Submitted:

30 April 2024

Posted:

01 May 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Review of Literature

2.1. Value Add Tax (VAT)

2.2. The Saudi Arabia Stock Performance

2.3. Effects of Stock Performance

3. Theoretical Framework and Hypothesis Formulation

3.1. VAT and Bank Stock Performance

3.2. Liquidity and Financial Market Dynamics

3.3. Hypotheses Development

3.4. Methodological Approach for Hypothesis Testing

4. Methodological Design

5. Data Analysis and Results

6. Conclusion

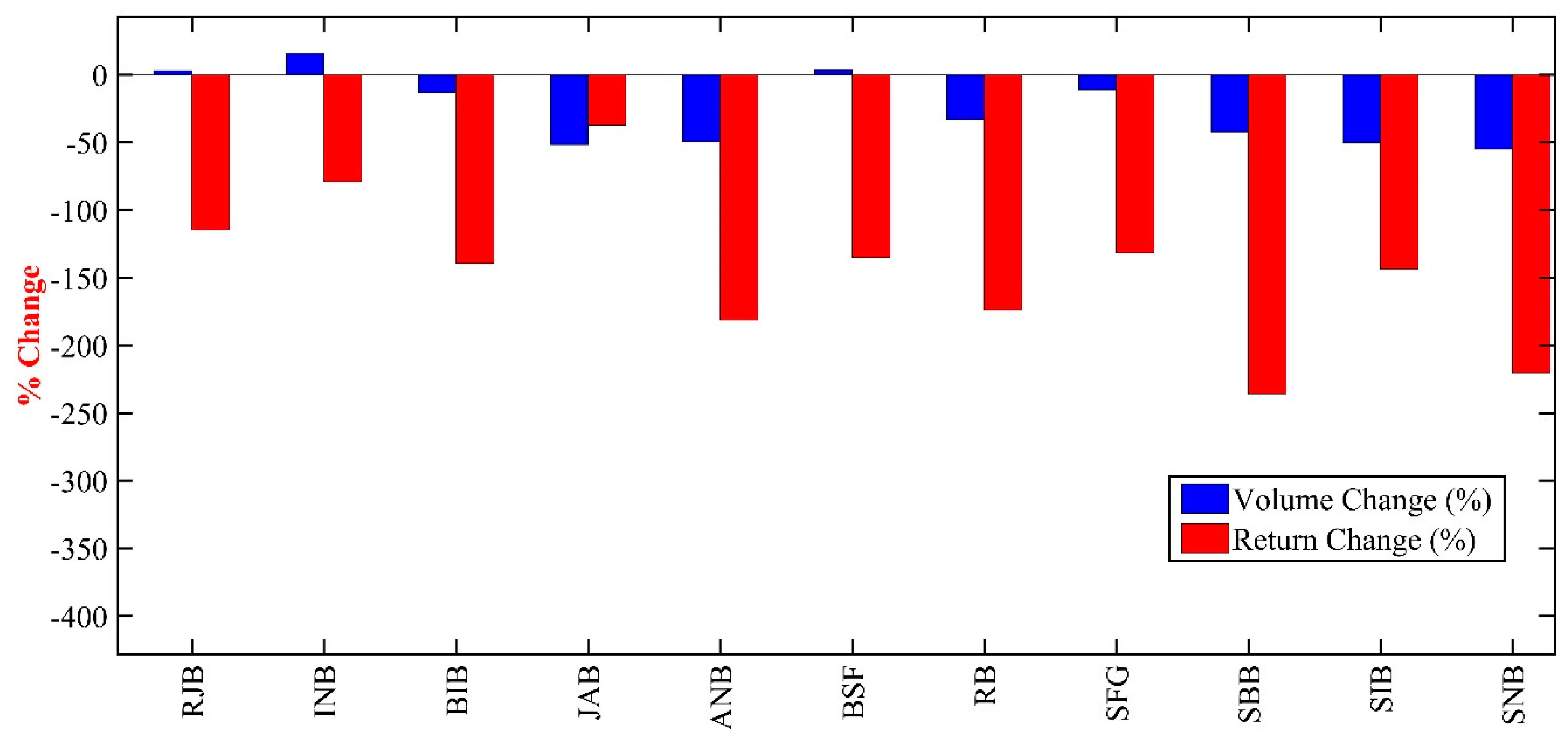

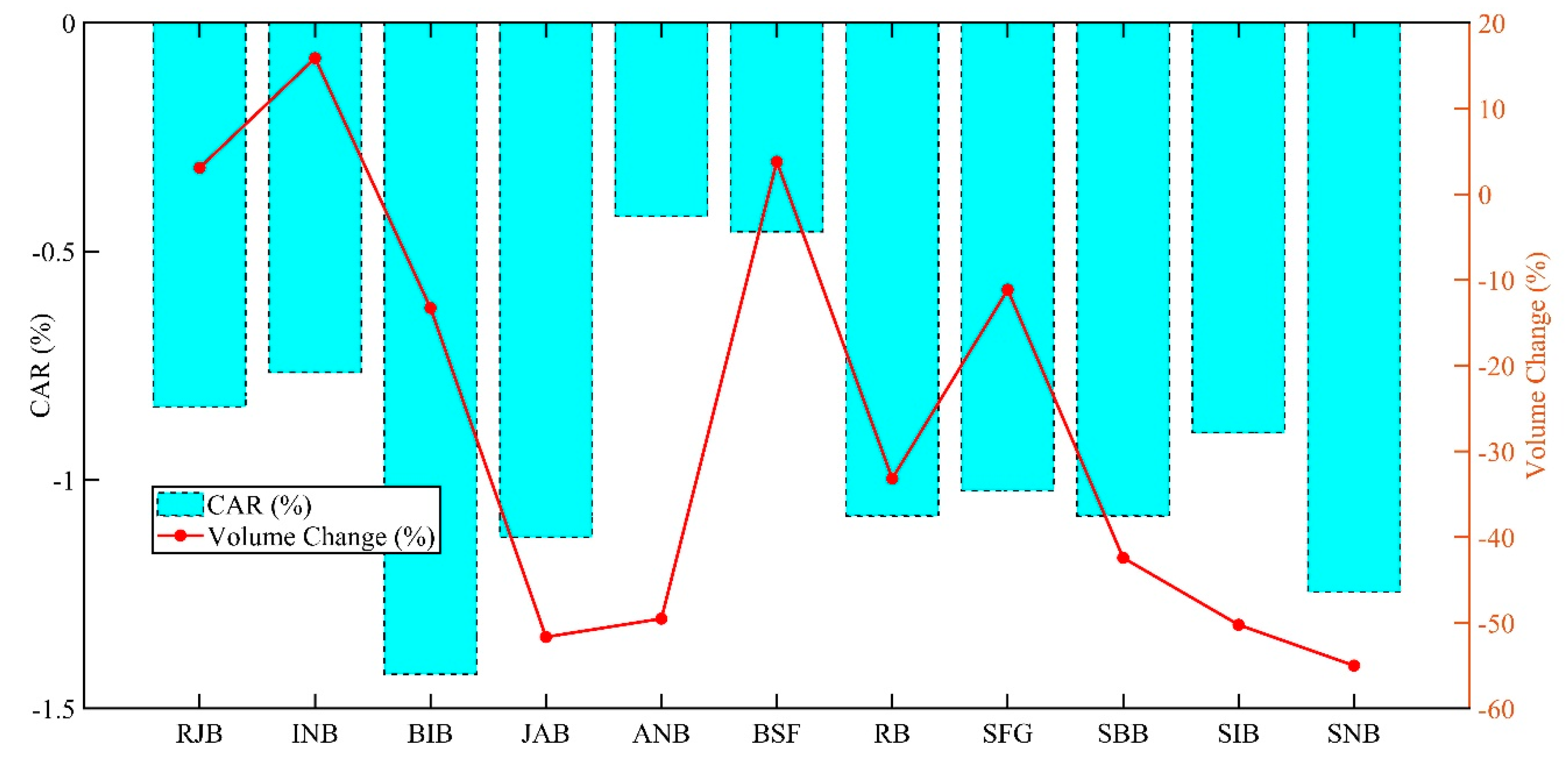

- The imposition of a 5% VAT led to a substantial downturn in trading volumes and stock returns. Specifically, trading volumes decreased by 9.5%, and stock returns plummeted by 39.5%, indicating a pronounced adverse market reaction to the new tax imposition.

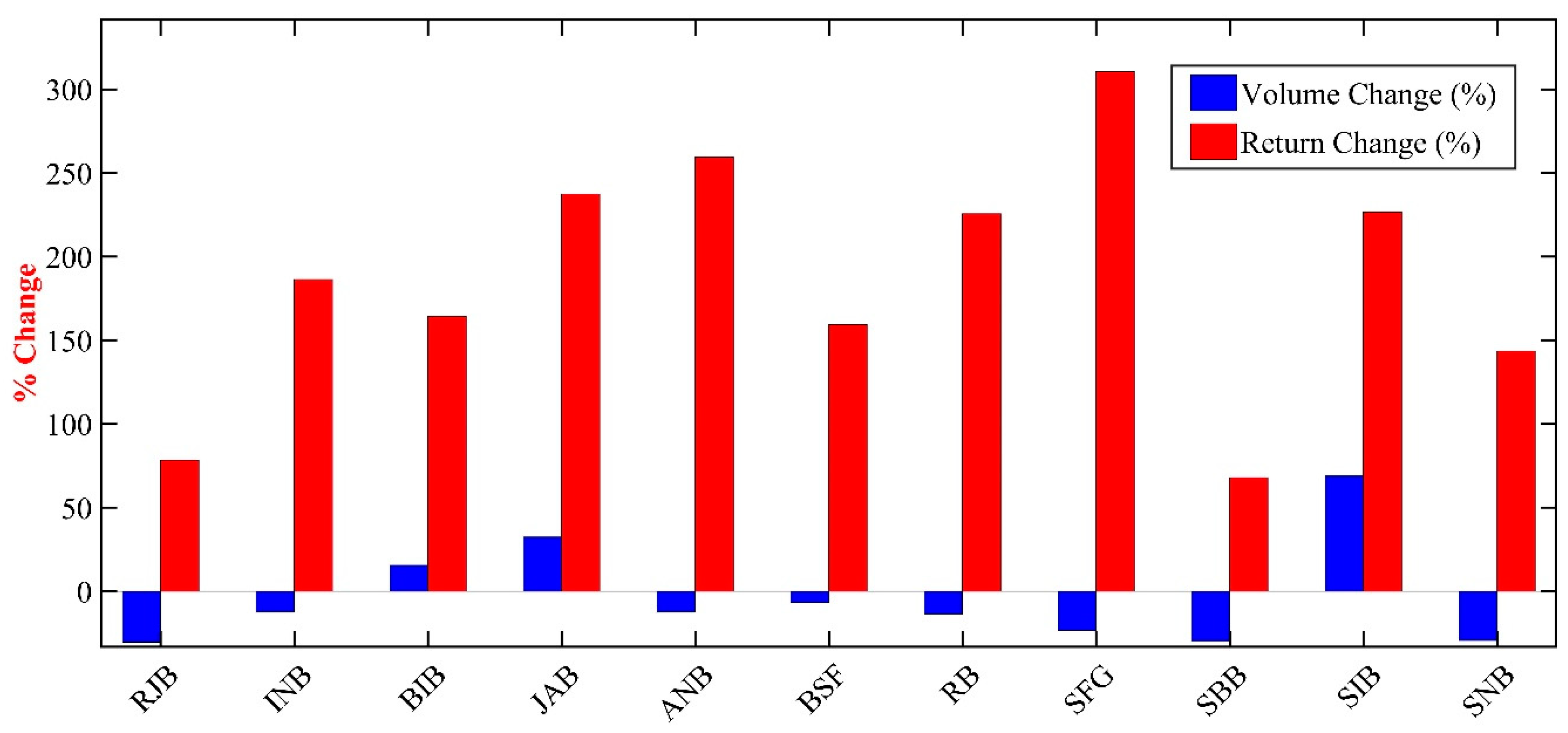

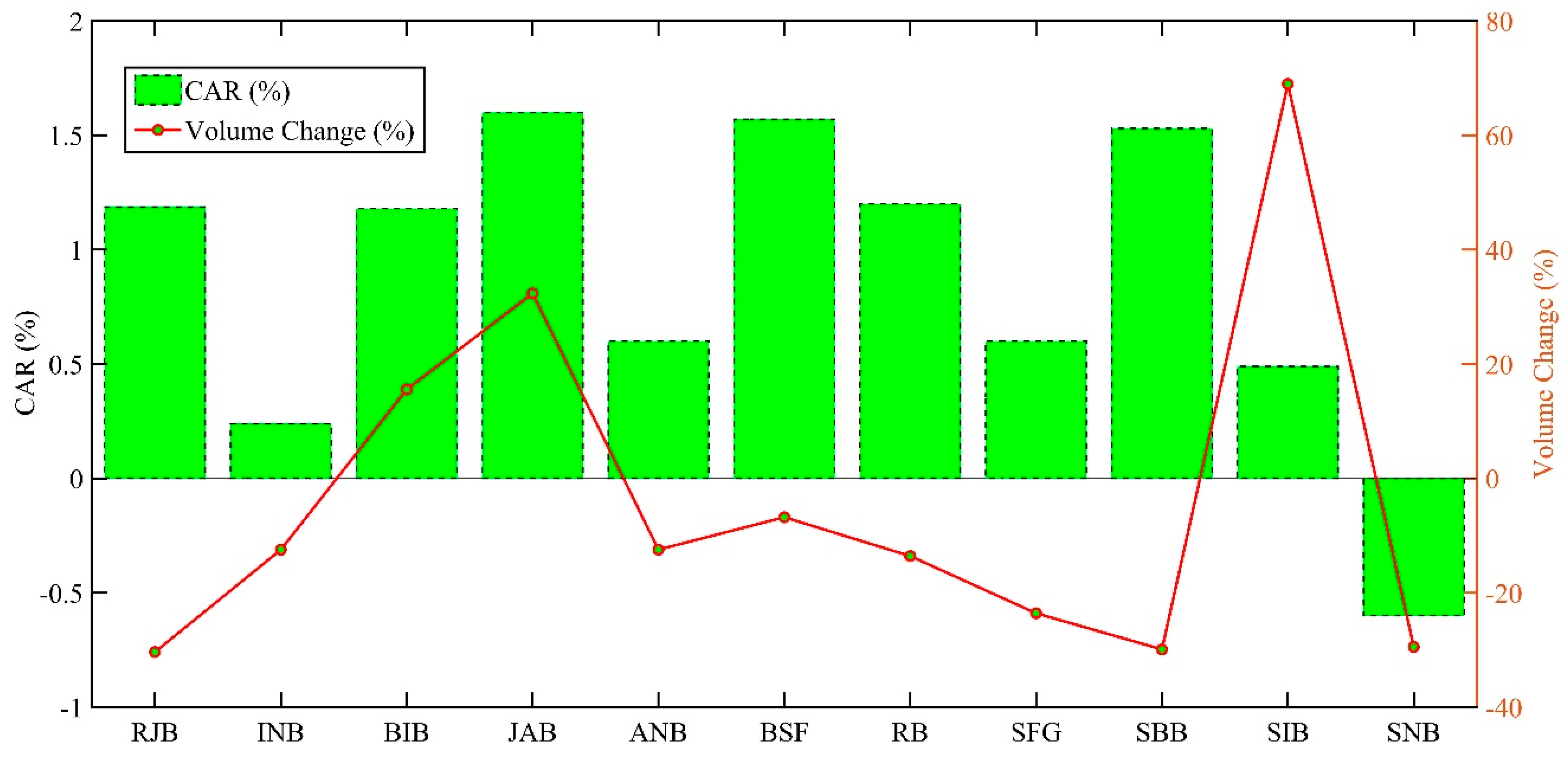

- Conversely, when VAT was increased to 15%, the market exhibited a mixed but ultimately positive response. Trading volumes slightly increased by 3.3%, and stock returns experienced a robust recovery, soaring by 128.7% on average, suggesting that the market adapted to the heightened tax rate and investor sentiment stabilised.

- The t-tests applied confirmed the significant impacts of VAT changes. For the initial VAT introduction, the sharp reductions in trading volumes and stock returns yielded t-statistics of -7.75 and -8.44, respectively. Conversely, the second VAT increase event showed a significant positive transformation in stock returns, with a t-statistic of 6.60, affirming a considerable rebound in investor confidence.

- The impact of VAT changes varied significantly among individual banks, highlighting their diverse resilience and strategic adjustments. Notably, Al Jazira Bank exhibited substantial increases in both trading volumes (59.2%) and stock returns (228.6%) following the VAT increase to 15%, underscoring strong investor confidence or strategic adaptations to the new fiscal environment.

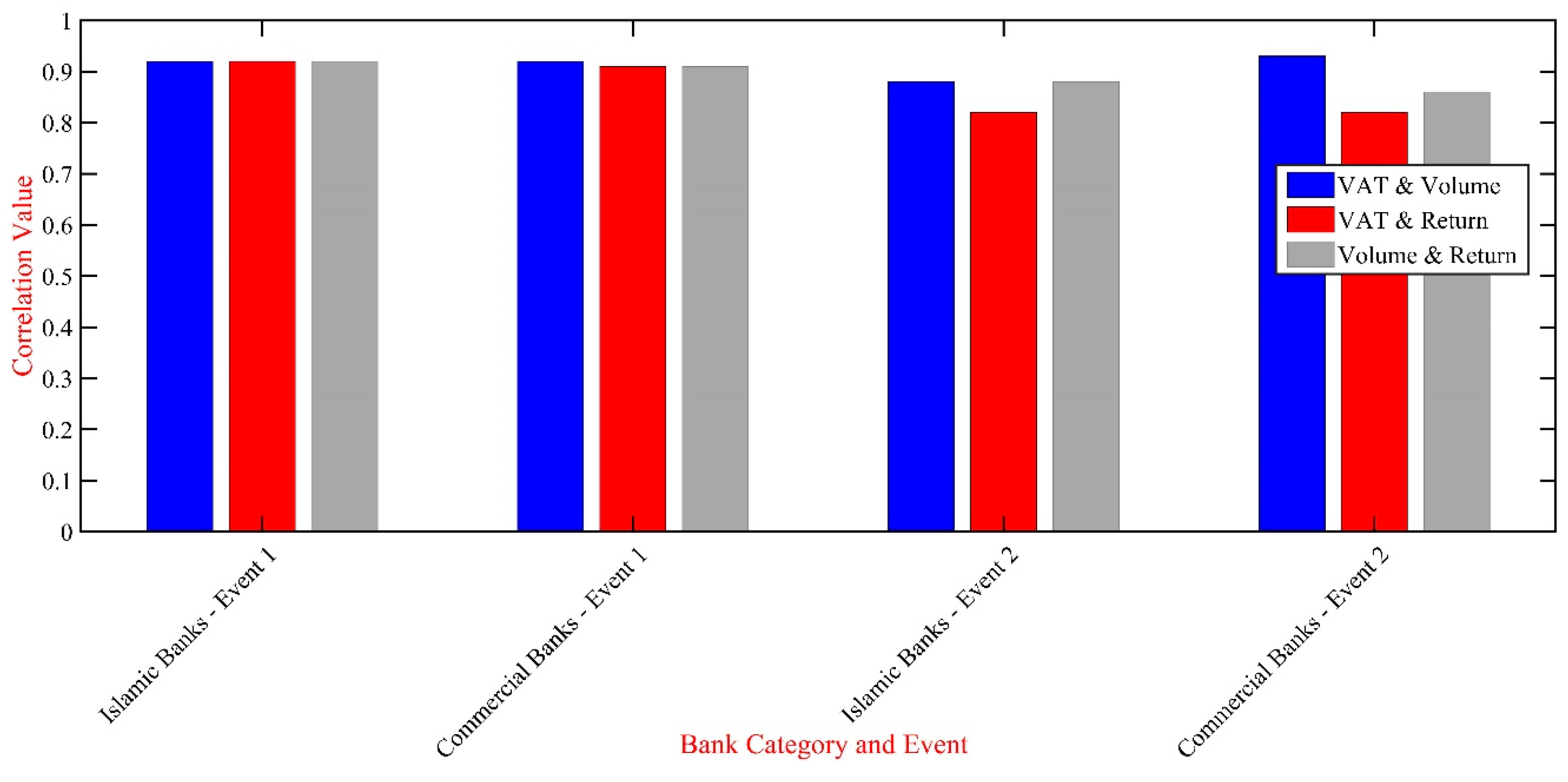

- The study's correlation analyses strongly support liquidity theory, with consistently robust correlations between VAT changes and trading volumes across the events, directly illustrating VAT’s profound impact on market liquidity.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Brown, S.; economics, J.W.-J. of financial; 1985, undefined Using Daily Stock Returns: The Case of Event Studies. ElsevierSJ Brown, JB WarnerJournal of financial economics, 1985•Elsevier.

- The Great Gap: Inequality and the Politics of Redistribution in Latin America - Merike Blofield - Google Books. Available online: https://books.google.com.my/books?hl=en&lr=&id=1UQhpL00n80C&oi=fnd&pg=PA313&dq=REDISTRIBUTION+VIA+TAXATION:+THE+LIMITED+ROLE+OF+THE+PERSONAL+INCOME+TAX+IN+DEVELOPING+COUNTRIESZolt+E,+Bird+R,+Rotman+J&ots=hH0lqR51J_&sig=f7vWT7PLZNj8hIp_Kug03Zrg8YY&redir_esc=y#v=onepage&q&f=false (accessed on 22 April 2024).

- Alhussain, M. The Impact of Value-Added Tax (VAT) Implementation on Saudi Banks. Journal of Accounting and Taxation 2020, 12, 12–27. [Google Scholar] [CrossRef]

- Elmawazini, K.; Khiyar, K.A.; Aydilek, A. Types of Banking Institutions and Economic Growth. International Journal of Islamic and Middle Eastern Finance and Management 2020, 13, 553–578. [Google Scholar] [CrossRef]

- Pandiangan, R.; Murwaningsari, E. Effect of Investment Decision and Tax Management on Stock Liquidity. International Journal of Finance & Banking Studies (2147-4486) 2020, 9, 64–77. [Google Scholar] [CrossRef]

- Risk, W.H.-J. of O.; Forthcoming, undefined; 2019, undefined Difference between the Determinants of Operational Risk Reporting in Islamic and Conventional Banks: Evidence from Saudi Arabia. papers.ssrn.com. papers.ssrn.com.

- Management, J.E.-J. of E. and; 2021, undefined Contribution of VAT to Economic Growth: A Dynamic CGE Analysis. sciendo.comJL EreroJournal of Economics and Management, 2021•sciendo.com 2021, 43, 22–51. [CrossRef]

- De La Feria, R.; Swistak, A. Designing a Progressive VAT. 2024.

- Bellon, M.; Dabla-Norris, E.; Khalid, S.; Economics, F.L.-J. of P.; 2022, undefined Digitalization to Improve Tax Compliance: Evidence from VAT e-Invoicing in Peru. ElsevierM Bellon, E Dabla-Norris, S Khalid, F LimaJournal of Public Economics, 2022•Elsevier.

- Kowal, A.; Sustainability, G.P.-; 2021, undefined VAT Efficiency—a Discussion on the VAT System in the European Union. mdpi.com.

- Bernardino, T.; Gabriel, R.; … J.Q.-; (March, and R.; 2024, undefined A Temporary VAT Cut in Three Acts: Announcement, Implementation, and Reversal. papers.ssrn.comT Bernardino, RD Gabriel, JN Quelhas, MLSS PereiraImplementation, and Reversal (March 29, 2024), 2024•papers.ssrn.com. 29 March.

- Bhattarai, K.; Nguyen, D.; Economies, C.N.-; 2019, undefined Impacts of Direct and Indirect Tax Reforms in Vietnam: A CGE Analysis. mdpi.com.

- Baydur, I.; Money, F.Y.-J. of; Banking, C. and; 2021, undefined VAT Treatment of the Financial Services: Implications for the Real Economy. Wiley Online LibraryI Baydur, F YilmazJournal of Money, Credit and Banking, 2021•Wiley Online Library 2021, 53, 2167–2200. [CrossRef]

- Caro, P. Di; Macroeconomics, A.S.-J. of; 2020, undefined The Heterogeneous Effects of Labor Informality on VAT Revenues: Evidence on a Developed Country. Elsevier.

- Sow, S.; of, M.G.-I.J.; 2020, undefined Effect of VAT Adoption on Manufacturing Firms in Ethiopia. pdfs.semanticscholar.orgS Sow, M GebresilasseInternational Journal of Economics and Finance, 2020•pdfs.semanticscholar.org 2020, 12. [CrossRef]

- Tian, Q.; Hu, A.; Zhang, Y.; Meng, Y. The Impact of Export Tax Rebate Reform on Industrial Exporters’ Soot Emissions: Evidence from China. Front Environ Sci 2023, 10. [Google Scholar] [CrossRef]

- Gopakumar, A.; Kaur, A.; … V.R.-J. of R. and; 2022, undefined The Sectoral Effects of Value-Added Tax: Evidence from UAE Stock Markets. mdpi.comAA Gopakumar, A Kaur, V Ramiah, K ReddyJournal of Risk and Financial Management, 2022•mdpi.com.

- Bubić, J.; Mladineo, L.; Šušak, T. VAT RATE CHANGE AND ITS IMPACT ON LIQUIDITY *; 2016.

- Ding, K.; Xu, H.; Yang, R. Taxation and Enterprise Innovation: Evidence from China’s Value-Added Tax Reform. Sustainability (Switzerland) 2021, 13. [Google Scholar] [CrossRef]

- Liu, Y.; Mao, J. How Do Tax Incentives Affect Investment and Productivity? Firm- Level Evidence from China. Am Econ J Econ Policy 2019, 11, 261–291. [Google Scholar] [CrossRef]

- Alsuhaibani, W.; Houmes, R.; Review, D.W.-E.M.; 2023, undefined The Evolution of Financial Reporting Quality for Companies Listed on the Tadawul Stock Exchange in Saudi Arabia: New Emerging Markets’ Evidence. Elsevier.

- Wasiuzzaman, S. Impact of COVID-19 on the Saudi Stock Market: Analysis of Return, Volatility and Trading Volume. Journal of Asset Management 2022, 23, 350–363. [Google Scholar] [CrossRef]

- Keen, M.; Lockwood, B. The Value Added Tax: Its Causes and Consequences. J Dev Econ 2010, 92, 138–151. [Google Scholar] [CrossRef]

- Emran, M.S.; Stiglitz, J.E. On Selective Indirect Tax Reform in Developing Countries. J Public Econ 2005, 89, 599–623. [Google Scholar] [CrossRef]

- Keen, M. VAT, Tariffs, and Withholding: Border Taxes and Informality in Developing Countries. J Public Econ 2008, 92, 1892–1906. [Google Scholar] [CrossRef]

- Boadway, R.; Sato, M. Optimal Tax Design and Enforcement with an Informal Sector. Am Econ J Econ Policy 2009, 1, 1–27. [Google Scholar] [CrossRef]

- Ibrahim, M.H. Issues in Islamic Banking and Finance: Islamic Banks, Shari’ah-Compliant Investment and Sukuk. Pacific-Basin Finance Journal 2015, 34, 185–191. [Google Scholar] [CrossRef]

- Owning Development: Taxation to Fight PovertyItriago D(2011) - Google Scholar. Available online: https://scholar.google.com/scholar?hl=en&as_sdt=0%2C5&q=Owning+Development%3A+Taxation+to+fight+povertyItriago+D%282011%29&btnG= (accessed on 22 April 2024).

- Bird, R.; Rev., E.Z.-U.L.; 2004, undefined Redistribution via Taxation: The Limited Role of the Personal Income Tax in Developing Countries. HeinOnline.

- Gemmell, N.; Morrissey, O. Distribution and Poverty Impacts of Tax Structure Reform in Developing Countries: How Little We Know. Development Policy Review 2005, 23, 131–144. [Google Scholar] [CrossRef]

- Shukeri, S.; Financial, F.A.-I.J. of; 2021, undefined Valued Added Tax (VAT) Impact on Economic and Societal Well-Beings (Pre-and Post COVID19): A Perception Study From Saudi Arabia. pdfs.semanticscholar.orgSN Shukeri, FD AlfordyInternational Journal of Financial Research, 2021•pdfs.semanticscholar.org.

- Review, A.A.-A.E. and F.; 2022, undefined Board Structure and Stock Market Liquidity: Evidence from Saudi’s Banking Industry. ideas.repec.orgAA AlmulhimAsian Economic and Financial Review, 2022•ideas.repec.org.

- Mgammal, M.H.; Al-Matari, E.M.; Alruwaili, T.F. Value-Added-Tax Rate Increases: A Comparative Study Using Difference-in-Difference with an ARIMA Modeling Approach. Humanities and Social Sciences Communications 2023 10:1 2023, 10, 1–17. [Google Scholar] [CrossRef]

- Boscá, J.E.; Doménech, / R; Ferri, / J; Rubio-Ramírez, / J; Doménech, R.; Ferri, J.; Rubio-Ramirez, J. Macroeconomic Effects of Taxes on Banking Macroeconomic Effects of Taxes on Banking *. 2019.

- Ramiah, V.; Martin, B.; Finance, I.M.-J. of B.&; 2013, undefined How Does the Stock Market React to the Announcement of Green Policies? ElsevierV Ramiah, B Martin, I MoosaJournal of Banking & Finance, 2013•Elsevier.

- Alghfais, M. SAMA Working Paper. 2017.

- Mackinlay, A.C. Event Studies in Economics and Finance; 1997; Vol. XXXV.

| Ref. | VAT | Market Liquidity | Volume Trading | Stock Performance | Banks | Method |

| Alhussain (2020) [3] | ✓ | ✓ | - | |||

| Gopakumar et al. (2020) [17] | ✓ | - | - | - | ✓ | ✓ |

| Bhattarai et al. [12] | ✓ | - | - | - | - | - |

| Bubić et al. (2016) [18] | ✓ | ✓ | - | - | - | - |

| Ding et al. (2021) [19] | ✓ | ✓ | - | - | ✓ | - |

| Liu et al. (2019) [20] | ✓ | - | - | - | ✓ | - |

| Current Study | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

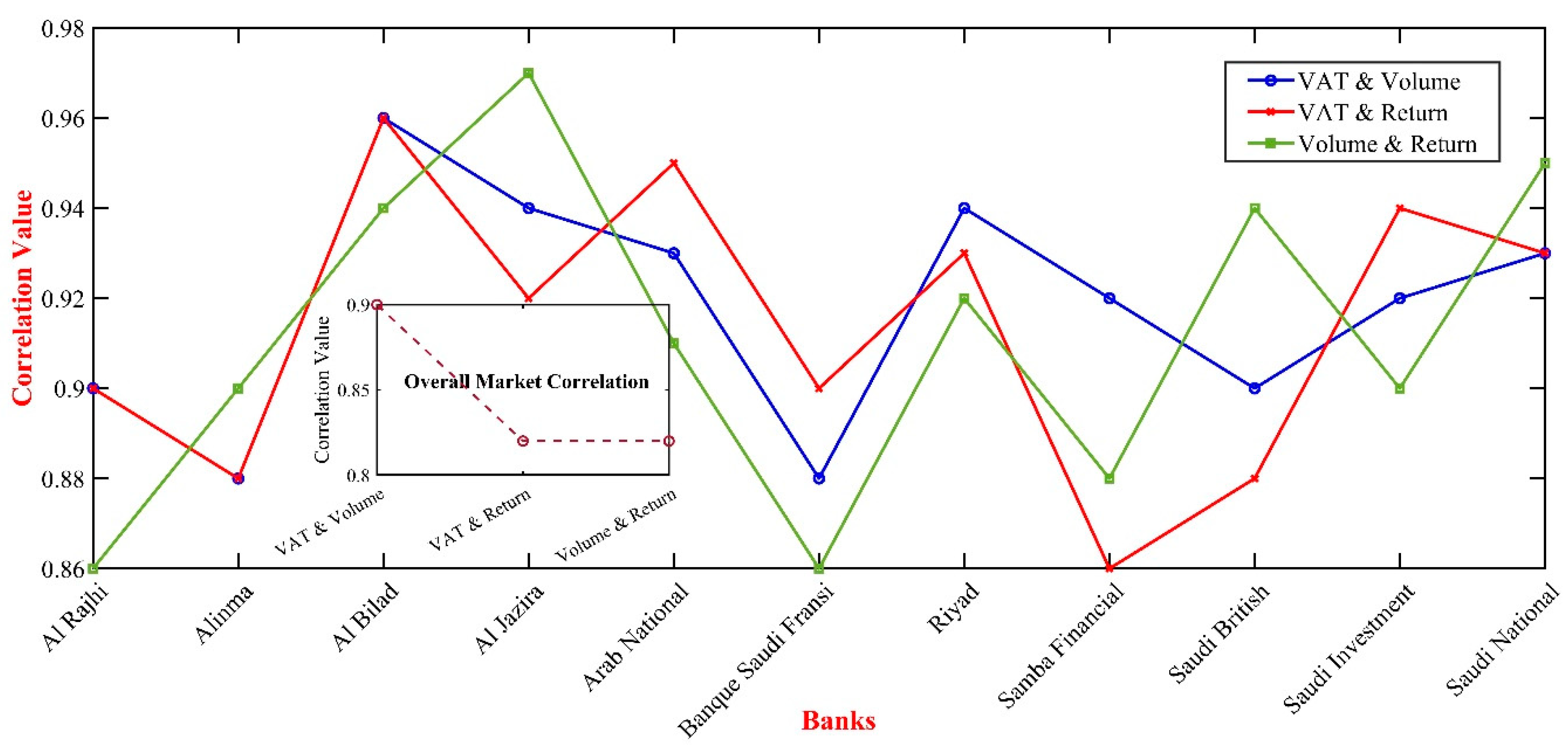

| Banks/Market | VAT & Volume | VAT & Return | Volume & Return |

| Overall Market | 0.90 | 0.82 | 0.82 |

| Al Rajhi (RJB) | 0.90 | 0.90 | 0.86 |

| Alinma (INB) | 0.88 | 0.88 | 0.90 |

| Al Bilad (BIB) | 0.96 | 0.96 | 0.94 |

| Al Jazira (JAB) | 0.94 | 0.92 | 0.97 |

| Arab National (ANB) | 0.93 | 0.95 | 0.91 |

| Banque Saudi Fransi (BSF) | 0.88 | 0.90 | 0.86 |

| Riyad (RB) | 0.94 | 0.93 | 0.92 |

| Samba Financial (SFG) | 0.92 | 0.86 | 0.88 |

| Saudi British (SBB) | 0.90 | 0.88 | 0.94 |

| Saudi Investment (SIB) | 0.92 | 0.94 | 0.90 |

| Saudi National (SNB) | 0.93 | 0.93 | 0.95 |

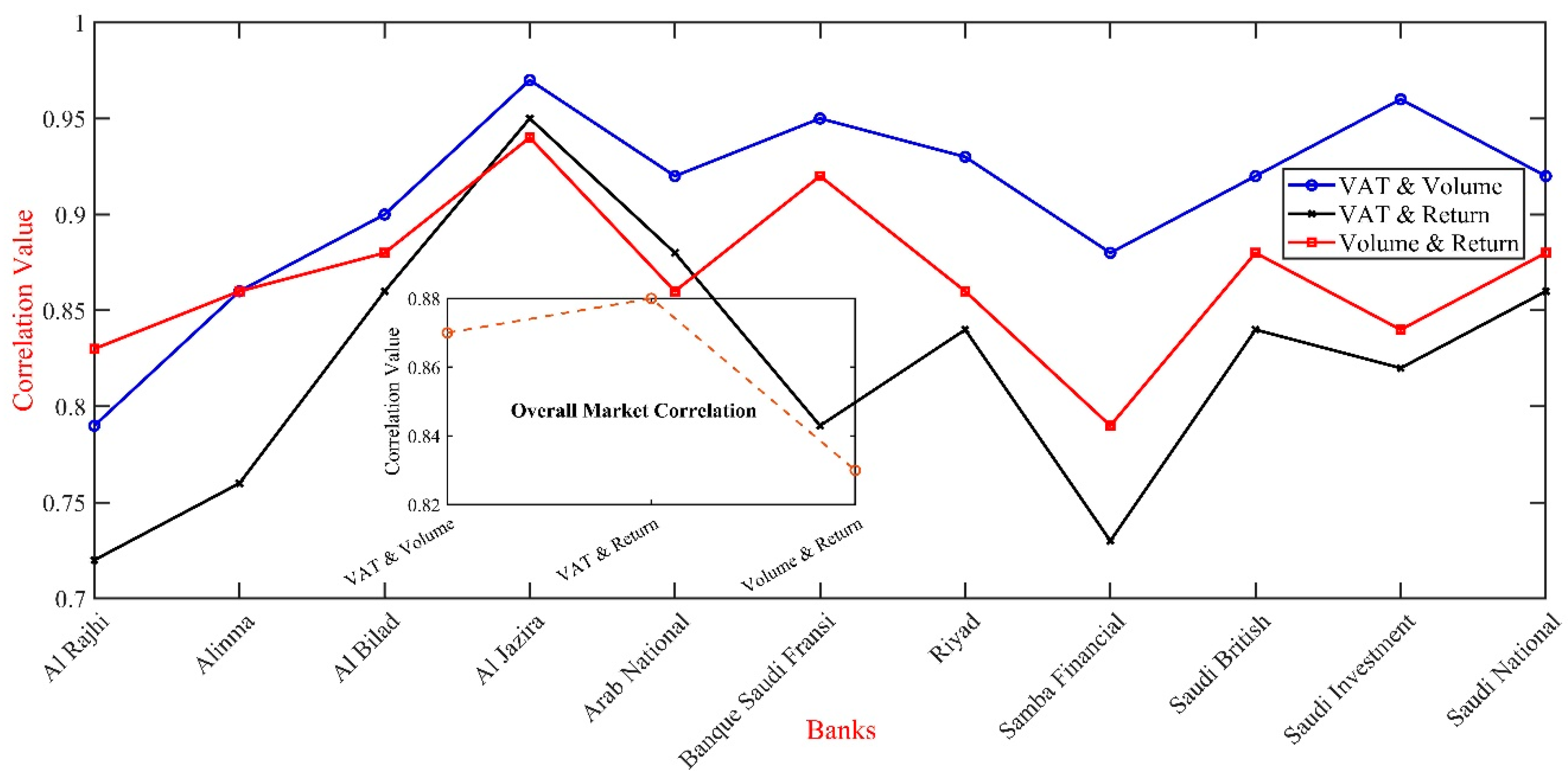

| Banks/Market | VAT & Volume | VAT & Return | Volume & Return |

| Overall Market | 0.87 | 0.88 | 0.83 |

| Al Rajhi (RJB) | 0.79 | 0.72 | 0.83 |

| Alinma (INB) | 0.86 | 0.76 | 0.86 |

| Al Bilad (BIB) | 0.90 | 0.86 | 0.88 |

| Al Jazira (JAB) | 0.97 | 0.95 | 0.94 |

| Arab National (ANB) | 0.92 | 0.88 | 0.86 |

| Banque Saudi Fransi (BSF) | 0.95 | 0.79 | 0.92 |

| Riyad (RB) | 0.93 | 0.84 | 0.86 |

| Samba Financial (SFG) | 0.88 | 0.73 | 0.79 |

| Saudi British (SBB) | 0.92 | 0.84 | 0.88 |

| Saudi Investment (SIB) | 0.96 | 0.82 | 0.84 |

| Saudi National (SNB) | 0.92 | 0.86 | 0.88 |

| Bank | 1st Event Volumes Change | 1st Event Returns Change | 2nd Event Volumes Change | 2nd Event Returns Change |

| Overall Market | ▼9.5% | ▼39.5% | ▲ 3.3% | ▲128.7% |

| Al Rajhi (RJB) | ▼2.2% | ▼123.4% | ▼32.2% | ▲86.4% |

| Alinma (INB) | ▼12.3% | ▼89.7% | ▼16.4% | ▲194.4% |

| Al Bilad (BIB) | ▲20.1% | ▼147.5% | ▲30.4% | ▲165.9% |

| Al Jazira (JAB) | ▼26.9% | ▼50% | ▲59.2% | ▲228.6% |

| Arab National (ANB) | ▼64.3% | ▼186.4% | ▼18.5% | ▲131.5% |

| Banque Saudi Fransi (BSF) | ▼62.5% | ▼143% | ▼16.4% | ▲151.1% |

| Riyad (RB) | ▼11.7% | ▼179.7% | ▼17.9% | ▲210.3% |

| Samba Financial (SFG) | ▼47.4% | ▼139.8% | ▼30.1% | ▲473.3% |

| Saudi British (SBB) | ▼25.7% | ▼238.5% | ▼35.5% | ▲81% |

| Saudi Investment (SIB) | ▼55.8% | ▼150.9% | ▲91.7% | ▲189.2% |

| Saudi National (SNB) | ▼63.4% | ▼224.5% | ▼35.5% | ▲144.2% |

| Metric | Event | Mean Difference | Standard Error of Difference | t-statistic |

| Trading Volume | 1st | -28.85% | 3.72% | -7.75 |

| Stock Returns | 1st | -124.1% | 14.70% | -8.44 |

| Trading Volume | 2nd | -8.55% | 2.53% | -3.38 |

| Stock Returns | 2nd | +193.65% | 29.35% | 6.60 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).