1. Introduction

During economic turnover, obligations arise for sold goods or services as well as public-law fees. These obligations are not always repaid on time by a debtor, or not repaid at all. In such a situation, the creditor may attempt to recover the debt themselves or sell it at a discount to a specialized debt recovery firm. Debt collection companies purchase overdue debts in order to recover as much as possible from them. The process of collecting overdue debts is usually lengthy, involves many stages, and does not always result in repayment of a debt at a satisfactory level.

The debt collection process requires collection agency employees to have multiple contacts with debtors to enforce debt repayment. These contacts are often very psychologically demanding and quickly lead to burnout, resulting in short employment durations. Avoiding unnecessary contacts for debts with low recovery chances and reducing the frequency of contacts when the nature of the debt allows it are methods to make work in a collection agency more sustainable. Awareness of the debt collection company's responsibility for employees can lead to their greater job engagement and reduce the risk of burnout [

1].

One type of activity conducted by debt collection companies is the purchase of mass debts of small amounts. Mass debt portfolio comprises usually telephone subscription, energy charges, purchase of access to streaming services, etc. Managing the portfolio of purchased debt packages is one of the key management areas in a debt collection company. The portfolio of debts is built on the basis of the selection of debt packages available on the market. The proper debt recovery process influences the financial result of a debt collection company.

The models of debt collecting process used in practice do not always lead to proper recoveries of a receivables portfolio. This state of affairs is due to not fully utilized knowledge contained in the historical data on the debt collection process in a given collection company. In our opinion, the solution of the problem is the use of machine learning methods to discover dependencies in historical datasets. The use of knowledge discovery methods, followed by the automation of the debt purchasing and collection process, is a current necessity, as the European debt purchase market approached 25 billion EUR in 2020 and has been growing at double-digit rates [

2].

The main goal of our research was to build a model for collection process of mass receivables using machine learning techniques based on the characteristics of receivables. To achieve our main goal, we have formulated the following research questions.

Q1. Is it possible to construct a set of decision rules for the debt collection process based on the data held by a debt collection company?

Q2. Will machine learning methods allow the creation of non-trivial rules of conduct consistent with expert knowledge?

Q3. Will machine learning methods provide new insights into the debt collection process leading to the elimination of unnecessary actions?

Q4. Will it be possible to automate the debt collection process based on discovered decision rules and an inference engine?

As part of the research, a number of machine learning methods were compared, and consequently, decision tree was selected as a tool to discover the relationships between the characteristics of debts and the level of recoveries obtained through various procedural methods in the historical data. These dependencies took into account both: the characteristics of debts and the features of debtors themselves. The use of the decision tree also made it possible to generate decision rules understandable to experts conducting the collecting process of receivables.

The further part of the article is organized as follows.

Section 2 presents the procedures and legal foundations of the debt collection process using the example of Poland, as well as a review of global research in the field of debt collection.

Section 3 provides a brief formal introduction to the methodology of acquiring decision rules in the machine learning process.

Section 4 outlines the characteristics of the data used in the study and the methodology for building a machine learning model for generating rules.

Section 5 presents the research results, including a list of generated debt collection rules and a proposed new model for managing the process of mass debt collection. The article concludes with a discussion of the results and a summary of the research along with suggestions for further research directions.

2. Debt Collecting Methodology and Related Works

2.1. Mass Debt Collection - The Case of Poland

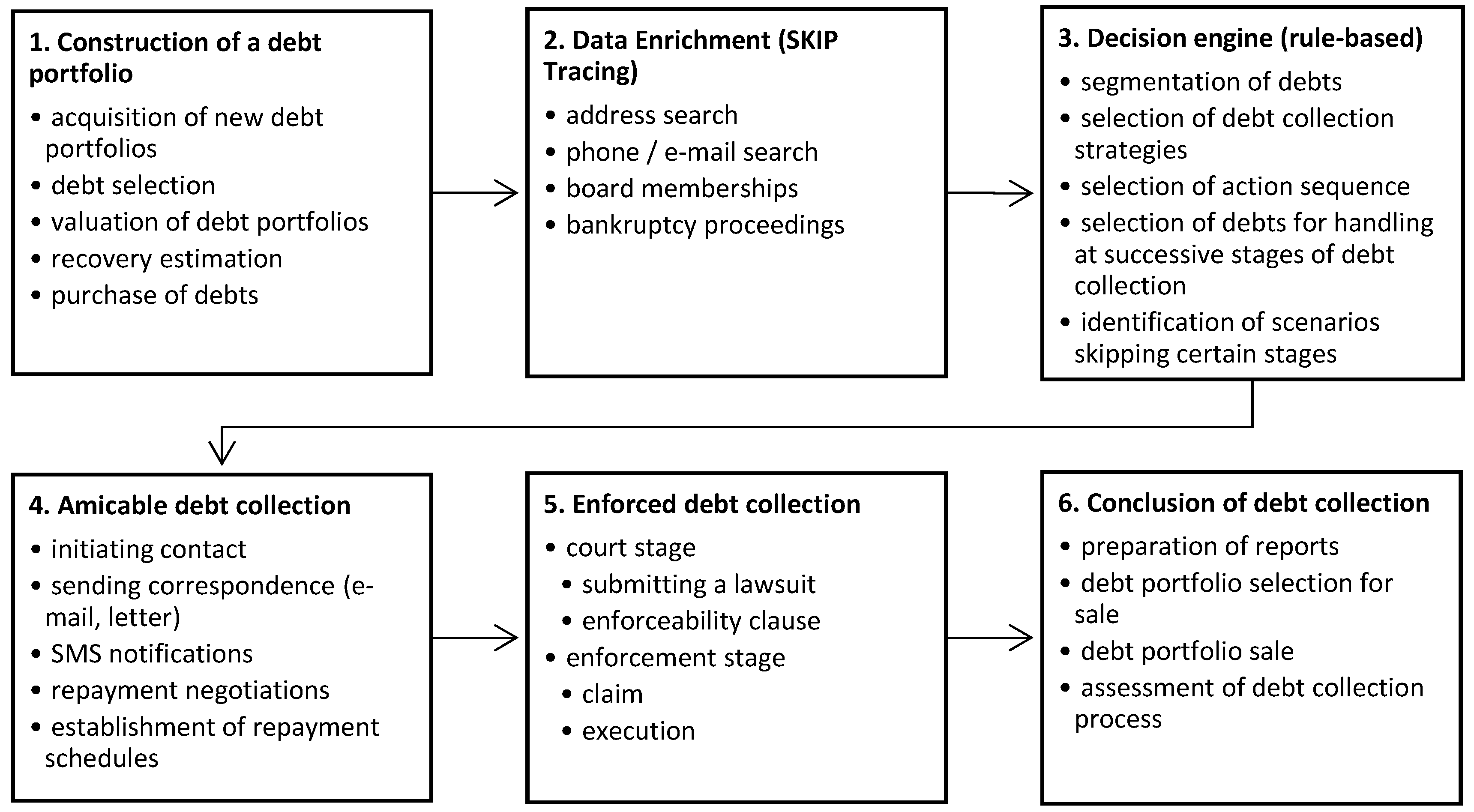

The purchase of mass debt portfolios is carried out by specialized debt collection entities. Such purchases may involve debts at various stages of delinquency and originating from different creditors. The traditional model of debt portfolio acquisition by a debt collection entity includes [

3]:

Selection of a debt portfolio from those available on the market.

Analysis of the debt portfolio to estimate the associated risk of purchasing the portfolio, usually based on a random sample drawn from the entire portfolio.

Valuation of the debt portfolio based on factors such as the risk level of debt non-payment, the number and distribution of nominal values of the debts being sold, the debtor's organizational structure, the completeness of source documentation, and the statute of limitations.

Negotiations regarding the acquisition terms, including the price of the debt portfolio, payment forms and schedule, and acceptable debt collection techniques (if the seller imposes such requirements during the bidding process).

Subsequent stages include: signing a debt assignment agreement, transferring data, payment for the debts according to the agreed schedule, initiating the preparation process, and then debt collection according to the procedures adopted by the debt collection entity.

The turnover of mass debts is not limited solely to the purchase of debt portfolios. Existing forms of turnover evolve with the development of the market towards, for example, factoring or debt exchange, constituting a secondary market for the turnover of bulk debts.

Acquiring a mass debt portfolio initiates the debt collection process in the debt collection entity, the optimization of which is the aim of this research. Regardless of the adopted collection model, the process of debt recovery can be divided into stages. The basic division includes two stages of debt collection [

4]:

In the case of amicable debt collection, activities undertaken do not involve the use of legal coercion, unlike court proceedings and enforcement actions, which constitute the basis of the compulsory stage of debt collection. This division is one of the basic ones, but a more comprehensive one distinguishes 3-4 stages of the debt collection process, namely amicable, judicial, enforcement, and post-enforcement stages [

5]. The debt collection process in banks involves: early monitoring, late monitoring, pre-litigation debt collection, litigation debt collection, enforcement proceedings, and debt sale [

6]. In our research, we have adopted a two-stage division, treating the legal debt collection stage and enforcement (execution) as one stage – enforcement debt collection.

Below is an attempt to briefly characterize the stages of debt collection, along with indicating possible actions and collection techniques.

Amicable debt collection is a process that involves negotiations with the debtor aimed at voluntary settlement of the debt. Voluntary settlement by the debtor does not involve as high costs as the judicial route and is less time-consuming [

7].

The aim of the amicable debt collection process is both to recover the debt and to prepare for any subsequent actions or stages of debt collection. At this stage, missing documents are supplemented, information about the debtor is obtained and updated. Such actions are also taken in an automated manner, creating connections based on data such as tax identification number, insurance number, address, contact phone number, and linking cases and debts under one debtor.

Actions taken in the amicable debt collection stage require the use of tools aimed at persuading the debtor to settle the arrears. These tools include: telephone debt collection, reminder letters, formal demand letters, pre-litigation demand letters, field collector visits, reminder notices (SMS, email), public disclosure of debt information, debt sale, and interest calculation and collection. They are usually applied in various combinations. The scope of their application and the order will depend on the adopted debt collection path, debt collection procedures, or the classification of debts serviced in the mass model [

8].

Signing agreements with the debtor at the amicable debt collection stage aims not only to establish a repayment schedule but also to confirm the acknowledgment of the obligation, which is significant in the event of the debtor breaching the agreement and consequently initiating legal proceedings. Taking punitive actions at the amicable debt collection stage involves charging and collecting penalty interest on overdue obligations or public disclosure of debt. The most commonly used form of debt disclosure is registration in existing debtor registers in a given country.

In the case of mass debts, tools supporting the debt collection process include [

7]: electronic payment identification, automatic generation and sending of correspondence. The importance of automating the generation and sending of correspondence increases with the number of cases (debts) handled, resulting in cost reduction, shorter preparation time for correspondence, and easier verification of its correctness. Conducting debt collection at the amicable stage, in accordance with social norms and legal regulations, is the primary way of recovering overdue debts. It is important to note the increasing significance of cultural differences, which must be taken into account by debt collection entities. The importance of this aspect of debt collection grows when conducting debt collection concerning different cultural groups, for example, as a result of conducting debt collection in international markets. Also crucial is the market value of assets owned by the debtor, as it determines the debtor's willingness to negotiate and repay [

9].

The compulsory debt collection stage includes successive actions related to court debt collection and enforcement (enforcement). In compulsory debt collection, the creditor resorts to legal instruments to secure and enforce the amounts owed, which may be a continuation of the unsuccessful amicable debt collection stage or a deliberate choice of the creditor. At the judicial debt collection stage, the creditor may pursue claims according to the legal regulations of a given country [

10].

The general model of the judicial debt collection process follows the following scheme [

11]:

Initiation of proceedings.

Obtaining an enforcement title.

Obtaining an enforcement order.

Obtaining an enforcement order opens the possibility of proceeding to the enforcement (execution) stage. The execution of actions by the court bailiff is carried out only at the request of the creditor and is not automatically initiated upon the issuance of the enforcement order. The creditor can only influence the actions of the bailiff and exercise control over the actions taken to a limited extent. In the case of mass debt collection, it is common practice to build an indicator based on which the effectiveness of bailiffs is evaluated in order to direct debts to bailiffs with the highest effectiveness indicator.

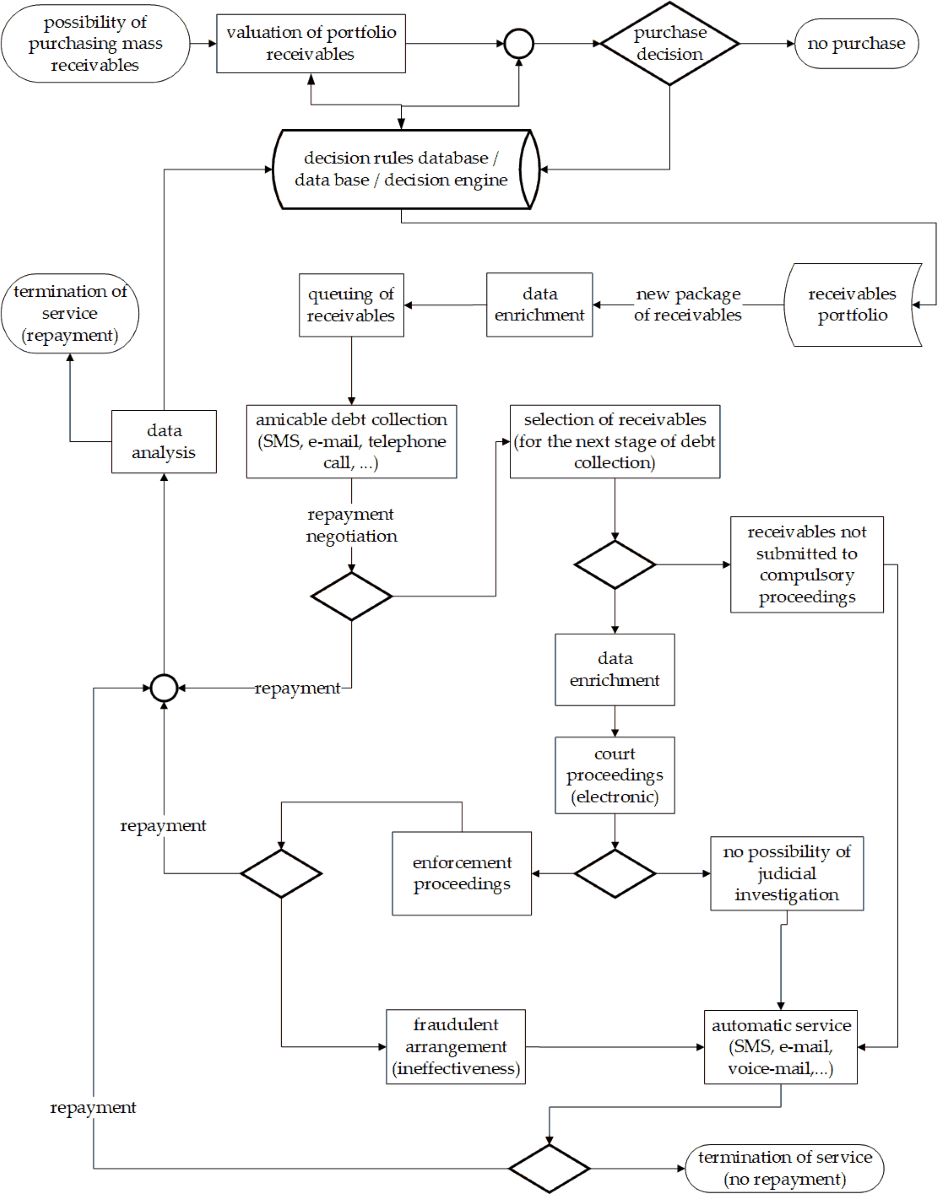

The proposed sequence of the debt collection process is presented in

Figure 1. The key task served by our research is to replace the third stage currently conducted based on the internal procedures of the debt collection company with an automatic decision-making process based on a decision engine and a rule base. The rule database can be created and updated based on data collected by the debt collection company during the debt collection activities conducted on previously purchased debts.

2.2. Related Works

Research results regarding debt collection in debt collection companies are not very common in the literature. These studies can be classified into two main areas - the first one is the classification of debts into those that can be recovered and those that are unlikely to be repaid. The second area of research concerns the valuation of debts and the schedule of their future repayment. However, there are no studies that aim to determine a detailed model of debt handling in a debt collection company. For example, Santos et al. [

12] attempted to find the best machine learning algorithm to predict the success rate in the amicable debt collection process of debts originating from private schools in Brazil. Pinheiro et al. [

13] used machine learning methods to recommend (classification problem) amicable proceedings instead of resorting to court proceedings.

A very recent study on the use of machine learning and artificial intelligence methods in human resource management was conducted by the international team of Xiang et al. [

14]. Based on extensive data from multiple countries and numerous enterprises, they attempted to determine the impact of artificial intelligence and digital transformation on the sustainable development of employee lifecycle management.

Sanches et al. [

15], based on data from Chilean financial institutions, attempted to determine the likelihood of success in three tasks of debt collection process: establishing contact with the debtor, obtaining a promise of repayment, and actual repayment of overdue debts. They used several machine learning methods for this purpose. Using the three-SHAP method, they determined the impact of explanatory variables on the probabilities of success for the three debt collection tasks they analyzed.

On the other hand, Kribel and Yam [

16] demonstrated in their research that debt collection companies play a very important role in obtaining information about debtors. Recovery rates increase when additional debtor information is gathered by debt collection companies compared to recovery rates without additional data collected by debt collection companies. The additional information included: spatial information, external credit assessments, customer relationship information, and information on financial and nonfinancial assets.

Furthermore, Geer et al. [

17] focused on the time-consuming component of the amicable debt collection process, which is making phone calls to debtors. They optimized the procedure for making phone calls by adjusting their frequency or discontinuing contacts depending on the characteristics of the debt. They significantly improved the debt collection procedure compared to the traditional method using a uniform scheme for making phone calls to debtors.

Sancarlos et al. [

2] used machine learning techniques to calculate the propensity to pay (PtP). The calculated probability of debt repayment allows for a decision on further debt collection actions in the amicable debt collection process or for referring the debt to court. These studies only determine the probability of repayment but do not specify detailed debt collection procedures. These studies offer the possibility of application in the debt portfolio valuation process.

The selection of explanatory variables in the process of building a debt collection model may include a more or less extensive set of attributes. For example, Pinheiro et al. [

13] used: type of debt occurrence, debt situation, stage of debt process, debt balance, protest office, date of occurrence, date of registration, and irregularity (missing/wrong data). Kribel and Yam [

16] applied in their study: exposure (amount in euros), age of the debtor, dummy variable for insolvent accounts, dummy variable for a corporation, dummy variable for availability of telephone contact, age of the account.

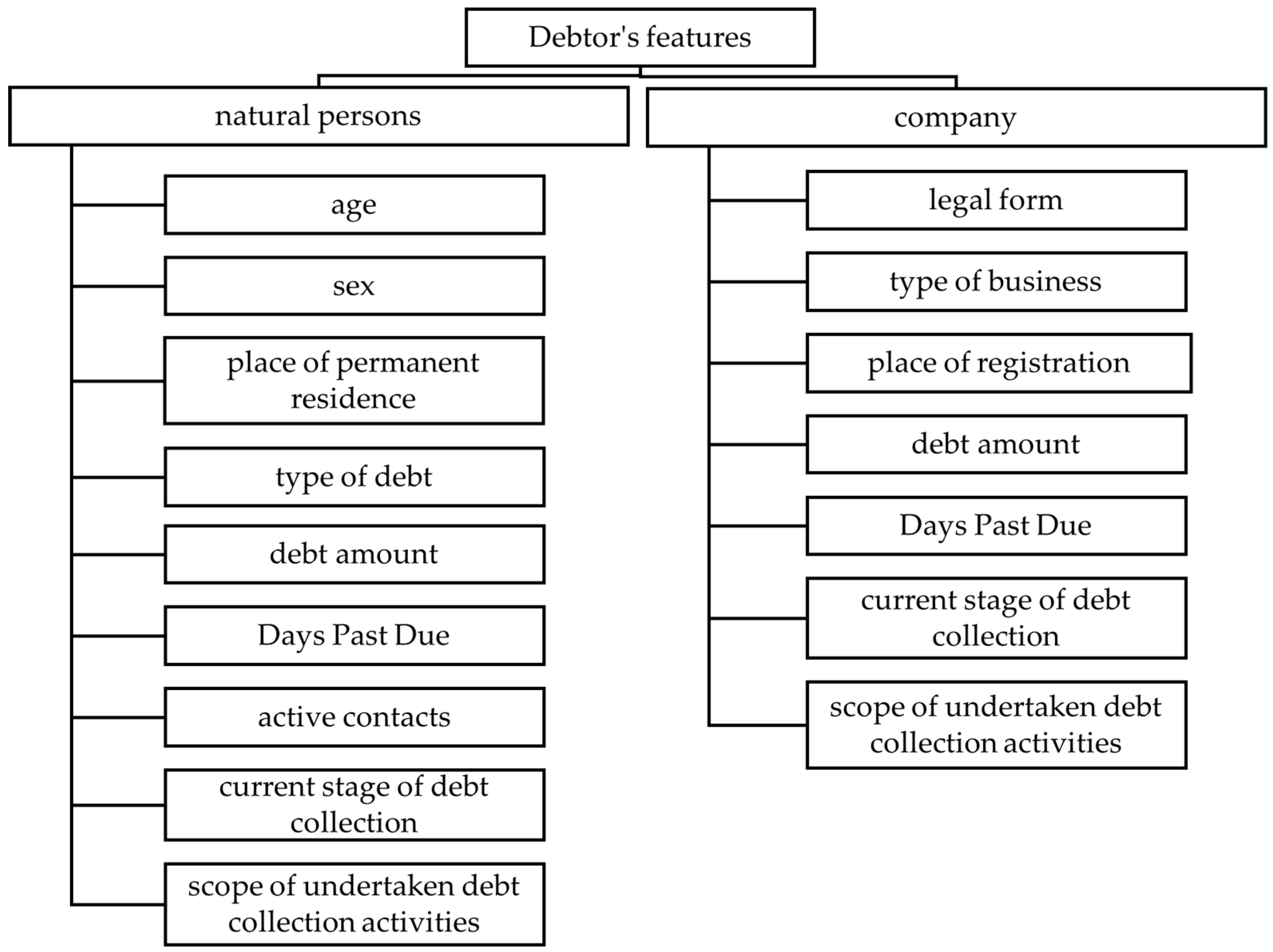

Features describing the receivables usually include [

18]: the class of receivables (in terms of value), the reason for the arrears, the overdue period, the type of document confirming the receivables, and the scope of debt collection activities. In the case of debtor characteristics, a further division is made - another set of characteristics applies to natural persons, and a different set applies to business entities. Examples of personal debtor characteristics for natural persons are: gender, age, place of residence, education. In the group of debtor businesses, an exemplary set of their characteristics may include: legal form, type of business, place of business, and other payment arrears. Taking into account the characteristics of both debts and debtors in the valuation process is based on the assumption that specific features translate into the level of debt repayment. The proposed debtor features are illustrated in

Figure 2.

3. Acquisition of Decision Rules in the Process of Machine Learning

3.1. Induction of Decision Rules

The knowledge contained in the available datasets, utilized in the management process of a debt collection entity, can be represented in the form of decision rules. Each rule is described in the form of an implication consisting of attributes and one of the possible decision alternatives. The attributes form the left-hand side of the implication, while the decision alternative forms the right-hand side. Inducing decision rules requires determining the representation method of the data, which constitutes a set of training examples. Such a set is often presented as an information table (

IT) or a decision table [

19]. From a formal perspective, an information table represents a set of pairs:

where:

To describe the objects, attributes of nominal, ordinal, and numerical types can be used. Introducing a set of decision classes

K such that

K = {

Kj:

j=1, …,

r}, considered in a supervised learning process as an additional attribute, leads to the creation of a decision table

DT:

where:

The elements of the set A are called conditional attributes. In the case where the decision table DT contains examples of concepts, then for each x ∈ U, the value of the information function will be given f(x, d) ∈ K.

In such a case, a decision rule

r describing

Kj is defined by the expression:

where:

The premise

P is also called the antecedent, while the conclusion

Q is the decision part of the rule. In some works, decision rules are written in the form

P→

Q or

r: (Condition)→(Conclusion), where the condition consists of a conjunction of tests on attributes, and the conclusion represents the decision class. The conditional part

P consists of composing elementary conditions

wi in the form [

20]:

where:

By elementary condition

wi of rule

r, we mean the dependency:

where:

αi – attribute,

x – object,

f(αi, x) – the value of attribute αi assigned to object x,

term(αi) – a constant representing the value from the domain of αi (elementary term),

∝ – relation operator from the set {<, ≤, >, ≥, =, ≠, ∈}.

For the conjunction of elementary conditions, coverage is also determined in a specific decision table as a set of objects from the DT (Decision Table) that satisfy the elementary conditions expressed by P. This coverage can be divided into two parts: positive and negative.

The problem of inducing decision rules can be classified as NP-complete [

21], and the process itself boils down to finding the minimum set of rules that cover the set of examples [

22]. Additionally, the obtained set of rules should enable correct classification of new examples. Generating a set of rules is done according to an adopted algorithm, based on generating subsequent coverages of the training set (set of examples). The general procedure leading to the generation of a rule set can be presented as recurring actions: learning a single rule, removing cases covered by the rule, restarting learning from scratch on the remaining training set (examples). The generation of a single rule should be guided by the principle that the rule should cover as many positive examples as possible while covering the fewest negative examples. Each of the obtained rules is subject to further refinement by adding elementary conditions

wi. This process is repeated until the accepted conditions for accepting the decision rule are met. Subsequent rules are sought as long as there are positive examples in the set of examples that have not been covered by other obtained rules. Some algorithms alternatively allow for the possibility of early termination of the search for a decision rule [

23], e.g., when a coverage of the set is found, e.g., in 95% of cases.

From a historical perspective, the first algorithm realizing the idea of generating coverages was the AQ algorithm [

20]. This algorithm was further developed in the form of algorithms such as AQ11, AQ15, and AQ17. Another class of algorithms used for inducing decision rules consists of algorithms combining the idea of generating coverages with techniques used for inducing decision trees. The combination of these two solutions was necessitated by the need to consider noisy information (examples). The first example of implementing such an approach was the CN2 algorithm [

23,

24]. The family of algorithms enabling the induction of decision rules can also be expanded to include algorithms based on rough sets.

Due to the small number of literature items related to the application of machine learning in relation to the debt market, the literature review mainly covered applications related to financial markets. As a result, the scope of research was narrowed down to knowledge discovery methods based, among others, on artificial neural networks, associations, clustering, and decision trees. Artificial neural networks are used in predicting debt repayment [

25,

26], estimating credit risk [

27], fraud detection [

28], forecasting stock indices [

29], and many others. Unfortunately, artificial neural networks operate in a “black box” model, which makes impossible the creation of rules defining the sequence of debt collection actions.

The possibility of using association rule mining methods in the context of mass debt collection was verified by us based on an experiment involving multiple attempts to generate rules for the existing database. This led to the construction of rules that are obvious, resulting from legal regulations (e.g., indicating the necessity of sending a payment demand before filing a lawsuit) or have no business application.

Another of the considered approaches was a group of methods related to decision trees. A literature review demonstrated the usefulness of decision trees and derivative methods, including customer classification [

30], credit risk assessment [

31], and determining the frequency of contact between a debt collector and a debtor [

32].

As a result, decision trees were chosen as a tool enabling the construction of procedural rules and the classification of debts into classes indicating the level of debt repayment ability. The use of decision trees (classification trees) in rule construction has the advantage that the rule conditions directly result from successive splits in the decision tree nodes. The use of decision trees, which are a model of the so-called ”white box”, additionally reveals the structure of splits and their course, creating the possibility of justifying the procedure when recommending the choice of debt classification in the valuation or debt collection process. Our further research confirmed that decision trees also exhibited the highest level of classification accuracy compared to the results obtained with other selected methods (SVM, k-NN, ANN). We presented the results of comparing the accuracy levels of individual methods in the subsequent part of the article in Table 13.

3.2. Decision Tree Classifier

Decision trees are one of the most popular groups of algorithms used in the classification problem. Despite the creation of many implementations over the last few years, e.g. ID3, C4.5, CART, CHAID, all these classifiers have similar structure scheme and general principles of operation [

33]. An important element that distinguishes them is the criterion by which splits are made in successive nodes.

The purpose of classification trees is to divide the provided dataset into smaller, more homogeneous groups. Homogeneity in this case means striving to ensure that in each division node is a proportional excess of observation of one of the output classes over the other. The algorithm searches among the set of attributes for the one, which division according to a given value will bring the most information in the node. The effect of splitting a node is the creation of a new node for which the increment of information or the final leaf determining the membership in a given class will be recalculated. The following rules determine the completion of the process of generating successive nodes and the formation of a leaf:

All (or almost all) observations in a node belong to one class.

No further attributes on the basis of which a further division of data could be made.

The tree has reached its predetermined maximum depth.

In the ID3 and C4.5 algorithms, the division is determined by the cleanliness of a node, which is determined using the information gain indicator. This is a function that maximizes the difference between the purity of the node before and after splitting. The most popular used indicator directly determining the purity of a given node is entropy. Entropy is defined as follows:

where:

X – the attribute for which the entropy is calculated,

pi – is the proportion of observations belonging to class i.

For the assumed division of

S, which divides the training set

T into several smaller subsets, the weighted sum of the entropy of individual subsets is the average demand for information

H and is described by the formula:

The value of

H is used to determine the information gain that can be obtained as a result of the division of the training set

T, based on the possible division of

S.

The division in the decision node with the highest information gain is selected by the C4.5 algorithm as optimal [

34].

The CART (Classification And Regression Trees) algorithm [

35] uses the following formula as a criterion for the optimal division (for a possible division of

s in node

t):

where

PL and

PP describe the ratio of the number of descendants (left and right branches) to the number of the entire training set, and

Q(

s|

t) shows the quantitative difference in the sub-tree tops for each value of the target variable. The indicator

Q can take the theoretical maximum value of

k, which is equal to the number of classes of the target variable. The optimal division is the one that achieves the highest value of the

ϕ index.

For this purpose, the CART algorithm uses the Gini index, which can be interpreted as a criterion for minimizing the probability of incorrect classification [

36]. It reaches the minimum (0) when all the observations in the node belong to one category. The Gini index is expressed by the formula:

where:

Learning decision trees creates decision rules that are used to infer about future, unknown observations. One rule means any path from root to leaf. The advantage of this solution over other algorithms is ease interpretation. The rules are built in the form if predecessor then successor ”if – then” [

37].

Our goal was not only to find the most effective machine learning algorithm in the debt classification process, but above all to find rules for the classification of receivables based on results of recovery process. For this reason, decision tree generating rules was recognized as the basic tool for assessing the results of debt recovery process. These rules can be conveyed directly to the employees of the debt collection company or implemented in an automated decision-making system.

4. Materials and Methods

4.1. Data

The aim of the research was to build a model for handling mass debts in the form of a rule base. The study was conducted in three stages. In the first stage, interviews were conducted with experts responsible for the debt collection process in debt collection entities. This group comprised 6 individuals representing 6 distinct economic entities: 2 owners of debt collection entities, 2 individuals directly responsible for the debt collection process, 1 operational director, and 1 board member.

The characteristics of receivables identified during the interviews were compared with the characteristic features of debts contained in the available data. As a result, the data were modified and prepared for use by data mining methods applied in the second, main stage of the research. The identification of characteristic features of debts, the results of in-depth interviews, and the knowledge discovered in the available data set formed the basis for building the model of mass debt collection process. Subsequently, in the third stage, the in-depth interview method was again used to validate the constructed rule-based model and to make corrections to it based on expert feedback.

The data used in the study came from 4 debt collection companies belonging to a capital group operating continuously in the Polish market since 2001. The original data set contained information on 1,054,237 debts with a total nominal value exceeding 2.7 billion PLN (current approximate exchange rate: 4 PLN = 1 USD) from the period between 2006 and 2022. For the purposes of the study, this set was reduced to 879,007 observations (debts). The reduction of the original data set resulted from a series of actions aimed at both improving data quality and preparing it for use with selected machine learning methods. As part of pre-processing, incomplete data and outliers were removed. When analyzing the original data, we also examined whether there was an imbalance in the number of observations in each category. In selected cases, debt payment dates were also adjusted to ensure that the first payment date was not earlier than the date of debt package purchase (this phenomenon sometimes occurs when the seller sets a ”cut-off date” against which all debtor payments are credited towards the price paid by the debt package buyer). The data provided by debt collection entities for research purposes were transformed into the required format for the applied algorithms, largely undergoing discretization, e.g., debt amounts were discretized so that they are represented in the model as classes covering debts in specified intervals. Similarly, data on residential areas were categorized based on postal codes. Additionally, we narrowed down the data set to debts purchased within serviced securitization funds from 2010 to 2021 to standardize them.

The accuracy of the data prepared for the mass debt management model was verified by 6 experts and formed the basis for model corrections. Attributes considered in our research encompassed both debt characteristics and debtor characteristics. During the data preparation process, the original data was transformed or discretized. Based on the dataset available, 10 variables were obtained.

Account class: Created as a result of discretization of the amount of receivables, respectively: (0, 500], (500, 1k], (1k, 2k), (2k, 5k], (5k, 10k], (10k, 25k], (25k, 50k], (50k,100k], (100k, 250k], (250k, 500k], (500k, 1000k].

Legal form: The attribute assumes one of 10 states – 8 storing the legal form under which business activity can be conducted in Poland, and two states of the attribute reserved for indicating natural persons not conducting business activity or in case of missing data.

Gender: Two states and NA for missing or incorrect data.

Age: The age of the debtor or their legal representative in the case of a company at the time of the creation of the receivable, rounded to full years, and NA for missing or erroneous data.

Region: Information about the geographic region of the debtor or the company's headquarters, containing 11 values – 10 geographic region codes in Poland and NA for missing or incorrect data.

Phone call: A binary attribute created as a result of discretization of the number of initiated phone calls by the debt collection entity. In cases where at least one call was made, the value YES (True) was adopted; otherwise, NO (False).

email: A binary attribute created as a result of discretization of the number of emails sent by the debt collection entity. The attribute took the value YES (True) if an email was sent, otherwise NO (False).

Letter: A binary attribute created as a result of discretization of the number of physical letters sent by traditional mail by the debt collection entity. The attribute took the value YES (True) if at least one letter was sent traditionally; otherwise, NO (False).

SMS: A sent SMS message, the attribute took two states: YES (True) if at least one SMS message was sent, otherwise NO (False). The class was considered in the previous version of the model but was removed due to minimal information transfer, as in every case (receivable), where a mobile phone number was available, at least one SMS message was sent.

Collection stage: Information about the stage at which the debt collection was completed. The attribute assumed two states: Amicable or Enforcement.

A concise description of the variables is presented in

Table 1.

In the sample, natural persons accounted for 66% of cases, and enterprises – the remaining 34%. Among natural persons, women accounted for 46% of cases. The amicable recovery stage occurred in 38.5% of cases, and legal enforced recovery – in the remaining cases. The vast majority – 43.7% – consisted of receivables with small amounts up to 500 PLN.

In tables A1–A4 attached, we presented a detailed breakdown of receivables into classes along with selected characteristics of the receivables.

Table A5 presents basic statistics for selected attributes before discretization.

4.2. Building the Model

Constructing decision trees requires considering not only the splitting criterion but also the selection of dependent variables for the model. Natural candidates for the splitting criterion are variables dividing the stages of the debt collection process and variables indicated by experts (e.g., gender, place of residence, legal form, debt class). Such splitting criteria were used in the initial stage of constructing classification trees. As it turned out, some of these attributes proved to be insignificant, partially questioning the opinions expressed by the experts. Equally natural is the use of repayment class as the dependent variable, understood as the ratio of the sum of payments to the nominal value of the debt. With the goal of constructing a classification tree characterized by a high degree of classification accuracy, several possible divisions into repayment classes were experimentally verified.

Another challenge in building decision trees is their susceptibility to overfitting. Hence, the decision tree cannot be too complex, as it will be overfitted and unable to generalize. On the other hand, a too simple tree with a high level of generalization will create too few and too obvious decision rules.

For the construction of classification trees and evaluation of classification accuracy, the machine learning module of the TIBCO Statistica® package version 13.3 x64 [

38] was used, employing the mechanism of V-fold cross-validation. In the study, we adopted the parameter V=10. Initially, we divided the data into four repayment classes, resulting in a total of eight repayment classes when considering the stages of debt collection. Assignments to classes were made based on the relationship between the amount of repayment received and the original debt amount. The defined classes along with the threshold for assignment to each class and the group code are presented in

Table 2.

Adopting 8 debt repayment classes (case one) leads to the construction of a classification tree that almost entirely classifies into two extreme classes – Full repayment or Non-repayment. The accuracy of the decision tree classification for the 8 repayment classes is presented in tabular form in Appendix in

Table A6.

Leaving 8 repayment classes unchanged, when only extreme classes are recognized and cases assigned to the Good Repayment and Low Repayment classes are completely misclassified, is not acceptable. In the next step, we divided the receivables into 6 repayment classes, taking into account the stage of debt collection. These classes are: Very Good Repayment, Good Repayment, and Low Repayment (each in one of two debt collection stages: amicable and enforcement). This division is presented in

Table 4.

Once again, we obtained classification for two extreme classes with almost complete omission of the “good repayment” class. Both of the above cases lead to the observation that correct classification is possible into two distinct repayment classes, a situation also confirmed in the literature [

39]. The binary division into the Good Repayment and Low Repayment classes simultaneously constitutes a natural division for the classification and regression trees (C&RT) used by us. Ultimately, we adopted a division into 2 repayment classes and 2 debt collection stages within each of them.

Another particularly important task turned out to be assigning debts to repayment classes based on the level of debt recovery. When proposing the allocation of receivables to a given repayment class, one must primarily consider the cost of acquiring the receivables and the level of direct debt collection costs. We proposed 5 potential ways of allocating receivables to repayment categories, as presented in Table 15.

Table 5.

Proposed methods of classifying receivables by repayment level.

Table 5.

Proposed methods of classifying receivables by repayment level.

| Variant |

A |

B |

C |

D |

E |

| Repayment class |

Splitting criterion |

| Good repayment |

>25% |

>35% |

>45% |

>75% |

Total payments > debt prices |

| Low repayment |

[0 – 25)% |

[0 – 35)% |

[0 – 45)% |

[0 – 75)% |

Total payments ≤ debt prices |

Adopting a repayment criterion at the 25% level of the original receivables value assumes covering the average purchase price of the receivables package (calculated based on the source data). Choosing the 35% level as the splitting criterion is based on the fact that at this level, the sum of repayments covers the average purchase price of the receivables as well as 50% of the direct costs of conducting the recovery process. Setting the 45% level as the criterion is dictated by the fact that at this level, the sum of repayments to the original receivables value covers the average purchase price as well as the average direct costs of conducting recovery activities, amounting to approximately 20% of the debt. Repayments at the 75% level of the nominal receivables value cover the average purchase cost, direct service costs, indirect costs, and the expected profit of the debt collection entity. The division according to variant E was introduced as a control against case A (division at the 25% level). Variant E is based on a real comparison of repayments with the purchase amount of the receivables, rather than the assumed average purchase price. For the proposed five variants, classification trees were constructed, and the accuracy of classification was estimated. A summary of the results of experiments with different division variants into repayment classes is presented in

Table 6.

Ultimately, after a series of experiments, we decided to classify all receivables into the Low Repayment category in cases where the outcomes of the recovery process did not cover the receivables purchase price and the average direct costs of the recovery process. Receivables would be classified as Good Repayment if the total repayments, regardless of the stage of the recovery process, covered at least the purchase price of the receivables package and the average cost of recovery. This approach corresponds to variant C and allows for covering the costs of purchasing receivables and the direct costs of the recovery process. The new classification into repayment classes includes:

Good Repayment Amicable Recovery (GoodAmicable) – total repayments greater than the receivables purchase price.

Good Repayment Enforced Recovery (GoodEnforced) – total repayments greater than the receivables purchase price.

Low Repayment Amicable Recovery (LowAmicable) – total repayments less than or equal to the receivables purchase price.

Low Repayment Enforced Recovery (LowEnforced) – total repayments less than or equal to the receivables purchase price.

5. Results

For the adopted variant of dividing debt repayment classes, classification trees were rebuilt using the V-fold validation test mechanism and a randomly split dataset into a training set and a validation set in a 2/3 and 1/3 ratio. The overall achieved classification accuracy is summarized in

Table 7.

The accuracy of the constructed decision tree for classifying debts into one of the four repayment classes remains at a very high level in each class, ranging from 82.2% to 87.2%. This is an important argument in favor of using decision trees in the debt classification process. However, to check whether such a high level of classification accuracy is not due to the specificity of the dataset and whether it can be achieved using other machine learning methods, we conducted a comparison with other methods:

Support Vector Machine (SVM) – model parameters: random assignment to the training and test sets, maintaining a 75% proportion of the dataset for the training set, and the remaining 25% for the test set. Kernel type: linear and RBF (radial basis function). For both types of kernels, 1000 iterations were performed.

Neural Networks (SNN) – random sampling was adopted, with the following sample sizes: 70% for the training set, 15% for the test set, and 15% for the validation set. The considered type of network is MLP (from 4 to 12 hidden layers), with the following activation functions: linear, logistic, hyperbolic tangent, exponential, and sinusoidal. The sum of squares error or mutual entropy was used as the error functions.

k-Nearest Neighbors (k-NN) – parameters: random allocation to the training set with a size of 75% of cases; Euclidean distance measure.

For each of the considered comparison methods, the same dataset was used as for decision trees. The TIBCO Statistica® package was used again to build the models.

The average classification accuracy obtained using decision trees and the selected comparative methods is summarized in

Table 8.

The decision tree achieved the highest classification accuracy among the machine learning methods tested in the automatic learning process. Based on this, the decision to use a decision tree as an effective tool for generating rules for dealing with purchased mass debt portfolios was made, regardless of the fact that artificial neural networks and support vector machines are unable to generate decision rules in an explicit form.

The construction of the classification tree was based on several attributes describing the characteristics of debts, creditors, and actions that can be taken in the debt collection process. In the process of building the classification tree, its depth was adjusted by changing parameters determining the minimum number of observations in a leaf and the proportion of observations from a given class in the total number of observations in a leaf from 0.5 to 0.65. By comparing the classification accuracy on the training and test sets, we aimed to achieve comparable classification quality results indicative of good tree generalization with no overfitting. After a series of experiments, it was assumed that the proportion of observations from the dominant class in a leaf must be no less than 65% for the leaf to be classified into a specific class.

After setting the threshold for assigning a leaf to one of the four classes at 65% of observations from that class, we proceeded with selecting the optimal tree based on criteria of tree construction costs and misclassification costs. The final tree was selected from a sequence of 17 classification trees representing subsequent stages of tree building and pruning. The sequential tree construction involved trees containing from 29 leaves to 1 leaf. The criterion for selecting the tree was comparing the cost of cross-validation, which increases with the growth of the tree, to the cost of resubstitution (error rate), which decreases for a smaller tree [

40].

The final decision tree is presented in the attached

Figure A1 and

Table A7 in the Appendix. The chosen decision tree consists of 7 levels and 16 end nodes (leaves) labeled with unique identifiers. An assessment of predicate importance was conducted for the final decision tree. The obtained results are presented in

Table 9.

Heading towards developing a set of rules based on the decision tree structure, we formulated rules representing successive splits from the root to each leaf. As a result of these actions, we obtained 16 rules, one for each leaf. The leaf numbers do not correspond to the rule numbers and are the result of continuing numbering during the sequential construction of subsequent trees. The set of obtained rules is presented in

Table 10. The structure of observations in each leaf is presented in

Table A8 in the Appendix. The compilation includes information regarding the number of cases classified in each leaf into one of the considered repayment classes, taking into account the stage of debt collection. The obtained values indicate the proportion of the dominant class in each leaf of the analyzed decision tree.

6. Discussion

The obtained set of 16 rules indicates for which amounts of debt and under what debtor characteristics selected actions should be taken within the scope of amicable or compulsory debt collection. The rules also specify for which types of debt no actions should be taken due to minimal chances of recovery. For example, rule 1 indicates that debts above 500 PLN from women residing in specified regions of Poland should not be directed to legal proceedings, as they do not promise repayment (and additionally expose the debt collection company to legal costs). On the other hand, rule 15 informs that if the debt is above 500 PLN but below 2000 PLN, and contact can be established via phone, good repayment during the amicable collection stage is possible.

The set of rules developed using machine learning methods constitutes a ready-made solution introducing a division of debts enabling their direction to either the amicable or compulsory collection stage. At the same time, by indicating the effect of the actions taken, the rules create an opportunity to develop debt management strategies. The obtained rules can be directly implemented in the information systems of the debt collection entity using generated SQL code or a set of decision rules. An example of such a system is the REBIT rule-based system [

41] utilizing a relational database as a tool for collecting business rules. The presented concept of a debt management model based on a set of procedural rules highlights the very significant impact of debt classification based on their characteristic features on the way they are handled in the debt collection process.

Determining the number of debt classes and the required debt recovery level proved to be a crucial element in data preparation, upon which the subsequent accuracy of the model and its ability to generate stable procedural rules depended. This required numerous experiments, the results of which may differ for other types of debts than the mass debts analyzed by us. However, it turned out that with a greater number of classes, the decision tree algorithm mainly classified into two extreme classes.

The obtained set of rules was presented to 6 experts, who positively evaluated it and proposed an additional 16 expert rules. They mainly concerned the organization of debt collection teams and their activities. We do not present these rules, as they do not directly result from the available dataset. However, expert rules indicate that in order to obtain an effective automatic tool for building a set of procedural rules in the debt collection process, it is necessary to supplement the dataset with additional attributes. These attributes should include detailed information transferred from debt collectors' notes regarding contacts with the debtor, as well as data considering the frequency of contacts with the debtor through various methods, such as in [

17].

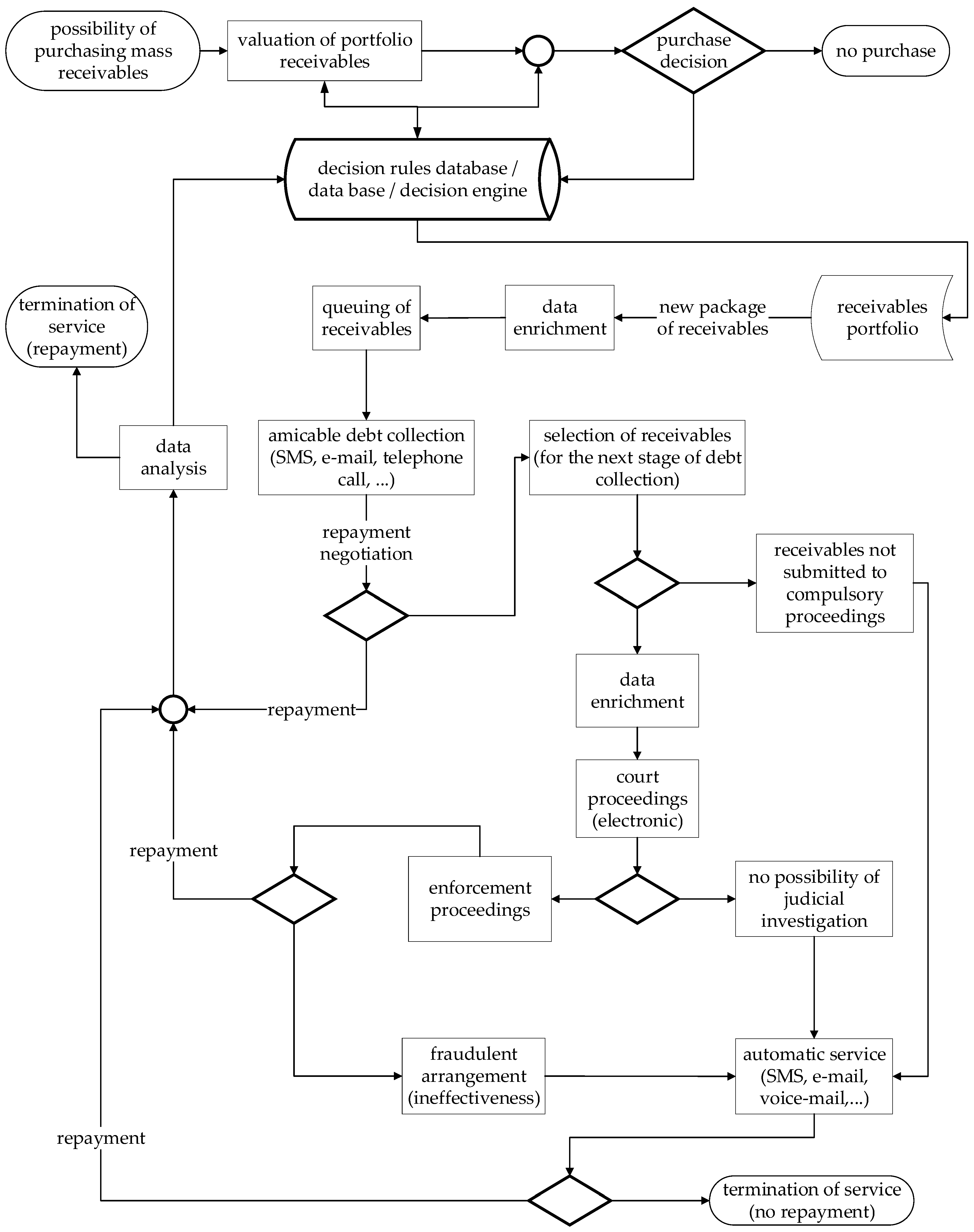

Based on the conducted research, we proposed a general model of the debt collection process management for bulk debts. The schematic model is drawn at a very high level of generality and is one of many that can be built based on the developed rule base. It is illustrated by a simplified BPMN diagram in

Figure 3. Particularly important in the model of the debt collection process proposed by us is that as a result of data collection during subsequent debt collection processes, the rule base is updated. The continuously updated rule database can be used to automate the debt valuation and acquisition process, and then to support decisions about the selection of procedures for handling the acquired debts.

7. Conclusions

Our research confirmed the possibility of generating rules for managing mass debt collection processes based on a dataset from a debt collection company. In the case of mass debts, a large dataset with a similar data structure allows for the utilization of decision tree algorithms to create a set of business rules. Attempting to use association methods did not yield satisfactory results.

The dataset, comprising over 800,000 records on debts, related activities, and outcomes of the debt collection process, underwent preprocessing and discretization, enabling the creation of 16 procedural rules using decision trees. A significant challenge in preparing the data for inference was deciding on the number of target repayment classes and the debt recovery level assigned to each class. Ultimately, we divided the data into 2 classes of low and high repayment, where high repayment indicated covering the purchase price of the debt. The classification accuracy of the final decision tree version was 85.5%. The attributes that had the strongest impact on the debt collection process outcome were the debtor's legal form, initiating a phone call to the debtor, and sending a payment reminder letter.

We successfully addressed the research questions Q1-Q3 posed at the beginning. We managed to create a set of non-trivial decision rules for the debt collection process, providing new insights into the selection of the appropriate process depending on the characteristics of the debt and debtor. Question Q4 remains unresolved at this stage due to the limited dataset concerning debtor characteristics and detailed descriptions of the debt collection process.

A decision rule-based model will improve the efficiency of collection agency employees’ actions and reduce excessive contact with debtors in unpromising situations. The sense of greater effectiveness and the reduction of psychologically taxing interactions with difficult debtors will help mitigate burnout and ensure sustainable employee development, thereby extending the currently short employment duration in collection agencies.

The main limitation of the study was the relatively limited set of predictors that could be obtained based on available data from debt collection companies. Further work should primarily involve expanding the information systems of debt collection companies to collect detailed information about actions taken regarding each debt under collection.

Future research should focus on expanding the set of attributes, allowing for the creation of a more extensive and detailed set of rules. Such a rule set could then be used for automatic debt purchase and to support the management of bulk debts using an inference engine (e.g., Business Rules Management System “REBIT” [

41,

42]). Only then will it be possible to answer research question Q4 regarding the possibility of automating the debt purchase and collection process.

During the research, we noticed the potential to use datasets to build a recommendation system for individual debt collection strategies tailored to debtor characteristics. Such actions will require further research to determine the relationships and effectiveness of applied debt collection techniques (negotiation strategies) concerning specific debtor groups.

Supplementary Materials

The following supporting information can be downloaded at the website of this paper posted on Preprints.org, Rules extracted form decision tree in form of SQL code.

Author Contributions

Conceptualization, R.J. and A.P.; methodology R.J. and A.P.; software, R.J. and A.P.; validation, R.J. and A.P.; formal analysis, R.J. and A.P.; investigation, R.J. and A.P.; resources, R.J. and A.P.; data curation, R.J. and A.P.; writing—original draft preparation, R.J. and A.P.; writing—review and editing, R.J. and A.P.; visualization, R.J. and A.P.; supervision, R.J. and A.P.; project administration, R.J. and A.P.; funding acquisition, R.J. and A.P. All authors have read and agreed to the published version of the manuscript.

Funding

The APC was funded under subvention funds for the Faculty of Management of the AGH University of Krakow.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

Table A1.

Division of receivables into classes according to the nominal debt value in PLN.

Table A1.

Division of receivables into classes according to the nominal debt value in PLN.

| Debt class |

Quantity |

Percentage share [%] |

| (0, 500] |

384,158 |

43.7 |

| (500, 1k] |

105,087 |

12.0 |

| (1k, 2k) |

126,209 |

14.4 |

| (2k, 5k] |

154,221 |

17.5 |

| (5k, 10k] |

63,064 |

7.2 |

| (10k, 25k] |

30,756 |

3.5 |

| (25k, 50k] |

12,632 |

1.4 |

| (50k,100k] |

2186 |

0.2 |

| (100k, 250k] |

636 |

0.1 |

| (250k, 500k] |

40 |

0.0 |

| (500k, 1000k] |

18 |

0.0 |

| Total |

879,007 |

100.0 |

Table A2.

Division of receivables according to the legal form of the debtor.

Table A2.

Division of receivables according to the legal form of the debtor.

| Legal form |

Quantity |

Share [%] |

| Business activity (sole proprietorship) |

263,094 |

29.9 |

| Joint-Stock company (JSC) |

1737 |

0.2 |

| Partnership |

6668 |

0.8 |

| General partnership (GP) |

1759 |

0.2 |

| Limited partnership (LP) |

572 |

0.1 |

| Limited Liability Company (LLC) |

23,557 |

2.7 |

| Association |

304 |

0.0 |

| Individual (natural person) |

581,036 |

66.1 |

| Other |

280 |

0.0 |

| Total |

879,007 |

100.0 |

Table A3.

Number of receivables by method of communication with the debtor.

Table A3.

Number of receivables by method of communication with the debtor.

| Attribute |

Outbound call |

Sent email |

Sent letter |

| YES (True) |

732,111 |

39,461 |

540,993 |

| NO (FALSE) |

146,896 |

839,546 |

338,014 |

Table A4.

Distribution of receivables by debt collection method.

Table A4.

Distribution of receivables by debt collection method.

| Name |

Quantity |

Share [%] |

| Amicable debt collection |

338,014 |

38.5 |

| Enforced debt collection |

540,993 |

61.5 |

Table A5.

Basic statistics of selected variables before discretization.

Table A5.

Basic statistics of selected variables before discretization.

| Name |

Average |

Standard Deviation |

Minimum |

Maximum |

| Principal debt [PLN] |

2647 |

8162 |

0.3 |

995,514 |

| Age [years] |

45 |

14 |

19 |

98 |

| Number of phone calls |

38 |

69 |

0 |

285 |

| Number of letters sent |

1 |

0.7 |

0 |

6 |

| Number of emails sent |

1 |

0.2 |

0 |

6 |

Table A6.

Classification Accuracy Levels for 8 Repayment Classes.

Table A6.

Classification Accuracy Levels for 8 Repayment Classes.

| |

|

|

Predicted repayment class [%] |

| |

|

|

Full repayment |

Good repayment |

Low repayment |

Non-repayment |

| |

|

|

Amicable debt collection |

Enforced debt collection |

Amicable debt collection |

Enforced debt collection |

Amicable debt collection |

Enforced debt collection |

Amicable debt collection |

Enforced debt collection |

| Observed repayment class |

Full repayment |

Amicable debt collection |

87.3 |

|

|

|

|

|

|

|

| Enforced debt collection |

|

84.0 |

|

|

|

|

|

|

| Good repayment |

Amicable debt collection |

|

|

0.0 |

|

|

|

|

|

| Enforced debt collection |

|

|

|

0.0 |

|

|

|

|

| Low repayment |

Amicable debt collection |

|

|

|

|

0.0 |

|

|

|

| Enforced debt collection |

|

|

|

|

|

8.9 |

|

|

| Non-repayment |

Amicable debt collection |

|

|

|

|

|

|

79.6 |

|

| Enforced debt collection |

|

|

|

|

|

|

|

83.4 |

Figure A1.

Final decision tree (15 nodes, 16 leaves).

Figure A1.

Final decision tree (15 nodes, 16 leaves).

Table A7.

Conditions for splitting nodes of final decision tree.

Table A7.

Conditions for splitting nodes of final decision tree.

| Node |

Left |

Right |

Dominant class |

Division (Variable) |

Value |

| 1 |

2 |

3 |

LowEnforced |

Letter |

NO |

| 2 |

4 |

5 |

GoodAmicable |

Account class |

(0, 500], (500, 1k], (1k, 2k) |

| 4 |

6 |

7 |

GoodAmicable |

Account class |

(500, 1k], (1k, 2k) |

| 6 |

8 |

9 |

GoodAmicable |

Phone call |

NO |

| 8 |

|

|

LowAmicable |

|

|

| 9 |

|

|

GoodAmicable |

|

|

| 7 |

20 |

21 |

GoodAmicable |

email |

NO |

| 20 |

|

|

GoodAmicable |

|

|

| 21 |

|

|

LowAmicable |

|

|

| 5 |

|

|

LowAmicable |

|

|

| 3 |

60 |

61 |

LowEnforced |

Account class |

(0, 500] |

| 60 |

62 |

63 |

GoodEnforced |

Gender |

Male, NA |

| 62 |

64 |

65 |

LowEnforced |

Region |

Lubelskie, Kieleckie, Warszawskie |

| 64 |

66 |

67 |

GoodEnforced |

Gender |

Male |

| 66 |

|

|

GoodEnforced |

|

|

| 67 |

|

|

LowEnforced |

|

|

| 65 |

76 |

77 |

LowEnforced |

Phone call |

NO |

| 76 |

|

|

GoodEnforced |

|

|

| 77 |

80 |

81 |

LowEnforced |

Legal form |

Natural person, LLC, LP, Assoc., Other |

| 80 |

|

|

LowEnforced |

|

|

| 81 |

|

|

GoodEnforced |

|

|

| 63 |

|

|

GoodEnforced |

|

|

| 61 |

108 |

109 |

LowEnforced |

Gender |

Male |

| 108 |

|

|

LowEnforced |

|

|

| 109 |

128 |

129 |

LowEnforced |

Region |

Lubelskie, Kieleckie, Krakowskie, Rzeszowskie, Warszawskie, Olsztynskie, Bialostockie |

| 128 |

130 |

131 |

LowEnforced |

Account class |

(2k, 5k], (5k, 10k], (10k, 25k], (25k, 50k], (50k,100k], (100k, 250k], (250k, 500k] |

| 130 |

|

|

LowEnforced |

|

|

| 131 |

134 |

135 |

GoodEnforced |

Legal form |

GP, LLC, LP, JSC, Assoc., Other |

| 134 |

|

|

LowEnforced |

|

|

| 135 |

|

|

GoodEnforced |

|

|

| 129 |

|

|

LowEnforced |

|

|

Table A8.

Count of observations in the terminal node (leaf).

Table A8.

Count of observations in the terminal node (leaf).

| Leaf |

Class LowAmicable |

Class GoodAmicable |

Class LowEnforced |

Class GoodEnforced |

| 8 |

12,594 |

4760 |

0 |

0 |

| 9 |

7854 |

28,356 |

0 |

0 |

| 20 |

13,991 |

164,739 |

0 |

0 |

| 21 |

3312 |

1544 |

0 |

0 |

| 5 |

78,368 |

22,496 |

0 |

0 |

| 66 |

0 |

0 |

6512 |

22,016 |

| 67 |

0 |

0 |

792 |

481 |

| 76 |

0 |

0 |

4296 |

12,155 |

| 80 |

0 |

0 |

39,987 |

5056 |

| 81 |

0 |

0 |

4376 |

8694 |

| 63 |

0 |

0 |

22,183 |

74,024 |

| 108 |

0 |

0 |

181,424 |

13,262 |

| 130 |

0 |

0 |

20,431 |

2068 |

| 134 |

0 |

0 |

758 |

171 |

| 135 |

0 |

0 |

10,493 |

21,881 |

| 129 |

0 |

0 |

81,120 |

8813 |

References

- Huang, S.Y.B.; Fei, Y.-M.; Lee, Y.-S. Predicting Job Burnout and Its Antecedents: Evidence from Financial Information Technology Firms. Sustainability 2021, 13, 4680. [Google Scholar] [CrossRef]

- Sancarlos, A.; Bahilo, E.; Mozo, P.; Norman, L.; Rehma, O.U.; Anufrijevs, M. Towards a Data-Driven Debt Collection Strategy Based on an Advanced Machine Learning Framework 2023.

- Szabłowska, E. Polish debt market (in Polish: Polski rynek wierzytelności). Annales Universitatis Mariae Curie-Skłodowska 2010, 571–584. [Google Scholar]

- Kreczmańska-Gigol, K. Amicable and forced debt collection. Process, market, receivables valuation (in Polish: Windykacja polubowna i przymusowa. Proces, rynek, wycena wierzytelności); Difin SA, 2015; ISBN 978-83-7930-605-3.

- Turaliński, K. Economic debt collection - a textbook for learning the profession (in Plish: Windykacja Gospodarcza - podręcznik do nauki zawodu); Wydawnictwo - “Media Polskie”: Radom, 2012. [Google Scholar]

- Kuryłek, W. Organization of the mass receivables management process in banks (in Polish: Organizacja procesu zarządzania wierzytelnościami masowymi w bankach). SiM WZ UW 2017, 1, 178–191. [Google Scholar] [CrossRef]

- Bekas, M. Debt collection in practice: How to verify the creditworthiness of customers and recover money from debtors (in Polish: Windykacja należności w praktyce: Jak weryfikować zdolność kredytową klientów i odzyskiwać pieniądze od dłużników); Wolters Kluwer Polska, 2021; ISBN 978-83-264-6017-3.

- Wang, H.-Y.; Liao, C.; Kao, C.-H. A Credit Assessment Mechanism for Wireless Telecommunication Debt Collection: An Empirical Study. Inf Syst E-Bus Manage 2013, 11, 357–375. [Google Scholar] [CrossRef]

- Paliński, A. Loan Payment and Renegotiation: The Role of the Liquidation Value. Argumenta Oeconomica 2018, 1, 225–252. [Google Scholar] [CrossRef]

- Djankov, S.; Hart, O.; McLiesh, C.; Shleifer, A. Debt Enforcement around the World. Journal of Political Economy 2008, 116, 1105–1149. [Google Scholar] [CrossRef]

- Machowska-Okrój, S. Obligations of Enterprises in the Context of Their Delay and Non-Payment (in Polish: Zobowiązania Przedsiębiorstw w Kontekście Ich Opóźniania i Niespłacania). Wybrane zagadnienia z zakresu przedsiębiorczości i zarządzania finansami 2020, 59. [Google Scholar]

- Santos, L.; de Paula, N.; Santos, M. Evaluation and Modeling of Debt Collection Process for Private Schools: A Machine Learning Approach; 2022. [Google Scholar]

- F. Pinheiro, A.; Silveira, D.; Lima Neto, F. Use of Machine Learning for Active Public Debt Collection with Recommendation for the Method of Collection Via Protest, 2022.

- Xiang, H.; Lu, J.; Kosov, M.E.; Volkova, M.V.; Ponkratov, V.V.; Masterov, A.I.; Elyakova, I.D.; Popkov, S.Y.; Taburov, D.Y.; Lazareva, N.V.; et al. Sustainable Development of Employee Lifecycle Management in the Age of Global Challenges: Evidence from China, Russia, and Indonesia. Sustainability 2023, 15, 4987. [Google Scholar] [CrossRef]

- Sánchez, C.; Maldonado, S.; Vairetti, C. Improving Debt Collection via Contact Center Information: A Predictive Analytics Framework. Decision Support Systems 2022, 159, 113812. [Google Scholar] [CrossRef]

- Kriebel, J.; Yam, K. Forecasting Recoveries in Debt Collection: Debt Collectors and Information Production. European Financial Management 2020, 26, 537–559. [Google Scholar] [CrossRef]

- Geer, R.; Wang, Q.; Bhulai, S. Data-Driven Consumer Debt Collection via Machine Learning and Approximate Dynamic Programming. SSRN Electronic Journal 2018. [Google Scholar] [CrossRef]

- Nastarowicz, E. Changing the Model of Debt Management in Companies Operating in Poland (in Polish: Zmiana modelu zarządzania wierzytelnościami w przedsiębiorstwach działających w Polsce). Zeszyty Naukowe Uniwersytetu Szczecińskiego. Finanse, Rynki Finansowe, Ubezpieczenia 2012, 339–350. [Google Scholar]

- Pawlak, Z. Rough Sets. International Journal of Computer and Information Sciences 1982, 11, 341–356. [Google Scholar] [CrossRef]

- Michalski, R.S. 4 - A THEORY AND METHODOLOGY OF INDUCTIVE LEARNING. In Machine Learning; Michalski, R.S., Carbonell, J.G., Mitchell, T.M., Eds.; Morgan Kaufmann: San Francisco (CA), 1983; pp. 83–134. ISBN 978-0-08-051054-5. [Google Scholar]

- Hyafil, L.; Rivest, R.L. Constructing Optimal Binary Decision Trees Is NP-Complete. Information Processing Letters 1976, 5, 15–17. [Google Scholar] [CrossRef]

- Andersen, T.; Martinez, T. Learning and Generalization with Bounded Order Rule Sets. In Proc. of 10th Int. Symp. On Computer and Information Sciences; 1995.

- Clark, P.; Niblett, T. The CN2 Induction Algorithm. Mach Learn 1989, 3, 261–283. [Google Scholar] [CrossRef]

- Clark, P.; Boswell, R. Rule Induction with CN2: Some Recent Improvements. In Proceedings of the Machine Learning — EWSL-91; Kodratoff, Y., Ed.; Springer: Berlin, Heidelberg, 1991; pp. 151–163. [Google Scholar]

- Adebiyi, M.O.; Adeoye, O.O.; Okesola, J.O.; Adebiyi, A.A. SECURED LOAN PREDICTION SYSTEM USING ARTIFICIAL NEURAL NETWORK. Journal of Engineering Science and Technology 2022, 17. [Google Scholar]

- Nair, A.; Oksoy, A.; Chen, M.-J. Portfolio Recovery Associates: Seeking Competitive Advantage in the Debt Collection Industry; London, 2021. [Google Scholar]

- Teles, G.; Rodrigues, J.; Rabê, R.; Kozlov, S. Artificial Neural Network and Bayesian Network Models for Credit Risk Prediction. Journal of Artificial Intelligence and Systems 2020, 2, 118–132. [Google Scholar] [CrossRef]

- Awotunde, J.B.; Misra, S.; Ayeni, F.; Maskeliunas, R.; Damasevicius, R. Artificial Intelligence Based System for Bank Loan Fraud Prediction. In Proceedings of the Hybrid Intelligent Systems; Abraham, A., Siarry, P., Piuri, V., Gandhi, N., Casalino, G., Castillo, O., Hung, P., Eds.; Springer International Publishing: Cham, 2022; pp. 463–472. [Google Scholar]

- Chong, E.; Han, C.; Park, F.C. Deep Learning Networks for Stock Market Analysis and Prediction: Methodology, Data Representations, and Case Studies. Expert Systems with Applications 2017, 83, 187–205. [Google Scholar] [CrossRef]

- Silva, C.; Faria, P.; Vale, Z. Classification of New Active Consumers Performance According to Previous Events Using Decision Trees. IFAC-PapersOnLine 2022, 55, 297–302. [Google Scholar] [CrossRef]

- Tian, Z.; Xiao, J.; Feng, H.; Wei, Y. Credit Risk Assessment Based on Gradient Boosting Decision Tree. Procedia Computer Science 2020, 174, 150–160. [Google Scholar] [CrossRef]

- Shoghi, A. Debt Collection Industry: Machine Learning Approach. Journal of Monetary and Banking Research 2019, 14, 453–473. [Google Scholar]

- Quinlan, J.R. Induction of Decision Trees. Mach Learn 1986, 1, 81–106. [Google Scholar] [CrossRef]

- Quinlan, J.R. C4.5: Programs for Machine Learning; Morgan Kaufmann Publisher: San Francisco (CA), 1993; ISBN 978-0-08-050058-4. [Google Scholar]

- Breiman, L.; Friedman, J.; Olshen, R.A.; Stone, C.J. Classification and Regression Trees; Wadsworth Books: New York, 1984; ISBN 978-1-315-13947-0. [Google Scholar]

- Raschka, S.; Julian, D.; Hearty, J. Python: Deeper Insights into Machine Learning; Packt Publishing Ltd, 2016; ISBN 978-1-78712-854-5.

- Kuhn, M.; Johnson, K. Introduction. In Applied Predictive Modeling; Kuhn, M., Johnson, K., Eds.; Springer: New York, NY, 2013; pp. 1–16. ISBN 978-1-4614-6849-3. [Google Scholar]

- Spotfire Statistica® 14.2.0. Available online: https://docs.tibco.com/products/spotfire-statistica-14-2-0 (accessed on 28 May 2024).

- Jankowski, R.; Paliński, A. Valuation of Receivables in Decision-Making Process of a Debt Collection Company with Use of Decision Trees. In Proceedings of the 38th International Business Information Management Association Conference (IBIMA) [Dokument elektroniczny] : Innovation Management and Sustainable Economic Development in the Era of Global Pandemic : 23-24 November 2021; Seville, Spain, IBIMA: Seville, Spain, 2021; pp. 8272–8281. ISBN 978-0-9998551-7-1. [Google Scholar]

- StatSoft Electronic Statistics Textbook. Available online: https://www.statsoft.pl/textbook/stathome.html (accessed on 2 May 2024).

- Macioł, A.; Macioł, P.; Jȩdrusik, St.; Lelito, J. The New Hybrid Rule-Based Tool to Evaluate Processes in Manufacturing. Int J Adv Manuf Technol 2015, 79, 1733–1745. [Google Scholar] [CrossRef]

- Maciol, A.; Jedrusik, S.; Paliński, A. How to Increase Effectiveness of Inference in Rule-Based Systems. In Proceedings of the 2019 Second International Conference on Artificial Intelligence for Industries (AI4I); IEEE, September 2019. 107–110.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).