1. Introduction

Since information technology (IT)-based non-financial institutions entered the financial market as “Fintech” or “Techfin” in the 2010s, the application of IT to financial services has fundamentally changed the distribution and sales structure of financial products. It also makes a substantial contribution to the creation of sustainable new business models in the financial markets of both developed and developing countries. Among these models, open banking application programming interface (API) platforms built based on open API technology have transformed the structure of financial markets by separating the manufacturing and distribution of financial products [

1]. Korea established an open banking API platform that can be used by both fintech companies and banks as the first step of the three-stage roadmap for introducing open banking service, which was announced by the Financial Services Commission in February 2019 and launched on December 18, 2019 [

2]. Unlike the European model, in which fintech companies link platforms provided separately by individual banks, Korea's open banking API platform was built as a single shared platform that relays all information to users. It also opened an interbank payment network, which was previously available only to financial institutions, to the fintech industry, providing an environment in which fintech can compete under nearly the same conditions as banks. These policies have commercial banks, which traditionally dominated the market, to find new services using open banking to survive [

3]. With traditional financial institutions offering new services based on open banking APIs, financial consumers have begun to experience many new benefits.

With a single application, it has become possible to inquire about the balance and transaction history of all of one’s bank accounts, as well as transfer funds. This eliminates the need for customers to install and manage multiple separate applications for every financial institution they use. In addition, it has become possible to inquire about the details of financial assets simultaneously in applications provided by fintech companies and receive recommendations for suitable financial services [

4]. Owing to various novel services, the number of customers using open banking services and the frequency of use have exploded. As of December 2022, the cumulative number of subscribers had reached 160 million, the cumulative number of registered accounts had reached 350 million, and the daily average number of API uses had reached 30 million. This is very rapid growth, given that the UK, which introduced the world's first open banking system and implemented its open banking API two years earlier than Korea (January 2018), had an average daily number of 27 million users in January 2022, four years after the service launched [

5]. This rapid growth is unusual, owing to the nature of the financial market, in which new services generally take a relatively long time to spread.

However, no studies to date have systematically classified the new business models created using this new infrastructure. Thus, the present study is meaningful, in that it systematically classifies new business models created through the new financial market infrastructure of Korea’s open banking API platform. This study aims to examine how Korean fintech companies use the open banking API platform to create business models and systematically classify them. The results of this study can contribute to more in-depth research on how new IT-based infrastructure can contribute to the creation of new business models. This study is also expected to contribute to further research on how these new types of infrastructure can be used to create sustainable business models in the fintech industry. Finally, we expect this study to provide guidance for policymakers in countries preparing to build open banking API infrastructure by allowing them to make comparisons referring to the Korean open banking API platform case.

2. Literature Review

2.1. Open API

Banks use API technology to exchange messages and provide customer information to fintech companies [

6]. BIS [

7] defines an API as "a set of rules and specifications for software programs to communicate with each other, that forms an interface between different programs to facilitate their interactions." Thus, APIs are predetermined communication rules that allow other programs to access the functions or data of a specific program and act as a medium for connecting functions or data between different programs in a network. APIs are classified as either closed or open APIs according to the scope of those with access rights [

1]. Closed APIs use private interfaces that are used only between communication parties, and access to programs through closed APIs is allowed only between designated parties or inside an institution. Open APIs are interfaces that use published standards, allowing third parties to access programs. In summary, open APIs are open to the outside so that internal services, information, and data can be easily used anytime and anywhere and are disclosed in the form of general web services; thus, they are not dependent on a specific platform.

Financial APIs allow API users such as fintech companies to execute financial functions, including payments and remittances, or obtain customer information from financial institutions, which are API providers. For example, if a fintech company sends a pre-promised "transfer command" to a financial company according to the API, the financial company executes the remittance according to that command.

2.2. Open Banking Policy

Although systems based on the concept of open banking have been introduced in several countries, open banking has not been widely and extensively researched in the academic field with available studies mainly limited to the legal, business, and technical fields in the practical sector. However, unlike the early days, when it was completely dependent on research by international organizations and financial institutions, the fact that many studies have been conducted in orthodox academia in the 2020s shows that open banking can be the subject an academic study. However, no consensus has been reached on the definition of open banking [

8]. In general, the widely accepted definition is a new financial ecosystem that allows third parties to access customer accounts or information held by banks [

9]. According to BIS [

7], open banking is a concept that collectively refers to a series of means, systems, and policies on how banks share customers' data with the fintech industry.

The first open banking policy was implemented in 2013 when the European Union conceived PSD2 to add a clause to the Payment Service Directive (PSD), obliging banks to share customer information with third-party financial service providers (TPPs) [

6]. In 2014, the European Commission drafted PSD2, and in October 2015, PSD2 was adopted by the European Parliament before being implemented in January 2016. In PSD2, an account information service provider (AISP) and a payment initiation service provider (PISP) are created by allowing third parties with customer consent to access and use the accounts of financial companies through open APIs. Subsequently, Regulatory Technical Standards (RTS) for PSD2 were prepared in 2016, adopted by the European Commission in January 2017, and implemented in September 2019.

The European Union's General Data Protection Regulation (GDPR), which took effect in May 2018, provides a legal basis for implementing new business models created by PSD2 by strengthening operators' personal information protection obligations and specifying the right to data portability. Based on legal grounds such as PSD2 and GDPR, the system for each country in Europe to perform its own open banking services has been reorganized. The representative country is the UK. The Competition and Markets Authority (CMA), which is the authority in charge of fair market competition in the UK, announced the Retail Banking Market Investigation Order in October 2017, mandating that major banks in the UK provide customer account information to third parties with customer consent under the API standards set by the Open Banking Implementation Body (OBIE) [

10].

With the implementation of PSD2 and the subsequent introduction of open banking systems across Europe, TPPs can legally receive customer information from financial companies and provide new types of services. The most representative new services are Account Information Service Providers (AISPs) and Payment Instruction Service Providers (PISPs), also called “MyData” and “MyPayment,” respectively, in Korea [

11].

An AISP is a third-party financial service provider that integrates and provides financial information, such as account information (deposit owner, account number), transaction history, and balance information, to customers. Through AISPs, companies and individuals can receive integrated information on their financial status, and AISPs can use this data to expand various types of businesses such as risk management, cross-selling opportunities, and product recommendations. A PISP sends and receives the payment information necessary for transactions from the payer's bank in response to a payment order and instructs the payee’s bank to pay the recipient. This enables online payments through account-to-account (A2A) payment instructions such that even organizations that do not have an account can provide payment services.

2.3. Open API Platform

PSD2 stipulates that TPPs should not be blocked or interfere with access to customers' accounts, and financial institutions are mandated to ensure that information is available to TPPs without discrimination. However, TPPs can access customer information only within the range explicitly agreed upon by the customer. In addition, the guidelines separately stipulate the information requirements and scope that TPPs can receive from financial companies to provide financial services to customers, and the information exchange methods apply mutatis mutandis to the information requirements and scope specified by RTS guidelines. The RTS recommends that each financial company establish an open API platform for TPPs to use as an account access interface. A platform generally refers to an open and participatory infrastructure that enables transactions to create value between external service providers and customers [

12]. Among them, an open API platform is a software system that provides APIs based on publicly established standards. With the establishment of the open banking API platform, fintech companies can create and provide new types of services to customers based on the data and functions provided by financial companies through the open platform [

13].

2.4. Open Banking API Platform of Korea

Korea's open banking API platform was introduced in 2015. Starting with NH Bank's disclosure of its own open API consisting of 125 APIs in 2015, KEB Hana Bank and Shinhan Financial Group announced their own open APIs in 2018 [

14]. As such, it is not different from Europe to disclose open APIs by establishing its own platform for large banks. However, the need for a single point of contact was raised because of the difficulties fintech companies faced in linking APIs from different banks individually. Accordingly, the government established a standard API for the financial sector and started building a shared platform on which fintech companies could use the API at a single contact point.

After the Financial Services Commission announced its plans to build a fintech open platform in 2015, a working-level council involving 16 banks and 18 securities was formed in August of the same year to begin full-scale construction. In January 2016, the Korea Financial Telecommunications and Clearings Institute (KFTC) and Koscom were confirmed to establish a shared platform in the banking and securities sectors, respectively. In August 2016, the shared open API platform in the financial sector began a pilot system for small- and medium-sized fintech companies. This shared open API platform consists of open APIs that standardize and provide financial services so that fintech services can be developed easily and quickly and serve as an environment to test whether developed services work normally.

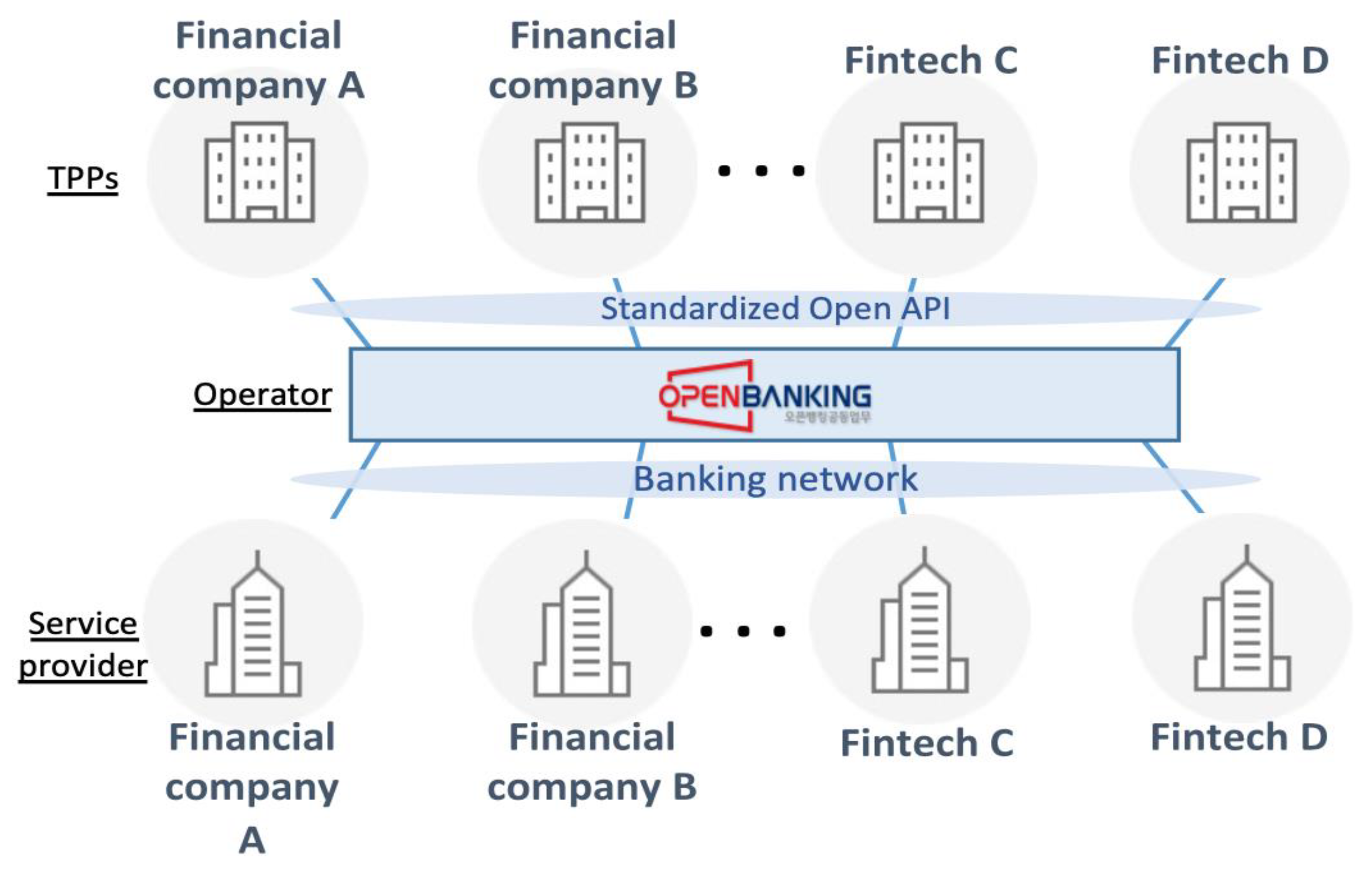

Korea's shared financial API platform was built separately in the banking and securities industries; however, this study focuses only on the open banking API platform built within the banking sector. Korea's open banking API platform is a shared open infrastructure in the banking sector that provides key financial services with standardized open APIs, allowing fintech operators to provide banking-related financial services to consumers smoothly. The KFTC, which operates an interbank payment network, established and is operating the platform. Notably, the interbank payment network previously available only to banks was opened to the fintech industry through this platform [

15].

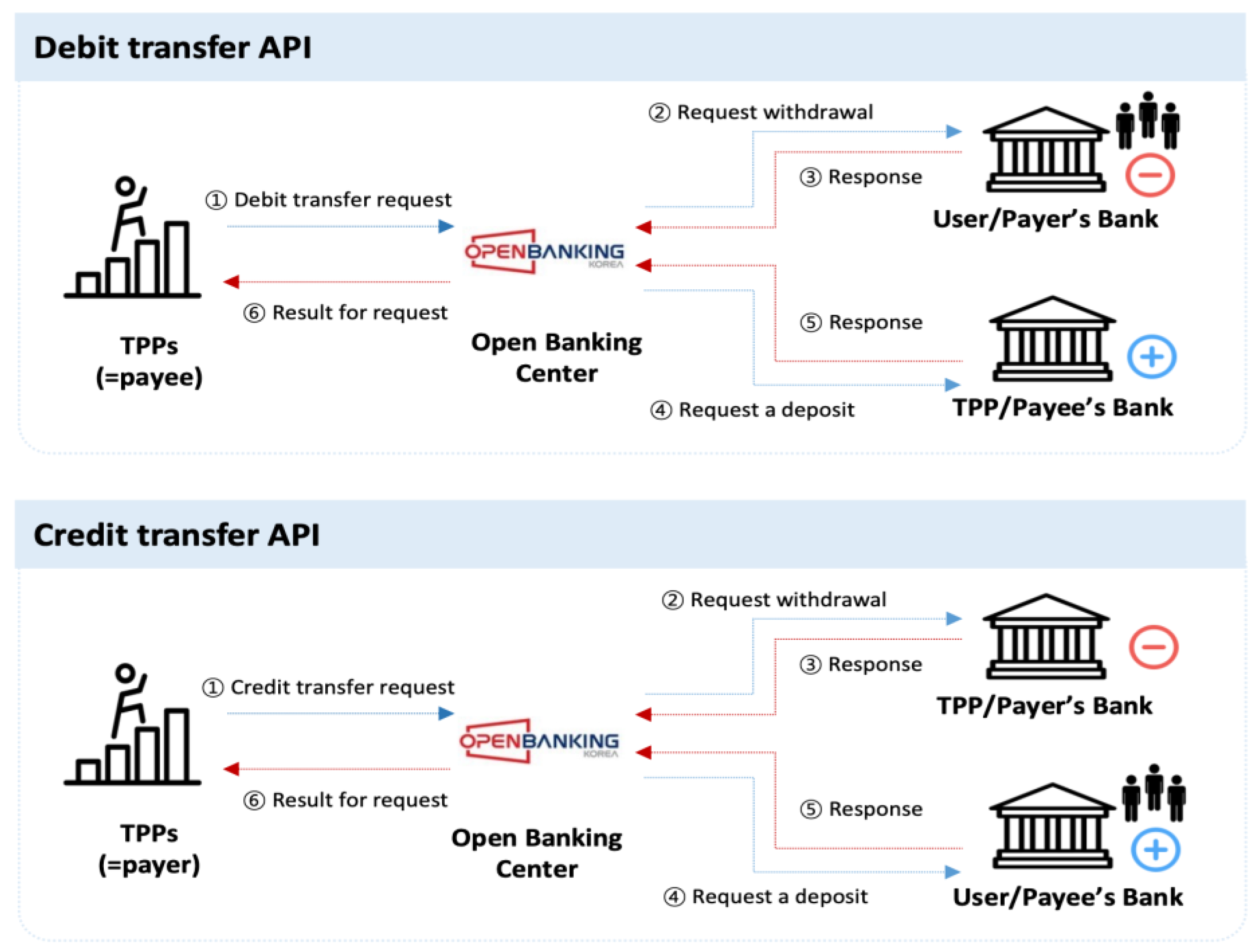

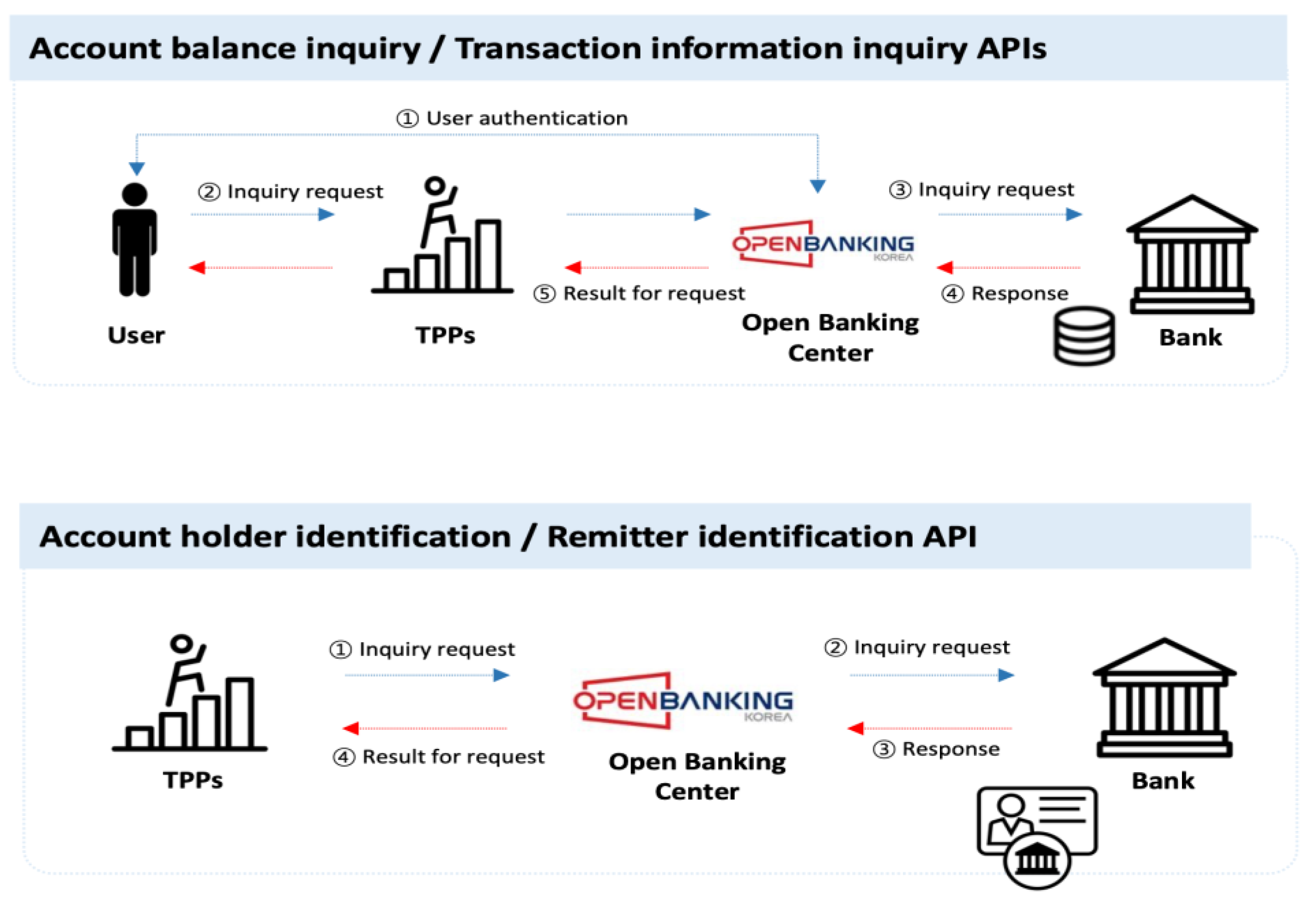

Based on the needs of fintech companies, the open API consists of two types of APIs for transferring funds, namely debit transfer and credit transfer (

Figure 1), and four types of inquiry APIs, namely balance inquiry, transaction history inquiry, account holder’s name inquiry, and payment receipt inquiry (

Figure 2). When a platform user requests a transfer to the center through the transfer APIs, the center instructs the payer’s and payee’s banks to process the transfer sequentially, and the center is notified of the processing result and delivers it to the user. Additionally, when requesting an inquiry from the center through the inquiry APIs, the center instructs the data provider to process the inquiry, receives the data from the relevant bank, and delivers it to the user. Fintech companies that use open banking APIs can provide new services by combining transfer and inquiry APIs. However, the pilot service only included small- and medium-sized companies; thus, the big tech companies dominating the fintech market were excluded. However, in February 2019, the Financial Services Commission announced a policy to fully open the interbank payment network previously available only to banks to all fintech companies, regardless of size, through the Financial Payment Infrastructure Innovation Plan to revitalize fintech and financial platforms [

16].

Under this plan, the open banking API platform, which was previously available only to small- and medium-sized fintech companies, was made available to all fintech companies and banks (

Figure 3). The scope of commercial banks has been expanded from simply providing functions and data through open APIs to "users" who can provide various additional services to their customers using the platform. A policy was included to lower the fees paid for the use of open APIs to 10% of the previous fees. Based on the Financial Payment Infrastructure Innovation Plan announced in February 2019, a fully reorganized open banking API platform was established and ultimately launched on December 18. Since then, in December 2020, second-tier financial institutions, such as securities institutions, have participated as providers of open APIs, leading to credit card companies joining in May 2021. However, it has been continuously argued in the financial sector that fintech companies only use the functions and information of financial institutions through the platform and do not provide their own information; thus, fair competition cannot be achieved [

17]. As the transaction volume of financial services used by big tech companies has grown rapidly since the platform was established, the persuasiveness of these opinions has inevitably increased. Accordingly, in July 2021, the information held by prepaid payment services among fintech companies was also provided through the platform as an open API.

3. Materials and Methods

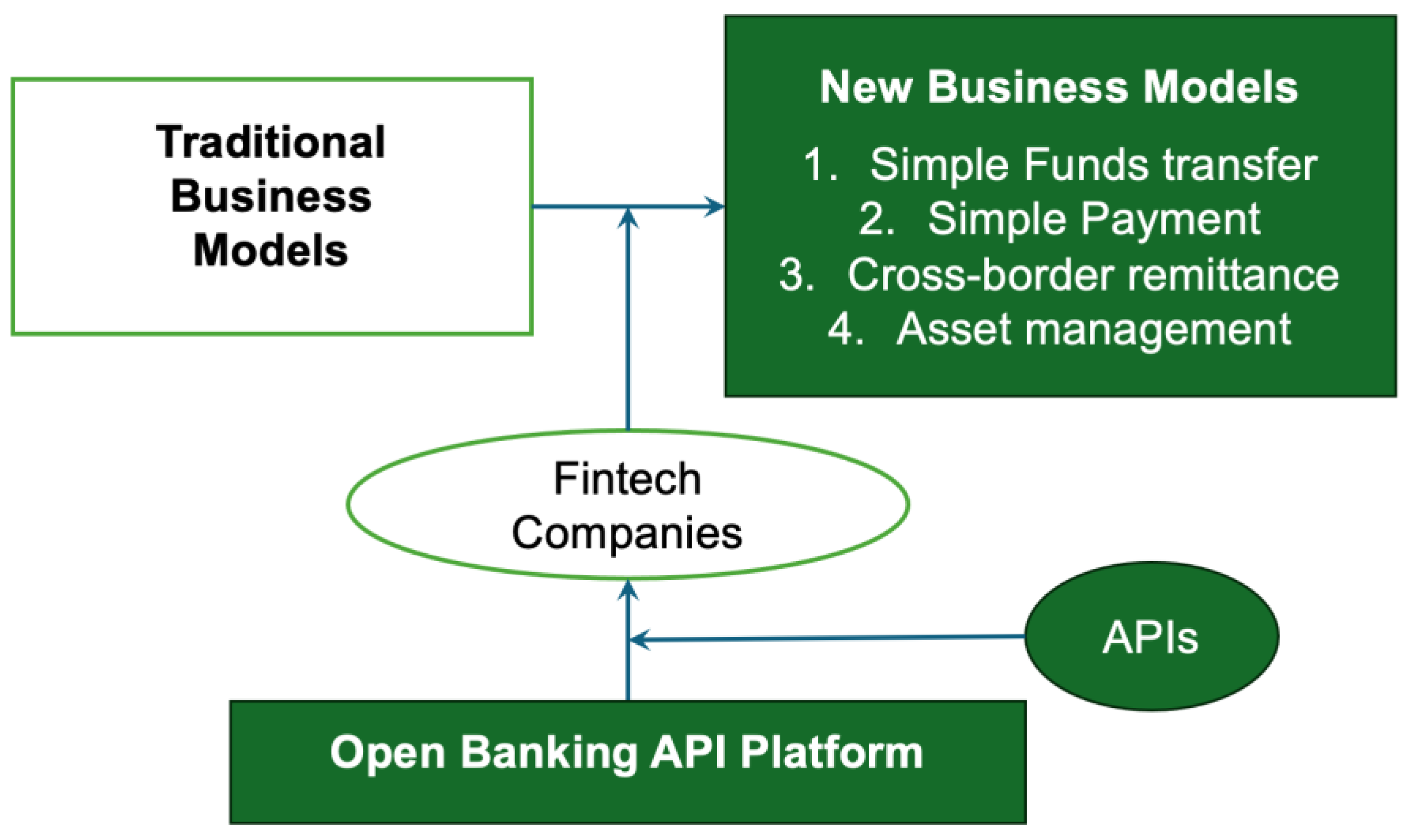

3.1. Research Model

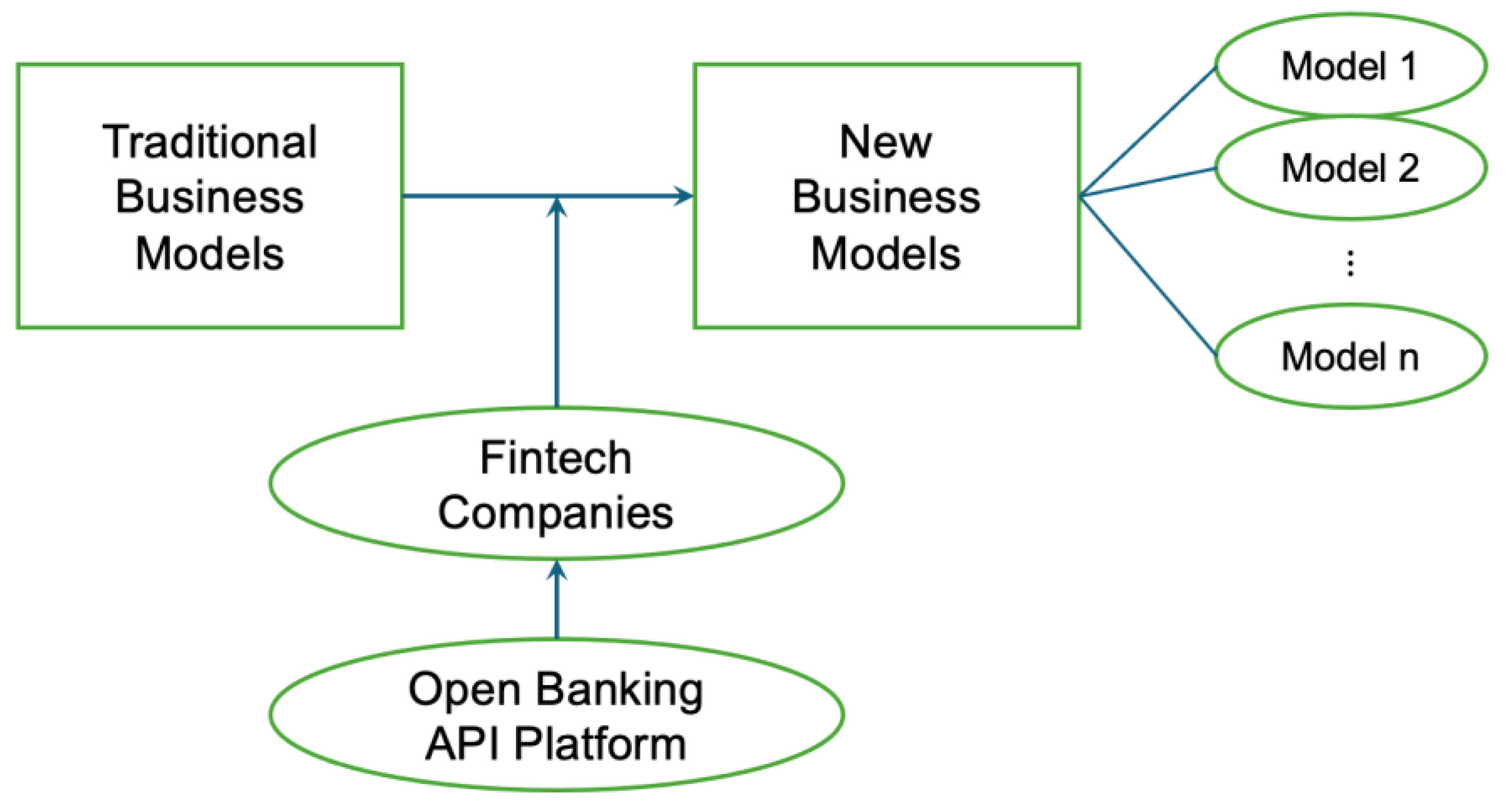

In this study, the creation of new business models is expected to be promoted through the process shown in

Figure 4. Even before the introduction of the open banking API platform, fintech companies provided traditional financial services. However, after the introduction of this new infrastructure, it has become possible to provide services that did not exist before. This study investigates new sustainable fintech business models fintech companies have created using this new infrastructure and classifies them into typical types.

3.2. Research Method

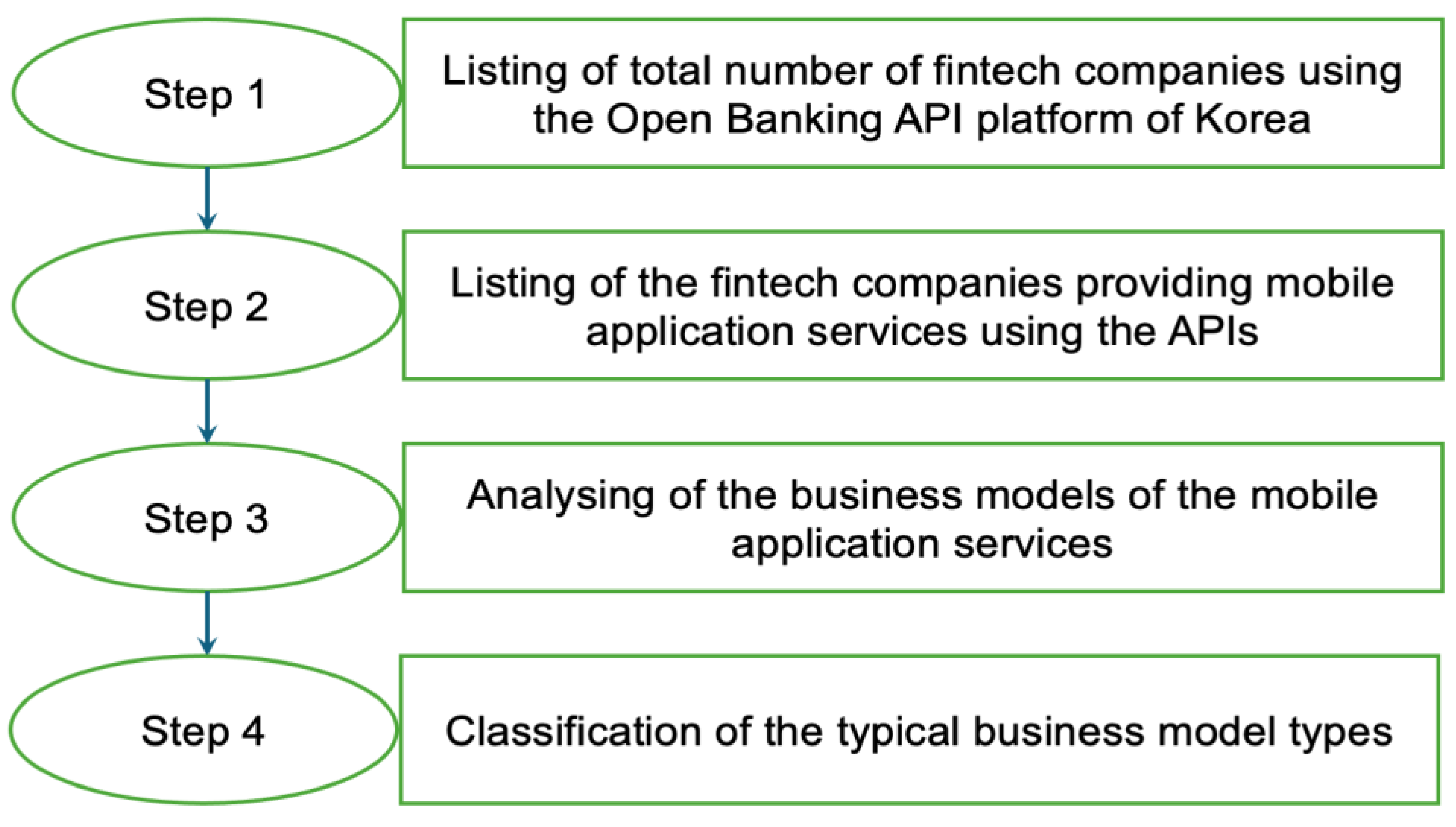

This study was conducted to analyze each newly created business model by fintech companies and classify them into typical types. This research method is suitable for identifying the APIs used by each business model and analyzing the processes through which these APIs are used in actual services. Therefore, a collective case study was conducted using qualitative business model analysis. This study was performed in four steps. The detailed process is illustrated in

Figure 5.

3.3. Data Collection

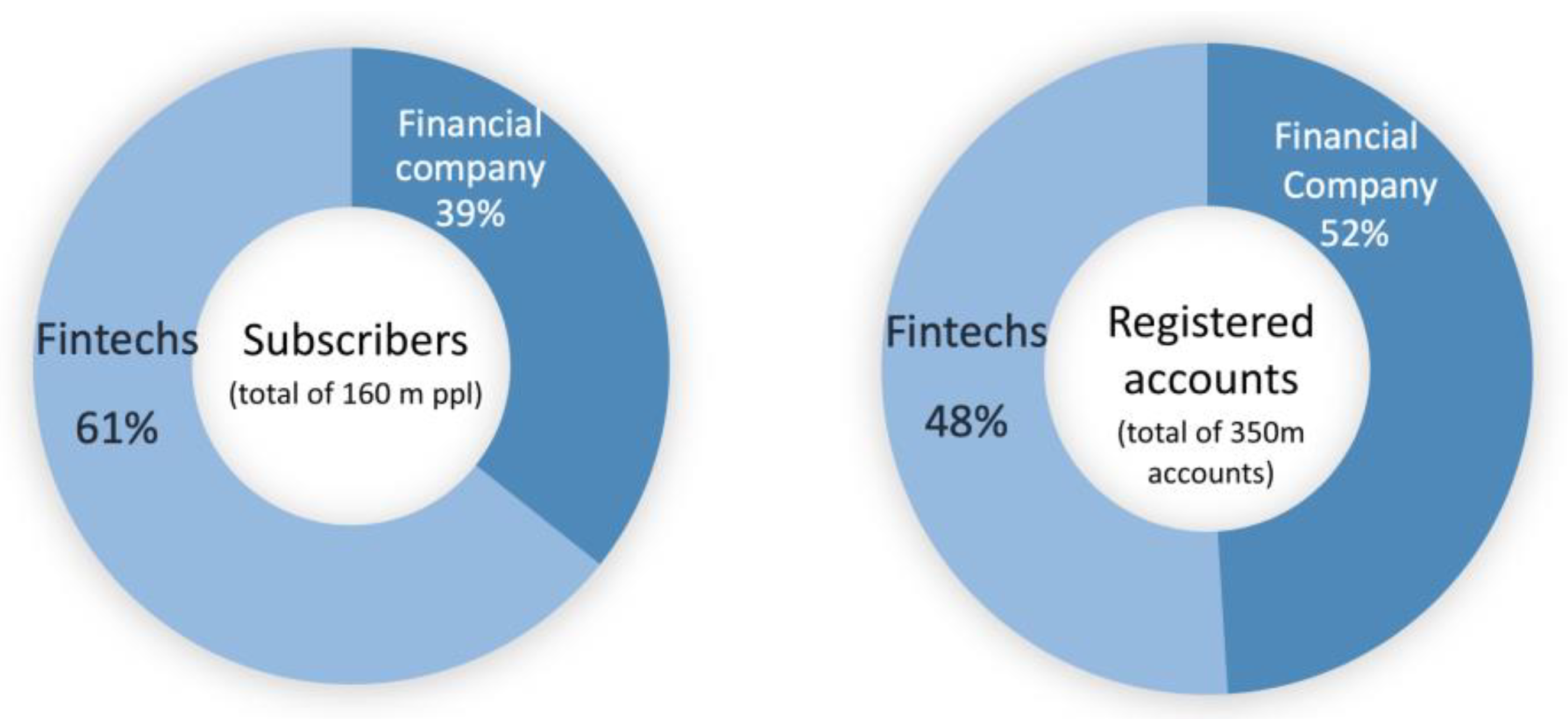

First, data on the users of the Korean open banking API platform were collected from the KFTC, which operates the platform. The Korean open banking API platform was fully implemented in December 2019 and has since grown rapidly, with 34 million net subscribers (160 million cumulative subscribers) as of December 2022, which is approximately 118% of the domestic economically active population (29 million). In addition, the number of net registered accounts has reached 160 million (350 million cumulative registered accounts) and the average daily number of API transactions has reached 30 million. When the number of subscribers and registered accounts is classified by the platform user’s business area, fintech companies account for 61% of the cumulative number of subscribers and 48% of the cumulative number of registered accounts (

Figure 6).

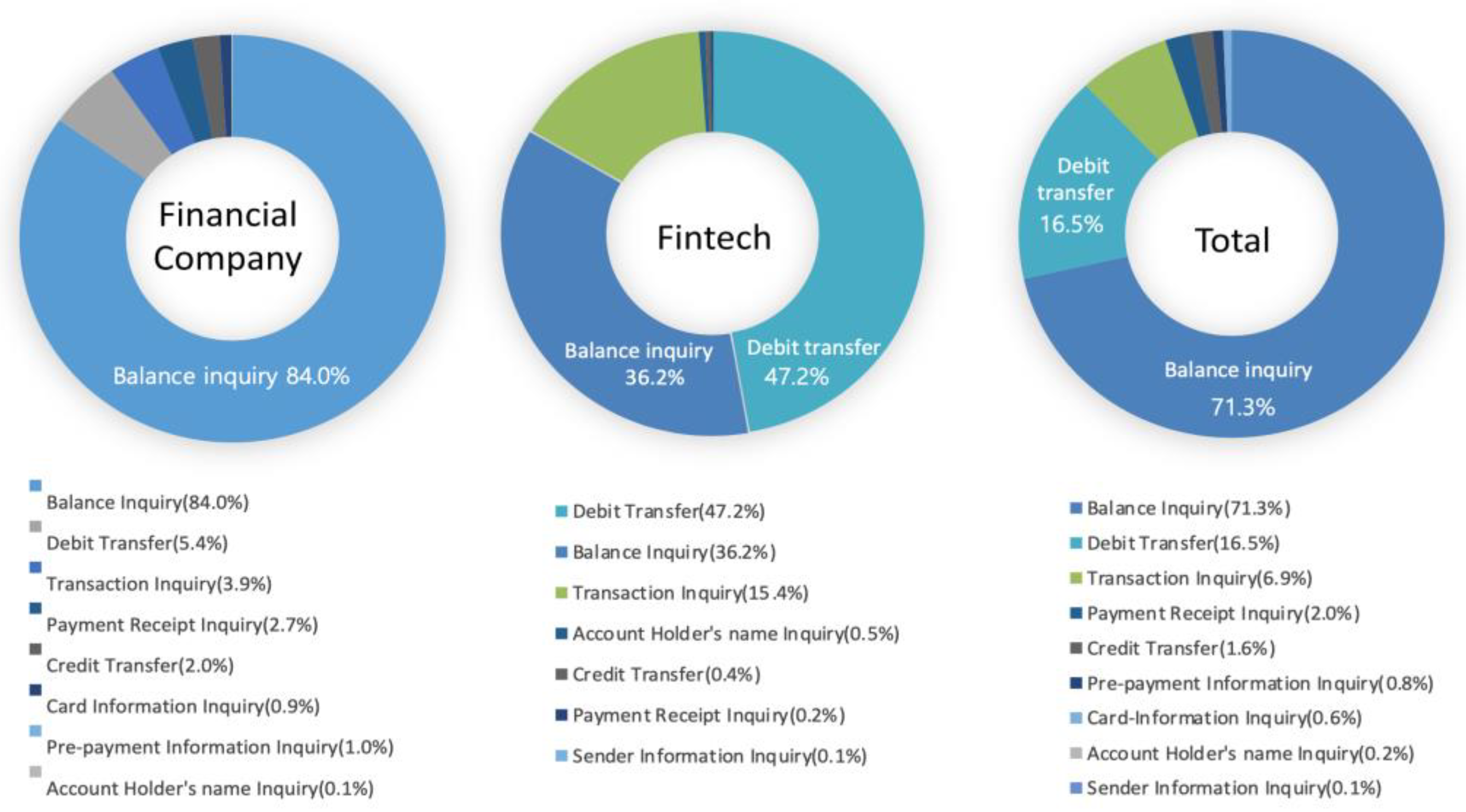

When classifying the total number of uses by transaction type, balance inquiries accounted for the largest proportion (71.3 %), followed by debit transfers (16.5 %). However, when classified by industry, debit transfers accounted for only 5.4% for financial companies but 47.2% for fintech companies, comprising a larger percentage than balance inquiries (

Figure 7).

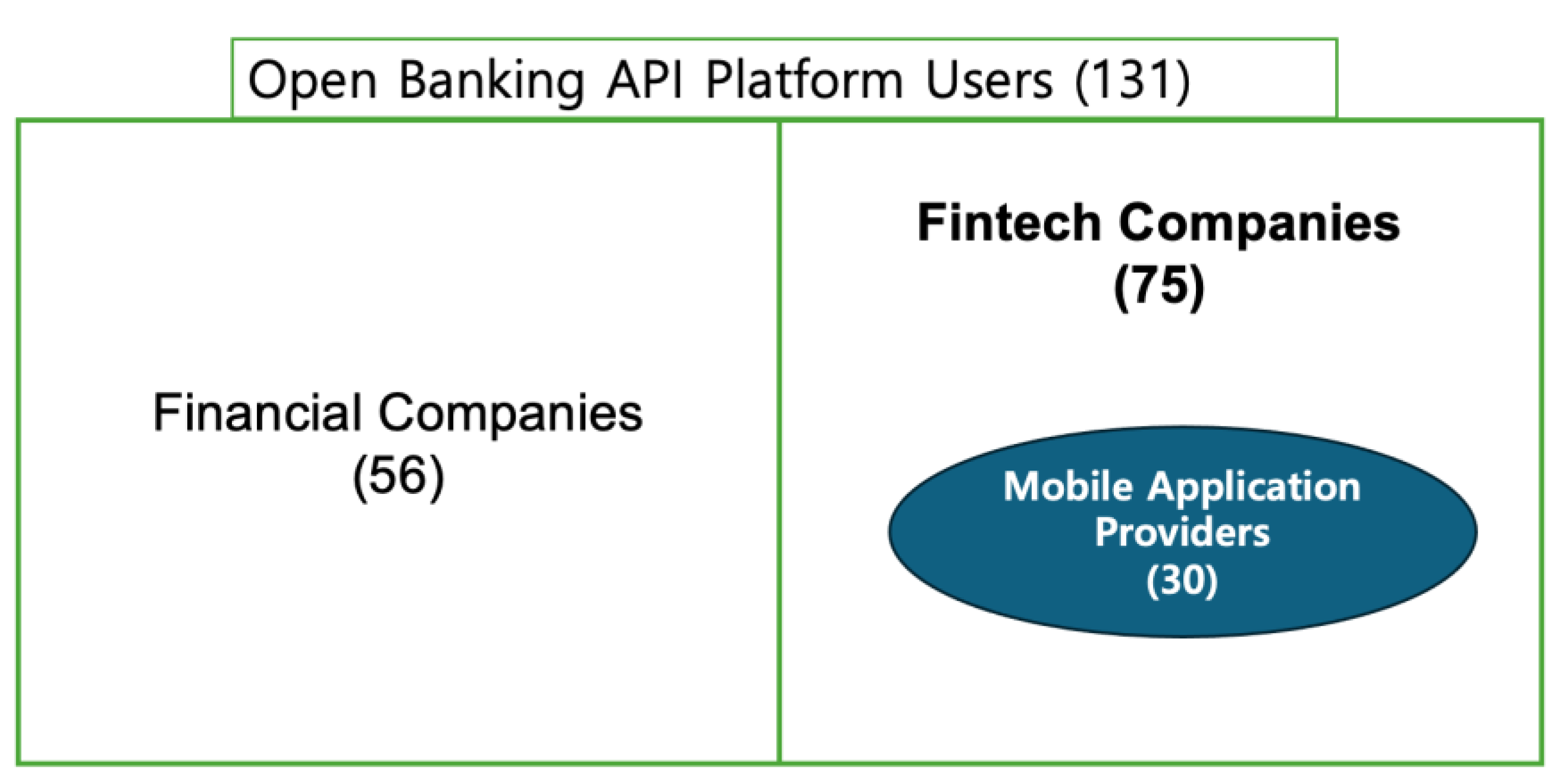

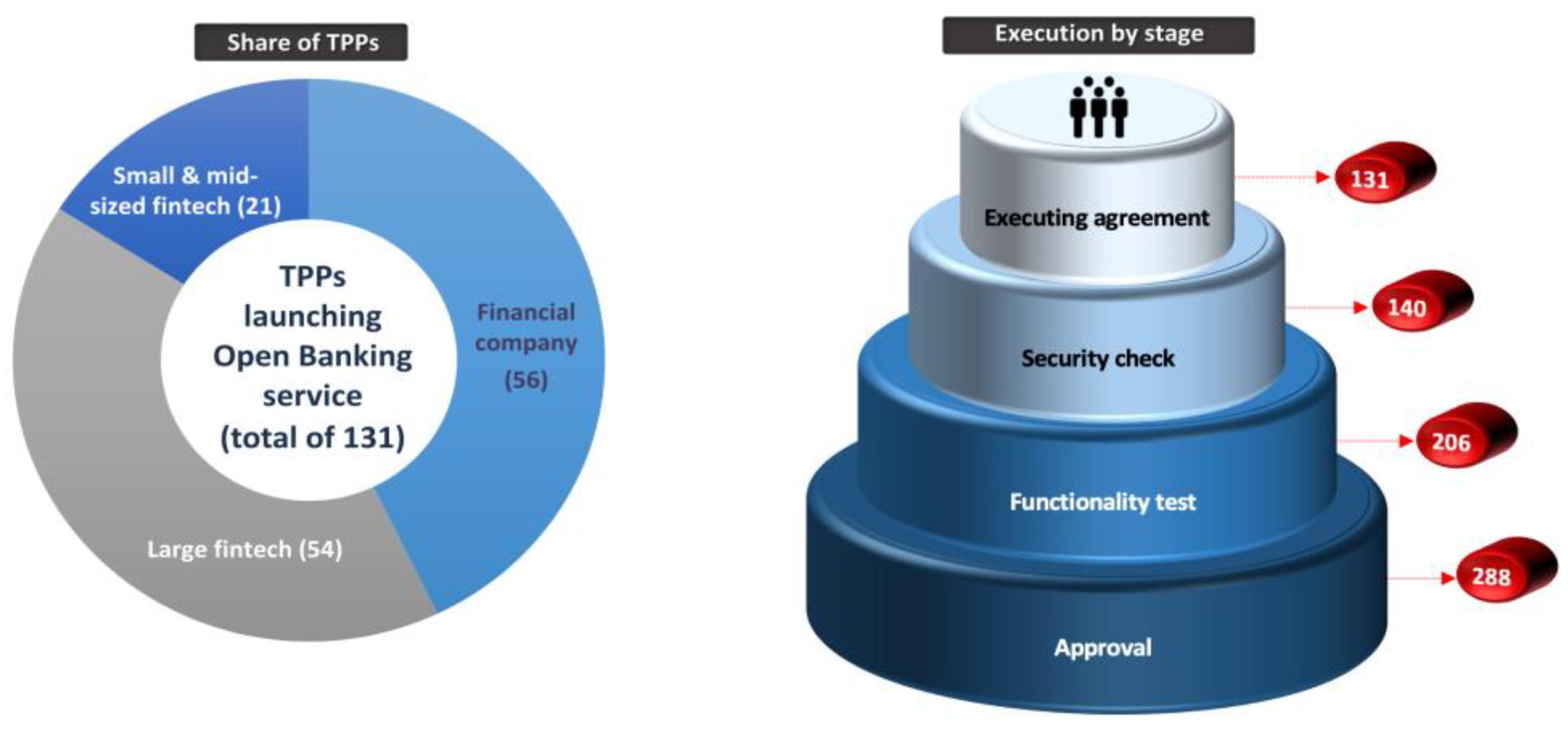

It is giving approvals to the applicants for using the platform after the test at the test bed. According to data from the KFTC, as of December 2022, 288 businesses out of 355 applicants have been approved for use as a TPP, and 131 of them have launched actual services using APIs after completing functional tests and security inspections as well as executing agreements. The TPPs comprise 53 financial companies (19 banks, 8 credit cards, and others), 54 big tech companies (including Kakao Pay and Toss), and 21 small- and medium-sized fintech companies (

Figure 8).

In the second to fourth stages of this research, 30 fintech companies using the open banking API platform for mobile application services were identified (for a list of mobile applications and providers, see the

Appendix). We focused on mobile application services currently using the open banking API platform. This is because mobile applications are directly used for customer service. Finally, each mobile device application business model was analyzed and classified into typical business model types. The list includes mobile applications provided by the most representative Korean big tech companies, such as Naver, Kakao, and Toss. Other popular applications already have a customer base in the market, such as PAYCO, Finnq, and Banksalad. The remaining had previously provided services in their own areas. However, all have created new types of business models using the infrastructure of the Open Banking API platform.

Figure 9.

Companies analyzed in the present study.

Figure 9.

Companies analyzed in the present study.

4. Results

4.1. Business Model Analysis Results

In this study, we analyzed 30 mobile applications that provide fintech services to customers in Korea using the open banking API platform. Fintech companies provide services by combining multiple APIs, rather than one, to create new businesses. We analyzed how APIs can be combined to provide services. New business models were classified into four types: simple fund transfers, simple payments, cross-border remittances, and asset management. We analyzed four cases to determine how fintech companies use open APIs for each new business model.

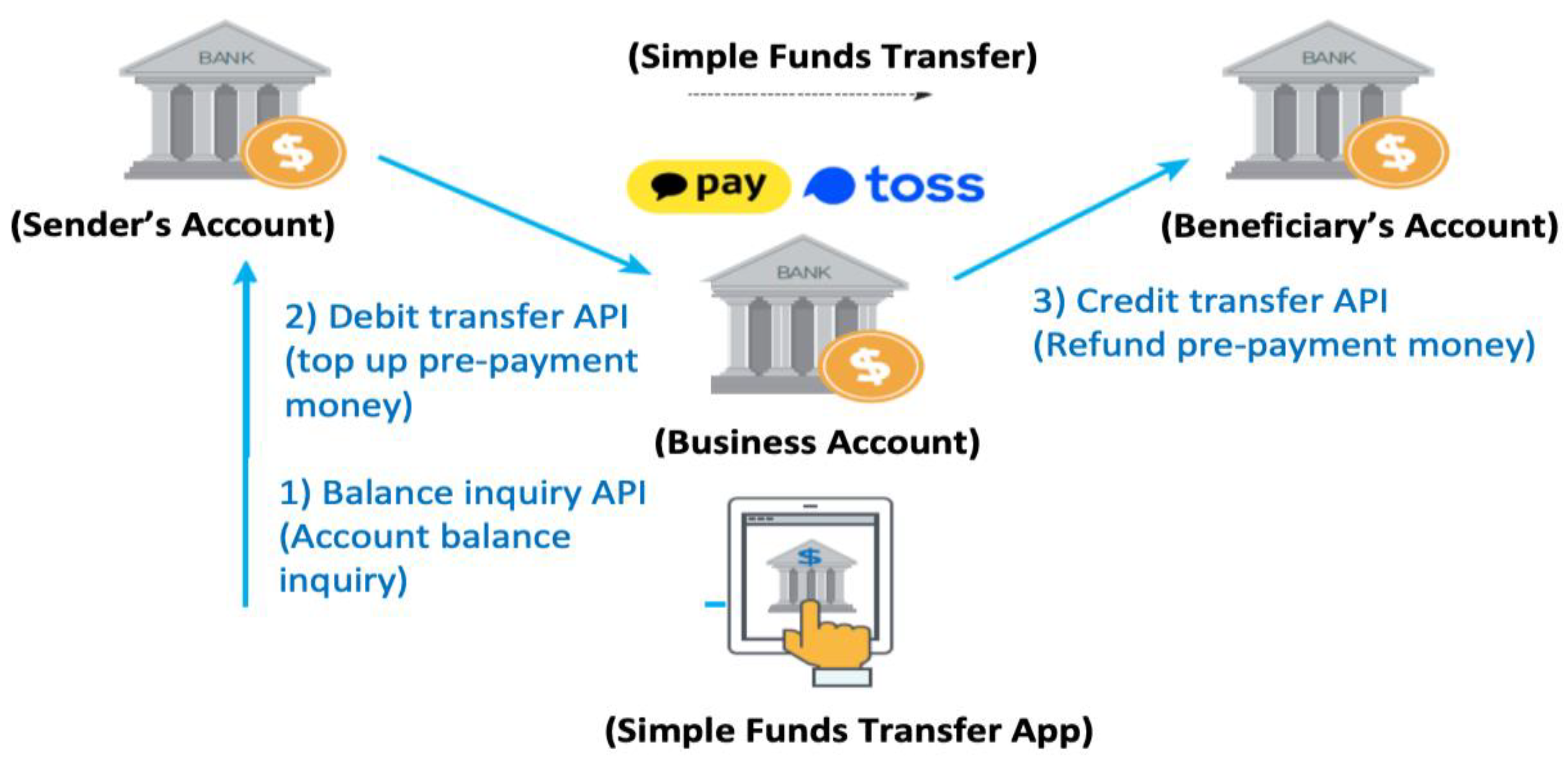

4.1.1. Simple Fund Transfers

A simple fund transfer is a service that simplifies the complex security and authentication procedures required in the previous fund transfer process, making it faster and more convenient for consumers. The sender can make a fund transfer transaction using the phone number, email address, or messenger ID of the beneficiary without knowing the account number. Even before the introduction of the open banking API platform, a service called simple remittance was provided by a few fintech companies; however, this service was difficult to activate. For fintech companies to provide simple remittance services, they were required to sign a contract with each bank and use the services provided by banks at a high fee. Thus, services could not be provided to accounts at banks that did not have a contract with the fintech company. With the introduction of the open banking API platform, fintech companies can now provide fund transfer services to accounts at all banks without signing separate contracts with each bank. Among the 30 mobile applications we analyzed, these services are provided by seven of them and are usually based on big tech platforms, such as Toss, PAYCO, NaverPay, Kakaopay, SSGPAY, CheckPay, and Finnq.

For this service, fintech companies combine the following three APIs:

Balance inquiry: before the transfer, a balance inquiry is made, and the customer’s account balance is displayed.

Debit transfer: When the customer enters the amount that he or she intends to send, the money transfer service provider debits the customer’s bank account to top up the pre-payment funds.

Credit transfer: The money transfer service provider completes the transfer by providing a refund of topped-up pre-payment funds to the beneficiary’s account.

Figure 10.

Combination of APIs for a simple funds transfer.

Figure 10.

Combination of APIs for a simple funds transfer.

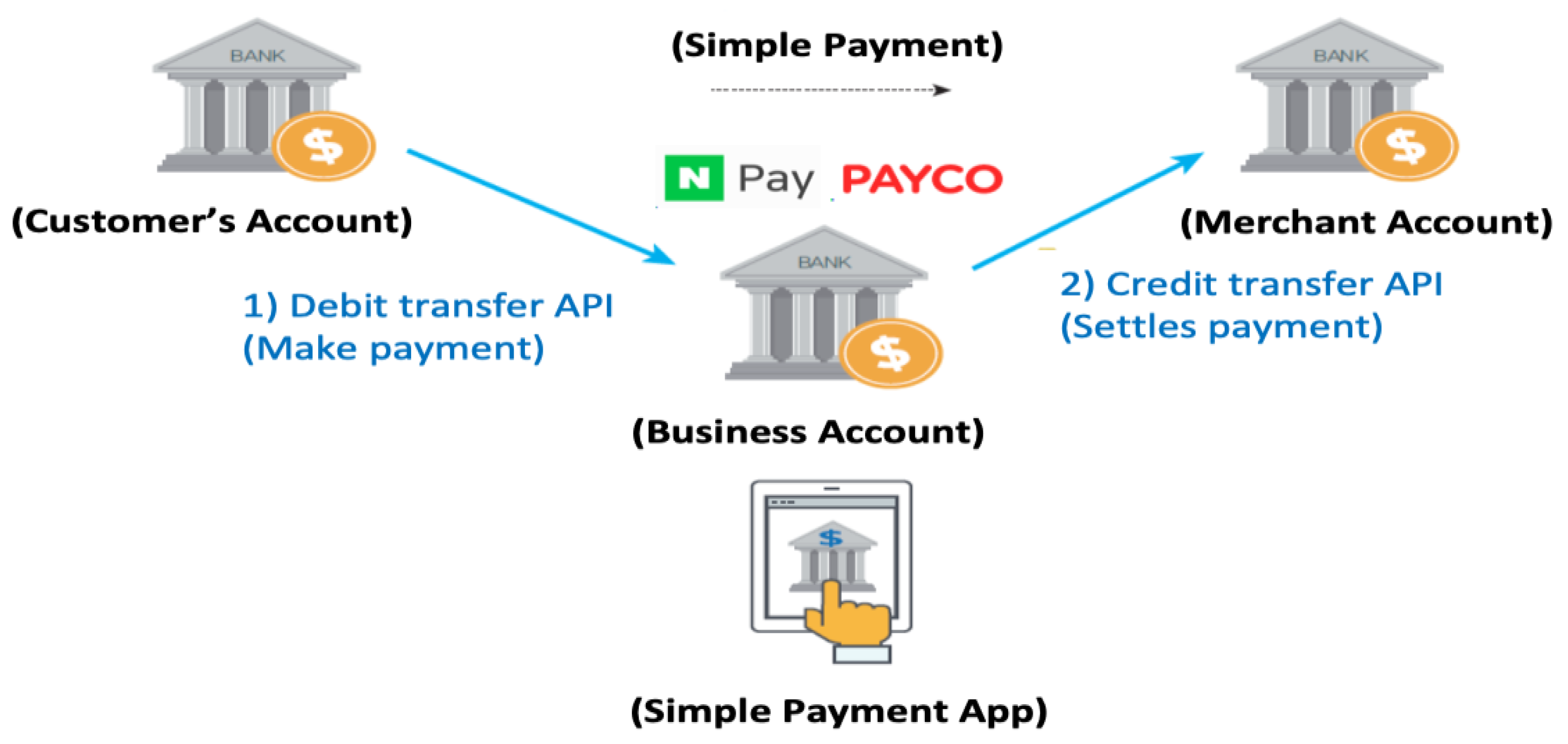

4.1.2. Simple Payment

Simple payment is a service that simplifies the payment process by using a mobile phone as a payment device, thereby making payments quick and convenient. Fintech companies that provide simple payment services store payment information registered by customers on a server, and then use commercial transaction payments to provide payment services by omitting separate authentication procedures. Customers who want to use this service register their bank accounts as simple payment accounts. Each time a payment is made, it is automatically withdrawn from the registered payment account.

Similar services were provided before the introduction of the open banking API platform, but because most of them used credit cards, fintech companies needed separate contracts and system connections with many credit card companies. Merchants who used this service also needed to pay high credit card transaction fees. With the introduction of the open banking API platform, fintech companies can now register and use all bank accounts as customer payment accounts without connecting each bank individually. In addition, it has become possible for customers to add a bank-account-based prepaid recharge account to use in a company's mobile wallet, allowing them to charge their mobile wallet's prepaid account from their bank account and use it for payments. Among the 30 mobile applications we analyzed, these services are provided by 13 of them and are typically based on mobile payment service providers, such as UBpay, Toss, Yammi, Tmoney Pay, Moneytree, DGU Upay TONG, L. POINT with L.PAY, PAYCO, NaverPay, SSGPAY, CheckPay, Kakaopay, and Finnq.

When a fintech customer makes a payment at either an online or offline store, the fintech company combines the following two APIs to provide a simple payment service:

- 1)

Debit transfer: When a customer requests payment for a purchase, the payment service provider debits the amount from the customer’s account.

- 2)

Credit transfer: On a designated settlement day (normally after one to three business days), the payment service provider pays (settles) the amount after payment fees to the merchant’s account.

Figure 11.

Combination of APIs for simple payment.

Figure 11.

Combination of APIs for simple payment.

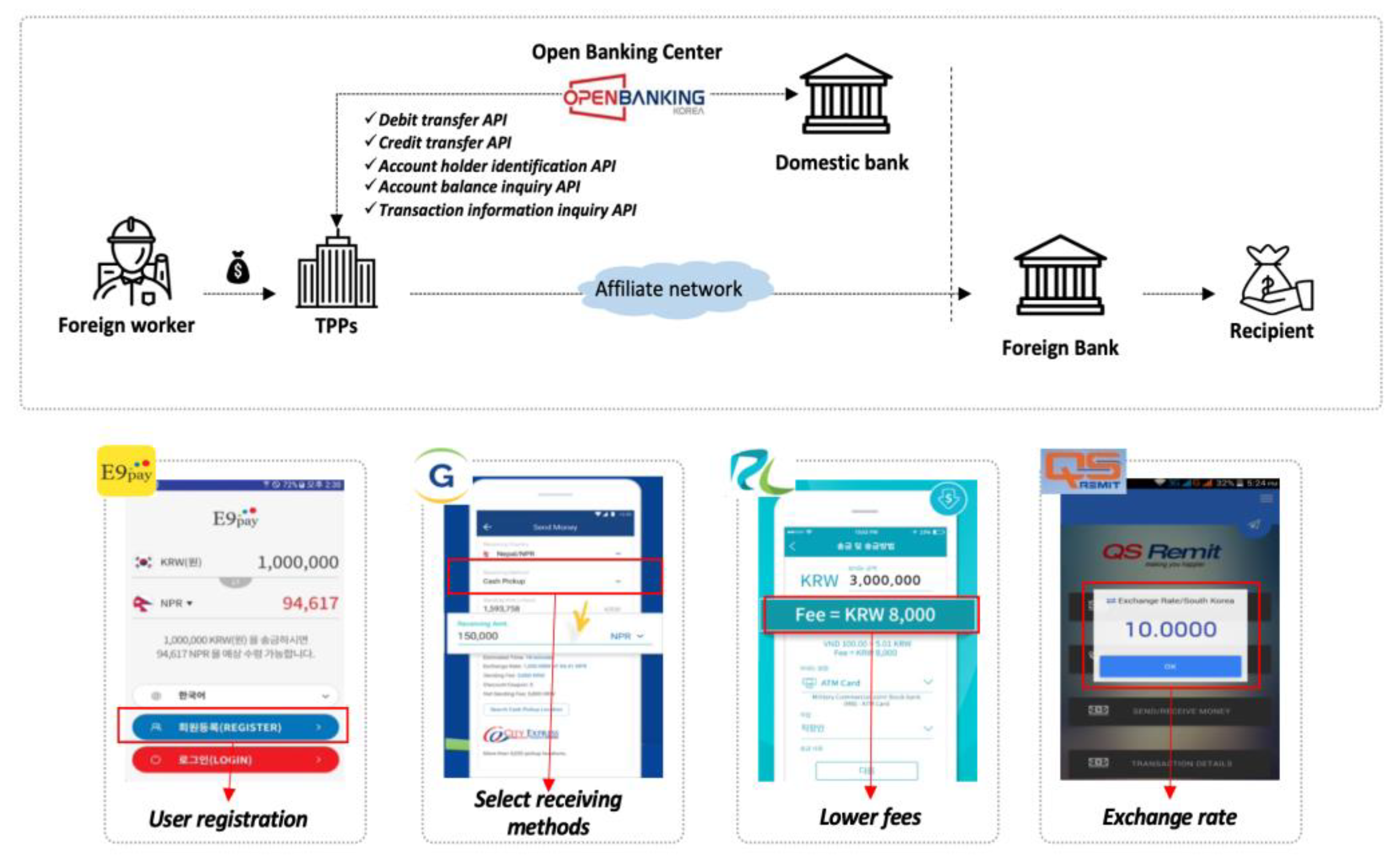

4.1.3. Cross-border Remittance

Cross-border remittance services have traditionally been recognized as difficult to innovate because of their high cost and slow processing speed, as these services have been provided mainly by the banking sector that provides foreign exchange services. However, as the size of cross-border remittances has increased, the demand for improving the efficiency and convenience of these services has also grown, and fintech companies have been working to introduce new services that are more convenient, cheaper, and faster. Fintech companies' innovation in this area has largely been achieved in two directions. First, fintech companies have been striving to develop services that enable cross-border remittances through a simple authentication process using various non-face-to-face channels to improve customer convenience. Second, fintech companies have also tried to provide services at a lower cost by simplifying the fund transfer process between the remittance service providers of both countries and lowering the cost of transferring funds. As a result, the remittance process through traditional foreign exchange banks has been simplified.

Korea’s open-banking API platform has enabled fintech companies to provide faster and more convenient cross-border remittance services at low fees. For example, if a migrant worker wants to transfer money to their home country, the fintech company first withdraws money from the customer's account in Korea, deposits it in the company’s account, and then sends the message to its partner in the foreign country. Finally, the partner delivers the money to the recipient. They use a pairing method that produces the same effect as traditional cross-border remittances by offsetting and netting the money between both parties. This provides cheaper and faster services by creating new mechanisms, without using the existing foreign exchange banking system. Throughout this process, fintech companies use multiple APIs. Among the 30 mobile applications analyzed, this service is provided by 12 of them, usually based on cross-border remittance service providers such as Debunk, CROSS, JRFKorea, InterRemit Money Transfer, TravelPay, Hanpass, GME Remit, E9PAY, QSRemit, GmoneyTrans, ReLe Transfer, and SENTBE.

For this service, five types of APIs are used: account holder identification, account balance inquiry, debit transfer, credit transfer, and transaction information inquiry.

- 1)

When a customer registers an account in the domestic bank for remittance, the fintech checks whether the customer is the real holder of the account through the account holder identification API.

- 2)

When the customer asks to send funds to another country, the fintech checks whether the customer has sufficient money through the account balance inquiry API.

- 3)

The fintech then withdraws the requested amount of money from the customer’s account using the debit transfer API.

- 4)

Next, the fintech deposits the money into its account through the credit transfer API.

- 5)

Finally, the fintech sends a message to its partner in the other country requesting that the specified amount of money be transferred to the recipient.

Figure 12.

Process of cross-border remittance using open APIs.

Figure 12.

Process of cross-border remittance using open APIs.

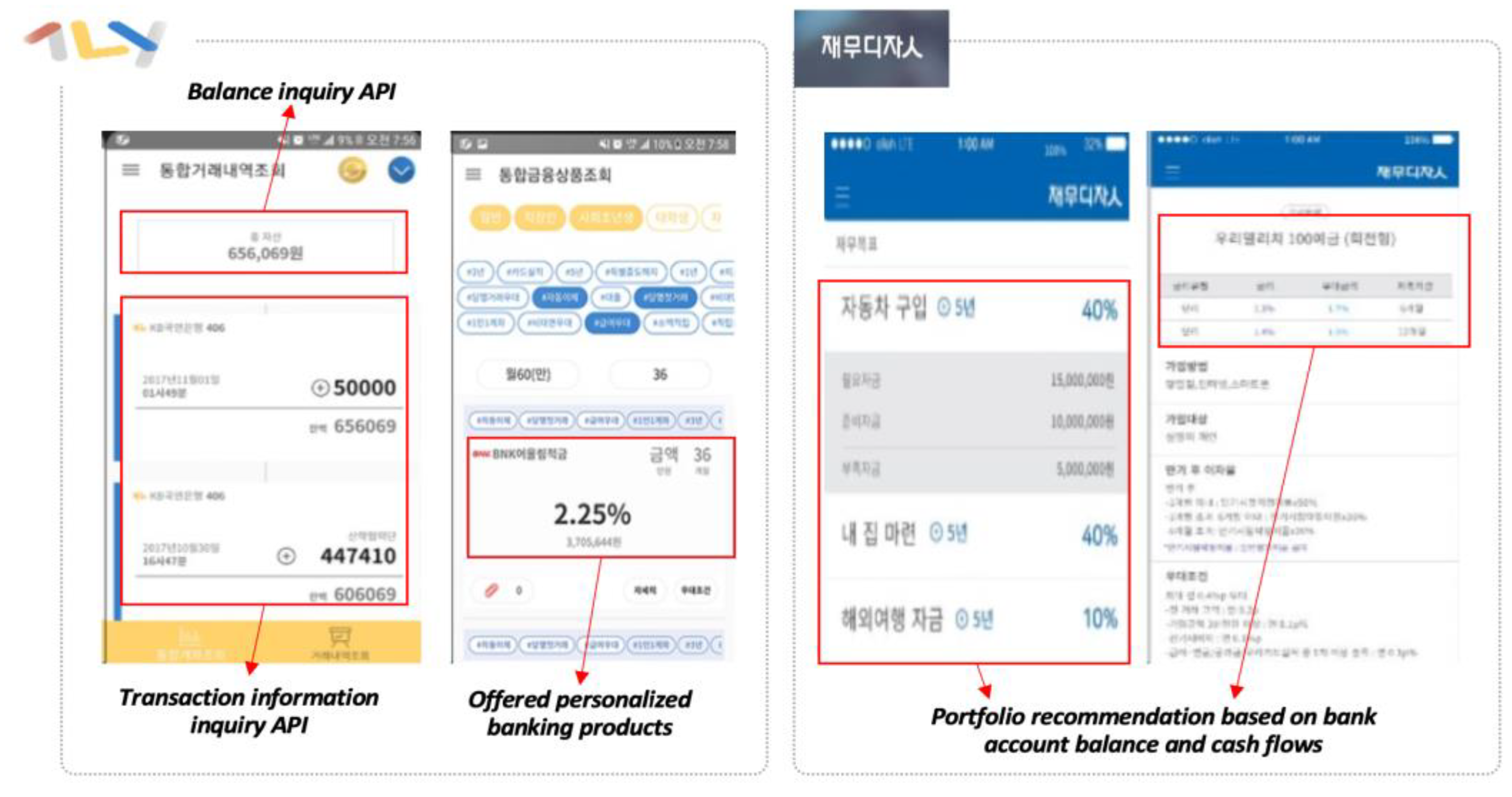

4.1.4. Asset Management

Fintech companies provide various asset management services, such as automatic investment services. This service utilizes algorithms or artificial intelligence to make investment decisions automatically. Investors input information such as their investment goals and risk preferences, and based on market analysis and data, the service constructs and optimizes the investor’s portfolio. These services typically have low fees and offer the advantage of utilizing the expertise of investment professionals, while reducing investment amounts. This model can also be used to provide asset-allocation and rebalancing services, which appropriately diversify investment portfolios to minimize risks and maximize returns. Fintech companies construct portfolios tailored to each customer's investment profile and automatically rebalance them whenever assets deviate from target allocations, thus maintaining optimal portfolios. Several fintech companies also provide investment education and advisory services to enhance customers' understanding of investments, boosting their confidence in investment decisions, and assisting them in achieving their financial goals. In addition, fintech companies can offer asset management services that can help minimize customers' tax burdens by adjusting their portfolios. By utilizing strategies such as tax-loss harvesting, tax-efficient fund placement, and tax deferment, these services aim to minimize tax expenses and maximize investment returns. Finally, fintech companies offer services that enable customers to automatically save towards their goals. This allows customers to start with small amounts and gradually increase their assets over time.

Even before financial institutions provided APIs, fintech companies offered customers some inquiry services, such as integrated account information inquiries and "screen scraping." Screen scraping is a technology that automatically collects and stores necessary data from data shown on an Internet website. Websites are written in a programming language called HTML, and screen scraping collects and analyzes HTML code to extract customer data. In countries where data cannot be collected through APIs owing to a lack of financial open API infrastructure, screen scraping technology is still used as an alternative. However, this method can open customer information up to vulnerabilities, as solution providers directly store and use customer authentication information (e.g., ID, password, certificate). The solution provider collects the displayed information by scraping after performing authentication with information on behalf of the customer. The solution company directly stores and uses the customer authentication information to relieve the inconvenience of the customer repeatedly entering authentication information. In addition, reliably obtaining data is challenging if a website's user interface or program changes because, unlike APIs, information is collected using only the customer's authentication information without a formal contract with a financial company. Owing to these shortcomings, financial services are often prohibited from using screen scraping. Thus, APIs can be considered more suitable than screen scraping for financial services that prioritize safety and standardization.

The first step for asset management services based on open APIs is to gather and show customers’ individual financial information, such as their bank account balance. Korea’s open banking API platform enables fintech companies to gather and show each customer’s individual financial information with their permission. Through a single application based on information inquiry APIs, customers can manage their dispersed bank account information from all the banks with which they trade and obtain customized recommendations from fintech companies that provide asset management services. Among the 30 mobile applications we analyzed, 10 provided this service, including SAVLE, TOSS, WireBarley, SBI Cosmoney, PAYCO, NaverPay, Banksalad, Fint, Kakaopay, and Finnq.

For this service, fintech companies use balance inquiry and transaction information APIs as follows:

- 1)

The fintech shows the customer the asset amount at each financial company together through the balance inquiry API.

- 2)

The fintech shows the customer the transaction history of each financial company together using the transaction information inquiry API.

- 3)

The fintech offers personalized banking products or recommends a portfolio based on the customer’s bank account balance and cash flow.

Figure 13.

Asset management process using open APIs.

Figure 13.

Asset management process using open APIs.

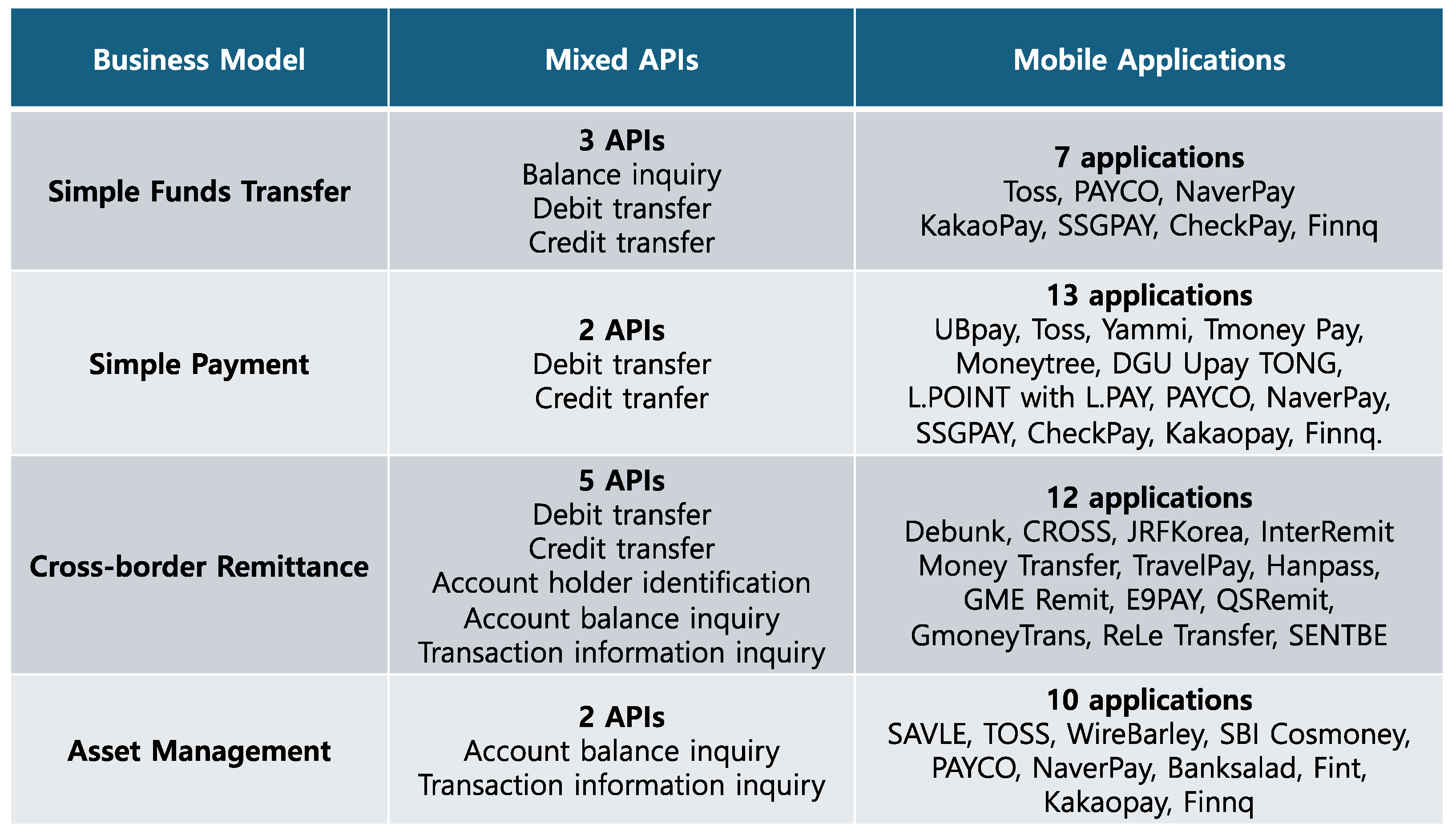

4.2. New Business Model Classification

We analyzed the business models of 30 mobile applications from fintech companies that provide customers with services using Korea’s open banking API platform and classified them into four business models: simple fund transfer, simple payment, cross-border remittance, and asset management. The first business model, simple fund transfer, is composed of three APIs–balance inquiry, debit transfer, and credit transfer–and is implemented by seven mobile applications. The second business model, simple payment, is composed of two APIs, debit transfer and credit transfer, and is applied by 13 applications. The third business model, cross-border remittance, comprises five APIs: debit transfer, credit transfer, account holder identification, account balance inquiry, and transaction information inquiry, and it is provided by 12 applications. The final business model, asset management, is composed of two APIs, account balance inquiry and transaction information inquiry, and is offered by 10 applications. Among the mobile applications, five applications provided by big tech platforms such as Toss, PAYCO, NaverPay, KakaoPay, and Finnq apply three business models through a single application, excluding cross-border remittances. Mobile cross-border remittance applications are typically provided by fintech companies that focus on this area.

Table 1.

New business model Classifications.

Table 1.

New business model Classifications.

5. Discussion

This study analyzed new fintech business models created by open API technology applied to the financial infrastructure shared by banks and fintech companies. The study found that the convergence of IT and financial services has contributed to the creation of new sustainable business models for fintech companies. This has implications for developing countries in which fintech services play a substantial role in financial inclusion by providing new sustainable financial services. Korea's open banking API platform is growing at the fastest pace worldwide, despite getting a relatively late start compared to European countries. The various new business models analyzed in this study have led to its rapid growth. Therefore, it is necessary to examine the characteristics of the Korean open API banking infrastructure that have enabled such rapid growth. The characteristics identified in this study can be summarized as follows.

The first is the diversity of APIs. In other open banking platforms, such as those in the UK and EU, open API platforms mainly provide inquiry APIs, whereas the Korean open banking platform provides various APIs, such as transfer APIs. In particular, the debit transfer API, which is the API most actively used by fintech companies, is a crucial factor that makes it possible to transfer money in real time through an interbank network directly linked to all commercial banks. Fintech companies create new financial services by combining various APIs.

The second feature is a single unified interface. In the UK and EU, in most cases, individual banks provide their own interfaces through separate contacts using standardized open APIs. For example, in the UK, each bank provides an interface according to the standards and requirements set by the OBIE, and TPPs such as fintech companies use the services through those bank interfaces. However, in Korea, the provider and user exchange information through a single interface on the shared platform. In addition, the KFTC, which is the organization operating the open API platform, signs a contract on behalf of all information providers, providing convenience for platform users in utilizing all APIs. This feature benefits both information providers and users. Because the user can exchange messages with all information providers through a single interface, costs for service launch and management can be greatly reduced, and the preparation period also can be shortened. The biggest advantage is that it can increase the competitiveness of a service by linking customers with all financial institutions. From a provider’s perspective, it is possible to provide information to all users through a single interface, thereby increasing the efficiency of IT resources and reducing the management burden.

The third aspect is a structure of participation based on reciprocity. In the UK and EU, financial companies such as banks are limited to providing information through APIs, and TPPs, such as fintech companies, are limited in the information they can use; therefore, in most cases, they are only in one position. However, in Korea, financial companies such as banks can use the platform to provide services to their customers, and some fintech companies operating in the prepaid business also provide information on the platform; thus, most participating organizations are both information users and providers. This principle of reciprocity significantly contributes to the activation of the entire platform by enabling fair competition among various players in the market. This characteristic acts as an incentive for large commercial banks, which play the most decisive role in the platform's growth, to actively participate in this network.

We also found that government policy is crucial for the success of the open banking platform as a financial market infrastructure. Despite the rapid growth and success of Korea’s open banking API platform, financial authorities need to establish long-term strategies and action plans for future development and support them through policies.

First, to maximize the platform’s network effect, it is necessary to continuously expand the number of institutions participating in open banking. In 2019, it was fully implemented for banks and fintech companies, the service area was expanded to virtually all financial sectors, including financial investment, credit card, insurance, and capital companies.

Second, to strengthen the virtuous cycle structure of the platform ecosystem, it is necessary to expand the scope of services. In the case of the fund transfer API, an additional payment instruction API that can be used in the new services created by the AISP platform, also called the “MyData” platform in Korea, would be useful for creating new business models. For the inquiry API, it is necessary to expand the scope of accounts, such as corporate, trust, checking, and individual retirement pension accounts.

Finally, from a long-term perspective, the open banking API platform should seek to standardize “Banking as a Service” (BaaS) APIs. To maximize the synergy between banks and fintech companies, the need to revolve financial services around Baas has recently emerged. The open banking API platform, which has already become essential in the Korean financial market, is expected to play an optimal infrastructure role in creating a BaaS base for market players to focus on their specialized functions.

6. Conclusion

We conducted a case study on Korea’s open banking API platform to analyze new sustainable fintech models created by the open API technology applied to the new financial infrastructure. With the establishment and implementation of the open banking API platform, both large and small changes have occurred for market players. Financial customer data, held exclusively by financial institutions, and payment functions are shared with fintech companies in the form of standardized open APIs that can easily and quickly launch services. These companies have the opportunity to compete with traditional financial institutions by reducing costs, focusing on service innovation, and developing customized financial services that reflect customer needs. With the launch of the open banking API platform, diverse new business models have been created and provided through mobile applications, significantly improving convenience for financial consumers. This study classified the new business models into four representative types, and their academic significance is described below.

First, while previous studies on open banking were limited to open API technology or open banking policy, this study focused on the application of the technology to new fintech business models. This allowed us to expand the scope of the study to include the effects of technology convergence and policy on fintech business models. From this perspective, this study can contribute to further research on the relationships between fintech business models and both technology and policy, as well as the convergence of technology factors and business models in the financial market.

Second, as this study focused on the specific case of the open banking API platform in Korea, which could be considered one of the most successful cases in open banking, it can contribute to further studies on the factors that potentially lead to the success of the application of the open banking API platform to the real financial market. Therefore, this study has practical implications for national authorities preparing to introduce open banking policies in their countries.

Third, this study will contribute to academic research on open banking platforms. Although open banking platforms have already been introduced in many countries, they have not been studied extensively in the academic field, with most studies from the legal, business, and technical fields, depending on the research of international organizations and financial institutions. This study demonstrates that open banking API platforms could be an academic subject for further research.

Fourth, this study could contribute to improving financial inclusion in developing countries by providing sustainable fintech business models using open API technology. In many developing countries, fintech companies complement financial institutions by providing more accessible financial services through mobile applications for service channels. This study suggests various real financial service cases that can serve as references for sustainable fintech business models in developing countries.

Despite this study’s academic and practical contributions, it has limitations that should be addressed in future studies.

First, it was limited to a single case in Korea. It is necessary to expand the research subjects to multiple cases across countries, especially European countries, including the UK, which introduced an open banking policy earlier than Korea, to generalize the findings of the study. A comparative analysis with the European case would be effective in finding implications for the authorities of other countries that are preparing to introduce the open banking policy.

Second, this study was based on a qualitative analysis of the Korean case. Additional empirical research based on this case study is required to enhance the validity and reliability of the findings. A statistical study of the change caused by the introduction of the open banking API platform would be effective in analyzing the impact of the new API platform on changes in the financial market.

Third, we focus on a new business model created using an open banking API platform. Further studies on a variety of factors related to open API technology in the fintech industry or financial market would be necessary to expand the academic scope for research.

Fourth, this study refers only to developed countries that already have an advanced financial market infrastructure. Therefore, its direct application to developing countries is limited. Further studies are needed to suggest ways to improve financial inclusion in developing countries using open API technology.

Author Contributions

Conceptualization, S. O. and G. C.; methodology, S. O.; software, G. C.; validation, K. C.; formal analysis, S. O.; writing—original draft preparation, S. O. and G. C.; writing—review and editing, S. O. and K. C.; supervision, K. C. All authors have read and agreed to the published version of the manuscript.

Funding

This study received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix

The List of Mobile Applications using Open API Platform of Korea (As of December 2023)

| |

Mobile Application name (Developer & Provider) |

| 1 |

UBpay (HAREX Infotech) |

| 2 |

SAVLE (Buencamino) |

| 3 |

Debunk (ICB Co., Ltd.) |

| 4 |

CROSS (CROSS ENF INC.) |

| 5 |

JRFKorea (JAPAN REMIT FINANCE) |

| 6 |

Toss (Viva Republica) |

| 7 |

Yammi (YCONS CO.,LTD) |

| 8 |

WireBarley (WireBarley Corp.) |

| 9 |

Tmoney Pay (Tmoney Co., Ltd.) |

| 10 |

SBI Cosmoney (SBI Cosmoney) |

| 11 |

Moneytree (Galaxia Moneytree Co., Ltd.) |

| 12 |

DGB Upay TONG (DGb Upay co.,Ltd.) |

| 13 |

L.POINT with L.PAY (Lotte Members Co., Ltd.) |

| 14 |

PAYCO (NHN Corp.) |

| 15 |

NaverPay (Naver Financial Corporation) |

| 16 |

SSGPAY (ShinsegaeMall) |

| 17 |

CheckPay (COOCON Co., LTD) |

| 18 |

Banksalad (Banksalad Co., Ltd.) |

| 19 |

Fint (December & Company Inc.) |

| 20 |

Kakaopay (kakaopay corp.) |

| 21 |

Finnq (Finnq inc.) |

| 22 |

InterRemit Money Transfer (Intercall Inc.) |

| 23 |

TravelPay (Travel Wallet Co., Ltd.) |

| 24 |

Hanpass (Han Pass Holdings Co., Ltd.) |

| 25 |

GME Remit (Global Money Express Co., Ltd.) |

| 26 |

E9PAY (E9PAY Co., Ltd.) |

| 27 |

QSRemit (NNP Korea Co., Ltd.) |

| 28 |

GmoneyTrans (GmoneyTrans Co., Ltd.) |

| 29 |

ReLe Transfer (Finger. Inc.) |

| 30 |

SENTBE (SENTBE) |

References

- EBA. (2016). Understanding the business relevance of Open APIs and Open Banking for banks. EBA Working Group on Electronic Alternative Payments.

- Hyun, J. (2019). Strategic and Desirable solutions to Widen Access of Fintech Firms to Payment & Settlement. Journal of Payment and Settlement 11(2): 39-86.

- Suh, J. (2019). Tasks in the Looming Era of Open Banking. KIF. Financial Research Brief 28(13):3-12.

- Kwon, H. (2020). Outcomes of Open Banking System Thus Far and Tasks Ahead. KIF. Financial Research Brief 29(17):3-12.

- Lee, H. (2021). Payment Market Insight from Statistics. KFTC, Payment Insight No.5., 68-75.

- Kassab, M. and Laplate, P. (2022). Open Banking, What It Is, Where It's at, and Where It's Going. Computer 55(1):53-63.

- BIS. (2019). Report on Open Banking and Application Programming Interfaces. Basel Committee on Banking Supervision.

- Palmieri, A. and Nazeraj, B. (2021). Open Banking and Competition: An Intricate Relationship. EU and Comparative Law Issues and Challenges 5(1):217-237.

- Laplate, P. and Kshetri, N. (2021). Open Banking: Definition and Description. Computer 54(10):122-128.

- Kwon, N. and Kim, I. (2020). Improvement of Regulations to Strengthen the Safety and Protect Users of Domestic Open Banking. Journal of Information and Security 20(2):37-52.

- Noh, H. (2021). MyData Business Status and Insurance Company Implications. KIRI Research Report 21(4).

- Alstyne, M., Parke, G. and Chandary, S. (2016). Pipelines, Platforms, and New Rules of Strategy. Harvard Business Review. April 2016, 54-60.

- Nah, J. and Na, J. (2018). Open Platform Standardization Trend for Safe Fintech Services. Review of KIISE, 28(4):13-17.

- Suh, J. (2018). Korean Banks’ Innovation Strategies Using Open APIs. KIF VIP Report, Dec 2018.

- Park, J. and Kim, I. (2020). A Study on the Current Status and Policy Direction of Open Banking. Journal of Service Research and Studies, 10(1):17-31.

- FSC. (2019). Banks’ Financial Payment System to Be Open to Fintech Firms. Press Release. Feb 25, 2019.

- Lee, S. (2022). Data Sharing through MyData Services: Implications for Big Techs’ Fair Competition. Korea Capital Market Institute. Opinion. Oct. 25, 2022.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).