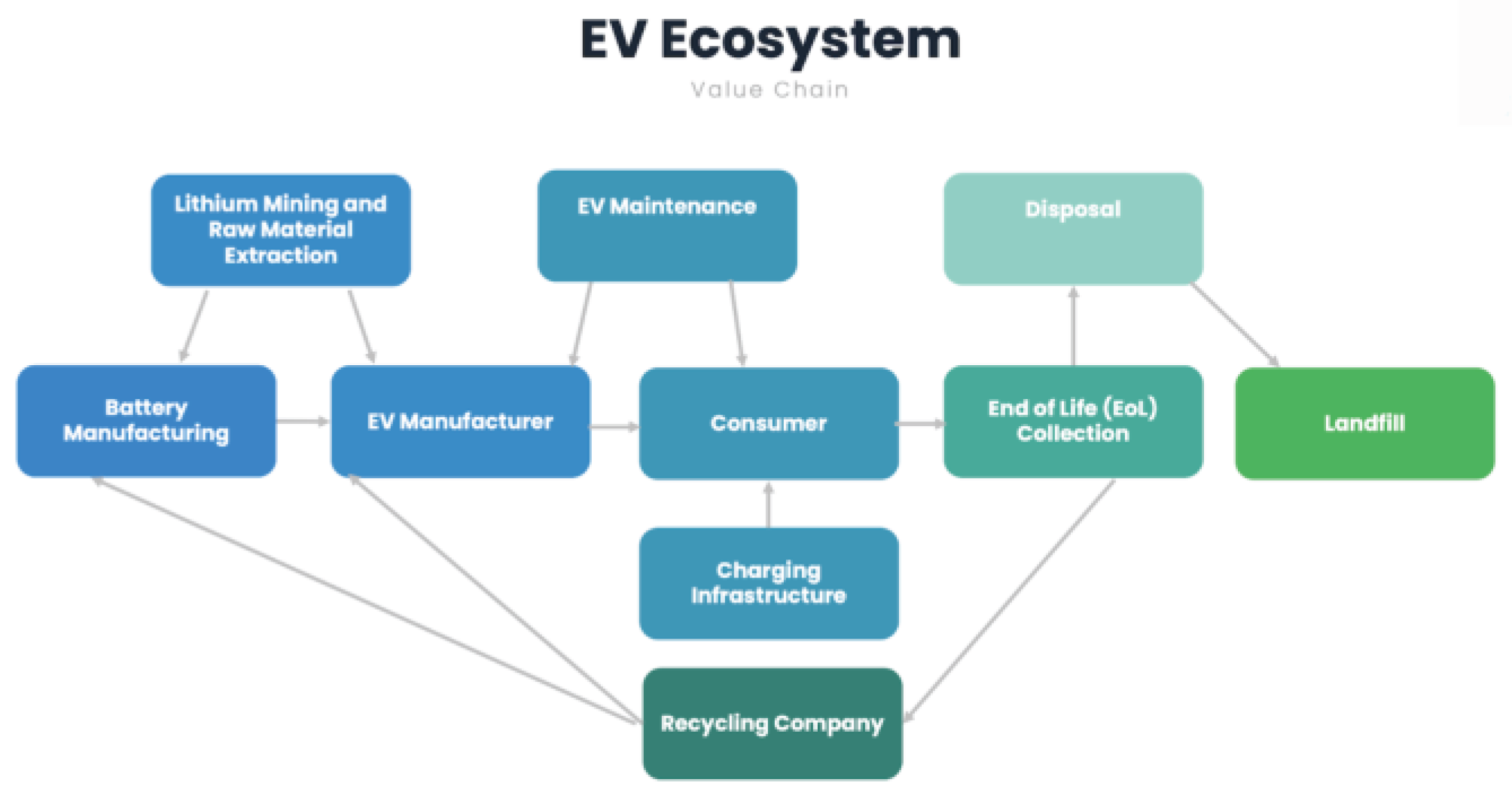

1.0. Introduction to the EV Value Chain

The EV value chain consists of manufacturing batteries and cars from mined raw materials, building an EV infrastructure and EoL of the EVs. The End of Life (EoL) of EV vehicles remains uncertain as most vehicles are still early in their usage.

In a circular economy, the lifecycle of EVs would include the reuse, repurpose and recycling of EV components and materials including the EV batteries. EV batteries could be recycled to recover Lithium and other critical raw materials, when not reused or repurposed. Ensuring circularity could minimize the environmental impact linked to EoL of EV batteries. Evaluating the carbon footprint of recycling facilities themselves is a further area to explore to complete the full evaluation of the life cycle of the EV ecosystem. Currently, less than 5% of EV batteries are recycled.

Figure 1.

EV Ecosystem Value Chain.

Figure 1.

EV Ecosystem Value Chain.

1.1. Challenges linked to EoL of EV Batteries

At a basic level, recycling involves extraction of the raw materials and reusing them in the manufacturing cycle. There is some complexity around EV battery recycling as it is fundamentally a complex mechanical structure to recycle as it involves hundreds of individual lithium-ion cells connected together with adhesives and connectors. EV battery recyclers have to keep pace with innovation that continues to evolve EV battery technology and design. This gap might widen as the EV industry grows and EV manufacturers invest to pull ahead of competition. The recycling industry will need similar levels of investment to keep up with technological development.

Reuse and repurposing is generally deemed a more viable solution because it is less environmentally taxing and prolongs the use of existing EV technology. In addition, Extended Producer Responsibility policies have generally focused on incentivizing recycling rather than reuse strategies. [

1] While the potential of reuse is out of the scope of this paper, it is an important factor to consider when understanding the effectiveness of battery recycling compared to other solutions.

1.2. The Case for Battery Recycling

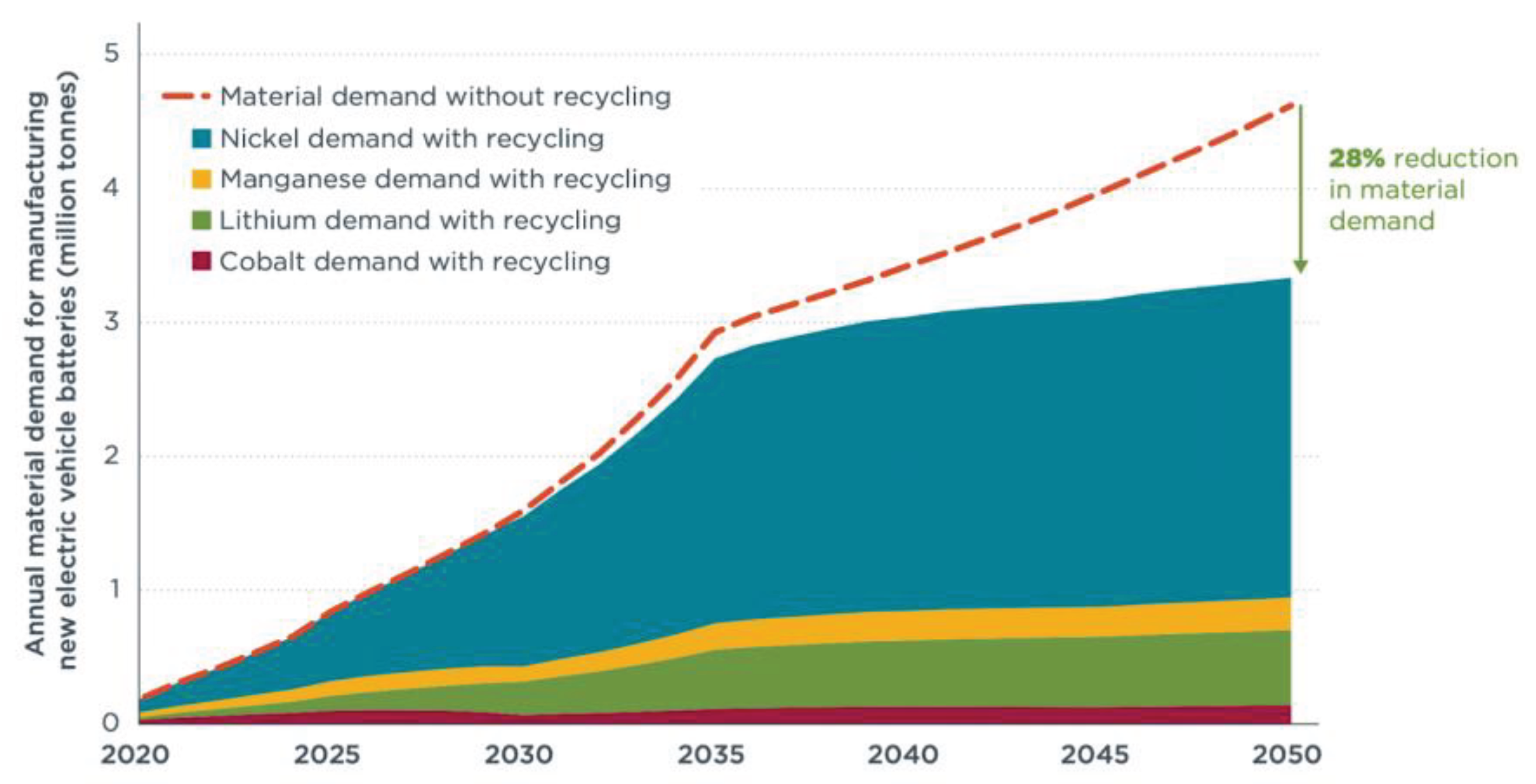

Recycling Reduces the Demand of Raw Material Mining

By 2030, 50% of all cars on the road are expected to be EVs, and as early as 2025 we could be seeing shortages in lithium available for EV batteries. [

2] Currently the many tonnes of raw materials mined to create the EV battery creates significant environmental damage. Already with just 1% of global vehicles being EVs, the world is strained with the sudden uptake in demand for EVs. To meet the projected lithium demand for EVs, 74 new lithium mines with a capacity of 45,000 tonnes would have to be created each year by 2035. [

3] As of 2023, there are only 26 lithium mines in operation around the world mining 130,000 tonnes annually which is not enough to satisfy the forecasted demand of EVs. [

4]

Currently, only 5% of lithium batteries in all industries are recycled which is very low given the potential of the recycling process being able to recover up to 95% of the key raw materials from an EV battery pack. In the automotive sector, EVs are currently driving 90% of the global lithium demand. [

5] As the EV industry continues to grow, the demand for mined lithium will increase; battery recycling is a solution that could reduce the strain on the mining industry. Under idealized conditions, by 2040, recycling could meet 53% of the lithium demand for batteries. [

6,

7]

Although some projections have mining companies able to meet the 575% increase in lithium over the next decade, many argue that it is imperative to minimize the stress on creation of potentially unsustainable mines by instead improving the battery recycling infrastructure, which allows for mines to be built at a more manageable and sustainable pace. [

8]

Figure 2.

Annual lithium, nickel, cobalt and manganese demand for global sales of light-duty and heavy-duty BEVs and PHEVs ([

9]).

Figure 2.

Annual lithium, nickel, cobalt and manganese demand for global sales of light-duty and heavy-duty BEVs and PHEVs ([

9]).

Emission Reduction

By 2028, the world will have to deal with at least one million tonnes of lithium (waste) material from EoL vehicles p.a. [

10] Furthermore, 30-50% of GHG emissions in the lifecycle of an EV come from batteries. [

11] Investment into the EoL of EVs to recover the lithium (and other materials) will lead to both economic and environmental benefits through reduction in energy demand linked to mining of virgin lithium. For example, every tonne of mined lithium equates to roughly 15 tonnes of CO2 in the air. [

12,

13] Battery recycling could be seen as a more environmentally favorable alternative to mining.

Table 1.

CO2 emissions in EV value chain.

Table 1.

CO2 emissions in EV value chain.

| Step in the Value Chain |

CO2 Emissions/Car (Tonnes) |

| Mining |

3 [14] |

| Battery Production |

7 [15] |

| EV Production |

5-10 [16] |

| Usage |

Zero direct emissions; emissions from charging electricity source can vary |

| End-of-Life |

N/A |

While most of the CO2 emissions are related to EV and EV battery production, further study is required to understand emissions related to EOL of EVs as this will help in understanding the sustainability/feasibility of implementing battery recycling into the EV ecosystem.

1.3. Economic Viability of Battery Recycling

As the battery recycling industry is still in the early stages of its development there is limited data on the financial viability of the sector. A McKinsey report projects the industry’ revenues to grow to more than

$95 billion by 2040. [

17] It is estimated that it can take up to five years for a battery recycling plant to turn profitable. [

18] Lithium recovered from recycling batteries is expected to be cheaper than mined lithium, with some projections estimating that the cost of lithium recovered from recycling could be 60-70% lower than the cost of primary lithium production by 2030. [

19] This could make the economic case for EV battery recycling.

1.4. Policies That Help Further Battery Recycling:

Due to the growing awareness of EV battery recycling, governments have issued numerous incentives to help advance innovation within the recycling industry and creation of recycling infrastructure. These incentives include grants, policies and initiatives to promote battery recycling. The industry is witnessing increasing financial backing and there is government support for its importance within the EV ecosystem.

2.0. EV Ecosystem in an Indian Context

2.1. Background of EV Growth and Policies in India

The EV industry in India is expected to become a

$100bn revenue industry by 2030. [

20] This is due to a combination of attractive incentives and other government policies. One of the main governmental policies driving this growth is FAME II, which incentivizes EV manufacturers if they produce over 50% of the vehicle in India. However, the manufacturers are unable to meet this quota due to the lack of necessary infrastructure to produce the EVs in India. Therefore, they tend to manufacture overseas which has led to governmental hesitancy about the initiative past 2024. [

21] In an industry where India projects heavy growth, it is necessary that the government can domesticate parts of the EV ecosystem through these policies.

Other policies incentivizing the adoption of EVs in India are various Production-Linked Incentive Schemes (PLIs) and reduction in Goods and Service Tax (GST) which work towards incentivizing domestic production of batteries and electrifying vehicle fleets. [

22] While these initiatives have been effective in the short term, it is difficult to forecast their success in the longer term in the context of India’s ambitious EV goals.

2.2. Battery Recycling and Informal Sector

India’s well established Lead Acid Battery (LAB) recycling infrastructure could lead to a promising Li-ion recycling ecosystem. India processes 2.1 million tonnes of LABs per year. However, one of the main challenges India and other developing nations face is the presence of an informal sector, which has become a problem in the LAB ecosystem with 90% of those batteries reaching the informal market. [

23]

There are numerous risks within the informal market such as poor working conditions, safety hazards linked to operation, and the use of rudimentary technology like pyrometallurgy which is unsustainable and yields lower quality output, not extracting the key metals of the battery. Furthermore, it is difficult to forecast how successful the informal sector would be in recycling EV batteries when EoL vehicles are in full circulation.

2.3. The Lithium Market in India

Currently, India’s dependence on foreign lithium imports has hindered its development of a domestic mining infrastructure, importing almost 70% of their li-ion cell requirements from China and Hong Kong. [

24] Although there is recent promise of lithium reserves domestically, the lack of a prominent domestic EV ecosystem can be attributed to a shortage in domestic mines and readily available lithium. [

25] Thus, it is important that India bolsters its domestic lithium mining infrastructure at a reasonable rate whilst at the same time investing in the recycling industry. Recycling will help reduce the dependence on lithium imports and mining, allowing for the sustainable development of India’s lithium mining infrastructure.

3.0. The Case for Battery Recycling in India

Investment into battery recycling infrastructure in India would be beneficial as it reduces dependence on foreign raw metal imports, helping the country to control aspects of the domestic EV ecosystem. Furthermore, EV battery recycling will help solve the waste issues linked to EoL batteries. The country generates around 2 million tons of e-waste annually, including over 50,000 tonnes of LiB waste. [

26,

27] Without proper recycling infrastructure, EoL LiB can contribute to this e-waste burden.

LiB recycling will create a sustainable infrastructure for the e-mobility future that the Indian government promised.

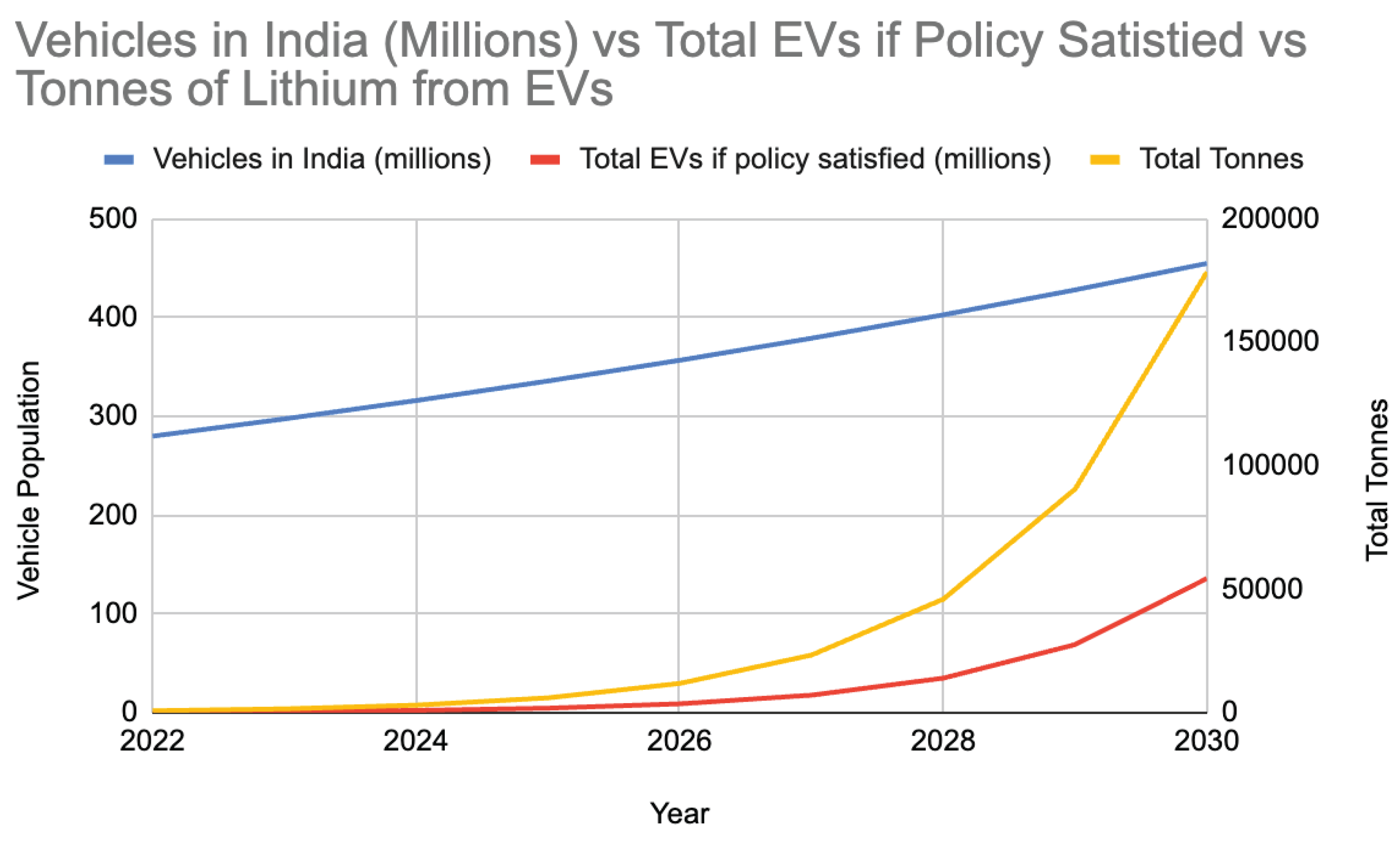

Figure 3.

Forecasted EV Fleet in India vs Projected Tonnes of Lithium.

Figure 3.

Forecasted EV Fleet in India vs Projected Tonnes of Lithium.

3.1. Current Policies Supporting Recycling and Vehicle Scrapping in India

| Policy Initiative |

Goals |

Areas for further consideration |

| Vehicle Scrapping Policy |

After 15 years, if a vehicle fails a mandatory fitness test it is sent for scrapping |

Difficult policy to maintain in a larger country. Other nations have stricter vehicle fitness tests through policies that have been implemented for a longer period of time. |

| Cash for Clunkers [28] |

Cash Incentives for voluntarily scrapping of old vehicles |

Voluntary nature of the program could hinder its success because previous programs needed large incentives to justify voluntary scrapping (i.e USA in 2009) [29] |

| Waste Management Rules |

First official mandate requiring a minimum recovery percentage of the materials in a battery. |

Challenges related to monitoring and enforcement |

| EPR |

Mandating responsible battery waste management |

Only recently considered for EV Battery Recycling. Policies might need to be refined to achieve this goal. |

4.0. Battery Technologies and Recycling Technologies

4.1. Lithium Use in Batteries

Lithium has a high energy per unit mass relative to other types of electrical batteries. Furthermore, due to lithium’s other characteristics, it allows for a long charging life and fast charging compared to other rare materials. Many predict that we will be using lithium ion battery chemistries for EVs in the foreseeable future as there are very few viable alternatives. [

30]

4.2. Drawbacks of Lithium

Lithium is in high demand with currently low supply due to its versatile applicability. Thus, the mining infrastructure is not currently established enough to fully support such a rapid growth in the EV industry.

LIBs cannot be easily used for larger modes of transport such as planes and boats as it is unable to provide the power needed to sustain longer flights and boat journeys due to the fact that it will become too heavy for those ranges. While this is not a problem when dealing with 2Ws and 4Ws, in a full-scale multi-mode e-mobility movement these issues will arise.

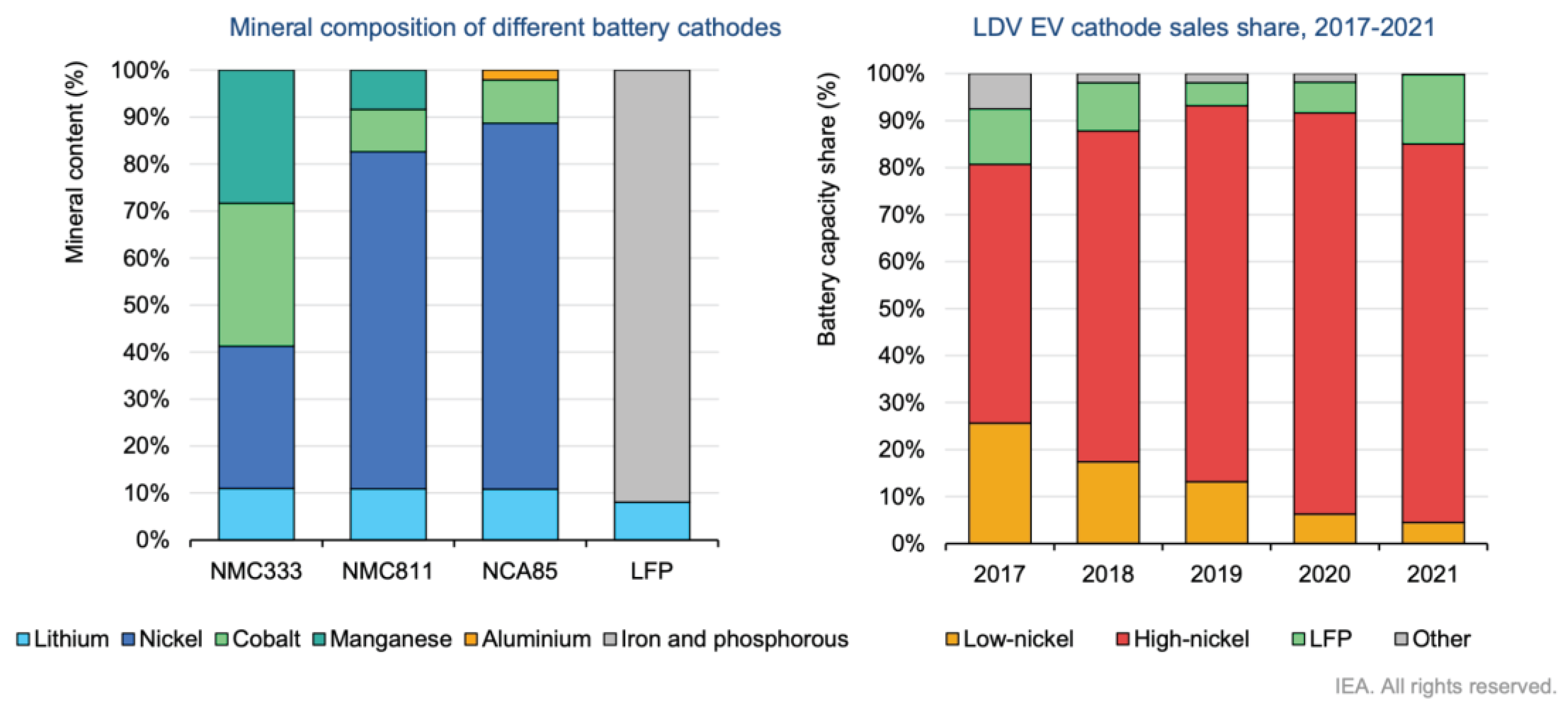

4.3. Battery Chemistries

There are varying technologies and material chemistries that go into EV battery design. Additionally, variability of prices and availability of minerals has influenced the overall battery market. Premium chemistries of LIBs are generally reserved for larger EV manufacturers.

Generally, the less complex the battery technology is, the easier it is for the recycling companies to understand the characteristics of the battery and extract the raw materials. As there is more innovation within the EV battery industry, EV manufacturers will continue to prioritize the performance of the EVs which makes the battery chemistries more complex and thus less recyclable. Dominant battery chemistries on the market are still moderately recyclable, however a shift to more complex chemistries hinders the outlook for recyclability-conscious batteries. The incentives of battery manufacturers may not always be aligned with battery recycling, thus policies and incentives need to be developed in order to ensure that recyclability is considered in the design of batteries

Figure 4.

Current battery chemistries in the market. [

31] (International Energy Agency).

Figure 4.

Current battery chemistries in the market. [

31] (International Energy Agency).

In 2022, lithium nickel manganese cobalt oxide (NMC) remained the dominant battery chemistry with a market share of roughly 60%, followed by lithium iron phosphate (LFP) with a and nickel cobalt aluminum oxide (NCA). [

32,

33]

Analysis of Different LIB Chemistries

Table 2.

Analysis of LIB Battery Chemistries and their Recyclability (Author’s own analysis) [

34,

35].

Table 2.

Analysis of LIB Battery Chemistries and their Recyclability (Author’s own analysis) [

34,

35].

| |

Pros |

Cons |

Companies who Use |

Recyclability |

| Lithium Manganese Oxide |

Overcomes the cost and instability compared to other cobalt batteries |

High self-discharge rate. Reduced energy density leads to safety concerns |

Volkswagen, Early Nissan and Tesla models |

Challenging due to manganese, which is reactive and affects stability and efficiency of recycling |

| Lithium Cobalt Oxide |

High density to low cost ratio, longer life cycle and thermal stability |

Lower voltage meaning less powerful EV performance |

BMW and Audi |

Moderately recyclable due to established technologies for NMC battery chemistry |

| Lithium Iron Phosphate |

Cheaper due to no cobalt, scalability of battery. Stable with long life cycle |

Major issues when functioning in cooler temperatures |

E-public transport and some Teslas |

Less thermal runway so simplified recycling process. Well defined cathode structure for easy separation |

| Lithium Nickel Cobalt Aluminium Oxide |

Decent lifespan, power and energy density suitable for premium EV |

Low thermal stability (unsafe), can be unreliable and costly |

Main Tesla Battery |

Complex recycling process due to mix of valuable metals |

4.4. Recycling Technologies

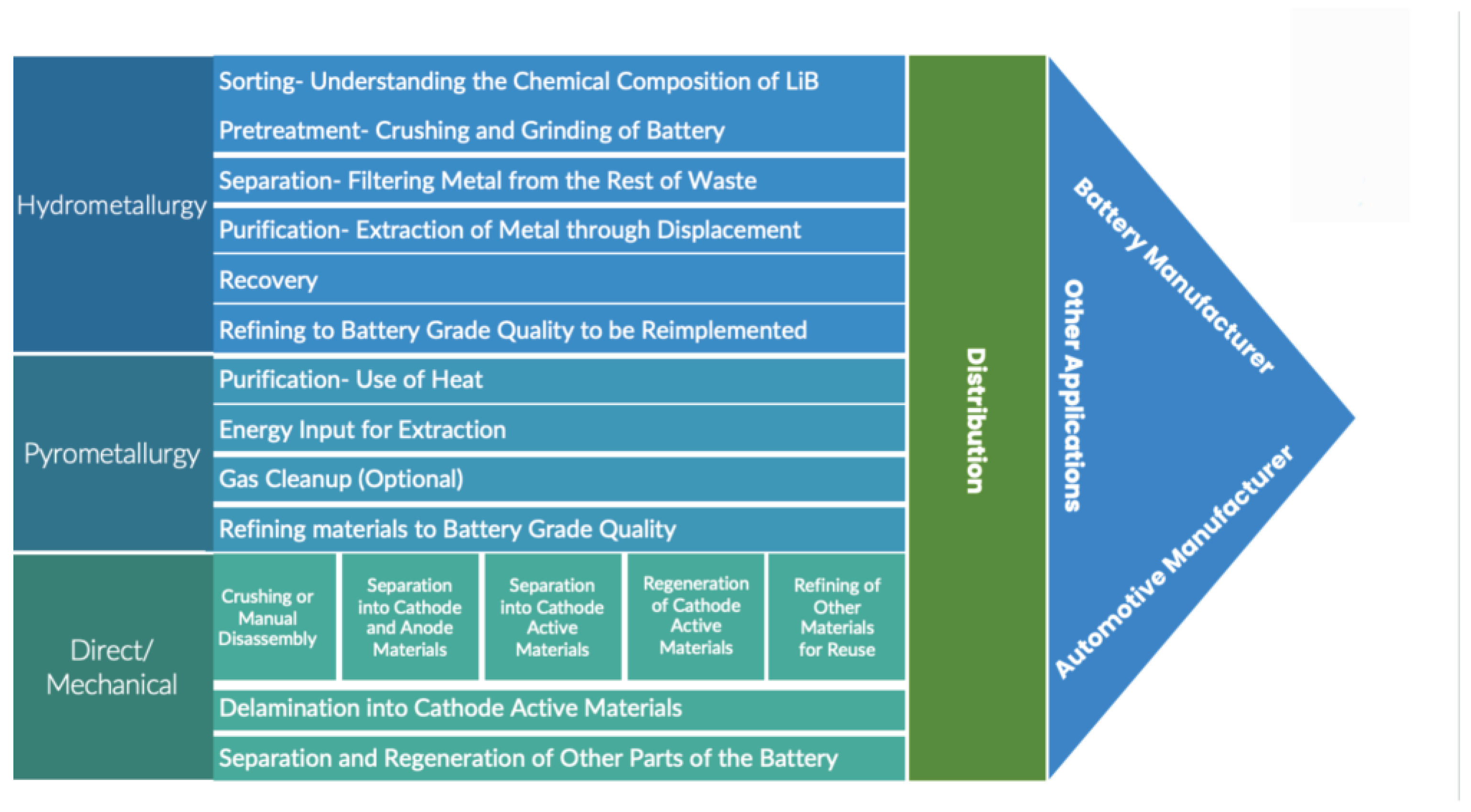

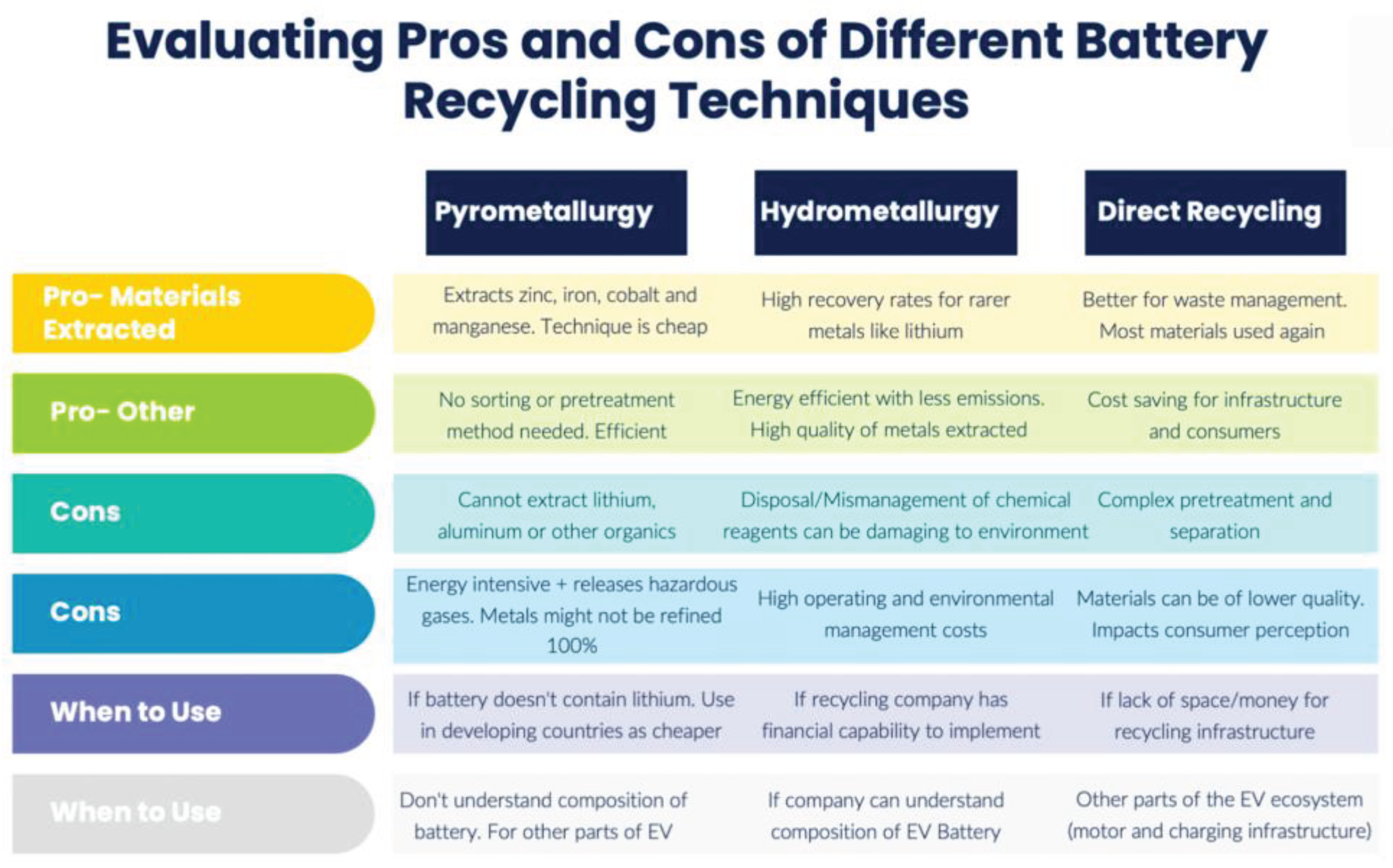

There are two main techniques for EV battery recycling: pyrometallurgy and hydrometallurgy. Another technique which is occasionally used is direct recycling.

When evaluating recycling technologies on an absolute basis, hydrometallurgy is the best technology due to its high yield/purity and lower impact on the environment. However, each recycling process has various situational benefits. For example, if cheap recycling needs to be introduced to a region with limited recycling infrastructure, pyrometallurgy is beneficial due to its variety of functions and low cost. Each technology varies in its environmental footprint, cost, complexity, and purity of outputs; therefore, it is important to evaluate each factor of a certain recycling technology before integrating it into an area.

Figure 5.

Comparison of different battery recycling techniques (Author’s own analysis) [

36,

37,

38,

39].

Figure 5.

Comparison of different battery recycling techniques (Author’s own analysis) [

36,

37,

38,

39].

Table 3.

Evaluating Pros and Cons of Different Battery Recycling Technologies (Author’s own analysis) [

40,

41,

42].

Table 3.

Evaluating Pros and Cons of Different Battery Recycling Technologies (Author’s own analysis) [

40,

41,

42].

5.0. Battery Recycling Companies in India

In India, there are many battery recycling companies/initiatives that have come up in the last two decades. The key ones include Attero Recycling, ACE Recycling, Lohum, and Mahindra CERO. The 2022 Battery Waste Management Rules brings in the extended producer responsibility (EPR), that mandates that all waste batteries be collected and sent for recycling/refurbishment, and it prohibits disposal in landfills and incineration. The rules also require certain targets in recycling and quantity of recycled materials in batteries. [

43]

Table 4.

Overview of key India EV battery recycling companies [

45,

46,

47,

48,

49,

50,

51].

Table 4.

Overview of key India EV battery recycling companies [

45,

46,

47,

48,

49,

50,

51].

| Company |

Capacity (tonnes) |

Technology |

Key Partnerships/Growth Plans |

| Attero |

20,000 |

Mechanical and hydrometallurgical |

Investment into facilities for lithium ion battery recycling outside of India.

|

| ACE Green Recycling |

1,800 |

Electrified hydrometallurgical process. |

Planned global expansion Texas, Dubai, New Delhi etc. + local supply chains |

| Lohum Recycling |

1,000. |

Hydrometallurgical incorporating repurposing |

Presence in the US- Set up facility for upstream capacities [44] + Embracing Informal Sector.

Investment into the 2W and 3W market |

| Mahindra CERO |

2400 Vehicles Scrapped |

Vehicle Scrappage- Dismantling for spare parts

|

Partnerships and projects to deliver value of vehicle scrapping.Initiative aided by government policies |

5.1. Projected Demand for Recycling

According to estimations as elaborated in

Appendix A, there will be approximately 180,000 tonnes of lithium coming from EVs in India in 2030. This is a figure that the Indian recycling capacity (at its current growth rate) will not be able to process. If reuse, repurposing and recycling strategies are not adequately developed, this will be a missed opportunity and a significant environmental challenge.

Source (own analysis based on data from “Economic Times”, “World Economic Forum”, “Hero Electric”)

5.2. Integrating the Informal Sector

The informal sector within India creates competition for battery recycling companies within India as battery supply for recycling does not always go through the organized market. While stakeholders see the benefit in phasing out the informal sector, they also acknowledge its role as an easily accessible battery recycling location. Therefore, these recycling companies must embrace the informal sector and integrate them in their operations to arrive at a more feasible and just solution. The dilemma that recycling companies face is whether they should trust the government to properly regulate the informal sector or that they should intervene within the process.

Table 5.

Current Policies supporting Recycling and Vehicle Scrapping in India.

Table 5.

Current Policies supporting Recycling and Vehicle Scrapping in India.

| Policy Initiative |

Goals |

Areas for further consideration |

| Vehicle Scrapping Policy |

After 15 years, if a vehicle fails a mandatory fitness test it is sent for scrapping |

Difficult policy to maintain in a larger country. Other nations have stricter vehicle fitness tests through policies that have been implemented for a longer period of time. |

| Cash for Clunkers [52] |

Cash Incentives for voluntarily scrapping of old vehicles |

HVoluntary nature of the program could hinder its success because previous programs needed large incentives to justify voluntary scrapping (i.e USA in 2009) [53] |

| Waste Management Rules |

First official mandate requiring a minimum recovery percentage of the materials in a battery. |

Challenges related to monitoring and enforcement |

| EPR |

Mandating responsible battery waste management |

Only recently considered for EV Battery Recycling. Policies might need to be refined to achieve this goal. |

6.0. Battery Recycling in the RoW

In order to evaluate the performance of battery recycling companies in India, it is important to compare the Indian infrastructure with other global companies. However, one must acknowledge that the progress of a country’s EV ecosystem reflects the growth of their battery recycling infrastructure, which is why certain recycling companies might appear more developed.

| Company |

Capacity (Tonnes) |

Technology |

Key Partnerships/Growth |

| SungEel Hitech |

50,000 [54] |

Hydrometallurgical with electrolyte solution treatment to ensure an eco friendly process. [55] |

Increasing Presence in the US Building mega-facility in the state of Georgia. [56]

Maintaining appearance domestically [57]

|

| Licycle Holdings |

80,000 [58] |

Mechanical and hydrometallurgical. [59]

|

Maintaining Strong Presence in the US and Canada while branching into Europe. [60] + Partnering with Glencore. [61]

|

| Redwood Materials |

120,000 [62] |

Emphasis on cathode and anode recycling through mechanical and hydrometallurgical . [63] |

Automotive Partnerships with VW. Recently received $2bn in debt funding from the DOE and large US auto manufacturers. [64]

|

| Hydrovolt Recycling |

12,000 [65] |

Automated hydrometallurgical.

>95% recovery rate.

100% renewable energy [66] |

Started in Scandinavia with high EV market penetration. Branching into other EU markets. Initial Sustainability- First plant runs on 100% renewable energy. [67]

|

6.1. Characteristics of a Successful Recycling Company

Large Recycling Capacity

Due to economies of scale, the production cost per recycled battery in a recycling company will be cheaper the larger the capacity of the operations. Furthermore, the larger the recycling capacity, the more clients the company can take on, allowing these companies to scale their operations. However, it is important for a recycling company with large capacity to ensure a reliable supply of EoL lithium to maximize the infrastructure and guarantee client supply.

Sustainable Technology

Although there are currently few concrete regulations regarding the sustainability of battery recycling technology, it is necessary to carry out sustainable recycling should regulations be implemented when the industry becomes more developed. Furthermore, sustainable technology allows the recycling company to focus their efforts on improving the yield/purity of recovered lithium and rather than working on adapting to changing innovation in battery technologies.

Domestic Presence

Whilst a global outlook is necessary for a battery recycling company to grow, one must not forget the importance of domestic control as it can potentially be an easier market to dominate. Furthermore, domestic control allows for local partnerships which can lead to streamlined operations and reduced dependence on foreign facilities for progress.

Presence in Multiple Geographies

Battery recycling companies are likely to benefit from a global presence to facilitate partnerships with global OEMs to leverage their investment in key battery technologies. Furthermore, a global presence in facilities allows for a diverse range of clients and ensures the company can be flexible with further investment into the field wherever they see EV industry growth.

7.0. Gap Assessment and Recommendations: India

| |

Current |

Ideal |

Recommendation + Example |

| Organized Vehicle Collection Infrastructure |

Poor infrastructure stemmed from the informal market.

Improper storage of vehicles before scrapping.

Voluntary Nature of Vehicle Scrapping

|

Applicable to both ICEs and EVs.

Efficient + Sustainable collection.

Consumer Awareness. |

Policy needs to be tailored to the EV market.

Germany EoL Vehicle Act: authorized collection and dismantling facility within 50 km of residency.

|

| Organized Battery Recycling Infrastructure |

Unorganized Facilities don’t pass government standards.

Sustainability of Pyrometallurgical technology should be assessed.

Current recycling capacity is not enough to handle future EoL EVs demand. |

Organized Facilities capable of handling future EoL demand

Partnerships with manufacturers.

Attractive to foreign recycling companies incentivizing recycling infrastructure in India. |

Recycling Capacity.

Organization of the informal sector.

South Korea-recycling fund is available for facilities to levy fees on manufacturers to fund operations.

|

| Consumer Behavior and Policies |

Lack of consumer cooperation during the EV EoL process.

EPR regulations are recent- difficult to forecast impact.

|

Incentivize consumers to collaborate in the EoL process.

Recycling companies are compelled to create a circular economy.

EPR regulations achieve their goals

|

Lack of connectivity between manufacturers and recycling companies.

Refined regulations from the Indian government.

Norway- Deposit-refund system for EV battery recycling

|

| Recycling Technology |

Pyrometallurgy base- low quality yield + unsustainable

Hydrometallurgy is only present in the largest facilities. |

Hydrometallurgical technologies prominent throughout the country.

High quality, safe informal market

Research into innovative technology beyond hydrometallurgy

|

Lack of incentives for sustainable technology and nation-wide quality checks on informal market

Germany- Feed-in tariffs to incentivize sustainable recycling technology |

8.0. Overall Conclusions and Recommendations

Overall, the battery recycling industry in India is still growing and has the potential to play a major role alongside the growth of EVs in India. However, it is important that the Indian government considers a variety of factors in creating policies to regulate the sector and to foster circularity. The following are our recommendations to further consider to promote EV battery recycling and the importance of their roles in the overall EV ecosystem.

Vehicle Collection

Rigorous EPR standards in India are needed to ensure more LIBs get to recycling facilities. Furthermore, regulations related to the management of scrapped vehicles and their raw materials are necessary when considering the sustainability of vehicle collection. Vehicle scrapping will play an important role in the future of vehicle recycling as a medium through which consumers can create a second life for their cars. Vehicle scrapping companies should continue to focus on growth strategies which incentivize consumer collaboration. As India’s vehicle fitness policies take into effect, the industry should hopefully become more prominent and more resources will be dedicated to vehicle scrapping.

Recycling Infrastructure

Currently, the projected growth in battery recycling capacity within India is not sufficient to meet the demands of the growth in the overall EV market in India. Therefore, it is important to understand the factors that can help grow this industry domestically to a necessary level. When creating policies to grow the domestic capacity of the industry, one must evaluate the specific incentives that recycling companies need. This means reflecting on the shortcomings of the FAME II policies and how well they target the needs of the companies in the EV ecosystem. These revamped favorable policies within India could incentivize battery recycling companies to invest resources domestically and thus increase the Indian battery recycling capacity to a level where it becomes an important part of the domestic EV ecosystem.

Consumer Collaboration

On the consumer side, government incentives should focus on creating awareness over the e-mobility movement, the potential of battery recycling, and benefits for vehicle collection. In such a high-potential market like India, policies need to be heavily refined and directly target the consumer’s needs to ensure the growth that the Indian government promised.

Battery Chemistry Design for Recycling

As the EV battery market continues to innovate, EV manufacturers need to collaborate with battery recycling companies to create batteries with recyclability as a priority in their considerations. Innovation within the EV battery field is faster than the adaptability of current recycling technologies, therefore complex batteries become increasingly difficult to recycle. By considering battery recyclability as a factor within battery manufacturing, it simplifies the recycling process and allows recycling technologies to innovate at a manageable rate.

Battery Manufacturing for Recycling

To ensure the successful implementation of EV battery recycling, its consideration needs to be represented across all EV lifecycle stages. Therefore, within the construction of the battery, EV manufacturers need to prioritize creating batteries that are easy to dismantle to maximize the potential of recycling. This should not be confused with choosing a battery chemistry that is more recyclable. In addition to recycling friendly battery chemistries, this aspect of battery design will aid EV battery recycling companies in finding efficient ways to dismantle batteries to maximize the yield, cost-effectiveness, and purity of battery recycling.

Funding

This research received no external funding.

Acknowledgments

Dr. Shilpi Kapur (Advisor for Project), Dr. Prasad Modak.

Conflicts of Interest

The authors declare no conflicts of interest.

Acronyms

| LIB |

Lithium Ion Battery |

| LAB |

Lead Acid Battery |

| EV |

Electric Vehicle |

| EPR |

Extended Producer Responsibility |

| EoL |

End of Life |

| GHG |

Greenhouse Gas |

| BEV |

Battery Electric Vehicle |

| PHEV |

Plug-in Hybrid Electric Vehicle |

| NEMMP |

National Electric Mobility Mission Plan- NEMMP |

| FAMEII |

Faster Adoption and Manufacturing of Hybrid and Electrical Vehicles II |

| 2W |

Two wheeler |

| 4W |

Four Wheeler |

| PLI |

Product Linked Incentive Schemes |

| GST |

Goods & Service Tax |

| NMC |

Nickel Manganese Cobalt |

| LFP |

Lithium Iron Phosphate |

| NCA |

Nickel Cobalt Aluminium Oxide |

| CO2 |

Carbon Dioxide |

| GHG |

Greenhouse Gas |

| p.a |

Per Annum |

| CERO |

Zero |

| VW |

Volkswagen |

| DOE |

Department of Energy |

| KWH |

Kilowatt Hours |

| GWH |

Gigawatt Hours |

Appendix A

As of 2022, there were 210 million 2W and 70 million 4W vehicles in India. Furthermore, it was reported that there were approximately 550,000 2W EVs and 51,000 4W EVs registered in the country. [

68] Then, I attempted to calculate the average vehicle growth within the country; however, this statistic is difficult to predict as vehicle sales had fallen the past three years before growing by double digit percentages this year. [

69] Therefore, I assumed a conservative growth rate of 7% for 4Ws and 6% for 2Ws compounded annually until 2030. This gave me a total of roughly 450 million vehicles in 2030.

To calculate the growth of EVs, I worked under the assumption that the policy for 30% of vehicles on the road being EVs is satisfied. This led me to calculate a 97% growth rate in sales of EVs compounded annually to reach roughly 135 million EVs by 2030.

In order to calculate the growth in terms of lithium, I used a statistic from the world economic forum which stated that the average amount of lithium in a 4W EV was 8kg which allowed me to calculate lithium for 4Ws. [

70] Within the 2W sector, I researched the most popular e-motorbike in India, which is the Hero Electric Optima. The bike has a 3 KWH battery which means each bike has roughly 600 grams of lithium. This allowed me to calculate total lithium in EVs in India, which equates to roughly 180,000 tonnes of lithium in 2030; the statistic is weighted heavily onto 2Ws. [

71]

Afterwards, using a report from ET India, I found that projections suggest the recycling capacity will be 128 GWH (51,000) tonnes in India in 2030. One also needs to account for an offset between EV fleet growth and EoL vehicle growth, which I assumed to be roughly 4-5 years.These statistics led me to the conclusion that India will not have enough battery recycling capacity to manage the growth in demand of EoL EV batteries.

References

- Richter, J.L. A circular economy approach is needed for electric vehicles. Nat. Electron. 2022, 5, 5–7. [Google Scholar] [CrossRef]

- Niese, Nathan, Cornelius Pieper, Aakash Arora, and Alex Xie. 2020. “The Case for a Circular Economy in Electric Vehicle Batteries.” BCG Global. BCG Global. September 14, 2020.

- Donnelly, Grace. 2023. “Lithium Demand for EVs, in Four Charts.” Emerging Tech Brew. Morning Brew. February 17, 2023.

- Carmen. 2022. “The World’s Ten Largest Lithium Mines.” Mining Technology. Mining Technology. June 3, 2022.

- Maya Ben Dror, Abhishek Gupta, and Patrick Schaufuss. 2022. “3 Challenges En Route to Electric Vehicle Batteries Driving the Circular Economy.” World Economic Forum. December 12, 2022.

- Maisel, F.; Neef, C.; Marscheider-Weidemann, F.; Nissen, N.F. A Forecast on Future Raw Material Demand and Recycling Potential of Lithium-Ion Batteries in Electric Vehicles. Resources Conservation and Recycling 2023, 192, 106920–20. [Google Scholar] [CrossRef]

- “Global Lithium Production 2022 | Statista.” 2022. Statista. Statista. 2022.

- Beaudet, A.; Larouche, F.; Amouzegar, K.; Bouchard, P.; Zaghib, K. Key Challenges and Opportunities for Recycling Electric Vehicle Battery Materials. Sustainability 2020, 12, 5837. [Google Scholar] [CrossRef]

- Tankou, Alexander, Georg Bieker, and Dale Hall. 2023. “SCALING up REUSE and RECYCLING of ELECTRIC VEHICLE BATTERIES: ASSESSING CHALLENGES and POLICY APPROACHES.”.

- Lithium Batteries – 1.2m Tons Ready for Recycling by 2030” 2019. 2030.

- Beaudet, A.; Larouche, F.; Amouzegar, K.; Bouchard, P.; Zaghib, K. Key Challenges and Opportunities for Recycling Electric Vehicle Battery Materials. Sustainability 2020, 12, 5837. [Google Scholar] [CrossRef]

- Zheng, March. 2023. “The Environmental Impacts of Lithium and Cobalt Mining.” Earth.org. Earth.org. March 31, 2023.

- “How Much CO2 Is Emitted by Manufacturing Batteries?” 2022. MIT Climate Portal. 2022.

- “How Much CO2 Is Emitted by Manufacturing Batteries? | MIT Department of Mechanical Engineering.” 2022. Mit.edu. 2022.

- Linder, Martin, Alexander Pfeiffer, Nikola Vekić, Stefan Nekovar, and Tomas Nauclér. 2023. “The Race to Decarbonize Electric-Vehicle Batteries.” McKinsey & Company. McKinsey & Company. February 23, 2023.

- Linder, Martin, Alexander Pfeiffer, Nikola Vekić, Stefan Nekovar, and Tomas Nauclér. 2023. “The Race to Decarbonize Electric-Vehicle Batteries.” McKinsey & Company. McKinsey & Company. February 23, 2023.

- Breiter, Andreas, Martin Linder, Thomas Schuldt, Giulia Siccardo, and Nikola Vekić. 2023. “Battery Recycling Takes the Driver’s Seat.” McKinsey & Company. McKinsey & Company. March 13, 2023.

- Jorgensen, Barbara. 2023. “EV Battery Recycling Capacity: Not so Fast - EE Times.” EE Times. February 16, 2023.

- “Do We Have a Lithium Supply Problem? IRENA’s Webinar Series Critical Materials for the Energy Transition” 2022.

- “Electric Vehicles Are Poised to Create a $100B+ Opportunity in India by 2030.” Bain. December 14, 2022.

- PTI. 2023. “Government Plans to Increase Outlay for E-2-Wheelers under FAME II Scheme.” The Economic Times. Economic Times. May 17, 2023.

- “Three Schemes Launched and Several Steps Taken by the Centre to Promote Adoption of Electric Vehicles in India.” 2023. Pib.gov.in. 2023.

- Getting. 2020. “Getting the Lead Out: Why Battery Recycling Is a Global Health Hazard.” Yale E360. 2020.

- Bundhun, Rebecca. 2022. “Can India Ramp up Battery Cell Manufacturing to Meet EV Goals?” The National. The National. October 10, 2022.

- ET EnergyWorld. 2023. “Lithium Discovery Important for India’s EV Push but Mining Poses Serious Environmental Risks: Experts.” ETEnergyworld.com. PTI. February 24, 2023.

- Koshy, Jacob. 2018. “India Produces 2 Million Tonnes of E-Waste Every Year, and the New Regulations Are Not Helping Deal with It.” Thehindu.com. January 13, 2018.

- S Shanthi. 2023. “Why Recycling Lithium-Ion Batteries Is Still the Need of the Hour.” Entrepreneur. Entrepreneur India. February 15, 2023.

- Bloomberg. 2021. “India’s ‘Cash-For-Clunkers’ Scrappage Policy Needs Strong Incentives to Succeed.” The Economic Times. Economic Times. February 10, 2021.

- Bloomberg. 2021. “India’s ‘Cash-For-Clunkers’ Scrappage Policy Needs Strong Incentives to Succeed.” The Economic Times. Economic Times. February 10, 2021.

- in. 2023. “Trends in Batteries – Global EV Outlook 2023 – Analysis - IEA.” IEA. 2023.

- International Energy Agency. 2022. “Global Supply Chains of EV Batteries.”.

- “Trends in Batteries – Global EV Outlook 2023 – Analysis - IEA.” IEA. 2023.

- International Energy Agency. 2022. “Global Supply Chains of EV Batteries.”.

- Battery University. 2010. “Battery University.” Battery University. September 19, 2010.

- Dragonfly Energy. 2021. “A Guide to the 6 Main Types of Lithium Batteries | Dragonfly Energy.” Dragonfly Energy. Dragonfly Energy. September 27, 2021.

- Singh, Sunita, and Adrian L Schwan. 2011. “Sulfur Metabolism in Plants and Related Biotechnologies.” Elsevier EBooks, January, 257–71.

- Mrozik, Wojciech, Mohammad Ali Rajaeifar, Oliver Heidrich, and Paul Christensen. 2021. “Environmental Impacts, Pollution Sources and Pathways of Spent Lithium-Ion Batteries.” Energy and Environmental Science 14 (12): 6099–6121.

- TES. 2023. “Hydrometallurgy and Pyrometallurgy Battery Recycling | TES.” Tes-Amm.com. TES . February 5, 2023.

- “Table 2 : Advantages and Disadvantages of the Hydrometallurgical Technologies” 2017. ResearchGate. ResearchGate. 2017.

- “Table 2 : Advantages and Disadvantages of the Hydrometallurgical Technologies” 2017. ResearchGate. ResearchGate. 2017.

- Popescu, Ioana, Sorin-Aurel Dorneanu, and Petru Ilea. n.d. “Economic Analysis of Li-Ion Battery Recycling Using Hydrometallurgical Processes.”.

- Sloop, S.; Crandon, L.; Allen, M.; Koetje, K.; Reed, L.; Gaines, L.; Sirisaksoontorn, W.; Lerner, M. A Direct Recycling Case Study from a Lithium-Ion Battery Recall. Sustainable Materials and Technologies 2020, 25, e00152–52. [Google Scholar] [CrossRef]

- Partners, AZB . 2023. “Battery Waste Management Rules, 2022: A New Era for Battery Recycling.” Mondaq.com. AZB & Partners. January 11, 2023.

- Financialexpress. 2023. “Financial Express.” Financialexpress.com. Financial Express. January 4, 2023.

- Mehta, Tanvi. 2022. “India’s Attero to Set up Lithium-Ion Battery Recycling Plant.” U.S. November 3, 2022.

- ACE Green Recycling. 2022. “ACE Green Recycling to Roll out Four New Lithium-Ion Battery Recycling Facilities Worldwide.” Prnewswire.com. May 13, 2022.

- Green Giant Ltd. 2023. “Green Giant Energy Texas and ACE Green Recycling Plan to Develop Lithium-Ion Recycling Facility in Texas.” Prnewswire.com. March 2, 2023.

- “About LOHUM : Leading Lithium Ion Battery Material Company.” 2023. LOHUM - Safeguarding Earth’s Tomorrow, Today -. March 14, 2023.

- “ESG Investing and the Sustainable Development Goals | Lohum.” 2023. LOHUM - Safeguarding Earth’s Tomorrow, Today -. February 3, 2023.

- “Renault India Announces Partnership with CERO Recycling to Support the New Scrappage Policy.” 2021. Auto Recycling World. April 12, 2021.

- BL Chennai Bureau. 2022. “Daimler India in Pact with CERO to Boost Sales of BharatBenz Trucks.” BusinessLine. February 21, 2022.

- Bloomberg. 2021. “India’s ‘Cash-For-Clunkers’ Scrappage Policy Needs Strong Incentives to Succeed.” The Economic Times. Economic Times. February 10, 2021.

- Bloomberg. 2021. “India’s ‘Cash-For-Clunkers’ Scrappage Policy Needs Strong Incentives to Succeed.” The Economic Times. Economic Times. February 10, 2021.

- Circular Energy Storage. 2021. “Sungeel Hitech Opens Europe’s Largest EV Battery Recycling Plant in Hungary.” CES Online. July 6, 2021. https://www.circularenergystorage-online.com/post/sungeel-hitech-opens-europe-s-largest-ev-battery-recycling-plant-in-hungary.

- “SungEel HiTech.” 2022. SungEel HiTech. 2022.

- “Gov. Kemp: Korean Lithium-Ion Battery Recycler SungEel HiTech to Build First U.S. Recycling Facility, SungEel Recycling Park Georgia.” 2022. Governor Brian P. Kemp Office of the Governor. 2022.

- Bailey, Mary. 2022. “SK Innovation and SungEel HiTech Form Battery-Recycling Joint Venture.” Chemical Engineering. Chemical Engineering. December 13, 2022.

- “Homepage.” 2023. Li-Cycle. March 7, 2023.

- “SUSTAINABILITY at LI-CYCLE.” n.d.

- “Operations.” 2023. Li-Cycle. August 2023.

- “Li-Cycle Customers.” 2017. Cbinsights.com. 2017.

- Cuthrell, Shannon. 2023. “Redwood Materials Recycles 500K Pounds of EV Batteries.” Eepower.com. EEPower.com. March 22, 2023.

- “Solutions | Redwood Materials.” 2023. Redwoodmaterials.com. 2023.

- “Redwood Receives Conditional Commitment for $2B Department of Energy Loan for Battery Materials.” 2023. Redwoodmaterials.com. February 9, 2023.

- digital@thepitch.no. 2021. “Hydrovolt Is Establishing a World-Leading Battery Recycling Hub in Norway - Hydrovolt.” Hydrovolt. February 16, 2021.

- “About Us - Hydrovolt.” 2022. Hydrovolt. May 15, 2022.

- “Hydrovolt Has Started to Construct World-Leading Battery Recycling Plant in Norway.” 2019. Hydro.com. 2019.

- PTI. 2022. “Over 21 Crore Two-Wheelers, 7 Crore Four-Wheelers and above Category of Vehicles Registered in India.” The Economic Times. Economic Times. August 4, 2022.

- ET Online. 2023. “Passenger Vehicle Sales in India up 26.7% in FY23: SIAM.” The Economic Times. Economic Times. April 13, 2023.

- Shine, Ian. 2022. “Electric Vehicle Demand – Has the World Got Enough Lithium?” World Economic Forum. July 20, 2022.

- “Hero Electric Optima CX–Dual Battery.” 2023. Hero Electric. April 25, 2023.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).