Submitted:

03 June 2024

Posted:

03 June 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Literature Review

H1: Privately controlled utilities are more likely to achieve better efficiency in revenue collection.

H2: Corporatized utilities with shares on the stock exchange are more likely to achieve greater efficiency in revenue collection.

3. Materials and Methods

3.1. Data Collection

3.2. Model Specification for Efficiency Score Model

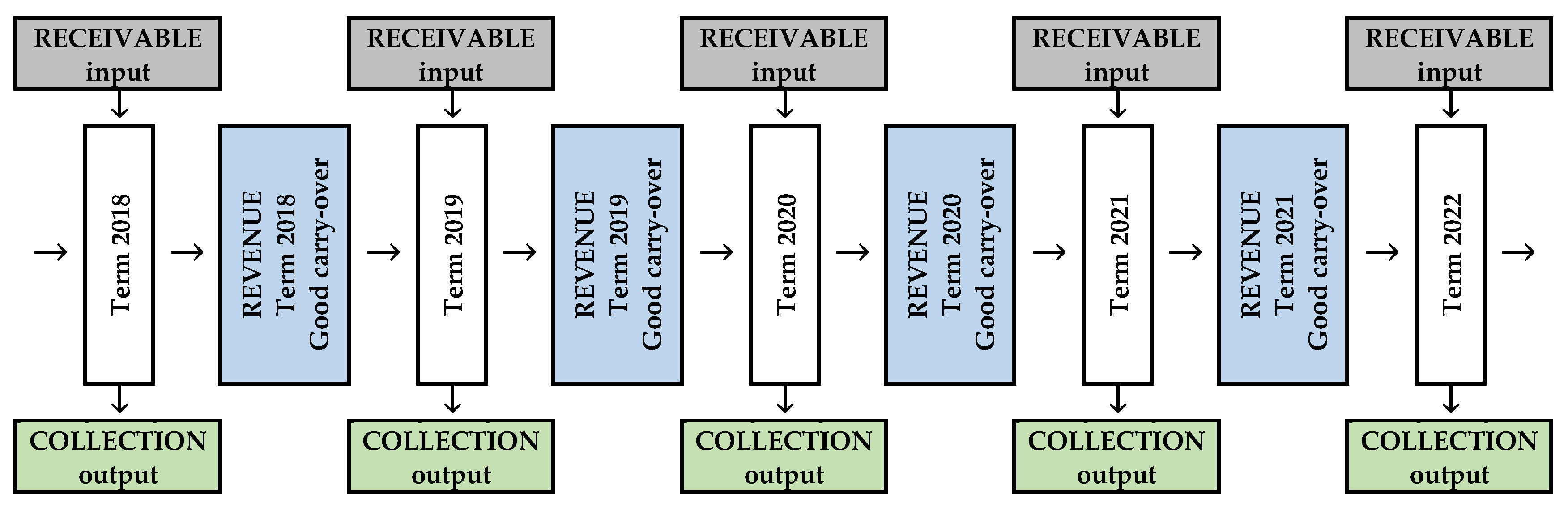

3.2.1. The Data Envelopment Analysis Model Proposed

3.2.2. Variable Selection for Efficiency Assessment

3.3. Econometric Model Construction and Variables Measurement

3. Results and Discussion

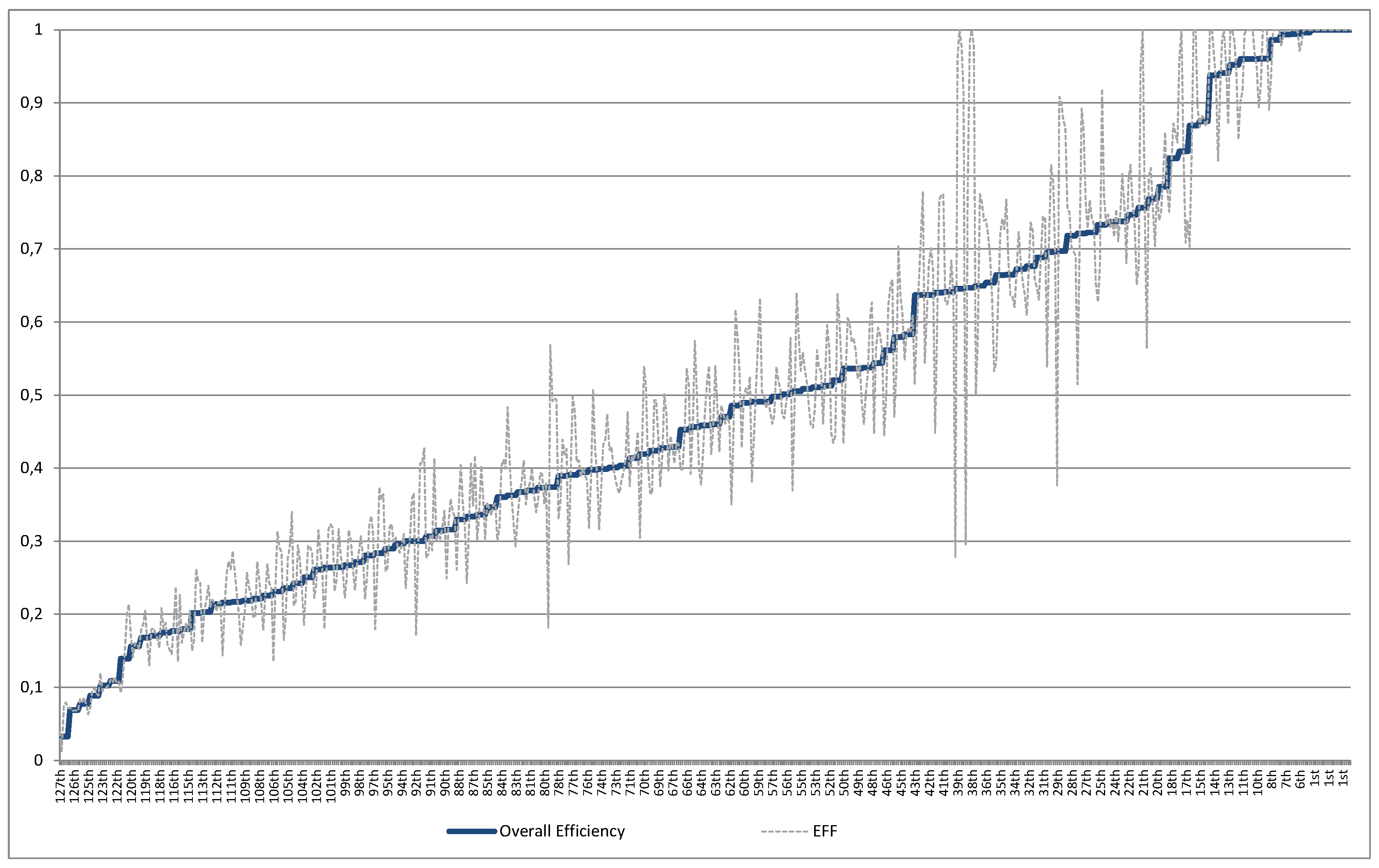

3.1. Revenue Collection Efficiency Assessment

3.2. Econometric Explanatory Model

3.2.1. Descriptive Statistic

3.3. Explanatory Econometric Analysis

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Variable | Description | Expectation a priori and hypothesis |

|---|---|---|

| Revenue collection efficiency score of utility j in year t, calculated using the DSBM model under the premises of VRS and input-oriented, considering customer accounts receivables (input), revenue collections (output), and revenue (good carry-over). Source: DSBM Score | Dependent Variable | |

| Corporatization of utility j in year t. This variable captures whether a utility is publicly listed. 1 for utilities listed with the CVM, 0 otherwise. Source: CVM | - (H2) | |

| Ownership structure of utility j in year t. Was collected through SNIS platform, using the information of “Natureza juridica”. 1 for utilities with private control (“Empresa Privada” and “Sociedade de economia mista com gestão privada”), 0 for utilities with public control (“Empresa Pública” and “Sociedade de economia mista com gestão pública”). | -/+ (H1) | |

| Proportion of residential customers per economies of utility j in year t. Thus, the number of active residential water (AG013 of the SNIS) and wastewater (ES008 of the SNIS) units that were fully operational on the last day of the reference year proportional to active water (AG003 of the SNIS) and wastewater (ES003 of the SNIS) economies refer to the number of units connected to the water supply network and provided with water for user consumption in the reference year. | + | |

| Density of the service area of utility j in year t. Therefore, the total population served with water (AG001 of the SNIS) and wastewater (ES001 of the SNIS) services by the service provider on the last day of the reference year proportional to active water (AG003 of the SNIS) and wastewater (ES003 of the SNIS) economies refer to the number of units connected to the water supply network and provided with water for user consumption in the reference year. | -/+ | |

| Average per Capita Consumption (IN022 from the SNIS) * Average Applied Tariff (IN004) proportional of water services relative to GDP per capita. On this portal, the GDP per municipality, the population attended per municipality, and the GDP per capita per municipality can be found. For this work, the GDPs per municipality were summed to calculate the GDP per company. Then, the GDP per capita per company was obtained by dividing this total by the sum of the total population served per company. Average Tariff and GDP adjusted using the Brazilian price index IPCA/IBGE. | - | |

| Size of utility j in year t. Total assets relative to the number of economies served. So, The annual value of the sum of Current Assets, Long-Term Receivables, and Permanent Assets (BL002 of the SNIS) proportional to active water (AG003 of the SNIS) and wastewater (ES003 of the SNIS) economies refer to the number of units connected to the water supply network and provided with water for user consumption in the reference year and then adjusted using the Brazilian price index IPCA/IBGE (measured in BR/Econ). | - | |

| Proportion of the urban population served in relation to the total active economies of utility j in year t. It represents the value of the urban population served with water supply by the service provider on the last day of the reference year, in proportion to the total population served with water (AG001 from the SNIS) and wastewater (ES001 from the SNIS) services by the service provider on the last day of the reference year. | + | |

| Joint provision of water and wastewater of utility j in year t. Was collected through SNIS platform, using the information of “Tipo de serviço”.1 for utilities providing both water and wastewater services (“Água e Esgoto”), 0 for utilities providing either water or wastewater services (“Água”; “Esgoto”). | -/+ | |

| Effect of COVID-19 on utility j in year t 2020 onwards. | -/+ |

Appendix B

| DMU | Overall Score | 2018 | 2019 | 2020 | 2021 | 2022 | DMU | Overall Score | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 11000212-AA | 0,284 | 0,180 | 0,261 | 0,374 | 0,357 | 0,364 | 35334011-CODEN | 0,961 | 0,925 | 1,000 | 1,000 | 1,000 | 0,891 |

| 11001812-APB | 0,271 | 0,233 | 0,266 | 0,287 | 0,307 | 0,275 | 35350011-ESAP | 0,505 | 0,370 | 0,493 | 0,640 | 0,581 | 0,533 |

| 11002000-CAERD | 0,170 | 0,179 | 0,181 | 0,174 | 0,167 | 0,154 | 35356012-CAEPA | 0,721 | 0,515 | 0,714 | 0,892 | 0,864 | 0,763 |

| 11002812-ARM | 0,300 | 0,172 | 0,279 | 0,407 | 0,406 | 0,427 | 35385011-AP | 0,419 | 0,305 | 0,424 | 0,539 | 0,512 | 0,404 |

| 11004512-ABU | 0,139 | 0,092 | 0,114 | 0,152 | 0,200 | 0,214 | 35407011-BRK | 0,428 | 0,375 | 0,418 | 0,501 | 0,474 | 0,395 |

| 13026000-COSAMA | 0,033 | 0,039 | 0,012 | 0,075 | 0,079 | 0,072 | 35452012-SANESALTO | 0,733 | 0,627 | 0,678 | 0,919 | 0,773 | 0,732 |

| 13026011-MA | 0,180 | 0,161 | 0,174 | 0,187 | 0,177 | 0,205 | 35467011-BRK | 0,424 | 0,366 | 0,364 | 0,493 | 0,493 | 0,443 |

| 14001000-CAER | 0,637 | 0,515 | 0,594 | 0,653 | 0,710 | 0,779 | 35475012-COMASA | 0,869 | 0,703 | 0,826 | 1,000 | 1,000 | 0,892 |

| 15013012-ASF | 0,236 | 0,165 | 0,194 | 0,277 | 0,291 | 0,340 | 35503000-SABESP | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 |

| 15014000-COSANPA | 0,307 | 0,277 | 0,283 | 0,307 | 0,287 | 0,413 | 35524012-BRK | 0,508 | 0,559 | 0,536 | 0,516 | 0,484 | 0,459 |

| 15050311-PMNP/ANP | 0,281 | 0,221 | 0,254 | 0,320 | 0,335 | 0,307 | 35570011-CAV | 0,677 | 0,609 | 0,672 | 0,736 | 0,725 | 0,657 |

| 15061312-BRK | 0,217 | 0,287 | 0,257 | 0,228 | 0,202 | 0,158 | 41069000-SANEPAR | 0,960 | 1,000 | 1,000 | 0,968 | 0,949 | 0,894 |

| 17210000-SANEATINS | 0,941 | 0,912 | 0,987 | 1,000 | 0,947 | 0,871 | 41182011-PS | 0,401 | 0,425 | 0,430 | 0,400 | 0,385 | 0,372 |

| 21075012-BRK | 0,089 | 0,073 | 0,096 | 0,099 | 0,092 | 0,089 | 42020712-GS | 0,646 | 0,279 | 0,961 | 1,000 | 0,978 | 0,913 |

| 21112012-BRK | 0,156 | 0,169 | 0,141 | 0,161 | 0,159 | 0,152 | 42024012-BRK | 0,785 | 0,739 | 0,749 | 0,803 | 0,860 | 0,786 |

| 21113000-CAEMA | 0,077 | 0,084 | 0,080 | 0,086 | 0,077 | 0,063 | 42024511-AB | 0,458 | 0,378 | 0,420 | 0,477 | 0,519 | 0,540 |

| 21122013-AT | 0,373 | 0,355 | 0,393 | 0,392 | 0,351 | 0,381 | 42032012-AC | 0,561 | 0,445 | 0,502 | 0,622 | 0,650 | 0,658 |

| 22110000-AGESPISA | 0,102 | 0,120 | 0,095 | 0,098 | 0,099 | 0,103 | 42054000-CASAN | 0,737 | 0,747 | 0,730 | 0,740 | 0,717 | 0,754 |

| 22110011-AT | 0,489 | 0,428 | 0,496 | 0,509 | 0,501 | 0,525 | 42062012-GS | 0,697 | 0,375 | 0,908 | 0,902 | 0,876 | 0,867 |

| 23042011-SAAEC | 0,203 | 0,161 | 0,205 | 0,218 | 0,239 | 0,210 | 42083011-CIA de Águas | 0,501 | 0,472 | 0,468 | 0,493 | 0,509 | 0,578 |

| 23044000-CAGECE | 0,429 | 0,444 | 0,430 | 0,407 | 0,436 | 0,433 | 42084512-IS | 0,650 | 0,500 | 0,574 | 0,775 | 0,765 | 0,739 |

| 24081000-CAERN | 0,938 | 1,000 | 1,000 | 0,967 | 0,926 | 0,821 | 42091012-CAJ | 0,641 | 0,629 | 0,624 | 0,637 | 0,684 | 0,635 |

| 25075000-CAGEPA | 0,347 | 0,353 | 0,345 | 0,336 | 0,349 | 0,352 | 42125012-AP | 0,403 | 0,366 | 0,384 | 0,395 | 0,413 | 0,477 |

| 26116000-COMPESA | 0,470 | 0,486 | 0,474 | 0,461 | 0,471 | 0,460 | 42162012-ASFS | 0,538 | 0,460 | 0,503 | 0,530 | 0,606 | 0,627 |

| 27043000-CASAL | 0,168 | 0,178 | 0,187 | 0,205 | 0,162 | 0,130 | 42187012-TBSSA | 0,300 | 0,236 | 0,282 | 0,299 | 0,358 | 0,366 |

| 28003000-DESO | 0,214 | 0,220 | 0,215 | 0,204 | 0,217 | 0,216 | 43149000-CORSAN | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 |

| 29148011-EMASA | 0,696 | 0,538 | 0,723 | 0,815 | 0,791 | 0,688 | 43224011-BRK | 0,394 | 0,411 | 0,388 | 0,400 | 0,391 | 0,383 |

| 29274000-EMBASA | 0,718 | 0,756 | 0,750 | 0,702 | 0,697 | 0,691 | 50027000-SANESUL | 0,723 | 0,728 | 0,767 | 0,742 | 0,734 | 0,653 |

| 29307711-EMSAE | 0,202 | 0,150 | 0,164 | 0,262 | 0,245 | 0,243 | 50027011-AG | 0,414 | 0,376 | 0,417 | 0,410 | 0,423 | 0,450 |

| 31039011-SANARJ | 0,391 | 0,269 | 0,396 | 0,497 | 0,479 | 0,408 | 51002511-AAF | 0,360 | 0,300 | 0,320 | 0,403 | 0,412 | 0,399 |

| 31062000-COPASA | 0,994 | 0,979 | 0,990 | 1,000 | 1,000 | 1,000 | 51013011-AA | 0,996 | 0,982 | 1,000 | 1,000 | 1,000 | 1,000 |

| 31367011-CESAMA | 0,654 | 0,740 | 0,720 | 0,691 | 0,632 | 0,533 | 51018012-ABG | 0,498 | 0,461 | 0,472 | 0,539 | 0,520 | 0,507 |

| 31471011-CAPAM | 0,664 | 0,545 | 0,631 | 0,722 | 0,742 | 0,727 | 51026711-ACV | 0,399 | 0,317 | 0,374 | 0,432 | 0,439 | 0,474 |

| 31472011-COSÁGUA | 0,580 | 0,470 | 0,535 | 0,704 | 0,635 | 0,612 | 51027011-AC | 0,641 | 0,448 | 0,592 | 0,767 | 0,774 | 0,775 |

| 32012011-BRK | 0,537 | 0,577 | 0,561 | 0,522 | 0,541 | 0,490 | 51027911-AGUASCAR | 0,231 | 0,135 | 0,244 | 0,313 | 0,291 | 0,284 |

| 32053000-CESAN | 0,875 | 0,867 | 0,883 | 0,879 | 0,868 | 0,878 | 51030511-AC | 0,316 | 0,249 | 0,325 | 0,358 | 0,342 | 0,333 |

| 33002011-CAJ | 0,689 | 0,647 | 0,631 | 0,693 | 0,744 | 0,744 | 51032011-AC | 0,511 | 0,455 | 0,482 | 0,561 | 0,538 | 0,532 |

| 33007011-PROLAGOS | 0,314 | 0,300 | 0,309 | 0,303 | 0,321 | 0,342 | 51033011-AC | 0,486 | 0,350 | 0,455 | 0,617 | 0,577 | 0,530 |

| 33010011-CAP | 0,491 | 0,504 | 0,501 | 0,482 | 0,492 | 0,478 | 51033511-ACO | 0,264 | 0,180 | 0,252 | 0,316 | 0,323 | 0,319 |

| 33018511-FSSG | 0,175 | 0,208 | 0,181 | 0,188 | 0,158 | 0,152 | 51034011-CBA | 0,297 | 0,305 | 0,292 | 0,284 | 0,293 | 0,310 |

| 33024012-BRK | 0,374 | 0,181 | 0,569 | 0,492 | 0,497 | 0,493 | 51035012-ADI | 0,242 | 0,212 | 0,218 | 0,294 | 0,275 | 0,233 |

| 33033011-CAN | 0,986 | 0,935 | 1,000 | 1,000 | 1,000 | 1,000 | 51041011-AG | 0,389 | 0,330 | 0,356 | 0,439 | 0,419 | 0,426 |

| 33034011-CANF | 0,952 | 1,000 | 1,000 | 0,985 | 0,943 | 0,850 | 51049011-SBJ | 0,226 | 0,178 | 0,225 | 0,268 | 0,243 | 0,235 |

| 33038011-CAPY | 0,367 | 0,337 | 0,362 | 0,385 | 0,410 | 0,351 | 51050011-AJ | 0,216 | 0,144 | 0,210 | 0,256 | 0,273 | 0,262 |

| 33039011-CAI | 0,747 | 0,794 | 0,815 | 0,760 | 0,737 | 0,651 | 51055811-AMA | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 |

| 33042011-CAAN | 0,824 | 0,751 | 0,805 | 0,872 | 0,860 | 0,846 | 51056011-AM | 0,334 | 0,243 | 0,318 | 0,406 | 0,349 | 0,417 |

| 33045511-FABZO | 0,069 | 0,072 | 0,068 | 0,069 | 0,068 | 0,068 | 51060011-ANOR | 0,109 | 0,110 | 0,107 | 0,114 | 0,106 | 0,108 |

| 35021011-AA | 0,513 | 0,461 | 0,527 | 0,596 | 0,564 | 0,448 | 51062511-SETAE | 0,994 | 1,000 | 1,000 | 1,000 | 1,000 | 0,971 |

| 35028011-SAMAR | 0,738 | 0,711 | 0,749 | 0,802 | 0,758 | 0,681 | 51063012-APA | 0,222 | 0,197 | 0,195 | 0,272 | 0,248 | 0,214 |

| 35029011-CAA | 0,520 | 0,435 | 0,445 | 0,638 | 0,603 | 0,546 | 51063711-SBPP | 0,264 | 0,231 | 0,247 | 0,317 | 0,280 | 0,261 |

| 35095011-SANASA | 0,769 | 0,799 | 0,811 | 0,756 | 0,704 | 0,784 | 51064211-APA | 0,330 | 0,261 | 0,342 | 0,406 | 0,353 | 0,322 |

| 35110011-EAC | 0,337 | 0,302 | 0,334 | 0,403 | 0,361 | 0,303 | 51065011-APO | 0,219 | 0,181 | 0,206 | 0,257 | 0,237 | 0,227 |

| 35144011-EMDAEP | 0,756 | 0,676 | 0,951 | 1,000 | 0,764 | 0,565 | 51067511-APL | 0,267 | 0,223 | 0,250 | 0,315 | 0,302 | 0,265 |

| 35177011-GUARA | 0,398 | 0,318 | 0,390 | 0,508 | 0,428 | 0,390 | 51068211-APE | 0,177 | 0,145 | 0,188 | 0,237 | 0,135 | 0,227 |

| 35184011-SAEG | 0,834 | 0,958 | 1,000 | 0,840 | 0,709 | 0,739 | 51070411-APL | 0,370 | 0,371 | 0,380 | 0,401 | 0,363 | 0,340 |

| 35190512-AH | 0,544 | 0,448 | 0,563 | 0,592 | 0,582 | 0,562 | 51072411-ASC | 0,647 | 0,295 | 0,770 | 0,985 | 1,000 | 0,978 |

| 35253012-CAJA | 0,637 | 0,544 | 0,615 | 0,681 | 0,701 | 0,671 | 51073011-ASJ | 0,261 | 0,222 | 0,240 | 0,315 | 0,287 | 0,262 |

| 35259011-DAE Jundiaí | 0,583 | 0,548 | 0,582 | 0,592 | 0,587 | 0,609 | 51079011-AS | 0,491 | 0,382 | 0,445 | 0,508 | 0,568 | 0,632 |

| 35269011-BRKL | 0,665 | 0,768 | 0,686 | 0,636 | 0,635 | 0,620 | 51079211-AS | 0,536 | 0,433 | 0,512 | 0,605 | 0,599 | 0,574 |

| 35284011-SM | 0,453 | 0,399 | 0,398 | 0,452 | 0,536 | 0,513 | 51083011-AUS | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 |

| 35293011-AM | 0,290 | 0,259 | 0,262 | 0,319 | 0,324 | 0,299 | 51085011-AVE | 0,250 | 0,185 | 0,237 | 0,295 | 0,292 | 0,284 |

| 35294012-BRK | 0,363 | 0,483 | 0,411 | 0,362 | 0,323 | 0,293 | 52087000-SANEAGO | 0,960 | 0,901 | 0,916 | 0,994 | 1,000 | 1,000 |

| 35298011-AMT | 0,457 | 0,392 | 0,463 | 0,574 | 0,499 | 0,400 | 53001000-CAESB | 0,673 | 0,667 | 0,723 | 0,685 | 0,655 | 0,639 |

| 35303011-SANESSOL | 0,460 | 0,418 | 0,453 | 0,540 | 0,489 | 0,423 |

References

- Olaoye, Clement Olatunji; Atilola, Oluseyi Olabanji. Effect of e-tax payment on revenue generation in Nigeria. 2018, 4, 56-65.

- Muriithi, J. M.; Ochieng, I.; Nzioki, Paul M. The Effect Of Improved Revenue-Collection Efficiency Strategy On The Performance Of Wsps In Kenya: A Case Nyahururu Water And Sanitation Company, Nyahururu, Kenya. The Strategic Journal of Business & Change Management 2019, 6, p. 1335-1341.

- Ngotho, Joyce; Kerongo, Francis. Determinants of revenue collection in developing countries: Kenya’s tax collection perspective. Journal of management and business administration 2014, 1, 1-9.

- Nekemia, Ampiire; Atukunda, Gershom; Nuwagaba, Arthur. On-spot billing system, cost of water, revenue collection mechanism & revenue collection performance of public utility entities evidence from NWSC Mbarara Centre. Journal of development, education & technology 2023, 1, 29-54.

- Brazil. Conselho Nacional do Ministério Público. Revista do CNMP: água, vida e direitos humanos / Conselho Nacional do Ministério Público. – n. 7 (2018). – Brasília: CNMP, 2018. Available in: <https://www.cnmp.mp.br/portal/images/revista_final.pdf>.

- Nauges, Celine; Whittington, Dale. Evaluating the performance of alternative municipal water tariff designs: Quantifying the tradeoffs between equity, economic efficiency, and cost recovery. World Development 2017, 91, 125-143.

- Barbosa, Alexandro; Brusca, Isabel. Governance structures and their impact on tariff levels of Brazilian water and sanitation corporations. Utilities Policy 2015, 34, 94–105. [CrossRef]

- Romano, Giulia; Guerrini, Andrea; Vernizzi, Silvia. Ownership, investment policies and funding choices of Italian water utilities: an empirical analysis. Water resources management 2013, 27, 3409-3419.

- Pereira, J. M. Defesa da concorrência e regulação econômica no Brasil. RAM. Revista de Administração Mackenzie 2022, 5, 35-55.

- Leibenstein, Harvey. Allocative efficiency vs." X-efficiency". The American economic review 1966, 56, 392-415.

- Brazil. Lei nº. 11.445, de 5 de janeiro de 2007. Diário Oficial da União, Brasília, DF. 5 jan. 2007. Available in: < https://www.planalto.gov.br/ccivil_03/_ato2007-2010/2007/lei/l11445.htm>.

- Brazil. Lei n. 14.026, de 15 de julho DE 2020. Diário Oficial da União, 16 de julho de 2020. Available in: < https://www.planalto.gov.br/ccivil_03/_ato2019-2022/2020/lei/l14026.htm#:~:text=%E2%80%9CEstabelece%20as%20diretrizes%20nacionais%20para,11%20de%20maio%20de%201978.%E2%80%9D>.

- Estrin, Saul; Pelletier, Adeline. Privatization in developing countries: what are the lessons of recent experience? The World Bank Research Observer 2018, 33, 65–102. [CrossRef]

- Gonçalves, Mariana Berardinelli Vieira Braz. Privatização da Cedae: Na Contramão do Movimento Mundial de Remunicipalização dos Serviços de Saneamento. Geo UERJ 2017, 31, 81-103.

- Ferreira, José Gomes; Gomes, Matheus Fortunato Barbosa; Dantas, Maria Wagna de Araújo. Challenges and controversies of the new legal framework for basic sanitation in Brazil. Brazilian Journal of Development 2021, 7, 65449–65468. [CrossRef]

- Kishimoto, Satoko; Petitjean, Olivier. Cómo ciudades y ciudadanía están escribiendo el futuro de los servicios públicos. The Transnational Institute. Available in: <https://www.tni.org/es/publicaci%C3%B3n/remunicipalizacion-el-futuro-de-los-servicios-p%C3%BAblicos>.

- Berg, Sanford. Water utility benchmarking: measurement, methodologies and performance incentives, v. 9; International Water Association Publishing: London, United Kingdom, 2010.

- Baker, S. R., Bloom, N., Davis, S. J., & Terry, S. J. Covid-induced economic uncertainty. National Bureau of Economic Research 2020.

- Oliveira, Gesner; Marcato, Fernando S.; Scazufca, Pedro; Ferreira, Artur Villela. Estudo técnico: Remunicipalização dos serviços de saneamento básico. estudos de caso e debate. 2018. Available at: https://goassociados.com.br/wpcontent/uploads/2018/11/Parecer-remunicipaliza%C3%A7%C3%A3o-saneamento.pdf>. [CrossRef]

- Vieira, A. C. O direito Humano à água. Imprenta: Arraes Belo Horizonte; Brazil. 2016. pp. 1-128.

- Wichman, C. J. Perceived price in residential water demand: Evidence from natural experiment. Journal of Economic Behavior & Organization 2014, 107, 308–323. [Google Scholar] [CrossRef]

- Namaliya, Nicholas Gracious. Strategies for maximizing revenue collection in public water utility companies. Walden Dissertations and Doctoral Studies. Walden University, 2017.

- Martínez-Espiñeira, Roberto; García-Valiñas, María A.; González-Gómez, Francisco. Does private management of water supply services really increase prices? An empirical analysis in Spain. Urban Studies 2009, 46, 923–945. [CrossRef]

- García-Valiñas, María De Los Ángeles; González-Gómez, Francisco; Picazo-Tadeo, Andres J. Is the price of water for residential use related to provider ownership? Empirical evidence from Spain. Utilities Policy 2013, 24, 59–69. [CrossRef]

- Guerrini, Andrea; Romano, Giulia; Campedelli, Bettina. Factors affecting the performance of water utility companies. International Journal of Public Sector Management 2011, 24, 543–566.

- Romano, Giulia; Guerrini, Andrea; Masserini, Lucio. Endogenous and environmental determinants of water pricing policy in Italy. 2013. Available at: SSRN: < https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2331391>.

- Chong, E.; Huet, F.; Saussier, S.; Steiner, F. Public-private partnerships and prices: Evidence from water distribution in France. Review of Industrial Organization 2006, 29, 149–169. [Google Scholar] [CrossRef]

- Ruester, Sophia; Zschille, Michael. The impact of governance structure on firm performance: An application to the German water distribution sector. Utilities Policy 2010, 18, 154-162.

- Bitrán, Gabriel A.; Valenzuela, Eduardo P. Water services in Chile: comparing private and public performance. 2003. Available at: <https://documents1.worldbank.org/curated/pt/455861468769468006/pdf/261260viewpoint.pdf>.

- Marin, Philippe. Public private partnerships for urban water utilities: A review of experiences in developing countries, nº 8, The world Bank, United States, 2009; pp. 1-177.

- Estache, Antonio; Trujillo, Lourdes. Efficiency effects of “privatization” in argentina’s water and sanitation services. Water policy 2003, 5, 369-380.

- Zaki, Saeed; Nurul Amin, A. T. M. Does basic services privatisation benefit the urban poor? Some evidence from water supply privatisation in Thailand. Urban Studies 2009, 46, 2301–2327. [CrossRef]

- Oliveira, Andre R. Private provision of water service in Brazil: Impacts on access and affordability. MPRA paper 11149 2008. University Library of Munich, Germany. Available at: <https://mpra.ub.uni-muenchen.de/11149/1/MPRA_paper_11149.pdf>.

- Berg, Sanford; Marques, R. C. Quantitative studies of water and sanitation utilities: a benchmarking literature survey. Water Policy 2011, 13, 591-606.

- ABBOTT, Malcolm; COHEN, Bruce. Productivity and efficiency in the water industry. Utilities Policy 2009, 17, 233–244. [CrossRef]

- Carvalho, Pedro; Marques, Rui Cunha; Berg, Sanford. A meta-regression analysis of benchmarking studies on water utilities market structure. Utilities Policy 2012, 21, 40-49.

- Worthington, A. C. A review of frontier approaches to efficiency and productivity measurement in urban water utilities. Urban Water Journal 2014, 11, 55–73. [Google Scholar] [CrossRef]

- Barbosa, Alexandro; De Lima, Severino Cesário; Brusca, Isabel. Governance and efficiency in the Brazilian water utilities: A dynamic analysis in the process of universal access. Utilities Policy 2016, 43, 82-96.

- Sabbioni, Guillermo. Efficiency in the Brazilian sanitation sector. Utilities Policy 2008, 16, 11–20. [CrossRef]

- Motta, Ronaldo Seroa; Moreira, Ajax. Efficiency and regulation in the sanitation sector in Brazil. Utilities Policy 2006, 14, 185–195. [CrossRef]

- Cetrulo, Tiago Balieiro; Marques, Rui Cunha; Malheiros, Tadeu Fabrício. An analytical review of the efficiency of water and sanitation utilities in developing countries. Water research 2019, 161, 372–380. [CrossRef]

- Mello, Marina Figueira. Privatização do setor de saneamento no Brasil: quatro experiências e muitas lições. Econ. Apl. 2005, Ribeirão Preto, 9, 495-517.

- Vining, Aidan R.; Boardman, Anthony E. Ownership versus competition: Efficiency in public enterprise. Public choice 1992, 73, 205-239.

- Akerlof, G. A. The Market for ‘Lemons’: Quality Uncertainty and the Market for Lemons. The Quarterly Journal of Economics 1970, 84, 488–500. [Google Scholar] [CrossRef]

- Spence, Michael. Job Market Signaling. In: Uncertainty in economics. Academic Press 1978, 281-306.

- Morris, Richard D. Signalling, agency theory and accounting policy choice. Accounting and business Research 1987, 18, 47-56.

- Sato, Ivone Dias. Gestão econômica em serviços: procedimento de cobrança para recuperação de receita em núcleos de baixa renda. Masters Degree. Universidade Nove de Julho, São Paulo, 2013.

- Wagenhofer, A. The role of revenue recognition in performance reporting. Accounting and Business Research 2014, 44, 349–379. [Google Scholar] [CrossRef]

- Oghoghomeh, T.; Anthony, O. Entrepreneur‘s nightmare—Corporate failure: Consequences and probable solutions. Research Journal of Finance and Accounting 2013, 4(19), 45–53. [Google Scholar]

- Boyle, C. E. Adapting to change: Water utility financial practices in the early twenty-first century. American Water Works Association 2014, 106, E1–E9. [Google Scholar] [CrossRef]

- Zhu, Joe. Multi-factor performance measure model with an application to Fortune 500 companies. European Journal of Operational Research 2000, 123, 105–124. [CrossRef]

- Dyson, R.G.; Allen , R.; Camanho , A.S.; Podinovski , V.V.; Sarrico , C.S.; Shale , E.A.Pitfalls and protocols in DEA, European Journal of Operational Research, v. 132, Issue 2, 2001, Pg. 245-259. [CrossRef]

- Färe, R.; Grosskopf, S. Intertemporal Production Frontiers: with Dynamic DEA, 1st ed.; Kluwer Academic Publishers: Boston, US, 1996; 202 pp.

- Nemoto, Jiro; Goto, Mika. Dynamic data envelopment analysis: modeling intertemporal behavior of a firm in the presence of productive inefficiencies. Economics Letters 1999, 64, 51-56.

- Nemoto, Jiro; Goto, Mika. Measurement of Dynamic Efficiency in Production: An Application of Data Envelopment Analysis to Japanese Electric Utilities. Journal of Productivity Analysis 2003, 19, 191-210.

- Sengupta, Jati K. A dynamic efficiency model using data envelopment analysis. International Journal of Production Economics 1999, 62, 209–218. [CrossRef]

- Sengupta, Jati K. Nonparametric efficiency analysis under uncertainty using data envelopment analysis. International Journal of Production Economics 2005, 95, 39–49. [CrossRef]

- Sengupta, Jati K. Persistence of dynamic efficiency in Farrell models. Applied Economics 2010, 29, 665- 671.

- Wang, Mei-Hu; Huang, Tai-Hsin. A study on the persistence of Farrell’s efficiency measure under a dynamic framework. European Journal of Operational Research 2007, 180, 1302-1316.

- Geymueller, Von, P. Static versus dynamic DEA in electricity regulation: the case of US transmission system operators. Cent Eur J Oper Res 2009, 17, 397–413. [CrossRef]

- Chen, Chien-Ming; Dalen, Jan van. Measuring dynamic efficiency: Theories and an integrated methodology. European Journal of Operational Research 2010, 203, 749-760.

- Tone, K., Tsutsui, M. Dynamic DEA:Aslacks-based measure approach. Omega 2010, 38, 145-156.

- Pointon, Charlotte; Matthews, Kent. Dynamic Efficiency in the English and Welsh Water and Sewerage Industry. Omega 2015, 58, 86–96. [CrossRef]

- Addae, E.A.; Sun, D.; Abban, O.J. Evaluating the effect of urbanization and foreign direct investment on water use efficiency in West Africa: application of the dynamic slacks-based model and the common correlated effects mean group estimator. Environ Dev Sustain 2023, 25, 5867–5897. [Google Scholar] [CrossRef]

- Carvalho, Anne Emília Costa; Sampaio, Raquel Menezes Bezerra; Sampaio, Luciano Menezes Bezerra. The impact of regulation on the Brazilian water and sewerage companies’ efficiency. Socio-Economic Planning Sciences 2023, 87, 101537.

- Pronunciamento Técnico CPC 48 Instrumentos Financeiros, Correlação às Normas Internacionais de Contabilidade – IFRS 9. (2016, 04 de novembro). Brasília, DF: Comitê de Pronunciamentos Contábeis. Available at: http://static.cpc.aatb.com.br/Documentos/530_CPC_48.pdf.

- Azhar, Syed; Zeeshan, Khudisya. Receivables Management: A Study of Select State Owned Power Distribution Utilities in India. Finance India 2021, 35, 1173.

- Wejer, Małgorzata; Patterson, Robert. Selected reasons for payment delays and its financial consequences from Polish perspective. Zeszyty Naukowe Wyższej Szkoły Ekonomii i Informatyki w Krakowie 2015, 11, 207-220.

- Murrar, Abdullah; Batra, Madan; Rodger, James. Service quality and customer satisfaction as antecedents of financial sustainability of the water service providers. The TQM Journal 2021, 33, 1867–1885. [CrossRef]

- World Bank. Performance Improvement Planning: Developing Effective Billing and Collection Practices (April 1, 2008). World Bank Policy Research Working Paper No. 44119, Available at SSRN: https://ssrn.com/abstract=1149069.

- Carteado-fatima, E. F.; Vermersch-michel. Non-Revenue Water and Revenue Collection Ratio: Review, Assessment and Recommendations 2016. Available at: https://mcast.edu.mt/wp-content/uploads/New-Appendix-6-Non-Revenue-Water-and-Revenue-Collection-Ratio-Review-Assessment-and-Recommendations.-Carteado.pdf.

- Murrar, Abdullah; Paz, V.; Yerger, D.; Batra, M. Enhancing financial efficiency and receivable collection in the water sector: Insights from structural equation modeling. Utilities Policy 2024, 87, 101723.

- Alegre, H.; Baptista, J. M.; Cabrera Jr, E.; Cubillo, F.; Duarte, P.; Hirner; Merkel, W.; Parena, R. Performance indicators for water supply services. IWA publishing 2010.

- Matos, R., Cardoso, A., Ashley, R. M., Duarte, P., Molinari, A., & Schulz, A. (Eds.). Performance indicators for wastewater services. IWA publishing 2003.

- Liang, Kung-Yee; Zeger, Scott L. Longitudinal data analysis using generalized linear models. Biometrika, 1986; 73, 13–22.

- Hardin, J., Hilbe, J. Generalized linear model and extensions. 2nd ed, Stata Press Publication 2007.

- Mbuvi, Dorcas; Witte, Kristof; Perelman, Sergio. Urban water sector performance in Africa: A step-wise bias-corrected efficiency and effectiveness analysis. Utilities Policy 2012, 22, 31-40.

- See, Kok Fong. Exploring and analysing sources of technical efficiency in water supply services: some evidence from Southeast Asian public water utilities. Water Resources and Economics 2015, 9, 23-44.

- Gupta, Shreekant; Kumar, Surender; Sarangi, Gopal K. Measuring the performance of water service providers in urban India: implications for managing water utilities. Water Policy 2012, 14, p. 391-408.

- Ferro, Gustavo; Romero, Carlos A.; Covelli, María Paula. Regulation and performance: A production frontier estimate for the Latin American water and sanitation sector. Utilities Policy 2011, 19, 211-217.

- Marques, Rui Cunha. Measuring the total factor productivity of the Portuguese water and sewerage services. Economia Aplicada 2008, 12, 215–237.

- Souza, Geraldo Da Silva; Faria, Ricardo Coelho De; Moreira, Tito Belchior S. Efficiency of Brazilian public and private water utilities. Estudos Econômicos (São Paulo) 2008, 38, 905-917.

- Carvalho, Anne Emília Costa; Sampaio, Luciano Menezes Bezerra. Paths to universalize water and sewage services in Brazil: The role of regulatory authorities in promoting efficient service. Utilities Policy 2015, 34, 1-10.

- Nauges, Céline; Van Den Berg, Caroline. Economies of density, scale and scope in the water supply and sewerage sector: a study of four developing and transition economies. Journal of Regulatory Economics 2008, 34, 144-163.

- Brazil. Lei nº. 13.982, de 2 de abril de 2020. Diário Oficial da União, Brasília, DF. 2 abr. 2020. Available in: < https://www.planalto.gov.br/ccivil_03/_ato2019-2022/2020/lei/l13982.htm>.

- Companhia de Água e Esgotos do Rio Grande do Norte (CAERN). 2023 Relatório Integrado de Gestão. Available in: < https://arquivos-transparencia.caern.com.br/s/OUb6QbzywOcNeAe>.

| Variable | Description | DSBM Specification |

|

|---|---|---|---|

| Accumulated gross balance of amounts receivable from utility j in year t, considering the last day of the reference year, as a result of billing for direct and indirect water and wastewater services (FN008 of the SNIS), adjusted using the Brazilian price index IPCA/IBGE (measured in BR). |

|

||

| Value effectively collected from all operating revenues of utility j in year t (FN006 of the SNIS), adjusted using the Brazilian price index IPCA/IBGE (measured in BR). |

|

||

| Value of revenue from the direct and indirect provision of water and wastewater services proportional to the delay in accounts receivable of utility j in year t. Adjusted using the Brazilian price index IPCA/IBGE (measured in BR). |

|

||

| Variable | Obs. | Mean | Std. Dev. | Min | Max | |

|---|---|---|---|---|---|---|

| RECEIVABLE (Input) | 2018 | 127 | 165.869.467,21 | 657.283.064,94 | 74.646,46 | 6.897.348.366,50 |

| 2019 | 167.374.566,76 | 561.457.858,19 | 30.585,57 | 5.530.197.982,14 | ||

| 2020 | 158.014.639,85 | 491.273.835,81 | 79.843,79 | 4.591.003.333,72 | ||

| 2021 | 157.639.908,21 | 504.144.089,44 | 124.037,10 | 4.810.883.363,14 | ||

| 2022 | 163.443.068,09 | 533.186.618,26 | 15.745,76 | 5.071.957.155,28 | ||

| COLLECTION (Output) | 2018 | 127 | 471.691.116,07 | 1.749.687.069,82 | 692.011,06 | 17.226.245.956,49 |

| 2019 | 492.783.587,21 | 1.806.613.058,97 | 731.916,37 | 17.697.395.904,04 | ||

| 2020 | 488.928.181,88 | 1.777.387.685,86 | 781.831,46 | 17.223.734.191,47 | ||

| 2021 | 471.055.305,68 | 1.692.515.241,82 | 738.760,91 | 16.353.129.233,29 | ||

| 2022 | 496.094.613,70 | 1.810.782.140,01 | 984.241,22 | 17.821.953.434,74 | ||

| REVENUE (Good Carry-over) | 2018 | 127 | 502.398.538,08 | 1.835.741.403,66 | 686.753,62 | 18.093.571.779,99 |

| 2019 | 532.450.227,00 | 1.983.504.112,52 | 726.061,35 | 19.634.345.685,23 | ||

| 2020 | 513.724.131,31 | 1.829.264.675,43 | 775.733,16 | 17.648.578.345,92 | ||

| 2021 | 499.887.041,02 | 1.779.251.733,57 | 754.463,03 | 17.248.220.283,74 | ||

| 2022 | 529.384.479,57 | 1.912.209.670,65 | 1.013.075,30 | 18.837.156.721,07 | ||

| Variable | REVENUE (Good Carry-over) | COLLECTION (Output) | |

| RECEIVABLE (Input) | 2018 | 0.845(***) | 0.827(***) |

| 2019 | 0.836(***) | 0.815(***) | |

| 2020 | 0.847(***) | 0.830(***) | |

| 2021 | 0.851(***) | 0.827(***) | |

| 2022 | 0.837(***) | 0.821(***) | |

| COLLECTION (Output) | 2018 | 0.973(***) | |

| 2019 | 0.964(***) | ||

| 2020 | 0.971(***) | ||

| 2021 | 0.964(***) | ||

| 2022 | 0.977(***) | ||

| Overall Score | 2018 | 2019 | 2020 | 2021 | 2022 | |||||||

| Mean | Std.Dev. | Mean | Std.Dev. | Mean | Std.Dev. | Mean | Std.Dev. | Mean | Std.Dev. | Mean | Std.Dev. | |

| Efficiency % | 49.53 | 25.87 | 44.93 | 26.70 | 49.90 | 27.47 | 54.08 | 27.16 | 52.90 | 26.70 | 51.03 | 25.70 |

| Inefficiency % | 50.47 | 55.07 | 50.10 | 45.92 | 47.10 | 48.97 | ||||||

| Freq. | % | Freq. | % | Freq. | % | Freq. | % | Freq. | % | Freq. | % | |

| Extreme inefficiencies | 30 | 23.62 | 41 | 32.28 | 34 | 26.77 | 22 | 17.32 | 22 | 17.32 | 26 | 20.47 |

| High inefficiencies | 59 | 46.46 | 56 | 44.09 | 57 | 44.88 | 59 | 46.46 | 60 | 47.24 | 59 | 46.46 |

| 25% with the lowest inefficiencies | 34 | 26.77 | 22 | 17.32 | 24 | 18.90 | 33 | 25.98 | 33 | 25.98 | 34 | 26.77 |

| Efficient | 4 | 3.15 | 8 | 6.30 | 12 | 9.45 | 13 | 10.24 | 12 | 9.45 | 8 | 6.30 |

| Total | 127 | 100 | 127 | 100 | 127 | 100 | 127 | 100 | 127 | 100 | 127 | 100 |

| Variable | Obs | Mean | Std. Dev. | Min | Max |

| EFF | 635 | 0.5057 | 0.2686 | 0.0115 | 1.0000 |

| Mann-Whitney tests | |||||

| Utilities on the stock market | 71 | 0.4767 | 0.2545 | Prob > |z| = 0.0000 | |

| Other utilities | 564 | 0.7361 | 0.2562 | ||

| Privately owned utilities | 475 | 0.4761 | 0.2439 | Prob > |z| = 0.0000 | |

| Publicly owned utilities | 160 | 0.5934 | 0.3162 | ||

| Water and sewage utilities | 487 | 0.5224 | 0.2554 | Prob > |z| = 0.0003 | |

| Utilities water or wastewater | 148 | 0.4505 | 0.3024 | ||

| Pre-COVID-19 period | 254 | 0.4741 | 0.2715 | Prob > |z| = 0.0072 | |

| COVID-19 period | 381 | 0.5267 | 0.2649 | ||

| CORP | 635 | 0.1118 | 0.3154 | 0.0000 | 1.0000 |

| OWN | 635 | 0.7480 | 0.4345 | 0.0000 | 1.0000 |

| REPCUST | 635 | 0.9166 | 0.0436 | 0.6025 | 1.0000 |

| DENSITY | 635 | 245.6764 | 112.1077 | 53.1081 | 728.0620 |

| SIZECUST | 635 | 10117.7800 | 109895.7000 | 0.0017 | 1647134.0000 |

| URB | 635 | 2.5378 | 0.6100 | 0.5278 | 5.3328 |

| AFFOR | 635 | 0.1944 | 0.1415 | 0.0021 | 1.9383 |

| JOINT | 635 | 0.7669 | 0.4231 | 0.0000 | 1.0000 |

| COVID19 | 635 | 0.6000 | 0.4903 | 0.0000 | 1.0000 |

| Model 1 – Exchangeable | Model 2 - Independent | Model 2 - AR(1) | |||||

|---|---|---|---|---|---|---|---|

| Binomial Logit |

Binomial Identity | Binomial Logit |

Binomial- Identity | Binomial Logit |

Binomial- Identity | ||

| CORP | 0.130064000 | 0.108718100 | 0.207300200 | 0.188442800 | 0.095203100 | 0.074438700 | |

| 1.74(0.082)* | 1.68(0.093)* | 2.52(0.012)** | 2.49(0.013)** | 1.66(0.097)* | 1.7(0.089)* | ||

| OWN | -0.061651900 | -0.050723000 | -0.111411700 | -0.111236400 | -0.087367800 | -0.081416900 | |

| -0.97(0.332) | -0.84(0.404) | -1.82(0.069)* | -1.98(0.047)** | -1.45(0.147) | -1.37(0.171) | ||

| REPCUST | 0.001722000 | -0.009210100 | -0.272000200 | -0.313330100 | 0.110811400 | 0.094847600 | |

| 0.01(0.993) | -0.04(0.964) | -0.67(0.504) | -0.78(0.434) | 0.48(0.628) | 0.43(0.668) | ||

| DENSITY | 0.000220000 | 0.000215300 | -0.000016300 | -0.000045500 | 0.000219000 | 0.000219400 | |

| 1.43(0.152) | 1.5(0.133) | -0.07(0.944) | -0.22(0.825) | 0.94(0.350) | 0.98(0.329) | ||

| SIZECUST | -0.000000065 | -0.000000038 | 0.000000009 | 0.000000041 | -0.000000011 | -0.000000004 | |

| -3.72(0.000)*** | -2.07(0.038)** | 0.11(0.914) | 0.65(0.517) | -1.12(0.261) | -0.3(0.763) | ||

| URB | -0.016778700 | -0.014840200 | -0.168176000 | -0.153196900 | -0.021120200 | -0.018322600 | |

| -0.81(0.418) | -0.74(0.461) | -3.87(0.000)*** | -4.48(0.000)*** | -0.94(0.348) | -0.83(0.406) | ||

| AFFOR | 0.067605200 | 0.065856700 | -0.419747600 | -0.377515900 | 0.089764100 | 0.088255400 | |

| 0.83(0.404) | 0.89(0.373) | -2.5(0.012)** | -3.85(0.000)*** | 0.86(0.388) | 0.94(0.348) | ||

| JOINT | 0.069453100 | 0.074361500 | 0.037114700 | 0.036536300 | 0.060850500 | 0.063340200 | |

| 3.3(0.001)*** | 3.88(0.000)*** | 0.68(0.497) | 0.74(0.459) | 4.74(0.000)*** | 5.58(0.000)*** | ||

| COVID19 | 0.053706100 | 0.052483800 | 0.031000500 | 0.029180300 | 0.042980300 | 0.041824700 | |

| 6.31(0.000)*** | 6.21(0.000)*** | 2.63(0.008)*** | 2.86(0.004)*** | 7.39(0.000)*** | 7.36(0.000)*** | ||

| Robustness analysis | |||||||

| Wald chi2(9) | 196.91 | 260.77 | 421.87 | 414.02 | 201.38 | 242.71 | |

| Prob > chi2 | 0.000*** | 0.000*** | 0.000*** | 0.000*** | 0.000*** | 0.000*** | |

| QIC | 875.447 | 878.636 | 851.644 | 849.911 | 877.857 | 884.791 | |

| QICu | 884.913 | 886.591 | 853.405 | 853.37 | 887.421 | 892.179 | |

| Number of observations: 635 | |||||||

| Number of groups: 127 | |||||||

| Variance inflation factor (mean): 1.2 | |||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).