Introduction

The global carbon market has boomed in recent years; its reach has led to worldwide annual revenues from carbon taxes and emission trading systems topping an all time high of USD 95 billion in 2023 (World Bank Group 2023). Carbon markets incentivise actions to remove atmospheric carbon by generating and trading carbon credits, often to offset carbon emitting activities. In 2021 a framework for international carbon trading was established under Article 6 of the Paris Agreement, which enables countries to collaborate in achieving their Nationally Determined Contributions (NDCs) by trading mitigation outcomes (UNFCCC 2021). Already 80% of countries have signalled their intention to use Article 6 to achieve their NDC targets and 24% have already started to engage with pilots and/or bilateral agreements. A common and increasingly popular way to generate forest-based carbon credits is through forest restoration (reestablishing forests in areas where they have been depleted) and afforestation (establishing forests in areas that have not historically been forested). The forest-based market has the potential to sequester 28.9 PgC by 2050 (assuming current climatic conditions) (see

Table S3 (Walker et al. 2022)) by encouraging emission reductions while contributing to other global objectives such as sustaining biodiversity and improving human well-being (Brondizio et al. 2019). Despite these benefits, there are an increasing number of examples showing that these markets can lead to unintended social, environmental and economic consequences that can reverse progress made towards the Sustainable Development Goals (SDGs). Further, inadequate transparency in investment decision-making, project monitoring, and reporting has created scepticism and reduced the market's integrity.

For example, a recent assessment of voluntary REDD+ (Reducing Emissions from Deforestation and Forest Degradation in Developing Countries) projects in the Brazilian Amazon found evidence of “leakage effects” (shifts in deforestation to a different location) in a quarter of the projects assessed, reducing the effectiveness of these carbon sequestration projects and leading to negative socio-economic consequences (West et al. 2020)

. Yet, one typically overlooked issue that can exacerbate these negative effects is telecoupling.

Telecoupling refers to interactions between social-ecological systems across large, often global, distances such as international trade or land use change in one region due to changing consumption patterns and food demands in another (Liu et al. 2013). A major consequence of telecoupling is that it significantly increases the challenge of effective governance for managing potential negative consequences of global carbon markets because of the complexity and uncertainty in global supply chains and international projects. However, we argue that a telecoupling lens (Liu et al. 2013) can also enable the formulation of targeted policy recommendations through understanding cross-boundary interactions that occur among locations and stakeholders that demand and supply carbon abatement projects.

Telecoupled processes, while facilitating many benefits, have been identified as an obstacle to meeting many of the world's global sustainability goals because they facilitate the externalisation of environmental impacts (Zeng et al. 2022). The global forest-based carbon market is a telecoupled process because it facilitates the buying and selling of carbon credits, allowances, and offsets across international and regional borders. Yet, how telecoupling drives negative impacts has been underreported, and therefore, likely vastly underestimated. This is particularly concerning as nations set to ramp up their international forest-based carbon trading under Article 6 (UNFCCC 2021).

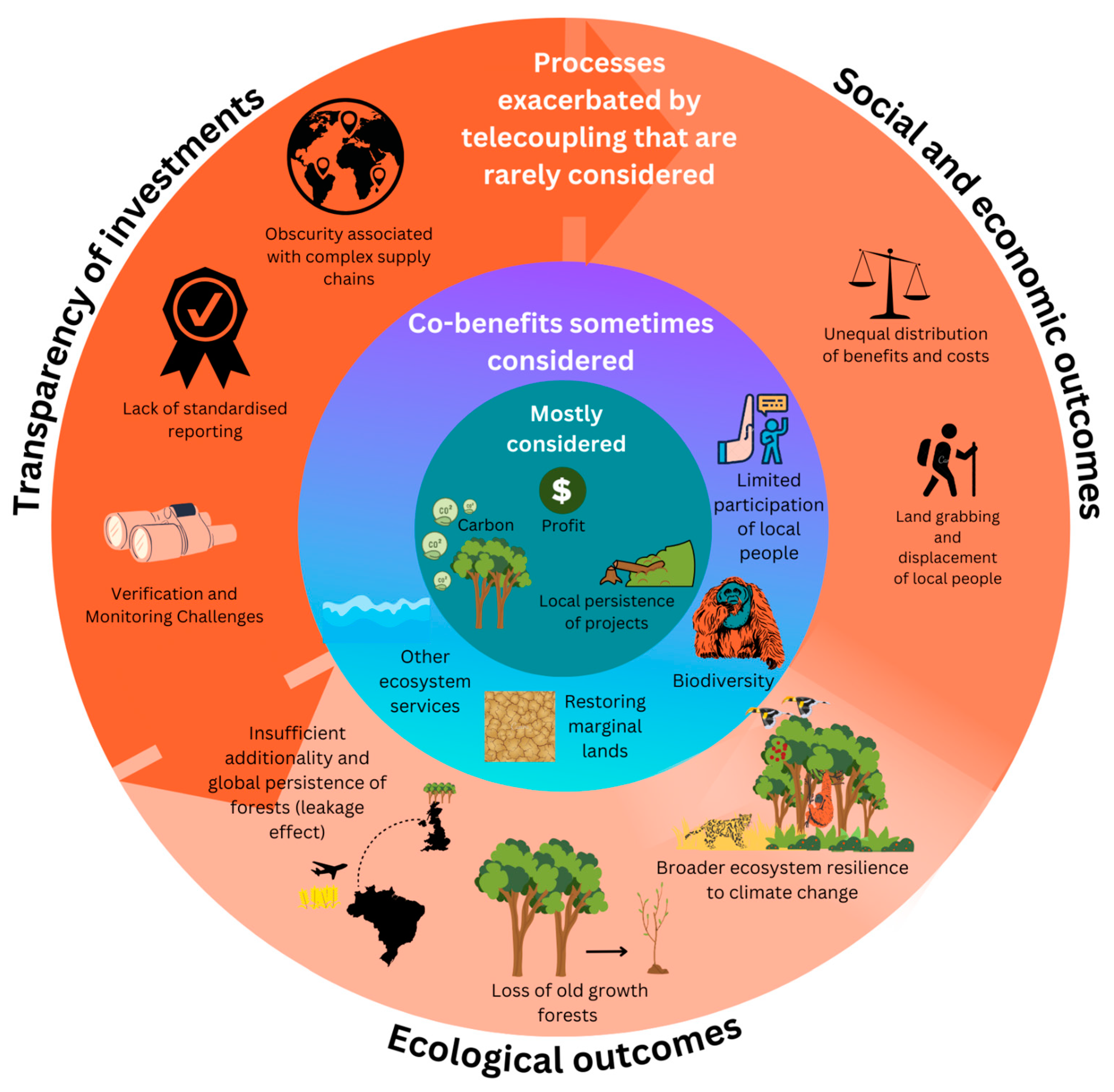

Using a random sample of 100 forest-based carbon abatement projects, we find that important impacts that are exacerbated by telecoupling and lead to negative consequences are rarely considered in project designs (

Figure 1,

Table S1). Some examples of these negative consequences include displaced deforestation (“leakage effect”) (Streck 2021) and unequal distributions of project benefits and costs (McMorran et al. 2022). Using a telecoupling lens, we identify how these unintended negative impacts may occur and provide recommendations for the forest-based carbon market to better account for telecoupling effects by prioritising positive social impact, expanding comprehensive ecological outcomes, and improving transparency of its investments. We provide recommendations for how these impacts could be addressed, and call for a carbon market that is designed to account for its global or broad-scale interconnectedness. One essential component is a global policy framework that quantifies and accounts for the wider array of effects arising from forest-based carbon projects, with explicit consideration of the telecoupling processes that drive them at global and regional scales. By applying a telecoupling lens, the carbon market can achieve more equitable and sustainable net positive impacts.

Social and Economic Outcomes

Projects are often implemented in locations that have weaker regulatory processes compared to the investors' originating country. This situation leaves market actors ill-equipped to fully comprehend (or able to conveniently ignore) the full (positive and negative) range of impacts resulting from the projects. There are documented instances where forest-based carbon abatement projects have been implemented through unjust land acquisition, or have limited people’s access to land, negatively impacting local communities (known as ‘green land grabbing’). Stories of displacement of marginalised peoples have been observed across developing countries, so frequently in fact that the term ‘carbon cowboys’ has been coined for unruly actors who seek to gain control over the forested lands of Indigenous People and Local Communities around the world to profit from carbon credits (Aguilar-Støen 2017).

Many carbon offset projects operate through top-down implementation, shifting responsibilities from governments to other actors including international organisations, transnational networks and corporations, and non-governmental organisations. This lacks local participation and disenfranchises communities. Examples from Colombia demonstrate how Indigenous communities can be easily disenfranchised through carbon offset projects as companies are left to create their own implementation rules through contracts that Indigenous leaders do not fully comprehend (they are in a foreign language or leaders are tricked into signing while inebriated) (Aguilar-Støen 2017). The distance between investors and local actors can also lead to unequal distributions of benefits and costs (

Figure 1). A recent report to the Scottish Land Commission has revealed that high demand for land, largely from

overseas corporations looking for carbon offset investments, drove farmland values up by 31.2% in Scotland in 2021 compared with 6.2% across the United Kingdom (UK) (McMorran et al. 2022). With investments in rural land exempt from many taxes and driven by the UK Government targets to plant 30,000 hectares of new forest per year to meet net-zero emissions pledges, the rapid increases in land values are pricing out local communities from the market. This has been flagged as potentially leading to a reduction in local employment, tourism, ecological management and micro-businesses (McMorran et al. 2022).

Ecological Outcomes

Although the carbon market can mobilise funding for ecosystem restoration for positive biodiversity outcomes, it can have a pernicious effect by weakening actions to conserve areas rich in biomass and biodiversity. These effects are well documented at the site-level and landscape-level, but are exacerbated by global transboundary transaction processes that leverage vast amounts of funding to favour restoration in marginal areas with low opportunity cost (those less favourable for agricultural or urban use), driven by distant demand for carbon credits. In a globalised market, deforestation can also be spatially-displaced (“leakage effect”), which is more difficult to control beyond local boundaries (Streck 2021), affecting the maintenance and persistence of forests in other locations, and thus compromising the additionality of the system as a whole. This is further complicated by telecoupling as it can facilitate projects in countries that have ineffective regulation or governance. Further, large-scale global investment tends to be towards creating new forests with higher rates of carbon sequestration, where lands are cheaper, rather than conserving existing mature forests where biodiversity benefit is higher (

Figure 1;

Table S1).

The global forest based carbon market exists to mitigate climate change; however, when projects focus on site-level carbon sequestration alone, they can fail to incentivise environmental activities that enhance a wider range of ecosystem services (the benefits nature provides to humanity). These ecosystem services include those linked to overall ecosystem integrity, and thus climate adaptation. Positive adaptation outcomes associated with high-integrity forested ecosystems include increased water quality, water regulation and retention, climate and atmospheric regulation, protection from natural disasters, improved human well-being, facilitated species movement, increased phenotypic plasticity, thermal buffering, rainfall buffering, resilience to environmental stressors, increasing agricultural productivity, and creating habitat and climate refugia (Brancalion and Chazdon 2017, Elsen et al. 2023). However, carbon credits are much more competitive in the market when generated at sites with low opportunity and restoration costs, but this disregards the broader potential benefits of forest restoration (Brancalion and Chazdon 2017). The pursuit of projects purely for carbon storage at the expense of neglecting biodiversity and other ecosystem services outcomes can lead to the prioritisation of monoculture plantation projects that homogenise and decline forest biodiversity and their services (

Figure 1). A telecoupled, globally-operating market can exacerbate this process by providing broadscale access to cheap land with low restoration costs, but with poor co-benefits regarding other ecosystem services.

Transparency of Investments

Telecoupling can hamper transparency in the forest-based carbon market and hinder the market's ability to achieve environmental and social benefits (

Figure 1) (Chen et al. 2021). Multilateral carbon offset projects mean that numerous actors and entities are usually involved across different stages of the supply chain, from project developers and implementers to verifiers, brokers, and buyers, making regulation a challenge (Schaltegger and Csutora 2012). Understanding the flows and feedback of a complex market is made more difficult by the prevalence of unregulated intermediaries acting between buyers and sellers. Transactions of carbon credits are often carried out through brokers who facilitate the sale, resale, and ultimate retirement of carbon credits with little oversight, transparency, or regulation (Chen et al. 2021). In a highly telecoupled market with many intermediaries, it can be challenging to track and verify the outcomes of projects. This can lead to difficulties in assessing the integrity and effectiveness of carbon abatement projects, further exacerbated by the lack of global standardised reporting. While global carbon certifications exist, their voluntary nature makes it difficult to uncover the full range of impacts from forest-based carbon projects. Countries also have different reporting requirements, making it difficult to determine the additionality of these projects.

Leveraging a telecoupling lens to improve the forest-based carbon market

There is a critical need to avoid the pervasive impacts of telecoupled processes in the global carbon market. This first requires better global carbon accounting. For example, there is currently a lack of even seemingly simple statistics on how much of the forest-based carbon market is traded globally across international borders. Improved forest-based carbon accounting requires robust regulatory infrastructures, and thus we echo the growing calls for a globally consistent framework for monitoring, reporting, and verifying carbon offsets (Boyd et al. 2023). There are existing well-developed telecoupling frameworks that can help to inform the design of such a system (Liu et al. 2013), but these have not yet been utilised in the design of carbon markets. Adopting a telecoupling lens allows for a more complete assessment of the performance of carbon projects, which can be used to harness the benefits of telecoupling (e.g., efficiency, increasing options, innovation, etc.) while helping avoid market failure. By integrating well-documented carbon accounting information with a telecoupling lens it becomes possible to estimate the full suite of consequences of forest-based carbon abatement projects (many unanticipated) across scales through existing economic, ecosystem, and integrated tools (McCord et al. 2018, Johnson et al. 2023).

With an improved understanding of telecoupled effects, strategies such as cross-border governance and telecoupling impact assessments could be developed to guide actions to help mitigate the pervasive impacts of telecoupling, or eliminate them all together. This information can then be used to develop new standards for forest-based carbon projects and assessment metrics. Current carbon abatement standards, for example see (VERRA 2023) and (IC 2022), overlook many of the negative social and environmental consequences that arise due to telecoupled processes. Some included criteria, such as stakeholder participation, deforestation control, and carbon persistence, could relate to telecoupling if considered at broad scales, but currently these are only considered at the local project level (

Figure 1). To guarantee additionality, new metrics and criteria must consider impacts not only in systems and countries directly related to the locations where the carbon capture projects are being implemented, but also those that are subsequently impacted through telecoupled processes. These more comprehensive metrics should be linked to financial mechanisms to incentivise projects that meet higher transparency standards, thus boosting investor confidence.

As with all broad-scale policy frameworks, there are many associated challenges with implementation and its operationalisation, especially as a large telecoupled system. However, with rapid growth in global carbon markets, there has never been a better time to establish coordinated principles within a comprehensive global policy framework to ensure global and regional net social and environmental gains from forest-based carbon projects.

Supplementary Materials

The following supporting information can be downloaded at the website of this paper posted on Preprints.org. Table S1. Random sample of 100 out of 315 registered projects from Verra’s public registry

https://registry.verra.org/app/search/VCS/All%20Projects. The sample was obtained from carbon offsets for forest-based projects (codes VM0003, VM0004, VM0005, VM0006, VM0007, VM0009, VM0010, VM0011, VM0012, VM0015, VM0034, VM0035, VM0037, VM0045

https://verra.org/methodologies-main/). Link to the table:

https://docs.google.com/spreadsheets/d/1nza_zddAbZhlRctWlx1ut0gpnCpVc24bcSNnb6IfvoA/edit?usp=sharing.

Acknowledgements

This work was conceptualised in a workshop supported by the UQ Global Strategy and Partnerships Seed Funding Scheme, the QUEX Institute, and Centre for Biodiversity and Conservation Science (CBCS). JR and BAW are supported by Australia Research Council Future Fellowship Project FT200100096. SLC is supported by a McKenzie Postdoctoral Fellowships from the University of Melbourne. Figure 1 was created using Canva

https://www.canva.com/, of which all free photos, music and video files on Canva can be used for free for commercial and noncommercial use

https://www.canva.com/policies/free-media-license-agreement-2022-01-03/.

References

- Aguilar-Støen M. 2017. Better Safe than Sorry? Indigenous Peoples, Carbon Cowboys and the Governance of REDD in the Amazon. Forum for development studies 44: 91–108. [CrossRef]

- Boyd PW, Bach L, Holden R, Turney C. 2023. Carbon offsets aren’t helping the planet — four ways to fix them. Nature Publishing Group UK. (19 September 2023. [CrossRef]

- Brancalion PHS, Chazdon RL. 2017. Beyond hectares: four principles to guide reforestation in the context of tropical forest and landscape restoration. Restoration Ecology 25: 491–496. [CrossRef]

- Brondizio ES, Settele J, Díaz S, Ngo HT, (editors). 2019. IPBES (2019): Global assessment report on biodiversity and ecosystem services of the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services. IPBES secretariat, Bonn, Germany.

- Chen S, Marbouh D, Moore S, Stern K. 2021. Voluntary Carbon Offsets: An Empirical Market Study.

- Elsen PR, Oakes LE, Cross MS, DeGemmis A. 2023. Priorities for embedding ecological integrity in climate adaptation policy and practice. One Earth. [CrossRef]

- IC. 2022. Part 2: Core Carbon Principles. The integrity council for the voluntary carbon market.

- Johnson JA, Baldos UL, Corong E, Hertel T, Polasky S, Cervigni R, Roxburgh T, Ruta G, Salemi C, Thakrar S. 2023. Investing in nature can improve equity and economic returns. Proceedings of the National Academy of Sciences of the United States of America 120: e2220401120.

- Liu J, Hull V, Batistella M, DeFries R, Dietz T, Fu F, Hertel TW, Izaurralde RC, Lambin EF, Li S, Martinelli LA, McConnell WJ, Moran EF, Naylor R, Ouyang Z, Polenske KR, Reenberg A, de Miranda Rocha G, Simmons CS, Verburg PH, Vitousek PM, Zhang F, Zhu C. 2013. Framing Sustainability in a Telecoupled World. Ecology and Society 18. [CrossRef]

- McCord P, Tonini F, Liu J. 2018. Making strides in sustainable development with the Telecoupling GeoApp. Science Trends. [CrossRef]

- McMorran R, Glendinning J, Glass J. 2022. Rural Land Markets Insights Report. Scottish Land Commission, Commissioned Report.

- Schaltegger S, Csutora M. 2012. Carbon accounting for sustainability and management. Status quo and challenges. Journal of cleaner production 36: 1–16. [CrossRef]

- Streck C. 2021. REDD+ and leakage: debunking myths and promoting integrated solutions. Climate Policy 21: 843–852. [CrossRef]

- UNFCCC. 2021. Decision 3/CMA.3.

- VERRA. 2023. Verified Carbon Standard (VCS) Standard.

- Walker WS, Gorelik SR, Cook-Patton SC, Baccini A, Farina MK, Solvik KK, Ellis PW, Sanderman J, Houghton RA, Leavitt SM, Schwalm CR, Griscom BW. 2022. The global potential for increased storage of carbon on land. Proceedings of the National Academy of Sciences of the United States of America 119: e2111312119.

- West TAP, Börner J, Sills EO, Kontoleon A. 2020. Overstated carbon emission reductions from voluntary REDD+ projects in the Brazilian Amazon. Proceedings of the National Academy of Sciences of the United States of America 117: 24188–24194.

- World Bank Group. 2023. State and Trends of Carbon Pricing 2023. [CrossRef]

- Zeng Y, Runting RK, Watson JEM. 2022. Telecoupled environmental impacts are an obstacle to meeting the sustainable development goals. Sustainable. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).