1. Introduction

In recent decades, green finance instruments have attracted considerable attention due to their role in international cooperation and national policies regarding sustainability and climate change. To understand the concepts of green finance, it is important to start by understanding the definition of ‘sustainability’. It is imperative to note that there are several definitions available to explain this term. Sustainability has been presented as the “meeting the needs of the present without compromising the ability of future generations to meet their own needs” through the publication Our Common Future by the United Nations in 1987 (United Nations 1987). Sustainable finance generally involves the integration of sustainability with economic and financial practices. Green finance is part of sustainable finance and concerns financial instruments facilitating environmentally sustainable development, energy transition and the fight against global warming. Investors and financial institutions can actually contribute to combating climate change by investing in enterprises and projects pursuing objectives related to energy transition and environmental protection. Although green finance is expanding significantly, a fully harmonized regulatory framework and categorical criteria for determining what is green and what is not are not yet available. For this reason, the European Union and the competent financial regulatory authorities are developing rules on green finance. These will enable investors interested in green finance to avoid the greenwashing risk, that is, the unsubstantiated or false claims that the investments are green. According to the European Commission, sustainable finance (or green finance) refers to “process of taking environmental, social and governance (ESG) considerations into account when making investment decisions in the financial sector, leading to more long-term investments in sustainable economic activities and projects” (European Commission 2021). This leads to a greater focus on long-term investments in sustainable economic activities and projects. The European Commission further elaborates on ESG considerations, highlighting environmental factors like climate change and pollution, social factors such as human rights and inequality, and governance factors including institutional policies and employee relations. In simpler terms, green finance is a segment of finance aimed at supporting economic growth while also alleviating environmental pressures, all while taking into consideration ESG factors. In recent times, there has been increasing recognition of the significance of ESG factors. ESG, previously viewed as non-financial aspects of businesses, are now fundamental values embraced by companies, major financial institutions, and shareholders worldwide. These factors are now given utmost importance in core management strategies adopted by businesses for sustainable management and investment.

Hence, green finance can be seen as a financial instrument crafted with the noble goal of aligning financial choices with the evolving requirements of both society and the environment. Its aim is to encourage investments that foster sustainable development. Green finance has been the subject of extensive research, examining various aspects related to the role of greenhouse gas emissions (Saeed Meo, M., and Karim, M. Z. A. 2022; Wu, G. et al. 2023), climatic disaster (Ezroj, A. 2020), environmental disclosures (Brooks, C., and Schopohl, L. 2020; Lyon, T. P., and Shimshack, J. P. 2015; Steuer, S., and Tröger, T. H. 2022), economic consequences of global warming and temperature shifts (Burke, M., et al. 2015; Dell M., et al. 2012), the relationship between temperature and aggregate risk (Lamperti, F., et al. 2021), the influence of climate policy risk on the financial system (Lin, C.-Y., et al. 2022). Green finance manifests in various forms, such as green bonds, which fund eco-friendly projects (Yu, K. 2016), socially responsible investing (SRI), which evaluates ESG factors in investment choices (Walls, A. 2024), or impact investing, which strives to yield financial gains alongside positive social and environmental effects (Yasar, B. 2021). Governments, organizations, and individuals are recognizing the need for a more sustainable and responsible approach to finance, and are taking steps to integrate ESG factors into financial decision-making. As awareness of the importance of sustainability continues to grow, it seems likely that green finance will become an increasingly important part of the financial system.

Despite its considerable potential to drive positive change, the field of green finance is replete with intricate challenges and uncertainties that require meticulous and rigorous academic scrutiny to fully understand and navigate.

This complexity underscores the need for comprehensive research to develop effective strategies and solutions within the domain of green finance. The direction of the research process is determined by the research objective and research questions.

The main objective of the study is to identify the current state of research in the field of green finance for sustainable development, as well as to propose recommendations for future research and practice. In such a case it is logical this study addresses the following research questions:

RQ1: What are the most influential publications, authors, journals and institutions involved in green finance research for sustainable development?;

RQ2: How has the green finance for sustainability literature developed over time and what is the trend of their citation impact?;

RQ3: What are the most common and influential keywords used in green finance research?;

RQ4: What is the geographic distribution and institutional affiliations of the research?;

RQ5: What is the scope of research and what are the key trends for future research in green finance for sustainable development?.

2. Materials and Methods

A bibliometric analysis was performed with the collected information from published research and citations to determine their impact. The purpose of bibliometric analysis is to “summarizes large quantities of bibliometric data to present the state of the intellectual structure and emerging trends of a research topic or field” (Donthu, N., et al. 2021). The objects of analysis can be scientific publications (articles, reports, books, etc.), sources (scientific journals, collections of reports, etc.), keywords and terms characteristic of the researched field, authors, including teams of co-authors, institutions (universities, departments, research groups and teams, business organizations, NGOs, etc.), countries and regions.

The research data were generated by Scopus. In addition to broad coverage with open access content, Scopus provides a wide range of metrics and tools for assessing research impact and author profiles for collaborating and creating collaborative networks. Therefore, it is widely used for bibliometric studies (Vieira, E. S., and Gomes, J. A. N. F. 2009). At this step of the scientific research, the identification of keywords and terms, and a database search field, the selection of additional search criteria, and the data sample for the study were generated.

We conducted bibliometric analysis in the following directions: (1) performing a descriptive analysis; (2) citation analysis (by sources, by publications, by author, by country and by organization); (3) structural analysis of the scientific field (conceptual structure, intellectual structure, and social structure). In this way, the contribution of the objects of analysis to the given scientific field is shown. However, the relationships between them can be well visualized through scientific mapping (Donthu, N., et al. 2021).

We used the features of Biblioshiny 4.1 application, a configurable web interface package from bibliometrix of the R programming language for bibliometric analysis, as well as VOSviewer (version 1.6.19) (Van Eck, N., and Waltman, L. 2010).

We start our process by searching the keywords in Scopus database. Determining keywords is the result of a panel discussion among specialists from academic and practical backgrounds in the fields of finance, sustainability, accounting. The query in the database using keywords “green financ*” and “sustainab*” was conducted on March 25, 2024, in a specifically selected field in Scopus - (Article title, Abstract, Keyword), and generated a result of 1,429 documents. In terms of the number and type of documents in the sample, the criteria outlining it can be inclusive andexclusive criteria. The selected options for exclusive criteria limited the sample as follows:

Open Access: Only including documents with open access, resulting in 531 documents.

Year: Studies published between 2016 and 2024 are selected, resulting in 525 documents.

Document Type: Only articles are of interest, resulting in 451 documents.

Source Type: Only articles published in journals are chosen, resulting in 451 documents.

Language: Only articles in English are included, resulting in 436 documents.

The remaining filters Subject area, Publication Stage, Author name, Source title, Keyword, Affiliation, Funding Sponsor, and Country/territory were not utilized. They serve as inclusive criteria. Querying the database after applying these additional criteria organized the data in the result in a sample of 436 documents.

3. Results

The conduct of bibliometric analysis is profiled by sources, publications and authors. In order to establish their influence, the so-called citation analysis is used. Citation analysis is a way of measuring the influence of a journal, publication or author according to the total number of citations (of the journal, publication or author) in other scientific works. The impact of a study is beneficial to other researchers (Bornmann, L., et al. 2008).

Citations are intended to show that a publication has used the content of several other publications (in the form of other people's ideas, research results, etc.) Thus, the number of citations used in evaluating a study serves as a determinant of its impact (Bornmann, L., and Daniel, H. 2007).

Bibliometrix and VOSviewer enable citation analysis to be profiled in the following directions: by sources, by publications, by authors, by countries and by organizations.

3.1. Descriptive Analysis

The sample consists of 436 scientific articles, authored by a total of 1,131 authors, and published in 159 scientific journals. Out of the 436 articles, 55 are authored by a single author, while the co-authored articles amount to 381. The temporal scope of the study spans nine years between 2016 and 2024. The average number of published articles per year is approximately 48 (precisely 48.4).

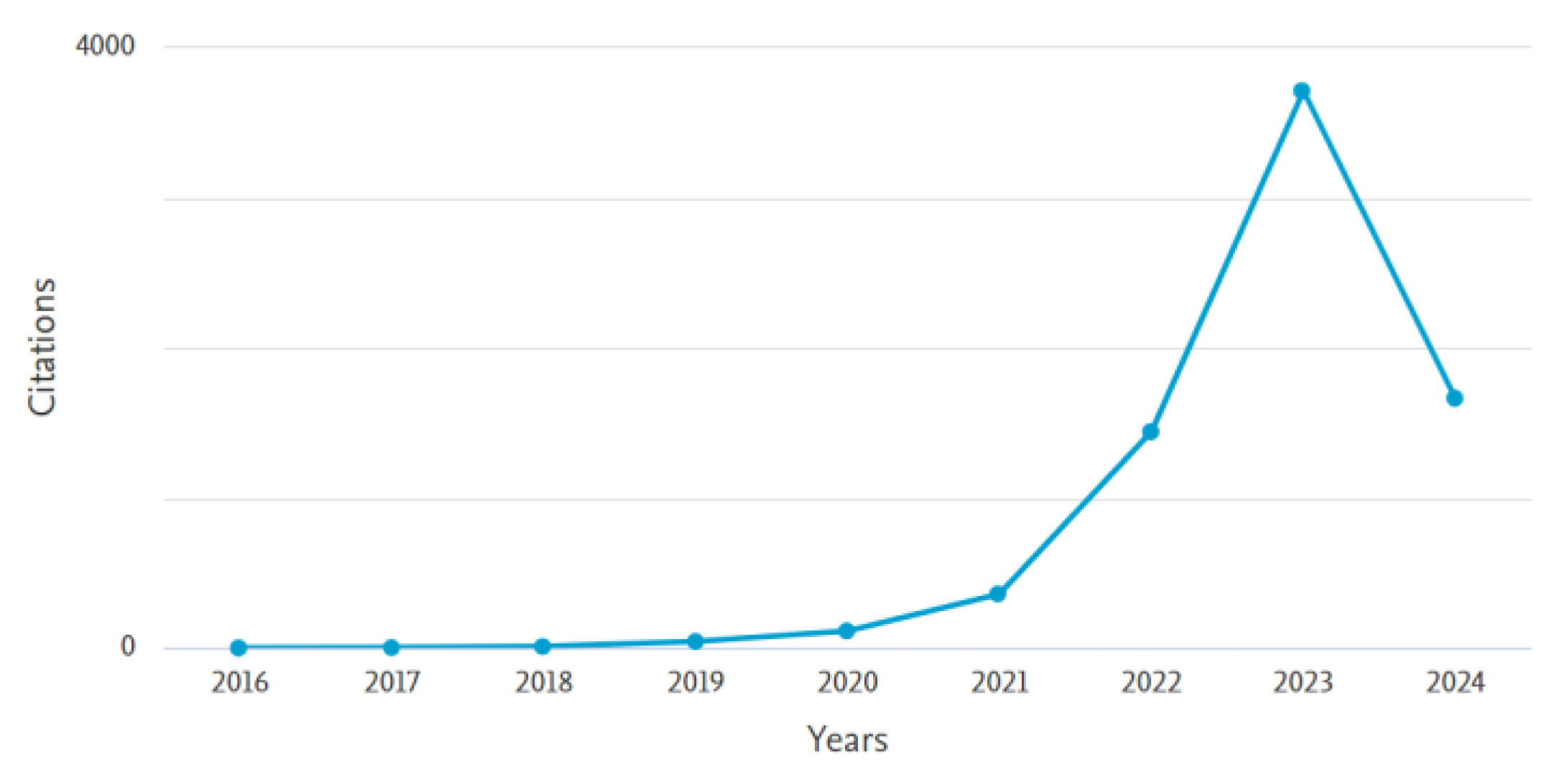

We used information generated as a result of the query in Scopus regarding citations. Its visualization is facilitated through Bibliometrix. Not all 436 articles from the sample have been cited in other research studies at least once. The number of cited articles is 351, which constitutes 80.5% of the sample. The total number of citations in other research studies for these 351 articles (including self-citations) is 7,351. The average number of citations per article is 16.92. The trend in article citations over time is positive, indicating a rapidly growing overall interest in the issues of green finance and sustainable development (see

Figure 1).

3.2. Citation Analysis

3.2.1. Citation Analysis by Sources

Table 1 presents the top 5 prolific journals with Scopus coverage years (SCY) and publisher on green finance in the sustainability context with their few metrics as TP (total publications), TC (total citations), h_index (h), CS 2022 (Cite Score 2022), SNIP (Source Normalized Impact per Paper).

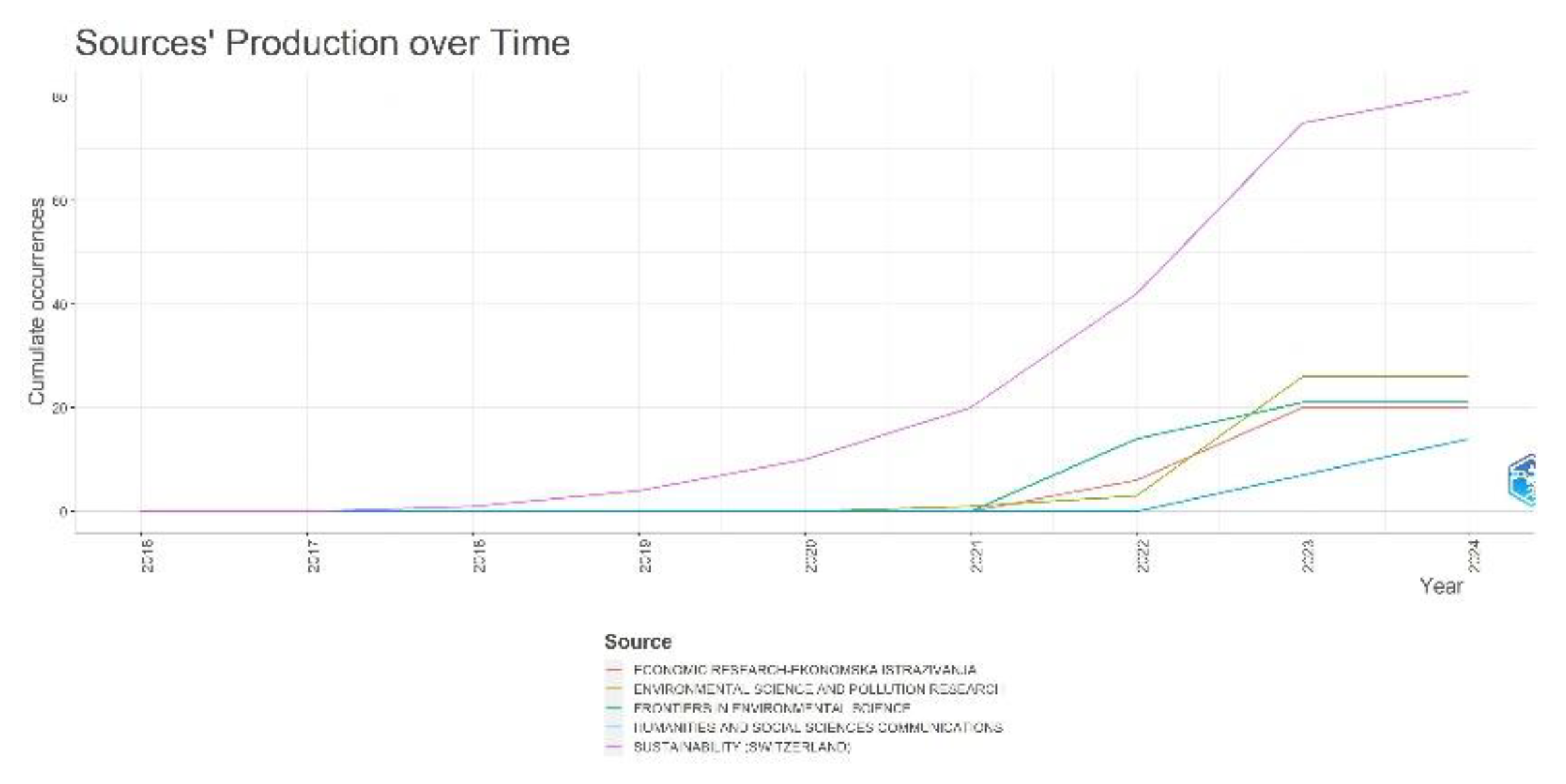

The analysis reveals that "Sustainability (Switzerland)" is the most influential and relevant journal in the field, with a total of 80 publications, accounting for the highest number of total citations (1,445) and an h-index of 19. This suggests that it not only publishes a significant number of articles but also that these articles are widely recognized and cited within the academic community. The journal's Cite Score of 5.8 and SNIP of 1.198 further highlight its impact and relevance in the domain of green finance and sustainability. "Environmental Science and Pollution Research," published by Springer Nature since 1994, follows with 26 publications and a total of 670 citations, demonstrating an h-index of 14. Its Cite Score of 7.9 and SNIP of 1.214 indicate its strong influence and the quality of research it publishes. "Frontiers in Environmental Science," with 21 publications and 147 citations, shows a lower h-index of 4 but stands out with a high Cite Score of 9.8 and a SNIP of 1.257. This suggests that while it has fewer publications, the articles it does publish are of significant quality and impact. "Economic Research-Ekonomska Istraživanja," published by Taylor & Francis since 2000, has 20 publications and 417 citations, with an h-index of 9. Its Cite Score is 6.2, and it has a SNIP of 1.408, indicating a steady contribution to the field of green finance and sustainability. Lastly, "Humanities and Social Sciences Communications," a relatively new journal from Springer Nature starting in 2020, has quickly made its mark with 14 publications and 47 citations. Its h-index is 4, with a Cite Score of 3.0 and a SNIP of 1.620. Despite being the newest journal in the top 5, it shows a promising start in contributing to the discourse on green finance and sustainability. These journals collectively highlight the diversity and depth of research being conducted in the area of green finance and sustainability, each contributing uniquely through their publication volumes, citation impact, and overall influence in the academic community.

In a dynamic aspect, journals have different behavior – all of them show a relative increase in the number of publications over time, but the rates of increase are different. The jump in publication activity during the period 2018 - 2024 for the first journal in the ranking - Sustainability (Switzerland) is huge, while this satisfactory trend of increasing the number of publications is observed in the remaining journals later in the period 2021-2024, but very more smoothly and on much smaller scales (see

Figure 2).

3.2.2. Citation Analysis by Publications

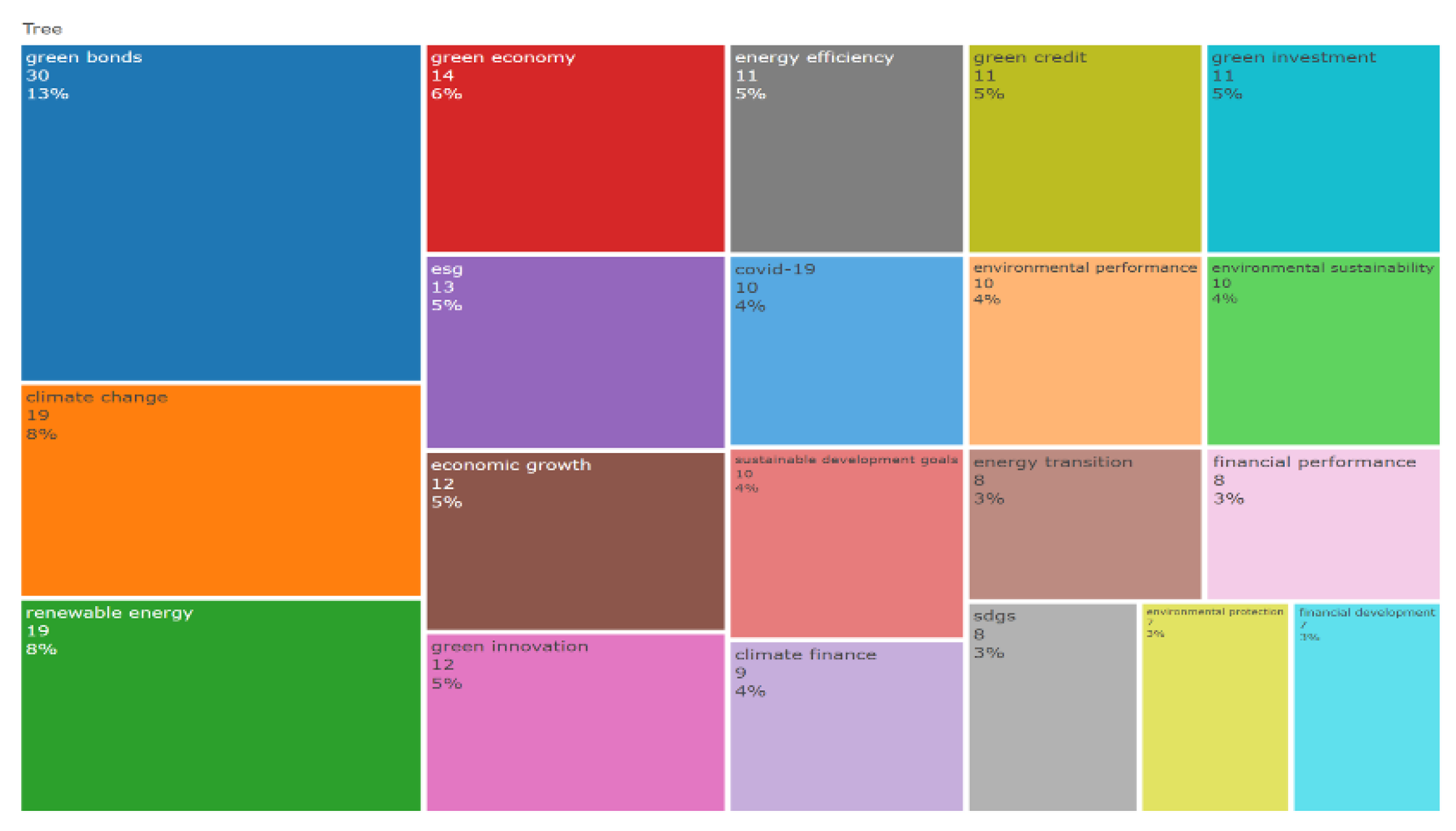

This type of analysis of publications intuitively focuses on their thematic content. To reveal it, the keywords in the publications of the sample are used, the total number of which is 1,171 author`s keywords. Bibliometrix allows the set of keywords to be "cleaned" from unsuitable for further work with them, which was done by drawing up a list of words to remove. After this manipulation, the following

most common keywords among all 436 documents in the sample were identified according to their frequency of occurrence:

green bonds, climate change,

renewable energy, green economy, ESG, etc. For the top 20 most common words, a word tree was created – to identify their structure in the overall set of keywords, as well as a word cloud – to further visualize their influence (see

Figure 3 and

Figure 4).

In seeking the most influential publications, articles from the sample are ranked according to their total number of citations in other documents in the entire Scopus database. Only 351 documents of the sample gather a total of 7,351 citations. Another 85 documents aren’t cited yet. At this stage, VOSviewer allows only those articles to be selected whose minimum number of citations per publication is chosen by the user. In the current study, this number has been chosen to be 160 citations. According to this criteria, 5 documents from the sample meet this requirement, which is approximately 1.15% of the total volume of 436 articles. An additional indicator of the impact of publications is the average number of citations per year, which is generated by the Bibliometrix tool. Ranking by the two indicators “total number of citations in Scopus (TCS)” and “average number of citations per year (ACy)” yields different results—the first may reflect nominal impact (NI), while the second reflects real impact (RI) of the publication. It is considered that the real impact carries more weight. The results from this more in-depth analysis are shown in

Table 2.

These five articles collect 1,052 citations, which represents an impressive result—14.31% of all citations in the sample. The data also show that the most influential articles in the field of green finance for sustainable development, which are repeatedly cited in Scopus, address issues related to the challenges of green finance and investment in renewable energy projects and the achievement of high energy efficiency, the integration of topics on sustainable and green finance in the activities of central banks around the world, accelerating a mechanism for sustainable finance through green bonds, the importance of green finance for economic and environmental well-being and growth, etc.

In addition to the metrics mentioned, the analysis underscores the significance of these top-cited articles in shaping current research trends and discussions. These highly influential publications provide critical insights into various aspects of green finance, emphasizing its role in driving sustainability and economic development. For instance, the study by Rasoulinezhad, E., and Taghizadeh-Hesary, F. (2022) explores the pivotal role of green finance in enhancing energy efficiency and promoting renewable energy development, a topic of growing importance as the world transitions to more sustainable energy sources. Taghizadeh-Hesary, F., and Yoshino, N. (2020) discuss sustainable solutions for green financing and investment in renewable energy projects, highlighting the financial mechanisms necessary to support large-scale green initiatives. Dikau, S., and Volz, U. (2021) examine the integration of sustainability objectives within central bank mandates, an innovative approach to embedding green finance principles at the core of financial regulation and monetary policy. The work by Sinha et al. (2021) investigates the broader social and environmental responsibilities of green financing, offering a framework for achieving Sustainable Development Goals (SDGs) through advanced quantile modeling. Soundarrajan and Vivek (2016) focus on the context of India, analyzing how green finance can foster sustainable economic growth. Their research provides a case study of the challenges and opportunities faced by emerging economies in adopting green finance practices. Overall, these publications not only contribute significantly to the academic discourse but also provide practical frameworks and insights for policymakers, financial institutions, and stakeholders aiming to implement and promote green finance. The high citation counts and substantial impact of these articles reflect their critical role in advancing the field and influencing both theory and practice in green finance and sustainability.

3.2.3. Citation Analysis by Author

The metric for citation analysis by publications (see

Table 2) identifies

E. Rasoulinezhad and F. Taghizadeh-Hesary as the

most influential authors due to the highest number of citations received for their co-authored article from 2022. Their article is dedicated to examining the relationship between the deployment of green energy and the achievement of sustainable development in the energy and environmental sectors. Using the STIRPAT model, the authors investigate the connection between CO2 emissions, energy efficiency, the Green Energy Index (GEI), and green finance in the top ten economies supporting green finance. The findings demonstrate that green bonds serve as a suitable method for promoting green energy projects and significantly reducing CO2 emissions. However, no causal link is found between these variables in the short term. Consequently, governments are urged to implement supportive policies with a long-term approach to incentivize private investment in green energy projects, aiming for sustainable economic growth in environmental matters. This policy may prove applicable during and after the COVID-19 era, when green projects encounter greater difficulties accessing finance.

3.2.4. Citation Analysis by Country

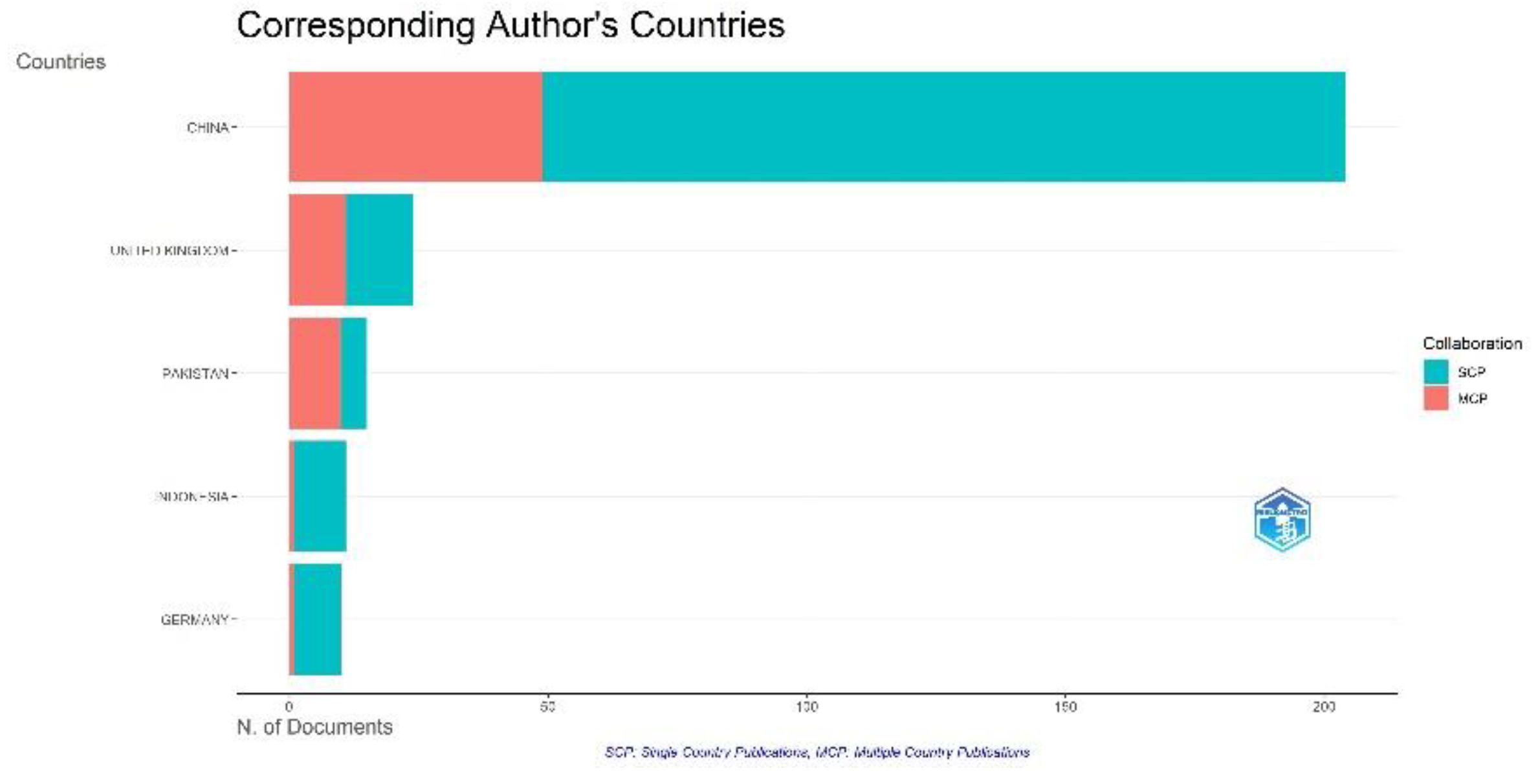

The sample includes publications whose authors are affiliated with 646 scientific institutions and organizations, published from 53 countries in 159 peer-reviewed journals in the fields of business, management, economics, environmental studies, computer science, and others. For 42 of the articles, there is no information about their origin, and therefore the analysis related to the geographical distribution of the researched issues covers the remaining 394 articles.

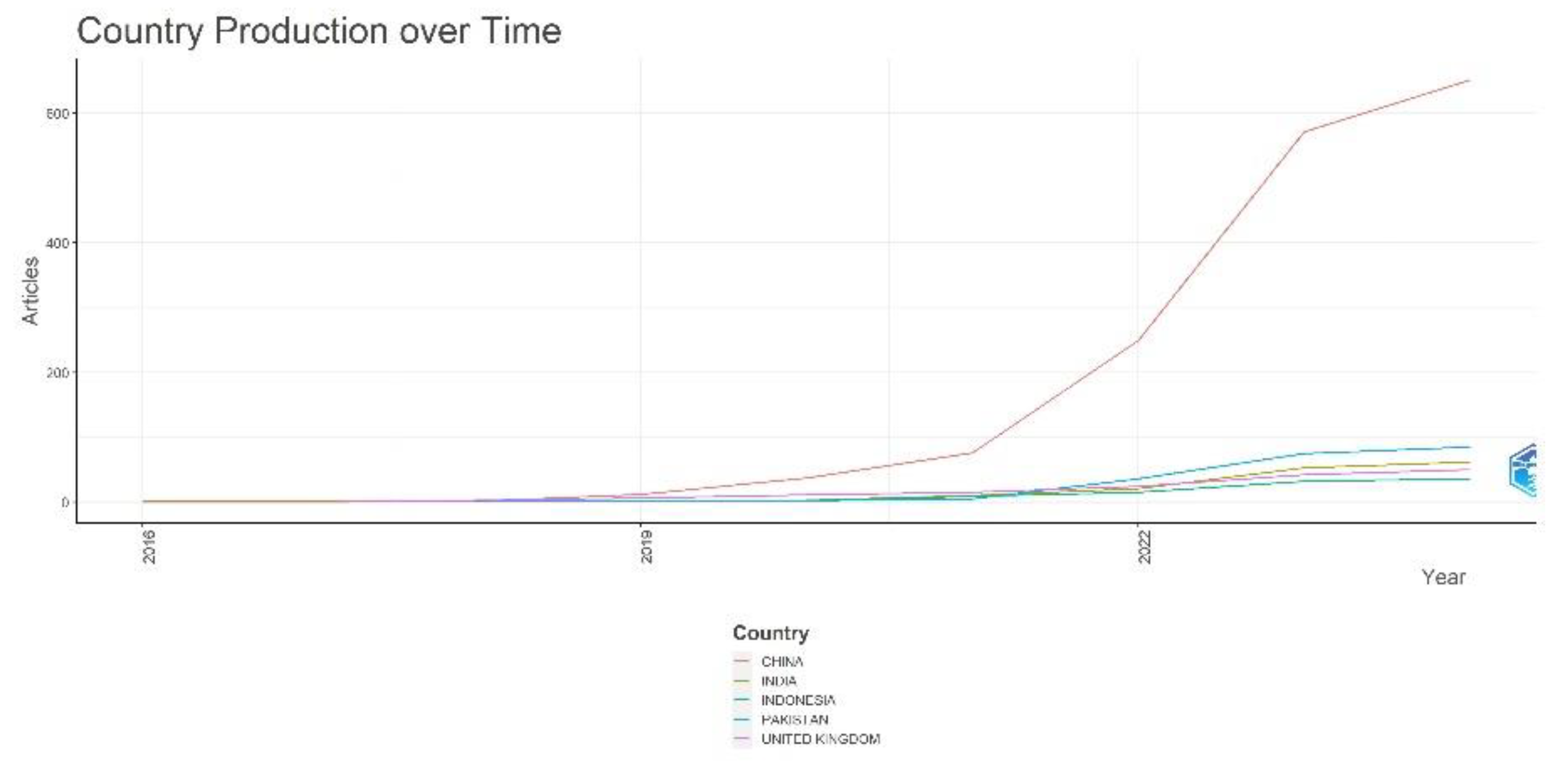

An analysis of scientific production by countries has been conducted, and a ranking has been made based on the number of published articles. Leading the rank list with 204 publications from the sample is

China, followed by the

United Kingdom with 24 publications and

Pakistan with 15 publications. The top 5 countries/regions cover 264 of the published articles, which is approximately 61% of their total number (see

Figure 5).

In a dynamic aspect, the number of publications shows a relative increase over time. There is a significant leap during the period for the China, while the trend is more gradual for the Pakistan, India, United Kingdom, and Indonesia (see

Figure 6).

Countries with the highest contribution, measured by the number of citations, are also of interest in Bibliometrix. The quantitative information on the total and average citations (TC, AC) of documents from the sample in the countries where they are published enables their ranking. The top 10 entries according to this criterion are shown in

Table 3.

In addition to analyzing the number of publications, examining the impact of research from different countries provides further insight into the global distribution and influence of scholarly work in green finance and sustainability. The data reveals that China, while leading in the number of publications, also has a substantial total citation count (TC) of 2,762, with an average citation (AC) of 13.50 per article. This indicates a broad and significant impact of Chinese research in this field. The United Kingdom, although having fewer publications, demonstrates a high average citation rate of 31.10, with a total of 747 citations. This suggests that UK publications, though fewer in number, are highly influential and frequently referenced in subsequent research. Japan, with a total of 648 citations and an impressive average of 129.60 citations per article, shows exceptional impact. The analysis of these top contributing countries reveals not only the geographical spread of research activities but also highlights regions that produce high-impact work in green finance and sustainability. This information is crucial for understanding the global landscape of research in this domain and identifying key players and emerging contributors to the field.

3.2.5. Citation Analysis by Organization

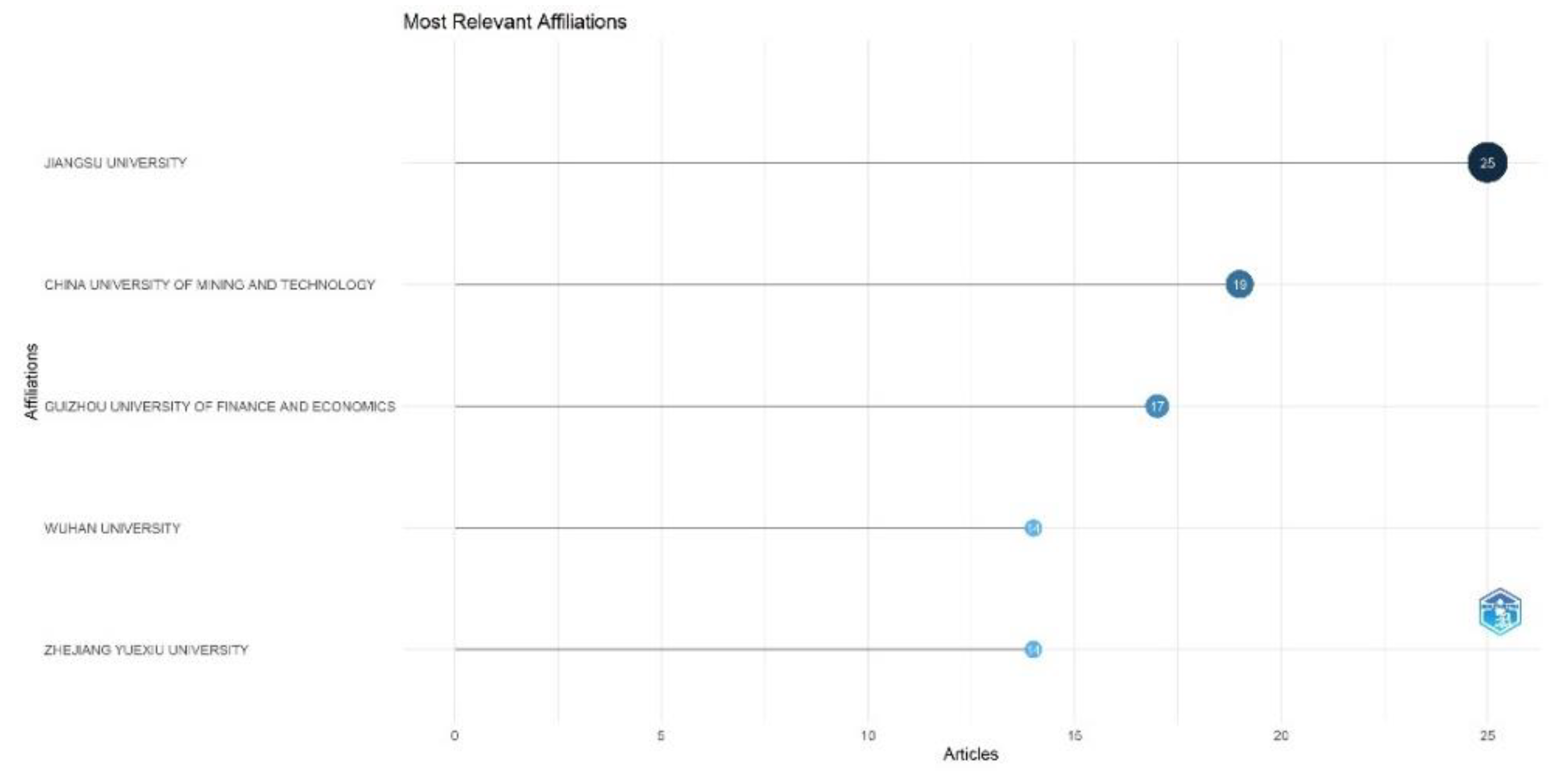

The measurement of the most relevant affiliations (institutions, universities, organizations), which are a means of generating scientific output by the authors in the field of green finance and sustainability, is through the number of their publications. According to this indicator, among all 646 affiliations,

the Jiangsu University (Zhenjiang, China) has the largest number of articles (25), followed by China University of Mining and Technology (Xuzhou, China) with 19 articles and Guizhou University of Finance and Economics (Guiyang, China) with 17 articles (see

Figure 7).

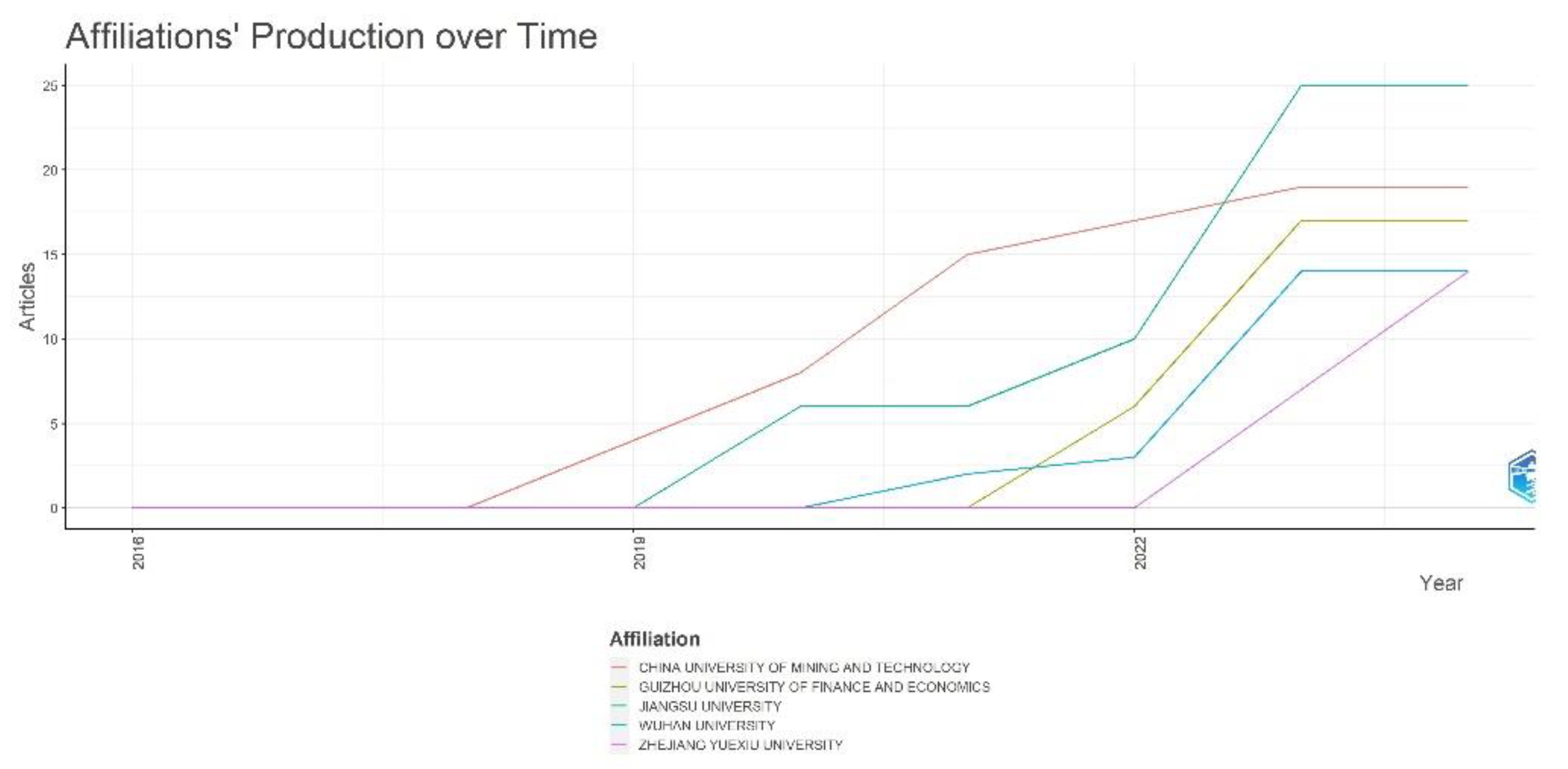

In a dynamic plan, the leadership of the

Jiangsu University (Zhenjiang, China) is confirmed too because this institution has seen a remarkable growth in the number of publications in the research area (see

Figure 8).

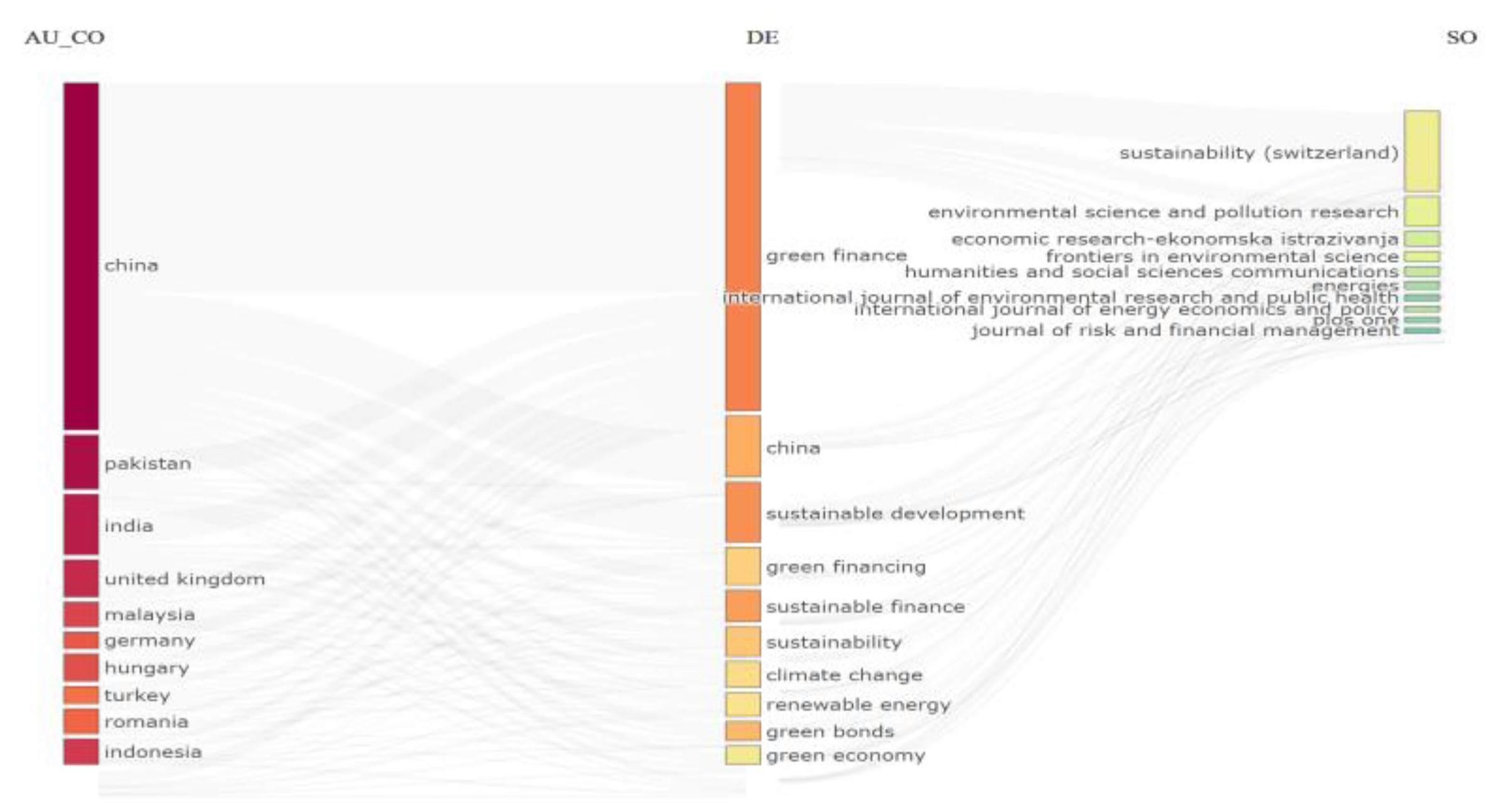

An even deeper analysis of the influence and interest of countries/regions, as well as of the respective journals, can be achieved using the Bibliometrix tool

"Three-field plot," developed based on the Sankey diagram. The diagram allows a user-defined number of values of a given variable (e.g., keywords describing the research topic) to be placed in the central position, followed by values of two other variables (e.g., authors, countries, universities, sources, etc.) on either side. The three-field plot shows how the side variables are interested and/or active in relation to the central variable. In this case, the keywords in the sample publications are placed as the central variable, and their number is set to 10, resulting in the terms appearing in rectangles of different colors and sizes. They visually correspond to similar rectangles on either side, which in this example are countries/regions and sources (see

Figure 9).

The data shows that the greatest interest is in green finance. They are an element of scientific publications from China, Pakistan, India and to a lesser extent from other countries, as well as they are the subject of scientific articles published most often in the journal "Sustainability (Switzerland),” and less often in some of the other journals in the example.

The visual presentation of the graph of the three fields is the basis for other similar, more in-depth analyzes that provide insight into individual fragments of the studied topic (in the example, these are sustainable development, climate change, renewable energy, green bonds), as well as the attitude towards them by different countries or journals.

3.3. Structural Analysis

The considerable expansion of green finance in response to multiple global initiatives, guidelines from task forces or special networks, and the institutional frameworks of various countries has triggered an exponential growth of literature on green finance and sustainable development over the last decade (see

Figure 1). Therefore, it is fundamental to explore the structures of knowledge in green finance research—the intellectual structure, the network of research collaborations, and the conceptual structure.

3.3.1. Intellectual Structure (Co-Citation Analysis)

Co-citation analysis involves identifying sets of publications that are frequently referenced together, which can imply emerging research areas or specialized fields within a particular discipline. By examining the connections among highly cited articles, researchers can gain valuable insights into the foundational concepts of their field and potential directions for further investigation. This method relies on a co-citation matrix, which tracks how often pairs of articles are cited jointly. Each article is represented by a row and column in the matrix, with cell values indicating the frequency of co-citation between them. Ultimately, this process creates a network of interconnected citations, offering a visual depiction of the intellectual progress within the field of study.

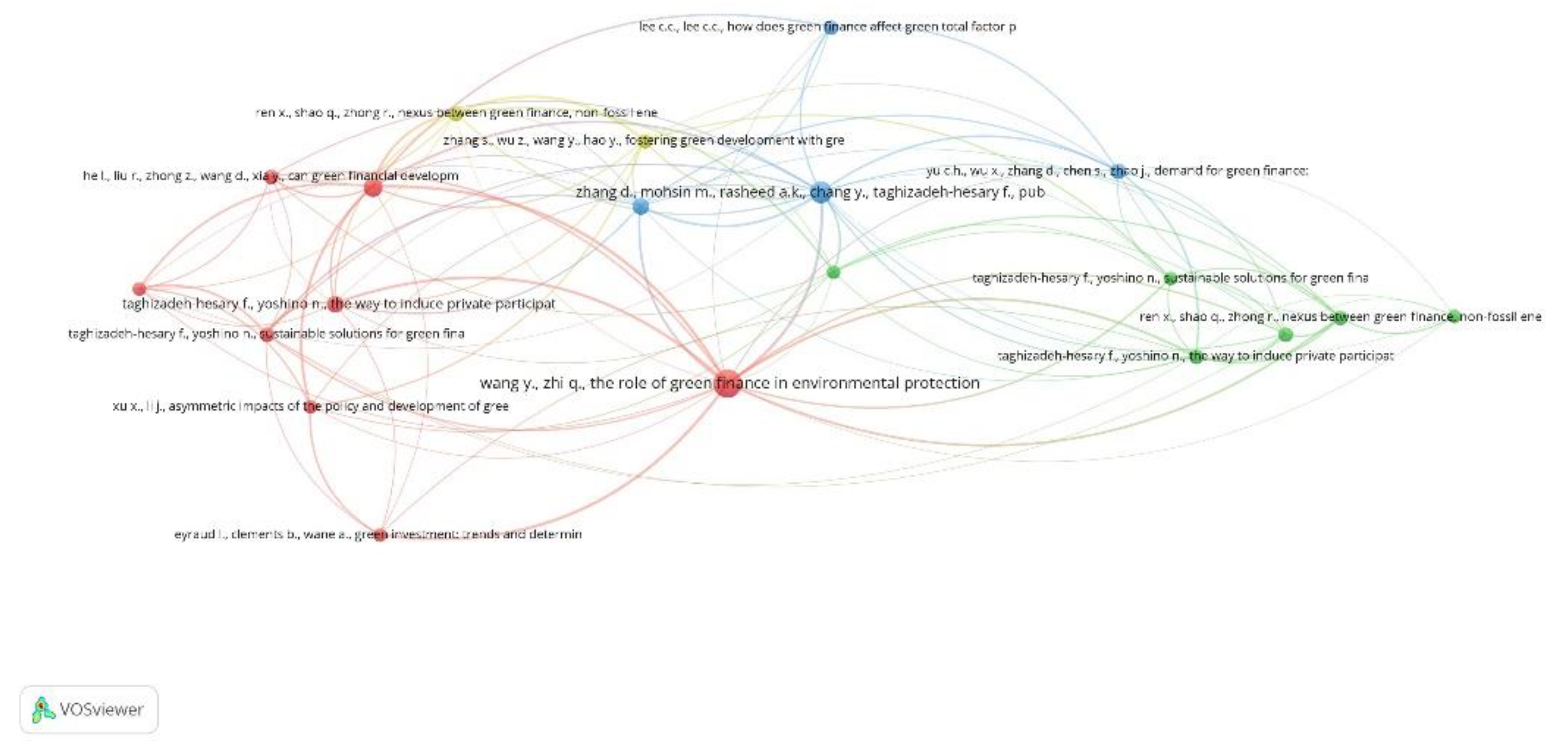

VOSviewer tool has capabilities for co-citation analysis by references, sources and authors. In the study, only co-citation analysis by references is applied.

VOSviewer requires a threshold to be set, i.e. maximum number of identical references of at least two articles from the sample. In the studied sample of 436 articles, the total number of references is 23,658. At a selected threshold of 10 co-cited references (ten times) 20 references correspond, one of which occurs 40 times in the sample articles, another one - 25, resp. 18, 15, 14, 13 times, two - 12 times, one is cited 12 times, 6 references are used in the sample articles 11 times each, and the remaining 6 references are cited 10 times. Four clusters are formed, which show a relative "clustering" of the joint citations around individual topics.

It can be argued that the subject matter, i.e. the intellectual structure in the clusters is as follows:

red cluster (8 items) “Green investments and finance” - supporting sustainability and renewable energy development through financial mechanisms (Eyraud, L., et al. 2013; He, L., et al. 2019; Rasoulinezhad, E., and Taghizadeh-Hesary, F. 2022; Taghizadeh-Hesary, F., and Yoshino, N. 2020; Taghizadeh-Hesary, F., and Yoshino, N. 2019; Wang, Y., and Zhi, Q. 2016; Xu, X., and Li, J. 2020; Zhou, X., et al. 2020);

green cluster (6 items) “Green finance: empirical insights and sustainable solutions” - analyzing the nexus between green finance, renewable energy, and carbon intensity, as well as exploring sustainable financial mechanisms and investments in renewable energy projects (Khan, M. A., et al. 2021; Ren, X., et al. 2020; Taghizadeh-Hesary, F., and Yoshino, N. 2020; Taghizadeh-Hesary, F., and Yoshino, N. 2019; Yu, C.-H., et al. 2021; Zhang, D., et al. 2019);

blue cluster (4 items) “Green finance: impact and opportunities” - examining the effect of green finance on green total factor productivity, exploring research trends and opportunities in green finance and energy policy, addressing financing constraints on green innovation, and investigating the role of public spending in green economic growth within the BRI region (Lee, Chi-Chuan, and Lee, Chien-Chiang 2022; Wang, M., et al. 2021; Yu, C.-H., et al. 2021; Zhang, D., et al. 2021);

yellow cluster (2 items) “Green finance and environmental impact”- examining the relationship between green finance, renewable energy, and carbon intensity in selected Asian countries, as well as investigating the environmental effects of green credit policies in China (Xu, L., and Wu, Y. 2023; Zhang, S., et al. 2021).

Thus, the analysis of joint citations groups in a certain way and outlines the current aspects of the problems of green finance in the context of sustainable development and demonstrates the intellectual structure of the thematic area.

The science map of the analysis produced using VOSviewer, is shown in

Figure 10.

3.3.2. Social Structure

The importance of the interaction between authors, institutions and countries in the process of joint research work in the field of the green finance in a sustainability context is indisputable. As a result of this interaction, the realization of joint fundamental scientific and practical projects is possible, the sharing of good practices between individual authors, institutions, collectives are strengthened, experience is exchanged and, most valuable, added value is generated in the context of globalization and sustainable development of society and the planet.

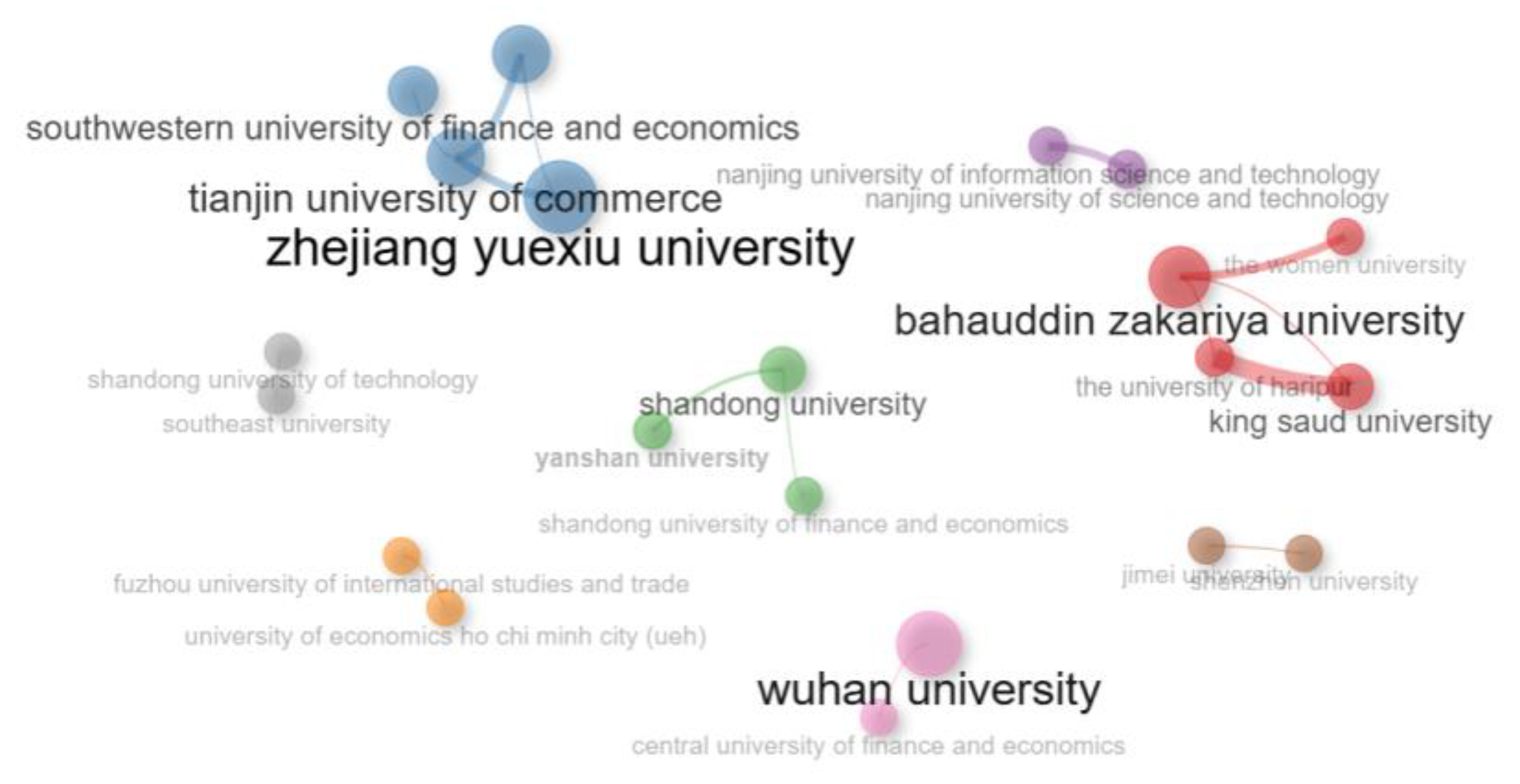

The disclosure of the social structure in the studied issues is carried out with the help of Bibliometrix, where it is possible to follow the collaboration between the individual authors, institutions and countries of all 436 articles from the sample. For the purposes of the present development, an analysis of social cooperation, co-authorship, joint research work is carried out only by institutions. It refers to analyzing and visualizing collaboration patterns between authors from different organizations (academic, teaching, research, practice, non-governmental) based on their joint co-authorship.

The object of the social interaction analysis are actually 646 institutions to which the authors of published articles from the sample under investigation are affiliated. The purpose of this type of analysis is to outline the inter-institutional collaboration network within the research topic and understand the extent of collaboration between authors from different organizations. At this point Bibliometrix allows to select only those articles whose authors have affiliations to different organizations. 21 organizations correspond to the restrictions. Countries are ranked simultaneously according to the number of articles in the sample that are published by the individual institution and the number of citations of an article from one organization to an article from another organization.

The scientific map shows which are those organizations where authors collaborate through joint publications and create a network of co-authorship. Thus, an insight is gained into the social interaction and cooperation between organizations that are engaged in publications in the field of green and sustainable finance.

Bibliometrix identified 8 clusters or groups of authors from the same or different institutions who often collaborate. The visualization can help to identify the main centers of interinstitutional cooperation and to understand the overall structure of the network.

The most active institutions regarding social interaction are clearly defined - Zhejiang Yuexiu University (China), Wuhan University (China) and Bahauddin Zakariya University (Pakistan).

The results of this deeper analysis are visualized by the science map in

Figure 11.

Such analyzes may also reveal cooperating countries and authors, but these are not the focus of this study.

The social structure reveals the leading entities (institutions, authors or countries) that, through their mutual cooperation, demonstrate an interest in the field of scientific research, namely digitization in accounting.

3.3.3. Conceptual Structure

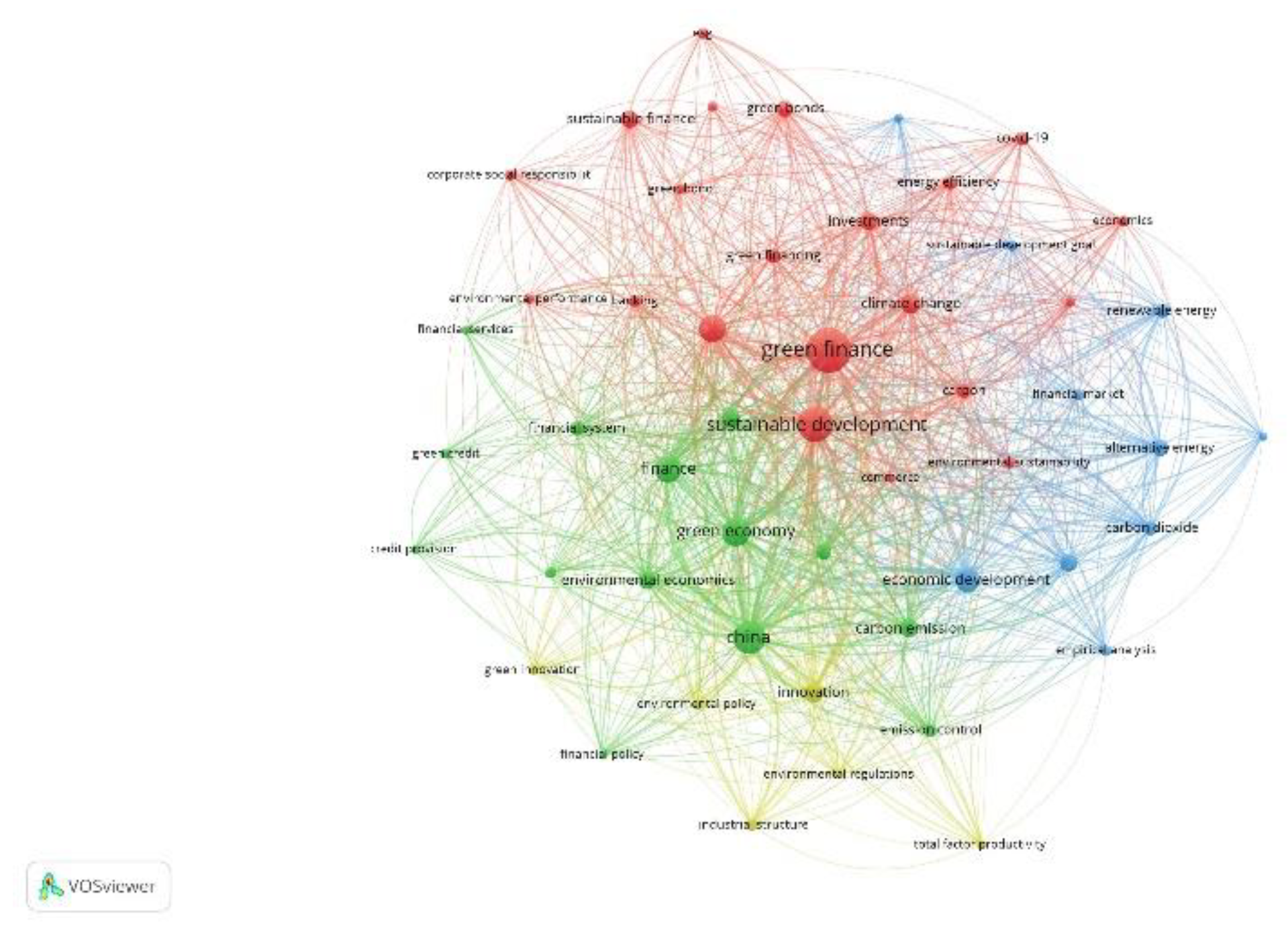

The conceptual structure of research devoted to the problems of Green Finance in the Context of Sustainable Development is revealed with the help of the analysis of the co-occurrences of keywords and terms. This type of analysis focuses on the frequency with which certain terms or keywords appear together in scientific publications. By identifying common terms, the scope and connections within the researched scientific issues are outlined.

Out of the total number of 2,008 keywords from all articles of the research material of the present development, only 57 words were initially selected. The selection is a result of the option in VOSviewer to select a minimum number of occurrences of the keywords. The choice is that a given word or term occurs at least ten times as a keyword in the sampled articles. From the generated list of keywords, another 6 were manually removed, which were judged to be irrelevant to the analysis (e.g. article, human, panel data, etc.).

The remaining 51 words form 4 clusters with 886 links between them.

The analysis continues by uncovering the most common keywords and terms. The product generates a list of them and the number of their occurrences. The words most frequently present in the posts are visualized with larger circles and are in the central part of the figure. Such are the words "green finance", "green economy", "economic development", "China", "innovation", etc. (see

Figure 12).

The visualization shows the formed clusters, which are colored in different colors – red, green, blue and yellow. It can be assumed that the clusters of keywords outline the conceptual structure of the researched scientific field, namely the role of green finance in the sustainability development, in a substantive, thematic aspect.

4. Discussion

This research, regarding the posed research questions, has yielded results, which allow the following assertions to be made:

First, RQ1 aims to identify the most influential publications, authors, and institutions researching the integration of green finance within the context of sustainable development. The analysis reveals that the article by Rasoulinezhad and Taghizadeh-Hesary (2022), titled "Role of green finance in improving energy efficiency and renewable energy development," published in Energy Efficiency, is the most influential with the highest number of citations in Scopus, totaling 267. These authors are affiliated with Jiangsu University and the Asian Development Bank Institute, showcasing the significant contributions of these institutions to the field. Similarly, notable works include Taghizadeh-Hesary and Yoshino's (2020) article on sustainable solutions for green financing in Energies and Dikau and Volz's (2021) study on central bank mandates and sustainability objectives in Ecological Economics. These findings highlight the prominence of certain institutions and publications in driving forward the discourse on green finance and sustainable development.

Second, RQ2 examines the trend of green finance publications over time and their citation impact. The bibliometric analysis indicates a consistent increase in the number of publications from 2016 to 2024, with a significant surge in recent years. Journals such as "Sustainability (Switzerland)" lead the field with the highest number of publications and citations, reflecting their central role in disseminating research on green finance. The journal "Environmental Science and Pollution Research" also stands out with substantial contributions. The increasing trend of publication and citation counts underscores a growing interest and recognition of green finance as a critical area of research within sustainable development.

Third, RQ3 focuses on the most common and influential keywords used in green finance research. The analysis identifies key terms such as "green bonds," "climate change," "renewable energy," "green economy," and "ESG (Environmental, Social, and Governance)" as prevalent in the literature. These keywords reflect the core themes and research interests within the field, emphasizing the multi-faceted nature of green finance and its intersection with various sustainability aspects. The word tree and word cloud visualizations further elucidate the structure and impact of these keywords, providing a comprehensive overview of the thematic focus in the literature.

Fourth, RQ4 delves into the geographic distribution and institutional affiliations of the research. The findings show that China leads in both the number of publications and total citations, followed by the United Kingdom and Pakistan. Institutions such as Jiangsu University, China University of Mining and Technology, and Guizhou University of Finance and Economics are identified as the most prolific in terms of publication output. This geographic and institutional analysis highlights the global spread of research activities and the significant contributions from certain regions and organizations.

Fifth, RQ5 focuses on the scope of research and key trends for future research in green finance for sustainable development. Research in this field has expanded significantly in response to multiple global initiatives, guidelines from task forces or special networks, and the institutional frameworks of various countries. The analysis of co-citations reveals the intellectual structure in this area, creating a network of interconnected citations and visualizing intellectual progress. This includes identifying key publications and themes through co-citation analysis, such as green investments, the green financial sector, renewable energy, and their economic and ecological impacts.

The social structure of research is also an important aspect, revealing interactions between authors, institutions, and countries contributing to research in green finance. Analysis of co-authorship networks shows the collaboration network between different organizations, highlighting leading institutions such as Zhejiang Yuexiu University, Wuhan University, and Bahauddin Zakariya University.

The conceptual structure of research is revealed through the analysis of co-occurring keywords and terms in scientific publications. This analysis outlines the scope and connections within the researched scientific issues, identifying key terms such as "green finance," "green economy," "economic development," "China," and "innovation."

Regarding the key trends for future research, the following are outlined:

Sustainable solutions in green finance: Future studies will continue to analyze the effectiveness of various financial mechanisms and investments in renewable energy projects;

Impact of green finance on economic development and environment: Future research will explore how the green financial sector influences green total factor productivity, financing constraints on green innovation, and the role of public spending in green economic growth;

Geographical and institutional analysis: Ongoing research will focus on the geographical distribution and institutional affiliations, revealing the global spread of research activities and significant contributions from different regions and organizations;

Analysis of key terms and concepts: Continued analysis of the frequency of specific terms will outline the major themes and interests in the field of green finance Second bullet.

Overall, this bibliometric analysis provides valuable insights into the challenges and trends in green finance research. It identifies key publications, influential authors, leading institutions, prevalent themes, and geographic distribution, offering a comprehensive understanding of the field's landscape. These findings not only reflect the current state of research but also guide future studies by highlighting critical areas of interest and influential contributors in the domain of green finance and sustainable development.

Author Contributions

Conceptualization, B.K. and R.K.-H.; methodology, B.K. and R.K.-H.; software, R.K.-H.; validation, B.K. and R.K.-H.; formal analysis, B.K. and R.K.-H.; investigation, B.K. and R.K.-H.; resources, B.K.; data curation, B.K. and R.K.-H.; writing—original draft preparation, B.K. and R.K.-H.; writing—review and editing, B.K. and R.K.-H.; visualization, R.K.-H.; supervision, B.K.; project administration, B.K. and R.K.-H.; funding acquisition, B.K. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the European Union’s Horizon 2020 research and innovation programme, grant number 101035815. The APC was funded by UARD, Plovdiv, Bulgaria.

Data Availability Statement

Restrictions apply to the availability of these data. Data was obtained from Scopus and are available at

http://www.scopus.com (accessed on 25 March 2024) with the permission of Scopus.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Bornmann, L., Daniel, H. (2007). What do we know about the h index? Journal of the American Society for Information Science and Technology, 58(9), 1381-1385. [CrossRef]

- Bornmann, L., Mutz, R., Neuhaus, C., Daniel, H. (2008). Citation counts for research evaluation: Standards of good practice for analysing bibliometric data and presenting and interpreting results. Ethics in Science and Environmental Politics, 8(1), 93-102. [CrossRef]

- Brooks, C., Schopohl, L. (2020). Green Accounting and Finance: Advancing Research on Environmental Disclosure, Value Impacts and Management Control Systems. SSRN Electronic Journal. [CrossRef]

- Burke, M., Hsiang, S., Miguel, E. (2015). Global non-linear effect of temperature on economic production. Nature, 527, 235–239. [CrossRef]

- Dell M., Jones, B. F., Olken, B. A. (2012). Temperature Shocks and Economic Growth: Evidence from the Last Half Century. American Economic Journal: Macroeconomics, 4 (3), 66–95. [CrossRef]

- Dikau, S., Volz, U. (2021). Central bank mandates, sustainability objectives and the promotion of green finance. Ecological Economics, 184, 107022. [CrossRef]

- Donthu, N., Kumar, S., Mukherjee, D., Pandey, N., Lim, W. (2021). How to conduct a bibliometric analysis: An overview and guidelines. Journal of Business Research, 133, 287. [CrossRef]

- European Commission (2021) Overview of sustainable finance. European Commission. https://finance.ec.europa.eu/sustainable-finance/overview-sustainable-finance_en. European Commission (2021). Overview of sustainable finance. Available online: https://ec.europa.eu/info/business-economy-euro/banking-and-finance/sustainable-finance/overview-sustainable-finance_en (accessed on 25 February 2024).

- Eyraud, L., Clements, B., & Wane, A. (2013). Green investment: Trends and determinants. Energy Policy, 60, 852–865. [CrossRef]

- Ezroj, A. (2020). Carbon Risk and Green Finance (1st ed.). London: Routledge, pp. 1-8. [CrossRef]

- He, L., Liu, R., Zhong, Z., Wang, D., Xia, Y. (2019). Can green financial development promote renewable energy investment efficiency? A consideration of bank credit. Renewable Energy, 143, 974–984. [CrossRef]

- Khan, M. A., Riaz, H., Ahmed, M., Saeed, A. (2021). Does green finance really deliver what is expected? An empirical perspective. Borsa Istanbul Review, 22(3), 586-593. [CrossRef]

- Lamperti, F., Bosetti, V., Roventini, A., Tavoni, M., Treibich, T. (2021). Three green financial policies to address climate risks. Journal of Financial Stability, 54, 100875. [CrossRef]

- Lee, Chi-Chuan, Lee, Chien-Chiang (2022). How does green finance affect green total factor productivity? Evidence from China. Energy Economics, 107, 105863. [CrossRef]

- Lin, C.-Y., Chau, K. Y., Tran, T. K., Sadiq, M., Van, L., Phan, T. T. H. (2022). Development of renewable energy resources by green finance, volatility and risk: Empirical evidence from China. Renewable Energy, 201(1), 821-831. [CrossRef]

- Lyon, T. P., Shimshack, J. P. (2015). Environmental Disclosure: Evidence From Newsweek’s Green Companies Rankings. Business & Society, 54(5), 632-675. [CrossRef]

- Rasoulinezhad, E., Taghizadeh-Hesary, F. (2022). Role of green finance in improving energy efficiency and renewable energy development. Energy Efficiency, 15(2). [CrossRef]

- Ren, X., Shao, Q., Zhong, R. (2020). Nexus between green finance, non-fossil energy use, and carbon intensity: Empirical evidence from China based on a vector error correction model. Journal of Cleaner Production, 277, 122844. [CrossRef]

- Saeed Meo, M., Karim, M.Z.A. (2022). The role of green finance in reducing CO2 emissions: An empirical analysis. Borsa Istanbul Review, 22(1), 169-178. [CrossRef]

- Sinha, A., Mishra, S., Sharif, A., Yarovaya, L. (2021). Does green financing help to improve environmental & social responsibility? Designing SDG framework through advanced quantile modelling. Journal of Environmental Management, 292, 112751. [CrossRef]

- Soundarrajan, P., Vivek, N. (2016). Green finance for sustainable green economic growth in India. Agricultural Economics (Zemědělská Ekonomika), 62(1), 35–44. [CrossRef]

- Steuer, S., Tröger, T. H. (2022). The Role of Disclosure in Green Finance. Journal of Financial Regulation, 8(1), 1–50. [CrossRef]

- Taghizadeh-Hesary, F., Yoshino, N. (2020). Sustainable Solutions for Green Financing and Investment in Renewable Energy Projects. Energies, 13(4), 788. [CrossRef]

- Taghizadeh-Hesary, F., Yoshino, N. (2019). The way to induce private participation in green finance and investment. Finance Research Letters, 31, 98–103. [CrossRef]

- United Nations (1987). Report of the World Commission on Environment and Development: Our Common Future. Available online: https://sustainabledevelopment.un.org/content/documents/5987our-common-future.pdf (accessed on 25 February 2024).

- Van Eck, N., Waltman, L. (2010). Software survey: VOSviewer, a computer program for bibliometric mapping. Scientometrics, 84, 523-538. [CrossRef]

- Vieira, E. S., Gomes, J. A. N. F. (2009). A comparison of Scopus and Web of Science for a typical university. Scientometrics, 81, 587-600. [CrossRef]

- Walls, A. (2024). Investing with a Conscience: An Introduction to Socially Responsible Investing (SRI). Available online: https://www.theethicalfuturists.com/investing-with-a-conscience-an-introduction-to-socially-responsible-investing-sri/ (accessed on 14 March 2024).

- Wang, M., Li, X., Wang, S. (2021). Discovering research trends and opportunities of green finance and energy policy: A data-driven scientometric analysis. Energy Policy, 154, 112295. [CrossRef]

- Wang, Y., Zhi, Q. (2016). The Role of Green Finance in Environmental Protection: Two Aspects of Market Mechanism and Policies. Energy Procedia, 104, 311–316. [CrossRef]

- Wu, G., Liu, X., Cai, Y. (2023). The impact of green finance on carbon emission efficiency. Heliyon, 10(1), e23803. [CrossRef]

- Xu, L., Wu, Y. (2023). Nexus between green finance, renewable energy and carbon emission: Empirical evidence from selected Asian economies. Renewable Energy, 215, 118983. [CrossRef]

- Xu, X., and Li, J. (2020). Asymmetric impacts of the policy and development of green credit on the debt financing cost and maturity of different types of enterprises in China. Journal of Cleaner Production, 121574. [CrossRef]

- Yasar, B. (2021). Impact investing: A review of the current state and opportunities for development. Istanbul Business Research, 50(1), 177-196. [CrossRef]

- Yu, C.-H., Wu, X., Zhang, D., Chen, S., Zhao, J. (2021). Demand for green finance: Resolving financing constraints on green innovation in China. Energy Policy, 153, 112255. [CrossRef]

- Yu, K. (2016). Green Bonds, Green Boundaries: Building China’s green financial system on a solid foundation. Available online: https://www.iisd.org/articles/insight/green-bonds-green-boundaries-building-chinas-green-financial-system-solid (accessed on 14 March 2024).

- Zhang, D., Mohsin, M., Rasheed, A. K., Chang, Y., Taghizadeh-Hesary, F. (2021). Public spending and green economic growth in BRI region: Mediating role of green finance. Energy Policy, 153, 112256. [CrossRef]

- Zhang, D., Zhang, Z., Managi, S. (2019). A bibliometric analysis on green finance: Current status, development, and future directions. Finance Research Letters, 29, 425–430. [CrossRef]

- Zhang, S., Wu, Z., Wang, Y., Hao, Y. (2021). Fostering green development with green finance: An empirical study on the environmental effect of green credit policy in China. Journal of Environmental Management, 296, 113159. [CrossRef]

- Zhou, X., Tang, X., Zhang, R. (2020). Impact of green finance on economic development and environmental quality: a study based on provincial panel data from China. Environmental Science and Pollution Research 27, 19915–19932. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).