Submitted:

18 April 2024

Posted:

22 April 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Materials and Methods

2.1. Study Design, Sample, and Setting

2.2. Data Collection

2.3. Study Sample

2.4. Data Analysis

2.5. Rigor and Trustworthiness

3. Results

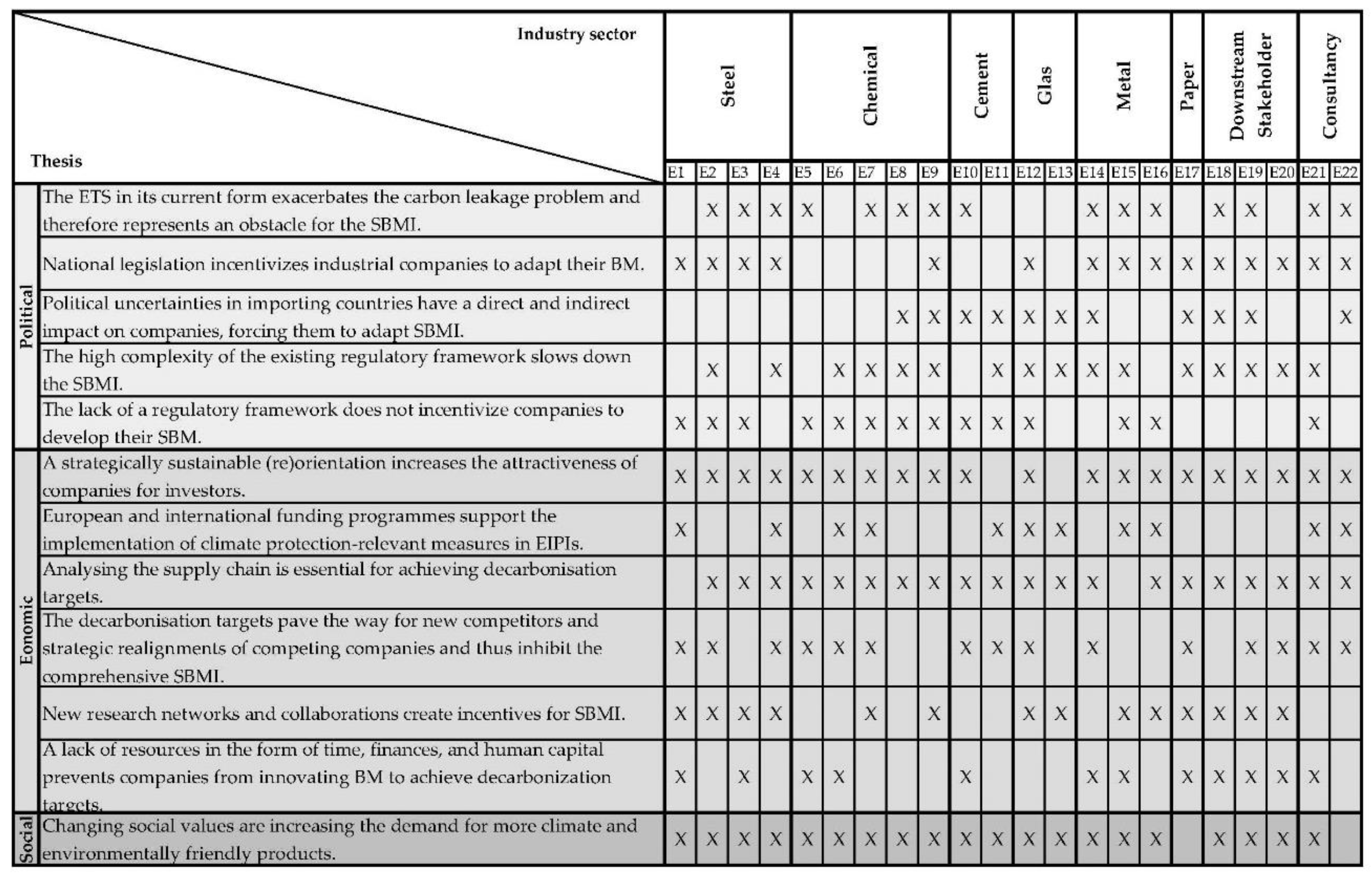

3.1. Description of the Theses Derived from the Literature

| No. | Thesis | Source |

|---|---|---|

| Political | ||

| 1 | The European Emissions Trading Scheme (ETS) in its current form exacerbates the carbon leakage problem and therefore represents an obstacle for the SBMI. | [46,47,48,49,50,51] |

| 2 | National legislation incentivizes industrial companies to adapt their BM. | [10,52,53,54,55,56] |

| 3 | Political uncertainties in importing countries have a direct and indirect impact on companies, forcing them to adapt SBMI. | [57,58,59,60,61] |

| 4 | The high complexity of the existing regulatory framework slows down the SBMI. | [18,62,63,64] |

| 5 | The lack of a regulatory framework does not incentivize companies to develop their SBM. | [11,18,63,64,65,66,67,68,69,70] |

| Economical | ||

| 6 | A strategically sustainable (re)orientation increases the attractiveness of companies for investors. | [10,18,19,58,62,72,73,74] |

| 7 | European and international funding programs support the implementation of climate protection-relevant measures in EIMIs. | [53,62,75,76,77,78,79] |

| 8 | Analyzing the supply chain is essential for achieving decarbonization targets. | [29,71,81,82,83,84,85] |

| 9 | The decarbonization targets pave the way for new competitors and strategic realignments of competing companies, thus inhibiting the comprehensive SBMI. | [12,58,74,84,86,87,89] |

| 10 | New research networks and collaborations create incentives for SBMI. | [29,90,91,92] |

| 11 | A lack of resources in the form of time, finances, and human capital prevents companies from innovating BM to achieve decarbonization targets. | [75,86,93] |

| Social | ||

| 12 | Changing social values are increasing the demand for more climate and environmentally friendly products. | [12,18,71,73,74,94,95] |

- T1: The European Emissions Trading Scheme (ETS) in its current form exacerbates the carbon leakage problem and therefore represents an obstacle to SBMI.

- T2: National legislation incentivizes industrial companies to adapt their BM.

- T3: Political uncertainties in importing countries have a direct and indirect impact on companies, forcing them to adapt SBMI.

- T4: The high complexity of the existing regulatory framework slows down the SBMI.

- T5: The lack of a regulatory framework does not incentivize companies to develop their SBM.

- T6: A strategically sustainable (re)orientation increases the attractiveness of companies for investors.

- T7: European and international funding programs support the implementation of climate protection-relevant measures in EIMIs.

- T8: Analyzing the supply chain is essential for achieving decarbonization targets.

- T9: The decarbonization targets pave the way for new competitors and strategic realignments of competing companies, thus inhibiting the comprehensive SBMI.

- T10: New research networks and collaborations create incentives for SBMI.

- T11: A lack of resources in the form of time, finances and human capital prevens companies from innovating BM to achieve decarbonization targets.

- T12: Changing social values are increasing the demand for more climate and environmentally friendly products.

3.2. Falsification of the Results

Political (T1 – T5):

- T1: The majority of experts (13 out of 22) from the EIMI confirm that the ETS in its current form exacerbates the carbon leakage problem and represents an obstacle for the SBMI, but at the same time, recognize considerable potential in this instrument for promoting sustainable innovation, which, however, requires significant adjustments.

- T2: 18 out of 22 experts confirm the thesis that national legislation incentivizes EIMI SBMI.

- T3: 10 out of 22 experts emphasize the direct impact of political uncertainty on supply chains, such as the diversion of shipping routes due to conflicts in the Middle East, while others point to indirect consequences, such as delays in procurement and equipment or rising costs for renewable energy.

- T4: The experts (14 out of 22) confirm that the high complexity of the regulatory framework represents a barrier for SBMI.

- T5: 10 out of 22 experts confirm that the lack of a regulatory framework will hinder SBMI. No generally valid falsification is possible for this thesis.

Economical (T6 – T11):

- T6: The expert statements significantly confirm the thesis, with 17 out of 22 experts believing that a sustainable (re)orientation increases a company’s attractiveness.

- T7: According to the experts (7 out of 22), the number of instruments and the total amount of funding from global and European funding programs is sufficient, but implementation has a significant negative impact on the EIMI's SBMI. The hypothesis is, therefore, refuted.

- T8: The requirement to analyze the supply chain in the context of achieving decarbonization targets requires an industry-specific approach within the EIMI. Particularly in scenarios in which the supply chains consist primarily of small and medium-sized enterprises, such an analysis proves impractical due to an insufficient database or the limited number of suppliers for whom switching is impossible.

- T9: The thesis that decarbonization targets inhibit SBMI through new competitors and strategic realignments cannot be clearly confirmed due to differing expert opinions and industry-specific differences. While some sectors are dominated by first movers, others are focused on replacement.

- T10: According to 15 out of 22 experts, new research networks and collaborations create incentives for SBMI.

- T11: The thesis is confirmed by 12 of the 22 experts, with the lack of financial and human capital resources taking center stage.

Social (T12):

- T12: Although more than half of the experts believe that changing social values increase the demand for climate and environmentally friendly products, some point to the influence of the supply chain and the lack of a significant increase in demand, which limits the overall validity of the thesis.

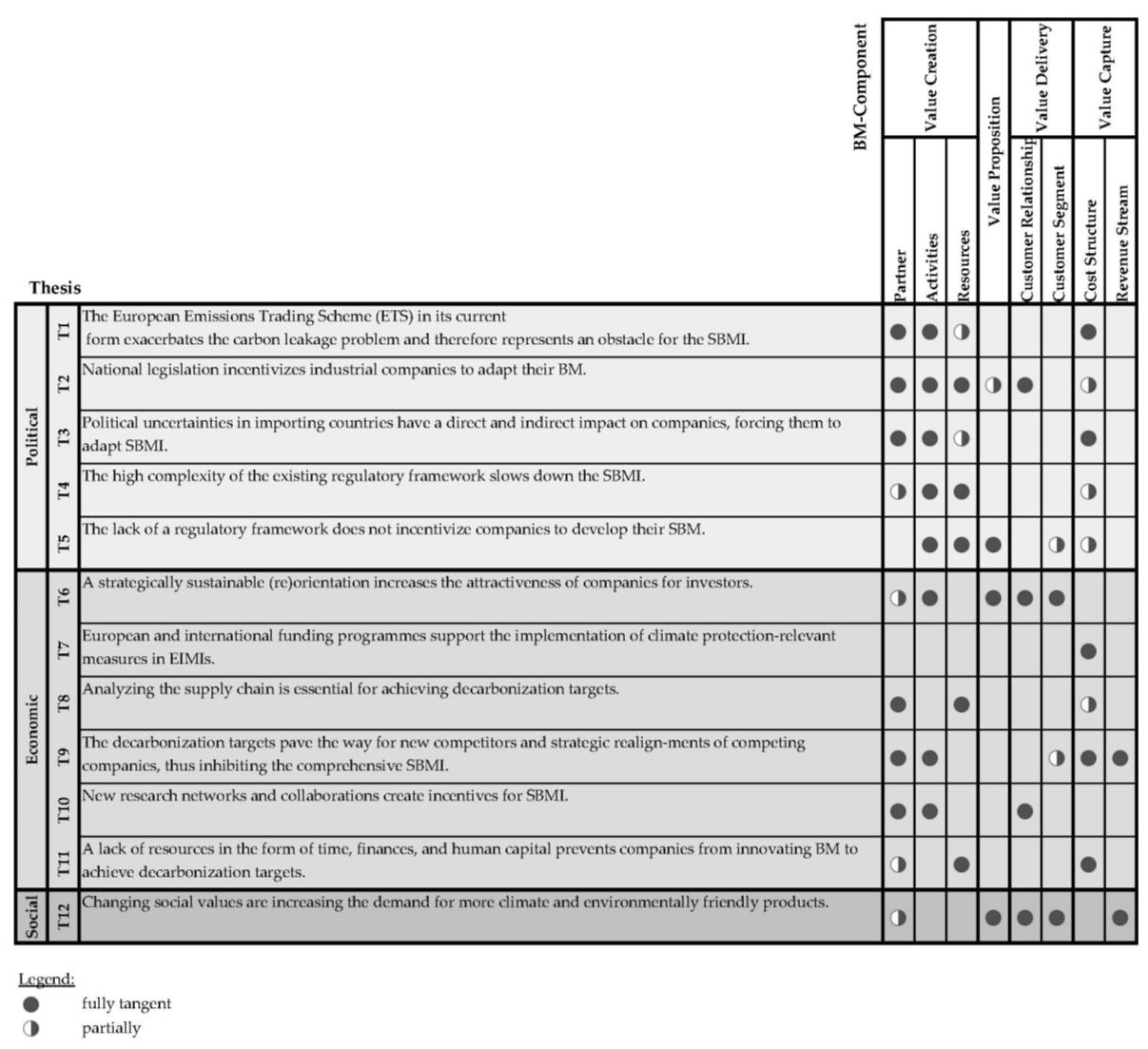

3.3. Analysis of the Influence of the Drivers (T1-T12) on the Business Model Components

4. Discussion

4.1. Statement of Principal Findings

4.2. Strengths and Limitations

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| No. | Position | Industry |

|---|---|---|

| 1 | Senior ESG Manager | Steel |

| 2 | Project spokesperson for a million euro decarbonization project | Steel |

| 3 | Head of Public and Regulatory Affairs | Steel |

| 4 | Head of Competence Center Climate and Energy | Steel |

| 5 | Corporate Sustainability Manager | Chemical |

| 6 | Head of Sustainability Business Integration | Chemical |

| 7 | Head of Corporate Sustainability | Chemical |

| 8 | Senior Manager Sustainability Reporting | Chemical |

| 9 | Head of Corporate Strategy | Chemical |

| 10 | Senior engineer in the areas of climate protection, environment and operational technology | Cement |

| 11 | Test center manager in concrete and application technology | Cement |

| 12 | Global Affairs Manager | Glas |

| 13 | Sustainability Director | Glas |

| 14 | Sustainability Manager | Metal |

| 15 | Member of Board | Metal |

| 16 | Head of Decarbonization | Metal |

| 17 | Manager Sustainability & Energy | Paper |

| 18 | Sustainability Manager | Downstream Stakeholder |

| 19 | Sustainability Manager | Downstream Stakeholder |

| 20 | Sustainability Manager | Downstream Stakeholder |

| 21 | Partner Strategy & Transactions | Consultancy |

| 22 | Senior Manager Strategy & Transactions | Consultancy |

References

- European Commission. A clean planet for all - A European long-term strategic vision for a prosperous, modern, competitive and climate neutral economy. 2018. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52018DC0773 (accessed on 10.01.2024).

- Wyns, T.G.; Khandekar, G.A.; Axelson, M.; Sartor, O.; Neuhoff, K. Industrial Transformation 2050 - Towards an Industrial strategy for a Climate Neutral Europe.; Institute for European Studies Vrije Universiteit Brussel: Brussel, Belgium, 2019; Available online: https://www.ies.be/files/Industrial_Transformation_2050_0.pdf (accessed on 10.01.2024).

- Europäische Kommission. Der europäische Grüne Deal. 2023. Available online: https://eur-lex.europa.eu/resource.html?uri=cellar:b828d165-1c22-11ea-8c1f-01aa75ed71a1.0021.02/DOC_2&format=PDF (accessed on 10.01.2024).

- BMUB. Klimaschutzplan 2050 - Klimapolitische Grundsätze und Ziele der Bundesregierung. 2016. Available online: https://www.bmwk.de/Redaktion/DE/Publikationen/Industrie/klimaschutzplan-2050.pdf?__blob=publicationFile&v=1 (accessed on 23.02.2023).

- Axelson, M.; Oberthür, S.; Nilsson, L.J. Emission reduction strategies in the EU steel industry: Implications for business model innovation. Journal of Industrial Ecology 2021, 25, 390–402. [Google Scholar] [CrossRef]

- Statistisches Bundesamt (Destatis). Anthropogene Luftemissionen - 2000 bis 2019. 2021. Available online: https://www.destatis.de/DE/Themen/Gesellschaft-Umwelt/Umwelt/UGR/energiefluesse-emissionen/Publikationen/Downloads/anthropogene-luftemissionen-5851103197004.html (accessed on 20.12.2023).

- Gross, S. The challenge of decarbonizing heavy industry. 2021. Available online: https://www.brookings.edu/articles/the-challenge-of-decarbonizing-heavy-industry/ (accessed on 08.2023).

- Agora Energiewende, Wuppertalinstitute. Klimaneutrale Industrie: Schlüsseltechnologien und Politikoptionen für Stahl, Chemie und Zement. 2019. Available online: https://epub.wupperinst.org/frontdoor/index/index/docId/7675 (accessed on 30.11.2023).

- Wesseling, J.H.; Lechtenböhmer, S.; Åhman, M.; Nilsson, L.J.; Worrell, E.; Coenen, L. The transition of energy intensive processing industries towards deep decarbonization: Characteristics and implications for future research. Renewable and Sustainable Energy Review 2017, 79, 1303–1313. [Google Scholar] [CrossRef]

- Wyns, T.; Axelson, M. Decarbonising Europe's Energy Intensive Industries. The Final Frontier.; Institute for European Studies Vrije Universiteit Brussel: Brussel, Belgium, 2016; Available online: https://carbonmarketwatch.org/wp/wp-content/uploads/2016/05/Final-Frontier-Innovation-Report-Web-Version.pdf (accessed on 30.11.2023).

- Mobarakeh, M.R.; Kienberger, T. Climate neutrality strategies for energy-intensive industries: An Austrian case study. Cleaner Engineering and Technology 2022, 10, 100545. [Google Scholar] [CrossRef]

- Evans, S.; Vladimirova, D.; Holgado, M.; Van Fossen, K.; Yang, M.; Silva, E.A.; Barlow, C.Y. Business Model Innovation for Sustainability: Towards a Unified Perspective for Creation of Sustainable Business Models. Business Strategy and the Environment 2017, 26, 597–608. [Google Scholar] [CrossRef]

- Rosato, P.F.; Caputo, A.; Valente, D.; Pizzi, S. 2030 Agenda and sustainable business models in toursim: A bibliometric analysis. Ecological Indicators 2021, 121, 106978. [Google Scholar] [CrossRef]

- Sinkovics, N.; Gunaratne, D.; Sinkovics, R.R.; Molina-Castillo, F.-J. Sustainable Business Model Innovation: An Umbrella Review. Sustainability 2021, 13, 7266. [Google Scholar] [CrossRef]

- Galvão, G.D.; Evans, S.; Ferrer, P.S.; de Carvalho, M.M. Circular business modell: Breaking down barriers towards sustainable development. Business Strategy and the Environment 2022, 31, 1504–1524. [Google Scholar] [CrossRef]

- Reinhardt, R.; Christodoulou, I.; Gassó-Domingo, S.; Gracía, B.A. Towards sustainable business models for electric vehicle battery second use: A critical review. Journal of Environmental Management 2019, 245, 432–446. [Google Scholar] [CrossRef]

- Rennings, K. Redefining innovation - eco-innovation research and the contribution from ecological economics. Ecological Economics 2000, 32, 319–332. [Google Scholar] [CrossRef]

- Asswad, J.; Hake, G.; Gómez, J.M. Overcoming the Barriers of Sustainable Business Model Innovations by Integrating Open Innovation. In Business Information System, 1st ed.; Abramowicz, W., Alt, R., Franczyk, B., Eds.; Springer: Cham, 2016; Volume 255, pp. 302–314. [Google Scholar] [CrossRef]

- Rahman, H.U.; Zahid, M.; Al-Faryan, M.A. ESG and firm performance: The rarely explored moderation of sustainability strategy and top management commitment. Journal of Cleaner Production 2023, 404, 136859. [Google Scholar] [CrossRef]

- Alshehhi, A.; Nobanee, H.; Khare, N. The Impact of Sustainability Practices on Corporate Financial Performance: Literature Trends and Future Research Potential. Sustainability 2018, 10, 494. [Google Scholar] [CrossRef]

- Pulino, S.C.; Ciaburri, M.; Magnanelli, B.S.; Nasta, L. Does ESG disclosure Influence Firm Performance? Sustainability 2022, 14, 7595. [Google Scholar] [CrossRef]

- Stubbs, W.; Cocklin, C. Conceptualizing a "Sustainability Business Model". Organization & Environment 2008, 21, 103–127. [Google Scholar] [CrossRef]

- Upward, A.; Jones, P. An Ontology for Strongly Sustainable Business Models: Defining an Enterprise Framework Compatible with Natural and Social Science. Organization & Environment 2016, 29, 97–123. [Google Scholar] [CrossRef]

- Hernández-Chea, R.; Jain, A.; Bocken, N.M.; Gurtoo, A. The Business Model in Sustainability Transition: A Conceptualization. Sustainability 2021, 13, 5763. [Google Scholar] [CrossRef]

- Geissdoerfer, M. Sustainable Business Model Innovation: Process, challenge and implementation. Procedia Manufacturing 2019, 8, 262–269. [Google Scholar] [CrossRef]

- Bocken, N.; Short, S.; Rana, P.; Evans, S. A literature and practice review to develop sustainable business model archetypes. Journal of Cleaner Production 2014, 65, 42–56. [Google Scholar] [CrossRef]

- Teece, D.J. Business Models, Business Strategy and Innovation. Long Range Planning 2010, 43, 172–194. [Google Scholar] [CrossRef]

- Osterwalder, A.; Pigneur, Y.; Tucci, C.L. Clarifying Business Models: Origins, Present, and Future of the Concept. Communications of the Association for Information Systems 2005, 16. [Google Scholar] [CrossRef]

- van Delft, S.; Zhao, Y. Business models in process industries: Emerging trends and future research. Technovation 2021, 105, 102195. [Google Scholar] [CrossRef]

- Lüdeke-Freund, F.; Carroux, S.; Joyce, A.; Massa, L.; Breuer, H. The sustainable business model pattern taxonomy - 45 patterns to support sustainability-oriented business model innovation. Sustainable Production and Consumption 2018, 15, 145–162. [Google Scholar] [CrossRef]

- Trapp, C.T.; Kanbach, D.K. Green entrepreneurship and business models: Deriving green technology business model archetypes. Journal of Cleaner Production 2021, 297, 126694. [Google Scholar] [CrossRef]

- Boons, F.; Lüdeke-Freund, F. Business models for sustainable innovation: state-of-the-art and steps towards a research agenda. Journal of Cleaner Production 2013, 45, 9–19. [Google Scholar] [CrossRef]

- Bocken, N.; Schuit, C.; Kraaijenhagen, C. Experimenting with a circular business model: Lessons from eight cases. Environmental Innovation and Societal Transitions 2018, 28, 79–95. [Google Scholar] [CrossRef]

- Mangold, H.; van Vacano, B. The Frontier of Plastics Recycling: Rethinking Waste as a Resource for High-V2160alue Applications. Macromolecular Chemistry and Physics 2022, 223, 2100488. [Google Scholar] [CrossRef]

- Vernay, A.-L.; Cartel, M.; Pinkse, J. Mainstreaming Business Models for Sustainability in Mature Industries: Leveraging Alternative Institutional Logics for Optimal Distinctiveness. Organization & Environment 2022, 35, 414–445. [Google Scholar] [CrossRef]

- Geissdoerfer, M.; Weerdmeester, R. Managing business model innovation for relocalization in the process and manufacturing industry. Journal of Business Chemistry 2019, 16, 11–25. [Google Scholar] [CrossRef]

- Mais, F.; Schmitt, L.; Bauernhansl, T. Treiber der nachhaltigen Geschäftsmodellinnovation. Zeitschrift für wirtschaftlichen Fabrikbetrieb 2023, 113, 525–530. [Google Scholar] [CrossRef]

- Meinhold, M.-L. Methodologie. In Die Wissensnutzung und ihre Hindernisse, Gabler Edition Wissenschaft; Deutscher Universitätsverlag: Wiesbaden, Germany, 2001; p. 125. [Google Scholar] [CrossRef]

- Moher, D.; Liberati, A.; Tetzlaff, J.; Altman, D.G.; PRISMA Group. Preferred Reporting Items for Systematic Review and Meta-Analyses: The PRISMA Statement. Annals of Internal Medicine 2009, 151, 264–269. [Google Scholar] [CrossRef]

- Fahey, L.; Narayanan, V.K. Macroenvironmental analysis for strategic management, 1st ed.; South-Western, 1986. [Google Scholar]

- Schallmo, D.R. Geschäftsmodelle erfolgreich entwickeln und implementieren - Mit Aufgaben, Kontrollfragen und Tamplates, 2nd ed.; Springer Gabler: Berlin, Heidelberg, Germany, 2013. [Google Scholar] [CrossRef]

- Osterwalder, A.; Pigneur, Y. Business Model Generation: A Handbook for Visionaries, Game Changers, and Challengers, 1st ed.; John Wiley & Sons: Hoboken, United States, 2010. [Google Scholar]

- Helfferich, C. Die Qualität qualitativer Daten, 4th ed.; VS Verlag für Sozialwissenschaften: Wiesbaden, Germany, 2011. [Google Scholar] [CrossRef]

- Bogner, A.; Littig, B.; Menz, W. Das Experteninterview: Theorie, Methode, Anwendung, 1st. ed.; VS Verlag für Sozialwissenschaften: Wiesbaden, Germany, 2002. [Google Scholar] [CrossRef]

- Döring, N.; Bortz, J. Forschungsmethoden und Evaluation in den Sozial- und Humanwissenschaften, 5th ed.; Springer: Berlin, Heidelberg, Germany, 2016. [Google Scholar] [CrossRef]

- aus dem Moore, N.; Großkurth, P.; Themann, M. Multinational corporations and the EU Emissions Trading System: the specter of asset erosion and creeping deindustralization. Journal of Environmental Economics and Management 2019, 94, 7–9. [Google Scholar] [CrossRef]

- Graichen, V.; Förster, H.; Graichen, J.; Healy, S.; Repenning, J.; Schumacher, K.; Duscha, V.; Friedrichsen, N.; Lehmann, S.; Erdogmus, G.; Haug, I.; Kim, S.; Zaklan, A.; Diekmann, J. Evaluierung und Weiterentwicklung des EU-Emissionshandels aus ökonomischer Perspektive für die Zeit nach 2020 (EU-ETS-7). 2019. Available online: https://www.umweltbundesamt.de/publikationen/evaluierung-weiterentwicklung-des-eu-0 (accessed on: 30.11.2023).

- FUTURIST.; PIK.; Bain & Company. Wie Deutschlands CEOs ihre Unternehmen auf Nachhaltigkeitskurs bringen.2021. Available online: https://www.bain.com/de/insights/nachhaltigkeitsstudie-von-haltung-zu-handlung/ (accessed on: 30.11.2023).

- Åhman, M.; Nilsson, L.J.; Johansson, B. Global climate policy and deep decarbonization of energy-intensive industries. Climate Policy 2017, 17, 634–649. [Google Scholar] [CrossRef]

- Europäische Kommission. Klimaneutral werden. Empfehlung einer Expertengruppe sollen energieintensive Industriezweige bei der Erreichung des EU-Ziels 2050 unterstützen. 2019. Available online: https://ec.europa.eu/commis-sion/presscorner/detail/de/IP_19_6353 (accessed on 16.06.2023).

- Umweltbundesamt. Der Europäische Emissionshandel. 2023. Available online: https://www.umweltbundesamt.de/daten/klima/der-europaeische-emissionshandel#teilnehmer-prinzip-und-umsetzung-des-europaischen-emissionshandels (accessed on: 30.11.2023).

- Nilsson, L.J.; Bauer, F.; Åhman, M.; Andersson, F.N.; Bataille, C.; de la Rue du, Can; Ericsson, K.; Hansen, T.; Johansson, B.; Lechtenböhmer, S.; von Sluiseved, M.; Vogl, V. An industrial policy framework for transforming energy and emissions intensive industries towards zero emissions. Climate Policy 2021, 21, 1053–1065. [Google Scholar] [CrossRef]

- Filho, W.L. Aktuelle Ansätze zur Umsetzung der UN-Nachhaltigkeitsziele, 1st ed.; Springer Spektrum: Berlin, Heidelberg, Germany, 2019. [Google Scholar] [CrossRef]

- Die Bundesregierung. Generationenvertrag für das Klima: Klimaschutzgesetz. 2022. Available online: https://www.bundesregierung.de/breg-de/schwerpunkte/klimaschutz/klimaschutzgesetz-2021-1913672 (accessed on 30.11.2023).

- Hansson, A.M.; Pedersen, E.; Karlsson, N.P.; Weisner, S.E. Barriers and drivers for sustainable business model innovation based on a radical farmland change scenario. Environmental, Development and Sustainability 2023, 25, 8097. [Google Scholar] [CrossRef]

- Long, T.B.; Looijen, A.; Blok, V. Critical success factors for the transition to business models for sustainability in the food and beverage industry in the Netherlands. Journal of Cleaner Production 2018, 175, 82–95. [Google Scholar] [CrossRef]

- Fremery, M.; Gerards Iglesias, S. Abhängigkeit - Was bedeutet sie und wo besteht sie? - Ein Überblick über wirtschaftliche und politische Abhängigkeiten. 2022. Available online: https://www.iwkoeln.de/fileadmin/user_upload/Studien/Report/PDF/2022/IW-Report_2022-Abh%C3%A4ngigkeit.pdf (accessed on 30.11.2023).

- Zollenkop, M. Charakteristika von Geschäftsmodellen und Geschäftsinnovationen. In Geschäftsmodellinnovationen; Gabler Verlag: Wiesbaden, Germany, 2006; p. 114. [Google Scholar] [CrossRef]

- Hermwille, L.; Lechtenböhmer, S.; Åhman, M.; van Asselt, H.; Bataille, C.; Kronshage, S.; Tönjes, A.; Fischedick, M.; Oberthür, S.; Garg, A.; Hall, C.; Jochem, P.; Schneider, C.; Cui, R.; Obergassel, W.; Fragkos, P.; Vishwanathan, S.S.; Trollip, H. A climate club to decarbonize the global steel industry. Nature Climate Change 2022, 12, 494–496. [Google Scholar] [CrossRef]

- Barth, G.; Bernicke, M.; Blum, C.; Ehlers, K.; Fiedler, T.; Jäger-Glidemeister, F.; Juhrich, K.; Kahrl, A.; Kohlmeyer, R.; Kosmol, J.; Krüger, F.; Leuthold, S.; Marty, M.; Menger, M.; Mönch, L.; Plickert, S.; Proske, C.; Rechenber, B.; Reichart, A.; Thalheim, D.; Vogel, J.; (2022). Kurs halten in der Krise - schneller auf den Pfad zur industriellen Dekarbonisierung: Folgen der Ukraine-Krise für die Industrie. 2022. Available online: https://www.umweltbundesamt.de/sites/default/files/medien/1410/publikationen/texte_84-2022_kurs_halten_in_der_krise_0.pdf (accessed on 30.11.2023).

- Umbach, F. Energiesicherheit unter Bedingungen der Dekarbonisierung von Wirtschaft und Verkehr. SIRIUS - Zeitschrift für Strategische Analysen 2023, 7, 113–132. [Google Scholar] [CrossRef]

- Brennan, S.; Gonzalez, R.B.; Puzniak-Holford, M.; Kilsby, R.; Subramoni, A.; (2023). EU regulations drives the sustainability transistion - Sustainability regulation outlook. 2023. Available online: https://www2.deloitte.com/us/en/insights/environmental-social-governance/transition-to-net-zero.html (accessed on 30.11.2023).

- Alvarez-Meaza, I.; Pikatza-Gorrotxategi, N.; Rio-Belver, R.M. Sustainable Business Model Based on Open Innovation: Case Study of Iberdrola. Sustainability 2020, 12, 10645. [Google Scholar] [CrossRef]

- Cai, W.; Li, G. The drivers of eco-innovation and its impact on performance: Evidence from China. Journal of Cleaner Production 2018, 176, 110–118. [Google Scholar] [CrossRef]

- BMU. Deutsches Ressourceneffizienzprogramm III - 2020 bis 2023: Programm zur nachhaltigen Nutzung und zum Schutz der natürlichen Ressourcen.2020. Available online: https://www.bmuv.de/fileadmin/Daten_BMU/Pools/Broschueren/ressourceneffizienz_programm_2020_2023.pdf (accessed on 30.11.2023).

- Fernando, Y.; Wah, W.X. The impact of eco-innovation drivers on environmental performance: Empirical results from the green technology sector in Malaysia. Sustainable Production and Consumption 2017, 12, 27–43. [Google Scholar] [CrossRef]

- Sáez-Martínez, F.; Lefebvre, G.; Hernández, J.J.; Clark, J.H. Drivers of sustainable cleaner production and sustainable energy options. Journal of Cleaner Production 2016, 138, 1–7. [Google Scholar] [CrossRef]

- Department for Business, Energy & Industrial Strategy. Hydrogen Analytical Annex. 2021. Available online: https://assets.publishing.service.gov.uk/media/611b34f9d3bf7f63a906871e/Hydrogen_Analytical_Annex.pdf (accessed on 30.11.2023).

- Linnemann, M.; Peltzer, J. Wasserstoffhandel. In Wasserstoffwirtschaft kompakt; Linnemann, M., Peltzer, J., Eds.; Springer Vieweg: Wiesbaden, Germany, 2022; p. 215. [Google Scholar] [CrossRef]

- Munangmee, C.; Dacko-Pikiewicz, Z.; Meekaewkunchorn, N.; Kassakorn, N.; Khalid, B. Green Entrepreneurial Orientation and Green Innovation in Small and Medium-Sized Enterprises (SMEs). Social Sciences 2021, 10, 136. [Google Scholar] [CrossRef]

- Brenner, B.; Drdla, D. Business Model Innovation toward Sustainability and Circularity - A Systematic Review of Innovation Types. Sustainability 2023, 15, 11625. [Google Scholar] [CrossRef]

- pwc. ESG Empowered Value Chains 2025: PwC Study: Bold plans, but ESG implementation is slow. 2022. Available online: https://www.pwc.de/en/strategy-organisation-processes-systems/operations/global-esg-in-operations-survey.html (accessed on 30.11.2023).

- Rauter, R.; Jonker, J.; Baumgartner, R.J. Going one's own way: drivers in developing business modes for sustainability. Journal of Cleaner Production 2017, 140, 144–154. [Google Scholar] [CrossRef]

- Heuss, R.; Helmcke, S.; Engel, H.; Hieronimus, S. Net-Zero Deutschland: Chancen und Herausforderungen auf dem Weg zur Klimanuetralität bis 2045. 2021. Available online: https://www.mckinsey.de/~/media/mckinsey/locations/europe%20and%20middle%20east/deutschland/news/presse/2021/21-09-10%20net%20zero%20deutschland/mckinsey%20net-zero%20deutschland_oktober%202021.pdf (accessed on: 30.11.2023).

- Neri, A.; Cago, E.; Di Sebastiano, G.; Trianni, A. Industrial sustainability: Modelling drivers and mechanisms with barriers. Journal of Cleaner Production 2018, 194, 454–472. [Google Scholar] [CrossRef]

- Die Bundesregierung. Klimaschutzprogramm 2023 der Bundesregierung. 2023. Available online: https://www.bmwk.de/Redaktion/DE/Downloads/klimaschutz/20231004-klimaschutzprogramm-der-bundesregierung.pdf?__blob=publicationFile&v=4 (accessed on 11.10.2023).

- Klimaschutzzentrum. Klimaschutz in energieintensiven Industrien. Leitfaden zum Förderprogramm: "Dekarbonisierung in der Industrie". 2023. Available online: https://www.klimaschutz-industrie.de/fileadmin/kei/Dateien/Foerderprogramm/KEI_Leitfaden_Foerderprogramm_Dekarbonisierung.pdf (accessed on 30.11.2023).

- Fugazza, M.; Trade Analysis Branch, Division on International Trade and Commodities; United Nations Conference on Trade and Development. Carbon pricing - A development ad trade reality check. 2022. Available online: https://unctad.org/system/files/official-document/ditctab2022d6_en.pdf (accessed on 30.11.2023).

- Matthes, F.C. Der Preis auf CO2: über ein wichtiges Instrument ambitionierter Klimapolitik: eine Studie (Bd. 48). 2020. Available online: https://www.boell.de/sites/default/files/2020-07/Der-Preis-auf-CO2_Web.pdf (accessed on 30.11.2023).

- BMU. Klimaschutzprogramm 2030 der Bundesregierung zur Umsetzung des Klimaschutzplans 2050. 2019. p. 91 f. Available online: https://www.bundesfinanzministerium.de/Content/DE/Downloads/Klimaschutz/klimaschutzprogramm-2030-der-bundesregierung-zur-umsetzung-des-klimaschutzplans-2050.pdf?__blob=publicationFile&v=4 (accessed on 30.11.2023).

- Zott, C.; Amit, R.; Massa, L. The Business Model: Recent Developments and Future Research. Journal of Management 2011, 37, 1019–1042. [Google Scholar] [CrossRef]

- Hertwich, E.G.; Wood, R. The growing importance of scope 3 greenhouse gas emissions from industry. Environmental research letters 2018, 13, 104013. [Google Scholar] [CrossRef]

- Hechelmann, R.-H.; Andree, P.; Paris, A. Wege zum klimaneutralen Unternehmen. In Klimaneutralität in der Industrie; Böhm, U., Hildebrandt, A., Kästle, S., Eds.; Springer Gabler: Berlin, Heidelberg, Germany, 2023. [Google Scholar] [CrossRef]

- Ludwig, M.; Lüers, M.; Lorenz, M.; Hegesholt, E.; Kim, M.; Pieper, C.; Meidert, K. The Green Tech Opportunity in Hydrogen. 2021. Available online: https://mkt-bcg-com-public-pdfs.s3.amazonaws.com/prod/capturing-value-in-the-low-carbon-hydrogen-market.pdf (accessed on 30.11.2023).

- Kaufmann, T. Klassische Wertkettenanalyse (Supply Chain). In Strategiewerkzeuge aus der Praxis; Springer Gabler: Berlin, Heidelberg, Germany, 2021. [Google Scholar] [CrossRef]

- Szilagyi, A.; Mocan, M.; Verniquet, A.; Churican, A.; Rochat, D. Eco-innovation, a business approach towards sustainable processes, products and services. Procedia - Social and Behavioural Sciences 2018, 238, 475–484. [Google Scholar] [CrossRef]

- Kranich, P.; Wald, A. Does model consistency in business model innovation matter? A contingency-based approach. Creativity and Innovation Management 2018, 27, 209–220. [Google Scholar] [CrossRef]

- Schlemme, J.; Schimmel, M.; Achtelik, C. Energiewende in der Industrie: Potenziale und Wechselwirkungen mit dem Energiesektor. 2019. Available online: https://www.bmwk.de/Redaktion/DE/Downloads/E/energiewende-in-der-industrie-ap2a-branchensteckbrief-stahl.pdf?__blob=publicationFile&v=4 (accessed on: 30.11.2023).

- Hübner, T.; Guminski, A.; Rouyrre, E.; von Roon, S. Industrie 2050: Energiewende in der Industrie. 2019. Available online: https://www.ffe.de/wp-content/uploads/2021/10/Industrie-2050_Energiewende-in-der-Industrie.pdf (accessed on: 30.11.2023).

- Oskam, I.; Bossink, B.; De Man, A.-P. Valuing Value in Innovation Ecosystems: How Cross-Sector Actors Overcome Tensions in Collaborative Sustainable Business Model Development. Business & Society 2021, 60, 1059–1091. [Google Scholar] [CrossRef]

- Derks, M.; Berkers, F.; Tukker, A. Toward Accelerating Sustainability Transitions through Collaborative Sustainabel Business Modeling: A Conceptual Approach. Sustainability 2022, 14, 3803. [Google Scholar] [CrossRef]

- BMWi. Die Nationale Wasserstoffstrategie: Nationales Reformprogramm 2020. 2020. Available online: https://www.bmwk.de/Redaktion/DE/Publikationen/Energie/die-nationale-wasserstoffstrategie.pdf?__blob=publicationFile&v=11 (accessed on 30.11.2023).

- Meyer, D.; Fauser, J.; Hertweck, D. Business model transformation in the German energy sector: key barriers and drivers of a smart and sustainable transformation process in practise. ISPRS Annals of the Photogrammetry, Remote Sensing and Spital Information 2021, VIII-4/W1-2021, 73–80. [Google Scholar] [CrossRef]

- Naidoo, M.; Gasparatos, A. Corporate environmental sustainability in the retail sector: Drivers, strategies and performance measurement. Journal of Cleaner Production 2018, 203, 125–142. [Google Scholar] [CrossRef]

- Orji, I. Examining barriers to organizational change for sustainability and drivers of sustainable performance in the metal manufacturing industry. Resources, Conservation and Recycling 2019, 140, 102–114. [Google Scholar] [CrossRef]

- Terlau, W.; Hirsch, D. Sustainable consumption and the attitude-behaviour-gap phenomenon - causes and measurements towards a sustainable development. Proceedings in System Dynamics 2015, 199–214. [Google Scholar] [CrossRef]

- Minatogawa, V.; Franco, M.; Rampasso, I.S.; Holgado, M.; Garrido, D.; Pinto, H.; Quadros, R. Towards Systematic Sustainable Business Model Innovation: What Can We Learn from Business Model Innovation. Sustainability 2022, 14, 2939. [Google Scholar] [CrossRef]

- Yun, J.J.; Liu, Z. Micro- and Marco-Dynamics of Open Innovation with a Quadruple-Helix Model. Sustainability 2019, 11, 3301. [Google Scholar] [CrossRef]

- Pedersen, E.R.; Lüdeke-Freund, F.; Henriques, I.; Seitanidi, M.M. Toward collaborative cross-sector business models for sustainability. Business & Society 2021, 60, S. 1039–1058. [Google Scholar] [CrossRef]

- Kimpimäki, J.-P.; Malacina, I.; Lähdeaho, O. Open and sustainable: An emerging frontier in innovation management? Technological Forecasting and Social Change 2022, 174, 121229. [Google Scholar] [CrossRef]

- Yaghmaie, P.; Vanhaverbeke, W. Identifying and describing constituents of innovation ecosystems: A systematic review of the literature. EuroMed Journal of Business 2020, 15, 283–314. [Google Scholar] [CrossRef]

| Categories in questionnaire | Sample questions for the categories of the questionnaire |

|---|---|

| Classification of the experts and current situation of decarbonization in the company |

|

| Political drivers |

|

| Economic drivers |

|

| Social drivers |

|

| Requirements for a new methodology |

|

| “(...) the challenges arising from these regulatory requirements. The massive administrative effort." (E18) |

| “(...) then we also need a system that protects us against unfair competition from outside, and there are two options: one is to create a second market, so to speak, for green products in order to diversify or, as long as this is not yet perfect, to ensure protection against imports from third countries that grant us our protection. “ (E3) |

| “(...) Reporting is also a burden and additional effort." (E9) |

| “So we have very specific enquiries from end customers who ask us how you deal with the issue, we need you as a green (raw material) supplier, and at the same time we have a situation where this issue has not yet been sufficiently considered." (E6) |

| “The Climate Protection Act may have played a role somewhere in the background (...) but it was more of a momentum that was created. We want to do this precisely because we also see ourselves as pioneers." (E12) |

| “The individual areas do not deal with the topic in such depth that they are even aware of its complexity (...) What is relevant for me now? Which law is relevant for me?” (E19) |

| “The fact that many raw materials are not produced in Europe, regardless of whether we are poor in raw materials or not, must come as a surprise, but this has a lot to do with energy policy.” (E15) |

| “Ultimately, it's the economic perspective at the top. We can only afford decarbonization if we actually earn money (...) And the political framework conditions are of course also very important, because this in turn affects investment decisions.” (E17) |

| "In their financing structure, banks are increasingly making sure that they only reinvest in sustainable business models, green assets and the like." (E21) |

| "(...) political uncertainties in importing countries are also part of the daily routine. (...) Due to the natural resource deposits, they are simply in politically exposed countries for the time being and companies have learnt over many years to adapt these risks for themselves somewhere and to integrate them into their own risk management strategy." (E22) |

| "And that's where the journey will take us, towards having standardized products, uniform products and then, above all, enabling service and the replacement and repairability of individual modules." (E19) |

| "At the moment, we are suffering financial disadvantages because we are decarbonising. And the other company that simply sits back gets a competitive advantage." (E12) |

| "You can see that everyone is facing the same challenges, especially with data transparency, and that everyone is pulling in the same direction. But you can also see that this is more of an issue in Europe, meaning that our non-European competitors in particular are not even thinking about it yet." (E20) |

| And accordingly, we put ourselves under more pressure intrinsically or, of course, driven by the shareholders. (...) And what the competition does. As I said, it's more of a price war." (E17) |

| "Customers are having difficulties themselves and are suffering from increased energy costs and inflation. (...) the feedback from customers is that at some point it will actually be one of the competitive advantages. Certainly not for every customer, but for some it will certainly be so high on the agenda that they will be prepared to pay the price premium." (E13) |

| " we are counting on the fact that the demand for green steel will increase faster and more strongly than the available production capacity and that we will therefore benefit from this first mover or pioneering approach in terms of profitability." (E1) |

| "We came to the conclusion early on that it was a good idea to set ourselves up as partners for this transformation, because it affects the entire process chain (...) We have formed partnerships along the value chains and this was preceded by various collaborations in the field of research, because this is simply a sensible way to learn more about the process." (E2) |

| "The key here is clearly on the demand side and of course it is therefore important for companies to continue to be transparent with key customers in order to be able to present certain solutions portfolios of their own." (E4) |

| "Demand has grown due to increased customer requirements across Europe and worldwide." (E18) |

| "We look at the regulations, but of course also at the competitors or customers, what activities or goals are being set. Of course, that has an influence and will probably affect us sooner than the regulations." (E20) |

| "The topic of sustainability is very overarching and dissolves these divisional boundaries, and we're all dealing with that at the moment." (E6) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).