1. Introduction

The bond market, known for its complexity and dynamism, challenges traditional methods of predicting market trends due to its non-linear and multifaceted nature. This has necessitated the exploration of more advanced and adaptive methodologies. Machine learning (ML), a subset of artificial intelligence (AI), offers a promising solution, with its ability to develop algorithms that enable computers to learn from data and make predictions or decisions. ML has already proven its efficacy in various domains, including image and speech recognition, natural language processing, and more recently, in financial market analysis.

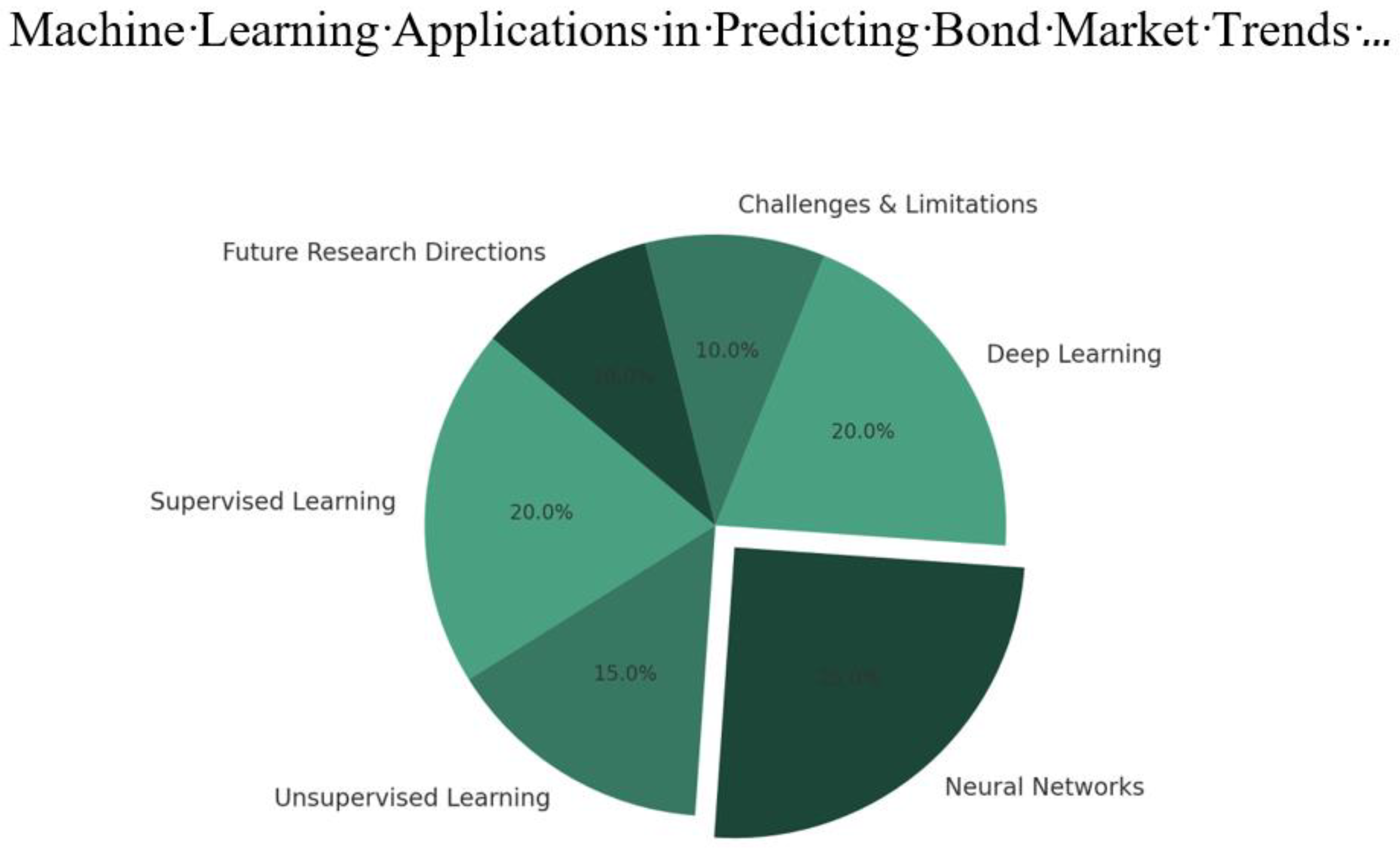

Figure 1.

Different parts of Machine Learning Algorithm.

Figure 1.

Different parts of Machine Learning Algorithm.

This paper focuses on the application of ML techniques such as supervised and unsupervised learning, neural networks, and deep learning in the fixed bond market. It details the process of training and testing various ML models using historical bond market data, demonstrating the potential of ML in this field.

Despite the promise of ML, there are significant challenges and limitations to consider. These include the complexity of managing large datasets, the intricacies of model training, and the ever-present risk of over fitting. Understanding and addressing these issues is crucial for the effective application of ML in financial analysis.

Finally, the paper outlines future research directions. In today’s market, which is characterized by diverse and voluminous data, the need for more sophisticated ML algorithms is evident. Future research will focus on exploring new models, refining existing ones, and continually adapting to the evolving landscape of the bond market. This ongoing development is essential for harnessing the full potential of ML in bond market analysis.

2. Main Body

Machine learning (ML) is increasingly pivotal in FinTech, owing to its adeptness at managing and interpreting complex, large-scale datasets. Its predictive accuracy improves over time, benefiting from diverse and intricate training data. ML stands out in distilling insights from financial datasets — such as price movements, trading volumes, and economic indicators — by uncovering patterns imperceptible to human analysis. These predictions often surpass those made by traditional methods. In practical applications, ML contributes significantly to risk management, algorithmic trading, and offering tailored financial services. In the realm of bond market analysis, ML aids in forecasting market trends, enhancing credit risk assessment, optimizing investment portfolios, and conducting sentiment analysis. This multifaceted utility underscores ML’s growing importance in modern financial technology.

2.1. Theoretical Framework of Machine Learning Techniques

The theoretical framework of ML involves selecting the optimal technique based on data characteristics. In supervised learning, each input data is paired with a desired output, facilitating tasks like credit scoring, fraud detection, and market trend prediction. On the other hand, unsupervised learning uncovers hidden patterns without pre-defined pairings, making it suitable for market segmentation, anomaly detection, and finding correlations in financial indicators. Neural networks and deep learning, inspired by the human brain, excel in recognizing complex patterns and are instrumental in high-frequency trading, stock price prediction, and customer data analysis. Time series analysis, focusing on time-ordered data, is pivotal in extracting trends and patterns, playing a crucial role in forecasting stock prices and economic trends. This integration of time series with ML is invaluable in finance due to the time-sensitive nature of financial data.

Figure 2.

Different types of Machine Learning Technologies.

Figure 2.

Different types of Machine Learning Technologies.

2.2. Data Collection and Preprocessing for Bond Market Analysis

Data for bond market analysis is sourced from market data, economic indicators, credit ratings, and news reports. Key challenges include managing the large volume and diversity of data, ensuring data quality for accuracy and consistency, and overcoming accessibility issues. The data processing steps encompass cleaning (addressing missing data and outliers), preprocessing (normalizing and feature engineering), structuring (formatting time series and encoding categorical data), and transformation (applying techniques like PCA). Integration with ML models involves data splitting into training, validation, and test sets, and careful feature selection. These stages are critical to ensure the accuracy and reliability of the ML model’s predictions.

2.3. Experimental Setup and Methodology and Analysis

In my research, I adopt a systematic approach for selecting, evaluating, and applying machine learning (ML) models to historical bond market data. The process begins with the careful selection of appropriate ML models, including linear regression, decision trees, and neural networks, tailored to suit the specific characteristics of bond market data. The evaluation criteria for these models are rigorously defined, utilizing metrics such as Mean Absolute Error (MAE), Root

Mean Squared Error (RMSE), and Area Under the ROC Curve (AUC) to ensure a comprehensive assessment of their performance.

The methodology encompasses a structured process for training and testing these models. This involves splitting the data into distinct training, validation, and testing sets, followed by meticulous feature selection and engineering to optimize the model’s predictive capabilities. The training phase focuses on fine-tuning the models while addressing challenges like overfitting, whereas the testing phase evaluates their effectiveness on new, unseen data. Additionally, special attention is given to preprocessing historical bond market data, which includes cleaning, normalization, and time series considerations such as stationarity checks and lag features, ensuring that the ML models are robustly equipped to deliver reliable and insightful predictions in the complex realm of bond market analysis.

2.4. Challenges and Limitations in Applying ML to Bond Market Analysis

In my research on applying machine learning in FinTech, I’ve identified several challenges and limitations. Data quality and availability are significant concerns, as real-time, comprehensive bond market data is often expensive and restricted. Model overfitting presents another challenge, where models accurately predict historical data but fail with new data, impacting real-time financial analysis. Additionally, the generalizability of models is limited, especially when future market conditions are influenced by unprecedented events. Lastly, regulatory and ethical considerations, including compliance with data privacy and transparency standards, are crucial in the highly regulated finance sector. These factors collectively underscore the complexities involved in leveraging machine learning for financial risk management.

ML has already begun to transform financial market analysis, particularly in bond market predictions, there’s vast potential yet to be tapped. The future of ML in finance is poised for significant advancements, driven by continuous technological innovation, deeper data integration, and an expanding scope of application. This trajectory not only promises enhanced analytical capabilities but also a more profound understanding of the intricate dynamics governing financial markets.

3. Conclusion

In my research, I have explored the integral role of machine learning (ML) in forecasting bond market trends within the FinTech sector. The study focused on selecting the most appropriate ML techniques, such as supervised and unsupervised learning, neural networks, and deep learning, based on the specific characteristics of the dataset. My experiments have strongly evidenced ML’s capability in risk prediction, with a particular emphasis on time series analysis and advanced deep learning techniques.

Despite the clear benefits, ML applications in this domain are not without challenges. Key issues include data quality and availability, the risk of model overfitting, and the necessity for models to adapt to unpredictable market conditions. Looking forward, the development of more sophisticated and adaptable ML models is crucial, particularly those capable of real-time data analysis. This research highlights not only the potential of ML in financial analysis but also the importance of continuous innovation and training to effectively process and interpret complex financial data. As the field evolves, the significance and impact of ML in financial market analysis are poised to increase, offering deeper insights and more accurate predictions.

4. Disclaimer

During the preparation of this work the author(s) used ChatGPT in order to modify the content. After using this tool/service, the author(s) reviewed and edited the content as needed and take(s) full responsibility for the content of the publication.

References

- Z. He, S. Zhang and L. Li, “Machine learning in bond market prediction: A methodology survey,”Journal of Financial Data Science, 1 Spring, 2019. https://jfds.pm-research.com/content/1/2/25.

- S. Gu, B. Kelly and D. Xiu, “Empirical asset pricing via machine learning,”The Review of Financial Studies, 33 May, 2020. https://academic.oup.com/rfs/article/33/5/2223/5738823.

- D. Bianchi, M. Buchner and A. Tamoni, “Bond risk premia with machine learning,”¨ TheReviewofFinancialStudies, 32 September, 2019. https://academic.oup.com/rfs/article/32/9/3600/5427784.

- G. Feng, S. Giglio and D. Xiu, “Taming the factor zoo: A test of new factors,”Journal of Finance, 75 June, 2020. https://onlinelibrary.wiley.com/doi/abs/10.1111/jofi.12883. [CrossRef]

- P. Nystrup, B. W. Hansen, H. Madsen and E. Lindstrom,¨ “Dynamic trading strategies with machine learning and sentiment analysis,”Quantitative Finance, 19 December, 2019. https://www.tandfonline.com/doi/abs/10.1080/14697688.2019.1622295.

- J. Sirignano and R. Cont, “Universal features of price formation in financial markets: Perspectives from deep learning,”Quantitative Finance, 19 September, 2019. https://www.tandfonline.com/doi/abs/10.1080/14697688.2019.1573689. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).