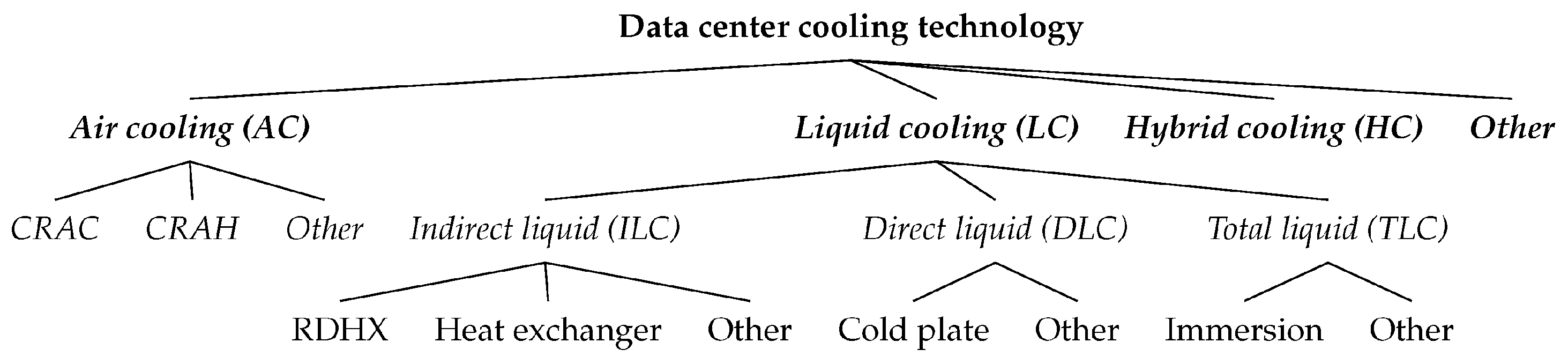

4. Analysis and Discussion of the Data

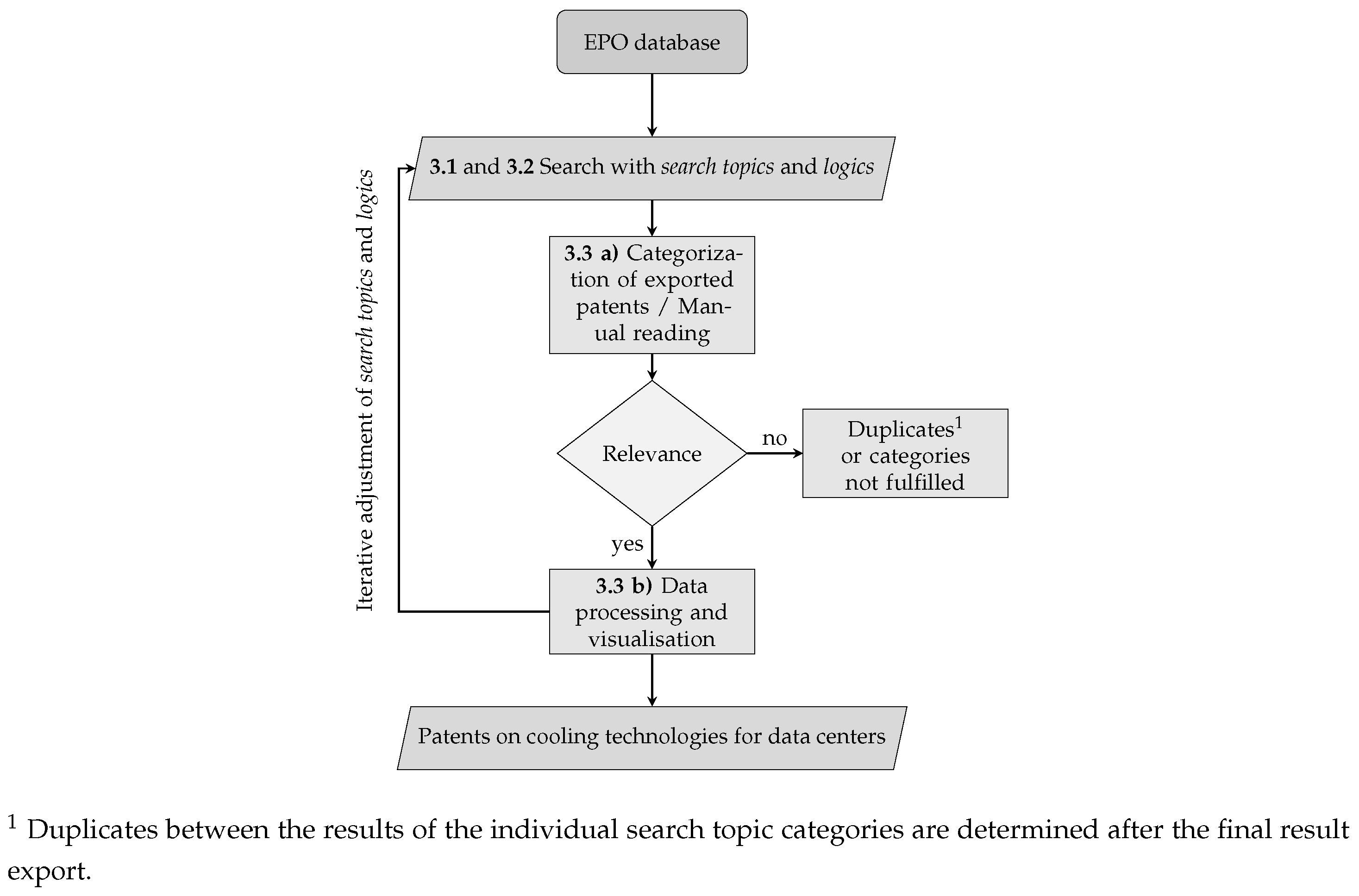

Table 2 lists the “simple search results” for the search terms from

Table 1. As Espacenet is a family-based tool, not all retrieved patents are shown. Instead, only one of the family members selected by the system to represent the entire family is returned. Since a patent family is a collection of several patent applications covering the same or a similar technical field, it is sufficient to consider only one representative patent from this family [

51]. Depending on the search terms, “all publication matchings” are listed in the second column. To classify the simple search results, the number of complete publication hits and their ratios have been identified. Depending on the search term, the simple family matches cover 44 to 82 % of all matches; the average is 60 %. To classify the patent applications, the last three entries include the number of patents for general search terms in the context of data centers and cooling. Within the data center, cooling technologies at the server, rack and room cooling levels covers less than 1 % of the patents in the period 2000 to 2023. Within cooling, the results of detailed search queries account for 34 %. Most patents were identified with the search terms “CRAC / CRAH” and “server cooling”, followed by “immersion” and “direct chip water cooling”. “GPU cooling” and “RDHX” had the fewest search results.

Table 3 expands the results from

Table 2 with the number of patents classified as relevant and the difference resulting from the subsequent determination of duplicates between or within the search terms. In addition, the ratio of simple family matches to those classified as relevant was determined. Almost every search term is affected by overlapping duplicates. Consequently, 68 % of the results of the matches are considered relevant.

The small number of patent applications in the field of data center cooling indicates that no major application activities are being carried out in this area. The comparison between the general search term for data center cooling and the specific search terms shows that the levels of cooling investigated in this study only account for 34 %. The remaining patents presumably deal primarily with cooling in the cooling infrastructure. In addition, the search results for coolants show a wide range of applications. This ranges from server cooling to the fluid circuits of recoolers. For this reason, no detailed analysis was carried out.

The search terms that were more generic and had more common industry names tended to have more search hits. This can be seen in particular when looking at “CRAC / CRAH”, “RDHX” and “Rack Cooling”. While RDHX refers to a special technology that has only been in use for two decades, the term rack cooling is more general and also includes technologies that are similar to RDHX. The partial overlapping of general and specific search terms leads to a higher proportion of duplications between the search terms. Another search term for which this applies is "Server Cooling". In contrast, the search query for air cooling using "CRAC / CRAH" is both sufficiently precise and familiar in terms of the name of the technology.

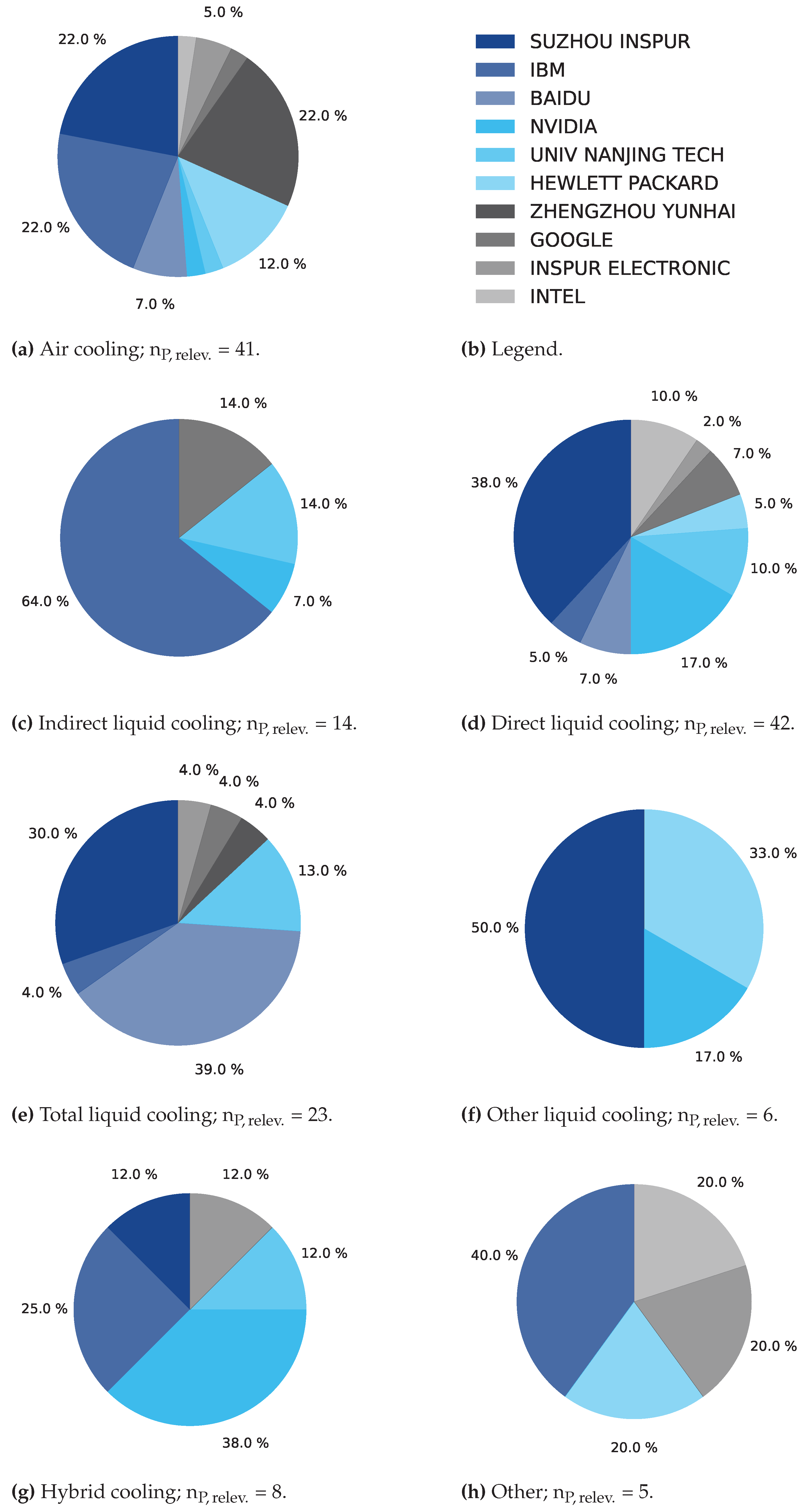

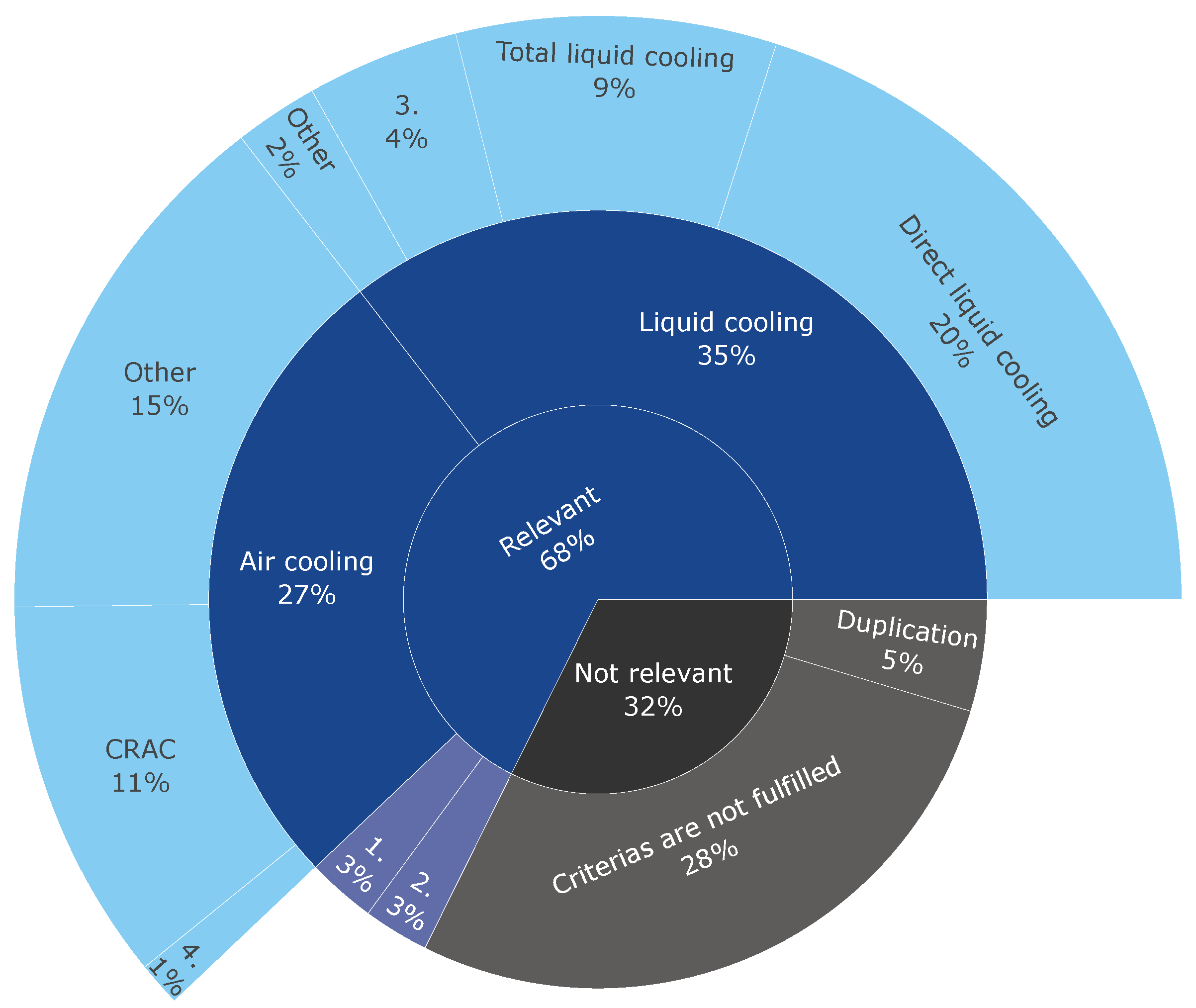

The distribution of relevant and irrelevant patents is illustrated in

Figure 3 with the addition of the classification according to

Figure 1. The further classificatio in

Figure 3 is also contained in

Table A1 in the appendix. Within the “Not relevant” category, the required criteria in particular were not met. In the “Relevant" section, air (27 %) and liquid (35 %) cooling are the most typical mentioned technologies. Both hybrid cooling and others account only for 3 % of the total number of applications. In liquid cooling, direct cooling (20 %) is used before (9 %) and indirect cooling (4 %). Within these sub-categories, cold plates (17 %), immersion (8 %) respectively RDHX (2 %) are the most common technologies addressed in the patent applications. If a specification of the coolant was available, a fraction of two-phase coolants of 2 % could be determined for both the cooling plates and the immersion cooling. In the domain of air cooling, there is a distribution into CRAC (11 %), CRAH (5 %) and “Other” (15 %).

The further classification in

Figure 3 revealed a relatively high proportion of patents (28 %) that did not fulfil the criteria required in

Section 3.3. The non-fulfilment of the developed requirements for relevant patents is mainly due to the fact that the search syntax does not have any strict specifications regarding the order of search terms. Their share could have been reduced by using proximity operators. The proportion of duplicates, on the other hand, is relatively low, which indicates a low overall overlap of patents.

Within the relevant patents, air and liquid cooling are the most widespread technologies. Although there are also combinations of different technology approaches and other technologies, these do not account for a high proportion. Other technologies include, in particular, all approaches that utilise thermoelectric effects in any form (especially

Seebeck and

Peltier effect). Technologies based on thermoelectric effects have not yet been used to any substantial extent in the data center sector, which is why their patent numbers are low and have not progressed as far as the classic solutions. Hybrid cooling, on the other hand, is a relatively new approach. Their development has mainly taken place in the last decade (82 %; see

Figure 5). Due to the increasing demands on cooling and the simultaneous advances in the various cooling solutions, a combination of these for targeted and customized heat dissipation was expedient. The combination of cold plates and immersion cooling is a particularly common approach. On the one hand, all waste heat is absorbed into a liquid and, on the other hand, the powerful and less temperature-sensitive components can be cooled in a controlled manner even at higher coolant inlet temperatures. Although other cooling technologies such as direct or indirect liquid cooling could also be regarded as hybrid cooling, the classification is still based on the patent title and the focus of the patent description.

Air cooling is primarily made up of CRAC systems and other approaches that cannot be classified further. Although CRAH systems can also be found, they only make up a minor fraction. In today’s data centers with an IT power of more than several hundred kilowatts, however, CRAH systems are increasingly the preferred choice [

52]. A global market survey by VM Reports on the market shares of CRAC and CRAH across various applications revealed a slightly larger share for CRAH compared to CRAC [

53].

Within liquid cooling, the focus is on cold plates (DLC) and immersion cooling (TLC). In most cases, these are not specified further. As the coolant is only explicitly emphasised in a few cases - in the case of two-phase cooling - it can be assumed that single-phase coolants are more likely to be preferred due to their easier and safer handling. The widespread use of DLC can in turn be attributed to the fact that the necessary structural changes to an air-cooled standard server are less than those required for TLC. In addition, the requirements for the coolant are not as high as for the TLC.

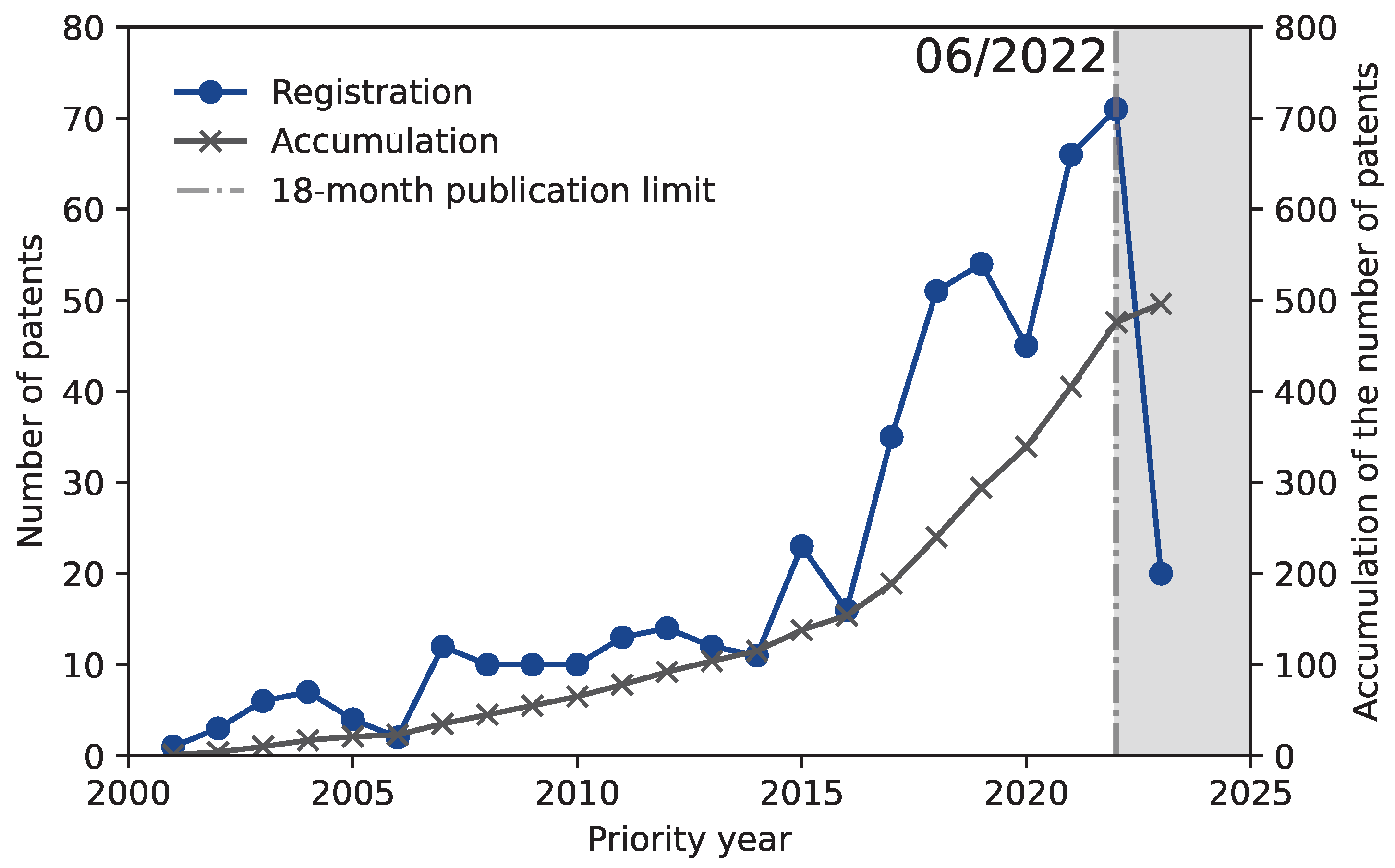

Figure 4 visualises the aggregated annual distribution of patent applications, taking into account the search terms from

Table 1. In addition, these values are cumulated. Despite recurring deviations, the overall trend over the past 20 years shows an increase in the number of patent applications. There was a sharp increase from 2016 in particular. Both 2022 and 2023 have not yet exceeded the publication deadline, which means that it is likely that not all patents from those years are yet public.

The development of the annual patent application for cooling technologies for data centers reveals an increasing growth over the period under observation. This is mainly due to technical progress in the area of server hardware and increasing performance densities. This is compounded by the increasing demand for corresponding hardware solutions and the intense competition between manufacturers. In order to maintain this trend, further developments are required at server and rack cooling level. The increasing relevance of energy-intensive technologies such as AI is simultaneously causing significant growth boosts at chip level, which have an impact on cooling requirements.

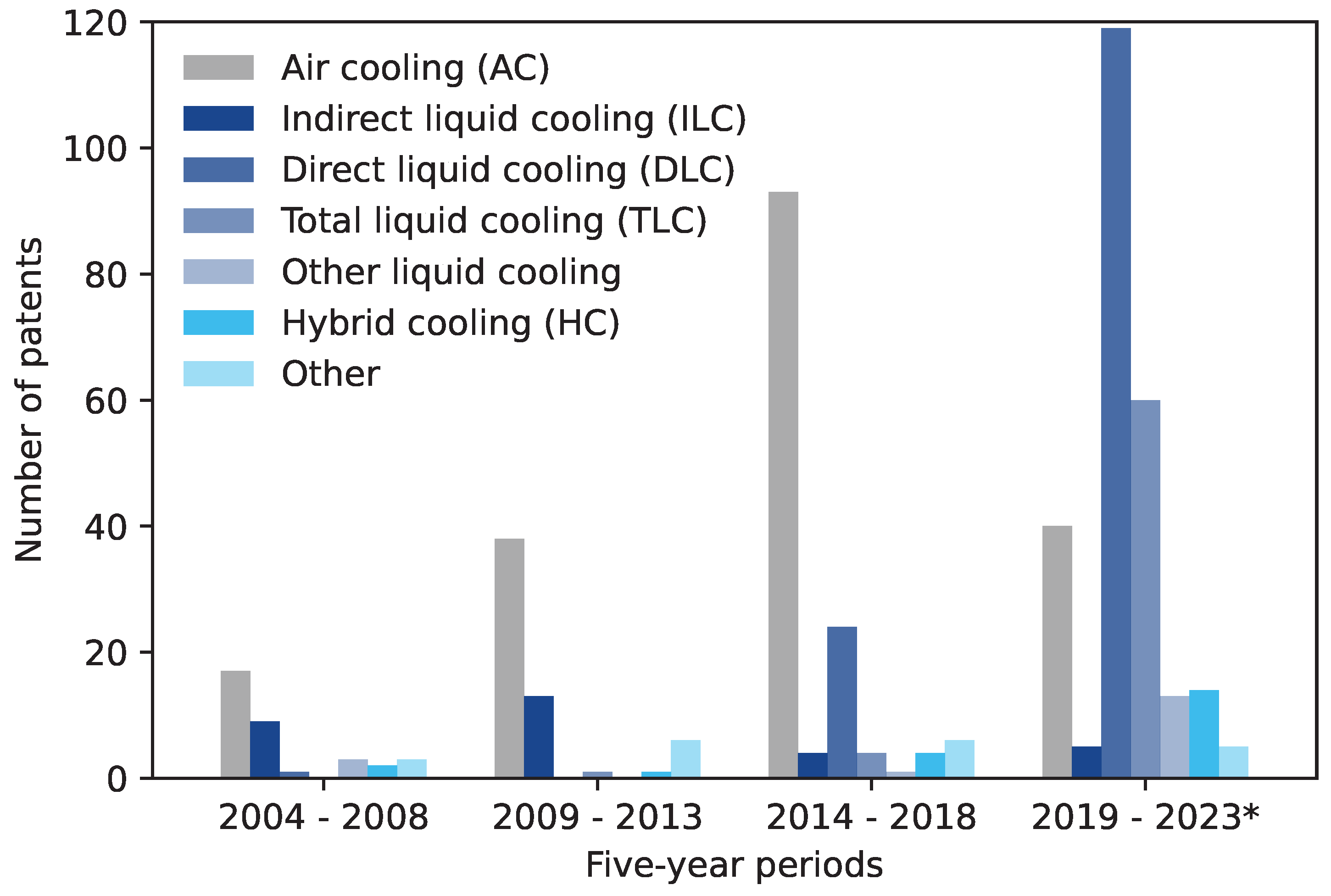

Based on

Figure 4,

Figure 5 breaks down the annual patent applications by technology with an additional aggregation in 5 annual periods from 2004 until 2023. Patents with air cooling rose steadily until 2018. Subsequently, application numbers fell by 57 % between the third and fourth period. All other technologies were at a low level in the comparison period and rarely exceeded a maximum of 20 % of the patent applications for air cooling. The two exceptions are indirect (1

st and 2

nd period) and direct (3

rd) liquid cooling, which reached between 26 and 53 % of the applications of patents for air cooling. At the same time, the sum of the four liquid cooling technologies analysed was always below that of air cooling within the first three periods. It was only in the fourth period that both direct and total liquid cooling registered more patent applications than air cooling. Within liquid cooling, the focus in the first two periods was on indirect liquid cooling and in the last two periods on direct liquid cooling. Total liquid cooling, in turn, has increased significantly since 2014 in particular, whereby it was the second most common technology after direct liquid cooling in the fourth period. Indirect liquid cooling, by contrast, recorded a decline in patent applications from the third period onwards.

Figure 4.

Historical development of relevant patents in the field of data center cooling (nP, relev. = 496); period: 2000 - 2023 (earliest priority year).

Figure 4.

Historical development of relevant patents in the field of data center cooling (nP, relev. = 496); period: 2000 - 2023 (earliest priority year).

Figure 5.

Development over time of relevant patents in the field of data center cooling by cooling technology in five year periods (nP, relev. = 486); period: 2004 - 2023 (earliest priority year). * Not all relevant patents have presumably been published for 2023 and the second half of 2022.

Figure 5.

Development over time of relevant patents in the field of data center cooling by cooling technology in five year periods (nP, relev. = 486); period: 2004 - 2023 (earliest priority year). * Not all relevant patents have presumably been published for 2023 and the second half of 2022.

The technology change that is taking place is clearly highlighted in

Figure 5. Since 2019, liquid cooling has accounted for the largest share of annual patent applications, replacing air cooling. In previous years, air cooling was sufficient for most applications and liquid cooling was generally not strictly necessary and more expensive. However, this has changed in recent years due to increased cooling demand as a result of technical developments to meet the performance requirements of the applications used on the server. Although the number of patent applications for air cooling has not fallen to zero, there is no longer any major potential for optimization here. It is a proven technology that has been developed and used for decades. Even if liquid cooling is becoming increasingly important, air cooling may be relevant. This applies in particular to hybrid cooling, which also uses air cooling to some extent, depending on the concept. In the case of direct liquid cooling, the remaining waste heat must be dissipated with a different technological approach (e. g. air cooling) due to a limited heat to water ratio. These types of concepts have only been specifically developed in recent years (since 2014).

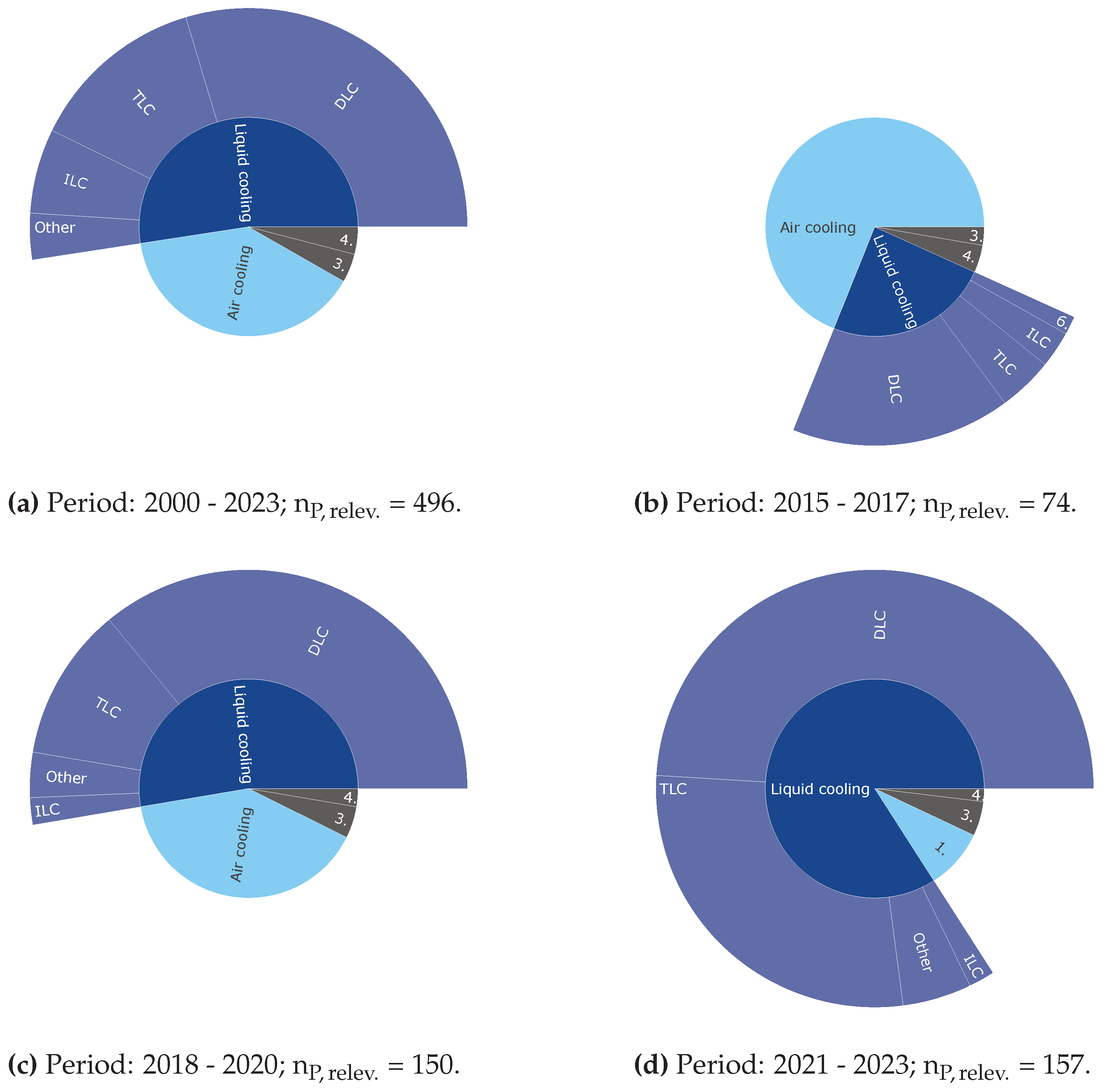

To illustrate the aggregated development over three equal periods from 2015 onwards to gain a better insight into technology breakdown in the recent past, the shares of the individual cooling technologies are shown in

Figure 6b–d and in

Table A2 in the appendix. Together, these cover 77 % of the relevant patents identified. In all three periods, the share of hybrid cooling and “Other” was less than 5 %. Over the three periods, the proportion of air cooling gradually decreased, while liquid cooling increased. Air cooling fell from 69 to 9 %, while liquid cooling increased from 24 to 84 %. Within liquid cooling, the focus was on direct liquid cooling. This accounted for at least 58 and up to 68 % of liquid cooling in all three periods. At the same time, the proportion of total cooling increased from 17 to 33 %.

The aggregated comparison of the technologies over three equal time periods compared to

Figure 6a makes the general development especially visible. Today’s developments are dominated by liquid cooling in direct and total technologies for the reasons mentioned above.

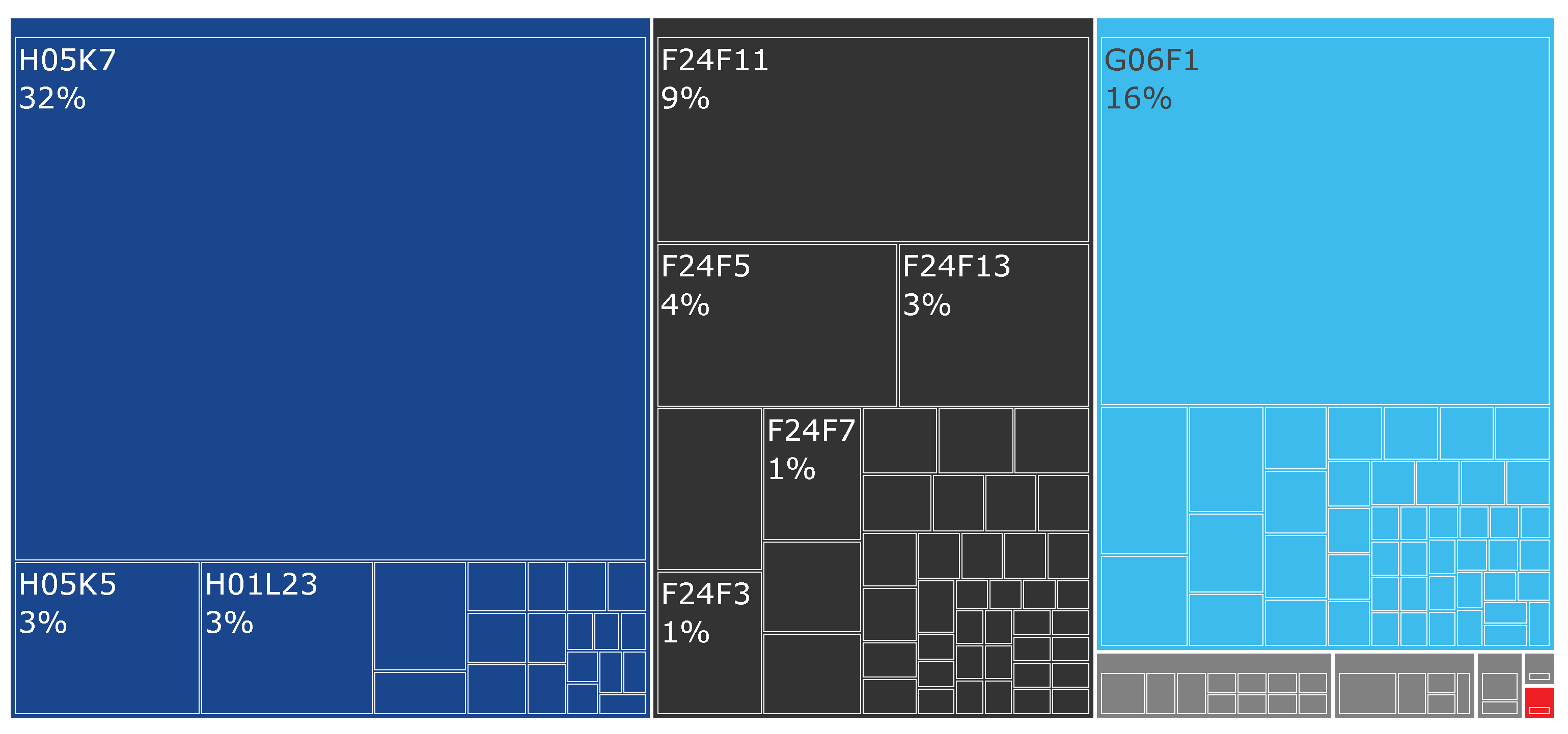

Figure 7 illustrates the hierarchical structures depending on the IPC section and main group of the patents in a treemap. The corresponding results are summarised in

Table A3 in the appendix. The number of patents resulting from the main groups is higher than that determined in

Table 3, as a patent can be assigned to several main groups. The three most common sections are in descending order:

Electricity H (434),

Mechanical engineering […] F (299) and

Physics G (278) [

37]. Within the three most common sections, the main groups

H05K7 (32 %; Constructional details common to different types of electric apparatus […]),

G06F1 (16 %; Details not covered by groups G06F 3/00-G06F 13/00 and G06F 21/00 […]) and

F24F11 (9 %; Control or safety arrangements) are the most common main groups [

54]. There are also sections

Performing operations; Transporting B (15),

Fixed constructions E (9),

Chemistry; Metallurgy C (3),

Human necessities A (1) and one patent that cannot be assigned as the corresponding text field is empty.

With regard to the distribution of patent classes there are large shares for H05K7 (32 %), G06F1 (16 %) and F24F11 (9 %). The first main group deals with constructive elements, the second with cooling and the third with control and safety elements. Apart from the superior subclass of the second main group, the issue of cooling is not central to the others. Their sections, in turn, are strongly represented. H, F and G are sections which, precisely because of their titles, could be assigned to the area of cooling data centers in advance. With the exception of section Textilies; Paper D, all other sections were present. On the one hand, other classes tended to be represented more frequently, on the other hand, the focus of section D was not on cooling technology. Nevertheless, the results are similar in both cases.

The absolute number of different IPC sections depending on the search term and cooling technology are specified in

Table 4 and

Table 5 respectively. All search terms are represented in sections F to H. Less than half of the search terms have patents in sections B and E. Within Section F, the largest share (58 %) is attributable to “CRAC / CRAH”. In section G, the allocation is more evenly balanced with focus on “CPU” (22 %) and “Server Cooling” (24 %). In section H with the highest number of patents, several search terms have a similarly high share. These include in particular “Immersion Cooling” (17 %), “Server Cooling” (16 %), “CRAC / CRAH” (16 %), “Direct Chip Cooling” (16 %) and “Rack Cooling” (14 %).

The distribution of the IPC sections according to cooling technology in

Table 5 is similar to

Table 4. Section F focuses on the area of air cooling (74 %), whereas liquid cooling predominates in sections G (51 %) and H (59 %). In both sections G and H, air cooling achieves a share of 34 %, in contrast to liquid cooling in section F with a share of 27 %. In terms of the various forms of liquid cooling, section H is the most occurring section. With regard to hybrid cooling, the focus is on sections F to H, with an even distribution. In the case of “Other” cooling technologies, sections F to H have also been used in particular. Within “Other”, Section G has the largest share of over 51 %.

As a result of the aggregation at cooling technology level, the technical focus of the sections can be determined in relevance to data centre cooling. To determine the reason for this breakdown,

Figure 10 and

Figure 12 visualises the composition of the

TOP 10 main and subgroups in terms of cooling technology. In contrast, with regard to the “Other” cooling technologies, which primarily utilise the thermoelectric effect, which is a physical effect, it can be stated that there is the greatest overlap with Section G in terms of subject content.

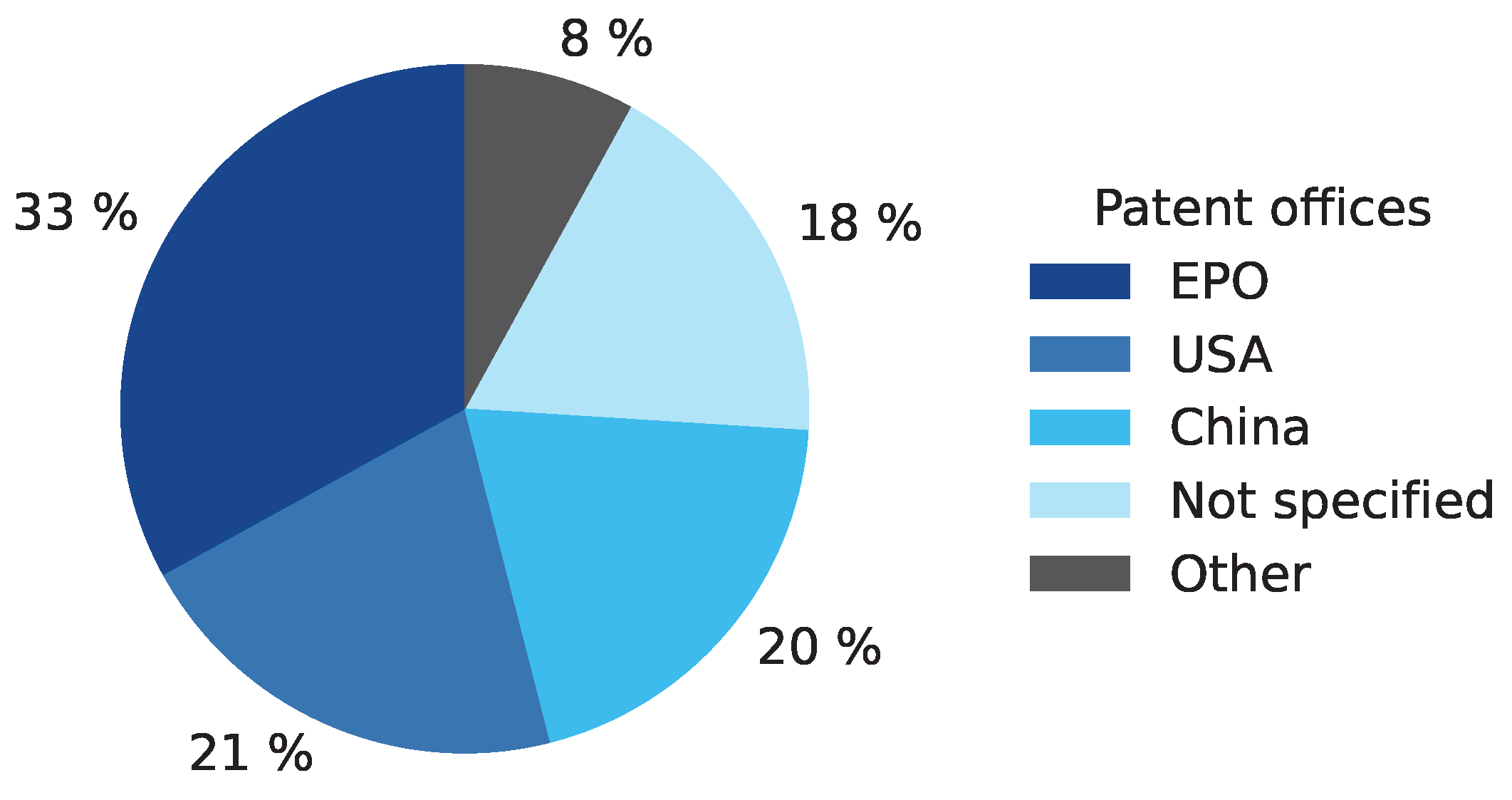

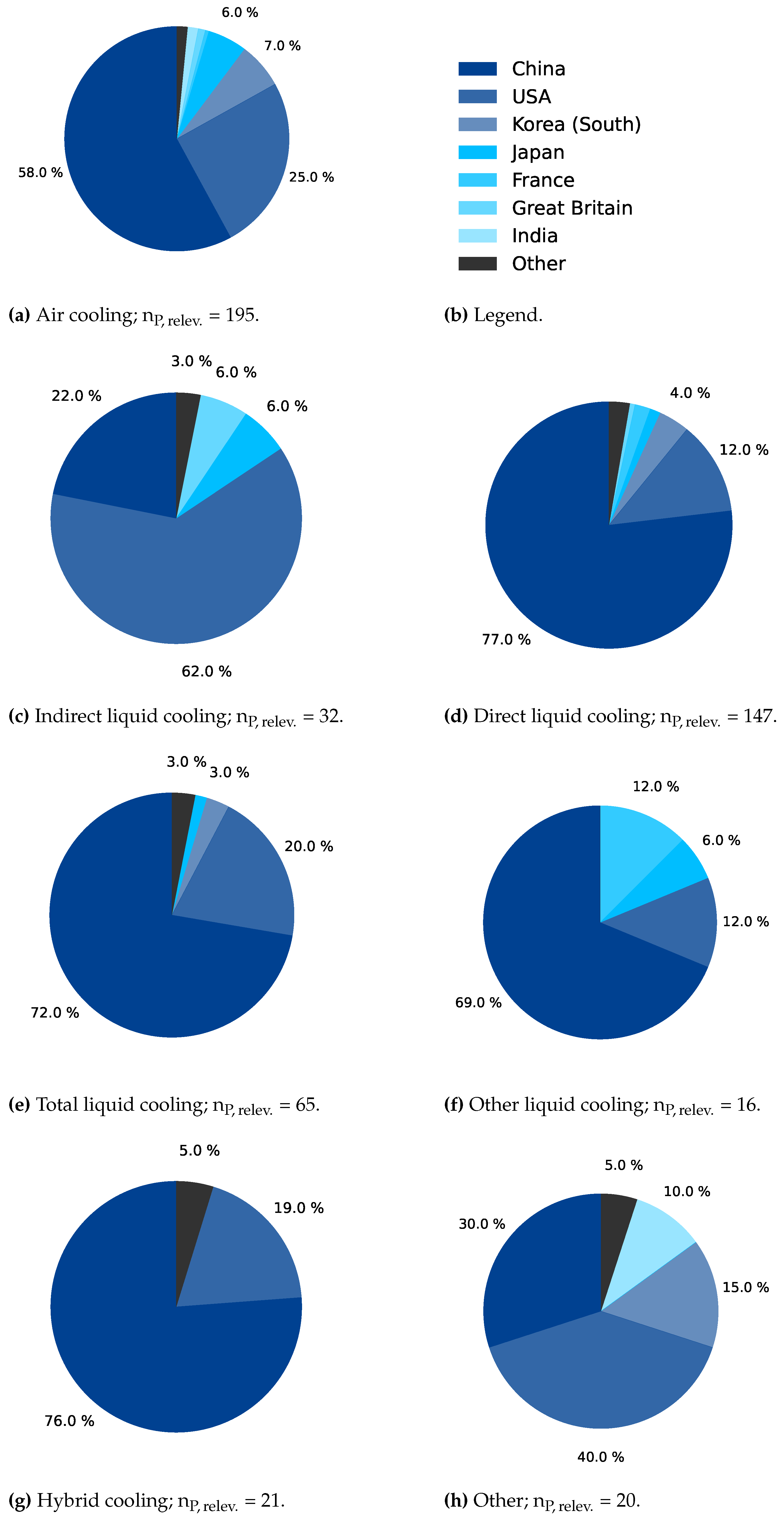

The regional distribution of patents is visualised in

Figure 8 on the basis of the patent offices and in

Figure 9 on the basis of the country code in the patent number or the applicant. The number of patents based on patent offices is higher, as a patent can be registered by several patent offices at the same time. The most patent applications were filed in Europe, the USA and China. 18 % of the patents could not be assigned to a patent office. 86 % of the patents affected can be related to China based on the applicant’s country of origin. In addition, 6 % could not be allocated in this way. However, taking into account the country code in the publication number, these patents could also be attributed to China. The remaining 8 % can be allocated to Japan, South Korea and Singapore on the basis of the applicants. Taking into account the country allocation for patents without direct indication of the patent office, it can be concluded that China probably has the most patent applications (37 %).

Figure 8.

Distribution of all data center cooling patents by patent offices (nP, total = 733, nP, relev. = 496, nP, PO, relev. = 840); period: 2000 - 2023 (earliest priority year).

Figure 8.

Distribution of all data center cooling patents by patent offices (nP, total = 733, nP, relev. = 496, nP, PO, relev. = 840); period: 2000 - 2023 (earliest priority year).

Most of the so-called IP5, the 5 largest patent offices (

China,

Europe, Japan, Korea and

USA), are represented in

Figure 8. Together they process around 85 % of the world’s patent applications [

55]. As a result of their economic and technological importance, this leads to a high proportion of patents being processed. In this case, they account for a combined share of 74 or 91 % with the uncertainty in the allocation of the patent office in cases “Not specified”. However, it should be considered that a patent can be registered simultaneously with several patent offices across the various patent classes it contains.

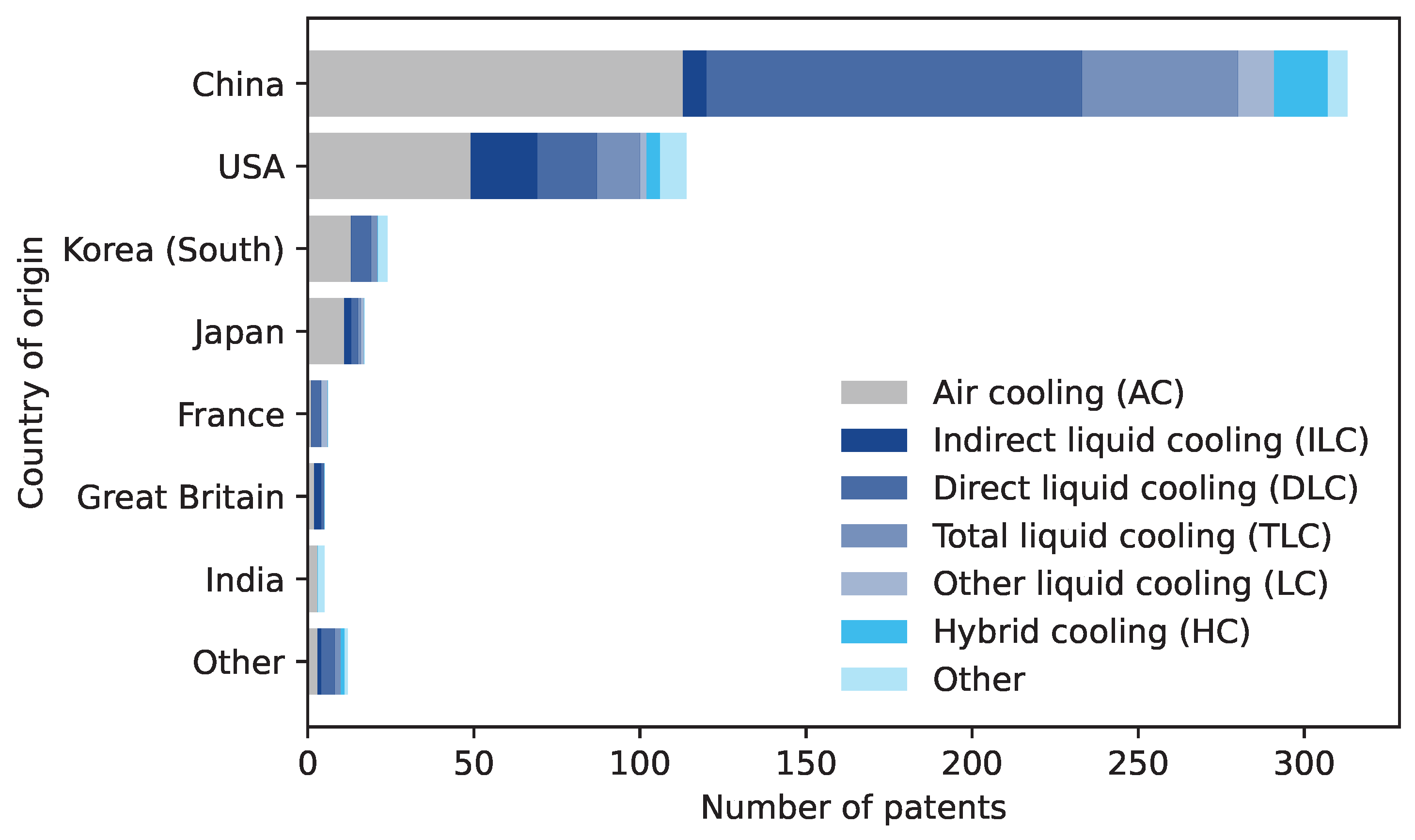

Figure 9.

Distribution of patents by country of origin (nP, relev. = 496); period: 2000 - 2023 (earliest priority year).

Figure 9.

Distribution of patents by country of origin (nP, relev. = 496); period: 2000 - 2023 (earliest priority year).

In terms of patent applications by country of origin, China (313) and the USA (114) reveal the highest level of activity. Their share of the total number of relevant patents in the area of data center cooling is 63 and 23 % respectively. The remaining countries together account for less than 14 %. Chinese patents have a share of 36 % for air cooling and of 57 % for liquid cooling. In the case of American patents, the distribution is more even — it is 43 % for air cooling and 46 % for liquid cooling. Within the liquid cooling category, the focus in China is on direct (63 %) and in the USA on indirect liquid cooling (38 %).

Figure A1 in the appendix additionally presents a differentiation of the country distribution by cooling technology.

China and the USA are by far the most active countries. This also correlates very strongly with general patent applications [

56]. France and Japan are also represented as part of the general

TOP 5. This means that the general distribution of patent offices roughly corresponds to that of all patents. The high proportion of liquid cooling, both in China and the USA, is presumably due to the increasing importance of high-performance hardware and applications (AI, big data and cloud computing). A number of large providers of these services are represented in these two countries in particular, which also operate worldwide.

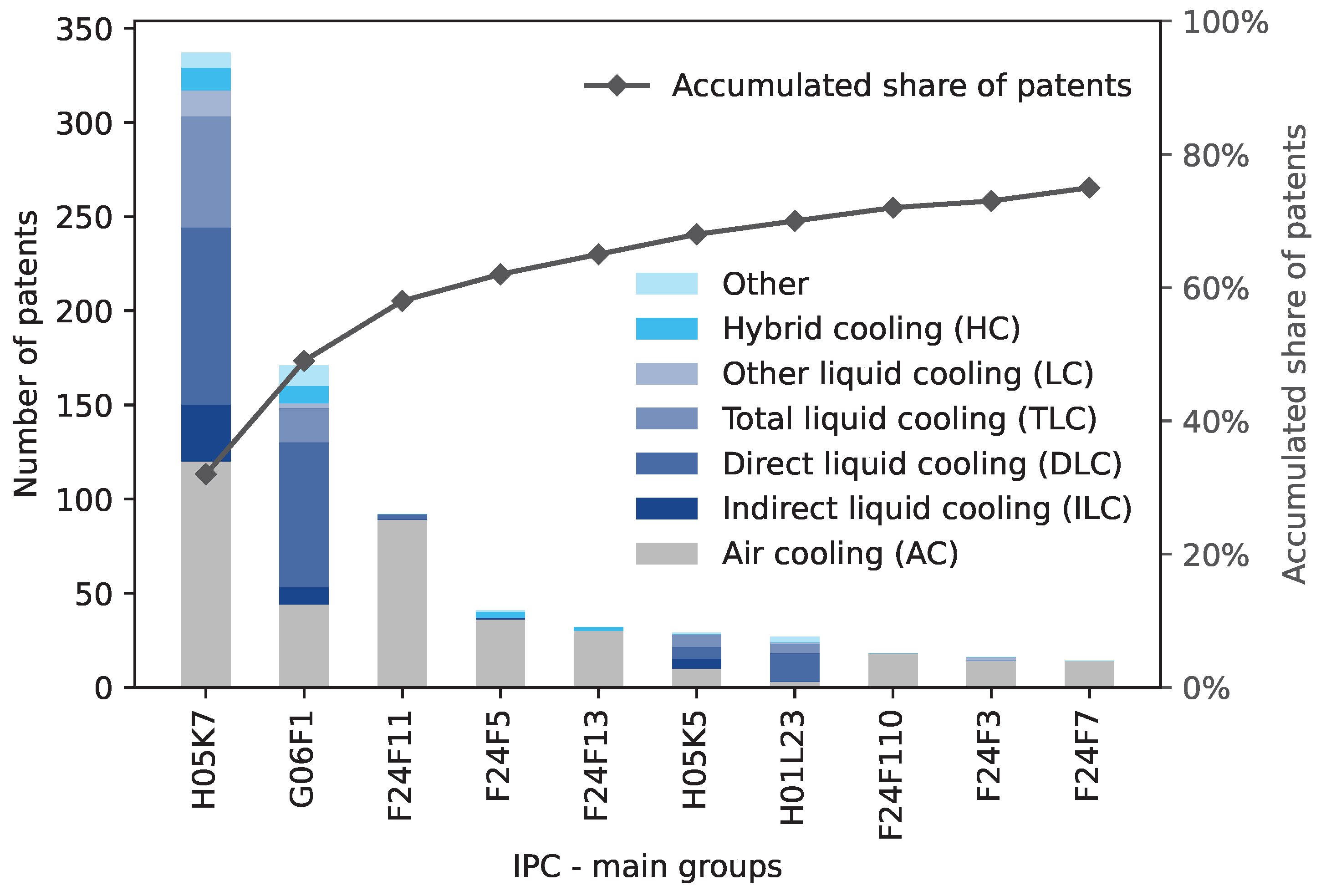

Figure 10 is showing the distribution of the 10 most often used IPC main classes in addition to

Figure 7. The corresponding explanation of the main groups can be found in

Table A4 in the appendix. A differentiation is furthermore made according to cooling technology. In addition, their cumulative share of all patents is included and amounts to 75 % of all main groups. The main groups

H05K7 and

G06F1 alone account for 49 % of all main groups. Most of the main groups are primarily characterised by air cooling, whereas

H05K7,

G06F1,

H05K5 (Casings, cabinets or drawers for electric apparatus […]) and

H01L23 (Details of semiconductor or other solid state devices […]) have a share of liquid cooling of between 58 and 78 % [

54]. In these cases, the technology is characterised in the following descending order: direct, total and indirect liquid cooling. In the area of hybrid cooling and “Other”,

H05K7 and

G06F1 have the most patents.

Figure 10.

Distribution of the 10 most common IPC main groups (n

MG, relev. = 1040, n

MG, relev., TOP 10 = 777); period: 2000 - 2023 (earliest priority year).

H05K7: Constructional details common to different types of electric apparatus […],

G06F1: Details not covered by groups G06F 3/00-G06F 13/00 and G06F 21/00 […],

F24F11: Control or safety arrangements,

F24F5: Air-conditioning systems or apparatus not covered by group F24F 1/00 or F24F 3/00 [

54].

Figure 10.

Distribution of the 10 most common IPC main groups (n

MG, relev. = 1040, n

MG, relev., TOP 10 = 777); period: 2000 - 2023 (earliest priority year).

H05K7: Constructional details common to different types of electric apparatus […],

G06F1: Details not covered by groups G06F 3/00-G06F 13/00 and G06F 21/00 […],

F24F11: Control or safety arrangements,

F24F5: Air-conditioning systems or apparatus not covered by group F24F 1/00 or F24F 3/00 [

54].

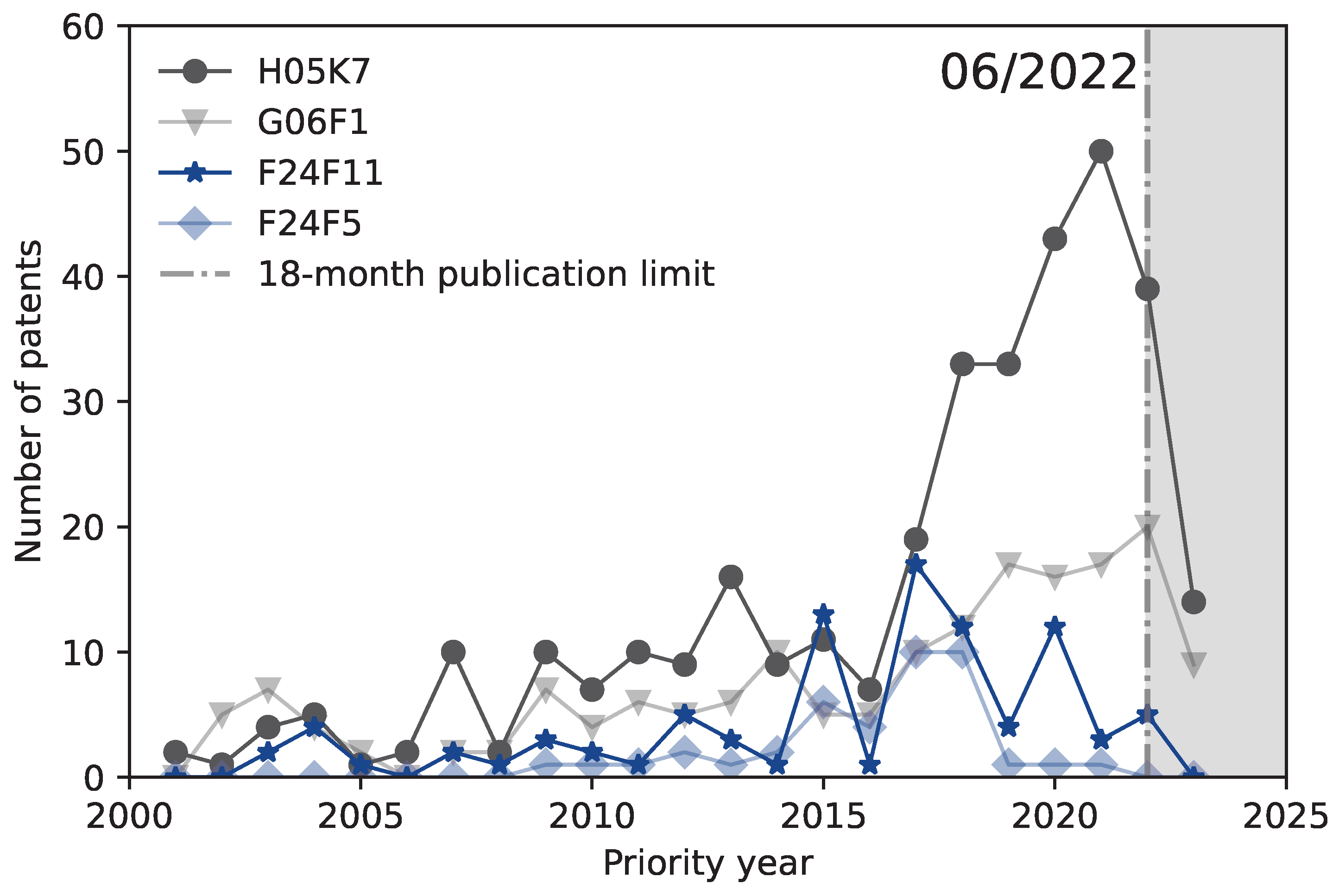

The development of patent applications over time for the four most common main groups is visualised in

Figure 11. They account for 82 % of the

TOP 10. In addition, the black dashed vertical line shows the 18-month limit for the completed publication of a patent. For all patents with an priority date before mid-June 2022, it is important to emphasise that not all patents have yet to be published. The result is that 49 and 70 % of all patent applications in the first two main groups are published before the 18-month-limit. This does not apply to patents from subclass

F24F. Over the past 22 years, the ranking of the main groups has tended to remain the same. For the first time, more than 10 patent applications per year were achieved by

H05K7 in 2007. Significant decreases can be seen in 2008 and 2010, especially for

H05K7. In addition, the

TOP 4 reveal a dip to almost zero in 2016. Thereafter, patent activity increases significantly, with subclass F24F remaining at a low level close to zero. In the years from 2019, a total of 285 patents were registered in the

TOP 4, accounting for 44 % of all registrations since 2001.

The initial decline in patent applications is the result of the general global economic situation following the financial crisis in 2008. The subsequent sharp rise in

H05K7 in particular can be explained by a significant increase in the proportion of liquid cooling in general (see

Figure 5) and the high proportion of liquid cooling in this main group (see

Figure 10). This is the result of the increasing need for liquid cooling for high-performance applications such as AI or complex simulation calculations and the trend towards further increases in the

thermal design power (TDP) expectations of CPUs and GPUs. The main reason why the two main groups from the subclass

F24F tend to rank behind the first two main groups at the end of the period under review is due to the significant proportion of air cooling (88 to 97 %). At the same time, the general trend showed a decrease in patent applications in the field of air cooling.

Figure 11.

Development of patent applications over time for the four most predominant main groups (nMG, relev., TOP 4 = 641); period: 2000 - 2023 (earliest priority year).

Figure 11.

Development of patent applications over time for the four most predominant main groups (nMG, relev., TOP 4 = 641); period: 2000 - 2023 (earliest priority year).

To illustrate the significance of the individual main groups of the

TOP 10 and their occurrence in combination with other main groups,

Table 6 presents their appearance independently of other main groups on the main diagonal. A main group is considered independent if a patent uses only one main group and this occurs once. The secondary diagonal in turn indicates the absolute frequency of cases in which two different

TOP 10 main groups occur together in a patent. All other main groups as well as multiple occurrences of a

TOP 10 main group in a patent are not taken into account.

With regard to the TOP 10 main groups, F24F5, F24F7, F24F11, G06F1, H05K5 and H05K7 were used individually. With the exception of H01L23, all other TOP 10 main groups are only used in combination with other TOP 10 main groups. The most common independent main groups are H05K7 (184), G06F1 (77) and F24F11 (10). With regard to a combination with other TOP 10 main groups, mainly H05K7 (8) as well as F24F3, F24F5 and F24F11 (7) are used. The most identified combinations are G06F1 / H05K7, F24F11 / H05K7 and F24F5 / F24F11 as well as F24F5 / F24F13.

The reason why certain main groups can occur independently is probably because they are sufficient to describe a cooling technology in terms of their content alone (see

Table A4 in the appendix). The fact that the

TOP 3 main groups in particular occur most often alone is due on the one hand to their significant importance for cooling technologies and their frequent appearance. In cases where there is a combination with other main groups, the main groups can complement each other. On the other hand, it would also be conceivable to integrate additional main groups in order to make it more difficult to find and clearly categorise them. Main group H01L23 deals with semiconductors and other fixed devices, which in contrast to the other

TOP 10 main groups is very close to the actual server components and the original heat source and is less associated with the cooling of the corresponding components. For this reason, it probably does not occur in combination with the other

TOP 10 main groups. In terms of combinations, there is a concentration in the area of section F. Three different main groups can be found here, which are characterised above all by their high proportion of air cooling. This makes them particularly suitable for combined use. In contrast, the main groups G06F1 / H05K7 are characterised above all by their high proportion of liquid cooling. These two main groups cover the area of computer architecture on the one hand and supporting superstructures on the other, which complement each other ideally with regard to liquid cooling. The combination of main groups F24F11 and H05K7, on the other hand, presumably contributes to the proportion of air cooling in main group H05K7.

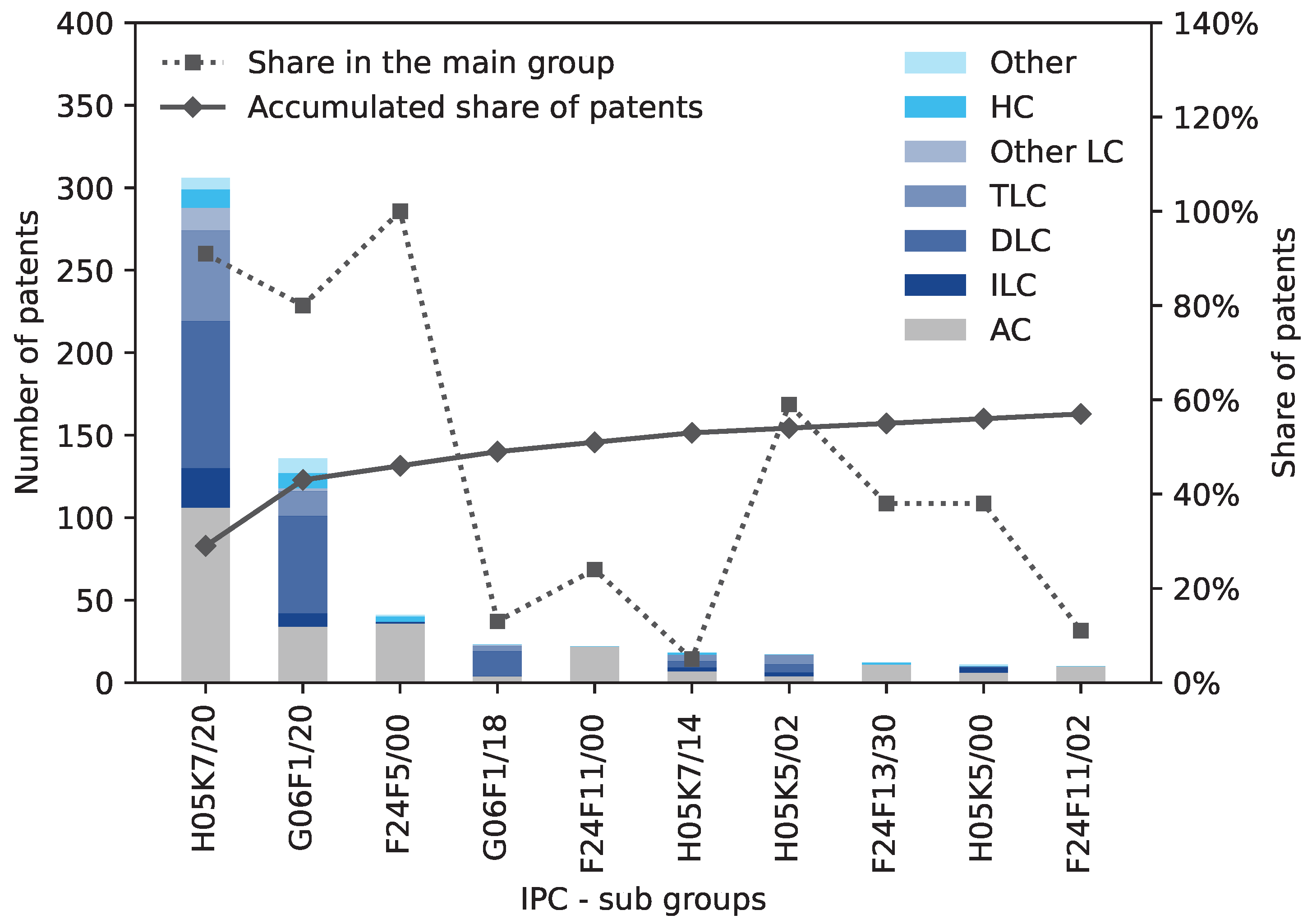

Figure 12 illustrates the distribution of the

TOP 10 subgroups. The share of the sub group in the main group is also indicated. In this case, the

TOP 10 represent 57 % of all patents in the sub group. The first three subgroups show a high degree of intersection with the main group - shares are in the range of 80 to 100 %. The subgroups, whose main groups also deal with cooling technologies other than air cooling, show a high proportion of liquid cooling. These include in particular

H05K7/20,

G06F1/20,

G06F1/18,

H05K7/14 and

H05K5/00. The first two represent 43 % of the

TOP 10 results and embody the majority of the patents in the

TOP 10 subgroups.

All patents in the subclass

F24F are predominantly composed of air cooling, which is due to their focus on air conditioning etc. In contrast the two most common main groups in particular account for a large proportion of liquid cooling (see

Figure 10). The reason for this can be seen in the

TOP 10 distribution of the subgroups in

Figure 12. As subclass

F24F is explicitly limited to cooling with the aid of air, air-based solutions are presumably primarily registered in this subclass. The subordinate frequency of the other subgroups from sections

H and

G is presumably due to the fact that they do not deal directly with direct cooling, but rather with the supporting technologies required for this. For example,

H05K7/14 and

H05K5/02 address “mounting supporting structure” and “casing details”.

It is therefore also possible the allocation of search terms and cooling technologies by section based on the technological distribution of cooling technologies in the

TOP 10 main groups and subgroups (

Table 4 and

Table 5). Section F is dominated by main groups and subgroups, which are primarily technologies focussing on air cooling. In contrast, the main and subgroups of sections G and H have a high proportion of liquid cooling, but not exclusively.

Figure 12.

Distribution of the 10 most common IPC sub groups (n

SG relev. = 1040, n

SG, relev., TOP 10 = 596); period: 2000 - 2023 (earliest priority year).

H05K7/20: … Modifications to facilitate cooling, ventilating, or heating, G06F1/20: … Cooling means, F24F5/00: Air-conditioning systems or apparatus not covered by group F24F 1/00 or F24F 3/00, G06F1/18: … Packaging or power distribution.

Figure 12.

Distribution of the 10 most common IPC sub groups (n

SG relev. = 1040, n

SG, relev., TOP 10 = 596); period: 2000 - 2023 (earliest priority year).

H05K7/20: … Modifications to facilitate cooling, ventilating, or heating, G06F1/20: … Cooling means, F24F5/00: Air-conditioning systems or apparatus not covered by group F24F 1/00 or F24F 3/00, G06F1/18: … Packaging or power distribution.

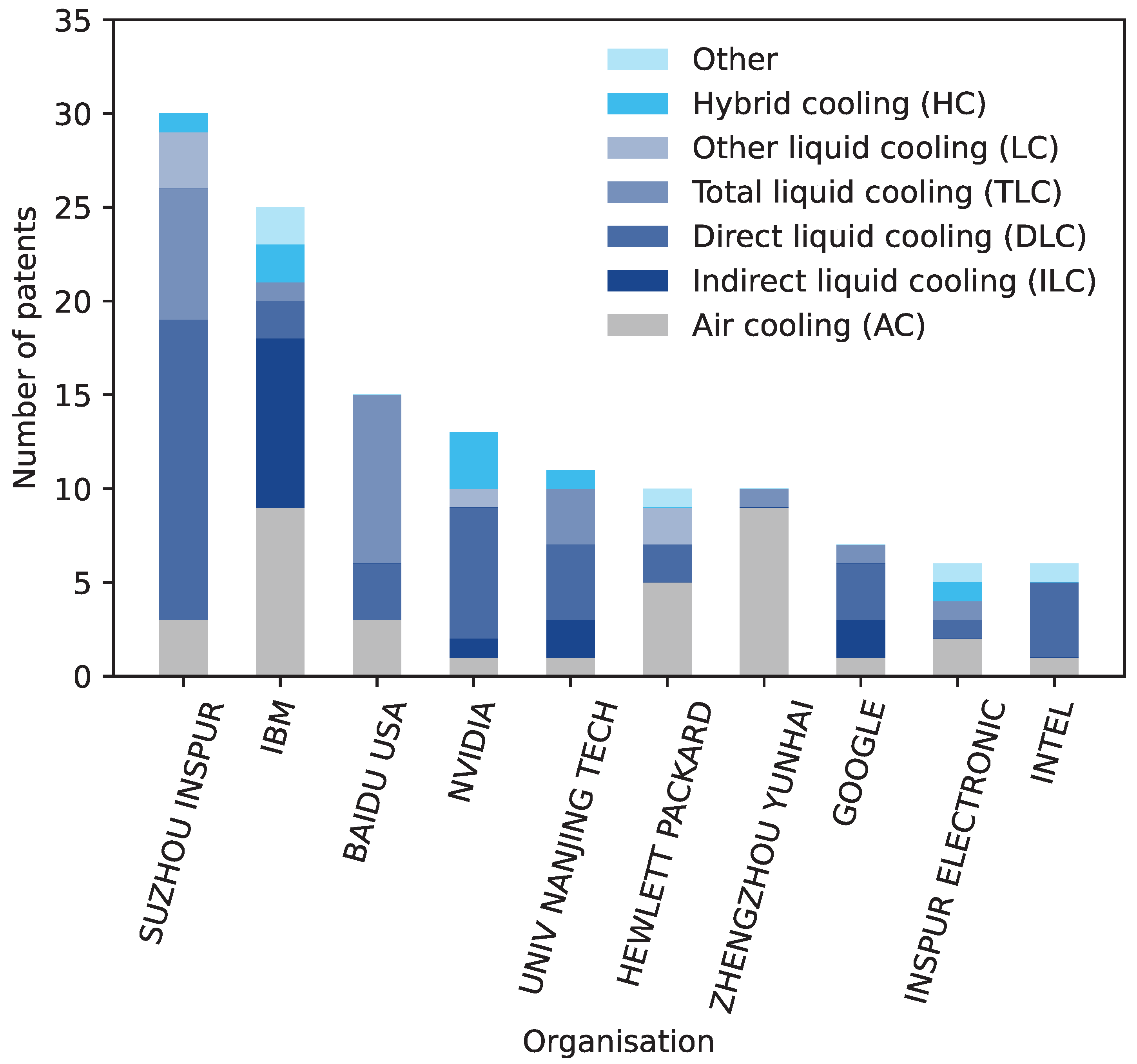

In addition to the countries of origin, it is also possible to differentiate according to the applicant’s organisation. The

TOP 10 most frequently listed organisations, including the technology structure, are shown in

Figure 13. The associated distribution by cooling technology is provided in

Figure A2 in the appendix. The companies are from the USA or China, and the technological focus is mostly on liquid cooling. They account for 22 % of the patent activities of all identified companies. In terms of patents,

NVIDIA,

Univ. Nanjing Tech,

Google and

Intel in particular have a high proportion of different liquid cooling solutions. At

IBM, on the other hand, the focus is on indirect liquid cooling using RDHX in addition to air cooling. With regard to direct liquid cooling,

Suzhou Inspur has the largest share, whereas in total liquid cooling

Baidu has the largest contribution. The chip manufacturers listed in the

TOP 10,

NVIDIA and

Intel, have a high proportion of direct liquid cooling. In contrast to Intel and Nvidia, AMD is not listed at all in the patent results. Further globally active server manufacturer are

Lenovo (5) and

DELL (2).

The composition of the

TOP 10 companies in

Figure 13 shows a concentration of Chinese and American companies. It corresponds essentially to the country distribution in

Figure 9. The “BECH-Index” analyzes the demand capacity for business-to-business information technology and related services worldwide [

57]. The USA and China in particular are in the top two places, which explains their high demand for IT technologies. At the same time, this also results in a high concentration of companies in these countries that serve this demand. The high proportion of liquid cooling used by CPU and GPU manufacturers can be explained by the trend towards increasing TDPs, which can no longer be cooled reliably with air alone from a certain performance range. The fact that IBM in particular has the highest proportion of indirect liquid cooling results from its early activities and fundamental research in this area (see [

58]). The search engine providers and hyperscalers also have a high proportion of liquid cooling. This is the result of their activities in the field of AI, which requires specialized high-performance hardware, which in turn reaches its limits with air cooling. Nevertheless, most of the applications that are run on the server are not computationally intensive programmes.

In order to be able to classify the patent activities of the

TOP 10 organisations,

Table 7 lists all their patent applications for the period 2013 - 2023. In contrast to the targeted search for patents in the field of data center cooling, the search period for the general search could not be extended beyond the year 2013. The ratio can be calculated on the basis of the two patent numbers, whereby these are given in per mille due to the different orders of magnitude. For the most part, the ratio is less than one per mille. This threshold is only exceeded by the following companies in descending order of ranking:

Baidu (14.91 ‰),

Suzhou Inspur (2.12 ‰),

NVIDIA (4.78 ‰) and

Inspur Electronic (1.21 ‰).

Baidu,

Suzhou Inspur,

NVIDIA and

Inspur Electronic show the greatest degree of specialisation in the field of data center cooling based on their patent applications by exceeding the specified threshold value (> 1.00 ‰). There is no case in which companies have a specialization share in the percentage range, indicates that cooling is of minor importance for the business. The reason that

Baidu in particular has such a high proportion of patents on cooling technologies compared to the company’s general activities, and that direct and total liquid cooling in particular accounts for the largest share, can be seen, among other things, in the content of its company reports [

59,

60,

61]. The research and development of suitable cooling technologies for use in data centres is of great importance in this context, and the use of direct and total liquid cooling is already being tested extensively in data centres [

61].

5. Conclusions and Outlook

The secure and appropriate cooling of a data center’s IT infrastructure at all times is of fundamental importance for its operation. At the same time, cooling can account for a large proportion of total energy consumption. The optimisation of this area in particular has contributed to a improvement of the power usage effectiveness (PUE). In addition to the further development of existing concepts such as air cooling, which is the current standard solution for server cooling, intensive research is being carried out into high-performance alternatives, such as liquid cooling. This study aims to investigate the development in the field of data centre cooling. Therefore the patent applications in various patent databases are a comprehensive source of data for determining research developments in this area.

This source of information has not yet been used systematically to investigate technological developments in the field of data center cooling technologies. As part of this study, the European Patent Office database was examined using Espacent. Suitable keywords and logics were used to determine relevant patents, which were iteratively optimised on the basis of the search results. The information obtained was then classified in order to visualise and analyzed the technological developments over the last two decades. The technological focus of the developments in the past as well as the future trend can be derived from this. In addition to categorisation by cooling technology, the countries of origin, patent offices, applicants and patent classes are included in the analysis. Furthermore, a differentiation was generally applied according to the cooling technology.

The patent analysis of data center cooling technologies at server / rack / IT room level revealed a trend towards an increase in the importance of liquid cooling due to a rising number of patent applications. In this context, the focus was primarily on the general classification of technological approaches for cooling data centres, such as direct or total liquid cooling. In addition, possible characteristics of the individual technology options were to be determined. They include, for example, the medium used as a coolant (water, single-phase or two-phase fluids, etc.).

The investigation carried out here revealed two things in particular. On the one hand, the number of patents registered in the field of liquid cooling has increased rapidly, especially in the last 10 years. In contrast, patent application activities in the field of air cooling declined in the same period. Despite the contrary trend, however, total annual patent applications of server cooling technologies increased. This highlights a trend switch in cooling technology, which also confirms the expectations made. Besides this, the research results confirm the assumption regarding the distribution of the various technological approaches within liquid cooling with direct liquid cooling as a key technologie. Total liquid cooling is a technological approach that faces a number of challenges. These include the different system design of the racks and the highly specialised cooling fluids, which can sometimes be hazardous to the environment. In both cases, the focus is primarly on single-phase coolants, while two-phase coolants make up a small part. Nevertheless, the proportion of total liquid cooling has increased significantly over the period under review, which is presumably due to the further development of cooling liquids. The area of two-phase coolants in combination with direct or total liquid cooling can be a technology of the future by utilising the enthalpy of vaporisation to increase the cooling capacity. Another approach could become increasingly important in the future - the combination of different cooling approaches in the form of hybrid cooling.

Even though hybrid cooling was rarely mentioned directly, most of the patents in the field of liquid cooling could be allocated to this area. Although the relative share has not changed much, the absolute number of patent applications has increased significantly (+600 % from the period 2004 - 2008 to 2019 - 2023). The great advantage of hybrid cooling is the targeted combination of the benefits of the different cooling approaches. If the TDP limit of 500 or 1000 W for CPU and / or GPU is exceeded in the future, liquid cooling must be used with more recent server setups. However, this limit does not apply to applications that do not require or have a high power density - air cooling is still sufficient here. In particular, the use of direct liquid cooling in combination with air or immersion cooling enables high-performance CPUs and GPUs to be cooled precisely, reliably and efficiently. In the coming years, the combination with air cooling, which is already a proven technology, can be suitable. These or modified forms of cooling can be further developed and optimised in the future.

On the other hand, the assumptions regarding the importance of the USA in patent applications in the area of data centre cooling were only partially confirmed. A significant proportion of patent applications are based on applications from companies from the USA or were filed at the US Patent Office. However, it turned out that the majority of patent applications were filed by Chinese organisations or at the Chinese Patent Office. As a result, the 10 most applicants identified only come from these two countries. In order to gain an up-to-date understanding of current developments, both regions should be observed in particular, as this is where most of the research activities based on patent applications can be observed.

This is in line with the general market situation, especially from the perspective of the most important component manufacturers and end users. The most important chip (INTEL, NVIDIA and AMD) and server manufacturers (HP, DELL, Cisco etc.) are located in the USA, while some of the largest data centre operators (Google, Baidu, etc.) also come from these two countries. Due to their great importance as suppliers and users of server hardware and the direct link to the issue of cooling, they will continue to play a major role in the coming years.

Furthermore, the most important sections according to the IPC for data centre cooling technologies were identified. These are in detail “Electricity” (42 %), “Mechanical Engineering” (29 %) and “Physics” (27 %), which is due to the high degree of similarity in content between the thematic focal points of the patents and cooling technology. Based on the patent analysis, we anticipate that these patent classes will continue to be the focus of patent applications in this field in the future. However, it also became apparent that “Mechanical Engineering” in particular has a special focus on air cooling, while the other two sections do not only contain technologies based on liquid cooling. Nevertheless, it can be assumed that all approaches based on coolants will continue to be found in “Electricity” and “Physics”.

This study was able to identify the most important applicants and patent classes as well as technologie developments in the area of data center cooling. On the basis of this study, past developments can be confirmed and possible future research priorities can be identified. At the same time, the relevant main groups and subgroups were identified depending on the cooling technology, which will support further research and investigations in this area.

The qualitative analysis of cooling technologies was carried out using the European patent database. Other “IP5” databases should be analysed to validate the results. In particular, the Chinese and American patent databases should be used to validate the results. In addition, the other patents that were identified with the more general search terms for coolant and cooling can be analysed in greater depth. Moreover, not only the simple family matches but the totality of all patent search results should be used for validation. However, this would probably lead to a misinterpretation of the results, especially if the entirety of a patent family were to unilaterally change the share of a technology. This study did not include a qualitative classification and a corresponding weighting of the results, which is why the patents identified could be categorised in future with regard to their technological significance and impact on the cooling of data centers.

The study uses patent analysis to investigate the historical evolution and potential future technology paths in the field of data center cooling, focusing on server and computer room levels, in order to meet the increasing cooling demands driven by higher performance and power density of components.