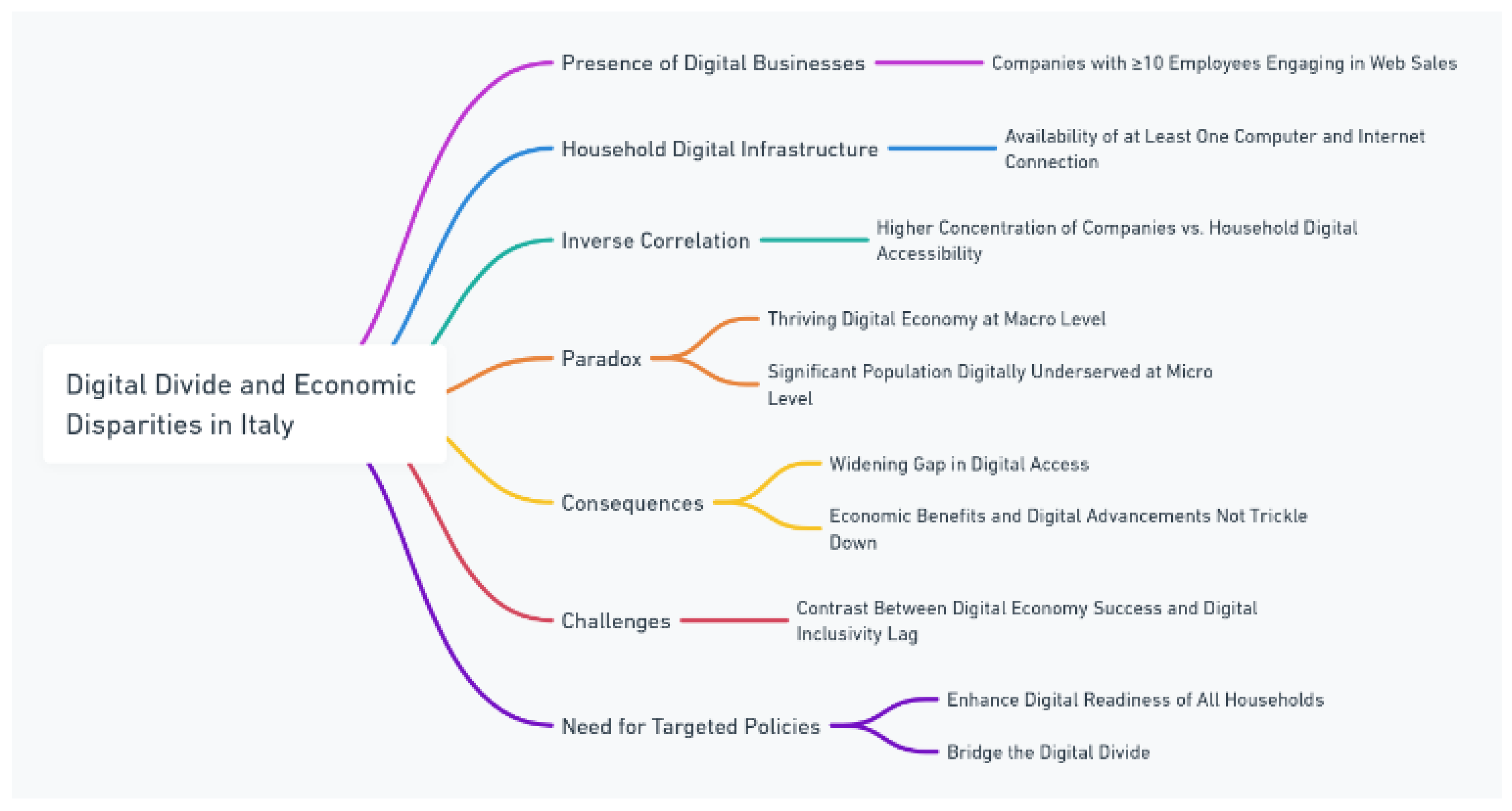

AOC: the exploration of the paradoxical relationship between the proliferation of digital-commerce companies with significant employee numbers and the uneven distribution of household digital infrastructure across Italian regions sheds light on deeper issues of digital divide and socio-economic inequality. This inverse relationship indicates that while some regions may host a vibrant digital economy, signified by companies adept in web sales, this prosperity does not necessarily translate into improved digital access for all households. This discrepancy lays bare a stark digital divide, where economic growth in the digital sector coexists with a lack of digital inclusivity at the individual and family levels. This paradox is not merely a matter of technological distribution but reflects broader economic disparities. Regions with a dense concentration of digital-commerce businesses often see these enterprises as engines of economic development and innovation. However, the benefits yielded by these digital economies—such as job creation in the tech sector and increased regional GDP—may not be accessible to all residents, especially those in lower socio-economic brackets. The assumption that corporate success in the digital realm naturally leads to widespread digital empowerment is flawed. Instead, the growth of digital businesses may inadvertently exacerbate existing inequalities, leaving behind those without the means to access or utilize digital technologies effectively. The scenario reveals a nuanced layer of socio-economic stratification, where the digital economy's success story masks the reality of those it fails to reach. For families lacking in digital resources—be it the absence of a computer or an inadequate internet connection—the divide grows wider, not just in terms of technology but in access to opportunities that the digital world affords, such as education, telework, and online services. This situation is particularly concerning as the world becomes increasingly digitized, making digital access a cornerstone of modern life rather than a luxury. Addressing this challenge requires targeted interventions that go beyond the market-driven dynamics of digital commerce. It calls for a concerted effort involving government, industry, and community stakeholders to ensure that digital advancements lead to inclusive growth. Policies aimed at subsidizing internet access, providing digital literacy programs, and ensuring affordable digital devices are available to underprivileged families can play a significant role in mitigating the digital divide. Moreover, initiatives that encourage digital-commerce companies to invest in community digital infrastructure as part of their corporate social responsibility efforts could further bridge the gap. Furthermore, this complex interplay between digital commerce success and household digital access underscores the need for a holistic approach to economic development, one that integrates digital inclusivity as a fundamental objective (

Figure 11).

The econometric results are presented in tables and graphs in the

Appendix A.

6. Machine Learning Algorithms for Prediction

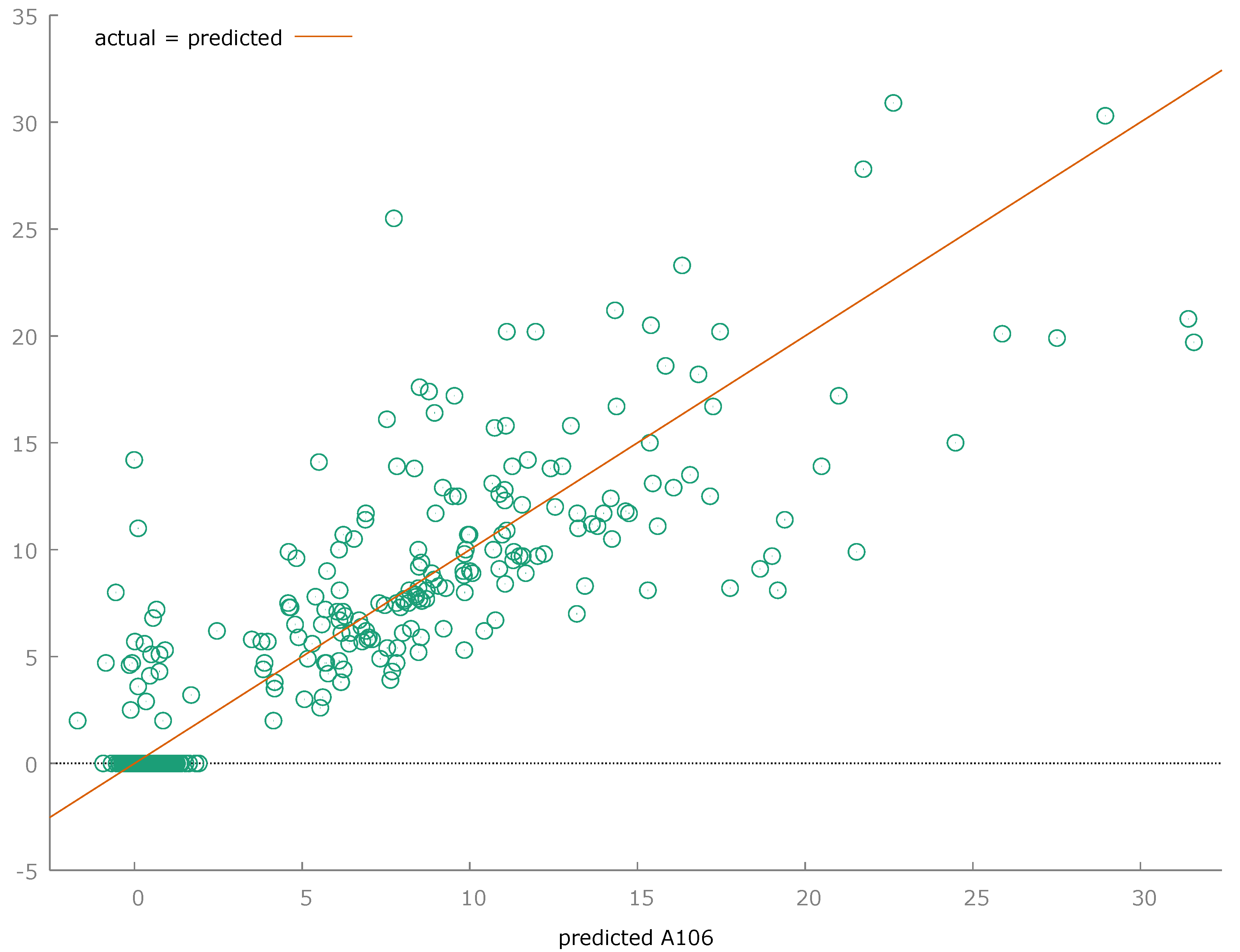

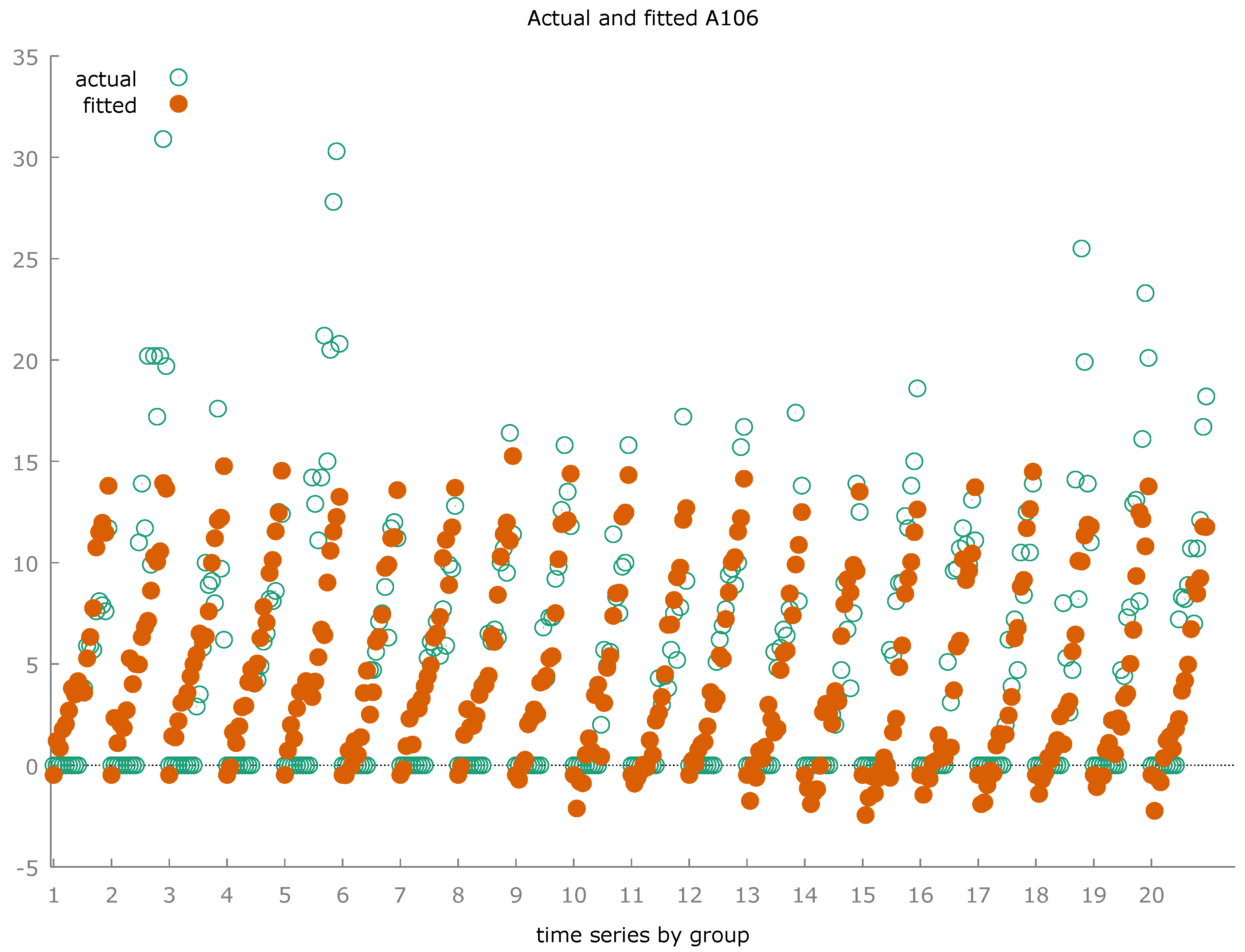

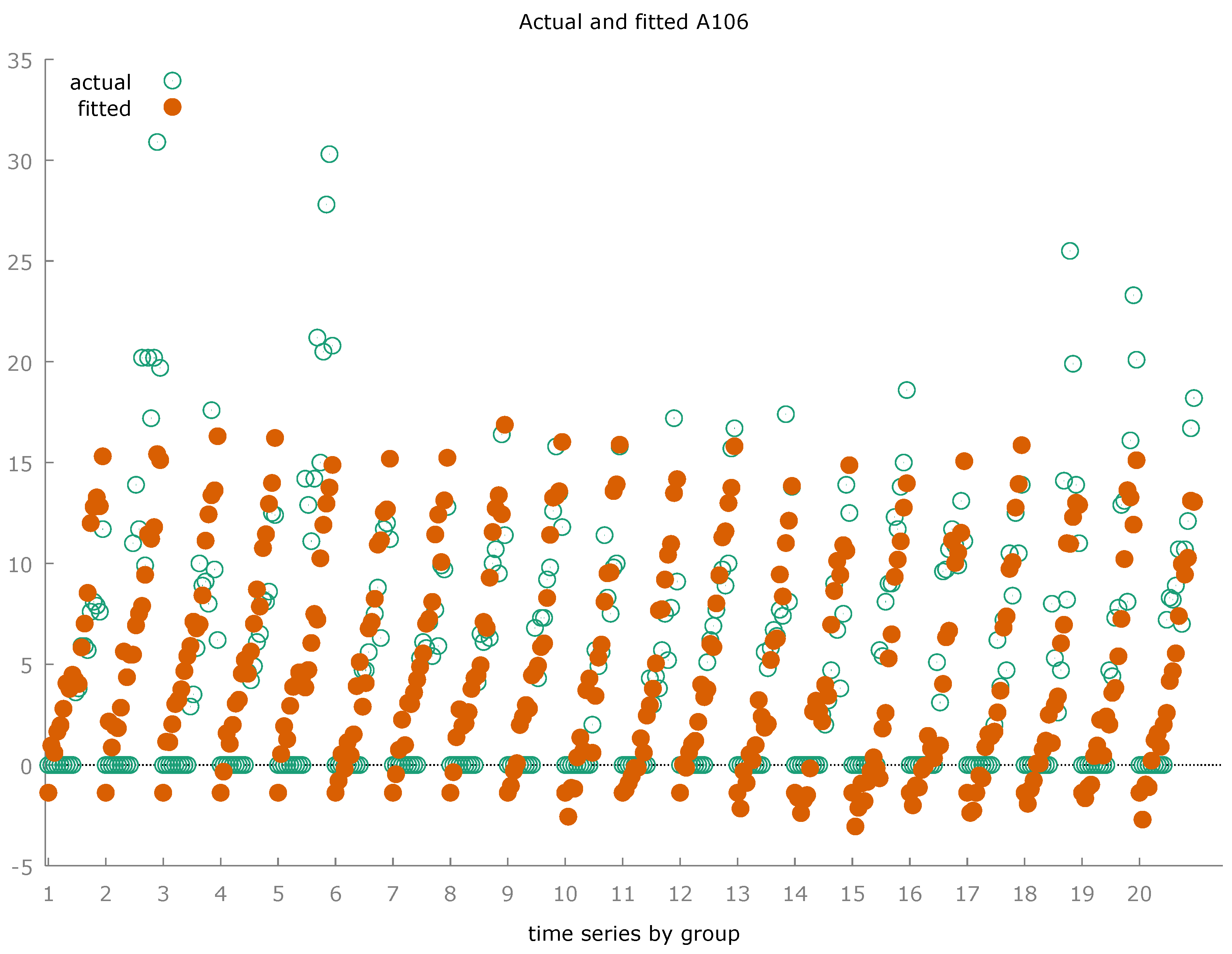

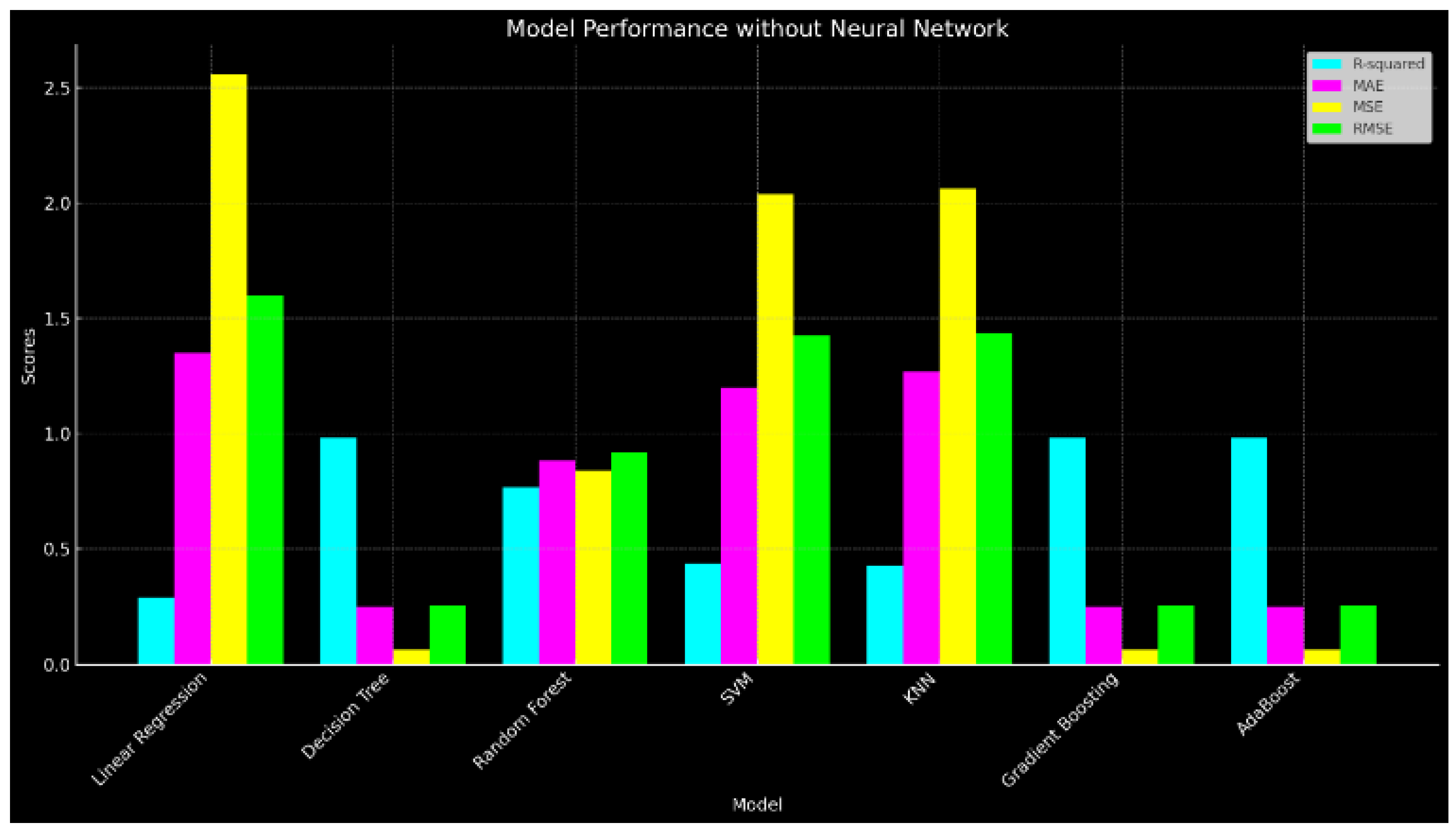

Below is a comparison of machine learning algorithms for predicting the value of companies with at least 10 employees with web sales to end customers in the Italian regions. Algorithms are evaluated based on their ability to maximize R-squared and minimize statistical errors (

Table 2). After choosing the best algorithm on the basis of qualitative-quantitative criteria, the predictions and the percentage and absolute variations compared to the last historical series survey are detected.

Given these metrics, the Decision Tree, Gradient Boosting, and AdaBoost models stand out with an R-squared value of 0.982, which indicates that these models can explain 98.2% of the variance in the dependent variable. They also have the lowest error rates across MAE, MSE, and RMSE, making them the most accurate models among those listed. However, the choice between these three might depend on additional considerations such as:

Interpretability: Decision Trees are typically easier to interpret and visualize compared to Gradient Boosting and AdaBoost.

Computation Time and Complexity: Gradient Boosting and AdaBoost may require more computational resources and time to train than a simple Decision Tree, especially with large datasets.

Tendency to Overfit: Complex models like Gradient Boosting and AdaBoost might have a higher tendency to overfit, especially with noisy data, compared to Decision Trees which can be pruned to reduce overfitting.

If accuracy is the sole concern, either Gradient Boosting or AdaBoost would be recommended due to their high R-squared value and low error metrics, suggesting they are both highly predictive and precise (

Figure 12).

When choosing among Decision Tree, Gradient Boosting, and AdaBoost based on their performance metrics, which are identical in this case (R-squared: 0.982, MAE: 0.250, MSE: 0.065, RMSE: 0.255), the decision comes down to other factors such as model complexity, interpretability, and how they handle overfitting and bias-variance trade-offs. Here's a brief overview:

Decision Trees are highly interpretable, easy to visualize, and simple to understand. They are useful for capturing linear and non-linear relationships but can easily overfit, especially with complex datasets. They're best when you need a model that is easy to explain to stakeholders or when the dataset is not overly complex.

Gradient Boosting is a powerful ensemble technique that builds one tree at a time, where each new tree helps to correct errors made by previously trained trees. Gradient Boosting has a high level of predictive accuracy but is more complex and less interpretable than a single Decision Tree. It tends to perform well on a wide range of problems, especially where the data complexity requires capturing intricate patterns. However, it can be prone to overfitting if not carefully tuned and can be computationally intensive to train.

AdaBoost (Adaptive Boosting) starts by fitting a simple model (e.g., a Decision Tree) to the data and then fits additional copies of the model to the same dataset but where the weights of incorrectly classified instances are adjusted such that subsequent models focus more on difficult cases. It's less prone to overfitting compared to Gradient Boosting and can be more robust with noisy data. However, like Gradient Boosting, its interpretability is lower than a single Decision Tree, and its performance heavily depends on the data and the complexity of the base estimator.

If interpretability and simplicity are key, and the dataset is not overly complex, choose a Decision Tree. If predictive accuracy is paramount and the dataset is complex, involving intricate patterns or relationships that a simple model cannot capture, Gradient Boosting is often the best choice. For a balance between accuracy and handling overfitting, especially in cases where data might be noisy or you're concerned about the model being too sensitive to outliers, AdaBoost can be an effective choice. It's also versatile but slightly easier to configure compared to Gradient Boosting. Considering the identical performance metrics Gradient Boosting might be favored for scenarios demanding the highest predictive power, assuming resources and efforts are allocated for proper tuning and validation to manage overfitting.

The predictions obtained through the application of the Gradient Boosting algorithm are shown in

Table 3.

Within this intricate tapestry of regional economies, distinct patterns emerge, offering both promising avenues for growth and sobering challenges to confront. Notably, regions such as Liguria, Trentino-Alto Adige, Emilia-Romagna, Marche, Puglia, Calabria, and Sicilia stand out with positive trajectories in web sales, hinting at buoyant markets and favourable conditions ripe for further expansion and market penetration. This upward momentum underscores the potential for strategic investment and resource allocation within these regions, as businesses aim to capitalize on the burgeoning digital economy and evolving consumer preferences. Conversely, amidst these pockets of growth, other regions paint a contrasting picture, grappling with stagnation or decline in web sales. Regions like Friuli-Venezia Giulia, Umbria, Lazio, Abruzzo, Molise, and Basilicata reveal negative trends, signalling challenges that demand attention and strategic intervention. Whether due to shifting consumer behaviours, competitive pressures, or infrastructural limitations, these regions present complex landscapes that require nuanced approaches to revitalization and reinvigoration. Understanding the underlying factors driving these trends is essential for businesses and policymakers alike, as they seek to foster resilience and stimulate economic vibrancy across all regions. Moreover, while some regions showcase marginal fluctuations in web sales, others exhibit more pronounced shifts, reflecting the dynamic nature of the market and the diverse array of influences shaping regional economies. These variations underscore the importance of agility and adaptability in navigating the intricacies of the digital marketplace, as businesses must remain responsive to evolving consumer demands and market dynamics. By leveraging data-driven insights and embracing a nuanced understanding of regional nuances, companies can position themselves strategically to harness growth opportunities, mitigate risks, and cultivate sustainable success in an ever-evolving landscape (

Figure 13).

7. Political Implications

To boost the number of companies with at least 10 employees engaging in web sales to end customers across Italian regions, policymakers could consider a complex set of economic policies.

E-commerce Infrastructure Development. Investing in the infrastructure crucial for e-commerce encompasses a broad spectrum of efforts, aimed at both the tangible and intangible facets required for a thriving digital marketplace. This includes the expansion of high-speed internet access to ensure equitable online availability across diverse populations and geographical areas, thereby addressing the digital divide. It also involves enhancing the reliability and security of online payment systems through secure payment gateways, which safeguard against fraud and protect user data, underpinning consumer trust in digital transactions. Additionally, the development of user-friendly e-commerce platforms is paramount. Such platforms must be accessible and intuitive, catering to users of varying ages, technical skills, and including provisions for people with disabilities, to ensure the inclusivity of digital commerce.

Financial Incentives and Tax Breaks. Providing financial incentives and tax breaks to companies investing in e-commerce capabilities is a strategic approach that serves multiple purposes in fostering a digital economy. By offering deductions for expenses incurred in establishing online sales channels, governments can lower the entry barrier for small and medium-sized enterprises (SMEs) looking to digitalize. Reduced corporate taxes on e-commerce revenues further encourage businesses to prioritize and expand their online presence, recognizing and rewarding their efforts to adapt to digital marketplaces. Grants for technology adoption play a crucial role in leveling the playing field, especially for smaller players who might otherwise struggle to afford the upfront costs associated with digital transformation. This strategy not only stimulates economic growth by expanding the digital ecosystem but also promotes innovation and competitiveness among businesses. By incentivizing the shift towards e-commerce, policymakers can catalyze a more dynamic, inclusive, and resilient economy, where companies are encouraged to innovate and where the benefits of digital commerce can reach wider segments of the society, including underserved communities.

Access to Funding and Support. Facilitating access to funding and support for businesses aiming to bolster their online presence is a pivotal strategy in nurturing the growth of the digital economy. By establishing dedicated funding programs and offering low-interest loans tailored for e-commerce development, governments and financial institutions can effectively lower financial barriers that often deter small and medium-sized businesses from investing in online platforms. Such financial instruments not only provide the necessary capital to jumpstart e-commerce ventures but also signal a commitment to supporting digital entrepreneurship. Moreover, complementing these financial incentives with advisory services and technical assistance is crucial. It ensures that businesses are not just financially equipped but also well-informed and technically prepared to navigate the complexities of establishing and expanding their online operations. This comprehensive support system not only accelerates the digital transformation of traditional businesses but also fosters an environment where innovation thrives.

Training and Skill Development. Offering training programs and workshops that focus on building digital skills pertinent to e-commerce is a vital strategy for empowering businesses and their workforce to thrive in the digital marketplace. Such educational initiatives should cover a broad spectrum of topics, including website development, digital marketing, and online sales management, ensuring that participants gain a comprehensive understanding of the digital tools and strategies essential for successful e-commerce operations. Tailoring these programs to the specific needs of different industries and business sizes is crucial, as it allows for a more targeted approach that addresses the unique challenges and opportunities within each sector. An emphasis on practical, hands-on learning ensures that participants can immediately apply the skills and knowledge acquired, thereby facilitating the swift implementation of e-commerce solutions within their operations. This approach not only boosts the e-commerce readiness of businesses but also enhances the digital literacy of the workforce at large. By investing in such training and skill development initiatives, governments and industry leaders can foster a culture of continuous learning and adaptation, which is critical in the rapidly evolving digital economy. Inizio modulo

Regional Collaboration and Networking. Fostering collaboration and networking among businesses, industry associations, and local government agencies to share knowledge and best practices in e-commerce is a strategic approach that leverages collective expertise to propel the digital economy forward. By establishing regional e-commerce clusters or hubs, stakeholders can create a concentrated ecosystem where cooperation and information exchange flourish. Such clusters serve as incubators for innovation, where businesses, regardless of their size, can benefit from shared resources, insights, and technological advancements. This collaborative environment not only accelerates the adoption of e-commerce practices but also encourages a culture of continuous improvement and adaptation to emerging digital trends. Moreover, these hubs can act as catalysts for regional economic development, attracting investment and talent by showcasing the collective capabilities and success stories within the e-commerce sector. They also offer a platform for government agencies to more effectively engage with the business community, tailoring support services and regulatory frameworks to foster a conducive environment for e-commerce growth. Through regional collaboration and networking, the barriers to entry for online markets can be significantly reduced, leveling the playing field for smaller enterprises and enabling them to compete more effectively on a larger stage.

Promotion of Digital Literacy. Investing in initiatives aimed at improving digital literacy among both businesses and consumers is a critical strategy for enhancing the ecosystem within which e-commerce operates. Educating businesses on the myriad benefits of e-commerce, including wider market access, cost reduction, and enhanced customer insights, is essential. By providing resources that help businesses overcome common barriers to adoption, such as technological challenges, security concerns, and logistical issues, policymakers and industry leaders can stimulate a more robust demand for online products and services. This approach not only accelerates the digital transformation of traditional businesses but also nurtures a more digitally savvy consumer base. Consumers who are informed about the advantages and safeguards of online shopping are more likely to engage in e-commerce, creating a virtuous cycle that further drives demand. Enhanced digital literacy leads to increased confidence in using online platforms, which in turn encourages businesses to innovate and improve their online offerings. Moreover, initiatives focused on digital literacy contribute to leveling the playing field, enabling small and medium-sized enterprises to compete more effectively with larger players.

Streamlined Regulatory Environment. Simplifying and streamlining regulations related to e-commerce, encompassing online transactions, data protection, and consumer rights, is imperative for fostering a conducive environment for digital commerce growth. A clear and favorable regulatory environment removes significant barriers to entry for businesses looking to venture into or expand their online operations. By eliminating unnecessary bureaucratic hurdles and providing a predictable legal framework, businesses can plan and invest in e-commerce initiatives with greater confidence. This is particularly crucial for small and medium-sized enterprises, which often face greater challenges in navigating complex regulatory landscapes. Moreover, clear regulations around data protection and consumer rights not only protect individuals but also build consumer trust in online platforms. When consumers feel confident about the security of their data and their rights in digital transactions, they are more likely to engage in e-commerce, thereby driving demand. Streamlining regulations, therefore, not only supports businesses but also contributes to a healthier e-commerce ecosystem where trust, innovation, and accessibility lead to mutual benefits for businesses and consumers alike. Such an environment encourages investment, innovation, and growth in the digital economy, making it an essential component of a thriving e-commerce sector.

8. Conclusions

The value of companies with at least 10 employees selling online to end consumers grew in the Italian regions by an average of 154.84% between 2013 and 2022. This value grew in all Italian regions even if some regions recorded increases very high growth rates such as Umbria with +690.00%, Basilicata with 595.00%, Molise with 400.00%, Sicily with +327.66%, Lazio with 227.45%. The southern macro-regions appear to have much higher levels of the observed variable than the central-northern regions. This condition could be because companies with more than 10 employees in the centre-north tend to be more oriented towards offering products and services within supply chains in the B2B context rather than goods to final consumers in the context of online sales. This trend is partly confirmed by the clustering which highlights, on the one hand, an absolute leadership condition in the sector of Valle d'Aosta and Trentino Alto Adige, and on the other hand a good performance of southern companies compared to those of the central-northern Italy. The econometric analysis highlights the positive relationship between businesses oriented towards online sales, regular internet users and employment in the cultural and creative sector. The predictions made through the Gradient Boosting algorithm essentially confirm the trend of the historical series detected. Policy makers can intervene with economic policies to increase the use of e-commerce by Italian companies both in the goods and services sectors. Furthermore, new metrics could also be introduced to evaluate the use of digital systems in B2B sales to track the use of digital tools along supply chains.

Funding

The author received no financial support for the research, authorship, and/or publication of this article.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The author declares that there is no conflict of interests regarding the publication of this manuscript. In addition, the ethical issues, including plagiarism, informed consent, misconduct, data fabrication and/or falsification, double publication.

Appendix A

| Fixed-effects, using 380 observations |

| Included 20 cross-sectional units |

| Time-series length = 19 |

| Dependent variable: A106 |

| |

Coefficient |

Std Error. |

t-ratio |

p-value |

|

| const |

−1.42015 |

0.604930 |

−2.348 |

0.0194 |

** |

| A101 |

0.508037 |

0.184417 |

2.755 |

0.0062 |

*** |

| A103 |

0.579465 |

0.0468708 |

12.36 |

<0.0001 |

*** |

| A104 |

−0.422816 |

0.0472772 |

−8.943 |

<0.0001 |

*** |

| Mean dependent var |

5.123684 |

|

S.D. dependent var |

6.175282 |

| Sum squared resid |

3527.740 |

|

S.E. of regression |

3.143505 |

| LSDV R-squared |

0.755913 |

|

Within R-squared |

0.736518 |

| LSDV F(22, 357) |

50.25437 |

|

P-value(F) |

3.61e-95 |

| Log-likelihood |

−962.5625 |

|

Akaike criterion |

1971.125 |

| Schwarz criterion |

2061.749 |

|

Hannan-Quinn |

2007.085 |

| rho |

0.393438 |

|

Durbin-Watson |

1.167506 |

| Joint test on named regressors - |

| Test statistic: F(3, 357) = 332.644 |

| with p-value = P(F(3, 357) > 332.644) = 5.21481e-103 |

| |

| Test for differing group intercepts - |

| Null hypothesis: The groups have a common intercept |

| Test statistic: F(19, 357) = 6.25462 |

| with p-value = P(F(19, 357) > 6.25462) = 6.72601e-14 |

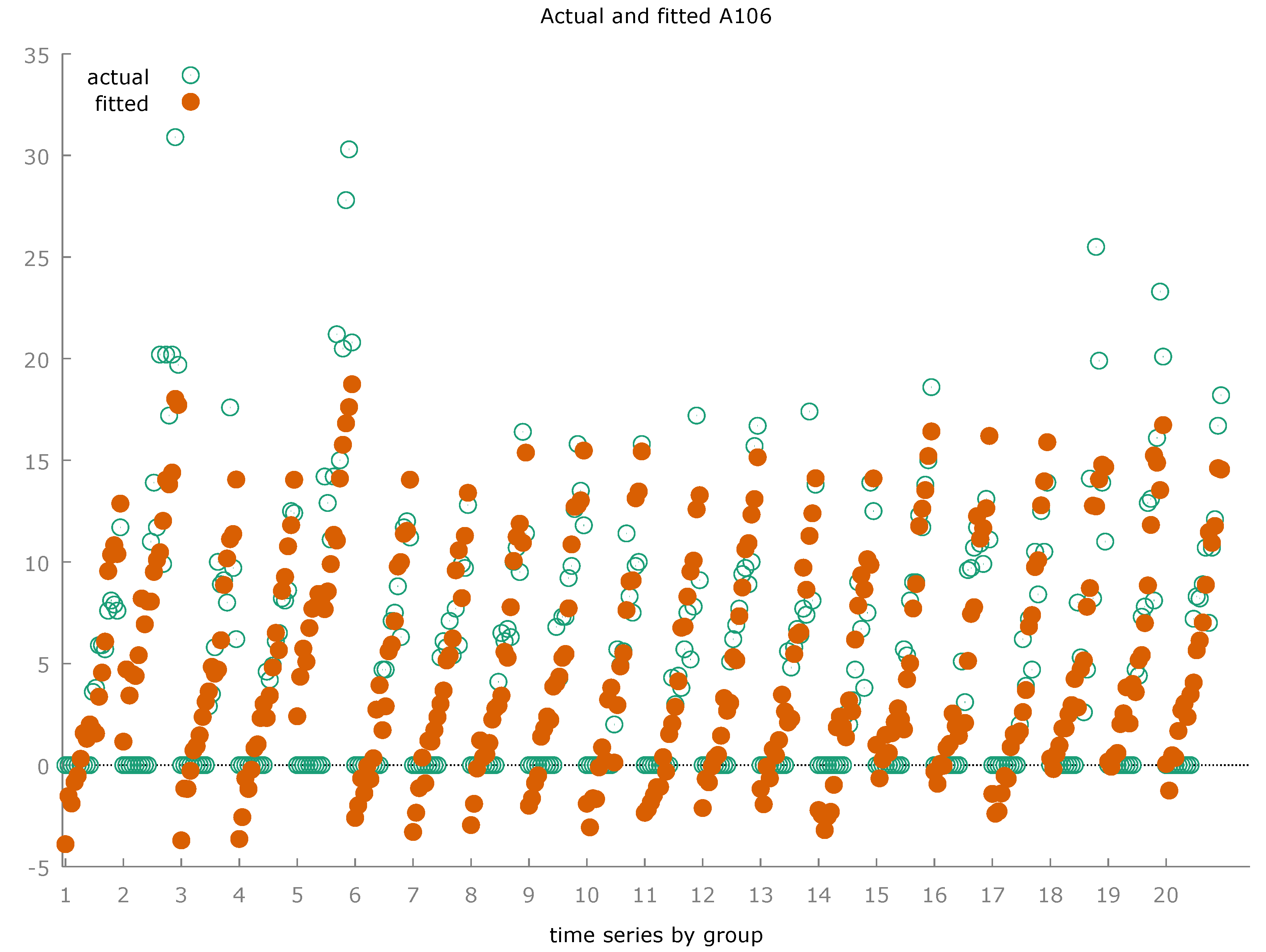

Figure A1.

Fixed Effects.

Figure A1.

Fixed Effects.

| 1-step dynamic panel, using 340 observations |

| Included 20 cross-sectional units |

| Dependent variable: A106 |

| |

Coefficient |

Std. Error |

z |

p-value |

|

| A106(-1) |

0.0806305 |

0.103969 |

0.7755 |

0.4380 |

|

| A101 |

0.461132 |

0.143743 |

3.208 |

0.0013 |

*** |

| A103 |

0.365913 |

0.0725689 |

5.042 |

<0.0001 |

*** |

| A104 |

−0.196533 |

0.0666831 |

−2.947 |

0.0032 |

*** |

| Sum squared resid |

3961.374 |

|

S.E. of regression |

2.413618 |

| Number of instruments = 39 |

| Test for AR(1) errors: z = -3.20667 [0.0013] |

| Test for AR(2) errors: z = -0.52505 [0.5995] |

| Sargan over-identification test: Chi-square(35) = 131.363 [0.0000] |

| Wald (joint) test: Chi-square(4) = 161.717 [0.0000] |

Figure A2.

Dynamic Panel.

Figure A2.

Dynamic Panel.

| WLS, using 380 observations |

| Included 20 cross-sectional units |

| Dependent variable: A106 |

| Weights based on per-unit error variances |

| |

Coefficient |

Std. Error |

t-ratio |

p-value |

|

| const |

−0.475347 |

0.473178 |

−1.005 |

0.3157 |

|

| A101 |

0.425236 |

0.137181 |

3.100 |

0.0021 |

*** |

| A103 |

0.534744 |

0.0343246 |

15.58 |

<0.0001 |

*** |

| A104 |

−0.405610 |

0.0344756 |

−11.77 |

<0.0001 |

*** |

| Statistics based on the weighted data: |

| Sum squared resid |

355.2174 |

|

S.E. of regression |

0.971971 |

| R-squared |

0.770023 |

|

Adjusted R-squared |

0.768188 |

| F(3, 376) |

419.6492 |

|

P-value(F) |

1.4e-119 |

| Log-likelihood |

−526.3828 |

|

Akaike criterion |

1060.766 |

| Schwarz criterion |

1076.526 |

|

Hannan-Quinn |

1067.020 |

| Statistics based on the original data: |

| Mean dependent var |

5.123684 |

|