Submitted:

02 May 2024

Posted:

06 May 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

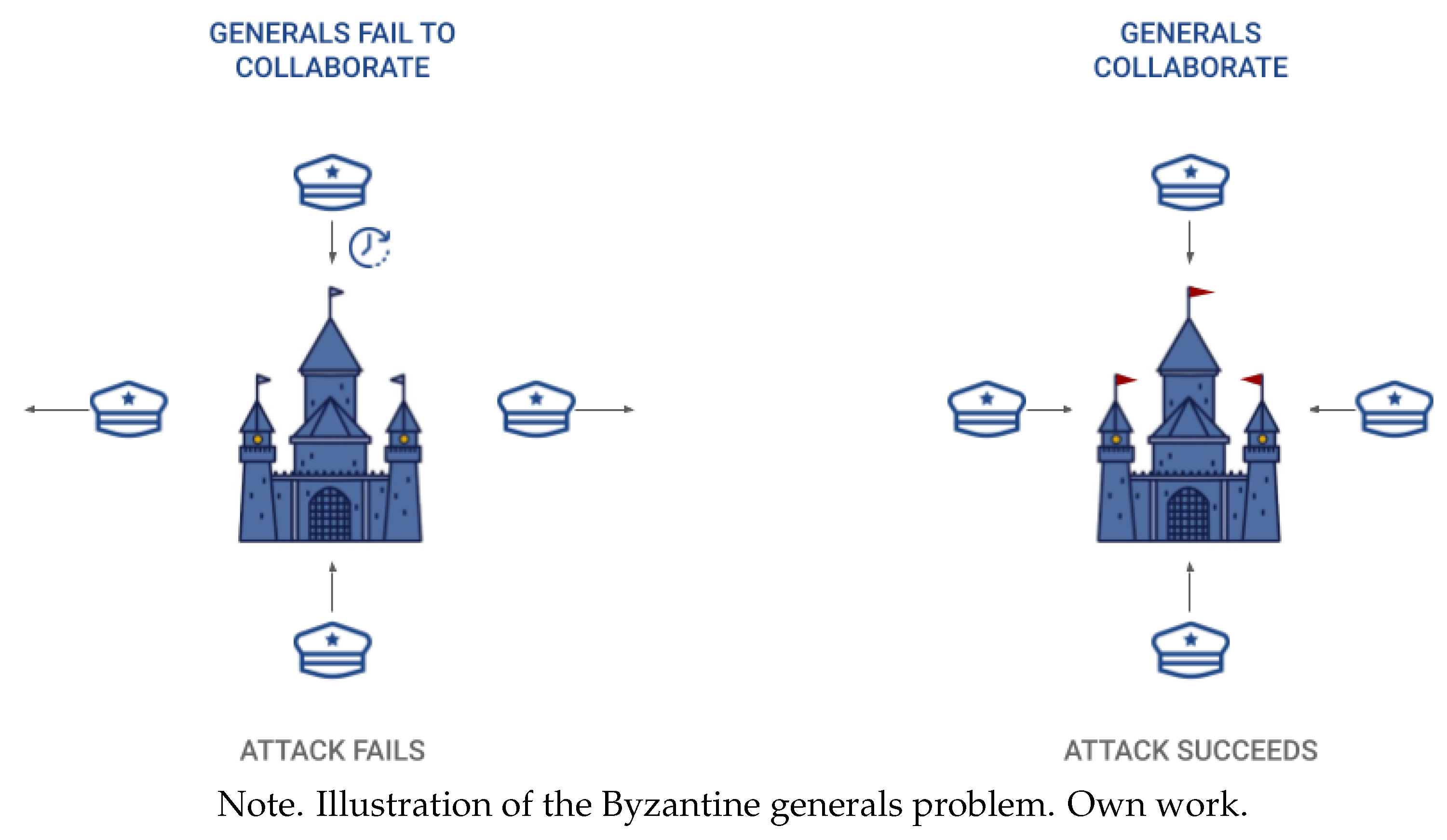

1.1. Blockchain: A Trust Machine

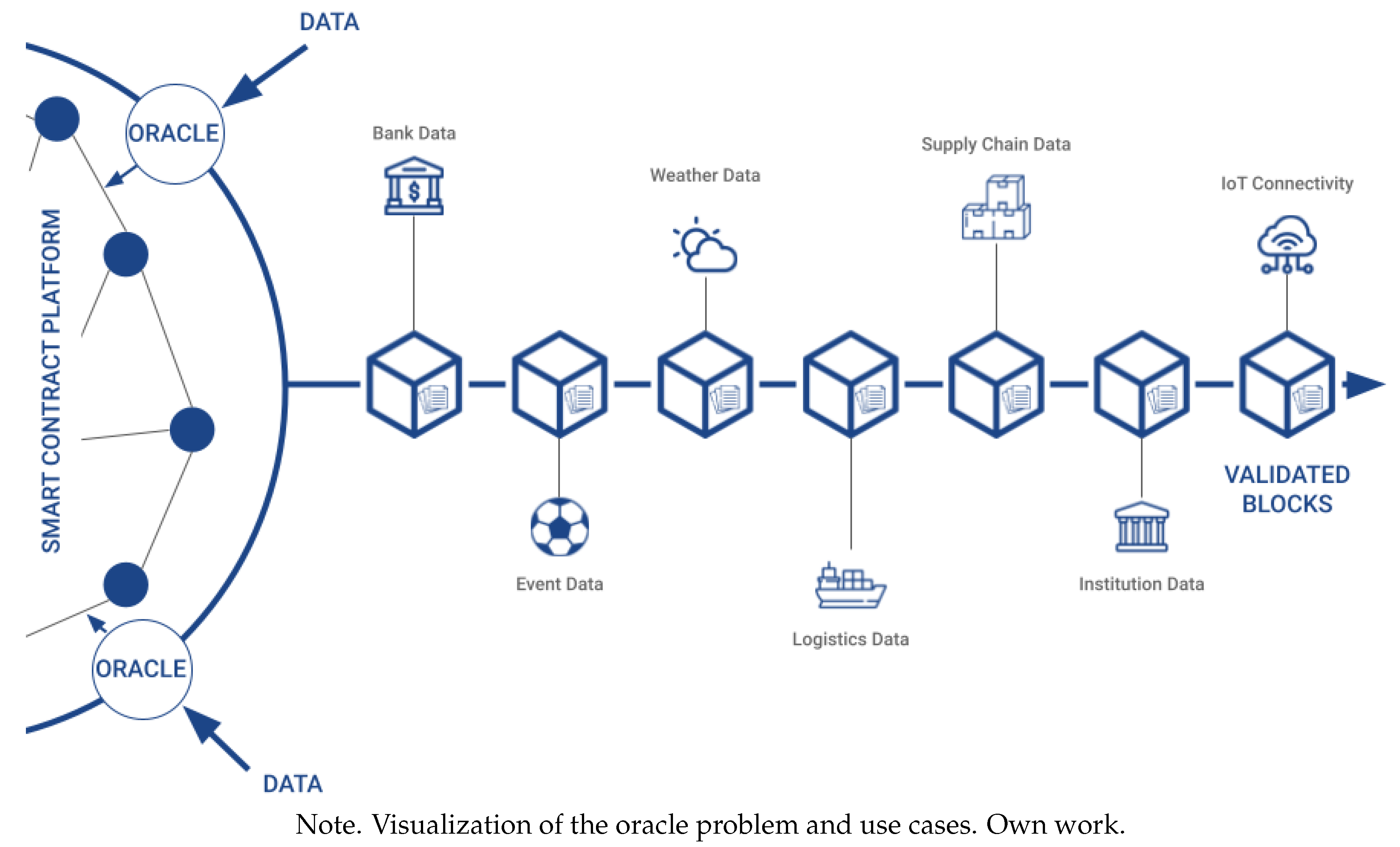

1.2. The Oracle Problem

1.3. Research Direction

2. Theory

2.1. Data Economy

2.1.1. Infrastructure

2.1.2. Data Brokers & Aggregators

2.1.3. Data Users

2.2. Data in Web3

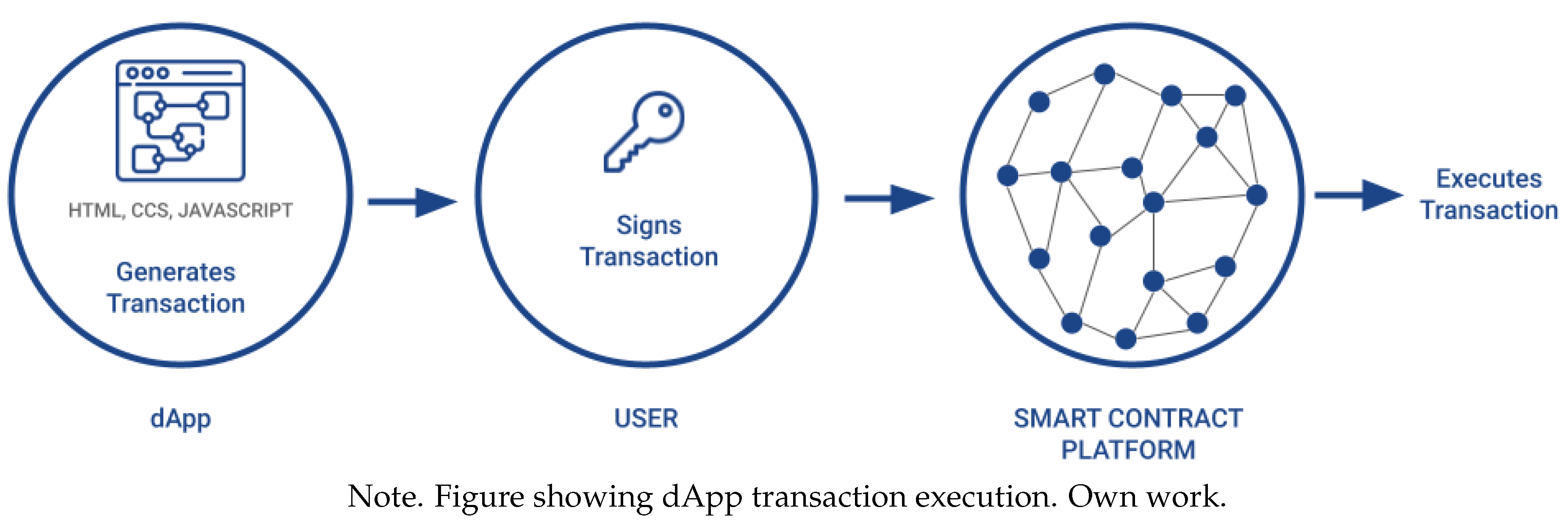

Ethereum’s state is a large data structure that holds not only all accounts and balances, but a machine state, which can change from block to block according to a predefined set of rules, and which can execute arbitrary machine code.

2.3. Significance

2.4. Use Cases

2.4.1. Interoperability, Real World Assets, Perpetuals

2.4.2. Supply Chain

As information on the blockchain is immutable but not necessarily true, without a trusted third party to verify the data to be inserted, the details provided should not be considered any more trustworthy than those contained in a legacy database.

2.4.3. Other

2.5. Oracle Implementations & Functions

2.5.1. Oracle Risks

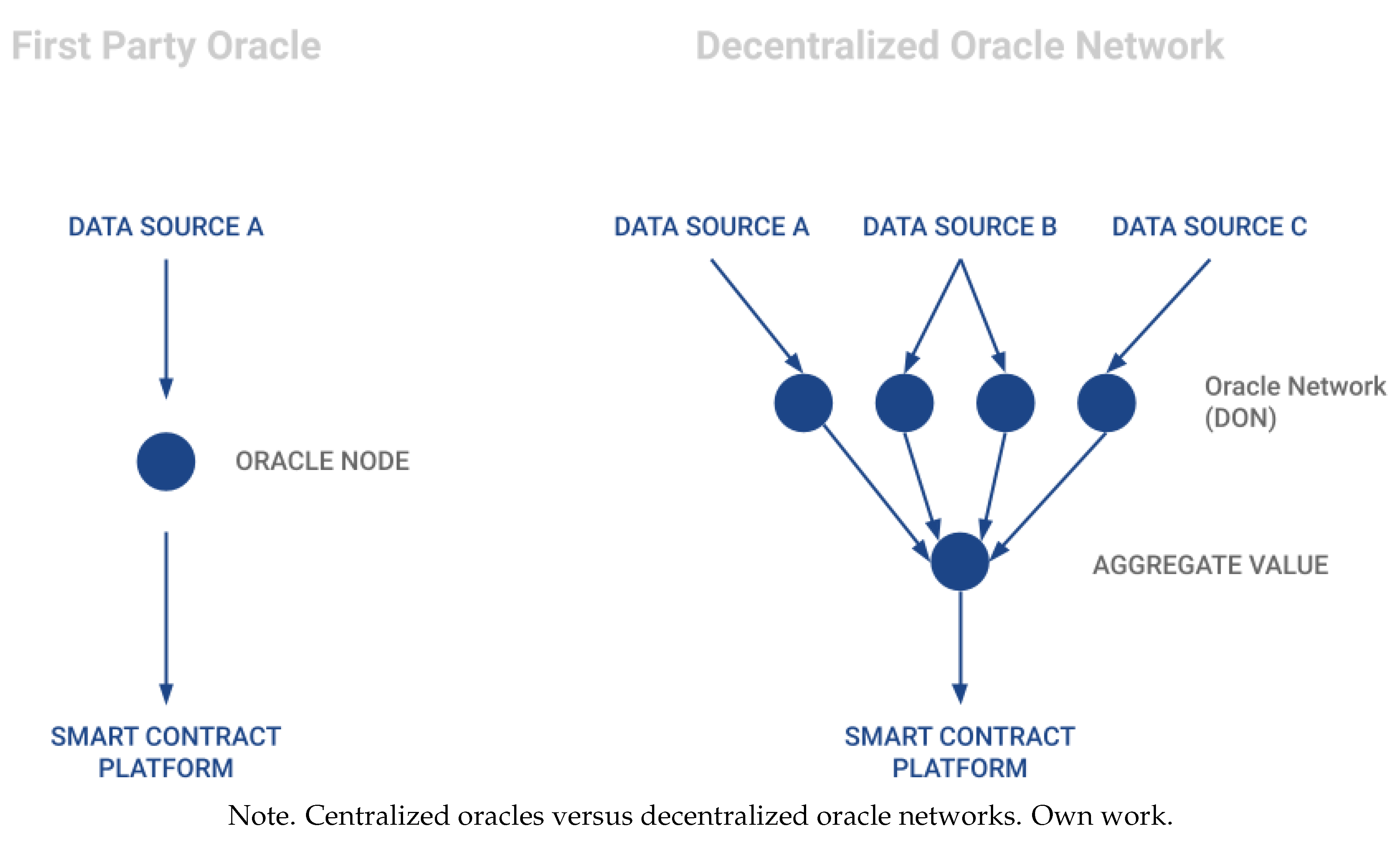

2.5.2. Oracle Implementations

| Protocol | Architecture | Networks | Token | Launch | Team |

|---|---|---|---|---|---|

| Chainlink | Multiplea | 11 | Yes | May 2019 | 400+ |

| Band | Algorithmic | 18 | Yes | Sept 2021b | 32 |

| API3 | 1st Party | 10 | Yes | July 2021 | 33 |

| Pyth | 1st Party | 20 | Yes | Aug 2021 | 25 |

| RedStone | Algorithmic | 39 | Planned | Jan 2022 | 14 |

| Tellor | Optimistic | 6 | Yes | Aug 2019 | 12 |

| Witnet | Algorithmic | 25 | Yes | Nov 2020 | 10 |

| DIA | Algorithmic | 8 | Yes | 2018c | 25 |

| Supra | Algorithmic | N/ad | Planned | N/ad | 90 |

| UMA | Optimistic | 2 | Yes | May 2021 | 136 |

Chainlink

Band Protocol

API3

Pyth

RedStone

Tellor

Witnet

DIA

Supra

UMA

Kleros

Augur

The Graph

2.5.3. Inputs and Functions

2Data

Computation & Functions

Automation

Randomness

Scalability & Off-Chain Computations

Privacy & Security

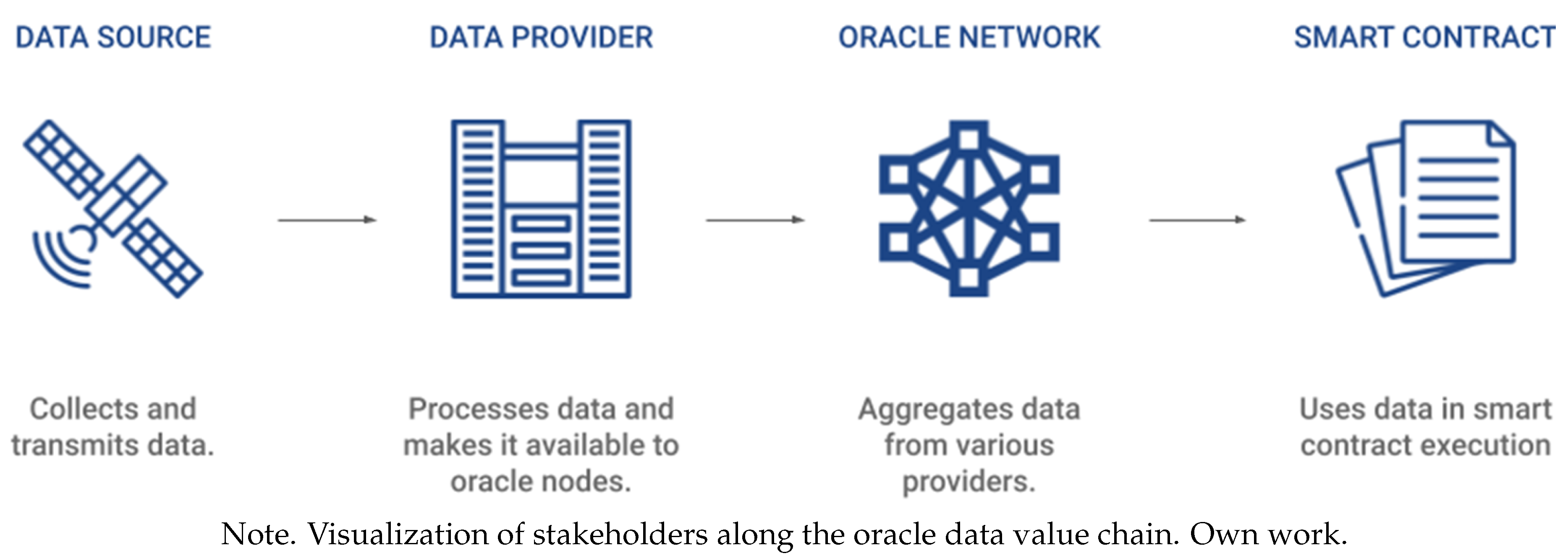

2.6. Stakeholders & Economics

2.6.1. Data Providers

2.6.2. Node Operators

2.6.3. Customers

2.6.4. Economics, Incentives, Staking

3. Literature Review

3.1. Summary of Research

3.2. Open Questions and Challenges

3.3. Focus of this Paper

- a)

-

Industry LandscapeThis includes questions regarding current stakeholders in the data delivery process, their interactions, and incentives. Furthermore, speaking with experts developing different oracle implementations may provide insights regarding the competitiveness and positioning of oracle projects. Also, we will explore the overall industry maturity and future outlook as perceived by these experts.

- b)

-

Innovation & OpportunitiesHere, we explore stand-out use cases beyond what exists today and opportunities for auxiliary business models that may improve processes along the value chain from data sourcing to data delivery. Finally, this category explores the process by which new use cases and in-demand data types are identified, implemented, and ultimately scaled.

- c)

-

Challenges & ImplementationsFocuses on elements of decentralization, security, validity, and reliability. Additionally, which data types are readily available and in demand, and which data types are difficult to make available on-chain? Furthermore, different design elements and the positioning of various oracle implementations to overcome challenges will be explored.The primary goal of this paper is to contribute to the current research by evaluating interviews with a wide variety of industry stakeholders, including oracle projects, node operators, and data providers, along with related companies and researchers. More details about the interviews and how collected data is processed are described below.

4. Methodology

5. Results & Discussion

5.1. Interviewee Pool

5.2. Industry Landscape

5.2.1. Market Dominance, Competition, and Implementation Design

5.2.2. Maturity & Current Use Cases

5.2.3. Future Outlook & Stakeholders

[there] might be a big market for it [tokenization] because obviously [the] financial market and financial industry is so big, you know, ten times or a hundred times bigger than I ever thought in my wildest dreams, even having studied economics, but it’s just so, so gigantic.

5.3. Innovation & Opportunities

5.3.1. Business Models

5.3.2. Innovation

5.3.3. Innovation Drivers

5.4. Challenges & Implementations

5.4.1. General Challenges & Design

[if] you need an oracle one time there, and it doesn’t need to be fast, and it doesn’t need to respond very often, it just needs to respond once. That requires a very different architecture than something like price feeds that need accurate data to the second and are like constantly being triggered.

5.4.2. Transparency

5.4.3. Project-Specific Comments

5.4.4. Protocol Decentralization

5.4.5. Use Case Decentralization

6. Summary

6.1. Conclusions

6.2. Practical Applications

6.3. Recommendations for Future Research

6.4. Limitations

Appendix A. Interviewee List

| Interview | Company / Position | Interview Date | Interview Duration |

| #1 | Team Lead - API3 | 31.05.2023 | 36:57 |

| #2 | Node Operations - Blocksize | 13.06.2023 | 47:52 |

| #3 | Team Lead - Blockdaemon | 14.06.2023 | 12:34 |

| #4 | Frmr. Node Operator - Blocksize | 18.06.2023 | 25:57 |

| #5 | CEO - Hyphen Global AG | 27.07.2023 | 22:30 |

| #6 | Independent researcher & Advisor | 31.07.2023 | 33:04 |

| #7 | Independent researcher (Academic) | 25.07.2023 | 37:19 |

| #8 | Node Operations - North West Nodes | 09.06.2023 | 49:10 |

| #9 | Anonymized PoR Feed Provider | 28.07.2023 | 28:30 |

| #10 | Executive - Pyth Data Association | 27.07.2023 | 24:47 |

| #11 | Executive - RedStone Oracles | 04.08.2023 | 39:11 |

| #12 | Founder - Truflation | 14.06.2023 | 38:02 |

| #13 | Executive - Tellor | 17.07.2023 | 32:13 |

| #14 | Founder - Witnet | 21.06.2023 | 36:24 |

| #15 | Executive and R&D - Supra | 04.08.2023 | 35:47 |

Appendix B. Interview Transcripts

Appendix C. Abbreviations

References

- Anderson, J. ’Ike Pono—designing the political and economic systems of the Internet generation 2019.

- Khalil, M.; Khawaja, K.F.; Sarfraz, M. The adoption of blockchain technology in the financial sector during the era of fourth industrial revolution: a moderated mediated model. Quality & Quantity 2022, 56, 2435–2452.

- Corradi, F.; Höfner, P. The disenchantment of Bitcoin: unveiling the myth of a digital currency. International Review of Sociology 2018, 28, 193–207. [CrossRef]

- Wang, X.; Ni, W.; Zha, X.; Yu, G.; Liu, R.P.; Georgalas, N.; Reeves, A. Capacity analysis of public blockchain. Computer Communications 2021, 177, 112–124. [CrossRef]

- Nakamoto, S. Bitcoin: A peer-to-peer electronic cash system 2008.

- Tapscott, A. Blockchain Revolution | Talks at Google. https://www.youtube.com/watch?v=3PdO7zVqOwc, 2016.

- Zheng, P.; Jiang, Z.; Wu, J.; Zheng, Z. Blockchain-based decentralized application: A survey. IEEE Open Journal of the Computer Society 2023. [CrossRef]

- Liu, J.; Liu, Z. A survey on security verification of blockchain smart contracts. IEEE access 2019, 7, 77894–77904. [CrossRef]

- Borge, M.; Kokoris-Kogias, E.; Jovanovic, P.; Gasser, L.; Gailly, N.; Ford, B. Proof-of-personhood: Redemocratizing permissionless cryptocurrencies. In Proceedings of the 2017 IEEE European Symposium on Security and Privacy Workshops (EuroS&PW). IEEE, 2017, pp. 23–26.

- Lamport, L.; Shostak, R.; Pease, M. The Byzantine generals problem. In Concurrency: the works of leslie lamport; 2019; pp. 203–226.

- Jakobsson, M.; Juels, A. Proofs of work and bread pudding protocols. In Proceedings of the Secure Information Networks: Communications and Multimedia Security IFIP TC6/TC11 Joint Working Conference on Communications and Multimedia Security (CMS’99) September 20–21, 1999, Leuven, Belgium. Springer, 1999, pp. 258–272.

- Saleh, F. Blockchain without waste: Proof-of-stake. The Review of financial studies 2021, 34, 1156–1190. [CrossRef]

- Solat, S.; Calvez, P.; Naït-Abdesselam, F. Permissioned vs. Permissionless Blockchain: How and Why There Is Only One Right Choice. J. Softw. 2021, 16, 95–106. [CrossRef]

- Athey, S.; Parashkevov, I.; Sarukkai, V.; Xia, J. Bitcoin pricing, adoption, and usage: Theory and evidence 2016.

- Chohan, U.W. The limits to Blockchain? Scaling vs. decentralization 2019.

- Liao, S. Steam No Longer Accepting Bitcoin Due to ’High Fees and Volatility’. https://www.theverge.com/2017/12/6/16743220/valve-steam-bitcoin-game-store-payment-method-crypto-volatility, 2017.

- Uddin, M.A.; Ali, M.H.; Masih, M. Bitcoin—A hype or digital gold? Global evidence. Australian economic papers 2020, 59, 215–231. [CrossRef]

- Zhang, X.; Li, Y.; Sun, M. Towards a formally verified EVM in production environment. In Proceedings of the Coordination Models and Languages: 22nd IFIP WG 6.1 International Conference, COORDINATION 2020, Held as Part of the 15th International Federated Conference on Distributed Computing Techniques, DisCoTec 2020, Valletta, Malta, June 15–19, 2020, Proceedings 22. Springer, 2020, pp. 341–349.

- Buterin, V. Devcon1: Understanding the Ethereum Blockchain Protocol. https://www.youtube.com/watch?v=gjwr-7PgpN8, 2016.

- Khan, S.N.; Loukil, F.; Ghedira-Guegan, C.; Benkhelifa, E.; Bani-Hani, A. Blockchain smart contracts: Applications, challenges, and future trends. Peer-to-peer Networking and Applications 2021, 14, 2901–2925. [CrossRef]

- Presthus, W.; O’Malley, N.O. Motivations and barriers for end-user adoption of bitcoin as digital currency. Procedia Computer Science 2017, 121, 89–97. [CrossRef]

- Shah, K.; Lathiya, D.; Lukhi, N.; Parmar, K.; Sanghvi, H. A systematic review of decentralized finance protocols. International Journal of Intelligent Networks 2023. [CrossRef]

- Caldarelli, G.; Rossignoli, C.; Zardini, A. Overcoming the blockchain oracle problem in the traceability of non-fungible products. Sustainability 2020, 12, 2391. [CrossRef]

- Beniiche, A. A study of blockchain oracles. arXiv preprint arXiv:2004.07140 2020.

- Nazarov, S. The Chainlink Network in 2023. https://blog.chain.link/the-chainlink-network-in-2023/, 2023.

- Breidenbach, L.; Cachin, C.; Chan, B.; Coventry, A.; Ellis, S.; Juels, A.; Koushanfar, F.; Miller, A.; Magauran, B.; Moroz, D.; et al. Chainlink 2.0: Next steps in the evolution of decentralized oracle networks. Chainlink Labs 2021, 1, 1–136.

- Palmer, M. Data is the new oil. ANA marketing maestros 2006, 3.

- McAfee, A.; Brynjolfsson, E.; Davenport, T.H.; Patil, D.; Barton, D. Big data: the management revolution. Harvard business review 2012, 90, 60–68.

- Marr, B. Big data in practice: how 45 successful companies used big data analytics to deliver extraordinary results; John Wiley & Sons, 2016.

- Davenport, T.H.; Harris, J.G. Competing on analytics: the new science of Winning. Harvard business review press, Language 2007, 15, 24.

- Lindecrantz, E.; Gi, M.T.P.; Zerbi, S. Personalized Experience for Customers: Driving Differentiation in Retail| McKinsey. McKinsey & Company 2020.

- Raghupathi, W.; Raghupathi, V. Big data analytics in healthcare: promise and potential. Health information science and systems 2014, 2, 1–10. [CrossRef]

- Baldwin, R. Netflix gambles on big data to become the HBO of streaming. Wired. Retrieved April 2012, 9, 2021.

- Alphabet Inc.. Alphabet Inc. Form 10-K For the Fiscal Year Ended December 31, 2022. https://abc.xyz/assets/investor/static/pdf/20230203_alphabet_10K.pdf?cache=5ae4398, 2023.

- Amazon. AMAZON.COM, INC. FORM 10-K For the Fiscal Year Ended December 31, 2022. https://d18rn0p25nwr6d.cloudfront.net/CIK-0001018724/d2fde7ee-05f7-419d-9ce8-186de4c96e25.pdf, 2023.

- Microsoft 2022 Annual Report. https://www.microsoft.com/investor/reports/ar22/index.html, 2023.

- Oracle Announces Fiscal 2022 Fourth Quarter and Fiscal Full Year Financial Results. https://investor.oracle.com/investor-news/news-details/2022/Oracle-Announces-Fiscal-2022-Fourth-Quarter-and-Fiscal-Full-Year-Financial-Results/default.aspx, 2023.

- Ofulue, J.; Benyoucef, M. Data monetization: insights from a technology-enabled literature review and research agenda. Management Review Quarterly 2022, pp. 1–45.

- Melendez, S.; Pasternack, A. Here are the data brokers quietly buying and selling your personal information. Fast Company 2019, 2.

- Giombi, K.; Viator, C.; Hoover, J.; Tzeng, J.; Sullivan, H.W.; O’Donoghue, A.C.; Southwell, B.G.; Kahwati, L.C. The impact of interactive advertising on consumer engagement, recall, and understanding: A scoping systematic review for informing regulatory science. Plos one 2022, 17, e0263339. [CrossRef]

- Loomis, C.J. BlackRock: The $4.3 Trillion Force. https://fortune.com/2014/07/07/blackrock-larry-fink/, 2014.

- Haberly, D.; MacDonald-Korth, D.; Urban, M.; Wójcik, D. Asset management as a digital platform industry: A global financial network perspective. Geoforum 2019, 106, 167–181. [CrossRef]

- Ungarino, R. Here are 9 fascinating facts to know about BlackRock, the world’s largest asset manager. https://www.businessinsider.com/what-to-know-about-blackrock-larry-fink-biden-cabinet-facts-2020-12, 2020.

- Henderson, R.; Walker, O. BlackRock’s black box: The technology hub of modern finance. Financial Times 2020.

- Bailly, A.; Blanc, C.; Francis, É.; Guillotin, T.; Jamal, F.; Wakim, B.; Roy, P. Effects of dataset size and interactions on the prediction performance of logistic regression and deep learning models. Computer Methods and Programs in Biomedicine 2022, 213, 106504. [CrossRef]

- Elallid, B.B.; Benamar, N.; Hafid, A.S.; Rachidi, T.; Mrani, N. A comprehensive survey on the application of deep and reinforcement learning approaches in autonomous driving. Journal of King Saud University-Computer and Information Sciences 2022, 34, 7366–7390. [CrossRef]

- Chui, M.; Hazan, E.; Roberts, R.; Singla, A.; Smaje, K. The economic potential of generative AI 2023.

- Szabo, N. The God Protocols. http://web.archive.org/web/20061230075325/http://www.theiia.org/ITAudit/index.cfm?act=itaudit.archive&fid=216, 1999.

- Szabo, N. Unenumerated: Bit Gold. https://unenumerated.blogspot.com/2005/12/bit-gold.html, 2008.

- Lee, D.K.C.; Guo, L.; Wang, Y. Cryptocurrency: A new investment opportunity? Available at SSRN 2994097 2017.

- Bitnodes. https://bitnodes.io/.

- CoinGecko. Total Crypto Market Cap Chart. https://www.coingecko.com/en/global-charts.

- Covarrubias, L.; Zadamig, J. Organization, Autonomy and Decentralization in the Information Age. Journal of Legislation Science-Number 2019.

- Ethereum.org. Ethereum Virtual Machine (EVM). https://ethereum.org/en/developers/docs/evm/, 2023.

- Chainlink. Understanding How Data and APIs Power Next-Generation Economies. https://blog.chain.link/understanding-how-data-and-apis-power-next-generation-economies/, 2020.

- Caldarelli, G. Real-world blockchain applications under the lens of the oracle problem. A systematic literature review. In Proceedings of the 2020 IEEE International Conference on Technology Management, Operations and Decisions (ICTMOD). IEEE, 2020, pp. 1–6.

- Chainlink. Hybrid Smart Contracts Explained. https://chain.link/education-hub/hybrid-smart-contracts, 2023.

- Kshetri, N. Blockchain-based smart contracts to provide crop insurance for smallholder farmers in developing countries. IT Professional 2021, 23, 58–61. [CrossRef]

- O’Donnell, A.R. Etherisc Launches Blockchain-Backed Parametric Flight Delay Insurance. https://iireporter.com/etherisc-launches-blockchain-backed-parametric-flight-delay-insurance/, 2022.

- Hamledari, H.; Fischer, M. Role of blockchain-enabled smart contracts in automating construction progress payments. Journal of legal affairs and dispute resolution in engineering and construction 2021, 13, 04520038. [CrossRef]

- Ghosh, R.K.; Gupta, S.; Singh, V.; Ward, P.S. Demand for crop insurance in developing countries: New evidence from India. Journal of agricultural economics 2021, 72, 293–320. [CrossRef]

- Rataj, E.; Kunzweiler, K.; Garthus-Niegel, S. Extreme weather events in developing countries and related injuries and mental health disorders-a systematic review. BMC public health 2016, 16, 1–12. [CrossRef]

- Brüntrup, M.; Heidhues, F. Subsistence agriculture in development: Its role in process of structural change; Grauer, 2002.

- Ranasinghe, R.; Ruane, A.C.; Vautard, R.; Arnell, N.; Coppola, E.; Cruz, F.A.; Dessai, S.; Saiful Islam, A.; Rahimi, M.; Carrascal, D.R.; et al. Climate change information for regional impact and for risk assessment 2021.

- Petram, L.O.; et al. The world’s first stock exchange: How the Amsterdam market for Dutch East India Company shares became a modern securities market, 1602-1700. PhD thesis, Universiteit van Amsterdam [Host], 2011.

- Cong, L.W.; He, Z. Blockchain disruption and smart contracts. The Review of Financial Studies 2019, 32, 1754–1797. [CrossRef]

- Attaran, M.; Gunasekaran, A. Applications of blockchain technology in business: challenges and opportunities 2019.

- Semenzin, S.; Rozas, D.; Hassan, S. Blockchain-based application at a governmental level: disruption or illusion? The case of Estonia. Policy and Society 2022, 41, 386–401. [CrossRef]

- Young, C.R. A Lawyer’s Divorce: Will Decentralized Ledgers and Smart Contracts Succeed in Cutting Out the Middleman. Wash. UL Rev. 2018, 96, 649.

- Bush, C. Dealing with the conflicts of interest of credit rating agencies: a balanced cure for the disease. Capital Markets Law Journal 2022, 17, 334–364. [CrossRef]

- Merle, R. A guide to the financial crisis—10 years later. Washington Post. https://www. washingtonpost. com/business/economy/a-guide-to-the-financial-crisis–10-years-later/2018/09/10/114b76ba-af10-11e8-a20b-5f4f84429666_story. html 2018.

- Caldarelli, G.; Ellul, J. The blockchain oracle problem in decentralized finance—a multivocal approach. Applied Sciences 2021, 11, 7572. [CrossRef]

- Chainalysis. Wormhole Hack: Lessons from the Wormhole Exploit. https://www.chainalysis.com/blog/wormhole-hack-february-2022/, 2022.

- Circle. Cross-Chain Transfer Protocol (CCTP) | Circle. https://www.circle.com/en/cross-chain-transfer-protocol.

- Chainlink. Verifiable Randomness for Blockchain Smart Contracts. https://blog.chain.link/chainlink-vrf-on-chain-verifiable-randomness/, 2020.

- Scott, S.V.; Zachariadis, M. The Society for Worldwide Interbank Financial Telecommunication (SWIFT): Cooperative governance for network innovation, standards, and community; Taylor & Francis, 2014.

- Swift. Swift Explores Blockchain Interoperability to Remove Friction from Tokenised Asset Settlement. https://www.swift.com/news-events/news/swift-explores-blockchain-interoperability-remove-friction-tokenised-asset-settlement, 2023.

- Sazandrishvili, G. Asset tokenization in plain English. Journal of Corporate Accounting & Finance 2020, 31, 68–73.

- Kim, S. Fractional ownership, democratization and bubble formation-the impact of blockchain enabled asset tokenization 2020.

- He, S.; Manela, A.; Ross, O.; von Wachter, V. Fundamentals of perpetual futures. arXiv preprint arXiv:2212.06888 2022.

- Ng, T.S. Blockchain and beyond: smart contracts. Bus. L. Today 2017, p. 1.

- Kamath, R. Food traceability on blockchain: Walmart’s pork and mango pilots with IBM. The Journal of the British Blockchain Association 2018, 1. [CrossRef]

- PYMNTS. Walmart Puts Pricey Blockchain Food Tracking Platform on Ice. https://www.pymnts.com/blockchain/2022/walmart-puts-pricey-blockchain-food-tracking-platform-on-ice/, 2022.

- Caldarelli, G. Understanding the blockchain oracle problem: A call for action. Information 2020, 11, 509. [CrossRef]

- Meinert, E.; Alturkistani, A.; Foley, K.A.; Osama, T.; Car, J.; Majeed, A.; Van Velthoven, M.; Wells, G.; Brindley, D.; et al. Blockchain implementation in health care: Protocol for a systematic review. JMIR research protocols 2019, 8, e10994. [CrossRef]

- Zeiselmair, A.; Steinkopf, B.; Gallersdörfer, U.; Bogensperger, A.; Matthes, F. Analysis and Application of Verifiable Computation Techniques in Blockchain Systems for the Energy Sector. Frontiers in Blockchain 2021, 4, 725322. [CrossRef]

- Latifi, S.; Zhang, Y.; Cheng, L.C. Blockchain-based real estate market: One method for applying blockchain technology in commercial real estate market. In Proceedings of the 2019 IEEE international conference on blockchain (blockchain). IEEE, 2019, pp. 528–535.

- Caldarelli, G.; Zardini, A.; Rossignoli, C. Blockchain adoption in the fashion sustainable supply chain: Pragmatically addressing barriers. Journal of Organizational Change Management 2021, 34, 507–524. [CrossRef]

- Chipolina, S. Oracle exploit sees $89 million liquidated on compound. Decrypt 2020.

- Qin, K.; Zhou, L.; Gamito, P.; Jovanovic, P.; Gervais, A. An empirical study of defi liquidations: Incentives, risks, and instabilities. In Proceedings of the Proceedings of the 21st ACM Internet Measurement Conference, 2021, pp. 336–350.

- Chainlink. Three Years on Mainnet. https://blog.chain.link/three-years-on-mainnet/, 2022.

- Chainlink. How Chainlink Price Feeds Secure the DeFi Ecosystem. https://blog.chain.link/chainlink-price-feeds-secure-defi/, 2022.

- Berger, B.; Huber, S.; Pfeifhofer, S. OraclesLink: An architecture for secure oracle usage. In Proceedings of the 2020 Second International Conference on Blockchain Computing and Applications (BCCA). IEEE, 2020, pp. 66–72.

- SmartContent. Band Protocol and Chainlink: A Comparative Analysis. https://smartcontentpublication.medium.com/a-comparative-analysis-of-band-protocol-and-chainlink-54b7d14823b5, 2021.

- Band. Band Protocol | LinkedIn | Team. https://th.linkedin.com/company/band-protocol.

- Benligiray, B.; Milic, S.; Vänttinen, H. Decentralized apis for web 3.0. API3 Foundation Whitepaper 2020.

- API3. Api3 | linkedin | Team. https://www.linkedin.com/company/api3.

- API3. What are first-party oracles? | Documentation. https://dapi-docs.api3.org/explore/introduction/first-party.html.

- Pyth Network: A First-Party Oracle. https://pyth.network/whitepaper.pdf, 2022.

- Pyth Data Association. https://pyth.network/.

- Pyth. Pyth Network | LinkedIn | Team. https://ch.linkedin.com/company/pyth-network.

- RedStone. https://app.redstone.finance/.

- Redstone Docs. https://docs.redstone.finance.

- RedStone. Introducing RedStone. https://medium.com/@RedStone_Finance/introducing-redstone-1b79875df4f0, 2022.

- RedStone. Redstone Oracles | LinkedIn | Team. https://ch.linkedin.com/company/redstone-finance.

- Tellor. The Tellor Whitepaper | Decentralized Oracle Protocol. https://tellor.io/whitepaper/, 2022. Accessed on 2024-03-20.

- Tellor. Tellor | LinkedIn | Team. https://www.linkedin.com/company/tellorinc/about/.

- Core, T. Tellor Launches to Mainnet! https://tellor.io/tellor-launches-to-mainnet/, 2019. Accessed on 2024-03-20.

- Witnet. Witnet Oracle Docs. https://docs.witnet.io/. Retrieved August 26, 2023.

- Sánchez de Pedro, A. Witnet After Mainnet: This Is Just the Beginning! https://medium.com/witnet/witnet-after-mainnet-this-is-just-the-beginning-e4b27485c36b, 2020.

- Dia App | Cross-Chain Oracles for Web3. https://www.diadata.org/app.

- DIA Technical Structure. https://docs.diadata.org/introduction/dia-technical-structure.

- Coinmonks. Dia—Open Source Oracles for Web3. https://medium.com/coinmonks/dia-open-source-oracles-for-Web3-c873ddd46a50, 2022.

- DIA. Dia Association | LinkedIn | Team. https://ch.linkedin.com/company/diadata-org.

- Supra Research. Dora: Distributed Oracle Agreement. https://supraoracles.com/docs/SupraOracles-DORA-Whitepaper.pdf, 2023.

- Supra. Supra Oracles | LinkedIn | Team. https://www.linkedin.com/company/supraoracles/people/.

- Supra Oracles. https://supraoracles.com/.

- UMA. https://uma.xyz. Retrieved August 26, 2023.

- UMA. Uma | LinkedIn | Team. https://www.linkedin.com/company/umaproject. Retrieved August 26, 2023.

- Lambur, H. Introducing UMA’s Optimistic Oracle. https://medium.com/uma-project/introducing-umas-optimistic-oracle-d92ce5d1a4bc, 2021.

- Lesaege, C.; George, W.; Ast, F. Kleros: Long Paper v2. 0.2. Kleros 2021.

- Kleros. Kleros. https://kleros.io/.

- Kleros. Kleros | LinkedIn | Team. https://fr.linkedin.com/company/kleros.

- Augur. The Augur White Paper: A Decentralized Oracle and Prediction Market Platform 2018.

- Ramirez, B. A Resurgent Online Betting Market Is Boosted by Crypto and Current Events. https://www.nbcnews.com/tech/internet/polymarket-online-bet-submersible-russia-war-rcna93122, 2023.

- Tal, Y.; Ramirez, B.; Pohlmann, J. The Graph: A Decentralized Query Protocol for Blockchains. Disponibile all’indirizzo: https://raw. githubusercontent. com/graphprotocol/research/master/papers/whitepaper/the-graph-whitepaper. pdf 2018.

- Kaleem, M.; Shi, W. Demystifying pythia: A survey of chainlink oracles usage on ethereum. In Proceedings of the Financial Cryptography and Data Security. FC 2021 International Workshops: CoDecFin, DeFi, VOTING, and WTSC, Virtual Event, March 5, 2021, Revised Selected Papers 25. Springer, 2021, pp. 115–123.

- Aquilina, M.; Frost, J.; Schrimpf, A. Decentralised finance (DeFi): a functional approach. Available at SSRN 4325095 2023. [CrossRef]

- DeFiLlama. https://defillama.com/.

- Chainlink. The Chainlink Economics 2.0 Staking Protocol and Staking v0.1 Launch Details. https://blog.chain.link/chainlink-staking-launch-details/, 2022.

- Chainlink Data. Mainnet Data. https://data.chain.link/ethereum/mainnet.

- Chainlink Labs Research. Deco Research Series #1: Introduction. https://blog.chain.link/deco-introduction/, 2023.

- Papacharissiou, H. Build a Parametric Insurance Smart Contract with Chainlink. https://blog.chain.link/parametric-insurance-smart-contract/, 2020.

- Chainlink Blog. How to Connect a Tesla to a Smart Contract via a Chainlink Node. https://blog.chain.link/create-tesla-smart-contract-rental/, 2020.

- Stipčević, M.; Koç, Ç.K. True random number generators. In Open Problems in Mathematics and Computational Science; Springer, 2014; pp. 275–315.

- Solouki, M.; Bamakan, S.M.H. An in-depth insight at digital ownership through dynamic NFTs. Procedia Computer Science 2022, 214, 875–882. [CrossRef]

- Hafid, A.; Hafid, A.S.; Samih, M. Scaling blockchains: A comprehensive survey. IEEE access 2020, 8, 125244–125262. [CrossRef]

- Chainlink. What is Off-chain Data and Off-chain Computation? https://chain.link/education-hub/off-chain-data, 2023.

- Conti, M.; Kumar, E.S.; Lal, C.; Ruj, S. A survey on security and privacy issues of bitcoin. IEEE communications surveys & tutorials 2018, 20, 3416–3452.

- Finck, M. Blockchains and data protection in the European Union. Eur. Data Prot. L. Rev. 2018, 4, 17. [CrossRef]

- Zhang, F.; Cecchetti, E.; Croman, K.; Juels, A.; Shi, E. Town crier: An authenticated data feed for smart contracts. In Proceedings of the Proceedings of the 2016 aCM sIGSAC conference on computer and communications security, 2016, pp. 270–282.

- Juels, A. Town Crier and Chainlink: Enriching the Function of Blockchain Oracles. https://blog.chain.link/town-crier-and-chainlink/, 2019.

- Jessel, B. Chainlink’s New Acquisition from Cornell University Could Transform Blockchain for Good. https://www.forbes.com/sites/benjessel/2020/08/29/chainlinks-new-acquisition-from-cornell-university-could-transform-blockchain-for-good/, 2020.

- Zhao, Y.; Kang, X.; Li, T.; Chu, C.K.; Wang, H. Toward trustworthy defi oracles: past, present, and future. IEEE Access 2022, 10, 60914–60928.

- Truflation. Methodology. https://truflation.com/methodology. Retrieved August 26, 2023. [CrossRef]

- Kessler, S. Chainlink ‘Proof of Reserve’ Proves Little Beyond Data Going In, Coming Out. https://www.coindesk.com/tech/2023/07/05/chainlink-proof-of-reserve-proves-little-beyond-data-going-in-coming-out/, 2023.

- LinkRiver. Guardians of the Web3 Economy: Chainlink Node Operators. https://blog.linkriver.io/chainlink-node/, 2023.

- Mühlberger, R.; Bachhofner, S.; Castelló Ferrer, E.; Di Ciccio, C.; Weber, I.; Wöhrer, M.; Zdun, U. Foundational oracle patterns: Connecting blockchain to the off-chain world. In Proceedings of the Business Process Management: Blockchain and Robotic Process Automation Forum: BPM 2020 Blockchain and RPA Forum, Seville, Spain, September 13–18, 2020, Proceedings 18. Springer, 2020, pp. 35–51.

- Ampleforth docs. https://docs.ampleforth.org/.

- Murimi, R.M.; Wang, G.G. On elastic incentives for blockchain oracles. Journal of Database Management (JDM) 2021, 32, 1–26. [CrossRef]

- Ellis, S.; Juels, A.; Nazarov, S. Chainlink: A decentralized oracle network. Retrieved March 2017, 11, 1.

- De Collibus, F.M.; Partida, A.; Piškorec, M.; Tessone, C.J. Heterogeneous preferential attachment in key ethereum-based cryptoassets. Frontiers in Physics 2021, 9, 720708.

- Egberts, A. The oracle problem-an analysis of how blockchain oracles undermine the advantages of decentralized ledger systems. Available at SSRN 3382343 2017.

- Eberhardt, J.; Tai, S. On or off the blockchain? Insights on off-chaining computation and data. In Proceedings of the Service-Oriented and Cloud Computing: 6th IFIP WG 2.14 European Conference, ESOCC 2017, Oslo, Norway, September 27-29, 2017, Proceedings 6. Springer, 2017, pp. 3–15.

- Xu, X.; Weber, I.; Staples, M. Architecture for blockchain applications; Springer, 2019.

- Al-Breiki, H.; Rehman, M.H.U.; Salah, K.; Svetinovic, D. Trustworthy blockchain oracles: review, comparison, and open research challenges. IEEE access 2020, 8, 85675–85685.

- Lo, S.K.; Xu, X.; Staples, M.; Yao, L. Reliability analysis for blockchain oracles. Computers & Electrical Engineering 2020, 83, 106582.

- Nazarov, S.; Shukla, P.; Erwin, A.; Rajput, A. Bridging the governance gap: Interoperability for blockchain and legacy systems. In Proceedings of the World Economic Forum whitepaper. https://www. weforum. org/whitepapers/bridging-the-governance-gap-interoperability-for-blockchain-and-legacy-systems, 2020.

- Caldarelli, G. Wrapping trust for interoperability: A preliminary study of wrapped tokens. Information 2021, 13, 6.

- Šimunić, S.; Bernaca, D.; Lenac, K. Verifiable computing applications in blockchain. IEEE access 2021, 9, 156729–156745.

- Eskandari, S.; Salehi, M.; Gu, W.C.; Clark, J. Sok: Oracles from the ground truth to market manipulation. In Proceedings of the Proceedings of the 3rd ACM Conference on Advances in Financial Technologies, 2021, pp. 127–141.

- Ezzat, S.K.; Saleh, Y.N.; Abdel-Hamid, A.A. Blockchain oracles: State-of-the-art and research directions. IEEE Access 2022, 10, 67551–67572.

- API3. API3 DAO Tracker - on-chain analytics: Members, staking rewards, API3 token circulating supply. https://tracker.api3.org/.

- Band. Band Protocol - Cross-Chain Data Oracle. https://bandprotocol.com.

- Blockchains could breathe new life into prediction markets. The Economist 2018.

- Chainlink. Linkedin. https://www.linkedin.com/company/chainlink-labs.

- Chainlink. A Global Team of Smart Contract Experts. https://chain.link/team.

- Chainlink. Chainlink Developer Docs. https://docs.chain.link/.

- Chainlink. Mixicles: Smart Contract Privacy for DeFi on Public Blockchains. https://blog.chain.link/breaking-down-mixicles-and-its-potential-to-unlock-enterprise-demand-for-defi-applications-on-public-blockchains/, 2019.

- Pyth-Network. Governance and Staking for Pyth Tokens. https://github.com/pyth-network/governance, 2022.

- Ranasinghe, R.; Ruane, A.; Vautard, R.; Arnell, N.; Coppola, E.; Cruz, F.; Dessai, S.; Islam, A.; Rahimi, M.; Ruiz Carrascal, D.; et al., Climate Change Information for Regional Impact and for Risk Assessment. In Climate Change 2021: The Physical Science Basis. Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change; Masson-Delmotte, V.; Zhai, P.; Pirani, A.; Connors, S.; Péan, C.; Berger, S.; Caud, N.; Chen, Y.; Goldfarb, L.; Gomis, M.; et al., Eds.; Cambridge University Press: Cambridge, United Kingdom and New York, NY, USA, 2021; p. 1767–1926. [CrossRef]

- Schletz, M. ReFi Ecosystem Litepaper. https://www.openearth.org//blog/current-state-of-refi-a-litepaper-exploring-how-to-create-interoperability-in-the-ecosystem, 2022.

- Core, T. Tellor launches to Mainnet! | tellor. https://tellor.io/tellor-launches-to-mainnet/, 2019.

- U.S. Bureau of Labor Statistics. Consumer Price Index. https://www.bls.gov/cpi/.

- Witnet. Witnet Foundation | LinkedIn | Team. https://es.linkedin.com/company/witnet. Retrieved August 26, 2023.

- Caldarelli, G. Overview of blockchain oracle research. Future Internet 2022, 14, 175.

- Juels, A.; Breidenbach, L.; Coventry, A.; Nazarov, S.; Ellis, S.; Magauran, B. Mixicles: Simple private decentralized finance, 2019.

- Team, M. The Maker Protocol: MakerDAO’s Mulfi-Collateral Dai (MCD) System. White paper 2020, pp. 1–25.

- Mammadzada, K.; Iqbal, M.; Milani, F.; García-Bañuelos, L.; Matulevičius, R. Blockchain oracles: A framework for blockchain-based applications. In Proceedings of the Business Process Management: Blockchain and Robotic Process Automation Forum: BPM 2020 Blockchain and RPA Forum, Seville, Spain, September 13–18, 2020, Proceedings 18. Springer, 2020, pp. 19–34.

- Marbouh, D.; Abbasi, T.; Maasmi, F.; Omar, I.A.; Debe, M.S.; Salah, K.; Jayaraman, R.; Ellahham, S. Blockchain for COVID-19: review, opportunities, and a trusted tracking system. Arabian journal for science and engineering 2020, 45, 9895–9911.

- Pasdar, A.; Lee, Y.C.; Dong, Z. Connect api with blockchain: A survey on blockchain oracle implementation. ACM Computing Surveys 2023, 55, 1–39.

- PwC. Blockchain: The $5 Billion Opportunity for Reinsurers 2016.

- Al Sadawi, A.; Hassan, M.S.; Ndiaye, M. On the integration of blockchain with IoT and the role of oracle in the combined system: The full picture. IEEE Access 2022, 10, 92532–92558.

- De Pedro, A.S.; Levi, D.; Cuende, L.I. Witnet: A decentralized oracle network protocol. arXiv preprint arXiv:1711.09756 2017.

- White, L.J.; et al. Credit-rating agencies and the financial crisis: Less regulation of CRAs is a better response. Journal of international banking law 2010, 25, 170.

- Xu, X.; Pautasso, C.; Zhu, L.; Gramoli, V.; Ponomarev, A.; Tran, A.B.; Chen, S. The blockchain as a software connector. In Proceedings of the 2016 13th Working IEEE/IFIP Conference on Software Architecture (WICSA). IEEE, 2016, pp. 182–191.

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).