1. Introduction

FinTech, with its groundbreaking advancements, has significantly transformed the finance sector. This evolution, however, brings with it a pivotal challenge: ensuring the security of an ever-increasing volume and complexity of financial data. In this research paper, we delve into the importance of robust and effective data security measures in FinTech, addressing the critical role they play in the industry.

With the surge in data volume, the risk of data breaches escalates, potentially leading to severe financial and reputational damage for both clients and companies. To illustrate this, a graphical figure depicting the rising trend in data breaches over recent years can be included. This research paper thoroughly examines the various challenges faced by FinTech companies, including common vulnerabilities that malicious entities might exploit.

- 2

Implementing Effective Data Security Measures in Fintech Applications ...

We provide an in-depth analysis of technical solutions for these challenges, focusing on encryption, blockchain technology, and cloud security methodologies. These technologies are essential in strengthening FinTech data security. A comparative graph or chart could effectively showcase the effectiveness of each technology in various FinTech scenarios. We also discuss realworld case studies where leading FinTech firms have successfully implemented these technologies, yielding significant benefits.

Additionally, the paper highlights the importance of adhering to regulatory frameworks and security compliances, crucial for maintaining data security in the FinTech sector. A flow diagram illustrating the relationship between regulatory compliance, technological implementation, and data security could be insightful here.

In conclusion, we propose an integrated security system model tailored for FinTech applications. This model emphasizes the synergy between technological innovation, regulatory compliance, and proactive risk management. Incorporating a graphical representation of this model would illustrate how bridging the gap between technology and regulation enhances data security.

By offering a comprehensive overview of the current landscape and forward-thinking strategies, this paper aims to contribute significantly to the ongoing discourse on data security in the FinTech industry.

2. Main Body

As the FinTech sector experiences rapid growth and digital transformation, data security has emerged as a paramount concern. This expansion has ushered in unprecedented challenges in safeguarding sensitive financial information. The complexity of these challenges has surged in tandem with the exponential increase in the volume of data handled by FinTech platforms. Within this vast sea of financial data lies not just personal information but also intricate transaction histories, credit scores, and comprehensive investment portfolios. The exposure of such highly sensitive data poses not only financial risks but also jeopardizes the reputation of both clients and the FinTech companies, underscoring the critical importance of robust data security measures.

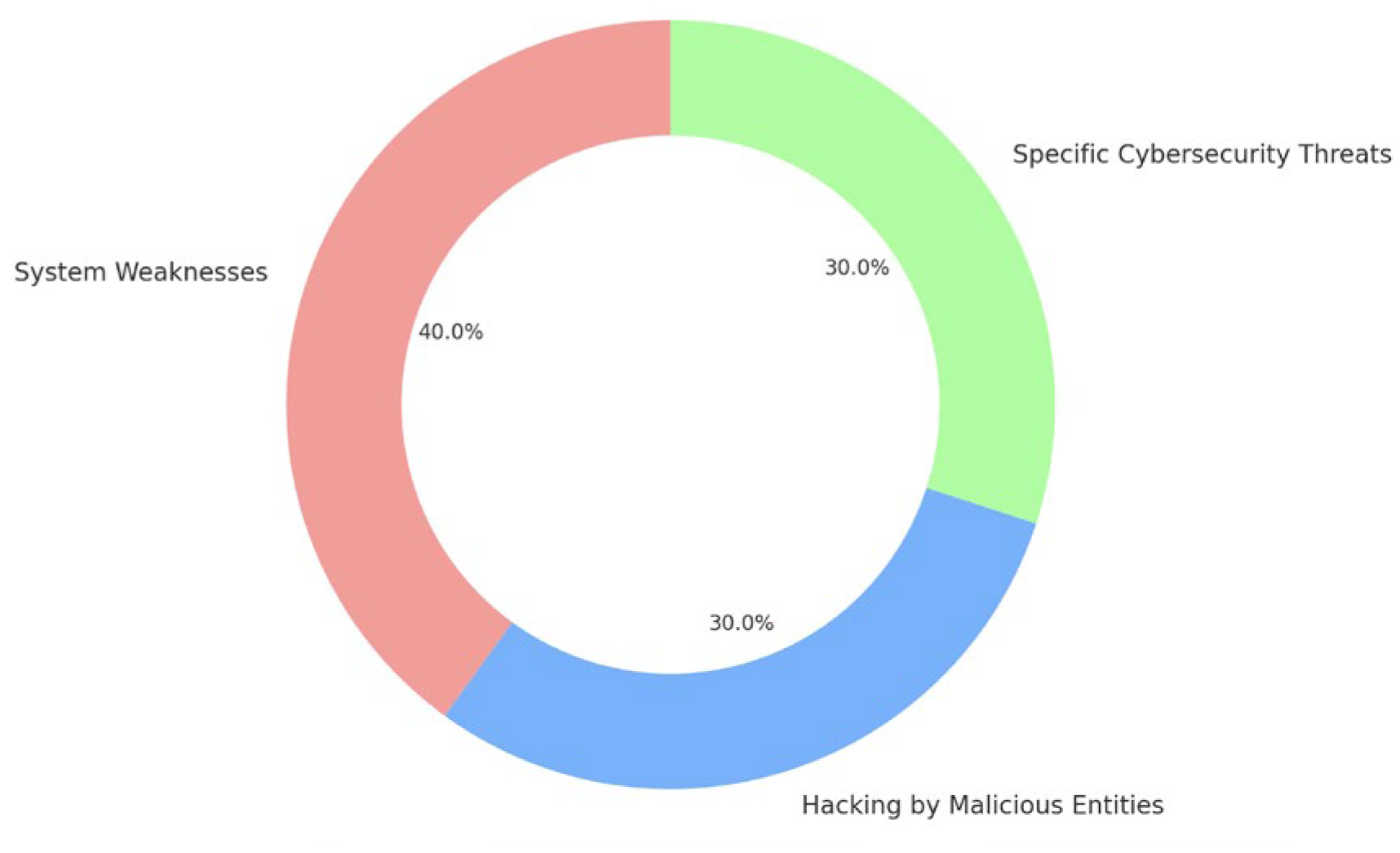

Figure 1.

Common Vulnerabilities in FinTech Applications.

Figure 1.

Common Vulnerabilities in FinTech Applications.

2.1. Common Vulnerabilities in FinTech Applications

The vast volume of FinTech data is accompanied by significant vulnerabilities. Firstly, system weaknesses, software bugs, and human errors stemming from outdated software components or improper configurations create openings for attackers to gain unauthorized access and exploit sensitive data. Subsequently, malicious entities, including hackers and cybercriminals, can exploit these vulnerabilities through hacking and other tactics, compromising the integrity of sensitive data. Additionally, specific cybersecurity threats to the FinTech sector, such as phishing, ransomware, and insider threats, pose substantial risks. These threats have the potential to expose sensitive data to unauthorized parties, resulting in substantial losses for the company.

2.2. Technological Solutions to Data Security Challenges

Critical technical solutions underpin data security in the FinTech sector. Encryption plays a pivotal role, safeguarding sensitive data by transforming it into ciphertext, accessible only to authorized parties with decryption keys. Protocols like Secure Socket Layer (SSL) and Transport Layer Security (TLS) are widely employed to encrypt data during online transactions, ensuring both confidentiality and data integrity. Blockchain technology revolutionizes the sector by establishing decentralized and immutable transaction ledgers, fostering data integrity and transparency across all financial activities. Moreover, embracing cloud security methodologies, which include data encryption, access controls, and Identity and Access Management (IAM), has translated into reduced security incidents and improved scalability in FinTech operations. Additionally, emerging technologies like AI-driven threat detection and quantum-safe cryptography are poised to further fortify data security, ensuring FinTech remains resilient and adaptable in the face of evolving threats.

2.3. Case Studies: Success Stories in FinTech

A FinTech giant grappling with data security and transaction transparency adopted Blockchain technology, enhancing transparency and trust by recording transactions in a tamper-proof manner. Concurrently, a payment company addressed cloud security issues through robotic methodologies, data encryption, strict access controls, and continuous monitoring, with Identity and Access Management (IAM) significantly reducing security incidents. A startup improved threat detection by using advanced AI, identifying and mitigating threats in real-time. Meanwhile, a wealth management firm combatted unauthorized data access by implementing Multi-Factor Authentication (MFA), markedly decreasing security risks.

2.4. Regulatory Frameworks and Compliance in Data Security

The FinTech sector operates within a tightly regulated environment to safeguard data security and uphold consumer and market interests. Key regulatory frameworks and standards, such as GDPR, PSD2, and industry-specific financial compliances, are fundamental in ensuring data protection and security. These regulations mandate stringent operational requirements for FinTech firms. Compliance plays a critical role in deterring financial crimes and maintaining financial system integrity. Adherence to these standards often requires comprehensive security measures like encryption, stringent access controls, and rigorous data breach reporting protocols. Moreover, companies are obligated to conduct Data Protection Impact Assessments (DPIAs) and demonstrate a steadfast commitment to data privacy. While these regulations are essential for security, they also present significant compliance challenges to financial firms.

- 4

Implementing Effective Data Security Measures in Fintech Applications ...

2.5. Integrated Security System Model for FinTech

The Integrated Security System Model for FinTech is a dynamic blend of advanced technology, stringent regulatory compliance, and proactive risk management. At its core lies the technical section, featuring state-of-the-art solutions like sophisticated encryption, biometric authentication, and AI-driven real-time threat detection. Ensuring adherence to global and regional regulations such as GDPR, PSD2, and sector-specific compliances, the regulatory compliance aspect is crucial. It guarantees that all FinTech operations align with established legal standards. The model also emphasizes proactive risk management through ongoing monitoring, thorough vulnerability assessments, and well-prepared incident response strategies.

Strategic planning is essential for implementing this model, with a key focus on bridging the gap between technological advancements and regulatory requirements. Agile methodologies play a vital role in achieving this alignment.

Furthermore, FinTech companies handling sensitive data must adopt robust security measures to maintain trust and integrity. As cyber threats evolve, so must our defenses. Future developments like quantum-resistant encryption and decentralized identity management are anticipated to fortify FinTech security further.

3. Conclusions

In conclusion, this research paper comprehensively addresses the various aspects of data security within the FinTech sector, emphasizing the crucial interaction between advanced technological solutions, rigorous regulatory compliance, and proactive risk management strategies. Through in-depth analysis and real-world examples, we have underscored the significance of robust security measures like encryption, blockchain, and cloud security in protecting financial data. The importance of adhering to regulatory standards to mitigate cyber threats is also highlighted. Additionally, the paper proposes an Integrated Security System Model, demonstrating how the synergy between technology and regulation can bolster data security. It further acknowledges the escalating nature of cyber threats and stresses the need for continuous advancement in security measures to safeguard the evolving FinTech landscape.

References

- Ali, R.; Barrdear, J.; Clews, R.; Southgate, J. Blockchain in finance. Bank of England Quarterly Bulletin 2016, 56. [Google Scholar]

- Roman, C.; Ashworth, M.; Young, J. Features, expectations, and challenges of identity management for electronic health records: A literature review. International Journal of Medical Informatics 2013, 82. [Google Scholar]

- Matten, R. Explaining the adoption of blockchain technology in financial services. International Journal of Information Management 2017, 37. [Google Scholar]

- Arner, D.W.; Barberis, J.; Buckley, R.P. Fintech, regtech, and the reconceptualization of financial regulation. Northwestern Journal of International Law & Business 2016, 37. [Google Scholar]

- Dinh, T.T.A.; et al. . Untangling blockchain: A data processing view of blockchain systems. IEEE Transactions on Knowledge and Data Engineering 2018, 30. [Google Scholar] [CrossRef]

- Schneier, B. Lessons from the sony hack. Journal of Cyber Policy 2019, 4. [Google Scholar]

- Rodrigues, J.J.; de la Torre, I.; Fernandez, G.; L´opez-Coronado, M. An analysis of security issues for cloud´ computing. Journal of Internet Services and Applications 2016, 4. [Google Scholar]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).