1. Introduction

At the beginning of the third millennium, no hard importance was attached to new renewable energy sources. Energy production from fossil fuels dominated, so renewable sources were considered a small niche and were often called alternative energy. Uncertainty in the energy production from renewable sources (wind and solar energy) was the product of numerous factors such as production, technology, investor preferences, in-vestment return, risk, existing energy system grid, etc. It is also caused by global expectations that conventional energy production has no competition. Despite these circumstances, investments were not absent even in the first decade [

1]. In the period 2000-2009. the state, investors, and the public invest in the energy sector (wind, solar energy, and biofuels, excluding hydropower). Despite the financial crisis, only in 2009, about 147 billion dollars were invested in new renewable energy capacities. The Green Economy Initiative, led by the United Nations Environment Program since 2008, has played a significant role in promoting investments in green sectors.

In the next decade 2010-2019, according to the GTR [

1], three times more investments (

$2.6 trillion) were made in renewable energy capacities (solar energy

$1.3 trillion, wind energy

$1 trillion, and biomass and waste

$115 billion). The largest green investments in Europe, over 700 billion dollars, were achieved by Germany and Great Britain. Spain entered the "1 billion dollars plus club" (investment in capacities jumped more than five times in 2018), while Sweden, the Netherlands, and Russia have doubled their investments. The world leader in investments in 2010 was China (

$758 billion), which is almost a third of the total global investments in sustainable energy. It is followed by the USA (14%) and Japan (8%). These investments have led to positive economic results - competition costs have enhanced, technology has improved, equipment production efficiency has increased, financing costs have decreased, and larger capacities have been installed in the energy sector. On the other hand, developing countries record a continuous negative in-vestment gap in renewable energy every year (they need

$1.7 trillion, and generate

$544 billion). That is why initiatives are being strengthened to help the latter countries attract investments and sustainable funds.

Investment policies (at the national and international level) play a key role in financing the green economy. In developing and least-developed countries conventional instruments, such as tax incentives, dominate. In contrast, developed countries are moving to financial incentives and targeting new, more complex tools (feed-in tariffs and green certificates) to promote investment and facilitate the green transition. They are dominated by private investment funds, followed by public funds, while at the back are institutional investors. Therefore, governments in developing and emerging economies are including green investment measures in their national recovery plans [

2]. According to UNCTAD data [

3,

4], the volume of introduced policies and measures from 2010 to 2022 grew annually at 13% (13.1% for G20 members and 13.7% for other economies).

The applicability of all these policies, measures, and instruments consequently influenced the creation of a greater number of indicators used in sustainable development. Due to the specificity of their countries, policymakers create derivative indicators of sustainable development, which give relatively good results and reflect acceptable outcomes for the community. However, it is often complicated to successfully compare different countries using methodologically the same indicators from the database. This makes it hard to find a unique solution to specific issues. The best example is the SDGs, where 17 unique goals apply to all countries without exception but with many different indicators. Thus, a model was created that helps in the process of making decisions about green investments. The OECD Green Growth Indicators (OECDGGI) database was used in the analysis. Based on the assessment of criteria and alternatives, the multiple decision-making model will facilitate the estimation of sustainability and decision-making on green investments in countries that do not have all the indicators from the database above. The idea of this research is to examine the criteria that are crucial for investors when they decide whether to invest in the green economy or not. Based on this statement, the expected hypothesis is: that the criteria determine the types of investors in green investments in developed economies. The criteria on which we base our analysis are an integral part of the OECDGGI database: 1. Ecological and resource productivity of the economy (ERP), 2. Natural goods database (NAB), 3. Ecological dimension of quality of life (EDKL) and 4. Economic opportunities and policy responses (EOPR). The investors were selected into three groups: institutional investors (II), public investors (PU), and private investors (PR).

The rest of the paper is organized as follows.

Section 2 presents a literature review. Methodological issues and the application of the methods used are shown in section 3. The results and discussion are discussed in section 4. The final section provides a summary of our findings.

2. Materials and Methods

2.1. General Review

The concept of green economy itself is relatively new and has not been finally defined yet which allows for different degrees of trade-offs between environmental, economic, and social benefits, which can be useful in deciding. Here, we will focus on an important and current issue from the green economy, namely green investments. Green investments rep-resent public and private investments that, either directly or indirectly, are aimed at the sustainable use of resources, protection of natural capacities, and green growth [

5,

6].

In the 21st century, a need to move towards a green economy is reflected through economic growth based on environmental quality and social well-being [

7,

8,

9,

10]. The initiatives of large economies, such as China, the USA, and the EU, which create policies for sustainable financing while strengthening transparency and setting standards [

4] are especially current. The Green Economy Initiative follows broader international efforts, including the Sustainable Development Goals (SDGs) and the Paris Agreement on Climate Change. It recognizes the need for a holistic and integrated approach to address environ-mental challenges while fostering economic growth and social well-being. The concept of a green economy has become global, and the introduction of green economy strategies, policies, and measures has become massive [

11]. Different economies have different pat-terns in their "greening" programs [

12]. According to Loiseau et al. [

13], the purpose of establishing relevant concepts, approaches, partnership tools, funds, and other measures is to deal with risks affecting economies. Carraro et al. [

14] see the ideal political framework in full direct cooperation of all countries.

Through the strategies related to the green transition, developed countries have introduced strategies and programs to improve efficiency and improve the system [

15]. The green transition implies a transformation towards a green economy, achieved by finding less harmful alternatives that require huge investments. This transformation covers a series of steps that need to be taken to achieve greater investment efficiency. Governments use numerous measures and tools to encourage green investments. The Dutch government encourages investment in green funds through the Green Funds Scheme, which includes a tax credits mix (lower than market) and tax exemptions (on dividends and interest payments) to all interested investors. Multilateral banks and international development institutions also play a crucial role in technical assistance and support for capacity building [

16]. The ambiguity of green investments exists in the labour market. Until recently, most literature has emphasized job losses and lost earnings in the green economy [

17,

18,

19]. Training programs provide upskilling for the unemployed or employed, leading to recognized qualifications in green jobs [

12,

20]. These workers in developed countries receive a wage premium of around 4 percent [

21]. The premium reflects knowledge of sustainability, renewable energy, and environmental management.

Green investment involves directing financial resources and capital towards projects that yield positive environmental and social outcomes [

22]. Turbulence in the global market in recent years, caused by high inflation, rising interest rates, and the looming risk of a recession, did not slow down investment in green economies. According to UNCTAD data [

4], the value of the sustainable financial market (bonds, funds, and voluntary carbon markets) reached almost 6 trillion dollars in 2022. More than half (

$3.3 trillion) is the value of the sustainable bond market. Green bonds continue to represent a growing source of financing for certain sectors of sustainable development (energy and water), in addition to the overall weakness of the bond market (down 11% compared to 2021). Nonetheless, financial institutions and supranational entities recorded gains, which preserved a high share of green bonds (56.2% or

$501 billion). Among the BRICS countries, China has be-come the leading issuer of green bonds [

23]. China is considered the most proactive country, a global front-runner, and a leading force in green finance [

24].

With the growth of the role of the green economy, the number of scientific analyses and research has significantly increased. Batrancea et al. [

25] show that restructuring the market economy and a green economy transition implies continuous efforts and interdependence because it cannot be achieved in isolation. Zhang et al. [

26] assess the impacts on investments and public finances of the transition to a green economy using a mix of the AHP and COPRAS-G methods. Li and Gan [

27] investigate the role of finance in promoting green development and highlight the significant positive effect of spatial spillovers. A broader framework of analysis of the financial regulations' role in the sustainable green economy in Turkey was conducted by Odugbesan et al. [

28]. In the study, they showed that there is a long-term causal relationship between laws, economic freedom, inflation, and carbon productivity. Ye and Dela's [

29] study deals with the effect of green financing and investment on corporate social responsibility and the sustainable performance of a company in the chemical industry in Indonesia.

Multi-criteria decision-making (MCDM) is an increasingly popular tool in energy planning, and its high flexibility enables decision-making, taking into account all criteria and objectives [

30]. Various models have been developed and used effectively for the decision-making problem considering several factors/criteria [

31,

32]. Saaty's Analytical Heuristic Process (AHP method) has been widely used for several decades in numerous sec-tors of the economy, mining [

33], agro-economy [

34], the IT sector [

35], banking [

36], sustainable development [

26], etc. Rezeai's Best-Worst Method (BWM) is a newer MCDM technique that resolves the inconsistency of pairwise comparisons. It finds application in an increasing number of areas, such as banking [

37], energy sector [

38], manufacturing [

39], innovation [

40], etc.

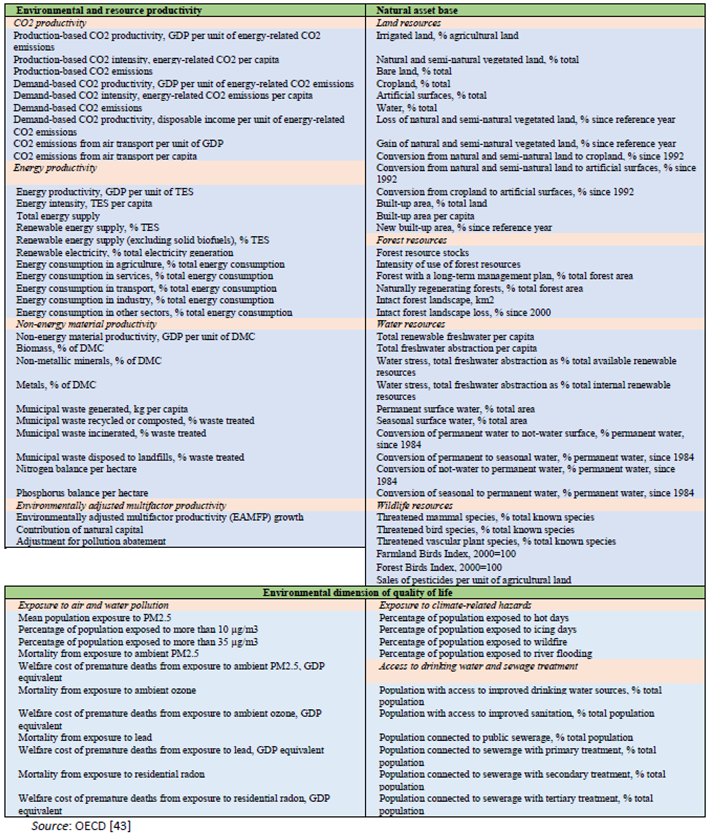

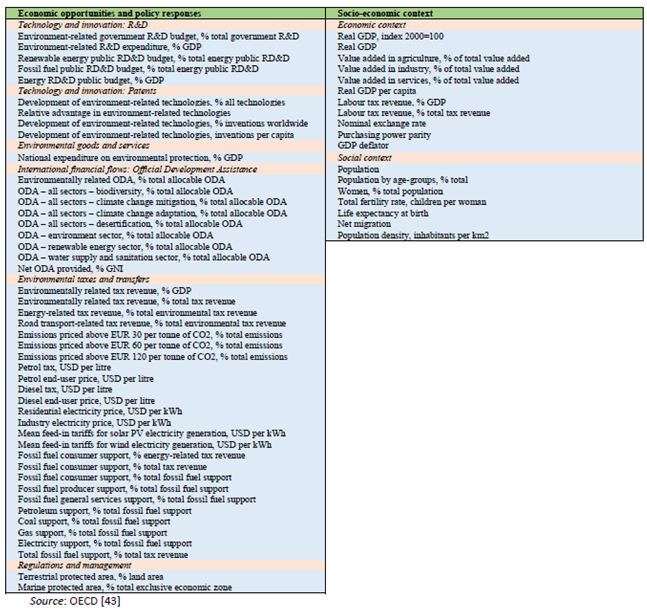

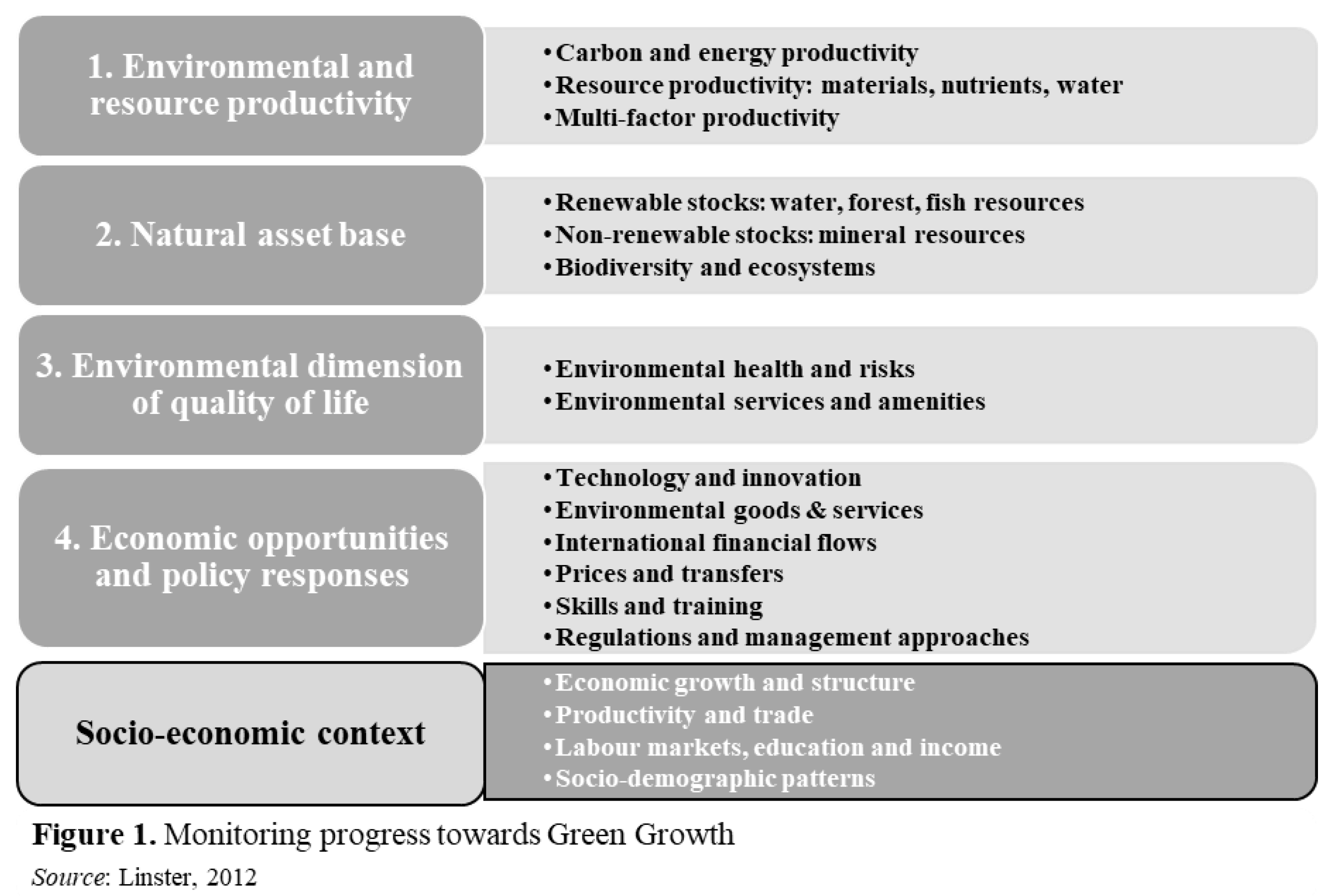

2.2. OECD Green Growth Indicators

The OECDGGI database [

41] is part of the general OECD database [

42]. Data for 251 indicators and by country are available on the official website. This database consists of numerous and diverse indicators concerning the combination of economics and environ-mental policy [

43]. In general, it is structured through three levels. The first level consists of a set of areas (

Figure 1): 1. Environmental and Resource Productivity of the Economy (ERP), 2. Natural Assets Base (NAB), 3. Environmental Dimension of Quality of Life (EDKL) and 4. Economic Opportunities and Policy Responses (EOPR). Indicators of socioeconomic context and growth characteristics complete the picture of the database. The latter sublimates the relevant baseline information for measuring the effects of green economy policies and measures on economic development and social goals (poverty reduction, social justice, and inclusion). The second level consists of sectors, of which there are a total of 18 for all five areas. The third level consists of indicators. This structure is favourable for researchers because the database provides numerous modelling possibilities. The data series is suitable for econometric models and aims to stimulate various discussions and analyses of the green economy.

This is not a series of composite indicators but a set of internationally comparable indicators (

Table A1 in

Appendix A). It is important to emphasize that the database does not identify a finite number of indicators. The crucial advantage is the flexible framework in which the data is available, as it is easily adapted to country circumstances and easily improved and further developed [

44]. Therefore, the use of this database is widespread. The lack of this base is objective. For some countries, data are missing for many indicators, or the time series is incomplete (e.g. for Australia, data are available for 156 indicators, but not the same time series). This makes it difficult to compare countries across indicators so researchers can manage the data based on alternative levels.

The OECD [

9] report states that the details for indicators are sometimes limited and need to be placed in a valid context for analysis. An example is given where data on environmental pressure are rarely available in industrial activities, and favourable information can only be constructed at the level of the entire economy. In such cases, it is important to supplement the indicator. This led the authors to stay at the area level in the analysis and avoid the potential problem or subjective assessment of certain information due to missing data for an indicator.

The research is focused on four areas from the OECDGGI database (refer to

Figure 1), according to their weights. Subsequently, a multi-criteria decision-making approach is employed to rank these areas. The primary objective is to facilitate a comprehensive comparison of various countries at a broader scale, overcoming limitations posed by the absence of concrete official data, particularly in situations where such data is not readily available. The task of this research is to use a combination of MCDM techniques to aid in decision-making. We recognize the advantage of the model in a shorter decision-making process. Namely, the problem is solved using algorithms within a hierarchical structure and a decision is made. This is an alternative procedure to models based on time series or cross-sectional data, which may sometimes be unavailable.

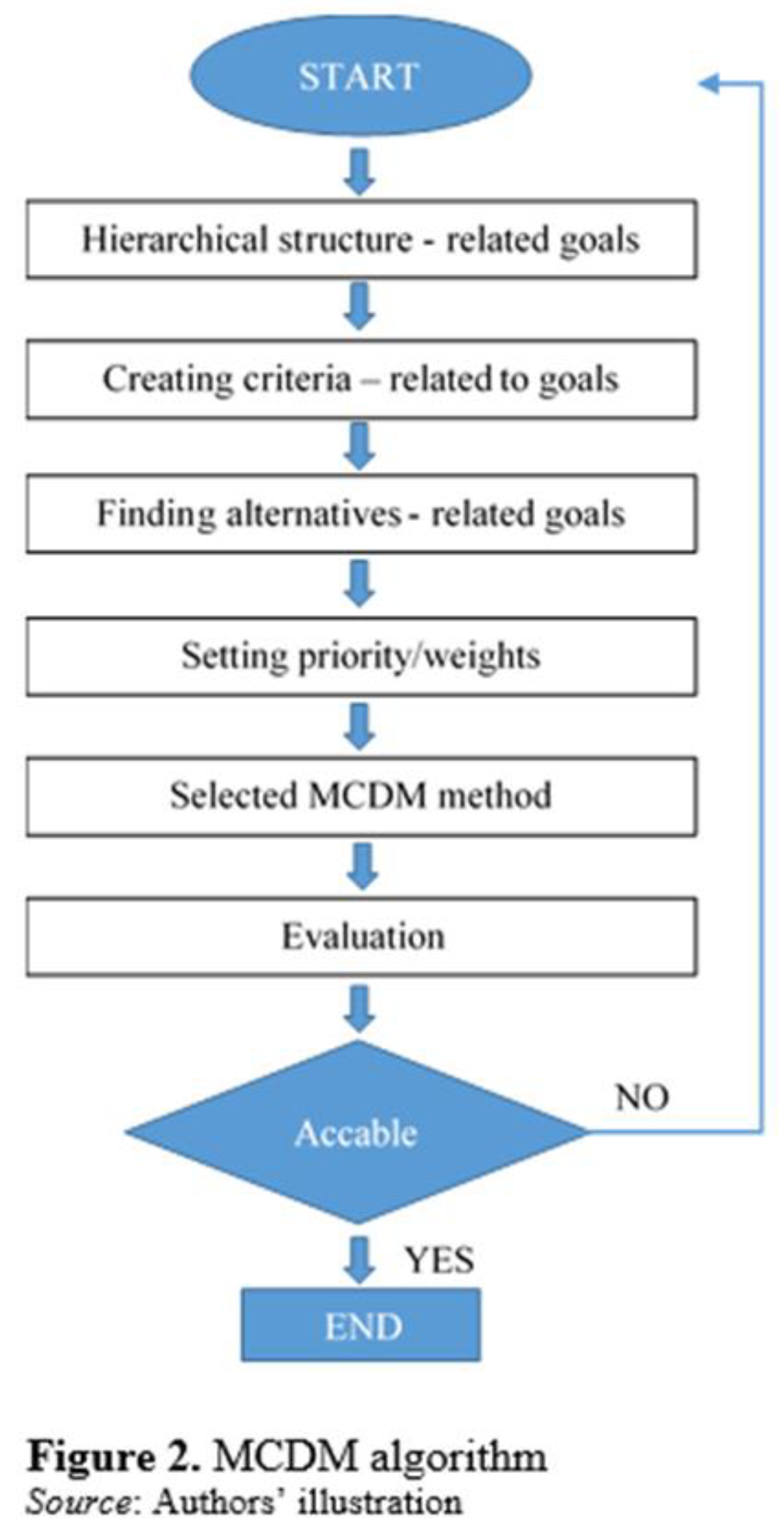

2.3. Multi-Criteria Decision-Making (MCDM)

The application of MCDM is widespread in various research fields. It is increasingly represented in sustainable development, energy, water treatment, environmental pollution recovery, etc. MCDM has many techniques that manage the perfect design with multiple dimensions. They make available all the criteria, rank them according to priority, in the presence of other goals, and help to make the appropriate decision (

Figure 2). A good decision-maker can extend the model in a few steps without leaving the methodological framework and make the right decision. MCDM techniques help the decision maker to quantify certain criteria according to their importance within a hierarchical structure.

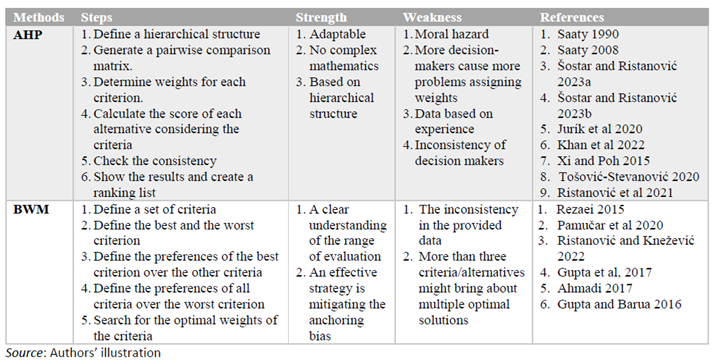

The goals set in the hierarchy can usually lead to different solutions at different times based on the priorities set by the decision-makers. Even a certain problem can be approached with other methods. Each method or model has its shortcomings and limitations. AHP and BWM techniques will be used in this research (

Table 1).

Table 1.

MCDM methods. Source: Authors’ illustration.

Table 1.

MCDM methods. Source: Authors’ illustration.

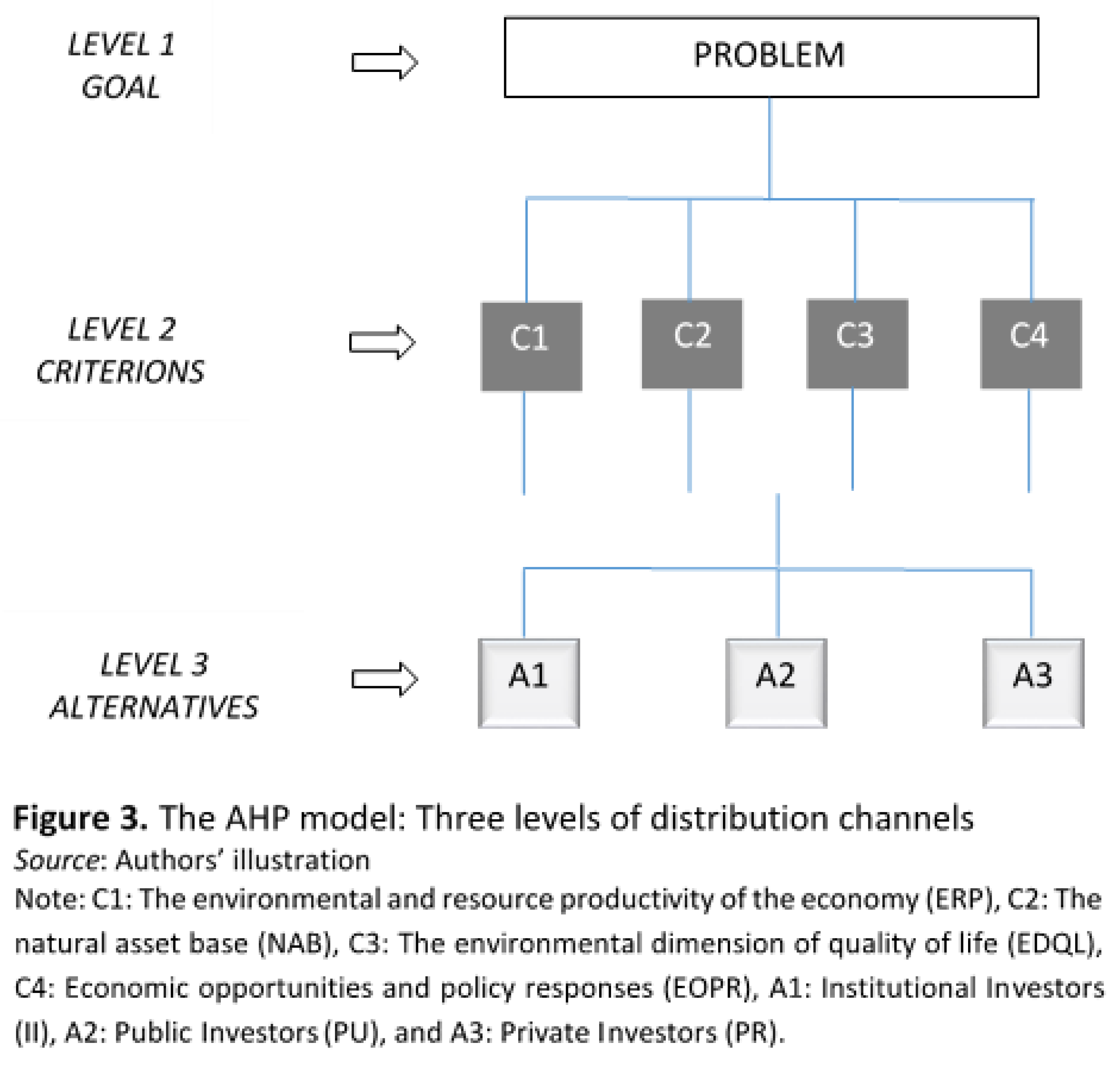

The decision-making process implies a hierarchical structure in which alternatives are evaluated according to several criteria. The best of the ranked alternatives was selected, which is also the best solution to the problem. The AHP method is the most commonly used MCDM decision-making technique. This method is based on the assumption that criteria are mutually independent, and interactions between sub-criteria do not exist. The logical structure of interconnected components is shown in

Figure 3. The hierarchical structure of AHP consists of a series of steps. Defining the problem is the first step. Then the goals are defined, a matrix is created, and a pairwise comparison with experts. Experts from different work experience and education levels participate in the assessment. The priority of the criteria is determined according to the problem. The next step is to calculate the priority of the alternatives for the previously mentioned criteria. Finally, the priorities of the alternatives according to the obtained problem are defined. This procedure further leads to a vector of weights for each level, which are then ranked. The highest values give the best solution to choose, which is also the final green investment decision. A major drawback of this method is the inconsistency of decision makers in pairwise comparisons (due to the large number of pairwise comparisons of criteria). To overcome this shortcoming of the model, the BWM method is applied. By applying only 2n-3 comparisons, optimal values of the weighting coefficients are obtained. In BWM, the first step is to define a set of criteria. The best and worst criteria are determined and the preferences of the criteria over others are given. The weights of the criteria are calculated and finally, the criteria are ranked. The Best Worst Method (BWM) is a powerful MCDM tool used to define criterion weights. It has excellent results in decision-making for criteria with the same influence on the maker. The application of the method is simple because it defines a unique best/worst criterion within the set of observed criteria.

Note: C1: The environmental and resource productivity of the economy (ERP), C2: The natural asset base (NAB), C3: The environmental dimension of quality of life (EDQL), C4: Economic opportunities and policy responses (EOPR), A1: Institutional Investors (II), A2: Public Investitors (PU), and A3: Private Investors (PR).

3. Results

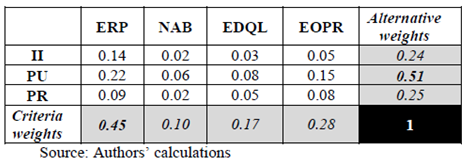

From the results of the AHP model (

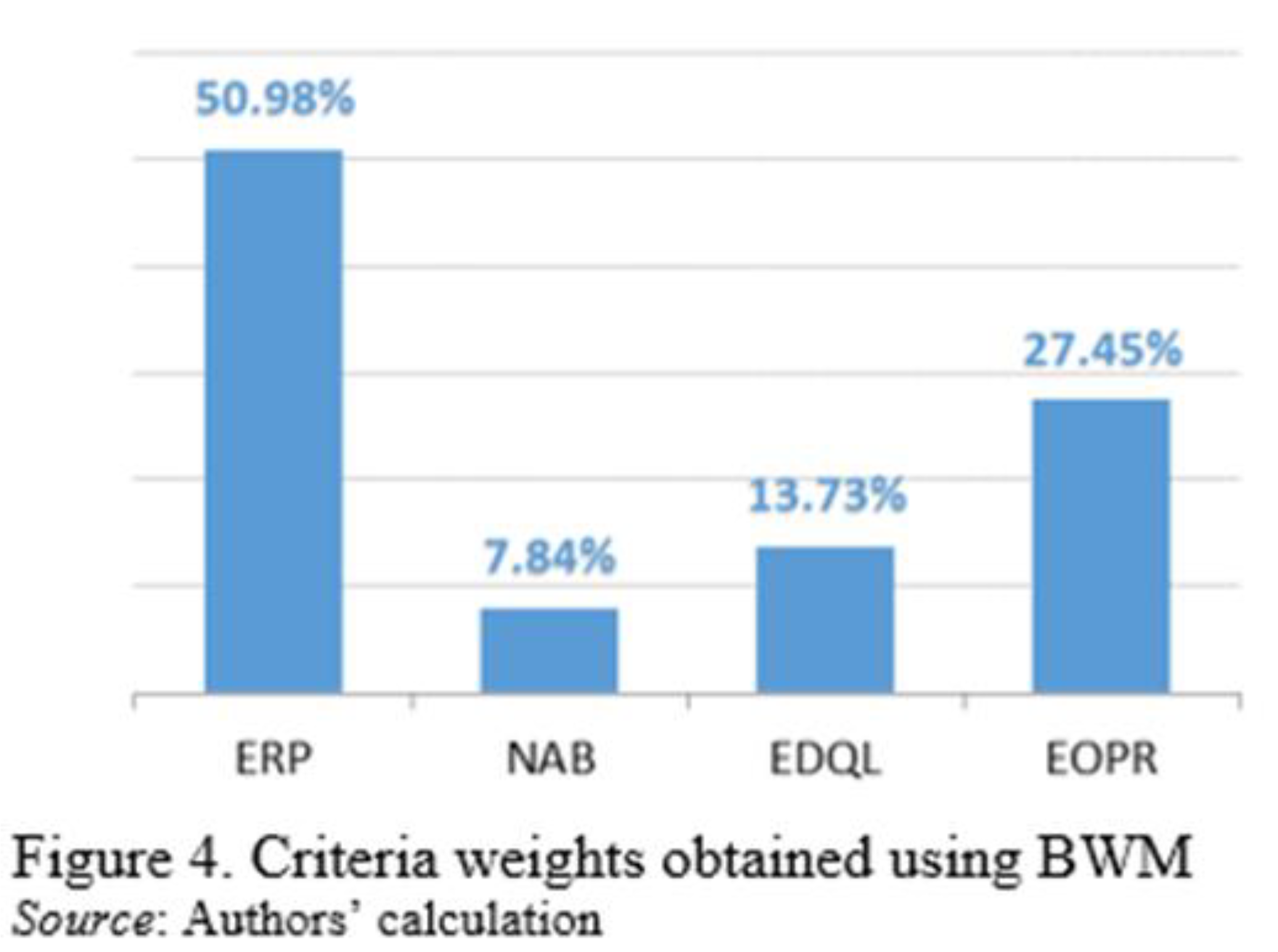

Table 2), it can be determined that public investments dominate (alternative 2) in green economy investments (0.51). Investments from private sources (alternative 1) and institutional investments (alternative 3), which have an approximate score (0.25 and 0.24), have a great advantage. At the same time, the obtained results on the criteria show that ERP factors are dominant when deciding on investments in the green economy (0.45). The following important set of factors is determined by the EOPR criterion with a weight of 0.28. The EDKL and NAB criteria give the lowest importance, with weights of 0.17 and 0.10, respectively.

Table 2.

Finale result, AHP method. Source: Authors’ calculations. MCDM methods.

Table 2.

Finale result, AHP method. Source: Authors’ calculations. MCDM methods.

Most public funds are state funds, and these results confirm that these are the main ones focused on sustainability issues. Public funds include a wide range of institutional measures, such as fiscal targets, rules, and measures; sectoral development panels; coordination of national bodies; project financing; and public infrastructure. A crucial role of public funds is to encourage private investment. Ocolisanu et al. [

45] confirm a strong positive correlation between public and private investment (crowd-in or crowd-out effect). In a broader context, public funds can include large and small businesses, mutual funds, pension funds, individual investors, and non-profit organizations. Private sources of funds are mainly focused on profit. It is known that investing in sustainability is a risky and short-term non-profit investment, less attractive for private capital. Private investors include companies, banks, and insurance companies. Individual investors include high-net-worth individuals, venture capitalists, and private investors. Their investments are in technology and innovation or sectors with some incentives and social benefits. Social responsibility is a crucial issue so the range of investments in sustainable development is gradually expanding. Institutional investors, such as international financial institutions, insurance companies, and funds, provide support through various forms of global investment to encourage sustainable development. Numerous initiatives have be-come part of national strategies and all significantly contribute to the processes of implementation and financing of sustainable development [

46].

A substantial amount of funds is invested in three main areas: resources, productivity factors, and energy productivity. At the same time, they are integral parts of sustainable development strategies and sustainability policies, covering the issues of CO2 neutrality [

47], resource productivity in the EU [

48], and energy productivity [

49]. The following important criterion in deciding to invest in the green economy or not is policy issues of sustainable development and how these policies are implemented in the labour market, education, regulations, technology, innovation, etc. The criteria related to environmental protection mainly refer to the introduced policies of sustainable development and their implementation. Such implementation requires time for investment, implementation, and outcome. The issues of natural resources, ecosystems, and biodiversity are exclusively national, and there is no question from which sources of funds are financed. The states are most interested in preserving resources, and investing in resources implies large-value funds, high risk, longer repayment periods, and high investment costs. Sustainable development strategies are focused on sustainable development policies, regulations, and action plans to maintain resources and resource productivity. These are mainly long-term and strategic investments.

Based on the results of BWM, the first-ranked criterion for the decision to invest in the green economy is ERP. The worst criterion is NAB. When there is a need for an alternative criterion, i.e. investment, the EOPR option can still be adopted instead of EDKL. This is certainly because there is a broader range of things are publicly funded that. Also, it maintains continuity in the long term. Due to the structured approach of BWM, inconsistencies in comparisons are minimized and are shown to be consistent with previously obtained AHP model results. Also, the results are accurate in decision-making due to secondary comparison elimination. Considering investment characteristics has been added to support the investment selection approach. This approach is considered valuable, as it helps future researchers to implement similar approaches on different types of investments.

5. Conclusions

Our research encompasses several objectives. Firstly, we aim to evaluate the significance of specific criteria in the decision-making process related to potential investments in the green economy. Additionally, our interest lies in delivering crucial insights that can enhance the governance of green policies. A key objective is to address knowledge and policy gaps within green investment, encouraging stakeholders to embrace new practices in green finance for sustainable resource management. By concentrating on developed countries, our study provides valuable insights applicable to policy-making in developing countries. Ultimately, our goal is to expand the context of the analysis globally, emphasizing the necessity for multidimensional and innovative approaches to green finance.

In the structure of green investments in developed countries, public finances dominate (alternative 2), while private sources of financing make up the largest part of total in-vestments (alternative 1), and institutional investors represent a small part of these flows (alternative 3). The environmental and resource productivity of the economy (ERP) is the most important of the criteria that influence the decision to invest in the green economy. Investment decisions based on The natural asset base (NAB) are the smallest as they are tied to available advantages at the national level and require long-term investments with low returns, or even in some cases with high investment costs. Private investors are more interested in profitable businesses with minimal social responsibility in the matter of sustainable development. While institutional investors mostly have a stimulating role and provide support from a global level. The above results confirm the expected hypothesis that investors are guided by the criteria of whether they invest in the green economy.

The advantages of a green economy for developing countries, based on the experience of developed countries, would be economic growth and creation of new jobs, protection and preservation of the environment, and improved quality of life. Sustainable results of the emerging economies have shown that the exciting investment opportunities available in the green economy should not be missed. For developing countries, green investments should be a challenge. On the one hand, they are in a better position than developed countries because they can install modern and efficient capacities previously unavailable. On the other hand, they are also at an advantage because their initial position will be based on efficient capacities.

Author Contributions

Conceptualization, V.R. and D.P.; methodology, V.R.; formal analysis, V.R.; investigation, V.R. and B.D.; resources, V.R.; data curation, V.R.; writing—original draft preparation, V.R., D.P. and B.D.; writing—review and editing, V.R.; visualization, V.R.; supervision, V.R.; project administration, B.D.; funding acquisition, D.P. and B.D.

Informed Consent Statement

All authors have approved the manuscript and agree its submission to Sustainability.

Data Availability Statement

We confirm that neither the manuscript nor any parts of its content are currently under consideration or published in another journal.

Acknowledgments

This research paper is the result of a research project entitled: "GREEN ECONOMY IN THE ERA OF DIGITALIZATION (Phase I)" of the Institute for Strategic Studies and Development "Petar Karić" ALFA BK UNIVERSITY, Serbia. The authors are grateful to the Institute for European Studies, serving as the coordinator of the Green Finance subproject, for supporting this research.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

Table A1.

OECD Green Growth Indicators. Source: /www.oe.cd/ggi.

Table A1.

OECD Green Growth Indicators. Source: /www.oe.cd/ggi.

References

- GTR. 2019. Global Trends in Renewable Energy Investment 2019, Frankfurt School-UNEP Centre/BNEF.

- Zhan, J. X.; Santos-Paulino, A. U. Investing in the Sustainable Development Goals: Mobilization, channeling, and impact. J Int Bus Policy. 2021, 4, 166–183. [Google Scholar] [CrossRef]

- UNCTAD. World Investment Report 2022 – International Tax Reforms and Sustainable Investment, United Nations Publications, 2022. New York.

- UNCTAD. World Investment Report 2023 – Investing in Sustainable Energy for All, United Nations Publications, 2023. New York.

- Eyraud. L.; Wane, A. A.; Zhang, C.; Clements, B. J. Who’s Going Green and Why? Trends and Determinants of Green Investment. 2011 IMF Working Paper No. 296. International Monetary Fund.

- Lović Obradović, S. Environmental Investments. In L. Filho, A. M. Azul, L. Brandli, P. G. Özuyar, & T. Wall (Eds.), Climate Action. Encyclopedia of the UN Sustainable Development Goals. 2019. pp. 1–12 Switzerland: Springer Nature.

- US. Inflation Reduction Act, Public Law No. 117-169 (08/16/2022) 2022. US Congess.

- EC. The European Green Deal, COM/2019/640 final, 2019. European Commision.

- OECD. Monitoring the transition to a low-carbon economy: a Strategic Approach to Local Development. 2015.

- UN. Green Investment Scheme, UN Conference on Sustainable Development (UNCSD), 2010.

- Wang, Z.; Wang, X.; Liang, L. Green economic efficiency in the Yangtze River Delta: spatiotemporal evolution and influencing factors. Ecosystem Health and Sustainability. 2019, 5(1), 20–35. [Google Scholar] [CrossRef]

- Cedefop. Skills for green jobs: 2018 update. European synthesis report. Luxembourg: Publications Office. Cedefop reference series; 2019, No 109.

- Loiseau. E.; Saikku, L.; Antikainen, R.; Droste, N.; Hansjürgens, B.; Pitkänen, K.; Leskinen, P.; Kuikman, P.; Thomsen, M.; Green Economy and Related Concepts: An overview. Journal of Cleaner Production 2016, 139, 361–371. [CrossRef]

- Carraro, C.; Favero, A.; Massetti, E. Investments and public finance in a green, low carbon, economy. Energy Economics 2012, 34, S15–S28. [Google Scholar] [CrossRef]

- UK. Green Finance Strategy – Transforming Finance for a Greener Future, June 2019. HM Governement.

- Hyung, K.; Baral, P. Use of innovative public policy instruments to establish and enhance the linkage between green technology and finance. In Handbook of Green Finance: Energy Security and Sustainable Development; Sachs, J.D., Woo, W.T., Yoshino, N., Taghizadeh-Hesary, F., Eds.; 2019. Springer: Singapore 1–24.

- Greenstone, M. The Impacts of Environmental Regulations on Industrial Activity: Evidence from the 1970 and 1977 Clean Air Act Amendments and the Census of Manufactures, Journal of Political Economy 2002, 110(6), 1175–1219. [CrossRef]

- Curtis, E. M. Who Loses under Cap-and-Trade Programs? The Labor Market Effects of the NOx Budget Trading Program The Review of Economics and Statistics 2018, 100(1), 151–166. [Google Scholar]

- Hafstead, M. A. C.; Williams, C. R. Unemployment and environmental regulation in general equilibrium, Journal of Public Economics 2018, 160, 50–65.

- Aldieri, L.; Vinci, C. P. Green Economy and Sustainable Development: The Economic Impact of Innovation on Employment, Sustainability 2018, 10, 3541. [CrossRef]

- EBRD. Transition Report 2023-24: Transition big and small, European Bank for Reconstruction and Development 2023.

- Inderst, G.; Kaminker, C.; Stewart, F. Defining and Measuring Green Investments: Implications for Institutional Investors‟ Asset Allocations, OECD Working Papers on Finance, Insurance and Private Pensions, No.24, 2012 OECD Publishing.

- UNCTAD. BRICS Investment Report, United Nations Publications, 2023 New York.

- Zhang, L. Y. Green bonds in China and the Sino-British collaboration: More a partnership of learning than commerce. The British Journal of Politics and International Relations 2019, 21(1), 207–225. [Google Scholar] [CrossRef]

- Batrancea, L.; Pop, M. C.; Rathnaswamy, M. M.; Batrancea, I.; Rus, M-I. An Empirical Investigation on the Transition Process toward a Green Economy, Sustainability 2021, 13(23), 13151. [CrossRef]

- Zhang, Y.; Tan, Y.; Li, N.; Liu, G.; Luo, T. Decision-Making in Green Building Investment Based on Integrating AHP and COPRAS-Gray Approach. International Conference on Construction and Real Estate Management 2018 (ICCREM 2018).

- Li, C.; Gan, Y. The spatial spillover effects of green finance on ecological environment—empirical research based on spatial econometric model, Environ Sci Pollut Res 2021, 28, 5651–5665. [CrossRef]

- Odugbesan, J. A.; Rjoub, H.; Ifediora, C. U.; Iloka, C. B. Do financial regulations matters for sustainable green economy: evidence from Turkey. Environ Sci Pollut Res 2021, 28, 56642–56657. [Google Scholar] [CrossRef] [PubMed]

- Ye, J.; Dela, E. The Effect of Green Investment and Green Financing on Sustainable Business Performance of Foreign Chemical Industries Operating in Indonesia: The Mediating Role of Corporate Social Responsibility. Sustainability 2023, 15, 11218. [Google Scholar] [CrossRef]

- Kumara, A.; Sahb, B.; Singhc, A. R.; Denga, Y.; Hea, X.; Kumarb, P.; Bansal, R. C. A review of multi criteria decision making (MCDM) towards sustainable renewable energy development, Renewable and Sustainable Energy Reviews 2017, 69, 596–609.

- Vučićević, B.; Jovanović, M.; Afgan, N.; Turanjanin, V. Assessing the sustainability of the energy use of residential buildings in Belgrade through multi-criteria analysis. Energy and Buildings 2014, 69, 51–61. [Google Scholar] [CrossRef]

- Matteson, S. Methods for multi-criteria sustainability and reliability assessments of power systems. Energy 2014, 71, 130–136. [Google Scholar] [CrossRef]

- Sivakumar, R.; Kannan, D.; Murugesan, P. Green vendor evaluation and selection using AHP and Taguchi loss functions in production outsourcing in mining industry, Resources Policy 2014, 46(1), 64-75. [CrossRef]

- Ristanović, V.; Tošović-Stevanović, A.; Maican, S.; Muntean, A. Economic overview of the distribution channels used by Eastern European small farms for their agricultural products. Agric. Econ. – Czech. 2022, 68(8), 299-306. [CrossRef]

- Durão, L. F. C. S.; Carvalho, M. M.; Takey, S.; Cauchick-Miguel, P. A.; Zancul, E. Internet of things process selection: AHP selection method. Int J Adv Manuf Technol. 2018, 99, 2623–2634 Springer London. [CrossRef]

- Ristanović, V.; Primorac, D.; Kozina, G. Operational risk management using multi-criteria assessment (AHP model). Tech. Gaz. 2021, 28, 678–683. [Google Scholar] [CrossRef]

- Ristanović, V.; Knežević, G. Multi-criteria Decision-Making on Operational Risk in Banks, Proceedings of the 1st International Conference on Innovation in Information Technology and Business (ICIITB 2022) 2022, pp. 5–21.

- Gupta, P.; Anand, S.; Gupta, H. Developing a roadmap to overcome barriers to energy efficiency in buildings using best worst method, Sustainable Cities and Society 2017, 31, 244-259. [CrossRef]

- Ahmadi, H. B.; Kusi-Sarpong, S.; Rezaei, J. Assessing the social sustainability of supply chains using Best Worst Method. Resources, Conservation and Recycling 2017, 126, 99–106. [CrossRef]

- Gupta, P.; Barua, M. K. Identifying enablers of technological innovation for Indian MSMEs using best–worst multi criteria decision making method, Technological Forecasting and Social Change 2016, 107, 69-79.

- OECD Green Growth Indicators Available online: https://oe.cd/ggi (accessed on 15 February 2024).

- OECD DataBase, Available online: https://data.oecd.org/ (accessed on 28 January 2024).

- OECD. Green Growth Indicators 2017, OECD Green Growth Studies, OECD Publishing, 2017 Paris.

- Linster, M. Monitoring progress towards Green Growth: OECD indicators, Workshop on Green Growth Indicators in LAC countries OECD-UNIDO Paris 7 June 2012.

- Ocolișanu, A.; Dobrotă, G.; Dobrotă, D. The Effects of Public Investment on Sustainable Economic Growth: Empirical Evidence from Emerging Countries in Central and Eastern Europe. Sustainability 2022, 14, 8721. [Google Scholar] [CrossRef]

- UNGO Private Sector Investment and Sustainable Development – The current and potential role of institutional investors, companies, banks and foundations in sustainable development, UN Global Compact, UNCTAD, UNEPFI, PRI, 2015.

- Chen, L.; Msigwa, G.; Yang, M.; Osman, A. I.; Fawzy, S.; Rooney, D. W.; Yap, P-S. Strategies to achieve a carbon neutral society: a review, Environmental Chemistry Letters 2022, 20, 2277–2310. [CrossRef]

- Taušová, M.; Tauš, P.; Domaracká, L. Sustainable Development According to Resource Productivity in the EU Environmental Policy Context. Energies 2022, 15, 4291. [CrossRef]

- Addai, K.; Ozbay, R. D.; Castanho, R. A.; Genc, S. Y.; Couto, G.; Kirikkaleli, D. Energy Productivity and Environmental Degradation in Germany: Evidence from Novel Fourier Approaches, Sustainability 2022, 14, 16911. [CrossRef]

- Jurík, L.; Horňáková, N.; Šantavá, E.; Cagáňová, D.; Sablik, J. Application of AHP method for project selection in the context of sustainable development Wirel. Netw. 2020, 28, 893–902.

- Khan, K.; Depczyńska, K. S.; Dembińska, I.; Ioppolo, G. Most Relevant Sustainability Criteria for Urban Infrastructure Projects—AHP Analysis for the Gulf States Sustainability 2022, 14, 14717.

- Pamučar, D.; Ecer, F.; Cirovic, G.; Arlasheedi, M. A. Application of Improved Best Worst Method (BWM) in Real-World Problems. Mathematics 2020, 8, 1342. [Google Scholar] [CrossRef]

- Rezaei, J. Best-worst multi-criteria decision-making method: Some properties and a linear model. Omega 2015, 64, 126–130. [Google Scholar] [CrossRef]

- Saaty, T. L. How to make a decision: The analytic decision process. Eur. J. Oper. Res. 1990, 48, 9–26. [Google Scholar] [CrossRef]

- Saaty, T. L. Decision making with the analytic hierarchy process. Int. J. Serv. Sci. 2008, 1, 83–98. [Google Scholar] [CrossRef]

- Šostar, M.; Ristanović, V. Assessment of Influencing Factors on Consumer Behavior Using the AHP Model. Sustainability 2023, 15, 10341. [Google Scholar] [CrossRef]

- Šostar, M.; Ristanović, V. An Assessment of the Impact of the COVID-19 Pandemic on Consumer Behavior Using the Analytic Hierarchy Process Model. Sustainability 2023, 15, 15104. [Google Scholar] [CrossRef]

- Tošović-Stevanović, A.; Ristanović, V.; Ćalović, D.; Lalić, G.; Žuža, M.; Cvijanović, G. Small Farm Business Analysis Using the AHP Model for Efficient Assessment of Distribution Channels. Sustainability 2020, 12, 10479. [Google Scholar] [CrossRef]

- Xi, X.; Poh, K. L. A Novel Integrated Decision Support Tool for Sustainable Water Resources Management in Singapore: Synergies Between System Dynamics and Analytic Hierarchy Process. Water Resour. Manag. 2015, 29, 1329–1350. [Google Scholar] [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).